Innovations and ICT: Do They Favour Economic Growth and Environmental Quality?

Abstract

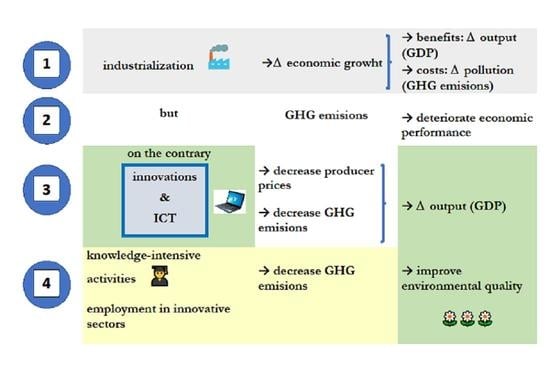

:1. Introduction

2. Literature Review

2.1. ICT and Economic Growth

2.2. Environmental Quality and Economic Growth

3. Research Questions and Data

4. Methodology

5. Empirical Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Angrist, J.; Lavy, V. New evidence on classroom computers and pupil learning. Econ. J. 2002, 112, 735–765. [Google Scholar] [CrossRef] [Green Version]

- Machin, S.; McNally, S.; Silva, O. New Technology in Schools: Is There a Payoff? Econ. J. 2007, 117, 1145–1167. [Google Scholar] [CrossRef]

- Baker, G.; Hubbard, T. Contractability and asset ownership: On board computers and governance in US trucking. Q. J. Econ. 2004, 119, 1443–1480. [Google Scholar] [CrossRef]

- Athey, S.; Stern, S. The impact of information technology on emergency health care outcomes. Rand J. Econ. 2002, 33, 399–432. [Google Scholar] [CrossRef]

- World Bank. ICT and MDGs: A World Bank Group Perspective; The World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Krugman, P. The Age of Diminished Expectations, 3rd ed.; U.S. Economic Policy in the 1990s; MIT Press: Cambridge, MA, USA, 1997; p. 11, Chapter 1. [Google Scholar]

- Avgerou, C. Information systems in developing countries: A critical research review. J. Inf. Technol. 2008, 23, 133–146. [Google Scholar] [CrossRef] [Green Version]

- Jha, A.K.; Bose, I. Innovation research in information systems: A commentary on contemporary trends and issues. Inf. Manag. 2016, 53, 297–306. [Google Scholar] [CrossRef]

- Hudson, J.; Minea, A. Innovation, intellectual property rights and economic development: A unified empirical investigation. World Dev. 2013, 46, 66–78. [Google Scholar] [CrossRef]

- Dedrick, J.; Gurbaxani, V.; Kraemer, K.L. Information technology and economic performance: A critical review of the empirical evidence. ACM Comput. Surv. 2003, 35, 1–28. [Google Scholar] [CrossRef]

- Dutta, S.; Shalhoub, Z.K.; Samuels, G. Promoting Technology and Innovation: Recommendations to Improve Arab ICT Competitiveness; The Arab World Competitiveness Report, 81–96; World Economic Forum: Geneva, Switzerland, 2007. [Google Scholar]

- Cardona, M.; Kretschmer, T.; Strobel, T. ICT and productivity: Conclusions from the empirical literature. Inf. Econ. Policy 2013, 25, 109–125. [Google Scholar] [CrossRef]

- Chen, D.H.C.; Kee, H.L. A Model on Knowledge and Endogenous Growth; World Bank Policy Research Working Paper, No. 3539; The World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Cuervo, M.R.V.; Menendez, A.J.L. A multivariate framework for the analysis of the digital divide: Evidence from the European Union-15. Inf. Manag. 2006, 43, 756–766. [Google Scholar] [CrossRef]

- OECD. OECD Information Technology Outlook 2010; Organisation for Economic Co-Operation and Development: Paris, France, 2010. [Google Scholar]

- Arvanitis, S.; Loukis, E.; Diamantopoulou, V. The effect of soft ICT capital on innovation performance of Greek firms. J. Enterp. Inf. Manag. 2013, 26, 679–701. [Google Scholar] [CrossRef]

- Zhang, F.; Li, D. Regional ICT access and entrepreneurship: Evidence from China. Inf. Manag. 2018, 55, 188–198. [Google Scholar] [CrossRef]

- Vu, K.M. Information and communication technology (ICT) and Singapore’s economic growth. Inf. Econ. Policy 2013, 25, 284–300. [Google Scholar] [CrossRef]

- Sassi, S.; Goaied, M. Financial development, ICT diffusion and economic growth: Lessons from MENA region. Telecommun. Policy 2013, 37, 252–261. [Google Scholar] [CrossRef]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Veugelers, R. An innovation deficit behind Europe’s overall productivity slowdown? In Proceedings of the Investment and Growth in Advanced Economies Conference Proceedings, European Central Bank Forum on Central Banking, Sintra, Portugal, 26–28 June 2017. [Google Scholar]

- Braga, C.; Fink, C.; Sepulveda, C. Intellectual Property Rights and Economic Development; World Bank TechNet Working Paper; World Bank: Washington, DC, USA, 1998. [Google Scholar]

- Van Ark, B. Measuring the new economy: An international comparative perspective. Rev. Income Wealth 2002, 48, 1–14. [Google Scholar] [CrossRef]

- Farhadi, M.; Fooladi, M. The impact of information and communication technology use on economic growth. In International conference on Humanities, Society and Culture IPEDR; IACSIT Press: Singapore, 2011; Volume 20. [Google Scholar]

- Niebel, T. ICT and economic growth-comparing developing, emerging and developed countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef] [Green Version]

- Appiah-Otoo, I.; Song, N. The impact of ICT on economic growth-comparing rich and poor countries. Telecommun. Policy 2021, 45, 102082. [Google Scholar] [CrossRef]

- Findlay, R. Relative Backwardness, Direct Foreign Investment, and the Transfer of Technology: A Simple Dynamic Model. Q. J. Econ. 1978, 92, 1–16. [Google Scholar] [CrossRef]

- Findlay, R. Some Aspects of Technology and Direct Foreign Investment. Am. Econ. Rev. Pap. Proc. 1978, 68, 275–279. [Google Scholar]

- Johnson, H.G. Technological Change and Comparative Advantage: An Advanced Country’s Viewpoint. J. World Trade Law 1975, 9, 1–14. [Google Scholar]

- Jones, R.W.; Neary, J.P. The Role of Technology in the Theory of International Trade. In The Technology Factor in International Trade; Vernon, R., Ed.; NBER: New York, NY, USA, 1970; pp. 95–127. [Google Scholar]

- Jones, R.W.; Neary, J.P. The Positive Theory of International Trade. In Handbook of International Economics; Elsevier: Amsterdam, The Netherlands, 1984; pp. 1–62. [Google Scholar]

- Krugman, P. A Model of Innovation, Technology Transfer, and the World Distribution of Income. J. Political Econ. 1979, 87, 253–266. [Google Scholar] [CrossRef]

- Markusen, J.R.; Svensson, L. Trade in Goods and Factors with International Differences in Technology; Working Paper No. 1101; National Bureau of Economic Research: Cambridge, MA, USA, 1983. [Google Scholar]

- Röller, L.H.; Waverman, L. Telecommunications infrastructure and economic development: A simultaneous approach. Am. Econ. Rev. 2001, 91, 909–923. [Google Scholar] [CrossRef] [Green Version]

- Koutroumpis, P. The economic impact of broadband on growth: A simultaneous approach. Telecommun. Policy 2009, 33, 471–485. [Google Scholar] [CrossRef]

- Vu, K.M. ICT as a source of economic growth in the information age: Empirical evidence from the 1996–2005 period. Telecommun. Policy 2011, 35, 357–372. [Google Scholar] [CrossRef]

- Thompson, H.G.; Garbacz, C. Economic impacts of mobile versus fixed broadband. Telecommun. Policy 2011, 35, 999–1009. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Nair, M.; Bennett, S.E.; Hall, J.H. The information revolution, innovation diffusion and economic growth: An examination of causal links in European countries. Qual. Quant. 2019, 53, 1529–1563. [Google Scholar] [CrossRef]

- Nair, M.; Pradhan, R.P.; Arvin, M.B. Endogenous dynamics between R&D, ICT and economic growth: Empirical evidence from the OECD countries. Technol. Soc. 2020, 62, 101315. [Google Scholar]

- Park, J.; Shin, S. The Maturity and Externality Effects of Information Technology Investments on National Productivity Growth; Working Paper Series 2004-05 No. 2; University of Rhode Island, College of Business Administration: South Kingstown, Rhode Island, 2004. [Google Scholar]

- Venturini, F. ICT and productivity resurgence: A growth model for the information age. BE J. Macroecon. 2007, 7, 1–26. [Google Scholar] [CrossRef] [Green Version]

- Seo, H.J.; Lee, Y.S.; Oh, J.H. Does ICT investment widen the growth gap? Telecommun. Policy 2009, 33, 422–431. [Google Scholar] [CrossRef]

- Jorgenson, D.W.; Stiroh, K.J. US economic growth at the industry level. Am. Econ. Rev. 2000, 90, 161–168. [Google Scholar] [CrossRef] [Green Version]

- Oliner, S.D.; Sichel, D.E. The resurgence of growth in the late 1990s: Is information technology the story? J. Econ. Perspect. 2000, 14, 3–22. [Google Scholar] [CrossRef] [Green Version]

- David, P. They dynamo and the computer: An historical perspective on the modern productivity paradox. Am. Econ. Rev. 1990, 80, 355–361. [Google Scholar]

- Becchetti, L.; Adriani, F. Does the digital divide matter? The role of information and communication technology in cross-country level and growth estimates. Econ. Innov. New Technol. 2005, 14, 435–453. [Google Scholar] [CrossRef] [Green Version]

- Stiroh, K.J. Are spillovers driving the new economy? Rev. Income Wealth 2002, 48, 33–57. [Google Scholar] [CrossRef]

- Galperin, H. Wireless networks and rural development: Opportunities for Latin America. Inf. Technol. Int. Dev. 2005, 2, 47–56. [Google Scholar] [CrossRef]

- Buhalis, D.; Law, R. Progress in information technology and tourism management: 20 years on and 10 years after the internet-the state of eTourism research. Tour. Manag. 2008, 29, 609–623. [Google Scholar] [CrossRef] [Green Version]

- Inklaar, R.; Timmer, M.P.; Van Ark, B. Market services productivity across Europe and the US. Econ. Policy 2008, 23, 140–194. [Google Scholar]

- Jorgenson, D.W.; Vu, K. The rise of developing Asia and the new economic order. J. Policy Model. 2011, 33, 698–716. [Google Scholar] [CrossRef] [Green Version]

- KPMG. Future State 2030: The Global Megatrends Shaping Governments; KPMG International Cooperative: Amstelveen, The Netherlands, 2014. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Kaika, D.; Zervas, E. The environmental Kuznets Curve (EKC) theory-part A: Concept, causes and the CO2 emissions case. Energy Policy 2013, 62, 1392–13402. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. Economic growth and the environment: A review of theory and empirics. In Handbook of Economic Growth 1B; Aghion, P., Durlauf, S.N., Eds.; Springer: Heidelberg, Germany, 2005; pp. 1749–1821. [Google Scholar]

- Sadik-Zada, E.R.; Ferrari, M. Environmental policy stringency, technical progress and pollution haven hypothesis. Sustainability 2020, 12, 3380. [Google Scholar] [CrossRef]

- Lapinskiene, G.; Tvaronaviciè, M.; Vaitkus, P. Greenhouse gases emissions and economic growth-evidence substantiating the presence of environmental Kuznets curve in the EU. Technol. Econ. Dev. Econ. 2014, 20, 65–78. [Google Scholar] [CrossRef] [Green Version]

- Chow, G.C.; Li, J. Environmental Kuznets curve: Conclusive econometric evidence for CO2. Pac. Econ. Rev. 2014, 19, 1–7. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W.; Noman, A.H.M.; Ozturk, I. Relationships among carbon emissions, economic growth, energy consumption and population growth: Testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecol. Indic. 2016, 70, 466–479. [Google Scholar] [CrossRef]

- Ahmad, A.; Zhao, Y.; Zhang, Z. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Yang, X.; Lou, F.; Sun, M.; Wang, R.; Wang, Y. Study of the relationship between greenhouse gas emissions and the economic growth of Russia based on the Environmental Kuznets curve. Appl. Energy 2017, 193, 162–173. [Google Scholar] [CrossRef]

- He, J.; Richard, P. Environmental Kuznets curve for CO2 in Canada. Ecol. Econ. 2010, 69, 1083–1093. [Google Scholar] [CrossRef] [Green Version]

- Katz, D. Water use and economic growth: Reconsidering the Environmental Kuznets curve relationship. J. Clean. Prod. 2015, 88, 205–213. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R.; Ewing, B.T. Energy consumption, income and carbon emissions in the United States. Ecol. Econ. 2007, 62, 482–489. [Google Scholar] [CrossRef]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Magazzino, C. Economic growth, CO2 emissions and energy use in Israel. Int. J. Sustain. Dev. World Ecol. 2015, 22, 89–97. [Google Scholar]

- Riti, J.S.; Shu, Y. Renewable energy, energy efficiency and eco-friendly environment (R-E5) in Nigeria. Energy Sustain. Soc. 2016, 6, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Paukert, F. Income distribution at different levels of economic development: A survey of evidence. Int. Labour Rev. 1973, 108, 97–125. [Google Scholar]

- Martinez-Zarzoso, I.; Bengochea-Morancho, A. Pooled mean group estimation of an environmental Kuznets curve for CO2. Econ. Lett. 2004, 82, 121–126. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 2010, 38, 7850–7860. [Google Scholar] [CrossRef]

- Richmond, A.K.; Kaufmann, R.K. Energy prices and turning points: The relationship between income and energy use/carbon emissions. Energy J. 2006, 27, 157–180. [Google Scholar] [CrossRef]

- Handrich, L.; Kemfert, C.; Mattes, A.; Pavel, F.; Traber, T. Turning Point: Decoupling Greenhouse Gas Emissions from Economic Growth; Heinrich-Boll-Stiftung: Cologne, Germany, 2015. [Google Scholar]

- Friedl, B.; Getzner, M. Determinants of CO2 emissions in a small open economy. Econol. Econ. 2003, 45, 133–148. [Google Scholar] [CrossRef]

- Ekins, P.; Anandarjah, G.; Strachan, N. Towards a low-carbon economy: Scenarios and policies for the UK. Clim. Policy 2011, 11, 865–882. [Google Scholar] [CrossRef]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable economic development and greenhouse gas emissions: The dynamic impact of renewable energy consumption, GDP and corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef] [Green Version]

- Agras, J.; Chapman, D.A. Dynamic approach to the environmental Kuznets curve hypothesis. Ecol. Econ. 1999, 28, 267–277. [Google Scholar] [CrossRef]

- Mor, S.; Jindal, S. Estimation of environmental Kuznets curve and Kyoto parties: A panel data analysis. Int. J. Comput. Eng. Manag. 2012, 15, 5–9. [Google Scholar]

- Huh, T. Compartative and relational trajectory of economic growth and greenhouse gas emission: Coupled or decoupled? Energies 2020, 13, 2550. [Google Scholar] [CrossRef]

- Oliner, S.D.; Sichel, D.E. Information technology and productivity: Where are we now and where are we going? Fed. Reserve Bank Atlanta Econ. Rev. 2002, 87, 15–44. [Google Scholar] [CrossRef]

- Vértesy, D. The Innovation Output Indicator 2017; JRC Technical Reports EU 28876; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar]

- Huang, W.M.; Lee, G.W.M.; Wu, C. GHG emissions, GDP growth and the Kyoto Protocol: A revisit of environmental Kuznets curve hypothesis. Energy Policy 2008, 36, 239–247. [Google Scholar] [CrossRef]

- Esteve, V.; Tamarit, C. Threshold integration and nonlinear adjustment between CO2 and income: The environmental Kuznets curve in Spain 1857–2007. Energy Econ. 2012, 34, 2148–2156. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J.; Mohd, S. Economic growth and CO2 emissions in Malaysia: A cointegration analysis of the environmental Kuznets curve. Energy Policy 2012, 51, 184–191. [Google Scholar] [CrossRef]

- Culas, R. REDD and forest transition: Tunnelling through the environmental Kuznets curve. Ecol. Econ. 2012, 79, 44–51. [Google Scholar] [CrossRef]

- Baltagi, B. Econometric Analysis of Panel Data, 4th ed.; Wiley: Chichester, UK, 2008. [Google Scholar]

- Hsiao, C. Analysis of Panel Data, 3rd ed.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Andreß, H.-J.; Golsch, K.; Schmidt, A.W. Applied Panel Data Analysis for Economic and Social Surveys; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Aghion, P.; Howitt, P. The Economics of Growth; The MIT Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Levin, A.; Lin, C.-F.; Chu, C.-S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Harris, R.D.F.; Tzavalis, E. Inference for unit roots in dynamic panels where the time dimension is fixed. J. Econom. 1999, 91, 201–226. [Google Scholar] [CrossRef]

- Breitung, J. The local power of some unit root tests for panel data. Adv. Econom. 2000, 15, 161–177. [Google Scholar]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- White, H. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Frankel, J.; Romer, D. Does trade cause growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef] [Green Version]

- Frankel, J.; Rose, A. An estimate of the effect of common currencies on trade and income. Q. J. Econ. 2002, 117, 437–466. [Google Scholar] [CrossRef] [Green Version]

- Dollar, D.; Kraay, A. Trade, growth and poverty. Econ. J. 2004, 114, 22–49. [Google Scholar] [CrossRef] [Green Version]

- Freund, C.; Bolaky, B. Trade, regulations and income. J. Dev. Econ. 2008, 87, 309–321. [Google Scholar] [CrossRef]

- Chang, R.; Kaltani, L.; Loayza, N.V. Openness can be good for growth: The role of policy complementarities. J. Dev. Econ. 2009, 90, 33–49. [Google Scholar] [CrossRef] [Green Version]

- Hye, Q.M.A.; Lau, W.Y. Trade openness and economic growth: Empirical evidence from India. J. Bus. Econ. Manag. 2015, 16, 188–205. [Google Scholar] [CrossRef] [Green Version]

- Boamah, J.; Adongo, F.A.; Essieku, R.; Lewis, J.A., Jr. Financial depth, gross fixed capital formation and economic growth: Empirical analysis of 18 Asian economies. Int. J. Sci. Educ. Res. 2018, 2, 4. [Google Scholar] [CrossRef]

- Rani, R.; Kumar, N. On the causal dynamics between economic growth, trade openness and gross capital formation: Evidence from BRICS countries. Glob. Bus. Rev. 2019, 20, 795–812. [Google Scholar] [CrossRef]

- Bruno, M.; Easterly, W. Inflation crises and long-run growth. J. Monet. Econ. 1998, 41, 3–26. [Google Scholar] [CrossRef] [Green Version]

- Afonso, A.; Blanco Arana, C. Financial development and economic growth: A study for OECD countries in the context of crisis. REM Work. Pap. 2018, 046-2018. [Google Scholar] [CrossRef] [Green Version]

- Stock, J.H.; Yogo, M. Testing for weak instruments in linear IV regression. In Identification and Inference for Econometric Models: Essays in Honor of Thomas Rothenberg; Andrews, D.W.K., Stock, J.H., Eds.; Cambridge U and Press: Cambridge, UK, 2005; pp. 80–108. [Google Scholar]

| Level | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Test Statistics | Economic Growth | Exports High Technology | Employment in High-Technology | Employment in Knowledge-Intensive High-Technology | Employment in Information and Communication | PP | Greenhouse Gas Emissions | POPGROW | GKF | INF | OPEN |

| LLC | |||||||||||

| Level | −15.1429 (0.0000) | −9.0390 (0.0000) | −7.1451 (0.0000) | −7.2279 (0.0000) | −8.9595 (0.0000) | −12.2807 (0.0000) | −5.5727 (0.0000) | −3.9300 (0.0000) | −9.3934 (0.0000) | −8.9166 (0.0000) | −17.3962 (0.0000) |

| Trend | −20.2548 (0.0000) | −6.2019 (0.0000) | −9.6222 (0.0000) | −11.3476 (0.0000) | −12.4290 (0.0000) | −15.5713 (0.0000) | −10.3223 (0.0000) | −10.0201 (0.0000) | −14.8569 (0.0000) | −9.8176 (0.0000) | −11.1120 (0.0000) |

| HT | |||||||||||

| Level | 0.2904 (0.0000) | 0.7887 (0.7858) | 0.4939 (0.0000) | 0.4426 (0.0000) | 0.4200 (0.0000) | −0.0987 (0.0000) | 0.6609 (0.0340) | 0.6519 (0.0223) | 0.5178 (0.0000) | 0.2429 (0.0000) | 0.7620 (0.5971) |

| Trend | 0.1717 (0.0000) | 0.2132 (0.0006) | 0.2315 (0.0014) | 0.1708 (0.0000) | 0.2016 (0.0003) | −0.1670 (0.0000) | 0.4094 (0.4157) | 0.3533 (0.1389) | 0.3022 (0.0301) | 0.1472 (0.0000) | 0.3998 (0.3588) |

| Breitung | |||||||||||

| Level | −7.1897 (0.0000) | 1.2878 (0.9011) | 2.9267 (0.9983) | 1.8119 (0.9650) | 2.6465 (0.9959) | −5.2659 (0.0000) | 0.9962 (0.8404) | 0.3131 (0.6229) | −1.0782 (0.1405) | −2.4057 (0.0081) | −0.8109 (0.2087) |

| Trend | −6.6495 (0.0000) | −0.2685 (0.3942) | −2.1177 (0.0171) | −3.6308 (0.0001) | −4.1080 (0.0000) | −2.2642 (0.0118) | −0.0293 (0.4883) | 3.0070 (0.9987) | 1.4798 (0.9305) | −0.7003 (0.2419) | −2.9325 (0.0017) |

| IPS | |||||||||||

| Level | −4.0086 (0.0000) | −0.4050 (0.3427) | −2.0079 (0.0223) | −2.2953 (0.0109) | −2.5063 (0.0061) | −6.5728 (0.0000) | −1.7695 (0.0384) | −0.3508 (0.3629) | −4.0077 (0.0000) | −6.0474 (0.0000) | −0.2813 (0.3892) |

| Trend | −5.7496 (0.0000) | −2.4858 (0.0065) | −3.1423 (0.0008) | −3.6573 (0.0001) | −3.5728 (0.0002) | −6.4491 (0.0000) | −3.8719 (0.0001) | −1.0454 (0.1479) | −2.7043 (0.0034) | −4.4589 (0.0000) | −0.7599 (0.2237) |

| Fisher | |||||||||||

| Level | 4.6334 (0.0000) | 0.7975 (0.2126) | 12.7333 (0.0000) | 15.6291 (0.0000) | 6.2934 (0.0000) | 4.2036 (0.0000) | −0.9832 (0.8372) | 1.4351 (0.0756) | 8.1558 (0.0000) | 6.1770 (0.0000) | 4.9927 (0.0000) |

| Trend | 5.7487 (0.0000) | −1.9772 (0.9760) | 15.4283 (0.0000) | 30.7267 (0.0000) | 14.8060 (0.0000) | 0.1391 (0.4447) | −3.0959 (0.9990) | 2.2059 (0.0137) | 4.1056 (0.0000) | 1.2351 (0.1084) | 4.0112 (0.0000) |

| Level | |||||||||||

| Test Statistic | Communication Prices | Audio Prices | Machinery Prices | Electrical Prices | Software Prices | Durable Goods Prices | Capital Goods Prices | ||||

| LLC | |||||||||||

| Level | −7.6510 (0.0000) | −4.9112 (0.0000) | −8.9885 (0.0000) | −8.1707 (0.0000) | −13.2777 (0.0000) | −5.7774 (0.0000) | −4.4491 (0.0000) | ||||

| Trend | −10.3705 (0.0000) | −8.5856 (0.0000) | −15.4493 (0.0000) | −12.8485 (0.0000) | −16.2574 (0.0000) | −9.2569 (0.0000) | −26.7447 (0.0000) | ||||

| HT | |||||||||||

| Level | 0.7550 (0.5404) | 0.0559 (0.0000) | 0.5461 (0.0000) | 0.5473 (0.0000) | 0.4833 (0.0000) | 0.5092 (0.0000) | 0.6547 (0.0255) | ||||

| Trend | 0.3290 (0.0718) | −0.1012 (0.0000) | 0.4862 (0.8369) | 0.3577 (0.1546) | 0.2563 (0.0048) | 0.3753 (0.2288) | 0.4066 (0.3986) | ||||

| Breitung | |||||||||||

| Level | 1.6545 (0.9510) | −4.3833 (0.0000) | −0.6653 (0.2529) | −1.5317 (0.0628) | −1.0480 (0.1473) | −1.1327 (0.1287) | −1.0627 (0.1440) | ||||

| Trend | −2.5060 (0.0061) | −3.6541 (0.0001) | −0.4640 (0.3213) | −0.9592 (0.1687) | −0.7134 (0.2378) | −1.3460 (0.0891) | −0.1944 (0.4229) | ||||

| IPS | |||||||||||

| Level | 0.4692 (0.6805) | −5.3416 (0.0000) | −1.3533 (0.0880) | −2.3055 (0.0106) | −1.9055 (0.0284) | −3.3831 (0.0004) | −1.2972 (0.0973) | ||||

| Trend | −3.4419 (0.0003) | −6.0374 (0.0000) | −1.7958 (0.0363) | −3.5121 (0.0002) | −2.7901 (0.0026) | −4.2392 (0.0000) | −3.7152 (0.0001) | ||||

| Fisher | |||||||||||

| Level | 1.8167 (0.0346) | −2.3352 (0.9902) | 1.9661 (0.0246) | 0.3963 (0.3459) | 0.0804 (0.4680) | 0.4492 (0.3267) | 1.5737 (0.0578) | ||||

| Trend | 4.0839 (0.0000) | −2.5861 (0.9951) | −0.9895 (0.8388) | 3.0246 (0.0012) | 8.4653 (0.0000) | −1.6632 (0.9519) | 2.4129 (0.0079) | ||||

| KERRYPNX | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| −0.1517 * (0.0852) | −0.1473 * (0.0853) | −0.1506 * (0.0849) | |

| −0.0991 ** (0.0446) | |||

| −0.0793 ** (0.0412) | |||

| −0.0939 *** (0.0391) | |||

| Constant | 7.3072 *** (2.2546) | 6.9528 *** (2.3631) | 7.5907 *** (2.2247) |

| Country FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 297 | 297 | 297 |

| R2 overall | 0.0106 | 0.0116 | 0.0141 |

| R2 within | 0.0258 | 0.0215 | 0.0288 |

| R2 between | 0.0106 | 0.0507 | 0.0399 |

| BIC | 1707.79 | 1709.12 | 1706.89 |

| AIC | 1696.71 | 1698.03 | 1695.81 |

| Explanatory Factors | FE | RE | POLS | FE-2SLS | RE-2SLS |

|---|---|---|---|---|---|

| 0.2015 *** (0.0608) | 0.4146 *** (0.0525) | 0.4146 *** (0.0525) | 0.1360 ** (0.0620) | 0.3170 *** (0.0554) | |

| 0.1552 * (0.0938) | 0.0581 (0.0923) | 0.0581 (0.0923) | 0.4147 * (0.2376) | 0.6905 (0.6683) | |

| 3.6204 *** (0.6258) | 0.3920 *** (0.1484) | 0.3920 *** (0.1484) | 2.6285 *** (1.0045) | 0.2959 * (0.1655) | |

| 0.2496 *** (0.0631) | 0.2479 *** (0.0640) | 0.2479 *** (0.0640) | 0.1384 ** (0.0712) | 0.0994 (0.0802) | |

| 0.2278 *** (0.0897) | 0.1023 * (0.0588) | 0.1023 * (0.0588) | 0.2179 *** (0.0911) | 0.2505 *** (0.0908) | |

| −0.7897 *** (0.1520) | −0.7835 *** (0.1489) | −0.7835 *** (0.1489) | −0.7116 *** (0.1712) | −0.7110 *** (0.1905) | |

| 0.1307 *** (0.0236) | 0.1555 *** (0.0238) | 0.1555 *** (0.0238) | 0.0514 ** (0.0268) | 0.0579 ** (0.0293) | |

| 0.1556 *** (0.0475) | 0.0715 ** (0.0327) | 0.0715 ** (0.0327) | 0.1174 *** (0.0501) | 0.0143 (0.0332) | |

| Constant | −17.6796 *** (3.4449) | −2.2100 ** (1.2017) | −2.2100 * (1.017) | −5.6058 (3.7971) | |

| Country FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 270 | 270 | 270 | 243 | 243 |

| R2 overall | 0.2202 | 0.4300 | 0.4300 | 0.2709 | 0.2323 |

| R2 within | 0.4608 | 0.3901 | 0.1856 | 0.1308 | |

| R2 between | 0.3402 | 0.6490 | 0.5204 | 0.5488 | |

| BIC | 1322.72 | 1320.60 | 1382.92 | 1125.73 | 1235.68 |

| AIC | 1293.93 | 1300.85 | 1354.13 | 1097.79 | 1147.99 |

| Breusch and Pagan test (POLS vs. RE) | 0.00 [1.0000] | Endogeneity test of regressors | 8.184 [0.0167] | ||

| F test for fixed effects (POLS vs. FE) | 2.27 [0.0007] | Weak identification test (Cragg-Donald Wald F statistic) | 16.705 10%: 7.03 15%: 4.58 20%: 3.95 25%: 3.63 | ||

| Haussman test (FE vs. RE) | 97.38 [0.0000] | Haussman test (FE-2SLS vs. RE-2SLS) | 56.34 [0.0000] | ||

| Underidentification test | 29.894 [0.0000] | ||||

| Overidentification test (Sargan statistic) | [0.0000] | ||||

| Explanatory Factors | FE | RE | POLS | FE-2SLS | RE-2SLS |

|---|---|---|---|---|---|

| 0.1744 *** (0.0627) | 0.4098 *** (0.0532) | 0.4098 *** (0.0532) | 0.1252 ** (0.0655) | 0.3161 *** (0.0555) | |

| 0.1500 (0.0938) | 0.0563 (0.0925) | 0.0563 (0.0925) | 0.4250 * (0.2390) | 0.6896 (0.6676) | |

| 3.7678 *** (0.6296) | 0.4073 *** (0.1509) | 0.4073 *** (0.1509) | 2.7012 *** (1.0334) | 0.2992 * (0.1661) | |

| 0.2448 *** (0.0629) | 0.2484 *** (0.0641) | 0.2484 *** (0.0641) | 0.1477 ** (0.0721) | 0.1002 (0.0799) | |

| 0.2668 *** (0.0923) | 0.1137 * (0.0620) | 0.1137 * (0.0620) | 0.2330 *** (0.0950) | 0.2529 *** (0.0968) | |

| −0.6934 *** (0.1620) | −0.7711 *** (0.1506) | −0.7711 *** (0.1506) | −0.6862 *** (0.1781) | −0.7091 *** (0.1898) | |

| 0.1273 *** (0.0236) | 0.1548 *** (0.0238) | 0.1548 *** (0.0238) | 0.0503 * (0.0269) | 0.0579 ** (0.0294) | |

| 0.1513 *** (0.0475) | 0.0711 ** (0.0327) | 0.0711 ** (0.0327) | 0.1171 ** (0.0502) | 0.0143 (0.0333) | |

| −0.0705 * (0.0422) | −0.0145 (0.0247) | −0.0145 (0.0247) | −0.0333 * (0.0478) | −0.0029 (0.0252) | |

| Constant | −12.6312 *** (4.5685) | −1.1793 (2.1326) | −1.1793 (2.1326) | −5.3944 (4.1382) | |

| Country FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 270 | 270 | 270 | 243 | 243 |

| R2 overall | 0.2164 | 0.4307 | 0.4307 | 0.1656 | 0.2325 |

| R2 within | 0.4672 | 0.3921 | 0.1311 | ||

| R2 between | 0.3250 | 0.6432 | 0.5493 | ||

| BIC | 1325.13 | 1322.18 | 1388.16 | 1132.76 | 1256.81 |

| AIC | 1292.74 | 1296.80 | 1355.77 | 1101.32 | 1186.52 |

| Breusch and Pagan test (POLS vs. RE) | 0.00 [1.0000] | Endogeneity test of regressors | 8.235 [0.0163] | ||

| F test for fixed effects (POLS vs. FE) | 2.38 [0.0004] | Weak identification test (Cragg-Donald Wald F statistic) | 16.483 10%: 7.03 15%: 4.58 20%: 3.95 25%: 3.63 | ||

| Haussman test (FE vs. RE) | 290.54 [0.0000] | Haussman test (FE-2SLS vs. RE-2SLS) | 56.07 [0.0000] | ||

| Underidentification test | 29.673 [0.0000] | ||||

| Overidentification test (Sargan statistic) | [0.0000] |

| Explanatory Factors | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| 0.4368 *** (0.1091) | 0.4518 *** (0.1112) | 0.4475 *** (0.1070) | |

| −0.5530 *** (0.0572) | |||

| −0.4771 *** (0.0537) | |||

| −0.5077 *** (0.0493) | |||

| Constant | 103.5522 *** (2.8863) | 103.3523 *** (3.0812) | 104.3183 *** (2.8046) |

| Country FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 297 | 297 | 297 |

| R2 overall | 0.0537 | 0.1372 | 0.1309 |

| R2 within | 0.3151 | 0.2864 | 0.3378 |

| R2 between | 0.0373 | 0.1404 | 0.1285 |

| BIC | 1854.51 | 1866.72 | 1844.50 |

| AIC | 1843.43 | 1855.63 | 1833.42 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Díaz-Roldán, C.; Ramos-Herrera, M.d.C. Innovations and ICT: Do They Favour Economic Growth and Environmental Quality? Energies 2021, 14, 1431. https://doi.org/10.3390/en14051431

Díaz-Roldán C, Ramos-Herrera MdC. Innovations and ICT: Do They Favour Economic Growth and Environmental Quality? Energies. 2021; 14(5):1431. https://doi.org/10.3390/en14051431

Chicago/Turabian StyleDíaz-Roldán, Carmen, and María del Carmen Ramos-Herrera. 2021. "Innovations and ICT: Do They Favour Economic Growth and Environmental Quality?" Energies 14, no. 5: 1431. https://doi.org/10.3390/en14051431