Opportunity Costs, Cognitive Biases, and Autism

Abstract

1. Introduction

2. Materials and Methods

2.1. AI-Driven Experiment

2.2. Questionnaires

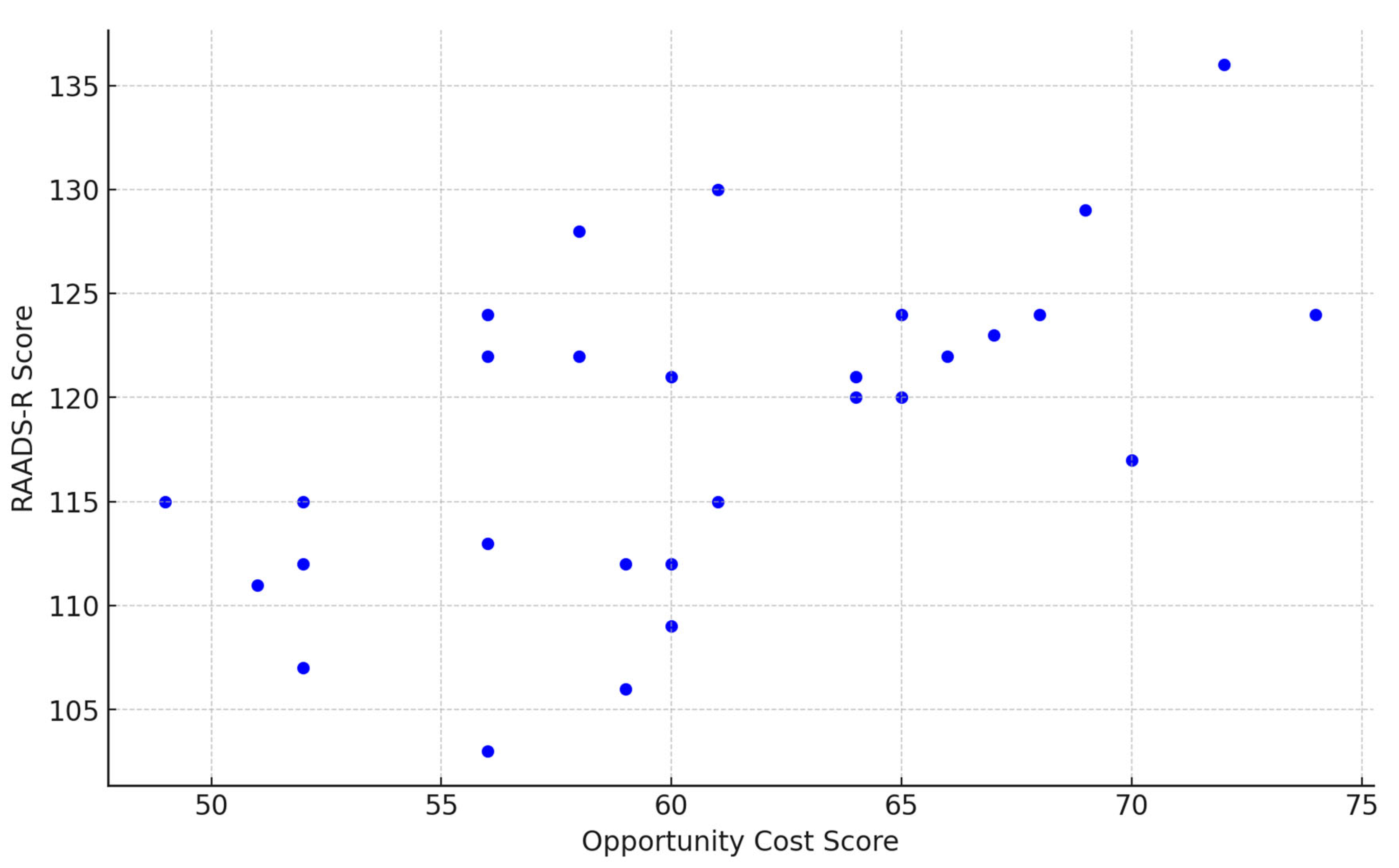

3. Results

4. Discussion

5. Limitations and Future Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kahneman, D. Thinking, Fast and Slow; Farrar, Straus and Giroux: New York, NY, USA, 2011. [Google Scholar]

- Da Silva, S. System 1 vs. System 2 Thinking. Psych 2023, 5, 1057–1076. [Google Scholar] [CrossRef]

- Judgment Under Uncertainty: Heuristics and Biases; Kahneman, D., Slovic, P., Tversky, A., Eds.; Cambridge University Press: New York, NY, USA, 1982. [Google Scholar]

- Highlights in Psychology: Cognitive Bias; Da Silva, S., Gupta, R., Monzani, D., Eds.; Frontiers Media SA: Lausanne, Switzerland, 2023. [Google Scholar]

- Wieser, F. Natural Value; Smart, W., Ed.; Malloch, C.A., Translator; Macmillan: London, UK; New York, NY, USA, 1893. [Google Scholar]

- Marshall, A. Principles of Economics; Macmillan: London, UK, 1890. [Google Scholar]

- Samuelson, P.A. Economics: An Introductory Analysis; McGraw-Hill: New York, NY, USA, 1948. [Google Scholar]

- Hayek, F.A. The Use of Knowledge in Society. Am. Econ. Rev. 1945, 35, 519–530. [Google Scholar]

- Solomons, D. Costs of Production. In Studies in Costing; Solomons, D., Ed.; Sweet & Maxwell: London, UK, 1952; pp. 45–67. [Google Scholar]

- Mas-Colell, A.; Whinston, M.D.; Green, J.R. Microeconomic Theory; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Bharat, S. Opportunity Cost: Beginning, Evolution and a Much-Needed Clarification; BASE Working Paper No. 02/2020; BASE University: Bengaluru, India, 2020. [Google Scholar]

- Alchian, A.A. Cost. In International Encyclopedia of the Social Sciences; Macmillan: New York, NY, USA, 1968; Volume 3, pp. 404–415. [Google Scholar]

- Buchanan, J.M. Cost and Choice: An Inquiry in Economic Theory. In Collected Works of James M. Buchanan; Liberty Fund: Indianapolis, IN, USA, 1969; Volume 6. [Google Scholar]

- Nozick, R. On Austrian Methodology. Synthese 1977, 36, 353–392. [Google Scholar]

- Becker, S.W.; Ronen, J.; Sorter, G.H. Opportunity Costs: An Experimental Approach. J. Account. Res. 1974, 12, 317–329. [Google Scholar]

- Hernandez-Villafuerte, K.; Zamora, B.; Feng, Y.; Parkin, D.; Devlin, N.; Towse, A. Estimating Health System Opportunity Costs: The Role of Non-Linearities and Inefficiency. Cost. Eff. Resour. Alloc. 2022, 20, 56. [Google Scholar]

- Schaffer, S.K.; Sussex, J.; Hughes, D.; Devlin, N. Opportunity Costs and Local Health Service Spending Decisions: A Qualitative Study from Wales. BMC Health Serv. Res. 2016, 16, 103. [Google Scholar]

- Jouan, J.; Ridier, A.; Carof, M. Economic Drivers of Legume Production: Approached via Opportunity Costs and Transaction Costs. Sustainability 2019, 11, 705. [Google Scholar] [CrossRef]

- Carr, R.I. Competitive Bidding and Opportunity Costs. J. Constr. Eng. Manag. 1987, 113, 151–165. [Google Scholar]

- Nela, S. How Can Opportunity Cost Be Used in Determining the Profit? Analele Univ. Constantin Brâncuşi Din Târgu Jiu 2014, 4, 73–79. [Google Scholar]

- Yuanlin, C.; Liu, Y.; Chai, Y.; Sun, H. Opportunity Cost Based Constraint Model for Transaction Credit Evaluation. In Proceedings of the 2014 IEEE 18th International Conference on Computer Supported Cooperative Work in Design, Hsinchu, Taiwan, 21–23 May 2014; pp. 231–235. [Google Scholar]

- Atallah, G. Opportunity Costs, Competition, and Firm Selection. Int. Econ. J. 2006, 20, 409–430. [Google Scholar] [CrossRef]

- Naidoo, R.; Ricketts, T.H. Mapping the Economic Costs and Benefits of Conservation. PLoS Biol. 2006, 4, e360. [Google Scholar] [CrossRef]

- Schneider, R.R.; Hauer, G.; Farr, D.; Adamowicz, W.L.; Boutin, S. Achieving Conservation when Opportunity Costs Are High: Optimizing Reserve Design in Alberta’s Oil Sands Region. PLoS ONE 2011, 6, e23254. [Google Scholar]

- Frederick, S.; Novemsky, N.; Wang, J.; Dhar, R.; Nowlis, S. Opportunity Cost Neglect. J. Consum. Res. 2009, 36, 553–561. [Google Scholar]

- Spiller, S.A. Opportunity Cost Consideration. J. Consum. Res. 2011, 38, 595–610. [Google Scholar] [CrossRef]

- Polman, E.; Effron, D.A.; Thomas, M.R. Other People’s Money: Money’s Perceived Purchasing Power Is Smaller for Others Than for the Self. J. Consum. Res. 2018, 45, 109–125. [Google Scholar]

- Maguire, A.; Persson, E.; Tinghög, G. Opportunity Cost Neglect: A Meta-Analysis. J. Econ. Sci. Assoc. 2023, 9, 176–192. [Google Scholar] [CrossRef]

- Thaler, R. Toward a Positive Theory of Consumer Choice. J. Econ. Behav. Organ. 1980, 1, 39–60. [Google Scholar]

- Plantinga, A.; Krijnen, J.M.T.; Zeelenberg, M.; Breugelmans, S.M. Evidence for Opportunity Cost Neglect in the Poor. J. Behav. Decis. Mak. 2018, 31, 65–73. [Google Scholar] [CrossRef]

- Read, D.; Olivola, C.Y.; Hardisty, D.J. The Value of Nothing: Asymmetric Attention to Opportunity Costs Drives Intertemporal Decision Making. Manag. Sci. 2017, 63, 4277–4297. [Google Scholar] [CrossRef]

- Spiller, S.A. Opportunity Cost Neglect and Consideration in the Domain of Time. Curr. Opin. Psychol. 2019, 26, 98–102. [Google Scholar] [CrossRef]

- Persson, E.; Tinghög, G. Opportunity Cost Neglect in Public Policy. J. Econ. Behav. Organ. 2020, 170, 301–312. [Google Scholar]

- Aharoni, E.; Kleider-Offutt, H.M.; Brosnan, S.F. The Price of Justice: Cost Neglect Increases Criminal Punishment Recommendations. Leg. Crim. Psychol. 2020, 25, 47–61. [Google Scholar]

- Greenberg, A.E.; Spiller, S.A. Opportunity Cost Neglect Attenuates the Effect of Choices on Preferences. Psychol. Sci. 2016, 27, 103–113. [Google Scholar] [CrossRef]

- Garety, P.A.; Bebbington, P.; Fowler, D.; Freeman, D.; Kuipers, E. Implications for Neurobiological Research of Cognitive Models of Psychosis: A Theoretical Paper. Psychol. Med. 2007, 37, 1377–1391. [Google Scholar]

- Freeman, D.; Garety, P.A.; Kuipers, E. Persecutory Delusions: Developing the Understanding of Belief Maintenance and Emotional Distress. Psychol. Med. 2001, 31, 1293–1306. [Google Scholar]

- Livet, A.; Navarri, X.; Potvin, S.; Conrod, P. Cognitive Biases in Individuals with Psychotic-Like Experiences: A Systematic Review and a Meta-Analysis. Schizophr. Res. 2020, 222, 10–22. [Google Scholar] [CrossRef]

- Sanchez-Gistau, V.; Cabezas, A.; Manzanares, N.; Sole, M.; Corral, L.; Vilella, E.; Gutierrez-Zotes, A. Cognitive Biases in First-Episode Psychosis with and without Attention-Deficit/Hyperactivity Disorder. Front. Psychol. 2023, 14, 1127535. [Google Scholar]

- De Martino, B.; Harrison, N.A.; Knafo, S.; Bird, G.; Dolan, R.J. Explaining Enhanced Logical Consistency During Decision Making in Autism. J. Neurosci. 2008, 28, 10746–10750. [Google Scholar]

- Pellicano, E. Testing the Predictive Power of Cognitive Atypicalities in Autistic Children: Evidence From a 3-Year Follow-Up Study. Autism Res. 2013, 6, 258–267. [Google Scholar]

- American Psychiatric Association. Diagnostic and Statistical Manual of Mental Disorders, 5th ed.; American Psychiatric Publishing: Arlington, VA, USA, 2013. [Google Scholar]

- World Health Organization. International Classification of Diseases, 11th ed.; World Health Organization: Geneva, Switzerland, 2019; Available online: https://www.who.int/standards/classifications/classification-of-diseases (accessed on 20 March 2025).

- Nesse, R.M. Good Reasons for Bad Feelings: Insights from the Frontier of Evolutionary Psychiatry; Dutton: New York, NY, USA, 2019. [Google Scholar]

- Crawford, M.B. The World Beyond Your Head: On Becoming an Individual in an Age of Distraction; Farrar, Straus and Giroux: New York, NY, USA, 2016. [Google Scholar]

- Ritvo, R.A.; Ritvo, E.R.; Guthrie, D.; Ritvo, M.J.; Hufnagel, D.H.; McMahon, W.; Tonge, B.; Mataix-Cols, D.; Jassi, A.; Attwood, T.; et al. The Ritvo Autism Asperger Diagnostic Scale-Revised (RAADS-R): A Scale to Assist the Diagnosis of Autism Spectrum Disorder in Adults: An International Validation Study. J. Autism. Dev. Disord. 2011, 41, 1076–1089. [Google Scholar]

- Ritvo, R.A.; Ritvo, E.R.; Guthrie, D.; Yuwiler, A.; Ritvo, M.J.; Weisbender, L. A Scale to Assist the Diagnosis of Autism and Asperger’s Disorder in Adults (RAADS): A Pilot Study. J. Autism Dev. Disord. 2008, 38, 213–223. [Google Scholar] [PubMed]

- Da Silva, S. Reevaluating the Rotten Kid theorem: The Impact of Behavioral Biases on Family Economic Decisions. Econ. Bull. 2024, 44, 3. [Google Scholar]

- O’Donoghue, T.; Rabin, M. Doing It Now or Later. Am. Econ. Rev. 1999, 89, 103–124. [Google Scholar]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. J. Econ. Perspect. 1991, 5, 193–206. [Google Scholar]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Experimental Tests of the Endowment Effect and the Coase Theorem. J. Pol. Econ. 1990, 98, 1325–1348. [Google Scholar]

- Weaver, R.; Frederick, S. A Reference Price Theory of the Endowment Effect. J. Mark. Res. 2012, 49, 696–707. [Google Scholar]

- Morewedge, C.K.; Giblin, C.E. Explanations of the Endowment Effect: An Integrative Review. Trends Cogn. Sci. 2015, 19, 339–348. [Google Scholar]

- Baron, J. Thinking and Deciding, 2nd ed.; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Thaler, R.H. Mental Accounting and Consumer Choice. Mark. Sci. 1985, 4, 199–214. [Google Scholar]

- Lichtenstein, S.; Fischhoff, B.; Phillips, L.D. Calibration of Probabilities: The State of the Art to 1980. In Judgment Under Uncertainty: Heuristics and Biases; Kahneman, D., Slovic, P., Tversky, A., Eds.; Cambridge University Press: Cambridge, UK, 1982; pp. 306–334. [Google Scholar]

- Pallier, G.; Wilkinson, R.; Danthiir, V.; Kleitman, S.; Knezevic, G.; Stankov, L.; Roberts, R.D. The Role of Individual Differences in the Accuracy of Confidence Judgments. J. Gen. Psychol. 2002, 129, 257–299. [Google Scholar]

- Moore, D.A.; Healy, P.J. The Trouble with Overconfidence. Psychol. Rev. 2008, 115, 502–517. [Google Scholar]

- Tversky, A.; Kahneman, D. Judgment under Uncertainty: Heuristics and Biases. Science 1974, 185, 1124–1131. [Google Scholar] [CrossRef]

- Fudenberg, D.; Levine, D.K.; Maniadis, Z. On the Robustness of Anchoring Effects in WTP and WTA Experiments. Am. Econ. J.-Microecon. 2012, 4, 131–145. [Google Scholar] [CrossRef]

- Thaler, R.H. Some Empirical Evidence on Dynamic Inconsistency. Econ. Lett. 1981, 8, 201–207. [Google Scholar] [CrossRef]

- Laibson, D. Golden Eggs and Hyperbolic Discounting. Q. J. Econ. 1997, 112, 443–477. [Google Scholar] [CrossRef]

- Grüne-Yanoff, T. Models of Temporal Discounting 1937–2000: An Interdisciplinary Exchange between Economics and Psychology. Sci. Context. 2015, 28, 675–713. [Google Scholar] [CrossRef]

- Arkes, H.R.; Ayton, P. The Sunk Cost and Concorde Effects: Are Humans Less Rational than Lower Animals? Psychol. Bull. 1999, 125, 591–600. [Google Scholar]

- Nickerson, R.S. Confirmation Bias: A Ubiquitous Phenomenon in Many Guises. Rev. Gen. Psychol. 1998, 2, 175–220. [Google Scholar] [CrossRef]

- Oswald, M.E.; Grosjean, S. Confirmation Bias. In Cognitive Illusions: A Handbook on Fallacies and Biases in Thinking, Judgement and Memory; Pohl, R.F., Ed.; Psychology Press: Hove, UK, 2004; pp. 79–96. [Google Scholar]

- Zajonc, R.B. Feeling and Thinking: Preferences Need No Inferences. Am. Psychol. 1980, 35, 151–175. [Google Scholar]

- Finucane, M.L.; Alhakami, A.; Slovic, P.; Johnson, S.M. The Affect Heuristic in Judgment of Risks and Benefits. J. Behav. Decis. Making 2000, 13, 1–17. [Google Scholar]

- Slovic, P.; Finucane, M.; Peters, E.; MacGregor, D. Risk as Analysis and Risk as Feelings: Some Thoughts about Affect, Reason, Risk, and Rationality. Risk Anal. 2004, 24, 311–322. [Google Scholar]

- Przybylski, A.K.; Murayama, K.; DeHaan, C.R.; Gladwell, V. Motivational, Emotional, and Behavioral Correlates of Fear of Missing Out. Comput. Hum. Behav. 2013, 29, 1841–1848. [Google Scholar] [CrossRef]

- Dempsey, A.E.; O’Brien, K.D.; Tiamiyu, M.F.; Elhai, J.D. Fear of Missing Out (FoMO) and Rumination Mediate Relations between Social Anxiety and Problematic Facebook Use. Addict. Behav. Rep. 2019, 9, 100150. [Google Scholar] [CrossRef] [PubMed]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Routledge: Abingdon, UK, 1988. [Google Scholar]

- Da Silva, S.; Matsushita, R.; Valcanover, V.; Campara, J.; Da Costa, N., Jr. Losses Make Choices Nonpositional. SN Bus. Econ. 2022, 2, 182. [Google Scholar] [CrossRef]

- Frith, U. Autism and Asperger Syndrome; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Wing, L. Asperger’s Syndrome: A Clinical Account. Psychol. Med. 1981, 11, 115–129. [Google Scholar] [CrossRef]

- Gillberg, C. The Emanuel Miller Lecture: Autism and Autistic-Like Conditions: Subclasses among Disorders of Empathy. J. Child. Psychol. Psychiatry 1992, 33, 813–842. [Google Scholar] [CrossRef]

- Dinishak, J. The Deficit View and Its Critics. Disabil. Stud. Q. 2016, 36, 4. [Google Scholar] [CrossRef]

- Holt, A.; Bounekhla, K.; Welch, C.; Polatajko, H. “Unheard Minds, Again and Again”: Autistic Insider Perspectives and Theory of Mind. Disabil. Rehabil. 2021, 44, 5887–5897. [Google Scholar] [CrossRef]

- Sandin, S.; Lichtenstein, P.; Kuja-Halkola, R.; Larsson, H.; Hultman, C.M.; Reichenberg, A. The Familial Risk of Autism. JAMA 2014, 311, 1770–1777. [Google Scholar] [CrossRef]

- Gaugler, T.; Klei, L.; Sanders, S.J.; Bodea, C.A.; Goldberg, A.P.; Lee, A.B.; Mahajan, M.; Manaa, D.; Pawitan, Y.; Reichert, J.; et al. Most Genetic Risk for Autism Resides with Common Variation. Nat. Genet. 2014, 46, 881–885. [Google Scholar] [CrossRef]

- Fitzgerald, M.; Corvin, A. Diagnosis and Differential Diagnosis of Asperger Syndrome. Adv. Psychiatr. Treat. 2001, 7, 310–318. [Google Scholar] [CrossRef]

- Baron-Cohen, S. Mindblindness: An Essay on Autism and Theory of Mind; The MIT Press: Cambridge, MA, USA, 1995. [Google Scholar]

- Ritvo, E.R. Understanding the Nature of Autism and Asperger’s Disorder; Jessica Kingsley Publication: London, UK, 2006. [Google Scholar]

- Baron-Cohen, S.; Wheelwright, S. The Empathy Quotient: An Investigation of Adults with Asperger Syndrome or High Functioning Autism, and Normal Sex Differences. J. Autism Dev. Disord. 2004, 34, 163–175. [Google Scholar] [PubMed]

- Klin, A.; Pauls, D.; Schultz, R.; Volkmar, F. Three Diagnostic Approaches to Asperger’s Syndrome: Implications for Research. J. Autism Dev. Disord. 2005, 35, 221–234. [Google Scholar] [CrossRef] [PubMed]

- Volkmar, F.; Lord, C. Diagnosis and Definition of Autism and Other Pervasive Developmental Disorders. In Autism and Pervasive Developmental Disorders; Volkmar, F., Ed.; Cambridge University Press: Cambridge, UK, 1998; pp. 1–31. [Google Scholar]

- Lai, M.C.; Lombardo, M.V.; Auyeung, B.; Chakrabarti, B.; Baron-Cohen, S. Sex/Gender Differences and Autism: Setting the Scene for Future Research. J. Am. Acad. Child Adolesc. Psychiatry 2015, 54, 11–24. [Google Scholar] [CrossRef] [PubMed]

- Baron-Cohen, S.; Knickmeyer, R.C.; Belmonte, M.K. Sex Differences in the Brain: Implications for Explaining Autism. Science 2005, 310, 819–823. [Google Scholar]

| 1. I consider what I might miss out on financially by choosing a more expensive vacation over a less costly one. |

| 2. When deciding to go back to school, I think about the income I could lose by not working during this time. |

| 3. If I choose to renovate my kitchen, I assess the alternative ways I could have used the money. |

| 4. I evaluate the benefits of accepting a higher-paying job that requires longer hours against staying in my current position with more free time. |

| 5. When considering paying for a gym membership, I think about other health improvements I could invest in with that money. |

| 6. I weigh the cost of buying tickets to a concert against what else I could do with the money. |

| 7. Before buying the latest smartphone, I consider what else I could achieve with the funds needed for the purchase. |

| 8. I compare potential returns from investing in stocks to other investment vehicles like bonds or real estate. |

| 9. When choosing to invest more in my retirement, I contemplate the immediate lifestyle changes I would have to make. |

| 10. Before upgrading to a newer car model, I evaluate the financial trade-offs of keeping my current vehicle. |

| 11. As a business owner, I consider the opportunity costs of expanding my business versus investing the funds elsewhere. |

| 12. When choosing between public and private schooling for my children, I think about the financial impact of each option. |

| 13. I assess the benefits of taking out a loan for a major purchase versus saving up and buying it later. |

| 14. I evaluate whether attending a social event is worth the time and money compared to other potential activities. |

| 15. When deciding to eat out frequently, I consider the savings I could amass by cooking at home instead. |

| 16. When offered a job in a new city, I think about the cost of living and social changes compared to my current situation. |

| 17. I weigh the costs and benefits of spending money on personal development courses versus self-study. |

| 18. I consider the impact of donating to one charity over another, based on what each contribution could achieve. |

| 19. I evaluate whether subscribing to multiple streaming services is worth the expense over other entertainment options. |

| 20. I think about what I might gain or lose by spending my time on one activity over another. |

| 1. Vacation planning | Present bias [49]: Prioritizing immediate enjoyment over financial savings. |

| 2. Higher education | Loss aversion [50]: The fear of losing income during a study period might outweigh potential long-term gains from further education. |

| 3. Home improvement | Endowment effect [51,52,53]: Overvaluing the current state of the home, leading to hesitancy in making significant changes. |

| 4. Career advancement | Status quo bias [50,54]: Preference for current job stability over potentially more demanding but lucrative alternatives. |

| 5. Health investments | Mental accounting [55]: Assigning different values to money depending on its intended use, such as health improvement. |

| 6. Entertainment choices | Opportunity cost neglect [25,28]: Failing to adequately consider what other pleasures or benefits could be achieved with the money spent on a concert. |

| 7. Tech purchases | Overconfidence [56,57,58]: Overestimating the necessity or utility of having the latest technology. |

| 8. Investment opportunities | Anchoring [59,60]: Influenced heavily by initial impressions or past performances of different investment types. |

| 9. Retirement planning | Hyperbolic discounting [61,62,63]: Undervaluing the benefit of future financial security in favor of present spending. |

| 10. Vehicle upgrades | Sunk cost fallacy [64]: Continuing to invest in a new car because of the money already spent on the old one. |

| 11. Business expansion | Confirmation bias [65,66]: Looking for information that supports pre-existing beliefs about business growth or alternative investments. |

| 12. Educational choices for children | Affect heuristic [67,68,69]: Emotional attachment to the perceived quality of education influencing financial decisions. |

| 13. Borrowing decisions | Loss aversion [50]: The focus on potential losses from interest payments overshadowing the benefits of the purchase. |

| 14. Social engagements | Fear of missing out [70,71]: The anxiety about missing enjoyable events can override the consideration of opportunity costs. |

| 15. Dining out | Present bias [49]: The immediate gratification of eating out overshadowing the long-term savings from cooking at home. |

| 16. Job relocation | Status quo bias [50,54]: The comfort of current living conditions making the cost of moving seem more daunting. |

| 17. Personal development | Opportunity cost neglect [25,28]: Not properly evaluating the benefits of alternative ways to spend on self-improvement. |

| 18. Charitable donations | Affect heuristic [67,68,69]: Emotional responses to charities can influence decisions without considering the impact thoroughly. |

| 19. Subscription services | Mental accounting [55]: Viewing subscription costs as minor expenses without considering their cumulative impact. |

| 20. Time management | Hyperbolic discounting [61,62,63]: Preferring immediate leisure activities over potentially more beneficial but future tasks. |

| 1. I am a sympathetic person. |

| 2. I often use words and phrases from movies and television in conversations. |

| 3. I am often surprised when others tell me I have been rude. |

| 4. Sometimes I talk too loudly or too softly, and I am not aware of it. |

| 5. I often don’t know how to act in social situations. |

| 6. I can “put myself in other people’s shoes”. |

| 7. I have a hard time figuring out what some phrases mean, like “you are the apple of my eye”. |

| 8. I only like to talk to people who share my special interests. |

| 9. I focus on details rather than the overall idea. |

| 10. I always notice how food feels in my mouth. This is more important to me than how it tastes. |

| 11. I miss my best friends or family when we are apart for a long time. |

| 12. Sometimes I offend others by saying what I am thinking, even if I don’t mean to. |

| 13. I only like to think and talk about a few things that interest me. |

| 14. I’d rather go out to eat in a restaurant by myself than with someone I know. |

| 15. I cannot imagine what it would be like to be someone else. |

| 16. I have been told that I am clumsy or uncoordinated. |

| 17. Others consider me odd or different. |

| 18. I understand when friends need to be comforted. |

| 19. I am very sensitive to the way my clothes feel when I touch them. How they feel is more important to me than how they look. |

| 20. I like to copy the way certain people speak and act. It helps me appear more normal. |

| 21. It can be very intimidating for me to talk to more than one person at the same time. |

| 22. I have to “act normal” to please other people and make them like me. |

| 23. Meeting new people is usually easy for me. |

| 24. I get highly confused when someone interrupts me when I am talking about something I am very interested in. |

| 25. It is difficult for me to understand how other people are feeling when we are talking. |

| 26. I like having a conversation with several people, for instance around a dinner table, at school or at work. |

| 27. I take things too literally, so I often miss what people are trying to say. |

| 28. It is very difficult for me to understand when someone is embarrassed or jealous. |

| 29. Some ordinary textures that do not bother others feel very offensive when they touch my skin. |

| 30. I get extremely upset when the way I like to do things is suddenly changed. |

| 31. I have never wanted or needed to have what other people call an “intimate relationship”. |

| 32. It is difficult for me to start and stop a conversation. I need to keep going until I am finished. |

| 33. I speak with a normal rhythm. |

| 34. The same sound, color or texture can suddenly change from very sensitive to very dull. |

| 35. The phrase “I’ve got you under my skin” makes me uncomfortable. |

| 36. Sometimes the sound of a word or a high-pitched noise can be painful to my ears. |

| 37. I am an understanding type of person. |

| 38. I do not connect with characters in movies and cannot feel what they feel. |

| 39. I cannot tell when someone is flirting with me. |

| 40. I can see in my mind in exact detail things that I am interested in. |

| 41. I keep lists of things that interest me, even when they have no practical use (for example sports statistics, train schedules, calendar dates, historical facts and dates). |

| 42. When I feel overwhelmed by my senses, I have to isolate myself to shut them down. |

| 43. I like to talk things over with my friends. |

| 44. I cannot tell if someone is interested or bored with what I am saying. |

| 45. It can be very hard to read someone’s face, hand and body movements when they are talking. |

| 46. The same thing (like clothes or temperatures) can feel very different to me at different times. |

| 47. I feel very comfortable with dating or being in social situations with others. |

| 48. I try to be as helpful as I can when other people tell me their personal problems. |

| 49. I have been told that I have an unusual voice (for example flat, monotone, childish, or high-pitched). |

| 50. Sometimes a thought or a subject gets stuck in my mind and I have to talk about it even if no one is interested. |

| 51. I do certain things with my hands over and over again (like flapping, twirling sticks or strings, waving things by my eyes). |

| 52. I have never been interested in what most of the people I know consider interesting. |

| 53. I am considered a compassionate type of person. |

| 54. I get along with other people by following a set of specific rules that help me look normal. |

| 55. It is very difficult for me to work and function in groups. |

| 56. When I am talking to someone, it is hard to change the subject. If the other person does so, I can get very upset and confused. |

| 57. Sometimes I have to cover my ears to block out painful noises (like vacuum cleaners or people talking too much or too loudly). |

| 58. I can chat and make small talk with people. |

| 59. Sometimes things that should feel painful are not (for instance when I hurt myself or burn my hand on the stove). |

| 60. When talking to someone, I have a hard time telling when it is my turn to talk or to listen. |

| 61. I am considered a loner by those who know me best. |

| 62. I usually speak in a normal tone. |

| 63. I like things to be exactly the same day after day and even small changes in my routines upset me. |

| 64. How to make friends and socialize is a mystery to me. |

| 65. It calms me to spin around or to rock in a chair when I’m feeling stressed. |

| 66. The phrase, “He wears his heart on his sleeve”, does not make sense to me. |

| 67. If I am in a place where there are many smells, textures to feel, noises or bright lights, I feel anxious or frightened. |

| 68. I can tell when someone says one thing but means something else. |

| 69. I like to be by myself as much as I can. |

| 70. I keep my thoughts stacked in my memory like they are on filing cards, and I pick out the ones I need by looking through the stack and finding the right one (or another unique way). |

| 71. The same sound sometimes seems very loud or very soft, even though I know it has not changed. |

| 72. I enjoy spending time eating and talking with my family and friends. |

| 73. I can’t tolerate things I dislike (like smells, textures, sounds or colors). |

| 74. I don’t like to be hugged or held. |

| 75. When I go somewhere, I have to follow a familiar route or I can get very confused and upset. |

| 76. It is difficult to figure out what other people expect of me. |

| 77. I like to have close friends. |

| 78. People tell me that I give too much detail. |

| 79. I am often told that I ask embarrassing questions. |

| 80. I tend to point out other people’s mistakes. |

| 1. I am a sympathetic person. |

| 6. I can “put myself in other people’s shoes”. |

| 11. I miss my best friends or family when we are apart for a long time. |

| 18. I understand when friends need to be comforted. |

| 23. Meeting new people is usually easy for me. |

| 26. I like having a conversation with several people, for instance around a dinner table, at school, or at work. |

| 33. I speak with a normal rhythm. |

| 37. I am an understanding type of person. |

| 43. I like to talk things over with my friends. |

| 47. I feel very comfortable dating or being in social situations with others. |

| 48. I try to be as helpful as I can when other people tell me their personal problems. |

| 53. I am considered a compassionate type of person. |

| 58. I can chat and make small talk with people. |

| 62. I usually speak in a normal tone. |

| 68. I can tell when someone says one thing but means something else. |

| 72. I enjoy spending time eating and talking with my family and friends. |

| 77. I like to have close friends. |

| Step | Development |

|---|---|

| 1. Online AI Tool Integration | ChatGPT 4o is used to assist in questionnarie design, model predictions, and parameter calibration based on cognitive biases. |

| 2. Parameter Calibration Based on Cognitive Biases | ChatGPT is tasked with predicting hypothetical parameter values for cognitive biases, using insights from behavioral economics and the related literature. |

| 3. Opportunity Cost Questionnaire Development | A 20-question survey is created to assess how participants consider opportunity costs, with each question tied to a cognitive bias. |

| 4. RAADS-R Autism Test Application | The RAADS-R test is utilized to assess the likelihood of autism spectrum traits in artificial participants. |

| 5. Data Collection from Artificial Participants | Artificial participants, generated through AI simulations, respond to the opportunity cost questionnaire and the RAADS-R test. |

| 6. Simulation and Analysis | Simulations are run using the AI-generated data, incorporating the cognitive biases and RAADS-R test results for analysis. |

| 7. Evaluation of Results | The data from the simulations are evaluated to understand the relationship between cognitive biases, opportunity cost neglect, and autism traits. |

| 8. Interpretation and Conclusion | The findings are interpreted to draw conclusions about the impact of cognitive biases and how individuals with autism might handle opportunity costs differently. |

| Question from Table 2 | Impact on the RAADS-R Score |

|---|---|

| 1. Vacation planning (present bias) | Individuals with present bias may have difficulty with long-term planning, a trait sometimes seen in autism, potentially affecting their RAADS-R scores in sections related to future-oriented thinking. |

| 2. Higher education (loss aversion) | The focus on immediate losses over long-term gains could parallel challenges with abstract or future-oriented thinking in autism, possibly leading to higher RAADS-R scores. |

| 3. Home improvement (endowment effect) | The overvaluation of current possessions might relate to resistance to change, a common autism trait, suggesting a potential for higher RAADS-R scores. |

| 4. Career advancement (status quo bias) | A preference for stability and routine is a noted feature in autism, possibly correlating with higher scores on questions about adherence to a routine. |

| 5. Health investments (mental accounting) | Compartmentalizing finances may relate to difficulties in integrating information, a challenge noted in autism, potentially leading to elevated RAADS-R scores. |

| 6. Entertainment choices (opportunity cost neglect) | This neglect might indicate a broader pattern of missing subtle social and environmental cues, a common issue in autism, suggesting higher scores. |

| 7. Tech purchases (overconfidence) | Overconfidence could overlap with unusual social confidence levels sometimes observed in autism, affecting social interaction scores on the RAADS-R. |

| 8. Investment opportunities (anchoring) | Difficulty adjusting one’s initial beliefs could relate to rigid thinking in autism, possibly influencing higher RAADS-R scores. |

| 9. Retirement planning (hyperbolic discounting) | Prioritizing immediate rewards over future benefits is relevant to some autistic traits, such as challenges in long-term planning. |

| 10. Vehicle upgrades (sunk cost fallacy) | Persistence with ineffective strategies could mirror repetitive behaviors in autism, leading to specific patterns in RAADS-R responses. |

| 11. Business expansion (confirmation bias) | Seeking information that only supports pre-existing beliefs might correlate with specific interests and repetitive behaviors in autism. |

| 12. Educational choices for children (affect heuristic) | Emotional decision-making could reflect the intense focus on specific interests or emotional attachments seen in autism. |

| 13. Borrowing decisions (loss aversion) | Similar to what occurs in the higher-education question, this bias may affect the RAADS-R scores where long-term planning and decision-making are involved. |

| 14. Social engagements (fear of missing out) | This could reflect impaired social interaction strategies, potentially resulting in elevated RAADS-R scores in social-related questions. |

| 15. Dining out (present bias) | Similar to the vacation-planning question, difficulties with foreseeing long-term health or financial outcomes might reflect broader autism traits. |

| 16. Jog relocation (status quo bias) | Like the career advancement question, a preference for familiar settings could correlate with autism spectrum traits noted on the RAADS-R. |

| 17. Personal development (opportunity cost neglect) | Not evaluating all options might reflect a narrow focus or specialized interests common in autism. |

| 18. Charitable donations (affect heuristic) | Decisions driven by emotions over logical assessment could align with the emotional processing traits scored on the RAADS-R. |

| 19. Subscription services (mental accounting) | Viewing expenses compartmentally could relate to challenges in a broader financial or social understanding in autism. |

| 20. Time management (hyperbolic discounting) | Preferring immediate leisure could relate to difficulties in time management and planning seen in autism. |

| Sample Size | Baseline Mean | Adjusted Mean | Baseline Std. Dev. | Adjusted Std. Dev. | t-Statistic | p-Value |

|---|---|---|---|---|---|---|

| 30 | 208.07 | 306.10 | 49.03 | 50.63 | −46.54 | <0.0001 |

| 100 | 208.68 | 303.29 | 38.73 | 40.81 | −79.35 | <0.0001 |

| 1000 | 205.70 | 300.54 | 38.40 | 41.54 | −257.95 | <0.0001 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Da Silva, S.; Fiebig, M.; Matsushita, R. Opportunity Costs, Cognitive Biases, and Autism. J. Mind Med. Sci. 2025, 12, 11. https://doi.org/10.3390/jmms12010011

Da Silva S, Fiebig M, Matsushita R. Opportunity Costs, Cognitive Biases, and Autism. Journal of Mind and Medical Sciences. 2025; 12(1):11. https://doi.org/10.3390/jmms12010011

Chicago/Turabian StyleDa Silva, Sergio, Maria Fiebig, and Raul Matsushita. 2025. "Opportunity Costs, Cognitive Biases, and Autism" Journal of Mind and Medical Sciences 12, no. 1: 11. https://doi.org/10.3390/jmms12010011

APA StyleDa Silva, S., Fiebig, M., & Matsushita, R. (2025). Opportunity Costs, Cognitive Biases, and Autism. Journal of Mind and Medical Sciences, 12(1), 11. https://doi.org/10.3390/jmms12010011