Abstract

Oil and gas construction projects are of great importance to support and facilitate the process of operation and production. However, these projects usually face chronic risks that lead to time overrun, cost overrun, and poor quality, affecting the projects’ success. Hence, this study focused on identifying, classifying, and modeling the risk factors that have negative effects on the success of construction projects in Yemen. The data were collected through a structured questionnaire. Statistical analysis, relative important index method, and probability impact matrix analysis were carried out to classify and rank the risk factors. The partial least squares path modeling or partial least squares structural equation modeling (PLS-PM, PLS-SEM) is a method for structural equation modeling that allows an estimation of complex cause–effect relationships in path models with latent variables. PLS-SEM was employed to analyze data collected from a questionnaire survey of 314 participants comprising the clients, contractors, and consultants working in oil and gas construction projects. The results showed that the goodness of fit index of the model is 0.638. The developed model was deemed to fit because the analysis result of the coefficient of determination test (R2) of the model was 0.720, which indicates the significant explanation of the developed model for the relationship between the causes of risks and their effects on the success of projects. The most impacted internal risk categories include project management, feasibility study design, and resource material availability. The main external risk elements include political, economic, and security considerations. The created risk factor model explained the influence of risk factors on the success of construction projects effectively, according to statistical and expert validation tests.

1. Introduction

In the construction industry, uncertainty constitutes a global phenomenon, and very few projects complete within the expected costs and timetable. In both developed and the least developed countries, the risk is a major issue in construction projects; however, this trend in the least developed countries is very serious, where it sometimes exceeds 100% of expected costs and time [1,2]. Construction risks typically result in time and expense overruns, as well as consequences on project deadlines. As a result, most construction projects were delayed or over budget because project managers were unable to effectively manage risk [3]. Contrarily, the growing complexity of economies of the world’s least developed nations has led to an increasing perception that these issues are increasingly commonplace. Complexity of design and planning, involvement of various parties (project manager, designers, suppliers, and vendors, etc.), the availability of resources (materials, facilities, and funds), the environment, political, and economic situation of the country are just some of the factors that contribute to today’s engineering projects having a higher risk of failure [4]. In addition, ventures to develop oil and gas are subjected to risks due to considerable investment in resources, the intervention of many parties involved, the use of advanced technology, and high social and climate impacts [5]. It is very important to develop a model of risk factors that affect the success of the construction project, according to the recommendations of many project management researchers [6,7,8,9].

In addition, there is a lack of studies on the analysis of causality and the impacts between risk factors in gas and oil projects in Yemen, which provides the researcher with the ability to analyze and model the risk factors impacting project performance using the structural equation modeling (SEM) method. SEM is a conceptual representation visual equivalent [10] with advance multivariate instrument functionality to assess the magnitude of the relations between the factors [11,12,13,14,15,16]. Evaluating cause and effect interactions between variables is becoming more popular [17,18]. Through this analysis, major risk factors are identified, which have an adverse effect on project performance, and the structural model is built to account for risk factors that affect oil and gas projects. Accordingly, oil and gas developing projects are facing multiple challenges that can adversely affect the execution of projects. Risk management research in oil and gas project management are therefore urgently needed. The study objective is to determine the relation between risk factors and project performance in oil and gas construction projects in Yemen as a case study in order to provide suggestions for reducing significant risks. There are many aims in this research, including:

- Determine the most prevalent risk variables and their impact on the success of oil and gas construction projects.

- Provide a risk factor framework for construction projects.

- Assess and categorize the risk variables affecting construction projects.

- Develop a structural model that evaluates the relation between cause-and-effect factors on project success.

The main objective of this research is to develop a model that explains the underlying relationship between the causes of risks in construction projects in the oil sector and their effects on the success of the construction project. This will be verified by analyzing the data received from the participants in the questionnaire using structural equation modeling.

2. Research Background

Risk management is crucial in the construction sector to achieve project goals (time, cost, quality, professional safety). The risk management system helps project managers prioritize resources and make more reliable judgments, resulting in project success and attaining goals. No party competent to fund and handle the risks should have assigned/allocated them. To shorten the time between the theoretical and practical stages of a construction project, the project team must recognize and manage numerous risks and uncertainties. Construction hazards are a common occurrence in most, if not all, construction projects. Failure, loss, or unexpected returns are all examples of risk. The risk is considered to be a possible threat, especially in the construction industry, taking into account investment and time constraints [19]. Construction is one of the most competitive, dangerous, and demanding sectors with mega-organizational and project-based needs [20]. Because of the difficulty and novelty of construction projects, not only do they exceed the number of risks in the other sectors, but the risks often vary from one construction project to another [16].

By protecting their most precious assets and resources, risk management helps people and organizations cope with uncertainty. Avoidance, reduction, or control of risks is risk management. The cost of risk management should be weighed against the potential returns. Systematic risk management is a management technique that involves practical experience and training [20]. Every risk management process requires particular tools and techniques to be utilized, and for this purpose, a great variety of techniques have been sophisticated in the literature review, where the most widely adopted ones are shown in Table 1.

Table 1.

Risk management process techniques.

Furthermore, each step of the risk assessment requires a distinct amount of information and depth, necessitating the use of appropriate approaches [37]. The purpose of the risk analysis, such as monitoring economic and financial outcomes, verifying quality variation, or tracking time delays, may also serve as a criterion for determining the most effective risk management approaches to be used in the situation [42]. According to [43], the construction projects in some cases fail to meet budgeted targets, since cost performance is one of the measures used to judge their success. Success is measured by time, cost, and quality. Compared to project success, risks heavily impact these three key factors. Because project operations are unique, complex, and dynamic, these hazards may be categorized. A lack of quality projects or even project cancellation or failure might come from these risks. One of the problems of construction projects is forecasting unnecessary costs and finishing on time. Studies suggest that risk variables may significantly affect construction projects, as seen in Table 2. This research will describe the direct and indirect link between risk sources and consequences throughout the construction project’s life cycle.

2.1. Relationship between Risk Factor Causes and Project Success

Since risk variables vary greatly across sectors and nations, the study of risk management for successful projects in oil and gas construction is vital for good project management. This study’s goal is to establish a link between the risk factors studied and the success of oil and gas operations in Yemen. According to [3], risks and their sources and characteristics must be properly assessed in order to help the project team come up with realistic solutions to reduce them.

To make risk management more beneficial to construction project participants, a model for assessing risk variables impacting project performance should be studied [44]. According to [45], an oil and gas refinery construction project in India was used to develop an integrated analytical framework for project risk management. Project managers identified time, financial, and quality risks using cause-and-effect diagrams for each project work package. The risk management group then collated the identified factors for the full project. The AHP (analytic hierarchy process) enables the discovery of significant variables impacting time, cost, and quality. The authors of [46] used correlation analysis to assess the causal linkages between causes and effects. However, [47] found the time and cost overruns may be caused by client–contractor relationships, whereas client–contractor relationships and external circumstances may cause conflicts. Disagreements may be arbitrated rather than sued because of client, labor, contract, and external situations [48]. Many writers have examined both direct and indirect correlations between factors and outcomes, as previously indicated.

2.2. Conceptual Research Model

Through previous studies and a literature review in construction projects and in particular in the oil and gas sector, a model containing 13 hypotheses of risk groups was developed to ascertain the impact of risk factors on the success of the construction project in the oil and gas sector in Yemen. A theoretical or hypothetical model is developed from a review of the literature [49]. This model serves as the basis for testing the relationships between independent and dependent variables [51]. The developed theoretical model focuses on the relationships between the risk factors (e.g., client, contractor, consultant, tendering and contract, risk management, economic risk and equipment, and materials) and effects (e.g., project success, effect on time and effect on cost) of construction projects in oil and gas as well as integrates such linkage. To address a research gap and to provide a complete understanding of the risk factors and effects integrated into this model, the following hypotheses are constructed based on the relationships of the risk factors (independent variables) with effects on construction projects (dependent variable):

- H1: Client-related risks affect the success of construction projects.

- H2: Contractor-related risks affect the success of construction projects.

- H3: Consultant-related risks affect the success of construction projects.

- H4: Construction project success is influenced by feasibility research and design risk considerations.

- H5: Tendering and contract-related risks impact the success of construction projects.

- H6: Supply chain risk considerations impact construction project success.

- H7: Project management-related risks impact construction project success.

- H8: Country economic risk variables affect the success of construction projects.

- H9: Country political risk considerations affect the success of construction projects.

- H10: Local people-related risk variables affect the success of construction projects.

- H11: Environmental and safety risks impact construction project success.

- H12: Security-related risks impact construction project success.

- H13: Risk issues associated to force majeure affect the success of construction projects.

Table 2.

Risk factors effects in the previous study.

Table 2.

Risk factors effects in the previous study.

| Risk Effects | References |

|---|---|

| Time overruns | [52,53,54,55,56,57] |

| Cost overruns | [44,45,46,47,48,49,50] |

| Poor quality | [7,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70] |

| Failure to achieve the project objectives | [1,54,55,56] |

| Stop the project | [1,57,58,59,60,61,62] |

2.3. Taxonomy of Literature Review

Similarities and differences with the study aims of past research, what the researcher plans to complete, and the researcher should continue from past research are outlined in this section. Most research in this subject involves brainstorming, checklists of prior projects, literature reviews, and expert opinions to identify potential risks in construction projects. These include brainstorming, checklists, sensitivity analyses and risk registers [52]. We evaluate studies in construction for many nations such as Yemen, and then, we review studies in oil and gas construction projects as well as the preceding research. The resultant framework, which incorporates 51 risk variables in oil and gas construction projects, must be reviewed and studied using multiple methodologies, each with benefits and drawbacks.

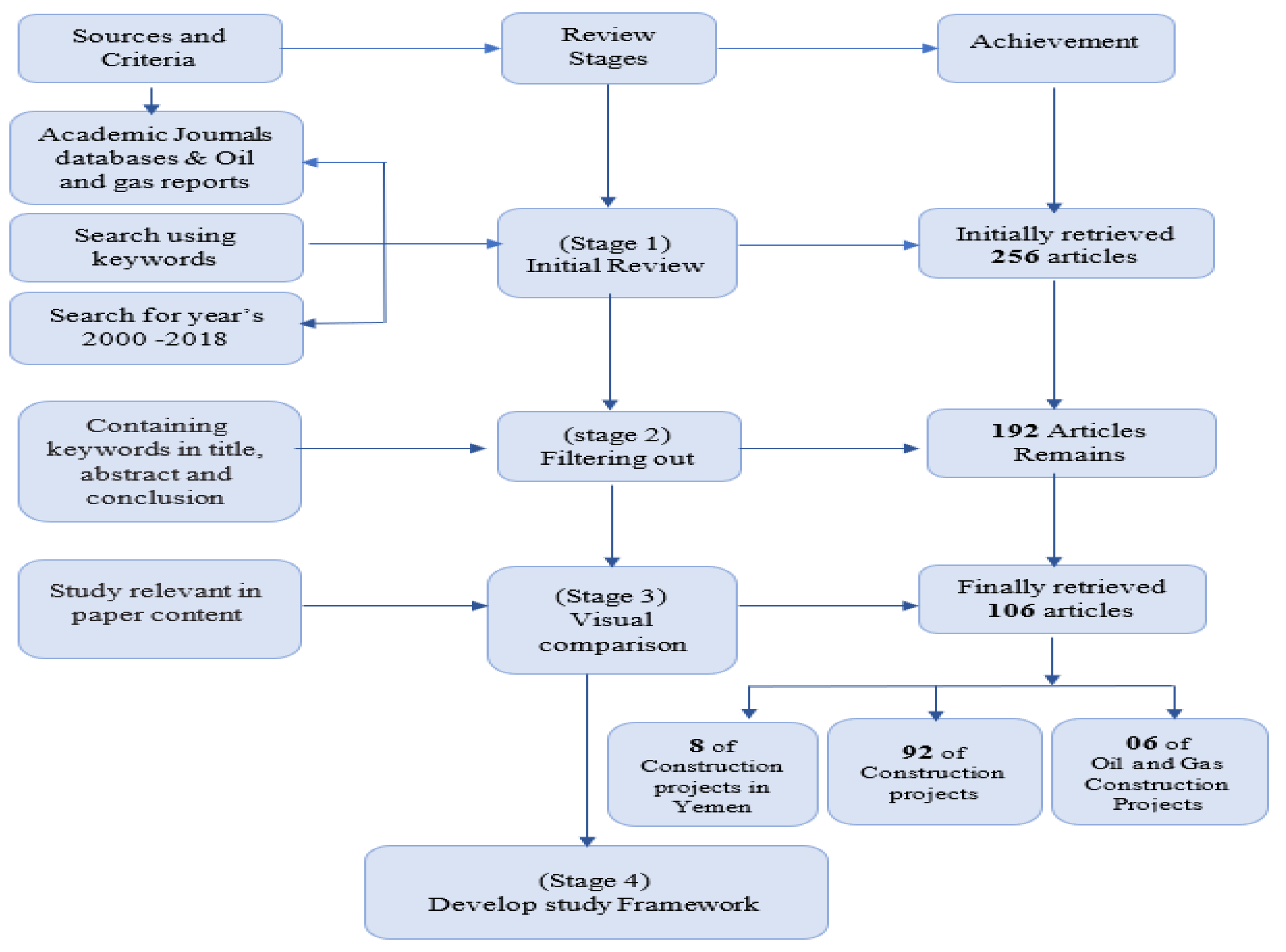

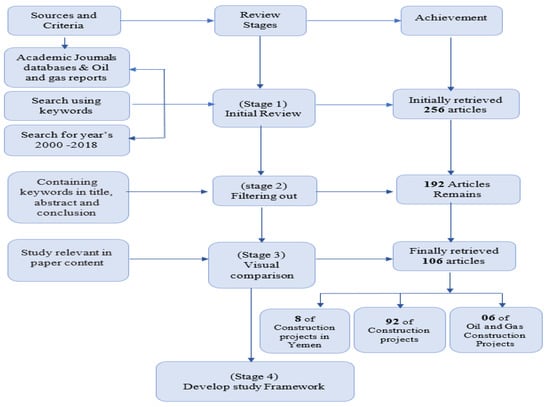

Most of the published articles on construction project delays used CB-SEM or the Relative Importance Index (RII), whilst some articles used Statistical Package for the Social Science (SPSS), Frequency index (FI), and Severity index (SI). The literature study was implemented in current scientific journals between 2008 and 2018, and most of the elements impacting project performance were limited by the articles, as shown in Figure 1. This is also the start of the data gathering phase, which is crucial to the study’s outcome.

Figure 1.

Taxonomy of literature review.

3. Research Methodology

The research methodology is the way to answer questions and indicate the problem, and whenever an appropriate methodology is chosen, it helps to obtain proper research and contributes effectively to knowledge. This stage includes also the development of the risk factors framework for further study and analysis of these factors, their reliability and the validity at the next stage design of the questionnaire, the pilot study, and the subsequent development of the final questionnaire, which will be presented to the participants in the community chosen to conduct the study.

This stage includes the first stages of the analysis of the pilot study and takes participants’ notes to redesign the final questionnaire and send it to survey participants. The pilot study results were presented to a group of experts and project managers in Yemeni oil companies who have more than 20 years of experience in this field. After the final questionnaire design, we determined the sample size of the study, and the survey was sent to participants and the tracking response. Moreover, the data collection phase began and was coordinated in preparation to begin a process of analysis, which are the most critical stages of the study before obtaining the results. This study adopted a quantitative method in the analysis of data received from participants in the survey and passed several stages of analysis from the demographic analysis of participants and then statistical analysis of the data to know the degree of correlation between the independent and dependent variables. Then, we used the structural equation method to analyze the study’s hypotheses and their validity through the PLS-SEM technique using SmartPLS 3 software. The authors will discuss the data analysis stage in detail later, followed by the recommendations and conclusion of this research.

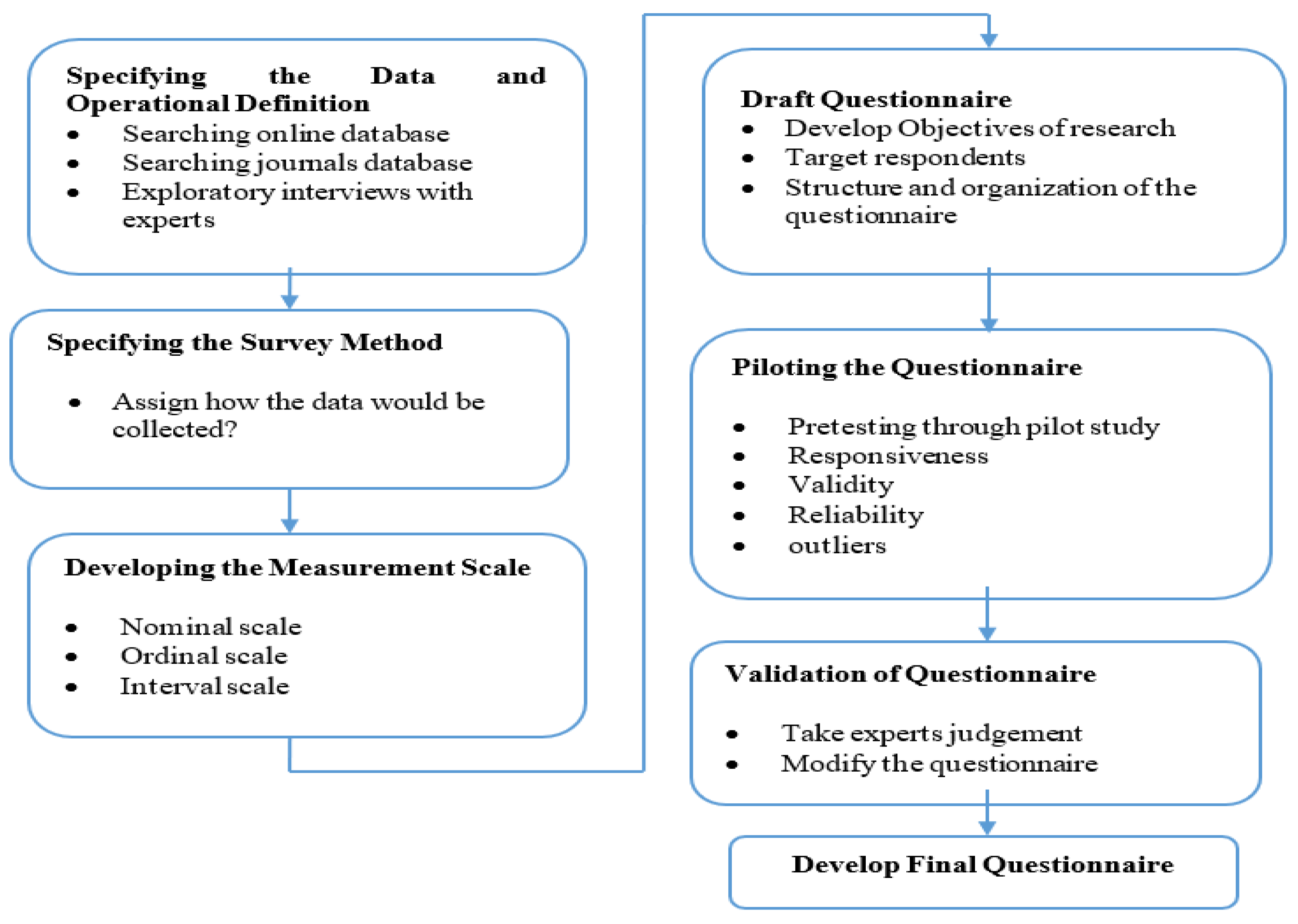

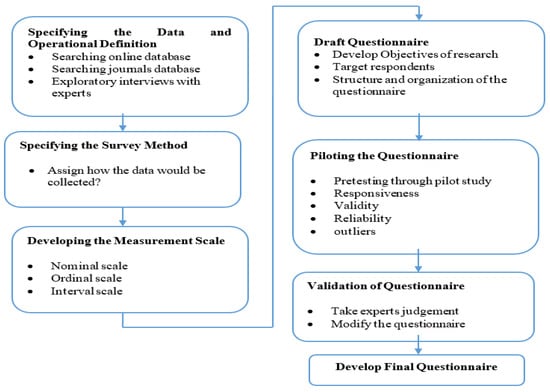

3.1. Questionnaire Design Steps

The survey questionnaire was used to experimentally examine the hypothesized associations; the study framework’s variables should be developed and assessed. Much research implies that creating a questionnaire is a complex endeavor requiring creative, scientific, and experiential abilities. Figure 2 presents the six steps in the planning of the questionnaire design:

Figure 2.

Stages of the questionnaire’s design.

The main purpose of this survey is to investigate and assess the risk factors affecting construction projects’ success and their management strategies in Yemen, examine the current knowledge base regarding the concept of risk management risks and practices in the oil field sector, and identify the main risk factors that affect the main elements of the project (time, cost, and quality), which cause projects to be delayed or fail due these risks.

The questionnaire is divided into eight sections:

- Introduction.

- General information about the participant.

- General questions about construction risk management in Yemen.

- The measurement scale of the impact of internal risk factors.

- The measurement scale of the probability of internal risk factors.

- The measurement scale of the impact of external risk factors.

- The measurement scale of the probability of external risk factors.

- The measurement scale of effects of risk factors in oil and gas project success.

3.2. Data Analysis Methods

Following a descriptive data analysis, the relative significance of risk factors is determined using the relative important index method (RII), which was followed by the degree of risk impact using a probability impact matrix (PIM) of risk factors. We used structural equation modeling (PLS-SEM) to test the study’s hypotheses about risks in construction projects in Yemen’s oil and gas industry and to determine the impact on the project’s success.

3.2.1. Statically Analysis

The first step of the analysis is the statistical analysis, which includes the demographic analysis of the questionnaire participants and the descriptive analysis of data, as well as the validity and reliability of the questionnaire. This gives a preliminary and essential indication of the authenticity and accuracy of the data and the missing data during the questionnaire. At this stage, the statistical program SPSS v25 was used, which contains a set of useful and essential tests, and this will help to check the missing and duplicated data and initiate data processing for use in structural equation modeling by the SMART PLS Program. Descriptive analysis and a reliability test are used to identify whether the data are valid and reliable or not; the result of Cronbach’s alpha for all variables should be more than 0.7 to be accepted.

3.2.2. Relative Important Index (RII)

Using Equation (1), we computed the relative importance index (RII) for each risk. The risk rating is derived by multiplying the likelihood and effect of risk [43]. The risk classification may be used to prioritize hazards for quantitative evaluation or response planning. The unique mix of chance and effect determines whether a risk is classified as high, moderate, or low (importance).

where RII refers to the Relative Importance Index.

RII = W/(A × N)

W is the respondents’ weighted average of each factor, ranging from 1 to 5.

The maximum weight (in this case, five) is A, and the total number of answers is N.

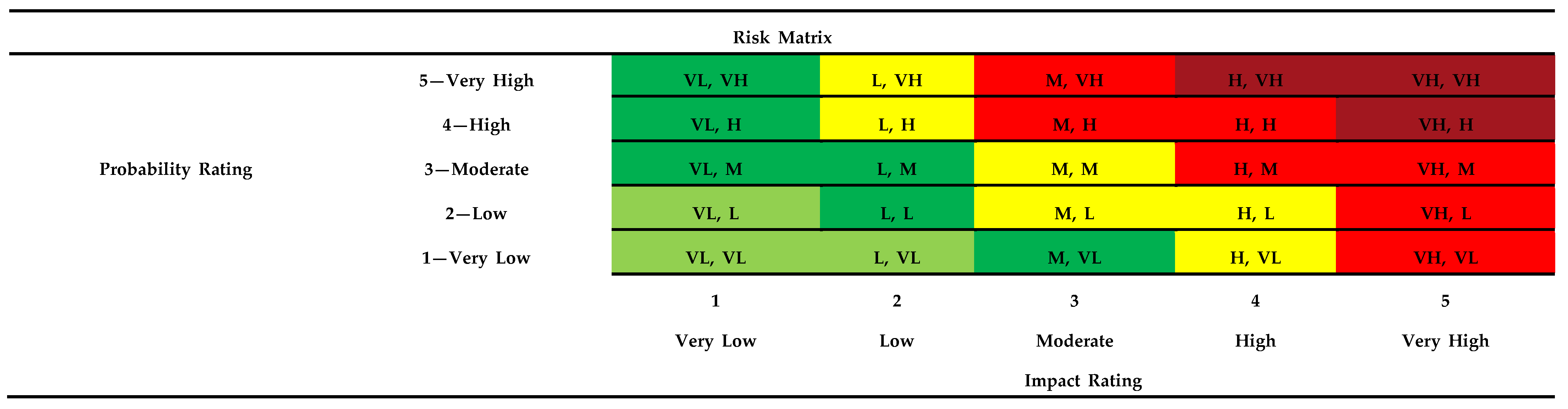

3.2.3. Probability–Impact Matrix (PIM)

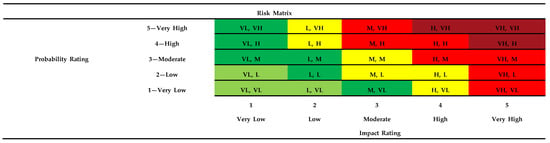

PMI stands for probability and impact matrix, risk categorization, and data quality evaluation [4]. According to [45], the project risk analysis (risk matrix or Ishikawa diagram) is often used to detect and assess risk in project assessment and selection. This research may use the probability and impact matrix as a qualitative technique. According to [38], Figure 3 shows the Likelihood and Impact Matrix, which is a “relative scale” that provides values such as high, major, moderate, and low.

Figure 3.

The risk matrix includes five zones [38].

- Red zone (light and dark): Risks in this zone are serious and should be avoided or mitigated at all costs.

- Yellow zone: moderate risks that should be controlled.

- Green zone (light and dark): Low-level risks that may be monitored, controlled, or disregarded.

According to [50], a matrix integrating probability and impact to determine risk ratings (very low, low, moderate, high, and very high) is useful. Risks with high likelihood and impact should be investigated extensively, with proactive risk management. The authors of [51] indicate the project’s overall risk score from qualitative risk analysis, while the authors of identify prioritized risks, risks for further research and management, and qualitative risk analysis trends. The authors of [52] consider having team members redo qualitative risk analysis during the project’s lifespan to see whether risk management action is required or a mitigation strategy is effective. The P-I Matrix approach uses a probability impact matrix to assist the construction project team with concentrating on the most important influence of risk variables. The likelihood and impact matrix may be employed as a qualitative tool in this study.

3.2.4. Structural Equation Modeling (SEM)

SEM allows researchers to account for measurement error in observed variables as well as unobservable ones evaluated indirectly through indicator variables [53]. PLS-SEM is a growing statistical modeling technique with several articles published on it. The authors of [89] clarify the nature and role of PLS-SEM in social and management sciences research and hopefully make researchers aware of a tool that will enable them to follow research opportunities in new and different ways.

3.2.5. Partial Least Squares–Structural Equation Modeling (PLS-SEM)

Partial least squares structural equation modeling (PLS-SEM) is a new generation statistical data analysis approach that, despite its recent inception, is rapidly gaining traction in academia: it has piqued the interest of academics across a wide range of methodologies, resulting in a vibrant and ever-evolving tool. Managers of organizations and government agencies, as well as academics and researchers, now have access to a significant amount of data to evaluate for decision making and the discovery of new results. The goal of PLS-SEM is to maximize the explained variance of endogenous latent components (dependent variables). PLS-SEM was chosen for its ability to detect important driving structures [54] and handle non-normal data sets [55]; it has minimum demand for sample size. Moreover, PLS-SEM was conducted using the SmartPLS software package [56]. Many construction project management academics use this strategy to generate models in project risk management [57,58] in research into the causes of cost overruns for projects [59] or delays in project execution time [60] and featuring precise calculations and modern methods to develop models and check the validity of hypotheses.

The steps of structural equation modeling analysis using partial least square (PLS-SEM) can be seen in Table 3.

Table 3.

PLS-SEM analysis steps [61].

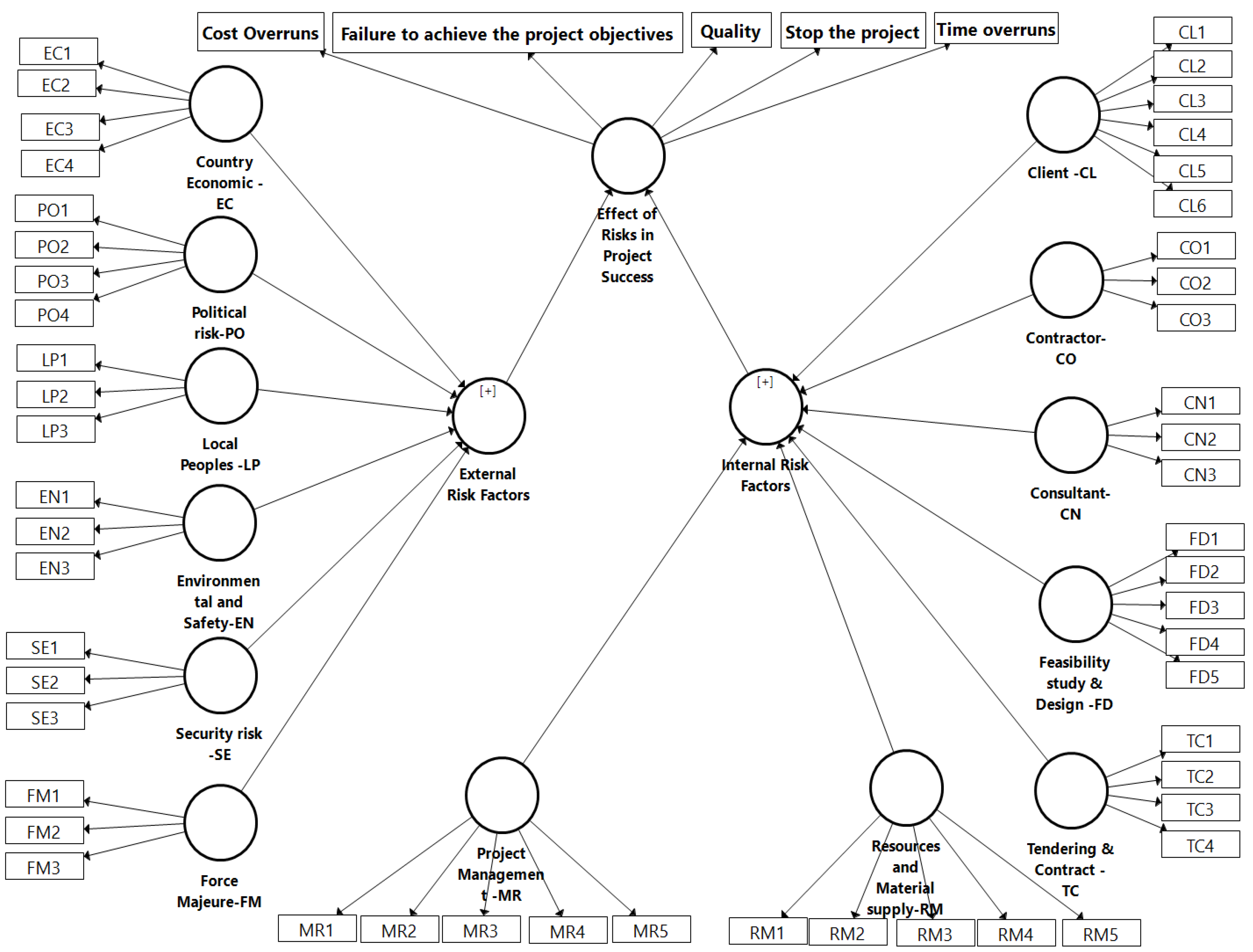

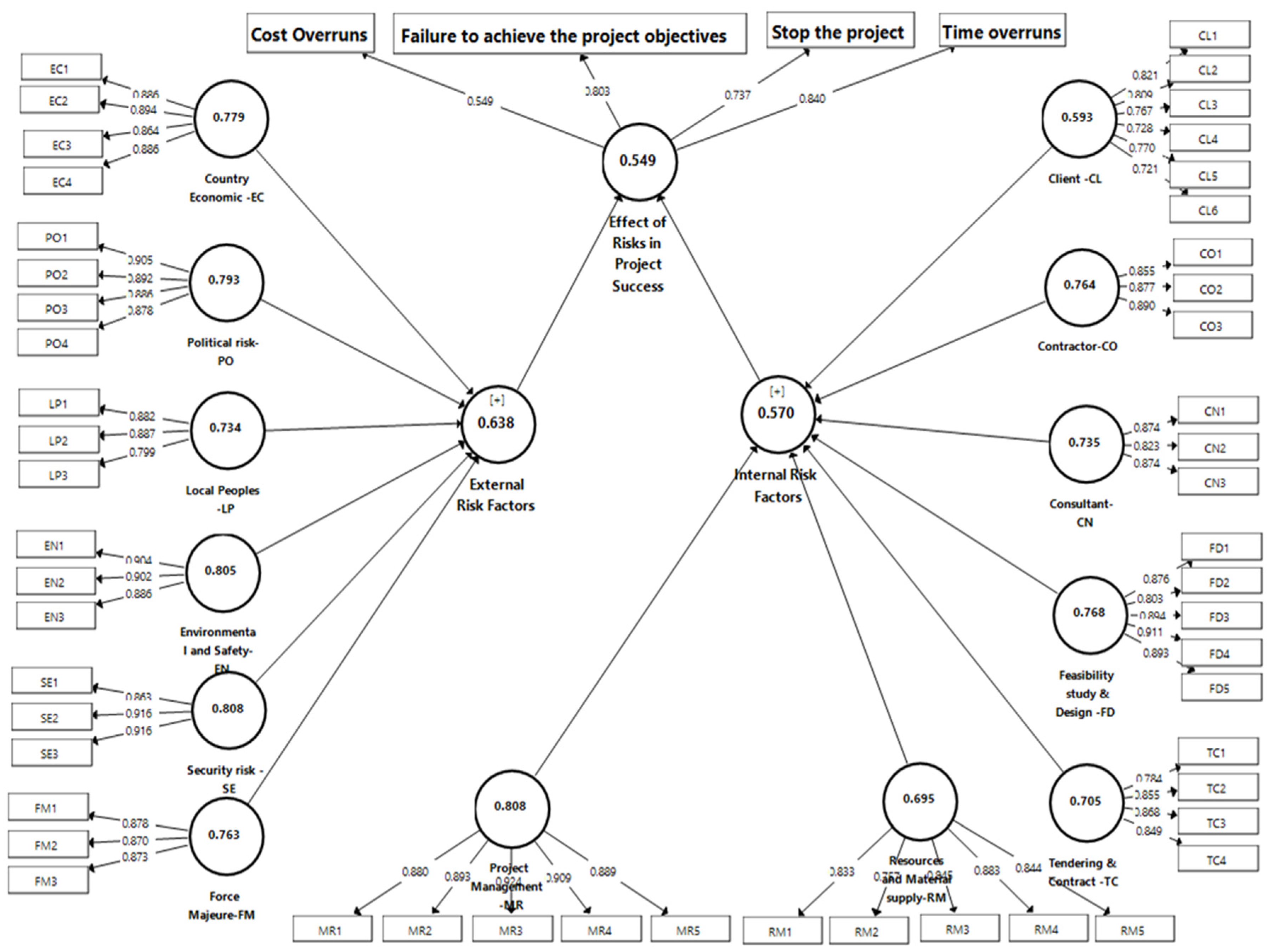

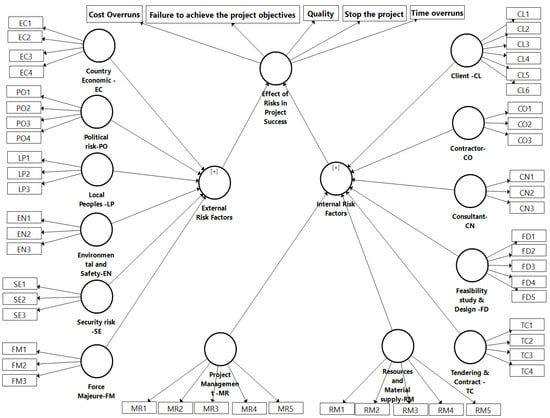

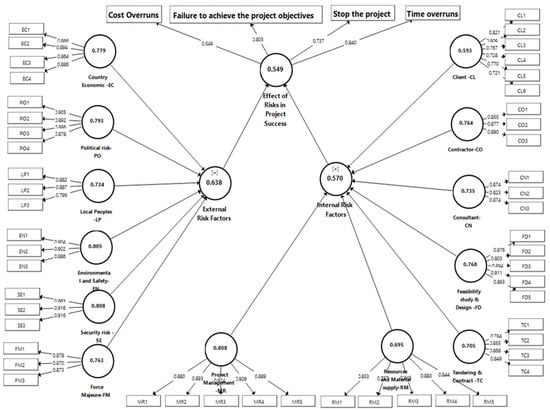

Figure 4 depicts the suggested model of risk variables and their influence on the success of oil and gas operations in Yemen. The first order includes the thirteen groups of risk factors, as shown in the framework earlier, and the second order includes the main categories of internal and external risks, which will be analyzed on the basis of the PLS-SEM.

Figure 4.

The research model (cause and effect of risk factors).

The appropriate methodology for any scientific research is to answer the questions and achieve the objectives of the research. At the end of this section, we summarize the methodology used to achieve the objectives of the study with the methods and tools necessary to achieve this, as in the following Table 4.

Table 4.

The methods, techniques, and tools used in research.

4. Research Result

4.1. Reliability Test for Risk Factors

In this section, the initial Cronbach’s alpha values are computed based on 61 risk factors and five effects on oil and gas construction project success. There are thirteen groups of risk factors on the group of effects available for different success parameters. The Cronbach’s alpha is computed in SPSS. If the result of the initial Cronbach’s alpha value is smaller than the minimum, some problems are deleted, and the item deletion process will be stopped when the improved coefficient alpha value meets the minimum [62].

A reliability study examines the obtained data’s consistency using Cronbach’s alpha, which spans from 0 to 1. Cronbach’s alpha indicates the data’s internal consistency [63]. If the Cronbach’s alpha value is less than 0.3, the data are unreliable. If the Cronbach’s alpha score is greater than 0.7, the data are consistent. [64]. Table 5 shows the Cronbach’s alpha of the pilot study.

Table 5.

Cronbach’s alpha test of risk factors and effects (pilot study) [38].

The model’s Cronbach’s alpha was substantially above 0.7, indicating all components are reliable and the test is internal.

4.2. Pilot Study Validation Using Experts Judgment

After performing pilot research, the list of 61 risk indicators was forwarded to four specialists in oil and gas construction projects in Yemen with over 20 years of experience. As they suggested to combine some, to eliminate some, and that some have no meaningful influence or the chance of occurrence is extremely tiny and cannot be regarded within the risk factors impacting projects, expert opinion was very useful in identifying the most crucial variables. Based on the results of the pilot research and expert opinion, the study’s risk variables will be reduced from 61 to 51. Having a final risk factors framework helps this research concentrate on elements that impact the success of an oil and gas construction project.

4.3. Background of the Respondents

A total of 360 questionnaire sets were distributed to randomly selected oil and gas companies operating in Yemen; of which 323 were received, and 314 were deemed acceptable.

4.3.1. The Average Age of the Participant

About 44% of the participants are the largest number of participants aged between 40 and 50 years, which were followed by the second category, aged 30–40 years, with 41%. The smallest group was the 12 respondents aged under 30 years.

4.3.2. Years of Experience

Fortunately, the majority of the participants have more than 10 years of experience in oil and gas construction projects. Amongst the 314 respondents, 102 (32.50%) had 10 to 20 years of experience, 81 (25.80%) had 5 to 10 years of experience, 66 (21.00%) had 20 to 30 years of experience, and 20 (6.40%) had more than 30 years of experience.

4.3.3. Job Title of Participants

In this study, the sample was carefully selected to have a direct relationship with the project management during the life cycle of the construction project from the feasibility study to the delivery and operation of the project, and the job titles were distributed to include the administrative side, procurement, contracts, designs, engineers and supervising the site. The respondents were asked to specify their job title.

4.3.4. Probability-Impact Matrix Analysis

Table 6 provides the probability and effect matrices for the top 10 risk variables. This analysis is critical in preparing the risk response strategy throughout the project’s different phases. For optimum risk management, there should be a strategy to handle risks with high impact and probability initially, while risks with low impact and probability are addressed later in the response plan. In practice, balancing high probability risks with little effect versus low probability risks with significant impact may be difficult. To rank risk variables, the researcher aims to combine probability and effect metrics (PIM-Analysis).

Table 6.

Probability–Impact Matrix for top ten risk factors [38].

4.3.5. Relative Importance Index Method (RII)

Table 7 ranks the risk variables based on their relative relevance index, combining their likelihood of occurrence and impact to provide a reliable risk analysis based on (Risk Index = Risk Probability × Risk Severity) [65].

Table 7.

The RII for the cause of risk factors [66].

The complete RII analysis finds that the largest risk factor in oil and gas projects is (Unstable Government), with an RII of 0.578, followed by (Incorrect Project Cost Estimation), with an RII of 0.568, and (Delay in Decision Making), with an RII of 0.554. As a result, items are prioritized based on their relative importance to the project’s success. While it is difficult to grant all risk factors the same amount of attention, time, effort, and money, the table below enables the risk management team to classify and prioritize their influence on project success.

4.3.6. Partial Least Squares Structural Equation Modeling (PLS-SEM)

SEM, similar to many other multivariate statistical approaches, is a relatively recent discovery. However, as noted before in the literature review, SEM has begun to influence finance, accounting, and project management. SEM is often used to study connections between combinations, such as satisfaction, ambiguity of role, position, or cause-and-effect relationships [67]. This portion analyzes data using structural equation modeling and PLS to identify the sources and impacts of risk in oil and gas construction projects.

Assessment of Measurements Model

The outer measurement model seeks to calculate observable and hidden variables’ reliability, internal consistency, and validity. Convergent and discriminant validity tests are used to evaluate.

a. Convergent Validity

An AVE score of 0.50 or higher shows that the build explains more than half of the variability of its measurements [64]. Table 8 and Figure 5 illustrate convergent validity findings. So, the suggested conceptual model has to be reliable, convergent, and have discriminant validity.

Table 8.

Results of measurements model—Convergent validity.

Figure 5.

AVE and factor loading analysis.

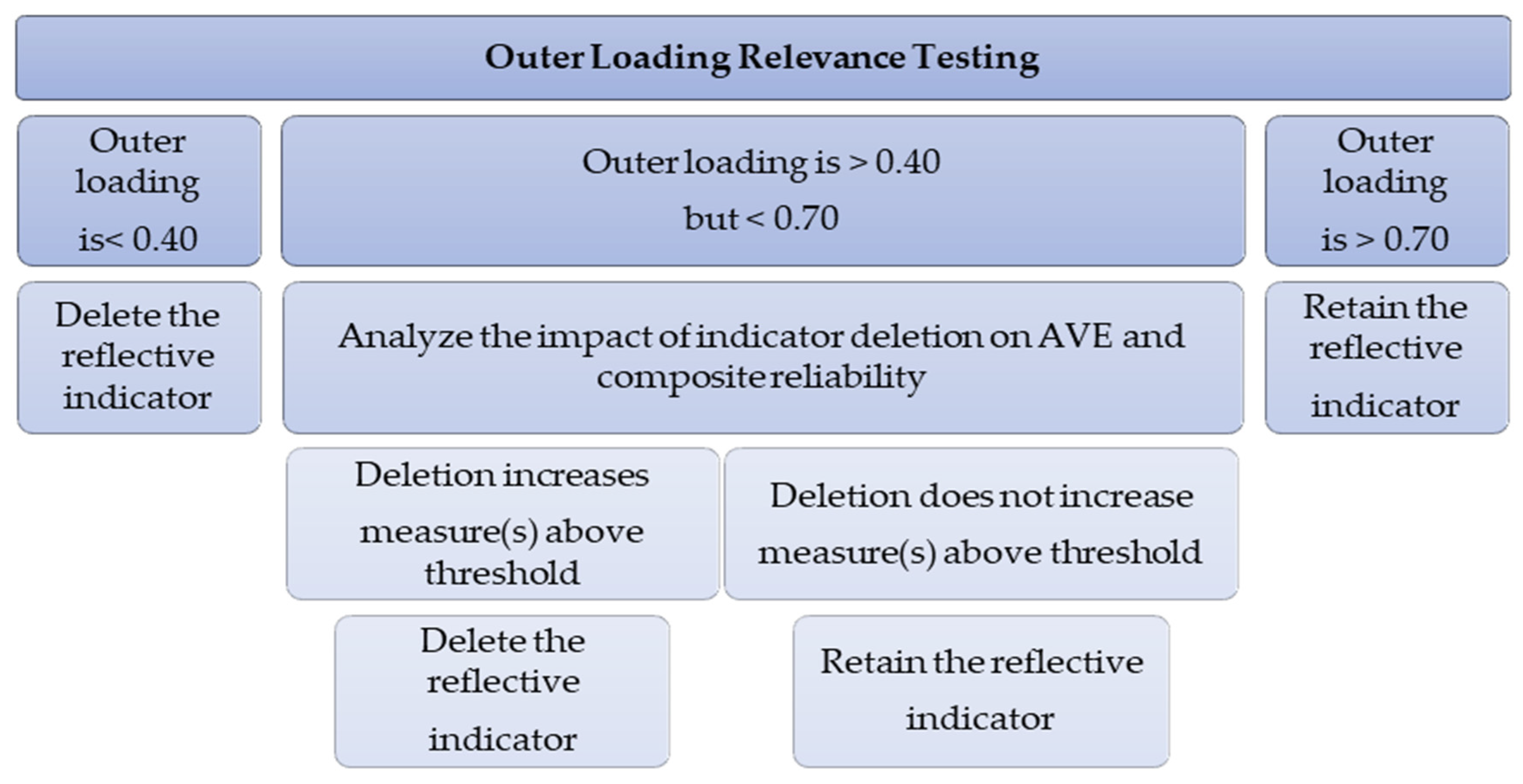

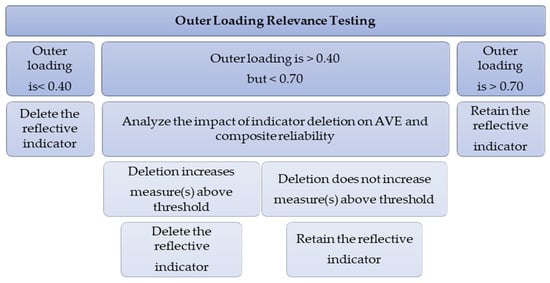

Based on [68], rather than removing signs when their exterior load falls below 0.70, scientists will assess the impact of removal on the concrete’s quality and the construction’s substance. If the composite dependability is more than the suggested threshold, then we eliminate indications with outer loads between 0.40 and 0.70. Content validity values generally retain indicators with reduced outside loads. Figure 6 shows the deleted proposals based on outer loadings.

Figure 6.

The testing of outer loading relevance.

b. The Discriminant Validity

The discriminant validity based on [56] is the concept’s empirical differentiation from other constructs. Nonetheless, discriminating validity implies that the concept is distinct from other constructs in the model.

c. Fornell–Larcker Test

The Fornell–Larcker criteria assess discriminant validity in a more conservative manner [90]. Latent variable correlations are squared using the AVE. The highest correlation should surpass the square root of each construct’s AVE. That is, the AVE should be greater than the squared correlation. This method’s dialectic assumes that a construct’s variance is higher than other measurements. Table 9 shows the Discriminant Validity Fornell–Larcker for risk factors.

Table 9.

Discriminant validity Fornell–Larcker risk factors.

d. Cross-Loading

Two new selective validity mechanisms are presented. The first step is to examine the cross-loadings of the indicators. This means the indicators outside loading on a variable should be greater than all other variables’ outer loadings combined. Cross-loadings beyond the outer loadings of the indicators are a discriminating validity concern. Discriminatory validity is established by this condition [12]. As indicated in Table 10, it is quite probable that two or more notions have discriminant validity. A cross-loading table is one of the important tests to examine the affiliation of risk factors to the group specified in the proposed study model and not to overlap with another group. The result of the analysis showed that all risk factors are more related to its group than to any other group within the study model, and this indicates that the correlation is strong between the risk factor and the variable to which it belongs.

Table 10.

Discriminant validity—Cross-loading for risk factors.

The Structural Model Evaluation (Inner Model)

A structural model’s prediction capabilities and internal linkages between the dependent variables are examined after the validity and reliability of the construction measurements have been verified.

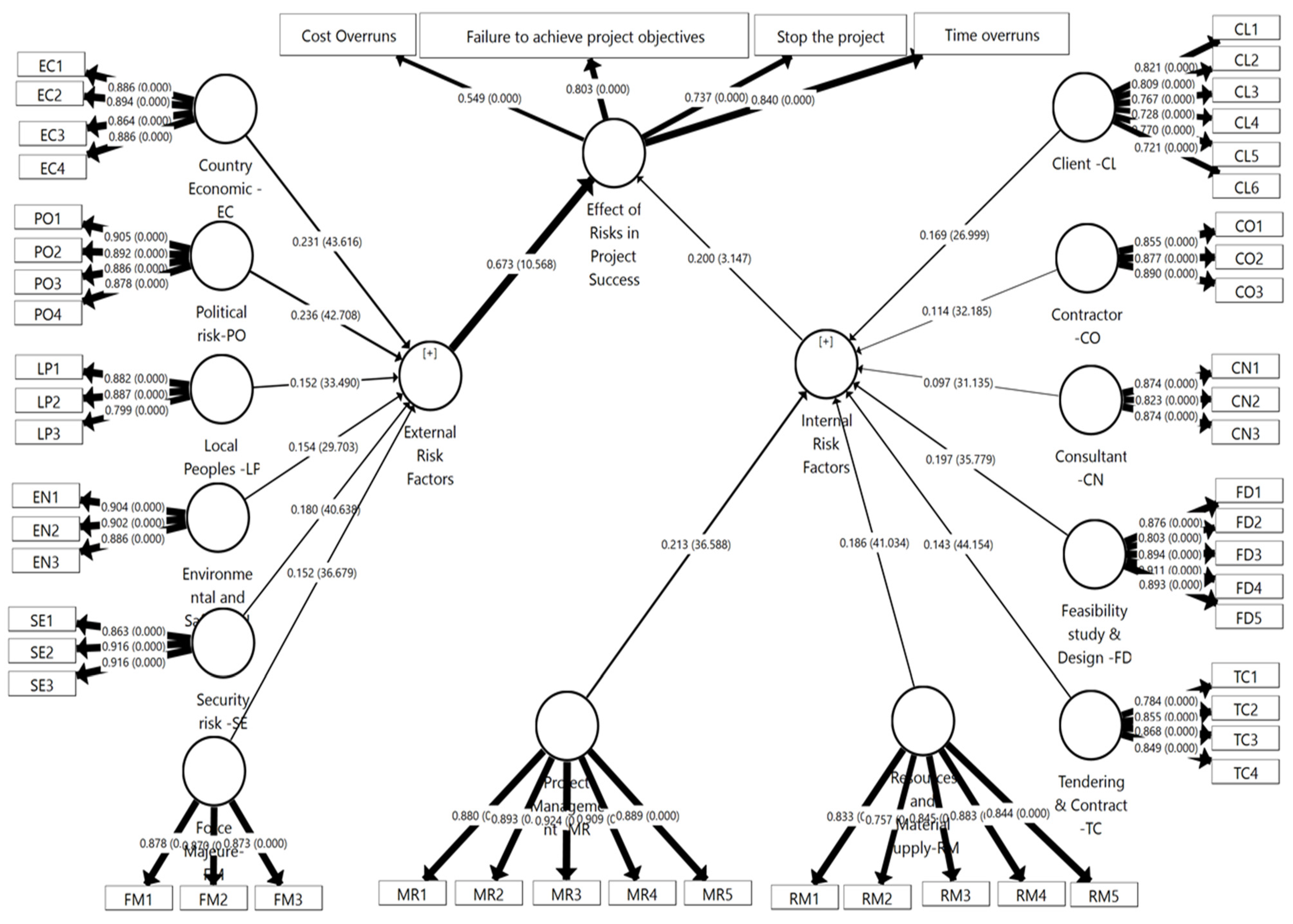

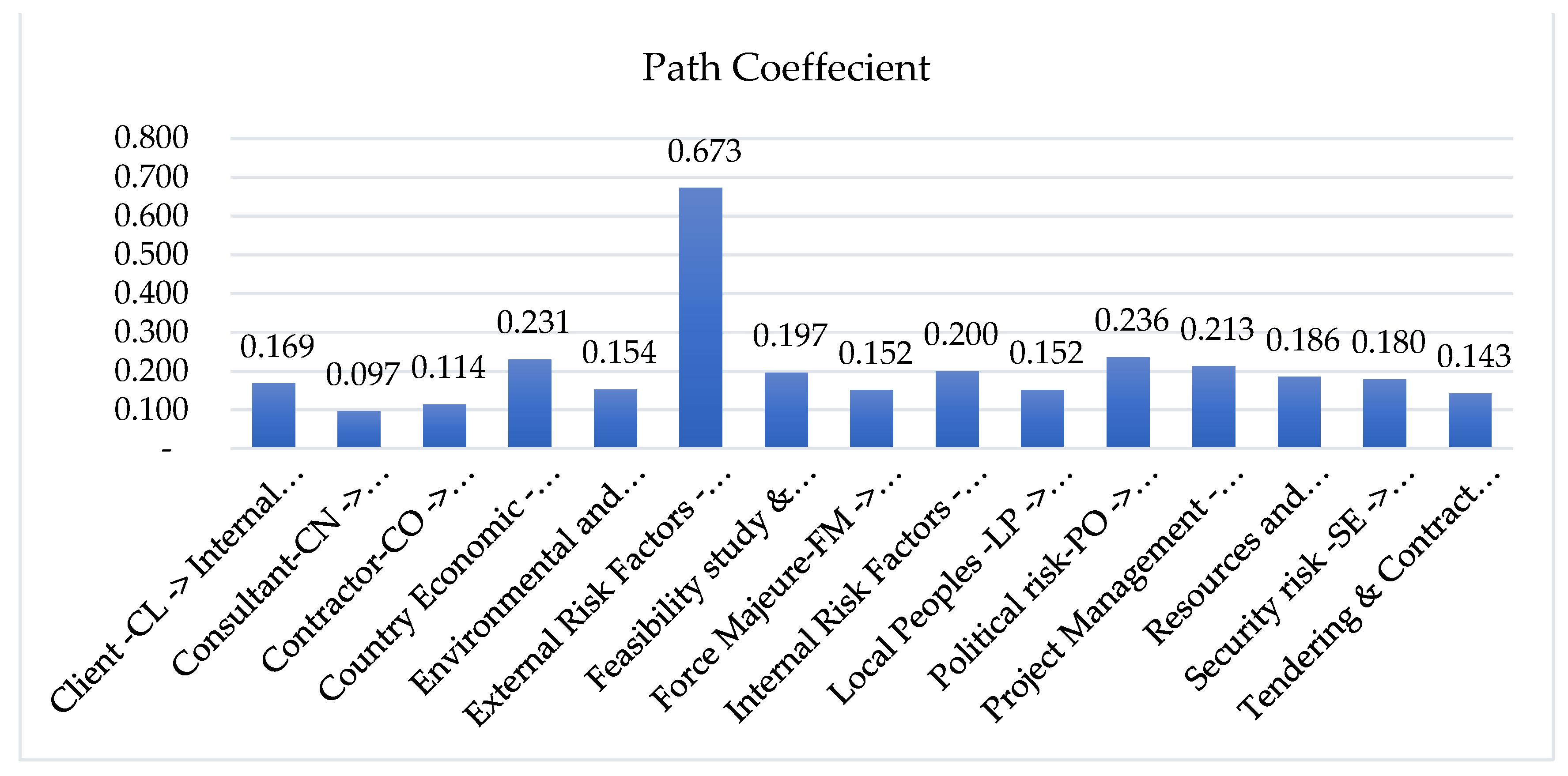

a. The Hypotheses Testing (Path Coefficient)

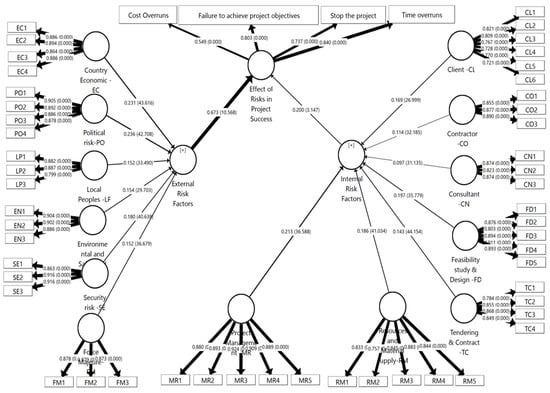

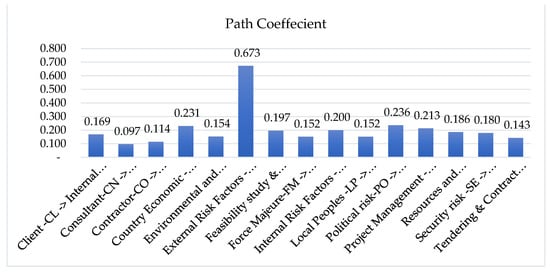

For each route coefficient, the researcher calculates a p value, which may be one-tailed or two-tailed based on the researcher’s previous knowledge of the path’s direction and related coefficient’s sign [69]. Table 11 and Figure 7 show the hypotheses test of internal and external risk factors.

Table 11.

The research hypotheses path coefficient.

Figure 7.

Path analysis of the research hypotheses.

Project success is influenced by all of the criteria as shown in Table 11 and Figure 7 of the model. The most significant categories affected by external risk factors are project management, feasibility study and design, and resources and material supply, which have path coefficient values of 0.213, 0.197, and 0.186, respectively, while political factors, country economics, and security have path coefficient values of 0.236, 0.231, and 0.180, respectively.

b. Coefficient of Determination (R2 Value)

PLS-SEM assessment of structural models also requires an understanding of R squared, which is often referred to as the determination coefficient; this is the most widely used metric for structural model evaluation [70].

Table 12 shows strong regression results with strong coefficients of determination and significant coefficients. The R2 coefficient of determination measures the regression’s effectiveness. Realized volatility accounts for 72% of the fluctuation in risk variables impacting project performance in oil and gas, indicating the study’s research model’s suitability.

Table 12.

Endogenous latent variables R-square.

c. Measuring the Effect Size (f2)

The 0.35 (Strong Effect), 0.15 (Moderate Effect), and 0.02 (Weak Effect) values are based on the criteria [71]. The evaluation of Effect Size (f2) is shown in Table 13.

Table 13.

Effect size (f2).

To ensure project success, the results of effect size analyses show that external risk factors such as economic, political, and security affect construction projects in Yemen more than internal factors.

d. Blindfolding and Predictive Relevance (Q2)

It was confirmed by [54] that each endogenous latent reflecting variable indicator data point was eliminated and forecasted. Q2 requires the conceptual model to predict the latent endogenous component (Table 14).

Table 14.

Results of predictive relevance (Q2) values.

The study model can predict risk factors and their relationship to the success of projects in the oil and gas sector in Yemen, allowing researchers and companies operating in this industry to determine the most important risk factors affecting the success of construction projects.

e. Assessment of The Goodness of Fit–GoF

The objective of GoF is to evaluate the research model’s measurement and structural characteristics [72,73]. The calculation formula of GoF is as follows:

The GoF result for our model is 0.638, which is greater than 0.36 and deemed significant.

5. Result Discussion

In this study, 51 risk factors were identified, which were divided into two groups: internal and external factors, with five possible effects on the success of an oil and gas construction project. These factors and effects were examined in multiple methods to obtain a ranking, classification, and impact, and the development of a model explains the cause-and-effect relationship.

5.1. Evaluation of Risk Factors in Construction Project

Based on a literature review, pilot study, and expert evaluation, the key risk factors of construction projects were categorized into two categories: internal and external. Internal factors included client, contractor, consultant, feasibility study, design, contracting, resource and material supply, and project management. Economic, political, human, environmental, security, and force majeure are the six kinds of external risk factors [74]. The categories are as follows.

Client-related risk factors: [75] revealed that client-related risks are viewed as the most significant, followed by consultant-, contractor-, and exogenous-related risks. In the RII study (Table 7), CL2 and CL1 had the highest RII scores (0.578 and 0.554) among customer group variables. As one of the top 10 risk variables in oil and gas construction projects, CL1 is in the dark red zone in PIM analysis (Table 6). Moreover, SEM analysis (Table 11) supports Hypothesis 1: client risk variables influence project success. The path coefficient for client variables is 0.169, indicating a strong link between client factors and project success.

Contractor-related risk factors: Among the contractor group variables, CO1 had the highest RII score of 0.458 (Table 7). In addition, in PIM analysis (Table 6), all contractor group components are in the red. A substantial influence of contractor risk variables on project performance is also supported by SEM analysis (Table 11) with a t value 32.359 > 1.96. The outcome is explained by the contractor’s risk considerations. The path coefficient for contractor variables is 0.114, indicating a strong link between contractor risk factors and project success.

Consultant-related risk factors: Among consultant group variables, CN1 had the highest RII score of 0.472 (Table 7). CN1 and CN3 are also in the red zone in PIM analysis (Table 6). A significant p-value less than 0.01 is further supported by SEM analysis (Table 11) for Hypothesis 3: consultant risk variables affect project success. However, the path coefficient for consultant components is 0.097, indicating a strong link between consultant risk factors and project performance.

Feasibility study and design risk factors: FD4 and FD5 had the highest RII scores of 0.568 and 0.556 among the consultant group factors and the RII top ten factors list (Table 7). FD1, FD4, and FD5 are in the dark red zone of PIM analysis (Table 6), indicating their impact on the success of construction projects. A strong influence of feasibility study and design-related risk variables on project success is also supported by SEM analysis (Table 11). The most major hazards that follow the project throughout construction include design flaws, inadequate feasibility studies, and inaccuracies in cost estimations and schedules. The findings of the study confirmed the research hypothesis primarily in this category [76].

Tendering and contractrisk factors: Based on [77], during the tendering and procurement of construction projects, construction stakeholders should be aware of high impact and likelihood hazards. Among the tendering and contract group variables, CT3 had the highest RII score of 0.547 (Table 7). Moreover, PIM analysis (Table 6) placed all components in this group in the red zone. On the other hand, the SEM analysis (Table 11) does not support Hypothesis 5: tendering and contract-related risk variables have a substantial influence on project success. Despite the prominence of this group’s risk elements, this indicates the potential of defining criteria and methods to overcome risks in the bidding stage and contracts. However, the path coefficient for bidding and contract-related risk variables is 0.143, indicating a substantial link between these risk factors and project success.

Resources and material supply risk factors: The material purchase is represented in three aspects: cost, quality, and time [78]. Aside from that, among the elements in the resources and material supply group (Table 7), the RII score for RM1 is 0.513, and it is in the top ten list. Moreover, in PIM analysis (Table 6), all components in this group were in the red zone except for RM2, indicating their impact on the success of construction projects. A significant p-value of less than 0.01 is also supported by SEM analysis (Table 11) for Hypothesis 6: resources and material supply risk factors influence project success. However, the path coefficient for resource and material supply-related risk variables is 0.186, indicating a considerable link between these risk factors and project success.

Project management risk factors: According to [3,79], the existence of high-ranking management-related hazards demonstrates the customers’ inability to plan, organize, motivate, lead, and control projects. MR3 obtained the highest RII score of 0.467 among the project management group variables, according to the RII study (Table 7). Additionally, all components in this group were positioned in the red zone in PIM analysis (Table 6). Although participants stated that risk factors in this category occurred often and had a substantial influence on the project, this implies that these elements have a major impact on the success of construction projects. Additionally, the SEM analysis (Table 11) indicates that Hypothesis 7, project management-related risk variables having a significant influence on project performance, is supported by the greatest path coefficient (= 0.213) among internal risk factors. This collection of risk variables is believed to be one of the most influential on the success of a project.

Country economicrisk factors: According to [80,81], the investment environment of a country is determined by its fiscal policies. EC1 also had the highest RII score of 0.504 among the country economic group components (Table 7). Moreover, PIM analysis (Table 6) shows all components in the red zone. Furthermore, SEM analysis (Table 11) supports Hypothesis 8: country economic-related risk factors have a substantial effect on project success, with t = 44.850 and path coefficient = 0.231.

Political risk factors: Construction may be threatened by political risk events stemming from the host country’s political system or its inherent setting for political situations [61,67]. PO1 had the highest RII score of 0.549 among political group components (Table 7). PO1 is also in the dark red zone in PIM analysis (Table 6), whereas all other variables in this group are in the yellow zone. With a t value of 42.486 and path coefficient of 0.236, Hypotheses 9, political-related risk variables have a significant influence on project performance, is supported by SEM analysis (Table 11).

Local peoplesrisk factors: Based on [82,83], people in the least developed countries face social stress despite the fact that oil and gas companies are required to hire a specific percentage of locals to operate. Among the local peoples group components, LP2 had the highest RII score of 0.489 (Table 7). In addition, in PIM analysis (Table 6), all local peoples components are in the red zone. Furthermore, SEM analysis (Table 11) supports Hypothesis 10: local people-related risk variables have a substantial influence on project performance, with a t value of 33.260 and path coefficient of 0.152.

Environmental and safety risk factors: Increasing health, safety, and environmental challenges stemming from previous and current catastrophic incidents significantly harm the environment, industry image, and social lease [84,85]. Among the environmental and safety group components, EN2 had the highest RII score of 0.470 (Table 7). The PIM analysis (Table 6) places only EN1 Environmental Protection Pressure in the red zone, while EN2 and EN3 are in the yellow. The SEM analysis (Table 11) further supports Hypothesis 11, environmental and safety-related risk variables have a substantial influence on project performance, with a t value of 30.052 and path coefficient of 0.154. The strict regulations in the oil and gas industry decrease the risk elements in this category and are regarded high challenges.

Security risk factors: According to [86], constant security concerns and tribal strife make it a high-risk environment to operate in. In a turbulent nation such as Yemen, security is a major element impacting the advancement of oil and gas operations. Among the security group variables, SE3, unsafe transportation routes, had the highest RII score of 0.502 (Table 7). In addition, in PIM analysis (Table 6), all security factors are in the red zone. Furthermore, SEM analysis (Table 11) supports Hypothesis 12: security-related risk variables have a substantial influence on project performance, with a t value of 40.252 and path coefficient of 0.180.

Force majeure risk factors: According to [87], natural disasters and weather issues are examples of risks that are beyond the control of project participants. The conflict in Yemen has halted most oil and gas production and projects since 2015. In the RII analysis (Table 7), FM3 had the highest RII score of 0.548 among security group factors and ranked sixth overall. FM1 and FM3 are in the red zone in PIM analysis (Table 6), whereas FM2 is positioned in the yellow zone as a moderate influence. Furthermore, SEM analysis (Table 11) supports Hypothesis 13, force majeure-related risk variables have a substantial influence on project performance, with a t value of 36.786 and path coefficient of 0.152. The country’s conflict is also one of the top 10 important causes, according to the report.

In the event of an “act of God”, a party to a contract is released from liability or duty. Unless precisely specified, these behaviors are regarded as unusual events having a low probability of occurring. Force majeure provisions move risk distribution from construction contractors to consumers or other mutual partners. Some studies discovered these force majeure risk variables that influenced project success [87,88,89,90,91] and approved the aforementioned items. The 2011 Arab Spring demonstrations and rioting were a difficult time for project managers in the area, with expatriates leaving, services moving, and a demotivated local populace.

5.2. Evaluation for Effect of Risk Factors in Construction Project Success

The findings of the literature study, statistical analysis, and SEM analysis revealed five categories of impacts caused by risk factors: cost overruns, time overruns, quality effects, failure to accomplish goals, and project termination.

Effect of Risk Factors to Project Time—EF1: Time overruns differ between developing and wealthy nations, as do their causes and influence on project costs. Keep construction projects under budget and time needs good planning, precise execution, and good judgement [65]. EF1 ranked top by mean analysis with 3.917. EF1 also had a high score in the PIM analysis. There is also a substantial association between risk variables and project success in SEM analysis.

Effect of Risk Factors to Project Cost—EF2: The authors of [92] present various risk variables that affect both time and cost. Moreover, statistics show that 47% of overall projects had schedule and expense overruns in Yemen [93]. Cost overruns in construction projects are common, and oil and gas construction projects are no exception. EF2 ranked fourth by mean analysis with 2.755. EF2 also had a high score in the PIM analysis. There is also a substantial association between risk variables and project success in SEM analysis.

Effect of Risk Factors to Project Quality—EF3: According to [22], in both traditional and community-based procurement methods, failure to analyze and manage construction risks may result in schedule and expense overruns as well as substandard constructions. Moreover, based on [94], traditional risk management approaches have failed to help contractors complete projects on time and under budget. EF3 ranked sixth by means analysis with 2.755. EF3 also had a good score in the PIM analysis. Even if the load factor is over 0.4, the link between risk factors and impacts on project success is less significant in SEM analysis; therefore, I need to remove it to enhance EVA for the effect of project success.

Effect of Risk Factors to Failure to Achieve the Project Objectives—EF4: According to [95], risk management increases the likelihood of success and profitability, reduces the impact of hazardous and unpredictable occurrences on project goals, and can grab opportunities. However, every project is unique, with distinct goals and risks to its important aspects; this is especially true if situations and events unknown to occur cause project risks that may damage project objectives [96]. EF4 ranked second by mean analysis with 3.420. EF4 also had a good score in the PIM analysis. In addition, in SEM analysis, there is a substantial association between risk variables and project success.

Effect of Risk Factors to Stop the Project—EF5: According to [97], financial troubles lead to late payments to subcontractors and manufacturers, causing delays and work stoppages. Furthermore, external hazards such as conflict and economic issues might delay or terminate a project if they are not handled via risk management. EF5 ranked third by mean analysis with 2.975. EF5 also had a good score in the PIM analysis. Furthermore, SEM analysis shows a significant relationship between risk factors and project failure.

5.3. Evaluation of the Research Models

This exploratory model may also explain the factor loading of each risk element on the construction project in Yemen. This model also visualizes the causes and impacts of risks in construction projects holistically, filling in research gaps. The study indicates all loading factors over 0.7, while cross-loading demonstrates a good correlation between each item and its group.

Internal risk factors model: There are seven risk categories that affect project success, which can be classified into client risks, feasibility and design risks, tendering risks, resource risk, contractor risk, and consultant risk. Using structural equation modeling, it has been found that all elements with factor loadings greater than or equal to 0.7 explain the relationship between oil and gas construction project risk and success. A result of 0.720 shows a medium R-squared value, but it is really near to the high value necessary for 0.67, which represents the proportion of variance in the dependent variable that can be explained by one or more predictor variables. Furthermore, the Q2 is 0.527 above zero, which shows that the conceptual model can accurately predict the endogenous latent constructs. As a result, the positive correlation shows that the hypotheses H1 through H7 and H14 are valid. In our model, the Goodness of Fit of the Model GoF for internal risk factors’ effect on project success is 0.638 (more significant than 0.36). Beta coefficient (β) is a measure of how strong the link between external and internal latent constructs is between the two. Path coefficients for the research hypotheses test are shown in Table 11 and Table 13. The management risks (=0.213), resources and materials (=0.186), and feasibility study and design risk factors (=0.197) are the most important internal factors related to the impact on project success. These factors require more attention and the development of an effective strategy to respond and mitigate the effects on project costs and schedule.

External risk factors model: In-country economic risks, political risks, local peoples risks, environmental and safety risks, security risks, and force majeure risks were shown to be the six external risk elements affecting project success, according to the statistical analysis. External risk factors and project success in oil and gas construction projects can be explained by factor loading all items above the required value of 0.7, according to the results of the structural equation model. A value of R-squared more than 0.720 is considered to be greater than the high value required by R-squared, which measures the proportion of variation in the dependent variable (or variables) explained by one or more predictor variables. Q2 is also 0.590 higher than zero, indicating that the conceptual model can forecast the endogenous latent constructs. As a result of the positive correlation, H8 to H13, and H15 appear to be valid hypotheses. External risk factors have a significant impact on project success, according to our model’s Goodness of Fit (GOF) score of 0.638.

Figure 8 and Table 11, on the other hand, illustrate the beta coefficient and the path coefficient of the research hypotheses test, respectively. For a project to be successful, it must address and mitigate external risks such as those related to security (0.18), politics (0.233), and economics (0.231). These external risks must be addressed and mitigated in order to reduce project costs and timeliness as well as their impact on the project’s success.

Figure 8.

Path coefficient values for the research model.

6. Recommendations

6.1. Recommendations to the Project Stakeholders

The following recommendations are based on statistically significant SEM for risk variables in oil and gas construction projects. Project scope and goals should be established in detail to avoid ambiguity in project objectives and activities. In the project life cycle, it is critical to clearly outline the risks and obligations of all stakeholders. Recommendations for future researchers and participants:

6.1.1. Client

- To control and monitor risks throughout the project lifetime, the client should design a risk management plan that includes risk identification and reaction strategy depending on the effect of each element.

- The customer (government or oil corporations) must speed up decision making and decrease administrative routine, which slows down project duration.

- Minimize construction project interference, particularly in aspects under contractor authority.

- The customer should be aware that frequent changes in project stages affect project costs and timelines. So, the contractor and the customer must agree on the proportion of adjustments and how to deal with them beforehand.

- Clients should not postpone progress payments based on project length, job progress, and budget.

6.1.2. Contractor

- Hire competent, experienced, and qualified engineers.

- Their personnel should be trained, and workshops should be held to promote a culture of risk assessment and response.

- A long-term supply chain strategy must be created for the project, and supplies must not be delayed.

- The contractor should have a plan to analyze, monitor, and react to the risks he is responsible for.

- Update design drawings, scope of work, and client collaboration to minimize implementation mistakes.

6.1.3. Consultant

- The consultant should be adequately aware of the project needs at the site and follow up any revisions in drawings, designs, and ongoing contact with the client and contractor.

- Prepare quarterly reports to track progress and identify potential delays.

- Manage the contract properly, actively monitor the job, and identify potential project risks.

6.1.4. Government

- Create an enabling environment for the development of oil and gas operations in Yemen as a tributary of the national economy.

- Build roads and infrastructure in Yemen’s oil and gas fields.

- Work to minimize red tape in official transactions and check corruption in oil and gas tenders.

- To expedite decisions on projects, budgets, and government oversight of the oil industries.

- To strengthen the economic and political climate in Yemen for long-term investment.

- Interruption of processes or movement of items due to security failures.

- Coordination with oil and gas corporations to educate and develop local people to manage the industry in the future.

- Prepare strategies to address possible hazards to oil and gas industry projects.

- For future initiatives, the government should require all enterprises to give lessons learned and ideas for future projects.

6.2. Recommendations for Future Research

Project, oil and gas, and risk management are all complex issues in the oil and gas industry. Despite previous research in this subject, to investigate this research goal more deeply, there are still areas for additional research. The following are some suggestions for further research:

- Risk management in construction in Yemen.

- Risk management in private and governmental construction projects in Yemen.

- Research on construction risk management in Yemen concentrating on project categories (construction, road, utility, oil, and gas) to identify distinct hazards associated with each.

- Risk management of construction projects in Yemen is examined from both positive and negative perspectives.

- Further study may be conducted in other nations to allow for comparison studies—between Yemen and other countries—to see how this research’s distinctive contribution can be expanded upon:

- By replicating the study’s approach (using a comparable questionnaire) in different nations to compare results.

- Examine how other nations handle risk in oil and gas construction projects.

- Examine the cause-and-effect connection of risk variables in oil and gas projects abroad.

- Examine how other nations’ proactive and reactive risk management systems compare to Yemen’s.

7. Conclusions

After defining the most significant risks confronting oil and gas construction projects, as well as the importance of these projects to the continued operation and export of oil and gas products, the researcher moved on to the next stage of analysis of these factors to see if they influenced the country’s economy. The development of a model that explains the link between risk variables and the success of oil and gas construction projects was an essential aim of this research.

A partial least square structural equation model was developed based on thirteen main categories or constructs generated through a risk factor analysis test for the internal and external risk factors, and the results showed that the Goodness of Fit index of the model is 0.638. The developed model was deemed to fit because the analysis result of the coefficient of determination test (R2) of risk factors, affecting the success of the oil and gas construction project, was 0.720, which indicates the significant explanation of the developed model for the relationship between the causes of risks and their effects on the success of projects at a high rate. The findings from the model indicate that all categories have a significant effect on project success. The most significant categories in the internal risk factors are project management factors, feasibility of the study design, and resources–material supply with path coefficient values of 0.213, 0.197, and 0.186, respectively. Meanwhile, the most significant categories in the external risk factors are the political factors and the country’s economic and security factors with path coefficient values of 0.236, 0.231, and 0.180, respectively. The developed model was validated statistically (using G power analysis), and the predictive relevancy values were 0.369, 0.590, and 0.527 for the effect of risk as well as internal and external risk factors. Statistical and experts’ validation tests showed that the developed risk factor model had achieved substantial ability in explaining the effect of risk factors on the success of oil and gas construction projects.

Academics, governments, and the oil and gas business companies all gain from the study. This paper, as an intellectual contribution, explains the advantages and disadvantages of each risk aspect found in the oil and gas business. There is a common reaction strategy (response), as well as risk factors that influence the most individuals (client, contractor, tendering, project management, economic, political, security, etc.). This could allow future scholars to investigate other aspects and organizations as well as their influence on other sectors. This study will promote stakeholder engagement and integration throughout the project life cycle. The government may also help oil corporations by organizing additional infrastructure and transportation improvements to the desert’s onshore oil-producing zones (all Yemeni oil sectors are onshore in the desert, and construction projects are part of oil and gas projects stages either upstream, midstream, or downstream). The article also discusses potential government actions to attract and promote investment. The study also analyzes the economic and political dangers that the government faces, as well as offers ideas and solutions to assist it in enhancing the environment for the success of Yemen’s oil and gas activities.

The study stressed that stakeholders in oil and gas construction projects must use risk-mitigation techniques and share responsibilities to reduce dangers. Because of the potential implications throughout the project implementation phase, oil firms must develop plans to track the construction project from the feasibility study and design stage to the stage of bids and contracts. Effective risk management is essential for meeting project deadlines and staying under budget.

Author Contributions

Conceptualization, M.A.K.; Methodology, M.A.K.; validation, M.A.K.; formal analysis, M.A.K., writing—original draft preparation, M.A.K.; writing—review and editing, M.A.K., visualization, M.A.K.; project administration, M.A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Universiti Teknologi Malaysia (UTM) Research Grant Vot No: J130000.7113.05E79.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data sets used during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Acknowledgments

The authors are grateful to Universiti Teknologi Malaysia (UTM) Research Grant Vot No: J130000.7113.05E79 for supporting this research and providing research facilities.

Conflicts of Interest

The authors declare no conflict of interest.

References

- El-Karim, M.S.B.A.A.; El Nawawy, O.A.M.; Abdel-Alim, A.M. Identification and assessment of risk factors affecting construction projects. HBRC J. 2015, 13, 202–216. [Google Scholar] [CrossRef]

- Dziadosz, A.; Rejment, M. Risk analysis in construction project—Chosen methods. Procedia Eng. 2015, 122, 258–265. [Google Scholar] [CrossRef]

- Thuyet, N.V.; Ogunlana, S.O.; Dey, P.K. Risk management in oil and gas construction projects in Vietnam. Int. J. Energy Sect. Manag. 2007, 1, 175–194. [Google Scholar] [CrossRef]

- El-Shehaby, M.; Nosair, I.; Sanad, A.E.-M. Risk assessment and analysis for the construction of off shore oil & gas projects. Int. J. Sci. Res. 2014, 2, 317. [Google Scholar]

- Sweis, R.; Moarefi, A.; Amiri, M.H.; Moarefi, S.; Saleh, R. Causes of delay in Iranian oil and gas projects: A root cause analysis. Int. J. Energy Sect. Manag. 2019, 13, 630–650. [Google Scholar] [CrossRef]

- Kamalirad, S.; Kermanshachi, S.; Shane, J.; Anderson, S. Assessment of construction projects’ impact on internal communication of primary stakeholders in complex projects. In Proceedings of the 6th CSCE/CRC International Construction Specialty Conference, Vancouver, BC, Canada, 31 May–3 June 2017; pp. 1–10. [Google Scholar]

- Doloi, H. Understanding impacts of time and cost related construction risks on operational performance of PPP projects. Int. J. Strateg. Prop. Manag. 2012, 16, 316–337. [Google Scholar] [CrossRef]

- Sultan, B.; Kajewski, S. The Yemen construction industry: Readying the industry for the successful implementation of sustainability. In Proceedings of the International Conference on Smart and Sustainable Built Environment, Brisbane, QL, Australia, 19–21 November 2003; pp. 1–9. Available online: http://eprints.qut.edu.au/164/1/Kajewski_SASSBE.pdf (accessed on 1 May 2022).

- Mubin, S.; Mubin, G. Risk analysis for construction and operation of gas pipeline projects in Pakistan. Pak. J. Eng. Appl. Sci. 2008, 2, 22–37. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial least squares: The better approach to structural equation modeling? Long Range Plann. 2012, 45, 312–319. [Google Scholar] [CrossRef]

- Lowry, P.B.; Gaskin, J. Partial least squares (PLS) structural equation modeling (SEM) for building and testing behavioral causal theory: When to choose it and how to use it. IEEE Trans. Prof. Commun. 2014, 57, 123–146. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar] [CrossRef]

- Dijkstra, T.K. Research essay consistent partial least squares path modeling. MIS Q. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Jun, L.; Qiuzhen, W.; Qingguo, M. The effects of project uncertainty and risk management on IS development project performance: A vendor perspective. Int. J. Proj. Manag. 2011, 29, 923–933. [Google Scholar] [CrossRef]

- Memon, A.H.; Rahman, I.A.; Aziz, A.A.A.; Abdullah, N.H. Using structural equation modelling to assess effects of construction resource related factors on cost overrun. World Appl. Sci. J. 2013, 21, 6–15. [Google Scholar] [CrossRef]

- Pham, L.H.; Hadikusumo, H. Schedule delays in engineering, procurement, and construction petrochemical projects in Vietnam: A qualitative research study. Int. J. Energy Sect. Manag. 2014, 8, 3–26. [Google Scholar] [CrossRef]

- Sultan, B.; Alaghbari, W.E. Priorities for sustainable construction industry development in Yemen. Int. J. Appl. Eng. Res. 2017, 12, 886–893. [Google Scholar]

- Ahmed, R.Y. The effect of risk allocation on minimizing disputes in construction projects in Egypt. Int. J. Eng. Res. Technol. 2016, 5, 523–528. [Google Scholar]

- Banaitiene, N.; Banaitis, A.; Banaitene, N.; Banaitis, A. Risk Management in Construction Projects; IntechOpen: London, UK, 2012; pp. 67–96. [Google Scholar] [CrossRef]

- Zadeh, M.T.; Dehghan, R.; Ruwanpura, J.Y.; Jergeas, G. An index to assess project management competencies in managing design changes. Int. J. Constr. Eng. Manag. 2016, 5, 11–24. [Google Scholar] [CrossRef]

- Mañelele, I.; Muya, M. Risk identification on community-based construction projects in Zambia. J. Eng. Des. Technol. 2008, 6, 145–161. [Google Scholar] [CrossRef]

- Akadiri, O.P. Development of a Multi-Criteria Approach for the Selection of Sustainable Materials for Building Projects. Ph.D. Thesis, University of Wolverhampton, Wolverhampton, UK, 2011; pp. 1–437. Available online: http://wlv.openrepository.com/wlv/bitstream/2436/129918/1/Akadiri_PhD%20thesis.pdf (accessed on 1 May 2022).

- Chien, L.; Chiu, S.; Tseng, W.; Chen, K. Risk assessment of offshore wind-farm construction. In Proceedings of the The 23rd International Offshore and Polar Engineering Conference, Anchorage, AK, USA, 30 June–5 July 2013; Volume 9, pp. 414–420. [Google Scholar]

- Issa, U.H.; Farag, M.A.; Abdelhafez, L.M.; Ahmed, S.A. A risk allocation model for construction projects in Yemen. Civ. Environ. Res. 2015, 7, 78–89. [Google Scholar]

- Lam, K.C.; Wang, D.; Lee, P.T.K.; Tsang, Y.T. Modelling risk allocation decision in construction contracts. Int. J. Proj. Manag. 2007, 25, 485–493. [Google Scholar] [CrossRef]

- Dey, P.K. Project risk management using multiple criteria decision-making technique and decision tree analysis: A case study of Indian oil refinery. Prod. Plan. Control. 2012, 23, 903–921. [Google Scholar] [CrossRef]

- Sharma, S.; Goyal, P.K. Cost overrun factors and project cost risk assessment in construction industry—A state of the art review. Int. J. Civ. Eng. 2014, 3, 139–154. [Google Scholar]

- Nasirzadeh, F.; Khanzadi, M.; Rezaie, M. Dynamic modeling of the quantitative risk allocation in construction projects. Int. J. Proj. Manag. 2014, 32, 442–451. [Google Scholar] [CrossRef]

- Cagliano, A.C.; Grimaldi, S.; Rafele, C. Choosing project risk management techniques. A theoretical framework J. Risk Res. 2015, 18, 232–248. [Google Scholar] [CrossRef]

- Abdelgawad, M.; Fayek, A.R. Risk management in the construction industry using combined fuzzy FMEA and fuzzy AHP. J. Constr. Eng. Manag. 2010, 136, 1028–1036. [Google Scholar] [CrossRef]

- Aven, T. Perspectives on risk in a decision-making context—Review and discussion. Saf. Sci. 2009, 47, 798–806. [Google Scholar] [CrossRef]

- Rodhi, N.N.; Anwar, N.; Wiguna, I.P.A. A review on disaster risk mitigation in the oil and gas project. In Proceedings of the IOP Conference Series: Earth and Environmental Science, the 4th International Seminar on Sustainable Urban Development, Jakarta, Indonesia, 9–10 August 2017. [Google Scholar] [CrossRef]

- Chaher, Z.; Soomro, A.R. Facilitate risk management in construction process by using hierarchical risk breakdown structure. Int. J. Sci. Res. Publ. 2016, 6, 703–709. [Google Scholar]

- Choudhry, R.M.; Aslam, M.A.; Hinze, J.W.; Arain, F.M. Cost and schedule risk analysis of bridge construction in Pakistan: Establishing risk guidelines. J. Constr. Eng. Manag. 2014, 140, 04014020. [Google Scholar] [CrossRef]

- Tah, J.H.M.; Carr, V. Information modelling for a construction project risk management system. Eng. Constr. Archit. Manag. 2000, 7, 107–119. [Google Scholar] [CrossRef]

- Yildiz, A.E.; Dikmen, I.; Birgonul, M.T.; Ercoskun, K.; Alten, S. A knowledge-based risk mapping tool for cost estimation of international construction projects. Autom. Constr. 2014, 43, 144–155. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Using probability impact matrix (PIM) in analyzing risk factors affecting the success of oil and gas construction projects in Yemen. Int. J. Energy Sect. Manag. 2019, 14, 527–546. [Google Scholar] [CrossRef]

- Gamil, Y.; Rahman, I.A. Assessment of critical factors contributing to construction failure in Yemen. Int. J. Constr. Manag. 2018, 20, 429–436. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Using relative importance index method for developing risk map in oil and gas construction projects. J. Kejuruter. 2020, 32, 85–97. [Google Scholar]

- Forteza, F.J.; Carretero-Gómez, J.M.; Sesé, A. Effects of organizational complexity and resources on construction site risk. J. Safety Res. 2017, 62, 185–198. [Google Scholar] [CrossRef] [PubMed]

- Yimam, A.H. Project Management Maturity in the Construction Industry of Developing Countries; University of Maryland: College Park, MD, USA, 2011. [Google Scholar]

- Salleh, J. Critical Success Factors of Project Management for Brunei Construction Projects: Improving Project Performance. Ph.D. Thesis, Queensland University of Technology, Brisbane, QL, Australia, 2009. [Google Scholar]

- Chandra, H.P. Structural equation model for investigating risk factors affecting project success in Surabaya. Procedia Eng. 2015, 125, 53–59. [Google Scholar] [CrossRef]

- Falamarzi, A.; Moridpour, S.; Nazem, M. A review on existing sensors and devices for inspecting railway infrastructure. J. Kejuruter. 2019, 31, 1–10. [Google Scholar] [CrossRef]

- Samarah, A.; Bekr, G.A. Causes and effects of delay in public construction projects in Jordan. Am. J. Eng. Res. 2016, 5, 87–94. Available online: https://www.ajer.org (accessed on 8 February 2019).

- Sambasivan, M.; Soon, Y.W. Causes and effects of delays in Malaysian construction industry. Int. J. Proj. Manag. 2007, 25, 517–526. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Structural modelling of internal risk factors for oil and gas construction projects. Int. J. Energy Sect. Manag. 2020, 14, 975–1000. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Theoretical review on critical risk factors in oil and gas construction projects in Yemen. Eng. Constr. Archit. Manag. 2020, 28, 934–968. [Google Scholar] [CrossRef]

- Njogu, P.M. Assessment of Effects of Construction Risks on Project Delivery among Contractors in Kenya. Ph.D. Thesis, Jomo Kenyatta University of Agriculture and Technology, Juja, Kenya, 2015. Available online: http://ir.jkuat.ac.ke/bitstream/handle/123456789/1798/Peter%20MSc%202015.pdf?sequence=1&isAllowed=y (accessed on 1 May 2022).

- Graves, R. Qualitative risk assessment. Proj. Manag. Inst. 2000, 14, 61–66. Available online: https://www.pmi.org/learning/library/qualitative-risk-assessment-cheaper-faster-3188 (accessed on 1 May 2022).

- Mander, J.B.; Dhakal, R.P.; Mashiko, N.; Solberg, K.M. Incremental dynamic analysis applied to seismic financial risk assessment of bridges. Eng. Struct. 2007, 29, 2662–2672. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach to Structural Equation Modeling. Modern Methods for Business Research; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Hair, J.F.J.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Elsevier: Amsterdam, The Netherlands, 2014. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modelling. Handb. Mark. Res. 2017, 26, 1–40. [Google Scholar]

- Zhao, X.B.; Wu, P.; Wang, X.Y. Risk paths in BIM adoption: Empirical study of China. Eng. Constr. Archit. Manag. 2018, 25, 1170–1187. [Google Scholar] [CrossRef]

- Kloppers, C.; Hirst, R. Conducting labour risk audits and implementing a labour risk management programme in order to create and maintain labour stability. In Proceedings of the Middle East Health, Safety, Security, and Environment Conference and Exhibition, Manama, Bahrain, 4 October 2010. [Google Scholar]

- Rahman, I.A.; Memon, A.H.; Azis, A.A.A.; Abdullah, N.H. Modeling causes of cost overrun in large construction projects with partial least square SEM approach constructions perspective. Res. J. Appl. Sci. Eng. Technol. 2013, 5, 1963–1972. [Google Scholar] [CrossRef]

- Randhawa, J.S.; Ahuja, I.S. The moderating effect of project risk mitigation strategies on the relationship between delay factors and construction project performance. J. Sci. Technol. Policy Manag. 2017, 21, 191–206. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Assessment of the effect of external risk factors on the success of an oil and gas construction project. Eng. Constr. Archit. Manag. 2020, 27, 2767–2793. [Google Scholar] [CrossRef]

- Kim, H. A sample size calculator for SMART pilot studies. SIAM Undergrad. Res. Online 2016, 9, 229–250. [Google Scholar] [CrossRef]

- Sekaran, U.; Bougie, R. Research Methods for Business: A Skill-Building Approach. 2010. Available online: https://books.google.com.my/books?hl=en&lr=&id=Ko6bCgAAQBAJ&oi=fnd&pg=PA19&dq=Sekaran,+U.,+%26+Bougie,+R.+(2010).+Research+Methods+for+Business:+A+Skill+Building+Approach.+London:+Wiley.&ots=2B2LT4LZmL&sig=Ag9yzsNyyO2IMHXG1su5pfbY5eM&redir_esc=y#v=onepage (accessed on 14 February 2019).

- Xiong, B.; Skitmore, M.; Xia, B.; Masrom, M.A.; Ye, K.; Bridge, A. Examining the influence of participant performance factors on contractor satisfaction: A structural equation model. Int. J. Proj. Manag. 2014, 32, 482–491. [Google Scholar] [CrossRef]

- Famiyeh, S.; Amoatey, C.T.; Adaku, E.; Agbenohevi, C.S. Major causes of construction time and cost overruns: A case of selected educational sector projects in Ghana. J. Eng. Des. Technol. 2017, 15, 181–198. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Evaluation of risk factors affecting on oil and gas construction projects in Yemen. Int. J. Eng. Technol. 2019, 8, 6–14. [Google Scholar] [CrossRef]

- Deng, X.; Low, S.P.; Zhao, X.; Chang, T. Identifying micro variables contributing to political risks in international construction projects. Eng. Constr. Archit. Manag. 2018, 25, 317–334. [Google Scholar] [CrossRef]

- Hulland, J.S. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Kock, N. Hypothesis testing with confidence intervals and P values in PLS-SEM. Int. J. E-Collab. 2016, 12, 1–6. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Taylor and Francis: Abingdon, UK, 1988; pp. 1–3. [Google Scholar] [CrossRef]

- Hussain, S.; Fangwei, Z.; Siddiqi, A.F.; Ali, Z.; Shabbir, M.S. Structural equation model for evaluating factors affecting quality of social infrastructure projects. Sustainability 2018, 10, 1415. [Google Scholar] [CrossRef]

- Henseler, J.; Sarstedt, M. Goodness-of-fit indices for partial least squares path modeling. Comput. Stat. 2013, 28, 565–580. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Evaluation of risk factors affecting time and cost of construction projects in Yemen. Int. J. Eng. Technol. 2018, 8, 168–178. [Google Scholar]

- Jarkas, A.M.; Haupt, T.C. Major construction risk factors considered by general contractors in Qatar. Eur. J. Mark. 2015, 24, 41–49. [Google Scholar] [CrossRef]