Millennials and Early Retirement: An Exploratory Study

Abstract

:1. Introduction

2. Literature Review: Millennials and Retirement

2.1. The Millennial Generation and the Workplace

2.2. Early Retirement and the Workplace

2.3. Expectations for the Analysis

3. Materials and Methods

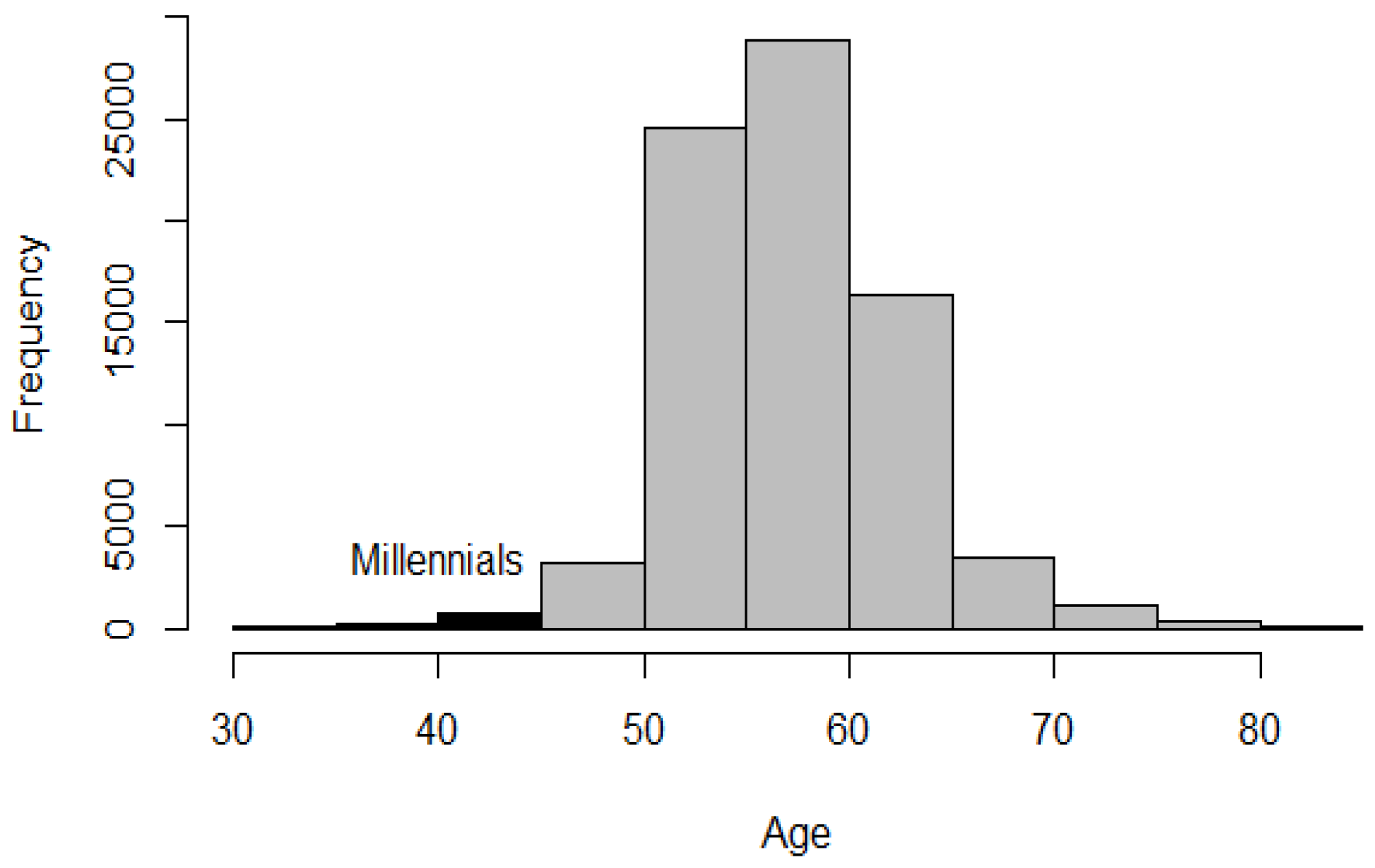

3.1. Data, Samples, and Variables

3.2. Classification Decision Tree Model

4. Results

4.1. Probabilities for Target Classes

4.2. Feature Importance

4.3. Limitations

5. Discussion

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Responses to the Survey Question on Early Retirement ep036 _mod

| ER | ||

| Country | No | Yes |

| Austria | 75.76 | 24.24 |

| Belgium | 83.02 | 16.98 |

| Bulgaria | 100.00 | 0.00 |

| Croatia | 100.00 | 0.00 |

| Czech Republic | 74.36 | 25.64 |

| Denmark | 57.14 | 42.86 |

| Estonia | 83.33 | 16.67 |

| Finland | 100.00 | 0.00 |

| France | 46.67 | 53.33 |

| Germany | 64.29 | 35.71 |

| Greece | 45.00 | 55.00 |

| Hungary | 33.33 | 66.67 |

| Ireland | 66.67 | 33.33 |

| Israel | 50.00 | 50.00 |

| Italy | 64.29 | 35.71 |

| Latvia | 100.00 | 0.00 |

| Luxembourg | 100.00 | 0.00 |

| Netherlands | 73.68 | 26.32 |

| Poland | 50.00 | 50.00 |

| Portugal | 33.33 | 66.67 |

| Slovakia | 100.00 | 0.00 |

| Slovenia | 42.86 | 57.14 |

| Spain | 64.71 | 35.29 |

| Sweden | 70.83 | 29.17 |

| Switzerland | 70.59 | 29.41 |

Appendix B. Confusion Matrix for ER (Early Retirement)

| Predicted | ||

| No | Yes | |

| no | 100 | 6 |

| yes | 30 | 5 |

Appendix C. Correlation Tests

| Kruskal–Wallis Test p-Value | ||

| Job_satisf | Doctor_Visits | |

| Doctor_visits | 0.6706 | NA |

| BMI | 0.9317 | 0.4888 |

| Hours_worked | 0.1055 | 0.63 |

| Life _quality_cat | 0.0004868 * | 0.04101 * |

| Depression | 0.6396 | 0.21 ‡ |

| Self_health | 0.2367 | 4.766 × 10−10 * |

| Job_term | 0.2617 | 0.5839 |

| Chronic_dis | 0.6501 | 0.0012 * |

| Job_satisf | NA | 0.2509 |

References

- Burkus, D. Developing the Next Generation of Leaders: How to Engage Millennials in the Workplace. Leadersh. Adv. Online 2010, 19, 1–6. [Google Scholar]

- Hershatter, A.; Epstein, M. Millennials and the World of Work: An Organization and Management Perspective. J. Bus. Psychol. 2010, 25, 211–223. [Google Scholar] [CrossRef]

- Myers, K.K.; Sadaghiani, K. Millennials in the Workplace: A Communication Perspective on Millennials’ Organizational Relationships and Performance. J. Bus. Psychol. 2010, 25, 225–238. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Twenge, J.M.; Kasser, T. Generational Changes in Materialism and Work Centrality, 1976-2007: Associations With Temporal Changes in Societal Insecurity and Materialistic Role Modeling. Personal. Soc. Psychol. Bull. 2013, 39, 883–897. [Google Scholar] [CrossRef] [PubMed]

- Twenge, J.M.; Campbell, S.M.; Hoffman, B.J.; Lance, C.E. Generational Differences in Work Values: Leisure and Extrinsic Values Increasing, Social and Intrinsic Values Decreasing. J. Manag. 2010, 36, 1117–1142. [Google Scholar] [CrossRef]

- Lyons, S.T.; Schweitzer, L.; Ng, E.S. How have careers changed? An investigation of changing career patterns across four generations. J. Manag. Psychol. 2015, 30, 8–21. [Google Scholar] [CrossRef]

- NBC. Millennials Are Determined to Retire Early. Here’s How That May Actually Be Possible. NBC News. 2021. Available online: https://www.nbcnews.com/better/lifestyle/millennials-are-determined-retire-early-here-s-how-they-can-ncna1042911 (accessed on 27 December 2022).

- Hillary Business Insider. Are People Retiring Earlier or Later? Both Are True—And It Says a Lot about the Youngest Generations Entering and Defining the Workforce. Business Insider. 2020. Available online: https://www.businessinsider.com/young-generations-early-retirement-never-retiring-careers-2020-1 (accessed on 27 December 2022).

- Steve Adcock. Personal Finance Tips to Get You to Early Retirement. Acorns 2022. Available online: https://www.acorns.com/learn/retiring/personal-finance-tips-to-get-you-to-early-retirement/ (accessed on 27 December 2022).

- The New York Times. Millennials Want to Retire at 50. How to Afford It Is Another Matter. The New York Times. 2022. Available online: https://www.nytimes.com/2022/09/24/business/millennials-retirement.html (accessed on 27 December 2022).

- CNA. Commentary: By Wanting to Retire Early, Millennials Are Subverting Conventional Ideas of Work and Finances—CNA. Channel News Asia. 2022. Available online: https://www.channelnewsasia.com/commentary/fire-financial-independence-retire-early-work-jobs-invest-2881331 (accessed on 27 December 2022).

- van den Berg, T.I.J.; Elders, L.A.M.; Burdorf, A. Influence of Health and Work on Early Retirement. J. Occup. Environ. Med. 2010, 52, 576–583. [Google Scholar] [CrossRef]

- Blekesaune, M.; Solem, P.E. Working Conditions and Early Retirement: A Prospective Study of Retirement Behavior. Res. Aging 2005, 27, 3–30. [Google Scholar] [CrossRef]

- Boumans, N.P.; de Jong, A.H.; Vanderlinden, L. Determinants of early retirement intentions among Belgian nurses. J. Adv. Nurs. 2008, 63, 64–74. [Google Scholar] [CrossRef] [PubMed]

- Karpansalo, M.; Manninen, P.; Kauhanen, J.; Lakka, T.A.; Salonen, J.T. Perceived health as a predictor of early retirement. Scand. J. Work. Environ. Health 2004, 30, 287–292. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ng, E.S.W.; Schweitzer, L.; Lyons, S.T. New Generation, Great Expectations: A Field Study of the Millennial Generation. J. Bus. Psychol. 2010, 25, 281–292. [Google Scholar] [CrossRef]

- Kowske, B.J.; Rasch, R.; Wiley, J. Millennials’ (Lack of) Attitude Problem: An Empirical Examination of Generational Effects on Work Attitudes. J. Bus. Psychol. 2010, 25, 265–279. [Google Scholar] [CrossRef]

- Deal, J.J.; Altman, D.G.; Rogelberg, S.G. Millennials at Work: What We Know and What We Need to Do (If Anything). J. Bus. Psychol. 2010, 25, 191–199. [Google Scholar] [CrossRef]

- Bannon, S.; Ford, K.; Meltzer, L. Understanding Millennials in the Workplace. CPA J. 2011, 81, 61–65. [Google Scholar]

- Lyons, S.; Kuron, L. Generational differences in the workplace: A review of the evidence and directions for future research: Generational Differences in the Workplace. J. Organ. Behav. 2014, 35, S139–S157. [Google Scholar] [CrossRef]

- Dorn, D.; Sousa-Poza, A. ‘Voluntary’ and ‘involuntary’ early retirement: An international analysis. Appl. Econ. 2010, 42, 427–438. [Google Scholar] [CrossRef]

- Lund, T.; Villadsen, E. Who retires early and why? Determinants of early retirement pension among Danish employees 57–62 years. Eur. J. Ageing 2005, 2, 275–280. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Blundell, R.; Meghir, C.; Smith, S. Pension Incentives and the Pattern of Early Retirement. Econ. J. 2002, 112, C153–C170. [Google Scholar] [CrossRef]

- Engels, B.; Geyer, J.; Haan, P. Pension incentives and early retirement. Labour Econ. 2017, 47, 216–231. [Google Scholar] [CrossRef] [Green Version]

- Schils, T. Early Retirement in Germany, the Netherlands, and the United Kingdom: A Longitudinal Analysis of Individual Factors and Institutional Regimes. Eur. Sociol. Rev. 2008, 24, 315–329. [Google Scholar] [CrossRef]

- Buzza, J.S. Are You Living to Work or Working to Live? What Millennials Want in the Workplace. J. Hum. Resour. Manag. Labor Stud. 2017, 5, 15–20. [Google Scholar] [CrossRef] [Green Version]

- Johnson, R.W.; Smith, K.E.; Cosic, D.; Wang, C.X. Retirement Prospects for the Millennials: What Is the Early Prognosis? Working paper 2017-17; Center for Retirement Reserach: Boston, MA, USA, 2017. [Google Scholar] [CrossRef] [Green Version]

- Brown, J.E. Millennials and Retirement; Technical Report; National Institute of Retirement Security: Washington, DC, USA, 2018. [Google Scholar]

- Gale, W.G.; Gelfond, H.; Fichtner, J.J. How Will Retirement Saving Change By 2050? Prospects for the Millennial Generation. SSRN Electron. J. 2018. [Google Scholar] [CrossRef] [Green Version]

- Munnell, A.H.; Hou, W. Will Millennials Be Ready for Retirement? Technical Report 18-2; Center for Retirement Research at Boston College: Chestnut Hill, PA, USA, 2018. [Google Scholar]

- DeBard, R. Millennials coming to college. New Dir. Stud. Serv. 2004, 2004, 33–45. [Google Scholar] [CrossRef]

- Brant, K.K.; Castro, S.L. You can’t ignore millennials: Needed changes and a new way forward in entitlement research. Hum. Resour. Manag. J. 2019, 29, 527–538. [Google Scholar] [CrossRef] [Green Version]

- Ng, E.S.; Johnson, J.M. Millennials: Who are they, how are they different, and why should we care? In The Multi-Generational and Aging Workforce; Edward Elgar Publishing: Cheltenham, UK, 2015; pp. 121–137. [Google Scholar] [CrossRef]

- Wood, J.C. Millennials in the Workplace: Mystery or Magic? Disput. Resolut. J. 2019, 74, 111–120. [Google Scholar]

- Calk, R.; Patrick, A. Millennials Through The Looking Glass: Workplace Motivating Factors. Disput. Resolut. J. 2017, 16, 131–139. [Google Scholar]

- Stewart, J.S.; Oliver, E.G.; Cravens, K.S.; Oishi, S. Managing millennials: Embracing generational differences. Bus. Horizons 2017, 60, 45–54. [Google Scholar] [CrossRef]

- Peyton, F.C. Workplace Design: The Millennials Are not Coming—They’re here. DMI Spring 2015, 26, 54–63. [Google Scholar]

- Chou, S.Y. Millennials in the Workplace: A Conceptual Analysis of Millennials’ Leadership and Followership Styles. Int. J. Hum. Resour. Stud. 2012, 2, 71. [Google Scholar] [CrossRef] [Green Version]

- Geraci, J.C.; Nagy, J. Millennials—The new media generation. Young Consum. 2004, 5, 17–24. [Google Scholar] [CrossRef]

- McDonald, N.C. Are Millennials Really the “Go-Nowhere” Generation? J. Am. Plan. Assoc. 2015, 81, 90–103. [Google Scholar] [CrossRef]

- Vermeulen, B.; Kesselhut, J.; Pyka, A.; Saviotti, P. The Impact of Automation on Employment: Just the Usual Structural Change? Sustainability 2018, 10, 1661. [Google Scholar] [CrossRef] [Green Version]

- Litwin, H. Does early retirement lead to longer life? Ageing Soc. 2007, 27, 739–754. [Google Scholar] [CrossRef]

- Wilson, D.M.; Errasti-Ibarrondo, B.; Low, G.; O’Reilly, P.; Murphy, F.; Fahy, A.; Murphy, J. Identifying contemporary early retirement factors and strategies to encourage and enable longer working lives: A scoping review. Int. J. Older People Nurs. 2020, 15, e12313. [Google Scholar] [CrossRef] [PubMed]

- Őzdemir, E.; Ward, T.; Fuchs, M.; Ilinca, S.; Lelkes, O.; Rodrigues, R.; Zolyomi, E. Employment of Older Workers; Research Note no. 5/2015; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Directorate General for Economic and Financial Affairs. In The 2021 Ageing Report: Underlying Assumptions and Projection Methodologies; Publications Office: Luxembourg, 2020. [Google Scholar]

- European Commission. Directorate General for Employment, Social Affairs and Inclusion. In 2021 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in the EU; Publications Office: Luxembourg, 2021; Volume 2. [Google Scholar]

- Guardiancich, I.; Natali, D. The Changing EU “Pension Programme”: Policy tools and ideas in the shadow of the crisis (Final draft). In The New Pension Mix in Europe. Recent Reforms, Their Distributional Effects and Political Dynamics; Natali, D., Ed.; Travail et Société/Work and Society, PIE-Peter Lang: Brussels, Belgium, 2017; p. 20. [Google Scholar]

- Parker, O.; Pye, R. Mobilising social rights in EU economic governance: A pragmatic challenge to neoliberal Europe. Comp. Eur. Politics 2018, 16, 805–824. [Google Scholar] [CrossRef]

- Jackson, R.; Howe, N.; Nakashima, K. The Global Aging Preparedness Index; Technical Report; Center for Strategic & International Studies, Jackson National Life Insurance Company: Denver, CO, USA, 2010. [Google Scholar]

- Mercer, M. Melbourne Mercer Global Pension Index; Technical Report; Australian Centre for Financial Studies: Melbourne, Australia, 2011. [Google Scholar]

- Survey of Health, Ageing and Retirement in Europe, SHARE Research Data Center. Guide to easySHARE Release 8.0.0; Version Number: 8.0.0; Type: Dataset; Survey of Health, Ageing and Retirement in Europe, SHARE Research Data Center: Munich, Germnay, 2022. [Google Scholar] [CrossRef]

- Siegrist, J.; Wahrendorf, M.; von dem Knesebeck, O.; Jurges, H.; Borsch-Supan, A. Quality of work, well-being, and intended early retirement of older employees–baseline results from the SHARE Study. Eur. J. Public Health 2007, 17, 62–68. [Google Scholar] [CrossRef] [Green Version]

- Hartshorn, S. Machine Learning with Random Forests and Decision Trees: A Visual Guide for Beginners. E-Book Kindle Edition. 2016. Available online: https://www.amazon.com/Machine-Learning-Random-Forests-Decision-ebook/dp/B01JBL8YVK (accessed on 27 December 2022).

- Mitchell, T.M. Machine Learning, 1st ed.; McGraw-Hill Education: New York, NY, USA, 1997. [Google Scholar]

- Therneau, T.; Atkinson, B. Rpart: Recursive Partitioning and Regression Trees R Package Version 4.1.19. 2022. Available online: https://www.rdocumentation.org/packages/rpart/versions/4.1.19/topics/rpart (accessed on 27 December 2022).

- Milborrow, S. Rpart.plot: Plot ’rpart’ Models: An Enhanced Version of ’plot.rpart R Package Version 3.1.1. 2022. Available online: https://cran.r-project.org/web/packages/rpart.plot/rpart.plot.pdf (accessed on 27 December 2022).

- Kuhn, M. Caret: Classification and Regression Training R Package Version 6.0-93. 2022. Available online: https://rdrr.io/cran/caret/ (accessed on 27 December 2022).

- Greenwell, B.; Boehmke, B. Variable Importance Plots—An Introduction to the vip Package. R J. 2020, 12, 343–366. [Google Scholar] [CrossRef]

- Greenwell, B. pdp: An {R} Package for Constructing Partial Dependence Plots. R J. 2017, 9, 421–436. [Google Scholar] [CrossRef] [Green Version]

| Country | Statutory Age | Average Effective Age | Difference |

|---|---|---|---|

| Belgium | 65 | 63.3 | 1.7 |

| Bulgaria | 64.2 | 64.7 | −0.5 |

| Czech Republic | 63.5 | 63.5 | 0 |

| Denmark | 65.5 | 65 | 0.5 |

| Germany | 65.7 | 64.7 | 1 |

| Estonia | 63.6 | 65.2 | −1.6 |

| Ireland | 66 | 65.5 | 0.5 |

| Greece | 67 | 63 | 4 |

| Spain | 65.7 | 63.4 | 2.3 |

| France | 66.8 | 62.3 | 4.5 |

| Croatia | 65 | 62.7 | 2.3 |

| Italy | 67 | 65.2 | 1.8 |

| Cyprus | 65 | 64.4 | 0.6 |

| Latvia | 63.5 | 63.2 | 0.3 |

| Lithuania | 63.8 | 63.4 | 0.4 |

| Luxembourg | 65 | 60.4 | 4.6 |

| Hungary | 64 | 63.2 | 0.8 |

| Malta | 62.9 | 62.8 | 0.1 |

| Netherlands | 66.3 | 65.8 | 0.5 |

| Austria | 65 | 63.2 | 1.8 |

| Poland | 65 | 64.5 | 0.5 |

| Portugal | 66.4 | 64.6 | 1.8 |

| Romania | 65 | 64.1 | 0.9 |

| Slovenia | 65 | 62.1 | 2.9 |

| Slovakia | 62.5 | 62 | 0.5 |

| Finland | 63.5 | 63.9 | −0.4 |

| Sweden | 67 | 65.6 | 1.4 |

| Group | Predictor | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| Depression | 2.081 | 1.81 | 0 | 9 | |

| Health | Doctor_visits | 3.512 | 4.97 | 0 | 50 |

| Levels | |||||

| Health | Self_health | 5 | 1 = excellent; 5 = poor | ||

| Chronic_dis | 5 | 0 = none; 4 = stroke or cerebral vascular disease | |||

| BMI | 4 | 1 = underweight; 4 = obese | |||

| Work | Job_term | 2 | 1 = short-term; 2 = permanent | ||

| Life_quality_cat | 2 | higher > 38.9; lower < 38.9 | |||

| Hours_worked | 2 | more than 40 > 40; less than 40 < 40 | |||

| Job_satisf | 4 | 1 = strongly agree; 4 = strongly disagree | |||

| n = 421 | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tkalec, I. Millennials and Early Retirement: An Exploratory Study. Merits 2023, 3, 248-262. https://doi.org/10.3390/merits3020015

Tkalec I. Millennials and Early Retirement: An Exploratory Study. Merits. 2023; 3(2):248-262. https://doi.org/10.3390/merits3020015

Chicago/Turabian StyleTkalec, Igor. 2023. "Millennials and Early Retirement: An Exploratory Study" Merits 3, no. 2: 248-262. https://doi.org/10.3390/merits3020015

APA StyleTkalec, I. (2023). Millennials and Early Retirement: An Exploratory Study. Merits, 3(2), 248-262. https://doi.org/10.3390/merits3020015