Each cost element will be described separately while labeling it with a cost object

C. For this purpose, each cost element has a specific input set, which comes from the mission, the vehicle data or the airlines business. The last input describes the usage of a vehicle effecting the potential flight cycles (FC) per time segment. To calculate the FC per day, the calculated flight time for each use case will be computed by taking the vehicle data and mission profiles from

Section 3 into account. All inputs and assumptions for the DOC model are summed up in

Appendix B.

2.2.1. Flight Cycles

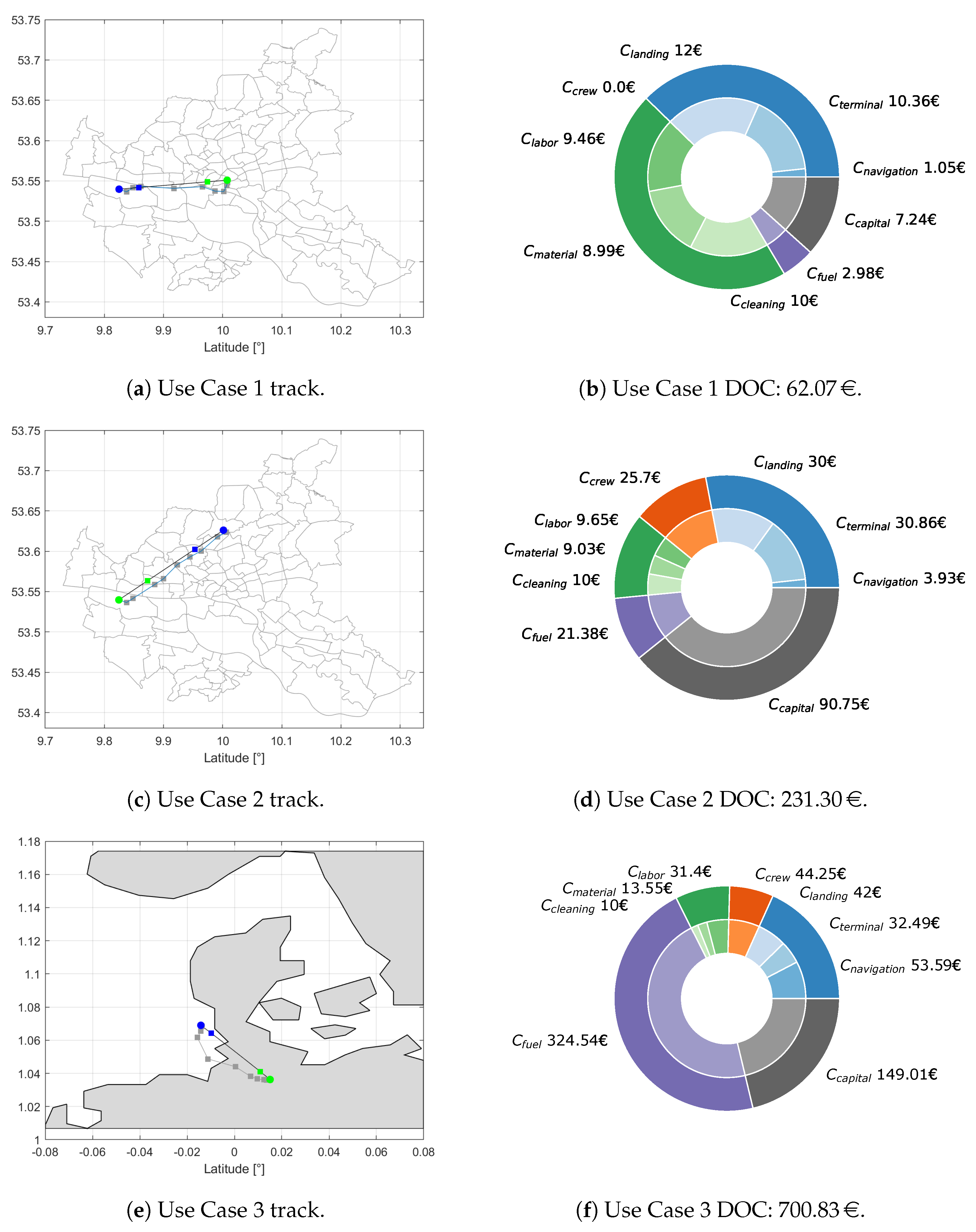

For the prediction of flight profiles regarding time of flight, vertical and horizontal velocities, altitudes as well as the mission specific consumed energy, a trajectory calculation is carried out based on a point mass moving according to Newton’s laws [

12].

Figure 1 presents an exemplary flight profile.

The simplified flight profile starts with a vertical acceleration phase, inducing an initial vertical climb (phase 1). In phase 2, starting with green dot, the vehicle climbs with a varying trajectory inclination angle, following a parabolic curve until reaching the top of climb (green square). This curve is generated by superimposing a horizontal acceleration and a vertical deceleration. During cruise (phase 3), we assume a constant altitude and cruise speed. At end of cruise flight (blue square), parabolic (phase 4) and vertical descent phases (phase 5) are conducted in analogy to phases 1 and 2, but in reverse order. The derived parameters of the total flight mission, such as flight time, flight distance and the resulting estimated energy consumption provide crucial input for modeling direct operating costs of individual flights. We determine the vehicle specific flight cycles per year based on the average mission and block time of all routes. When calculating a flight time, Equation

3 presents the link to the flight cycles (FC) per year.

Here, the potential yearly operation time

and the yearly forced downtime

of

h are fixed concerning Niklaß et al. [

12]. The ground time is estimated roughly as about 50% of the statistical average value of

h for conventional aviation and assumed to be a constant value in contrast to the flight time

, which depends on the routing and vehicle performance. Individual flight times are investigated based on pre-defined use cases that are described in

Section 3.

2.2.2. Landing and Terminal Fees and Navigation Charges

Unlike taxes, whose revenue can in principle be used to finance any public expenditure, fees are used either to cover costs or must be used for a specific purpose. In this case, a fee is a cost element that an airline has to pay to another UAM system stakeholder. However, without knowing the future design of the UAM system, estimating the UAM fees is associated with particularly high uncertainties. At this stage of AAM investigation, airspace infrastructure and detailed routing have not been elaborated yet. As a solution, we adopt established fee and cost models of general aviation. This is why this cost element is route-independent, but distance-dependent.

At this stage, we separate an AAM airline from a vertiport operator. As a result, a vertiport operator acts as a further AAM stakeholder and imposes fees for its services. Since AAM operates in urban areas, vertiports might have characteristics of a public transport station as well as of a commercial airport. We therefore split this vertiport service fee into a landing and a terminal component. The first part represents a passenger landing fee (), while the second fee is a flat rate () per landing. Other sources of vertiport income can be retail, car parking fees or further means of income. If an operator runs an AAM airline and the vertiports, cost at the vertiport will still occur. However, a passenger landing fee will be prorated in accounting.

The passenger landing fee depends on the number of passenger transported in the vehicle. Here, the ground handling justifies this additional fee. In theory, each vertiport and vertiport operator can charge its own passenger fare system. Since no information about the operations in a vertiport is given, landing fees must be estimated.

For setting the level of landing fee

per passenger, we adopted existing prices in manned aviation. The Ultimate Aviation Group runs a helicopter business in South Africa where they charge a passenger fee of approx.

€ when landing [

13]. This value is in line with the landing charge at the airport GWT in Sylt and HAJ in Hannover in 2022 [

14,

15].

The flat-rate landing fee represents the costs incurred by vertiports for handling the vehicle in the infrastructure. At this point, terminal charges of manned aviation are used, where the fee depends on the vehicle mass and country-specific parameters, to calculate a landing charge at a vertiport [

16].

In the case of Frankfurt, Germany, the parameters for manned aviation are (), and . In addition, the fee can be levied based on the noise and emissions generated by the vehicle. However, due to unknown landing procedures and vehicle performance in terms of noise emission, this study does not take any fees for noise into account yet.

Furthermore, an air navigation service provider (ANSP), which is responsible for the air traffic management, charges a distance-dependent fee in general. Such an ANSP does not exist yet, so that a fare system is not established. This is why this cost model adapts an en route charge method of general aviation [

16]. Navigation costs are calculated as follows:

with the distance

d and the country-specific parameters of

/km,

and

for Germany. For both

and

,

MTOW is given in metric tons.

2.2.3. Maintenance and Overhaul

According to an evaluation of general aviation traffic and their delays, technical issues on the aircraft are the main reason for disruptions in the flight schedule [

17]. In the case of a technical issue at a vehicle, an airline has to reorganize its business and allocate available vehicles to fulfill the flight schedule. In the event of AAM in special, the out-of-service vehicle needs to be checked and maintained if necessary. Additionally, it blocks a parking pad at a vertiport, which could lead to capacity constraints on the ground if not enough space is available. Such an analysis depends on the location and the design of the vertiport itself that is out of the scope of this investigation.

Detailed information about the AAM vehicle configurations is unknown in general. For this reason, there is no statement about the life-cycle cost management (LCCM) of component assemblies or line-replaceable units (LRU). As a consequence, this study considers the vehicle as one assembly and does not differentiate between different hardware or battery systems. Previous studies already investigated maintenance intervals and possible labor and material effort for AAM vehicle as shown in

Table 1 [

18].

The maintenance costs are split into material costs and labor costs, while the wage of a maintenance hour is /h. After each 100 h and 200 h as well as after each 1750 FC and 3500 FC, the vehicle will be maintained with respect to the mentioned effort. Here, the maintenance is independent of the vehicle configuration and size, weight and power (SWAP), and includes all aspects of inspection activities.

In general, there is no information about detailed cabin designs and its cleaning procedures for an AAM vehicle yet. According to [

19], a full-service car wash for a SUV or van is about

. When operating with a four-passenger cabin for AAM, the interior of both means of transport looks nearly the same, resulting in comparable cleaning procedures. Assuming a full-service at the end of the day by operating approx. 20 flights per day,

of cleaning cost accrue every FC for an AAM transport mode.

2.2.4. Capital Cost

The capital costs describe the write-off of the aircraft. Therefore, the calculation of the annuity consists of several fixed values for the interest rate (

), depreciation period (

) and the residual value factor (

) [

11].

,

in years and

are set as fix values for every use case [

12]. This is why the value

is constant in this study. Additionally, the insurance rate (

) is fixed to

%. Finally, the capital cost per flight cycle is an expression of the unit cost as a function of the Operating Empty Weight (OEW), insurance rate and the annuity. The cost per OEW

depends on the vehicle and its price on the market and varies among the three use cases.

While EHang has set a unit price for its vehicle, unit prices for the Joby S4, Lilium Jet and Archer Midnight do not exist yet. On the other side, airlines like United Airlines from the US and Azul from Brazil announced a declaration of intent for the Archer and Lilium configuration. Based on the monetary volume of the declarations, a unit price for each aircraft is deviated.

Figure 2 shows the unit price of the vehicles over their operating empty weight (OEW). In this case, the OEW includes all necessities to fulfill a mission without having a payload and an optional pilot on-board. To enhance comparability, deputies of existing helicopters and general aviation aircraft are added to

Figure 2 as well as their Entry Into Service (EIS).

Different vehicle configurations are indicated by different markers. AAM vehicles are marked in red while helicopters and aircraft of general aviation are marked in blue and green. The dashed line presents a linear fit by taking the AAM vehicle into account, consisting of a slope m and an axis intercept b. Here, the unit price increases with the OEW of the aircraft. As a reference to general aviation, this figure includes three examples of manned aviation, Piper Archer, Cirrus Vision SF50 and a Citation CJ3+. Their passenger capacity ranges from five to eight seats including a pilot. All examples of general aviation and the helicopters fit to the SWAP of the presented AAM and are quite in line with the red linear fit.

This study assumes that an airline buys the aircraft by the OEM at any time. Aircraft leasing as an established financing form in other transport modes has not been considered yet. Whenever leasing is introduced to AAM, this DOC model needs to be adapted around the cost element .

2.2.5. Fuel Cost

The consumed energy en route depends on the flight trajectory including vertical and horizontal flight phases, as well as the vehicle configuration itself. While the calculation of the flight time and FC per day uses a detailed flight trajectory, the energy consumption depends on the flight distance only in this study. Due to the fact, that the consumed energy during vertical and horizontal flight phases are not known for several vehicle configurations, this study refers to the previous work of Sripad and Viswanatha [

38].

Assuming every vehicle operates as fully electrical, the energy consumption has to be multiplied by the relevant energy price. Current developments in the energy business act on

directly. In general, energy prices increase, while detailed forecasts include a set of uncertainties [

39]. Since the energy price per kWh varies and business concepts for AAM applications are not negotiated yet, this study sets the energy price to

/kWh as a conservative derivation of the energy price in Germany in November 2022 [

40].

2.2.6. Crew

With the EIS of AAM a pilot on board is expected during flight operations [

41]. From the passengers’ point of view a pilot on board offers confidence while an airline plans operation without a crew, so that the vehicle operates autonomous [

42]. An airline has three major benefits when operating without a pilot: (1) reducing human factors in their business concept, (2) increasing the ASK since one more seat can be sold to a passenger and (3) decreasing labor cost when no pilot have to be paid. For this investigation, only the last item has an impact on the DOC model. In a first step, the cost model includes a pilot salary (

), as long as the regarded vehicle offers a pilot seat. Therefore, the US Department of Labor published statistics of pilot wages in the US, in which the median for airline pilots, copilots and flight engineers is 160,970

$ in 2020 [

43].