Appendix A. Proof of propositions and Corollaries

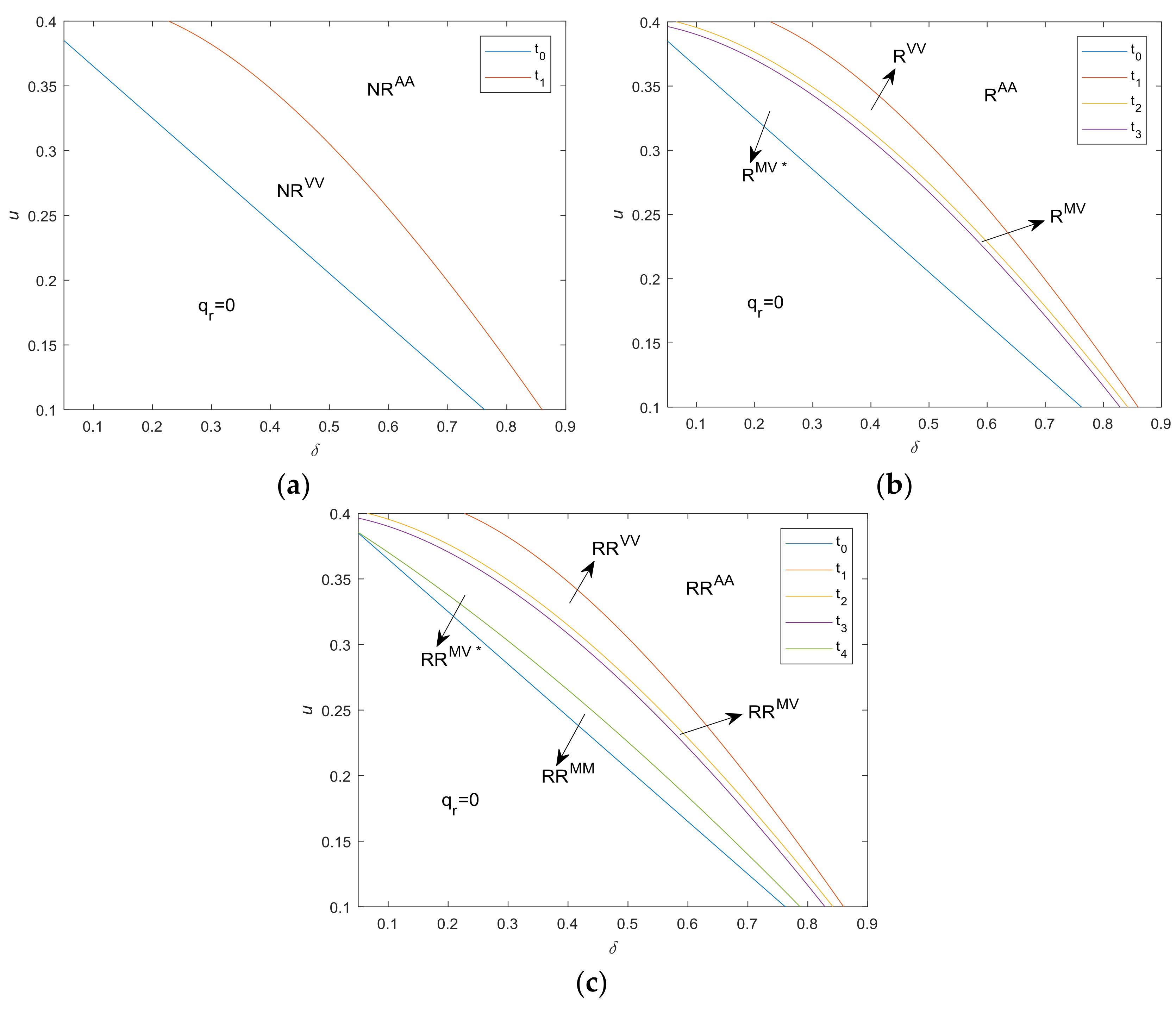

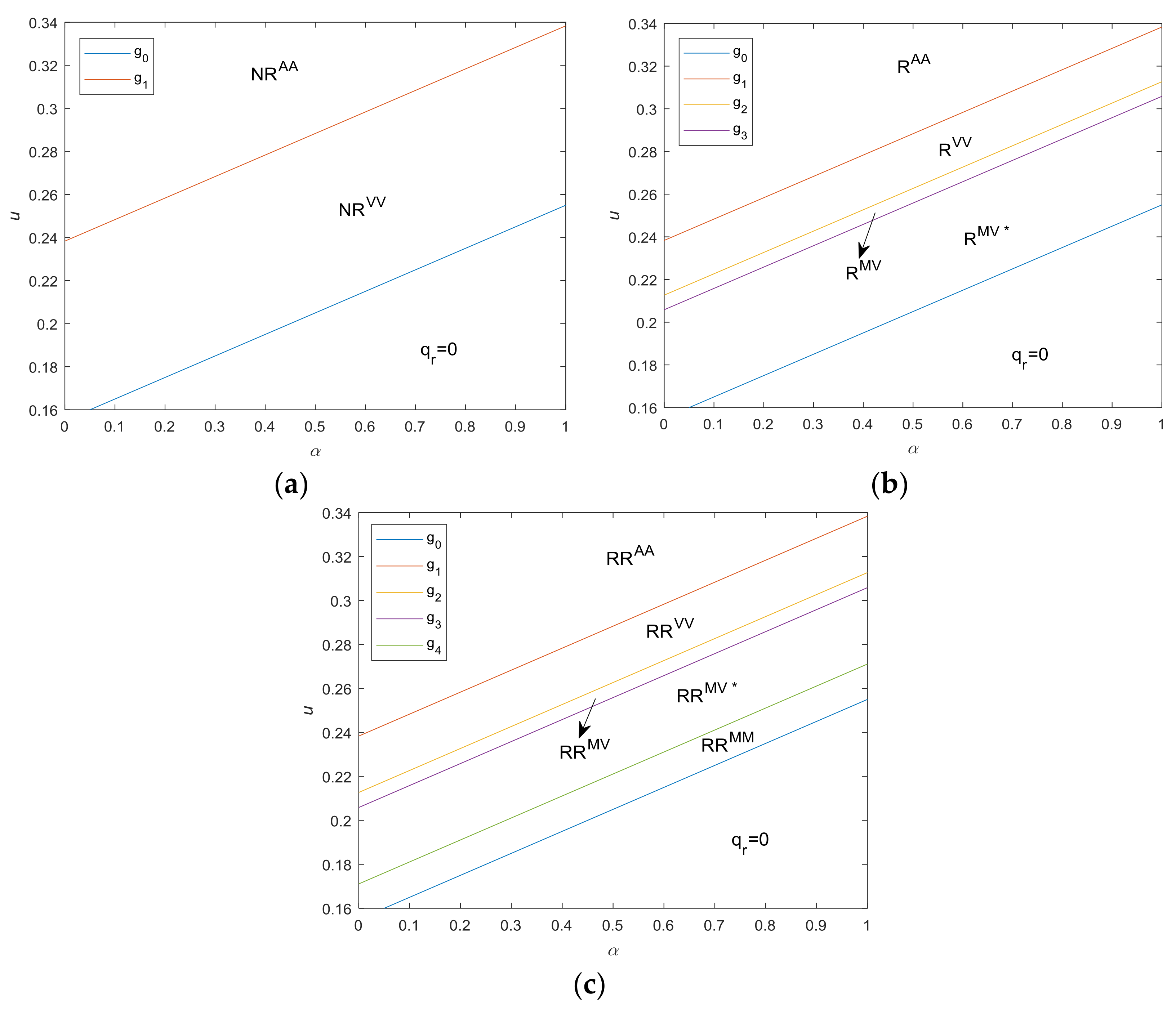

Proof of Proposition 1. The Lagrange function is , where , are Lagrange multipliers. The corresponding Hessian Matrix is , as , , and the Hessian Matrix is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , and , we can get three solutions:

Solution 1: Here, , , , and , the manufacturer only produces new products, however, we only focused on the situation that new and remanufactured products coexist.

Solution 2 (NRVV): Here, , and . The optimality condition implies , while implies .

Solution 3 (NRAA): Here, , , and . The optimality condition can be written as .□

Proof of Corollary 1. According to , we get . □

Proof of Proposition 2. The Lagrange function is . The Hessian is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , , , and , after eliminate the redundant solutions, we get five solutions:

Solution 1: , we don’t consider this case, as we assume the manufacturer participates in remanufacturing in the absence of regulation.

Solution 2 (RMV*): Here, , and . The optimality condition implies .

Solution 3 (RMV): Here, , , , and . The optimality condition can be written as , while can be written as ().

Solution 4 (RVV): Here, , , and . The optimality conditions implies , while implies , furthermore (as ). Note that this is the same as solution 2 under no regulation (NRVV).

Solution 5 (RAA): Here, , , and . The optimality condition can be written as . Note that this is the same as solution 3 under no regulation (i.e., NRAA). □

Proof of Corollary 2. According to , we have . And according to , we have . □

Proof of Proposition 3. The Lagrange function is . The Hessian is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , , , and , we get four solutions, among which, solutions 3–5 are the same as the corresponding ones under regulation only with collection target. After the redundant OCs are eliminated, we characterize the optimal solutions as follows:

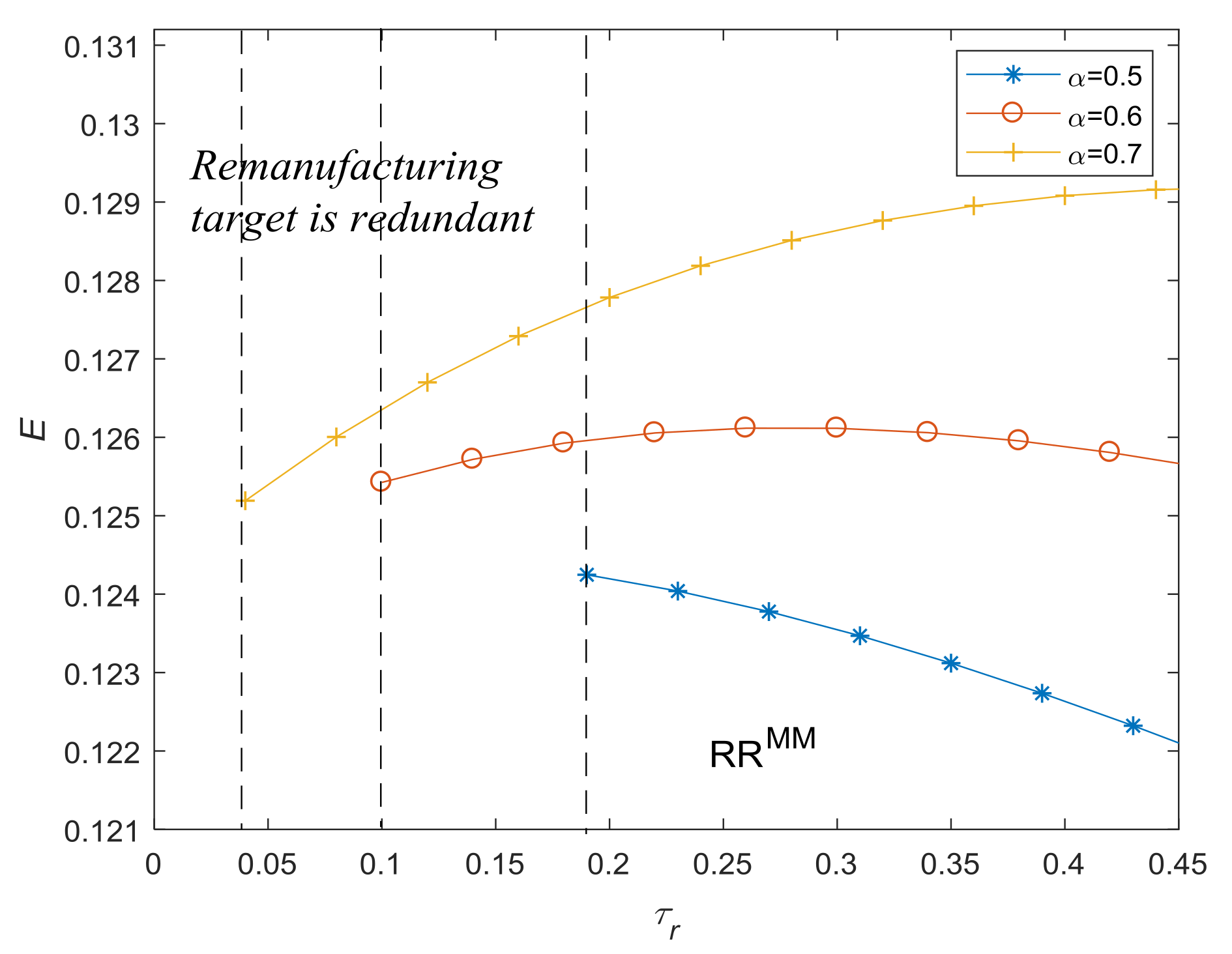

Solution 1 (RRMM): Here, , , , and . The optimality condition can be written as .

Solution 2 (RRMV*): Here, , , and . The optimality condition implies , while implies , furthermore (as ). Note that this is the same as solution 1 under regulation only with collection target (RMV*), however, the lower boundary of u is different. □

Proof of Corollary 3. According to , and , we have . □

Proof of Proposition 4. The Lagrange function is , where are Lagrange multipliers. The corresponding Hessian Matrix is , as , , and , the Hessian Matrix is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , and , we can get three solutions:

Solution 1: Here, , , , and , the manufacturer only produces new products, however, we only focused on the situation that new and remanufactured products coexist.

Solution 2 (NRVV): Here, , and . The optimality condition implies , while implies .

Solution 3 (NRAA): Here, , , and . The optimality condition can be written as . □

Proof of Corollary 4. According to , we get . □

Proof of Proposition 5. The Lagrange function is . The Hessian is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , , , and , after eliminate the redundant solutions, we get five solutions:

Solution 1, , we don’t consider this case, as we assume manufacturer participates in remanufacturing in absence of take-bake regulation.

Solution 2 (RMV*): Here, , and . The optimality condition implies .

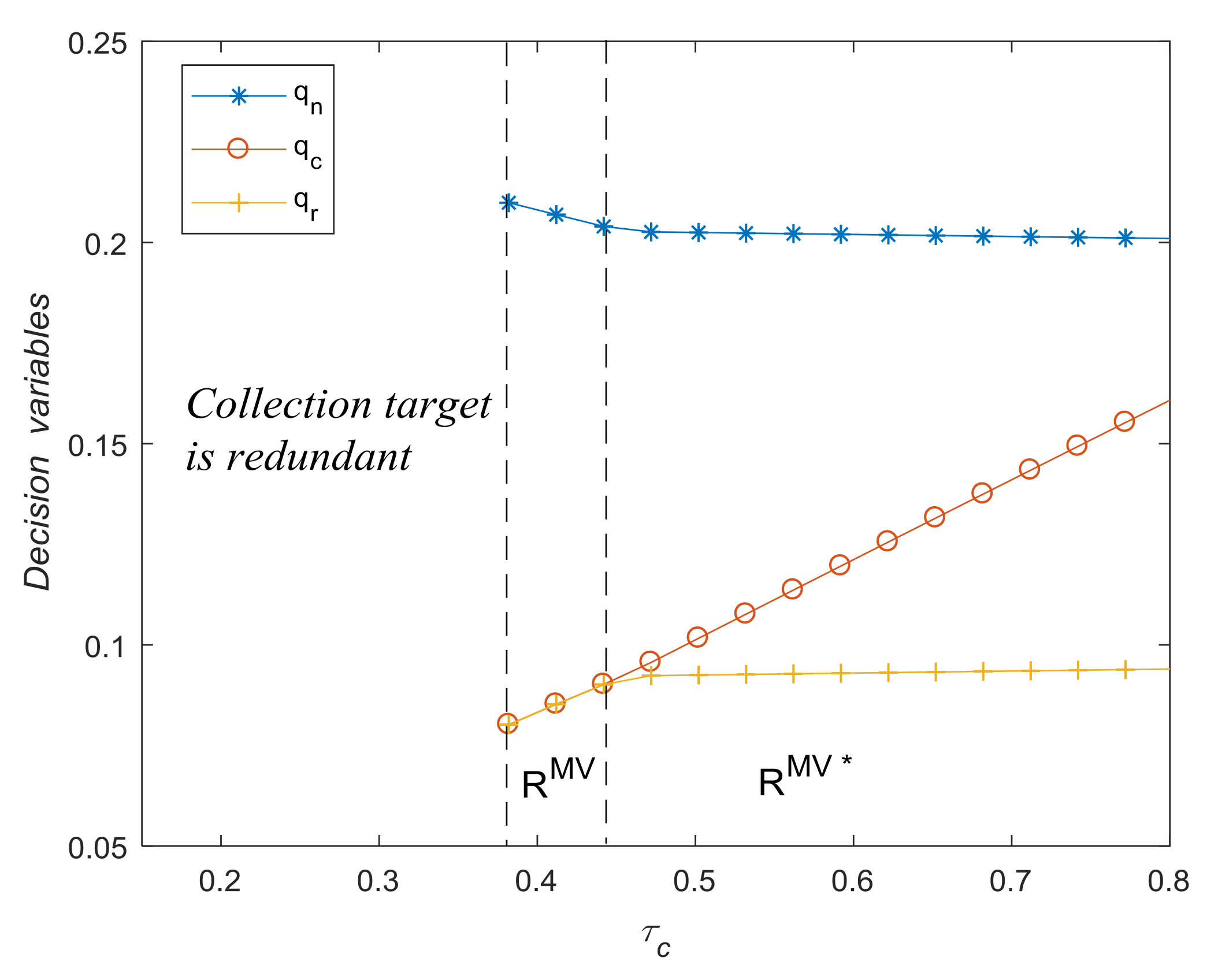

Solution 3 (RMV): Here, , and , and . The optimality condition can be written as , while can be written as , what’s more, .

Solution 4 (RVV): Here, , and . The optimality condition implies , while implies , furthermore (as ). Note that this is the same as solution 2 under no regulation (NRVV).

Solution 5 (RAA): Here, , , and . The optimality condition can be written as . Note that this is the same as solution 3 under no regulation (i.e., NRAA). □

Proof of Corollary 5. According to , we have . And according to , we have . □

Proof of Proposition 6. The Lagrange function is . The Hessian is negative semidefinite, and thus the first-order conditions guarantee optimality. Then, solving the Karush-Kuhn-Tucker (KKT) conditions, , , , , , , , , , , and , we get four solutions, among which, solutions 3–5 are the same as the corresponding ones under regulation with collection target al.one. After the redundant OCs are eliminated, we characterize the optimal solutions as follows:

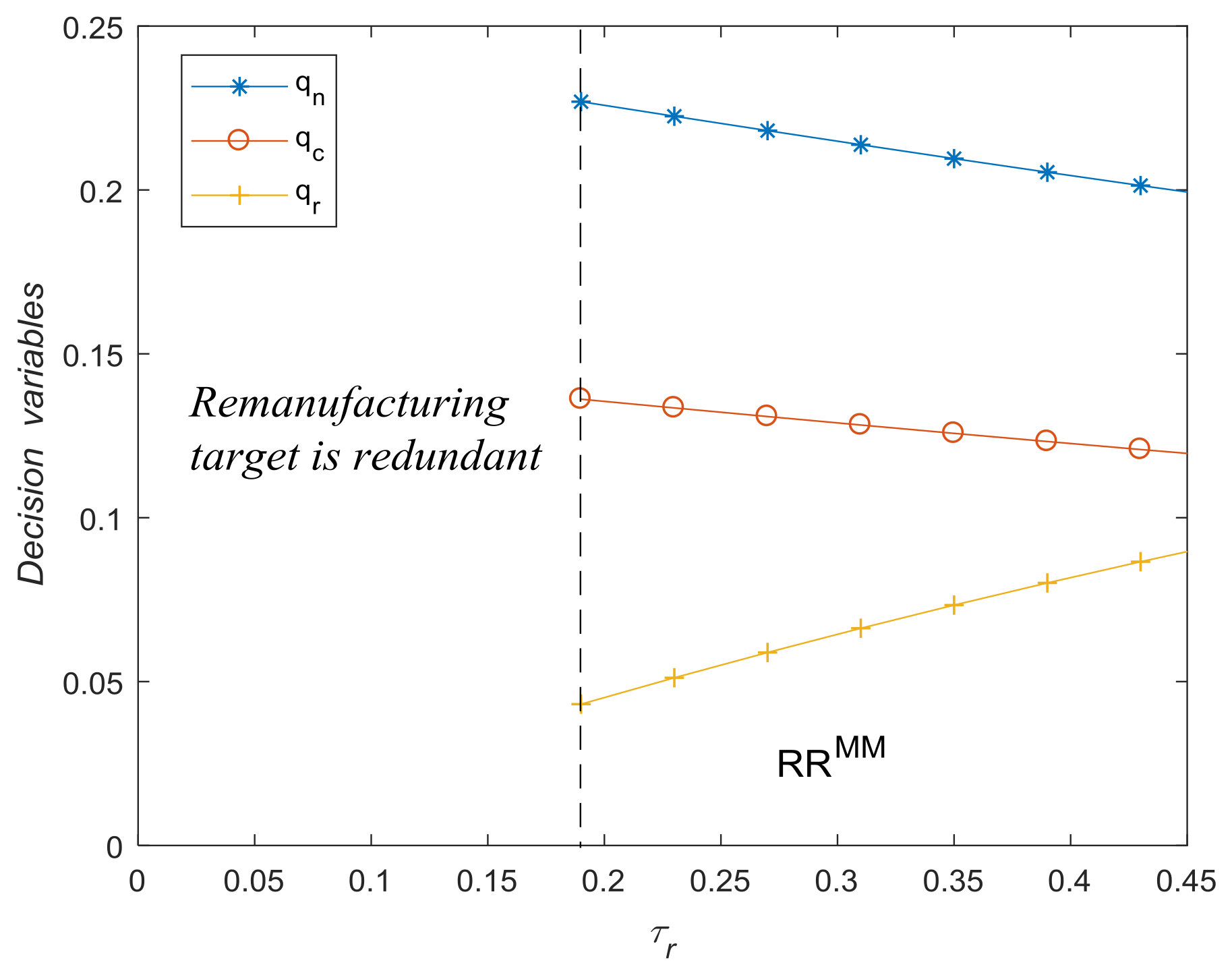

Solution 1 (RRMM): Here, , , , and . The optimality condition can be written as .

Solution 2 (RRMV*): Here, , and . The optimality conditions implies , while implies , furthermore (as ). Note that this is the same as solution 1 under regulation only with collection target (RMV*), however, the lower boundary of u is different.

Proof of Corollary 6. According to , and , we have . □

Proof of Lemma 1. - (i)

According to Proposition 5, in solution RMV*, and . In solution RMV, and .

- (ii)

According to Proposition 6, in solution RRMM, and . □

Proof of Proposition 7. There are two solutions (RMV* and RMV) that characterize the optimal strategies of the manufacturer under regulation with binding collection target in Proposition 5. Under solution RMV*, . Therefore, if , then . Under solution RMV, . Therefore, if and , then , where . □

Proof of Proposition 8. Proposition 6 implies that under regulation with additional remanufacturing target, the optimal strategies are the same as ones under regulation only with collection target, except solution RRMM. Under solution RRMM, . Therefore, if and , then , where . □

Proof of Proposition 9. (i) Comparing the carbon emissions in

Table 7 with the carbon emissions in

Table 5, we can obtain the former with less carbon emissions; (ii) According to

Table 5, we have

. □