Aggregation Potentials for Buildings—Business Models of Demand Response and Virtual Power Plants

Abstract

:1. Introduction

2. Aggregation Models

2.1. Demand Response (DR)

DR Programs

2.2. Virtual Power Plants

2.2.1. Components of VPPs

2.2.2. Systems-of-Interests in Virtual Power Plants

2.2.3. The VPP Stakeholders

3. Buildings and Energy Flexibility

4. Methods

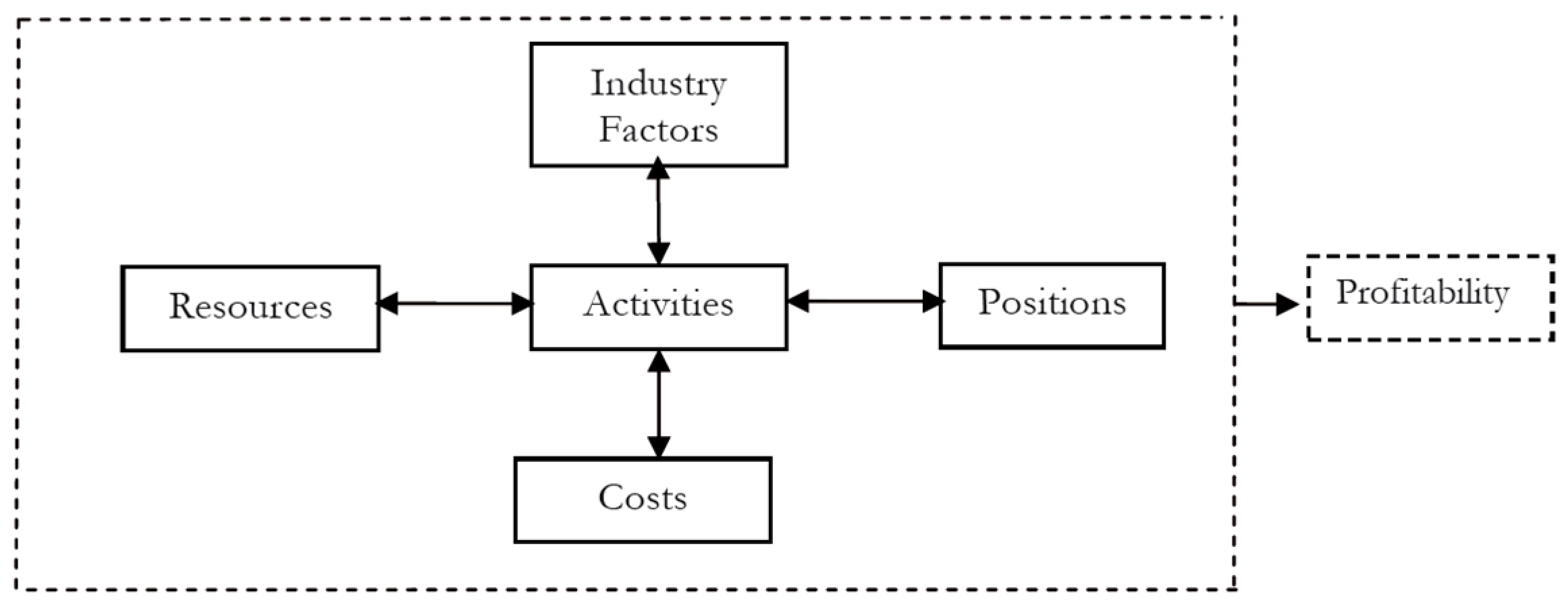

4.1. Business Model Canvas

4.2. Evaluation Tool for Business Model Analysis

4.3. SWOT Analysis and TOWS Analysis

5. Results

5.1. Business Model 1—Buildings Participate in the Implicit DR Program via Retailers

5.2. Business Model 2—Buildings (Especially with Small Energy Consumption) Participate in the Explicit DR Program via Aggregators

5.3. Business Model 3—Buildings (with Large Energy Consumption) Directly Access Explicit DR Program

5.4. Business Model 4—Buildings Access the Energy Market via VPP Aggregators by Providing DERs

6. Case Study—The Aggregation Potential for Buildings in the Nordic Electricity Market

6.1. Value of the Business Model (VBM) in the Nordic Electricity Market

6.2. Recommendation for Encouraging Building Participation

- Regulation needs to be adjusted to allow buildings easy access to the aggregation market;

- Incentives from regulators, TSOs/DSOs can encourage buildings to participate in the energy aggregation market;

- Clear monetary benefits (e.g., payment) needs to be defined;

- Financial support, e.g., loans, renting, cost reduction strategies and packages, for installation of control systems, DERs, and controllable appliances;

- Easy and user-friendly control systems with accurate forecast and analysis;

- Customized service (e.g., payment and control solutions) for different types of buildings;

- Selective market access for buildings which can have visible benefit from the aggregation market (e.g., large energy consumers or industrial buildings with large capacity of DERs);

- Utilization of ADR (automatic DR) in buildings with challenges of privacy, user acceptance, and security needs to be addressed.

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- European Commission. The Future Role and Challenges of Energy Storage; Europa.eu: Brussels, Belgium, 2017. [Google Scholar]

- Papalexopoulos, A.; Hansen, C.; Frowd, R.; Tuohy, A.; Lannoye, E. Impact of the transmission grid on the operational system flexibility. In Proceedings of the 2016 Power Systems Computation Conference (PSCC), Genoa, Italy, 20–24 June 2016; pp. 1–10. [Google Scholar]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. Thermal generation flexibility with ramping costs and hourly demand response in stochastic security-constrained scheduling of variable energy sources. IEEE Trans. Power Syst. 2015, 30, 2955–2964. [Google Scholar] [CrossRef]

- Ma, Z.; Badi, A.; Jørgensen, B.N. Market opportunities and barriers for smart buildings. In Proceedings of the 2016 IEEE Green Energy and Systems Conference (IGSEC), Long Beach, CA, USA, 6–7 November 2016; pp. 1–6. [Google Scholar]

- Ma, Z.; Billanes, J.D.; Kjærgaard, M.B.; Jørgensen, B.N. Energy flexibility in retail buildings: From a business ecosystem perspective. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; p. 6. [Google Scholar]

- Annala, S.; Honkapuro, S. Demand response in Australian and European electricity markets. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar]

- Du, H.; Liu, S.; Kong, Q.; Zhao, W.; Zhao, D.; Yao, M.G. A microgrid energy management system with demand response. In Proceedings of the 2014 China International Conference on Electricity Distribution (CICED), Shenzhen, China, 23–26 September 2014; pp. 551–554. [Google Scholar]

- Minou, M.; Stamoulis, G.D.; Thanos, G.; Chandan, V. Incentives and targeting policies for automated demand response contracts. In Proceedings of the 2015 IEEE International Conference on Smart Grid Communications (SmartGridComm), Miami, FL, USA, 2–5 November 2015; pp. 557–562. [Google Scholar]

- Liu, Z.; Zeng, X.J.; Ma, Q. Integrating demand response into electricity market. In Proceedings of the 2016 IEEE Congress on Evolutionary Computation (CEC), Vancouver, BC, Canada, 24–29 July 2016; pp. 2021–2027. [Google Scholar]

- Son, J.; Hara, R.; Kita, H.; Tanaka, E. Energy management considering demand response resource in commercial building with chiller system and energy storage systems. In Proceedings of the 2014 International Conference on Power Engineering and Renewable Energy (ICPERE), Bali, Indonesia, 9–11 December 2014; pp. 96–101. [Google Scholar]

- De Vries, L.J.; Verzijlbergh, R. Organizing flexibility: How to adapt market design to the growing demand for flexibility. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Ma, Z.; Friis, H.T.A.; Mostrup, C.G.; Jørgensen, B.N. Energy flexibility potential of industrial processes in the regulating power market. In Proceedings of the 6th International Conference on Smart Cities and Green ICT Systems, Porto, Portugal, 22–24 April 2017; pp. 109–115. [Google Scholar]

- Bertoldi, P.; Zancanella, P.; Boza-Kiss, B. Demand Response Status in EU Member States; Europa.eu: Brussels, Belgium, 2016. [Google Scholar]

- Sebastian, S.; Margaret, V. Application of demand response programs for residential loads to minimize energy cost. In Proceedings of the 2016 International Conference on Circuit, Power and Computing Technologies (ICCPCT), KK Dist, India, 18–19 March 2016; pp. 1–4. [Google Scholar]

- Lamprinos, I.; Hatziargyriou, N.D.; Kokos, I.; Dimeas, A.D. Making demand response a reality in Europe: Policy, regulations, and deployment status. IEEE Commun. Mag. 2016, 54, 108–113. [Google Scholar] [CrossRef]

- Yu, M.; Hong, S.H.; Beom, K.J. Incentive-based demand response approach for aggregated demand side participation. In Proceedings of the 2016 IEEE International Conference on Smart Grid Communications (SmartGridComm), Sydney, Australia, 6–9 November 2016; pp. 51–56. [Google Scholar]

- Gharesifard, B.; Başar, T.; Domínguez-García, A.D. Price-based coordinated aggregation of networked distributed energy resources. IEEE Trans. Autom. Control 2016, 61, 2936–2946. [Google Scholar] [CrossRef]

- Ghavidel, S.; Li, L.; Aghaei, J.; Yu, T.; Zhu, J. A review on the virtual power plant: Components and operation systems. In Proceedings of the 2016 IEEE International Conference on Power System Technology (POWERCON), Wollongong, Australia, 28 September–1 October 2016; pp. 1–6. [Google Scholar]

- Vandoorn, T.L.; Zwaenepoel, B.; de Kooning, J.D.M.; Meersman, B.; Vandevelde, L. Smart microgrids and virtual power plants in a hierarchical control structure. In Proceedings of the 2011 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies, Manchester, UK, 5–7 December 2011; pp. 1–7. [Google Scholar]

- Goutard, E.; Passelergue, J.C.; Sun, D. Flexibility marketplace to foster use of distributed energy resources. In Proceedings of the 22nd International Conference and Exhibition on Electricity Distribution (CIRED 2013), Stockholm, Sweden, 10–13 June 2013; pp. 1–4. [Google Scholar]

- Saboori, H.; Mohammadi, M.; Taghe, R. Virtual Power Plant (VPP), definition, concept, components and types. In Proceedings of the 2011 Asia-Pacific Power and Energy Engineering Conference, Wuhan, China, 22–28 March 2011; pp. 1–4. [Google Scholar]

- Bakari, K.E.; Kling, W.L. Development and operation of virtual power plant system. In Proceedings of the 2011 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies, Manchester, UK, 5–7 December 2011; pp. 1–5. [Google Scholar]

- Hatziargyriou, N.D.; Tsikalakis, A.G.; Karfopoulos, E.; Tomtsi, T.K.; Karagiorgis, G.; Christodoulou, C.; Poullikkas, A. Evaluation of Virtual Power Plant (VPP) operation based on actual measurements. In Proceedings of the 7th Mediterranean Conference and Exhibition on Power Generation, Transmission, Distribution and Energy Conversion (MedPower 2010), Agia Napa, Cyprus, 7–10 November 2010; pp. 1–8. [Google Scholar]

- Plancke, G.; de Vos, K.; Belmans, R.; Delnooz, A. Virtual power plants: Definition, applications and barriers to the implementation in the distribution system. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Zehir, M.A.; Bagriyanik, M. Smart energy aggregation network (SEAN): An advanced management system for using distributed energy resources in virtual power plant applications. In Proceedings of the 2015 3rd International Istanbul Smart Grid Congress and Fair (ICSG), Istanbul, Turkey, 29–30 April 2015; pp. 1–4. [Google Scholar]

- Ravichandran, S.; Vijayalakshmi, A.; Swarup, K.S.; Rajamani, H.S.; Pillai, P. Short term energy forecasting techniques for virtual power plants. In Proceedings of the 2016 IEEE 6th International Conference on Power Systems (ICPS), New Delhi, India, 4–6 March 2016; pp. 1–6. [Google Scholar]

- Kessels, K.; Claessens, B.; hulst, R.D.; Six, D. The value of residential flexibility to manage a BRP portfolio: A Belgian case study. In Proceedings of the 2016 IEEE International Energy Conference (ENERGYCON), Leuven, Belgium, 4–8 April 2016; pp. 1–6. [Google Scholar]

- The European Association for the Promotion of Cogeneration (COGEN Europe). The Role of Aggregators in Bringing District Heating and Electricity Networks Together: Integrated Supply Maximising the Value of Energy Assets; Europa.eu: Brussels, Belgium, 2014; pp. 1–3. Available online: http://www.cogeneurope.eu/medialibrary/2014/12/03/4bb831e2/Case%20Study%20-%20Neas%20Energy%20-%20December%202014%20FINAL.pdf (accessed on 15 July 2017).

- Puglia, L.; Patrinos, P.; Bernardini, D.; Bemporad, A. Reliability and efficiency for market parties in power systems. In Proceedings of the 2013 10th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 28–30 May 2013; pp. 1–8. [Google Scholar]

- Nordic Energy Research. Denmark: Danish Energy Used Mostly in Buildings. 2013. Available online: http://www.nordicenergy.org/figure/energy-consumption-by-sector/danish-energy-used-mostly-in-buildings/ (accessed on 12 January 2017).

- Thavlov, A.; Bindner, H.W. An aggregation model for households connected in the low-voltage grid using a VPP interface. In Proceedings of the IEEE PES ISGT Europe 2013, Lyngby, Denmark, 6–9 October 2013; pp. 1–5. [Google Scholar]

- Kimmo, I.; Sirvio, A. Sustainable Buildings for the High North. Existing Buildings—Technologies and Challenges for Residential and Commercial Use; ePooki: Oulu, Finland, 2015; Available online: http://www.oamk.fi/epooki/2015/high-north-project-existing-buildings/ (accessed on 15 March 2017).

- Safdarian, A.; Fotuhi-Firuzabad, M.; Lehtonen, M. Benefits of Demand Response on Operation of Distribution Networks: A Case Study. IEEE Syst. J. 2016, 10, 189–197. [Google Scholar] [CrossRef]

- Energy Information Administration (EIA). Residential Site Energy Consumption by End Use. Available online: http://buildingsdatabook.eren.doe.gov/ChapterIntro2.aspx (accessed on 15 June 2016).

- Yang, Z.; Wang, L. Demand Response Management for multiple utility companies and multi-type users in smart grid. In Proceedings of the 2016 35th Chinese Control Conference (CCC), Chengdu, China, 27–29 July 2016; pp. 10051–10055. [Google Scholar]

- Energy Information Administration (EIA). Commercial Site Energy Consumption by End Use. Available online: http://buildingsdatabook.eren.doe.gov/ChapterIntro3.aspx (accessed on 23 February 2017).

- Ea Energianalyse for Energunet. Dk; Dansk Energi. Kortlægning af Potentialet for Fleksibelt Elforbrug I Industri, Handel og Service; Energinet.dk: Vejle, Denmark, 2011. [Google Scholar]

- Štefan, S.; Richard, B. Analysis of business models. J. Compet. 2014, 6, 19–40. [Google Scholar]

- Duening, T.N.; Hisrich, R.D.; Lechter, M.A. Chapter 1—Fundamentals of Business. In Technology Entrepreneurship; Academic Press: Boston, MA, USA, 2010; pp. 1–27. [Google Scholar]

- Mullins, J.; Komisar, R. Getting to Plan B: Breaking through to a Better Business Model; Harvard Business Press: Boston, MA, USA, 2009. [Google Scholar]

- Afuah, A. Business Models: A Strategic Management Approach; McGraw-Hill/Irwin: New York, NY, USA, 2003. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Díaz-Díaz, R.; Muñoz, L.; Pérez-González, D. The business model evaluation tool for smart cities: Application to smart santander use cases. Energies 2017, 10, 262. [Google Scholar] [CrossRef]

- Ma, Z.P.Z.; Jørgensen, B.N. The international electricity market infrastructure-insight from the nordic electricity market. In Proceedings of the 13th European Energy Market Conference (EEM 2016), Porto, Portugal, 6–9 June 2016; p. 5. [Google Scholar]

| Actors | Offers | To |

|---|---|---|

| Aggregator | Pay for BRPs’ energy loss | BRP |

| Market access | Consumer | |

| DR incentives | ||

| Ancillary services | Transmission System Operator (TSO) | |

| Tariff | ||

| Network balancing services | Distribution System Operation (DSO) | |

| Tariff | ||

| Supplier/retailer | Incentives and contract package for the implicit DR program | Consumers |

| Regulator | DR incentives | All actors |

| DR regulations | ||

| DR awareness | ||

| Consumer | Demand profile | Aggregator |

| Direct control | Supplier/retailer | |

| Large consumers can directly provide energy flexibility to the DR market | Demand Response (DR) market |

| Actor | Offers | To |

|---|---|---|

| VPP aggregator | Market access | DER owners |

| Ancillary services | TSO | |

| Balancing services | BRP | |

| Buy and sell electricity | Wholesale Market | |

| Network services | DSO | |

| DER owner | Produce electricity | VPP aggregator |

| Direct control | VPP aggregator | |

| BRP | Settle the imbalance | Market |

| Accurate forecast of supply and demand | VPP aggregator | |

| Bilateral contracts [29] | VPP aggregator | |

| Policy maker | Energy rules | All actors |

| Industry | Electricity Consumption, GWh/Year (2001) | Flexibility Potential, MW | ||||

|---|---|---|---|---|---|---|

| Eastern Denmark | Western Denmark | Total | East | West | Total | |

| Agriculture | 405 | 2150 | 2555 | 13 | 69 | 82 |

| Food and beverage | 518 | 1738 | 2526 | 13 | 43 | 56 |

| Textile | 14 | 194 | 208 | 0 | 4 | 4 |

| Wood industry | 123 | 281 | 404 | 2 | 6 | 8 |

| Paper and printing industry | 228 | 527 | 755 | 5 | 11 | 16 |

| Chemical industry | 1116 | 1079 | 2195 | 17 | 16 | 33 |

| Stone, clay, and glass industry | 211 | 719 | 930 | 4 | 15 | 20 |

| Iron and steel mills | 528 | 117 | 645 | 26 | 6 | 32 |

| Foundries | - | 196 | 196 | 0 | 10 | 10 |

| Iron and metal | 447 | 1304 | 1751 | 20 | 59 | 79 |

| Trade & Service | 1507 | 2206 | 3173 | 54 | 79 | 134 |

| Elements from Business Model Canvas | Value Criteria |

|---|---|

| Value Proposition | 1: if provide significant more benefits to customers compared to existing solutions (product/service) 0.5: if provide around half more benefits to customers compared to existing solutions 0.1: if not provide visible benefits to customers compared to existing solutions |

| Customer segment | Value of customer segment = size × purchasing power Size: 1: if majority of the total potential customers can be targeted, otherwise the percentage of the total potential customers can be targeted Purchasing power: 1: high 0.5: medium 0.1: low |

| Partners | 1: if the partner is the existing partner 0.5: if it is new but easy to reach 0: if it is new but difficult to reach Note: total value = ∏(value of individual partners), because the more partners you need to have, the more risk exists |

| Resources | 1: if it is an existing resource 0.5: if it is new but easy to reach 0: if it is new but difficult to reach Note: total value = Σ(individual resource)/number of compulsory resources |

| Revenue streams | Depends mainly on customers’ familiarity and companies’ affordability 1: if it is familiar to customers and fits to companies’ normal business 0.5: if it partly familiar to customers and companies need to make small changes 0: if it is totally new to customers and companies |

| Cost | 1: if large spending for devices and personals 0.5: if within the range of affordable spending 0: if based on existing devices and personals |

| Customer relationship | Mainly depends on how simple and easy the approach is. 1: if it is for keeping existing customers 0.5: if it is for growing existing customers 0.1 if it for getting new customers Note: If it is easy to get new customers, you can move it to 0.5 or even 1. Total value = Σ(individual customer relationship)/number of compulsory customer relationships |

| Channels | 1: if it is an existing channel 0.5: if it is new but easy to establish 0: if it is new but difficult to establish |

| Activities | 1: if it is an existing activity or similar to the existing activities 0.5: if it is new but easy to conduct 0: if it is new but difficult to conduct Note: total value = Σ(individual activity)/number of activity, because the more activities you need to manage, the more difficult the task |

| Strategy Options | Opportunities | Threats |

|---|---|---|

| Strengths | S-O Strategies Strategies that use strengths to take advantages of opportunities | S-T Strategies Strategies that use strengths to avoid threats |

| Weaknesses | O-W Strategies Strategies that take advantages from opportunities for mitigating weaknesses | W-T Strategies Strategies that mitigate weakness and avoid threat |

| Aggregation Market | Types | Business Model | Direct Participants | Indirect Building Participants |

|---|---|---|---|---|

| Demand Response | Implicit DR (price based) | 1—buildings participate in the implicit DR program via retailers | Retailers | All buildings |

| Explicit DR | 2—buildings (small energy consumers) participate in the explicit DR via aggregators | Independent aggregator | Buildings with small energy consumption | |

| 3—buildings (large energy consumers) directly access the explicit DR program | Buildings with large energy consumption | - | ||

| Virtual Power Plants | Trading, balancing, network services | 4—buildings access the energy market via VPP aggregators by providing DERs | VPP aggregators | DER owners (buildings which equip the DERs) |

| Partners | Activities | Value Proposition | Customer Relation | Customers |

|---|---|---|---|---|

|

| Buildings receive a lower electricity bill |

| All buildings |

| Resources | Channels | |||

| Part of the electricity supply contract | |||

| Cost Structure | Revenue Streams | |||

| Integration of DR offers into electricity supply contract (which might need DR experts and facility purchasing) Price signal sending to customers (facilities and staffs) | Optional choices for existing customers | |||

| Partners | Activities | Value Proposition | Customer Relation | Customers |

|---|---|---|---|---|

|

| Buildings receive direct payment by participating in the explicit DR market via aggregators |

| Buildings (who are small energy consumers) |

| Resources | Channels | |||

|

| |||

| Cost Structure | Revenue Streams | |||

|

| |||

| Partners | Activities | Value Proposition | Customer Relation | Customers |

|---|---|---|---|---|

|

| Buildings receive direct payment by providing energy flexibility to the market |

| DR market (wholesale market, and ancillary service to TSOs) |

| Resources | Channels | |||

|

| |||

| Cost Structure | Revenue Streams | |||

|

| |||

| Partners | Activities | Value Proposition | Customer Relation | Customers |

|---|---|---|---|---|

|

| Buildings can access the market with direct payment and low risk |

| Building with DERs (e.g., PV, micro-CHP) |

| Resources | Channels | |||

|

| |||

| Cost Structure | Revenue Streams | |||

|

| |||

| Note | ||||

| ||||

| Business Model | 1—buildings participate in the implicit DR program via retailers | 2—buildings participate in the explicit DR via aggregators | 3—buildings directly access to the explicit DR program | 4—buildings access the energy market via VPP aggregators by providing DERs |

| Value Proposition | 1 | 0.5 | 1 | 1 |

| Customer Segment | 1 | 0.21 | 0.21 | 0.19 |

| Partners | 1 | 0.025 | 1 | 0.125 |

| Resources | 1 | 0.83 | 0.75 | 0.75 |

| Revenue Streams | 0.5 | 1.1 | 1.2 | 1.7 |

| Cost | −0.5 | −1.4 | −0.5 | −1.4 |

| Customer Relationship | 0.75 | 0.425 | 0.75 | 0.875 |

| Channels | 1 | 1 | 1.5 | 1.5 |

| Activities | 1 | 0.6 | 0.67 | 1 |

| Value of Business Model | 3.75 | ≅0.17 (0.1659) | ≅1.34 (1.3377) | ≅0.77 (0.7695) |

| Opportunities | Threats | |

|

| |

| Strenghts | S-O Strategies | S-T Strategies |

|

|

|

| Weaknesses | O-W Strategies | W-T Strategies |

|

|

|

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, Z.; Billanes, J.D.; Jørgensen, B.N. Aggregation Potentials for Buildings—Business Models of Demand Response and Virtual Power Plants. Energies 2017, 10, 1646. https://doi.org/10.3390/en10101646

Ma Z, Billanes JD, Jørgensen BN. Aggregation Potentials for Buildings—Business Models of Demand Response and Virtual Power Plants. Energies. 2017; 10(10):1646. https://doi.org/10.3390/en10101646

Chicago/Turabian StyleMa, Zheng, Joy Dalmacio Billanes, and Bo Nørregaard Jørgensen. 2017. "Aggregation Potentials for Buildings—Business Models of Demand Response and Virtual Power Plants" Energies 10, no. 10: 1646. https://doi.org/10.3390/en10101646

APA StyleMa, Z., Billanes, J. D., & Jørgensen, B. N. (2017). Aggregation Potentials for Buildings—Business Models of Demand Response and Virtual Power Plants. Energies, 10(10), 1646. https://doi.org/10.3390/en10101646