Abstract

Background: Logistics and supply chain management are crucial in modern commerce, impacting global competition, and both can directly benefit by using enterprise resource planning (ERP) systems. This case study examines key success factors behind a significant operational transformation in a company in the countryside of Alagoas, Brazil. From this context, two research questions emerge: (a) What are the main success factors that drove a significant operational transformation in logistics and supply chain management, and how did these factors impact the company’s growth? (b) How does digital transformation and adopting an ERP impact the company’s logistics activities? Methods: Data were collected through on-site observations, interviews with supervisors and a manager, and analysis of company-provided documentation. Results: The study identified key processes, stakeholders, and practices, focusing on critical success factors, mission-critical processes, and the integration of core and support functions. Notable changes were observed through key logistics performance indicators, tracking the evolution from pre-implementation to post-implementation and revealing their impact on the company’s growth. Conclusions: Improved decision making between departments significantly enhanced performance and growth. The analyzed company’s success can be attributed to a process-oriented approach, digital transformation in logistics, and investment in information technology.

1. Introduction

In the contemporary world, logistics and supply chain management are gaining prominence and expression in commercial relations, mainly because the quality of their management affects the competitiveness processes in the productive sectors on a global scale [1,2]. The main economic changes affecting logistics are globalization, increased economic uncertainties, product proliferation, shorter product life cycles, and higher service demand [3]. Information systems (IS) act as bridges to connect logistical activities to an integrated chain, creating a significant competitive advantage [4] and ensuring better coordination of the involved partners for value creation [5]. It is also essential that information technology (IT) professionals make strategic decisions to formulate security policies, thereby assuring the authenticity, integrity, and confidentiality of the database and maintaining business sustainability [6].

Enterprise resource planning (ERP) integrates business processes and information from all functional areas, such as supply chain management, sales, finance, project management, and staffing [7]. This coordination allows for central administration of the organization’s data. Improved measurement systems are essential for evaluating process performance, reflecting company principles, and enabling past monitoring, future planning, and decision making [7].

These systems also enable the application of e-commerce strategies as they connect with other corporate processes in the value chain [8]. IT resources support information management within a company, aiding in authorizing, tracking, and managing returns, reducing costs, and improving business processes and service quality [9,10].Adopting business process management and automating and implementing activities through information systems is a significant challenge for companies in digital transformation and process automatization [9,11]. This aims to improve corporate performance and advance positioning and competitive advantage within the market segment [12].

Despite the established importance of logistics and supply chain management in global commerce and the recognized role of IT/IS and ERP in driving efficiency and competitive advantage, a research gap exists concerning these technologies’ impacts in developing regions to identify, for instance, reasons for success or failure [13]. While the literature highlights the general benefits of ERP and digital transformation, there are several gaps in in-depth studies examining the real impacts faced by companies in emerging markets when implementing and configuring these systems, involving both technical and human aspects [14].

Specifically, it is necessary to understand how factors like new technological infrastructures, the impacts on professional activities, and the specific characteristics of organizational culture and maturity influence the adoption and effectiveness of digital transformation, such as using ERP systems to support managing logistics operations [15]. Furthermore, there is a lack of research seeking to understand practitioners’ views on the differential impact of these technologies on operational transformation and business growth in developing contexts [16].

Based on these gaps, this study brings the two main questions:

- (a)

- What are the main success factors that drove a significant operational transformation in logistics and supply chain management within a company in the countryside of Alagoas, Brazil, and how did these factors impact the company’s growth?

- (b)

- How does digital transformation and adopting an ERP system impact the company’s logistics activities?

This research addresses the improvements and benefits of integrated logistics management by implementing an ERP system in a retail distribution company in the Alagoas countryside (Brazil). The research is characterized as a case study, with the research problem centered on understanding how the integration process, involving process redesign and system implementation, which directly impacts performance indicators within the logistics sector and other corporate areas. It intends to explore how integrated logistics were transformed through process redesign and information management via a corporate ERP system.

The remainder of this article is structured as follows: Section 2 presents the literature review on the topics related to the reported research; Section 3 presents the methodology used to obtain and analyze the data required for the case study; Section 4 presents the results and discussion; Section 5 summarizes the research implications and discusses some challenges according to the literature; and finally, Section 6 contains the conclusion of the work.

2. Literature Review

According to Seethamraju and Sundar [17], ERP systems have historically streamlined operations, but their impact on business agility is ambiguous. While process integration and standardization can boost speed and decision-making, poorly implemented ERPs can create rigidity. However, well-executed ERP implementations, incorporating best practices and regular updates, generally enhance agility through improved process efficiency. Although tight technical integration can pose challenges, vertical and horizontal integration and process standardization benefits ultimately contribute positively to a firm’s agility.

The literature review presented by Elmonem et al. [18] dealt with the theme of adopting cloud computing in implementing ERP systems, providing availability, scalability, and flexibility to attend to daily needs in organizations, ensuring effective integrated processes and efficient development of activities. In their findings in the literature, by adopting this strategy, it can be highlighted that cloud ERP’s cost benefits primarily suit companies lacking existing ERP or IT infrastructure, reducing initial expenses. For those with established systems, savings depend on comparing maintenance versus subscription costs. However, cloud ERP’s generic nature often necessitates costly customizations, as providers rarely offer individual feature development.

Syreyshchikova et al. [19] explored how automating production planning enhances efficiency in machine-building enterprises. They developed an experiment with a methodology that enhances SAP ERP planning, leading to more efficient control, reduced workload, greater stability, increased market responsiveness, and cost reductions. They highlighted the following as achievements: enhanced responsiveness, delivery reliability, streamlined documentation, and early issue resolution resulted in a 20% decrease in management labor and a 25% boost in process stability, driving sustainable success.

Regarding inventory control and the impact of implementing a real-time management system, Ali and Kuar et al. [20] developed a study on warehouse practices driven by 4.0 technologies aiming to assess related performance. Their three main findings can be summarized as follows:

- (a)

- Smart warehouses apply robotic automation to reduce manual tasks and minimize downtime, improving efficiency and quality through advanced sensing.

- (b)

- Optimized planning systems are crucial for effective inventory management, controlling distribution and shipping stages using sales, stock, and forecasting.

- (c)

- Storage optimization for capacity and cost reduction remains important despite lower ratings, as customized warehouse setups and strategic locations have not achieved expected efficiency gains.

According to their findings, modern warehouses prioritize automation and data-driven planning to boost efficiency and responsiveness across the supply chain. While physical storage remains relevant, technology integration is paramount for achieving real-time visibility and streamlined operations, ultimately driving a more agile and competitive supply chain.

Still, in the real-time inventory control and management perspective, Constantino et al. [21] developed a study to evaluate a real-time inventory replenishment system, incorporating smoothing through control charts, for use in dynamic and complex supply chain scenarios. They indicated that SPC-based inventory replenishment outperformed standard (R, S) policies, improving operational performance and customer service across various demand patterns. SPC’s forecasting also surpassed the moving average methods. While both were sensitive to lead time, SPC was less so, with smoothing reducing this impact. Enhanced information sharing improved both policies, with SPC showing superior performance in collaborative settings. Though information sharing lessened the bullwhip effect, smoothing rules like SPC are vital for its elimination, enhancing overall supply chain stability.

Implementing the ERP system also notably reduces production time and operational costs, aligning with operational management theory. Wulan et al. [22] support inventory management theory, indicating that ERP systems enhance efficiency in inventory management. This study’s observed increase in productivity corresponds with the theory that ERP systems can boost employee productivity. The authors discuss that an increase in cash flow related to ERP system implementation supports financial theory, suggesting that ERP systems aid in better cash flow management. Additionally, the considerable reduction in operating costs after implementing the ERP system aligns with the cost efficiency theory.

Additionally, e-commerce and cloud-based tools are generating a wealth of accessible operational data, which creates opportunities for data-driven organizational strategies. Consequently, businesses must analyze and understand supply chain stakeholders’ changing patterns and needs and their complex interactions to build competitive advantages, enhance logistics efficiency, and deliver positive environmental and socioeconomic impacts [23]. The integration of production and information technology spurred the development of computer-integrated manufacturing and automated processes, leveraging ERP and modular factory architectures [24] and leveraging AI, particularly machine learning, which allows businesses to streamline logistics and cut costs by optimizing delivery routes, forecasting demand, automating supplier selection, implementing dynamic pricing, and improving scheduling [25].

Table 1 summarizes the studies presented throughout this section, indicating their focus and highlighted findings.

Table 1.

Literature summary.

The literature indicates a clear trend towards utilizing advanced technologies to optimize logistics and supply chain management. However, although the benefits of using these technologies are clear, companies need to go through a process of adoption and implementation. This specific aspect has been studied emphasizing multiple critical factors, as listed below. While some studies converge on best practices, others reveal divergences based on organizational context.

- Organizational readiness

A model proposed by Malik and Khan [13] suggests that to succeed in the implementation process, it is necessary to consider good project management, effective change management, business process re-engineering, and top management commitment. However, ERP systems are often primarily adopted as an operational necessity rather than an innovative leap. In other words, market expansion needs and competitive pressure can be stronger motivators than performance metrics per se [26]. Moreover, small- and medium-sized enterprises (SMEs) in logistics may require more tailored ERP solutions than larger enterprises, which can afford standardized systems [27].

On the other hand, this leads organizations into a business model experimentation and innovation [28], requiring the organization to adapt its processes to use the systems. Companies must also define which performance indicators will be used and how they will be weighted in decision-making processes to maximize productivity [29].

- Cost–benefit ratio of embedded technologies

Emerging technologies such as blockchain, AI, and IoT are increasingly integrated with ERP systems, but adoption varies. Blockchain technology can bring several benefits such as minimizing risks by improving transparency in contracts and payment systems [30], enhancing sustainability and supply chain traceability [31], and reducing human errors in data entry [32]. However, there may be a low willingness to automate logistics systems due to resistance to change and cost barriers [32].

One could suggest an IoT-based framework for an organization, arguing that real-time tracking could optimize supply chains but will require a significant infrastructure investment [33]. Although SMEs often struggle with ERP implementation due to cost and complexity, it must be seen as an investment since the immediate results are inventory and scheduling optimization and support for decision making [34], but the consequence is a reduction in logistics costs [35,36], one of the main indicators to be used in the management of logistics systems and which should also be included in the payback analysis.

- Team training

A consistent finding across ERP research is the importance of training and user adoption for successful implementation. In New Zealand, 42.7% of training effectiveness was explained by three key factors: mastery goal orientation, computer self-efficacy, and motivation [37]. However, training approaches must be adapted to the different organizational contexts, focusing on structured training [37] and facing the challenges in supplier relationship integration [38] to obtain the best improvements that ERP adoption can benefit organizations with in its inventory management. It suggests that specific training may be necessary to address unique operational hurdles.

Technologies are essential for developing responsive and adaptive logistics strategies capable of delivering substantial environmental and socioeconomic benefits. Consequently, the literature also underscores the importance of adopting data-driven approaches and AI technologies to refine organizational logistics practices. It also highlights aspects that influence the decision-making process on the ERP adoption strategy. Therefore, research on implementing these systems must have an approach that considers human/user, business, and technology issues.

3. Methodological Approach

The case study approach was adopted as the core of our research, with observation and analysis as its essential tasks, centered on a descriptive process of the research problem, using both qualitative and quantitative approaches. A case study is an empirical research approach that investigates a particular, generally contemporary phenomenon within a real-life context. Furthermore, it is also applied when the boundaries between the phenomenon and the socio-technical environment in which it is inserted are not so clearly defined and when one wants to extract from “practice” the “influence factors” that determine the behavior of the system under study [39]. They can be classified according to their content and final objective (exploratory, explanatory, or descriptive) or the number of cases (single case—holistic or incorporated—or multiple cases—also categorized into holistic or embedded) [40,41].

The case study was selected as the research method because it allows an in-depth investigation of a particular phenomenon within its real-life context, essential when the boundaries between the phenomenon and the socio-technical environment are not clearly defined [42]. This method is particularly suitable for exploring the integration of new technologies in companies as it enables the extraction of practical insights and influence factors that determine the target system’s behavior. Moreover, the case study facilitates a comprehensive understanding of the decision-making processes, implementation strategies, and the results achieved.

The central goal in all case studies is to clarify why a decision or a set of decisions were made, how they were implemented, and what results were achieved [40]. Another aspect related to the applied methodological approach is that it starts qualitatively, covering documental analysis and the application of interviews and questionnaires to collect qualitative data about the explored topic in the case study [43,44].

However, relevant indicators related to logistics were quantitatively evaluated: stock-keeping unit (SKU) accuracy, on-time delivery (OTD), on-time in full (OTIF), and logistics costs. Monthly data were provided to analyze the related metrics, allowing the creation of graphs showing the evolution of the indicators and the trend.

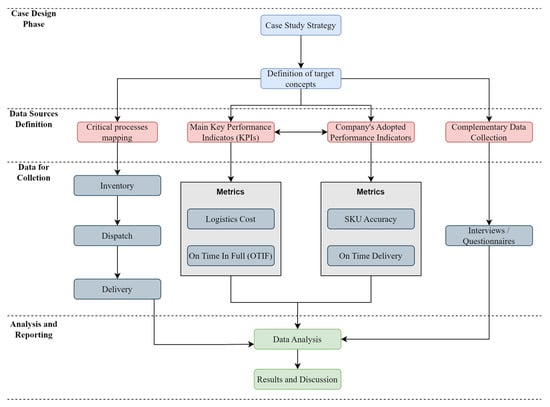

The research application was conducted in a food distributor based in the municipality of Arapiraca in the central west region (Agreste) of Alagoas state, Brazil. The proposal was to observe and analyze the critical success factors considered relevant for integrated logistics management and responsible for a process of change in managing the company’s operations. It was also observed how the implementation of ERP impacted this context, implying changes in performance indicators according to the experience of the company in question during the period in which the surveys were conducted and the results were qualitatively analyzed. Figure 1 represents the design adopted for the case study.

Figure 1.

Case study design.

Our research plan considered the following issues:

- Searching the supporting literature on critical success factors (CSF) in integrated logistics management to use these factors in the case study.

- Mapping of critical processes for planning and control using an ERP.

- Identification and analysis of key performance indicators affected by the logistics integration process through the ERP.

- Collection of supplementary data through interviews (within the company) for analysis and discussion of results.

Regarding items c and d, the following tasks were also performed:

- -

- Surveying and cataloging documents from the sectors involved with logistics processes in the study company.

- -

- Definition, planning, and application of questionnaires and interviews to employees participating in the study.

- -

- Surveying and cataloging the processes and databases of the corporate systems targeted by the study.

When collecting the complementary data from the interviews, the process considered five interviewees within the company: the logistics manager, the logistics supervisor, the former transport supervisor, the current transport supervisor, and the process supervisor. The selection criterion for these interviewees was their performance at a management or supervisory level, dealing with processes associated with logistics through the implemented system.

The interviews with these managers/supervisors were conducted to gather opinions from people who are at the forefront, that is, leading organizational processes and activities related to logistics, so that an initial impression of the new system’s impact could be obtained. This procedure within the research was important to enable the extraction of some complementary information, supporting the understanding of what can be analyzed objectively, for example, in terms of metrics that can be extracted from documents and from the system itself.

Appendix A of this article presents the questions raised throughout the interviews. The instrument’s construction was based on elements presented by Morgan et al. [24]. However, the necessary adaptation was made to ensure the fluidity of the interviews, mainly so that the information collected had the character of the opinion of the interviewed professionals, becoming qualitative. For this purpose, the premises of the work of Voss et al. [41] were adopted to construct case studies.

Trend Analysis

For the part of the case study where it was possible to collect some quantitative data, an approach was adopted to observe the evolution of the associated indicators (SKU accuracy, on-time delivery, and on-time in full) with the determination of the associated trend lines.

To plot the trend lines, a Python (version3.9.12) code was generated that received the months and the metrics associated with these months for each indicator, defining the trend based on the polyfit(x, y, deg) function from the NumPy library dedicated to numerical analysis [45]. This function returns an array z that contains the coefficients of the polynomial from largest to smallest where, on a straight line—corresponding to degree (1), there will be z [0] as the slope and z [1] as the linear coefficient. In other words, the polyfit function, using the provided parameters, finds the equation for the trend line. Mathematically, the polyfit function is defined in (1):

where the sum represents a quadratic error that must be minimized; yi is the value associated with the indicator in question at point i, that is, a specific month; xi is an index that represents a month in the indicated sequence of months; the an are the coefficients of the polynomial in degree n.

An analysis of related values and percentages was presented for the metrics associated with logistics costs; however, the trend analysis used for the previous indicators was not used since the information for this variable is on an annual basis, and it does not provide enough data to apply regression models.

4. Results and Discussion

The research findings will be presented and discussed based on the methodological process described previously for designing the case studies.

4.1. Company Overview

The distributor in this case study is headquartered in Arapiraca, in Alagoas. It serves many customers, from small grocery stores to regional supermarkets. Its operations began in the 1980s as a small local business, primarily in counter sales. The company’s establishment results from the ambition and entrepreneurial spirit of the founder, who was already involved in regional sales. Within its commercial portfolio, the main products offered by the enterprise were distilled alcoholic beverages produced from sugarcane, which were sourced from a small town near the capital of Pernambuco.

As the company grew, it moved beyond counter sales and established a central point in Arapiraca to store goods, gradually venturing into logistics due to the strategic location of this municipality in the state’s highway network. Its focus shifted to distributing food, distilled beverages, hygiene products, and cleaning items. Currently, the company has its headquarters in the Alagoas Hinterland, serving the entire state through its fleet and associated vehicles. Additionally, it operates a branch in the capital of Sergipe. The organizational structure employs hundreds of employees and has two owner partners. Having already established a strong regional presence, the company collaborates with partners and suppliers recognized nationally and internationally. Over decades of existence, it has evolved, professionalizing its structure and developing the capability to execute projects, map processes, and engage in strategic planning on a biennial basis.

4.2. Company’s Logistics Process

The logistics organizational chart consists of an operations director, a logistics manager, three supervisors (two for logistics—one for Alagoas and one for Sergipe—and one transportation supervisor who serves both branches). Below the supervisory level, the employees responsible for operations include eight administrative assistants, five receiving and dispatch supervisors, and two transportation supervisors. The remaining staff of eighty-two includes warehouse checkers, forklift operators, warehouse personnel, drivers, driver assistants, tracking assistants, and general services support.

At first, the company’s value chain consisted of 53 processes: 26 were management processes, 20 were support processes, and 7 were end processes. However, there was an organizational understanding through the investigation of the company’s business processes that streamlined these processes, which was necessary, resulting in 36 processes: 10 were management processes, 18 were support processes, and 8 were end processes.

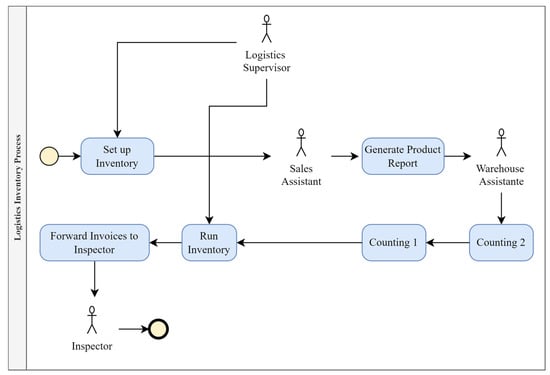

One of the key processes within the supply chain directly related to logistics is conducting stock (see Figure 2). Stocks provide critical information for the sector’s operations and are the data sources for analyzing indicators, such as stock accuracy.

Figure 2.

Logistics Stock Process.

As the process evolved, it involved more active participants to enhance control and reduce risks until completion. Initially, it consisted of three roles: logistics supervisor, billing assistant, and checker. With process evolution came changes and expansion. Now, it includes a logistics supervisor, a billing assistant, and two checkers and concludes with a fiscal analyst. The sequence shifted from starting with the logistics supervisor to beginning with the supervisor, who plans and organizes the stock using an ERP system. Next, the billing assistant generates reports based on the items specified by the supervisor through the system.

Two checkers perform necessary counts and recounts, and finally, the fiscal analyst analyzes and validates the data. This meticulous and well-aligned stock process ensures that the stock accuracy indicator reflects real and accurate data, aiding managers in decision-making. These insights are derived from the company’s internal records and the attached process map.

The dispatch process has evolved, initially involving six roles (billing assistant, finance, checker, warehouse personnel, driver, and distribution coordinator). It maintains the same number of actors but from different sectors and functions. These include an administrative logistics assistant, dispatch supervisor, driver, warehouse personnel, checker, and tracking assistant.

Leveraging the ERP system, the administrative logistics assistant accesses specific routines to verify orders, assemble loads, and assign drivers. Subsequently, the dispatch supervisor shares reports with the warehouse personnel and instructs the driver to position vehicles at the docks.

Before effectively loading the trucks, the checker examines all the items that will be loaded, and finally, the tracking assistant provides the cargo documents to the associated drivers. The dispatch process plays a crucial role in the OTIF indicator because, from dispatch, orders either leave complete or with some missing items, whether due to checking errors or stock shortages. This represents part of the indicator related to the order’s status—full or not. The distribution process initially involved four distinct actors: the driver, billing assistant, checker, and financial assistant.

However, with its evolution, it now relies on only two main actors: the driver and the helper. They assist in distributing and delivering goods through a structured and defined process. This directly impacts the on-time delivery performance indicator, which measures the elapsed time between order creation and completion upon delivery. Using a system integrated with the ERP system, which handles delivery management and routing, the elapsed time is measured, and reports are generated.

4.3. Adoption of Process Integration and ERP System

The implementation process of the current integrated logistics ERP system began in June 2018, with training and deployment lasting until December of the same year. In January of the following year (2019), the transition from the old system to the current one occurred, marking a significant milestone in the company’s integrated logistics management.

Processes were redesigned with the system’s change and subsequent integration across departments to meet their demands better. An office for projects and processes was established to maintain and assess process compliance for each sector, especially logistics. Over approximately six months before implementation, training sessions, tests, and meticulous planning were conducted to ensure a smooth transition without disrupting the company’s operations.

The change and integration process encompassed all company sectors, with leadership demonstrated by the information technology and projects/processes departments. Interviews and questionnaires conducted during the implementation process confirmed this. The “technology information” and “projects/processes” departments led this transformation, aligning digital transformation technologies with best practices in process-based management.

With the implementation of the integrated logistics ERP system, new equipment and technologies were acquired and deployed. These included GPS (satellite geolocation) for the entire fleet, fleet management systems, routing systems integrated with the ERP, and telematics systems to further measure all possible indicators across the fleet.

Integrated Logistics Management via ERP: Interviews Application Results

Following the integration of all departments facilitated by the ERP, improvements in the company’s indicators, communication, and task execution across sectors were reported. This information comes from a first interview (I1) conducted directly (face-to-face) with the logistics manager (LM), who has worked for the company for 4 years. Some relevant questions and answers are highlighted in the following. The first selected question (I1.Q1) from the interview is about the perception of the LM regarding the leading performance indicators:

I1.Q1. When discussing logistics management and integrated logistics, what are the main performance indicators that the company considers important?LM Answer: One of our main indicators is OTIF, which is on time in full. In addition to the logistical cost. So, there are these two indicators. It is an indicator that, in fact, we measure both the quality of our deliveries, how our service is, and also the whole part related to costs. Depending on the percentage of the logistics cost.

The second selected question (I1.Q2) is related to identifying CSF for logistics management:

I1.Q2. Still, in integrated logistics, what are the critical factors for management success, according to your experience?LM Answer: The main factor is communication between departments. Without effective communication, positive results are unlikely. Good relationships and clear communication are essential, especially between logistics and sales. Additionally, a motivated and well-trained team is crucial for meeting the company’s demands.

The following selected question (I1.Q3) was about ERP use in the company and its impact on improving internal processes:

I1.Q3. How did an ERP for company integration influence improving internal processes?LM Answer: Providing greater visibility with the numbers. A good ERP gives us confidence. Based on the numbers we extract from an ERP; we can perform various analyses and truly understand where we need to improve.

Another point asked to LM was about the impact of the ERP system on the monthly and annual results (I1.Q4):

I1.Q4. How did an ERP system with integrated logistics across various departments impact a company’s monthly and annual results?LM Answer: Well, when discussing this integrated system, as I mentioned earlier, a good integrated ERP system gives us a holistic view of everything happening. So, we can anticipate certain decisions by analyzing the system. For example, regarding the volume entering our base, we can extract various analyses and numbers to prepare and serve better. An integrated ERP system indeed provides data from all areas, allowing us to plan more effectively.

The following selected question (I1.Q5) was directed at the impact on the decision-making process:

I1.Q5. From a more specific perspective, how has ERP helped improve the internal decision-making process?LM Answer: A mature ERP system can map better processes and make them more mature and secure. Thus, with this ERP aspect, we can create new processes and make them more mature, ensuring that processes and activities are safer and more accurate.

The interview also concerned the LM perception of the related KPI (I1.Q6):

I1.Q6. Which main KPIs became possible to measure using the ERP system?LM Answer: As I mentioned, the two main indicators, among others, include evolution and mileage dispersion. Several metrics can be extracted from a system. However, the two primary ones I emphasize again relate to On-Time in Full (OTIF) performance and logistics costs. These two are the key indicators, but as I mentioned, there are various others, including stock-related metrics such as accuracy and external distribution considerations.

One last selected question (I1.Q7) in the interview process refers to the LM perspective about ERP implementation changes and opportunities brought to the company:

I1.Q7. Observing through a systemic vision, what are the main changes and opportunities that implementing the ERP brought to the company’s day-to-day operations?LM Answer: It is mainly about maturity and opportunities for us to design and carry out various processes. Based on the security that the system offers, we can do several things, including several processes. With a well-defined process area that is monitored, the company only tends to grow.

In summary, the strict line developed by the interview with LM demonstrated that the main CSFs, in his perception, are internal communications related to good relationships between the company’s departments and the motivation and training of the staff. The precepted improvements were related to bringing to evidence the numbers (or metrics) concerning the operations, giving confidence about the process’s execution by providing different analyses using the system and a holistic view of these processes. The main KPIs indicated by the LM are related to OTIF-related indicators, logistics costs, and stock and stock accuracy indicators.

With the integrated sectors working together, several process bottlenecks were resolved, such as stock shortages and products nearing expiration within the stock. This was reported during an asynchronous interview (I2) with the logistics supervisor (LS) (the questions were sent to him in a document, and the answers were returned in an audio record) and further confirmed through questionnaires sent to transportation, logistics, and process supervisors.

In the asynchronous interview (I2), the LS did not answer question-by-question as in the first interview but instead provided an audio recording about the whole management-related aspect. However, we could separate the same critical points related to the questions previously highlighted. He worked at the company for 7 years at the time of the interview (of these seven years, five were as a controller, and two were as a logistics supervisor).

The following excerpts are from his talk about the most general performance indicators and KPIs for Q1 and Q6.

I2.Q1. When discussing logistics management and integrated logistics, what are the main performance indicators that the company considers important?andI2.Q6. Which main KPIs became possible to measure using the ERP system?LS Answer:An ERP’s main function is precisely this information integration. Logistics’ main goal is precisely to deliver at the lowest possible cost, so our indicators are generally related to cost. It is like logistics costs are the main indicator for us; we do not reach a certain percentage [according to billing]. This is our main [performance indicator]. For stock, within stock quality, stock management, and loss control are the indicators that we look at most. If we move on to the distribution part, which is the transportation part. Then you have a cost per delivery. Cost per transportation. If you focus on quality, we will have the issue of on-time delivery. So, these are the main indicators that we have today, but all of them generally revolve around the cost part, which is the main indicator for us, which is the logistics cost.

When talking about the critical factors for the success of integrated management in logistics (regarding Q2), LS presented the following arguments:

I2.Q2. Still, in integrated logistics, what are the critical factors for management success, according to your experience?LS Answer: I believe the critical factor in any management is based on the tripod: people, processes, and technologies. You are keeping an eye on it all. These are the three points; I think they support any management and logical monitoring of the main indicators daily, right? But the main part is always focused on this tripod, people, that without people you cannot do anything. These are processes that you will organize your entire production chain, delivery chain, and technology, which will be able to support you. It even allows you to measure your indicators accurately and with much less work.

It was not possible to separate objectively the LS speech about the influence of ERP in company integration (Q3) and the decision-making process (Q5), as he developed his argumentation with an example in the sales force, as can be seen in the following:

I2.Q3. How did an ERP for company integration influence improving internal processes?andI2.Q5. From a more specific perspective, how has ERP helped improve the internal decision-making process?LS Answer: ERP has become essential for the size of operations we have today. We will directly integrate with sales because we can incorporate all the information. When we receive a product, it arrives from the factory in our warehouse, and we store it; it is already available to the entire sales force. This automatically means that the sales force has already sold it, the order is already in the system, and it is now available for logistics people to carry out the treatments. And all this financial part, sales, and returns, that is, everything is integrated. Everything is tied together from the beginning to the end, including the commercial, financial, and even the HR parts, so you can better manage people. So, in the end, you have a more correct cost, so by having an ERP, I can have all the information on all my operations, from all areas, in one place.

The speech related to the next selected question about the impact of the ERP system on the integrated logistics results (Q4) was in sequence to the previous answer:

I2.Q4. How did an ERP system with integrated logistics across various departments impact a company’s monthly and annual results?LS Answer: I believe that the main changes are related precisely to this increase in the advancement of technology. Information technology today is mainly based on e-commerce, and delivery is being demanded in less and less time, and logistics has a lot to adapt to this. If you must deliver in less time and with fewer costs, it must be cheap, fast delivery with the help of technology and good management. People have been successful, and those who are not are losing out in the market. However, the main advancement in logistics is technological assistance, which allows you to deliver faster and at a lower cost.[…]I believe that our most relevant result occurred in the last two years when, despite all the difficulties due to the pandemic and heavy rain, we managed to achieve our goals. We delivered on time, within the cost we expected, even below cost. ERP was fundamental to this. As we always mention here, you can direct resources much better if you have accurate information.

Finally, regarding the main changes and opportunities that the ERP brought to the company (Q7), the following excerpt with the main perception of these elements from the perspective of the LS is presented below:

I2.Q7. Observing through a systemic vision, what are the main changes and opportunities that implementing the ERP brought to the company’s day-to-day operations?LS Answer: I believe that the main change was concerning staff culture. Because today, everything must be there; everything must be measured. And I think our opportunity in the market is that our ERP accepts several tools. So, I believe that our main opportunities are that many tools can be integrated into the ERP, such as a WMS [Warehouse Management System], which is still missing, even for control with all topics, a BI [Business Intelligence] there so that we can do our analysis better. A powerful BI, then, in several opportunities in this sense of integration tools, which can improve and make our ERP much more robust.

To summarize other comments: the integration allowed real-time monitoring and visibility of low-stock products and those approaching expiration, aiding decision-making for new orders from suppliers and promotional campaigns to sell products with relatively close expiration dates; as the sectors integrated through the ERP system, operational results began to emerge, as indicated by the numbers in the performance indicators presented below, comparing different periods.

It is worth noting that there were other interviews with other agents within the company, seeking to corroborate the same elements already commented on according to the report of LM and LS as recorded above; however, for the sake of the length of the material, it was decided to choose these two agents and some of their comments for the presentation that was made.

4.4. Indicators Analysis

During the interviews, there was evidence through the participants’ perception that the company improved its operational performance by integrating its sectors. This resolved problems in the production process, such as a lack of products in stock and items about to expire. With the integration, it is possible to monitor in real-time which products have low quantities in stock and which are close to their expiration date. This information helps in decision making for new orders from suppliers and promotional campaigns focused on products close to the expiration date.

Next, the results of the leading indicators over the years during the analysis period will be presented. Some start with data from 2018 (the year the company changed systems and implemented the current ERP), others from 2019, and some improved or more in-depth from 2021.

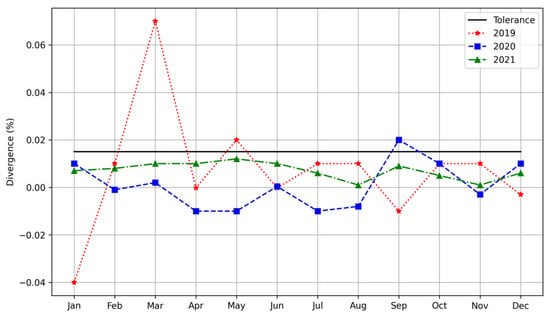

The stock value accuracy indicator focuses on the end of each stock, seeing the financial result, deducting shortages, and adding surpluses, with a tolerance of divergence of 0.015% (i.e., inventories have a target of 99.85% compliance and accuracy). Figure 3 contains the tolerance curve and the divergence in the metrics from 2019 to 2021.

Figure 3.

Divergence metrics regarding stock accuracy.

In 2019, March and May exceeded the tolerance limit of 0.015%. In 2020, the limit was only exceeded in September. In 2021, the stock complied with the defined limit. According to the company’s data for this issue of divergence, the ERP’s effect converged on what was identified from the interviews. The ERP’s effect brought better stock control in terms of accuracy.

Implementing the ERP system improved stock control and enhanced overall operational efficiency. By integrating involved departments and automating critical processes, the company achieved a more streamlined workflow, reducing the likelihood of errors and discrepancies. This integration facilitated real-time monitoring and visibility of stock levels, enabling proactive decision making and timely interventions [27]. Additionally, the ERP system provided valuable insights through comprehensive data analysis, allowing the company to identify trends, forecast demand, and reduce inventory costs [46,47]. As a result, the company experienced significant improvements in key performance indicators, such as SKU Accuracy, OTD, and OTIF, further demonstrating the positive impact of the ERP system on the company’s logistics and supply chain management.

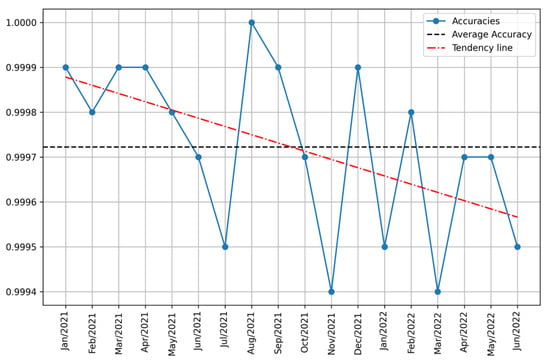

In 2021, the company began measuring inventory accuracy in SKU. This indicator brought corporate advantages, greater control over inventory, and gains to the company’s management, which, with greater inventory control, felt greater security when making decisions [48,49].

The previous graphs presented the numbers referring to the result of the inventory process (relating to the financial value) of the years covered by the study.

The company began inventorying its products in January 2021. Based on the results of the interviews with the supervisor and the logistics manager, there was a perception of an increase in stock/inventory control. Figure 4 presents the SKU monthly accuracies in 2021.

Figure 4.

SKU monthly accuracies (from January 2021 to July 2022).

The graph shows a slight downward trend in SKU accuracy in the analyzed period. However, the average accuracy recorded was 99.97%, indicating high precision in inventory management and control and better decision support, as shown in the interviews. Utilizing additional metrics beyond SKU accuracies provides a more comprehensive understanding of the company’s progress with the newly implemented practices.

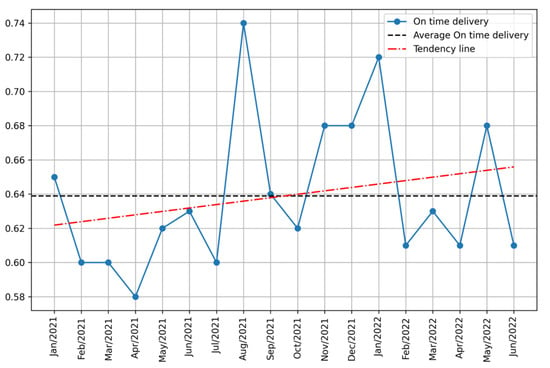

Figure 5 presents the on-time delivery (OTD) metrics beginning in January 2021. This metric represents the percentage of customer orders delivered on time and without delays [42]. This indicator began to be measured, analyzed, and monitored only in 2021. The company imposed a target of 62% of total orders within 48 h for all locations in the two states it serves.

Figure 5.

OTD monthly metrics (from January 2021 to July 2022).

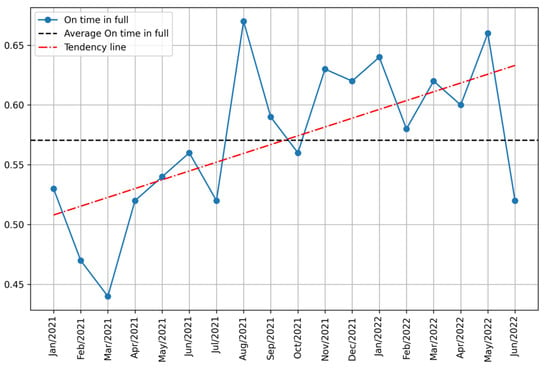

The graph shows a growth trend that was corroborated by the trendline, and the average OTD metric is 63.88%, indicating that for the measured period, the company kept above the defined target (62%). Another critical indicator that began to be measured in 2021 was on-time in full (OTIF), which, loosely translated, means the perfect order, delivered on time and completed by suppliers [50,51]. For this indicator, the company set a target of 55%. Figure 6 presents the data provided for the analyzed period.

Figure 6.

OTIF monthly metrics (2021).

Beginning in January 2021, the company achieved an average (on time in full (OTIF) performance of 57.05%, surpassing the established target of 55%. However, for both OTD and OTIF cases, it is noteworthy that the company still needs to consolidate its operational and management practices to improve these indicators. This perception at the management level led to the improvement shown in the trend line.

Table 2 presents the slopes of the trendlines for each set of metrics as presented in the previous graphs.

Table 2.

Slopes of trendlines for each set of metrics.

Finally, according to a survey conducted in July 2022 with managers/supervisors through interviews and questionnaires, the most critical indicator is logistics cost. Table 3 shows the evolution of logistics costs year by year from 2018 to 2022, where AMR is the average monthly revenue, AMOC is the average monthly operating cost, and %LC is the percentage of logistics cost.

Table 3.

Logistics costs evolution from 2018 to 2022.

According to these data, the variation in logistics costs between 2018 (the year before the ERP implementation) and the first half of 2022 is minus 31%, as presented in Table 4. In line with this, revenue increased by around 55%. The measures in the table are the revenue variation (RV) and the logistics cost variation (LCV), both in percentages.

Table 4.

Logistics costs year-on-year evolution percentages.

It is important to acknowledge that other factors beyond this study influenced the indicator results. However, the core impact stemmed from a shared cause: process improvements and implementing an ERP system that integrated company operations.

As indicated by their upward slopes, the positive trends in SKU Accuracy, OTD, and OTIF are consistent with the literature highlighting ERP systems’ role in improving supply chain responsiveness and customer service. However, it is important to highlight the need to constantly collect data associated with the operations involved to maintain a view of how these indicators behave and enable trend predictions. Studies by Nawaz and Channakeshavalu [52] and Sabnis et al. [53] underline the importance of ongoing monitoring and process refinement following ERP implementation to maintain inventory accuracy, which supports this observation.

Furthermore, the substantial reduction in logistics costs, a 31% decrease from 2018 to 2022, coupled with a 55% increase in revenue, signifies a notable improvement in operational efficiency. This aligns with the findings of Wu et al. [54], Awwad et al. [55], and Alzoubi and Yanamandra [56], which underscore the impact of IT capabilities, including ERP systems, on supply chain agility and related cost reduction. However, it is crucial to acknowledge the limitations of this study, particularly in isolating the ERP’s impact from other potential influencing factors. Future research should consider employing control groups or longitudinal studies to quantify the ERP’s contribution more accurately.

ERP systems can positively impact inventory control, delivery performance, and cost efficiency, but sustaining these benefits requires ongoing monitoring to keep processes running properly [57]. The company can refine its strategies and strengthen its operational excellence by integrating data analysis and related managerial insights.

5. Research Implications

Implementing an ERP system in a food distribution company in the countryside of Alagoas demonstrated how process integration can positively impact performance indicators. Department integration and the automation of critical processes improved internal communication and provided a holistic view of operations, allowing for more informed and strategic decision making.

Furthermore, adopting an ERP system revealed the importance of critical success factors (CSFs) in logistics management. Effective communication between departments, motivation, and team training were highlighted as essential elements for the success of integrated management. Combined with technology, these factors allowed for better logistics cost management and improved service quality. Measuring and analyzing performance indicators, such as OTIF and logistics costs, were fundamental for the company to achieve its objectives, even in challenging scenarios such as the pandemic and adverse weather conditions.

The digital transformation driven by the implementation of ERP brought significant cultural changes within the company. The need to measure and monitor all processes in real-time created a culture of accuracy and efficiency. The integration of additional tools, such as warehouse management systems (WMS) and business intelligence (BI), further enhanced the robustness of the ERP, offering new opportunities for continuous improvement and corporate growth. These theoretical implications highlight the importance of technology and integrated management for the competitiveness and sustainability of companies in the current market.

The interviews with the company’s employees revealed several important implications for integrated logistics management through an ERP system. Firstly, implementing the ERP brought greater visibility and confidence in the company’s numbers and performance indicators. The logistics manager (LM) highlighted that the ERP allowed for measuring crucial indicators such as OTIF and logistics costs, providing a holistic view of operations and facilitating informed decision making. Integrating departments through the ERP also improved internal communication, which was considered a critical factor for the success of logistics management. Effective communication between the logistics and sales departments and a motivated and well-trained team was essential to achieve positive results.

Furthermore, the logistics supervisor (LS) emphasized that the information integration provided by the ERP was fundamental for operational efficiency. He mentioned that integrating all information, from product reception to distribution, allowed for more accurate and efficient logistics costs and process management. The implementation of the ERP also brought significant technological advances, such as the use of routing systems and telemetry, which helped the company adapt to the demands of fast and low-cost deliveries. In summary, the interviews highlighted that the digital transformation driven by ERP improved the accuracy and efficiency of processes and created new opportunities for the company’s growth and competitiveness.

While the case study highlights the positive impact of the implementation of ERP on a set of performance indicators, it is important to acknowledge the limitations and challenges faced during the process:

One significant challenge was initial resistance from employees accustomed to the old system and hesitant to adapt to the new ERP system. This resistance was primarily due to the fear of change and the perceived complexity of the new system. The company invested in extensive training sessions and workshops to familiarize employees with the ERP system and its benefits. Despite these efforts, some employees struggled with the transition, leading to temporary disruptions in workflow and productivity.

Additionally, integrating the ERP system required substantial financial investment, which posed a challenge for the company, especially in the initial stages. The costs associated with purchasing new equipment, software licenses, and hiring external consultants for implementation were significant. This financial burden was further exacerbated by the need for ongoing maintenance and updates to ensure the system’s optimal performance.

Another limitation encountered during the ERP implementation was the complexity of data migration from the old system to the new ERP system. The process of transferring large volumes of data, including historical records and real-time information, was time-consuming and prone to errors. Data inconsistencies and inaccuracies were identified during the migration, necessitating additional efforts to rectify these issues.

Furthermore, the ERP system’s integration with existing processes and departments required meticulous planning and coordination. The company had to redesign several processes to align with the ERP system’s functionalities, which involved significant time and resources. This complexity was compounded by the need to ensure seamless communication and collaboration between different departments, which was essential for the ERP system’s success.

Challenges

As could be inferred by the results of this case study, implementing ERP systems for logistics and supply chain operations is challenging. Organizations face hurdles like integration with existing infrastructure, steep learning curves, and significant initial investments. Transitioning requires meticulous planning and changing management and organizational culture to ensure smooth adaptation. These complexities can overshadow benefits, so companies need a comprehensive strategy and awareness of potential obstacles.

A significant challenge is the lack of real-time visibility and coordination across the supply chain [17,22]. Traditional logistics models frequently use fragmented systems, resulting in information silos. Integrated, real-time software applications designed to support complex business processes, information flow, and analytics, enable the development of information-based products and services, facilitate organizational and inter-organizational relationship building through process optimization, and present assimilation challenges due to their inherent complexity [17]. ERP systems offer a single source of truth by integrating separate functional areas like procurement, production, and distribution into a unified platform [18]. This enables real-time tracking of inventory levels, order statuses, and delivery schedules, facilitating proactive decision making and improved responsiveness [20].

Inefficient stock control and warehouse management can lead to errors and delays. ERP systems automate and integrate all processes, which depend on inventory tracking, providing accurate information on stock levels and movements and stock reserves and supporting advanced warehouse management functions like automated picking and packing, optimized storage layouts, and real-time tracking [19,58]. This reduces manual effort, minimizes uncertainty and errors, and improves efficiency, leading to lower costs and faster order fulfillment [52,56]. ERP modules optimize delivery routes considering distance, traffic, and windows, ensuring timely deliveries and cost management [27]. They provide real-time shipment tracking for better visibility and proactive issue management. ERP integration with third-party logistics providers also enhances collaboration and reduces transportation cost.

Demand forecasting and planning can be a complex task. Accurate demand forecasting is necessary for matching supply with demand and preventing inventory imbalances [21]. Traditional forecasting methods often depend on historical data and may not include real-time market insights to support related decision making [23]. ERP systems can enhance demand forecasting accuracy with integrated data and advanced analytics capabilities. They analyze historical sales data, market trends, and customer behavior to produce more accurate forecasts, also considering the context of large data volumes, such as in Big Data [24]. This allows companies to plan production and procurement more efficiently, reducing inventory holding costs and improving customer service.

Considering the challenges presented above, it can be concluded that effectively managing complex supply chains requires visibility and coordination across the network. ERP systems offer integrated data, enabling comprehensive oversight of supply chain activities. This integration enhances collaboration and communication among people, reduces lead times, and increases resilience, ultimately leading to a more efficient and responsive supply chain.

6. Conclusions

This work presented a case study on integrated logistics through an ERP system in a wholesale distribution company in the countryside of Alagoas state (Brazil). The case study revealed that between 2018 and 2020, the company changed its process management, which also led to a shift in the integration and management platform for its corporate resources and functional units.

The study allowed field research, focusing on the logistics sector of the company, its key processes, and indicators. Considering contemporary supply chain and logistics management practices, these were examined and critically evaluated. It aims to prospect for and analyze aspects of the supply chain, primarily by considering a qualitative approach. Given that sociotechnical systems involve direct interaction among people, processes, and technologies, suitable qualitative instruments are necessary. These instruments allow us to explore and describe models of reality, considering not only technical factors but also sociotechnical factors that significantly impact decision-making processes. Only then can other factors and their variations be better explored and modeled.

Implementing the ERP system improved decision-making processes, enhanced communication between departments, and better logistics cost management. The study highlighted the importance of critical success factors such as effective communication, motivation, and team training in achieving positive results. Integrating departments through the ERP system provided a holistic view of operations, allowing for more informed and strategic decision-making. The study also demonstrated the impact of digital transformation on the company’s logistics activities, with notable improvements in key performance indicators such as OTIF and logistics costs.

6.1. Research Limitations

The main limitations of the study were: (i) access to more company data, in addition to the fact that when data collection was carried out, there were tabulated data only for the first half of 2022; (ii) the limitation related to the geographic space and number of companies, as the study was applied in just one company and a specific city; (iii) the need for more in-depth statistical analyses of the data to enable understanding whether the changes that occurred were statistically significant.

The method defined for the implementation of the ERP was through the evaluation of the trend of the indicators used, using the minimization of the quadratic error according to Equation (1). Therefore, there was no evaluation formally comparing the before and after implementation of the system. As an indication of future work/continuity of the research, the need for a study that formalizes this comparative analysis is indicated, including seeking more data within the company, to verify the consolidation of the impacts brought about by the implementation of the new system, especially in the logistics area. This will also be possible to overcome limitations (i) and (ii).

6.2. Future Extensions

This work is understood not as a definitive contribution but as a starting point for prospecting, analyzing, and studying the improvement and integration of logistics processes within the company studied. Furthermore, as future directions and research perspectives, it is suggested that other elements of the company’s production process could be collected and analyzed. A detailed analysis based on modeling and simulating logistics processes could also be conducted using quantitative approaches. The goal would be to intervene and further optimize these processes from the perspective of decision makers and process-oriented management, focusing on customer development. In-depth statistical analyses considering a more extensive and complete data set also indicate future direction. They consider ensuring the robustness of the analysis as a whole and verifying whether there have been significant changes, year after year or semester after semester, based on the implementation of the ERP. Another direction to be considered is the incorporation of elements from the external environment to the organization, such as market conditions or regulatory changes, seeking to verify how they impact organizational activities, especially taking into account the company’s new operating mode with the implemented system.

Author Contributions

Conceptualization, J.G.F.C. and R.J.R.d.S.; methodology, J.G.F.C.; software, J.G.F.C.; validation, R.J.R.d.S., T.L.d.B., V.D.H.d.C. and M.B.d.S.M.; formal analysis, J.G.F.C.; investigation, J.G.F.C.; resources, R.J.R.d.S.; data curation, J.G.F.C.; writing—original draft preparation, V.D.H.d.C., R.J.R.d.S. and M.B.d.S.M.; writing—review and editing, V.D.H.d.C., R.J.R.d.S., T.L.d.B. and M.B.d.S.M.; visualization, J.G.F.C.; supervision, R.J.R.d.S.; project administration, J.G.F.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Research data and scripts are available in the following GitHub repository: https://github.com/victorheuer/logistics_indicators (assessed on 26 March 2025).

Acknowledgments

During the preparation of this work, the authors used Microsoft Copilot for Word in Microsoft 365, Google’s Gemini Advanced 1.5 Pro, and Grammarly to translate and edit the text. After using these tools, the authors reviewed and edited the content as needed and take full responsibility for the content of the published article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

The following is the complete list of questions asked in the interviews. The questions in bold were those selected to be reported in the article.

- What is your position, and how long have you been with the company?

- What functions do you or did you perform in the company?

- What main modules do you access in the corporate ERP?

- In your opinion, what is the company’s main challenge?

- When discussing logistics management and integrated logistics, what are the main performance indicators that the company considers important?

- Still, in integrated logistics, what are the critical factors for management success, according to your experience?

- Based on everything you have experienced in the company’s daily life, what is your perception of the development of logistics over the years, considering the changes that the area has been undergoing?

- How did an ERP for company integration influence improving internal processes?

- Now, based on process maps over the last few years, is it possible to notice any company organization changes in terms of people, processes, technologies, infrastructure, and business culture? Which ones can be highlighted?

- How did an ERP system with integrated logistics across various departments impact a company’s monthly and annual results?

- From a more specific perspective, how has ERP helped improve the internal decision-making process?

- Which main KPIs became possible to measure using the ERP system?

- What are the strengths and weaknesses of ERP concerning the current needs of the company?

- Compared to the previous situation, what is the biggest existing bottleneck that the integrated logistics through ERP managed to solve before the ERP implementation?

- During the ERP implementation, what challenges were faced by the team, and how were they overcome?

- Observing through a systemic vision, what are the main changes and opportunities that implementing the ERP brought to the company’s day-to-day operations?

- Finally, which, among all the results obtained, is the most relevant and why?

References

- Chowdhury, M.M.H.; Quaddus, M. Supply Chain Resilience: Conceptualization and Scale Development Using Dynamic Capability Theory. Int. J. Prod. Econ. 2017, 188, 185–204. [Google Scholar] [CrossRef]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining Supply Chain Management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of Intertwined Supply Networks: Extending the Supply Chain Resilience Angles towards Survivability. A Position Paper Motivated by COVID-19 Outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Rossini, M.; Powell, D.J.; Kundu, K. Lean Supply Chain Management and Industry 4.0: A Systematic Literature Review. Int. J. Lean Six Sigma 2023, 14, 253–276. [Google Scholar] [CrossRef]

- Daneshvar Kakhki, M.; Gargeya, V.B. Information Systems for Supply Chain Management: A Systematic Literature Analysis. Int. J. Prod. Res. 2019, 57, 5318–5339. [Google Scholar] [CrossRef]

- Poleto, T.; de Carvalho, V.D.H.; da Silva, A.L.B.; Clemente, T.R.N.; Silva, M.M.; de Gusmão, A.P.H.; Costa, A.P.C.S.; Nepomuceno, T.C.C. Fuzzy Cognitive Scenario Mapping for Causes of Cybersecurity in Telehealth Services. Healthcare 2021, 9, 1504. [Google Scholar] [CrossRef]

- Starostka-Patyk, M. The Use of Information Systems to Support the Management of Reverse Logistics Processes. Procedia Comput. Sci. 2021, 192, 2586–2595. [Google Scholar] [CrossRef]

- Zdravković, M.; Panetto, H.; Weichhart, G. AI-Enabled Enterprise Information Systems for Manufacturing. Enterp. Inf. Syst. 2022, 16, 668–720. [Google Scholar] [CrossRef]

- Silva, L.C.; Poleto, T.; de Carvalho, V.D.H.; Costa, A.P.C.S. Selection of a Business Process Management System: An Analysis Based on a Multicriteria Problem. In Proceedings of the 2014 IEEE International Conference on Systems, Man, and Cybernetics (SMC), San Diego, CA, USA, 5–8 October 2014; Volume 2014, pp. 295–299. [Google Scholar]

- Ashik Sheik, P.; Sulphey, M.M. Enterprise Resource Planning (ERP) As a Potential Tool for Organizational Effectiveness. Webology 2020, 17, 317–327. [Google Scholar] [CrossRef]

- Moreira, S.; Mamede, H.S.; Santos, A. Business Process Automation in SMEs: A Systematic Literature Review. IEEE Access 2024, 12, 75832–75864. [Google Scholar] [CrossRef]

- Zongyuan, L.; Haiyan, H. The Impact of ERP Assimilation on Mass Customization Capability: A Dynamic Capabilities View. IEEE Access 2024, 12, 36778–36792. [Google Scholar] [CrossRef]

- Malik, M.O.; Khan, N. Analysis of ERP Implementation to Develop a Strategy for Its Success in Developing Countries. Prod. Plan. Control 2020, 32, 1020–1035. [Google Scholar] [CrossRef]

- Aboelmaged, M.G. An Empirical Analysis of ERP Implementation in a Developing Country: Toward a Generic Framework. Int. J. Enterp. Netw. Manag. 2009, 3, 309–331. [Google Scholar] [CrossRef]

- Huang, Z.; Palvia, P. ERP Implementation Issues in Advanced and Developing Countries. Bus. Process Manag. J. 2001, 7, 276–284. [Google Scholar] [CrossRef]

- Egdair, I.; Hachicha, M.; Sameda, A.A.; Rajemi, M.F. Enterprise Resource Planning Adoption and Organizational Performance: An Investigated Study in Libyan Public Organizations Using Structural Equation Modeling. Open J. Bus. Manag. 2024, 12, 2927–2948. [Google Scholar] [CrossRef]

- Seethamraju, R.; Krishna Sundar, D. Influence of ERP Systems on Business Process Agility. IIMB Manag. Rev. 2013, 25, 137–149. [Google Scholar] [CrossRef]

- Abd Elmonem, M.A.; Nasr, E.S.; Geith, M.H. Benefits and Challenges of Cloud ERP Systems–A Systematic Literature Review. Futur. Comput. Informatics J. 2016, 1, 1–9. [Google Scholar] [CrossRef]

- Syreyshchikova, N.V.; Pimenov, D.Y.; Mikolajczyk, T.; Moldovan, L. Automation of Production Activities of an Industrial Enterprise Based on the ERP System. Procedia Manuf. 2020, 46, 525–532. [Google Scholar] [CrossRef]

- Ali, S.S.; Kaur, R. Exploring the Impact of Technology 4.0 Driven Practice on Warehousing Performance: A Hybrid Approach. Mathematics 2022, 10, 1252. [Google Scholar] [CrossRef]

- Costantino, F.; Di Gravio, G.; Shaban, A.; Tronci, M. A Real-Time SPC Inventory Replenishment System to Improve Supply Chain Performances. Expert Syst. Appl. 2015, 42, 1665–1683. [Google Scholar] [CrossRef]

- Wulan, T.S.; Novika, P.W.; Nurvianti, E.; Putra, F.A. Impact of ERP System Implementation on Operational and Financial Efficiency in Manufacturing Industry. J. Econ. Educ. Entrep. Stud. 2024, 5, 491–501. [Google Scholar] [CrossRef]

- Gutierrez-Franco, E.; Mejia-Argueta, C.; Rabelo, L. Data-Driven Methodology to Support Long-Lasting Logistics and Decision Making for Urban Last-Mile Operations. Sustainability 2021, 13, 6230. [Google Scholar] [CrossRef]

- Ivanov, D.; Tang, C.S.; Dolgui, A.; Battini, D.; Das, A. Researchers’ Perspectives on Industry 4.0: Multi-Disciplinary Analysis and Opportunities for Operations Management. Int. J. Prod. Res. 2021, 59, 2055–2078. [Google Scholar] [CrossRef]

- Batz, A.; D’Croz-Barón, D.F.; Vega Pérez, C.J.; Ojeda-Sanchez, C.A. Integrating Machine Learning into Business and Management in the Age of Artificial Intelligence. Humanit. Soc. Sci. Commun. 2025, 12, 352. [Google Scholar] [CrossRef]

- Lázár, E.; Madaras, S. ERP adoption of SMEs in Romania: An IT innovation step or a business transactional necessity? Acta Oeconomica 2024, 74, 557–574. [Google Scholar] [CrossRef]

- Stefanov, T.; Varbanova, S.; Stefanova, M.; Hasanov, E. The Role of the Warehousing Module in the Building of a Modern Enterprise Resource Planning System. TEM J. Technol. Educ. Manag. Inform. 2023, 12, 2013–2022. [Google Scholar] [CrossRef]

- Molina-Castillo, F.J.; Rodríguez, R.; López-Nicolas, C.; Bouwman, H. The role of ERP in business model innovation: Impetus or impediment. Digit. Bus. 2022, 2, 100024. [Google Scholar] [CrossRef]

- Rahman, N.S.F.A.; Karim, N.H.; Hanafiah, R.M.; Hamid, S.A.; Mohammed, A. Decision analysis of warehouse productivity performance indicators to enhance logistics operational efficiency. Int. J. Product. Perform. Manag. 2023, 72, 962–985. [Google Scholar] [CrossRef]

- Quliyev, V.M.; Abbasova, S.A.; Aliyeva, M.S.; Samedova, E.R.; Mammadova, M.A. Analysis of corporate management risks in the work of logistics enterprises. Acta Logist. 2024, 11, 67–77. [Google Scholar] [CrossRef]

- Sislian, L.; Jaegler, A. Linkage of blockchain to enterprise resource planning systems for improving sustainable performance. Bus. Strategy Environ. 2022, 31, 737–750. [Google Scholar] [CrossRef]

- Carlan, V.; Vanelslander, T. Economic Aspects of Introducing Artificial Intelligence Solutions in Logistics and Port Sectors: The Data Entry Case. Front. Future Transp. 2021, 2, 710330. [Google Scholar] [CrossRef]

- Younis, H.; Shbikat, N.; Bwaliez, O.M.; Hazaimeh, I.; Sundarakani, B. An overarching framework for the successful adoption of IoT in supply chains. Benchmarking Int. J. 2025. [Google Scholar] [CrossRef]

- Pekarcikova, M.; Trebuna, P.; Kliment, M.; Kronova, J.; Dic, M. Master Production Schedule in the Consumer Product Goods Industry: Benefits of APS Applications. Appl. Sci. 2025, 15, 1642. [Google Scholar] [CrossRef]

- Teerasoponpong, S.; Sopadang, A. A simulation-optimization approach for adaptive manufacturing capacity planning in small and medium-sized enterprises. Expert Syst. Appl. 2021, 168, 114451. [Google Scholar] [CrossRef]

- Teerasoponpong, S.; Sopadang, A. Decision support system for adaptive sourcing and inventory management in small- and medium-sized enterprises. Robot. Comput.-Integr. Manuf. 2022, 73, 102226. [Google Scholar] [CrossRef]

- Arasanmi, C.N.; Ojo, A.O. Investigating the motivational antecedents of training transfer at the post-implementation phase of enterprise systems. Glob. Knowl. Mem. Commun. 2023, 72, 327–340. [Google Scholar] [CrossRef]

- Kapetanopoulou, P.; Kouroutzi, A.; Anastasiadou, S. The Impact of Information Systems Implementation in the Greek Manufacturing Enterprises. Appl. Sci. 2021, 11, 11781. [Google Scholar] [CrossRef]

- Johansson, R. On Case Study Methodology. Open House Int. 2007, 32, 48–54. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Voss, C.; Tsikriktsis, N.; Frohlich, M. Case Research in Operations Management. Int. J. Oper. Prod. Manag. 2002, 22, 195–219. [Google Scholar] [CrossRef]

- Baxter, P.; Jack, S. Qualitative Case Study Methodology: Study Design and Implementation for Novice Researchers. Qual. Rep. 2015, 13, 544–559. [Google Scholar] [CrossRef]

- Isensee, C.; Teuteberg, F.; Griese, K.M. Exploring the Use of Mobile Apps for Fostering Sustainability-Oriented Corporate Culture: A Qualitative Analysis. Sustainability 2022, 14, 7380. [Google Scholar] [CrossRef]

- Marriam, S.B. Qualitative Research: A Guide to Design and Implementation; Jossey-Bass: San Francisco, CA, USA, 2009; ISBN 978-0-470-28354-7. [Google Scholar]

- Harris, C.R.; Millman, K.J.; van der Walt, S.J.; Gommers, R.; Virtanen, P.; Cournapeau, D.; Wieser, E.; Taylor, J.; Berg, S.; Smith, N.J.; et al. Array Programming with NumPy. Nature 2020, 585, 357–362. [Google Scholar] [CrossRef] [PubMed]

- Muthuswamy, V.V.; Hu, Y. Enhancing Supply Chain Resilience And Performance: Leveraging Predictive Analytics And Erps In Vendor Selection. Int. J. Constr. Supply Chain Manag. 2023, 13, 112–133. [Google Scholar]

- Reyes, E.G.A.; Ong, A.K.S.; Andrada, M.F.; Diaz, J.F.T.; Gumasing, M.J.J. Examining Factors Influencing the Adoption of Enterprise Resource Planning Systems in Secondary Healthcare Institutions. J. Health Organ. Manag. 2025. [Google Scholar] [CrossRef]

- Trapero, J.R.; Fildes, R.; Davydenko, A. Nonlinear Identification of Judgmental Forecasts Effects at SKU Level. J. Forecast. 2011, 30, 490–508. [Google Scholar] [CrossRef]

- Wakle, S.P.; Toshniwal, V.P.; Jain, R.; Soni, G.; Ramtiyal, B. A Data-Driven Approach for Planning Stock Keeping Unit (SKU) in a Steel Supply Chain. Int. J. Math. Eng. Manag. Sci. 2024, 9, 283–304. [Google Scholar] [CrossRef]

- Raaymann, S.; Spinler, S. Working Paper: Measuring Supply Chain Resilience along the Automotive Value Chain—A Comparative Research on Literature and Industry. Transp. Res. Part E 2023, 192, 103792. [Google Scholar] [CrossRef]

- Tian, Z.; Pajić, V.; Kilibarda, M.; Andrejić, M. Enhancing Distribution Efficiency Through OTIF Performance Evaluation. Mathematics 2024, 12, 3372. [Google Scholar] [CrossRef]

- Nawaz, N.; Channakeshavalu, K. The Impact of Enterprise Resource Planning (ERP) Systems Implementation on Business Performance. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Sabnis, N.V.; Sagare, P.M.; Khan, A.S.; Khan, R. Case Study of Inventory Management Using ERP System. Int. J. Res. Eng. Sci. 2022, 10, 15–18. [Google Scholar]

- Wu, F.; Yeniyurt, S.; Kim, D.; Cavusgil, S.T. The Impact of Information Technology on Supply Chain Capabilities and Firm Performance: A Resource-Based View. Ind. Mark. Manag. 2006, 35, 493–504. [Google Scholar] [CrossRef]

- Awwad, A.S.; Ababneh, O.M.A.; Karasneh, M. The Mediating Impact of IT Capabilities on the Association between Dynamic Capabilities and Organizational Agility: The Case of the Jordanian IT Sector. Glob. J. Flex. Syst. Manag. 2022, 23, 315–330. [Google Scholar] [CrossRef] [PubMed]