Willingness-to-Pay for Produce: A Meta-Regression Analysis Comparing the Stated Preferences of Producers and Consumers

Abstract

:1. Introduction

1.1. Willingness-to-Pay

- As a dollar value, e.g., Yue et al. [8] found that U.S. apple growers would be willing to pay $0.16/lb to improve apple size from less than to larger than 2.9 inches.

- As a percentage premium, e.g., Onozaka et al. [18] found that consumers in Northern California were willing to pay a 15 percent price premium for bananas labeled “pesticide free’’ compared to bananas without the label.

- As a probability of adoption for a given price, e.g., Blend and van Ravenswaay [19] found that 72.6 percent of U.S. consumers were willing to purchase eco-labeled apples with zero price premium (compared to unlabeled apples), while 52.4 percent would purchase at a $0.20 price premium, falling to 42.3 percent with a $0.40 price premium.

- As an own- or cross-price elasticity, e.g., Bernard and Bernard [20] found that consumers in four Atlantic coast states would decrease their purchases of conventional potatoes by 3.15 percent in response to a one percent increase in the price of conventional potatoes, while purchases of organic potatoes would rise by 1.20 percent in response to this price increase.

1.2. Methods Used to Measure WTP

2. Materials and Methods

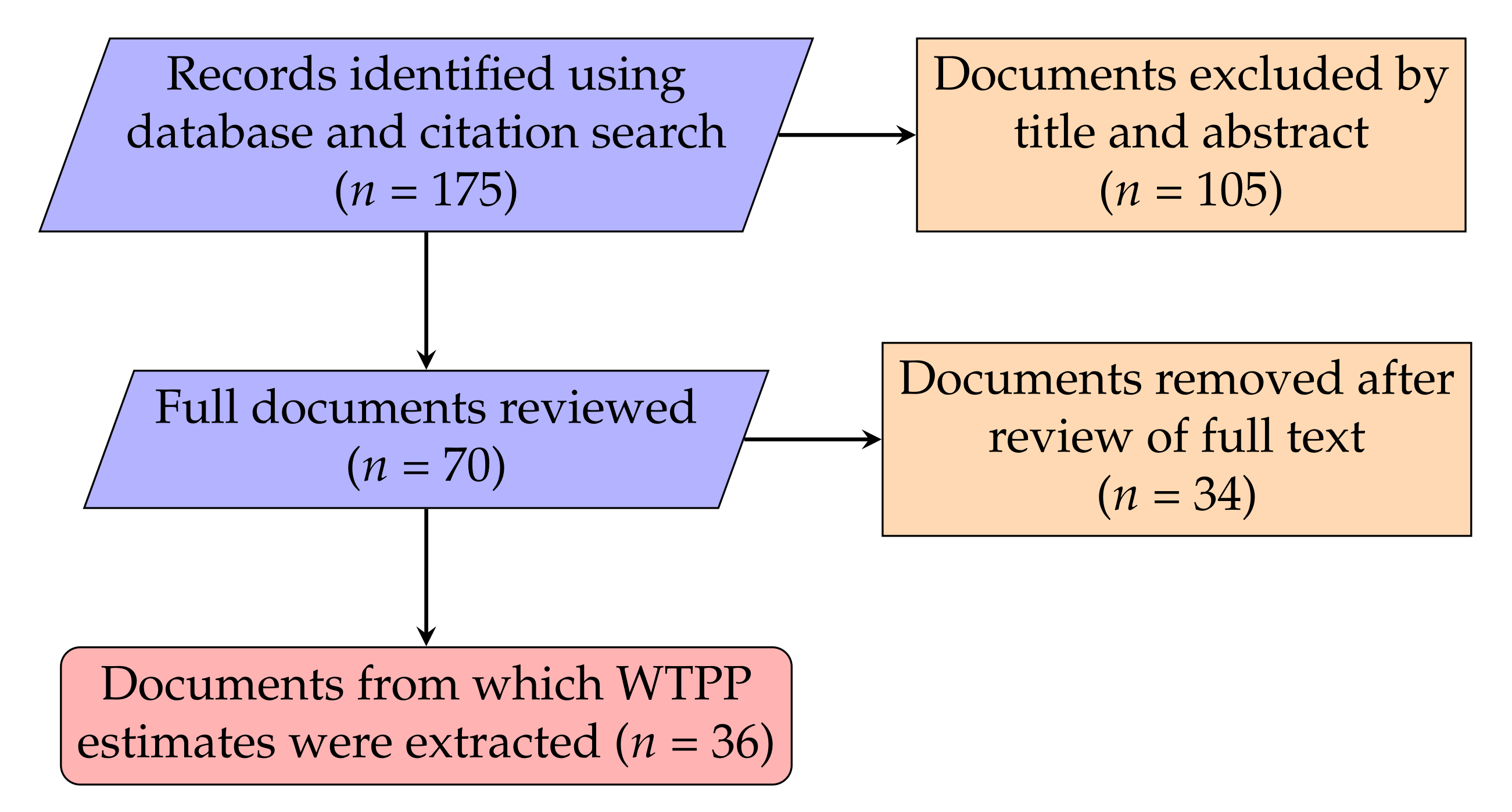

2.1. Collecting Papers

2.2. The Presence of Outliers and Their Removal

2.3. Meta-Regression Analysis

2.4. Alternative Regression Specifications

2.5. Controlling for Auto-Correlation and Heteroskedasticity

3. Results

3.1. Paper Attributes

3.2. Meta-Regression Analysis Results

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CA | Conjoint Analysis |

| CBC | Choice-Based Conjoint analysis |

| CVM | Contingent Valuation Method |

| DCE | Discrete Choice Experiment |

| EA | Experimental Auctions |

| FAT | Funnel Asymmetry Test |

| GM | Genetically Modified |

| LMIC | Low- to Middle-Income Country |

| MRA | Meta-Regression Analysis |

| MWTP | Marginal Willingness-to-Pay |

| WTA | Williness-to-Adopt |

| WTP | Willingness-to-Pay |

| WTPP | Willingness-to-Pay Percentage Premium |

Appendix A. Constructing the WTPP Estimate Dataset

Appendix A.1. Sample Size

Appendix A.2. Merging

| Paper | Year | Type | Crops | Group | Growing Method | Crop Type | Attributes | Study Type | Collect | Number of Measures | Measures | Number of WTPP Estimates | Number of Outliers |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Blend and van Ravenswaay [19] | 1999 | JA | Apples | C | - | P | Credence | CA | C | 2 | D; PR | 1 | - |

| Bond et al. [73] | 2008 | JA | Potatoes; melons | C | O | A | Local; credence; multiple crops | CVM | S | 1 | PP | 4 | - |

| Campbell et al. [85] | 2004 | JA | Citrus | C | O | P | - | CA | I | 1 | D | 4 | - |

| Carpio and Isengildina-Massa [86] | 2010 | JA | Fruits; vegetables | C | - | - | Local | CVM | S | 2 | E; PP | 3 | - |

| Carroll et al. [51] | 2013 | JA | Tomatoes | C | O | A | Local; credence | CA | S | 1 | D | 118 | 17 |

| Chen et al. [87] | 2019 | JA | Strawberries | C | - | A | Credence | CVM | S | 1 | D | 4 | - |

| Choi et al. [21] | 2017 | JA | Strawberries | P | - | A | - | CA | S | 1 | D | 12 | 2 |

| Choi et al. [55] | 2018 | JA | Apples | P | - | P | - | CA | S | 1 | D | 12 | 4 |

| Coffey et al. [67] | 2020 | JA | Strawberries | P | - | A | Credence | CVM | I | 1 | D | 3 | - |

| Darby et al. [88] | 2008 | JA | Strawberries | C | - | A | Local; credence | CA | I | 1 | D | 17 | - |

| Ernst et al. [89] | 2006 | JA | Strawberries | C | O | A | Local; credence | CA; CVM | I | 1 | D | 11 | - |

| Gallardo and Wang [31] | 2013 | JA | Apples; pears | P | C | P | Credence | CA | I | 1 | D | 40 | |

| Gallardo et al. [70] | 2015 | JA | Apples; cherries; peaches; strawberries | P | - | A and P | Multiple Crops | CA | I | 1 | D | 24 | 12 |

| Hu et al. [50] | 2009 | JA | Blueberries | C | - | P | Credence; processed | CA | I | 1 | D | 42 | 9 |

| Hu et al. [49] | 2011 | JA | Blueberries | C | - | P | Processed | CVM | I | 1 | D | 15 | 1 |

| Hu et al. [58] | 2021 | JA | Citrus | C | C | P | Credence; Processed | CA | S | 2 | D; PR | 7 | 2 |

| James et al. [90] | 2009 | JA | Apples | C | O | P | Credence; local; processed | CA | S | 1 | D | 48 | - |

| Jones and Brown [91] | 2019 | CP | Blueberries; citrus | C | C | P | Credence; processed | CA | S | 1 | PP | 18 | - |

| Li et al. [40] | 2020 | JA | Peaches | P | - | P | Credence | CA | S | 1 | D | 5 | 1 |

| Li et al. [59] | 2020 | JA | Strawberries | P | - | A | - | CA | S | 1 | D | 5 | 1 |

| Loureiro and Hine [92] | 2002 | JA | Potatoes | C | O | A | Credence; local | CVM | I | 1 | D | 4 | - |

| Loureiro et al. [93] | 2002 | JA | Apples | C | - | P | Credence | CA; CVM | I | 2 | D; PR | 1 | - |

| Markosyan et al. [94] | 2009 | JA | Apples | C | - | P | - | CVM | I | 2 | PP; PR | 5 | - |

| Meas et al. [57] | 2014 | JA | Blackberries | C | O | P | Credence; local; processed | CA | S | 1 | D | 20 | 2 |

| Oh et al. [95] | 2015 | JA | Apples; grapes | C | - | P | Credence; multiple crops | CA | S | 2 | D; PP | 8 | - |

| Onken et al. [72] | 2011 | JA | Strawberries | C | O | A | Credence; local; processed | CA | S | 2 | D; PP | 120 | - |

| [18] | 2006 | JA | Apples; bananas; leaf vegetables; broccoli | C | O and C | A and P | Credence; multiple crops | CA | S | 2 | D; PP | 24 | - |

| Sackett et al. [53] | 2012 | CP | Apples | C | O | P | Credence; local | CA | S | 1 | D | 4 | 3 |

| Teratanavat and Hooker [96] | 2006 | JA | Tomatoes | C | - | A | Credence; processed | CA | S | 1 | D | 9 | - |

| Thilmany et al. [97] | 2008 | JA | Melons | C | - | A | Credence; local | CVM | S | 1 | PP | 20 | - |

| Vassalos et al. [56] | 2016 | JA | Tomatoes | P | - | A | - | CA | S | 2 | D; PP | 9 | 3 |

| Wang et al. [98] | 2017 | JA | Strawberries | C | - | A | - | CA | S | 1 | PR | 18 | - |

| Xie et al. [52] | 2016 | JA | Broccoli | C | O and C | A | Credence | CA | S | 1 | D | 15 | 6 |

| Yue et al. [99] | 2007 | JA | Apples | C | O | P | - | CA | I | 1 | D | 9 | 4 |

| Yue et al. [8] | 2017 | JA | Apples; cherries; peaches; strawberries | P | - | A and P | Multiple Crops | CA | S | 1 | D | 28 | 7 |

| Zhao et al. [30] | 2017 | JA | Peaches | P | - | P | - | CA | S | 1 | D | 10 | 2 |

Appendix A.3. Calculating Percentage WTP Premium

| Constructed Market | No base price is given in the paper. External data was used to reconstruct the national market price during the year the study was conducted. |

| Given | In a choice scenario, the base price is set by the researchers; however, this base price is varied across respondents or choice scenarios. |

| Market | A contemporary market price for the good is given in the paper. This can be how much consumers report spending on the good typically, prices given by market experts, or price data collected by a government agency, such as the USDA. |

| Range Average | A discrete number of price levels are chosen for the price attribute, and the benchmark price is the average of these price levels. |

| Reference | The base price is set by researchers and is constant across all subjects and choice scenarios. |

| Response Average | The benchmark is the average of the responses given by participants. |

Appendix B. Regression Tests

| Base | Full | Consumers | Producers | |

|---|---|---|---|---|

| 0.16 * | 0.28 * | 0.26 * | −1.73 * | |

| Producers | 18.67 * | 21.17 * | ||

| Survey | −5.36 | −12.51 * | 0.57 | |

| WTP in Dollars | 5.44 * | 5.58 | ||

| Benchmark | −0.12 | −4.49 * | −0.19 * | |

| Local | 24.79 * | 28.39 * | ||

| Organic | 7.15 * | 10.06 | ||

| Processed | 5.96 | 12.17 * | ||

| Other Credence | 7.16 | 9.84 | −21.76 * | |

| FE | Year | Year | Year | Year |

| Clustered SE | Year, Paper | Year, Paper | Year, Paper | Year, Paper |

| Bootstrap SE | Wild | Wild | Wild | Wild |

| Adj. R2 | ||||

| Num. obs. | 615 | 615 | 510 | 105 |

| F statistic |

Appendix B.1. Tests for Auto-Correlation

Appendix B.2. Tests for Heteroskedasticity

| Model | Stastistic | p-Value |

|---|---|---|

| Base | 0.038 | 0.85 |

| Full | 2.83 | 0.09 |

| Consumers | 6.73 | 0.01 |

| Producers | 2.56 | 0.11 |

References

- Louviere, J.J.; Hensher, D.A.; Swait, J.D.; Adamowicz, W. Stated Choice Methods: Analysis and Applications; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Moser, R.; Raffaelli, R.; Thilmany, D.D. Consumer Preferences for Fruit and Vegetables with Credence-Based Attributes: A Review. Int. Food Agribus. Manag. Rev. 2011, 14, 121–142. [Google Scholar]

- Yencho, G.C.; Pecota, K.V.; Schultheis, J.R.; VanEsbroeck, Z.P.; Holmes, G.J.; Little, B.E.; Thornton, A.C.; Truong, V.D. ’Covington’ Sweetpotato. HortScience 2008, 43, 1911–1914. [Google Scholar] [CrossRef] [Green Version]

- Evans, K.M.; Barritt, B.H.; Konishi, B.S.; Brutcher, L.J.; Ross, C.F. ’WA 38’ Apple. HortScience 2012, 47, 1177–1179. [Google Scholar] [CrossRef] [Green Version]

- Luby, J.J.; Bedford, D.S. Cultivars as Consumer Brands: Trends in Protecting and Commercializing Apple Cultivars via Intellectual Property Rights. Crop Sci. 2015, 55, 2504–2510. [Google Scholar] [CrossRef]

- Katz, B. Meet ’Cosmic Crisp’, a New Hybrid Apple That Stays Fresh for a Year. Smithsonian Magazine, 4 December 2019. [Google Scholar]

- Lusk, J.L.; Hudson, D. Willingness-to-Pay Estimates and Their Relevance to Agribusiness Decision Making. Rev. Agric. Econ. 2004, 26, 152–169. [Google Scholar] [CrossRef]

- Yue, C.; Zhao, S.; Gallardo, K.; McCracken, V.; Luby, J.; McFerson, J.U.S. Growers’ Willingness to Pay for Improvement in Rosaceous Fruit Traits. Agric. Resour. Econ. Rev. 2017, 46, 103–122. [Google Scholar] [CrossRef] [Green Version]

- Boccaletti, S. Environmentally Responsible Food Choice. OECD J. Gen. Pap. 2008, 2008, 117–152. [Google Scholar] [CrossRef]

- Cecchini, L.; Torquati, B.; Chiorri, M. Sustainable Agri-Food Products: A Review of Consumer Preference Studies through Experimental Economics. Agric. Econ. Czech 2018, 64, 554–565. [Google Scholar] [CrossRef]

- Dolgopolova, I.; Teuber, R. Consumers’ Willingness to Pay for Health Benefits in Food Products: A Meta-Analysis. Appl. Econ. Perspect. Policy 2018, 40, 333–352. [Google Scholar] [CrossRef]

- De Steur, H.; Wesana, J.; Blancquaert, D.; Van Der Straeten, D.; Gellynck, X. Methods Matter: A Meta-Regression on the Determinants of Willingness-to-Pay Studies on Biofortified Foods. Ann. N. Y. Acad. Sci. 2016, 1290, 34–46. [Google Scholar] [CrossRef] [Green Version]

- Printezis, I.; Grebitus, C.; Hirsch, S. The Price Is Right!? A Meta-Regression Analysis on Willingness to Pay for Local Food. PLoS ONE 2019, 14, e0215847. [Google Scholar] [CrossRef] [Green Version]

- Olum, S.; Gellynck, X.; Juvinal, J.; Ongeng, D.; De Steur, H. Farmers’ Adoption of Agricultural Innovations: A Systematic Review on Willingness to Pay Studies. Outlook Agric. 2020, 49, 187–203. [Google Scholar] [CrossRef]

- Mamine, F.; Fares, M.; Minviel, J.J. Contract Design for Adoption of Agrienvironmental Practices: A Meta-analysis of Discrete Choice Experiments. Ecol. Econ. 2020, 176, 12. [Google Scholar] [CrossRef]

- Vecchio, R.; Borrello, M. Measuring Food Preferences through Experimental Auctions: A Review. Food Res. Int. 2019, 116, 1113–1120. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Onozaka, Y.; Bunch, D.; Larson, D. What Exactly Are They Paying For? Explaining the Price Premium for Organic Fresh Produce. Update Agric. Resour. Econ. 2006, 9, 2–4. [Google Scholar]

- Blend, J.R.; van Ravenswaay, E.O. Measuring Consumer Demand for Ecolabeled Apples. Am. J. Agric. Econ. 1999, 81, 1072–1077. [Google Scholar] [CrossRef]

- Bernard, J.C.; Bernard, D.J. Comparing Parts with the Whole: Willingness to Pay for Pesticide-Free, Non-GM, and Organic Potatoes and Sweet Corn. J. Agric. Resour. Econ. 2010, 35, 457–475. [Google Scholar]

- Choi, J.W.; Yue, C.; Luby, J.; Zhao, S.; Gallardo, K.; McCracken, V.; McFerson, J. Estimating Strawberry Attributes’ Market Equilibrium Values. HortScience 2017, 52, 742–748. [Google Scholar] [CrossRef] [Green Version]

- Johnston, R.J.; Boyle, K.J.; Adamowicz, W.V.; Bennett, J.; Brouwer, R.; Cameron, T.A.; Hanemann, W.M.; Hanley, N.; Ryan, M.; Scarpa, R.; et al. Contemporary Guidance for Stated Preference Studies. J. Assoc. Environ. Resour. Econ. 2017, 4, 319–405. [Google Scholar] [CrossRef] [Green Version]

- Lusk, J.L. Experimental Auctions for Marketing Applications: A Discussion. J. Agric. Appl. Econ. 2003, 35, 349–360. [Google Scholar] [CrossRef]

- Street, D.J.; Burgess, L. Typical Stated Choice Experiments. In The Construction of Optimal Stated Choice Experiments: Theory and Methods; Street, D.J., Burgess, L., Eds.; Wiley Series in Probability and Statistics; John Wiley & Sons: Hoboken, NJ, USA, 2007; pp. 1–13. [Google Scholar]

- McFadden, D. The Measurement of Urban Travel Demand. J. Public Econ. 1974, 3, 303–328. [Google Scholar] [CrossRef]

- Lloyd-Smith, P.; Zawojska, E.; Adamowicz, W.L. Is There Really a Difference between “Contingent Valuation” and “Choice Experiments”? In Proceedings of the American Agricultural and Applied Economics Association Annual Meeting, Washington, DC, USA, 5–7 August 2018; p. 36. [Google Scholar]

- Orme, B.K. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research; Research Publishers, LLC: Madison, WI, USA, 2006. [Google Scholar]

- Johnson, F.R.; Kanninen, B.; Bingham, M.; Ozdemir, S. Experimental Design for Stated Choice Studies. In Valuing Environmental Amenities Using Stated Choice Studies: A Common Sense Approach to Theory and Practice; Kanninen, B., Ed.; The Economics of Non-Market Goods and Resources; Springer: Dordecht, The Netherlands, 2007; pp. 159–202. [Google Scholar]

- Alberini, A.; Longo, A.; Veronesi, M. Basic Statistical Models for Stated Choice Studies. In Valuing Environmental Amenities Using Stated Choice Studies: A Common Sense Approach to Theory and Practice; The Economics of Non-Market Goods and Resources; Springer: Dordecht, The Netherlands, 2007; pp. 203–227. [Google Scholar]

- Zhao, S.; Yue, C.; Luby, J.; Gallardo, K.; McCracken, V.; McFerson, J.; Layne, D.R.U.S. Peach Producer Preference and Willingness to Pay for Fruit Attributes. HortScience 2017, 52, 116–121. [Google Scholar] [CrossRef] [Green Version]

- Gallardo, R.K.; Wang, Q. Willingness to Pay for Pesticides’ Environmental Features and Social Desirability Bias: The Case of Apple and Pear Growers. J. Agric. Resour. Econ. 2013, 38, 124–139. [Google Scholar]

- Stanley, T.D.; Jarrell, S.B. Meta-Regression Analysis: A Quantitative Method of Literature Surveys. J. Econ. Surv. 1989, 3, 161–170. [Google Scholar] [CrossRef]

- Stanley, T.D. Wheat From Chaff: Meta-Analysis as Quantitative Literature Review. J. Econ. Perspect. 2001, 15, 131–150. [Google Scholar] [CrossRef]

- Stanley, T.; Doucouliagos, H.; Giles, M.; Heckemeyer, J.H.; Johnston, R.J.; Laroche, P.; Nelson, J.P.; Paldam, M.; Poot, J.; Pugh, G.; et al. Meta-Analysis of Economics Research Reporting Guidelines. J. Econ. Surv. 2013, 27, 390–394. [Google Scholar] [CrossRef]

- Grant, M.J.; Booth, A. A Typology of Reviews: An Analysis of 14 Review Types and Associated Methodologies. Health Inf. Libr. J. 2009, 26, 91–108. [Google Scholar] [CrossRef]

- Machi, L.A.; McEvoy, B.T. The Literature Review: Six Steps to Success; Corwin Press: Thousand Oaks, CA, USA, 2012. [Google Scholar]

- Gusenbauer, M.; Haddaway, N.R. Which Academic Search Systems Are Suitable for Systematic Reviews or Meta-Analyses? Evaluating Retrieval Qualities of Google Scholar, PubMed, and 26 Other Resources. Res. Synth. Methods 2020, 11, 181–217. [Google Scholar] [CrossRef] [Green Version]

- Briscoe, S.; Bethel, A.; Rogers, M. Conduct and Reporting of Citation Searching in Cochrane Systematic Reviews: A Cross-Sectional Study. Res. Synth. Methods 2020, 11, 169–180. [Google Scholar] [CrossRef]

- Wright, K.; Golder, S.; Rodriguez-Lopez, R. Citation Searching: A Systematic Review Case Study of Multiple Risk Behaviour Interventions. BMC Med. Res. Methodol. 2014, 14, 73. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Gallardo, R.K.; McCracken, V.; Yue, C.; Whitaker, V.; McFerson, J.R. Grower Willingness to Pay for Fruit Quality versus Plant Disease Resistance and Welfare Implications: The Case of Florida Strawberry. J. Agric. Resour. Econ. 2020, 45, 199–218. [Google Scholar] [CrossRef]

- Yue, C.; Gallardo, R.K.; McCracken, V.A.; Luby, J.; McFerson, J.R.; Liu, L.; Iezzoni, A. Technical and Socioeconomic Challenges to Setting and Implementing Priorities in North American Rosaceous Fruit Breeding Programs. HortScience 2012, 47, 1320–1327. [Google Scholar] [CrossRef]

- Fernandez-Cornejo, J.; Beach, E.D.; Huang, W.Y. The Adoption of Integrated Pest Management Technologies by Vegetable Growers; Technical Report 1486-2018-6697; United States Department of Agriculture (USDA): Washington, DC, USA, 1992. [CrossRef]

- Barrett, C.E.; Zhao, X.; Hodges, A.W. Cost Benefit Analysis of Using Grafted Transplants for Root-knot Nematode Management in Organic Heirloom Tomato Production. HortTechnology 2012, 22, 252–257. [Google Scholar] [CrossRef] [Green Version]

- Gallardo, R.K.; Stafne, E.T.; DeVetter, L.W.; Zhang, Q.; Li, C.; Takeda, F.; Williamson, J.; Yang, W.Q.; Cline, W.O.; Beaudry, R.; et al. Blueberry Producers’ Attitudes toward Harvest Mechanization for Fresh Market. HortTechnology 2018, 28, 10–16. [Google Scholar] [CrossRef] [Green Version]

- Gallardo, R.K.; Klingthong, P.; Zhang, Q.; Polashock, J.; Atucha, A.; Zalapa, J.; Rodriguez-Saona, C.; Vorsa, N.; Iorizzo, M. Breeding Trait Priorities of the Cranberry Industry in the United States and Canada. HortScience 2018, 53, 1467–1474. [Google Scholar] [CrossRef] [Green Version]

- Dentoni, D.; Tonsor, G.T.; Calantone, R.; Peterson, H.C. Brand Coopetition with Geographical Indications: Which Information Does Lead to Brand Differentiation? New Medit 2013, 12, 14–27. [Google Scholar]

- Chen, K.J.; Galinato, S.P.; Marsh, T.L.; Tozer, P.R.; Chouinard, H.H. Willingness to Pay for Attributes of Biodegradable Plastic Mulches in the Agricultural Sector. HortTechnology 2020, 30, 437–447. [Google Scholar] [CrossRef]

- Guthman, J.; Zurawski, E. “If I Need to Put More Armor on, I Can’t Carry More Guns”: The Collective Action Problem of Breeding for Productivity in the California Strawberry Industry. Int. J. Sociol. Agric. Food 2020, 26, 69–88. [Google Scholar] [CrossRef]

- Hu, W.; Woods, T.A.; Bastin, S.; Cox, L.J.; You, W. Assessing Consumer Willingness to Pay for Value-Added Blueberry Products Using a Payment Card Survey. J. Agric. Appl. Econ. 2011, 43, 243–258. [Google Scholar] [CrossRef] [Green Version]

- Hu, W.; Woods, T.A.; Bastin, S. Consumer Acceptance and Willingness to Pay for Blueberry Products with Nonconventional Attributes. J. Agric. Appl. Econ. 2009, 41, 47–69. [Google Scholar] [CrossRef] [Green Version]

- Carroll, K.A.; Bernard, J.C.; Pesek, J.D. Consumer Preferences for Tomatoes: The Influence of Local, Organic, and State Program Promotions by Purchasing Venue. J. Agric. Resour. Econ. 2013, 38, 379–396. [Google Scholar]

- Xie, J.; Gao, Z.; Swisher, M.; Zhao, X. Consumers’ Preferences for Fresh Broccolis: Interactive Effects between Country of Origin and Organic Labels. Agric. Econ. 2016, 47, 181–191. [Google Scholar] [CrossRef]

- Sackett, H.M.; Shupp, R.S.; Tonsor, G.T. Discrete Choice Modeling of Consumer Preferences for Sustainably Produced Steak and Apples. In Proceedings of the 2012 AAEA/EAAE Food Environment Symposium, Boston, MA, USA, 30–31 May2012. [Google Scholar]

- Yue, C.; Jensen, H.H.; Mueller, D.S.; Nonnecke, G.R.; Gleason, M.L. Assessing Consumers’ Valuation of Cosmetically Damaged Apples Using a Mixed Probit Model; Iowa State University: Ames, IA, USA, 2005; p. 24. [Google Scholar]

- Choi, J.W.; Yue, C.; Luby, J.; Zhao, S.; Gallardo, K.; McCracken, V.; McFerson, J. Estimation of Market Equilibrium Values for Apple Attributes. China Agric. Econ. Rev. 2018, 10, 135–151. [Google Scholar] [CrossRef]

- Vassalos, M.; Hu, W.; Woods, T.; Schieffer, J.; Dillon, C. Risk Preferences, Transaction Costs, and Choice of Marketing Contracts: Evidence from a Choice Experiment with Fresh Vegetable Producers. Agribusiness 2016, 32, 379–396. [Google Scholar] [CrossRef]

- Meas, T.; Hu, W.; Batte, M.T.; Woods, T.A.; Ernst, S. Substitutes or Complements? Consumer Preference for Local and Organic Food Attributes. Am. J. Agric. Econ. 2014, 97, 1044–1071. [Google Scholar] [CrossRef]

- Hu, Y.; House, L.A.; McFadden, B.R.; Gao, Z. The Influence of Choice Context on Consumers’ Preference for GM Orange Juice. J. Agric. Econ. 2021, 72, 547–563. [Google Scholar] [CrossRef]

- Li, Z.; Gallardo, R.K.; McCracken, V.A.; Yue, C.; Gasic, K.; Reighard, G.; McFerson, J.R.U.S. Southeastern Peach Growers Preferences for Fruit Size and External Color versus Resistance to Brown Rot Disease. HortTechnology 2020, 30, 576–584. [Google Scholar] [CrossRef]

- Stanley, T.D. Beyond Publication Bias. J. Econ. Surv. 2005, 19, 309–345. [Google Scholar] [CrossRef]

- Card, D.; Krueger, A.B. Time-Series Minimum-Wage Studies: A Meta-analysis. Am. Econ. Rev. 1995, 85, 238–243. [Google Scholar]

- Egger, M.; Smith, G.D.; Schneider, M.; Minder, C. Bias in Meta-Analysis Detected by a Simple, Graphical Test. BMJ 1997, 315, 629–634. [Google Scholar] [CrossRef] [Green Version]

- Sterne, J.A.C.; Sutton, A.J.; Ioannidis, J.P.A.; Terrin, N.; Jones, D.R.; Lau, J.; Carpenter, J.; Rucker, G.; Harbord, R.M.; Schmid, C.H.; et al. Recommendations for Examining and Interpreting Funnel Plot Asymmetry in Meta-Analyses of Randomised Controlled Trials. BMJ 2011, 343, d4002. [Google Scholar] [CrossRef] [Green Version]

- Cheah, B.C. Clustering Standard Errors or Modeling Multilevel Data; University of Columbia: New York, NY, USA, 2009. [Google Scholar]

- Angrist, J.D.; Pischke, J.S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Graham, N.; Arai, M.; Hagströmer, B. Multiwayvcov: Multi-Way Standard Error Clustering. R Package Version 1.2.3. 2016. Available online: https://CRAN.R-project.org/package=multiwayvcov (accessed on 8 February 2022).

- Coffey, B.; Trinetta, V.; Nwadike, L.; Yucel, U. Producer Willingness to Pay for Enhanced Packaging to Prevent Postharvest Decay of Strawberries. J. Appl. Farm Econ. 2020, 3, 30–41. [Google Scholar] [CrossRef]

- Romer, D. In Praise of Confidence Intervals. AEA Pap. Proc. 2020, 110, 55–60. [Google Scholar] [CrossRef]

- Imbens, G.W. Statistical Significance, p-Values, and the Reporting of Uncertainty. J. Econ. Perspect. 2021, 35, 157–174. [Google Scholar] [CrossRef]

- Gallardo, R.K.; Li, H.; McCracken, V.; Yue, C.; Luby, J.; McFerson, J.R. Market Intermediaries’ Willingness to Pay for Apple, Peach, Cherry, and Strawberry Quality Attributes. Agribusiness 2015, 31, 259–280. [Google Scholar] [CrossRef]

- Silva, A.; Nayga, R.M.; Campbell, B.L.; Park, J.L. On the Use of Valuation Mechanisms to Measure Consumers’ Willingness to Pay for Novel Products: A Comparison of Hypothetical and Non-Hypothetical Values. Int. Food Agribus. Manag. Rev. 2007, 10, 165–180. [Google Scholar] [CrossRef]

- Onken, K.A.; Bernard, J.C.; Pesek, J.D. Comparing Willingness to Pay for Organic, Natural, Locally Grown, and State Marketing Program Promoted Foods in the Mid-Atlantic Region. Agric. Resour. Econ. Rev. 2011, 40, 33–47. [Google Scholar] [CrossRef]

- Bond, C.A.; Thilmany, D.D.; Keeling Bond, J. Understanding Consumer Interest in Product and Process-Based Attributes for Fresh Produce. Agribusiness 2008, 24, 231–252. [Google Scholar] [CrossRef]

- Evans, E.A.; Ballen, F.H.; De Oleo, B.; Crane, J.H. Willingness of South Florida Fruit Growers to Adopt Genetically Modified Papaya: An Ex-ante Evaluation. AgBioForum 2017, 20, 156–162. [Google Scholar]

- Gifford, K.; Bernard, J.C. Factor and Cluster Analysis of Willingness to Pay for Organic and Non-GM Food. J. Food Distrib. Res. 2008, 39, 26–39. [Google Scholar] [CrossRef]

- Govindasamy, R.; Arumugam, S.; Vellangany, I.; Ozkan, B. Willingness to Pay a High-Premium for Fresh Organic Produce: An Econometric Analysis. Agric. Econ. Res. Rev. 2018, 31, 45. [Google Scholar] [CrossRef] [Green Version]

- Govindasamy, R.; Italia, J. Willingness-to-Purchase Comparison of Integrated Pest Management and Conventional Produce. Agribusiness 1998, 4, 403–414. [Google Scholar] [CrossRef]

- Hamilton, S.F.; Sunding, D.L.; Zilberman, D. Public Goods and the Value of Product Quality Regulations: The Case of Food Safety. J. Public Econ. 2003, 87, 799–817. [Google Scholar] [CrossRef] [Green Version]

- Lagoudakis, A.; McKendree, M.G.; Malone, T.; Caputo, V. Incorporating Producer Opinions into a SWOT Analysis of the U.S. Tart Cherry Industry. Int. Food Agribus. Manag. Rev. 2020, 23, 547–561. [Google Scholar] [CrossRef]

- Loureiro, M.L.; McCluskey, J.J.; Mittelhammer, R.C. Assessing Consumer Preferences for Organic, Eco-labeled, and Regular Apples. J. Agric. Resour. Econ. 2001, 26, 404–416. [Google Scholar]

- Nelson, M.C.; Styles, E.K.; Pattanaik, N.; Liu, X.; Brown, J. Georgia Farmers’ Perceptions of Production Barrier in Organic Vegetable and Fruit Agriculture. In Proceedings of the 2015 Southern Agricultural Economics Association Annual Meeting, Atlanta, GA, USA, 31 January–3 February 2015. [Google Scholar] [CrossRef]

- Yu, H.; Neal, J.A.; Sirsat, S.A. Consumers’ Food Safety Risk Perceptions and Willingness to Pay for Fresh-Cut Produce with Lower Risk of Foodborne Illness. Food Control 2018, 86, 83–89. [Google Scholar] [CrossRef]

- Yue, C.; Gallardo, R.K.; Luby, J.J.; Rihn, A.L.; McFerson, J.R.; McCracken, V.; Gradziel, T.; Gasic, K.; Reighard, G.L.; Clark, J.; et al. An Evaluation of U.S. Peach Producers’ Trait Prioritization: Evidence from Audience Surveys. HortScience 2014, 49, 1309–1314. [Google Scholar] [CrossRef]

- Yue, C.; Gallardo, R.K.; Luby, J.; Rihn, A.; McFerson, J.R.; McCracken, V.; Whitaker, V.M.; Finn, C.E.; Hancock, J.F.; Weebadde, C.; et al. An Evaluation of U.S. Strawberry Producers Trait Prioritization: Evidence from Audience Surveys. HortScience 2014, 49, 188–193. [Google Scholar] [CrossRef] [Green Version]

- Campbell, B.L.; Nelson, R.G.; Ebel, R.C.; Dozier, W.A.; Adrian, J.L.; Hockema, B.R. Fruit Quality Characteristics That Affect Consumer Preferences for Satsuma Mandarins. HortScience 2004, 39, 1664–1669. [Google Scholar] [CrossRef]

- Carpio, C.E.; Isengildina-Massa, O. To Fund or Not to Fund: Assessment of the Potential Impact of a Regional Promotion Campaign. J. Agric. Resour. Econ. 2010, 35, 245–260. [Google Scholar]

- Chen, K.J.; Marsh, T.L.; Tozer, P.R.; Galinato, S.P. Biotechnology to Sustainability: Consumer Preferences for Food Products Grown on Biodegradable Mulches. Food Res. Int. 2019, 116, 200–210. [Google Scholar] [CrossRef] [PubMed]

- Darby, K.; Batte, M.T.; Ernst, S.; Roe, B. Decomposing Local: A Conjoint Analysis of Locally Produced Foods. Am. J. Agric. Econ. 2008, 90, 476–486. [Google Scholar] [CrossRef]

- Ernst, S.; Batte, M.T.; Darby, K.; Worley, T. What Matters in Consumer Berry Preferences: Price? Source? Quality? J. Food Distrib. Res. 2006, 37, 68–71. [Google Scholar]

- James, J.S.; Rickard, B.J.; Rossman, W.J. Product Differentiation and Market Segmentation in Applesauce: Using a Choice Experiment to Assess the Value of Organic, Local and Nutrition Attributes. Agric. Resour. Econ. Rev. 2009, 38, 357–370. [Google Scholar] [CrossRef]

- Jones, M.S.; Brown, Z.S. Landscape-Level Pest Control Externalities When Consumer Preferences Are Non-Neutral. In Proceedings of the Agricultural and Applied Economics Association Annual Meeting, Atlanta, GA, USA, 21–23 July 2019. [Google Scholar]

- Loureiro, M.L.; Hine, S.E. Discovering Niche Markets: A Comparison of Consumer Willingness to Pay for Local (Colorado Grown), Organic, and GMO-Free Products. J. Agric. Appl. Econ. 2002, 34, 477–487. [Google Scholar] [CrossRef] [Green Version]

- Loureiro, M.L.; McCluskey, J.J.; Mittelhammer, R.C. Will Consumers Pay a Premium for Eco-labeled Apples? J. Consum. Aff. 2002, 36, 203–219. [Google Scholar] [CrossRef]

- Markosyan, A.; McCluskey, J.J.; Wahl, T.I. Consumer Response to Information about a Functional Food Product: Apples Enriched with Antioxidants. Can. J. Agric. Econ./Revue Canadienne d’Agroeconomie 2009, 57, 325–341. [Google Scholar] [CrossRef]

- Oh, C.O.; Herrnstadt, Z.; Howard, P.H. Consumer Willingness to Pay for Bird Management Practices in Fruit Crops. Agroecol. Sustain. Food Syst. 2015, 39, 782–797. [Google Scholar] [CrossRef]

- Teratanavat, R.P.; Hooker, N.H. Consumer Valuations and Preference Heterogeneity for a Novel Functional Food. J. Food Sci. 2006, 71, 533–541. [Google Scholar] [CrossRef]

- Thilmany, D.D.; Bond, C.A.; Keeling Bond, J. Going Local: Exploring Consumer Behavior and Motivations for Direct Food Purchases. Am. J. Agric. Econ. 2008, 90, 1303–1309. [Google Scholar] [CrossRef]

- Wang, J.; Yue, C.; Gallardo, K.; McCracken, V.; Luby, J.; McFerson, J. What Consumers Are Looking for in Strawberries: Implications from Market Segmentation Analysis. Agribusiness 2017, 33, 56–69. [Google Scholar] [CrossRef]

- Yue, C.; Jensen, H.H.; Mueller, D.S.; Nonnecke, G.R.; Bonnet, D.; Gleason, M.L. Estimating Consumers’ Valuation of Organic and Cosmetically Damaged Apples. HortScience 2007, 42, 1366–1371. [Google Scholar] [CrossRef] [Green Version]

- Agricultrual Marketing Service. Report Results for Retail—Tomatoes, Grape Type; Technical Report; United States Department of Agriculture: Washington, DC, USA, 2022.

- Agricultrual Marketing Service. Report Results for Retail—Strawberries; Technical Report; United States Department of Agriculture: Washington, DC, USA, 2022.

- Economic Research Service. Fruit and Tree Nuts Yearbook Tables: Noncitrus Fruit; Technical Report; United States Department of Agriculture: Washington, DC, USA, 2021.

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

| Variable | |

|---|---|

| =The square root of the underlying study’s sample size | |

| Producer | =1 if the sample group was producers |

| Survey | =1 if a survey was used to collect the data (baseline is interview) |

| WTP in Dollars | =1 if results were reported as WTP in dollars |

| Benchmark Price | =Price used for the product(s) evaluated |

| Local | =1 if product was locally grown |

| Organic | =1 if study product was organic |

| Processed | =1 if product was processed |

| Other Credence | =1 if WTP for a credence attribute not otherwise listed |

| (health benefits, GM, sustainably produced, grown in US, or pesticide-free) |

| Key Variables | Full (N = 36) | Consumers (N = 26) | Producers (N = 10) |

|---|---|---|---|

| Study Type | |||

| CA | 28 | 19 | 9 |

| CVM | 10 | 9 | 1 |

| Data Collection Method | |||

| In-Person Survey (Interview) | 12 | 9 | 3 |

| Remote Survey | 24 | 17 | 7 |

| Results Measures | |||

| Dollar | 29 | 19 | 10 |

| Percent Premium | 9 | 8 | 1 |

| Elasticity | 1 | 1 | 0 |

| Probability of Purchase | 5 | 5 | 0 |

| Focus Attributes | |||

| Locally Grown | 11 | 11 | 0 |

| Organic | 10 | 10 | 0 |

| Processed Product | 8 | 8 | 0 |

| Other Credence | 20 | 18 | 2 |

| Rear Published | |||

| Min: | 1999 | 1999 | 2013 |

| Mean | 2012 | 2010 | 2017 |

| Max: | 2021 | 2021 | 2020 |

| Variable | Full (N = 615) | Consumers (N = 510) | Producers (N = 105) |

|---|---|---|---|

| WTP Premium (%) | |||

| Min. | −41.85 | −41.85 | −41.00 |

| Max. | 68.89 | 68.40 | 68.89 |

| Mean | 14.83 | 12.18 | 27.69 |

| Sample Size (n) | |||

| Min. | 13 | 56 | 13 |

| Max. | 8036 | 8036 | 321 |

| Mean | 683.87 | 809.87 | 71.85 |

| Baseline Price | |||

| Min. | 0.10 | 0.24 | 0.10 |

| Max. | 150.00 | 5.38 | 150.00 |

| Mean | 4.40 | 3.10 | 10.67 |

| Year | |||

| Min. | 1999 | 1999 | 2013 |

| Max. | 2021 | 2021 | 2020 |

| Mean | 2012 | 2011 | 2016 |

| Methods Indicators (Means) | |||

| Survey | 0.24 | 0.18 | 0.52 |

| WTP in Dollars | 0.89 | 0.86 | 1.00 |

| Attributes Indicators (Means) | |||

| Local | 0.25 | 0.30 | 0.00 |

| Organic | 0.18 | 0.21 | 0.00 |

| Processed | 0.43 | 0.52 | 0.00 |

| Other Credence | 0.33 | 0.36 | 0.15 |

| Base | Full | Consumers | Producers | |

|---|---|---|---|---|

| 0.28 * | 0.26 * | −1.73 * | ||

| Producers | 18.67 * | 21.17 * | ||

| Survey | −5.36 | −12.51 | 0.57 | |

| WTP in Dollars | 5.44 | 5.58 | ||

| Benchmark | −0.12 * | −4.49 | −0.19 * | |

| Local | 24.79 * | 28.39 * | ||

| Organic | 7.15 | 10.06 | ||

| Processed | 5.96 | 12.17 | ||

| Other Credence | 7.16 | 9.84 | −21.76 * | |

| FE | Year | Year | Year | Year |

| Clustered SE | Year, Paper | Year, Paper | Year, Paper | Year, Paper |

| Bootstrap SE | No | No | No | No |

| Adj. R2 | ||||

| Num. obs. | 615 | 615 | 510 | 105 |

| F statistic |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kilduff, A.; Tregeagle, D. Willingness-to-Pay for Produce: A Meta-Regression Analysis Comparing the Stated Preferences of Producers and Consumers. Horticulturae 2022, 8, 290. https://doi.org/10.3390/horticulturae8040290

Kilduff A, Tregeagle D. Willingness-to-Pay for Produce: A Meta-Regression Analysis Comparing the Stated Preferences of Producers and Consumers. Horticulturae. 2022; 8(4):290. https://doi.org/10.3390/horticulturae8040290

Chicago/Turabian StyleKilduff, Alice, and Daniel Tregeagle. 2022. "Willingness-to-Pay for Produce: A Meta-Regression Analysis Comparing the Stated Preferences of Producers and Consumers" Horticulturae 8, no. 4: 290. https://doi.org/10.3390/horticulturae8040290

APA StyleKilduff, A., & Tregeagle, D. (2022). Willingness-to-Pay for Produce: A Meta-Regression Analysis Comparing the Stated Preferences of Producers and Consumers. Horticulturae, 8(4), 290. https://doi.org/10.3390/horticulturae8040290