The Effects of Different Supply Chain Integration Strategies on Disruption Recovery: A System Dynamics Study on the Cheese Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Supply Chain Disruptions

2.2. Dimensions of Supply Chain Integration (SCI)

2.3. System Dynamics Modeling on SCI and Disruption Recovery

3. The Simulation Model and Analysis Methodology

3.1. Research Background

3.2. Simulation Assumptions, Types of Disruptions, and Scenarios

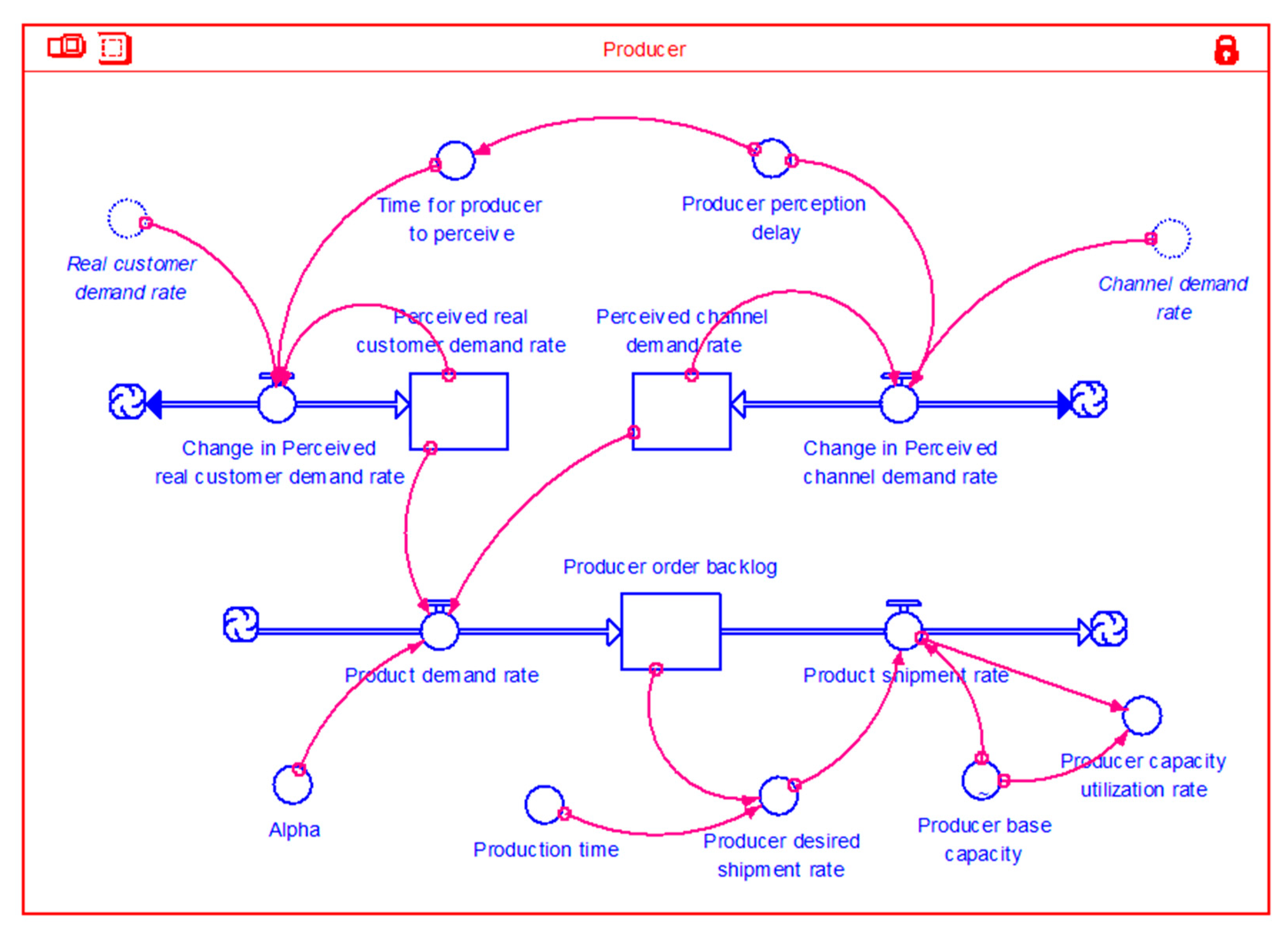

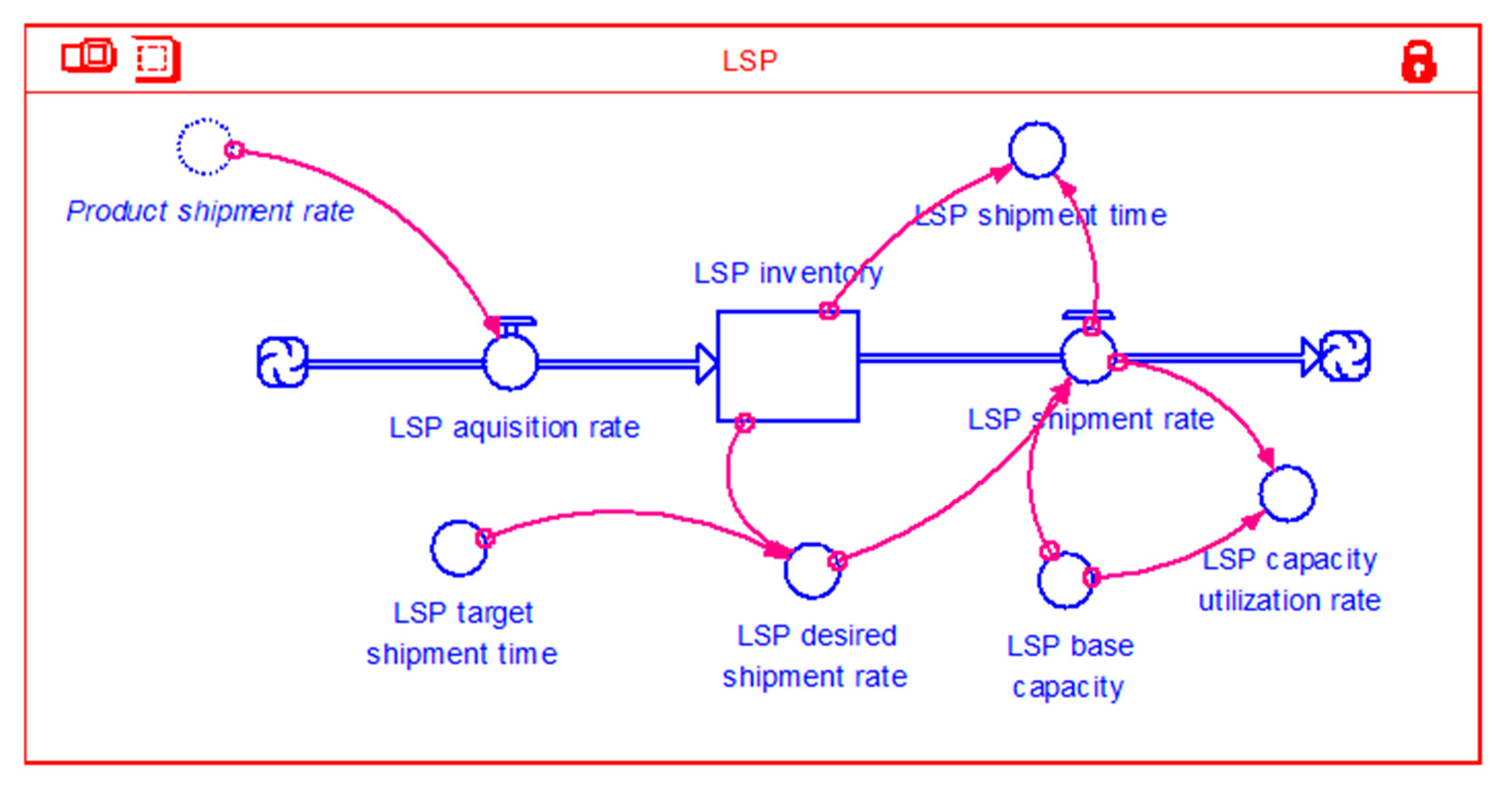

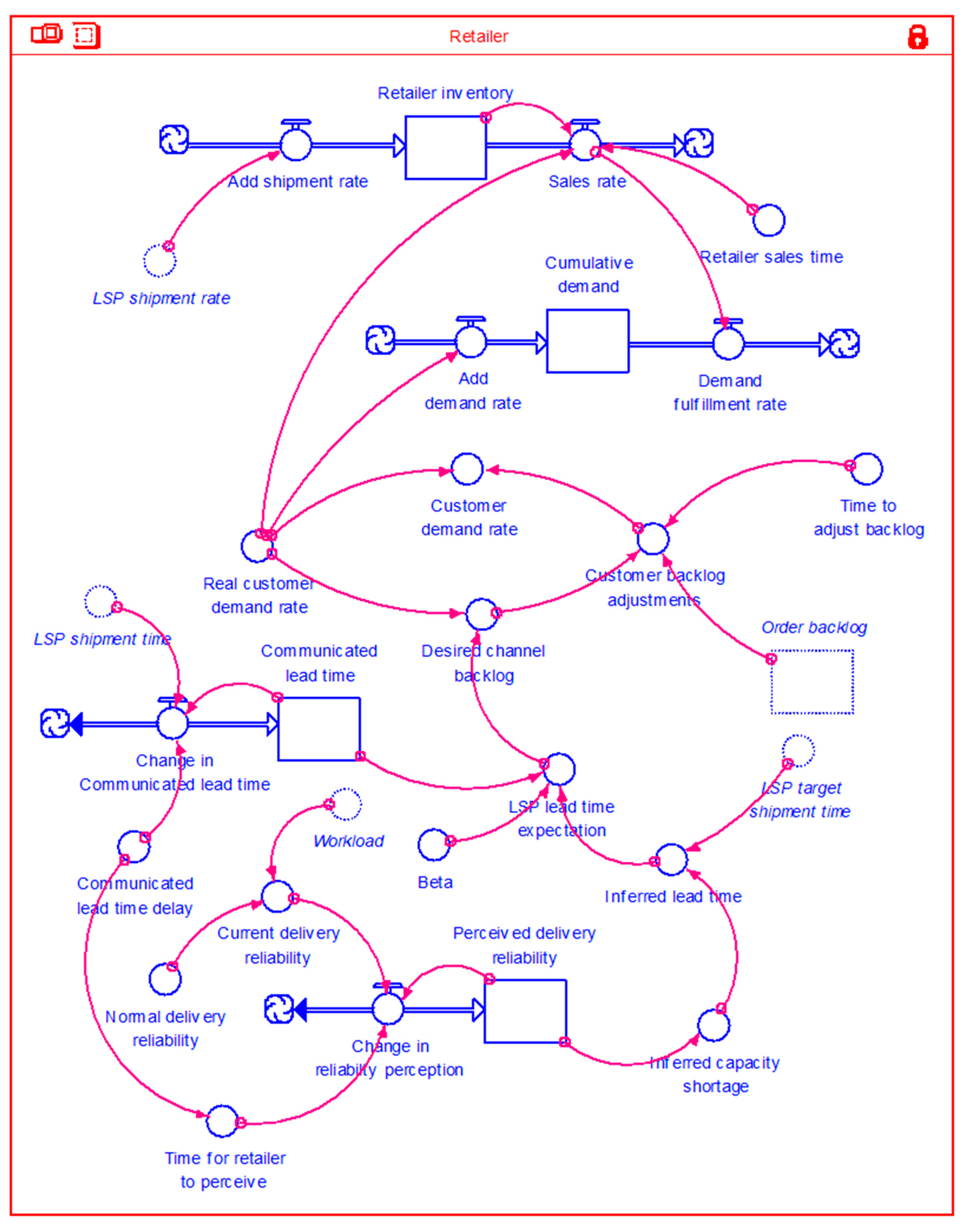

3.3. Model Structures

3.4. Analysis Methodology

4. Results

4.1. The MANOVA Results

4.2. The Parameter Scenario Testing Results

5. Discussions and Conclusion

5.1. Discussions

5.2. Managerial Implications

5.3. Conclusion, Limitations, and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alfalla-Luque, R.; Medina-Lopez, C.; Dey, P.K. Supply chain integration framework using literature review. Prod. Plan. Control 2013, 24, 800–817. [Google Scholar] [CrossRef] [Green Version]

- Datta, P.P.; Christopher, M.G. Information sharing and coordination mechanisms for managing uncertainty in supply chains: A simulation study. Int. J. Prod. Res. 2011, 49, 765–803. [Google Scholar] [CrossRef]

- Tang, C.; Tomlin, B. The power of flexibility for mitigating supply chain risks. Int. J. Prod. Econ. 2008, 116, 12–27. [Google Scholar] [CrossRef] [Green Version]

- Bottani, E.; Murino, T.; Schiavo, M.; Akkerman, R. Resilient food supply chain design: Modelling framework and metaheuristic solution approach. Comput. Ind. Eng. 2019, 135, 177–198. [Google Scholar] [CrossRef]

- Srivastava, S.K.; Chaudhuri, A.; Srivastava, R.K. Propagation of risks and their impact on performance in fresh food retail. Int. J. Logist. Manag. 2015, 26, 568–602. [Google Scholar] [CrossRef]

- Li, G.; Fan, H.; Lee, P.K.C.; Cheng, T.C.E. Joint supply chain risk management: An agency and collaboration perspective. Int. J. Prod. Econ. 2015, 164, 83–94. [Google Scholar] [CrossRef]

- Jüttner, U. Supply chain risk management: Understanding the business requirements from a practitioner perspective. Int. J. Logist. Manag. 2005, 16, 120–141. [Google Scholar] [CrossRef]

- Rao, S.; Goldsby, T.J. Supply chain risks: A review and typology. Int. J. Logist. Manag. 2009, 20, 97–123. [Google Scholar] [CrossRef]

- Leuschner, R.; Rogers, D.S.; Charvet, F. A meta-analysis of supply chain integration and firm performance. J. Supply Chain Manag. 2013, 49, 34–57. [Google Scholar] [CrossRef]

- Lee, C.W.; Kwon, I.-W.G.; Severance, D. Relationship between supply chain performance and degree of linkage among supplier, internal integration, and customer. Supply Chain Manag. Int. J. 2007, 12, 444–452. [Google Scholar] [CrossRef]

- Yao, Y.; Evers, P.T.; Dresner, M.E. Supply chain integration in vendor-managed inventory. Decis. Support Syst. 2007, 43, 663–674. [Google Scholar] [CrossRef]

- Fabbe-Costes, N.; Jahre, M. Supply chain integration and performance: A review of the evidence. Int. J. Logist. Manag. 2008, 19, 130–154. [Google Scholar] [CrossRef]

- Swink, M.; Narasimhan, R.; Wang, C. Managing beyond the factory walls: Effects of four types of strategic integration on manufacturing plant performance. J. Oper. Manag. 2007, 25, 148–164. [Google Scholar] [CrossRef]

- Fiala, P. Information sharing in supply chains. Omega 2005, 33, 419–423. [Google Scholar] [CrossRef]

- Wei, H.-L.; Wong, C.W.Y.; Lai, K. Linking inter-organizational trust with logistics information integration and partner cooperation under environmental uncertainty. Int. J. Prod. Econ. 2012, 139, 642–653. [Google Scholar] [CrossRef]

- Kulp, S.C.; Lee, H.L.; Ofek, E. Manufacturer benefits from information integration with retail customers. Manag. Sci. 2004, 50, 431–444. [Google Scholar] [CrossRef]

- Kannan, V.R.; Tan, K.C. Supply chain integration: Cluster analysis of the impact of span of integration. Supply Chain Manag. Int. J. 2010, 15, 207–215. [Google Scholar] [CrossRef] [Green Version]

- Flynn, B.B.; Huo, B.; Zhao, X. The impact of supply chain integration on performance: A contingency and configuration approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- Kim, S.W. Effects of supply chain management practices, integration and competition capability on performance. Supply Chain Manag. An Int. J. 2006, 11, 241–248. [Google Scholar] [CrossRef]

- Akkermans, H.A.; van Wassenhove, L.N. Searching for the grey swans: The next 50 years of production research. Int. J. Prod. Res. 2013, 51, 6746–6755. [Google Scholar] [CrossRef]

- Boulaksil, Y.; Grunow, M.; Fransoo, J.C. Capacity flexibility allocation in an outsourced supply chain with reservation. Int. J. Prod. Econ. 2011, 129, 111–118. [Google Scholar] [CrossRef] [Green Version]

- Sahin, F.; Robinson, E.P., Jr. Information sharing and coordination in make-to-order supply chains. J. Oper. Manag. 2005, 23, 579–598. [Google Scholar] [CrossRef]

- Reddi, K.R.; Moon, Y.B. System dynamics modeling of engineering change management in a collaborative environment. Int. J. Adv. Manuf. Technol. 2011, 55, 1225–1239. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Wagner, S.M. Do perceptions become reality? The moderating role of supply chain resiliency on disruption occurrence. J. Bus. Logist. 2010, 31, 1–20. [Google Scholar] [CrossRef]

- Manuj, I.; Esper, T.L.; Stank, T.P. Supply chain risk management approaches under different conditions of risk. J. Bus. Logist. 2014, 35, 241–258. [Google Scholar] [CrossRef]

- Wagner, S.M.; Bode, C. An empirical examination of supply chain performance along several dimensions of risk. J. Bus. Logist. 2008, 29, 307–325. [Google Scholar] [CrossRef]

- Tse, Y.K.; Matthews, R.L.; Tan, K.H.; Sato, Y.; Pongpanich, C. Unlocking supply chain disruption risk within the Thai beverage industry. Ind. Manag. Data Syst. 2016, 116, 21–42. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Q.; Krikke, H.; Caniëls, M.C.J.C.; Wang, Y. Twin-objective supply chain collaboration to cope with rare but high impact disruptions whilst improving performance. Int. J. Logist. Manag. 2017, 28, 488–507. [Google Scholar] [CrossRef]

- Revilla, E.; Sáenz, M.J. Supply chain disruption management: Global convergence vs national specificity. J. Bus. Res. 2014, 67, 1123–1135. [Google Scholar] [CrossRef]

- Wakolbinger, T.; Cruz, J.M. Supply chain disruption risk management through strategic information acquisition and sharing and risk-sharing contracts. Int. J. Prod. Res. 2011, 49, 4063–4084. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Melnyk, S.A.; Ragatz, G.L. An institutional theory perspective of business continuity planning for purchasing and supply management. Int. J. Prod. Res. 2005, 43, 3401–3420. [Google Scholar] [CrossRef]

- Frohlich, M.T.; Westbrook, R. Arcs of integration: An international study of supply chain strategies. J. Oper. Manag. 2001, 19, 185–200. [Google Scholar] [CrossRef]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Olorunniwo, F.O.; Li, X. Information sharing and collaboration practices in reverse logistics. Supply Chain Manag. Int. J. 2010, 15, 454–462. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.L.; Padmanabhan, V.; Whang, S. The bullwhip effect in supply chains. Sloan Manag. Rev. 1997, 38, 93–102. [Google Scholar] [CrossRef]

- Breuer, C.; Siestrup, G.; Haasis, H.-D.; Wildebrand, H. Collaborative risk management in sensitive logistics nodes. Team Perform. Manag. 2013, 19, 331–351. [Google Scholar] [CrossRef]

- Di Nardo, M.; Clericuzio, M.; Murino, T.; Sepe, C. An economic order quantity stochastic dynamic optimization model in a Logistic 4.0 environment. Sustainability 2020, 12, 4075. [Google Scholar] [CrossRef]

- Zhou, H.; Benton, W.C. Supply chain practice and information sharing. J. Oper. Manag. 2007, 25, 1348–1365. [Google Scholar] [CrossRef]

- Nagurneya, A.; Qiang, Q. Fragile networks: Identifying vulnerabilities and synergies in an uncertain age. Int. Trans. Oper. Res. 2012, 19, 123–160. [Google Scholar] [CrossRef] [Green Version]

- Van der Vaart, T.; Van Donk, D.P. A critical review of survey-based research in supply chain integration. Int. J. Prod. Econ. 2008, 111, 42–55. [Google Scholar] [CrossRef]

- Chen, J.; Sohal, A.S.; Prajogo, D.I. Supply chain operational risk mitigation: A collaborative approach. Int. J. Prod. Res. 2012, 57, 1–14. [Google Scholar] [CrossRef]

- Özbayrak, M.; Papadopoulou, T.C.; Akgun, M. Systems dynamics modelling of a manufacturing supply chain system. Simul. Model. Pract. Theory 2007, 15, 1338–1355. [Google Scholar] [CrossRef]

- Wilson, M.C. The impact of transportation disruptions on supply chain performance. Transp. Res. Part E Logist. Transp. Rev. 2007, 43, 295–320. [Google Scholar] [CrossRef]

- Sterman, J.D. System dynamics modeling: Tools for learning in a complex world. Calif. Manag. Rev. 2001, 43, 8–25. [Google Scholar] [CrossRef]

- Hilletofth, P.; Lattila, L. Agent based decision support in the supply chain context. Ind. Manag. Data Syst. 2012, 112, 1217–1235. [Google Scholar] [CrossRef] [Green Version]

- Di Nardo, M.; Gallo, M.; Murino, T.; Santillo, L.C. System dynamics simulation for fire and explosion risk analysis in home environment. Int. Rev. Model. Simul. 2017, 10, 43–54. [Google Scholar] [CrossRef]

- Mehrjoo, M.; Pasek, Z.J. Risk assessment for the supply chain of fast fashion apparel industry: A system dynamics framework. Int. J. Prod. Res. 2016, 54, 28–48. [Google Scholar] [CrossRef]

- Tako, A.A.; Robinson, S. The application of discrete event simulation and system dynamics in the logistics and supply chain context. Decis. Support Syst. 2012, 52, 802–815. [Google Scholar] [CrossRef] [Green Version]

- Helo, P.T. Dynamic modelling of surge effect and capacity limitation in supply chains. Int. J. Prod. Res. 2000, 38, 4521–4533. [Google Scholar] [CrossRef]

- Cooke, D.L.; Rohleder, T.R. Learning from incidents: From normal accidents to high reliability. Syst. Dyn. Rev. 2006, 22, 213–239. [Google Scholar] [CrossRef]

- Suryani, E.; Chou, S.-Y.; Hartono, R.; Chen, C.-H. Demand scenario analysis and planned capacity expansion: A system dynamics framework. Simul. Model. Pract. Theory 2010, 18, 732–751. [Google Scholar] [CrossRef]

- Disney, S.M.; Towill, D.R. The effect of vendor managed inventory (VMI) dynamics on the bullwhip effect in supply chains. Int. J. Prod. Econ. 2003, 85, 199–215. [Google Scholar] [CrossRef]

- Disney, S.M.; Towill, D.R. A methodology for benchmarking replenishment-induced bullwhip. Supply Chain Manag. Int. J. 2006, 11, 160–168. [Google Scholar] [CrossRef]

- Waller, M.; Johnson, M.E.; Davis, T. Vendor-managed inventory in the retail supply chain. J. Bus. Logist. 1999, 20, 183–204. [Google Scholar]

- Bianchi, C.; Rivenbark, W.C. Performance management in local government: The application of system dynamics to promote data use. Int. J. Public Adm. 2014, 37, 945–954. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Dilts, D. System dynamics of supply chain network organization structure. Inf. Syst. E-bus. Manag. 2004, 2, 187–206. [Google Scholar] [CrossRef]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; McGraw-Hill Education: New York, NY, USA, 2000; pp. 411–434. [Google Scholar]

- Nutt, P.C. Investigating the success of decision making processes. J. Manag. Stud. 2008, 45, 425–455. [Google Scholar] [CrossRef]

- Bienstock, C.C. Sample size determination in logistics simulations. Int. J. Phys. Distrib. Logist. Manag. 1996, 26, 43–50. [Google Scholar] [CrossRef]

- Zhu, Q.; Krikke, H.; Caniëls, M. Collaborate or not? A system dynamics study on disruption recovery. Ind. Manag. Data Syst. 2016, 116, 271–290. [Google Scholar] [CrossRef]

- Chang, H.H. An empirical study of evaluating supply chain management integration using the balanced scorecard in Taiwan. Serv. Ind. J. 2009, 29, 185–202. [Google Scholar] [CrossRef]

- Van der Vorst, J.G.A.J.; Tromp, S.O.; Van Der Zee, D.J. Simulation modelling for food supply chain redesign: Integrated decision making on product quality, sustainability and logistics. Int. J. Prod. Res. 2009, 47, 6611–6631. [Google Scholar] [CrossRef]

- Akkermans, H.; Bogerd, P.; van Doremalen, J. Travail, transparency and trust: A case study of computer-supported collaborative supply chain planning in high-tech electronics. Eur. J. Oper. Res. 2004, 153, 445–456. [Google Scholar] [CrossRef]

- Diabat, A.; Govindan, K.; Panicker, V. Supply chain risk management and its mitigation in a food industry. Int. J. Prod. Res. 2012, 50, 3039–3050. [Google Scholar] [CrossRef] [Green Version]

- Schmitt, A.J.; Singh, M. A quantitative analysis of disruption risk in a multi-echelon supply chain. Int. J. Prod. Econ. 2012, 139, 22–32. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantages. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef] [Green Version]

- Cao, M.; Zhang, Q. Supply chain collaboration: Impact on collaborative advantage and firm performance. J. Oper. Manag. 2011, 29, 163–180. [Google Scholar] [CrossRef]

- Bode, C.; Wagner, S.M.; Petersen, K.J.; Ellram, L.M. Understanding responses to supply chain disruptions: Insights from information processing and resource dependence perspectives. Acad. Manag. J. 2011, 54, 833–856. [Google Scholar] [CrossRef]

- Di Nardo, M. Developing a conceptual framework model of Industry 4.0 for industrial management. Ind. Eng. Manag. Syst. 2020, 19, 551–560. [Google Scholar] [CrossRef]

- Di Nardo, M.; Madonna, M.; Murino, T.; Castagna, F. Modelling a safety management system using system dynamics at the Bhopal incident. Appl. Sci. 2020, 10, 903. [Google Scholar] [CrossRef] [Green Version]

| Simulation Input | Value |

|---|---|

| Producer order backlog | 7.68 × 106 kg |

| Production time | 6 weeks |

| Alpha, Beta | 0.5 |

| Producer base capacity, Logistics service provider (LSP) base capacity | 1.28 × 106 kg/week |

| Producer surge capacity, LSP surge capacity | 3.20 × 105 kg/week |

| Order backlog, LSP inventory, Cumulative demand | 1 kg |

| LSP target shipment time, Retailer sales time | 1 week |

| Retailer inventory | 2.56 × 106 kg |

| Producer perception delay, Communicated lead time delay, Time to adjust backlog | 2 weeks |

| Normal delivery reliability | 0.95 |

| Real customer demand rate | Normal (1.28 × 106, 1.00 × 105) kg/week |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Content | Information integration | Relational integration | Operational integration |

| Information distortion | Yes | No | No |

| Distorted information | Channel demand rate, LSP shipment time | Not applicable | Not applicable |

| The most proper information | Real customer demand rate, Workload | Real customer demand rate, Workload | Real customer demand rate, Workload |

| Information used for decision-making | Alpha (or Beta) × Distorted information + [1 − Alpha (or Beta)] × The most proper information | The most proper information | The most proper information |

| Information delay | Yes | Yes | No |

| Delays | Producer perception delay, Communicated lead time delay | Producer perception delay, Communicated lead time delay | Not applicable |

| Producer Capacity Disruption | LSP Capacity Disruption | Demand Disruption | |

|---|---|---|---|

| Box’s M | 195 | 303 | 268 |

| F | 5.84 | 4.81 | 8.02 |

| df1 | 21.0 | 42.0 | 21.0 |

| df2 | 1.19 × 103 | 2.16 × 103 | 1.19 × 103 |

| p-value | 0.000 *** | 0.000 *** | 0.000 *** |

| Performance Measures | Mean (Standard Deviation) | F | p-Value | Duncan | ||

|---|---|---|---|---|---|---|

| Scenario 1 | Scenario 2 | Scenario 3 | ||||

| Producer capacity utilization rate | 0.88 (0.04) | 0.87 (0.05) | 0.87 (0.05) | 0.35 | 0.706 | (1 2 3) |

| Producer order backlog | 8.22 × 106 (5.69 × 105) | 8.00 × 106 (6.86 × 105) | 8.00 × 106 (6.86 × 105) | 0.36 | 0.699 | (1 2 3) |

| LSP capacity utilization rate | 0.80 (0.04) | 0.78 (0.05) | 0.79 (0.05) | 0.64 | 0.533 | (1 2 3) |

| LSP shipment time | 1.16 (0.09) | 1.13 (0.12) | 1.00 (0.00) | 7.03 | 0.003 ** | (1 2, 3) |

| Retailer inventory | 1.64 × 106 (3.96 × 105) | 1.45 × 106 (2.11 × 105) | 1.59 × 106 (3.22 × 105) | 1.01 | 0.379 | (1 2 3) |

| Cumulative demand | 6.77 × 105 (8.67 × 105) | 1.10 × 106 (9.77 × 105) | 1.10 × 106 (9.77 × 105) | 0.68 | 0.514 | (1 2 3) |

| Performance Measures | Mean (Standard Deviation) | F | p-Value | Duncan | ||

|---|---|---|---|---|---|---|

| Scenario 1 | Scenario 2 | Scenario 3 | ||||

| Producer capacity utilization rate | 0.99 (0.03) | 0.97 (0.05) | 0.97 (0.05) | 0.50 | 0.610 | (1 2 3) |

| Producer order backlog | 8.37 × 106 (8.36 × 105) | 7.89 × 106 (9.13 × 105) | 7.89 × 106 (9.13 × 105) | 0.97 | 0.392 | (1 2 3) |

| LSP capacity utilization rate | 0.87 (0.02) | 0.85 (0.03) | 0.85 (0.04) | 0.48 | 0.627 | (1 2 3) |

| LSP shipment time | 1.25 (0.08) | 1.20 (0.05) | 1.17 (0.05) | 4.54 | 0.020 * | (1 2, 2 3) |

| Retailer inventory | 1.73 × 106 (4.29 × 105) | 1.60 × 106 (2.46 × 105) | 1.63 × 106 (3.38 × 105) | 0.38 | 0.686 | (1 2 3) |

| Cumulative demand | 1.24 × 106 (1.22 × 106) | 1.25 × 106 (1.21 × 106) | 1.24 × 106 (1.22 × 106) | 0.00 | 1.000 | (1 2 3) |

| Performance Measures | Mean (Standard Deviation) | F | p-Value | Duncan | ||

|---|---|---|---|---|---|---|

| Scenario 1 | Scenario 2 | Scenario 3 | ||||

| Producer capacity utilization rate | 0.96 (0.04) | 0.91 (0.06) | 0.91 (0.06) | 2.38 | 0.112 | (1 2 3) |

| Producer order backlog | 7.74 × 106 (6.75 × 105) | 7.12 × 106 (6.72 × 105) | 7.06 × 106 (6.32 × 105) | 3.23 | 0.055 | (1, 2 3) |

| LSP capacity utilization rate | 0.93 (0.03) | 0.91 (0.05) | 0.91 (0.06) | 0.83 | 0.447 | (1 2 3) |

| LSP shipment time | 1.85 (0.17) | 1.78 (0.29) | 1.00 (0.00) | 59.8 | 0.000 *** | (1 2, 3) |

| Retailer inventory | 2.07 × 106 (6.77 × 105) | 1.80 × 106 (3.87 × 105) | 2.26 × 106 (4.13 × 105) | 2.10 | 0.141 | (1 2 3) |

| Cumulative demand | 4.29 × 105 (8.08 × 105) | 4.34 × 105 (8.18 × 105) | 2.98 × 105 (5.20 × 105) | 0.11 | 0.895 | (1 2 3) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, Q.; Krikke, H.; Caniëls, M.C.J. The Effects of Different Supply Chain Integration Strategies on Disruption Recovery: A System Dynamics Study on the Cheese Industry. Logistics 2021, 5, 19. https://doi.org/10.3390/logistics5020019

Zhu Q, Krikke H, Caniëls MCJ. The Effects of Different Supply Chain Integration Strategies on Disruption Recovery: A System Dynamics Study on the Cheese Industry. Logistics. 2021; 5(2):19. https://doi.org/10.3390/logistics5020019

Chicago/Turabian StyleZhu, Quan, Harold Krikke, and Marjolein C. J. Caniëls. 2021. "The Effects of Different Supply Chain Integration Strategies on Disruption Recovery: A System Dynamics Study on the Cheese Industry" Logistics 5, no. 2: 19. https://doi.org/10.3390/logistics5020019

APA StyleZhu, Q., Krikke, H., & Caniëls, M. C. J. (2021). The Effects of Different Supply Chain Integration Strategies on Disruption Recovery: A System Dynamics Study on the Cheese Industry. Logistics, 5(2), 19. https://doi.org/10.3390/logistics5020019