Comparative Analysis of the Determinants of Entrepreneurial Activities in the Middle East and Latin America

Abstract

:1. Introduction

2. Literature Review

2.1. Entrepreneurial Ecosystems

2.2. Determinants of Entrepreneurship in the Middle East

2.3. Determinants of Entrepreneurship in Latin America

3. Hypothesis

3.1. Government Programs and Entrepreneurial Activities

3.2. Research and Development Transfer and Entrepreneurial Activities

3.3. Commercial and Professional Infrastructure and Entrepreneurial Activities

3.4. Physical Infrastructure and Entrepreneurial Activity

3.5. Cultural and Social Norms and Entrepreneurial Activity

4. Method

Measurement of the Study Variables

- Government Programs: This condition was measured with six items on a nine-point Likert scale comprising the following statements: (a) In my country, a wide range of government assistance for new and growing firms can be obtained through contact with a single agency; (b) In my country, science parks and business incubators provide effective support for new and growing firms; (c) In my country, there is an adequate number of government programs for new and growing businesses; (d) In my country, the people working for government agencies are competent and effective in supporting new and growing firms; (e) In my country, almost anyone who needs help from a government program for a new or growing business can find what they need; (f) In my country, government programs aimed at supporting new and growing firms are effective.

- Research and Development Transfer: This condition was measured with six items on a nine-point Likert scale comprising the following statements: (a) In my country, new technology, science, and other knowledge are efficiently transferred from universities and public research centers to new and growing firms; (b) In my country, new and growing firms have just as much access to new research and technology as large, established firms; (c) In my country, new and growing firms can afford the latest technology; (d) In my country, there are adequate government subsidies for new and growing firms to acquire new technology; (e) In my country, the science and technology base efficiently supports the creation of world-class new technology-based ventures in at least one area; (f) In my country, there is good support available for engineers and scientists to have their ideas commercialized through new and growing firms.

- Commercial and Professional Infrastructure: This condition was measured with five items in a nine-point Likert scale comprising the following statements: (a) In my country, there are enough subcontractors, suppliers, and consultants to support new and growing firms; (b) In my country, new and growing firms can afford the cost of using subcontractors, suppliers, and consultants; (c) In my country, it is easy for new and growing firms to find good subcontractors, suppliers, and consultants; (d) In my country, it is easy for new and growing firms to find good, professional legal and accounting services; (e) In my country, it is easy for new and growing firms to get good banking services (checking accounts, foreign exchange transactions, letters of credit, and the like).

- Physical Infrastructure: This condition was measured with five items on a nine-point Likert scale comprising the following statements: (a) In my country, the physical infrastructure (roads, utilities, communications, waste disposal) provides good support for new and growing firms; (b) In my country, it is not too expensive for a new or growing firm to obtain good access to communications (phone, Internet, etc.); (c) In my country, a new or growing firm can obtain good access to communications (telephone, internet, etc.) in about a week; (d) In my country, new and growing firms can afford the cost of basic utilities (gas, water, electricity, sewer); (e) In my country, new or growing firms can obtain good access to utilities (gas, water, electricity, sewer) in about a month.

- Entrepreneurship Culture: This condition was measured with five items on a nine-point Likert scale comprising the next statements: (a) In my country, the national culture is highly supportive of individual success achieved through one’s own personal efforts; (b) In my country, the national culture emphasizes self-sufficiency, autonomy, and personal initiative; (c) In my country, the national culture encourages entrepreneurial risk-taking; (d) In my country, the national culture encourages creativity and innovativeness; (e) In my country, the national culture emphasizes the responsibility that the individual (rather than the collective) has in managing his or her own life.

- Total Early Stage Entrepreneurial Activity (TEA): measured by the percentage of the 18–64 population in a country who are either a nascent entrepreneur or owner-manager of a new business.

5. Results

5.1. Descriptive Analysis

5.2. Construct Validity and Reliability Analysis

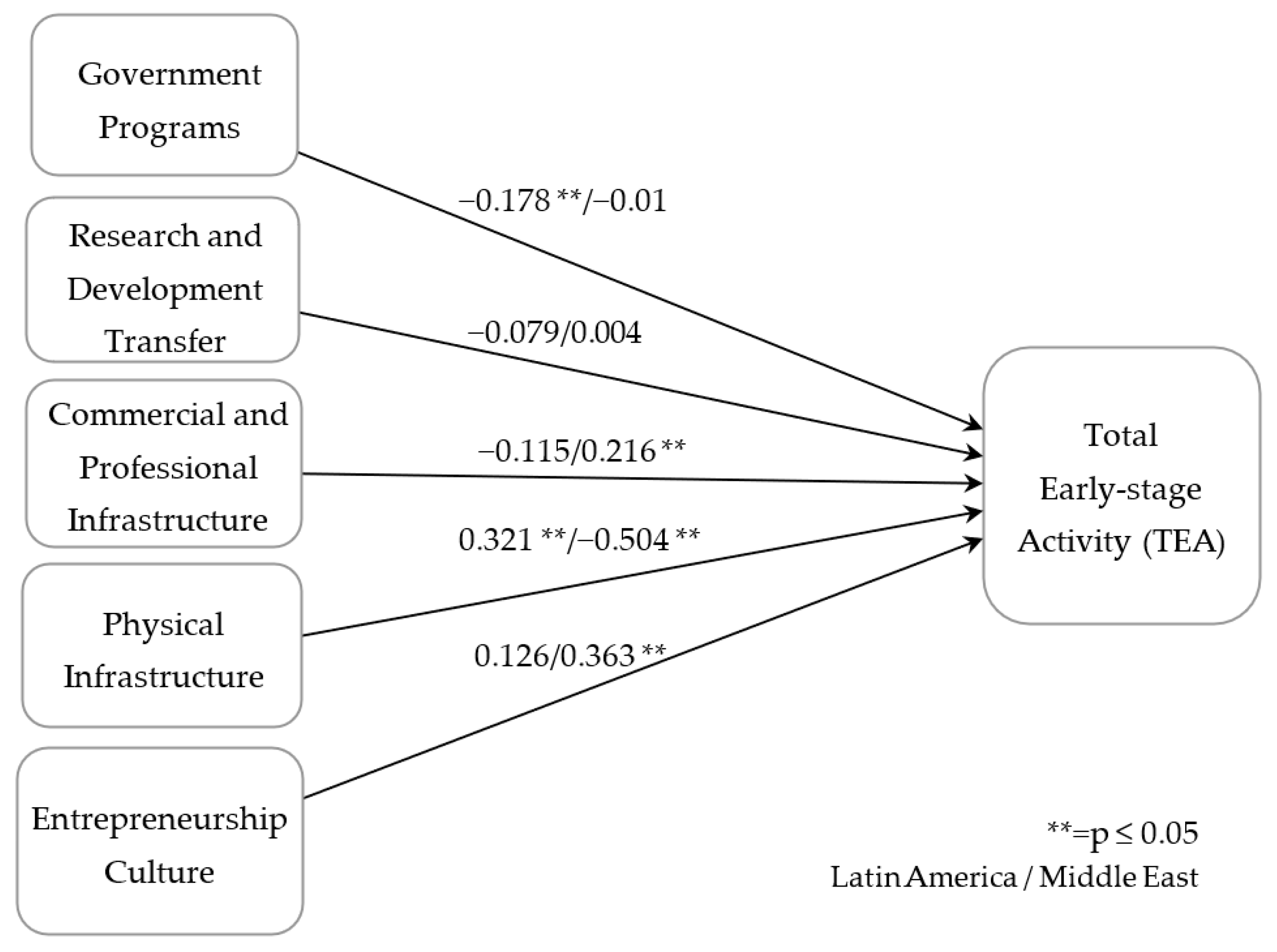

5.3. Path Coefficients

- (H1) Government Programs does not significantly impact Total Early Stage Activity in the Middle East (p-value 0.432, β = −0.010) but significantly and negatively impacts it in Latin America (p-value 0.011, β = −0.178);

- (H2) Research and Development Transfer significantly and negatively impacts Total Early Stage Activity in the Middle East (p-value 0.004, β = −0.163) but does not significantly impact it in Latin America (p-value 0.090, β = −0.079);

- (H3) Commercial and Professional Infrastructure significantly and positively impacts Total Early Stage Activity in the Middle East (p-value 0.000, β = 0.216) but does not significantly impact it in Latin America (p-value 0.176, β = −0.115);

- (H4) Physical Infrastructure significantly and negatively impacts Total Early Stage Activity in the Middle East (p-value 0.000, β = −0.504) but significantly and positively impacts it in Latin America impact (p-value 0.000, β = 0.321);

- (H5) Entrepreneurship Culture significantly and positively impacts Total Early Stage Activity in the Middle East (p-value 0.000, β = 0.363) but does not significantly impact it in Latin America (p-value 0.115, β = 0.126).

| Associations | Latin America | Middle East | ||

|---|---|---|---|---|

| Coefficient | p-Value | Coefficient | p-Value | |

| Government Programs→TEA | −0.178 | 0.011 | −0.01 | 0.432 |

| Research and Development Transfer→TEA | −0.079 | 0.090 | 0.004 | −0.163 |

| Commercial and Professional Infrastructure→TEA | −0.115 | 0.176 | 0.216 | 0.000 |

| Physical Infrastructure→TEA | 0.321 | 0.000 | −0.504 | 0.000 |

| Entrepreneurship Culture→TEA | 0.126 | 0.115 | 0.363 | 0.000 |

6. Discussion

6.1. Middle East Determinants of Entrepreneurial Activities

6.2. Latin America Determinants of Entrepreneurial Activities

7. Conclusions

7.1. Managerial Implications

7.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aljuwaiber, A. Enabling Knowledge Management Initiatives through Organizational Communities of Practice. South Asian J. Bus. Manag. Cases 2021, 10, 260–275. [Google Scholar] [CrossRef]

- Mason, C.; Brown, R. Creating good public policy to support high-growth firms. Small Bus. Econ. 2013, 40, 211–225. [Google Scholar] [CrossRef]

- Mohammadi, N.; Karimi, A. Entrepreneurial ecosystem big picture: A bibliometric analysis and co-citation clustering. J. Res. Mark. Entrep. 2021, 24, 23–38. [Google Scholar] [CrossRef]

- Hechavarría, D.M.; Ingram, A.E. Entrepreneurial ecosystem conditions and gendered national-level entrepreneurial activity: A 14-year panel study of GEM. Small Bus. Econ. 2019, 53, 431–458. [Google Scholar] [CrossRef]

- Crnogaj, K.; Bradač, H.B. Institutional Determinants and Entrepreneurial Action. Manag. J. Contemp. Manag. Issues Spec. Issue 2016, 21, 131–150. [Google Scholar]

- Espinoza-Benavides, J.; Guerrero, M.; Díaz, D. Dissecting the Ecosystems’ Determinants of Entrepreneurial Re-Entry after a Business Failure. Eur. Bus. Rev. 2021, 33, 975–998. [Google Scholar] [CrossRef]

- Biygautane, M. Analysis of the Impact of the Cultural and Institutional Characteristics of the Gulf Cooperation Council States in Entrepreneurship: Opportunities and Challenges. In Entrepreneurial Challenges in the 21st Century: Creating Stakeholder Value Co-Creation; Hans Ruediger, K., Riad, S., Eds.; Palgrave Macmillan: London, UK, 2015; pp. 222–238. [Google Scholar]

- Etchecopar, G.; Angelelli, P.; Galleguillos, G.; Schorr, M. Capital Semilla para el Financiamiento de las Nuevas Empresas. Avances y Lecciones Aprendidas en América Latina; Interamerican Development Bank: Washington, DC, USA, 2006. [Google Scholar]

- Kantis, H. Aportes para el Diseño de Políticas Integrales de Desarrollo Emprendedor en América Latina; Interamerican Development Bank: Washington, DC, USA, 2010. [Google Scholar]

- Kantis, H.; Federico, J. Entrepreneurship Policy in Latin America: Trends and Challenges. In Government, SMEs and Entrepreneurship Development: Policy, Practice and Challenges; Robert, B., Ed.; Routledge: London, UK, 2012; pp. 45–60. [Google Scholar]

- Villegas-Mateos, A. Regional entrepreneurial ecosystems in Chile: Comparative lessons. J. Entrep. Emerg. Econ. 2021, 13, 39–63. [Google Scholar] [CrossRef]

- WEF. Entrepreneurial Ecosystems around the Globe and Company Growth Dynamics; World Economic Forum: Davos, Switzerland, 2013. [Google Scholar]

- López, T.; Alvarez, C. Entrepreneurship research in Latin America: A literature review. Acad. Rev. Latinoam. Adm. 2018, 13, 736–756. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Belitski, M. Entrepreneurial ecosystems in cities: Establishing the framework conditions. J. Technol. Transf. 2017, 42, 31–52. [Google Scholar] [CrossRef]

- Feldman, M.P. The Character of Innovative Places: Entrepreneurial Strategy, Economic Development and Prosperity. Small Bus. Econ. 2014, 43, 9–20. [Google Scholar] [CrossRef]

- Stam, E. Entrepreneurial ecosystems and regional policy: A sympathetic critique. Eur. Plan. Stud. 2015, 23, 1759–1769. [Google Scholar] [CrossRef]

- Aljarwan, A.A.; Yahya, B.A.; Almarzooqi, B.M.; Mezher, T. Examining the Framework of Entrepreneurial Ecosystems: A Case Study on the United Arab Emirates. Int. J. Entrep. 2019, 23, 1–16. [Google Scholar]

- Bruns, K.; Bosma, N.; Sanders, M.; Schramm, M. Searching for the Existence of Entrepreneurial Ecosystems: A Regional Cross-Section Growth Regression Approach. Small Bus. Econ. 2017, 49, 31–54. [Google Scholar] [CrossRef]

- Cavallo, A.; Ghezzi, A.; Colombelli, A.; Casali, G.L. Agglomeration dynamics of innovative start-ups in Italy beyond the industrial district era. Int. Entrep. Manag. J. 2020, 16, 239–262. [Google Scholar] [CrossRef]

- Fritsch, M. New Business Formation and Regional Development: A Survey and Assessment of the Evidence. Found. Trends Entrep. 2013, 9, 249–364. [Google Scholar] [CrossRef]

- Purbasari, R.; Wijaya, C.; Rahayu, N. Interaction of Actors and Factors in Entrepreneurial Ecosystem: Indonesian Creatives Industries. Int. J. Entrep. 2019, 3, 123–146. [Google Scholar]

- Tsvetkova, A. Innovation, entrepreneurship, and metropolitan economic performance: Empirical test of recent theoretical propositions. Econ. Dev. Q. 2015, 29, 299–316. [Google Scholar] [CrossRef]

- Mack, E.A.; Mayer, H. The evolutionary dynamics of entrepreneurial ecosystems. Urban Stud. 2015, 53, 2118–2133. [Google Scholar] [CrossRef]

- Saxenian, A. The New Argonauts: Regional Advantage in a Global Economy; Harvard University Press: Cambridge, MA, USA, 2006. [Google Scholar]

- Spigel, B. The relational organization of entrepreneurial ecosystems. Entrep. Theory Pract. 2017, 41, 49–72. [Google Scholar] [CrossRef]

- Vedula, S.; Kim, P.H. Gimme shelter or fade away: The impact of regional entrepreneurial ecosystem quality on venture survival. Ind. Corp. Chang. 2019, 28, 827–854. [Google Scholar] [CrossRef]

- Sternberg, R.; von Bloh, J.; Coduras, A. A new framework to measure entrepreneurial ecosystems at the regional level. Z. Wirtsch. (Ger. J. Econ. Geogr.) 2019, 63, 103–117. [Google Scholar] [CrossRef]

- Madariaga, A. Variedades de capitalismo y sus contribuciones al estudio del desarrollo en américa latina. Polít. Gob. 2018, 25, 441–468. [Google Scholar]

- Dana, L.-P.; Palalic, R.; Ramadani, V. Entrepreneurship in the Gulf Cooperation Council Region: Evolution and Future Perspectives; World Scientific: New York, NY, USA, 2021. [Google Scholar]

- Thai, Q.H.; Mai, K.N.; Do, T.T. An Evolution of Entrepreneurial Ecosystem Studies: A Systematic Literature Review and Future Research Agenda. SAGE Open 2023, 13, 21582440231153060. [Google Scholar] [CrossRef]

- Bloom, P.N.; Dees, G. Cultivate your Ecosystem. Stanf. Soc. Innov. Rev. 2008, 6, 47–53. [Google Scholar]

- Wessner, C.W. Entrepreneurship and the innovation ecosystem policy lessons from the United States. In Local Heroes in the Global Village; Audretsch, D., Grimm, H., Wessner, C.W., Eds.; Springer: Berlin/Heidelberg, Germany, 2004; pp. 67–89. [Google Scholar]

- Kenney, M.; Von Burg, U. Technology, entrepreneurship and path dependence: Industrial clustering in Silicon Valley and Route 128. Ind. Corp. Chang. 1999, 8, 67–103. [Google Scholar] [CrossRef]

- Acs, Z.J.; Autio, E.; Szerb, L. National Systems of Entrepreneurship: Measurement Issues and Policy Implications. Res. Policy 2014, 43, 476–494. [Google Scholar] [CrossRef]

- Thomas, L.D.W.; Autio, E. Innovation Ecosystems in Management: An Organizing Typology; Oxford Research Encyclopedia, Oxford University Press: Oxford, UK, 2020. [Google Scholar]

- Theodoraki, C.; Dana, L.; Caputo, A. Building sustainable entrepreneurial ecosystems: A holistic approach. J. Bus. Res. 2021, 140, 346–360. [Google Scholar] [CrossRef]

- Volkmann, C.; Fichter, K.; Klofsten, M.; Audretsch, D.B. Sustainable entrepreneurial ecosystems: An emerging field of research. Small Bus. Econ. 2021, 56, 1047–1055. [Google Scholar] [CrossRef]

- Cohen, B. Sustainable Valley Entrepreneurial Ecosystems. Bus. Strategy Environ. 2006, 15, 1–14. [Google Scholar] [CrossRef]

- Cukier, D.; Kon, F.; Lyons, T.S. Software Startup Ecosystems Evolution: The New York City Case Study. In Proceedings of the International Conference on Engineering, Technology and Innovation/IEEE International Technology Management Conference, Trondheim, Norway, 13–15 June 2016. [Google Scholar]

- Isenberg, D. What an entrepreneurship ecosystem actually Is. Harv. Bus. Rev. 2014, 5, 1–7. [Google Scholar]

- Mason, C.; Brown, R. Entrepreneurial Ecosystems and Growth-Oriented Entrepreneurship; OCDE: Costa Mesa, CA, USA, 2014. [Google Scholar]

- Ben Hassen, T. The Entrepreneurship Ecosystem in the ICT Sector in Qatar: Local Advantages and Constraints. J. Small Bus. Enterp. Dev. 2020, 27, 177–195. [Google Scholar] [CrossRef]

- Villegas-Mateos, A. Qatar’s Entrepreneurial Ecosystem—2021 Edition: Empowering the Transformation; HEC: Paris, France, 2021; pp. 1–100. [Google Scholar]

- Ben Hassen, T. Developing a Vibrant Entrepreneurship Ecosystem in Qatar: A Sustainable Pathway toward the Knowledge-Based Economy? In Sustainable Qatar: Social, Political and Environmental Perspectives; Cochrane, L., Al-Hababi, R., Eds.; Springer Nature: Singapore, 2022; Volume 1, pp. 349–364. [Google Scholar]

- Saberi, M.; Hamdan, A. The moderating role of governmental support in the relationship between entrepreneurship and economic growth: A study on the GCC countries. J. Entrep. Emerg. Econ. 2019, 11, 200–216. [Google Scholar] [CrossRef]

- Shaukat, M.; Madbouly, A. Assessing the entrepreneurial ecosystem of Oman and discovering the innate suitability of Islamic finance. In Globalization and Development: Entrepreneurship, Innovation, Business and Policy Insights from Asia and Africa; Nezameddin, F., Ed.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 205–239. [Google Scholar]

- Arslan, A.; Al Kharusi, S.; Hussain, S.M.; Alo, O. Sustainable entrepreneurship development in Oman: A multi-stakeholder qualitative study. Int. J. Organ. Anal. 2023, 31, 35–59. [Google Scholar] [CrossRef]

- Masoumi, E.; Salehi, M.; Taghvaeeyazdi, M. Technology Startups and University-Based Entrepreneurial Ecosystems in the Universities of Golestan Province. Int. J. Inf. Sci. Manag. (IJISM) 2022, 20, 145–165. [Google Scholar]

- Ali, I.; Ali, M.; Badghish, S. Symmetric and asymmetric modeling of entrepreneurial ecosystem in developing entrepreneurial intentions among female university students in Saudi Arabia. Int. J. Gender Entrep. 2019, 11, 435–458. [Google Scholar] [CrossRef]

- Elnadi, M.; Gheith, M.H. Entrepreneurial ecosystem, entrepreneurial self-efficacy, and entrepreneurial intention in higher education: Evidence from Saudi Arabia. Int. J. Manag. Educ. 2021, 19, 100458. [Google Scholar] [CrossRef]

- Ben Hassen, T. The GCC economies in the wake of COVID-19: Toward post-oil sustainable knowledge-based economies? Sustainability 2022, 14, 11251. [Google Scholar] [CrossRef]

- Villegas-Mateos, A. Toward a sustainable entrepreneurial ecosystem in Qatar. Sustainability 2022, 15, 127. [Google Scholar] [CrossRef]

- Cantu-Ortiz, F.J.; Galeano, N.; Mora-Castro, P.; Fangmeyer, J., Jr. Spreading academic entrepreneurship: Made in Mexico. Bus. Horiz. 2017, 60, 541–550. [Google Scholar] [CrossRef]

- Guerrero, M.; Liñán, F.; Cáceres-Carrasco, F.R. The influence of ecosystems on the entrepreneurship process: A comparison across developed and developing economies. Small Bus. Econ. 2021, 57, 1733–1759. [Google Scholar] [CrossRef]

- Liberona, D.; Kumaresan, A.; Valenzuela, L.; Rojas, C.; Ferro, R. Entrepreneurship knowledge insights in emerging markets using a SECI model approach. In Proceedings of the Knowledge Management in Organizations: 14th International Conference, Zamora, Spain, 15–18 July 2019. [Google Scholar]

- Mellado Ibarra, C.I.; Sánchez Tovar, Y.; Hernández Hernández, N.G. Identificación de los ecosistemas de emprendimiento en México. Rev. Cienc. Soc. 2023, 29, 108–119. [Google Scholar]

- Schaeffer, P.R.; Guerrero, M.; Fischer, B.B. Mutualism in ecosystems of innovation and entrepreneurship: A bidirectional perspective on universities’ linkages. J. Bus. Res. 2021, 13, 184–197. [Google Scholar] [CrossRef]

- Dubou, G.; Bichueti, R.S.; Costa CR, R.D.; Gomes, C.M.; Kneipp, J.M.; Kruglianskas, I. Creating Favorable Local Context for Entrepreneurship: The Importance of Sustainable Urban Development in Florianópolis, SC, Brazil. Sustainability 2022, 14, 10132. [Google Scholar] [CrossRef]

- Sánchez, D.; Cerón, G. Entrepreneurship in popayán, cauca, colombia: Institutional support strategies. Rev. Venez. Gerenc. 2020, 25, 1600–1616. [Google Scholar]

- Hernández, C.; González, D. Study of the start-up ecosystem in Lima, Peru: Analysis of interorganizational networks. J. Technol. Manag. Innov. 2017, 12, 71–83. [Google Scholar] [CrossRef]

- Maglakelidze, A.; Erkomaishvili, G. Challenges of small and medium enterprises during the COVID-19 pandemic: Case of georgia. Probl. Perspect. Manag. 2021, 19, 20–28. [Google Scholar] [CrossRef]

- Sampaio, C.; Correia, A.; Braga, V.; Braga, A.M. The impact of entrepreneurship framework conditions in total early-stage entrepreneurship activity: An international approach. Int. J. Knowl.-Based Dev. 2018, 9, 244–260. [Google Scholar] [CrossRef]

- Pauceanu, A.M. Innovation and entrepreneurship in Sultanate of Oman–an empirical study. Entrep. Sustain. Issues 2016, 4, 83–102. [Google Scholar]

- Pilková, A.; Mikuš, J.; Rehák, J.; Pšenák, P. Differences and similarities between key drivers of youth and senior starting entrepreneurs in central and eastern european countries. Post-Communist Econ. 2022, 34, 1054–1082. [Google Scholar] [CrossRef]

- Walter, C.E.; Au-Yong-Oliveira, M.; Veloso, C.M. Innovation in brazilian micro and small enterprises: A systematic literature review. Qual. Access Success 2021, 22, 20–24. [Google Scholar]

- Kamran, S.M.; Nassani, A.A.; Abro MM, Q.; Khaskhely, M.K.; Haffar, M. Government as a facilitator versus inhibitor of social entrepreneurship in times of public health emergencies. Int. J. Environ. Res. Public Health 2023, 20, 5071. [Google Scholar] [CrossRef] [PubMed]

- Zacharias, T.; Yusriadi, Y.; Firman, H.; Rianti, M. Poverty alleviation through entrepreneurship. J. Leg. Ethical Regul. Issues 2021, 24, 1–5. [Google Scholar]

- Červený, J.; Pilková, A.; Rehák, J. Senior entrepreneurship in european context: Key determinants of entrepreneurial activity. Ekon. Cas. 2016, 64, 99–117. [Google Scholar]

- Guerrero, M.; Urbano, D. Institutional conditions and social innovations in emerging economies: Insights from mexican enterprises’ initiatives for protecting/preventing the effect of violent events. J. Technol. Transf. 2020, 45, 929–957. [Google Scholar] [CrossRef]

- Urrutia, D.M.; Marzábal, Ó.R. Explanatory factors of business creation in ten european countries: A proposal from the institutional perspective. Rev. Econ. Mund. 2015, 40, 91–122. [Google Scholar]

- Burhanuddin, H.; Nurmalina, R.; Pambudy, R. The determining factors of entrepreneurial activity in broiler farms. Media Peternak. 2013, 36, 230–236. [Google Scholar] [CrossRef]

- Etzkowitz, H. Entrepreneurial university icon: Stanford and Silicon Valley as innovation and natural ecosystem. Ind. High. Educ. 2022, 36, 361–380. [Google Scholar] [CrossRef]

- Fischer, B.; Salles-Filho, S.; Zeitoum, C.; Colugnati, F. Performance drivers in knowledge-intensive entrepreneurial firms: A multidimensional perspective. J. Knowl. Manag. 2022, 26, 1342–1367. [Google Scholar] [CrossRef]

- Hall, E.G.; Krenning, T.M.; Reardon, R.J.; Toker, E.; Kinch, M.S. A reconsideration of university gap funds for promoting biomedical entrepreneurship. J. Clin. Transl. Sci. 2022, 6, e28. [Google Scholar] [CrossRef]

- O’Kane, C.; Cunningham, J.A.; Menter, M.; Walton, S. The brokering role of technology transfer offices within entrepreneurial ecosystems: An investigation of macro–meso–micro factors. J. Technol. Transf. 2021, 46, 1814–1844. [Google Scholar] [CrossRef]

- Ghani, E.; Kerr, W.R.; O’Connell, S. Spatial determinants of entrepreneurship in India. Reg. Stud. 2014, 48, 1071–1089. [Google Scholar] [CrossRef]

- Patton, D. Realising potential: The impact of business incubation on the absorptive capacity of new technology-based firms. Int. Small Bus. J. 2014, 32, 897–917. [Google Scholar] [CrossRef]

- Suzuki, K.; Kim, S.; Bae, Z. Entrepreneurship in japan and silicon valley: A comparative study. Technovation 2002, 22, 595–606. [Google Scholar] [CrossRef]

- Stewart, S.A. Expert and entrepreneur: The unique research domain of professional service entrepreneurs. Int. Entrep. Manag. J. 2018, 14, 615–626. [Google Scholar] [CrossRef]

- Msimango-Galawe, J.; Majaja, B. Mapping the needs and challenges of SMEs: A focus on the city of Johannesburg entrepreneurship ecosystem. Cogent Bus. Manag. 2022, 9, 2094589. [Google Scholar] [CrossRef]

- Ajide, F.M. Infrastructure and Entrepreneurship: Evidence from Africa. J. Dev. Entrep. 2020, 25, 2050015. [Google Scholar] [CrossRef]

- Leendertse, J.; Schrijvers, M.; Stam, E. Measure twice, cut once: Entrepreneurial ecosystem metrics. Res. Policy 2022, 51, 49–72. [Google Scholar] [CrossRef]

- Chadha, S.; Dutta, N. Linking Entrepreneurship, Innovation and Economic Growth: Evidence from GEM Countries. Int. J. Technoentrepreneurship 2020, 4, 22–31. [Google Scholar] [CrossRef]

- Khyareh, M.M.; Khairandish, M.; Torabi, H. Macroeconomic effects of entrepreneurship: Evidences from factor, efficiency and innovation driven countries. Int. J. Entrep. 2019, 23, 1–21. [Google Scholar]

- Neck, H.; Meyer, G.; Cohen, B.; Corbett, A. An entrepreneurial system view of new venture creation. J. Small Bus. Manag. 2004, 42, 190–208. [Google Scholar] [CrossRef]

- Gatiyatullin, M.K.; Nigmatov, Z.G. Formation of entrepreneurship culture with technical university students. Middle-East J. Sci. Res. 2014, 19, 544–560. [Google Scholar]

- Huggins, R.; Thompson, P. Entrepreneurship, culture and resilience: The determinants of local development in uncertain times. In Creating Resilient Economies: Entrepreneurship, Growth and Development in Uncertain Times; Williams, N., Vorley, T., Eds.; Edward Elgar Publishing: Northampton, MA, USA, 2017; pp. 142–159. [Google Scholar]

- Audretsch, D.B.; Obschonka, M.; Gosling, S.D.; Potter, J. A New Perspective on Entrepreneurial Regions: Linking Cultural Identity with Latent and Manifest Entrepreneurship. Small Bus. Econ. 2017, 48, 681–697. [Google Scholar] [CrossRef]

- Breazeale, N.; Fortunato MW, P.; Allen, J.E.; Hustedde, R.J.; Pushkarskaya, H. Constructing a Multi-Dimensional Measure of Local Entrepreneurial Culture. Community Dev. 2015, 46, 516–540. [Google Scholar] [CrossRef]

- Kayed, R.N.; Hassan, M.K. Islamic entrepreneurship: A case study of saudi arabia. J. Dev. Entrep. 2010, 15, 379–413. [Google Scholar] [CrossRef]

- Global Entrepreneurship Monitor (GEM). GEM Global Entrepreneurship Monitor. 2022. Available online: https://www.gemconsortium.org/wiki/1599 (accessed on 18 November 2022).

- Hair, J.F., Jr.; Hult GT, M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory; McGraw-Hill, Inc.: New York, NY, USA, 1994. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Isenberg, D.J. How to start an entrepreneurial revolution. Harv. Bus. Rev. 2010, 88, 40–50. [Google Scholar]

- Stam, E.; Van de Ven, A. Entrepreneurial ecosystem elements. Small Bus. Econ. 2021, 56, 809–832. [Google Scholar] [CrossRef]

- Cowling, M.; Lee, N. How entrepreneurship, culture and universities influence the geographical distribution of UK talent and city growth. J. Manag. Dev. 2017, 36, 178–195. [Google Scholar] [CrossRef]

- Khursheed, A.; Fatima, M.; Mustafa, F.; Lodhi, R.N.; Akhtar, A. An empirical analysis of the factors influencing social entrepreneurship: A gendered approach. Cuad. Gestión 2021, 21, 49–62. [Google Scholar] [CrossRef]

- Yan, Y.; Guan, J. Entrepreneurial ecosystem, entrepreneurial rate and innovation: The moderating role of internet attention. Int. Entrep. Manag. J. 2019, 15, 625–650. [Google Scholar] [CrossRef]

- Amorós, J.E.; Felzensztein, C.; Gimmon, E. Entrepreneurial opportunities in peripheral versus core regions in chile. Small Bus. Econ. 2013, 40, 119–139. [Google Scholar] [CrossRef]

- Amorós, J.E.; Mandakovic, V. The Chilean entrepreneurial ecosystem: Understanding the gender gap in entrepreneurial activity. Entrep. Ecosyst. Growth Women’s Entrep. Comp. Anal. 2017, 31, 197–218. [Google Scholar]

- Pauceanu, A.M. Foreign Investment Promotion Analysis in Sultanate of Oman: The Case of Dhofar Governorate. Int. J. Econ. Financ. Issues 2016, 6, 392–401. [Google Scholar]

- Kupiainen, P.; Komulainen, K.; Eriksson, P.; Räty, H. Is older entrepreneurship being silenced? A policy analysis of Finnish government programmes. Entrep. Reg. Dev. 2023, 35, 746–761. [Google Scholar] [CrossRef]

- Morris, M.H.; Soleimanof, S.; Tucker, R. Drivers of fragility in the ventures of poverty entrepreneurs. Small Bus. Econ. 2023, 61, 305–323. [Google Scholar] [CrossRef]

- Sundarakumar, S.; Selvi, J.T.; Ilangovan, K.; Srinivasan, V.; Kannan, A.S.; Arunachalam, V. Influence of Government Initiatives and Information on Indian Women Entrepreneurial Ventures. In Data-Driven Decision Making for Long-Term Business Success; IGI Global: Hershey, PA, USA, 2024; pp. 209–220. [Google Scholar]

- Hasell, J.; Roser, M.; Ortiz-Ospina, E.; Arriagada, P. Poverty. 2021. Available online: https://ourworldindata.org/poverty (accessed on 19 March 2024).

- Lingappa, A.K.; Rodrigues, L.L.R.; Shetty, D.K. Performance differentials of necessity and opportunity entrepreneurs: Through the lens of motivation to learn and female entrepreneurial competencies. J. Entrep. Emerg. Econ. 2024, 16, 159–187. [Google Scholar] [CrossRef]

- Sipola, S. Another Silicon Valley? Tracking the role of entrepreneurship culture in start-up and venture capital co-evolution in Finland’s entrepreneurial ecosystem 1980–1997. J. Entrep. Emerg. Econ. 2021, 14, 469–494. [Google Scholar] [CrossRef]

- Montiel Mendez, O.J.; Pelly, R.D.M. Failed entrepreneurship in a heterotopia: The story of Villa Ahumada. J. Entrep. Emerg. Econ. 2022, 14, 449–468. [Google Scholar] [CrossRef]

| Variables | Latin America | Middle East |

|---|---|---|

| TEA | 17.7% | 11.5% |

| Government Programs | 4.4 | 4.2 |

| Research and Development Transfer | 3.6 | 3.8 |

| Commercial and Professional Infrastructure | 4.3 | 4.9 |

| Physical Infrastructure | 5.9 | 6.2 |

| Entrepreneurship Culture | 4.8 | 5.3 |

| Government Programs | 4.4 | 4.2 |

| Variable | No. of Items | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|---|

| Government Programs | 6 | 0.869 | 0.877 | 0.548 |

| Research and Development Transfer | 6 | 0.810 | 0.858 | 0.503 |

| Commercial and Professional Infrastructure | 6 | 0.840 | 0.839 | 0.526 |

| Physical Infrastructure | 5 | 0.798 | 0.840 | 0.534 |

| Entrepreneurship Culture. | 5 | 0.899 | 0.912 | 0.677 |

| Total Early stage Entrepreneurial Activity | 1 | 1.000 | 1.000 | 1.000 |

| Variable | No. of Items | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|---|

| Government Programs | 3 | 0.825 | 0.894 | 0.738 |

| Research and Development Transfer | 2 | 0.718 | 0.871 | 0.772 |

| Commercial and Professional Infrastructure | 2 | 0.703 | 0.863 | 0.761 |

| Physical Infrastructure | 5 | 0.817 | 0.868 | 0.570 |

| Entrepreneurship Culture. | 5 | 0.898 | 0.924 | 0.710 |

| Total Early stage Entrepreneurial Activity | 1 | 1.000 | 1.000 | 1.000 |

| Variable | Entrepreneurship Culture | Physical Infrastructure | Commercial and Professional Infrastructure | Government Programs | TEA | Research and Development Transfer |

|---|---|---|---|---|---|---|

| Entrepreneurship Culture | 0.823 | |||||

| Physical Infrastructure | 0.203 | 0.731 | ||||

| Commercial and Professional Infrastructure | 0.120 | 0.343 | 0.725 | |||

| Government Programs | 0.263 | 0.145 | 0.270 | 0.740 | ||

| TEA | 0.111 | 0.266 | −0.071 | −0.172 | 1.000 | |

| Research and Development Transfer | 0.247 | 0.193 | 0.426 | 0.543 | −0.132 | 0.709 |

| Variable | Entrepreneurship Culture | Physical Infrastructure | Commercial and Professional Infrastructure | Government Programs | TEA | Research and Development Transfer |

|---|---|---|---|---|---|---|

| Entrepreneurship Culture | 0.843 | |||||

| Physical Infrastructure | 0.123 | 0.755 | ||||

| Commercial and Professional Infrastructure | 0.292 | 0.272 | 0.872 | |||

| Government Programs | 0.325 | 0.322 | 0.341 | 0.859 | ||

| TEA | 0.304 | −0.455 | 0.116 | −0.080 | 1.000 | |

| Research and Development Transfer | 0.350 | 0.320 | 0.403 | 0.614 | −0.116 | 0.878 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Melchor-Duran, I.L.; Villegas-Mateos, A. Comparative Analysis of the Determinants of Entrepreneurial Activities in the Middle East and Latin America. World 2024, 5, 173-191. https://doi.org/10.3390/world5020010

Melchor-Duran IL, Villegas-Mateos A. Comparative Analysis of the Determinants of Entrepreneurial Activities in the Middle East and Latin America. World. 2024; 5(2):173-191. https://doi.org/10.3390/world5020010

Chicago/Turabian StyleMelchor-Duran, Irery L., and Allan Villegas-Mateos. 2024. "Comparative Analysis of the Determinants of Entrepreneurial Activities in the Middle East and Latin America" World 5, no. 2: 173-191. https://doi.org/10.3390/world5020010

APA StyleMelchor-Duran, I. L., & Villegas-Mateos, A. (2024). Comparative Analysis of the Determinants of Entrepreneurial Activities in the Middle East and Latin America. World, 5(2), 173-191. https://doi.org/10.3390/world5020010