The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries

Abstract

:1. Introduction

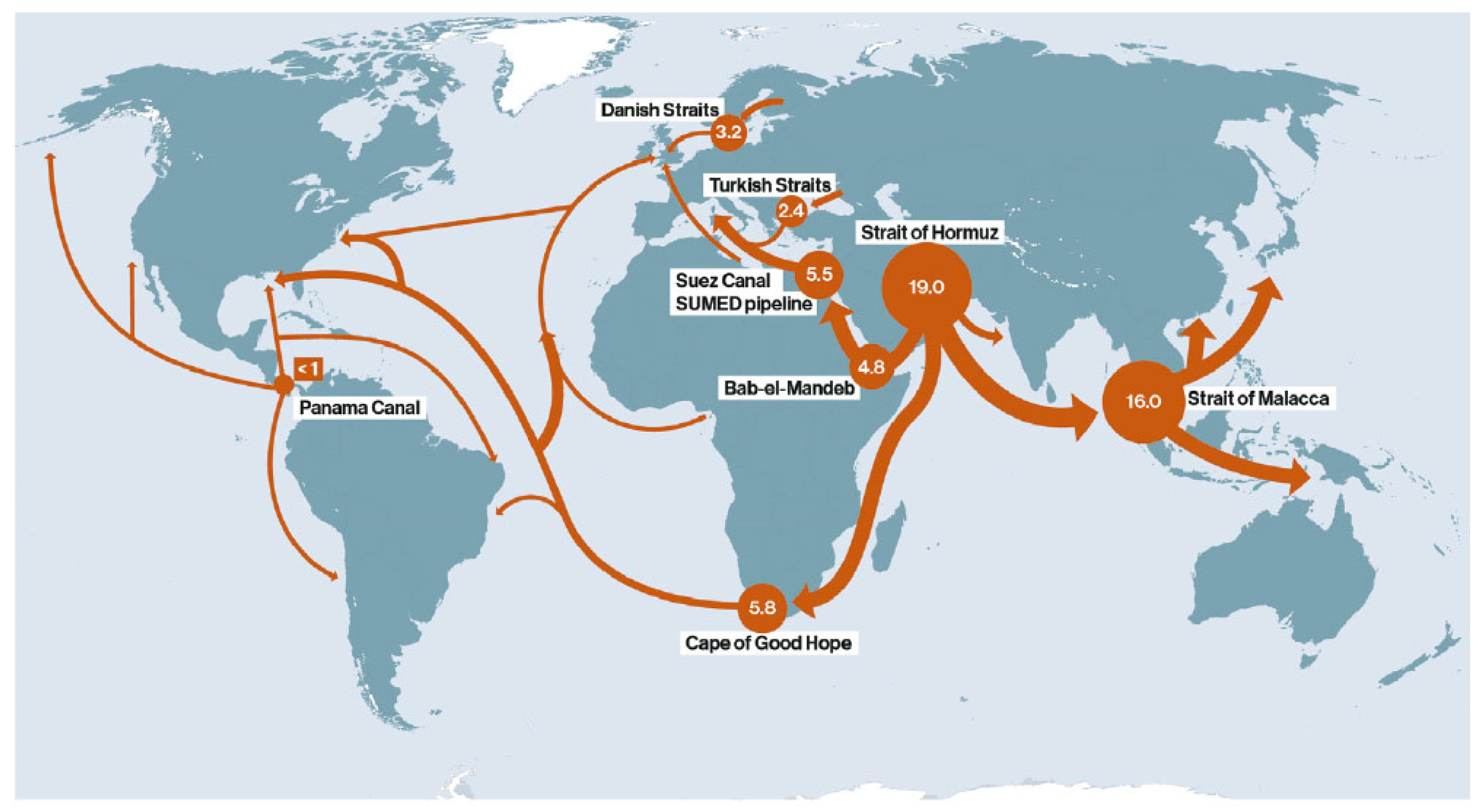

2. Persian Gulf Security

3. Impact of Technological Change and Energy Transition on Energy Geopolitics Worldwide

3.1. Predicting Fossil Fuel Demand in the 21st Century

3.2. Solar Energy Potential Worldwide

3.3. Wind Energy Potential Worldwide

3.4. Countries’ Dependence on Oil Imports—Patents in the Field of Renewable Energy

3.5. Development of Electric Transportation

3.6. Influence of Climate Change Policies

3.7. Quick Return on Investment in Shale Oil Extraction

4. Changes in the Trade of Fossil Fuels and the Raw Materials Required for Renewable Energy Worldwide

4.1. Percentage of Regional Trade in Fossil Fuels to GDP

4.2. Changes in Global Oil Production by Country (2006–2018)

4.3. Changes in Global Oil Demand by Country (2006–2018)

4.4. Diversifying Global Oil Supply (1968–2018)

4.5. Raw Materials Needed for Clean Energy

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Le Billon, P.; El Khatib, F. From free oil to “freedom oil”: Terrorism, war and US geopolitics in the Persian Gulf. Geopolitics 2004, 9, 109–137. [Google Scholar] [CrossRef]

- Delucchi, M.A.; Murphy, J.J. US military expenditures to protect the use of Persian Gulf oil for motor vehicles. Energy Policy 2008, 36, 2253–2264. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I.; Scholten, D. Renewable energy and geopolitics: A review. Renew. Sustain. Energy Rev. 2020, 122, 109547. [Google Scholar] [CrossRef]

- Scholten, D.; Bazilian, M.; Overland, I.; Westphal, K. The geopolitics of renewables: New board, new game. Energy Policy 2020, 138, 111059. [Google Scholar] [CrossRef]

- Scholten, D.; Bosman, R. The geopolitics of renewables; exploring the political implications of renewable energy systems. Technol. Forecast. Soc. Change 2016, 103, 273–283. [Google Scholar] [CrossRef]

- Klare, M.T. Carter Doctrine. In The Encyclopedia of War; Wiley: Hoboken, NJ, USA, 2011. [Google Scholar]

- Fürtig, H. Conflict and cooperation in the Persian Gulf: The interregional order and US policy. Middle East J. 2007, 61, 627–640. [Google Scholar] [CrossRef]

- Hughes, L.; Long, A. Is there an oil weapon?: Security implications of changes in the structure of the international oil market. Int. Secur. 2015, 39, 152–189. [Google Scholar] [CrossRef]

- Solarin, S.A. The effects of shale oil production, capital and labour on economic growth in the United States: A maximum likelihood analysis of the resource curse hypothesis. Resour. Policy 2020, 68, 101799. [Google Scholar] [CrossRef]

- Randall, T.; Warren, H. Peak Oil is Suddenly Uppon Us. 2020. Available online: https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/ (accessed on 2 December 2020).

- Dogan, E.; Altinoz, B.; Madaleno, M.; Taskin, D. The impact of renewable energy consumption to economic growth: A replication and extension of Inglesi-Lotz (2016). Energy Econ. 2020, 90, 104866. [Google Scholar] [CrossRef]

- Lane, B.; Shaffer, B.; Samuelsen, S. A comparison of alternative vehicle fueling infrastructure scenarios. Appl. Energy 2020, 259, 114128. [Google Scholar] [CrossRef]

- Çakır Melek, N.; Plante, M.; Yücel, M.K. Resource booms and the macroeconomy: The case of U.S. shale oil. Rev. Econ. Dyn. 2020, 42, 307–332. [Google Scholar] [CrossRef]

- Garlick, J.; Havlová, R. China’s “Belt and Road” Economic Diplomacy in the Persian Gulf: Strategic Hedging amidst Saudi–Iranian Regional Rivalry. J. Curr. Chin. Aff. 2020, 49, 82–105. [Google Scholar] [CrossRef]

- IRENA. A New World: The Geopolitics of the Energy Transformation; IRENA: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- IRENA. Global Energy Transformation: A Roadmap to 2050; IRENA: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Church, C.; Crawford, A. Green Conflict Minerals: The Fuels of Conflict in the Transition to a Low-Carbon Economy; IISD: Winnipeg, MB, Canada, 2018. [Google Scholar]

- Global Solar Atlas. Global Horizontal Irradiation. 2022. Available online: https://worldbank-atlas.s3.amazonaws.com/download/World/World_GHI_mid-size-map_160x95mm-300dpi_v20191015.png?AWSAccessKeyId=ASIAS2HACIWTCBP2WM5Z&Expires=1659505564&Signature=X1qDk4QcRPw3LrPG3REiL%2BlYQGU%3D&x-amz-security-token=IQoJb3JpZ2luX2VjEC4aCWV1LXd (accessed on 3 August 2022).

- Global Wind Atlas. Mean Wind Speed. 2022. Available online: https://s3-eu-west-1.amazonaws.com/globalwindatlas3/HR_posters/ws_World.pdf (accessed on 3 August 2022).

- IRENA. Smart Electrification with Renewables: Driving the Transformation of Energy Services; IRENA: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- Balke, N.S.; Brown, S.P.A. Oil supply shocks and the U.S. economy: An estimated DSGE model. Energy Policy 2018, 116, 357–372. [Google Scholar] [CrossRef]

- BP. BP Statistical Review of World Energy; BP p.l.c.: London, UK, 2021. [Google Scholar]

- Mukhtarov, S.; Mikayilov, J.I.; Humbatova, S.; Muradov, V. Do high oil prices obstruct the transition to renewable energy consumption? Sustainbility 2020, 12, 4689. [Google Scholar] [CrossRef]

- Månberger, A.; Johansson, B. The geopolitics of metals and metalloids used for the renewable energy transition. Energy Strateg. Rev. 2019, 26, 100394. [Google Scholar] [CrossRef]

| Solar Energy Technologies | Wind Energy Technologies | Electrical Vehicles/Energy Storage | Major Reserve Holders | |

|---|---|---|---|---|

| Cobalt | ✓ | ✓ | Congo, Australia, Cuba, Philippines | |

| Copper | ✓ | ✓ | ✓ | Chile, Australia, Peru, Mexico |

| Lithium | ✓ | Chile, China, Australia, Argentina | ||

| Manganese | ✓ | ✓ | South Africa, Ukraine, Brazil | |

| Nickel | ✓ | ✓ | Australia, Brazil, Russia, Cuba | |

| Rare Earth Elements | ✓ | ✓ | China, Brazil, Vietnam, Russia | |

| Selenium | ✓ | China, Russia, Peru, USA | ||

| Silicon | ✓ | ✓ | Australia, Brazil, Canada, China, Russia, South Africa | |

| Silver | ✓ | Peru, Australia, Poland, Russia | ||

| Tellurium | ✓ | China, Peru, USA, Canada |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salimi, M.; Amidpour, M. The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries. World 2022, 3, 607-618. https://doi.org/10.3390/world3030033

Salimi M, Amidpour M. The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries. World. 2022; 3(3):607-618. https://doi.org/10.3390/world3030033

Chicago/Turabian StyleSalimi, Mohsen, and Majid Amidpour. 2022. "The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries" World 3, no. 3: 607-618. https://doi.org/10.3390/world3030033