Abstract

The concept of a ‘business model’ refers to a collection of descriptions that highlight the most significant aspects of the business. The metaverse is already a reality that can be considered plausible; it is a digital world that can be accessed by various technologies, such as virtual or augmented reality, and it is a place in which people are able to communicate and collaborate with one another. Businesses are making an attempt to capitalize on a trend, since it is anticipated that the metaverse will become more decentralized in the near future because it provides outstanding possibilities for expanding business. In this article, we discuss a few aspects of the current business model, as well as the emergence of the metaverse and their influence in the existing business models, with emphasis on the fashion and retail industry. Users of the metaverse have the ability to personalize digital representations of themselves, known as avatars. These avatars may be utilized in virtual worlds, online games, and other types of online communities. The way advertising works in the metaverse is quite similar to how it operates in the real world. Because of this, there is a promising future in store for the future of marketing and advertising in the metaverse. The new virtual environment will inspire us to devise novel formulae and procedures, which will influence the user in previously unimaginable ways. In addition to that, the possibility of the metaverse becoming connected with generation Z (also known as gen Z) would be additional advantages that will help the company’s bottom line in the decades to come.

Keywords:

industry 5.0; metaverse; business model; blockchain; gen Z; IoT; NFT; data economy; fashion; textile 1. Introduction

The term “metaverse” is well known these days and it describes a realm that is rapidly developing and already holds the significant potential to transform the ways in which we work, live, and play. The term “metaverse” is used to refer to the integration of virtual reality (VR), augmented reality (AR), and mixed reality (MR) into our everyday life [1]. Early users say it will transform radical shifts in many sectors, including but not limited to retail, sales, marketing, training, education, and healthcare. The concept has traditionally been linked to computers and video games; when Facebook changed its name to Meta, it brought the metaverse to the attention of the public [2,3,4,5]. In addition, Google has been working on its own method of bridging the gap between the digital and physical worlds, by employing AR. Even Microsoft has made major investments in the development of virtual workspaces and working environments. VR and gaming are likely the two areas in which most people are aware of its involvement. However, what precisely is meant by the term “metaverse” [2,6], and how can this term affect the way businesses operate in the future?

People had the idea that the metaverse was designed for things, such as gaming and entertainment as well as engagement. The integration of various forms of technology, such as NFT, cryptocurrencies, blockchain, IoT, artificial intelligence, and machine learning, will be beneficial to the metaverse as a platform business model.

One of the primary purposes of the metaverse, from a business aspect, is to increase communication between people and businesses [7]. The metaverse will allow users to build their own avatars and explore diverse locales while connecting with other people nearby. People who can create an avatar will be able to feel more immersed in their experience, rather than simply watching from their computer screen, as they would a movie or television show [8]. This will allow them to feel as though they are participating in the event. It also creates new chances for businesses because firms can now communicate directly with clients through their avatars, rather than depending on traditional marketing tactics, such as print advertising or television commercials [9]. This is an advantage over the previous situation.

In light of the aforementioned competitive threats, both pipelines and platforms are pushed to consider adopting some of the defining characteristics of each other’s business models. While there are several examples of pipeline and platform businesses adopting each other’s business model characteristics, academic research on this topic is nascent. Specifically, there is a lack of research on the factors that enable or impede the movement between and/or adoption of characteristics across different types of business models. Thus, the purpose of this article is to examine the pathways for pipelines to adopt and integrate platform business models and vice versa for platforms, which we refer to as the convergence of business models. In this article, we define the convergence of business models as a phenomenon in which a firm transition from one type (i.e., either platform or pipeline) to a more integrated business model that adopts features from the other type. This shift in the business model allows a firm to develop and/or diversify its business by using pipeline and platform characteristics and integrating them in a synergistic manner [10,11]. This article provides a comprehensive discussion of the current business models by identifying, characterizing, and defining the phenomenon known as convergence with the further discussion on how the metaverse impacts the future business model. In addition, it discusses how the meta will synchronize their different layers, such as NFT, blockchain, and NFC. The business models are shaping into a digital format where there are only a few retail value chains, such as fashion and shoes, which have complicated structures and infrastructures, and need more technological layers to achieve this digital transformation for business transparency and data, that is provided by the IoT experience, provided by VR/AR/XR devices. The blockchain is for information and financial layers. In this paper, we will discuss in depth the possibilities for how the metaverse may become the platform for retail businesses.

2. Current Business Models

Over the last decade, the global economy has seen an explosion in the number of platform firms, particularly those that provide assets and other resources on a peer-to-peer (P2P) basis [12]. Consumers today are accustomed to renting houses from their peers on Airbnb, sharing a trip via Uber, borrowing (i.e., peer-to-peer clothing rental) luxury garments via Tulerie, and dining with local hosts. The platform business model is built around technology-enabled connectivity between service providers and customers, as well as a platform provider who orchestrates the value co-creation throughout the whole ecosystem. A business model is a supportive policy that outlines how a business will generate revenue. The model defines how a company will take its product, advertise it, and generate sales. A business model decides what things a firm should offer, how it should market its products, who it should strive to cater to, and what income streams it may expect. Business models have evolved in many shapes and phases, which we discuss in this article.

- a.

- Pipeline business model;

- b.

- Product platform business model;

- c.

- Industrial platform and multi-sided business model;

- d.

- Interaction field business model and multitude business model.

2.1. Pipeline Business Model

A pipeline business model is a traditional value chain in which parts or goods enter a system and are transformed through a linear process into a final product that reaches the customer, such as grocery stores, tailor shops, and McDonald’s, where producers produce goods operating in a buyer and supplier relationship, change of ownership after a sale, whatever the feature that delivers the customer benefit, deliver a product feature to exchange of money (Figure 1). The competition will be based on product features and cost, R&D, and the contemporary use of products and their demand. Here, the number of transactions (transactions involving both money and documents) is way too small. The supplier-bank-producer-bank-customer chain is very short, and the amount of data and money transferred through this process is very slow [13]. There is not much pressure in the system to catch up on trends or to reach the market quickly and on time. Traditional ledgers in notebooks/paper bills/paper contracts have been exchanged and each party has signed it physically, in order to move the short supply chain activity with more cash handling in this model.

Figure 1.

The pipeline business model.

2.2. Platform Business Models

A product platform means a family of products, based on a similar architecture that will typically contain many common parts and product specifications. Product platform producers produce goods operating within a network of suppliers, change of ownership, co-develop with a network of suppliers, and deliver value to customers. Products exchanged for money is a single revenue stream business. Globalization begins in this era of manufacturing product platforms which are created in different locations and in different market segments, using the competitive advantage mechanism of the platform business. This involves different business strategies, and it helps speed development, reduces costs, and contributes to increasing product variety. A lot more engineering is involved in this product platform business model. Analysis of products from the product development space narrows down the interfaces/subsystems from a common structure to create derivative products that are efficiently planned with the intention to bring a lot of advantages to the costs and product families [13].

The big move that comes from the product platform is the automation in the platform, which is the economy of scale. The initial product platform labor to machine ratio is 90:10, 90% of product platform manufacturing is carried out by manual labor firms who depend on the repetitive efficiency of an organized workflow/one person one operation, through time efficiency that reaches the peak operator and the firm that benefits from 10% of the work that is mechanized/electrified. When the product platform works in the fundamental network of suppliers and the engineering work demands the digital support of the supplier for the detail specific product/cost/time/delivery. In manufacturing, the operational efficiency, operator efficiency, raw material stock warehouse monitoring, and cash flow can be maintained by the books and manual ledgers [13,14].

Software programs have been solving major issues, such as data entry and data collection, and the recollection of the amount of data produced during manufacturing helps the firm to review, revisit, and improve the product, the process, and the cost. With help of the data produced by the firm, the standardization and modularization of products and product platforms is visible to the firm [15]. The visibility brings the possibility of more automation in this era of a product platform.

Example of a Product Platform: Sony Mirrorless Camera Case Study

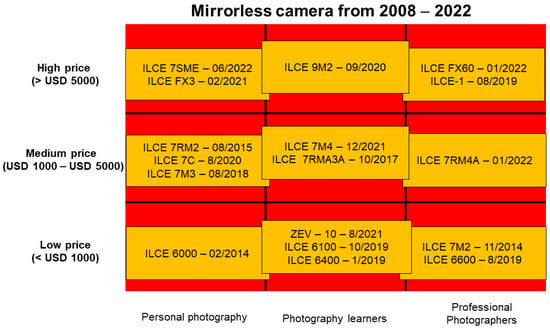

Sony is a leading camera manufacturer that provides customers with meaningful innovation when launching a product and product families at the right time, in the right segment without affecting the design architecture and platform architecture. The timely revisiting of the product families and platform renewal makes Sony a universal brand that keeps its identical market share in sound systems, TVs, cameras, and other products. Here in this case study, we De-code Sony’s mirrorless camera platform decision and architectural approach in manufacturing and product design commonalities [16,17,18].

Sony launched 20 different models between 2008–2022 with different market segments, in an interval period of 2–2.5 years (Figure 2). Most of the models are launched in medium- to high-end market segments with different segments of users [19]. Product platforms with a high commonality of components and elements (e.g., keeping monitor sizes the same, sharing sensors and autofocus features, creating variants in pixels and motion capture, kinds of sensors) shows that the product platform business runs well. Sony produces one of the best mirrorless cameras. Without changing the platform architecture, it creates variants and differentiations that run on a successful product platform.

Figure 2.

Sony mirrorless camera segment from 2008–2022.

Product platform frictions or interfaces can’t be handled as a pipeline platform with manual documents and cash. Since the product platform moved the product sales and the buy and sell became global, competitive advantages play a key role, where most of the apparel is produced in Asia; music instruments are manufactured in Italy; regeneration fibers are produced in Europe; bananas are produced in the Equator. The exchange of raw material for products to multiple supplier networks, has different standards of products and protocols and business standardization documents, that are exchanged in digital format, with banks involved in the contracts and the transfer of money exchanged from country to country by cheque, swift, and banking processes.

2.3. Industrial Platform/Multi-Side Platform Business Model

Conceptually, these are differentiated multi-sided platforms from other organizational forms that involve two or more transaction partners and highlight the different streams of the platform. Multi-sided platforms are intermediaries for value exchange between two or more market users and producers. The multi-sided market is dependent on enabling the interaction between different sides of the market. Each side seeks platform access to the participants on the other side [14,20].

2.3.1. Multi-Sided Platform Examples Are Amazon, eBay, Uber, and Airbnb

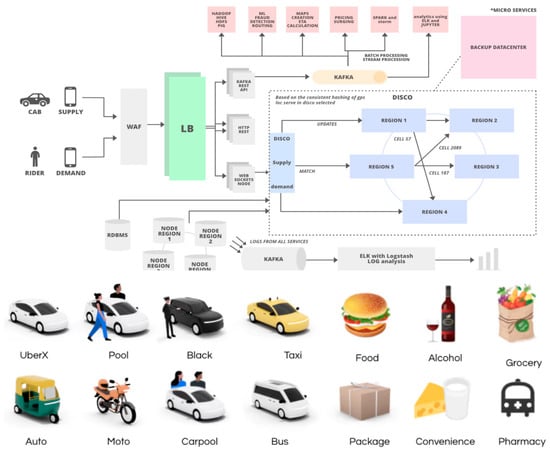

A multi-sided platform core is a digital infrastructure rather than a physical infrastructure. In the previous section, we see how the product platform handles the network of a supplier, in order to create a product and how the firm makes its revenue and profit. Now, when it comes to the multiple-sided market, everything happens in the network and one platform handles the multiple transactions of data and money [21,22]. The Uber Network includes, restaurants, the mobilization of goods, the mobilization of humans, independent driver contractors, independent restaurant contractors, and the direct connection of businesses and consumer. The Uber business model and their business expansion is well described in Figure 3.

Figure 3.

Uber business model and their business expansion.

The mobile networks and built-in location devices (IoT) bring leverage to businesses in another key part of this multi-sided market with transactions recorded and a huge amount of data created to forecast the demand and supply for digital payments that are mandatory, to use 80%. When a customer/user orders a product or requests transport from one location to another, the digital contract has been agreed and monetized price will be the sale or the price agreed by both parties, to proceed without a bank or 3rd party friction, to increase trust, safety, security, traceability, and transparency in a digital multi-sided market. Even a multi-sided market has other issues, such as privacy or other complexities that brings value to the users, and the higher exponential growth potential of this market is unstoppable [23,24,25].

2.3.2. Example: Uber Is a Multi-Sided Platform Business Model

Uber is built on an industrial platform, such as the android Google Play Store, or other app store, which are both open sourced to build any software application or open-source industrial platforms to provide API/user interfaces [26]. The application layer of Uber exponentially changes the business. Handling multiple sides of the market and engaging customers and businesses, drivers, and customization make things easier and affordable for customers, while using the application infrastructure to connect multiple products and multiple segments. Network power decides the platform performance of the buyer, seller, rider, and driver of the different products and product lines, maintaining the birth and death rate of the network, using different promotional offers and incentives, and sharing strategies with customers. The key takeaway in a multi-sided market is:

- High demand for mobility;

- High demand on the network;

- High demand for data;

- Storage of data;

- Instant contract;

- Executions;

- Digital payments;

- On-demand services.

2.4. Multitude Platform Business Model

This is a revolutionary way to create shared value for a business, customers, and society, by using the blockchain technology to connect different sides of one single sector of business. Here is an example of a multitude of business models from John Deere (No UI). It is a traditional manufacturing company that assembles big machines in factories, based in the United States. It has a corporate hierarchy, and the primary customers are farmers. Furthermore, with its services for the government, the military, and construction, as a big network of dealers and parts suppliers around the world, John Deere is the first company to adopt the distributed ledger technology (blockchain). John Deere offers tractors, harvesters, balers, mowers, foragers, and tillage equipment for crop care [27]. Using the technology built into the above equipment with IoT, Wi-Fi and Bluetooth, it facilitates communication between the farmland, cloud computing, and storage. The cloud shares the data between the Deere dealers and software providers of the equipment in a “two-way communication that tells the machine what to do”.

The multitude model is first the nucleus, which comprises the direct users and buyers of the offering, the second is an eco-system partner, in this case, the eco-system partners are interdependent seed producers. Perhaps if Deere shares data with the seed producer, they will improve the seed performance, efficiency, and the yield quality. They add value to the first nucleus without being involved in the system directly, yet still the work is paid for when they sell the seed to a farmer. The third category of participants is market makers (i.e., individuals/entities-public/private) who influence the multitude of platform examples, such as the US Department of Agriculture (USDA), that sets regulations and provides subsidies. This effect can be produced by sharing data. The first nucleus acquires benefits, then, the fourth category of students at universities and research labs who are exposed to data, have the real-time field study that brings more research value to the farming yield and the farming sector, to the food and beverage making companies, food processing companies, and the health care industry in the USA. The food and nutrient industry is public and private and is also included in this multitude of business models, to bring value to the nucleus [27,28,29,30].

Collecting data from vehicle telecommunication software, management software of a “farm sight” supervised autonomy (i.e., self-driving tractors) brings automatic seeding, plating, and watering from distances [31]. The all-around smart management field preparation, soil plating treatment, harvesting, and provides precision agriculture practices. Now, farming becomes a data-driven industry, and the expenditure on technology applications, such as AI-machine learning, GPS, computer vision cameras, and predictive analysis of land farms and weather, using this technology, achieve the best result of each seed precision usage of the fertilizer and the calculated yield, taking away:

- Communication between the supplier of equipment to research students is friction-less in this sector;

- Eco-system levers have been organized well, and those who can access that data have been clearly defined;

- Each participant brings value to the agriculture sector;

- All product suppliers benefit (i.e., seed producers/fertilizer manufacturers).

The overall quantity of data for the money transactions and their decisions is enormous, and if it is managed by a blockchain, there will be less friction in the online transactions. Using blockchain technology, John Deere has achieved business-to-business (B2B) and business-to-customer (B2C) services, and the whole supply chain has been connected and well-established by these shared business models [21].

3. Metaverse Is a New Platform Business Model

Going through this, we have seen how industry platforms merge, the product platform business, and the pipeline platforms together with a digital infrastructure to create a multi-sided platform business, to make product and service businesses more efficient and economical, sustainable, transparent, secure, and safe. Apart from these key examples, we are aware that there are 100s industries and sectors where this technology can be mapped perfectly. Retail and fast-moving consumer goods (FMCGs) are different industries where the customer experience and one size does not fit all complications are involved. The metaverse platform using blockchain technology merges the product platform, industrial platform, and the multi-sided platform with each component in the digital layer under one roof to create multiple interaction business models, built on mature distributed ledger technology to use in case the blockchain is huge, starting from cryptocurrencies, such as Bitcoin, to now real industrial use cases, that are termed commercially web3.0, or decentralized autonomous organizations (DAOs) [32].

Blockchains connect the business layer and user experience layers/user interaction layers, using 3D immersive technology, such as AR/VR devices. On-demand manufacturing is achieved by the multi-sided market, at a certain level, but still those are limited to sectors that are not flexible for all, such as health care, insurance, retail, FMCGs, education products, and services [33]. Metaverse business platforming models are bridged with flexibility for all business models.

The product platform has different layers of connection and interfaces, from the raw material to the finished products, which have various processes, quality monitoring, operations, and logistics, and the financial process, that must all be involved, when our platform is digital and the infrastructure implanted inside this product platform supply chain comes under the traceable (i.e., the process, quality, operation, financial, the logistics, even chemicals) product, it leads to the digital, expressed in the digital twin. The industrial digital platform brings digital twins into finance as a token or non-fungible tokens (NFTs), design, customer experience, and customer engagement [34].

Many brands and retailers are entering digital twins into their products now, to prepare for the next-generation buyers, and pro-consumers, and there is a reason why they are pro-consumers. Generally, consumers consume products that won’t be a part of the product design process or the financial process of the brand or product. Nowadays Gen-Z (i.e., generation Z) wants to be a part of the process, loyalties, and engagement. They have been participating actively in the development of the product, which enables them to presently be considered as a pro-consumer. When a pro-consumer regularly buys the same brand pair of sneakers, he/she is a true fan of the specific brand, the brand engages them with the design of its digital products and the running of a community vote. The pro-consumer does vote (i.e., these brands call it a community) and out of 10, these communities vote for two or three products, the top two or five, depending on the volume of voting and the voting rights shared by a community [35,36].

Let us say that this product is designed by a particular designer. Brands will expose the name of the designer and release NFTs for sale with all of the data of the product. NFTs are created by digital partners (i.e., for Nike, it is RTFKT) or some brands acquire a digital company. These NFTs are sold in a marketplace (i.e., open sea, super rare, variable) [37]. Following the vote (in a community, they call it the white list participants), a random selection of people will be eligible to collect NFTs. Selected digital products have been scheduled for a launch date in the marketplace, and the digital goods have been launched, as per the scheduled time and date.

Pro-consumers buy these NFTs by connecting their digital wallet, using an Ethereum (ETH) address, once they have acquired the digital ownership and the authentication is transferred to the wallet, they can use this digital product in their own digital avatar in digital universes (i.e., metaverse, Decentraland, Sandbox), and can even wear your AR application. This ownership is eligible to redeem physical products and these physical products are connected in near-field communication (NFC) chips, which can be traced when and where the mobile applications are used. Here, the pro-consumer can grant the manufacturer open data access, and they will receive a payment to their wallet as one method of gaining royalties in points or USDC (i.e., digital currency). Another method of NFTs are pro-consumer purchases that will lead to the next product launch offering, event priority, or ticket (sports/music) offering. While trade with other post-consumer NFTs has been locked and in escrow (i.e., the smart contract has been made), pro-consumer payment has been locked in the agreed amount of pro-consumer chips of the physical goods. The post-consumer has received a product and scan, after the audit conditions, to meet the smart contract that will be executed, and the locked funds have been transferred to the pro-consumer [38].

Moreover, the digital product creators will be obtaining royalties each time the pro- and post-consumers trade, as some percentage of the money will be shared between the creator/brand/marketplace, so this is not a one-time buy-and-sell mechanism of business, it has a multiple product life cycles and benefits. This is the customer side of the brand-to-consumer interactions and financial benefits. The bottom layer of this meta-economy demands a lot of technology and a deep understanding of knowledge gaps that need to be filled in operational and digital transformations. The front-end meta economy has experimented with luxury goods and services (i.e., sports and music and other industry NFTs that are working in a similar way and emerging in business models).

3.1. Manufacturing NFTs

Between the pro-consumer and manufacturing, there is only one connection when the pro-consumer allows data access to the manufacturers. This will help manufacturers to improve the product life cycle, in real-time, and improve the quality of the feature products or derivative products. To improve the performance of manufacturing, real products makers need to create an ecosystem to meet the expectation of pro-consumers and brands. Now it is possible to create an ecosystem. When there are 100s of suppliers and 100s of raw material, the quality and price will fluctuate around the globe. When we approach the ecosystem with a competitive advantage, it won’t be a good idea for any manufacturers. However, when we approach the ecosystem for circular fashion, retail, and sustainable initiative, it works better with a perspective of the sharing economy that can handle that with clear ecosystem definitions [39,40,41]. This, we call ecosystem empowerment. Here, there is no buy-and-sell concept of shared economy of value, scale economy.

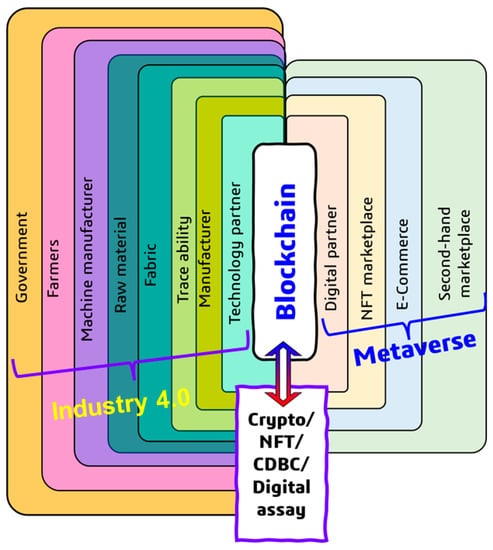

3.2. Ecosystem/Multiple Business Models

Multiple business models work in a sharing economy model and with information and traceability, technology supports driving the different levels of purpose and perspective to bring real skin to the game, which is a key in a multitude of business models (Figure 4). Here we will explore the fashion retail business as an example.

Figure 4.

Multitude business ecosystem.

- Fundamental layer of a multitude of businesses in digital and blockchain, with trust, transparency, unchanging, decentralized nature, and fewer human interventions.

- Each layer will be built on a blockchain, and the integration brings connectivity, trust, and transparency in real time, by making the workflow hierarchy more efficient, it will be monetized and the decisions are data-driven, bringing efficient business models active and engaging on all sides of the markets and system within a nucleus.

NFTs are more engaging customers and keeping the true loyal customer benefit in different ways, such as ticking events, music concerts, or metaverse access or limited version whitelisting participation, bringing more loyal customers into a multitude of business models, building one side of participant to make the other side of manufacturers and producers more attracted to join the nucleus. Even NFTs can be sold as fractions and regain the finance, renting NFTs that are covered by fintech (i.e., financial technology, security, NFT marketplaces such as OpenSea, CryptoPunks).

NFC is one of the kinds of IoT, which connects physical goods and digital products in the real-world to make them accessible with authentication and identity. These NFC chips have been attached to physical goods to trace the usage, collecting the real-time data on the stress and stretch of products and the resale purposes of these technologies are more interactive with the second-hand marketplace, and the life cycle assessment data storage. NFC is the IoT, which has active and passive connections, using different layers of technology, using cloud storage and operating systems. In the end, these NFC-connected garments or products are sent back to recycle the fiber or to disposal firms, companies, and brands to have a clear data of the contents and components inside the products, to run an efficient recycle process in a cost-effective way (data). A brand’s multitude of business models starts acquiring two key things about product management:

- Recycle;

- Digital partner;

- Raw material;

- NFT;

- Blockchain.

Multiple business models have more than 40–50 interactions, and to deliver a product in this challenging digital era, one single brand or investor cannot focus or own all of the 40–50 companies under one roof, in order to make a vertical setup, due to the geographic and financial viability within a product’s multitude, as there are different levels of the nucleus. Brands or product platform businesses are focusing on key customer engagement portfolios of metaverse partners, such as Roblox, Decentraland, and Sandbox, to engage customers in different levels, such as parties, events, product launches, and fashion shows, the kind of events that engage the customer to have active users, in order to be part of it and to make the consistent user experience. When a store is open in physical conditions, the entering and exiting a store is monitored by visual merchants. However, when it comes to the metaverse, any digital platform, such as an online sale or e-commerce clicks, views, and likes, calibrates the product potential.

Now, in the metaverse, key calibration is an interaction of a customer with the brand’s daily engagement (i.e., birth and death rate of the users). Since the metaverse is an open world, where we have multiple brands and games available in the meta ecosystem, our product interaction needs more engaging factors to bring the customer’s interaction with products at a higher level of co-creation, modification, and digital skins. Those who actively engage, gain rewards in points, digital skins, and cryptocurrencies. To bring more engagement in the metaverse, brands need a lot of design and graphic work in brand building the metaverse, so a digital partner is key. Just as Nike has acquired RTFKT, Tommy partnered with Ready Player Me, and most of these digital companies are gaming in nature since this is the era of gaming and e-sports. There is another opportunity for brands to sell their digital designs in the gaming sectors or to provide these brand designs as a reward for winning a game or an event. Since the metaverse has a higher potential than in other sectors, from a virtual office to a digital twin. These gaming companies have more affinity towards reputable brands to interact and partner with, in order to build their digital values at a higher level, it is the so-called network effect. When digital partners, such as RTFKT, ready players who work on one side of the market, who are on average 15–18-year-old, these brands of the two-sided market bring up the average age group they interact with to 25–35-year-old customers, there is more volume of customers and more network effect and vice versa, for the brands. Brands will be more familiar with the digital world of young generations than ever before because brand interaction with the network will go down from a 25-year average to 13–15 years, and this helps brands to increase the customer base and network effects [37]. Through the metaverse platform, customers have an in-store experience and immersive experience, and co-creation activities are going to be the key attractive facts for those Gen-Z (i.e., the growing workforce and spending power), and alpha (i.e., game players).

The raw material is a key for the products, product quality, the life cycle of the product, and product management in a platform of sales. Therefore, brands focus on the other side of the key components and price, and sustainability control over raw materials brings a lot of value in this multitude of businesses and have more control over the cost and quality of the products along with traceability. Brands using reduced quantities of virgin cotton and who bring policies for manmade fiber compositions and for recycling polyester (but recycling polyester generates more microplastics [42]) utilize the improvements of these kinds of initiations and acquire and partner with the different fiber and recycling partners, such as, for example Renewcell [43] that produces circulose, supplying both customers and recycle brands, the firm replaces existing virgin fibers with recycled fibers to bring more sustainable fashion products in the real-world. The benefits of this type of manufacturing are:

- Fashion supply chain;

- Technology (i.e., software for the product life cycle assessment, 3D designs, impact assessments, life cycle costing);

- IoT machine manufacturers (i.e., machines for fiber, yarn, fabric, dyeing, and garment manufacturing);

- Traceable chemicals and fibers (i.e., for the entire fashion supply chain);

- Blockchain.

In the past era of semi-digital and software base manufacturing, the supply chain integration has less trust and transparency, leading to business instability and more speculation. The current era of blockchains brings more confidence and predictable forecasts in the supply chain. Manufacturers work with different parts of the value chains, and raw material policies and align with customer expectations of fabric and fiber contents. Technology, such as a machine, and the processes are driven by automation and predictive maintenance, and advanced technologies, such as the use of less water, low impact chemicals, high performance, and low-cost driven chemicals bring into manufacturing to creation of a sustainable product, in terms of sustainability in the environment and cost [44].

The traceability of products in manufacturing, from fabric to products online and product quality, using digital infrastructure, such as inspectorates. Training and machine maintenance using a digital twin is a possible example of one operation of each manufacturing machine suppliers who have a different country and zone training team which increases the cost of the product and service. Now, N-number companies can be trained in one single platform of the metaverse using digital twins. Generally, digital twins have been misunderstood as a different technology or holographic. This term has been defined, depending on the place it is used. For example: the 3D design of any apparel or sneaker is a digital twin of that product. Similarly, even factories can be stimulated as a digital twin in live synchronization, which consumes high computer and network power. Digital twins are a more interactive and efficient way to understand the operating machine and to achieve the correct, high performance. Inventory management when the metaverse is a first touch point for a real end user accessing the end-user interaction data manufacturers, has two kinds of data available. The amount of demand and creation of the orders, those accurate data will reduce the inventory of raw materials and excess stocks. This will lead to a demand, based on the manufacturing of other challenges that come to manufacturers, to see how fast they can produce and deliver to the end user with quick logistics and quality assured. When we come to the next set of the supply chain, the fabric to the farm system. Fabric manufacturing is another big segment in a fashion that handles different kinds of supply chain and value chain partners and associations [44].

Similarly, machinery suppliers or manufacturers and chemical manufacturers, work on fiber and yarn quality and sustainability, in line with brands, since all information and transactions happen in the blockchain with permission with authentications. This part of the supply chain will also align with brands and product platform firms. These manmade fibers are mostly plant-based and petrochemical-based, and their level of recycling-reuse has been defined before it has been used in the fabric. The fabric manufacturers also work with farmers for their yield forecast and the expected quality of the natural fibers or natural dyes [45] in advance to calibrate and enhance the quality of raw materials used sustainably [46,47]. This next level of high speculative and price fluctuation comes from these natural sources of raw material, especially the cotton yield and quality are different between American cotton, African cotton, and Egyptian cotton [48]. Fabric suppliers also work with research institute data sharing to bring more value to the soil conditions, recommending ways to obtain high yields and suggested natural, pesticides for having a high production, even making machines and automation for farming possible, and for governments to support farmers who provide enough data with government subsidies for support to have a wealth of forecast conditions and the support required from the government and NGOs to maintain the yield’s overall wellness in that particular sector, which will be well defined and forecasted in the near future, with clear visibility for the governments.

3.3. Financial Transaction

Blockchain is a decentralized system where any kind of input will be considered as data for a blockchain, which can be encrypted money in the form of ETH (i.e., Ethereum, Doge) encrypted data (NFTs), or information. The blockchain is an open-source technology and decentralized and flexible to use for both money and data. Recently, Algorand, a blockchain company, has entered the metaverse and e-commerce. Hypewear is aiming to provide tech to the human concept of NFTs [49]. A digital platform to help to have a metaverse wardrobe with further technology and connectivity (NFC) with the physical products will be achieved sooner, these are examples of blockchain integration starting points. In this field of a multitude of business models, where technological understanding and benefits have been understood, each sector is moving towards a blockchain integration. The other side of retraced fiber traceability solutions using blockchain [50], a supply chain inspectorate [51], is a blockchain-based supply chain solution.

The major solution these all-supply chains of fashion try to solve is customer satisfaction and economy. From being commerce and economics, money is printed, based on metal-based plates. Now, we are in an era going from physical mining to digital minting. Money can’t be printed as much as governments and central banks want; this has reached saturation. Now, at the economical level of management, we need to increase the transaction speed of the money flow. Blockchain and digital currencies are the way to improve the efficiency of transactions to make transactions faster, the higher money circulation creates a healthier economy.

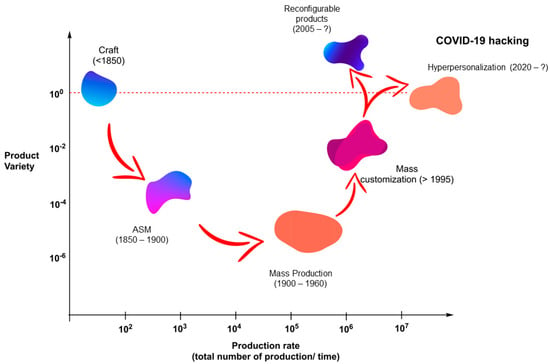

3.4. Hyper-Personalization

Since 1850, skilled artisans and their apprentices manufactured a small number of goods (i.e., perhaps one or two per day) and each item was somewhat different and crafted to fit each customer. The American system of manufacturing (ASM) was from 1850–1900. As the world population grew and manufacturing had to be scaled, it became necessary to standardize parts and processes (Figure 5). A precursor to mass production was the ASM, where larger series were manufactured using machines. Between 1900–1960, the advent of mass production, such as the Ford model-T assembly line, allowed the manufacturing of millions of products, using stable processes, the controlled inflow of raw materials, and the strict division of workers (Figure 5). Meanwhile, between 1960–2010, the diversification of market segments, globalization, and the instability of the supply led to improvements in processes and more of a pull-based system (i.e., lean manufacturing since 1960). This era also saw the emergence of product families and platforms, as an explicit strategy (i.e., and most importantly, since 1970). In this paradigm, firms no longer offer one-size-fits-all products but tailor products to different market segments and niches, while maintaining the benefits of mass production, as much as possible.

Figure 5.

Growth of the hyper-personalization markets.

From 2010 to today, more recent trends point towards hyper-differentiation and personalization, as well as reconfigurable products (Figure 5). Products, such as the iPhone, combine multiple functions in one single device, and products are tailored to individual needs and requirements (i.e., as in craft manufacturing), but use modern information and manufacturing technologies, such as web configurators, 3D printing, and laser cutting, that minimize the cost of personalization.

Platform business history has moved from different cultures and waves, and in 2010, reconfiguring products have moved quickly to personalization- hyper-personalization and hyper-personalization (Figure 5). This is only possible through the digital selection or interaction that we can’t roll the stones back to the tailoring era of appeal, now that the dots have been merely connected, the metaverse is the place for the digital selection and co-creation place where customer trends have been digitally recorded, and the data has been shared among the complete supply chain, to act and produce goods. This data-driven manufacturing needs geographical flexibility and digital transformation [52].

High-end brands are luxury brands that will be moved to regional production or near to custom manufacturing. Medium- and low-segmented products will be sourced, based on competitive advantage but without the digital transformation of the manufacturing competitive advantage, this will be hard for those countries to achieve (i.e., especially Vietnam, Indonesia, and India), even if there are resources, still the market fits the culture of the product manufacturing, which is overcome by time, to the market culture that has been dominating in data-driven manufacturing.

3.5. Blockchain Evolution

When the term blockchain appears, people often confuse it with Bitcoin, but there is a huge difference between blockchain and Bitcoin. Bitcoin is currency built-in a blockchain (i.e., it has been terminated as a blockchain currency, internet gold) blockchain is a technology, in simple terms, it is a digital ledger or virtual book. The blockchain is a system of record in the virtual book without any central authority (single source of control), it is decentralized and distributed with all participants in the network. The nature depends on where we are using this technology, if we use it for textile fiber tracing in the supply chain batch of fiber, from farming to bundle to local warehouses and the vehicle that drove and unloaded the fibers at each process and the method and transfer and the transaction can be scanned along the entire journey of the fiber that is tracked and recorded, and these records are immutable. An important future of a blockchain is the smart contract, in traditional manufacturing, agreements are signed on paper, and conditions are described in languages. In blockchain conditions, two or multiple parties agree to deal or a transaction with terms and conditions acceptable to all, and these terms and conditions are encoded into software programs that run automatically and ensure their enforcement. There is no need for any intermediates to verify or validate, as this is the core value of blockchain [53,54].

Fashion brands generally spend 3−7% of their spending on advertisement and there are a lot of intermediates in between the transaction of information and money. Brands, advertisement agencies, content creators, visual/sound graphics, advertising platforms (i.e., Facebook, Google, website, marketplace). Since in each of these, many people involved, they will take their part of the money and the absolute info is diluted and the content and concept are less concentrated than the actual brand purpose. There is no guarantee for the number of viewers and interactions in a blockchain, it is very clear from the brand to the digital platform advertisers how the many interactions and views of those data are shared among all parties and the value/money has been shared. Here we can eliminate lot more intermediates who don’t add legitimate value [55].

3.6. Provenance

Provenance is the ability to trace the origin of the product and track down its journey. This has been adopted by many luxury brands. Digital ID (NFT, digital twin) will be created for each product with a unique ID, via blockchain technology that can track from the fiber producers to the stores, and the post-buying of those products can be monitored using the underlying technology of the NFC’s most recent adoption of IoT technology. This also helps luxury brands lead the resale culture (most of the retail brands and fast fashion can’t enter this market, due to lack of raw quality material and product standards), where they can sell their product in secondhand marketplaces, or third buyers of the product can have the data of the history of the products. Based on these characteristics of a blockchain, these all benefits from farm to the meta digital platform, and shop shelves.

The nature of a blockchain can handle 50,000 to 65,000 transactions per sec, and it depends on which blockchain we build our business, The Solana blockchain can handle 65,000 transactions per sec, Polygon can handle 50,000 transactions per sec, this nature helps a multitude of business models to communicate effectively from all directions seamlessly and productively with real-time data integration [56]. When the flow of information is higher, the productivity of the products and services is higher. When we see this multitude of business models, it represents the human brain representative. The right and left brains are connected in a bundle of nerves, called the corpus callosum, where the left brain handles logic, fact, analytics, and linear thinking and the right brain handles intuition, imagination, holistic thinking, and arts.

Here, manufacturing is the left side of a multitude of business models (industry 4.0/industry 5.0) connected to the farm, fiber, yarn, and manufacturing of real and physical tangible products and services. The right-side of the business handles creativity, imagination, digital partner, e-tailer, e-commerce, secondhand marketplace metaverse of arts, creativity with unlimited potential, and personalized and hyper-personalized options of digital goods and commodities. The firm or a community represents the callosum part where they connect both sides of the business and produce an outcome of human potential of making and producing economy.

3.7. Data Is a New Oil of the Currency

When we investigate this multitude of businesses, the amount of data transfer in this is highly intensive. Data is a tool and analyzing data is the most significant driver of effective strategy and the efficient execution leveraging data, raw data will provide a competitive advantage. The data produced and acquired from a 3rd party or marketplace is similar to an ocean, cook it cool down, play with data, analysis in different levels of the lake, pool it, segmentation, deep analysis, and reuse of the data will provide product insight that the customer insight needs, demand forecast in a personal and hyper-personal level. These data provide an actionable insight and there is a big difference between insight and actionable insight, which is a prediction, actionable insight in real-time. These data can be used for proactive and reactive purposes. This data sharing collected data and insights will be the new revenue for each firm [57].

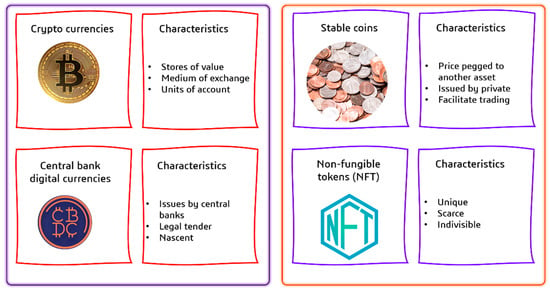

3.8. Financial Layer

When the metaverse is a key upfront in the customer interaction and touch points, this interaction happens not only for entertainment and gaming but there is also no economy, there is no human interaction, so the metaverse and business models require funds, in the metaverse, all interaction is digital, we need a digital economy or digital asset to trade off creativity, loyalty, and transaction needed to build birth and death rates of the meta participants [58]. The different currencies and their characteristics are shown in Figure 6.

Figure 6.

Different currencies and their characteristics.

- Stable coins (i.e., USDT/USD/USDC);

- Cryptocurrencies: depend on which meta-universe the customer, creator, or brands are interacting with, whether there is a decentralized currency, such as Decentraland (mana), Sandbox (sand), many brands popularly running and opening a store in this meta space;

- NFTs;

- CBDC: central bank digital currency (this comes in many countries but most of the countries are in the testing phase. China has been leading and testing CBDC since 2020).

3.9. Data Economy

Digital transformation is a high priority, since the customer expectation is high on traceable and tradeable products, reuse, and repurpose, so each product life cycle has been a key aspect for the customers. Institutional investors and governments require sustainable products and services that can reduce carbon footprints globally, because decreasing global warming and climate change is a difficult goal to achieve by 2030 [57]. When products and services are in digital form, they can be traced, and consumer and manufacturing behaviors are apparent. To change the behavior towards a positive impact direction we need clear data. The data-driven approach is the right way to drive sustainable and economically viable options for any industry. When it comes to fashion and textiles, more variation due to brands to brands, and geo-location, and this is a very complex web mess to form a clear strategy.

3.10. Industry Data

Industries are manufacturing products and services for a decade just buying and selling mechanisms. The production history is mostly recorded manually, those records are not reviewed and utilized by themself and not shared with another ecosystem to benefit from the generated data. Therefore, these data are not helping to give a cross-functional business model. The digital transformation happening now on a blockchain and other ERP/SAP systems to generate data for each operation, these data help in an inward and outward direction, and the inside data lake- data pooling- reuse data will help the firm to have the benefit of operational efficiency improvement, predictive maintenance, business decision, best practices, and business analysis [59].

3.11. Outward Direction

The supply chain has a high dependency on product sales, but product sales are not predictable in this retail era, since we produce any raw material or intermediate products without a demand cycle, and cases with economical and sustainable damages. On this occasion, sharing one industry’s data with another industry will help to predict their product and demand cycle. For example, the garment manufacturing industry can share the following data with other industries [59]:

- Data for the next one-year projection and three years production history- this data will help yarn/ fabric manufacturers and this data can be analyzed against the current trend and see the raw material cost/ availability of raw materials (i.e., fibers) and their productivity to bring benefit to the data shared ecosystem partners.

- For instance, because of the effects of climate change, cotton cultivation may decrease in certain years. Moreover, hemp and other fibers may cultivate more than was anticipated. When this occurs, the industry that manufactures fibers can communicate this information to the industry that manufactures yarn and fabric to replace cotton with hemp. This ensures that the industry will be sustainable.

This is not a one-way exchange of data; rather, if yarn and fabric manufacturers share data with garment manufacturers, it enables the latter to propose demand-based garments more effectively in high-end products, mid-demand fabrics for products in the middle segment, and low-demand fabrics for products in the lower segment. Data is oil in the data economy, to prevent the release of emissions, it ensures that the system of production and service operates smoothly and adds a significant amount of value to society. The advantages of data sharing across businesses and the data economy are:

- Utilize the infrastructure of manufacturing with high efficiency and performance;

- Use less, produce more;

- Prepared financial and operational cost;

- Quick to market;

- No stocks in the supply chain;

- No clustered transport;

- Measurable sustainable parameters and effects.

Moreover, there is a huge amount of data that has been generated in the past 10–12 years in every industry, but those have been kept stored in centralized data or supply chain software providers which centralized firms took advantage of to leverage data and trade services, for their own benefit. Now a blockchain integration brings the new value of controlling its own enterprise and industry data and its owner can provide access to the company or sector to utilize the data and leverage for the data owner. Data can be sold in the raw, lake, and pool form more insightfully [59].

3.12. Personal Data

Consumers have trusted companies, such as Google, Amazon, Facebook, Apple, and Microsoft, but those companies aggregate and use their data, in return they provide free services of social media and purchasing marketplace. Everyday data leakage of consumer data brings a lot of stress to consumers, often receiving unwanted advertisements on digital platforms, putting them into stress to buy a product or service, and at the same time, are suspicious about their data [60]. These data owners of personal data need control over their data. Customers’ front end of the future is more of a metaverse for products and services, where most of the purchase happens in the wallet-based ecosystem in the cryptic trade of money, which will bring the data protection of the exploitation of personal data wallets, have cryptic codes which don’t represent the person’s name or address. In the meta space, customer touch points can be recorded for the brands and retailers to learn of the trends and the co-creation of products and services, and personal data to be protected well. If the user is allowed to expose their data, the brand they enjoy, the product they co-create, and the service they wish to have. So this personal data to industry data integration can happen with the permission of the customer who wishes to share data, in return those personal data owners can acquire rewards and loyalty. Data is a commodity/product in the future of the digital transformation and the metaverse business models, at a personal level and at industry levels.

4. Conclusions and Future Scope

Business models have been changing and synchronizing with the technological evolution of a blockchain and the metaverse product platform and the industry platform is merging, the physical and digital interactions are higher, and the difference is nearly invisible (IoT plays a key role in this). Cryptocurrency is gaining popularity all around the world, and it will be much more important in the ecology of a metaverse, if it ever becomes one. In addition to that, the blockchain technology and cryptocurrencies have shown a number of noteworthy benefits over traditional forms of the financial business. Manufacturing and enterprises of different destinations need to re-look at their strategy. The maturity of existing digital infrastructure and understanding the potential of the data they need to utilize. Competitive advantages/sustainability are part of the organization’s lever to run and roll the business but only those are not going to satisfy the end customer needs and demand manufacturing infrastructure needs to establish demand and data-driven flexibility. Changing the mindset and approach is the key to align with the end customer expectations, that are highly beneficial.

In last, the metaverse has a pitfall in smell and touch sensing and the network of people is inconsistent. Therefore, the industry-level ecosystem is the new way of approaching the value chain and the digital understanding of smart contracts. This business model’s pace of progress, both forward and backward, will be determined by the progression of technology and the rates of its acceptance. However, it is quite evident that we are heading in the direction of the metaverse platform business.

In this context, the metaverse-based platforms provide the business to sell, ship, and collect payments very easily and securely, in addition, it engages the customers with phygital options, and it integrates the eCommerce sectors. In last, the metaverse-based platform enhances sustainability by reducing waste, as it is resulting in the reduction of the carbon footprint.

Author Contributions

Conceptualization, methodology, investigation, resources, writing—original draft preparation, writing—review, and editing, S.P. and A.P.P. All authors have read and agreed to the published version of the manuscript.

Funding

This work received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Burdea, G.C.; Coiffet, P. Virtual Reality Technology; Wiley: Hoboken, NJ, USA, 2017; ISBN 978-1-119-48572-8. [Google Scholar]

- Mystakidis, S. Metaverse. Encyclopedia 2022, 2, 486–497. [Google Scholar] [CrossRef]

- Kye, B.; Han, N.; Kim, E.; Park, Y.; Jo, S. Educational Applications of Metaverse: Possibilities and Limitations. J. Educ. Eval. Health Prof. 2021, 18, 32. [Google Scholar] [CrossRef]

- Zhao, Y.; Jiang, J.; Chen, Y.; Liu, R.; Yang, Y.; Xue, X.; Chen, S. Metaverse: Perspectives from Graphics, Interactions and Visualization. Vis. Inform. 2022, 6, 56–67. [Google Scholar] [CrossRef]

- Jon Radoff The Metaverse Value-Chain. Available online: https://medium.com/building-the-metaverse/the-metaverse-value-chain-afcf9e09e3a7 (accessed on 31 July 2022).

- Zallio, M.; John Clarkson, P. Designing the Metaverse: A Study on Inclusion, Diversity, Equity, Accessibility and Safety for Digital Immersive Environments. Telemat. Inform. 2022, 101909, in press. [Google Scholar] [CrossRef]

- Emma, C. Noika Six Trailblazing Use Cases for the Metaverse in Business. Available online: https://www.nokia.com/networks/insights/metaverse/six-metaverse-use-cases-for-businesses/ (accessed on 7 October 2022).

- Mina Alaghband What Is the Metaverse—and What Does It Mean for Business? Available online: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/what-is-the-metaverse-and-what-does-it-mean-for-business (accessed on 7 October 2022).

- Hagiu, A.; Wright, J. Marketplace or Reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef]

- Karlin, B.; Anki, M. Virtual Business Models: Entrepprnurial Risks and Rewards; Elsevier: Amsterdam, The Netherlands, 2016; ISBN 9780081001417. [Google Scholar]

- Business Modeling and Data Mining; Elsevier: Amsterdam, The Netherlands, 2003; ISBN 9781558606531.

- P2P—Peer-to-Peer Network. Available online: https://www.horizen.io/blockchain-academy/technology/advanced/a-peer-to-peer-p2p-network/ (accessed on 7 October 2022).

- Zhao, Y.; von Delft, S.; Morgan-Thomas, A.; Buck, T. The Evolution of Platform Business Models: Exploring Competitive Battles in the World of Platforms. Long Range Plann. 2020, 53, 101892. [Google Scholar] [CrossRef]

- Gawer, A. Bridging Differing Perspectives on Technological Platforms: Toward an Integrative Framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar] [CrossRef]

- Özkaya, A.; Ungan, E.; Demirors, O. Common Practices and Problems in Effort Data Collection in the Software Industry. In Proceedings of the 2011 Joint Conference of the 21st International Workshop on Software Measurement and the 6th International Conference on Software Process and Product Measurement, Nara, Japan, 3–4 November 2011; pp. 308–313. [Google Scholar]

- Arsalan, Strategic Analysis of Sony Corporation. Sep 2019. Available online: https://academic-master.com/strategic-analysis-of-sony-corporation/ (accessed on 9 October 2022).

- Sony Rides Wave of US Mirrorless Sales Surge. Available online: https://www.dpreview.com/articles/6223902518/sony-rides-wave-of-us-mirrorless-sales-surge (accessed on 9 October 2022).

- Marketing Mag Case Study: Sony ‘DSLR Gear No Idea’ Campaign. Available online: https://www.marketingmag.com.au/news/case-study-sony-dslr-gear-no-idea-campaign/ (accessed on 9 October 2022).

- Dpreview Sony Product Timeline. Available online: https://www.dpreview.com/products/timeline?year=all&brand=Sony&category=slrs (accessed on 26 October 2022).

- McIntyre, D.P.; Srinivasan, A. Networks, Platforms, and Strategy: Emerging Views and next Steps. Strateg. Manag. J. 2017, 38, 141–160. [Google Scholar] [CrossRef]

- Tessmann, R.; Elbert, R. Multi-Sided Platforms in Competitive B2B Networks with Varying Governmental Influence—A Taxonomy of Port and Cargo Community System Business Models. Electron. Mark. 2022, 32, 829–872. [Google Scholar] [CrossRef]

- Quirós, C.; Portela, J.; Marín, R. Differentiated Models in the Collaborative Transport Economy: A Mixture Analysis for Blablacar and Uber. Technol. Soc. 2021, 67, 101727. [Google Scholar] [CrossRef]

- Basaure, A.; Vesselkov, A.; Töyli, J. Internet of Things (IoT) Platform Competition: Consumer Switching versus Provider Multihoming. Technovation 2020, 90–91, 102101. [Google Scholar] [CrossRef]

- Zeng, J.; Khan, Z.; de Silva, M. The Emergence of Multi-Sided Platform MNEs: Internalization Theory and Networks. Int. Bus. Rev. 2019, 28, 101598. [Google Scholar] [CrossRef]

- Berkers, F.; Roelands, M.; Bomhof, F.; Bachet, T.; van Rijn, M.; Koers, W. Constructing a Multi-Sided Business Model for a Smart Horizontal IoT Service Platform. In Proceedings of the 2013 17th International Conference on Intelligence in Next Generation Networks (ICIN), Venice, Italy, 15–16 October 2013; pp. 126–132. [Google Scholar]

- Gary Fox Uber Business Model: How Uber Makes Money. Available online: https://www.garyfox.co/uber-business-model/ (accessed on 9 October 2022).

- Brockway, E. Started from the Plow Now We’re Deere: John Deere’s Transformation from an Equipment Manufacturer to a Tech Firm. Harv. Technol. Oper. Manag. 2016. Available online: https://d3.harvard.edu/platform-rctom/submission/started-from-the-plow-now-were-deere-john-deeres-transformation-from-an-equipment-manufacturer-to-a-tech-firm/ (accessed on 12 October 2022).

- Holmlund, M.; van Vaerenbergh, Y.; Ciuchita, R.; Ravald, A.; Sarantopoulos, P.; Ordenes, F.V.; Zaki, M. Customer Experience Management in the Age of Big Data Analytics: A Strategic Framework. J. Bus. Res. 2020, 116, 356–365. [Google Scholar] [CrossRef]

- Jha, A.K.; Bose, I.; Ngai, E.W.T. Platform Based Innovation: The Case of Bosch India. Int. J. Prod. Econ. 2016, 171, 250–265. [Google Scholar] [CrossRef]

- Ritter, T.; Pedersen, C.L. Digitization Capability and the Digitalization of Business Models in Business-to-Business Firms: Past, Present, and Future. Ind. Mark. Manag. 2020, 86, 180–190. [Google Scholar] [CrossRef]

- John Deere Reveals Fully Autonomous Tractor at CES 2022. John Deere. 2022. Available online: https://www.deere.com/en/news/all-news/autonomous-tractor-reveal/ (accessed on 12 October 2022).

- Murray, A.; Kim, D.; Combs, J. The Promise of a Decentralized Internet: What Is Web 3.0 and HOW Can Firms Prepare? Bus. Horiz. 2022, in press. [CrossRef]

- Björkdahl, J. Strategies for Digitalization in Manufacturing Firms. Calif. Manag. Rev. 2020, 62, 17–36. [Google Scholar] [CrossRef]

- Nielsen, C.P.; da Silva, E.R.; Yu, F. Digital Twins and Blockchain—Proof of Concept. Procedia CIRP 2020, 93, 251–255. [Google Scholar] [CrossRef]

- Vasan, M. Impact of Promotional Marketing Using Web 2.0 Tools on Purchase Decision of Gen Z. Mater. Today Proc. 2021, in press. [CrossRef]

- Serravalle, F.; Vannucci, V.; Pantano, E. “Take It or Leave It?”: Evidence on Cultural Differences Affecting Return Behaviour for Gen Z. J. Retail. Consum. Serv. 2022, 66, 102942. [Google Scholar] [CrossRef]

- Maghan Mcdowell Why Nike’s Next Web3 Move Is a Black Hoodie: Rtfkt’s Founders Tell All. Available online: https://www.voguebusiness.com/technology/why-nikes-next-web3-move-is-a-black-hoodie-rtfkts-founders-tell-all (accessed on 3 August 2022).

- Gunay, S.; Kaskaloglu, K. Does Utilizing Smart Contracts Induce a Financial Connectedness between Ethereum and Non-Fungible Tokens? Res. Int. Bus. Financ. 2022, 63, 101773. [Google Scholar] [CrossRef]

- Oliveira Silva, W.D.; Morais, D.C. Impacts and Insights of Circular Business Models’ Outsourcing Decisions on Textile and Fashion Waste Management: A Multi-Criteria Decision Model for Sorting Circular Strategies. J. Clean. Prod. 2022, 370, 133551. [Google Scholar] [CrossRef]

- Dragomir, V.D.; Dumitru, M. Practical Solutions for Circular Business Models in the Fashion Industry. Clean. Logist. Supply Chain 2022, 4, 100040. [Google Scholar] [CrossRef]

- Periyasamy, A.P.; Tehrani-Bagha, A. A Review on Microplastic Emission from Textile Materials and Its Reduction Techniques. Polym. Degrad. Stab. 2022, 199, 109901. [Google Scholar] [CrossRef]

- Periyasamy, A.P. Evaluation of Microfiber Release from Jeans: The Impact of Different Washing Conditions. Environ. Sci. Pollut. Res. 2021, 28, 58570–58582. [Google Scholar] [CrossRef]

- Renewcell: We Make Fashion Circular. Available online: https://www.renewcell.com/en/ (accessed on 9 October 2022).

- Niinimäki, K.; Peters, G.; Dahlbo, H.; Perry, P.; Rissanen, T.; Gwilt, A. The Environmental Price of Fast Fashion. Nat. Rev. Earth Environ. 2020, 1, 189–200. [Google Scholar] [CrossRef]

- Periyasamy, A.P. Natural Dyeing of Cellulose Fibers Using Syzygium Cumini Fruit Extracts and a Bio-Mordant: A Step toward Sustainable Dyeing. Sustain. Mater. Technol. 2022, 33, e00472. [Google Scholar] [CrossRef]

- Periyasamy, A.P.; Militky, J. Sustainability in Regenerated Textile Fibers. In Sustainability in the Textile and Apparel Industries; Springer Nature: Cham, Switzerland, 2020; pp. 63–95. [Google Scholar]

- Periyasamy, A.P.; Militky, J. Sustainability in Textile Dyeing: Recent Developments. In Sustainability in the Textile and Apparel Industries; Springer Nature: Cham, Switzerland, 2020; pp. 37–79. [Google Scholar]

- Zhang, Y.; Dong, H. Yield and Fiber Quality of Cotton. In Encyclopedia of Renewable and Sustainable Materials; Elsevier: Amsterdam, The Netherlands, 2020; pp. 356–364. [Google Scholar]

- von Jan Schroder Mit “Hypewear“ Ins Metaverse: About You Eröffnet Plattform Für Digitale Mode. Available online: https://fashionunited.de/nachrichten/einzelhandel/mit-hypewear-ins-metaverse-about-you-eroeffnet-plattform-fuer-digitale-mode/2022041246072 (accessed on 4 October 2022).

- Tai Ford Retraced & Artistic Milliners Launch Cotton Tracing Project. Available online: https://www.retraced.com/en/news/retraced-artistic-milliners-launch-cotton-tracing-project (accessed on 4 October 2022).

- Inspectorio Insight Partners Leads USD50M Series b for Compliance Platform Inspectorio. Available online: https://www.lavca.org/2022/02/22/insight-partners-leads-usd50m-series-b-for-compliance-platform-inspectorio/ (accessed on 4 October 2022).

- Jain, G.; Paul, J.; Shrivastava, A. Hyper-Personalization, Co-Creation, Digital Clienteling and Transformation. J. Bus. Res. 2021, 124, 12–23. [Google Scholar] [CrossRef]

- Guo, M.; Huang, Z.; Wu, L.; Tan, C.L.; Peng, J.; Guo, X.; Chen, H. Application of Blockchain Technology in Environmental Health: Literature Review and Prospect of Visualization Based on CiteSpace. Technologies 2022, 10, 100. [Google Scholar] [CrossRef]

- Krithika, L.B. Survey on the Applications of Blockchain in Agriculture. Agriculture 2022, 12, 1333. [Google Scholar] [CrossRef]

- Kim, Y.-K.; Sullivan, P. Emotional Branding Speaks to Consumers’ Heart: The Case of Fashion Brands. Fash. Text. 2019, 6, 2. [Google Scholar] [CrossRef]

- Ayushi Abrol Solana Vs. Polygon Vs. Ethereum—The Ultimate Comparison. Available online: https://www.blockchain-council.org/blockchain/solana-vs-polygon-vs-ethereum/#:~:text=Solana%20is%20known%20to%20process,has%20the%20most%20efficient%20ecosystem (accessed on 26 October 2022).

- Joris Toonder Data Is the New Oil of the Digital Economy. Available online: https://www.wired.com/insights/2014/07/data-new-oil-digital-economy/ (accessed on 23 October 2022).

- Vidal-Tomás, D. The New Crypto Niche: NFTs, Play-to-Earn, and Metaverse Tokens. Financ. Res. Lett. 2022, 47, 102742. [Google Scholar] [CrossRef]

- What Is Digital Transformation? Available online: https://www.sap.com/insights/what-is-digital-transformation.html (accessed on 24 October 2022).

- Sneaking into the Data Business. Available online: https://www.natlawreview.com/article/sneaking-data-business (accessed on 22 October 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).