Growth and Performance: Business Model Innovation in Family Firms

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Sample

3.2. Measures

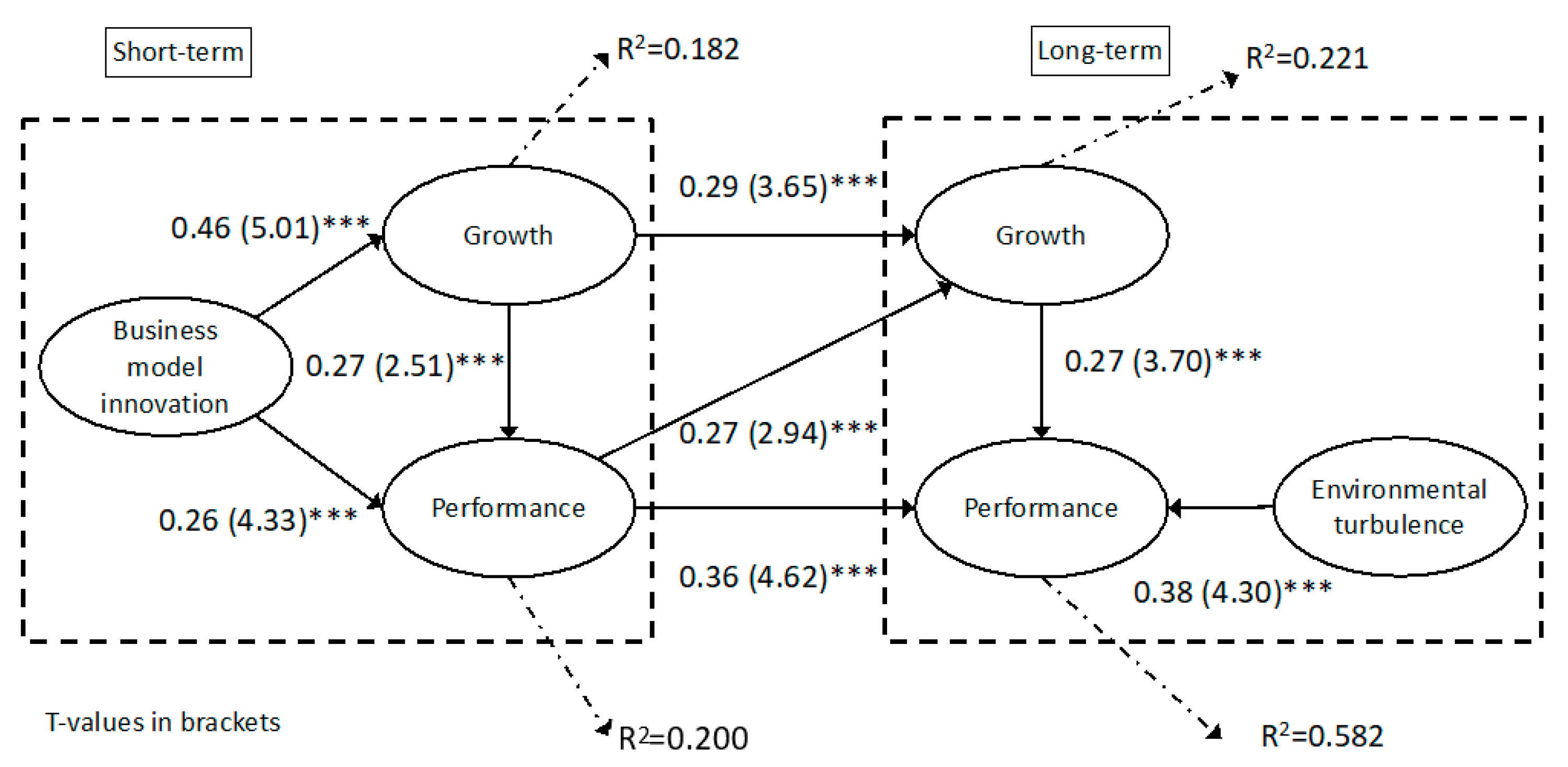

4. Results

5. Discussion

6. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- Bmi1: Distribution channels

- Bmi2: Customer relationship management

- Bmi3: Key resources in the organization

- Bmi4: Key partners in the organization

- Shortgrowth1: Number of clients

- Shortgrowth2: Number of markets

- Longgrowth1: Number of clients

- Longgrowth2: Number of markets

- Shortperf1: Sales turnover

- Shortperf2: Return on investment

- Longperf1: Sales turnover

- Longperf2: Return on investment

- Envturb1: Environmental turbulence at a national level

- Envturb2: Environmental turbulence at a regional level

- Envturb3: Environmental turbulence in your sector

References

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Ghezzi, A.; Cavallo, A. Agile Business Model Innovation in Digital Entrepreneurship: Lean Startup Approaches. J. Bus. Res. 2020, 110, 519–537. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business models: Origin, development and future research perspectives. Long Range Plan. 2016, 49, 36–54. [Google Scholar] [CrossRef]

- Szopinski, D.; Schoormann, T.; John, T.; Knackstedt, R.; Kundisch, D. Software tools for business model innovation: Current state and future challenges. Electron. Mark. 2019, 30, 469–494. [Google Scholar] [CrossRef]

- Molina-Castillo, F.-J.; Lopez-Nicolas, C.; Soto-Acosta, P. Interaction effects of media and message on perceived complexity, risk and trust of innovative products. Eur. Manag. J. 2012, 30, 577–587. [Google Scholar] [CrossRef]

- Rodriguez, R.; Molina-Castillo, F.-J.; Svensson, G. Enterprise resource planning and business model innovation: Process, evolution and outcome. Eur. J. Innov. Manag. 2020, 23, 728–752. [Google Scholar] [CrossRef]

- Clauss, T. Measuring business model innovation: Conceptualization, scale development, and proof of performance. RD Manag. 2017, 47, 385–403. [Google Scholar] [CrossRef]

- Spieth, P.; Schneider, S. Business model innovativeness: Designing a formative measure for business model innovation. J. Bus. Econ. 2016, 86, 671–696. [Google Scholar] [CrossRef]

- Cortimiglia, M.N.; Ghezzi, A.; German, A. Business model innovation and strategy making nexus: Evidence from a cross-industry mixed-methods study. RD Manag. 2016, 46, 414–432. [Google Scholar] [CrossRef]

- Bucherer, E.; Eisert, U.; Gassmann, O. Towards Systematic Business Model Innovation: Lessons from Product Innovation Management. Creat. Innov. Manag. 2012, 21, 183–198. [Google Scholar] [CrossRef]

- Snihur, Y.; Tarzijan, J. Managing complexity in a multi-business-model organization. Long Range Plan. 2018, 51, 50–63. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation. J. Manag. 2017, 43, 200–227. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaria, L.; Fernandez, Z. Understanding the Innovation Behavior of Family Firms. J. Small Bus. Manag. 2015, 53, 382–399. [Google Scholar] [CrossRef]

- EFB. 2019. Available online: https://europeanfamilybusinesses.eu/about-european-family-businesses/ (accessed on 24 April 2017).

- Prahalad, C.K. The Fortune at the Bottom of the Pyramid; Pearson Education: Noida, India, 2006. [Google Scholar]

- Kotlar, J.; De Massis, A.; Wright, M.; Frattini, F. Organizational Goals: Antecedents, Formation Processes and Implications for Firm Behavior and Performance. Int. J. Manag. Rev. 2018, 20, S3–S18. [Google Scholar] [CrossRef]

- Domenichelli, O.; Bettin, G. Generational Socioemotional Wealth and Debt Maturity: Evidence from Private Family Firms of GIPSI Countries. Int. J. Econ. Financ. 2021, 13, 67. [Google Scholar] [CrossRef]

- Gouëdard, M.; Radu-Lefebvre, M.; Vershinina, N. Innovative postures in a family business: Family priorities driving resource (re)configuration. Rev. L’entrepreneuriat Rev. Entrep. 2023, 1, 103–132. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Ariza-Montes, A.; Araya-Castillo, L. Socioemotional wealth, entrepreneurial orientation and international performance of family firms. Ekon. Istraz. 2020, 33, 3125–3145. [Google Scholar] [CrossRef]

- Hernández-Perlines, F.; Araya-Castillo, L.; Millán-Toledo, C.; Cisneros, M.A.I. Socioemotional wealth: A systematic literature review from a family business perspective. Eur. Res. Manag. Bus. Econ. 2023, 29, 100218. [Google Scholar] [CrossRef]

- De Massis, A.; Rondi, E.; Appleton, S.W. Innovation in Family Business; Springer: Berlin/Heidelberg, Germany, 2022. [Google Scholar] [CrossRef]

- Németh, K.; Dőry, T. Influencing factors of innovation performance in family firms—Based on an empirical research. Vez. Bp. Manag. Rev. 2019, 50, 58–71. [Google Scholar] [CrossRef]

- Sumaiyah, A.A.; Rosli, M. The relationship between business model and performance of manufacturing small and medium enterprises in Malaysia. Afr. J. Bus. Manag. 2011, 5, 8918–8932. [Google Scholar] [CrossRef]

- Diaz-Moriana, V.; Clinton, E.; Kammerlander, N.; Lumpkin, G.T.; Craig, J.B. Innovation motives in family firms: A transgenerational view. Entrep. Theory Pract. 2018, 44, 256–287. [Google Scholar] [CrossRef]

- Lee, Y.; Shin, J.; Park, Y. The changing pattern of SME’s innovativeness through business model globalization. Technol. Forecast. Soc. Chang. 2012, 79, 832–842. [Google Scholar] [CrossRef]

- Duran, P.; Kammerlander, N.; Van Essen, M.; Zellweger, T. Doing more with less: Innovation input and output in family firms. Acad. Manag. J. 2016, 59, 1224–1264. [Google Scholar] [CrossRef]

- Brink, T. Organising of dynamic proximities enables robustness, innovation and growth: The longitudinal case of small and medium-sized enterprises (SMEs) in food producing firm networks. Ind. Mark. Manag. 2018, 75, 66–79. [Google Scholar] [CrossRef]

- Barringger, B.R.; Jones, F.F.; Neubaum, D.O. A quantitative content analysis of the characteristics of rapid-growth firms and their founders. J. Bus. Ventur. 2005, 20, 663–687. [Google Scholar] [CrossRef]

- Wiklund, J.; Patzelt, H.; Shepherd, D. Building an integrative model of small business growth. Small Bus. Econ. 2007, 32, 351–374. [Google Scholar] [CrossRef]

- Kosmidou, V.; Ahuja, M.K. A Configurational Approach to Family Firm Innovation. Fam. Bus. Rev. 2019, in press. [Google Scholar] [CrossRef]

- Benavides-Velasco, C.A.; Quintana-GArcía, C.; Guzman-Parra, V.F. Trends in family business research. Small Bus. Econ. 2013, 40, 41–57. [Google Scholar] [CrossRef]

- Ward, J.L. Growing the family business: Special challenges and best practices. Fam. Bus. Rev. 1997, 10, 323–337. [Google Scholar] [CrossRef]

- Hamelin, M. Influence of family ownership on small business growth. Evidence from French SMEs. Small Bus. Econ. 2012, 41, 563–579. [Google Scholar] [CrossRef]

- Karlsson, N.P.; Halila, F.; Mattsson, M.; Hoveskog, M. Success factors for agricultural biogas production in Sweden: A case study of business model innovation. J. Clean. Prod. 2017, 142, 2929–2934. [Google Scholar] [CrossRef]

- González Álvarez, N.; Argothy, A. Research, development and growth in state-owned enterprises: Empirical evidence from Ecuador. Ind. Innov. 2019, 26, 158–175. [Google Scholar] [CrossRef]

- Coad, A.; Segarra, A.; Teruel, M. Innovation and firm growth: Does firm age play a role? Res. Policy 2016, 45, 387–400. [Google Scholar] [CrossRef]

- Green, D.H.; Barclay, D.W.; Ryans, A.B. Entry strategy and long-term performance: Conceptualization and empirical examination. J. Mark. 1995, 54, 1–16. [Google Scholar] [CrossRef]

- Taran, Y.; Boer, H.; Lindgren, P. A business model innovation typology. Decis. Sci. 2015, 46, 301–331. [Google Scholar] [CrossRef]

- Hu, Q.; Hughes, M. Radical innovation in family firms: A systematic analysis and research agenda. Int. J. Entrep. Behav. Res. 2020, 26, 1199–1234. [Google Scholar] [CrossRef]

- Prigge, S.; Thiele, F.K. Corporate Governance Codes: How to Deal with the Bright and Dark Sides of Family Influence. In The Palgrave Handbook of Heterogeneity among Family Firms; Memili, E., Dibrell, C., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 297–331. [Google Scholar]

- Block, J.; Hansen, C.; Steinmetz, H. Are Family Firms Doing More Innovation Output with Less Innovation Input? A Replication and Extension. Entrep. Theory Pract. 2023, 47, 1496–1520. [Google Scholar] [CrossRef]

- Meroño-Cerdán, A.L. Unexpected Successor in Family Firms: Opportunity or Trap for Women? J. Fam. Econ. Issues 2023, 44, 313–324. [Google Scholar] [CrossRef]

- Jones, O.; Ghobadian, A.; O’Regan, N.; Antcliff, V. Dynamic capabilities in a sixth-generation family firm: Entrepreneurship and the Bibby Line. Bus. Hist. 2013, 55, 910–941. [Google Scholar] [CrossRef]

- Olson, P.; Zuiker, V.; Danes, S.; Stafford, K.; Heck, R.; Duncan, K. The Impact of Family and Business on Family Business Sustainability. J. Bus. Ventur. 2003, 18, 639–666. [Google Scholar] [CrossRef]

- Gersick, K.E.; Feliu, N. Governing the Family Enterprise: Practices, Performance, and Research. In The SAGE Handbook of Family Business; SAGE: London, UK, 2013; pp. 196–225. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Fang, H.Q.; Vismara, S.; Wu, Z.Y. New insights on economic theories of the family firm. Small Bus. Econ. 2024, 15. [Google Scholar] [CrossRef]

- Arteaga, R.; Basco, R. Disentangling family firm heterogeneity: Evidence from a cross-country analysis. Eur. J. Fam. Bus. 2023, 13, 162–181. [Google Scholar] [CrossRef]

- Weimann, V.; Gerken, M.; Hülsbeck, M. Business model innovation in family firms: Dynamic capabilities and the moderating role of socioemotional wealth. J. Bus. Econ. 2020, 90, 369–399. [Google Scholar] [CrossRef]

- Minola, T.; Vismara, S.; Hahn, D. Screening model for the support of governmental venture capital. J. Technol. Transf. 2017, 42, 59–77. [Google Scholar] [CrossRef]

- Kraus, S.; Pohjola, M.; Koponen, A. Innovation in family firms: An empirical analysis linking organizational and managerial innovation to corporate success. Rev. Manag. Sci. 2012, 6, 265–286. [Google Scholar] [CrossRef]

- Audretsch, D.; Belitski, M.; Rejeb, N. Innovation in family firms: The Brittelstand. Int. J. Entrep. Behav. Res. 2022, 29, 116–143. [Google Scholar] [CrossRef]

- Chrisman, J.; Kellermanns, F.W.; Chan, K.C.; Liano, K. Intellectual foundations of current research in family business: An identification and review of 25 influential articles. Fam. Bus. Rev. 2010, 23, 9–26. [Google Scholar] [CrossRef]

- Habbershon, T.G.; Williams, M.L. A Resource-Based Framework for Assessing the Strategic Advantages of Family Firms. Fam. Bus. Rev. 1999, 12, 1–25. [Google Scholar] [CrossRef]

- Pittino, D.; Visintin, F. Innovation and strategic types of family SMEs: A test and extension of Miles and Snow’s configurational model. J. Enterprising Cult. 2009, 17, 257–295. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; De Massis, A.; Frattini, F.; Wright, M. The Ability and Willingness Paradox in Family Firm Innovation. J. Prod. Innov. Manag. 2015, 32, 310–318. [Google Scholar] [CrossRef]

- De Massis, A.; Frattini, F.; Lichtenthaler, U. Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Fam. Bus. Rev. 2012, 26, 10–31. [Google Scholar] [CrossRef]

- Brettel, M.; Strese, S.; Flatten, T.C. Improving the performance of business models with relationship marketing efforts—An entrepreneurial perspective. Eur. Manag. J. 2012, 30, 85–98. [Google Scholar] [CrossRef]

- DaSilva, C.M.; Trkman, P. Business Model: What It Is and What It Is Not. Long Range Plan. 2014, 47, 379–389. [Google Scholar] [CrossRef]

- Brannon, D.L.; Wiklund, J. An analysis of business models: Firm characteristics, innovation and performance. Acad. Entrep. J. 2016, 22, 1–21. [Google Scholar]

- Moreno, A.M.; Casillas, J.C. High-growth SMEs versus non-high-growth SMEs: A discriminant analysis. Entrep. Reg. Dev. 2007, 19, 69–88. [Google Scholar] [CrossRef]

- Wei, Z.; Yang, D.; Sun, B.; Gu, M. The fit between technological innovation and business model design for firm growth: Evidence from China. RD Manag. 2014, 44, 288–305. [Google Scholar] [CrossRef]

- Aspara, J.; Hietanen, J.; Tikkanen, H. Business model innovation vs. replication: Financial performance implications of strategic emphases. J. Strateg. Mark. 2009, 18, 39–56. [Google Scholar] [CrossRef]

- Pushkarskaya, H.; Marshall, M.I. Family Structure, Policy Shocks, and Family Business Adjustment Choices. J. Fam. Econ. Issues 2010, 31, 414–426. [Google Scholar] [CrossRef]

- D’Elia, E.; Nascia, L.; Zeli, A. Non-continuous growth of firms: Some empirical evidence from Italian manufacturing industry. Ind. Innov. 2019, 26, 78–99. [Google Scholar] [CrossRef]

- Brenner, T.; Schimke, A. Growth Development Paths of Firms—A Study of Smaller Businesses. J. Small Bus. Manag. 2015, 53, 539–557. [Google Scholar] [CrossRef]

- Gielnik, M.; Zacher, H.; Schmitt, A. How Small Business Managers’ Age and Focus on Opportunities Affect Business Growth: A Mediated Moderation Growth Model. J. Small Bus. Manag. 2017, 55, 460–483. [Google Scholar] [CrossRef]

- Berends, H.; Smits, A.; Reymen, I.; Podoynitsyna, K. Learning while (re) configuring: Business model innovation processes in established firms. Strateg. Organ. 2016, 14, 181–219. [Google Scholar] [CrossRef] [PubMed]

- Weber, P.; Geneste, L.; Connell, J. Small business growth: Strategic goals and owner preparedness. J. Bus. Strategy 2015, 36, 30–36. [Google Scholar] [CrossRef]

- Spescha, A.; Woerter, M. Innovation and firm growth over the business cycle. Ind. Innov. 2019, 26, 321–347. [Google Scholar] [CrossRef]

- Hart, S.J.; Hultink, E.J.; Tzokas, N.; Commandeur, H.R. Industrial companies’ evaluation criteria in new product development gates. J. Prod. Innov. Manag. 2003, 20, 22–36. [Google Scholar] [CrossRef]

- Lee, Y.; O’Connor, G.C. The impact of communication strategy on launching new products: The moderating role of product innovativeness. J. Prod. Innov. Manag. 2003, 20, 4–21. [Google Scholar] [CrossRef]

- Molina-Castillo, F.-J.; Munuera-Alemán, J.-L. New product performance indicators: Time horizon and importance attributed by managers. Technovation 2009, 29, 714–724. [Google Scholar] [CrossRef]

- Pieroni, M.P.; McAloone, T.; Pigosso, D.A. Business model innovation for circular economy and sustainability: A review of approaches. J. Clean. Prod. 2019, in press. [Google Scholar] [CrossRef]

- Hamelink, M.; Opdenakker, R. How business model innovation affects firm performance in the energy storage market. Renew. Energy 2019, 131, 120–127. [Google Scholar] [CrossRef]

- Velu, C. Evolutionary or revolutionary business model innovation through coopetition? The role of dominance in network markets. Ind. Mark. Manag. 2016, 53, 124–135. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Evans, S. The Cambridge business model innovation process. Procedia Manuf. 2017, 8, 262–269. [Google Scholar] [CrossRef]

- Casillas, J.; López-Fernández, M.; Merono-Cerdan, A. The Family Business in Spain; Instituto de la Empresa Familiar: Madrid, Spain, 2015. [Google Scholar]

- OECD. GDP and Spending—Gross Domestic Product (GDP). OECD Data. Available online: http://data.oecd.org/gdp/gross-domestic-product-gdp.htm (accessed on 1 April 2024).

- Molina-Castillo, F.J.; Munuera-Alemán, J.L. Efectos de la novedad y de la calidad del producto en el resultado a corto ya largo plazo en las empresas innovadoras españolas. Universia Bus. Rev. 2008, 20, 68–83. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying business models: Origins, present, and future of the concept. Commun. Assoc. Inf. Syst. 2005, 16, 1–25. [Google Scholar] [CrossRef]

- Griffin, A. Metrics for measuring product development cycle time. J. Prod. Innov. Manag. 1993, 10, 112–125. [Google Scholar] [CrossRef]

- Tse, A.C.; Sin, L.Y.; Yau, H.M.; Lee, J.S.; Chow, R. Market orientation and business performance in a Chinese business environment. J. Bus. Res. 2003, 56, 227–239. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market Orientation: Antecedents and Consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Van Riel, A.C.R.; Henseler, J.; Kemény, I.; Sasovova, Z. Estimating hierarchical constructs using consistent partial least squares. Ind. Manag. Data Syst. 2017, 117, 459–477. [Google Scholar] [CrossRef]

- Henseler, J. Bridging Design and Behavioral Research With Variance-Based Structural Equation Modeling. J. Advert. 2017, 46, 178–192. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modelling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Voorhees, C.M.; Brady, M.K.; Calantone, R.; Ramirez, E. Discriminant validity testing in marketing: An analysis, causes for concern, and proposed remedies. J. Acad. Mark. Sci. 2015, 44, 119–134. [Google Scholar] [CrossRef]

- Hacklin, F.; Björkdahl, J.; Wallin, M.W. Strategies for business model innovation: How firms reel in migrating value. Long Range Plan. 2018, 15, 82–110. [Google Scholar] [CrossRef]

- Hansen, M.B. Antecedents of Organizational Innovation: The Diffusion of New Public Management into Danish Local Government. Public Adm. 2011, 89, 285–306. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate Governance and Corporate Social Responsibility (CSR): The Moderating Roles of Attainment Discrepancy and Organization Slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Memili, E.; Fang, H.; Chrisman, J.; Massis, A.D. The impact of small- and medium-sized family firms on economic growth. Small Bus. Econ. 2015, 45, 771–785. [Google Scholar] [CrossRef]

- Baum, C.F.; Lööf, H.; Nabavi, P. Innovation strategies, external knowledge and productivity growth. Ind. Innov. 2019, 26, 348–367. [Google Scholar] [CrossRef]

| Item | Description | Loading | t-Value |

|---|---|---|---|

| Business model innovation | |||

| Bmi1 | Distribution channels | 0.91 | 11.02 |

| Bmi2 | Customer relationship management | 0.76 | 6.48 |

| Bmi3 | Key resources in the organization | 0.66 | 4.06 |

| Bmi4 | Key partners in the organization | 0.72 | 5.68 |

| Short-term growth | |||

| Shortgrowth1 | Number of clients | 0.80 | 7.78 |

| Shortgrowth2 | Number of markets | 0.84 | 9.54 |

| Long-term growth | |||

| Longgrowth1 | Number of clients | 0.89 | 12.69 |

| Longgrowth2 | Number of markets | 0.79 | 8.08 |

| Short-term performance | |||

| Shortperf1 | Sales turnover | 0.86 | 10.55 |

| Shortperf2 | Return on investment | 0.81 | 7.83 |

| Long-term performance | |||

| Longperf1 | Sales turnover | 0.91 | 19.20 |

| Longperf2 | Return on investment | 0.75 | 8.39 |

| Environmental turbulence | |||

| Envturb1 | Environmental turbulence at a national level | 0.81 | 9.19 |

| Envturb2 | Environmental turbulence at a regional level | 0.90 | 13.78 |

| Envturb3 | Environmental turbulence in your sector | 0.92 | 15.04 |

| Correlation Comparison | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| 1. Business model innovation | |||||

| 2. Short-term growth | 0.18 | ||||

| 3. Long-term growth | 0.05 | 0.15 | |||

| 4. Short-term performance | 0.12 | 0.15 | 0.14 | ||

| 5. Long-term performance | 0.11 | 0.13 | 0.27 | 0.35 | |

| 6. Environmental turbulence | 0.06 | 0.04 | 0.08 | 0.10 | 0.33 |

| Hypothesis | Result |

|---|---|

| H1: Business model innovation will have a positive impact on short-term performance. | Supported |

| H2: Business model innovation will have a positive impact on short-term growth. | Supported |

| H3: Short-term growth will have a positive impact on short-term performance. | Supported |

| H4: Short-term performance will have a positive impact on long-term growth. | Supported |

| H5: Long-term growth will have a positive impact on long-term performance. | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Meroño-Cerdan, A.-L.; Molina-Castillo, F.-J.; Lopez-Nicolas, C.; Ruiz-Nicolas, J. Growth and Performance: Business Model Innovation in Family Firms. Businesses 2024, 4, 211-224. https://doi.org/10.3390/businesses4020014

Meroño-Cerdan A-L, Molina-Castillo F-J, Lopez-Nicolas C, Ruiz-Nicolas J. Growth and Performance: Business Model Innovation in Family Firms. Businesses. 2024; 4(2):211-224. https://doi.org/10.3390/businesses4020014

Chicago/Turabian StyleMeroño-Cerdan, Angel-Luis, Francisco-Jose Molina-Castillo, Carolina Lopez-Nicolas, and Jesus Ruiz-Nicolas. 2024. "Growth and Performance: Business Model Innovation in Family Firms" Businesses 4, no. 2: 211-224. https://doi.org/10.3390/businesses4020014

APA StyleMeroño-Cerdan, A.-L., Molina-Castillo, F.-J., Lopez-Nicolas, C., & Ruiz-Nicolas, J. (2024). Growth and Performance: Business Model Innovation in Family Firms. Businesses, 4(2), 211-224. https://doi.org/10.3390/businesses4020014