Residential Natural Gas Demand Response Potential during Extreme Cold Events in Electricity-Gas Coupled Energy Systems

Abstract

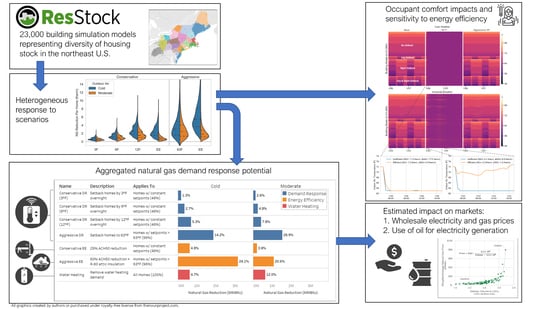

:1. Introduction

Case Study of the 2017–2018 Northeast Winter

2. Methods

- Establish a baseline set of building energy models representing the approximate 5.4 million detached homes that use natural gas for heating in the Northeast.

- Simulate the baseline models to estimate the total natural gas demand.

- Simulate aggressive and conservative demand response and energy efficiency strategies applied to the baseline home models.

- Compare natural gas savings potential and indoor temperature impacts to the building stock and individual buildings.

- Model the wholesale market response of natural gas supply and estimate the potential economic impacts of NG-DR.

2.1. Building Stock Modeling

2.2. Demand Response and Energy Efficiency Strategies

2.3. Modeling Pricing and Grid Impacts

3. Natural Gas Savings Potential of Demand Response

4. Implications of a Diverse Housing Stock

4.1. Impact of Conservative Strategies on Indoor Temperature

4.2. Impact of Aggressive Strategies on Indoor Temperature

5. Economic and Grid Analysis

6. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Jufri, F.H.; Widiputra, V.; Jung, J. State-of-the-art review on power grid resilience to extreme weather events: Definitions, frameworks, quantitative assessment methodologies, and enhancement strategies. Appl. Energy 2019, 239, 1049–1065. [Google Scholar] [CrossRef]

- Panteli, M.; Mancarella, P. Influence of extreme weather and climate change on the resilience of power systems: Impacts and possible mitigation strategies. Electr. Power Syst. Res. 2015, 127, 259–270. [Google Scholar]

- Abi-Samra, N.C.; Malcolm, W.P. Extreme weather effects on power systems. In Proceedings of the IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–28 July 2011. [Google Scholar]

- Grandoni, D. The Energy 202: Polar vortex tests gas and electric systems in Midwest, Mid-Atlantic. The Washington Post, 31 January 2019. [Google Scholar]

- Schwartz, M.S. Deep Freeze Puts Strain On Midwest Gas And Electricity Grids. Energy 2019. Available online: https://www.npr.org/2019/01/31/690230462/deep-freeze-puts-strain-on-midwest-gas-and-electricity-grids (accessed on 12 September 2019).

- EIA. Extreme Cold in the Midwest Led to High Power Demand and Record Natural Gas Demand. Today Energy 2019. Available online: https://www.eia.gov/todayinenergy/detail.php?id=38472 (accessed on 12 September 2019).

- U.S. DOE. Natural Gas Infrastructure Implications of Increased Demand from the Electric Power Sector; United States Department of Energy (DOE): Washington, DC, USA, 2015.

- EIA. Annual Energy Outlook 2019; U.S. Energy Information Administration: Washington, DC, USA, 2019.

- EIA. Northeastern Winter Energy Alert. Energy Market Alerts. 2018. Available online: https://www.eia.gov/special/alert/east_coast/ (accessed on 12 September 2019).

- EIA. 2018 Annual Electric Power Industry Report, Form EIA-861; U.S. Energy Information Administration (EIA): Washington, DC, USA, 2019.

- ISO New England. 2018 Regional Electricity Outlook; ISO New England: Holyoke, MA, USA, 2018. [Google Scholar]

- ABA. Aliso Canyon Storage Leak. 2017. Available online: https://www.americanbar.org/groups/infrastructure-regulated-industries/publications/infrastructure/2015-16/summer/aliso_canyon_storage_leak/ (accessed on 12 September 2019).

- Upchurch, J.; Peterson, C. Southern California’s Natural Gas Infrastructure May Face Constraints This Summer. Today Energy 2018. Available online: https://www.eia.gov/todayinenergy/detail.php?id=36416 (accessed on 12 September 2019).

- St. John, A. National Grid Isn’t Providing New Gas Hookups in New York. Wall Street Journal, 25 July 2019. [Google Scholar]

- HG&E. Natural Gas Service Notice; Holyoke Gas & Electric: Holyoke, MA, USA, 2019. [Google Scholar]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-khah, M.; Catalão, J.P.S. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- North American Electric Reliability Corporation (NERC). 2019–2020 Winter Reliability Assessment; NERC: Atlanta, GA, USA, 2019. [Google Scholar]

- Federal Energy Regulatory Commission (FERC). 2019 Assessment of Demand Response and Advanced Metering; Staff Report; FERC: Washington, DC, USA, 2019. [Google Scholar]

- ConEdison. Gas Demand Response Pilot Implementation Plan, 2018–2021; Consolidated Edison Company of New York Inc.: New York, NY, USA, 2018. [Google Scholar]

- SoCalGas. SoCalGas Smart Therm Program. 2019. Available online: https://www3.socalgas.com/save-money-and-energy/rebates-and-incentives/smart-therm (accessed on 31 January 2019).

- MA EEA. Baker-Polito Administration Announces Over $4.6 Million in Grants for Peak Demand Reduction Projects; Massachusetts Executive Office of Energy and Environmental Affairs: Boston, MA, USA, 2017. [Google Scholar]

- Rhodes, J.B. PSC Approves Con Edison’s Demand Response Pilot Program; N.Y.P.S. Commission: Albany, NY, USA, 2018. [Google Scholar]

- National Grid. Natural Gas Demand Response Pilot Program. 2017. Available online: https://www.nationalgridus.com/GDR (accessed on 1 March 2019).

- Moon, J.W.; Han, S.-H. Thermostat strategies impact on energy consumption in residential buildings. Energy Build. 2011, 43, 338–346. [Google Scholar]

- Armstrong, M.; Swinton, M.C.; Szadkowski, F.; Gusdorf, J.; Ruest, K. The Effects of Thermostat Set-back and Set-up on Seasonal Energy Consumption, Surface Temperatures and Recovery Times at the CCHT Twin House Facility. ASHRAE Trans. 2007, 113, 1–12. [Google Scholar]

- Ingersoll, J.; Huang, J. Heating energy use management in residential buildings by temperature control. Energy Build. 1985, 8, 27–35. [Google Scholar] [CrossRef] [Green Version]

- Nelson, L.W.; MacArthur, J.W. Energy savings through thermostat setback. ASHRAE J. 1978, 84. [Google Scholar]

- Pilati, D. Residential energy savings through modified control of space-conditioning equipment. Energy 1976, 1, 233–239. [Google Scholar] [CrossRef]

- Feldman, B. Natural Gas Demand Response—Not Just for Electricity Any More; Navigant Research: Boulder, CO, USA, 2017. [Google Scholar]

- The Brattle Group and Brown Rudnick LLP. Gas Demand Response—A Solution to the Electricity/Gas Interface Issue? In A Brainstorming Summit; The Brattle Group: Boston, MA, USA, 2014. [Google Scholar]

- Weiss, J.; Levine, S.; Sergici, S.; Thapa, A.; Grausz, L. Demand Response For Natural Gas Distribution; The Brattle Group: Boston, MA, USA, 2018. [Google Scholar]

- Faruqui, A.; Weiss, J. Gas Demand Response. 2014. Available online: http://spark.fortnightly.com/fortnightly/gas-demand-response (accessed on 12 September 2019).

- Wisely, J.; Hall, C. How Consumers Energy Customers Helped Avert a Michigan Gas Crisis. 2019. Available online: https://www.freep.com/story/news/local/michigan/2019/01/31/consumers-lower-heat-emergency-alert/2732252002/ (accessed on 12 September 2019).

- Schellenberg, J.; Savage, A.; Ciccone, A.; Nexant Inc. SoCalGas 2016–2017 Winter Demand Response Load Impact Evaluation; Southern California Gas Company: Los Angeles, CA, USA, 2017. [Google Scholar]

- Winston & Strawn LLP. Gas Demand Response Programs Are Alluring but Impractical. 2016. Available online: https://www.winston.com/images/content/1/1/v2/115461/Gas-Demand-Response-Programs-Are-Alluring-but-Impractical.pdf (accessed on 12 September 2019).

- Roth, K. Gas Demand Response: The Next Frontier. In Proceedings of the AEE East Energy Conference, Boston, MA, USA, 20–21 March 2019. [Google Scholar]

- ISO-NE. Real-Time Maps and Charts. Available online: https://www.iso-ne.com/isoexpress/ (accessed on 12 September 2019).

- EIA. Natural Gas Consumption by End Use. 2019. Available online: https://www.eia.gov/dnav/ng/ng_cons_sum_dcu_nus_m.htm (accessed on 13 February 2020).

- Wilson, E.J.; Christensen, C.B.; Horowitz, S.G.; Robertson, J.J.; Maguire, J.B. Energy Efficiency Potential in the U.S. Single-Family Housing Stock; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2017; 157p. [Google Scholar]

- DOE. EnergyPlus; U.S. Department of Energy (DOE): Washington, DC, USA, 2019. Available online: https://energyplus.net/ (accessed on 24 September 2020).

- DOE. U.S. EnergyPlus Version 9.2.0 Documentation. In Engineering Reference; DOE: Washington, DC, USA, 2019. [Google Scholar]

- NREL. OpenStudio 2.8.0; National Renewable Energy Lab (NREL): Golden, CO, USA, 2019. [Google Scholar]

- EIA. Residential Energy Consumption Survey (RECS); U.S. Energy Information Administration: Washington, DC, USA, 2015.

- S&P Global Market Intelligence. Pipeline Zone Summary—Algonquin Gas Transmission, LLC; SNL Energy Data: New York, NY, USA, 2019. [Google Scholar]

- S&P Global Market Intelligence. Natural Gas Summary; SNL Energy Data: New York, NY, USA, 2019. [Google Scholar]

- ISO-NE. Pricing Reports-Zonal Information; ISO New England: Holyoke, MA, USA, 2019. [Google Scholar]

- EIA. Electric Power Annual 2018; U.S. Energy Information Administration: Washington, DC, USA, 2019.

- Huang, J.; Hanford, J.; Fuqiang, Y. Residential Heating and Cooling Loads Component Analysis; Lawrence Berkley National Laboratory: Berkeley, CA, USA, 1999. [Google Scholar]

- Van Welie, G. Managing the Fuel-Security Risk During the Power System’s Rapid Transformation. In Proceedings of the 2018 EIA Energy Conference: Electric System Reliability and Operations, Washington, DC, USA, 23—26 September 2018; ISO New England: Holyoke, MA, USA, 2018. [Google Scholar]

- EIA. 2017 Annual Electric Power Industry Report, Form EIA-861; U.S. Energy Information Administration (EIA): Washington, DC, USA, 2018.

- EIA. Demand-Side Management Programs Save Energy and Reduce Peak Demand. Today Energy 2019. Available online: https://www.eia.gov/todayinenergy/detail.php?id=38872 (accessed on 26 November 2019).

| Scenario | Description | Applies To |

|---|---|---|

| Baseline | Normal Home Operation | All Homes |

| Conservative (3 °F) | Setback homes by 3 °F overnight (9 h) | Homes with constant heating setpoints (46%) |

| Conservative DR (6 °F) | Setback homes by 6 °F overnight (9 h) | |

| Conservative DR (12 °F) | Setback homes by 12 °F overnight (9 h) | |

| Conservative EE | 25% ACH50 reduction | |

| Aggressive DR | Setback homes to 63 °F (48 h) | Homes with existing setpoints > 63 °F (96%) |

| Aggressive EE | 50% ACH50 reduction + R-60 attic insulation | |

| Water Heater | Remove water heating demand (48 h) | All Homes |

| Outdoor Conditions | Scenario | Description | NG Reduction (MMBtu) | NG Reduction (%) | Estimated Electricity Price ($/MWh) | Maximum Additional NG Gen. (MWh) | Maximum Oil Gen. Displaced (%) |

|---|---|---|---|---|---|---|---|

| Cold (Jan. 6) | Baseline | N/A | Demand: 3,323,147 | N/A | $303 | N/A | N/A |

| Conservative DR (3 °F) | 3 °F Setback Overnight | 87,695 | 3% | $226 | 11,235 | 9% | |

| Conservative DR (6 °F) | 6 °F Setback Overnight | 176,750 | 5% | $176 | 22,749 | 18% | |

| Conservative DR (12 °F) | 12 °F Setback Overnight | 340,995 | 11% | $119 | 45,402 | 36% | |

| Conservative EE | 25% ACH50 Reduction | 338,452 | 10% | $122 | 40,774 | 32% | |

| Aggressive DR | 63 °F Setback for 48 h | 962,929 | 29% | $43 | 122,309 | 97% | |

| Aggressive EE | 50% ACH50 Reduction + R-60 Attic Insulation | 1,690,267 | 51% | NA * | 206,190 | 164% | |

| Moderate (Jan. 23) | Baseline | N/A | Demand: 2,192,782 | N/A | $34 | N/A | N/A |

| Conservative DR (3 °F) | 3 °F Setback Overnight | 69,360 | 3% | $31 | 8799 | N/A | |

| Conservative DR (6 °F) | 6 °F Setback Overnight | 127,737 | 6% | $28 | 16,472 | N/A | |

| Conservative DR (12 °F) | 12 °F Setback Overnight | 205,958 | 9% | $25 | 26,939 | ||

| Conservative EE | 25% ACH50 Reduction | 74,792 | 3% | $30 | 13,200 | N/A | |

| Aggressive DR | 63 °F Setback for 48 h | 738,794 | 34% | $10 | 99,746 | N/A | |

| Aggressive EE | 50% ACH50 Reduction + R-60 Attic Insulation | 421,765 | 19% | $18 | 71,263 | N/A |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Speake, A.; Donohoo-Vallett, P.; Wilson, E.; Chen, E.; Christensen, C. Residential Natural Gas Demand Response Potential during Extreme Cold Events in Electricity-Gas Coupled Energy Systems. Energies 2020, 13, 5192. https://doi.org/10.3390/en13195192

Speake A, Donohoo-Vallett P, Wilson E, Chen E, Christensen C. Residential Natural Gas Demand Response Potential during Extreme Cold Events in Electricity-Gas Coupled Energy Systems. Energies. 2020; 13(19):5192. https://doi.org/10.3390/en13195192

Chicago/Turabian StyleSpeake, Andrew, Paul Donohoo-Vallett, Eric Wilson, Emily Chen, and Craig Christensen. 2020. "Residential Natural Gas Demand Response Potential during Extreme Cold Events in Electricity-Gas Coupled Energy Systems" Energies 13, no. 19: 5192. https://doi.org/10.3390/en13195192