On Long-Term Transmission Rights in the Nordic Electricity Markets

Abstract

:1. Introduction

Literature Review

2. Introducing and Comparing FTRs, EPADs, and EPAD Combos

2.1. FTR

2.2. EPAD

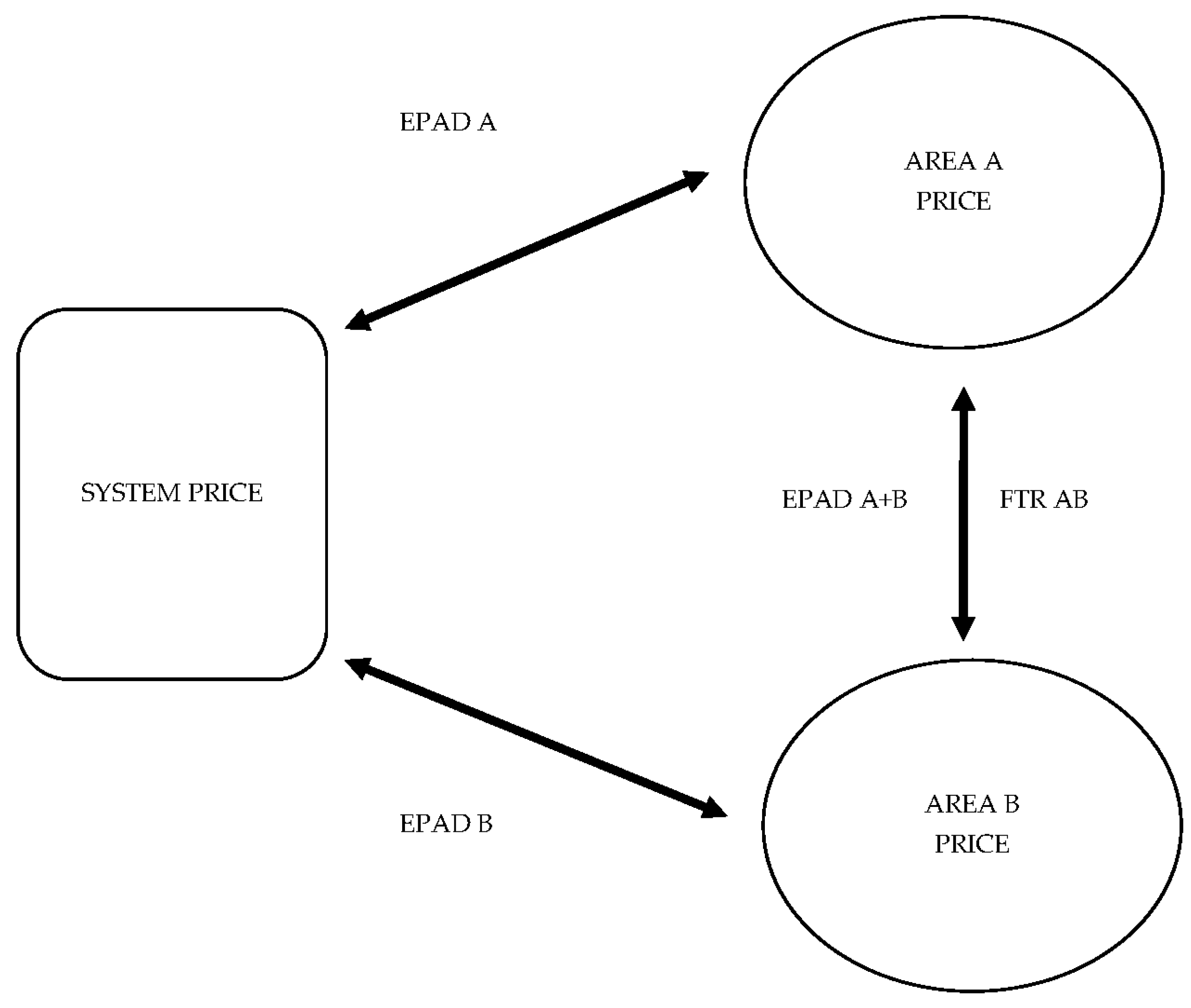

2.3. EPAD Combo

2.4. Short Structural Comparison of FTR, EPAD, and EPAD Combo

3. Hedging with FTRs in the Nordic Electricity Markets: An Empirical Analysis

3.1. Risk Premium Methodology

3.2. Data

3.3. Results and Discussion

4. Conclusions and Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| LTR | Long-term transmission rights |

| EPAD | Electricity price area differentials |

| FTR | Financial transmission rights |

| PTR | Physical transmission rights |

| TSO | Transmission system operators |

| ENTSO-E | European network of transmission system operators for electricity |

| ACER | Agency for the Cooperation of Energy Regulators |

Appendix A

| Summary Statistics | SE */SE3 > FI | SE1 > FI | SE2 > SE3 | SE3 > SE4 | NO1 > SE */SE3 | DK1 > DK2 | SE */SE3 > DK1 | SE */SE4 > DK2 | NO4 > FI | FI > EE |

|---|---|---|---|---|---|---|---|---|---|---|

| MEAN | −0.92 | −3.20 | −0.44 | −1.38 | −3.41 | −2.84 | 0.51 | −1.96 | −2.31 | 1.51 |

| SD | 6.49 | 9.20 | 3.49 | 5.37 | 17.60 | 27.45 | 26.92 | 16.42 | 9.25 | 27.35 |

| SKEW | −13.73 | −7.69 | −16.63 | −5.24 | −42.39 | 0.84 | −11.65 | −48.23 | −7.66 | −54.99 |

| KURT | 359.33 | 109.67 | 420.39 | 39.87 | 2692.74 | 2856.13 | 2407.04 | 5237.18 | 135.28 | 3950.30 |

| N | 70,128 | 19,008 | 19,008 | 19,008 | 70,128 | 70,128 | 70,128 | 70,128 | 34,824 | 32,904 |

| >0 | 2544 | 8 | 0 | 1 | 8763 | 6705 | 18,222 | 5000 | 3041 | 10,300 |

| <0 | 6315 | 5133 | 715 | 1871 | 24,330 | 19,313 | 16,089 | 13,133 | 8905 | 6948 |

| =0 | 61,269 | 13,867 | 18,293 | 17,136 | 37,035 | 44,110 | 35,817 | 51,995 | 22,878 | 15,656 |

| % > 0 | 4% | 0% | 0% | 0% | 12% | 10% | 26% | 7% | 9% | 31% |

| % < 0 | 9% | 27% | 4% | 10% | 35% | 28% | 23% | 19% | 26% | 21% |

| % = 0 | 87% | 73% | 96% | 90% | 53% | 63% | 51% | 74% | 66% | 48% |

References

- Wangensteen, I. Power System Economics: The Nordic Electricity Market, 2nd ed.; Tapir Academic Press: Trondheim, Norway, 2011. [Google Scholar]

- Houmøller, A.P. Hedging with FTRs and CCfDs; Technical Report; Houmøller Consulting: Middelfart, Denmark, 2014. [Google Scholar]

- THEMA Consulting Group. Market Design and the Use of FTRs and CfDs; Technical Report; THEMA Consulting Group: Oslo, Norway, 2011. [Google Scholar]

- Nasdaq OMX. Baltic Initiative Tallinn; Technical Report; Nasdaq OMX: Tallinn, Estonia, 2013. [Google Scholar]

- European Commission. Commision Regulation (EU)—Establishing a Guideline on Forward Capacity Allocation; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Fingrid. Integrity of Price Areas; Technical Report; Fingrid: Helsinki, Finland, 2015. [Google Scholar]

- Regulation (EC) No 714/2009 of the European Parliament and of the Council of 13 July 2009 on Conditions for Access to the Network for Cross-Border Exchanges in Electricity and Repealing Regulation (EC) No 1228/2003. Available online: http://eur-lex.europa.eu/eli/reg/2009/714/oj (accessed on 28 February 2017).

- Kristiansen, T. Markets for Financial Rights; John F. Kenedy School of Government, Harvard Electricity Policy Group: Cambridge, MA, USA, 2004. [Google Scholar]

- Spodniak, P.; Makkonen, M.; Honkapuro, S. Long-term Transmission Rights in the Nordic Electricity Markets: TSO Perspectives. In Proceedings of the International Conference on the European Energy Market, Porto, Portugal, 6–9 June 2016.

- Agency for the Cooperation of Energy Regulators (ACER). Framework Guidelines on Transmission Capacity and Congestion Management for Electricity; Technical Report; ACER: Ljubljana, Slovenia, 2011. [Google Scholar]

- ENTSO-E. Allocation Rules for Forward Capacity Allocation; Technical Report; ENTSO-E: Brussels, Belgium, 2015. [Google Scholar]

- Borenstein, S.; Bushnell, J.B.; Knittel, C.R. Market Power in Electricity Markets: Beyond Concentration Measures. Energy J. 1999, 20, 294–325. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.B.; Wolak, F.A. Measuring Market Inefficiencies in California’s Restructured Wholesale Electricity Market. Am. Econ. Rev. 2002, 92, 1376–1405. [Google Scholar] [CrossRef]

- Mansur, E.T. Measuring Welfare in Restructured Electricity Markets. Rev. Econ. Stat. 2008, 90, 369–386. [Google Scholar] [CrossRef]

- Wolfram, C.D. Measuring Duopoly Power in the British Electricity Spot Market. Am. Econ. Rev. 1999, 89, 805–826. [Google Scholar] [CrossRef]

- Fridolfsson, S.O.; Tangerås, T. Market Power in the Nordic Electricity Wholesale Market: A Survey of the Empirical Evidence. Energy Policy 2009, 37, 3681–3692. [Google Scholar] [CrossRef]

- Bergman, L. Why Has the Nordic Electricity Market Worked So Well? Technical Report; Elforsk: Stockholm, Sweden, 2005. [Google Scholar]

- Mirza, F.M.; Bergland, O. Pass-through of wholesale price to the end user retail price in the Norwegian electricity market. Energy Econ. 2012, 34, 2003–2012. [Google Scholar] [CrossRef]

- Von der Fehr, N.H.M.; Hansen, P.V. Electricity Retailing in Norway. Energy J. 2010, 31, 25–45. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.B.; Stoft, S. The competitive effects of transmission capacity in a deregulated electricity industry. RAND J. Econ. 2000, 31, 294–325. [Google Scholar] [CrossRef]

- Growitsch, C.; Jamasb, T.; Wetzel, H. Efficiency effects of observed and unobserved heterogeneity: Evidence from Norwegian electricity distribution networks. Energy Econ. 2012, 34, 542–548. [Google Scholar] [CrossRef]

- Bunn, D.; Zachmann, G. Inefficient Arbitrage in Inter-regional Electricity Transmission. J. Regul. Econ. 2010, 37, 243–265. [Google Scholar] [CrossRef]

- Joskow, P.; Tirole, J. Transmission Rights and Market Power on Electric Power Networks. RAND J. Econ. 2000, 31, 450–487. [Google Scholar] [CrossRef]

- Bushnell, J. Transmission Rights and Market Power. Electr. J. 1999, 12, 77–85. [Google Scholar] [CrossRef]

- Gilbert, R.; Neuhoff, K.; Newbery, D. Mediating Market Power in Electricity Networks; University of California: Berkeley, CA, USA, 2002. [Google Scholar]

- Harvey, S.; Hogan, W.W. On the Exercise of Market Power through Strategic Withholding in California; Harvard Electricity Policy Group: Cambridge, MA, USA, 2001. [Google Scholar]

- Hagman, B.; Bjørndalen, J. FTRs in the Nordic Electricity Market—Pros and Cons Compared to the Present System with CfDs; Technical Report; Elforskq: Stockholm, Sweden, 2011. [Google Scholar]

- Redpoint Energy. Long-Term Cross-Border Hedging between Norway and Netherlands; Technical Report; Baringa: London, UK, 2013. [Google Scholar]

- Economic Consulting Associates (ECA). European Electricity Forward Markets and Hedging Products—State of Play and Elements for Monitoring; Technical Report; ACER: London, UK, 2015. [Google Scholar]

- NordREG. The Nordic Financial Electricity Market; Technical Report; Nordic Energy Regulators: Eskilstuna, Sweden, 2010. [Google Scholar]

- Spodniak, P.; Collan, M.; Viljainen, S. Examining the Markets for Nordic Electricity Price Area Differentials—Focusing on Finland; Technical Report; Hokkipaino Oy: Lappeenranta, Finland, 2015. [Google Scholar]

- THEMA Consulting Group. Measures to Support the Functioning of the Nordic Financial Electricity Market; Technical Report; THEMA Consulting Group: Oslo, Norway, 2015. [Google Scholar]

- Pitkänaikavälinsiirto-Oikeudet—Long-Term Transmission Rights (LTRs). Fingrid’s Market Council Meeting; Fingrid: Helsinki, Finland, 2015; Available online: http://www.fingrid.fi/fi/asiakkaat/asiakasliitteet/Markkinatoimikunta/2015/20150210%20Markkinatoimikunta%20-%204%20-%20LTR%20selvitys.pdf (accessed on 11 December 2015).

- Kristiansen, T. Pricing of Contracts for Difference in the Nordic Market. Energy Policy 2004, 32, 1075–1085. [Google Scholar] [CrossRef]

- Marckhoff, J.; Wimschulte, J. Locational Price Spreads and the Pricing of Contracts for Difference: Evidence from the Nordic Market. Energy Econ. 2009, 31, 257–268. [Google Scholar] [CrossRef]

- Benth, F.E.; Cartea, Á.; Kiesel, R. Pricing Forward Contracts in Power Markets by the Certainty Equivalence Principle: Explaining the Sign of the Market Risk Premium. J. Bank. Financ. 2008, 32, 2006–2021. [Google Scholar] [CrossRef] [Green Version]

- Bessembinder, H.; Lemmon, M.L. Equilibrium Pricing and Optimal Hedging in Electricity Forward Markets. J. Financ. 2002, 57, 1347–1382. [Google Scholar] [CrossRef]

- Spodniak, P. Informational Efficiency in the Nordic Electricity Market—The Case of Electricity Price Area Differentials (EPAD). In Proceedings of the International Conference on the European Energy Market, Lisbon, Portugal, 19–22 May 2015.

- Agency for the Cooperation of Energy Regulators (ACER). Forward Risk-Hedging Products and Harmonisation of Long-Term Capacity Allocation Rules; Technical Report; ACER: Ljubljana, Slovenia, 2012. [Google Scholar]

- Transmission Risk Hedging Products—An ENTSO-E Educational Paper; Technical Report; ENTSO-E: Brussels, Belgium, 2012.

- ENTSO-E. Network Code on Forward Capacity Allocation; Technical Report; ENTSO-E: Brussels, Belgium, 2013. [Google Scholar]

- Rudby, A.-M. Nasdaq Commodities—How to Improve Hedging; Technical Report; Nasdaq: New York, NY, USA, 2015. [Google Scholar]

- Nasdaq OMX. Contract Specifications—Trading Appendix 2/Clearing Appendix 2; Technical Report; Nasdaq OMX: Oslo, Norway, 2014. [Google Scholar]

- Spodniak, P.; Chernenko, N.; Nilsson, M. Efficiency of Contracts for Differences (CfDs) in the Nordic Electricity Market. In Proceedings of the TIGER Forum 2014: Ninth Conference on Energy Industry at a Crossroads: Preparing the Low Carbon Future, Toulouse, France, 5–6 June 2014.

- ENTSO-E. Firmness Explanatory Document; Technical Report; ENTSO-E: Brussels, Belgium, 2013. [Google Scholar]

- Benth, F.E.; Meyer-Brandis, T. The information premium for non-storable commodities. J. Energy Mark. 2009, 2, 111–140. [Google Scholar] [CrossRef]

- Longstaff, F.A.; Wang, A.W. Electricity Forward Prices: A High-Frequency Empirical Analysis. J. Financ. 2004, 59, 1877–1900. [Google Scholar] [CrossRef]

- Hicks, J.R. Value and Capital; Oxford University Press: London, UK, 1939. [Google Scholar]

- Lutz, F.A. The Structure of Interest Rates. Q. J. Econ. 1940, 55, 36–63. [Google Scholar] [CrossRef]

- Keynes, J.M. Treatise on Money; Macmillan: London, UK, 1930. [Google Scholar]

- Duffie, D. Futures Markets; Prentice Hall: Englewood Cliffs, NJ, USA, 1989. [Google Scholar]

- Benth, F.E.; Benth, J.Š.; Koekebakker, S. Stochastic Modeling of Electricity and Related Markets; World Scientific: Singapore, 2008. [Google Scholar]

- Redl, C.; Haas, R.; Huber, C.; Böhm, B. Price Formation in Electricity Forward Markets and the Relevance of Systematic Forecast Errors. Energy Econ. 2009, 31, 356–364. [Google Scholar] [CrossRef]

- Kristiansen, T. Congestion Management, Transmission Pricing and Area Price Hedging in the Nordic. Int. J. Electr. Power Energy Syst. 2004, 26, 685–695. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.; Knittel, C.R.; Wolfram, C. Inefficiencies and Market Power in Financial Arbitrage: A Study of California’s Electricity Markets. J. Ind. Econ. 2008, 55, 347–378. [Google Scholar] [CrossRef]

- Viljainen, S.; Makkonen, M.; Gore, O.; Spodniak, P. Risks in Small Electricity Markets: The Experience of Finland in Winter 2012. Electr. J. 2012, 25. [Google Scholar] [CrossRef]

- THEMA Consulting Group. Nordic Bidding Zones; Technical Report; THEMA Consulting Group: Oslo, Norway, 2013. [Google Scholar]

- Makkonen, M.; Nilsson, M.; Viljainen, S. All Quiet on the Western Front?—Transmission Capacity Development in the Nordic Electricity Market. Econ. Energy Environ. 2015, 4, 161–176. [Google Scholar] [CrossRef]

- Siddiqui, A.S.; Bartholomew, E.S.; Marnay, C.; Oren, S.S. Efficiency of the New York Independent System Operator Market for Transmission Congestion Contracts. Manag. Financ. 2005, 31, 1–45. [Google Scholar] [CrossRef]

- Chang, E.C. Returns to Speculators and the Theory of Normal Backwardation. J. Financ. 1985, 40, 193–208. [Google Scholar] [CrossRef]

- De Roon, F.A.; Nejman, T.E.; Veld, C. Hedging Pressure Effects in Futures Markets. J. Financ. 2000, 55, 1437–1456. [Google Scholar] [CrossRef]

- Bartholomew, E.S.; Siddiqui, A.S.; Marnay, C.; Oren, S.S. The New York Transmission Congestion Contract Market: Is It Truly Working Efficiently? Electr. J. 2003, 16, 14–24. [Google Scholar] [CrossRef]

| Attributes | Long-Term Transmission Rights (LTR) | ||

|---|---|---|---|

| Financial Transmission Rights (FTRs) | Electricity Price Area Differentials (EPADs) | Combinations Of Electricity Price Area Differentials (EPAD Combos) | |

| Underlying | Hourly spot price difference between two bidding area prices | Hourly spot price difference between bidding area price and the system price | Hourly spot price difference between two bidding area prices |

| Specification | Position dependent on the chosen route and direction | Requirement for the system price calculation | Combination of two EPAD contracts; requirement for the system price calculation |

| Hedging | Provides a complete hedge, if market participants have a physical position in both markets. Option or obligation type | Provides a complete single area hedge, if market participants have a financial position for system price and physical position in the market. Obligation type | Provides a complete hedge, if market participants have a financial position for system price and physical positions in both markets. Obligation type. |

| Volume limits | Financial contract limited by the volume of physical transmission capacity, with the possible netting (selling higher volume due to counterflows) | Independent financial contract unrestricted by transmission capacity volumes | Independent financial contract unrestricted by transmission capacity volumes |

| Auctioneer/marketplace | Auctioned by transmission system operator (TSO) or “allocating company” | Sold and cleared by an exchange | Sold and cleared by an exchange |

| Risks | Firmness and counterparty risks, revenue adequacy, impacts on bottleneck income | Counterparty risks borne by the exchange; firmness ensured (OTC and bilateral trade risks separately) | Counterparty risks borne by the exchange; firmness ensured (OTC and bilateral trade risks separately) |

| Trading | Liquidity for longer timeframes supported by additional contracts, e.g., Auction Revenue Rights (ARR), liquidity dependent on secondary market place efficiency | Electronic trading system (ETS), OTC and bilateral trading; liquidity dependent on market place efficiency | Electronic trading system (ETS), OTC and bilateral trading; liquidity dependent on market place efficiency |

| Case | Bidding Areas A > B | Capacity (MW) | % Price Difference 1 | Background of the Interconnector |

|---|---|---|---|---|

| Sweden-Finland | SE/SE3 > FI | 1200 | 9% | In 2012, Russian electricity exports to Finland were significantly reduced due to market design changes in Russia. Finland substituted the capacity with increased imports from Sweden that strained the limited SE > FI interconnectors [56]. |

| SE1 > FI | 1500 | 27% | ||

| Sweden-internal | SE2 > SE3 | 7300 | 4% | Due to systematic internal congestions, Sweden was to split from a single bidding area into four areas in November 2011. Most of the low-cost hydro-production is located in Northern Sweden (areas SE1 and SE2), but consumption is mostly in the South (SE3 and SE4), see [57]. |

| SE3 > SE4 | 5300 | 10% | ||

| Norway-Sweden | NO1 > SE/SE3 | 2145 | 35% | The so-called “Hasle cross-section” from Norway to Sweden is important not only for Central-Sweden (SE3) to import power from the Southern Norway (NO1), but also for the whole of the Nordic market. However, the long-planned grid investment (Westlink) to this region was cancelled in 2013 by the Norwegian and the Swedish TSOs, see [58]. |

| Denmark internal | DK1 > DK2 | 600 | 28% | Areas DK1 and DK2 were initially not synchronized, and the first major power link (Great Belt) was built only in 2010. The DK1> DK2 interconnector has the most volatile price differences in the Nordic markets with frequent price spikes (see Appendix A). Area DK2 houses most of the Danish wind power capacity, which contributes to the area price spikes. Historically, the different production mix of Denmark (coal, wind) and Sweden (nuclear, hydro) have increased pressures on the interconnectors between the two countries [57]. |

| Sweden-Denmark | SE */SE3 > DK1 | 680 | 23% | |

| SE */SE4 > DK2 | 1300 | 19% | ||

| Norway-Finland | NO4 > FI | 100 | 26% | Norway is a lower production cost hydro-dominated market than the more thermal-energy-based Finnish market. The interconnector’s small capacity causes it to only have a limited impact on Finnish prices. |

| Finland-Estonia | FI > EE | 1000 | 21% | The main purpose of the Finland-Estonia interconnector is to improve the security of supply and competition in both markets. Transmission risk management is relevant for both sides of the Finnish-Estonian interconnector. |

| Scenario | Spot (S) | Futures (F) | Assumption (ABS *) | Risk Premium (F-S) |

|---|---|---|---|---|

| 1 | + | + | S > F | − |

| 2 | + | + | S < F | + |

| 3 | − | + | S > F | + |

| 4 | − | + | S < F | + |

| 5 | + | − | S > F | − |

| 6 | + | − | S < F | − |

| 7 | − | − | S > F | + |

| 8 | − | − | S < F | − |

| Interconnectors | Variables | YEARLY FTR | QUARTERLY FTR | MONTHLY FTR | |||

|---|---|---|---|---|---|---|---|

| Avg. | St. Dev. | Avg. | St. Dev. | Avg. | St. Dev. | ||

| SE */SE3 > FI | Spot price | −0.94 | 1.57 | −0.97 | 2.37 | −0.92 | 2.47 |

| Futures price | −0.90 | 1.26 | −1.17 | 2.13 | −1.12 | 2.73 | |

| Risk premium | 0.04 | 1.56 | −0.24 | 1.72 | −0.20 | 2.00 | |

| Sample size | 8 | 8 | 32 | 32 | 96 | 96 | |

| SE1 > FI | Spot price | −3.44 | 2.08 | −3.43 | 2.16 | −3.20 | 3.29 |

| Futures price | −4.59 | 0.93 | −5.71 | 2.76 | −5.85 | 4.35 | |

| Risk premium | −1.15 | 3.02 | −2.28 | 2.54 | −2.66 | 3.04 | |

| Sample size | 2 | 2 | 8 | 8 | 26 | 26 | |

| SE2 > SE3 | Spot price | −0.40 | 0.20 | −0.40 | 0.36 | −0.45 | 0.64 |

| Futures price | −1.92 | 0.83 | −1.69 | 1.10 | −1.84 | 1.78 | |

| Risk premium | −1.52 | 0.63 | −1.29 | 0.84 | −1.39 | 1.32 | |

| Sample size | 2 | 2 | 8 | 8 | 26 | 26 | |

| SE3 > SE4 | Spot price | −1.18 | 0.99 | −1.18 | 1.43 | −1.39 | 2.17 |

| Futures price | −4.76 | 2.53 | −2.63 | 2.12 | −2.21 | 2.39 | |

| Risk premium | −3.58 | 1.54 | −1.45 | 1.96 | −0.82 | 2.36 | |

| Sample size | 2 | 2 | 8 | 8 | 26 | 26 | |

| NO1 > SE */SE3 | Spot price | −3.39 | 3.83 | −3.39 | 5.98 | −3.42 | 6.65 |

| Futures price | −2.34 | 1.57 | −3.52 | 4.28 | −3.67 | 5.32 | |

| Risk premium | 1.05 | 4.28 | −0.14 | 4.85 | −0.38 | 4.11 | |

| Sample size | 8 | 8 | 32 | 32 | 96 | 96 | |

| DK1 > DK2 | Spot price | −2.85 | 3.43 | −2.85 | 5.90 | −2.82 | 7.87 |

| Futures price | −2.64 | 2.83 | −2.97 | 4.46 | −2.93 | 7.18 | |

| Risk premium | 0.21 | 4.25 | −0.12 | 6.62 | −0.11 | 6.94 | |

| Sample size | 8 | 8 | 32 | 32 | 78 | 78 | |

| SE */SE3 > DK1 | Spot price | 0.50 | 4.93 | 0.51 | 7.66 | 0.16 | 9.63 |

| Futures price | −2.68 | 6.22 | −1.23 | 8.05 | −0.43 | 10.41 | |

| Risk premium | −3.18 | 7.73 | −1.74 | 7.60 | −0.59 | 7.97 | |

| Sample size | 8 | 8 | 32 | 32 | 78 | 78 | |

| SE4 > DK2 | Spot price | −1.52 | 2.60 | −1.51 | 3.54 | −1.42 | 3.68 |

| Futures price | −0.65 | 0.07 | −1.39 | 2.04 | −1.81 | 3.66 | |

| Risk premium | 0.87 | 2.67 | 0.12 | 3.25 | −0.40 | 2.17 | |

| Sample size | 2 | 2 | 8 | 8 | 26 | 26 | |

| NO4 > FI | Spot price | −4.01 | 2.06 | −4.00 | 2.73 | −3.79 | 3.85 |

| Futures price | −5.13 | 1.17 | −5.65 | 2.81 | −6.47 | 4.62 | |

| Risk premium | −1.11 | 3.23 | −1.65 | 2.37 | −2.68 | 2.69 | |

| Sample size | 8 | 8 | 8 | 8 | 25 | 25 | |

| FI > EE | Spot price | −1.99 | − | −1.98 | 1.88 | −2.01 | 4.91 |

| Futures price | 1.05 | − | 0.82 | 0.88 | 0.38 | 2.63 | |

| Risk premium | 3.04 | − | 2.80 | 1.44 | 2.39 | 5.66 | |

| Sample size | 1 | 1 | 4 | 4 | 10 | 10 | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Spodniak, P.; Collan, M.; Makkonen, M. On Long-Term Transmission Rights in the Nordic Electricity Markets. Energies 2017, 10, 295. https://doi.org/10.3390/en10030295

Spodniak P, Collan M, Makkonen M. On Long-Term Transmission Rights in the Nordic Electricity Markets. Energies. 2017; 10(3):295. https://doi.org/10.3390/en10030295

Chicago/Turabian StyleSpodniak, Petr, Mikael Collan, and Mari Makkonen. 2017. "On Long-Term Transmission Rights in the Nordic Electricity Markets" Energies 10, no. 3: 295. https://doi.org/10.3390/en10030295

APA StyleSpodniak, P., Collan, M., & Makkonen, M. (2017). On Long-Term Transmission Rights in the Nordic Electricity Markets. Energies, 10(3), 295. https://doi.org/10.3390/en10030295