1. Introduction

Energy plays a central role in human development and improved quality of life. Society in the developed world has now become so dependent on energy provision that any sort of energy shortage or the total lack of it will create chaos or at least temporary panic. People’s lifestyles are very much shaped by the easy provision of modern energy—mainly in the form of electricity—that powers their appliances, buildings and industries. The lack of it is becoming increasingly parallel to the lack of fresh air which can lead to physical harm or even fatality. Real examples include impacts of the recent blackouts in South Australia [

1,

2] where power shortfalls were experienced by significant number of customers, and the deaths of a number of people due to an historically long heatwave [

3].

A review of the past blackouts reveals large costs to the society from the generated economic impacts, social impacts, impacts on the power system per se, and impacts on other critical infrastructure sectors [

4]. The vulnerability of electricity supply was clearly exposed with widespread power outages or failures in more than a decade ago across the UK, Italy, and North America. Supply side failures also led to rolling blackouts, voltage reductions, and public appeals for emergency conservation in California, Ontario, Chile, New Zealand, Brazil, and India, with major network failures in the Eastern and Western U.S. and Italy causing significant socio-economic disruptions [

5]. The blackout in Darwin in 2014 is another example where the business sectors such as tourism experienced impacts in the form of financial loss.

In modern society, energy has become a means for attaining comforts of life in various forms: thermal comfort, visual comfort, instant communication, instant food preparation, comfortable travel, etc. In the developing world, energy provision and availability mean a vehicle for achieving reasonable livelihoods. Viewed from this viewpoint, energy is a means for improving the quality of livelihoods through its use in various economic activities: from helping women in rural areas to reducing their reliance on manual activities to the provision of better educational materials to their children through distance learning through media powered by electricity. Even simple electric lighting for evening study and economic activity is an important aid to education that is easily taken for granted by those who have it. In a nutshell, “energy is vital for eradicating poverty, improving human welfare and rising living standards.” [

6].

“Electricity particularly is an important and sometimes irreplaceable input to modern productive activities, dissemination of information and other services industries.” (id., p. 879).

Asia, the largest and most populous continent on Earth, consists of countries and groupings of countries with diverse economic, political, social, and development status. Japan, an East Asia industrialized nation, relies on imported fossil fuel (LNG, coal and oil) for its domestic consumption [

7]. It also had 54 nuclear plants operating in 2010 that met 31.5 percent of the national electricity demand although the operation of the nuclear plants ceased after the Fukushima disaster in 2011. China, the world most populous country, has been experiencing consistently high economic growth in recent decades, resulting in rapidly growing energy demand, and the renewal and expansion of electricity generation, and transmission infrastructure. China’s fossil fuel, nuclear, and renewable energy resources have consequently been developed at a world-leading pace. India and ASEAN countries are expected to have accelerated increase in energy consumption due to their significant growth potential in the future. Nonetheless, there is an urgent need for innovative ways to generate power in socially, economically, and environmentally sustainable ways in Asia with energy demand projected to almost double in Asia due to economic growth and growing population.

Australia finds itself at an historical turning point, accidentally finding itself adjacent to the center of global economic activity after two centuries of neo-European political and economic development. With its major trading partners now in Asia and a diverse population creating cultural ties and an outwards perspective, Australia is in the process of broadening its loyalties and priorities and shaping its Asia Pacific if not South East Asian identity. With declining electricity demand due to a combination of energy efficiency, greater focus on service over manufacturing industries, and the rapid uptake of residential solar energy (the largest single installed base of residential solar in the world at over 6 GW and 1.5 million residential rooftops), Australia exemplifies the issues facing a mature industrialized nation and has a respite from growing its generation fleet that may allow it to reshape its energy mix.

This paper presents a critical appraisal of the prospect for an Australian–Asian electricity super grid—an inter-continental connection of electrical power grids between Australia and Asia. The paper begins with an overview of Asia’s energy situations followed by a discussion on global experience in grid interconnections. Thereafter, the paper presents an overview of the ASEAN power grid which will play a crucial role should the AAG initiative eventuate. Finally, the paper presents some general policy issues and challenges in both Australia and ASEAN/Asian that need to be considered and resolved to enable this initiative to come to fruition.

2. Asian Countries Energy Indicators—An Overview

To properly understand the relevance of the AAG, this section presents an overview of the energy situations in Asian countries. As shown in

Table 1 [

8,

9], energy use per capita of Asian countries ranges from those below threshold levels suggested by the International Energy Agency (IEA) to those on par with the other developed countries. According to the IEA [

8], the threshold level is 250 kWh per annum for rural areas and 500 kWh per annum for urban households. Such very low threshold levels are clearly too low. The figures clearly show the huge disparity of access to electricity between developing and developed worlds. This disparity is also reflected in the greenhouse gas emission (GHG) per capita of the respective countries.

The table also shows that the number of people relying on the threshold level of electricity consumption far outweighs the total population with significantly higher electrical consumption. Another important figure that emerges from the table is the fact that the majority of Asian countries have electricity access rate far below those of the OECD countries with only a handful of exceptions such as Singapore and Brunei Darussalam, two of Asia’s rich countries with a very low population, and Vietnam.

It is also worth looking at the status of trading status of the main fuel sources the Asian countries rely on: petroleum, natural gas and coal. The majority of these countries rely on petrol imports to fulfill their conventional fuel demands. This is not a sustainable situation given the constantly increasing demand for these finite conventional fuel sources.

In conclusion, energy provision, adequacy, security, exploitation and distribution are still big issues being faced by most of Asian countries.

Australia, on the other hand, is a country rich in energy resources such as coal (black and brown) and gas (conventional and unconventional), oil (crude oil, condensate and unconventional oil), and uranium and thorium (

Table 2), but with a low population. In addition, Australia also has abundant renewable energy sources such as solar, wind, tidal, and hydro. Energy exports were about two thirds of production in 2015–2016 [

10] which positions Australia as a very potential supplier of energy required to sustain or even boost Asia’s economic growths. The Asia pacific regions exhibit the potential to benefit from increased cross-border energy cooperation and trade by utilizing complementarities in energy demand variations, diversity in energy resource endowments, and gains from larger market access.

In addition to hydro energy, Australia’s main renewable resources (among the best in the world) include solar and wind energy, wave, tidal, and geothermal resources. In terms of production however, renewable energy accounts for only about 2% of total energy production, but 15% of electricity generation [

10]. The share of renewable electricity generation increased by 17% from 2015 to 2016, reflecting increased hydro dam levels, continued investment in wind and rooftop solar generation, and the start of production from the first large-scale solar farms.

3. Existing Grid Interconnections Worldwide—An Overview

3.1. The Global Power Grid “Dream”

The Global Power Grid “Dream” was initially coined by Dr. R. Buckminster Fuller—a futurist—who envisioned a global energy grid with renewable energy being the backbone [

12]. While this idea sounds unrealistic, its seed has already been planted in the forms of concepts or implementations at smaller scales through sub-regional, regional, and intercontinental interconnections. Notably in the Asian region, China has adopted Global Energy Interconnection as a policy response to the triple threats of climate change, pollution, and resource constraints, announced by President Xi Jinping at the UN Sustainable Development Summit in 2015. Accompanied by a China-centric vision of the development pathway, to which alternatives may be proposed, this lifts the conversation about a global power grid beyond theory into politics and practicality [

13].

3.2. Domestic Interconnections

3.2.1. Basslink

Basslink [

14,

15], SAPEI (Sardegna Peninsola Italy) [

16] and Java—Sumatera [

17] interconnection projects are examples of interconnections at the domestic levels which can be considered a technological template for cross-border or even intercontinental interconnection. (The term “technological template” here refers to technical or technological form or example that already exists on which structure or configuration of future systems can be based.) Basslink is an undersea high voltage direct current (HVDC) interconnection that facilitates electricity exchanges between Australian mainland and the island of Tasmania. It has a 290 km long HVDC cable with a 400 kV rated direct current (DC) voltage and DC current of 1250 A [

14] capable of transmitting “500 megawatts (MW) of energy on a continuous basis in either direction and up to 630 MW export from Tasmania for limited periods.” [

18]. The project, which commenced in 1997 and was finalized in 2004, came into operation with a total cost of A

$874 million, a

$250 million increase from the initial estimate due largely to a requirement for a return conductor instead of the sea return originally planned [

19]. Basslink was sold for A

$1.2 billion in 2007, emphasizing the attractiveness to international investors of transmission infrastructure projects that maintain value over a design life of 40 years or more.

3.2.2. Sumatra—Java Interconnection (ISJ—Interkoneksi Sumatera Jawa)

The Sumatra–Java interconnection is a project planned to connect mine-mouth coal-fired power plants being constructed in Bangko Tengah (South Sumatera) and the load centre in Java, Indonesia. This project will supply 3000 MW electric power from South Sumatera steam power plant of an Independent Power Producer (IPP, private electric power plant) to the Sumatera and Java system. The total length of ISJ HVDC Transmission is 742 km which consists of 464 km DC transmission and 278 km alternating current (AC) transmission [

20]. Upon completion, this will be Indonesia’s first electricity transmission system utilizing HVDC Technology and will aim at: (1) increasing the capacity and reliability of power supply in Sumatera and Java; (2) supporting the Indonesian government’s program of energy diversification by optimal utilization of abundant coal in Sumatra; (3) increasing the electrification ratio in Sumatra and Java; (4) boosting national economic growth [

17]. In

Section 5 the transmission path of the ISJ [

21] in the wider context of proposed international networks is shown on a map. This project is being “temporarily postponed” [

21].

3.3. Cross Border (Sub-Regional) Interconnections

At cross-border level, interconnections between the electrical grids of Italy and France, Denmark and Norway, Poland and Sweden, Thailand and Malaysia, and Norway and the Netherlands are existing real examples. Some are overland and some are submarine.

3.3.1. SAPEI

SAPEI is a submarine HVDC interconnector of ±500 kV with an exchange capacity of 1000 MW HVDC that links Sardinia Island and the Italian Peninsula. The SAPEI “connects the 380 kV Fiume Santo station located in the North-Western part of Sardinia, to the 380 kV Latina station located South of Rome, with both ends being able to be connected to the local AC system without any network reinforcements” ([

16], p. 2). SAPEI was commissioned in 2011 [

22] and improves the security of supply in Sardinia. It also enables export from the island and as such it enables a significant pipeline of wind generation projects. As such, and like many interconnectors, it is a good example of a business case built on multiple benefits. It also establishes an important technical precedent by reaching a depth of 1650 m, the deepest interconnector in the world, signaling a future where intercontinental submarine transmission will be achieved. SAPEI upgrades an older project, the SACOI link via Corsica that has been operating since 1967 under the Italy’s electric utility company, ENEL [

23,

24].

3.3.2. Mainland French—Italian Mainland Interconnections

On Italy’s mainland, there are three Italian–French interconnections, i.e., two 400 kV Rondissone–Albertville lines (1985), one 220 kV Camporosso–Trinitȇ Victor line (1973) and one 400 kV Venaus–Villarodin line (1969) [

25]. A new interconnection between Piedmont and Savoy started operation in 2013 with 190 km of DC extra-high voltage underground cable, increasing the electricity exchange capacity up 1200 MW [

26].

3.3.3. Denmark (Tjele)–Norway (Kristiansand)

Norway has abundant hydropower resources and its hydropower reservoirs make up nearly half of Europe’s energy storage capacity. On the other hand, Denmark relies on wind and thermal power for its electricity. The Cross-Skagerrak interconnection—owned and operated by Statnett (Norway) and Energinet.dk (Denmark) facilitates electricity exchange between Tjele (Denmark) and Kristiansand (Norway). The exchange enables Denmark to store excess wind energy it produces in the reservoir, and imports it back when needed. With the recent commissioning of the Skagerrak 4 with exchange capacity of 700 MW, the total capacity of Tjele–Kristiansand is 1700 MW [

27,

28].

3.3.4. Sweden Links with Finland, Germany and Poland

Sweden has DC interconnectors linking it to Finland, Germany and Poland [

29]. Sweden’s interconnection with the Finland was initiated at the end of the 1950s and indeed Sweden pioneered DC transmission technology at this time. In the 1970s Northern Finland and Sweden were connected through the construction of two 400 kV AC links [

30].

Fenno-Skan 1, the first 500 MW HVDC submarine cable interconnection in the Gulf of Bothnia commenced commercial operation in December 1989. It was then the world’s longest submarine cable interconnection with the highest voltage and capacity. The electricity market liberalization that followed has enabled interconnections to take full advantage of the well-functioning Nordic electricity market. The full capacity of the Fenno-Skan 1 link has been in use as a result of increased electricity use [

30].

Fenno-Skan 1 operation was followed by the construction of Fenno-Skan-2 consisting of 200 km of submarine cable and 100 km of overhead cable with 800 MW exchange capacity. The new link, operational since December 2011 and run by Svenska Kraftnät and Fingrid Oyj, was aimed to “strengthen the existing DC link between Finnböle (Sweden) and Rauma (Finland)” [

29].

The interconnection between Sweden and Germany was realized in 1991 through BalticCable link, a 600 MW submarine HVDC cable connecting Trelleborg (Sweden) and Lübeck (Germany). The interconnection is owned and operated by Baltic Cable AB [

29].

The SwePol link is an interconnection between the Stärnö peninsula (Sweden) and Bruskowo Wielkie (Poland) and consists of 250 km of HVDC submarine cable which became operational in 2000 [

29].

3.3.5. Norway–Nederland (NorNed)

NorNed is a grid interconnection between Norway and the Netherlands with an electricity exchange capacity of 700 MW through 580 km of HVDC submarine cable. It has been operational since May 2008 and owned (in equal share) by TenneT (The Netherlands) and Statnett (Norway). The interconnection enables the Netherlands to import hydropower from Norway during the day and export back to Norway during the night, the time when there is excess capacity due to lower consumption [

31].

3.3.6. Thailand (Khlong Ngae)–Malaysia (Gurun)

Closer to Australia is an electricity interconnection linking two neighboring ASEAN countries Malaysia and Thailand with an electricity exchange capacity of 300 MW through 110 km of 300 kV HVDC cable, see

Section 5. The system links Khlong Ngae (Thailand) and Gurun (Malaysia) as shown in Figure 3. The interconnection is claimed to be “an important stepping-stone to the realization of the ASEAN Power Grid which will significant enhance the greater energy security and economic integration of the region” [

32].

3.4. Regional Interconnections

The above overview of cross-border interconnections shows the practicality and value of international electricity trade, and it should not be forgotten that mainland Europe and North America also provide long-standing precedents that occurred through overwhelming benefits and shared cultural identities. This section continues with more ambitious projects, one existing and two at an advanced stage of proposal, clearly demonstrating that the super grid interconnection ‘dream’ has in fact come true albeit still on a ‘scattered’ basis.

3.4.1. Gulf Cooperation Council’s (GCC) Interconnection Project

The interconnection of electricity grids of the six Gulf States shown in

Figure 1 is an example of a grid interconnection at a regional level involving longer planning time, higher cost, larger exchange capacity, and more complex governance than those mentioned previously, yet realizable. The project consists of more than of 20 years of planning and execution with the “green light” from the countries involved in 1999 [

33].

To manage the project, the Gulf Cooperation Council Interconnection Authority (GCCIA) was established in 2001. The project was implemented through 3 phases as follows:

Phase 1—the GCC North Grid System linking four Gulf states: Kuwait, Saudi Arabia, Bahrain and Qatar, completed in 2009. The cost of Phase I was around US$1.2 billion, shared by the GCC governments.

Phase 2—the GCC South Grid System linking UAE and Oman. In 2011 UAE was connected to the system. In the implementation of Phase 2, the GCCIA was not involved.

Phase 3—linking GCC North and South Grids, the final stage of project.

Table 3 shows the exchange capacities for each country taking part in the project.

The cost of the Saudi Arabia HVDC substation was over US$200 million and the cost of the substations of 5 other states was US$50 million each. The economic benefit of the GCC Interconnection Project is summed up by the following statement made by Ahmed Ali Al-Ebrahim Director, System Operations and Maintenance and Market Operations, GCCIA:

“The interconnector alone will save countries up to US$3 billion in capital investment by avoiding the need to build more than 5 GW of generation capacity over 20 years. Operational and fuel efficiency savings across the system will amount to at least US$300 million, based on feasibility estimates to 2028”.

The future plans of the GCC Interconnection Project include: (1) expansion of the power grid beyond the GCC; (2) possible connection to the rest of the Middle East and North Africa, as well as Europe.

The above overview on the interconnections implemented at domestic, sub-regional (cross-border), and regional levels clearly demonstrate that this super grid interconnection ‘dream’ has in fact come true, albeit still on a ‘scattered’ basis.

3.4.2. Icelink

Considering the options for the UK to expand its renewable generation capacity, it may be cheaper to access hydro and geothermal resources in Iceland than to build domestic offshore wind generation [

36]. The Icelink project to enable this exchange has been discussed for some years, and submarine HVDC technology has now advanced to the point where it is feasible and economic, with strong support from both countries. The interconnector would be 1200 km to the UK with extensions to Norway, Germany, and the Netherlands, with a proposed exchange capacity of 1000 MW. The anticipated date for commencing operation is 2025.

3.4.3. The EuroAsia Interconnector

The EuroAsia Interconnector is arguably more ambitious than Icelink, being a 500 kW HVDC link 1518 km long in total with initially 1000 MW and ultimately 2000 MW of exchange capacity, though it can be approached in stages rather than as a single oceanic run. It is proposed for interconnecting the Cypriot, Israeli and Greek transmission networks and the business case is strong under a variety of potential future market conditions [

37]. The Israeli and Greek power systems have similar total capacity and annual generation, suggesting that they would be effective trading partners, with a compatible impact on both their power systems and their economies.

The major technical challenge is the depth that must be traversed: up to 2300 m between Israel and Cyprus and up to 2700 m between Cyprus and Crete. Such depths are significantly in excess of the 1650 m noted above for the SAPEI link. Work has commenced to finalize the design of the interconnector and to procure the associated works contracts. The first stage of construction is intended to commence in 2018, and the second stage, the deepest part, in 2020. When complete, this project will establish an excellent precedent for interconnection between Australia and Java, which must traverse a similar length and depth to the EuroAsia link.

4. The ASEAN Power Grid

This Section is dedicated to the ASEAN Power Grid (APG) with a rather detailed treatment for an obvious reason: the likelihood of an Asian—Australian Grid is very much intertwined with the successful realization of the APG. Since ASEAN is Australia’s gateway to countries beyond the Southeast Asian region, the development of APG is crucial to the future of Australasian grid. And on the other hand, if through a first interconnection project, constructed on bilateral terms and justified in its own right, Australia would be proven to be a secure, reliable and economic source of low-carbon electricity, and this would be a strong motive for the rapid development of the APG and interconnection beyond to Asia more generally. In this section, we will elaborate on the current and future energy landscape for ASEAN, and discuss the progress and possibility of APG.

4.1. ASEAN Electricity Generation and Generation Capacity

ASEAN demand for energy will increase dramatically due to its low rate of access to energy, large amount of traditional biomass usage and low level of energy usage. As a developing country block, the Southeast Asian energy sector faces challenges that are typical of other developing countries. The first high profile challenge is a lack of access to electricity. As of 2013, the total number of the ASEAN population without electricity is about 120 million (out of its total population of 616 million). The population without access to electricity is mainly from Indonesia (49 million), Myanmar (36 million), the Philippines (21 million), and Cambodia (10 million). Only four countries, that is, Brunei Darussalam, Malaysia, Singapore, and Thailand, have electrification rates and urban electrification rates of about 100% [

38]. In addition to a rural electrification, increase of supply of modern energy (compared with traditional biomass) is also a challenge. Southeast Asia’s energy use per capita was just half of the global average in 2011 [

39].

The power sector shapes the energy outlook for Southeast Asia as electricity demand almost triples by 2040, with the shift towards coal set to continue. According to recent scenario [

40], Southeast Asia will produce 2200 TWh of electricity in 2040, nearly triple the 2013 production level of 789 TWh. The share of fossil fuels (coal, gas and oil) in that scenario decreases from 82% to 77%, whilst renewable shares increases from 18% to 22%, with hydro still being the main renewable energy (RE) producer at 12%. Interestingly, coal still plays an important role in Southeast Asia electricity generation in 2040, with an increasing share of 50% from 32% in 2013. The report highlights the unusual path this region is taking in terms of its increased coal contribution to the power generation. This is however is not surprising, given the fact that coal is “cheap” and readily available in the region. The region’s urgent need for electricity to keep up economic momentum outweighs environmental concerns. This is despite the international financial institutions announcing in 2013 to “stop or limit funding for coal-fired power plants” ([

39], p. 40). The emergence of China as the key source of funding has helped maintaining the attractiveness of coal-fired power plants.

In terms of generating capacity, Southeast Asia’s generation capacity will increase from 210 GW in 2014 to 550 GW in 2040, of which 150 GW comes from coal (

Figure 2). To meet the increase in demand, 400 GW of power generation capacity—roughly equal to the combined installed capacity of Japan and Korea today—is added across the region between today and 2040, of which 40% is coal-fired [

39].

An increasing use of fossil fuels, particularly coal, will lead to considerable increase in GHG emissions, assuming that today’s technologies will be used. ASEAN’s energy-related CO

2 emissions have more than tripled since 1990 and are expected to almost triple again between 2013 and 2040. The rapid growth in primary energy supply and the dominance of fossil fuels will result in a corresponding 2.7% annual growth in CO

2 emissions from 1175 million tons (Mt) in 2013 to 2394 Mt in 2040 [

39]. Compared with current estimates, the amount of expected additional CO

2 emissions from ASEAN is roughly equivalent to that of the world’s fourth highest emitter (Russia) and about 21.4% of emissions of the world’s largest emitter—China—in 2010 data [

40].

The above figures pose a paradox: on the one hand, ASEAN aspires to be ‘green’, on the other hand, its outlook is brown and even dark. Utilization of low carbon energy sources, mainly renewables, is the only way to resolve the contradictory need between growth needs and emission control [

41].

4.2. ASEAN Resources Advantages

A core strength that ASEAN possesses as it seeks to move toward a cleaner, more sustainable energy mix is that it has vast potential for the greater use of low-carbon primary energy sources. It has been reported [

42] that hydropower capacity in the five ASEAN countries (Indonesia, Malaysia, the Philippines, Singapore and Thailand) could be up to 234 GW. Another report suggest that hydropower from Cambodia, Laos, and Myanmar, if well developed, may provide 18.9 gigawatts (GW) for China, 7.68 GW for Thailand, and 5.1 GW for Vietnam in 2025 [

43]. As a reference, total installed electricity generation capacity in 2015 was 1519 GW China, 41 GW for Thailand, and 40 GW for Vietnam [

8]. The low percentage of potential hydropower resources that have been developed indicates that there is significant potential to further greening the ASEAN energy mix [

44].

ASEAN members also have the second (Indonesia) and third (the Philippines) largest geothermal resources in the world. Indonesia was estimated to have over 27.5 GW, or about 40% of the world total geothermal resources, which, however, was reportedly only developed 5% [

45]. Yet despite this overall significant potential low-carbon energy resources in ASEAN, there are not evenly distributed across countries. This uneven distribution further limits each individual country’s choices in energy supply and causes low levels of development for hydroelectricity. Much of the hydropower potential in Laos, Cambodia, and Myanmar, has not yet to be developed, even though large hydropower has been demonstrated could be sustainable by Nam Theun 2 Hydroelectric Project in Laos [

46].

The significant low emission resource potential in ASEAN provides a potential solution to achieve ASEAN’s green aspiration [

41] without comprising its economic growth. The looming and growing supply-demand gap, and consequently growing import dependence, particularly for oil and natural gas supplies

41 could be partially mitigated by import of electricity through AAG. Such a regional power trade could provide opportunities for meeting ASEAN’s energy demand and maintain its green growth aspirations.

4.3. ASEAN Vision 2020 for Energy Interconnections

The APG is one of the main components of ASEAN Vision 2020 for Energy and Water (

www.asean.org) “to promote more efficient, economic, and secure operation of power systems through harmonious development of national electricity networks in ASEAN by region-wide interconnections” [

47]. The feasibility of APG was carried out through the ASEAN Interconnection Master Plan Study (AIMS) with the following considerations: (1) different load shape among ASEAN countries; (2) energy resources sharing (generation/reserve capacity); (3) “less dependency on fuel imports from non-ASEAN countries”; and (4) potential total cost savings from interconnection.

According to the first AIMS, the realization of APG would require investment of USD3687 million for interconnection. However, APG would be able to save ASEAN about USD4475 million on generation costs, and reduce installed capacity by 2013 MW [

48].

ASEAN made the first big push to develop a regional power grid in 1981 by setting up Heads of ASEAN Power Utilities/Authorities (HAPUA). The establishment of HAPUA laid the foundation for the formation of the 1982 ASEAN Cooperation Project on Interconnection. Since then, HAPUA gradually firmed up the plan for the APG [

49]. The eventual establishment of the APG was planned in the ASEAN Plan of Action for Energy Cooperation (APAEC) 1999–2004. By 1999, HAPUA had identified 14 interconnection projects, including the existing interconnections of Thailand–Laos PDR and Peninsular Malaysia–Singapore [

50]. In the updated report of the ASEAN Interconnection Master Plan Study (AIMS II) that was finalized in 2010, 16 interconnection systems were identified under the APG program. The East Sabah (Malaysia)–East Kalimantan (Indonesia) interconnection system, and the Sumatra–Singapore interconnection system are two new systems in the AIMS II. Meanwhile, the Sarawak–Sabah–Brunei interconnection system was modified by dropping the Sabah–Brunei line.

Both AIMS and AIMS II divide the APG into three sub-systems [

49], namely:

Upper West System: located in the Greater Mekong Sub-region (GMS) (Cambodia, Laos PDR, Myanmar, Thailand, and Vietnam).

Lower West System: located in Thailand, Indonesia (Sumatra, Batam), Malaysia (Peninsular), and Singapore.

East System: locating in Brunei, Malaysia (Sabah, Sarawak), Indonesia (West Kalimantan), and the Philippines.

To realize the AGP, HAPUA have adopted a gradual and incremental strategy: power connections will be initially bilateral, then gradually expand to a sub-regional basis and finally to a totally integrated Southeast Asian power grid system (

Table 4). In the current APG plan of activity, one of the priorities is to realize multiple nation power trade [

51].

As of November 2016, there were nine cross-border links belonging to six out of 16 interconnection systems in operation; six interconnections were ongoing and the rest of the 16 will be completed beyond 2020 [

53].

Realizing the APG faces various challenges in technical, economical, financial and institutional aspects, some of which are not readily solved in the near future. These institutional barriers such as licensing requirements, the expropriation of assets, consumer protection and safety standards, are unlikely to be solved in short period of time [

53]. A lack of political trust among ASEAN countries will also prevent a high interdependence of power grids [

54].

5. Australian–Asian Grid (Australasian Power Grid, AAG)

5.1. The Case

The case for the establishment of AAG comes from two seemingly ‘matching’ considerations, i.e., (a) Australia’s abundance of energy resources including renewable energy coupled with its technology and expertise; and (b) Asian’s increasing demand for energy to keep up with its economic growth.

5.2. Benefits

In a 2013 workshop [

55] a number of benefits of the existence of such an interconnection were identified as follows: security of energy supplies for the region, reduction in energy conflicts, a solution to climate change, a pathway to low carbon futures, maximize the regions’ natural advantage of renewable resources, build regional partnerships, and make some headway to reducing energy poverty in the region. These benefits are generally in line with benefits identified in the cases of interconnections mentioned in

Section 3 and with those found in [

56]. There is also potential for economic efficiency through integration. A model for 100% renewable energy supply in Southeast Asia [

57] found that a centralized interconnected scenario resulted in a lower overall levelized cost of energy than a decentralized scenario comprising independent national grids. This was partly due to the stabilization of the intermittency of renewable resources by integration over a large scale, and partly due to the integration of additional demand of industrial gas and desalinated water to provide flexible loads.

5.3. Existing Scenarios

Taggart et al.’s scenario [

58], also called the Pan Asian Grid, aims at facilitating exchanges of Renewable Energy based-electricity among several countries in North East Asia, ASEAN and Australia.

Table 5 shows renewable energy resources that can potentially harnessed and exchanged among these countries under this scenario.

In addition, the scenario also proposed the establishment of natural gas pipelines and fiber optic cables that “could stretch from Australia to China, and possibly beyond into Central Asia and the Russian Far East” [

58].

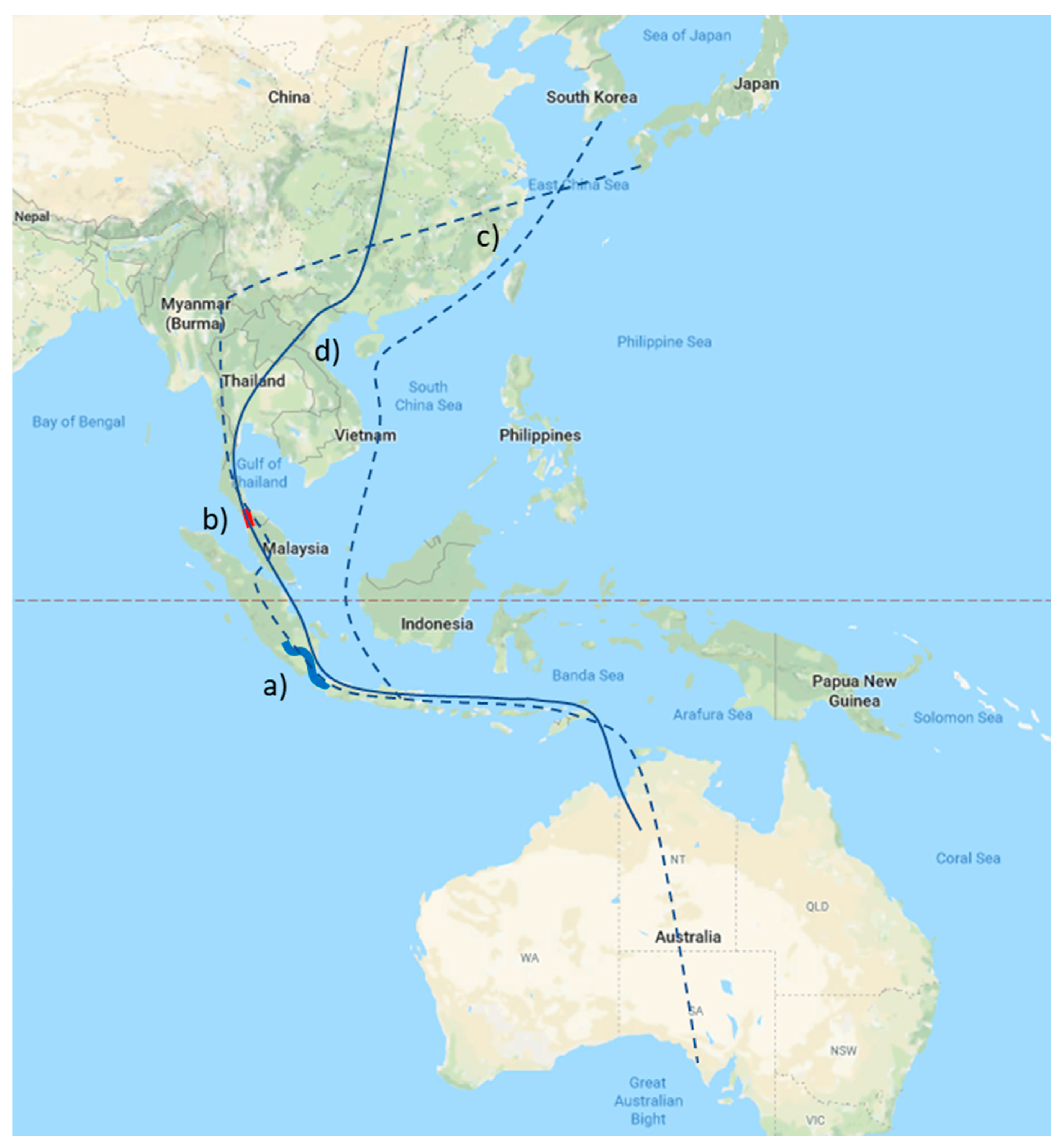

Figure 3 shows two proposed routes for the Pan-Asian Energy Infrastructure scenario, i.e., one route mostly by land and the other largely by sea.

Another scenario, known as the Asia Pacific Super Grid (

Figure 3) aims at promoting large-scale solar electricity exchange among countries involved. In this scenario, one third of the electricity is to be provided from Australia’s solar through HVDC cable by 2050 “on the basis that it is substantial but would still allow room for diverse electricity sources within each country to maintain robustness”. The scenario relies upon short term pumped hydroelectric storage with significant capacity for maintaining reliability including solar energy intermittency mitigation [

59].

Examining the practical and commercial considerations for the first interconnection between Australia and ASEAN, a recent study of the prospect for exporting solar energy from the Pilbara region of Western Australia [

60] presents a more focused scenario considering both the aggregation of solar generation and the submarine interconnection to a landing point in East Java. The study finds that it is technically feasible, though ambitious, to build this interconnection as a bipole HVDC submarine transmission line with an exchange capacity of 3000 MW using present technologies. The selected route is about 1500 km long and avoids the deepest parts of the Java trench, but still exceeds 2000 m deep in multiple locations. The commercial case is considered premature at the present costs of solar generation, battery energy storage, and HVDC transmission, but the first two of these are decreasing rapidly and, by the time such a complex project could be planned, approved, and developed, the economic case is likely to be favorable.

The study also considered the strategic benefits to Indonesia that a “grid extension” to the Pilbara may offer, emphasized the long process of sensitive engagement between Indonesia and Australia that will be necessary to achieve the project, and assessed the impacts and opportunities for traditional owners of the Pilbara’s prime solar generation land. And it may be that these factors, more than any others, will determine whether the interconnector has a serious prospect.

5.4. A Brief History of the Australia–ASEAN Engagement

Realizing and managing the proposed AAG will be certainly a mammoth task and pose serious challenges to the parties involved. However, experiences of (and lessons from) existing projects elsewhere (see previous Sections) should provide some valuable information for implementing and running this transnational energy business.

Within the region itself, there have been a number of cooperation or initiatives that can be employed as templates to initiate the discussion on the feasibility of the AAG concept and should it be deemed prospective, to endeavor for its realization.

The first historic meeting held in Canberra in 1974 between Australia and ASEAN marked the beginning of cooperation that have transformed the two groups of countries into a mutual dynamic partner. “Australia was ASEAN’s first dialogue partner—the first country ASEAN agreed to meet on a regular basis to discuss political, economic and functional cooperation. The first formal talks which brought together the then five members of ASEAN and Australia were held in Canberra in 1974.” [

61]. The same observation was made by Ravenhil [

62] and Severino [

63] (Severino noted that “The European Economic Community was actually the first of all Dialog Partners, but it was not a country” (p. 310)). Through the ASEAN—Australia Economic Cooperation Program (AAECP), Australia extended economic assistance to ASEAN regional projects [

63], including assistance to non-conventional energy research through the ASEAN Subcommittee on Nonconventional Energy Research (ASEAN SCNCER), a subcommittee within the ASEAN Committee of Science and Technology (ASEAN COST). The channeling of Australia’s technical assistance to the non-conventional energy research is staged through Phase I through Phase III of the AAECP.

Australia was also the first country with which ASEAN established a formal consultative structure on trade matters, called the ASEAN-Australia Consultative Meetings (AACM), in 1978 [

63].

In another sign of strengthening relationship between ASEAN and Australia, the ASEAN-Australia Development Cooperation Program (AADCP) was established in 2002. The six-year project costing

$45 million aimed at strengthening: regional and social cooperation, regional institutional capacities, science, technology and environmental cooperation, and expediting the new ASEAN Member Countries’ integration into ASEAN [

62,

64].

The above and many other forums/meetings between Australia and ASEAN and others which involve Australia as a partner are demonstration of the “closeness” of the communications between the regional neighbors.

Within the Master Plan on ASEAN Connectivity (MPAC) document [

65], one of the physical connectivity listed is energy (Others include: transport and information and communications technology (ICT)). The document also listed Australia as one among other ASEAN partners that might potentially provide funding for technical assistance.

Australia’s sustained engagement with ASEAN has been attributed to “the economic opportunities that Southeast Asia and the rest of East Asia present, by Southeast Asia’s strategic location between Australia and the rest of Asia, and by ASEAN’s role as the hub of East Asian regionalism” ([

63], p. 310).

6. Discussion

The challenges and issues facing the realization of the AAG will come from two fronts, i.e., (1) Australia as ‘the initiator’ of the concept; and (2) ASEAN/Asia who need to be convinced of the worthiness of such an idea.

6.1. Australian Front

There has been policy inconsistency about advancing renewable energy in Australia. The repealing of the carbon pricing scheme in Australia (also known as the carbon tax) and replacement with the Emissions Reduction Fund on 17 July 2014 is a prime example of such inconsistency. The carbon-pricing scheme was actually introduced on 1 July 2012 as the Clean Energy Act. Falling electricity demand due to an increase in the retail price of electricity; declining industrial demand; reduced manufacturing activity; energy efficiency initiatives; and solar PV systems is also concerning in the Australian context, since this has led to investment lock, as installed capacity lie idle. The regulatory decision to allocate investments based on increasing electricity demand when demand is actually falling is alarming in the Australian context.

Australia is rich in carbon-based energy resources such as coal and gas, and to date these resources have played an important role in the Australian economy. Any policy that undermines the role of fossil fuels is politically unpopular because this has been connected with rising end-user consumer prices despite there being multiple causes for rising prices—a topic beyond the scope of this paper. There have been some divergent (contrasting) views as to the impact of favorable renewable energy policy on the energy prices. Those who favor the high and quick penetration of RE argue that renewables are capable of delivering the energy policy ‘trilemma’ under a fair price of carbon and adequate capacity investments in regional interconnectors. On the other hand, advocates of fossil fuel consider renewables to be intermittent in nature—at least until mature and affordable storage technologies come into play—and costly, and hence they are unable to drive the affordability and security of supply objectives.

The ability of the National Electricity Market (NEM) to deliver the energy policy trilemma of secure supply of energy, affordability and sustainability is also questionable and is attracting increasing attention from policymakers [

66,

67]. The turmoil in the wind-reliant state of South Australia (SA) mirrors this view as a storm set off a catastrophic chain of events in September 2016 that resulted SA in becoming an electrical island and isolated from the national grid, as the interconnector stopped working, leading to a state-wide system blackout. The state is also facing an energy crisis since the high peaks in energy usage do not always match up with the increasingly intermittent supply. As a result, the state is considering a ‘go it alone’ policy to solve the energy crisis, which may result in its breaching the National Electricity Rules, augmenting more uncertainty about the survival of the NEM in its present form.

A recent report on optimizing Australia’s National Electricity Market, popularly known as the Finkel Review [

68], has advocated a technology neutral Clean Energy Target for the electricity sector in transitioning to a more sustainable energy mix in order to meet the Paris targets for greenhouse-gas emission reductions while maintaining energy security. The scope of clean energy is still under discussion in the political arena at the time of writing, and includes not only renewable energy production such as wind and solar but also nuclear energy, gas and coal production incorporating carbon capture and storage technology, which—according to the Review—should play a particularly important role as a transition resource. However, in the absence of a carbon price, the only investment is expected to be in new large-scale renewables electricity generation, primarily wind and solar, and in gas generators as flexible capacity. Addressing the tension in energy policy objectives tension between de-carbonization and energy security largely remains unanswered and so are the financing mechanisms for renewables.

Nevertheless, amid the political uncertainty, the public and many sectors of the business community are generally favorable towards a transition to renewable energy sources and realize that such a transition is necessary. The opportunity to export renewable energy in the form of electricity, hydrogen, or a hydrogen carrier such as methane or ammonia, is likely to generate much popular interest, because it can create an alternative contribution to Australia’s GDP should fossil-fuel exports be reduced due to policy or market developments domestic and abroad.

6.2. ASEAN/ASIAN Front

Indonesia’s Electrical Power Development Program does not even consider renewable energy as important part of the energy mix, although there is an allowance for renewable generation and for energy imports in the capacity expansion program presently underway. Indonesia’s National Development Plan is guided by the Nine Priorities Agenda, Nawacita or Nawa Cita in Sanskrit, which is: (1) Returning the state to its task of protecting all citizens and providing a safe environment; (2) Developing clean, trusted, and democratic governance; (2) Developing Indonesia’s rural areas; (4) Reforming law enforcement agendas; (5) Improving quality of life; (6) Increasing productivity and competitiveness; (7) Promoting economic independence by developing domestic strategic sectors; (8) Overhauling the character of the nation; (9) Strengthening the spirit of “unity in diversity” and social reform [

69].

Due to geographic reasons—which have an impact on economic, technical, and other related issues—any future Australian engagement with intercontinental interconnection must be realized through intensive engagement with ASEAN. Furthermore, due to its unique geographical position in ASEAN and as Australian neighbor, Indonesia plays a crucial role in the realization of such a very challenging endeavor.

No proposed interconnection scenarios have actually been properly taken into account for how they can fit into the existing APG initiative, the crucial key for Australia to enter into this intercontinental interconnection. As discussed in

Section 4, the APG is a formal plan among ASEAN countries through ASEAN Vision 2020 for Energy and Water. Any initiative—such as that described in in

Section 5.3—that is regarded as an alternative to the existing plan, will only be looked at more closely and seriously by ASEAN if such an initiative looks very compelling. A sensitive approach to international engagement is required to put a new proposal on the table.

ASEAN as a whole can, in theory, attain energy self-sufficiency status through energy exchanges among themselves, whereby the countries with abundant low-carbon energy resources export the energy to resource-poor countries in exchange for other economic commodities that bring mutual benefits to countries involved. In such an ideal scenario, the question: “Will (South-East) Asian nations be willing to import renewable energy from Australia?” [

70] will be irrelevant. Only if and when “domestic” exchanges among ASEAN are less economical or practicable than Australian energy imports, will the latter be an attractive option to ASEAN and other groupings beyond ASEAN.

However, such an ideal scenario is as challenging as ever, due to various reasons reflected in the progress of the APG implementation to date. Conflicting priorities for land use, complex approval processes, and difficulties of project implementation mean that energy resources that are available in principle cannot always be accessed in practice.

If one accepts the premise that the ASEAN through its APG is central to the realization of the AAG, then it follows that finding solutions to issues currently being faced by the APG is also the key to the realization of the AAG, whichever of the two scenarios would prevail. In other words, Australia will need to be actively involved in the APG discussion.

The challenges in opening discussions with the APG however, may be not the immediate question. The immediate question is how to connect Australia to one of the ASEAN countries, which would clearly be Indonesia, to demonstrate technical and economic feasibility, and to provide a track record of successful commercial operation. Before the AAG can be discussed by ASEAN, the Australian-Indonesia connection needs to have a likely proposal so that ASEAN can take it seriously. Even before ASEAN can make decision on AAG, the Indonesia-Australian interconnection could still be progressed, as Indonesia itself is a future demand centre and can provide market for Australian electricity export. The Indonesian government set an unconditional reduction target of 29% of GHGs against a BAU (business as usual) scenario by 2030 and an additional 12% reduction conditional on technology transfer, capacity building, results for payment, and access to finance [

71]. Indonesia’s climate change mitigation measures in the energy sector include “at least 23% (primary energy) coming from new and renewable energy by 2025” and gas was not mentioned in the INDC plan [

72].

As long as Australian electricity is cost competitive in the Indonesian market, it will warrant Indonesia’s attention. This past experience in electricity import has prepared Indonesia for further import of electricity. Indonesia has been importing electricity solely from Malaysia since 2009. The amount of import increased from 1.26 GWh in 2009 to 8.99 GWh in 2014 [

72]. After a new transmission line was put into operation on January 20, 2016, Indonesia has started importing more electricity from Malaysia. Indonesia has gained significant cost savings from this power trade [

73]. In 2012, the government issued a regulation on electricity exports and imports and allowed PLN to import and export electricity from and to neighboring countries [

73]. According to this regulation, power imports will be allowed for regions with available power capacities of less than 30% of peak demand, provided that there are no infringements on Indonesia’s sovereignty, security or economic development [

74]. Indonesia is also planning to export electricity to Malaysia within a few years [

74].

7. Conclusions

The Australian–Asian Grid is technically viable, with technology that is proven and improving, but economically, socially, politically, and administratively challenging. On the other hand, the seeds of such an idea have been sown across Asia in the forms of several Asian sub-regional initiatives on grid interconnections: ASEAN Power Grid, GobiTec, CASA-1000 → Asian Energy Highway.

This critical appraisal leads to the following two possible scenarios: (1) a pessimistic scenario where such a concept will not eventuate or that it will eventuate beyond the foreseeable future and (2) an optimistic scenario in which the idea will eventually be realized within the not-too-distant future. Both scenarios come with attached conditions.

The pessimistic scenario points to the complexity of many aspects involved in realizing such an initiative. Socio-economic and geopolitical circumstances of ASEAN/Asia which are in many ways in contrast to Australia seem too overwhelming to deal with.

In the optimistic scenario, the Australian–Asian Grid is considered to be an evolutionary process, starting with the realization of the above mentioned sub-regional interconnections and sealed with the super-grid linking Australia with the above interconnections through ASEAN Power Grid (APG). Energy scarcity, climate change concern, and technological advances will eventually push for the realization of this concept. In this regard, Australia should engage more actively in various forums for discussing such initiatives at ASEAN/Asian levels. Such a forum provides huge opportunities for Australia to offer vision, technologies, expertise in renewable energy and climate change. Future conceptualization of AAG entails the sound understanding of Australia’s neighbors’ priorities agendas, such as Indonesia’s Nawacita [

69].