Optimal Participation of Co-Located Wind–Battery Plants in Sequential Electricity Markets

Abstract

:1. Introduction

- A novel EMS methodology is proposed for operating wind–battery HPPs in electricity markets considering the battery degradation model and grid connection constraints. The novelty lies in the fact that there has been no method in the literature that considers operation in sequential markets, i.e., the spot market, the balancing market, and real-time operation, as well as the non-linear battery degradation model and grid connection constraints, simultaneously.

- The value of wind–battery HPPs providing regulation power, i.e., a balancing service in the Nordic balancing market in 2030, is investigated by comparing the annual profits of different operation strategies. This value quantification provides HPP developers and owners with knowledge of profit maximization from the balancing market while taking in cognizance the bulk-power offer in the spot market and limiting the overdegradation of batteries.

- The value of intra-hour re-dispatch optimization on improving the feasibility of the generation plan is analyzed through specific case studies. This is particularly relevant as numerous countries have legal or contractual obligations for power plants to adhere to their generation plans.

- A detailed investigation of the impacts of overplanting on wind energy curtailment and battery degradation is performed, which helps HPP developers and owners to understand the potential benefits or adverse effects of overplanting with respect to the grid connection constraints.

2. Methodology

2.1. Battery Degradation Model

2.2. Spot Market Optimization

2.2.1. Objective Function

2.2.2. Technical and Operation Constraints

2.3. Balancing Market Optimization

2.3.1. Objective Function

2.3.2. Technical and Operation Constraints

2.3.3. Imbalance Settlement Constraints

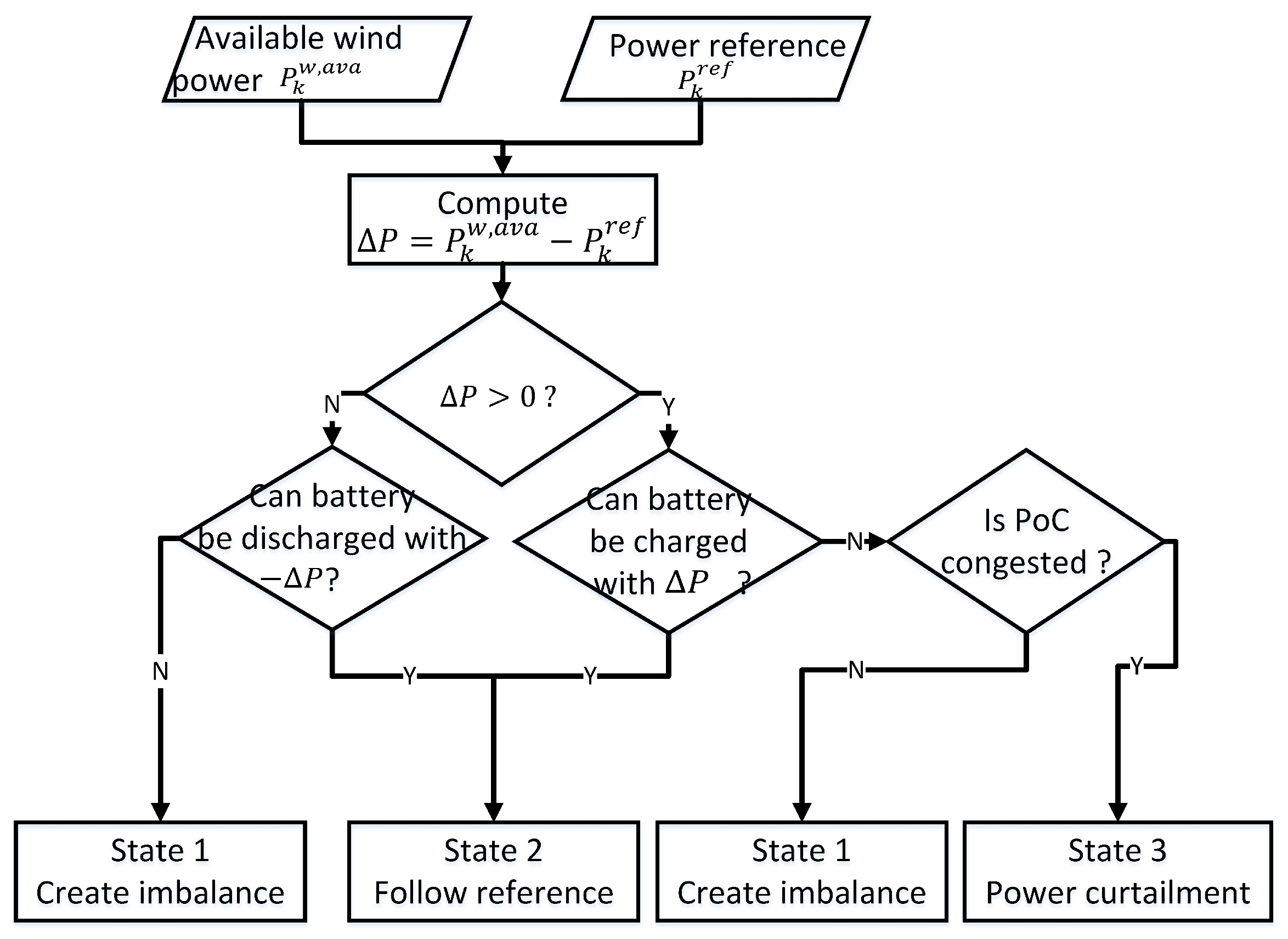

2.4. Re-Dispatch Optimization

2.4.1. Objective Function

2.4.2. Technical and Operation Constraints

2.4.3. Imbalance Settlement Constraints

2.5. Post-Calculation of Revenue and Cost

2.6. Real-Time Measurements

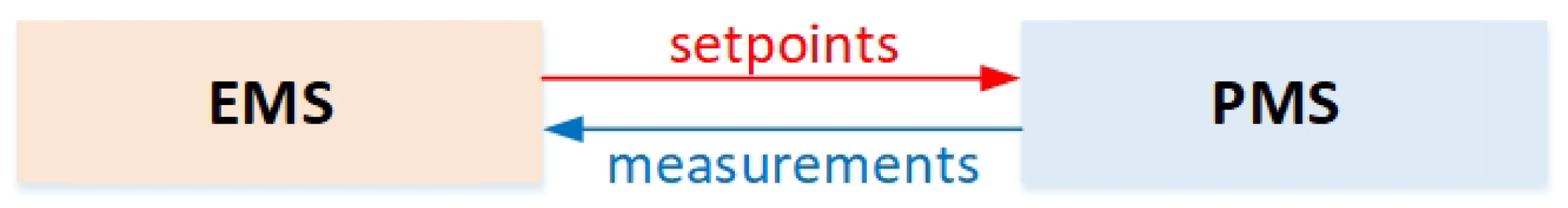

3. Case Studies

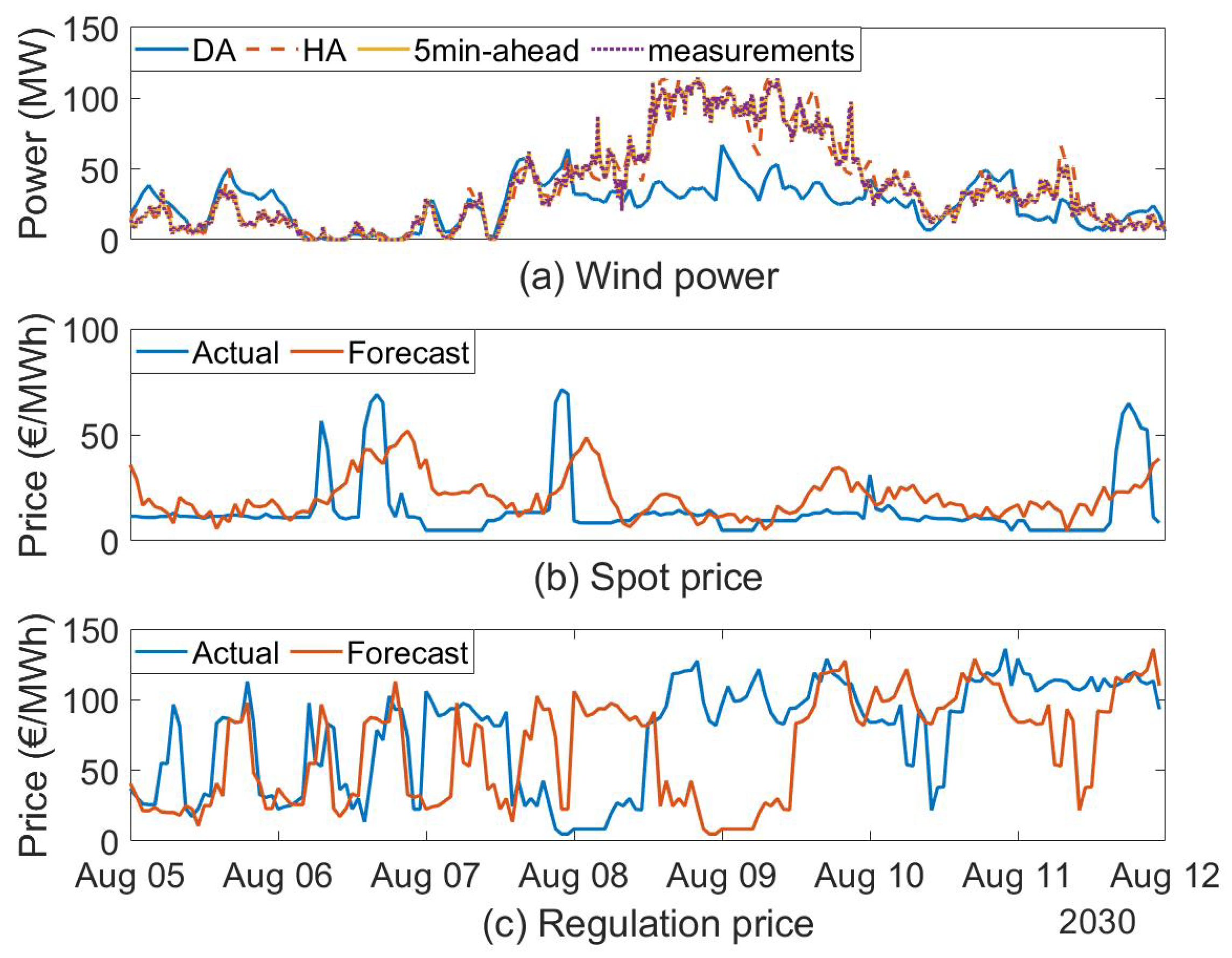

3.1. Wind and Market Data

3.2. Annual Profit of HPP

3.3. Value of Re-Dispatch Optimization

3.4. The Impacts of Overplanting on Wind Energy Curtailment

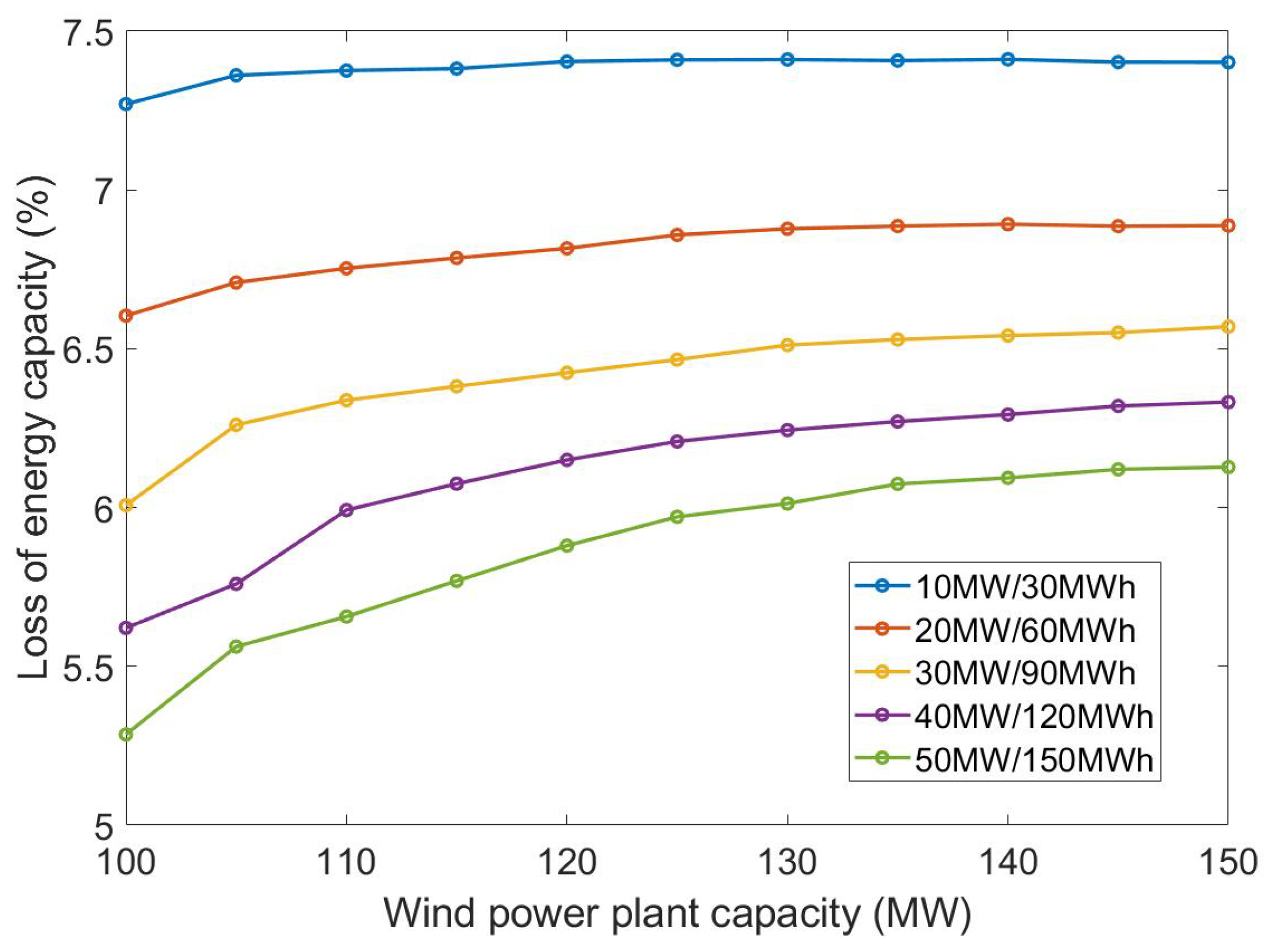

3.5. The Impacts of Overplanting on Battery Degradation

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| HPP | Hybrid power plant |

| EMS | Energy management system |

| SM | Spot market |

| BM | Balancing market |

| DA | Day-ahead |

| HA | Hour-ahead |

| WPP | Wind power plant |

| PV | Photovoltaic |

| BESS | Battery energy storage system |

| DoD | Depth of discharge |

| SMOpt | Spot market optimization |

| BMOpt | Balancing market optimization |

| RDOpt | Re-dispatch optimization |

| DI | Dispatch interval |

| SI | Settlement interval |

| OI | Offering interval |

| PMS | Power management system |

| HPPC | Hybrid power plant controller |

| RT | Real time |

| TSO | Transmission system operator |

| SEM | Semi-empirical model |

| LoC | Loss of capacity |

| SoC | State of charge |

| SoH | State of health |

| CorRES | Correlated renewable energy source simulation tool |

| BTC | Balancing tool chain |

| PoC | Point of connection |

References

- Agency, I.E. Renewables 2021-Analysis and forecast to 2026; Technical Report; International Energy Agency: Paris, France, 2021.

- Das, K.; Gea-Bermudez, J.; Kanellas, P.; Koivisto, M.; Leon, J.P.M.; Sørensen, P.E. Recommendations for balancing requirements for future North Sea countries towards 2050. In Proceedings of the 19th Wind Integration Workshop 2020, Online, 11–12 November 2020; Energynautics GmbH: Darmstadt, Germany, 2020. [Google Scholar]

- Shen, J.; Cheng, C.; Jia, Z.; Zhang, Y.; Lv, Q.; Cai, H.; Wang, B.; Xie, M. Impacts, challenges and suggestions of the electricity market for hydro-dominated power systems in China. Renew. Energy 2022, 187, 743–759. [Google Scholar] [CrossRef]

- Petersen, L.; Hesselbæk, B.; Martinez, A.; Borsotti-Andruszkiewicz, R.M.; Tarnowski, G.C.; Steggel, N.; Osmond, D. Vestas power plant solutions integrating wind, solar pv and energy storage. In Proceedings of the 3rd International Hybrid Power Systems Workshop, Tenerife, Spain, 8–9 May 2018; Energynautics: Darmstadt, Germany. [Google Scholar]

- Dykes, K.; King, J.; DiOrio, N.; King, R.; Gevorgian, V.; Corbus, D.; Blair, N.; Anderson, K.; Stark, G.; Turchi, C.; et al. Opportunities for Research and Development of Hybrid Power Plants; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2020.

- WindEurope. Renewable Hybrid Power Plants: Exploring the Benefits and Market Opportunities; WindEurope: Brussels, Belgium, 2019. [Google Scholar]

- Gorman, W.; Mills, A.; Bolinger, M.; Wiser, R.; Singhal, N.G.; Ela, E.; O’Shaughnessy, E. Motivations and options for deploying hybrid generator-plus-battery projects within the bulk power system. Electr. J. 2020, 33, 106739. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, H.; Li, P. Optimal offering and operating strategies for Wind-Storage system participating in spot electricity markets with progressive stochastic-robust hybrid optimization model series. Math. Probl. Eng. 2019, 2019, 2142050. [Google Scholar] [CrossRef] [Green Version]

- Ding, H.; Pinson, P.; Hu, Z.; Song, Y. Optimal offering and operating strategies for wind-storage systems with linear decision rules. IEEE Trans. Power Syst. 2016, 31, 4755–4764. [Google Scholar] [CrossRef] [Green Version]

- Das, K.; Grapperon, A.L.T.P.; Sørensen, P.E.; Hansen, A.D. Optimal battery operation for revenue maximization of wind-storage hybrid power plant. Electr. Power Syst. Res. 2020, 189, 106631. [Google Scholar] [CrossRef]

- Xu, X.; Hu, W.; Cao, D.; Huang, Q.; Liu, Z.; Liu, W.; Chen, Z.; Blaabjerg, F. Scheduling of wind-battery hybrid system in the electricity market using distributionally robust optimization. Renew. Energy 2020, 156, 47–56. [Google Scholar] [CrossRef]

- Mohamed, M.A.; Jin, T.; Su, W. An effective stochastic framework for smart coordinated operation of wind park and energy storage unit. Appl. Energy 2020, 272, 115228. [Google Scholar] [CrossRef]

- Loukatou, A.; Johnson, P.; Howell, S.; Duck, P. Optimal valuation of wind energy projects co-located with battery storage. Appl. Energy 2021, 283, 116247. [Google Scholar] [CrossRef]

- Wang, Y.; Zhou, Z.; Botterud, A.; Zhang, K.; Ding, Q. Stochastic coordinated operation of wind and battery energy storage system considering battery degradation. J. Mod. Power Syst. Clean Energy 2016, 4, 581–592. [Google Scholar] [CrossRef] [Green Version]

- Khaloie, H.; Anvari-Moghaddam, A.; Contreras, J.; Toubeau, J.F.; Siano, P.; Vallée, F. Offering and bidding for a wind producer paired with battery and CAES units considering battery degradation. Int. J. Electr. Power Energy Syst. 2022, 136, 107685. [Google Scholar] [CrossRef]

- Ding, H.; Pinson, P.; Hu, Z.; Song, Y. Integrated bidding and operating strategies for wind-storage systems. IEEE Trans. Sustain. Energy 2015, 7, 163–172. [Google Scholar] [CrossRef] [Green Version]

- Cai, Z.; Bussar, C.; Stöcker, P.; Moraes, L., Jr.; Magnor, D.; Sauer, D.U. Optimal dispatch scheduling of a wind-battery-system in German power market. Energy Procedia 2016, 99, 137–146. [Google Scholar] [CrossRef]

- Crespo-Vazquez, J.L.; Carrillo, C.; Diaz-Dorado, E.; Martinez-Lorenzo, J.A.; Noor-E-Alam, M. A machine learning based stochastic optimization framework for a wind and storage power plant participating in energy pool market. Appl. Energy 2018, 232, 341–357. [Google Scholar] [CrossRef]

- Al-Lawati, R.A.; Crespo-Vazquez, J.L.; Faiz, T.I.; Fang, X.; Noor-E-Alam, M. Two-stage stochastic optimization frameworks to aid in decision-making under uncertainty for variable resource generators participating in a sequential energy market. Appl. Energy 2021, 292, 116882. [Google Scholar] [CrossRef]

- Abdeltawab, H.H.; Mohamed, Y.A.R.I. Market-oriented energy management of a hybrid wind-battery energy storage system via model predictive control with constraint optimizer. IEEE Trans. Ind. Electron. 2015, 62, 6658–6670. [Google Scholar] [CrossRef]

- Han, X.; Hug, G. A distributionally robust bidding strategy for a wind-storage aggregator. Electr. Power Syst. Res. 2020, 189, 106745. [Google Scholar] [CrossRef]

- Crespo-Vazquez, J.L.; Carrillo, C.; Diaz-Dorado, E.; Martinez-Lorenzo, J.A.; Noor-E-Alam, M. Evaluation of a data driven stochastic approach to optimize the participation of a wind and storage power plant in day-ahead and reserve markets. Energy 2018, 156, 278–291. [Google Scholar] [CrossRef]

- Long, Q.; Das, K.; Pombo, D.V.; Sørensen, P.E. Hierarchical control architecture of co-located hybrid power plants. Int. J. Electr. Power Energy Syst. 2022, 143, 108407. [Google Scholar] [CrossRef]

- Xu, B.; Oudalov, A.; Ulbig, A.; Andersson, G.; Kirschen, D.S. Modeling of lithium-ion battery degradation for cell life assessment. IEEE Trans. Smart Grid 2016, 9, 1131–1140. [Google Scholar] [CrossRef]

- Downing, S.D.; Socie, D. Simple rainflow counting algorithms. Int. J. Fatigue 1982, 4, 31–40. [Google Scholar] [CrossRef]

- Shi, Y.; Xu, B.; Tan, Y.; Zhang, B. A convex cycle-based degradation model for battery energy storage planning and operation. In Proceedings of the 2018 Annual American Control Conference (ACC), Milwaukee, WI, USA, 27–29 June 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 4590–4596. [Google Scholar]

- Long, Q.; Zhu, R.; Das, K.; Sørensen, P.E. Interfacing Energy Management with Supervisory Control for Hybrid Power Plants. In Proceedings of the 20th Wind Integration Workshop 2021, Hybrid Conference, Berlin, Germany, 29–30 September 2021. [Google Scholar]

- Agency, D.E. Technology Data for Energy Storage. Available online: https://ens.dk/sites/ens.dk/files/Analyser/technology_data_catalogue_for_energy_storage.pdf (accessed on 25 November 2021).

- IBM. Decision Optimization Modeling for Python (DOcplex). Available online: https://github.com/IBMDecisionOptimization/docplex-doc (accessed on 25 November 2021).

- Technical University of Denmark. Sophia HPC Cluster. In Research Computing at DTU. 2019. Available online: https://dtu-sophia.github.io/docs/ (accessed on 25 November 2021). [CrossRef]

- Murcia Leon, J.P.; Koivisto, M.J.; Sørensen, P.; Magnant, P. Power fluctuations in high-installation-density offshore wind fleets. Wind. Energy Sci. 2021, 6, 461–476. [Google Scholar] [CrossRef]

- Koivisto, M.; Das, K.; Guo, F.; Sørensen, P.; Nuño, E.; Cutululis, N.; Maule, P. Using time series simulation tools for assessing the effects of variable renewable energy generation on power and energy systems. Wiley Interdiscip. Rev. Energy Environ. 2019, 8, e329. [Google Scholar] [CrossRef]

- Koivisto, M.; Jónsdóttir, G.M.; Sørensen, P.; Plakas, K.; Cutululis, N. Combination of meteorological reanalysis data and stochastic simulation for modelling wind generation variability. Renew. Energy 2020, 159, 991–999. [Google Scholar] [CrossRef]

- Kanellas, P.; Das, K.; Gea-Bermudez, J.; Sørensen, P. Balancing Tool Chain: Balancing and Automatic Control in North Sea Countries in 2020, 2030 and 2050; DTU Wind Energy: Roskilde, Denmark, 2020. [Google Scholar]

- Wiese, F.; Bramstoft, R.; Koduvere, H.; Alonso, A.P.; Balyk, O.; Kirkerud, J.G.; Tveten, Å.G.; Bolkesjø, T.F.; Münster, M.; Ravn, H. Balmorel open source energy system model. Energy Strategy Rev. 2018, 20, 26–34. [Google Scholar] [CrossRef]

- Koivisto, M.; Gea-Bermúdez, J.; Sørensen, P. North Sea offshore grid development: Combined optimisation of grid and generation investments towards 2050. IET Renew. Power Gener. 2020, 14, 1259–1267. [Google Scholar] [CrossRef] [Green Version]

- Gea-Bermúdez, J.; Pade, L.L.; Koivisto, M.J.; Ravn, H. Optimal generation and transmission development of the North Sea region: Impact of grid architecture and planning horizon. Energy 2020, 191, 116512. [Google Scholar] [CrossRef]

- Gea-Bermúdez, J.; Jensen, I.G.; Münster, M.; Koivisto, M.; Kirkerud, J.G.; Chen, Y.k.; Ravn, H. The role of sector coupling in the green transition: A least-cost energy system development in Northern-central Europe towards 2050. Appl. Energy 2021, 289, 116685. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Energinet. Regulation C2: The Balancing Market and Balance Settlement 2023. Available online: https://energinet.dk/media/pufj5pkx/forskrift-c2.pdf (accessed on 1 May 2023).

- Model, N.B. Current Requirements for Production Plans and Imbalances, Monitoring and the Use of Production Plans in Balancing. Available online: https://nordicbalancingmodel.net/wp-content/uploads/2020/03/Current-requirements-for-production-plans-and-imbalances_FINAL.pdf (accessed on 25 November 2021).

| Ref. No. | Time Scale | Battery Degradation | Grid Connection Constraints | ||

|---|---|---|---|---|---|

| DA Energy Offering | HA Regulation Power Offering | Intra-Hour Balancing | |||

| [8] | 🗸 | 🗸 | |||

| [9] | 🗸 | 🗸 | |||

| [10] | 🗸 | 🗸 | |||

| [11] | 🗸 | 🗸 | |||

| [12] | 🗸 | 🗸 | |||

| [13] | 🗸 | 🗸 | |||

| [15] | 🗸 | 🗸 | |||

| [14] | 🗸 | 🗸 | |||

| [16] | 🗸 | ||||

| [17] | 🗸 | ||||

| [18] | 🗸 | ||||

| [19] | 🗸 | ||||

| [20] | 🗸 | ||||

| [21] | 🗸 | ||||

| [22] | 🗸 | ||||

| This work | 🗸 | 🗸 | 🗸 | 🗸 | 🗸 |

| Operation Strategy | Spot Market | Balancing Market | |

|---|---|---|---|

| SMOpt | BMOpt | RDOpt | |

| SM | 🗸 | ||

| SM + RD | 🗸 | 🗸 | |

| SM + BM | 🗸 | 🗸 | |

| SM + BM + RD | 🗸 | 🗸 | 🗸 |

| Item | Parameters | Values |

|---|---|---|

| WPP | 120 MW | |

| BESS | 20 MW | |

| 60 MWh | ||

| 12 MWh | ||

| 97% | ||

| 98% | ||

| 0% | ||

| 0.142 M EUR/MWh | ||

| 11.72 M EUR | ||

| Grid | 100 MW |

| Operation Strategy | SM Revenues | BM Revenues | Total Revenues | Degradation Costs | Total Profits | |||

|---|---|---|---|---|---|---|---|---|

| Regulation Revenues | Imbalance Revenues | Special Imbalance Costs | Total | |||||

| SM | 14.7 | 0 | −2.0 | 2.0 | −4.0 | 10.7 | 0.4 | 10.3 |

| SM + RD | 14.5 | 0 | −1.8 | 0.0 | −1.8 | 12.7 | 0.5 | 12.2 |

| SM + BM | 14.6 | 3.9 | −4.1 | 0.1 | −0.3 | 14.3 | 0.7 | 13.6 |

| SM + BM + RD | 14.5 | 4.0 | −4.1 | 0.0 | −0.2 | 14.3 | 0.6 | 13.7 |

| SM | SM + RD | SM + BM | SM + BM + RD | |

|---|---|---|---|---|

| Percentage (%) | 19 | 0 | 2 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, R.; Das, K.; Sørensen, P.E.; Hansen, A.D. Optimal Participation of Co-Located Wind–Battery Plants in Sequential Electricity Markets. Energies 2023, 16, 5597. https://doi.org/10.3390/en16155597

Zhu R, Das K, Sørensen PE, Hansen AD. Optimal Participation of Co-Located Wind–Battery Plants in Sequential Electricity Markets. Energies. 2023; 16(15):5597. https://doi.org/10.3390/en16155597

Chicago/Turabian StyleZhu, Rujie, Kaushik Das, Poul Ejnar Sørensen, and Anca Daniela Hansen. 2023. "Optimal Participation of Co-Located Wind–Battery Plants in Sequential Electricity Markets" Energies 16, no. 15: 5597. https://doi.org/10.3390/en16155597