1. Introduction

To meet global societal needs and economic development, the demand for energy resources and other related services has been increased over the last several decades. Numerous companies are engaged in the international exchange of resources to stimulate sustainable growth, and different economies are promoting foreign direct investment and finance production. The increasing trend in energy resources has resulted in dramatic growth in environmental degradation and greenhouse gas (GHG) emissions [

1,

2,

3,

4]. Several studies have pointed out that the growth in CO

2 emissions has been mainly driven by the combustion of fossil energy (two-thirds of global CO

2 emissions) in support of human activities associated with economic growth and development [

5,

6,

7,

8]. Society is slowly moving towards more sustainable production methods, minimizing waste, reducing vehicle air pollution, distributed energy generation, protecting native forests and green spaces, and reducing greenhouse gas emissions [

9].

Although many factors, including financial development, foreign direct investment, and trade liberalization are the prerequisites for economic growth, which is the core ambition of every nation. Energy use has become a new paradigm of discussion between economists and practitioners, and this topic, in particular, has become a focus of serious attention, given the recent progression of the climate agreements [

10]. Growing awareness of global warming, unpredictable fossil energy costs, and environmental impacts of carbon emissions, renewable and nuclear energy supplies have emerged as the key pillar of global energy use. Increasing the use of renewable energy and replacing traditional sources with renewable sources is currently an important strategic goal of the economies of many countries. Countries that are able to create a friendly environment for the development of smart organizations constitute clear examples of a dynamically growing commitment to the effective handling of challenges associated with sustainable development issues [

11]. The number of research on sustainable development in management science is growing [

12,

13]. Sustainable development requires methods and tools to measure and compare the impact of human activities on the environment for different solutions [

14,

15]. Any analysis assessing the impact of natural resources on economic growth has played a key role in creating the analytical framework for sustainable development [

16]. Market entities are encouraged to orient their strategies towards sustainable development, which aims at both economic and social well-being on the one hand, equal opportunities for Earth’s inhabitants on the other, and environmental integrity on the other hand [

17,

18]. Moreover, research shows positive attitudes of enterprises towards sustainable development and investments in renewable energy sources (RES) [

19].

Socially responsible activities are beneficial for organizations’ brand image and also have a positive impact on their innovativeness [

20]. Simultaneously corporate social responsibility provides a comprehensive set of appropriate measures necessary to create value in a sustainable enterprise, which consists of achieving economic, ecological, and social goals [

18,

21].

Nowadays consumers are concerned by the environmental issues and long-term effects of human beings’ activities, purchasing behavior is enhanced by the ecological aspects of brands, which is perceived by customers as green brand equity [

19,

22,

23]. Individuals’ environmentally positive attitude related to environmental concern, environmental knowledge, and responsibility is the strong determinant of adopting responsible energy [

24,

25].

Empirical research discussed the causal link between economic development and energy use, and their effect on the environment [

26,

27]. Economic growth has therefore stressed eco-friendly growing rather than pure growth [

28]. Economic intermediation in developing economies could help them introduce new technologies and promote eco-friendly growth, and ultimately improve regional development [

29,

30]. Moreover, Jensen [

31] and World Bank [

32] stressed that even if financial growth could drive economic change, it could lead to ecological deprivation through increased industrial pollution. In contrast, it has been documented that higher financial and economic growth rates minimize environmental deterioration [

33].

Pakistan is one of those countries facing a shortage of electric power and its role in the growth of renewable and nuclear energy consumption is nominal. Pakistan relies on fossil fuels to meet its energy requirements. Nevertheless, the use of this energy is limited and can generate pollution emissions, which is a concerning issue. Approximately 99 percent of Pakistan’s energy supply is supplied by conventional energy sources including natural gas and oil, while the remaining about 1 percent of the energy supply comes from renewable sources. Approximately 140 million people either have no access to power or are facing more than 12 h’ blackout daily. The total average shortfall in the power sector is approximately 4000 MW and approximately two billion ft

3 per day of natural gas. According to the international energy agency (IEA), Pakistan’s overall energy production in 2017 was about 70 million tons (oil equivalent). Energy is the pillar of the economy [

27], while nuclear and renewable energy may offer a promising future for sustainable development and can also address the power shortage in Pakistan [

10].

Taking Pakistan as a case study, this paper aims to fill these gaps in the existing literature by examining the causal links among the endogenous and exogenous variables empirically. Specifically, we employed the NARDL model, proposed by Shin, et al. [

34] and the causality test of Hatemi-j [

35] and Kim and Perron [

36] to analyze the relationships between energy use, electric power consumption, energy imports, and economic growth in Pakistan during 1971 and 2016. The logic behind our use of asymmetry and non-linearity approaches is that the positive and negative changes of one exogenous variable have no influence on another variable in the same way [

37,

38]. The prevalence of non-linear relationships among variables is affected by social, political, economic, financial, and technological progress. These factors may cause positive or negative changes in exogenous variables that may cause heterogeneous environmental impacts. Furthermore, using unit root test, and Brock, Dechert, and Scheinkman (or BDS) test allows us to (i) account for the integration order and unknown structural breaks, and (ii) capture potential deviations from independence in data series like linear dependency, non-linear dependency or chaos [

36]. The findings from this study are envisaged to help policymakers in Pakistan to support modern and pollution-free technologies like renewable and nuclear energy and investment in a green portfolio. In addition, policymakers should concentrate and thoroughly incorporate environmental concerns into their policy agendas to maintain development without environmental degradation.

The previous studies have shown that despite the substantial evidence of improvement in economic growth in Pakistan, the energy use and carbon dioxide discharges have augmented over economic development. How to treat the relationship between energy usage, financial growth, and CO

2 emissions legitimately is a great contest [

39,

40]. The relationship between energy and economic growth may be very complex because there are many channels of influence between them. For example, financial development may cause a rise in energy consumption. In contrast, financial growth will increase investment and upgrade technology which may also reduce energy use [

38,

41]. Under these circumstances, it is very important to research how positive and negative shifts under financial growth influence energy consumption. Therefore, we suggest using econometric approaches that account for the evaluation of asymmetry in the analysis of co-integration and causalities among economic growth, financial development, and power usages such as energy consumption and energy imports in Pakistan from 1971 to 2016. Accordingly, Hatemi-J (2012) and Shin et al. (2014) have recently developed these approaches. In addition, we also use Zivot–Andrews structural break trended unit root test to reflect possible unknown structural breaks that may occur in the time series under investigation.

3. Results

Table 1 shows the descriptive statistics of variables. The Jarque-Bera test findings show that the variables are normally distributed, and there is no outlier in our data. The results show that energy imports (EM) are less volatile than energy consumption and electric power consumption (EPC) while financial development (FD) is more volatile than other variables such as energy consumption, electric power consumption, energy imports, and economic growth. Moreover, the finding reveals that economic growth (Y) has the lowest volatility among all variables. Based on skewness, the results show an asymmetric distribution.

Table 1 offers a further overview of the descriptive statistics of the variable.

NARDL model supports the variables of order I(0), I(1), or both. In order to estimate and conduct the NARDL model, it is imperative to confirm that none of the variables is I(2). Both the Phillips & Perron (PP) test and Dickey-Fuller generalized least square (GLS) test without the structural break were applied to check the presence of unit root over a time series. The findings reveal that all the variables are non-stationary and have a unit root at the level. However, at the first difference, the selected variables are stationary (

Table 2). The normal unit root test will yield inaccurate results and misrepresentative [

48]. The previous studies demonstrated that, in the existence of structural breakdown, the standard PP and DF-GLS test statistics do not consider the structural break and have low probabilities to reject the null hypothesis; thus, the outcomes seem misleading and fabricated [

28]. Such tests may go in favor of the null hypothesis and show that the series is stationary while the given series may have a structural breakdown. The possible bias increases the challenge of designing a test containing knowledge about the series’ structural breaks to obtain accurate empirical results. Kim and Perron [

36] overcome this problem by addressing structural break-dates, as shown in

Table 2. In the proximity of systemic break date, the variables are found as non-stationary during 1981, 2015, 1992, 1976, and 2003 as shown in

Table 2. The inclusion of unit root in the variables supports the application of the NARDL model to explore asymmetrical co-integration among the variables.

Moreover, Zivot and Andrews approach [

49] is suggested in the proximity of unidentified structural breakpoint in data, which is based on three models i.e., A, B, and C, where models A, B, and C allow one-time spontaneous variation in a variable at trend at the intercept, and both at intercept and trend, respectively.

Table 3 shows the outcomes of the Zivot–Andrews test. The finding reveals that all the considered variables are stationary at the trend with break dates of 1987, 1997, 1993, 2007, and 1999. Besides, all of the selected variables except for economic growth and electric power consumption are also stationary at intercept. Moreover, all of the selected variables except for electric power consumption are stationary at both trend and intercept.

The unregulated asymmetric analyses of the NARDL model, the long and short-run asymmetries, as shown in

Table 4. The null hypothesis of homogenous impact is rejected based on Wald statistics, which point out that various shocks to exogenous variables will bring diverse upshots in endogenous variables. The early literature has indicated that positive and negative shocks had disproportionate effects on their respective dependent variables both in the short and long term [

10,

26]. Overall results demonstrated in

Table 4 are in favor of the NARDL model to express the dynamic association among variables. In any dynamic modeling, the ignorance of asymmetries may lead to the misspecification of the model.

Table 4 also shows the analysis of diagnostic tests. The diagnostic investigations reject the null hypothesis and support the alternative hypothesis suggesting that the variables are homoscedastic, there is no serial correlation, and have the correct functional form (Ramsay Reset test). Furthermore,

Figure 1 and

Figure 2 show that the recursive residuals of CUSUM and CUSUMSQ test statistics are within critical values at 5% significant, suggesting that the series graphical plots are stable. The Durbin Watson test statistics (2.826) of the estimated model also confirms the nonexistence of autocorrelation. On the basis of Banerjee, et al. [

50], the

t-statistic (TBDM) authenticates the cointegration among the selected variables at a 1% significance level. Likewise, according to Shin, Yu, and Greenwood-Nimmo [

34], the F-statistic of the NARDL model (FPSS) validates the presence of asymmetric cointegration among the selected variables suggesting that energy intake, electric power consumption, financial development, and energy imports have a long-term asymmetric relationship.

Table 5 demonstrates the BDS independence test of non-linearity. The BDS test introduced by Broock, et al. [

51] is a non-parametric test configured primarily to examine the same and independent distribution identical and independent distribution (IID). BDS test is a general test broadly used to check the model specification when used for residuals from fitted models [

52]. The findings reveal that all the selected variables have a non-linear trend in all dimensions. The linearity (null hypothesis) is rejected at a 1% level of significance, while the alternative hypothesis is accepted, suggesting that the included variables are non-linear. Our outcomes show the accuracy and reliability of the estimated results and validate the model selection [

38]. More specifically, it is worth mentioning that the specified model of economic growth is appropriate for policymaking in Pakistan.

Table 6 gives an overview for both the long- and short-term NARDL cointegration test Shin et al. (2014). The finding demonstrates that in the long run any positive shock in energy significantly influences the economic growth with a coefficient of 4.780, which reveals that positive shock to energy acting a facilitating role to encourage economic growth in Pakistan. The previous studies also revealed that positive shocks to energy consumption may positively and significantly influence economic growth [

38,

40]. In contrast, negative shocks have no significant effect on economic growth. The outcomes of [

10] demonstrated that shocks to nuclear and renewable energy have a positive and significant influence on economic growth. In the context of the short-run, a rise in the consumption of energy in the current year and preceding years have a significant but negative impact on economic growth (coefficients −4.6219, −6.7646, −7.3947, and −7.4093 at lag 0, 1, 2, and 3, respectively). Meanwhile, negative shocks to energy consumption in an existing year and preceding years have a positive effect on economic growth (with coefficients 6.9595, 27.476, and 22.169 at lag 0, 2, and 3 respectively).

The results regarding the long-run association between electric power consumption and economic growth reveal that the significant positive shocks to electric power consumption will negatively influence the economic growth with coefficient −1.7973, while negative shocks to electric power consumption have no considerable impression on economic growth in Pakistan. These findings suggest that a rise in electric power by 1% will hamper economic growth by 1.79% in Pakistan. Meanwhile, the short-run connection of electric power consumption and economic growth shows that positive shocks to electric power consumption in the current period have a significantly negative effect (coefficient −1.8368), while in previous years at lag 3, the positive shocks have a significantly positive influence on economic growth (coefficients 2.7174). The negative shocks to electric power consumption in the current year have a significantly positive effect on economic growth with coefficients 3.9026 at lag 0, while that have negative and significant impacts with coefficients −3.4325 and −6.3325 in preceding years at lag 2 and lag 3, respectively. The findings of Lean and Smyth [

53] revealed that there is a long-run unidirectional causality running from electricity consumption to economic growth. While the findings of Akpan and Akpan [

54] reported that economic growth is linked with increasing electric power consumption.

Moreover, the results reveal that positive shock to financial development is significantly positive with a coefficient of 2.406, suggesting that a 1% increase in financial development will increase economic growth by 2.406% in Pakistan. However, a negative shock to financial development is non-significant. Meanwhile, the short-run connection shows that positive shocks in financial development have a significant but negative effect on economic growth with coefficients −2.7056, −3.8318, and −2.6763 at lag 1, lag 2, and lag 3, respectively. Whereas any negative shock to financial expansion may significantly cause a positive influence on economic progression with coefficients 1.5258, 0.8806, and 1.2116 with lag 0, lag 2, and lag 3 respectively.

Furthermore, the long-run association between energy imports and economic growth shows that positive and negative shocks to energy imports have a significantly negative influence on economic growth in Pakistan with coefficients −1.5949 and −3.5947, respectively. In the short run, a positive shock in energy import is inversely associated with economic growth having a coefficient of −1.1132 at lag 1. Whereas a negative shock to energy imports in the current and previous years has a significantly positive effect on economic growth with coefficients 1.9337, 2.3801.

Finally, we established dynamic multiplier adjustment of the variables. The cumulative multiplier for energy consumption, electric power consumption, financial development, and energy imports is shown in

Figure 3, which displays the outline of adjustment of economic growth towards long-term new equilibrium following the positive or negative shocks in the selected variables. In the case of energy consumption, the dynamic multiplier demonstrates that energy consumption and economic growth are interrelated. The detrimental energy consumption shocks are more prevalent than the positive shocks but have no significant impact on economic growth.

Figure 3 also illustrates that electric power consumption is positively associated with economic growth because negative shocks to electric power consumption have a positive effect on economic growth. The significant negative shocks to economic growth are more dominant than the positive shocks.

Similarly, the dynamic multiplier also confirms that financial development is positively associated with economic growth, where the positive shocks to financial development are more dominant than the negative shocks. Finally,

Figure 3 indicates that a negative relationship exists between energy imports and economic growth. However, there is a particular feature of the negative shocks in energy imports and they are initially less dominant than the positive shocks and become more prevailing in the lateral situation.

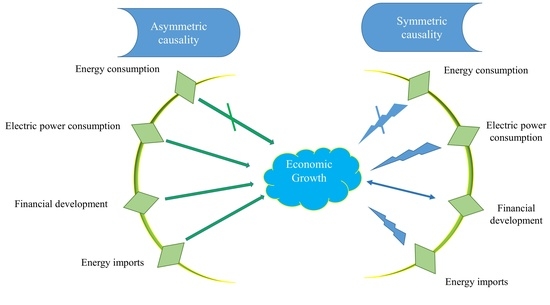

Table 7 display the results of the symmetric and asymmetric bootstrap causalities test. As demonstrated, both symmetric and asymmetric causalities between energy consumption and economic growth were found neutral. The causal association of electric power consumption and economic growth depicts a unidirectional symmetric causality from electric power consumption toward economic growth, meanwhile, a neutral asymmetric causal effect was found between the positive shocks in electric power consumption and economic growth. However, the negative shocks in electric power consumption create a positive shock in economic growth. Moreover, a bidirectional symmetric causality was found between financial development and economic growth. Meanwhile, only a unidirectional asymmetric causality was found running from financial development to economic growth, which shows that a negative shock to financial development will create a positive effect on economic growth. Finally, a neutral symmetric causality was found between energy imports and economic growth. Similarly, asymmetric causality reveals that positive shocks between energy imports and economic growth are not significant. In contrast, negative shocks between energy imports and economic growth are significant at a 10% level of significance (Wald test = 4.088), which indicates any decrease in energy import will boost the economic growth in the country.

4. Conclusions and Discussion

To achieve sustainable economic growth, developing nations, like Pakistan, must make considerable efforts to preserve a good environment without the expense of energy and resources.

The pillar of the environmental policy is sustainable development, oriented towards gradual and consistent rationalization of the use of natural resources, so as to provide the present inhabitants of the Earth with appropriate conditions, as well as future generations. Renewable energy sources (RES), as research shows, are gaining in importance in both developed and developing countries. Earlier studies evidence that enterprises are able to see benefits of investing in RES (so-called RES resonance) both in the area of their corporate social responsibility (CSR) strategy and sustainable development, as well as innovativeness and brand equity [

19]. The innovativeness of economic entities, in turn, is an important factor that strengthens the innovativeness of economies and fuels economic growth.

Despite the substantial improvement in economic growth, energy intake and carbon dioxide emissions have grown up in Pakistan. How to justifiably knob the relationship among the selected endogenous and exogenous variables is a considerable challenge. Accordingly, the key purpose of this study was to examine the impact of energy consumption, electric power consumption, financial development, and energy imports on economic growth by employing data set from 1971 to 2016. In this research paper, the asymmetric connection among the designated parameters was investigated by means of the nonlinear ARDL co-integration technique formulated by Shin, Yu, and Greenwood-Nimmo [

34] and the causality test of Hatemi-j [

35] and Kim and Perron [

36]. The outcomes validate the presence of asymmetric co-integration among variables.

The causality test reveals that both symmetric and asymmetric causalities between energy use and economic progression were found neutral. The causal connection between electric power consumption and economic growth confirms a unidirectional symmetric causality from electric power consumption to economic growth. Regarding asymmetric causalities, a neutral effect exists between the positive shocks in electric power consumption and economic growth. However, the negative shocks in electric power consumption were found significant and positive that may influence economic growth positively. Moreover, regarding the causal linkage between financial development and economic growth the findings reveal that there is bidirectional symmetric causality between financial development and economic growth. Meanwhile, only a unidirectional asymmetric causality was found running from financial development to economic growth, which points out that a negative shock to financial development will create a positive effect on economic growth. Finally, a neutral symmetric causality was found between energy imports and economic growth. Similarly, the asymmetric causality reveals that positive shocks between energy imports and economic growth are non-significant. In contrast, negative shocks between energy imports and economic growth are significant at a 10% level of significance, which indicates any decrease in energy imports will boost the economic growth in the country.

The conducted research, the results of which are presented in this paper, have their limitations, which include, above all, the period of the analyzed data. It poses on the other hand also the justification for the continuation of the research. Certainly, in view of the current global problems and trends related to sustainable development, it seems inevitable to pay more attention to renewable energy sources and the attitude of both the government, enterprises, and households towards investing in this field. Examples of developed countries show that sustainable economic growth is possible. However, it requires high environmental awareness, discipline, and commitment of all market entities.

Based on the findings, some critical policy implications emerged. Specifically, the Government of Pakistan and policymakers should pay more attention to the current and future energy crises in the country and overwhelm the shortfall of energy. Moreover, the Pakistani Government should encourage foreign direct investment especially in renewable energy, low Corban-technology, and promote the adoption of green technology in the agriculture sector, which will not only overwhelmed the energy crises in the country but rather improve the environment as well.