Abstract

After more than 40 years of development, China’s wine regulatory system has been constantly improved, from half-base wine standards to pure-juice fermented wine standards, and then to the establishment of a relatively complete and mature industry-standard system with product and manufacturing standards as the core and other relevant industry standards as accessories. This advancement supports that the Chinese wine industry has emerged from New World wine countries. Nowadays, according to statistics from the International Organization of Vine and Wine, China is one of the top grape producers, wine consumers, and importers globally. Still, wine production has fallen in recent years, and the balance of wine import and export trade also shows a growing trade deficit. Faced with this problem, it is worth thinking about how to improve the regulatory system to help domestic wines overcome the difficulties. In this article, we first review the development process of China’s wine legal supervision system and summarize the situation of Chinese wine production, consumption, and trade in the past 20 years. Then we elaborate on China’s current legal framework for the wine industry consisting of a series of laws, regulations, and standards, and introduce domestic wine geographical indications. Finally, some suggestions are put forward on brand building, wine testing standards, and taxation of domestic wine. This review will help someone interested in Chinese wine to have a deeper understanding of the wine from a legal supervision system perspective and promote international cooperation and communication in the wine industry. In addition, it will also provide references for the establishment of wine regulations and standards in New World wine countries or regions.

1. Introduction

Although grape cultivation and wine production have a history of several thousand years in China [1], since the beginning of the industrial revolution in the West, the Chinese wine industry has consistently been lagging behind the level of more advanced wine producers [2]. From 1978 to 2013, the Chinese wine industry experienced three stages: beginning, development, and rapid ascent [3,4]. Meanwhile, the legal supervision system of Chinese wine has also made three significant adjustments. The promulgation and implementation of new standards each time have played a considerable role in promoting the development of the wine industry [2].

From 1978 to 1994, with the beginning of a historical process of China’s reform and opening up to the international market, the Chinese wine industry entered a first regulatory phase. At first, there was no uniform standard for winemaking, and manufacturers just implemented their enterprise standards separately. It was not until 1984 that the former Ministry of Light Industry enacted the first Chinese wine standard, Wine and its testing methods (QB 921-1984), which marked a shift in the Chinese wine industry, the first step from disorder to standardization. However, due to the loose requirements set in this standard (dosage of grape juice between 30 and 70%) and its weak legal binding force, inferior quality wines flooded the market seriously damaging the reputation of domestic wines [2].

The years from 1994 to 2004 saw a significant development for the Chinese wine industry, as the winemaking technology gradually changed to pure-juice fermentation. In 1994, Wine (GB/T 15037-1994), the Half base wine (QB/T 1980–1994), and Vitis amurensis wines (QB/T 1982–1994) were promulgated, while Wine and its testing methods (QB 921-1984) was abolished [2]. Wine (GB/T 15037-1994), the first Chinese national standard for pure-juice fermented wine, played an essential role in this stage. Since then, product definitions and testing indexes were consistent with international standards. However, half-base wine still absorbed a particular share of the Chinese market because of the shortage of raw material supply, domestic consumer preference, and low consumption level, until 17 March 2003 when Half base wine (QB/T 1980–1994) was abrogated. On 1 January of the same year, Technical Specification for Grape Wine Making in China was put into effect. This important guiding document draws on international winemaking regulations and adapts them to China’s wine production conditions. Besides, the old edition of Wine (GB/T 15037-1994) was revised. Starting from 1 July 2004, the production and distribution of half-base wine stopped, which means that Chinese wine entered the era of pure-grape juice fermentation [2]. It also freed up nearly one-third of the total market capacity previously occupied by half-base wines for wineries producing high-quality wines, promoting the upgrading of China’s wine industry [5].

From 2004 to 2013, the Chinese wine industry entered a period of rapid ascent. On the one hand, the development of the wine industry benefited from the support of the national strategy, such as in 2002, the State Economic and Trade Committee announced that it would focus on the development of grape wine and other fruit wine. On the other hand, in the early 21st century, Chinese macroeconomic growth, lower import taxes, and free trade agreements supported a more prosperous wine market and more affordable wines for consumers [6]. At the same time, wine enterprises began to attach importance to the construction of raw material bases and brand building, significantly improving the quality of Chinese wine. In line with the wine market’s fast growth, to ensure the healthy development of the wine industry, the relevant departments of the state have improved and enacted a series of standards and regulations referring to the European Union (EU) and other international wine regulations. The EU is not only the largest global wine-producing region and the main importer and exporter of wine but also the most regulated wine market. The EU “quality regulations” are based on the “appellation” system and include several policy instruments such as the geographical delimitation of certain wine areas, rules on winegrowing and production, and rules on labeling [7]. The gradual improvement of the legal supervision system helped the Chinese wine industry enter a new stage of comprehensive standardization from production to market.

However, since 2013, due to the restrictions the Chinese government placed on the utilization of public funds for private banquets and the competitive pressure from imported wine was constantly increasing, the development of the Chinese wine industry (especially in the high-end wine market) has slowed down and entered a fluctuation stage. However, it is encouraging that the general trend of wine consumption in China is certain to rise again in the future, thanks to the rise of the affluent upper-middle class and digital innovations in communication and sales channels [6,8]. This situation reminds us that the Chinese wine industry needs to be upgraded urgently in order to overcome the current difficulties and meet a bigger market in the future [9]. Faced with these new challenges, it is worth thinking about how to update the wine policy and legal supervision.

At present, there are few reports, reviews, or summaries about the Chinese wine legal supervision system. In this article, we will review the status of Chinese wine production, consumption, and trade in the past 20 years, then summarize the current wine-related laws, regulations, and standards system of China, and introduce domestic wine geographical indications. We hope that while witnessing the progress of the Chinese wine industry, the practitioners in the wine industry, foreign investors, experts, and consumers interested in Chinese wine will also further understand the current legal supervision system that backs up its development. That will be conducive to the public community having a deeper understanding of Chinese wine, helping wine producers to develop their wine products for the Chinese market, accelerating international cooperation and communication in the wine industry, and motivating the amendment and improvement of the Chinese wine regulations and standards. In addition, this article will also provide references for the establishment of wine regulations and standards in New World wine countries or regions.

2. Development Process of China’s Wine Industry in the Past 20 Years

2.1. Production of Wine Grapes and Wine

According to the International Organization of Grapes and Wine (OIV) statistics, China has been the world’s largest grape producer since 2011 [10]. However, these grapes were mainly fresh grapes for direct human consumption, while wine grapes accounted for a small part of the production. In 2018, table grape and wine grape accounted for 84.1% and 10.3% of the total grape yield (11.7 million t) in China [11].

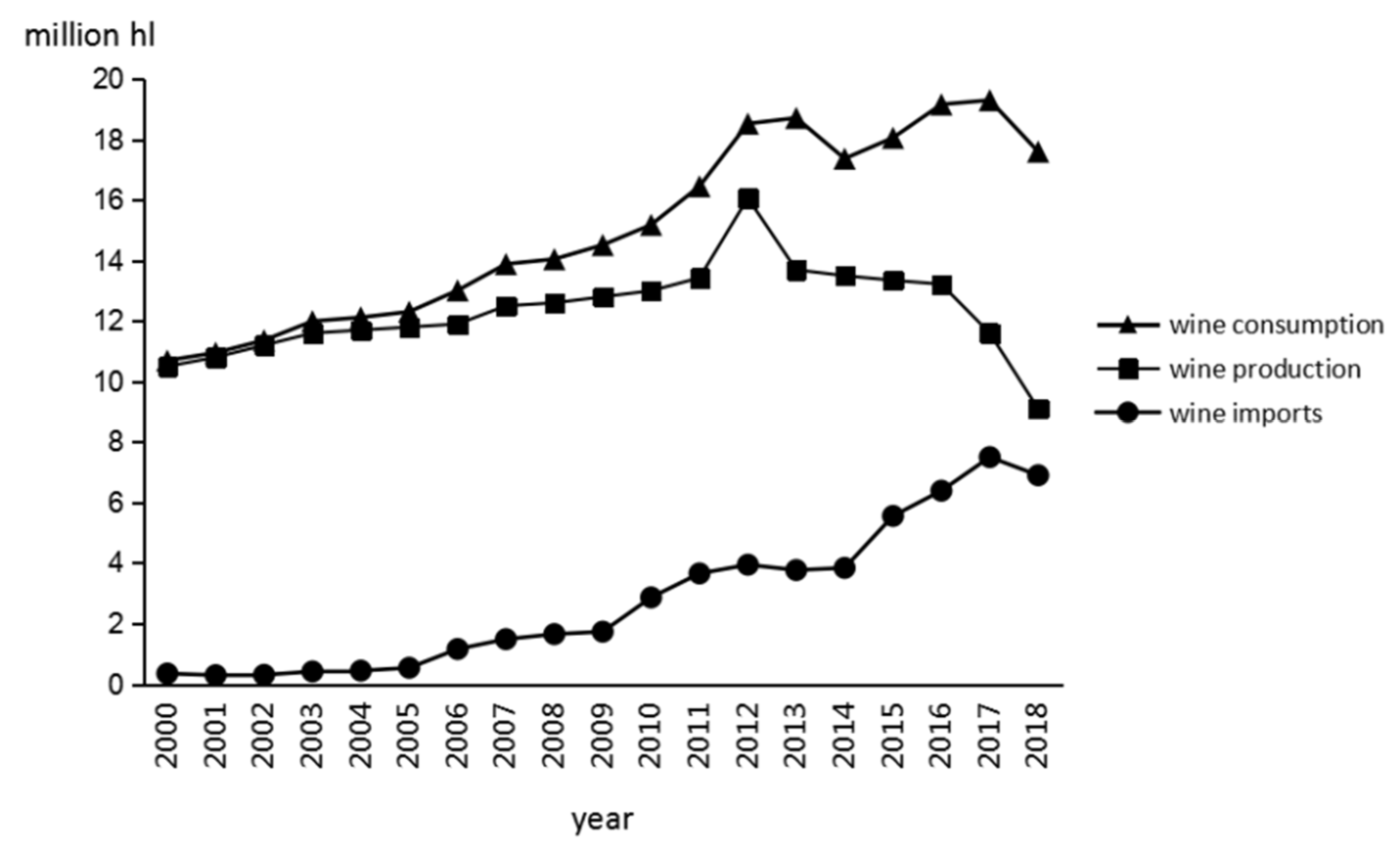

As for wine production, Figure 1 shows that Chinese wine production has been growing continuously since 2000 and reached its peak in 2012 (16.065 million hl). After 2013, the market and policy factors influencing Chinese wine production, the total output of wine expressed a negative trend, and the wine industry entered a period of stagnation [12]. From 2013 to 2018, the average annual decline of wine production was about 7.5%, even though in 2018, Chinese wine production was still as high as 9.1 million hl per year, ranking 10th in the world [11]. The most important reason behind this decline is that the cost of domestic wine is higher than imported wine, which puts China’s domestic production at a disadvantage in price performance and competitiveness. As for the high cost, on the one hand, it depends on the fact that Chinese new wineries need to invest in land, buildings, and equipment. On the other hand, unlike in Europe and the United States, which classify wine as agricultural products, wine in China is a light industrial product, and people have to bear a higher tax burden (13% value-added tax and 10% consumption tax) [13]. Besides, after China acceded to the WTO, China’s tariffs on imported wine have continued to decline, and even some countries have zero taxes (New Zealand, Chile, etc.), which has further widened the cost gap between imported wine and Chinese wine [14].

Figure 1.

Wine production, consumption, and imports of China from 2000 to 2018. (Data: source OIV).

2.2. Wine Consumption

The data from OIV indicate that Chinese wine consumption has exceeded wine production since 1997 [15]. From 2000 to 2017, wine consumption generally had a steep growth trend (Figure 1), and China has maintained its position as the fifth-largest global wine consumer since 2007 [10,16]. In 2018, the volume of wine sales was 17.6 million hl, a decrease of 8.8% compared to 2017 (19.3 million hl) [11]. This reduction might be related to the sharp decline in domestic wine production after 2016, even though higher wine imports made up for the market demand gap to a large extent.

2.3. Wine Trade

As visible from Figure 1, with the growth of wine consumption and the decline of wine import tariffs in China, imported wine started to account for an increasing market share. From 2015 to 2018, China maintained the position of the fifth-largest wine importer in the world. In 2018, the import volume of wine was up to 6.7 million hl. Although it was slightly lower than the previous year, it still showed a 79% increase compared to 2014 (3.8 million hl). Likewise, Chinese wine imports’ average annual growth rate from 2013 to 2018 was about 14.2% [11,15]. Compared with imports, the export volume of Chinese wine was still very small. In 2018, the export volume was only 6.37 million L, with Hong Kong accounting for 96.4% of the export market [17].

With the continuous expansion of the Chinese wine market and stronger cooperation between China and other countries in the wine trade, domestic wines will face more intense competitive pressure from imported wines. To promote the competitiveness of Chinese wines and better cope with future opportunities and challenges, the competent Chinese authorities are advancing the amendment and improvement of wine regulations and standards to strengthen the reputation of Chinese wines internationally. In the following text, we will introduce the current legal control system of China’s wine industry in detail from the aspects of laws, standards, and regulations.

3. Chinese Laws Related to Wine

Nowadays, China has established a basically perfect legal framework for the wine industry, consisting of a series of laws, regulations, and standards issued by the relevant administrative authorities. It covers all the aspects of the wine industry, from land to table, and adjusts the relationship among producers, operators, and consumers, to ensure the safety of wine grape production, wine production processes, and products, and the sound development of the market.

Among the laws regulating the wine industry, the Food Safety Law of the People’s Republic of China is core. Furthermore, some other rules are dealing with other aspects of the wine industry, such as the Product Quality Law, the Agricultural Product Quality Safety Law, the Metrological Law, the Trademark Law, the Environmental Protection Law, the Cleaner Production Promotion Law, the Import and Export Commodity Inspection Law, the Entry and Exit Animal and Plant Quarantine Law, the Frontier Health and Quarantine Law, the Law on Protection of Consumer Rights and Interests, the Anti-Unfair Competition Law, the Criminal Law, and the Standardization Law, etc. [18] The impact of these laws on the Chinese wine market is indirectly reflected through the formulation of standards and regulations. On the one hand, laws are the cornerstone of Chinese standards and regulations, and all of their provisions should not be inconsistent with existing laws. On the other hand, laws endow standards and regulations with certain legal forces, helping them to be effectively implemented on the road to promoting market standardization.

4. Wine Standard System in China

Before introducing the wine standards, it is necessary to understand some basic information on Chinese standards. According to the level of the standard issuing department and the applicable scope of the standard, The Standardization Law of the People’s Republic of China requires that Chinese standards can be classified into national standards, sector standards, local standards, association standards, and enterprise standards. National standards are divided into compulsory and voluntary standards, while both sector and local standards are voluntary. In addition, the technical requirements of voluntary national standards, sector standards, local standards, association standards, and enterprise standards must be stricter than the relevant technical requirements of compulsory national standards. The products and services that do not meet compulsory standards cannot be manufactured, sold, imported, or provided. If individuals or organizations violate these provisions, they will bear the corresponding liabilities under the law [19]. Moreover, The Regulations for the Implementation of the Standardization Law of the People’s Republic of China specify that trade standards shall be abolished automatically after the corresponding national standards have taken effect, and local standards shall be annulled immediately after the related national standards or trade standards are implemented. Besides, the technical requirements for export products and services shall be implemented under the agreement in the contract signed by both the importer and exporter [20]. At present, the most important current wine product standard in China, Wine GB 15037-2006, is mandatory.

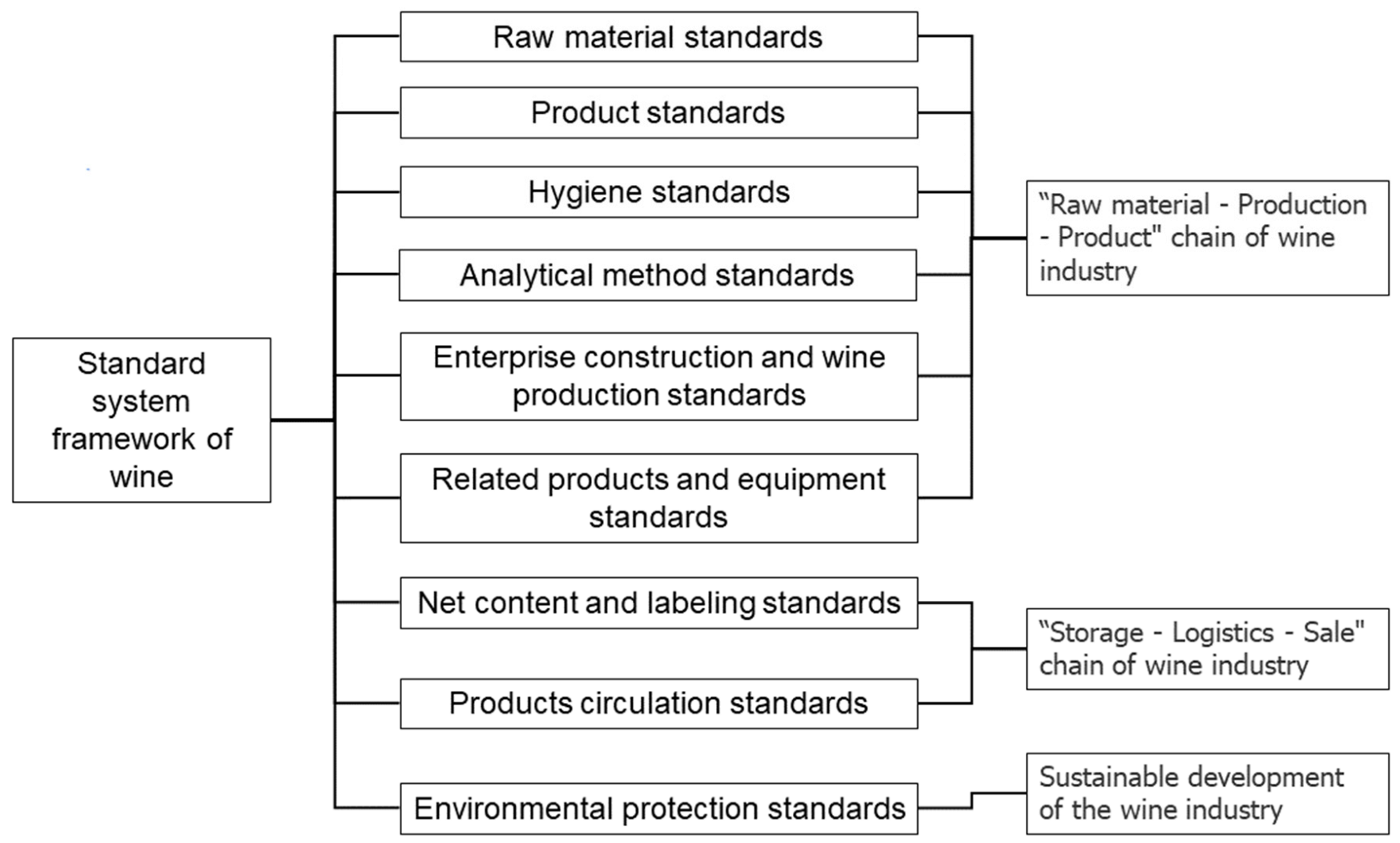

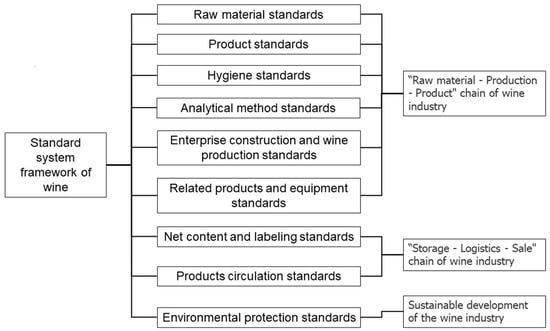

The standards system of wine in China is composed of a series of standards and relevant normative documents, pivoting on the Food Safety Law of the People’s Republic of China. The following exposition will only discuss current national and trade standards related to wine and will categorize these standards based on their content. Figure 2 provides a framework diagram of the wine standards system in China.

Figure 2.

Standard system framework of wine in China.

4.1. National Standards on Wine

The current national standards on wine can be divided into (a) product standards, (b) hygiene standards, (c) analytical method standards, (d) net content and labeling standards, (e) enterprise construction and production standards, and (f) related products and equipment standards.

4.1.1. Product Standards

Product standards are technical requirements for product quality and inspection methods and are the primary basis for determining whether a product is qualified for certification. The national product standards are listed in Table 1.

Table 1.

National wine product standards in China.

Wine GB 15037-2006 is China’s most important wine product standard. It defines different types of wine in the light of the 2003 International Vine and Wine Code drawn by OIV and the Technical Code of Wine Making in China (Details are presented in the preface of Wine (GB 15037-2006)). This standard establishes rules on product classification, requirements (sensory, physical and chemical, hygiene, net quantity), analytical methods, inspection rules, rules on wine labeling and packaging, transportation, and storage. It applies to the production, inspection, and sale of wine. However, it is essential to note that this standard’s sensory and physicochemical requirements do not apply to special wines. The national standards for special wines are only Icewines (GB/T 25504-2010) and Vitis amurensis wines (GB/T 27586-2011). Brandy is a distilled wine made from grapes. Its effective national standard is Brandy (GB/T 11856-2008), inspired by the section on brandy of the EU Regulation (EC) No 110/2008 on the definition, description, presentation, labeling, and the protection of geographical indication of spirit drinks (Details are presented in the preface of Brandy (GB/T 11856-2008)). In order to make the wine industry with a certain foundation progress toward a higher end, some geographical indication wine products are encouraged to develop, now there have been five national standards in this field.

4.1.2. Hygiene Standards

Hygiene standards refer to a set of health requirements concerning the maximum allowable concentration of the chemical, physical, and biological harmful components in the production of wine. The main idea is to allow for a “relatively safe concentration” of chemicals that do not directly or indirectly harm human health. The impact on human health is evaluated based on the dose—response relationship between harmful substances in the environment and the human organism while also considering vulnerable individuals and exposure time to harmful agents. The national hygiene standards applicable to wine are listed in Table 2.

Table 2.

National hygienic standards of wine in China.

The above-mentioned standard Wine (GB 15037-2006) emphasizes that the addition of synthetic colorants, sweeteners, essences, and thickeners is specifically prohibited and indicates that hygienic requirements of wine products must meet the National food safety standards—Fermented alcoholic beverages and their integrated alcoholic beverages (GB 2758-2012). For brandy, its hygiene requirements must comply with the National food safety standards—Distilled alcoholic beverages and their integrated alcoholic beverages (GB 2757-2012). For brandy, its hygienic requirements must comply with the mandatory national standard GB 2757-2012 and whether it is GB 2758 or GB 2757. Their regulations on contaminant limits, mycotoxins limits, and food additives are all quoted from National food safety standards—Maximum levels of contaminants in foods (GB 2762-2017), National food safety standards—Maximum levels of mycotoxins in foods (GB 2761-2017) and National Food Safety Standard—Use of Food Additives (GB 2760-2014). The difference is that GB 2758-2012 also specifies limits for microorganisms (Salmonella and Staphylococcus aureus), while no microbial limit has been set in GB 2757-2012. For wine raw materials, the National food safety standards—Hygiene specifications of production for fermented alcoholic beverages and their integrated alcoholic beverages (GB 12696-2016) requires that wine raw materials should comply with the relevant provisions set in National food safety standards—Maximum levels of pesticide residues in foods (GB 2763-2021).

4.1.3. Analytical Method Standards

The inspection of quality indicators mentioned in wine product standards (above, Section 4.1.1) mainly involves sensory, physicochemical, and hygienic. Among them, the analytical methods of sensory and physicochemical indicators (except benzoic and sorbic acid) should meet the requirements of Analytical methods of wine and fruit wine (GB/T 15038-2006).

It is worth noting that the methods for measuring methanol and alcohol in GB/T 15038-2006 have been replaced by National food safety standards—Determination of methanol in foods (GB 5009.266-2016) and National food safety standards—Determination of ethanol concentration in alcoholic beverages (GB 5009.225-2016), respectively [21], while the rest of the standard remains in effect. The detection of benzoic and sorbic acids in wine products should be carried out according to National food safety standards—Determination of benzoic acid, sorbic acid, and saccharin sodium in foods (GB 5009.28-2016). For brandy, the analytical methods of sensory and physicochemical indicators shall comply with the provisions set in Brandy (GB/T 11856-2008), which only specify alcohol content, non-alcoholic volatiles, and copper. Similar to the Analytical methods of wine and fruit wine (GB/T 15038-2006), the determination method of alcohol content has been replaced by GB 5009.225-2016 [21]. Besides, the measuring method of copper was taken from National food safety standards—Determination of copper in foods (GB 5009.13). If other physicochemical indicators, such as iron and methanol, are required for brandy products, they can be tested by referring to the provisions in GB/T 15038 (The determination methods of other physicochemical indicators can refer to the requirements of brandy in Product of geographical indication—Yantai wines (GB/T 18966-2008) and Product of geographical indication—Shacheng Wine (GB/T 19265-2008)). Table 3 recapitulates the current Chinese national standards for analytical methods of sensory and physicochemical indicators of wine.

Table 3.

National standards for analytical methods of sensory and physicochemical indicators of wine in China.

Some analytical methods of hygienic indicators correspond to the hygiene standards mentioned above for wine and brandy products. Table 4 contains a list of the Chinese national standards for analytical methods of hygienic indicators of wine currently in force. National food safety standards—Maximum levels of mycotoxins in foods (GB 2761-2017) specify only the maximum limit of ochratoxin A allowed for wine, to be determined according to the method selected in National food safety standards—Determination of Ochratoxin A in foods (GB 5009.96). National food safety standards—Maximum levels of contaminants in foods (GB 2762-2017) only establish a maximum level of lead in grapes, grape juice, and alcohol and mandate that this parameter must be measured according to the criteria set in the National food safety standards—Determination of plumbum in foods (GB 5009.12). For microbiological indicators, National food safety standards—Fermented alcoholic beverages and their integrated alcoholic beverages (GB 2758-2012) stipulates that the treatment and analysis of wine samples should comply with methods set in National food safety standards—General rules for microbiological testing of food (GB 4789.1) and Microbiological examination of food hygiene-Examination of wines (GB/T 4789.25). Most wine and brandy product standards reproduce these national standards for testing methods of hygienic indicators. Moreover, the method for analyzing the hygienic standard of fermented alcoholic beverages and their integrated alcoholic beverages (GB/T 5009.49-2008) is referenced by Vitis amurensis wines (GB/T 27586-2011).

Table 4.

National standards for testing methods of hygienic indicators of wine in China.

Those physicochemical and hygienic testing method standards mentioned above correspond to the physicochemical and hygienic requirements in wine product standards. As for other physicochemical and hygienic indicators not included in wine product standards but that still need to be measured, they can be analyzed by referring to the methods in the compilation of National Food Safety Standards, such as National food safety standards—Determination of 512 pesticides residues in fruit juice, vegetable juice and fruit wine—Liquid chromatography-mass spectrometry (GB 23200.14-2016).

4.1.4. Net Content and Labeling Standards

The wine product standards (These wine product standards include GB 15037-2006, GB/T 18966-2008, GB/T 20820-2007, GB/T 19049-2008, GB/T 19265-2008) require the net content to comply with Measures for the management of metrological supervision of products in prepackages with fixed content (Order of the former State General Administration of Quality Supervision, Inspection and Quarantine, No. 78, 2005), and its measurement should follow the Rules of metrological testing for the net quantity of products in prepackages with fixed content (JJF 1070-2005).

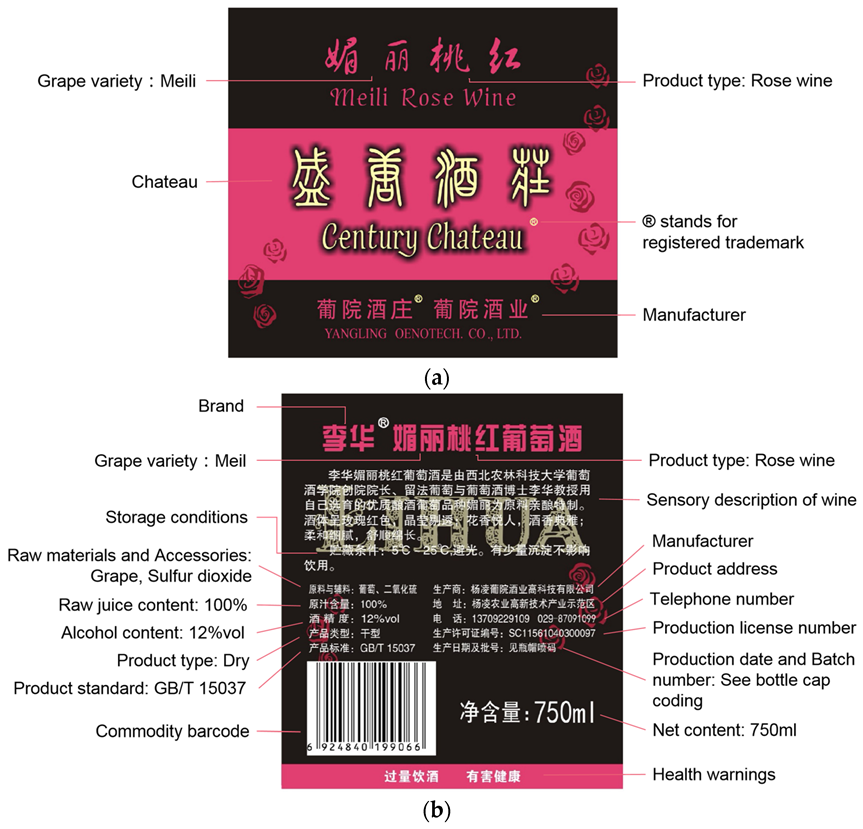

Wine (GB 15037-2006) contains two mandatory provisions on labeling. First, the labeling of prepackaged wine shall follow the General standard for the labeling of prepackaged alcoholic beverages (GB 10344), and product categories should be divided by the sugar content or labeled by the sugar content directly (e.g., Wine type: Dry or Sugar content: 4 g/L). In addition, there are two supplementary notes, stipulating that no indication of raw and supplementary materials is necessary for wines made from one single ingredient, and specific names of the antiseptics should be indicated for wines with antiseptics. Secondly, the year, variety, and original area shown on the label of the wines should conform to the definitions set in GB 15037-2006.

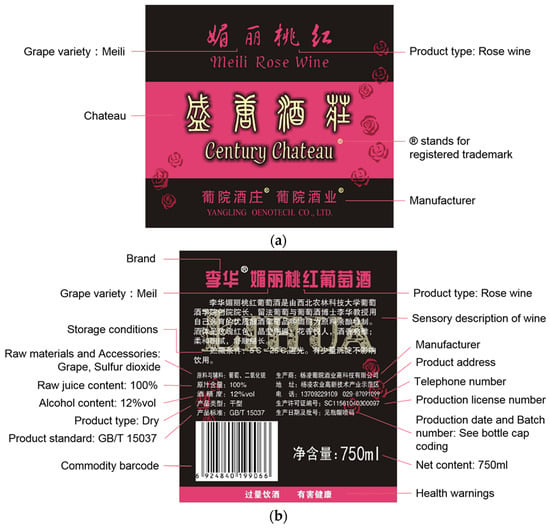

However, GB 10344 was abolished on 1 March 2015 [22] and has been replaced by National food safety standards—General standard for the labeling of prepackaged foods (GB 7718), which is referenced by several wine product standards (Product of geographical indication—Yantai wines (GB/T 18966-2008) and Product of geographical indication—Shacheng Wine (GB/T 19265-2008)). The logo for the packaging, transportation, and storage of wine products should conform with the requirements set in Packaging—Pictorial marking for the handling of goods (GB/T 191). Table 5 lists the national standards for net content and labeling of wine. Figure 3 represents a standard model of a Chinese wine label.

Table 5.

National standards for net content and labeling of wine in China.

Figure 3.

Explanation of information on a wine label in China. (a) Front label. (b) Back label.

4.1.5. Enterprise Construction and Wine Production Standards

National food safety standards—Hygiene specifications of production for fermented alcoholic beverages and their integrated alcoholic beverages (GB 12696-2016) is a compulsory national standard for wine production. It prescribes some basic requirements and management guidelines for the places, facilities, and staff involved in raw material procurement, processing, packaging, storage, transportation, and other stages in the production of fermented alcoholic beverages and integrated alcoholic beverages by referring to the National food safety standards—General Hygiene specifications for food production (GB 14881-2013).

Besides, the voluntary national standard, Good manufacturing practice for wine enterprises (GB/T 23543-2009), is also applicable to wine companies for winery design, construction (reconstruction and expansion), wine production, and quality management. Moreover, when building a winery, producers must also conform to the Code for the design of fire protection and prevention of alcoholic beverages factory (GB 50694-2011). The information recording and traceability in the wine production process should follow Implementation guidelines for traceability of wine production (GB/T 36759-2018). Finally, when evaluating the brand value of wine companies, the standards in Brand valuation—Alcohol, drink, and refined tea manufacturing industry (GB/T 31280-2014) can be followed.

Table 6 lists some national standards related to Chinese wine companies.

Table 6.

National standards related to Chinese wine companies.

4.1.6. Related Products and Equipment Standards

For wine-related products, specific national standards have been developed only for cork and coolers, while Packaging containers-wine bottle (BB/T 0018-2000) is a trade standard. There are only some national standards for testing methods of grape-harvesting machinery, grape presses, and mash pumps for wine production equipment. Table 7 contains a list of the national standards for wine-related products and equipment.

Table 7.

National standards of wine-related products and equipment.

4.2. Sector Standards in Wine Related Industries

At present, the national standards related to wine are still being improved. Regarding technical requirements that do not have national standards but need to be unified within a certain sector, the relevant administrative department of the State Council has formulated some sector standards to discipline them [20].

Therefore, in some wine-related sectors, such as agriculture, logistics, light industry, certification and accreditation services, work safety, environmental protection agencies, packaging, domestic trade, entry-exit inspection, and quarantine, some specific sector standards for the wine industry have been established. For example, Green Food—Wine (NY/T 274-2014) stipulates that the raw materials and their origin, as well as signs, labels, and packaging for the production of green wine, should comply with the series of agricultural standards of Green Food, which extends the standards of wine products. Technical specification for processing of organic wine (RB/T 167-2018) established by the certification and accreditation sector can be used as the standard for enterprises to produce organic wine. The relevant departments of light industry and entry–exit inspection and quarantine have also formulated a series of standards on wine quality inspection methods, such as using liquid chromatography coupled to isotope ratio mass spectrometry. Furthermore, Technical regulations for wine grape production (NY/T 2682-2015) and Grapes for processing (NY/T 3103-2017) issued by the former Ministry of Agriculture make up the standard gap in the wine grape field in China. The environmental protection sector has developed relevant standards requiring the wine production process to decrease the emission of pollutants as much as possible to reduce the harm to human health and the environment. Moreover, a series of wine product circulation standards established by sectors of logistics and domestic trade play a certain role in regulating the transportation and sales of wine in China. Table 8 lists some sector standards in wine-related industries. With the further development of these wine-related industries in the future, these sector standards are likely to be upgraded to national standards.

Table 8.

Sector standards in wine-related fields.

After more than 40 years of development, China’s wine industry has gradually built a relatively complete and mature industry-standard system that takes product and manufacturing standards as the core, and other relevant sector standards as accessories. Among these standards, raw material standards, enterprise construction and wine production standards, related products and equipment standards, hygiene standards, analytical method standards, and product standards work together to standardize the “raw material—production—product” chain of wine, which is the key to ensure the quality of the wine. In addition, product circulation standards, as well as net content and labeling standards, regulate the “storage-logistics-sale” chain of wines once wine products enter the market. Moreover, environmental protection standards limit the emission of pollutants during wine production to promote the sustainable development of the wine industry.

5. Regulations on Wine Production Management and Market Supervision

In the early stage of the rise of China’s wine industry, although some large enterprises consciously implement the national standards to maintain a high level of wine products, there are still a few small workshops to exploit the loopholes of sector standards (Half base wine) and produce inferior quality wine. Furthermore, a large number of popular wines are counterfeited, and price wars and vicious competition are common in the market [23]. In addition to amending and perfecting the existing standards, relevant administration authorities also formulated and supplemented a series of regulations for governing the wine industry. The interventions cover wine quality control and certification, production management and technical specification, circulation and market regulation, and some other aspects. The goal is to strengthen the supervision of winemaking and marketing behavior. Table 9 lists some regulations on wine production management and market supervision issued by different national departments.

Table 9.

Some regulations on wine production management and market supervision.

In terms of production management and technical specifications, in December 2000, the former State Light Industry Bureau promulgated the Measures for the management of wine production (trial), which is the first administrative regulation for the wine industry in China. The regulation reiterates the definition of wine and negates the half-base wine. Subsequently, in 2003, the Technical specification for grape wine making in China was implemente, bringing Chinese winemaking technology more in line with the level of advanced wine-producing countries in the world. Moreover, in 2005, the Rules for the implementation of food quality certification—Alcohol was issued. It is the first normative document in China to approve the quality level of alcohol products by means of certification. Alcohol products that have passed the quality level certification can use the national food quality certification mark, which proves the quality level of the product to the market and consumers. However, the quality certification has obvious defects, because it only reflects the hygienic condition of the wine, and cannot fully show the quality characteristics of wine, leading to it being difficult to be recognized by wineries and the market [5].

For practitioners in China’s wine industry, whether engaged in wine production or product wholesale and retail, they all need to obtain a qualification license first, the government implements a licensing system for food production and operation. The application, acceptance, review, decision and supervision, and inspection of food production license shall comply with the “Food Production Licensing Measures” issued by the State Administration for Market Supervision and Administration, which stipulates that local food and drug regulatory authorities at or above the county level shall be responsible for the food production license management and review work in the administrative area. Moreover, these review processes shall comply with the general rules and detailed rules of food production license review during the review (such as the standard of Detailed rules of grape wine and fruit wine production license review). When applying for a food production license, an enterprise or individual should first obtain a business license and other legal subject qualifications; corporate legal persons, partnerships, sole proprietorships, individual industrial and commercial households, etc., use the subjects specified in the business license as the applicant. The measures also stipulate the conditions that enterprises or individual industrial and commercial households applying for food production licenses should have in terms of locations, facilities, personnel, systems, equipment layout, technological processes, and legal responsibilities related to food production licenses. Regarding the business qualifications of wine wholesalers and retail operators, Alcohol commodities wholesale business management practices and Alcohol commodities retail business management practices stipulate that these two categories of operators must obtain business licenses, food hygiene permits, and tax registration certificates. In addition, wine wholesale operators must also have alcohol wholesale license certificates, and wine retail operators must also have alcohol retail license certificates. For the imported wine business, after the implementation of the Measures for the management of consumption tax on wine(trial), the domestic consumption tax of imported wine can be deducted from the consumption tax paid in the import process, thus further reducing the cost of imported wine.

These regulations, as part of the wine industry supervision system, cooperate with standards to strengthen the management of wine production and sales, guarantee product quality, protect legitimate business, safeguard the legitimate rights and interests of consumers, and promote the healthy development of the wine market in China [24].

6. The Development of Wine Geographical Indications in China

Since China acceded to the WTO, a large number of imported wines have entered the Chinese market, making domestic wines face huge competitive pressure. To cope with this dilemma, while expanding domestic wine production, improving wine quality and shaping “individualization” and “branding” have gradually become a new target of the development of domestic wine. The establishment of a geographical indication protection system for domestic wine has gradually attracted attention as an important means to achieve this goal. According to the definition of OIV, a geographical indication of wine is a geographical name to identify a wine or spirit made from grapes, and the wine or spirit must have qualities or characteristics or both attributable to the geographical environment in which it is located, including natural and cultural factors [25]. The implementation of wine geographical indications is conducive to promoting the formation of characteristic wine industry clusters, maintaining the legitimate rights and interests of wine-producing regions and wineries, enhancing the competitiveness of wine brands, and forming a unique wine culture [25].

On 17 August 1999, the former State Bureau of Quality and Technical Supervision issued the Regulations on the Protection of Products in The Regions of Origin, until 15 July 2005, it was replaced by the Regulations on the Protection of Products of Geographical Indication. By the end of 2018, 13 Chinese wine products had been approved for geographical indication product protection in China (Table 10). The execution of the protection system of geographical indication products marks that China’s wine industry has entered a stage of high-quality development [26]. For example, “YanTai wine” is the first batch of wine products to implement the protection of geographical indication products in China. This policy has helped “YanTai wine” to develop by leaps and bounds in terms of output, sales, and profit. In 2018, the large wine enterprises of YanTai jointly created a total output of 25,300 L, a main business income of 15.671 billion RMB, and a profit of 2.036 billion RMB [25]. Furthermore, the wine-producing region at the Helan Mountain’s East Foothill, where the wine industry started relatively late, was approved as a protection area of National Geographic Indication Product in 2003. By the end of 2021, there was 37,000 ha of wine grape fields, creating the largest contiguous wine grape planting area in China. In addition, some certain elite wineries in this region have gained an international reputation thanks to the quality of their wines [27,28]. Obviously, the implementation of the system of geographical indication products protection, on the one hand, improves the quality of the original region wine and promotes the formation of wine brands cluster, on the other hand, brings more economic value to wine-producing regions.

Table 10.

Products protected by geographical indications of wine in China.

7. The Proposal of Revising Chinese Wine Industry’s Supervision System

At present, although the wine industry in China has begun to take shape, the quality of domestic wines has been continuously improved, and even though some of them have repeatedly won international awards, domestic wine is still unable to increase its proportion in the Chinese alcohol consumer market. Data show that from 2015 to 2020, the gap between the total value of wine imports and the total sales of domestic wineries above state designated scale became smaller and smaller, especially after 2018, the two were almost flat [29]. Moreover, in China, where liquor culture is prevalent, domestic wine cannot compete with Chinese spirits. In 2020, the sales income of Chinese spirits was 583.64 billion RMB, while wine was only 10.02 billion RMB [30]. This situation shows that Chinese consumers still lack recognition and confidence in domestic wine. The key to expanding the domestic wine consumer market is to strengthen the branding construction, improve testing standards and reduce taxes [31].

7.1. Suggestions on Brand Building of Domestic Wines

It has been 20 years since China approved the first geographical indication product for wine in 2002. However, due to insufficient work in the management mechanism and publicity of wine geographical indications, enterprises and consumers do not realize the importance of the geographical indication system, resulting in the value of this system not being fully exerted and grape varieties and wine products have become homogenized. Moreover, a few manufacturers deliberately confuse the concept of geographical indications to produce counterfeit and shoddy wine, which overdrafts the reputation of the producing regions and destroys the order of the wine market [25]. Therefore, the government of each producing region needs to vigorously publicize the value of wine geographical indications and encourage enterprises to make full use of local natural and cultural factors to develop distinctive wine products, so as to promote the formation of standardized, characteristic, and large-scale wine industry clusters and improve the core competitiveness of wine-producing regions [25].

In addition, France, Italy, Germany, and other old world wine countries have established uniform wine classification standards, such as the wine classification standards of France, the most prestigious in the world. The concept of winery classification originated from the 1855 winery classification in Bordeaux Medoc, France [32]. The establishment of a winery and winery wine classification system can not only help consumers to judge the quality of wine according to the classification standards, but also be conducive to the healthy competition of wineries, improve wine quality, and promote the brand building of domestic wines. However, this system is still in its infancy and needs to be further explored. At present, only the Helan Mountain East Region in Ningxia has issued the Method for Evaluating the Grade of Winery [33].

Furthermore, it is necessary to strengthen the crackdown on counterfeiting and infringement behaviors in the wine industry and perfect the wine safety traceability system. In 2021, the Guiding Opinions on the Development of China’s Alcohol Industry during the 14th Five-Year Plan published by the China Alcohol Industry Association clearly pointed out that a committee would be established to promote anti-infringement and anti-counterfeiting work, and put forward some policy suggestions, such as increasing policy support for intellectual property protection of alcohol, implementation of a blacklist system for making and selling counterfeit goods, and increasing the cost of alcohol counterfeiting crimes [34].

7.2. Suggestions on Testing Standard of Wine Making Process

In the Chinese wine standard system, testing the quality of the end product is required. The test standards and analysis methods refer to GB 15037-2006 and GB/T 15038-2006. However, there is no standard for quantitatively restrict the content of various chemical components in the production process, for example ethyl carbamate (EC) and biogenic amine (BA) produced in the alcohol fermentation and malolactic fermentation, EC is a substance capable of causing cancer, and BA can trigger allergic reactions [35,36]. Winemaking is a complex process, and any production link from raw materials to finished wine is crucial [37]. Therefore, China needs to formulate more complete testing standards to ensure the quality of wine.

7.3. Suggestions on Taxation of Domestic Wine

Wine is classified as an industrial product in China and will be subject to 10% consumption tax, 13% value-added tax, 7% surtax, and 25% income tax, resulting in a comprehensive tax on domestic wine exceeding 30% [31]. It has brought enormous pressure to wine production enterprises and reduced the price-performance of domestic wines. In contrast, the major wine-producing countries in the west regard wine as an agricultural product, with subsidy policies and lower taxes. In addition, since China joined the WTO, the tariffs on imported wine have continued to decline or even become zero, which further enhances the advantages of imported wines in cost and price. Therefore, in recent years, some Chinese experts have suggested that the consumption tax on wine should be abolished, and the winemaking should be incorporated into the “scope of primary processing of agricultural products enjoying the preferential corporate income tax policy”, exempting or reducing corporate income tax, and decreasing the value-added tax rate from 13% to 9%, to accurately support the domestic wine industry chain and resist the impact of imported products [31].

8. Conclusions

During the last two decades, the Chinese wine industry has achieved rapid development and faced many opportunities and challenges. To ensure the safety of wine products and the healthy development of the wine industry, relevant Chinese administration authorities have established a wine standard system based on in-depth research on the Chinese wine industry and pivoted around the Food Safety Law, the Standardization Law, and other relevant regulations.

This legal framework standardizes all aspects of the wine industry from land to table, covering raw materials, products, hygiene, analytical methods, net content and labeling, enterprise construction and production, related products and equipment, environmental protection, and product circulation. Meanwhile, some regulations on the management of wine production and circulation have been enacted to supervise the behavior of winemakers during production and distribution. However, there are still many aspects of China’s wine policy that need to be strengthened, such as improving the grading system for product quality, enhancing legal protection of geographical indications, developing industrial informatization and mechanization, promoting the individuation and cost-performance of Chinese wine, canceling the consumption tax on wine, and reducing the value-added tax, etc. In the long run, the Chinese wine industry has great prospects for development. However, it is still necessary to strengthen international cooperation and exchanges in the standardization of the wine industry, such as holding an international conference on the legal system of wine and broadcasting its regulatory system when promoting domestic wine. Government support is also needed to push forward the amendment and improvement of wine laws and standards and help the Chinese wine industry better cope with adjustment and upgrading to increase wine consumption and promote the sustainable development of the industry.

Author Contributions

Conceptualization, C.Y., R.S. and H.L.; data curation, C.Y.; writing—original draft preparation, C.Y. and R.S.; writing—review and editing, C.Y., R.S., Y.D. and L.Z.; visualization, C.Y.; supervision, H.L. and H.W.; project administration, H.L. and H.W.; funding acquisition, H.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Ningxia Hui Nationality Autonomous Region Major Research and Development Project, 2020BCF01003; Key Research and Development Program of Shaanxi Province, 2020ZDLNY07_08; Research and Application of Key Technologies for Sustainable Development of Wine Industry, LYNJ202110; National Key Research and Development Project, 2019YFD1002500.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Wang, H.; Ning, X.; Yang, P.; Li, H. Ancient World, Old World and New World of Wine. J. Northwest A F Univ. (Soc. Sci. Ed.) 2016, 16, 150–153. [Google Scholar] [CrossRef]

- Yang, H.; Tao, Y.; Zhang, Y. The situation and development trend of wine standards and related regulations in China. China Brew. 2009, 8, 181–183. [Google Scholar]

- Li, H.; Li, J.; Yang, H. Review of Grape and Wine Industry Development in Recent 30 Years of China’s Reforming and Opening-up. Mod. Food Sci. Technol. 2009, 25, 341–347. [Google Scholar]

- Wang, X. The Development of Chinese Wine in Nearly 40 Years. Available online: https://new.qq.com/omn/20200117/20200117A0MI2400.650html (accessed on 23 May 2020).

- Lu, Q.F. Research on the Development of Chinese Wine Industry in Modern Times; Northwest A&F University: Xianyang, China, 2013. [Google Scholar]

- Zeng, L.; Szolnoki, G. Chapter 2—Some Fundamental Facts about the Wine Market in China. In The Wine Value Chain in China; Roberta, C., Steve, C., David, M., Jingxue, J.Y., Eds.; Chandos Publishing: Oxford, UK, 2017; pp. 15–36. ISBN 9780081007549. [Google Scholar] [CrossRef]

- Giulia, M.; Johan, S. The Political Economy of European Wine Regulations. J. Wine Econ. 2013, 8, 244–284. [Google Scholar]

- Ma, N.X. Study on the development strategy of Ningxia wine industry—Taking the eastern foothill of Helan Mountain as an example. Ind. Technol. Forum 2017, 16, 21–25. [Google Scholar]

- Tang, W.; Liu, S. Review on China Wine Market in 2013. Liquor Making 2014, 41, 14–17. [Google Scholar]

- OIV. OIV 2017 Report on the World Vitivinicultural Situation. PPT Presentation. 2017. Available online: http://www.oiv.int/en/oiv-life/oiv-2017-report-on-the-world-vitivinicultural-situation (accessed on 10 February 2020).

- OIV. OIV 2019 Report on the World Vitivinicultural Situation. PPT Presentation. 2019. Available online: http://www.oiv.int/en/oiv-life/oiv-2019-report-on-the-world-vitivinicultural-situation (accessed on 10 February 2020).

- Zhu, X.; Zhu, J.; Mu, W.; Feng, J. Analysis of the industrial distribution of wine in China. Sino-Overseas Grapevine Wine 2019, 3, 71–75. [Google Scholar]

- Zhong, A.; Zhou, H. Deputy to the National People’s Congress and Chairman of Changyu: Abolish Wine Consumption Tax and Change Unequal Competition between Domestic and Foreign Enterprises. The Economic Observer. 2021. Available online: https://baijiahao.baidu.com/s?id=1693361927656086009&wfr=spider&for=pc. (accessed on 5 March 2021).

- Gu, Y. Reducing Taxes and Strengthening Brand Building Will Help Chinese Domestic Wines Catch a Chance to Transcend Imported Wine in Market during the Epidemics of COVID-19. 2020. Available online: http://www.cnfood.cn/hangyexinwen156652.html (accessed on 23 May 2020).

- OIV. The Situation of Vineyard, Grapes and Wine in China. OIV Data, Country Profile. 2016. Available online: http://www.oiv.int/en/statistiques/?year=2016&countryCode=CHN (accessed on 1 May 2020).

- OIV. Analysis of Wine Consumption in China, UK, Spain, Russia, Argentina and Australia. OIV Data, Database. 2016. Available online: http://www.oiv.int/en/statistiques/recherche (accessed on 1 May 2020).

- China Industry Information Network. Analysis of the Chinese Wine Industry (Development Process, Industrial Chain, Import and Export, Competitive, etc.) in 2020: The Industry Has Entered a Period of Adjustment. 2020. Available online: https://www.chyxx.com/industry/202001/831009.html (accessed on 12 February 2020).

- Yang, H.; Li, H.; Li, J.; Wang, Y.; Zhang, Y. Discomfort terms and adjustment suggestions of Chinese wine regulation system. Food Ferment Ind. 2015, 41, 226–234. [Google Scholar]

- Standing Committee of the National People’s Congress. Standardization Law of the People’s Republic of China. 2017. Available online: http://www.gov.cn/xinwen/2017-11/05/content_5237328.htm (accessed on 20 February 2020).

- The State Council of China. The Regulations for the Implementation of the Standardization Law of the People’s Republic of China; Decree of State Council (No. 53); The State Council of China: Beijing, China, 1990. [Google Scholar]

- National Health and Family Planning Commission of China (NHFPC); The Department of China Food and Drug Administration (CFDA). Announcement Related to the Publication of National Food Safety Standards-Food Additives-Calcium Hydrophosphate (GB 1886.3-2016) and Other National Food Safety Standards and Two Standard Modification Lists; Notice of NHFPC and CFDA (No. 11); The National Health and Family Planning Commission of China and The Department of China Food and Drug Administration: Beijing, China, 2016. [Google Scholar]

- General Administration of Quality Supervision; Inspection and Quarantine of the People’s Republic of China (AQSIQ); Standardization Administration of the People’s Republic of China (SAC). Announcement on the Abolition of the General Standard for the Labeling of Prepackaged Alcoholic Beverage and other 13 National Standards; Notice of AQSIQ and SAC (No. 31); The General Administration of Quality Supervision, Inspection and Quarantine and Standardization Administration: Beijing, China, 2014. [Google Scholar]

- Yang, H.C. Discussion on the development strategy of China’s wine industry. China Brew. 2008, 11, 102–103. [Google Scholar]

- Xu, W.; Tie, J. Legislation to fill the gap of alcohol supervision in Our province. Jilin People’s Congr. 2008, 8, 25. [Google Scholar]

- Liu, S.; Gao, J. Study on the Value and Protection of Chinese Wine Geographical Indication. Anhui Agric. Sci. 2020, 48, 261–264. [Google Scholar]

- Li, H.; Fang, Y.L. Study on the mode of sustainable viticulture: Quality, stability, longevity and beauty. Sci. Technol. Rev. 2005, 23, 20–22. [Google Scholar]

- Ma, X.M. Ningxia Wine “when shocking the world”. Int. Bus. Dly. 2022. [Google Scholar]

- Jiao, L.; Ouyang, S. The Chinese Wine Industry. In The Palgrave Handbook of Wine Industry Economics; Alonso Ugaglia, A., Cardebat, J.M., Corsi, A., Eds.; Palgrave Macmillan: Cham, Switzerland, 2019. [Google Scholar] [CrossRef]

- Prospects Industrial Research Institute. Market Analysis of Chinese Wine Industry in 2021: Wine Market Downturn Reason Analysis, Market Still has the Opportunity to Pick Up. 2021. Available online: https://bg.qianzhan.com/trends/detail/506/210817-4dc59237.html (accessed on 17 August 2021).

- Yu, J.; China Wine Industry Development Status and Import and Export Situation Analysis in 2020. Winesinfo. 2021. Available online: https://www.winesinfo.com/html/2021/4/12-84409.html (accessed on 1 April 2021).

- Zhen, Y.X.; Two Sessions- Jiang Ming, NPC Deputy and Chairman of Tianming: It is Suggested to Increase the Support for Chinese Wine Brand Construction. Economic Observer Network. 2022. Available online: http://www.eeo.com.cn/2022/0305/524244.shtml (accessed on 5 March 2022).

- Zhu, K.Z.; Wang, C.P.; Zhen, L. Analysis of applicable laws and regulation of wine estate and discussion on construction of standard system. Sino-Overseas Grapevine Wine 2021, 21, 82–86. [Google Scholar]

- Wang, K.H.; Lin, Z.S. Research on existing problems and countermeasures of winery system in Ningxia. Commer. Econ. 2020, 2, 127–129. [Google Scholar]

- China Food Network. The Guidelines for the Development of China’s Wine Industry in the 14th Five-Year Plan are Released. 2021. Available online: http://food.china.com.cn/2021-04/09/content_77392532.htm (accessed on 9 April 2021).

- World Health Organization (WHO). Evaluation of Certain Food Contaminants: Sixty-Fourth Report of the Joint FAO/WHO Expert Committee on Food Additives. WHO Technical Report Series No. 930; World Health Organization: Geneva, 2006. Available online: http://whqlibdoc.who.int/trs/WHO_TRS_930_eng.pdf (accessed on 2 May 2022).

- Liu, J.; Ren, J.; Sun, K.J. Research progress on the safety of biogenic amines in foods. Food Sci. 2013, 34, 322–326. [Google Scholar]

- Müller, T.M.; Zhong, Q.; Fan, S. What’s in a wine?—A spot check of the integrity of European wine sold in China based on anthocyanin composition, stable isotope and glycerol impurity analysis. Food Addit. Contam.-Part A Chem. Anal. Control. Expo. Risk Assess. 2021, 38, 1289–1300. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).