Organizational Processes for Adopting Breakthrough Technology: Text Mining of AI Perception among Japanese Firms

Abstract

1. Introduction

2. Related Research

2.1. AI and Innovation Management

2.2. Innovation Adoption and the Adoption Process

2.3. Diverse Datasets and Nonfinancial Information Possibilities

3. Materials and Methods

3.1. Data Collection

3.2. Data Procedure

3.3. Analysis

4. Result

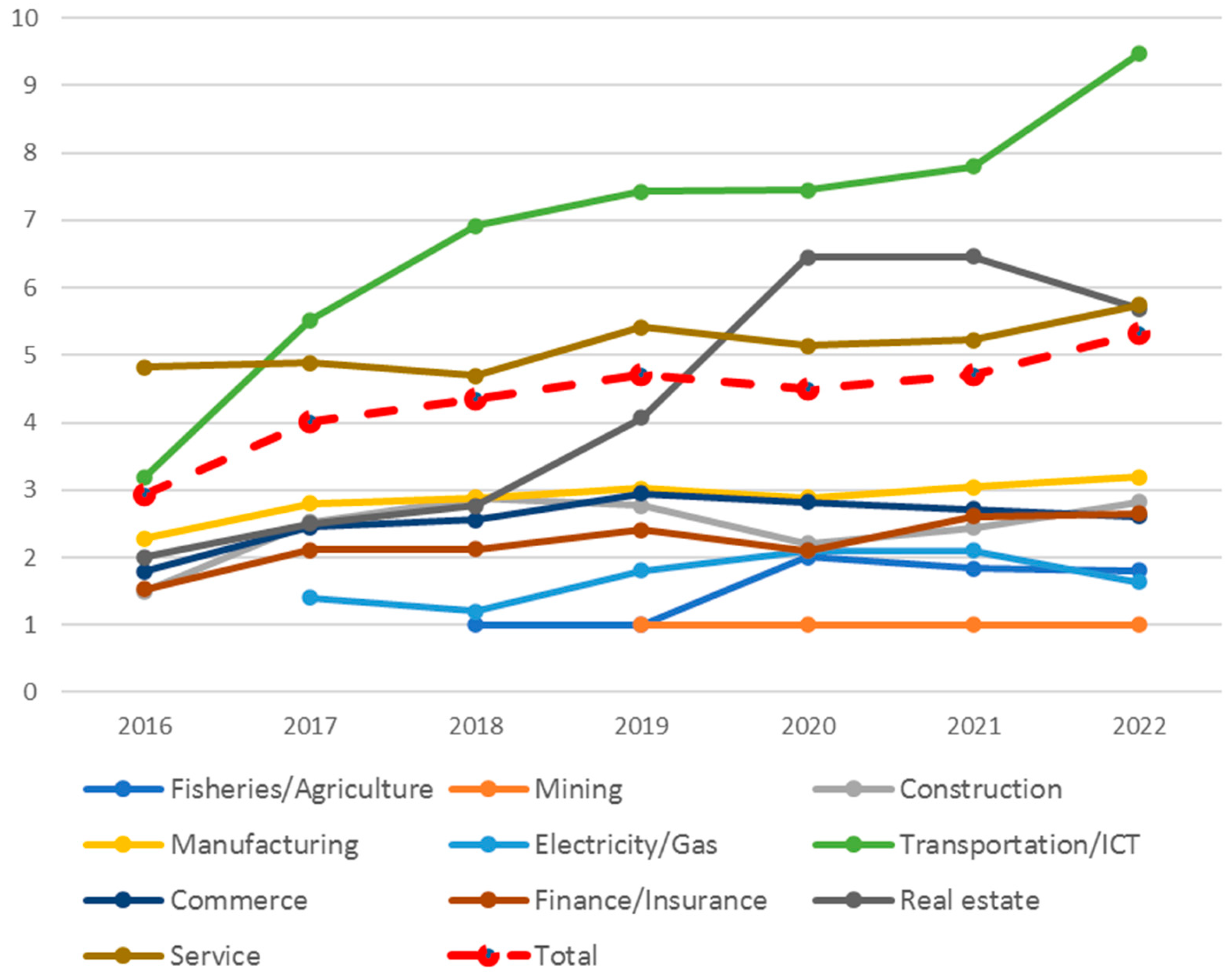

4.1. Descriptive Statistics

4.2. Co-Occurrence Network Analysis

4.3. Correspondence Analysis

4.3.1. Time-Series Analysis

4.3.2. Innovation Theory−Based Analysis

5. Discussion

5.1. Contributions

5.2. Implications

5.3. Limitations

5.4. Further Research

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Original Term | English Meanings of Original Terms | Organized Term | English Meanings of Organized Terms |

|---|---|---|---|

| artificial intelligence | ai | ||

| 人工知能 | artificial intelligence | ai | |

| デジタルトランス フォーメーション | digital transformation | dx | |

| robotic process automation | rpa | ||

| ロボティック・プロセス・オートメーション | robotic process automation | rpa | |

| cloud | クラウド | cloud | |

| deep learning | ディープラーニング | deep learning | |

| 技術 | technology | テクノロジー | technology |

| 事業 | business | ビジネス | business |

| 企業 | firm | 会社 | firm |

| management | 経営 | management | |

| マネージメント | management | 経営 | management |

| マネジメント | management | 経営 | management |

| 業界 | industry | 産業 | industry |

| 新しい | new | 新規 | new |

| 新た | new | 新規 | new |

| 解析 | analysis | 分析 | analysis |

| 領域 | area | 分野 | area |

Appendix B

| English | Japanese | English | Japanese | English | Japanese |

|---|---|---|---|---|---|

| accounting | 会計 | goods | 商品 | production | 生産 |

| activity | 活動 | group | グループ | quarter | 四半期 |

| add | 加える | growth | 成長 | realize | 実現 |

| administration | 管理 | hereafter | 今後 | recognition | 認識 |

| advance | 進める | human resource | 人材 | relevant | 関連 |

| AI | ai | image | 画像 | research | 研究 |

| aim at | 目指す | implementation | 推進 | revenue | 収益 |

| analysis | 分析 | improvement | 向上 | robot | ロボット |

| attempt | 図る | increase | 増加 | RPA | rpa |

| auto | 自動 | industry | 産業 | sales | 販売 |

| basis | 基盤 | information | 情報 | segment | セグメント |

| big data | ビッグデータ | innovation | 革新 | service | サービス |

| building-up | 構築 | internet | インターネット | situation | 状況 |

| business | ビジネス | introduce | 導入 | society | 社会 |

| change | 変化 | investment | 投資 | solution | ソリューション |

| cloud | クラウド | IoT | iot | sound | 音声 |

| consolidated | 連結 | issue | 課題 | start | 開始 |

| corporation | 株式会社 | IT | it | strategy | 戦略 |

| customer | 顧客 | management | 経営 | strengthen | 強化 |

| data | データ | market | 市場 | subsidiary | 子会社 |

| dealing with | 対応 | medical | 医療 | support | 支援 |

| demand | 需要 | needs | ニーズ | system | システム |

| deployment | 展開 | net sales | 売上 | tackle | 取り組む |

| development | 開発 | new | 新規 | task | 業務 |

| digital | デジタル | offer | 提供 | technology | テクノロジー |

| DX | dx | operation | 営業 | telecommunication | 通信 |

| efficiency | 効率 | our firm | 当社 | tie-up | 提携 |

| environment | 環境 | period | 期間 | turn toward | 向ける |

| expansion | 拡大 | platform | プラットフォーム | usage | 利用 |

| field | 分野 | positive | 積極 | use | 活用 |

| firm | 会社 | possible | 可能 | value | 価値 |

| function | 機能 | product | 製品 |

References

- Bokhari, S.A.A.; Myeong, S. Use of Artificial Intelligence in Smart Cities for Smart Decision-Making: A Social Innovation Perspective. Sustainability 2022, 14, 620. [Google Scholar] [CrossRef]

- Hutter, R.; Hutter, M. Chances and Risks of Artificial Intelligence—A Concept of Developing and Exploiting Machine Intelligence for Future Societies. Appl. Syst. Innov. 2021, 4, 37. [Google Scholar] [CrossRef]

- Lee, H.S.; Lee, J. Applying Artificial Intelligence in Physical Education and Future Perspectives. Sustainability 2021, 13, 351. [Google Scholar] [CrossRef]

- Al-Marsy, A.; Chaudhary, P.; Rodger, J.A. A Model for Examining Challenges and Opportunities in Use of Cloud Computing for Health Information Systems. Appl. Syst. Innov. 2021, 4, 15. [Google Scholar] [CrossRef]

- Lee, D.; Yoon, S.N. Application of Artificial Intelligence-Based Technologies in the Healthcare Industry: Opportunities and Challenges. Int. J. Environ. Res. Public Health 2021, 18, 271. [Google Scholar] [CrossRef] [PubMed]

- Frey, C.B.; Osborne, M.A. The Future of Employment: How Susceptible Are Jobs to Computerisation? Technol. Forecast. Soc. Change 2017, 114, 254–280. [Google Scholar] [CrossRef]

- Ebers, M.; Hoch, V.R.S.; Rosenkranz, F.; Ruschemeier, H.; Steinrötter, B. The European Commission’s Proposal for an Artificial Intelligence Act—A Critical Assessment by Members of the Robotics and AI Law Society (RAILS). J 2021, 4, 589–603. [Google Scholar] [CrossRef]

- Reier Forradellas, R.F.; Garay Gallastegui, L.M. Digital Transformation and Artificial Intelligence Applied to Business: Legal Regulations, Economic Impact and Perspective. Laws 2021, 10, 70. [Google Scholar] [CrossRef]

- Brendel, A.B.; Mirbabaie, M.; Lembcke, T.-B.; Hofeditz, L. Ethical Management of Artificial Intelligence. Sustainability 2021, 13, 1974. [Google Scholar] [CrossRef]

- Borges, A.F.S.; Laurindo, F.J.B.; Spínola, M.M.; Gonçalves, R.F.; Mattos, C.A. The Strategic Use of Artificial Intelligence in the Digital Era: Systematic Literature Review and Future Research Directions. Int. J. Inf. Manag. 2021, 57, 102225. [Google Scholar] [CrossRef]

- Kitsios, F.; Kamariotou, M. Artificial Intelligence and Business Strategy towards Digital Transformation: A Research Agenda. Sustainability 2021, 13, 2025. [Google Scholar] [CrossRef]

- Redchuk, A.; Walas Mateo, F. New Business Models on Artificial Intelligence—The Case of the Optimization of a Blast Furnace in the Steel Industry by a Machine Learning Solution. Appl. Syst. Innov. 2022, 5, 6. [Google Scholar] [CrossRef]

- Akundi, A.; Euresti, D.; Luna, S.; Ankobiah, W.; Lopes, A.; Edinbarough, I. State of Industry 5.0—Analysis and Identification of Current Research Trends. Appl. Syst. Innov. 2022, 5, 27. [Google Scholar] [CrossRef]

- Moshood, T.D.; Nawanir, G.; Sorooshian, S.; Okfalisa, O. Digital Twins Driven Supply Chain Visibility within Logistics: A New Paradigm for Future Logistics. Appl. Syst. Innov. 2021, 4, 29. [Google Scholar] [CrossRef]

- Orlova, E.V. Innovation in Company Labor Productivity Management: Data Science Methods Application. Appl. Syst. Innov. 2021, 4, 68. [Google Scholar] [CrossRef]

- Madsen, D.Ø.; Berg, T.; Di Nardo, M. Bibliometric Trends in Industry 5.0 Research: An Updated Overview. Appl. Syst. Innov. 2023, 6, 63. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Simon and Schuster: New York, NY, USA, 2003; ISBN 978-0-7432-5823-4. [Google Scholar]

- De Bustos, J.C.M.; Izquierdo-Castillo, J. Who Will Control the Media? The Impact of GAFAM on the Media Industries in the Digital Economy. Rev. Lat. Comun. Soc. 2019, 74, 803–821. [Google Scholar]

- Truong, Y.; Papagiannidis, S. Artificial Intelligence as an Enabler for Innovation: A Review and Future Research Agenda. Technol. Forecast. Soc. Change 2022, 183, 121852. [Google Scholar] [CrossRef]

- Li, J.; Bonn, M.A.; Ye, B.H. Hotel Employee’s Artificial Intelligence and Robotics Awareness and Its Impact on Turnover Intention: The Moderating Roles of Perceived Organizational Support and Competitive Psychological Climate. Tour. Manag. 2019, 73, 172–181. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D.; Farcane, N.; Dontu, A. Managing Change with and through Blockchain in Accountancy Organizations: A Systematic Literature Review. J. Organ. Change Manag. 2021, 34, 477–506. [Google Scholar] [CrossRef]

- Füller, J.; Hutter, K.; Wahl, J.; Bilgram, V.; Tekic, Z. How AI Revolutionizes Innovation Management—Perceptions and Implementation Preferences of AI-Based Innovators. Technol. Forecast. Soc. Change 2022, 178, 121598. [Google Scholar] [CrossRef]

- Vecchio, Y.; Agnusdei, G.P.; Miglietta, P.P.; Capitanio, F. Adoption of Precision Farming Tools: The Case of Italian Farmers. Int. J. Environ. Res. Public Health 2020, 17, 869. [Google Scholar] [CrossRef] [PubMed]

- Strong, R.; Wynn, J.T.; Lindner, J.R.; Palmer, K. Evaluating Brazilian Agriculturalists’ IoT Smart Agriculture Adoption Barriers: Understanding Stakeholder Salience Prior to Launching an Innovation. Sensors 2022, 22, 6833. [Google Scholar] [CrossRef] [PubMed]

- Gonera, A.; Svanes, E.; Bugge, A.B.; Hatlebakk, M.M.; Prexl, K.-M.; Ueland, Ø. Moving Consumers along the Innovation Adoption Curve: A New Approach to Accelerate the Shift toward a More Sustainable Diet. Sustainability 2021, 13, 4477. [Google Scholar] [CrossRef]

- Bjørge, N.M.; Hjelkrem, O.A.; Babri, S. Characterisation of Norwegian Battery Electric Vehicle Owners by Level of Adoption. World Electr. Veh. J. 2022, 13, 150. [Google Scholar] [CrossRef]

- Damanpour, F. Footnotes to Research on Management Innovation. Organ. Stud. 2014, 35, 1265–1285. [Google Scholar] [CrossRef]

- Yamaguchi, S.; Nitta, R.; Hara, Y.; Shimizu, H. Who Explores Further? Evidence on R&D Outsourcing from the Survey of Research and Development. RD Manag. 2021, 51, 114–126. [Google Scholar] [CrossRef]

- Zahra, S.A. Environment, Corporate Entrepreneurship, and Financial Performance: A Taxonomic Approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Coad, A.; Rao, R. Firm Growth and R&D Expenditure. Econ. Innov. New Technol. 2010, 19, 127–145. [Google Scholar] [CrossRef]

- Banker, R.D.; Potter, G.; Srinivasan, D. An Empirical Investigation of an Incentive Plan That Includes Nonfinancial Performance Measures. Account. Rev. 2000, 75, 65–92. [Google Scholar] [CrossRef]

- Cole, C.J.; Jones, C.L. Management Discussion and Analysis: A Review and Implications for Future Research. J. Account. Lit. 2005, 24, 135–174. [Google Scholar]

- Senave, E.; Jans, M.J.; Srivastava, R.P. The Application of Text Mining in Accounting. Int. J. Account. Inf. Syst. 2023, 50, 100624. [Google Scholar] [CrossRef]

- Berns, J.; Bick, P.; Flugum, R.; Houston, R. Do Changes in MD&A Section Tone Predict Investment Behavior? Financ. Rev. 2022, 57, 129–153. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, D.; Yan, L. Effect of Positive Tone in MD&A Disclosure on Capital Structure Adjustment Speed: Evidence from China. Account. Financ. 2021, 61, 5809–5845. [Google Scholar] [CrossRef]

- Romito, S.; Vurro, C. Non-Financial Disclosure and Information Asymmetry: A Stakeholder View on US Listed Firms. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 595–605. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Ding, B.Y.; Wei, F. Executive Resume Information Disclosure and Corporate Innovation: Evidence from China. Manag. Decis. Econ. 2022, 43, 3593–3610. [Google Scholar] [CrossRef]

- Jia, N. Corporate Innovation Strategy and Disclosure Policy. Rev. Quant. Finan. Acc. 2019, 52, 253–288. [Google Scholar] [CrossRef]

- Leung, S.; Parker, L.; Courtis, J. Impression Management through Minimal Narrative Disclosure in Annual Reports. Br. Account. Rev. 2015, 47, 275–289. [Google Scholar] [CrossRef]

- Cao, X. A New Era of Intelligent Interaction: Opportunities and Challenges Brought by ChatGPT. Geogr. Res. Bull. 2023, 2, 162–165. [Google Scholar] [CrossRef]

- Ting, D.S.J.; Tan, T.F.; Ting, D.S.W. ChatGPT in Ophthalmology: The Dawn of a New Era? Eye 2023, 38, 4–7. [Google Scholar] [CrossRef] [PubMed]

- Gupta, V.; Lehal, G. A Survey of Text Mining Techniques and Applications. J. Emerg. Technol. Web Intell. 2009, 1, 60–76. [Google Scholar] [CrossRef]

- Yano, Y.; Blandford, D.; Maruyama, A.; Nakamura, T. Consumer Perceptions of Fresh Leafy Vegetables in Japan: An Application of Word Co-Occurrence Network Analysis. Br. Food J. 2018, 120, 2554–2568. [Google Scholar] [CrossRef]

- Higuchi, K. KH Coder 3 Reference Manual; Ritsumeikan University: Kioto, Japan, 2016. [Google Scholar]

- Greenacre, M. Correspondence Analysis in Practice; CRC Press: Boca Raton, FL, USA, 2017. [Google Scholar]

- Jung, Y.; Suh, Y. Mining the Voice of Employees: A Text Mining Approach to Identifying and Analyzing Job Satisfaction Factors from Online Employee Reviews. Decis. Support Syst. 2019, 123, 113074. [Google Scholar] [CrossRef]

- Wang, X.; Inaba, M. Analyzing Structures and Evolution of Digital Humanities Based on Correspondence Analysis and Co-Word Analysis. Art Res. 2009, 9, 123–134. [Google Scholar]

- Birkinshaw, J.; Mol, M. How Management Innovation Happens. MIT Sloan Manag. Rev. 2006, 47, 81–88. [Google Scholar]

- Lin, H.; Su, J. A Case Study on Adoptive Management Innovation in China. J. Organ. Change Manag. 2014, 27, 83–114. [Google Scholar] [CrossRef]

- Kraśnicka, T.; Głód, W.; Wronka-Pośpiech, M. Management Innovation and Its Measurement. J. Entrep. Manag. Innov. 2016, 12, 95–121. [Google Scholar] [CrossRef]

- Benders, J.; Nijholt, J.; Heusinkveld, S. Using Print Media Indicators in Management Fashion Research. Qual. Quant. 2007, 41, 815–829. [Google Scholar] [CrossRef]

- Lagerwerf, L.; Govaert, C.G. Raising Clickworthiness: Effects of Foregrounding News Values in Online Newspaper Headlines. In News Values from an Audience Perspective; Temmerman, M., Mast, J., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 95–119. ISBN 978-3-030-45046-5. [Google Scholar]

- Paape, D. Five Degrees of (Non)Sense: Investigating the Connection between Bullshit Receptivity and Susceptibility to Semantic Illusions. Exp. Linguist. Mean. 2023, 2, 189–201. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic Capabilities: What Are They? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Reis, E. The Lean Startup; Crown Business: New York, NY, USA, 2011. [Google Scholar]

- Brandenburger, A.M.; Barry, J.N. The Right Game: Use Game Theory to Shape Strategy. Harv. Bus. Rev. 1995, 76, 57–71. [Google Scholar]

- Robert Baum, J.; Wally, S. Strategic Decision Speed and Firm Performance. Strateg. Manag. J. 2003, 24, 1107–1129. [Google Scholar] [CrossRef]

- Le Mens, G.; Hannan, M.T.; Pólos, L. Age-Related Structural Inertia: A Distance-Based Approach. Organ. Sci. 2015, 26, 756–773. [Google Scholar] [CrossRef]

| 10 Industries | 33 Industries |

|---|---|

| Fisheries/Agriculture | Fisheries and Agriculture |

| Mining | Mining |

| Construction | Construction |

| Manufacturing | Foodstuffs, Textiles, Pulp & Paper, Chemicals, Pharmaceuticals, Petroleum and Coal Products, Rubber Products, Glass & Ceramics Products, Iron and Steel, Nonferrous Metals, Metal Products, Machinery, Electrical equipment, Transportation equipment, Precision Equipment, Other Products |

| Electricity/Gas | Electricity and Gas |

| Transportation/ICT | Land Transportation, Marine Transportation, Air Transportation, Warehousing and Transportation, Information and Communication, |

| Commerce | Wholesale and Retail Trade |

| Finance/Insurance | Banking, Securities and Commodity Futures Trading, Insurance, Other Financial Industry |

| Real estate | Real Estate |

| Service | Service |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hoshino, Y.; Hirao, T. Organizational Processes for Adopting Breakthrough Technology: Text Mining of AI Perception among Japanese Firms. Appl. Syst. Innov. 2024, 7, 13. https://doi.org/10.3390/asi7010013

Hoshino Y, Hirao T. Organizational Processes for Adopting Breakthrough Technology: Text Mining of AI Perception among Japanese Firms. Applied System Innovation. 2024; 7(1):13. https://doi.org/10.3390/asi7010013

Chicago/Turabian StyleHoshino, Yusuke, and Takashi Hirao. 2024. "Organizational Processes for Adopting Breakthrough Technology: Text Mining of AI Perception among Japanese Firms" Applied System Innovation 7, no. 1: 13. https://doi.org/10.3390/asi7010013

APA StyleHoshino, Y., & Hirao, T. (2024). Organizational Processes for Adopting Breakthrough Technology: Text Mining of AI Perception among Japanese Firms. Applied System Innovation, 7(1), 13. https://doi.org/10.3390/asi7010013