Adverse Selection in Community Based Health Insurance among Informal Workers in Bangladesh: An EQ-5D Assessment

Abstract

:1. Introduction

2. Materials and Methods

2.1. CBHI Scheme

2.2. Study Design

2.3. Study Population and Sample

2.4. Data Collection

2.5. Health Status Measurement

2.6. Econometric Analysis

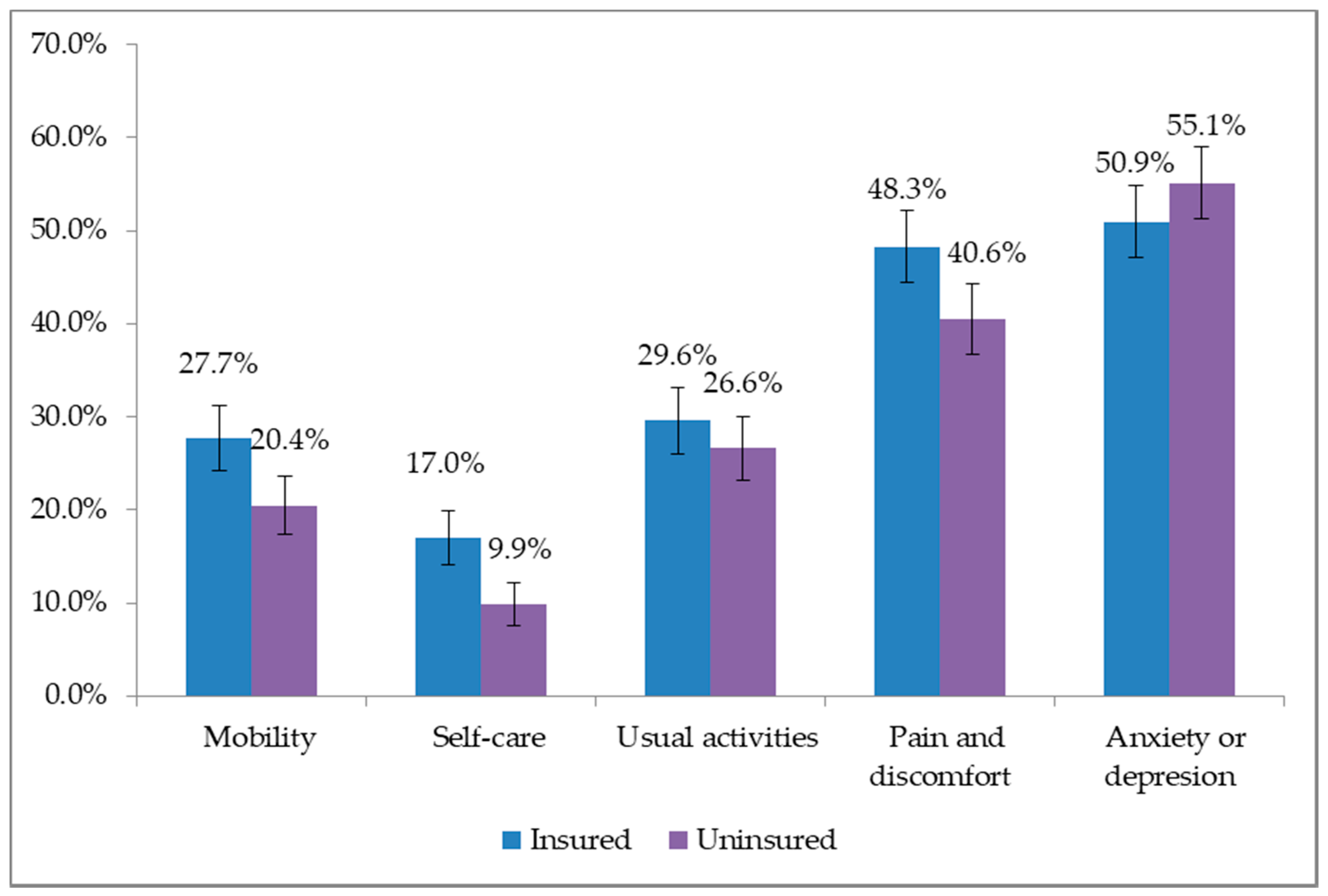

3. Results

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Mills, A. Health care systems in low- and middle-income countries. N. Engl. J. Med. 2014, 370, 552–557. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. Global Health Expenditure Database; World Health Organization: Geneva, Switzerland, 2012. [Google Scholar]

- World Health Organization. The World Health Report: Health Systems Financing: The Path to Universal Coverage; World Health Organization: Geneva, Switzerland, 2010. [Google Scholar]

- Bennett, S. The role of community-based health insurance within the health care financing system: A framework for analysis. Health Policy Plan. 2004, 19, 147–158. [Google Scholar] [CrossRef] [PubMed]

- Barasa, E.W.; Mwaura, N.; Rogo, K.; Andrawes, L. Extending voluntary health insurance to the informal sector: Experiences and expectations of the informal sector in Kenya. Wellcome Open Res. 2017, 2, 94. [Google Scholar] [CrossRef]

- Khan, J.A.M.; Ahmed, S.; Evans, T.G. Catastrophic healthcare expenditure and poverty related to out-of-pocket payments for healthcare in Bangladesh—An estimation of financial risk protection of universal health coverage. Health Policy Plan. 2017, 1–9. [Google Scholar] [CrossRef] [PubMed]

- MoHFW. Bangladesh National Health Accounts 1997–2015; MoHFW: Dhaka, Bangladesh, 2017.

- MoHFW. Expanding Social Protection for Health: Towards Universal Coverage, Health Care Financing Strategy 2012–2032; MoHFW: Dhaka, Bangladesh, 2012.

- Parmar, D.; Souares, A.; de Allegri, M.; Savadogo, G.; Sauerborn, R. Adverse selection in a community-based health insurance scheme in rural Africa: Implications for introducing targeted subsidies. BMC Health Serv. Res. 2012, 12, 181. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Donfouet, H.; Mahieu, P.-A. Community-based health insurance and social capital: A review. Health Econ. Rev. 2012, 2, 5. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ranson, M.K. Reduction of catastrophic health care expenditures by a community-based health insurance scheme in Gujarat, India: Current experiences and challenges. Bull. World Health Organ. 2002, 80, 613–621. [Google Scholar] [PubMed]

- Rothschild, M.; Stiglitz, J. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information Author(s): Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. Source Q. J. Econ. 1976, 90, 629–649. [Google Scholar] [CrossRef]

- Resende, M.; Zeidan, R. Adverse selection in the health insurance market: Some empirical evidence. Eur. J. Health Econ. 2010, 11, 413–418. [Google Scholar] [CrossRef] [PubMed]

- Wang, H.; Zhang, L.; Yip, W.; Hsiao, W. Adverse selection in a voluntary rural mutual health care health insurance scheme in China. Soc. Sci. Med. 2006, 63, 1236–1245. [Google Scholar] [CrossRef] [PubMed]

- Cutler, D.M.; Zeckhauser, R.J. The Anatomy of Health Insurance. In Handbook of Health Economics; Culyer, A.J., Newhouse, J.P., Eds.; Elsevier: Amsterdam, The Netherlands, 2000; pp. 563–637. [Google Scholar]

- Noterman, J.P.; Criel, B.; Kegels, G.; Isu, K. A prepayment scheme for hospital care in the Masisi district in Zaire: A critical evaluation. Soc. Sci. Med. 1995, 40, 919–930. [Google Scholar] [CrossRef]

- Dror, D.M.; Soriano, E.S.; Lorenzo, M.E.; Sarol, J.N.; Azcuna, R.S.; Koren, R. Field based evidence of enhanced healthcare utilization among persons insured by micro health insurance units in Philippines. Health Policy 2005, 73, 263–271. [Google Scholar] [CrossRef] [PubMed]

- De Allegri, M.; Kouyaté, B.; Becher, H.; Gbangou, A.; Pokhrel, S.; Sanon, M. Understanding enrolment in community health insurance in sub-Saharan Africa: A population-based case—Control study in rural Burkina Faso. Bull. World Health Organ. 2006, 84, 852–858. [Google Scholar] [CrossRef] [PubMed]

- Bangladesh Bank. Annual Report 2014–2015; Bangladesh Bank: Dhaka, Bangladesh, 2015; Volume 1. [Google Scholar]

- Asian Development Bank. The Informal Sector and Informal Employment in Bangladesh; Asian Development Bank: Manila, Philipines, 2010; ISBN 978-9-29-092923-9. [Google Scholar]

- Brooks, R.; Rabin, R.; de Charro, F. The Measurement and Valuation of Health Status Using EQ-5D: A European Perspective: Evidence from the EuroQol BIOMED Research Programme; Brooks, R., Rabin, R., de Charro, F., Eds.; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2003; ISBN 9401702330. [Google Scholar]

- Rabin, R.; Charro, F. EQ-SD: A measure of health status from. Ann. Med. 2001, 33, 337–343. [Google Scholar] [CrossRef] [PubMed]

- Saleh, F.; Mumu, S.J.; Ara, F.; Hafez, M.A.; Ali, L. Non-adherence to self-care practices & medication and health related quality of life among patients with type 2 diabetes: A cross-sectional study. BMC Public Health 2014, 14, 431. [Google Scholar] [CrossRef]

- Morris, S.; Devlin, N.J.; Parkin, D. Economic Analysis in Health Care, 2nd ed.; John Wiley & Sons, Ltd.: Chicheste, UK, 2012; ISBN 047001685X. [Google Scholar]

- Khan, J.A.M.; Ahmed, S. Impact of educational intervention on willingness-to-pay for health insurance: A study of informal sector workers in urban Bangladesh. Health Econ. Rev. 2013, 3, 12. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Schneider, P.; Diop, F. Community-Based Health Insurance in Rwanda. In Health Financing for Poor People: Resource Mobilization and Risk Sharing; Preker, A.S., Carrin, G., Eds.; The World Bank: Washington, DC, USA, 2005; pp. 251–272. [Google Scholar]

- Jütting, J. Do community-based health insurance schemes improve poor people’s access to health care? Evidence from rural Senegal. World Dev. 2003, 32, 273–288. [Google Scholar] [CrossRef]

| Services | Co-Payment/Description * |

|---|---|

| Health benefits | |

| General practitioner (GP) Consultation | 30 BDT (Market price = 300 BDT) |

| Medicine | 20% discount from maximum retail price |

| Diagnostic tests | 50% discount on market price |

| Specialist doctor consultation | 100 BDT (Market price = 500 BDT) |

| Hospitalization | Maximum 4000 BDT per household per year |

| Periodic satellite clinics in remote rural areas | Free of charge |

| Non-health benefits | |

| Savings opportunity |

|

| Training programs |

|

| Characteristics | Insured (N = 646) | Uninsured (N = 646) | p-Value |

|---|---|---|---|

| % (95% CI) | % (95% CI) | ||

| Age group | |||

| Adult (<60) | 95.8 (93.9–97.1) | 95.5 (93.6–96.9) | 0.780 a |

| Elderly (60+) | 4.3 (2.9–6.0) | 4.5 (3.1–6.4) | |

| Gender | |||

| Female | 51.7 (47.8–55.5) | 56.0 (52.2–59.8) | 0.120 a |

| Male | 48.3 (44.5–52.2) | 44.0 (40.2–47.8) | |

| Household size | |||

| Fewer than 4 members | 6.8 (5.1–9.0) | 15.8 (13.2–18.8) | 0.001 b |

| 4–5 members | 40.6 (36.8–44.4) | 53.9 (50.0–57.7) | |

| 6 members or more | 52.6 (48.8–56.5) | 30.3 (26.9–34.0) | |

| Characteristics | Insured | Uninsured | p-Value |

|---|---|---|---|

| % (95% CI) | % (95% CI) | ||

| EQ-5D mean score | 0.704 (0.682–0.727) | 0.749 (0.730–0.769) | 0.003 |

| EQ-5D median score | 0.726 | 0.766 | |

| VAS (mean score) | 77.0 (75.5–78.5) | 77.3 (75.9–78.7) | 0.783 |

| VAS (Median score) | 80.0 | 80.0 | |

| Self-reported chronic illness/symptoms | 9.8 (7.5–12.0) | 7.6 (5.5–9.6) | 0.166 |

| Variables | Description | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|---|

| Age group | Elderly, 60+ (Ref = Adult, <60) | 0.810 (0.455–1.440) | 0.891 (0.504–1.575) | 0.910 (0.516–1.603) | 0.887 (0.503–1.563) | 0.980 (0.555–1.728) |

| Gender | Female (Ref = Male) | 1.217 (0.965–1.534) | 1.247 (0.989–1.574) | 1.172 (0.931–1.476) | 1.188 (0.944–1.495) | 1.123 (0.893–1.411) |

| Household size | 4–5 members (Ref = Fewer than 4 members) | 1.747 ** (1.180–2.585) | 1.793 ** (1.207–2.662) | 1.730 ** (1.171–2.557) | 1.713 ** (1.158–2.532) | 1.719 ** (1.164–2.539) |

| 6 members or more (Ref = Fewer than 4 members) | 4.034 *** (2.705–6.016) | 4.272 *** (2.853–6.398) | 3.982 *** (2.675–5.927) | 3.957 *** (2.657–5.893) | 3.913 *** (2.631–5.820) | |

| Chronic illness | Yes (Ref = No) | 1.218 (0.808–1.834) | 1.252 (0.831–1.887) | 1.231 (0.817–1.856) | 1.178 (0.781–1.777) | 1.332 (0.886–2.001) |

| Mobility | Any problem (Ref = No problem) | 1.649 *** (1.253–2.170) | - | - | - | - |

| Self-care | Any problem (Ref = No problem) | - | 2.290 *** (1.617–3.245) | - | - | - |

| Usual activities | Any problem (Ref = No problem) | - | - | 1.244 (0.960–1.613) | - | - |

| Pain and discomfort | Any problem (Ref = No problem) | - | - | - | 1.431 ** (1.133–1.807) | - |

| Anxiety or depression | Any problem (Ref = No problem) | - | - | - | - | 0.878 (0.698–1.103) |

| Constant | 0.347 *** (0.236–0.509) | 0.331 *** (0.225–0.487) | 0.375 *** (0.256–0.550) | 0.343 *** (0.232–0.505) | 0.436 *** (0.295–0.646) | |

| N | 1291 | 1291 | 1291 | 1291 | 1291 | |

| LR chi2(27) | 90.12 | 99.84 | 79.94 | 86.32 | 78.45 | |

| Prob. > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Pseudo R2 | 0.050 | 0.056 | 0.045 | 0.048 | 0.044 |

| Variables | Description | Model 6 (Dependent = CBHI Enrollment; 1 = Insured, 0 = Uninsured) Odds Ratio (95% CI) |

|---|---|---|

| Age group | Elderly, 60+ (Ref = Adult, <60) | 0.861 (0.488–1.518) |

| Gender | Female (Ref = Male) | 1.196 (0.950–1.506) |

| Household size | 4–5 members (Ref ≤ 4 members) | 1.736 ** (1.173–2.570) |

| ≥6 members (Ref ≤ 4 members) | 4.049 *** (2.715–6.040) | |

| Chronic illness | Yes (Ref = No) | 1.164 (0.771–1.757) |

| Eq-5D score | 0.460 *** (0.307–0.689) | |

| Constant | 0.711 (0.444–1.137) | |

| N | 1291 | |

| LR chi2(27) | −848.9 | |

| Prob. > chi2 | 0.000 | |

| Pseudo R2 | 0.051 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, S.; Sarker, A.R.; Sultana, M.; Chakrovorty, S.; Hasan, M.Z.; Mirelman, A.J.; Khan, J.A.M. Adverse Selection in Community Based Health Insurance among Informal Workers in Bangladesh: An EQ-5D Assessment. Int. J. Environ. Res. Public Health 2018, 15, 242. https://doi.org/10.3390/ijerph15020242

Ahmed S, Sarker AR, Sultana M, Chakrovorty S, Hasan MZ, Mirelman AJ, Khan JAM. Adverse Selection in Community Based Health Insurance among Informal Workers in Bangladesh: An EQ-5D Assessment. International Journal of Environmental Research and Public Health. 2018; 15(2):242. https://doi.org/10.3390/ijerph15020242

Chicago/Turabian StyleAhmed, Sayem, Abdur Razzaque Sarker, Marufa Sultana, Sanchita Chakrovorty, Md. Zahid Hasan, Andrew J. Mirelman, and Jahangir A. M. Khan. 2018. "Adverse Selection in Community Based Health Insurance among Informal Workers in Bangladesh: An EQ-5D Assessment" International Journal of Environmental Research and Public Health 15, no. 2: 242. https://doi.org/10.3390/ijerph15020242