Life Cycle Assessment and Costing of Large-Scale Battery Energy Storage Integration in Lombok’s Power Grid

Abstract

:1. Introduction

- The integration of LCA and LCC analysis using 10 impact indicators for a large-scale BESS in Lombok for the first time.

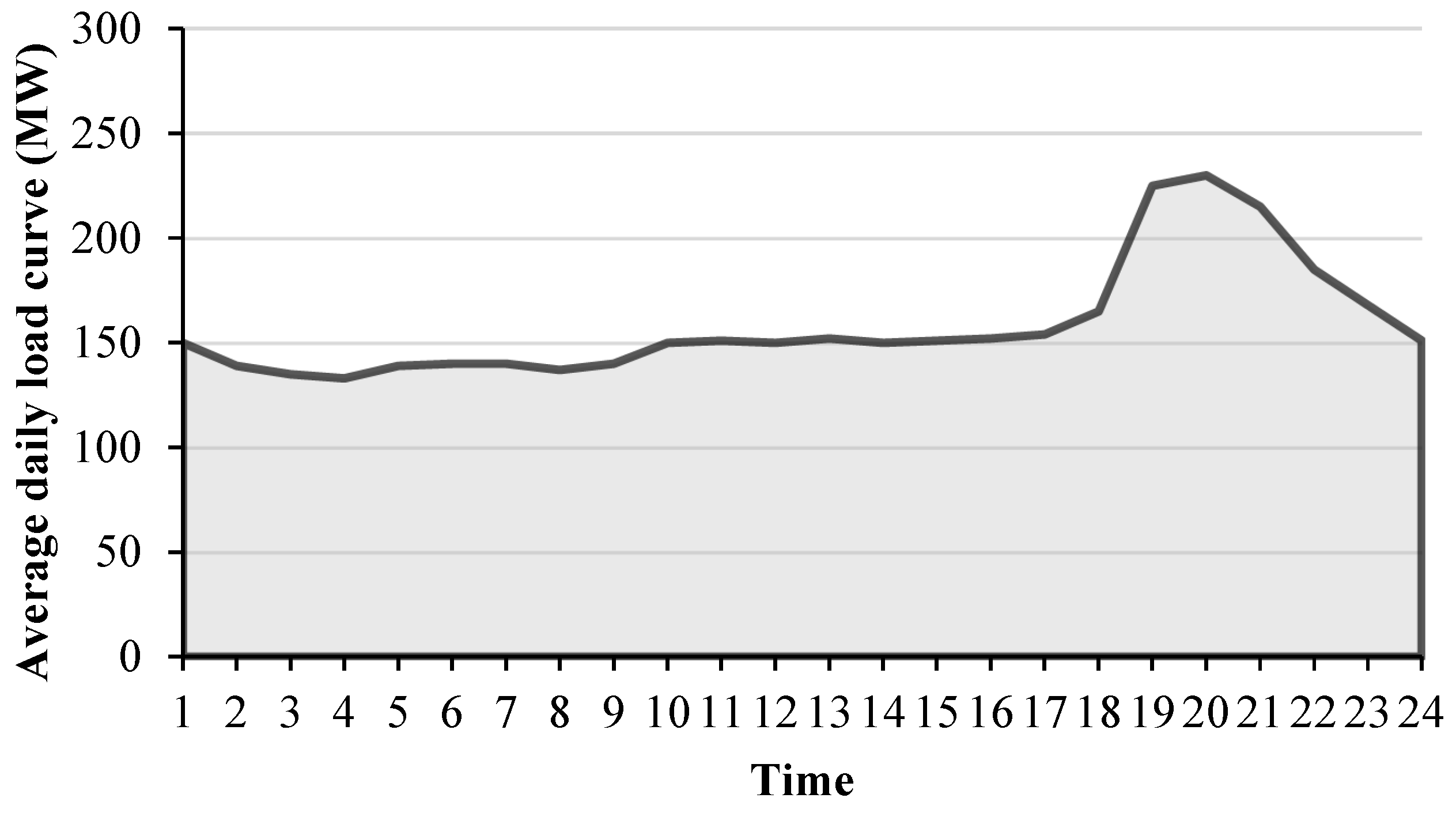

- The analysis of the LFP-based BESS integration in the future energy mix of Lombok to overcome the peak load issues.

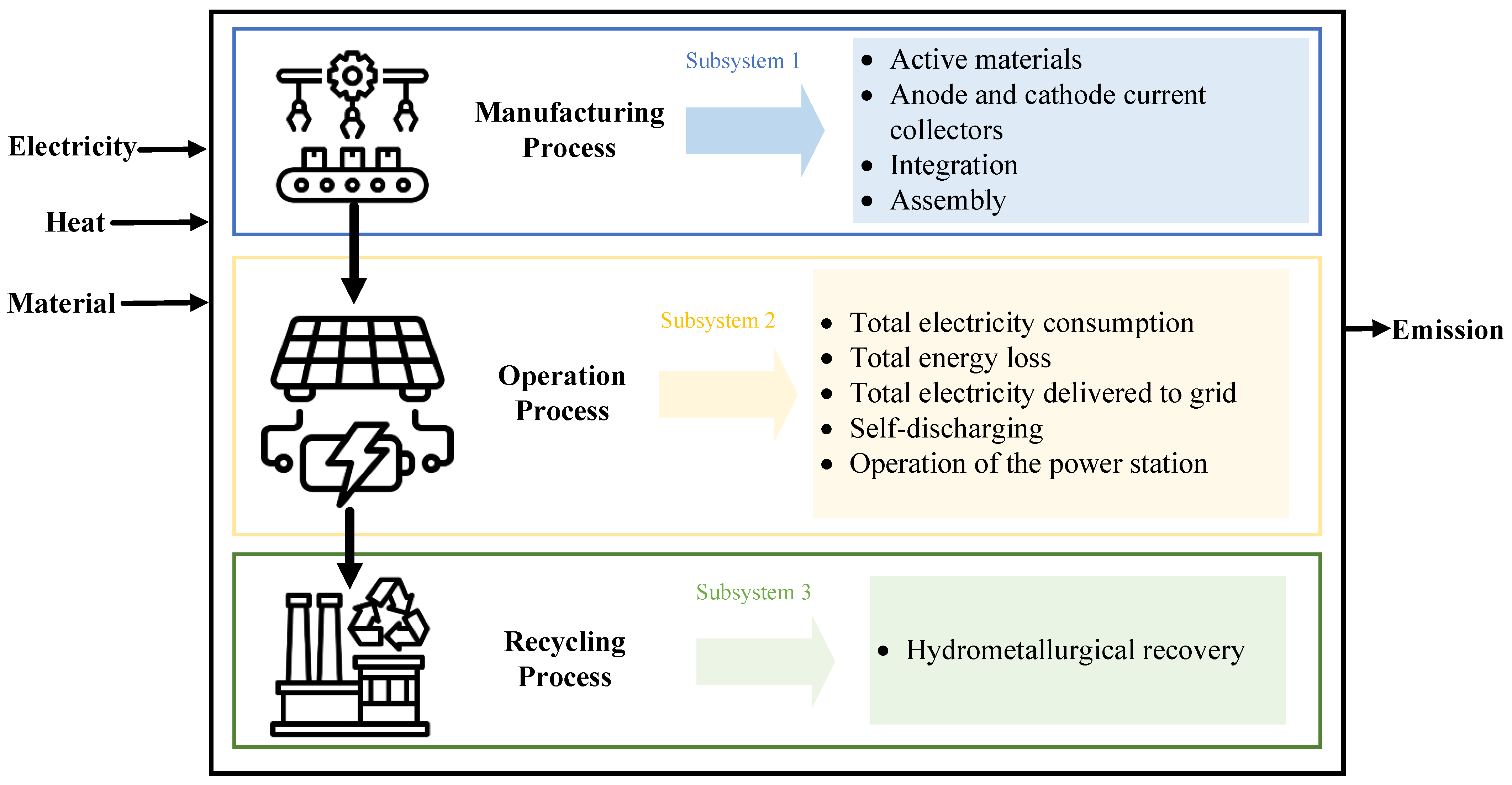

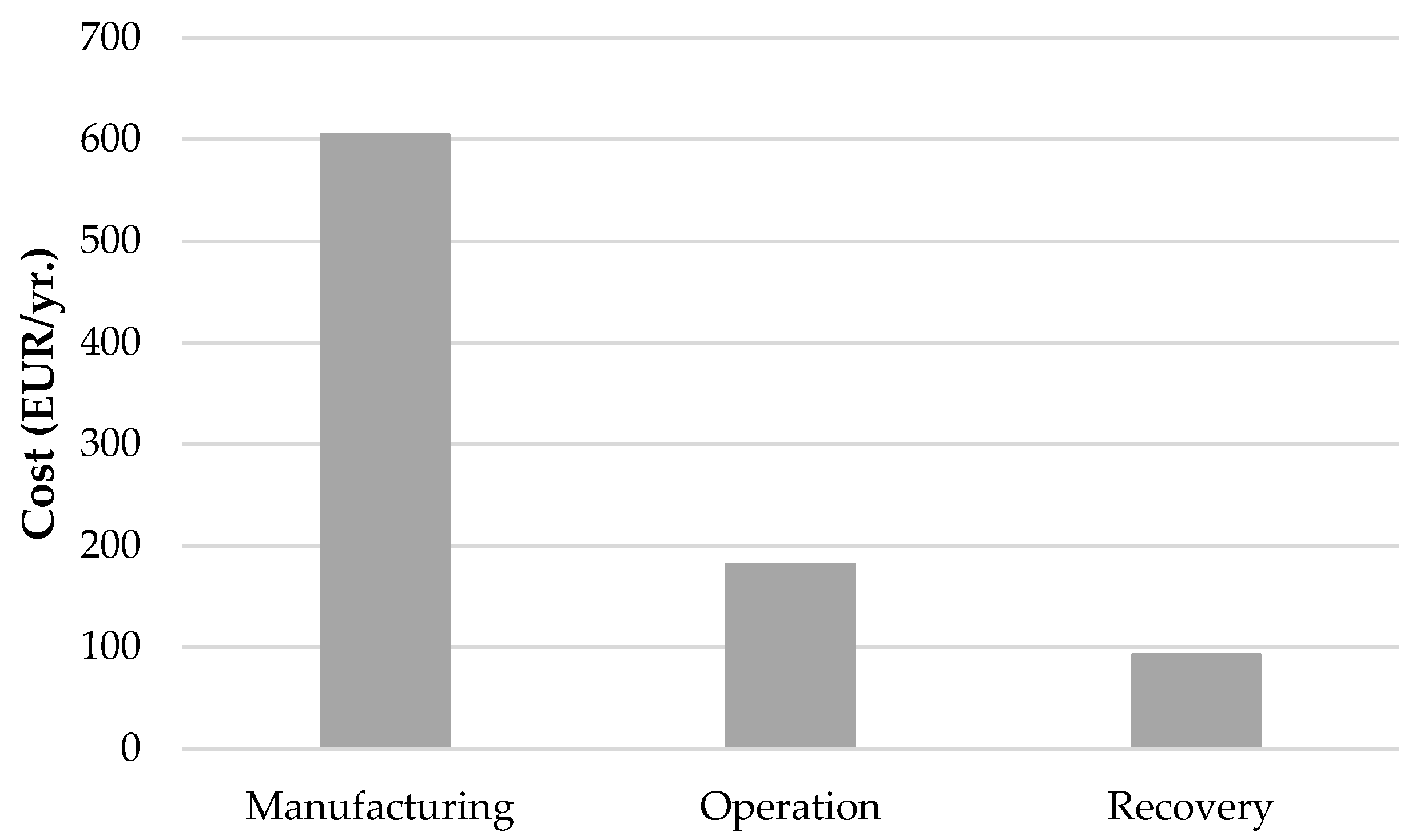

- The cradle-to-grave analysis of the BESS life chain, including manufacturing, operation, and recycling, besides examining the environmental and financial effects of each step.

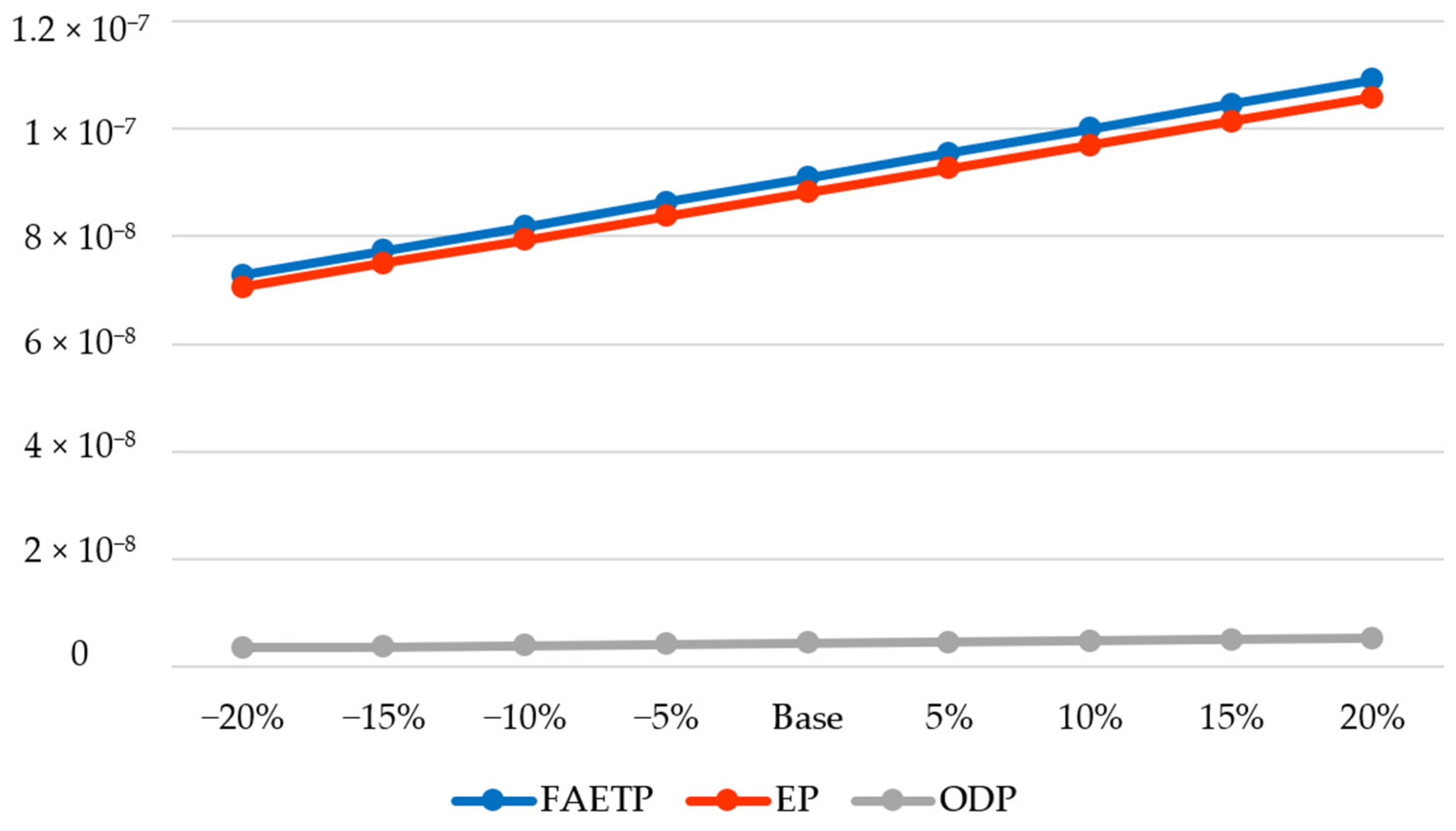

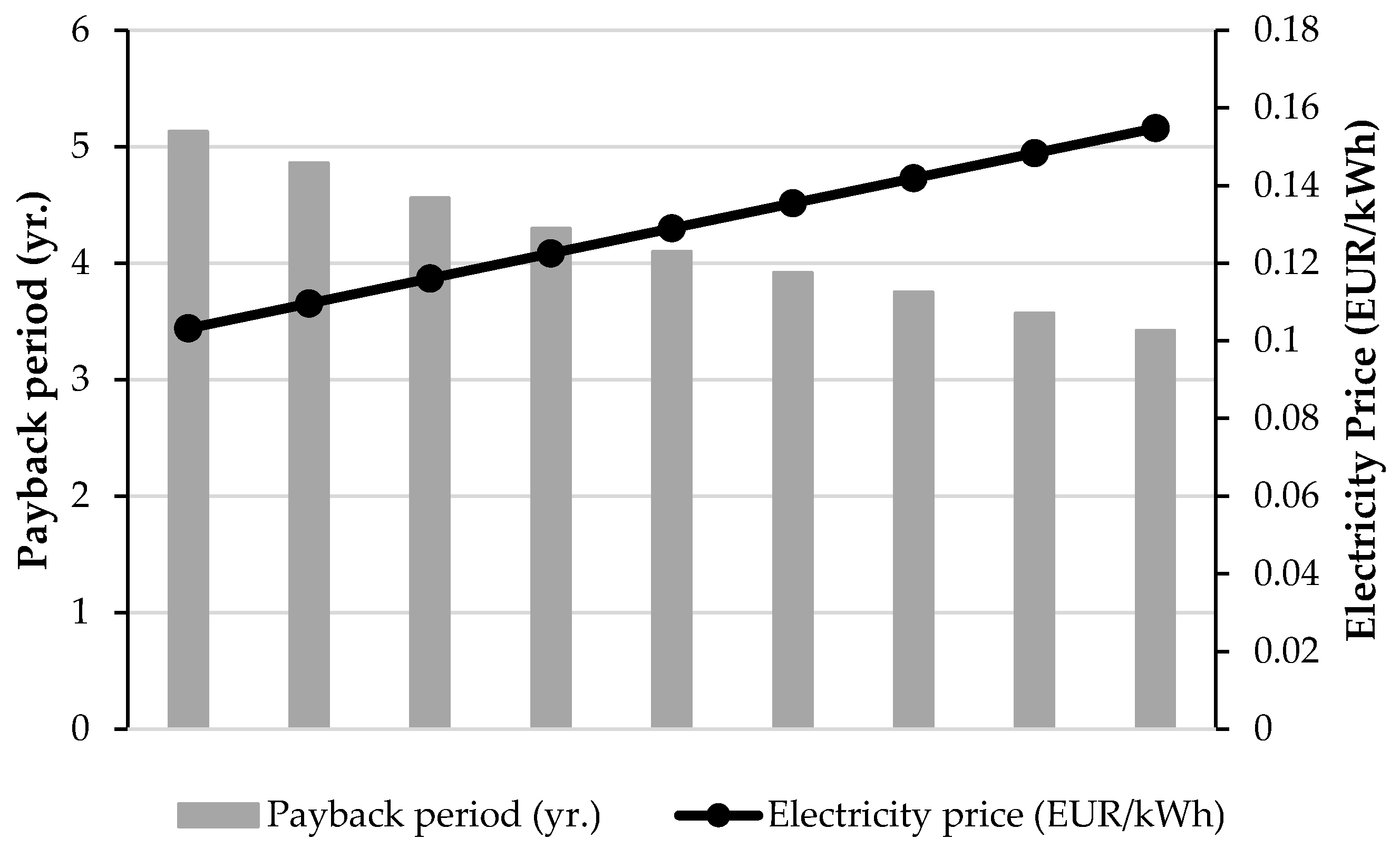

- The provision of a sensitivity analysis of electricity price, as well as the uncertainty of input data on BESS, to investigate their effects on environmental and economic indicators that can influence the strategy of decision-makers.

2. Materials and Methods

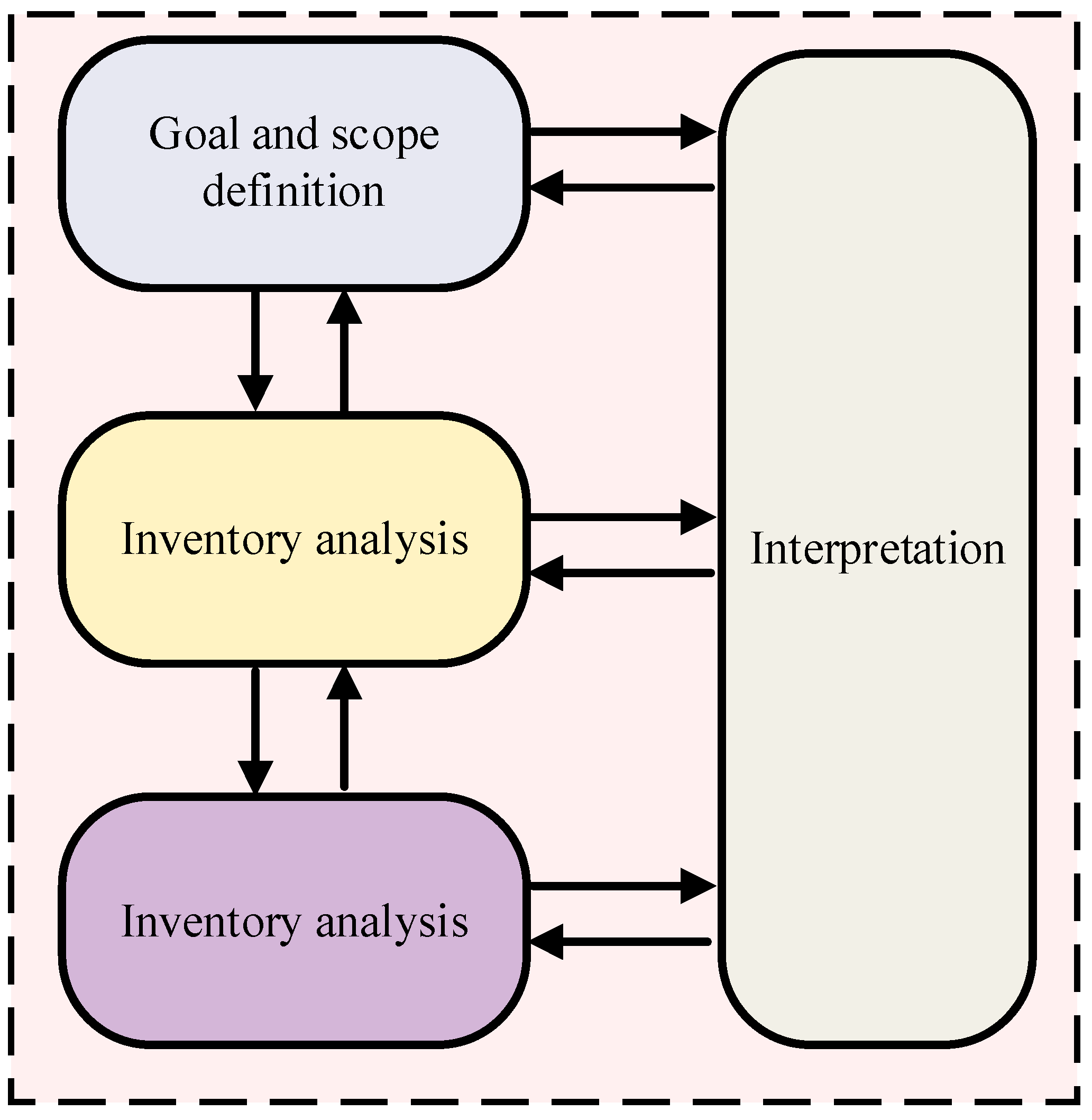

2.1. LCA Concept

2.1.1. Goal and Scope

2.1.2. Life Cycle Inventory

2.1.3. Impact Assessment

2.1.4. Interpretation

2.2. LCC Concept

3. Results and Discussion

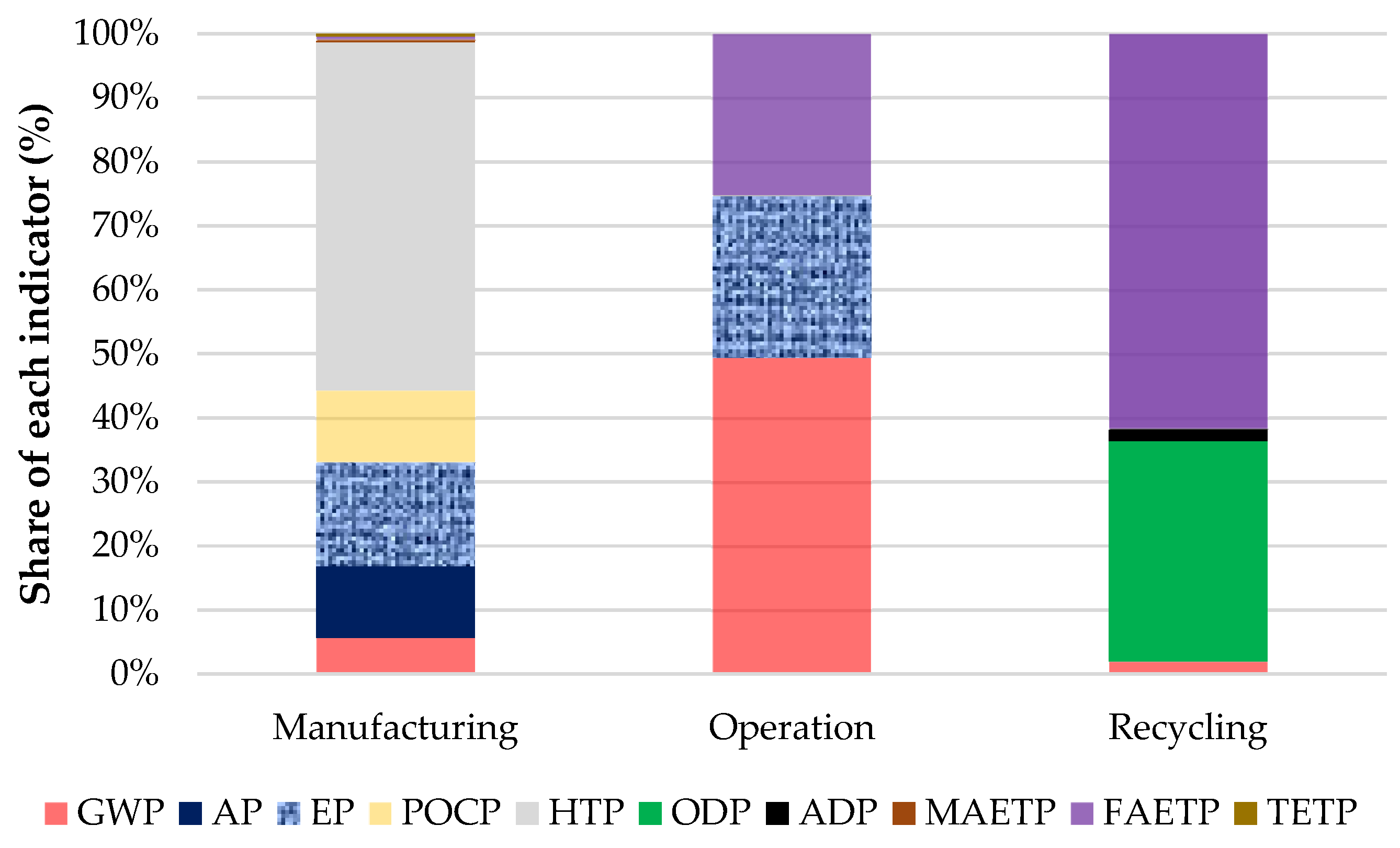

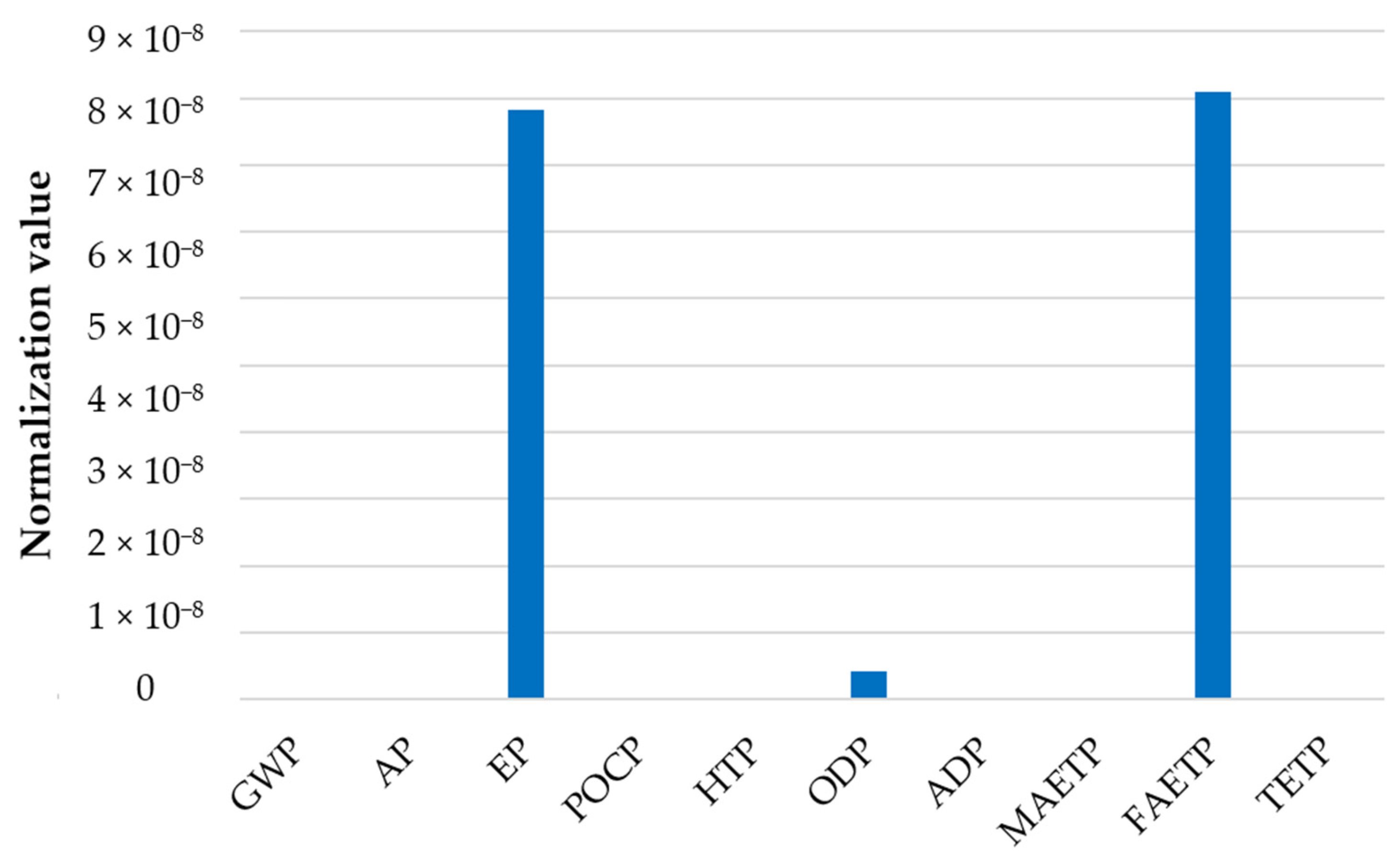

3.1. Results on LCA

3.2. Results on LCC

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- KPMG. Investing in Lombok—Prefeasibility Studies on Renewable Energy Solutions in Lombok; KPMG: Amstelveen, The Netherlands, 2019. [Google Scholar]

- Nasional, D.E. Technology Data for the Indonesian Power Sector: Catalogue for Generation and Storage of Electricity; Dewan Energi Nasional, Kemetrian Energi dan Sumber Daya Mineral: Jakarta, Indonesia, 2017. [Google Scholar]

- Hemmati, M.; Mohammadi-Ivatloo, B.; Abapour, M.; Anvari-Moghaddam, A. Day-ahead profit-based reconfigurable microgrid scheduling considering uncertain renewable generation and load demand in the presence of energy storage. J. Energy Storage 2020, 28, 101161. [Google Scholar] [CrossRef]

- Hosseini, A.; Yazdan, A.S.; Hemmati, M.; Abapour, M. Hybrid Robust Stochastic Bidding Strategy for Wind Farms Integrated with Compressed Air Energy Storage and Power to Gas Technology. J. Model. Eng. 2021, 19, 137–148. [Google Scholar]

- Arshad, F.; Lin, J.; Manurkar, N.; Fan, E.; Ahmad, A.; Tariq, M.-U.; Wu, F.; Chen, R.; Li, L. Life cycle assessment of lithium-ion batteries: A critical review. Resour. Conserv. Recycl. 2022, 180, 106164. [Google Scholar] [CrossRef]

- Pellow, M.A.; Ambrose, H.; Mulvaney, D.; Betita, R.; Shaw, S. Research gaps in environmental life cycle assessments of lithium ion batteries for grid-scale stationary energy storage systems: End-of-life options and other issues. Sustain. Mater. Technol. 2019, 23, e00120. [Google Scholar] [CrossRef]

- Yudhistira, R.; Khatiwada, D.; Sanchez, F. A comparative life cycle assessment of lithium-ion and lead-acid batteries for grid energy storage. J. Clean. Prod. 2022, 358, 131999. [Google Scholar] [CrossRef]

- Tolomeo, R.; De Feo, G.; Adami, R.; Osséo, L.S. Application of life cycle assessment to lithium ion batteries in the automotive sector. Sustainability 2020, 12, 4628. [Google Scholar] [CrossRef]

- Shafique, M.; Luo, X. Environmental life cycle assessment of battery electric vehicles from the current and future energy mix perspective. J. Environ. Manag. 2022, 303, 114050. [Google Scholar] [CrossRef] [PubMed]

- Rajaeifar, M.A.; Raugei, M.; Steubing, B.; Hartwell, A.; Anderson, P.A.; Heidrich, O. Life cycle assessment of lithium-ion battery recycling using pyrometallurgical technologies. J. Ind. Ecol. 2021, 25, 1560–1571. [Google Scholar] [CrossRef]

- Mohr, M.; Peters, J.F.; Baumann, M.; Weil, M. Toward a cell-chemistry specific life cycle assessment of lithium-ion battery recycling processes. J. Ind. Ecol. 2020, 24, 1310–1322. [Google Scholar] [CrossRef]

- Le Varlet, T.; Schmidt, O.; Gambhir, A.; Few, S.; Staffell, I. Comparative life cycle assessment of lithium-ion battery chemistries for residential storage. J. Energy Storage 2020, 28, 101230. [Google Scholar] [CrossRef]

- Porzio, J.; Scown, C.D. Life-Cycle assessment considerations for batteries and battery materials. Adv. Energy Mater. 2021, 11, 2100771. [Google Scholar] [CrossRef]

- Lai, X.; Chen, Q.; Tang, X.; Zhou, Y.; Gao, F.; Guo, Y.; Bhagat, R.; Zheng, Y. Critical review of life cycle assessment of lithium-ion batteries for electric vehicles: A lifespan perspective. eTransportation 2022, 12, 100169. [Google Scholar] [CrossRef]

- Da Silva Lima, L.; Quartier, M.; Buchmayr, A.; Sanjuan-Delmás, D.; Laget, H.; Corbisier, D.; Mertens, J.; Dewulf, J. Life cycle assessment of lithium-ion batteries and vanadium redox flow batteries-based renewable energy storage systems. Sustain. Energy Technol. Assess. 2021, 46, 101286. [Google Scholar] [CrossRef]

- Hiremath, M.; Derendorf, K.; Vogt, T. Comparative life cycle assessment of battery storage systems for stationary applications. Environ. Sci. Technol. 2015, 49, 4825–4833. [Google Scholar] [CrossRef]

- Koese, M.; Blanco, C.F.; Vert, V.B.; Vijver, M.G. A social life cycle assessment of vanadium redox flow and lithium-ion batteries for energy storage. J. Ind. Ecol. 2023, 27, 223–237. [Google Scholar] [CrossRef]

- Hemmati, M.; Bayati, N.; Ebel, T. Integrated life cycle sustainability assessment with future energy mix: A review of methodologies for evaluating the sustainability of multiple power generation technologies development. Renew. Energy Focus 2024, 49, 100581. [Google Scholar] [CrossRef]

- Rossi, F.; Heleno, M.; Basosi, R.; Sinicropi, A. Environmental and economic optima of solar home systems design: A combined LCA and LCC approach. Sci. Total. Environ. 2020, 744, 140569. [Google Scholar] [CrossRef]

- Zakeri, B.; Syri, S. Electrical energy storage systems: A comparative life cycle cost analysis. Renew. Sustain. Energy Rev. 2015, 42, 569–596. [Google Scholar] [CrossRef]

- Nikolaidis, P.; Chatzis, S.; Poullikkas, A. Life cycle cost analysis of electricity storage facilities in flexible power systems. Int. J. Sustain. Energy 2019, 38, 752–772. [Google Scholar] [CrossRef]

- Tang, H.; Wang, S. Life-cycle economic analysis of thermal energy storage, new and second-life batteries in buildings for providing multiple flexibility services in electricity markets. Energy 2023, 264, 126270. [Google Scholar] [CrossRef]

- Baumann, M.; Peters, J.F.; Weil, M.; Grunwald, A. CO2 footprint and life-cycle costs of electrochemical energy storage for stationary grid applications. Energy Technol. 2017, 5, 1071–1083. [Google Scholar] [CrossRef]

- Xu, T.; Meng, H.; Zhu, J.; Wei, W.; Zhao, H.; Yang, H.; Li, Z.; Ren, Y. Considering the life-cycle cost of distributed energy-storage planning in distribution grids. Appl. Sci. 2018, 8, 2615. [Google Scholar] [CrossRef]

- Colarossi, D.; Principi, P. Optimal sizing of a photovoltaic/energy storage/cold ironing system: Life Cycle cost approach and environmental analysis. Energy Convers. Manag. 2023, 291, 117255. [Google Scholar] [CrossRef]

- Marchi, B.; Pasetti, M.; Zanoni, S. Life cycle cost analysis for BESS optimal sizing. Energy Procedia 2017, 113, 127–134. [Google Scholar] [CrossRef]

- Cicconi, P.; Postacchini, L.; Pallotta, E.; Monteriù, A.; Prist, M.; Bevilacqua, M.; Germani, M. A life cycle costing of compacted lithium titanium oxide batteries for industrial applications. J. Power Sources 2019, 436, 226837. [Google Scholar] [CrossRef]

- Li, J.; Liang, M.; Cheng, W.; Wang, S. Life cycle cost of conventional, battery electric, and fuel cell electric vehicles considering traffic and environmental policies in China. Int. J. Hydrogen Energy 2021, 46, 9553–9566. [Google Scholar] [CrossRef]

- Minke, C.; Ledesma, M.A.D. Impact of cell design and maintenance strategy on life cycle costs of vanadium redox flow batteries. J. Energy Storage 2019, 21, 571–580. [Google Scholar] [CrossRef]

- Olmos, J.; Gandiaga, I.; Lopez, D.; Larrea, X.; Nieva, T.; Aizpuru, I. Li-Ion battery-based hybrid diesel-electric railway vehicle: In-depth life cycle cost analysis. IEEE Trans. Veh. Technol. 2021, 71, 5715–5726. [Google Scholar] [CrossRef]

- Torkashvand, M.; Khodadadi, A.; Sanjareh, M.B.; Nazary, M.H. A life cycle-cost analysis of Li-ion and lead-acid BESSs and their actively hybridized ESSs with supercapacitors for islanded microgrid applications. IEEE Access 2020, 8, 153215–153225. [Google Scholar] [CrossRef]

- Ogunjuyigbe, A.; Ayodele, T.; Akinola, O. Optimal allocation and sizing of PV/Wind/Split-diesel/Battery hybrid energy system for minimizing life cycle cost, carbon emission and dump energy of remote residential building. Appl. Energy 2016, 171, 153–171. [Google Scholar] [CrossRef]

- Mostafa, M.H.; Aleem, S.H.E.A.; Ali, S.G.; Ali, Z.M.; Abdelaziz, A.Y. Techno-economic assessment of energy storage systems using annualized life cycle cost of storage (LCCOS) and levelized cost of energy (LCOE) metrics. J. Energy Storage 2020, 29, 101345. [Google Scholar] [CrossRef]

- Hemmati, M.; Ghasemzadeh, S.; Mohammadi-Ivatloo, B. Optimal scheduling of smart reconfigurable neighbour micro-grids. IET Gener. Transm. Distrib. 2019, 13, 380–389. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, X.; Li, C.; Yu, Y.; Zhou, G.; Wang, C.; Zhao, W. Temperature prediction of lithium-ion battery based on artificial neural network model. Appl. Therm. Eng. 2023, 228, 120482. [Google Scholar] [CrossRef]

- Tian, J.; Liu, X.; Li, S.; Wei, Z.; Zhang, X.; Xiao, G.; Wang, P. Lithium-ion battery health estimation with real-world data for electric vehicles. Energy 2023, 270, 126855. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, K.; Liang, Y.; Yang, Y.; Chen, Z.; Liu, W. Life cycle environmental and economic assessment of electric bicycles with different batteries in China. J. Clean. Prod. 2023, 385, 135715. [Google Scholar] [CrossRef]

- Schaubroeck, T.; Schrijvers, D.; Schaubroeck, S.; Moretti, C.; Zamagni, A.; Pelletier, N.; Huppes, G.; Brandão, M. Definition of product system and solving multifunctionality in ISO 14040-14044: Inconsistencies and proposed amendments—Toward a more open and general LCA framework. Front. Sustain. 2022, 3, 9. [Google Scholar] [CrossRef]

- Hauschild, M.Z.; Rosenbaum, R.K.; Olsen, S.I. Life Cycle Assessment; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Mälkki, H.; Alanne, K. An overview of life cycle assessment (LCA) and research-based teaching in renewable and sustainable energy education. Renew. Sustain. Energy Rev. 2017, 69, 218–231. [Google Scholar] [CrossRef]

- Han, X.; Li, Y.; Nie, L.; Huang, X.; Deng, Y.; Yan, J.; Kourkoumpas, D.-S.; Karellas, S. Comparative life cycle greenhouse gas emissions assessment of battery energy storage technologies for grid applications. J. Clean. Prod. 2023, 392, 136251. [Google Scholar] [CrossRef]

- Hemmati, M.; Bayati, N.; Ebel, T. Life-Cycle Assessment of Renewable-based Hydrogen Production via PEM Electrolyzer in Indonesia. In Proceedings of the 2024 12th International Conference on Smart Grid (icSmartGrid), Setúbal, Portugal, 27–29 May 2024; pp. 112–117. [Google Scholar]

- Sinaga, P.D.L.; Moersidik, S.S.; Hamzah, U.S. Life Cycle Assessment of a combined cycle power plant in Indonesia. IOP Conf. Series Earth Environ. Sci. 2021, 716, 012122. [Google Scholar] [CrossRef]

- Duyan, Ö.; Ciroth, A. Life Cycle Costing Quick Explanation: Two Different Methods to Perform Life Cycle Costing in OPENLCA; GreenDelta: Berlin, Germany, 2013. [Google Scholar]

- Atilgan, B.; Azapagic, A. An integrated life cycle sustainability assessment of electricity generation in Turkey. Energy Policy 2016, 93, 168–186. [Google Scholar] [CrossRef]

- Yao, R.; Wang, L.; Huang, X.; Cao, Q.; Wei, J.; He, P.; Wang, S.; Wang, L. Global seamless and high-resolution temperature dataset (GSHTD), 2001–2020. Remote. Sens. Environ. 2023, 286, 113422. [Google Scholar] [CrossRef]

- Allacker, K.; Mathieux, F.; Pennington, D.; Pant, R. The search for an appropriate end-of-life formula for the purpose of the European Commission Environmental Footprint initiative. Int. J. Life Cycle Assess. 2017, 22, 1441–1458. [Google Scholar] [CrossRef]

| Item | Unit | Value |

|---|---|---|

| Input | ||

| Water | kg | 1.54 × 101 |

| Dimethyl carbonate | kg | 1.07 |

| Aluminum sheet | kg | 6.70 × 10−1 |

| Copper sheet | kg | 1.00 |

| Ethylene carbonate | kg | 6.50 × 10−1 |

| Carbon black | kg | 7.00 × 10−2 |

| Graphite | kg | 1.16 |

| Carboxymethyl cellulose | kg | 2.00 × 10−2 |

| Acrylonitrile–butadiene–styrene copolymer | kg | 5.80 × 10−1 |

| Lithium hexafluorophosphate | kg | 3.80 × 10−1 |

| N-methyl-2-pyrrolidone | kg | 1.20 × 10−1 |

| Polypropylene | kg | 2.00 × 10−2 |

| Polyethylene | kg | 2.00 × 10−2 |

| Nitrogen | kg | 9.29 × 10−3 |

| Glucose | kg | 1.00 × 10−1 |

| Iron phosphate | kg | 1.00 |

| Lithium carbonate | kg | 2.50 × 10−1 |

| Phosphoric acid | kg | 7.63 × 10−1 |

| Sulfuric acid | kg | 6.72 × 10−1 |

| Hydrogen peroxide | kg | 3.75 × 10−1 |

| Polyvinylidene fluoride | kg | 1.20 × 10−1 |

| Electricity | kWh | 3.55 × 101 |

| Heat | MJ | 1.80 × 101 |

| Natural gas | m3 | 1.67 |

| Cell container | kg | 1.02 |

| Lithium iron phosphate | kg | 2.67 |

| Emission to air | ||

| NMVOC | kg | 1.32 × 10−2 |

| Sulfur dioxide | kg | 2.21 × 10−4 |

| Nitrogen oxides | kg | 3.12 × 10−3 |

| Carbon monoxide | kg | 4.33 × 10−6 |

| Carbon dioxide | kg | 1.71 × 10−3 |

| Ammonia | kg | 1.23 × 10−4 |

| Emission to water | ||

| Wastewater | kg | 1.26 × 101 |

| COD | kg | 1.55 × 10−3 |

| Ammonia, as N | kg | 9.71 × 10−5 |

| Phosphorus, total | kg | 2.63 × 10−6 |

| Suspended substances | kg | 1.26 × 10−4 |

| Items | Unit | Value |

|---|---|---|

| Input | ||

| BMS | ||

| Integrated circuit | kg | 5.28 × 10−2 |

| Steel | kg | 4.00 × 10−1 |

| Wire drawing | kg | 5.00 × 10−1 |

| Sheet rolling | kg | 4.00 × 10−1 |

| Rail transport | km | 2.00 × 10−1 |

| Transport | km | 1.00 × 10−1 |

| Copper | kg | 5.00 × 10−1 |

| Plastic processing factory | p | 2.30 × 10−10 |

| Printed wiring board | kg | 8.90 × 10−2 |

| Module and battery packing | ||

| Injection module | kg | 1.00 |

| Polyethylene terephthalate | kg | 1.00 |

| Rail transport | km | 2.00 × 10−1 |

| Transport | km | 1.00 × 10−1 |

| Plastic processing factory | p | 7.40 × 10−10 |

| Cell container | ||

| Sheet rolling | kg | 1.00 |

| Metalworking factory | p | 4.60 × 10−10 |

| Transport | km | 2.00 × 10−1 |

| Transport | km | 1.00 × 10−1 |

| Aluminum sheet | kg | 1.00 |

| Electrode | ||

| Raw carbon felt | kg | 2.00 |

| Process steam from natural gas | MJ | 6.12 |

| Natural gas | MJ | 7.96 × 10−2 |

| Cable | ||

| Tap water | kg | 1.45 |

| Copper | kg | 9.40 × 10−1 |

| Polyvinylchloride | kg | 6.26 × 10−2 |

| Wire drawing | kg | 9.40 × 10−1 |

| Extrusion | kg | 6.26 × 10−2 |

| Transport | km | 9.37 × 10−2 |

| Emissions to air | ||

| Carbon dioxide | kg | 1.31 |

| Nitrogen | kg | 6.70 × 10−1 |

| Emissions to water | ||

| Wastewater | m3 | 1.36 × 10−3 |

| Hazardous waste | kg | 3.17 × 10−4 |

| Item | Unit | Value |

|---|---|---|

| Input | ||

| Used LFP battery | kWh | 1.00 |

| Water | kg | 2.16 |

| Sodium carbonate | kg | 1.14 |

| Sodium hydroxide | kg | 3.55 |

| Hydrochloric acid | kg | 8.09 |

| Hydrogen peroxide | kg | 1.36 |

| Electricity | kWh | 2.61 × 10−2 |

| Emission to water | ||

| Wastewater | kg | 1.45 × 101 |

| Lithium | kg | 4.69 × 10−4 |

| No. | Indicator | Description | Unit |

|---|---|---|---|

| 1 | GWP | Indicator of possible global warming brought on by greenhouse gas releases into the atmosphere | kg CO2-eq/kWh |

| 2 | AP | Indicator of the possible gas release-induced acidity of soils and water | kg mol H+/kWh |

| 3 | EP | Indicator of the terrestrial ecosystem’s enrichment | mol N-eq/kWh |

| 4 | POCP | Indications of gas emissions that influence the production of photochemical ozone | kg NMVOC-eq/kWh |

| 5 | HTP | Effects of harmful compounds released into the environment on humans. | CTUh/kWh |

| 6 | ODP | Indication of air pollution that destroys the ozone layer | kg CFC-11-eq/kWh |

| 7 | ADP | Indicator of the depletion of natural non-fossil sources | kg Sb-eq/kWh |

| 8 | MAETP | Indicator of the enrichment of the marine ecosystem | CTUe/kWh |

| 9 | FAETP | Impact on freshwater organisms of toxic substances | CTUe/kWh |

| 10 | TETP | Indicator of the enrichment of the terrestrial ecosystem | CTUe/kWh |

| Item | Unit | Value |

|---|---|---|

| Power conversion system cost | EUR/kW | 463 |

| Cost of storage section (container, electrolyte, etc.) | EUR/kWh | 795 |

| Fixed O&M cost | EUR/kW-yr. | 6.9 |

| Replacement cost | EUR/kWh | 369 |

| Capital cost | EUR/kW | 1160 |

| Discount rate | % | 5 |

| Lifetime | Year | 25 |

| Fuel cost for production | EUR/MWh | 20 |

| GWP | AP | EP | POCP | HTP | ODP | ADP | MAETP | FAETP | TETP | |

|---|---|---|---|---|---|---|---|---|---|---|

| Manufacturing | 1.71 × 10−3 | 3.34 × 10−3 | 4.89 × 10−3 | 3.35 × 10−3 | 1.63 × 10−2 | 0 | 2.63 × 10−6 | 1.26 × 10−4 | 1.26 × 10−4 | 1.26 × 10−4 |

| Operation | 1.31 | 0 | 6.70 × 10−1 | 0 | 0 | 0 | 3.17 × 10−4 | 0 | 6.70 × 10−1 | 0 |

| Recycling | 4.69 × 10−4 | 0 | 0 | 0 | 0 | 8.09 × 10−3 | 4.69 × 10−4 | 0 | 1.45 × 10−2 | 0 |

| Capital Cost (EUR/kWh) | Total Annualized Cost (EUR/yr.) | Levelized Cost (EUR/kWh) | Payback (yr.) |

|---|---|---|---|

| 696.75 | 703.65 | 0.0066 | 4.1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hemmati, M.; Bayati, N.; Ebel, T. Life Cycle Assessment and Costing of Large-Scale Battery Energy Storage Integration in Lombok’s Power Grid. Batteries 2024, 10, 295. https://doi.org/10.3390/batteries10080295

Hemmati M, Bayati N, Ebel T. Life Cycle Assessment and Costing of Large-Scale Battery Energy Storage Integration in Lombok’s Power Grid. Batteries. 2024; 10(8):295. https://doi.org/10.3390/batteries10080295

Chicago/Turabian StyleHemmati, Mohammad, Navid Bayati, and Thomas Ebel. 2024. "Life Cycle Assessment and Costing of Large-Scale Battery Energy Storage Integration in Lombok’s Power Grid" Batteries 10, no. 8: 295. https://doi.org/10.3390/batteries10080295

APA StyleHemmati, M., Bayati, N., & Ebel, T. (2024). Life Cycle Assessment and Costing of Large-Scale Battery Energy Storage Integration in Lombok’s Power Grid. Batteries, 10(8), 295. https://doi.org/10.3390/batteries10080295