1. Introduction

Global urbanization is one of the greatest challenges humanity faces after becoming social [

1]. Although cities have proven to be humanity’s engines of creativity, wealth creation, and economic growth, their rapid and ongoing growth has also been a source of pollution and disease [

2]. This has contributed to global problems such as climate change and incipient crises in food, energy, and water availability. The future of humanity and the long-term sustainability of the planet are inextricably linked to the fate of human settlements [

2].

Scaling studies reveal the underlying principles that determine the dominant behavior of highly complex systems [

3]. In urban studies, scaling research [

4] has demonstrated that the spatial and temporal levels of the social, economic, and political interactions of urban settlements are subject to constraints imposed by environmental conditions, technology, and institutions [

3,

5]. Settlement Scaling Theory (SST) provides the means to generate predictions for how measurable quantitative attributes of human settlements are related to their population sizes [

3].

Some surprisingly simple, but statistically significant, proportionalities have been recorded in the enterprise structures of many human settlements. One indicates that the total number of enterprises—a measure of total entrepreneurship (a fuller discussion of entrepreneurship follows below)—in human settlements such as South African towns [

6], U.S. counties [

7], U.S. micropolitan statistical areas [

8], and U.S. metropolitan statistical areas (MSAs) [

9] are linearly proportional to their population sizes [

6,

7,

8,

9]. The second proportionality indicates that new entrepreneurship (the ability to successfully start new business types not yet present in a human settlement) in South African towns [

10] and smaller U.S. counties [

11] is sub-linearly proportional to their total enterprise numbers. A third proportionality follows from the foregoing. Existing entrepreneurship (the ability to start more businesses of types already present) represents the difference between total and new entrepreneurship. Given that new entrepreneurship is related to total entrepreneurship, existing entrepreneurship is, therefore, also related [

11].

The first proportionality extends over many orders of magnitude of population size and enterprise numbers of MSAs. Youn et al. [

9] remarked that there is approximately one business establishment for every 22 people in U.S. cities, regardless of their size, and, on average, a new workplace is created each time a city size increases by 22 people. Due to the limitations of enterprise-type classification systems [

9], the second proportionality was found to apply to smaller human settlements (maximum enterprise richness values of approximately 300 to 350) [

6,

7]. This proportionality is a regular, but non-linear, increase of about 60 percent in the number of different enterprise types in human settlements when their enterprise numbers double [

10,

11,

12]. The third proportionality is a regular and super-linear increase of about 135 percent in the existing entrepreneurship of human settlements when their enterprise numbers double [

11].

Entrepreneurship clearly plays a role in these proportionalities. The first involves entrepreneurship that manifests in the total number of enterprises and employees in human settlements. The second involves abilities to identify and successfully pursue business opportunities of business types that have not previously been present in specific human settlements. The third involves abilities to identify and successfully pursue more business opportunities of business types that are already present in specific human settlements. These proportionalities have elicited some comments but are still not well understood. For instance, Youn et al. [

9] remarked that the remarkable constancy of the average number of employees and the average number of establishments across U.S. cities is contrary to previous wisdom and somewhat puzzling. Understanding the dynamics and vulnerabilities of these proportionalities should enhance knowledge about the entrepreneurial sustainability of human settlements. This is what is being pursued here.

1.1. Literature Survey

1.1.1. Human Settlements and Enterprise Dynamics

Cities are man’s greatest invention and are gateways for ideas [

13]. Cities are also a standard unit of observation in urban economics [

14]. A project of the Santa Fe Institute was started early in the new millennium to investigate the demographic and socioeconomic dynamics of cities [

2]. Scaling analyses were used to reveal the underlying dynamics and structure of cities [

2,

3,

4,

5,

15,

16]. The development of the SST [

4] provided a set of hypotheses and relationships that together estimate how measurable quantitative attributes of settlements are related per capita. The functional properties of cities, such as levels of economic productivity, material infrastructure, and even conflict, vary in a scale invariant way from the largest cities to the smallest towns within urban systems [

17]. Even the smallest settlements have elements that functionally find correspondence in larger modern cities. The power law is the preferred scale invariant function to describe the characteristics of cities across scales [

17]. Power laws quantify how measurable aggregate properties respond to changes in the size of a system [

18]. Their analytical power stems from the fact that responses are often simple, regular, and systematic over a wide range of sizes, indicating that there are underlying generic constraints at work on these systems as they develop. Power law analyses are used in this contribution.

However, the views and research practices of the Santa Fe group have been criticized [

19]. Martin & Sunley [

19] stated that a formal (mathematical) modelling methodology is neither necessary nor sufficient for understanding the complex behavior of the economic landscape. They added that evolutionary processes in the socioeconomic sphere are not easily reduced to, nor rarely can be adequately represented by, formal models. However, over the last few decades and in diverse disciplines such as economics, geography, and complex systems, perspectives have arisen that many properties of cities are quantitatively predictable due to agglomeration or scaling effects [

17,

20]. A theoretical framework that combines two main processes, namely, the dynamics of agglomeration/polarization and the unfolding of an associated nexus of locations, land uses, and human interactions, is now available and provides the means to understand all cities [

21]. Understanding the dynamics of the constraints mentioned in Ref. [

18] is obviously important and is a major reason for this contribution. In such a pursuit, it is necessary to consider innovation and entrepreneurship as potential constraints in the linkages of the demographic–socioeconomic domains of human settlements.

1.1.2. Innovation and Entrepreneurship as Elements in City Dynamics

The clustering of talent and economic assets, face-to-face interaction, buzz, diversity, and the critical mass that only cities can provide are essential elements in innovation, creativity, and economic growth [

22,

23]. The expansion of city populations requires the expansion of innovation cycles at a continually accelerating rate in order to sustain growth and avoid stagnation or collapse [

15]. For instance, patent production as an indicator of innovation scales super-linearly with increases in city populations [

2].

Entrepreneurship is a crucial mechanism in economic development [

24]. The function of entrepreneurs is to reform or revolutionize the patterns of production by exploiting inventions or untried technological possibilities for producing new commodities or producing old ones in new ways [

25,

26]. Such ‘industrial mutation’ revolutionizes the economic structure from within by incessantly destroying the old one and creating a new one [

25].

Entrepreneurship, in common with other unit ideas such as leadership, is an elusive concept [

27]. It is broad and wide-ranging, and its boundaries are fuzzy and may incorporate a number of disciplinary approaches. For instance, entrepreneurship has been defined over time in terms of: Environmental, structural, strategic, and leader personality qualities [

28]; attempts at new ventures or new business creations [

29]; the extraction of value from environments [

30]; and the pursuit of opportunity beyond resources controlled [

31]. Davidsson [

32] cautioned that there is a paradox if entrepreneurship research is limited to something that can be defined by an outcome criterion, e.g., a successful new business, then some important parts of the entrepreneurial process, e.g., failure, may be missed.

Given that the focus of this contribution is on the entrepreneurial dynamics of selected human settlements, it is necessary to focus on outcomes. Therefore, entrepreneurship is here defined in terms of three outcomes: (i) how many enterprises are in operation in a specific human settlement (i.e., total entrepreneurship, which is the manifestation of successful entrepreneurship), (ii) how many different enterprise types are present in the settlement (the ability to conceive business opportunities linked to enterprise types not yet present, i.e., new entrepreneurship), and (iii) existing entrepreneurship (the difference between total and new entrepreneurship, a measure of the repetition of business ideas that are already in operation).

How does entrepreneurship relate to SST? The enterprise numbers (measures of total entrepreneurship) of MSAs and U.S. counties have a linear or almost linear per capita relationship [

9,

33] and in this way appear to follow the basic SST tenet of being per capita based [

34]. However, the number of enterprises in U.S. counties is not only a function of their population numbers, but also of the prosperity/poverty levels of their communities, i.e., their buying power [

33] (which is more fully explained later). Total entrepreneurship in these counties is, therefore, only partially dependent on population numbers. In addition, new entrepreneurship and existing entrepreneurship are strongly and non-linearly related to total entrepreneurship [

35]. Their per capita links are, therefore, indirect. This contribution takes this difference into account by focusing on two entrepreneurially-based relationships: that between total entrepreneurship and new entrepreneurship, and that between total entrepreneurship and existing entrepreneurship. These links have not been explored before. It is now necessary to review knowledge about each of the entrepreneurship types mentioned before.

Total Entrepreneurship (Which Is Estimated from the Total Number of Enterprises in a Human Settlement)

Linear per capita indicators are often used to characterize and rank cities [

34]. This approach was initially used in this analysis but discarded when non-linear proportionalities were revealed (see later). Proportionalities between the population numbers and total entrepreneurship of human settlements are a seemingly common characteristic of human settlements [

6,

9,

12]. For instance, analyses by Youn et al. of a large number of U.S. MSAs [

9] revealed a linear relationship. Statistically significant linear relationships between the population sizes and total enterprises have also been reported for South African towns [

6] and Alabama counties [

12]. In these cases, the proportionalities were detected over ranges of small to large towns or counties.

These observations generated a number of questions: Why are there proportionalities between population and enterprise numbers when large numbers of human settlements (e.g., thousands of U.S. counties) that range widely in size and geographic location are investigated? What are the implications of these proportionalities? Three issues seem to be important. Firstly, there cannot be a lack of entrepreneurs in any settlement because its population size is involved in the determination of its enterprise numbers and not some entrepreneurial measure. In other words, population size contributes to the determination of the ‘entrepreneurial space’ of settlements. Entrepreneurial space determines how many enterprises can survive and exist in a settlement [

10,

11,

33]. Secondly, the population numbers and total enterprise numbers of human settlements have been linked in a measure of community prosperity/poverty, termed the enterprise dependency index (EDI) [

33]. This index expresses the financial ability of a settlement to sustain enterprises. It is expressed in terms of persons per enterprise. Higher indices indicate poorer communities, and vice versa. The number of enterprises in any human settlement, therefore, depends on both its population size as well as the buying power (financial ability) of its population to sustain enterprises. Stated differently, the population number and the prosperity/poverty status of a human community determine the extent of its entrepreneurial space. Thirdly, a full understanding of the resistance to change of total enterprises versus population proportionality should benefit from an examination of their behavior under stress conditions. Such conditions occurred in the U.S. economy in the 2000 to 2010 period. The U.S. economy grew from 1990 to 2007, a phenomenon that would stress the proportionality in one direction. Thereafter, the financial crisis and ensuing recession (starting in 2007 and lasting to 2010) injured the US economy [

36], a situation that would stress the proportionalities in a different direction. A comparison of the proportionalities of the same human settlements at three different time intervals, i.e., 2000 (during growth phase), 2007 (end of growth phase), and 2010 (end of the recession), would test the resistance to change of the proportionality between population size and total entrepreneurship.

New Entrepreneurship

New entrepreneurship is a measure of business diversity. However, is business diversity important? Diversity is a defining property of complex adaptive systems, whether it be ecosystems, social systems, or economies [

37]. The success and resilience of cities, together with their role in innovation and wealth creation, are driven by their ever-expanding diversity [

9]. The internal heterogeneity and diversity of cities contribute to their success [

38]. If business diversity is important in cities, is this also the case in regions (such as counties) or countries?

The relationship between regional economic diversity and growth and stability has been debated for many decades [

39,

40]. Some regional scientists have historically promoted policies of economic diversification to achieve economic goals [

41]. Regions are also subject to a never-ending process of creative destruction—the process that Schumpeter identified in 1939 as the driving force behind economic development [

26]. In the long run, regions depend on their ability to create and attract new industries to offset the decline in and destruction of other parts of their economies.

Making new products or offering new services involves significant challenges [

42]. The mix of products that countries are able to make is reflected in their business diversities [

43]. The diversity of products and services, therefore, stems from enterprise diversity, which is dependent on new entrepreneurship. The latter is, therefore, an important element in the success of regions and countries.

The number of enterprise types in an economy represents the number of times entrepreneurs in a specific location have successfully started enterprises of types that were not present before. This number, therefore, represents a measure of business diversity and, thus, of new entrepreneurship. A surprisingly simple non-linear proportionality between total entrepreneurship and new entrepreneurship has been detected in South African towns [

10,

35] and some U.S. counties [

11].

In natural ecology, there was confusion in the use of diversity terminologies to describe ecosystems [

44]. It was suggested that the term, species richness, should be used as a reference to the number of species in a given area or in a given sample and the term, species diversity, should be used as an expression or index of some relationship between the number of species and number of individuals in a natural ecosystem. Based on a similar logic, the term, enterprise richness, was adopted to reflect the number of enterprise types in human settlements [

10,

11,

35]. In this contribution, the term, new entrepreneurship, is based on the enterprise richness (i.e., number of different enterprise types) of human settlements. It reflects the number of instances where an entrepreneur or group of entrepreneurs successfully founded new business types that have not been present before in a settlement. It must be contrasted with existing entrepreneurship, which is necessary to start more enterprises of types that are already present in a human settlement, e.g., the second or third restaurant, and so on.

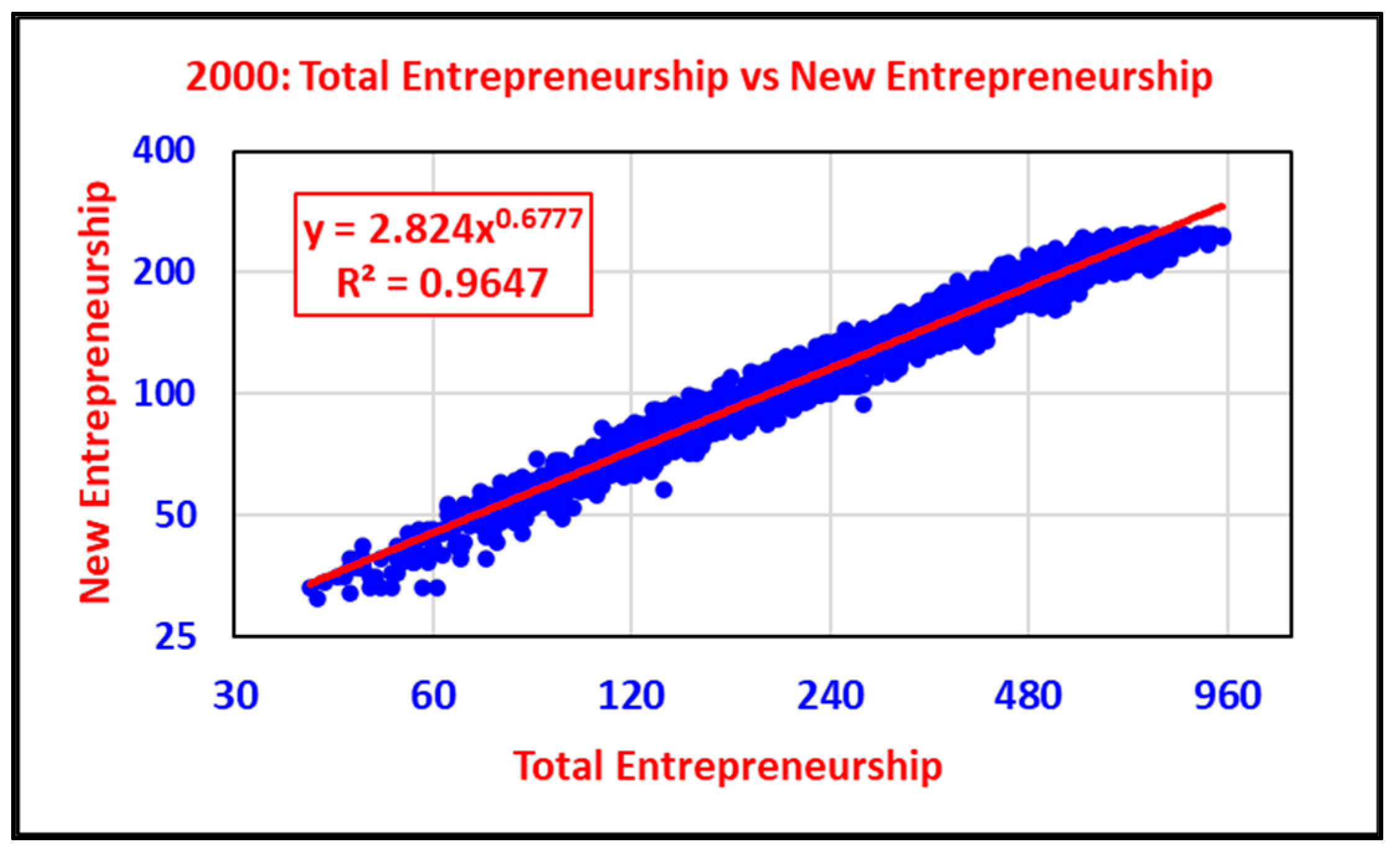

The exponent of the power law relationship between the total entrepreneurship and new entrepreneurship of human settlements is typically in the order of 0.65. This indicates that for every doubling (100% increase) of total entrepreneurship, new entrepreneurship increases by only approximately 60%.

Figure 1 illustrates the use of a hypothetical power law equation to show the importance of new and existing entrepreneurship as functions of the total entrepreneurship of a human settlement. At a total entrepreneurship of 180, the needs for new entrepreneurs and existing entrepreneurs are identical. Below this number new entrepreneurs are increasingly more important. Above this number existing entrepreneurs increasingly dominate. Therefore, the entrepreneurial challenges of small and large human settlements differ significantly. It is important to note that the growth of total entrepreneurship in human settlements always involves both new and existing entrepreneurship, albeit in different proportions. This situation is generally true for towns in South Africa, U.S. counties, and U.S. micropolitan statistical areas—and might apply elsewhere too.

Total entrepreneurship can be divided in more than one way. It can be divided into new and existing entrepreneurship and it can also be divided into entrepreneurship in tradable sectors and entrepreneurship in non-tradable sectors [

41]. There is some commonality between new entrepreneurship and entrepreneurship in the tradable sector of human settlements. Both sectors are related in a non-linear way with total entrepreneurship. However, the former scales strongly sub-linearly with total entrepreneurship [

11] and the latter slightly sub-linearly [

45]. New entrepreneurship and entrepreneurship in the tradable sector are, therefore, not identical. In this contribution, the focus is on new entrepreneurship rather than on entrepreneurship in the tradable sector.

How resistant to change is the total entrepreneurship and new entrepreneurship relationship? For instance, it might be geographically or temporally insensitive [

35]. Data about the growth phase before and during the subsequent decline of the U.S. economy (before and during the recession of 2007) [

36] provides an opportunity to stress test the resistance to change of the relationship. A comparison of the proportionality of the same human settlements at three different time intervals, i.e., 2000 (during an economic growth phase), 2007 (end of growth phase), and 2010 (after the recession), would test demographic and economic changes as constraints on the proportionality between total and new entrepreneurship.

Existing Entrepreneurship

There is a third entrepreneurial proportionality in human settlements, i.e., existing entrepreneurship [

11]. It is simply the difference between the total entrepreneurship and new entrepreneurship of a human settlement, i.e., entrepreneurship focused on business types already present in a human settlement. Therefore, it represents ‘more of the same’ entrepreneurship. A statistically significant power law relationship between total entrepreneurship and existing entrepreneurship was registered in Texas counties [

12] and South African towns [

45]. The exponents of the power laws are super-linear, and existing entrepreneurship increases by approximately 150% upon every doubling of total entrepreneurship (100% increase). In addition, there is a logarithmic relationship between new entrepreneurship and existing entrepreneurship [

11]. Existing entrepreneurship expands rapidly as the size of human settlements and their corresponding new entrepreneurship levels increase (

Figure 1).

There is some commonality between existing entrepreneurship and entrepreneurship in the non-tradable sector of human settlements. However, these entrepreneurial types are not identical. In South African towns, existing entrepreneurship scales strongly super-linearly and entrepreneurship in the non-tradable sector scales slightly super-linearly with total entrepreneurship [

45]. Existing entrepreneurship as well as entrepreneurship in the non-tradable sector are focused on local markets [

45,

46]. The vast majority of jobs in modern societies are in local services, which are served by people such as waiters, plumbers, nurses, teachers, real estate agents, hairdressers, etc. These people offer services that are produced and consumed locally [

46]. Local economies are differentiated by the geographical ranges of the markets of their traded and non-traded industries [

47]. In this contribution, the focus is on existing entrepreneurship rather than on entrepreneurship in the non-tradable sector.

1.2. Purpose of This Investigation

Entrepreneurship is a crucial mechanism in economic development [

24]. The characteristics of cities enhance innovation and creativity [

22,

23]. Constraints imposed by environmental conditions, technology, and institutions impact the spatial and temporal levels of the social, economic, and political interactions of urban settlements [

3,

5]. Therefore, constraints that might impact entrepreneurship in human settlements should be investigated. The prime purpose of this contribution is to investigate the resistance to change of the three entrepreneurial proportionalities present in human settlements, namely those between: total entrepreneurship and population size; total entrepreneurship and new entrepreneurship; and total entrepreneurship and existing entrepreneurship. Such analyses have not been carried out before. The basic hypothesis is that these proportionalities are temporally and geographically robust. To test the hypothesis, the influence of economic changes on the properties of the proportionalities during periods of economic growth and decline is examined. In other words, it is examined if time, geographic location, or community prosperity/poverty levels influence the properties of the proportionalities. U.S. counties were selected as the human settlements in the study.

4. Discussion

Global urbanization is a significant challenge to mankind [

1]. Its successful handling over the long-term requires knowledge of the behavior of highly complex systems [

3] such as the demographic–socioeconomic–entrepreneurial domain of human settlements [

2]. Scaling studies have contributed a lot of information in studies of human settlements [

3] and were also useful in this study.

Entrepreneurship remains a topic that attracts research attention. Recent studies focused on the business models of a subset of “blue” entrepreneurs focused on marine plastic pollution mitigation [

52] and on investigating how innovation promotes digital start-up performance in China [

53]. The business model innovation architecture was disassembled into three elements, value proposition, value creation, and value capture, to assess their roles [

53]. A psychoanalytic approach was used to investigate the entrepreneurial process of how individuals form ideas for new venture creation [

54]. A study of the role of the entrepreneurial orientation of Kenyan famers as reflected in their innovativeness, proactiveness, and risk-taking was also undertaken [

55]. These studies focused on the attitudes of individuals (i.e., entrepreneurs) [

54,

55] or aspects of the business models they use [

52,

53]. In contrast, this contribution has focused on the physical manifestation of entrepreneurship, i.e., enterprises linked to different entrepreneurial types.

It was kept in mind that entrepreneurship is an elusive concept, but that it can be measured in terms of outputs [

27]. Therefore, the number and types of enterprises present in U.S. counties were quantified. The related entrepreneurship entities are total entrepreneurship (the maximum number of enterprises that can be carried in a county), new entrepreneurship (the number of different enterprise types in a county economy), and existing entrepreneurship (the difference between total and new entrepreneurship). This was a useful strategy.

Many questions have been raised about the reasons for and implications of entrepreneurially-linked proportionalities in human settlements [

10,

11,

33,

35]. For instance, what is the reason that such proportionalities are present in human settlements when their populations extend over many orders of magnitude and when they are geographically widely spread? Why is there such a strong relationship between total enterprise numbers (total entrepreneurship) and the number of enterprise types? The latter relationship might be linked to the idea that entrepreneurial spaces control the total number of enterprises that can be ‘carried’ in specific human settlements [

11].

Increased financial instability in many countries led to the stress testing of financial systems to quantify their vulnerabilities [

56]. This contribution tested a hypothesis that the entrepreneurially-linked proportionalities of U.S. counties are temporally and geographically robust. The techniques used here to quantify the entrepreneurially-linked proportionalities during periods of economic growth and decline and for different geographic locations basically constituted stress testing of the proportionalities under vastly different economic and geographic conditions. This was a useful strategy, and the following was recorded.

The presence of orderliness in the demographic–socioeconomic–entrepreneurial domain of human settlements [

1,

2,

3,

4,

5,

6,

7,

8,

9,

10] was reconfirmed. This study focused on smaller U.S. counties in order to include sensible measurements of new entrepreneurship in the analysis. The 1785 selected counties (

Appendix A) housed about 28 million people (

Table 1), a sizeable portion of the U.S. population. County population numbers increased throughout the study period (2000 to 2010), but total enterprise numbers (total entrepreneurship) did not. Total enterprise numbers increased during the economic growth period but declined during the recession (

Table 1). Overall, the period of economic growth (2000 to 2007) led to an increase in community prosperity and the recession (2007 to 2010) led to a decrease (

Table 1).

Close to linear relationships between population and enterprise numbers were reported for U.S. metropolitan statistical areas [

9] and Texas counties [

12]. In this study, however, total enterprise numbers (total entrepreneurship) in the selected 1785 U.S. counties, representing smaller counties, were sub-linearly related (power law exponents about 0.8) to their population numbers in the 2000 to 2010 period (

Table 2). These sub-linear relationships might reflect an inherent characteristic of smaller counties, i.e., smaller counties have proportionately more enterprises in relation to their population sizes than larger counties. In other words, counties with smaller populations tend to have more prosperous communities than counties with larger populations (

Table 3). The relationships between county population and enterprise numbers are temporally robust.

An examination of the dynamics of population and total enterprise numbers of groups of counties from different states reflected a much more complex situation (

Table 4). During the economic growth period (2000 to 2007), the populations and total enterprises of some states increased in step. In others, they decreased in step, and in some there were mixed dynamics. In contrast, during the recession (2007 to 2010), populations kept on increasing in virtually all of the county groups while enterprise numbers decreased. In general, communities could not carry as many enterprises during the recession (communities became poorer) and their entrepreneurial spaces decreased.

The power law relationships between the population numbers and total entrepreneurship of counties from different states revealed several important issues. Firstly, all of the power law relationships are statistically significant (

p = 0.01) (

Table 5). In general, counties with larger populations have proportionally more total entrepreneurship. This is in step with previous research results [

7,

11,

12,

33,

51]. Secondly, the power law exponents of the counties from a specific state tended to be temporally stable (

Table 6). Conditions of economic growth or decline did not influence the exponents of the total entrepreneurship–total population relationships of individual county groups much, which is a finding reported here for the first time. Thirdly, there are distinct differences between the power law exponents of different county groups. Some are super-linear, some are linear, and some are sub-linear (

Table 6). These differences are probably linked to the prosperity/poverty statuses of the county groups (

Table 7), but this is an issue that deserves further investigation [

31].

Innovation and entrepreneurship are undeniably interrelated [

24,

57]. To assess the potential for innovation and entrepreneurship of European Union countries and regions, Ref. [

24] used extensive databases and a complex multivariate analysis entailing clustering, and Ref. [

57] used a complex matrix system. In contrast, this study quantified different entrepreneurial types with simple power law regression analyses. The power law relationships between total entrepreneurship and new entrepreneurship of the 1785 counties during the 2000 to 2010 period have sub-linear exponents (

Table 8). These relationships were temporally stable during the economic growth and decline periods. For the county groups of the different states, the relationships were also temporally and geographically stable (

Table 9). Economic or geographic stress factors, therefore, did not alter the proportional relationships between total entrepreneurship and new or existing entrepreneurship. Total entrepreneurship is only partially per capita dependent and new and existing entrepreneurship even less so. The per capita links of the different forms of entrepreneurship deserve to be studied further.

The similarity of the power law exponents of the total entrepreneurship–new entrepreneurship relationships in human settlements is remarkable. In South African towns, the exponents range from 0.67 to 0.71 [

35,

45]. In a group of small U.S. counties, the range is from 0.68 to 0.70 [

11]). In Texas counties, it is 0.68 [

12]), and in Alabama counties it is 0.61 [

58]. In this study, the range is 0.60 to 0.73 (

Table 8 and

Table 9). Despite the fact that two different enterprise classification systems were used in South Africa and the U.S., the magnitude of the exponents are very similar, and they appear to be temporally and geographically robust. This suggests that the total entrepreneurship–new entrepreneurship relationship might be universally applicable.

The relationship between total entrepreneurship and existing entrepreneurship is finally considered. The exponents of the power laws describing this relationship for the 1785 counties are super-linear and range from 1.34 to 1.35 (

Table 10), which is almost identical to an exponent of 1.35 that had been recorded for Texas counties [

12]. The relationship is undoubtedly temporally stable during economic growth and decline phases (

Table 10). Power laws also describe the same relationships of county groups of the different U.S. states (

Table 11). Their exponents vary between 1.26 and 1.39, which are very similar to that recorded for the 1785 counties (

Table 10). The relationship between total entrepreneurship and existing entrepreneurship is also geographically stable (

Table 11).

What does the non-linear and strong association of new entrepreneurship and existing entrepreneurship with total entrepreneurship signify? New entrepreneurship is a measure of the capacity of some members of a community to identify and successfully start enterprises of types not yet present. Given that the function of entrepreneurs is to exploit inventions or untried technological possibilities to produce new commodities or produce old ones in new ways [

21,

22], new entrepreneurship is a crucial measure of the innovative capacity of communities. Two aspects of this contribution are especially important: (1) The creative use of the power laws recorded in

Table 9 provide the means to estimate the total enterprise numbers at which new and existing county entrepreneurship equaled one another in the 2000 to 2010 period. Furthermore, there was surprising robustness with 215 total enterprises in 2000, 215 in 2007, and 211 in 2010. Counties with fewer than approximately 215 enterprises are more dependent on new entrepreneurship than counties with more than 215 enterprises. This illustrates that smaller human settlements have a significant challenge, i.e., to raise, find, or attract creative persons (new entrepreneurs) who can identify and successfully start businesses of types that are not present in the settlement (see more on this topic later). (2) New entrepreneurship remains important in all counties, even in very large ones where new entrepreneurship usually constitutes some 10 to 20 percent of total entrepreneurship (

Figure 1). Economic development strategies do not generally focus on this aspect.

Total entrepreneurship and new entrepreneurship are also closely related (

Figure 3) There is also some spread of data points around the line-of-best-fit in

Figure 3. For instance, at a new entrepreneurship level of 100, county total entrepreneurship varied from 167 to 240. New entrepreneurship is, therefore, not solely impacted by total entrepreneurship. One or more other factors also play a role. These factors must still be identified. The relationship between total entrepreneurship and existing entrepreneurship similarly exhibits some variation around the line-of-best-fit (

Figure 4). This is especially true for smaller counties. For instance, at an existing entrepreneurship level of 21 to 23, total entrepreneurship varied from 59 to 81, which is a large spread. Existing entrepreneurship is, therefore, also not solely impacted by total entrepreneurship. One or more additional factors play a role, and these must still be identified.

In this regard, the traded and non-traded economic sectors are of interest. The vast majority of jobs in local economies are in the non-tradable sector [

46,

47]. The enterprises of this sector offer services that are produced and consumed locally. The same market is served by existing entrepreneurship. However, entrepreneurship in the tradable economic sector, which is the main driver of prosperity in U.S. communities [

46,

47], is not identical to new entrepreneurship [

51]. It follows that existing entrepreneurship, which also serves local economies, cannot be identical to entrepreneurship in the non-tradable sector. There is a logarithmic relationship between new and existing entrepreneurship and in U.S. counties [

11]. When local economies expand, existing entrepreneurship increases much more rapidly than new entrepreneurship (

Figure 1). New entrepreneurship is, consequently, proportionally more important in smaller counties and existing entrepreneurship is more important in larger counties. This resonates with the view that the non-tradable sector is responsible for the vast majority of jobs in local economies [

46,

47]. Deeper insight gained here demonstrates the dynamics of existing entrepreneurship and add to the quantitative understanding of how different elements of entrepreneurship act as drivers of events in human settlements. This process should be continued.

The hypothesis tested in this study is that the entrepreneurially-linked proportionalities of human settlements are not temporally or geographically sensitive. The results indicate that this is true for the relationships of new and existing entrepreneurship, but not for those of total entrepreneurship. The latter relationships might be influenced by different levels of prosperity/poverty in human communities, and this has raised the need to think about the concept of entrepreneurial space [

11], which is defined as a combination of the population size of a human settlement and the population’s ability to buy goods.

The temporal robustness of all three proportionalities as well as the geographic robustness of new and existing entrepreneurship (determined by analyzing data of a large number of U.S. counties) inevitably led to a conclusion that there could not have been shortages of entrepreneurs in the large number of counties studied here. If there were shortages, there should have been much more patchiness in the enterprise numbers of the counties and such strong and statistically significant power law regressions would not have been observed.

Empirical data are often important in urbanization studies because it is impossible to perform experiments with human settlements. This was also the case in this contribution. Krugman [

59] remarked about an agglomeration phenomenon of people in cities (Zipf’s law) that a striking empirical regularity was detected with no good theory to account for it. The entrepreneurial regularities observed here also suffer from the same malady. There is still a lack of a theory to account for them. However, a fuller understanding of the concept of entrepreneurial spaces could be helpful.

Finally, there is an enigma to consider. The existence of the extensive entrepreneurial proportionalities observed here indicates temporal and geographic entrepreneurial constancy (stasis) in the economic systems of the counties studied here. How does one reconcile such stasis with Schumpeter’s process of creative destruction [

25,

26]? Schumpeter referred to ongoing change in the form of ‘industrial mutation’ that incessantly destroys the old economic system and creates a new one [

25]. Yet, proportionalities that equate with stasis have been observed. An examination of the enigma of stasis and change in the entrepreneurial domain of human settlements should receive research attention.