The Semi-Hyperbolic Distribution and Its Applications

Abstract

1. Introduction

2. Materials and Methods

3. Preliminary Formulas

4. Main Results

5. Applications

6. Numerical Analysis

7. Discussion

8. Conclusions

- –

- The review of the literature about the class of GH distribution confirms the necessity of the development of the mathematical methods of its analysis.

- –

- The subclass of the family of GH distributions, the semi-hyperbolic distributions, is analytically tractable similarly to the VG distributions.

- –

- The obtained formulas depend on the values of degenerate generalized hypergeometric functions and can be computed very fast.

- –

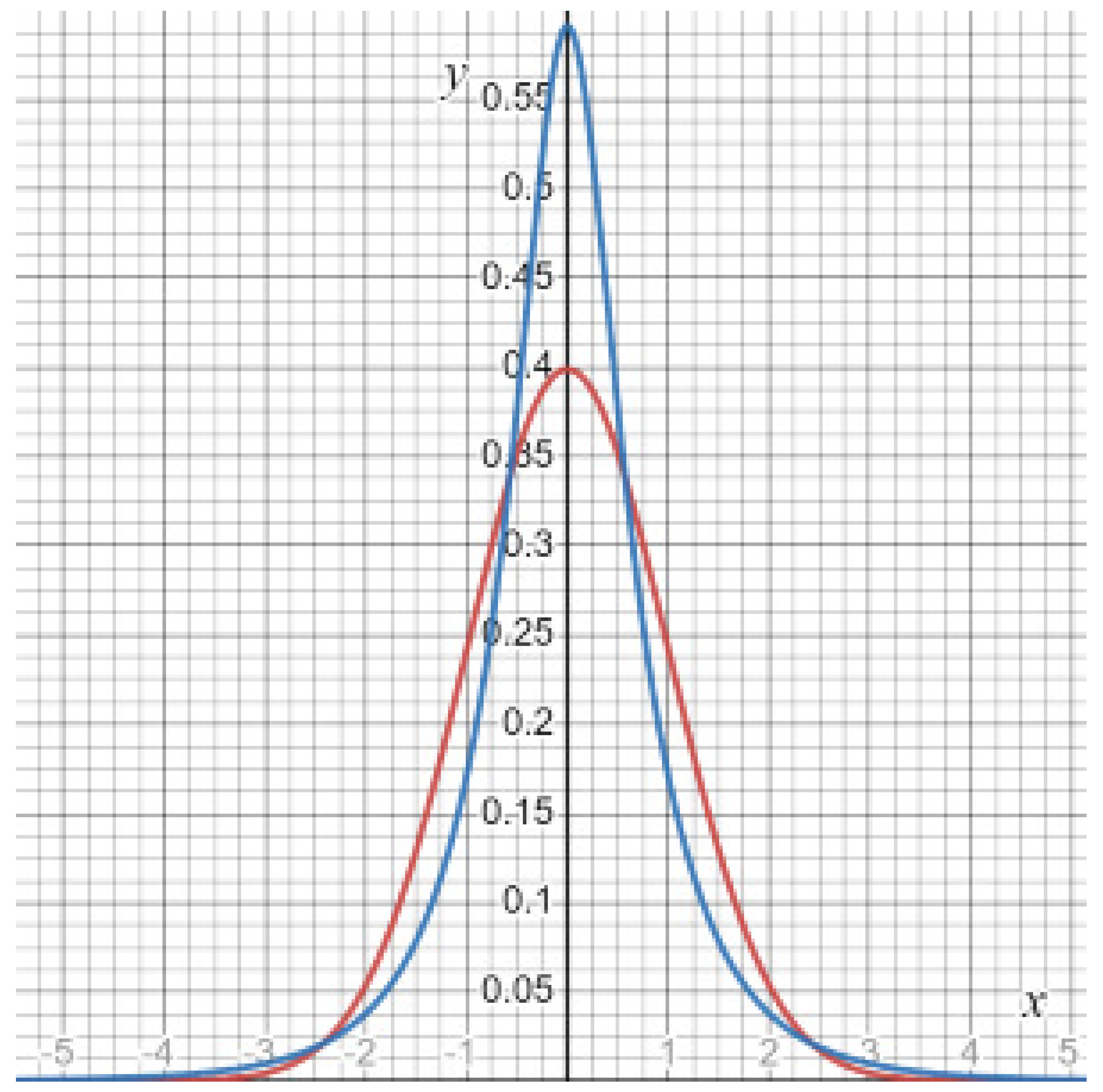

- The numerical analysis shows that the SH distribution discerns better than the normal data with heavy tails and a central part.

- –

- Keeping in mind the amount of work, we look forward to the future studies of the whole class of GH distribution.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| GH | Generalized Hyperbolic |

| SH | Semi-Hyperbolic |

| GIG | Generalized Inverse Gaussian |

| NIG | Normal-Inverse Gaussian |

| SHIG | Semi-Hyperbolic Inverse Gaussian |

| VaR | Value-at-Risk |

| ES | Expected Shortfall |

Appendix A

References

- Barndorff-Nielsen, O.E. Exponentially decreasing distributions for the logarithm of particle size. Proc. R. Soc. Lond. A 1977, 353, 401–419. [Google Scholar]

- Eberlein, E. Application of generalized hyperbolic Lévy motions to finance. In Lévy Processes: Theory and Applications; Barndorff-Nielsen, O.E., Mikosch, T., Resnick, S., Eds.; Birkhäuser Verlag: Berlin, Germany, 2001; pp. 319–337. [Google Scholar]

- Barndorff-Nielsen, O.E. Normal inverse Gaussian distributions and stochastic volatility modelling. Scand. J. Stat. 1997, 24, 1–13. [Google Scholar] [CrossRef]

- Rydberg, T.H. The normal-inverse Gaussian process: Simulation and approximation. Stoch. Model. 1997, 13, 887–910. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O.E. Processes of normal inverse Gaussian type. Financ. Stoch. 1998, 2, 41–68. [Google Scholar] [CrossRef]

- Pacheco-González, C.G. Approximation for the normal inverse Gaussian process using random sums. Stoch. Anal. Appl. 2009, 27, 1191–1200. [Google Scholar] [CrossRef]

- Rasmus, S. Pricing Exotic Derivatives Using Lévy Process Input; Media-Tryck: Lund, Sweden, 2004; pp. 31–49. [Google Scholar]

- Benth, F.E.; Di Persio, L.; Lavagnini, S. Stochastic modeling of wind derivatives in energy markets. Risks 2018, 6, 56. [Google Scholar] [CrossRef]

- Aguilar, J.-P. Explicit option valuation in the exponential NIG model. Quant. Financ. 2021, 21, 1281–1299. [Google Scholar] [CrossRef]

- Ivanov, R.V.; Temnov, G. Truncated moment-generating functions of the NIG process and their applications. Stoch. Dyn. 2017, 17, 1750039. [Google Scholar] [CrossRef]

- Venter, J.; de Jongh, R. Risk estimation using the normal inverse Gaussian distribution. J. Risks 2002, 2, 1–25. [Google Scholar] [CrossRef]

- Mabitsela, L.; Maré, E.; Kufakunesu, R. Quantification of VaR: A note on VaR valuation in the South African equity market. J. Risk Financ. Manag. 2015, 8, 103–126. [Google Scholar] [CrossRef]

- Eberlein, E.; Keller, U. Hyperbolic distributions in finance. Bernoulli 1995, 1, 281–299. [Google Scholar] [CrossRef]

- Eberlein, E.; Keller, U.; Prause, K. New Insights into smile, mispricing, and value at risk: The hyperbolic model. J. Bus. 1998, 71, 371–405. [Google Scholar] [CrossRef]

- Küchler, U.; Neumann, K.; Sorensen, M.; Streller, A. Stock returns and hyperbolic distributions. Math. Comput. Model. 1999, 29, 1–15. [Google Scholar] [CrossRef]

- Bauer, C. Value at risk using hyperbolic distributions. J. Econ. Bus. 2000, 52, 455–467. [Google Scholar] [CrossRef]

- Dorić, D.; Nikolić-Dorić, E. Return distribution and value at risk estimation for BELEX15. Yugosl. J. Oper. Res. 2011, 21, 103–118. [Google Scholar] [CrossRef]

- Eberlein, E.; von Hammerstein, E.A. Generalized hyperbolic and inverse Gaussian distributions: Limiting cases and approximation of processes. In Seminar on Stochastic Analysis, Random Fields and Applications IV, Progress in Probability; Dalang, R.C., Dozzi, M., Russo, F., Eds.; Birkhäuser Verlag: Berlin, Germany, 2004; Volume 58, pp. 221–264. [Google Scholar]

- Madan, D.B.; Seneta, E. The variance gamma (V.G.) model for share market returns. J. Bus. 1990, 63, 511–524. [Google Scholar] [CrossRef]

- Daal, E.A.; Madan, D.B. An empirical examination of the variance-gamma model for foreign currency options. J. Bus. 2005, 78, 2121–2152. [Google Scholar] [CrossRef]

- Rathgeber, A.W.; Stadler, J.; Stöckl, S. Modeling share returns—An empirical study on the variance gamma model. J. Econom. Financ. 2016, 40, 653–682. [Google Scholar] [CrossRef]

- Wallmeier, M.; Diethelm, M. Multivariate downside risk: Normal versus variance gamma. J. Futur. Mark. 2012, 32, 431–458. [Google Scholar] [CrossRef]

- Alvarez, S.; Baixauli, J.S. Evaluating effects of excess kurtosis on VaR estimates: Evidence for international stock indices. Rev. Quant. Financ. Account. 2006, 27, 27–46. [Google Scholar]

- Aas, K.; Haff, I.H. The generalized hyperbolic skew Student’s t-distribution. J. Financ. Econom. 2006, 4, 275–309. [Google Scholar] [CrossRef]

- Finlay, R.; Seneta, E. Stationary-increment student and variance-gamma processes. J. Appl. Probab. 2006, 43, 441–453. [Google Scholar] [CrossRef]

- Müller, F.M.; Righi, M. Comparison of value at risk (VaR) multivariate forecast models. Comput. Econ. 2022, 1–36. [Google Scholar] [CrossRef]

- Rathie, P.N.; de Sena Monteiro Ozelim, L.C. On the relation between Lambert w-function and generalized hypergeometric functions. Stats 2022, 5, 1212–1220. [Google Scholar] [CrossRef]

- Choi, J.; Hasanov, A.; Srivastava, H.M.; Turaev, M. Integral representations for Srivastava’s triple hypergeometric functions. Taiwan. J. Math. 2011, 15, 2751–2762. [Google Scholar] [CrossRef]

- Srivastava, H.M. A survey of some recent developments on higher transcendental functions of analytic number theory and applied mathematics. Symmetry 2021, 13, 2294. [Google Scholar] [CrossRef]

- Madan, D.B.; Carr, P.; Chang, E.C. The variance gamma process and option pricing. Rev. Financ. 1998, 2, 79–105. [Google Scholar] [CrossRef]

- Ano, K.; Ivanov, R.V. On exact pricing of FX options in multivariate time-changed Lévy models. Rev. Deriv. Res. 2016, 19, 201–216. [Google Scholar]

- Ivanov, R.V. The downside and upside beta valuation in the variance-gamma model. Int. J. Anal. Appl. 2021, 19, 319–340. [Google Scholar] [CrossRef]

- Ivanov, R.V. On the stochastic volatility in the generalized Black-Scholes-Merton model. Risks 2023, 11, 111. [Google Scholar] [CrossRef]

- Daskalaki, S.; Katris, C. Marginal distribution modeling and value at risk estimation for stock index returns. J. Appl. Oper. Res. 2014, 6, 207–221. [Google Scholar]

- Baciu, O.A. Generalized hyperbolic distributions: Empirical evidence on Bucharest stock exchange. Rev. Financ. Bank. 2015, 7, 7–18. [Google Scholar]

- Rathgeber, A.W.; Stadler, J.; Stöckl, S. Fitting generalized hyperbolic processes—New insights for generating initial values. Commun. Stat. Simul. Comput. 2017, 46, 5752–5762. [Google Scholar] [CrossRef]

- Balter, J.; McNeil, A.J. On the Basel liquidity formula for elliptical distributions. Risks 2018, 6, 92. [Google Scholar] [CrossRef]

- Klebanov, L.; Rachev, S.T. ν-Generalized hyperbolic distributions. J. Risk Financ. Manag. 2023, 16, 251. [Google Scholar] [CrossRef]

- Han, X.; Yin, C. Tail conditional moments for location-scale mixture of elliptical distributions. Mathematics 2022, 10, 606. [Google Scholar] [CrossRef]

- Good, I.J. On the population frequencies of species and the estimation of population parameters. Biometrika 1953, 40, 237–264. [Google Scholar] [CrossRef]

- Sichel, H. Statistical valuation of diamondiferous deposits. J. S. Afr. Inst. Min. Metall. 1973, 73, 235–243. [Google Scholar]

- Tsai, T.-R.; Xin, H.; Fan, Y.-Y.; Lio, Y. Bias-corrected maximum likelihood estimation and Bayesian inference for the process performance index using inverse Gaussian distribution. Stats 2022, 5, 1079–1096. [Google Scholar] [CrossRef]

- Lee, M.-L.T.; Whitmore, G.A. Multivariate threshold regression models with cure rates: Identification and estimation in the presence of the Esscher property. Stats 2022, 5, 172–189. [Google Scholar] [CrossRef]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions, 10th ed.; US Government Printing Office: Washington, DC, USA, 1972; pp. 355–456. [Google Scholar]

- Gradshteyn, I.S.; Ryzhik, I.M. Table of Integrals, Series and Products, 7th ed.; Elsevier Academic Press: New York, NY, USA, 2007. [Google Scholar]

- Shiryaev, A.N. Essentials of Stochastic Finance; World Scientific: Singapore, 1999; pp. 214–220. [Google Scholar]

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management; Princeton University Press: Princeton, NJ, USA, 2005; pp. 38, 73–88. [Google Scholar]

- Barndorff-Nielsen, O.E.; Stelzer, R. Absolute moments of generalized hyperbolic distributions and approximate scaling of normal inverse Gaussian Lévy processes. Scand. Stat. 2005, 32, 617–637. [Google Scholar] [CrossRef]

- Scott, D.J.; Würtz, D.; Dong, C.; Tran, T.T. Moments of the generalized hyperbolic distribution. Comput. Stat. 2011, 26, 459–476. [Google Scholar] [CrossRef]

- Paolella, M.S. Intermediate Probability: A Computational Approach; Wiley: Chichester, UK, 2007; pp. 306–328. [Google Scholar]

- Srivastava, H.M.; Karlsson, P.W. Multiple Gaussian Hypergeometric Series; Wiley: New York, NY, USA, 1985; pp. 15–33. [Google Scholar]

- Erdélyi, A.; Magnus, W.; Oberhettinger, F.; Tricomi, F.G. Tables of Integral Transforms; McGraw-Hill: New York, NY, USA, 1954; pp. 214–223. [Google Scholar]

- Srivastava, H.M.; Qureshi, M.I.; Quraishi, K.A.; Singh, R. Applications of some hypergeometric summation theorems involving double series. J. Appl. Math. Stat. Inform. 2012, 8, 37–48. [Google Scholar] [CrossRef][Green Version]

- Sadykov, T.M. On the analytic complexity of hypergeometric functions. Proc. Steklov Inst. Math. 2017, 298, 248–255. [Google Scholar] [CrossRef]

- Sadykov, T.M. Computational problems of multivariate hypergeometric theory. Program. Comput. Softw. 2018, 44, 131–137. [Google Scholar] [CrossRef]

- Cuchta, T.; Grow, D.; Wintz, N. Divergence criteria for matrix generalized hypergeometric series. Proc. Am. Math. Soc. 2022, 150, 1235–1240. [Google Scholar] [CrossRef]

- Cuchta, T.; Grow, D.; Wintz, N. Discrete matrix hypergeometric functions. J. Math. Anal. Appl. 2023, 518, 126716. [Google Scholar] [CrossRef]

- Artzner, P.; Delbaen, F.; Eber, J.-M.; Heath, D. Coherent measures of risk. Math. Financ. 1999, 9, 203–228. [Google Scholar] [CrossRef]

- Föllmer, H.; Schied, A. Stochastic Finance: An Introduction in Discrete Time, 2nd ed.; Walter de Gruyter: Berlin, Germany, 2004; p. 177. [Google Scholar]

- Armenti, Y.; Crépey, S.; Drapeau, S.; Papapantoleon, A. Multivariate shortfall risk allocation and systemic risk. SIAM J. Financ. Math. 2018, 9, 90–126. [Google Scholar] [CrossRef]

- Drapeau, S.; Kupper, M.; Papapantoleon, A. A Fourier approach to the computation of CVaR and optimized certainty equivalents. J. Risk 2014, 16, 3–29. [Google Scholar] [CrossRef]

- Ivanov, R.V. A credit-risk valuation under the variance-gamma asset return. Risks 2018, 6, 58. [Google Scholar] [CrossRef]

- Ivanov, R.V. The risk measurement under the variance-gamma process with drift switching. J. Risk Financ. Manag. 2022, 15, 22. [Google Scholar] [CrossRef]

- Rockafellar, R.T.; Uryasev, S. Conditional value-at-risk for general loss distributions. J. Bank. Financ. 2002, 26, 1443–1471. [Google Scholar] [CrossRef]

- Chun, S.Y.; Shapiro, A.; Uryasev, S. Conditional value-at-risk and average value-at-risk: Estimation and asymptotics. Oper. Res. 2012, 60, 739–756. [Google Scholar] [CrossRef]

- Mafusalov, A.; Uryasev, S. CVaR (superquantile) norm: Stochastic case. Europ. J. Operat. Res. 2016, 249, 200–208. [Google Scholar] [CrossRef]

- Cai, Z.; Wang, X. Nonparametric estimation of conditional var and expected shortfall. J. Econom. 2008, 147, 120–130. [Google Scholar] [CrossRef]

- Chen, S.X.; Tang, C.Y. Nonparametric inference of value-at-risk for dependent financial returns. J. Financ. Econom. 2005, 3, 227–255. [Google Scholar] [CrossRef]

- Scaillet, O. Nonparametric estimation of conditional expected shortfall. Insur. Risk Manag. J. 2005, 74, 639–660. [Google Scholar]

- Fontana, C.; Schweizer, M. Simplified mean-variance portfolio optimisation. Math. Financ. Econ. 2012, 6, 125–152. [Google Scholar] [CrossRef]

- Schweizer, M.; Zivoi, D.; Šikić, M. Dynamic mean-variance optimization problems with deterministic information. Int. J. Theor. Appl. Financ. 2018, 21, 1850011. [Google Scholar] [CrossRef]

- Nawrocki, D.N. A brief history of downside risk measures. J. Investig. 1999, 8, 9–25. [Google Scholar] [CrossRef]

- van der Meer, R.; Sortino, F.A. Downside risk: Capturing what’s at stake in investment situations. J. Portf. Manag. 1991, 17, 27–31. [Google Scholar]

- van der Meer, R.; Plantinga, A.; Sortino, F.A. The Dutch triangle. J. Portf. Manag. 1999, 26, 50–57. [Google Scholar]

- Barndorff-Nielsen, O.E.; Kinnebrouk, S.; Shephard, N. Measuring downside risk: Realised semivariance. In Volatility and Time Series Econometrics: Essays in Honor of Robert F. Engle; Bollerslev, T., Russell, J., Watson, M., Eds.; Oxford University Press: Oxford, UK, 2010; pp. 117–136. [Google Scholar]

- Ang, A.; Chen, J.; Xing, Y. Downside risk. Rev. Financ. Stud. 2006, 19, 1191–1239. [Google Scholar] [CrossRef]

- Jarrow, R.A.; Zhao, F. Downside loss aversion and portfolio management. Manag. Sci. 2006, 52, 558–566. [Google Scholar] [CrossRef]

- Ivanov, R.V. On lower partial moments for the investment portfolio with variance-gamma distributed returns. Lith. Math. J. 2022, 62, 10–27. [Google Scholar] [CrossRef]

- Brent, R.P. Multiple-precision zero-finding methods and the complexity of elementary function evaluation. In Analytic Computational Complexity; Traub, J.F., Ed.; Academic Press: Cambridge, MA, USA, 1976; pp. 151–176. [Google Scholar]

- Asmussen, S.; Glynn, P.W. Stochastic Simulation: Algorithms and Analysis; Springer: New York, NY, USA, 2007; pp. 325–344. [Google Scholar]

- Avramidis, A.N.; L’Ecuyer, P.; Tremblay, P.-A. Efficient simulation of gamma and variance-gamma processes. In Proceedings of the 2003 Winter Simulation Conference, New Orleans, LA, USA, 7–10 December 2003; Chick, S., Sánchez, P.J., Ferrin, D., Morrice, D.J., Hung, Y.-C., Eds.; IEEE: Piscataway, NJ, USA, 2003; pp. 319–326. [Google Scholar]

- Avramidis, A.N.; L’Ecuyer, P. Efficient Monte Carlo and quasi–Monte Carlo option pricing under the variance gamma model. Manag. Sci. 2006, 52, 1930–1944. [Google Scholar] [CrossRef][Green Version]

- Lemieux, C. Monte Carlo and Quasi-Monte Carlo Sampling; Springer: New York, NY, USA, 2009; pp. 234–238. [Google Scholar]

| 0 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ivanov, R.V. The Semi-Hyperbolic Distribution and Its Applications. Stats 2023, 6, 1126-1146. https://doi.org/10.3390/stats6040071

Ivanov RV. The Semi-Hyperbolic Distribution and Its Applications. Stats. 2023; 6(4):1126-1146. https://doi.org/10.3390/stats6040071

Chicago/Turabian StyleIvanov, Roman V. 2023. "The Semi-Hyperbolic Distribution and Its Applications" Stats 6, no. 4: 1126-1146. https://doi.org/10.3390/stats6040071

APA StyleIvanov, R. V. (2023). The Semi-Hyperbolic Distribution and Its Applications. Stats, 6(4), 1126-1146. https://doi.org/10.3390/stats6040071