Reducing Voltage Volatility with Step Voltage Regulators: A Life-Cycle Cost Analysis of Korean Solar Photovoltaic Distributed Generation

Abstract

:1. Introduction

2. Research Methodology and Data Collection

2.1. Data Collection

- Although four feeders are shown, the authors only simulated Feeder 1, as it is the most complex.

- The load ratio, consistent for all feeders, is 1 at the maximum load and 0.3 at the minimum load.

- The load of the whole system is 32.8 MW and the power factor is 0.9.

- The distribution system consists of four feeders, each of which has a load of 8.2 MW and a 0.9 power factor, with a total load capacity of 32.8 MW.

- The section data of the high-voltage distribution line is shown in Table 1, below.

- The output voltage of the main transformer is adjusted by the line drop compensation (LDC) method presented in Section 2.2. The parameters of the main transformer, OLTC and SVR are shown below.

- Pillar transformer taps shall be applied with 13,200 V taps when the voltage drop is less than 5% at full load, and 12,600 V taps when exceeding 5%.

- The DG power supply is connected to the ends of Feeders 1 and 2 first, and the power factor is 0.9. Thereafter, the location of the DG power supply is moved around along the feeder line one and two between the branches to assess the criticality of the voltage fluctuation and regulation. This is needed to generalize the model in the case of a different DG being connected along the line, as recent research by Mahmud and Zahedi highlighted [39].

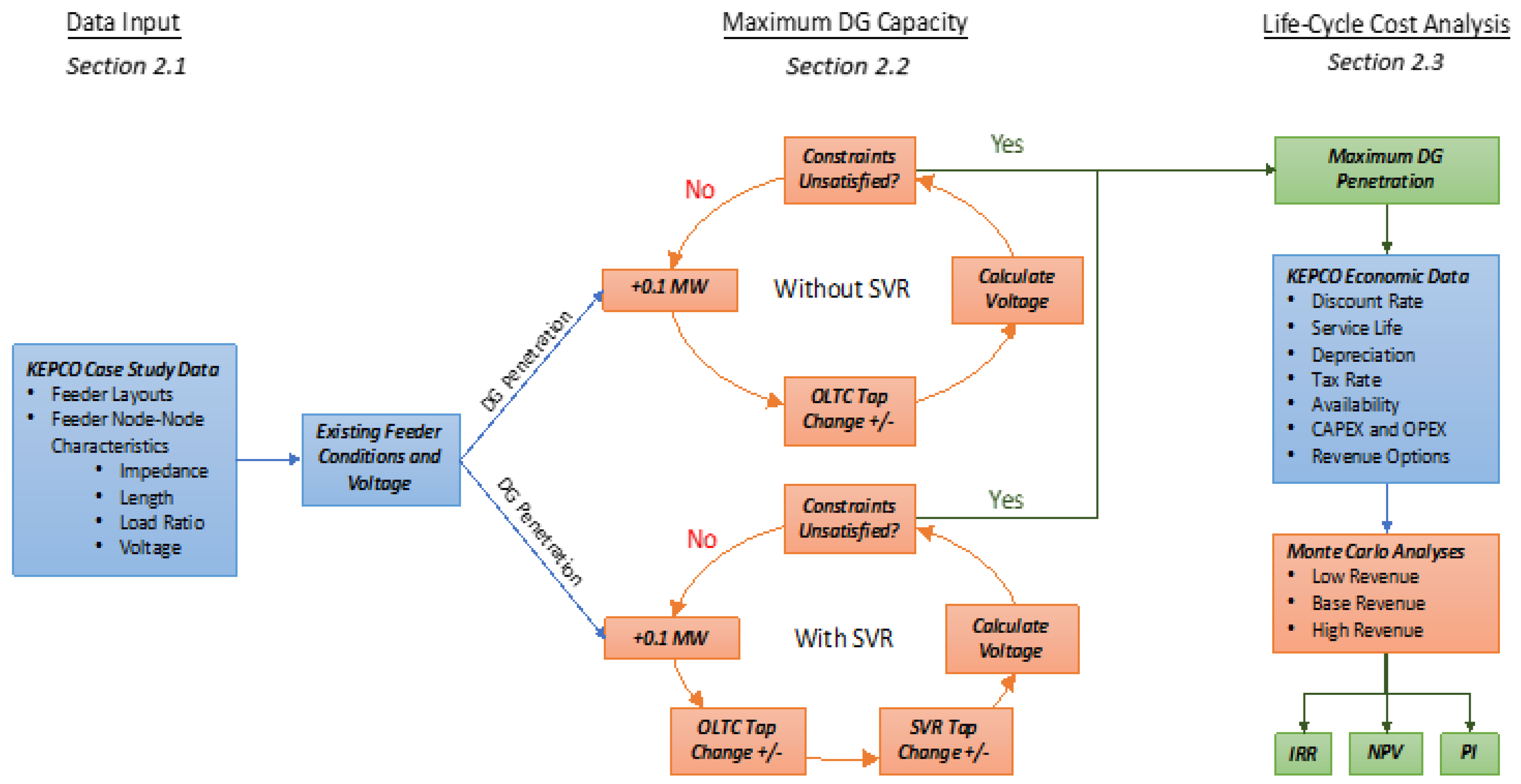

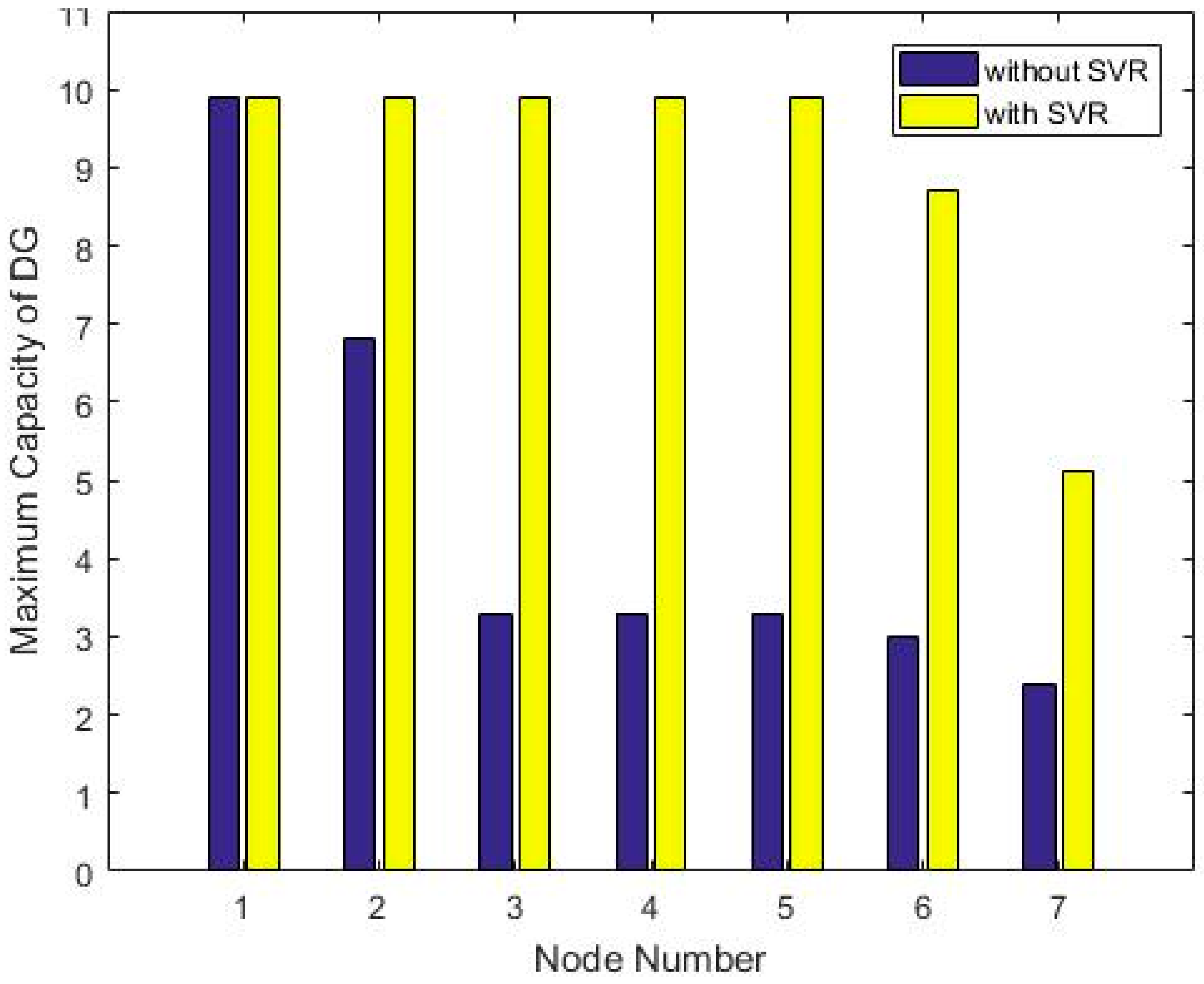

2.2. Maximum DG Capacity Analysis

2.3. Economic Analysis

3. Findings

4. Discussion

5. Conclusions and Future Research

Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CAPEX | Capital Expenditures |

| DG | Distributed generation |

| ETS | Emission Trading System |

| IRR | Internal Rate of Return |

| KCU | Korean Offset Credit |

| KEPCO | Korea Electric Power Corporation |

| LCCA | Life Cycle Cost Analysis |

| LDC | Line Drop Compensation |

| MATLAB | Matrix Laboratory |

| NPV | Net Present Value |

| OLTC | On-load tap-changers |

| OPEX | Operation Expenditure |

| PV | photovoltaic |

| REC | Renewable Energy Certificate |

| RPS | Renewable Portfolio Standard |

| SMP | System Marginal Price |

| SVR | Step Voltage Regulators |

References

- United Nations. Ensure Access to Affordable, Reliable, Sustainable, and Modern Energy. Sustainable Development Goals. 2018. Available online: https://www.un.org/sustainabledevelopment/energy/ (accessed on 14 November 2018).

- The Government of the Republic of Korea. The 7th Basic Plan for Long-Term Electricity Supply and Demand; Ministry of Trade, Industry Energy: Sejong City, Korea, 2015.

- Alanne, K.; Saari, A. Distributed energy generation and sustainable development. Renew. Sustain. Energy Rev. 2006, 10. [Google Scholar] [CrossRef]

- Lopes, J.P.; Hatziargyriou, N.; Mutale, J.; Djapic, P.; Jenkins, N. Integrating distributed generation into electric power systems: A review of drivers, challenges and opportunities. Electr. Power Syst. Res. 2007, 77, 1189–1203. [Google Scholar] [CrossRef]

- Sgouras, K.I.; Bouhouras, A.S.; Gkaidatzis, P.A.; Doukas, D.I.; Labridis, D.P. Impact of reverse power flow on the optimal distributed generation placement problem. IET Gener. Transm. Distrib. 2017, 11, 4626–4632. [Google Scholar] [CrossRef]

- Song, I.K.; Jung, W.W.; Chu, C.M.; Cho, S.S.; Kang, H.K.; Choi, J.H. General and simple decision method for DG penetration level in view of voltage regulation at distribution substation transformers. Energies 2013, 6, 4786–4798. [Google Scholar] [CrossRef]

- Kim, J.E. Distributed Power Distribution System Voltage Analysis. Trans. Korean Inst. Electr. Eng. 2012. [Google Scholar]

- Chae, W.K. A Study on the Application of SVR at the Distribution Line Interconnected with Wind Turbine. J. Korean Inst. Illum. Electr. Install. Eng. 2010, 24, 109–118. [Google Scholar] [CrossRef]

- Barker, P. Overvoltage considerations in applying distributed resources on power systems. In Proceedings of the IEEE Power Engineering Society Summer Meeting, Chicago, IL, USA, 21–25 July 2002; Volume 1, pp. 109–114. [Google Scholar] [CrossRef]

- Kim, S.H. A Study on the Analysis of Customer Voltage Characteristic with Distributed Generation. Trans. Korean Inst. Electr. Eng. 2010, 333–335. Available online: https://www.dbpia.co.kr/Journal/ArticleDetail/NODE01575855#/ (accessed on 5 December 2018).

- Duong, M.Q.; Tran, N.T.; Sava, G.N.; Scripcariu, M. The impacts of distributed generation penetration into the power system. InElectromechanical and Power Systems (SIELMEN). In Proceedings of the IEEE 2017 International Conference, Boston, MA, USA, 11–14 December 2017; pp. 295–301. [Google Scholar] [CrossRef]

- Quezada, V.M.; Abbad, J.R.; Roman, T.G. Assessment of energy distribution losses for increasing penetration of distributed generation. IEEE Trans. Power Syst. 2006, 21, 533–540. [Google Scholar] [CrossRef]

- Viral, R.; Khatod, D.K. An analy tical approach for sizing and siting of DGs in balanced radial distribution networks for loss minimization. Int. J. Electr. Power Energy Syst. 2015, 1, 191–201. [Google Scholar] [CrossRef]

- Esmaili, M.; Firozjaee, E.C.; Shayanfar, H.A. Optimal placement of distributed generations considering voltage stability and power losses with observing voltage-related constraints. Appl. Energy 2014, 1, 1252–1260. [Google Scholar] [CrossRef]

- Gkaidatzis, P.A.; Doukas, D.I.; Bouhouras, A.S.; Sgouras, K.I.; Labridis, D.P. Impact of penetration schemes to optimal DG placement for loss minimisation. Int. J. Sustain. Energy 2017, 36, 473–488. [Google Scholar] [CrossRef]

- Abdmouleh, Z.; Gastli, A.; Ben-Brahim, L.; Haouari, M.; Al-Emadi, N.A. Review of optimization techniques applied for the integration of distributed generation from renewable energy sources. Renew. Energy 2017, 113, 266–280. [Google Scholar] [CrossRef]

- Chiradeja, P.; Ramakumar, R. An approach to quantify the technical benefits of distributed generation. IEEE Trans. Energy Convers. 2004, 19, 764–773. [Google Scholar] [CrossRef]

- Lee, E.M.; Kim, M.Y.; Rho, D.S.; Sohn, S.W.; Kim, J.E.; Park, C.H. A Study on the Optimal Introduction of Step Voltage Regulator (SVR) in Distribution Feeders. Trans. Korean Inst. Electr. Eng. 2004, 53, 610–618. Available online: http://www.dbpia.co.kr/Journal/ArticleDetail/NODE01242881#/ (accessed on 5 December 2018).

- Takahashi, S.; Hayashi, Y.; Tsuji, M.; Kamiya, E. Method of Optimal Allocation of SVR in Distribution Feeders with Renewable Energy Sources. J. Int. Council Electr. Eng. 2012, 2, 159–165. [Google Scholar] [CrossRef] [Green Version]

- Liu, X.; Aichhorn, A.; Liu, L.; Li, H. Coordinated control of distributed energy storage system with tap changer transformers for voltage rise mitigation under high photovoltaic penetration. IEEE Trans. Smart Grid 2012, 3, 897–906. [Google Scholar] [CrossRef]

- Kojovic, L.A. Coordination of distributed generation and step voltage regulator operations for improved distribution system voltage regulation. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, Montreal, QC, Canada, 18–22 June 2006; p. 6. [Google Scholar] [CrossRef]

- Kojovic, L.A. Modern techniques to study voltage regulator—DG interactions in distribution systems. In Proceedings of the 2008 IEEE/PES Transmission and Distribution Conference and Exposition, Chicago, IL, USA, 21–24 April 2008; pp. 1–6. [Google Scholar] [CrossRef]

- Lee, H.O. A Study on Optimal Placement and Voltage Control Method of SVR in Smart Grid. Soongsil University, Seoul. 2014. Available online: http://www.riss.kr/link?id=T13515858/ (accessed on 5 December 2018).

- Kim, M.Y. A Study for Influence of Step Voltage Regulator in Distribution Systems with Distributed Generations. Trans. Korean Inst. Electr. Eng. 2009, 11, 284–285. Available online: http://www.dbpia.co.kr/Journal/ArticleDetail/NODE01394148#/ (accessed on 5 December 2018).

- Kim, M.Y.; Oh, Y.T.; An, J.Y.; Kim, J.E.; Kim, E.S.; Rho, D.S. A Study on the Optimal Voltage Regulation in Distribution Systems with Dispersed Generation Systems. Trans. Korean Inst. Electr. Eng. 2005, 54, 251–258. [Google Scholar] [CrossRef]

- Shin, K.H. A Study on the Method for Controlling Sending-End Voltage for Voltage Regulation at the Distribution System with Large Distributed Generation. Master’s Thesis; Soongsil University: Seoul, Korea, 2015. Available online: http://www.riss.kr/link?id=T13818300/ (accessed on 5 December 2018).

- Farag, H.E.; El-Saadany, E.F. Voltage regulation in distribution feeders with high DG penetration: From traditional to smart. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–29 July 2011; pp. 1–8. [Google Scholar] [CrossRef]

- Thirugnanam, K.; Kerk, S.G.; Yuen, C. Battery integrated solar photovoltaic energy management system for micro-grid. In Proceedings of the Innovative Smart Grid Technologies-Asia (ISGT ASIA), Bangkok, Thailand, 3–6 November 2015; pp. 1–7. [Google Scholar]

- Bjelic, I.B.; Ciric, R.M. Optimal distributed generation planning at a local level—A review of Serbian renewable energy development. Renew. Sustain. Energy Rev. 2014, 39, 79–86. [Google Scholar] [CrossRef]

- Strbac, G.; Ramsay, C.; Pudjianto, D. Integration of Distributed Generation into the UK Power System. Summary Report. DTI Centre for Distributed Generation and Sustainable Electrical Energy. 2007. Available online: https://www.ofgem.gov.uk/ofgem-publications/55759/dgseeewpdgvaluepaperv30.pdf/ (accessed on 7 December 2018).

- DECC. Review of the Generation Costs and Deployment Potential of Renewable Electricity Technologies in the UK: Study Report. 2011. Available online: http://www.gov.uk/government/uploads/system/uploads/attachment_data/file/147863/3237-cons-ro-banding-arup-report.pdf (accessed on 14 November 2018).

- Audenaert, A.; De Boek, L.; De Cleyn, S.; Lizin, S.; Adam, J.F. An economic evaluation of photovoltaic grid connected systems (PVGCS) in Flanders for companies: A generic model. Renew. Energy 2010, 35, 2674–2682. [Google Scholar] [CrossRef]

- Kolhe, M.; Kolhe, S.; Joshi, J.C. Economic viability of stand-alone solar photovoltaic system in comparison with diesel-powered system for India. Energy Econ. 2002, 24, 155–165. [Google Scholar] [CrossRef]

- Bernal-Agustin, J.L.; Dufo-Lopez, R. Economical and environmental analysis of grid connected photovoltaic systems in Spain. Renew. Energy 2006, 31, 1107–1128. [Google Scholar] [CrossRef]

- Muttaqi, K.M.; Le, A.D.; Aghaei, J.; Mahboubi-Moghaddam, E.; Negnevitsky, M.; Ledwich, G. Optimizing distributed generation parameters through economic feasibility assessment. Appl. Energy 2016, 165, 893–903. [Google Scholar] [CrossRef] [Green Version]

- Calovic, M.-S. Modeling and analysis of under load tap changing transformer control system. IEEE Trans. Power Appar. Syst. 1984, 107, 1909–1915. [Google Scholar] [CrossRef]

- Jordehi, A.R. Allocation of distributed generation units in electric power systems: A review. Renew. Sustain. Energy Rev. 2016, 1, 893–905. [Google Scholar] [CrossRef]

- Allan, G.; Eromenko, I.; Gilmartin, M.; Kockar, I.; McGregor, P. The economics of distributed energy generation: A literature review. Renew. Sustain. Energy Rev. 2015, 1, 543–556. [Google Scholar] [CrossRef]

- Mahmud, N.; Zahedi, A. Review of control strategies for voltage regulation of the smart distribution network with high penetration of renewable distributed generation. Renew. Sustain. Energy Rev. 2016, 64, 582–595. [Google Scholar] [CrossRef]

- KEPCO. Distributed Energy Resources Distribution System Interconnection Technology Standard. 2015. Available online: https://cyber.kepco.co.kr/ckepco/front/jsp/CY/H/C/CYHCHP00801.jsp (accessed on 14 November 2018).

- Seo, K.H. A Study on Output Voltage Method for Maintaining Line Voltage in High Capacity Distributed Power Distribution System Connection. Master’s Thesis, Graduate School of Soongsil University, Seoul, Korea, 2015. [Google Scholar]

- Choi, J.H.; Kim, J.-C. Advanced voltage regulation method of power distribution systems interconnected with dispersed storage and generation systems. IEEE Trans. Power Deliv. 2001, 16, 329–334. [Google Scholar] [CrossRef]

- Choi, J.H.; Moon, S.-I. The dead band control of LTC transformer at distribution substation. IEEE Trans. Power Syst. 2009, 24, 319–326. [Google Scholar] [CrossRef]

- Siemens Energy Sector. Power Engineering Guide; Siemens: Erlangen, Germany, 2016; Available online: http://www.energy.siemens.com/hq/en/energy-topics/publications/power-engineering-guide/ (accessed on 14 November 2018).

- Advanced Distribution System Engineering; Korean Institute of Electrical Engineers: Seoul, Korea, 2014.

- Korea Eximbank. Photovoltaic Industry Trend in the Second Quarter of 2017. Seoul, Korea, 2017. Available online: http://keri.koreaexim.go.kr/site/program/board/basicboard/view?boardtext8=PA03currentpage=3menuid=007002001003pagesize=10boardtypeid=168boardid=57900 (accessed on 5 December 2018).

- Rho, D.S.; Lee, E.M.; Park, C.H.; Kim, E.S. In Economic Evaluation of Step Voltage Regulator in Distribution Systems. Proceedings of the KIEE Conference, The Korean Institute of Electrical Engineers. Available online: http://www.dbpia.co.kr/Journal/ArticleDetail/NODE01339555#/ (accessed on 5 December 2018).

- Jun, K.S. A Case Study on Decision-Making Process for Economic Feasibility under Uncertainty for Steel Plant Projects. Master’s Thesis, POSTECH, Pohang, Korea, 2014. Available online: http://www.riss.kr/link?id=T13405695/ (accessed on 5 December 2018).

- Cottrell, W.D. Simplified program evaluation and review technique (PERT). J. Constr. Eng. Manag. 1999, 125, 16–22. [Google Scholar] [CrossRef]

- Gozde, H.; Taplamacioglu, M.C. Comparative performance analysis of artificial bee colony algorithm for automatic voltage regulator (AVR) system. J. Frankl. Inst. 2011, 348, 1927–1946. [Google Scholar] [CrossRef]

- Wolsink, M. The research agenda on social acceptance of distributed generation in smart grids: Renewable as common pool resources. Renew. Sustain. Energy Rev. 2012, 16, 822–835. [Google Scholar] [CrossRef]

- Fam, S.D.; Xiong, J.; Xion, G.; Yong, D.L.; Ng, D. Post-Fukushima Japan: the continuing nuclear controversy. Energy Policy 2014, 68, 199–205. [Google Scholar] [CrossRef]

- Karneyeva, Y.; Wüstenhagen, R. Solar feed-in tariffs in a post-grid parity world: The role of risk, investor diversity and business models. Energy Policy 2017, 106, 445–456. [Google Scholar] [CrossRef]

- Taylor, M.; Daniel, K.; Ilas, A.; So, E.Y. Renewable Power Generation Costs in 2014; International Renewable Energy Agency: Masdar City, Abu Dhabi, UAE, 2015. [Google Scholar]

- Owusu, P.A.; Asumadu-Sarkodie, S. A review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng. 2016, 3, 1167990. [Google Scholar] [CrossRef]

- Alyami, S.; Wang, Y.; Wang, C.; Zhao, J.; Zhao, B. Adaptive real power capping method for fair overvoltage regulation of distribution networks with high penetration of PV systems. IEEE Trans. Smart Grid 2014, 5, 2729–2738. [Google Scholar] [CrossRef]

- Hittinger, E.; Siddiqui, J. The challenging economics of US residential grid defection. Utilities Policy 2017, 45, 27–35. [Google Scholar] [CrossRef]

- Bergek, A.; Mignon, I.; Sundberg, G. Who invests in renewable electricity production? Empirical evidence and suggestions for further research. Energy Policy 2013, 56, 568–581. [Google Scholar] [CrossRef] [Green Version]

- Yan, R.; Marais, R.; Saha, T.K. Impacts of residential photovoltaic power fluctuation on on-load tap changer operation and a solution using DSTATCOM. Electric Power Syst. Res. 2014, 111, 185–193. [Google Scholar] [CrossRef]

- Wang, P.; Liang, D.H.; Yi, J.; Lyons, P.F.; Davison, P.J.; Taylor, P.C. Integrating Electrical Energy Storage Into Coordinated Voltage Control Schemes for Distribution Networks. IEEE Trans. Smart Grid 2014, 5, 1018–1032. [Google Scholar] [CrossRef]

| Node No. | Length (l) (km) | Load Ratio [%] | Pole Transformer Tap (V/V) | |

|---|---|---|---|---|

| From | To | |||

| 0 | 1 | 5 | 3 | 13,200/230 |

| 1 | 2 | 4 | 3 | 13,200/230 |

| 2 | 3 | 4 | 1 | 12,600/230 |

| 4 | 5 | 2 | 3 | 12,600/230 |

| 5 | 6 | 5 | 4 | 12,600/230 |

| 6 | 7 | 4 | 7 | 12,600/230 |

| 7 | 8 | 6 | 5 | 12,600/230 |

| Costs | Detailed Criteria | Estimated Value | Cost Used for Analysis * |

|---|---|---|---|

| Solar Panels |

| $400/kW | $400/kW |

| PV System Materials |

| $1000/kW | $1000/kW |

| Construction |

| 10% | $199/kW |

| Connection Fee |

| 8% | $159/kW |

| Design/Licensing |

| 2% | $40/kW |

| Indirect |

| 9.50% | $189/kW |

| Total Cost: | $1987/kW | ||

| Parameter | Value | Remark |

|---|---|---|

| Discount Rate | 5.50% | Korea Development Institute for public investment projects |

| Service Life | 25 years | - |

| Depreciation | 20-year straight line | Domestic Development Company Accounting Regulations |

| Tax Rate | 24.2% | - |

| Capacity | 2.4 MW (No SVR) 5.1 MW (SVR) | Introduced limit capacity to Node 7 of Feeder 1 |

| Days of operation | 365 days | - |

| Availability | 3.28 h/day | 20-year average value of national solar power generation |

| CAPEX | $2 M/MW (No SVR) $2.5 M/MW (SVR) | PV equipment and power system entrance cost [47] |

| OPEX | 1.0% | O M cost average of general solar industry |

| Electricity tariff | $0.0803/kWh | Average of November ’16 to October ’17 [48] |

| REC | $0.1372/kWh | Average of November ’16 to October ’17 [48] |

| KCU | $18.5/tCO2 | 16.11.9 Offset trading price |

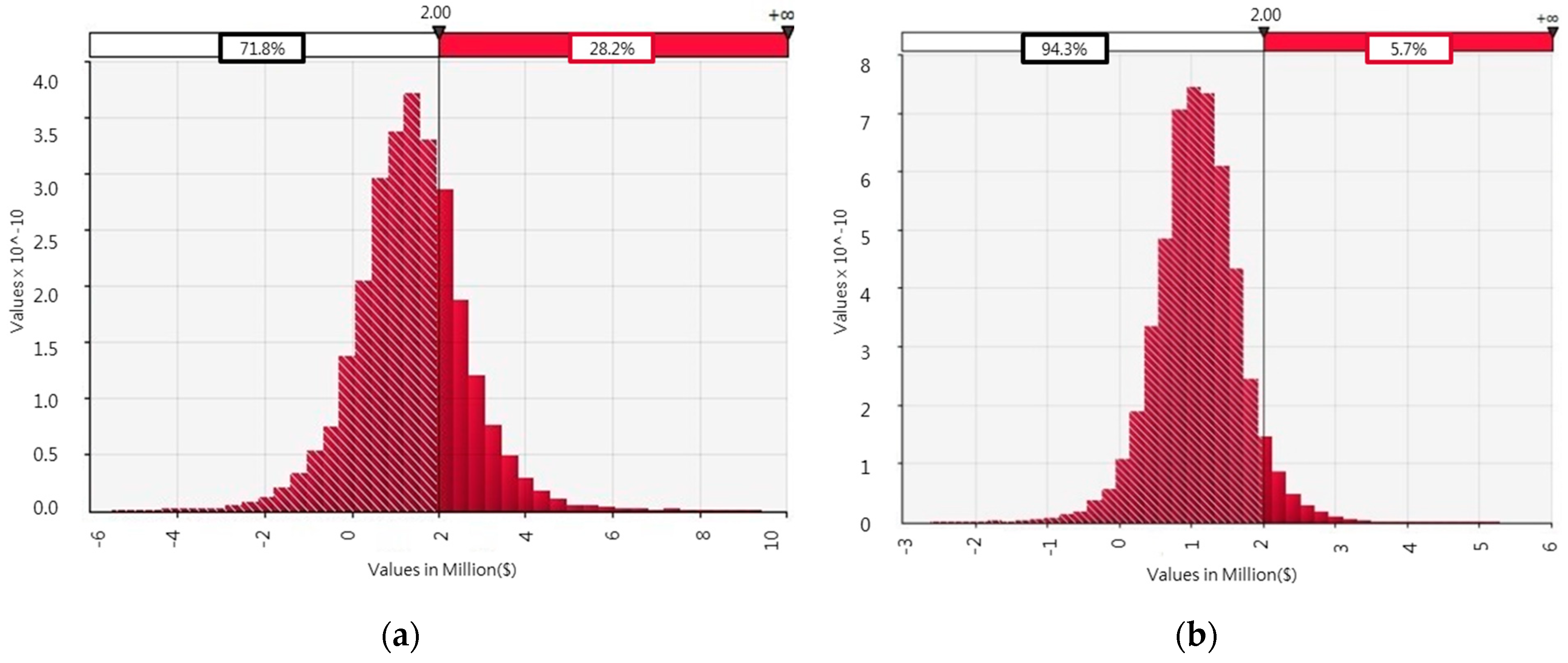

| Case Scenario | Economics Analysis Condition | |

|---|---|---|

| No SVR | Low-scenario | revenue: SMP |

| Base-scenario | revenue: SMP + REC | |

| High-scenario | revenue: SMP + REC + KCU | |

| SVR Installed | Low-scenario | revenue: SMP |

| Base-scenario | revenue: SMP + REC | |

| High-scenario | revenue: SMP + REC + KCU | |

| Power Penetration | Without SVR | With SVR | |||

|---|---|---|---|---|---|

| Consumer Voltage | Consumer Voltage | ||||

| Distributed Generation penetration: 0 MW | Minimum load | Maximum | 1.0345 | Maximum | 1.0345 |

| Minimum | 0.9774 | Minimum | 0.9774 | ||

| Maximum load | Maximum | 1.0420 | Maximum | 1.0420 | |

| Minimum | 0.9546 | Minimum | 0.9706 | ||

| Distributed Generation penetration: 3 MW | Minimum load | Maximum | 1.0717 | Maximum | 1.0379 |

| Minimum | 0.9662 | Minimum | 0.9662 | ||

| Maximum load | Maximum | 1.0566 | Maximum | 1.0420 | |

| Minimum | 0.9779 | Minimum | 0.9779 | ||

| LCCA Output | Low Scenario (SMP) | Base Scenario (SMP + REC) | High Scenario (SMP + REC + KCU) | |

|---|---|---|---|---|

| IRR (%) | without SVR | −1.6 | 8.41 | 9.36 |

| with SVR | −2.52 | 7.31 | 8.2 | |

| NPV ($M) | without SVR | −2.594 | 1.366 | 1.841 |

| with SVR | −6.644 | 1.945 | 2.954 | |

| PI | without SVR | 0.46 | 1.28 | 1.38 |

| with SVR | 0.41 | 1.17 | 1.26 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeong, Y.-C.; Lee, E.-B.; Alleman, D. Reducing Voltage Volatility with Step Voltage Regulators: A Life-Cycle Cost Analysis of Korean Solar Photovoltaic Distributed Generation. Energies 2019, 12, 652. https://doi.org/10.3390/en12040652

Jeong Y-C, Lee E-B, Alleman D. Reducing Voltage Volatility with Step Voltage Regulators: A Life-Cycle Cost Analysis of Korean Solar Photovoltaic Distributed Generation. Energies. 2019; 12(4):652. https://doi.org/10.3390/en12040652

Chicago/Turabian StyleJeong, Yu-Cheol, Eul-Bum Lee, and Douglas Alleman. 2019. "Reducing Voltage Volatility with Step Voltage Regulators: A Life-Cycle Cost Analysis of Korean Solar Photovoltaic Distributed Generation" Energies 12, no. 4: 652. https://doi.org/10.3390/en12040652