A Study of the Efficiency of Mediterranean Container Ports: A Data Envelopment Analysis Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Ports, Economic Development and Privatization

2.2. Port Efficiency with DEA Models

3. Materials and Methods

3.1. CCR—Constant Return to Scale Model

3.2. DEA-BCC—Variable Return to Scale Model

3.3. Scale Efficiency

4. Selection of Variables, DMUs Used and Data Collection

4.1. Input and Output Variables

- y1:

- Container throughput in TEUs. The total container traffic measured in 20-foot equivalent units.

- y2:

- Container volume in tons. Total weight of goods handled by the port within a period of one year.

- y3:

- Revenue in millions of euros. It plays an important role, since it provides information related to the economic efficiency of the port.

- x1:

- Length of berth (in m).

- x2:

- Terminal area (in hectares, ha). The area of the quay and land yard.

- x3:

- Number of quay cranes (quay cranes, ship to shore cranes, mobile cranes).

- x4:

- Number of gantry cranes in the stacking area (RTGs, RMGs).

4.2. DMUs Used and Data Collection

4.3. Data Collection

- To handle sufficiently large volumes of containers. A measure of the container traffic of each port was the total incoming/outgoing containers in TEUs (20-foot equivalent units)

- To handle a minimum of 1 million TEUs in the year 2021 (year of the most recent available data).

- To be located in the wider Mediterranean area.

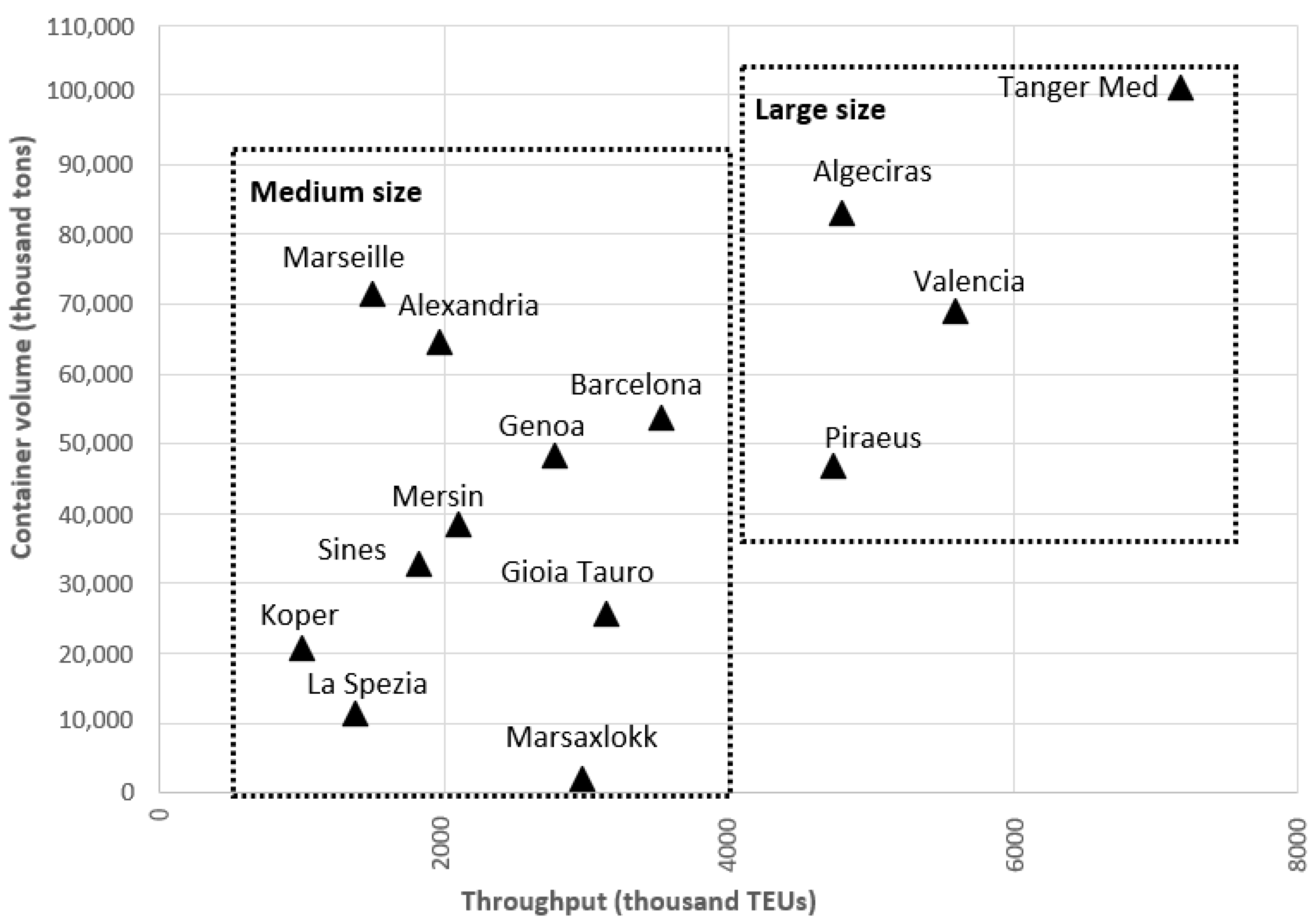

- Large ports: more than 4 million TEUs.

- Medium-sized ports: between 1 and 4 million TEUs.

5. Results

6. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Rodrigue, J.-P.; Notteboom, T. Chapter 7.2—Ports and economic development, in Theo Notteboom, Athanasios Pallis and Jean-Paul Rodrigue. In Port Economics, Management and Policy; Routledge: New York, NY, USA, 2022. [Google Scholar] [CrossRef]

- World Bank. The Container Port Performance Index, 2021: A Comparable Assessment of Container Port Performance; License: Creative Commons Attribution CC BY 3.0 IGO; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Cullinane, K.; Ping, J.; Wang, T.F. The relationship between privatization and DEA estimates of efficiency in the container port industry. J. Econ. Bus. 2005, 57, 433–462. [Google Scholar]

- UNCTAD. Port Management Series, Volume 4, Linking Performance Indicators to Strategic Objectives. 2016. Available online: https://unctad.org/system/files/official-document/dtlkdb2016d1_en.pdf (accessed on 7 May 2023).

- Moya, J.M.; Valero, M.F. Port choice in container market: A literature review. Transp. Rev. 2017, 37, 300–321. [Google Scholar]

- Arvis, J.-F.; Vesin, V.; Carruther, R.; Ducruet, C.; de Langen, P. Maritime Networks, Port Efficiency and Hinterland Connectivity in the Mediterranean; World Bank Publications, International Development in Focus; World Bank: Washington, DC, USA, 2019. [Google Scholar] [CrossRef]

- Notteboom, T.; Satta, G.; Persico, L.; Vottero, B.; Rossi, A. Operational productivity and financial performance of pure transhipment hubs versus gateway terminals: An empirical investigation on Italian container ports. Res. Transp. Bus. Manag. 2023, 47, 100967. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision-making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar]

- Bottasso, A.; Conti, M.; Ferrari, C.; Tei, A. Ports and regional development: A spatial analysis on a panel of European regions. Transp. Res. A Policy Pract. 2014, 65, 44–55. [Google Scholar]

- Shan, J.; Yu, M.; Lee, C. An empirical investigation of the seaport’s economic impact: Evidence from major ports in China. Transp. Res. E-Log 2014, 69, 41–53. [Google Scholar]

- Chang, Y.; Shin, S.; Lee, W. Economic impact of port sectors on south African economy: An input-output analysis. Transp. Policy 2014, 35, 333–340. [Google Scholar]

- Munim, Z.; Schramm, H. The impacts of port infrastructure and logistics performance on economic growth: The mediating role of seaborne trade. J. Shipp. Trade 2018, 3, 1. [Google Scholar]

- Miambo, C. The impact of port performance in trade: The case of selected African states. Economies 2021, 9, 135. [Google Scholar] [CrossRef]

- Cui, H.; Notteboom, T. Modelling emission control taxes in port areas and port privatization levels in port competition and co-operation sub-games. Transp. Res. Part D Transp. Environ. 2017, 56, 110–128. [Google Scholar]

- Pagano, A.M.; Grace, W.Y.W.; Sánchez, O.V.; Ungo, R. Impact of privatization on port efficiency and effectiveness: Results from Panama and US ports. Marit. Policy Manag. 2013, 40, 100–115. [Google Scholar]

- Tongzon, J.; Heng, W. Port privatization, efficiency and competitiveness: Some empirical evidence from container ports (terminals). Transp. Res. Part A Policy Pract. 2005, 39, 405–424. [Google Scholar]

- Wang, G.W.; Knox, K.J.; Lee, P.T.W. A study of relative efficiency between privatised and publicly operated US ports. Marit. Policy Manag. 2013, 40, 351–366. [Google Scholar]

- Qianqian, L.; Davarinou, P. Sino-Greek economic cooperation: COSCO’s investment in the port of Piraeus. In The Belt and Road Initiative and the SDGs: Towards Equitable, Sustainable Development; Sen, G., Leach, M., Gu, J., Eds.; IDS Bulletin 50.4; IDS: Brighton, UK, 2019. [Google Scholar]

- Israel Ministry of Finance. Available online: https://www.gov.il/en/departments/news/press_10012023 (accessed on 7 June 2023).

- Bnamericas, Will Lula Agree to the Priatization of Santos Port Authority? Available online: https://www.bnamericas.com/en/news/will-lula-agree-to-the-privatization-of-santos-port-authority (accessed on 7 June 2023).

- Baird, A.J. Privatization trends at the world’s top-100 container ports. Marit. Policy Manag. 2002, 29, 271–284. [Google Scholar]

- Choi, K.; Lim, S. Tariff protection and port privatization: An import-competing approach. Marit. Econ. Logist. 2018, 20, 228–252. [Google Scholar]

- Roll, Y.; Hayuth, Y. Port Performance Comparison Applying Data Envelopment Analysis. Marit. Policy Manag. 1993, 20, 153–161. [Google Scholar]

- Poitras, G.; Tongzon, J.; Li, H. Measuring Port Efficiency: An Application of Data Envelopment Analysis; Working Paper Singapore; National University of Singapore: Singapore, 1996. [Google Scholar]

- Martinez-Budria, E.; Diaz-Armas, R.; Navarro-Ibanez, M.; Ravelo-Mesa, T. A Study of the Efficiency of Spanish Port Authorities Using Data Envelopment Analysis. Int. J. Transp. Econ. 1999, 26, 237–253. [Google Scholar]

- Tongzon, J. Efficiency measurement of selected Australian and other international ports using data envelopment analysis. Transp. Res. Part A 2001, 35, 107–122. [Google Scholar]

- Turner, H.; Windle, R.; Dresner, M. North American container port productivity: 1984–1997. Transp. Res. Part E 2004, 40, 339–356. [Google Scholar]

- Barros, C.P.; Athanassiou, M. Efficiency in European Seaports with DEA: Evidence from Greece and Portuga. Marit. Econ. Logist. 2004, 6, 122–140. [Google Scholar]

- Song, J.Y.; Sin, C.H. An Empirical Study on the Efficiency of Major Container Ports with DEA Model. J. Korean Navig. Port Res. 2005, 29, 195–201. [Google Scholar]

- Lin, L.C.; Tseng, C.C. Operational performance evaluation of major container ports in the Asia-Pacific region. J. Marit. Policy Manag. 2007, 34, 535–551. [Google Scholar]

- Cullinane, K.; Wang, T. The efficiency analysis of container port production using DEA panel data approaches. OR Spectr. 2010, 32, 717–738. [Google Scholar] [CrossRef]

- Wu, J.; Yan, H.; Liu, J. DEA models for identifying sensitive performance measures in container port evaluation. Marit. Econ. Logist. 2010, 12, 215–236. [Google Scholar] [CrossRef]

- Bichou, K. A two-stage supply chain DEA model for measuring container-terminal efficiency. Int. J. Shipp. Transp. Logist. 2011, 3, 6–26. [Google Scholar]

- Nikolaou, P.; Dimitriou, L. Lessons to be Learned from Top-50 Global Container Port Terminals Efficiencies: A Multi-Period DEA-Tobit Approach. Marit. Transp. Res. 2021, 2, 100032. [Google Scholar]

- Cullinane, K.; Wang, T. Data Envelopment Analysis (DEA) and Improving Container Port Efficiency. Res. Transp. Econ. 2007, 17, 517–566. [Google Scholar]

- Mustafa, F.S.; Khan, R.U.; Mustafa, T. Technical efficiency comparison of container ports in Asian and Middle East region using DEA. Asian J. Shipp. Logist. 2021, 37, 12–19. [Google Scholar]

- Fernández, X.L.; Hidalgo-Gallego, S.; Pérez-Urbaneja, S.; Coto-Millán, P. When container specialisation makes a difference: An efficiency analysis of the Spanish port authorities. Marit. Policy Manag. 2021, 48, 629–650. [Google Scholar] [CrossRef]

- Kammun, R.; Abdennadher, C. The impact of competition and environmental factors on technical inefficiency of European ports. In Proceedings of the 14th International Conference of Logistics and Supply Chain Management LOGISTIQUA, El Jadida, Morocco, 25–27 May 2022; National School of Business and Management (ENCGJ), A. Chouaib Doukkali University. Available online: https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=9938039 (accessed on 7 June 2023).

- Nong, T.N.-M. Performance efficiency assessment of Vietnamese ports: An application of Delphi with Kamet principles and DEA model. Asian J. Shipp. Logist. 2023, 39, 1–12. [Google Scholar]

- Wang, C.-N.; Nguyen, P.-H.; Nguyen, T.-L.; Nguyen, T.-G.; Nguyen, D.-T.; Tran, T.-H.; Le, H.-C.; Phung, H.-T. A Two-Stage DEA Approach to Measure Operational Efficiency in Vietnam’s Port Industry. Mathematics 2022, 10, 1385. [Google Scholar] [CrossRef]

- Ben Mabrouk, M.; Elmsalmi, M.; Aljuaid, A.M.; Hachicha, W.; Hammami, S. Joined Efficiency and Productivity Evaluation of Tunisian Commercial Seaports Using DEA-Based Approaches. J. Mar. Sci. Eng. 2022, 10, 626. [Google Scholar] [CrossRef]

- Li, H.; Jiang, L.; Liu, J.; Su, D. Research on the Evaluation of Logistics Efficiency in Chinese Coastal Ports Based on the Four-Stage DEA Model. J. Mar. Sci. Eng. 2022, 10, 1147. [Google Scholar] [CrossRef]

- Sadri, E.; Harsej, F.; Hajiaghaei-Keshteli, M.; Siyahbalaii, J. Evaluation of the components of intelligence and greenness in Iranian ports based on network data envelopment analysis (DEA) approach. J. Model. Manag. 2022, 17, 1008. [Google Scholar]

- Yang, C. A DEA-Based Approach for Evaluating the Opportunity Cost of Environmental Regulations. Asia-Pacific J. Oper. Res. 2013, 30, 1250049-1–1250049-17. [Google Scholar]

- Wang, C.-N.; Nguyen, N.-A.-T.; Fu, H.-P.; Hsu, H.-P.; Dang, T.-T. Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models. Axioms 2021, 10, 48. [Google Scholar] [CrossRef]

- Kuo, K.-C.; Lu, W.-M.; Le, M.-H. Exploring the performance and competitiveness of Vietnam port industry using DEA. Asian J. Shipp. Logist. 2020, 36, 136–144. [Google Scholar]

- Nguyen, T.L.H.; Park, S.-H.; Kim, Y.; Yeo, G.-T. An efficiency analysis of container terminals in Southern Vietnam using DEA dynamic efficiency evaluation. Asian J. Shipp. Logist. 2021, 37, 329–336. [Google Scholar]

- Parra Santiago, J.I.; Camarero Orive, A.; González Cancelas, N. DEA-Bootstrapping Analysis for Different Models of Spanish Port Governance. J. Mar. Sci. Eng. 2021, 9, 30. [Google Scholar] [CrossRef]

- Pham, T.Q.M.; Park, G.K.; Choi, K.-H. The efficiency analysis of world top container ports using two-stage uncertainty DEA model and FCM. Marit. Bus. Rev. 2021, 6, 2–21. [Google Scholar] [CrossRef]

- Russo, F.; Rindone, C. Container maritime transport on an international scale: Data envelopment analysis for transhipment port. In Sustainable Development and Planning V; WIT Press: Billerica, MA, USA, 2011; Volume 150, pp. 831–846. [Google Scholar]

- Polyzos, S.; Niavis, S. Evaluating port efficiency in the Mediterranean. Int. J. Data Anal. Tech. Strateg. 2013, 5, 84–100. [Google Scholar]

- Gökçek, V.; Şenol, Y.E. Efficiency Analysis of Mediterranean Container Ports. J. ETA Marit. Sci. 2018, 6, 129–140. [Google Scholar]

- Nikolina, B.P.; Hua, Z.J. Technical and scale efficiency analysis of 25 nort Mediterranean ports: A data envelopment analysis approach. Int. J. Econ. Financ. 2020, 12, 55–63. [Google Scholar]

- Fancello, G.; Serra, P.; Aramu, V.; Mark Vitiello, D.M. Evaluating the efficiency of Mediterranean container ports using data envelopment analysis. Spec. Issue Compet. Issues Marit. Transp. Port Hinterl. 2021, 20, 1–26. [Google Scholar]

- Thanassoulis, E. Introduction to the Theory and Application of Data Envelopment Analysis; Springer: New York, USA, 2001. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, M.L.; Tone, K. Data Envelopment Analysis—A Comprehensive Text with Models, Applications, References and DEA—Solver Software, 2nd ed.; Springer: New York, NY, USA, 2007. [Google Scholar]

- Jenkins, L.; Anderson, M. A multivariate statistical approach to reducing the number of variables in data envelopment analysis. Eur. J. Oper. Res. 2003, 147, 51–61. [Google Scholar]

- Wong, W.-P. A Global Search Method for Inputs and Outputs in Data Envelopment Analysis: Procedures and Managerial Perspectives. Symmetry 2021, 13, 1155. [Google Scholar] [CrossRef]

- Boussofiane, A.; Dyson, R.G.; Thanassoulis, E. Applied data envelopment analysis. Eur. J. Oper. Res. 1991, 52, 1–15. [Google Scholar]

- Golany, B.; Roll, Y. An Application Procedure for DEA. Omega 1989, 1, 237–250. [Google Scholar]

- Ali, A.I.; Charnes, A.; Cooper, W.W.; Divine, D.; Klopp, G.A.; Stutz, J. An application of data envelopment analysis to US Army recruitment districts. In Applications of Management Science, A Research Annual; Schultz, R.L., Ed.; JAI Press: Stamford, CT, USA, 1989. [Google Scholar]

- Bowlin, W.F. Measuring performance: An introduction to data envelopment analysis (DEA). J. Cost Anal. 1998, 15, 3–27. [Google Scholar] [CrossRef]

- Dyson, R.G.; Allen, R.; Camanho, A.S.; Podinovski, V.V.; Sarrico, C.S.; Shale, E.A. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 1321, 245–259. [Google Scholar]

- Ding, Z.Y.; Jo, G.S.; Wang, Y.; Yeo, G.T. The Relative Efficiency of Container Terminals in Small and Medium-Sized Ports in China. Asian J. Shipp. Logist. 2015, 31, 231–251. [Google Scholar]

- Feng, L.; Notteboom, T. Peripheral challenge by Small and Medium Sized Ports (SMPs) in Multi-Port Gateway Regions: The case study of northeast of China. Pol. Marit. Res. Spec. Issue 2013, 79, 55–66. [Google Scholar]

- Niavis, S.; Tsekeris, T. Ranking and causes of inefficiency of container seaports in South-Eastern Europe. Eur. Transp. Res. Rev. 2012, 4, 235–244. [Google Scholar] [CrossRef] [Green Version]

- Chang, Y.-T.; Park, H.K.; Lee, S.; Kim, E. Have Emission Control Areas (ECAs) harmed port efficiency in Europe? Transp. Res. Part D Transp. Environ. 2018, 58, 39–53. [Google Scholar] [CrossRef]

- He, X.; Liu, W.; Hu, R.; Hu, W. Environmental Regulations on the Spatial Spillover of the Sustainable Development Capability of Chinese Clustered Ports. J. Mar. Sci. Eng. 2021, 9, 301. [Google Scholar] [CrossRef]

| Inputs | Outputs | ||||||

|---|---|---|---|---|---|---|---|

| Berth Length | Terminal Area | Quay-Side Cranes | Yard Gantry Cranes | Throughput | Volume | Revenue | |

| (m) | (ha) | (Number) | (Number) | (TEUs) | (Tons) | (Million Euros) | |

| Mean | 2873 | 120 | 23 | 51 | 3,176,871 | 47,825,000 | 687 |

| Standard Deviation | 1291 | 72 | 10 | 39 | 1,806,000 | 28,231,000 | 824 |

| Minimum | 695 | 27 | 11 | 0 | 1,000,000 | 1,906,000 | 123 |

| Maximum | 4812 | 231 | 43 | 113 | 7,173,000 | 101,055,000 | 2766 |

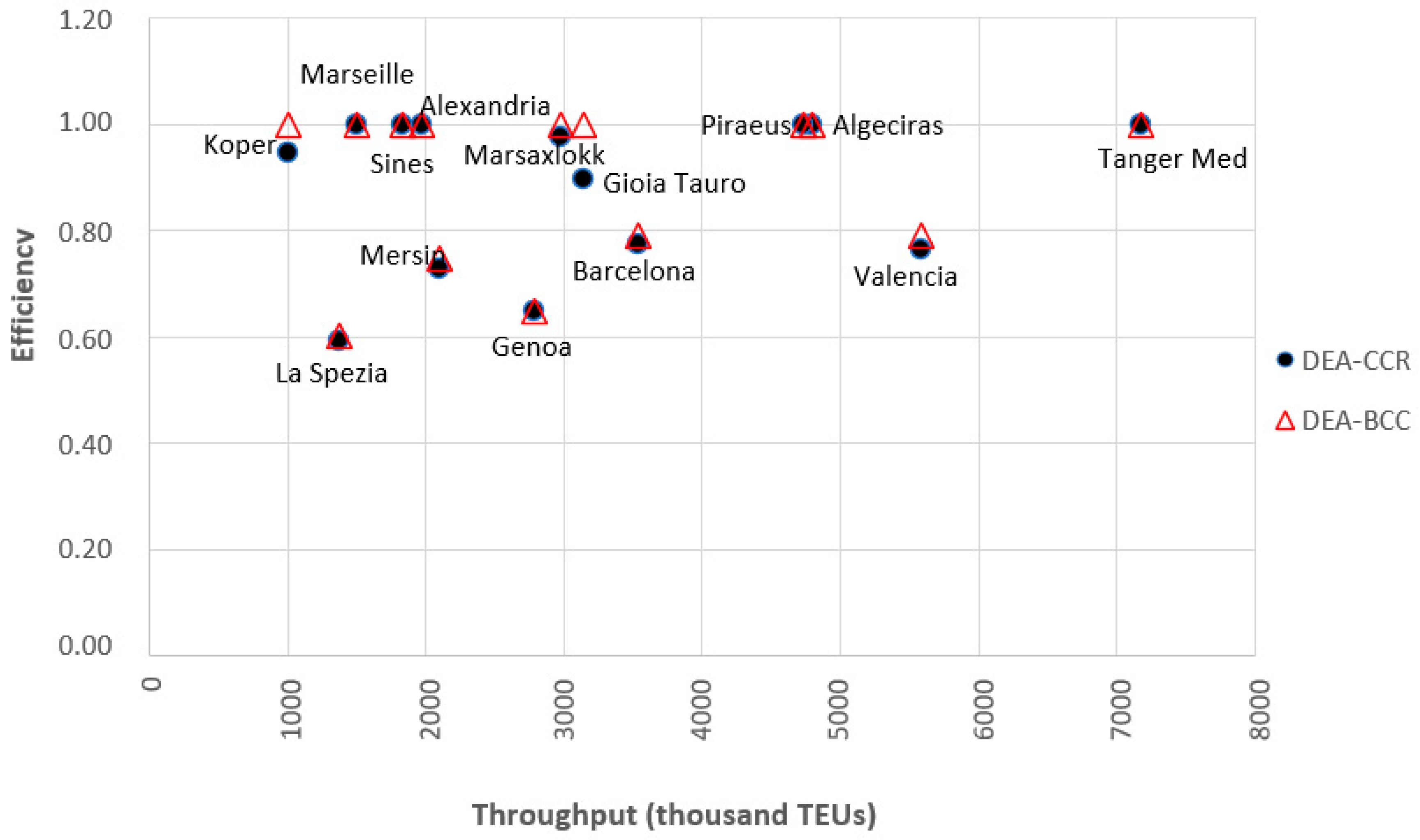

| Port | Container Throughput | Container Volume | Revenue | DEA-CCR | DEA-BCC | Scale Efficiency | Returns to Scale |

|---|---|---|---|---|---|---|---|

| (TEUs) | (Thousand Tons) | (Thousand Euros) | (CRS) | (VRS) | (CRS/VRS) | ||

| Tanger Med | 7,173,870 | 101,055 | 2,175,460 | 1.000 | 1.000 | 1.000 | con |

| Valencia | 5,588,000 | 69,131 | 1,346,890 | 0.764 | 0.791 | 0.966 | drs |

| Algeciras | 4,797,497 | 83,051 | 309,500 | 1.000 | 1.000 | 1.000 | con |

| Piraeus | 4,731,000 | 46,951 | 391,830 | 1.000 | 1.000 | 1.000 | con |

| Barcelona | 3,531,324 | 53,642 | 151,400 | 0.776 | 0.793 | 0.979 | drs |

| Gioia Tauro | 3,140,000 | 25,721 | 123,100 | 0.898 | 1.000 | 0.898 | drs |

| Marsaxlokk | 2,970,000 | 1906 | 500,800 | 0.977 | 1.000 | 0.977 | drs |

| Genoa | 2,781,112 | 48,212 | 409,000 | 0.650 | 0.650 | 1.000 | con |

| Mersin | 2,097,000 | 38,579 | 316,480 | 0.729 | 0.750 | 0.973 | irs |

| Alexandria | 1,967,000 | 64,500 | 2,766,000 | 1.000 | 1.000 | 1.000 | con |

| Marseilles | 1,500,000 | 71,590 | 162,000 | 1.000 | 1.000 | 1.000 | con |

| Sines | 1,823,767 | 32,904 | 575,040 | 1.000 | 1.000 | 1.000 | con |

| La Spezia | 1,375,626 | 11,486 | 161,900 | 0.580 | 0.589 | 0.985 | irs |

| Koper | 1,000,000 | 20,821 | 228,400 | 0.946 | 1.000 | 0.946 | irs |

| Average | 3,176,871 | 47,825 | 686,985 | 0.880 | 0.898 | 0.980 |

| Port | Container Volume (Thousand Tons) | Container Throughput (TEU) | Market Share % | Total Percentage |

|---|---|---|---|---|

| Tanger Med | 101,055 | 7,173,000 | 15.92% | 50.76% |

| Valencia | 69,131 | 5,588,000 | 12.40% | |

| Piraeus | 46,951 | 4,731,000 | 11.79% | |

| Algeciras | 83,051 | 4,797,497 | 10.65% | |

| Barcelona | 53,642 | 3,531,324 | 7.84% | 49.24% |

| Gioia Tauro | 25,721 | 3,140,000 | 6.97% | |

| Marsaxlokk | 1906 | 2,970,000 | 6.59% | |

| Genoa | 48,212 | 2,781,112 | 6.17% | |

| Mersin | 38,579 | 2,097,000 | 4.65% | |

| Alexandria | 64,500 | 1,967,000 | 4.37% | |

| Marseilles | 71,590 | 1,500,000 | 4.05% | |

| Sines | 32,904 | 1,823,767 | 3.33% | |

| La Spezia | 11,486 | 1,376,626 | 3.05% | |

| Koper | 20,821 | 1,000,000 | 2.22% | |

| Total | 44,476,196 | 100.00% | 100.00% | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moschovou, T.P.; Kapetanakis, D. A Study of the Efficiency of Mediterranean Container Ports: A Data Envelopment Analysis Approach. CivilEng 2023, 4, 726-739. https://doi.org/10.3390/civileng4030041

Moschovou TP, Kapetanakis D. A Study of the Efficiency of Mediterranean Container Ports: A Data Envelopment Analysis Approach. CivilEng. 2023; 4(3):726-739. https://doi.org/10.3390/civileng4030041

Chicago/Turabian StyleMoschovou, Tatiana P., and Dimitrios Kapetanakis. 2023. "A Study of the Efficiency of Mediterranean Container Ports: A Data Envelopment Analysis Approach" CivilEng 4, no. 3: 726-739. https://doi.org/10.3390/civileng4030041