Modelling the Coevolution of the Fuel Ethanol Industry, Technology System, and Market System in China: A History-Friendly Model

Abstract

:1. Introduction

2. Literature Review

2.1. The Effects of Technology Change on the Evolution of the Fuel Ethanol Industry

2.2. The Effects of Renewable Energy Policy on the Evolution of the Fuel Ethanol Industry

2.3. The Effects of Market Factors on the Evolution of the Fuel Ethanol Industry

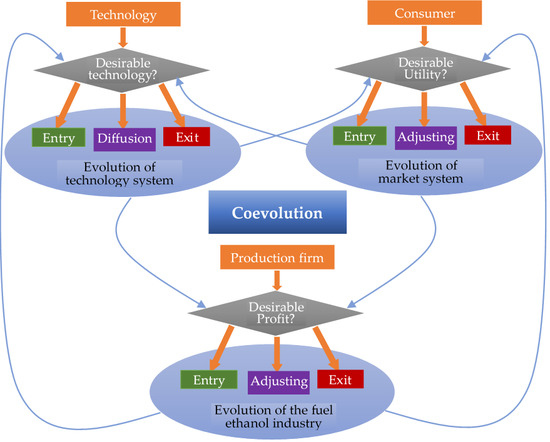

3. The Model

3.1. The History-Friendly Model

3.2. The Model Specification

3.2.1. Firm

3.2.2. Technology Progress

3.2.3. Market Demand

3.2.4. Industrial Dynamics

4. Results and Discussion

4.1. History Replicating Runs

4.1.1. Baseline Scenario

- (1).

- Once established, traditional technology firms would not withdraw even if they lost money, because the government subsidized loss-making firms to foster the growth of new energy industry.

- (2).

- There is a ceiling of the number of the traditional technology firms because the available raw materials (i.e., expired corn and wheat) used by these firms are limited.

- (3).

- All R&D firms established by the incumbent traditional technology firms failed to transform into new technology firms.

- (4).

- All new technology firms are derived from newly established firms with new production technology rather than the firms transforming from R&D firms.

- (5).

- The number of incumbent firms also has a ceiling because the maximum market capacity is fixed. When the aggregated output of the fuel ethanol beyond the maximum market capacity, there would be no new firms entering the industry.

- (6).

- The total output increased faster before the number of traditional firms reached the ceiling because the increasement of the total output is mainly caused by the entry of traditional technology firms.

- (7).

- When the number of traditional technology firms reaches the ceiling, the growth rate of their total output will decrease significantly, because the increasement of the total output is mainly caused by the relatively small expansion of the incumbent firms.

- (8).

- When the new technology firms start entering the industry, the total output will increase faster again until there is no entry of the new technology firms.

4.1.2. Robustness Test

4.2. Policy Impacts Simulation

4.2.1. The Impacts of Entry Regulation

4.2.2. The Impacts of Production Subsidy

4.2.3. The Impacts of R&D Subsidy

4.2.4. The Impacts of Ethanol Mandate

5. Conclusions and Policy Implications

6. Limitation and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

A1. Modeling the Basic Characteristics of the Firms in the Fuel Ethanol Industry in China

A2. The Initial Values of the Variables in the Coevolutionary Model of the Fuel Ethanol Industry

| Initial Values | Description |

|---|---|

| n[[1]]=1 | The total number of firms in the first period. |

| f[[1,1]][[1]]=0 | Types of technology firm: 0 denotes traditional technology firms; 1 denotes new technology firms. |

| f[[1,1]][[2]]=1 | Production status of firms: 0 is no production; 1 is in production. |

| f[[1,1]][[3]]=0.3 | Technical efficiency of firms. |

| f[[1,1]][[4]]=1000 | Initial capital of firms. |

| f[[1,1]][[5]] = 1 | Origin of the production firms: 0 denotes newly established firms; 1 denotes traditional technology firms. |

| f[[1,1]][[9]] = 0 | Production status of latecomers: 0 denotes production; 1 denotes stop production. |

| pf[[1]] = 2000 | Price of fossil fuel. |

| pnm[[1]] = 600 | Price of new feedstock. |

| nf[[1]] = 1 | The number of fuel ethanol firms in the first period. |

| nnf[[1]] = 0 | The number of fuel ethanol firms using new technology in the first period. |

| nntf1[[1]] = 0 | The number of R&D firms established by incumbent fuel ethanol firms in the first period. |

| nntf2[[1]] = 0 | The number of newly established R&D firms in the first period. |

| nntf[[1]] = 0 | The number of new technology firms in the first period. |

| ntf[[1]] = 1 | The number of traditional firms in the first period. |

A3. The Setting of the Parameters’ Values in the Coevolutionary Model of the Fuel Ethanol Industry

| Parameter Settings | Description |

|---|---|

| Φ = 0.6 | The degree of firm rationality. Less than 1 denotes imperfect rationality. |

| φ = 50 | The impact of profit on entry probability. |

| d = 0.1 | Rate of depreciation. |

| α = 0.21 × 10−3 | The amount of feedstock matched with the unit capital of traditional technology firm. |

| β = 0.0002 | The amount of feedstock matched with the unit capital of new technology firm. |

| z = 0.6 | Output elasticity of input. |

| m0 = 3 | The maximum supply of feedstock. |

| efficiency = 0.1 | Initial technical efficiency of the first group of R&D firms. |

| assetn0 = 1000 | The initial capital of the R&D firms. |

| δ = 0.2 | The ratio of R&D expenditure to the capital in one period. |

| totalrd = 20 | Total R&D investment of R&D firms. |

| σ = 0.3 | The proportion of profit used for R&D. |

| ε = 0.3 | Minimum boundary value for capacity utilization. |

| rdt = 1 | Minimum R&D input in each period of the traditional technology firms. |

| rdn = 2 | Minimum R&D input in each period of the incumbent new technology firms. |

| efftmax = 0.4 | The efficiency boundary value of traditional technology firms. |

| effnmax = 0.4 | The efficiency boundary value of new technology firms. |

| λ0 = 30 | Parameter related to technological change. |

| λ1 = 1 | Parameter related to technological change. |

| λ2 = 1 | Parameter related to technological change. |

| λ3 = 1 | Parameter related to technological change. |

| κ1 = 0.005 | Output efficiency of R&D firms established by incumbent firms. |

| κ2 = 0.008 | Output efficiency of newly established R&D firms. |

| ρ = 0 | The markup rate of pricing. |

| b1 = 0 | The growth rate of gasoline price |

| maxdemand = 2.5 | The maximum demand in the market. |

References

- Edenhofer, O.; Seyboth, K.; Creutzig, F.; Schlömer, S. On the Sustainability of Renewable Energy Sources. Annu. Rev. Environ. Resour. 2013, 38, 169–200. [Google Scholar] [CrossRef] [Green Version]

- Offermann, R.; Seidenberger, T.; Thrän, D.; Kaltschmitt, M.; Zinoviev, S.; Miertus, S. Assessment of global bioenergy potentials. Mitig. Adapt. Strat. Glob. Chang. 2011, 16, 103–115. [Google Scholar] [CrossRef]

- Hao, M.; Fu, J.; Jiang, D.; Yan, X.; Chen, S.; Ding, F. Sustainable Development of Sweet Sorghum-Based Fuel Ethanol from the Perspective of Water Resources in China. Sustainability 2018, 10, 3428. [Google Scholar] [CrossRef] [Green Version]

- Hu, M.C.; Phillips, F. Technological evolution and interdependence in China’s emerging biofuel industry. Technol. Forecast. Soc. Chang. 2011, 78, 1130–1146. [Google Scholar] [CrossRef]

- Chavez, E.; Liu, D.H.; Zhao, X.B. Biofuels Production Development and Prospects in China. J. Biobased Mater. Bioenergy 2010, 4, 221–242. [Google Scholar] [CrossRef]

- Wang, H. Building a regulatory framework for biofuels governance in China: Legislation as the starting point. Nat. Resour. Forum 2011, 35, 201–212. [Google Scholar] [CrossRef]

- Gallagher, P.W. Energy Production with Biomass: What Are the Prospects? Choices 2006, 21, 21–26. [Google Scholar]

- Furtado, A.T.; Scandiffio, M.I.G.; Cortez, L.A.B. The Brazilian sugarcane innovation system. Energy Policy 2011, 39, 156–166. [Google Scholar] [CrossRef]

- Meyer, S.; Binfield, J.; Westhoff, P. Technology adoption under US biofuel policies: Do producers, consumers or taxpayers benefit? Eur. Rev. Agric. Econ. 2012, 39, 115–136. [Google Scholar] [CrossRef]

- Talamini, E.; Dewes, H. The macro-environment for liquid Biofuels in Brazilian science and public policies. Sci. Public Policy 2012, 39, 13–29. [Google Scholar] [CrossRef]

- Tokgoz, S.; Elobeid, A.; Fabiosa, J.; Hayes, D.; Babcock, B.; Yu, T.; Dong, F.; Hart, C.; Beghin, J. Long-Term and Global Trade-offs between Bio-Energy, Feed and Food. Selected Paper Presented at the American Agricultural Economics Association Annual Meeting, Portland, OR, USA, 29 July–1 August 2007. [Google Scholar]

- Baker, M.L.; Hayes, D.J.; Babcock, B.A. Crop-Based Biofuel Production under Acreage Constraints and Uncertainty; Working Paper 08-WP460; Center for Agricultural and Rural Development, Iowa State University: Ames, IA, USA, 2008. [Google Scholar]

- Peters, M.; Stillman, R.; Somwaru, A. Biofuels Expansion in a Changing Economic Environment: A Global Modeling Perspective. In The Economic Impact of Public Support to Agriculture, Studies in Productivity and Efficiency; Ball, V.E., Fanfani, R., Gutierrez, L., Eds.; Springer: New York, NY, USA, 2010; Chapter 8; Volume 7, pp. 143–154. [Google Scholar]

- Zhang, Y.H.P. What is vital (and not vital) to advance economically-competitive biofuels production. Process Biochem. 2011, 46, 2091–2110. [Google Scholar] [CrossRef]

- Amigun, B.; Sigamoney, R.; von Blottnitz, H. Commercialisation of biofuel industry in Africa: A review. Renew. Sustain. Energy Rev. 2008, 12, 690–711. [Google Scholar] [CrossRef]

- Kang, S.; Önal, H.; Ouyang, Y.; Scheffran, J.; Tursun, Ü.D. Optimizing the Biofuels Infrastructure: Transportation Networks and Biorefinery Locations in Illinois. In Handbook of Bioenergy Economics and Policy; Khanna, M., Scheffran, J., Zilberman, D., Eds.; Natural Resource Management and Policy; Springer: New York, NY, USA, 2010; Chapter 10; p. 33. [Google Scholar]

- Perkis, D.F.; Tyner, W.E.; Preckel, P.V.; Brechbill, S.C. Spatial Optimization and Economies of Scale for Cellulose to Ethanol Facilities in Indiana. In Proceedings of the Risk, Infrastructure and Industry Evolution. Conference, Berkeley, CA, USA, 24–25 June 2008. [Google Scholar]

- Gardner, B. Fuel ethanol subsidies and farm price support. J. Agric. Food Ind. Organ. 2007, 5, 1–20. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Csordás, S.; Mevel, S. When does a carbon tax on fossil fuels stimulate biofuels? Ecol. Econ. 2011, 70, 2400–2415. [Google Scholar] [CrossRef]

- Tyner, W.E. Policy Alternatives for the Future Biofuels Industry. J. Agric. Food Ind. Organ. 2007, 5, 1123–1156. [Google Scholar] [CrossRef]

- Gehlhar, M.; Somwaru, A.; Dixon, P.B. Rimmer, and Ashley, R. Winston. Economywide Implications from US Bioenergy Expansion. Am. Econ. Rev. Pap. Proc. 2010, 100, 172–177. [Google Scholar] [CrossRef]

- Zhang, Z.; Wetzstein, M.E. New Relationships: Ethanol, Corn, and Gasoline Volatility. In Proceedings of the Risk, Infrastructure and Industry Evolution Conference, Berkeley, CA, USA, 24–25 June 2008. [Google Scholar] [CrossRef]

- EEA. How Much Bioenergy can Europe Produce without Harming the Environment? EEA Report No 7/2006; European Environment Agency; Available online: http://reports.eea.europa.eu/eea_report_2006_7/en (accessed on 8 August 2019).

- Etter, L. Ethanol Craze Cools As Doubts Multiply. Wall Str. J. 2007. Available online: https://www.wsj.com/articles/SB119621238761706021 (accessed on 10 May 2019).

- Senauer, B. Food Market Effects of a Global Resource Shift Toward Bioenergy. Am. J. Agric. Econ. 2008, 90, 1226–1232. [Google Scholar] [CrossRef]

- Kallis, G.; Norgaard, R. Coevolutionary ecological economics. Ecol. Econ. 2010, 69, 690–699. [Google Scholar] [CrossRef]

- Fagiolo, G.; Moneta, A.; Windrum, P. A critical guide to empirical validation of agent-based models in economics: Methodologies, procedures, and open problems. Comput. Econ. 2007, 30, 195–226. [Google Scholar] [CrossRef]

- Murmann, J.P. Knowledge and Competitive Advantage: The Coevolution of Firms, Technology, and National Institutions; Cambridge University Press: New York, NY, USA, 2003. [Google Scholar]

- Goldemberg, J.; Coelho, S.T.; Nastari, P.M.; Lucon, O. Ethanol learning curve-the Brazilian experience. Biomass Bioenergy 2004, 26, 301–304. [Google Scholar] [CrossRef]

- Bastin, C.; Szklo, A.; Rosa, L.P. Diffusion of new automotive technologies for improving energy efficiency in Brazil’s light vehicle fleet. Energy Policy 2010, 38, 3586–3597. [Google Scholar] [CrossRef]

- De Souza Nascimento, P.T.; Yu, A.S.O.; Silva, L.L.C.; Starke-Rodrigues, F.C.T.; Morais, C.H.B.; Silva, L.L.; Silva, A.P. The technological strategy of Brazilian automakers for flex-fuel vehicles: An exploratory study. In Proceedings of the PICMET 2010 Technology Management for Global Economic Growth, Phuket, Thailand, 18–22 July 2010; pp. 2846–2858. [Google Scholar]

- Sexton, S.E.; Rajagopal, D.; Hochman, G.; Roland-Holst, D.W.; Zilberman, D. Biofuel: Distributional and Other Implications of Current and the Next Generation Technologies. In Proceedings of the Risk, Infrastructure and Industry Evolution Conference, Berkeley, CA, USA, 24–25 June 2008. [Google Scholar]

- Perrone, C.C.; Appel, L.G.; MaiaLellis, V.L.; Ferreira, F.M.; De Sousa, A.M.; Ferreira-Leitao, V.S. Ethanol: An evaluation of its scientific and technological development and network of players during the period of 1995 to 2009. Waste Biomass Valorization 2011, 2, 17–32. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A.; Micheli, S. Costs assessments of European environmental policies. Comput. Oper. Res. 2016, 66, 327–335. [Google Scholar] [CrossRef]

- Burnes, E.; Wichelns, D.; Hagen, J.W. Economic and policy implications of public support for ethanol production in California’s San Joaquin Valley. Energy Policy 2005, 33, 1155–1167. [Google Scholar] [CrossRef]

- Larson, J.; English, B.; He, L. Economic Analysis of Farm-Level Supply of Biomass Feedstocks for Energy Production Under Alternative Contract Scenarios and Risk. In Proceedings of the Transition to a Bio-Economy Conferences, Integration of Agricultural and Energy Systems Conference, Atlanta, GA, USA, 12–13 February 2008. [Google Scholar]

- Lasco, C.; Khanna, M. US–Brazil Trade in Biofuels: Determinants, Constraints, and Implications for Trade Policy. In Handbook of Bioenergy Economics and Policy; Natural Resource Management and Policy; Khanna, M., Scheffran, J., Zilberman, D., Eds.; Springer: Berlin, Germany, 2010; Chapter 15; p. 33. [Google Scholar]

- Sheldon, I.; Roberts, W.U.S. Comparative Advantage in Bioenergy: A Heckscher-Ohlin-Ricardian Approach. Am. J. Agric. Econ. 2008, 90, 1233–1238. [Google Scholar] [CrossRef]

- Thompson, W.; Meyer, S.; Westhoff, P. Policy Risk for the Biofuels Industry. In Proceedings of the Risk, Infrastructure and Industry Evolution Conference, Berkeley, CA, USA, 24–25 June 2008; Burton, C., English, R., Jamey, M., Kim, J., Eds.; [Google Scholar]

- Petersen, J.E. Energy production with agricultural biomass: Environmental implications and analytical challenges. Eur. Rev. Agric. Econ. 2008, 35, 385–408. [Google Scholar] [CrossRef]

- Malerba, F.; Nelson, R.R.; Orsenigo, L.; Winter, S.G. ‘History-friendly’ models of industry evolution: The computer industry. Ind. Corp. Chang. 1999, 8, 3–40. [Google Scholar] [CrossRef]

- Kim, C.W.; Lee, K. Innovation, technological regimes and organizational selection in industry evolution: A ‘history friendly model’ of the DRAM industry. Ind. Corp. Chang. 2003, 12, 1195–1221. [Google Scholar] [CrossRef]

- Malerba, F.; Orsenigo, L. Innovation and market structure in the dynamics of the pharmaceutical industry and biotechnology: Towards a history-friendly model. Ind. Corp. Chang. 2002, 11, 667–703. [Google Scholar] [CrossRef]

- Malerba, F.; Nelson, R.R.; Orsenigo, L.; Winter, S.G. Vertical integration and disintegration of computer firms: A history-friendly model of the coevolution of the computer and semiconductor industries. Ind. Corp. Chang. 2008, 17, 197–231. [Google Scholar] [CrossRef] [Green Version]

- Brenner, T.; Murmann, J.P. Using simulation experiments to test historical explanations: The development of the German dye industry 1857–1913. J. Evol. Econ. 2016, 26, 907–932. [Google Scholar] [CrossRef] [Green Version]

- Landini, F.; Lee, K.; Malerba, F. A history-friendly model of the successive changes in industrial leadership and the catch-up by latecomers. Res. Policy 2017, 46, 431–446. [Google Scholar] [CrossRef]

- Capone, G.; Malerba, F.; Nelson, R.R.; Orsenigo, L.; Winter, S.G. History friendly models: Retrospective and future perspectives. Eurasian Bus. Rev. 2019, 9, 1–23. [Google Scholar] [CrossRef]

- Nelson, R.R.; Dosi, G.; Helfat, C.E. Modern Evolutionary Economics: An Overview; Cambridge University Press: New York, NY, USA, 2018. [Google Scholar]

- Malerba, F.; Nelson, R.R.; Orsenigo, L.; Winter, S.G. Innovation and the Evolution of Industries: History Friendly Models; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Garavaglia, C. Modelling industrial dynamics with “History-friendly” simulations. Struct. Chang. Econ. Dyn. 2010, 21, 258–275. [Google Scholar] [CrossRef]

- Li, D.; Capone, G.; Malerba, F. The “Long March” to catch-up: A history-friendly model of China’s mobile communications industry. Res. Policy 2019, 48, 649–664. [Google Scholar] [CrossRef]

- Tesfatsion, L. Agent-based computational economics: Growing economies from the bottom up. Artifcial Life 2002, 8, 55–82. [Google Scholar] [CrossRef] [Green Version]

- Dawid, H. Agent-based models of innovation and technological change. In Handbook of Computational Economics; Agent-Based Computational Economics; Tesfatsion, L., Judd, K., Eds.; Elsevier: Amsterdam, The Netherland, 2006; Volume 2, pp. 1235–1272. [Google Scholar]

- Malerba, F.; Nelson, R.; Orsenigo, L.; Winter, S. Competition and industrial policy in a history-friendly model of the evolution of the computer industry. Int. J. Ind. Organ. 2001, 19, 635–664. [Google Scholar] [CrossRef] [Green Version]

- Malerba, F.; Nelson, R.; Orsenigo, L.; Winter, S. Demand, innovation and the dynamics of market structure: The role of experimental users and diverse preferences. J. Evol. Econ. 2007, 17, 371–400. [Google Scholar] [CrossRef]

- Tesfatsion, L. Introduction to the special issue on agent-based computational economics. J. Econ. Dyn. Control 2001, 25, 281–293. [Google Scholar] [CrossRef]

- Winter, S.G.; Kaniovski, Y.M.; Dosi, G. A baseline model of industry evolution. J. Evol. Econ. 2003, 13, 355–383. [Google Scholar] [CrossRef] [Green Version]

- Wu, H.; Li, S. Volatility Spillovers in China’s Crude Oil, Corn and Fuel Ethanol Markets. Energy Policy 2013, 62, 878–886. [Google Scholar]

- Jiao, J.; Li, J.; Bai, J. Ethanol as a vehicle fuel in China: A review from the perspectives of raw material resource, vehicle, and infrastructure. J. Clean. Prod. 2018, 180, 832–845. [Google Scholar] [CrossRef]

- Garavaglia, C.; Malerba, F.; Orsenigo, L.; Pezzoni, M. A Simulation Model of the Evolution of the Pharmaceutical Industry: A History-Friendly Model. J. Artif. Soc. Soc. Simul. 2013, 16, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Brenner, T.; Murmann, J.P. The Use of Simulations in Developing Robust Knowledge about Causal Processes: Methodological Considerations and an Application to Industrial Evolution. In Papers on Economics & Evolution #0303; Max Planck Institute: Jena, Germany, 2003. [Google Scholar]

- Fatas-Villafranca, F.; Jarne, G.; Sanchez-Choliz, J. Industrial leadership in science-based industries: A co-evolution model. J. Econ. Behav. Organ. 2009, 72, 390–407. [Google Scholar] [CrossRef] [Green Version]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bi, C.; Zeng, J.; Zhang, W.; Wen, Y. Modelling the Coevolution of the Fuel Ethanol Industry, Technology System, and Market System in China: A History-Friendly Model. Energies 2020, 13, 1034. https://doi.org/10.3390/en13051034

Bi C, Zeng J, Zhang W, Wen Y. Modelling the Coevolution of the Fuel Ethanol Industry, Technology System, and Market System in China: A History-Friendly Model. Energies. 2020; 13(5):1034. https://doi.org/10.3390/en13051034

Chicago/Turabian StyleBi, Chao, Jingjing Zeng, Wanli Zhang, and Yonglin Wen. 2020. "Modelling the Coevolution of the Fuel Ethanol Industry, Technology System, and Market System in China: A History-Friendly Model" Energies 13, no. 5: 1034. https://doi.org/10.3390/en13051034