Data-Driven Optimization of Incentive-based Demand Response System with Uncertain Responses of Customers

Abstract

:1. Introduction

2. Related Works

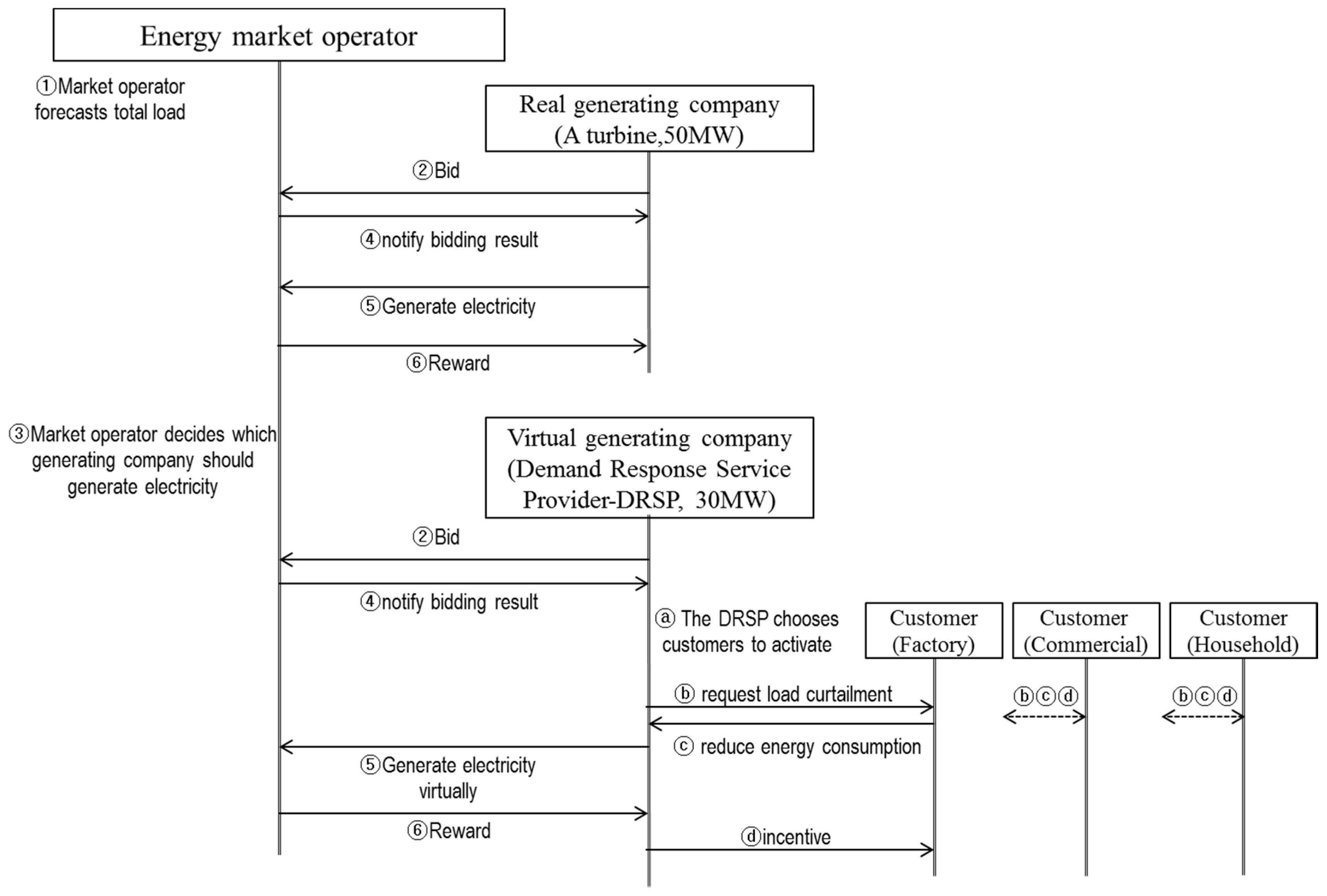

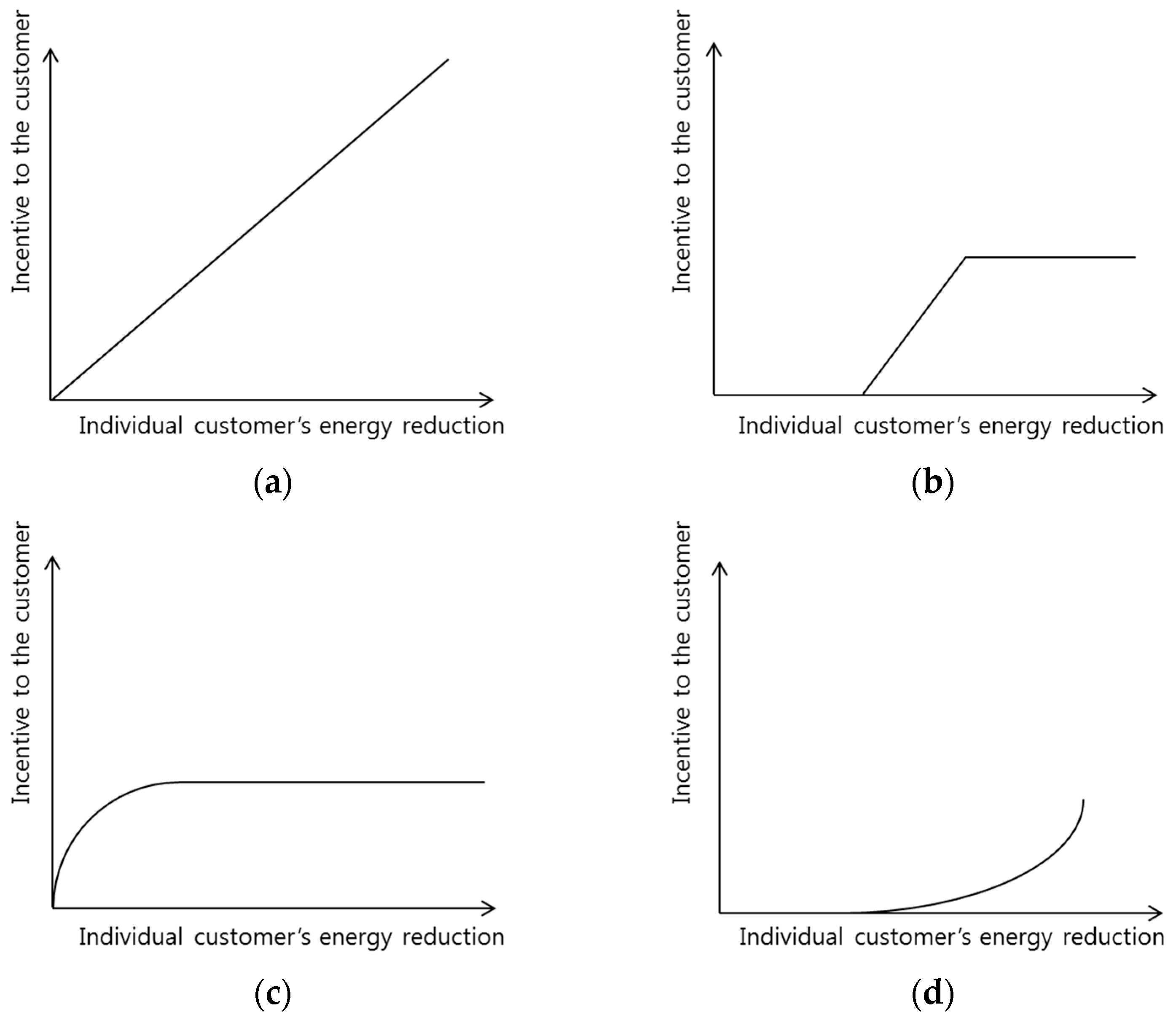

3. Structure of the Incentive-Based Demand Response Market

4. Optimization of Customer Selection with the Uncertain Responses of Customers

4.1. Problem Definition

4.2. Problem Solving with Stochastic Programming

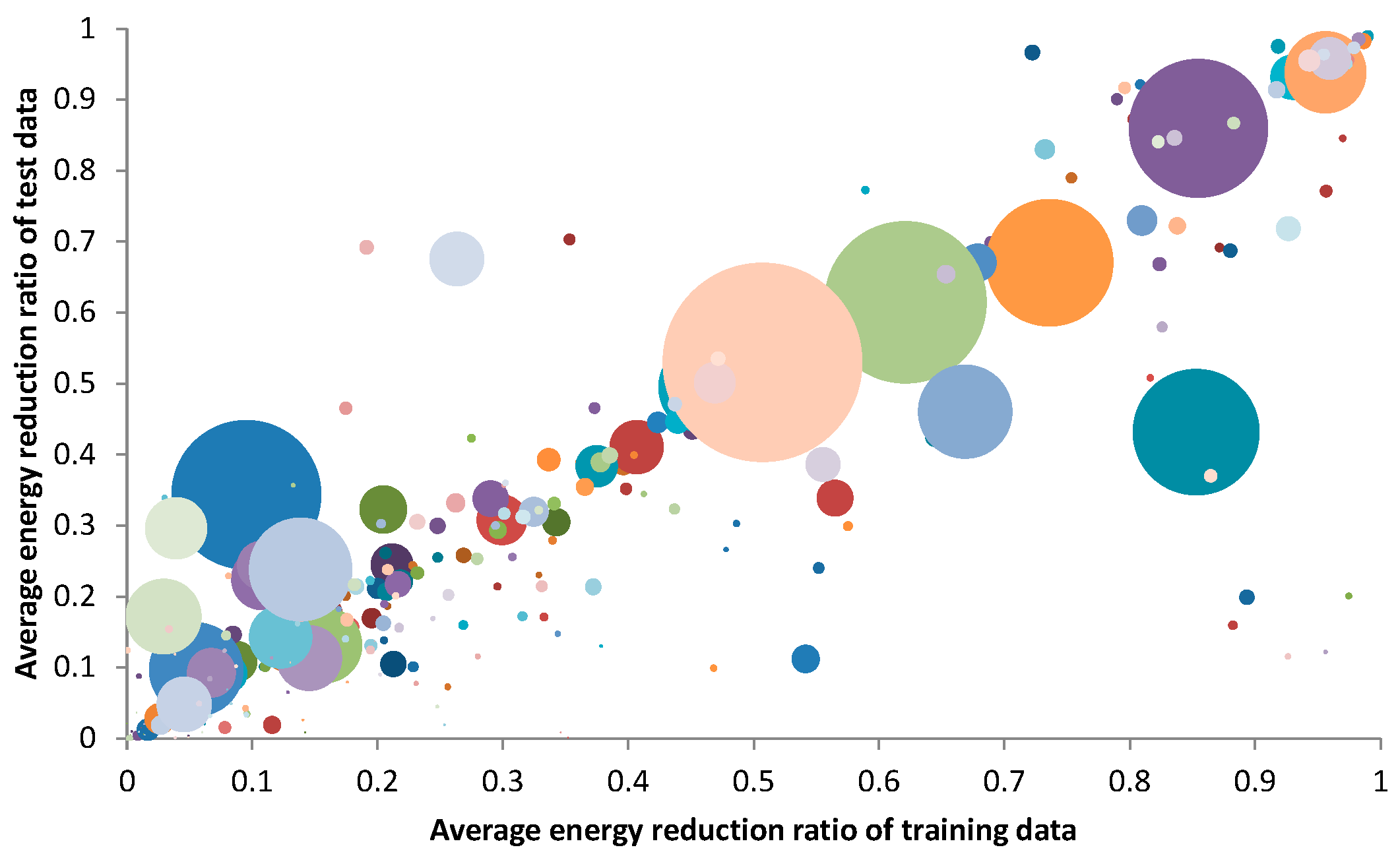

4.3. Prediction of Energy Reduction for Each Customer

5. Experiment

5.1. Data Set and Experimental Setup

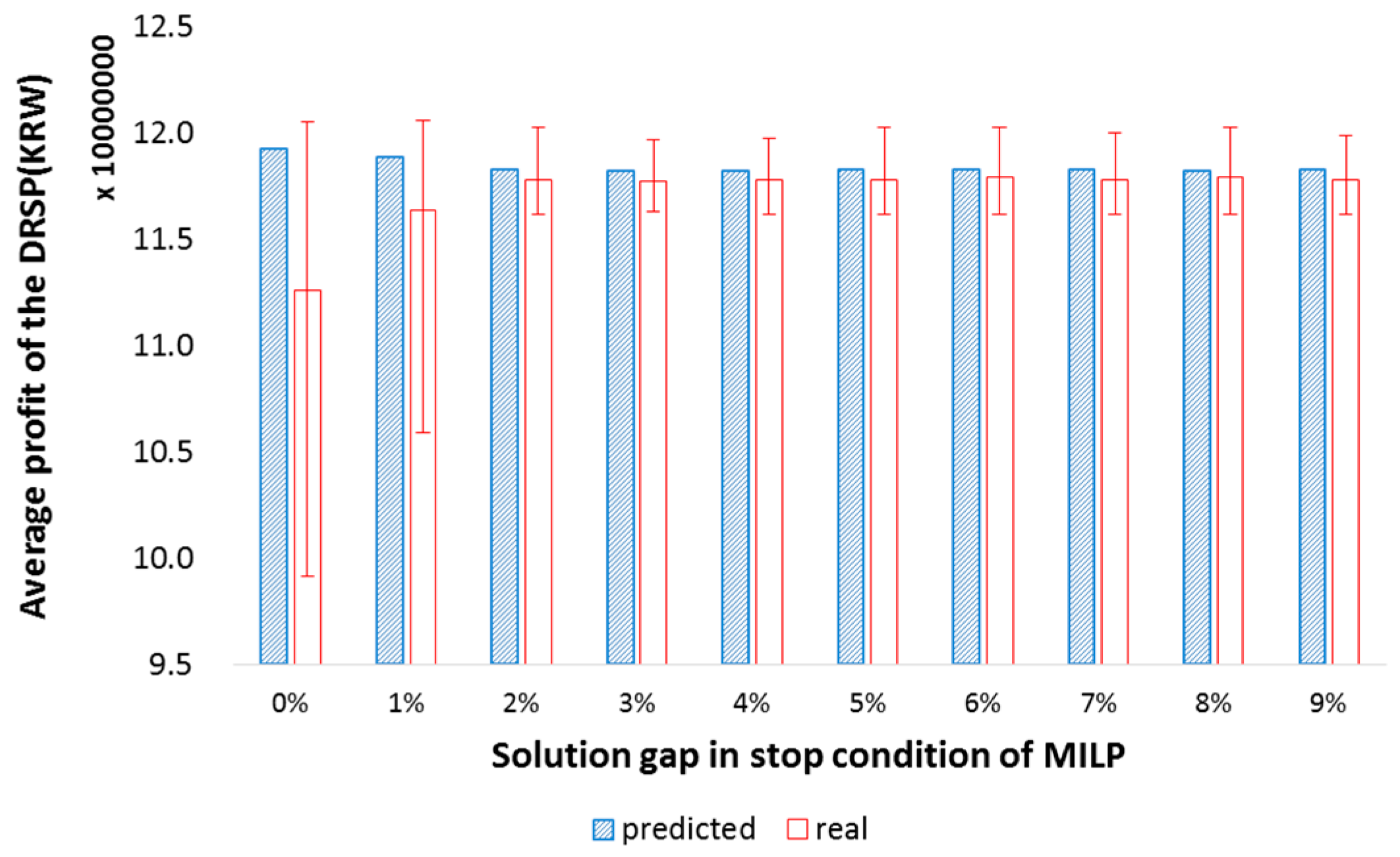

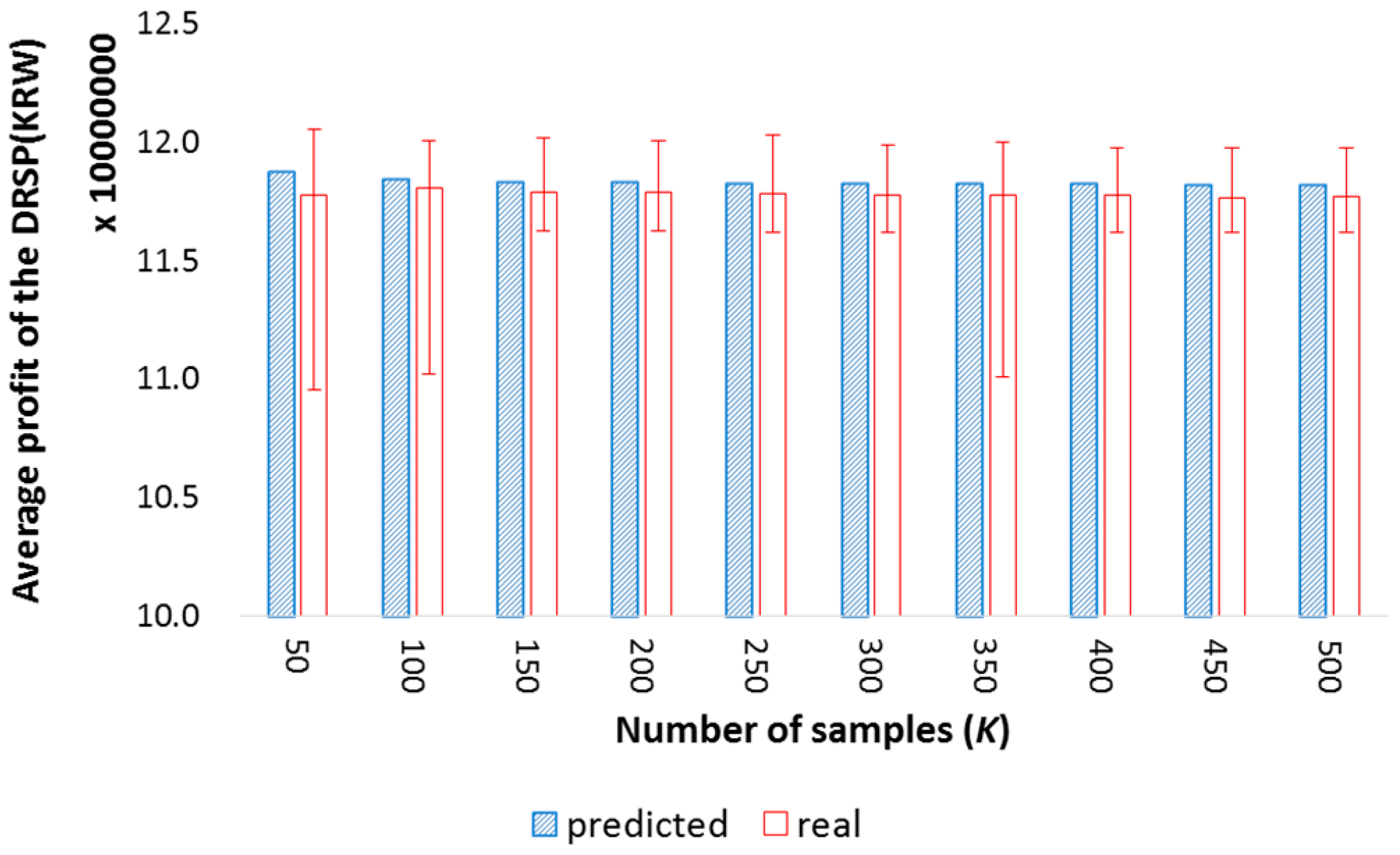

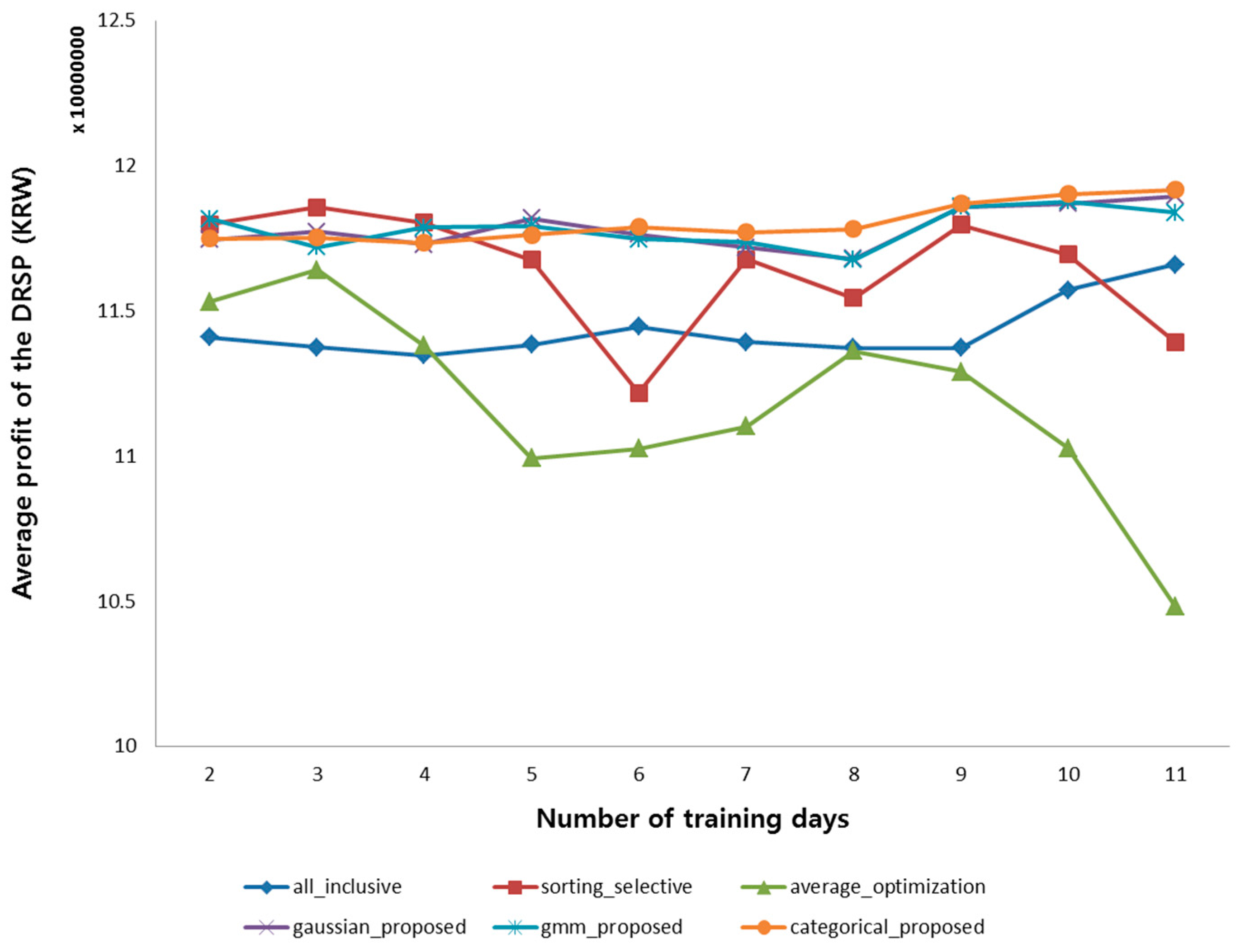

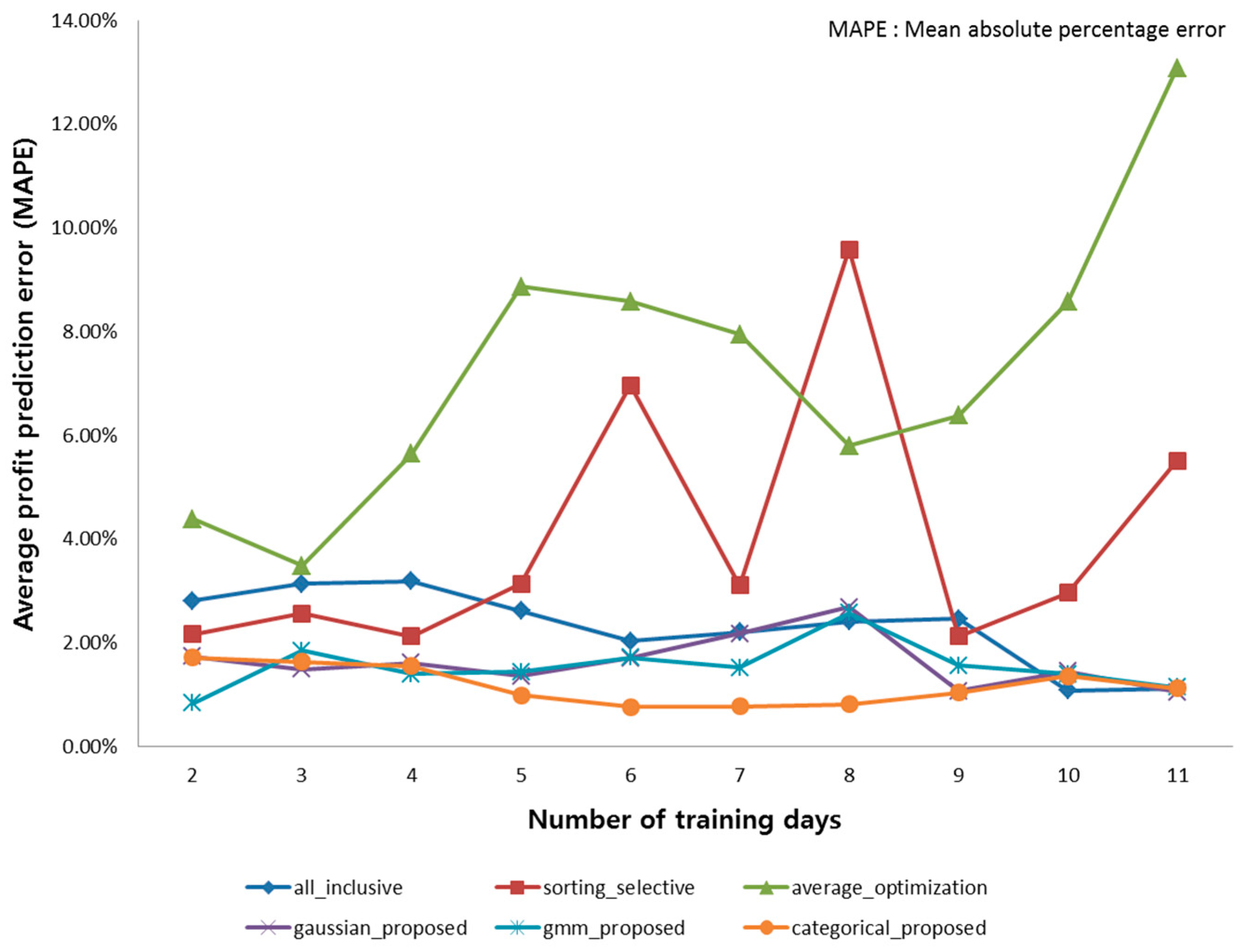

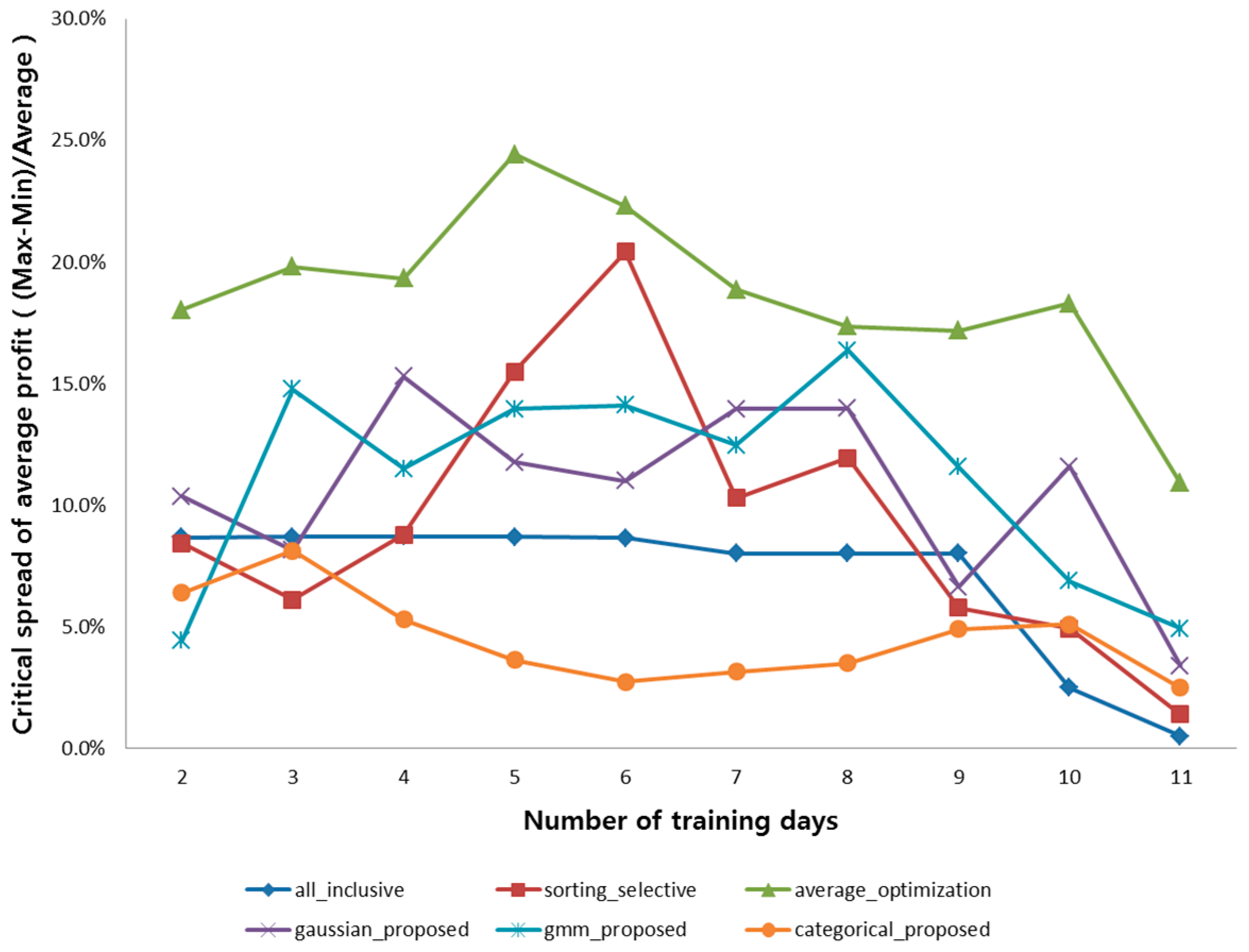

5.2. Experimental Results

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them. Available online: https://eetd.lbl.gov/sites/all/files/publications/report-lbnl-1252d.pdf (accessed on 29 September 2017).

- Agency, I.E. The Power to Choose: Demand Response in Liberalised Electricity Markets; OECD: Paris, France, 2003. [Google Scholar]

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Simmhan, Y.; Aman, S.; Cao, B.; Giakkoupis, M.; Kumbhare, A.; Zhou, Q.; Paul, D.; Fern, C.; Sharma, A.; Prasanna, V.K. An Informatics Approach to Demand Response Optimization in Smart Grids; Technical Report; University of Southern California: Los Angeles, CA, USA, 3 March 2011. [Google Scholar]

- Korea Energy Market Operation Protocol (In Korean). Available online: http://www.kpx.or.kr (accessed on 18 September 2017).

- Nguyen, D.T.; Negnevitsky, M.; Groot, M. Pool-based demand response exchange—Concept and modeling. IEEE Trans. Power Syst. 2011, 26, 1677–1685. [Google Scholar] [CrossRef]

- Albadi, M.H.; El-Saadany, E.F. Demand Response in Electricity Markets: An Overview. In Proceedings of the 2007 IEEE Power Engineering Society General Meeting, Tampa, FL, USA, 24–28 June 2007. [Google Scholar]

- Liu, Y.; Guan, X. Purchase allocation and demand bidding in electric power markets. IEEE Trans. Power Syst. 2003, 18, 106–112. [Google Scholar]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Demand response modeling considering interruptible/curtailable loads and capacity market programs. Appl. Energy 2010, 87, 243–250. [Google Scholar] [CrossRef]

- Atkinson, S.E. Responsiveness to time-of-day electricity pricing: First empirical results. J. Econom. 1979, 9, 79–95. [Google Scholar] [CrossRef]

- Herter, K. Residential implementation of critical-peak pricing of electricity. Energy Policy 2007, 35, 2121–2130. [Google Scholar] [CrossRef]

- Taylor, T.N.; Schwarz, P.M.; Cochell, J.E. 24/7 hourly response to electricity real-time pricing with up to eight summers of experience. J. Regul. Econ. 2005, 27, 235–262. [Google Scholar] [CrossRef]

- Demand Response Service System (In Korean). Available online: http://dr.kmos.kr/web/list.do (accessed on 30 September 2017).

- Rahimi, F.; Ipakchi, A. Demand Response as a Market Resource under the Smart Grid Paradigm. IEEE Trans. Smart Grid 2010, 1, 82–88. [Google Scholar] [CrossRef]

- Delfino, B.; Massucco, S.; Morini, A.; Scalera, P.; Silvestro, F. Implementation and comparison of different under frequency load-shedding schemes. In Proceedings of the Power Engineering Society Summer Meeting, Vancouver, BC, Canada, 15–19 July 2001. [Google Scholar]

- Ghazvini, M.A.F.; Faria, P.; Ramos, S.; Morais, H.; Vale, Z. Incentive-based demand response programs designed by asset-light retail electricity providers for the day-ahead market. Energy 2015, 82, 786–799. [Google Scholar] [CrossRef]

- Birge, J.R.; Louveaux, F. Introduction to Stochastic Programming; Springer Science & Business Media: Berlin, Germany, 2011. [Google Scholar]

- Kalos, M.H.; Whitlock, P.A. Monte Carlo Methods; John Wiley & Sons: San Francisco, CA, USA, 2008. [Google Scholar]

- Parvania, M.; Fotuhi-Firuzabad, M.; Shahidehpour, M. Optimal demand response aggregation in wholesale electricity markets. IEEE Trans. Smart Grid 2013, 4, 1957–1965. [Google Scholar] [CrossRef]

- Adika, C.O.; Wang, L. Smart charging and appliance scheduling approaches to demand side management. Int. J. Electr. Power Energy Syst. 2014, 57, 232–240. [Google Scholar] [CrossRef]

- Mishra, A.; Irwin, D.; Shenoy, P.; Kurose, J.; Zhu, T. Greencharge: Managing renewable energy in smart buildings. IEEE J. Sel. Areas Commun. 2013, 31, 1281–1293. [Google Scholar] [CrossRef]

- Gao, D.; Sun, Y.; Lu, Y. A robust demand response control of commercial buildings for smart grid under load prediction uncertainty. Energy 2015, 93, 275–283. [Google Scholar] [CrossRef]

- Chen, X.; Wei, T.; Hu, S. Uncertainty-aware household appliance scheduling considering dynamic electricity pricing in smart home. IEEE Trans. Smart Grid 2013, 4, 932–941. [Google Scholar] [CrossRef]

- Samadi, P.; Mohsenian-Rad, A.-H.; Schober, R.; Wong, V.W.; Jatskevich, J. Optimal real-time pricing algorithm based on utility maximization for smart grid. In Proceedings of the 2010 First IEEE International Conference on Smart Grid Communications (SmartGridComm), Gaithersburg, MD, USA, 4–6 October 2010. [Google Scholar]

- Li, N.; Chen, L.; Low, S.H. Optimal demand response based on utility maximization in power networks. In Proceedings of the Power and Energy Society General Meeting, Detroit, MI, USA, 24–29 July 2011. [Google Scholar]

- Yu, R.; Yang, W.; Rahardja, S. A statistical demand-price model with its application in optimal real-time price. IEEE Trans. Smart Grid 2012, 3, 1734–1742. [Google Scholar] [CrossRef]

- Qian, L.P.; Zhang, Y.J.A.; Huang, J.; Wu, Y. Demand response management via real-time electricity price control in smart grids. IEEE J. Sel. Areas Commun. 2013, 31, 1268–1280. [Google Scholar] [CrossRef]

- Li, Y.; Ng, B.L.; Trayer, M.; Liu, L. Automated residential demand response: Algorithmic implications of pricing models. IEEE Trans. Smart Grid 2012, 3, 1712–1721. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: Berlin, Germany, 2010. [Google Scholar]

- Soroudi, A.; Amraee, T. Decision making under uncertainty in energy systems: State of the art. Renew. Sustain. Energy Rev. 2013, 28, 376–384. [Google Scholar] [CrossRef]

- Erol-Kantarci, M.; Mouftah, H.T. Wireless sensor networks for cost-efficient residential energy management in the smart grid. IEEE Trans. Smart Grid 2011, 2, 314–325. [Google Scholar] [CrossRef]

- Setlhaolo, D.; Xia, X.; Zhang, J. Optimal scheduling of household appliances for demand response. Electr. Power Syst. Res. 2014, 116, 24–28. [Google Scholar] [CrossRef]

- Fakhrazari, A.; Vakilzadian, H.; Choobineh, F.F. Optimal energy scheduling for a smart entity. IEEE Trans. Smart Grid 2014, 5, 2919–2928. [Google Scholar] [CrossRef]

- Hussain, I.; Mohsin, S.; Basit, A.; Khan, Z.A.; Qasim, U.; Javaid, N. A Review on Demand Response: Pricing, Optimization, and Appliance Scheduling. Procedia Comput. Sci. 2015, 52, 843–850. [Google Scholar] [CrossRef]

- Mohsenian-Rad, A.-H.; Wong, V.W.; Jatskevich, J.; Schober, R.; Leon-Garcia, A. Autonomous demand-side management based on game-theoretic energy consumption scheduling for the future smart grid. IEEE Trans. Smart Grid 2010, 1, 320–331. [Google Scholar] [CrossRef]

- Chow, J.H.; Wu, F.F.; Momoh, J.A. Applied Mathematics for Restructured Electric Power Systems; Springer: Berlin, Germany, 2005. [Google Scholar]

- Kang, J.; Lee, J.-H. Electricity customer clustering following experts’ principle for demand response applications. Energies 2015, 8, 12242–12265. [Google Scholar] [CrossRef]

- Jin, C.H.; Pok, G.; Lee, Y.; Park, H.-W.; Kim, K.D.; Yun, U.; Ryu, K.H. A SOM clustering pattern sequence-based next symbol prediction method for day-ahead direct electricity load and price forecasting. Energy Convers. Manag. 2015, 90, 84–92. [Google Scholar] [CrossRef]

- Chao, H. Demand response in wholesale electricity markets: The choice of customer baseline. J. Regul. Econ. 2011, 39, 68–88. [Google Scholar] [CrossRef]

- Coughlin, K.; Piette, M.A.; Goldman, C.; Kiliccote, S. Statistical analysis of baseline load models for non-residential buildings. Energy Build. 2009, 41, 374–381. [Google Scholar] [CrossRef]

- Scheduled Load Reduction Program (SLRP). Available online: https://www.pge.com/en_US/business/save-energy-money/energy-management-programs/demand-response-programs/scheduled-load-reduction.page (accessed on 18 September 2017).

- Silvano, M.; Paolo, T. Knapsack Problems: Algorithms and Computer Implementations; John Wiley & Sons: San Francisco, CA, USA, 1990. [Google Scholar]

- Büther, M.; Briskorn, D. Reducing the 0-1 knapsack problem with a single continuous variable to the standard 0-1 knapsack problem. Int. J. Oper. Res. Inf. Syst. IJORIS 2012, 3, 1–12. [Google Scholar] [CrossRef]

- Reynolds, D.A.; Quatieri, T.F.; Dunn, R.B. Speaker verification using adapted Gaussian mixture models. Digit. Signal Process. 2000, 10, 19–41. [Google Scholar] [CrossRef]

- Agresti, A.; Kateri, M. Categorical data analysis. In International Encyclopedia of Statistical Science; Springer: Berlin, Germany, 2011. [Google Scholar]

- Shaphiro, S.S.; Wilk, M.B. An analysis of variance test for normality. Biometrika 1965, 52, 591–611. [Google Scholar] [CrossRef]

- Gurobi Optimization. The State-of-the-Art Mathematical Programming Solver. Available online: http://www.gurobi.com/ (accessed on 29 September 2017).

- Land, A.H.; Doig, A.G. An automatic method of solving discrete programming problems. Econom. J. Econom. Soc. 1960, 28, 497–520. [Google Scholar] [CrossRef]

- Pineda, S.; Conejo, A.J. Scenario reduction for risk-averse electricity trading. IET Gener. Transm. Distrib. 2010, 4, 694–705. [Google Scholar] [CrossRef]

- Amraee, T.; Soroudi, A.; Ranjbar, A. Probabilistic determination of pilot points for zonal voltage control. IET Gener. Transm. Distrib. 2012, 6, 1–10. [Google Scholar] [CrossRef]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kang, J.; Lee, J.-H. Data-Driven Optimization of Incentive-based Demand Response System with Uncertain Responses of Customers. Energies 2017, 10, 1537. https://doi.org/10.3390/en10101537

Kang J, Lee J-H. Data-Driven Optimization of Incentive-based Demand Response System with Uncertain Responses of Customers. Energies. 2017; 10(10):1537. https://doi.org/10.3390/en10101537

Chicago/Turabian StyleKang, Jimyung, and Jee-Hyong Lee. 2017. "Data-Driven Optimization of Incentive-based Demand Response System with Uncertain Responses of Customers" Energies 10, no. 10: 1537. https://doi.org/10.3390/en10101537