Assessing the Costs of Commercialising Tidal Energy in the UK

Abstract

:1. Introduction

2. Background

2.1. Growth in Renewable Energy Deployment

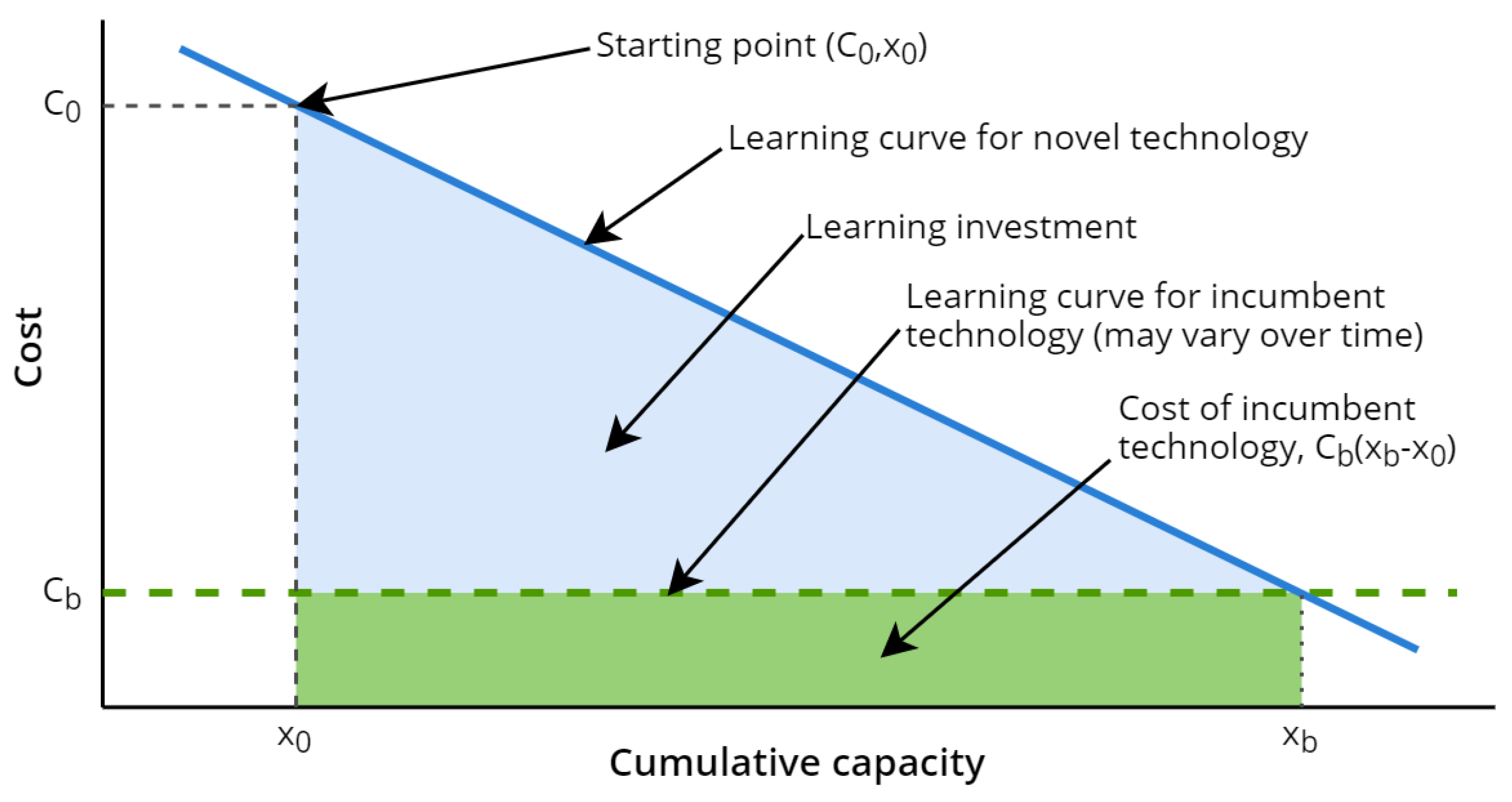

2.2. Modelling Cost Reductions and Learning Investment Using Learning Rates

- Learning by searching—improvements through research and development;

- Learning by doing and learning by using—improvements in product manufacturing mechanisms, labour efficiency, etc.;

- Learning by interacting—improvements in network interactions between research institutes, industry, end users, policy makers, etc., that improve knowledge diffusion;

- Upsizing/downsizing—changing the technology scale may reduce specific costs;

- Economies of scale—product standardisation and upscaling of production facilities.

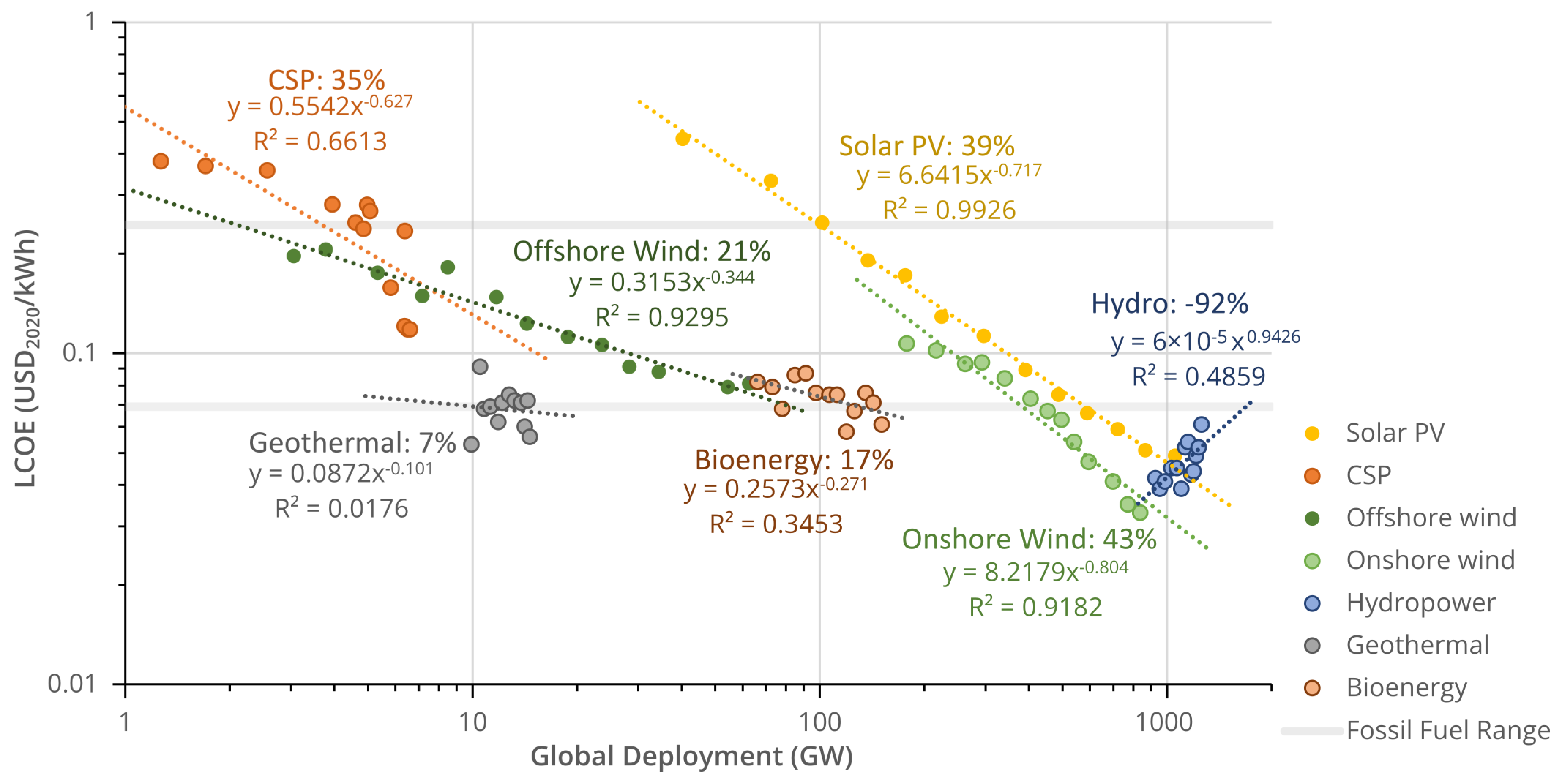

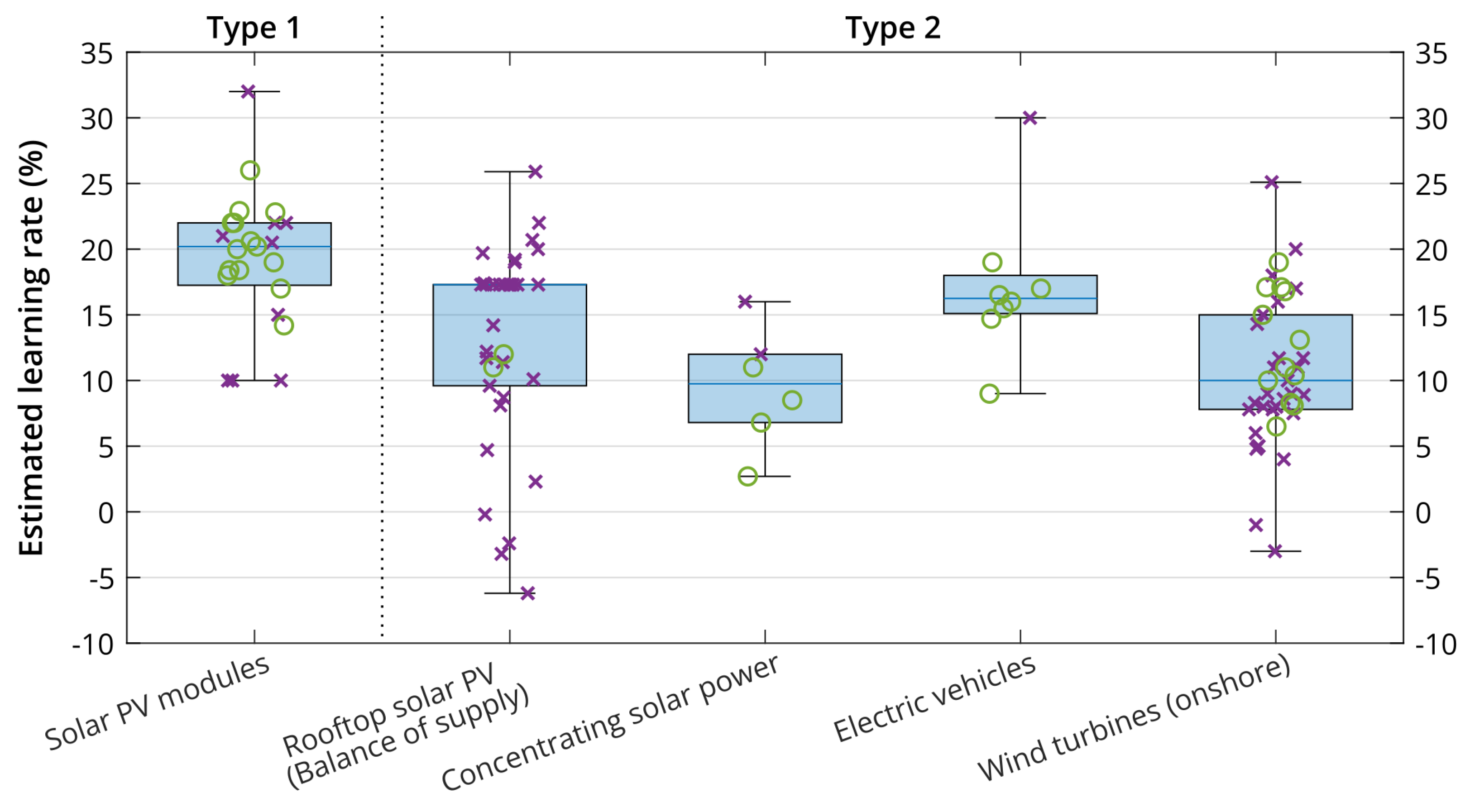

2.3. Historical Learning Rates for Other Renewable Energy Technologies

| Technology | Years | Scope | LR | Source |

|---|---|---|---|---|

| Onshore wind | 1979–2010 | All studies reviewed, various metrics | −11–32% | Rubin et al. [44] |

| 1980–1995 | Europe, cost of electricity vs. cumulative production | 18% | IEA [41] | |

| 1983–2015 | US project cost vs. global installed capacity | 6% | Samadi [46] | |

| 2010–2019 | Global, LCOE vs. Installed capacity | 24% | IRENA [42] | |

| 2010–2022 | Global, LCOE vs. Installed capacity | 43% | IRENA [43] | |

| Offshore wind | 1985–2001 | Both studies reviewed, various | 5–19% | Rubin et al. [44] |

| 2010–2019 | Global, LCOE vs. installed capacity | 10% | IRENA [42] | |

| 2010–2022 | Global, LCOE vs. installed capacity | 21% | IRENA [43] | |

| Solar PV | 1959–2011 | All studies reviewed, various metrics | 10–47% | Rubin et al. [44] |

| 1975–2015 | Global, module price vs. Installed capacity | 22% | Samadi [46] | |

| 2010–2019 | Global, LCOE vs. installed capacity | 36% | IRENA [42] | |

| 2010–2022 | Global, LCOE vs. installed capacity | 39% | IRENA [43] | |

| Biomass † | 1976–2005 | All studies reviewed, various metrics | 0–24% | Rubin et al. [44] |

| Bioenergy | 2010–2022 | Global, LCOE vs. installed capacity | 17% | IRENA [43] |

| Gas turbine | 1958–1990 | All studies reviewed, various metrics | 10–22% | Rubin et al. [44] |

| Concentrating solar power | 2010–2019 | Global, LCOE vs. installed capacity | 23% | IRENA [42] |

| 2010–2022 | Global, LCOE vs. installed capacity | 35% | IRENA [43] | |

| Geothermal | 2010–2022 | Global, LCOE vs. installed capacity | 7% | IRENA [43] |

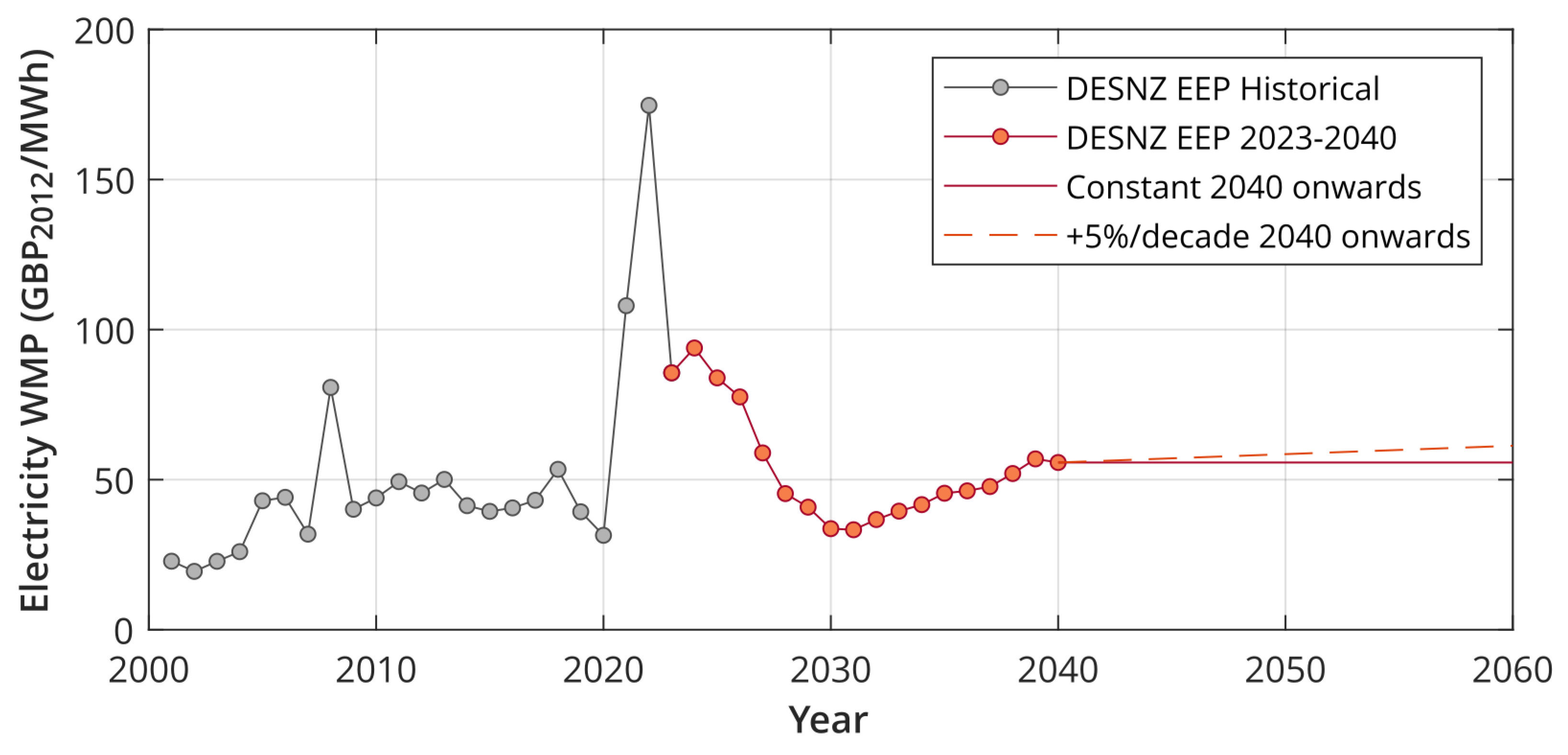

2.4. UK Electricity Market Subsidy

3. Methodology

3.1. Model Inputs and Assumptions

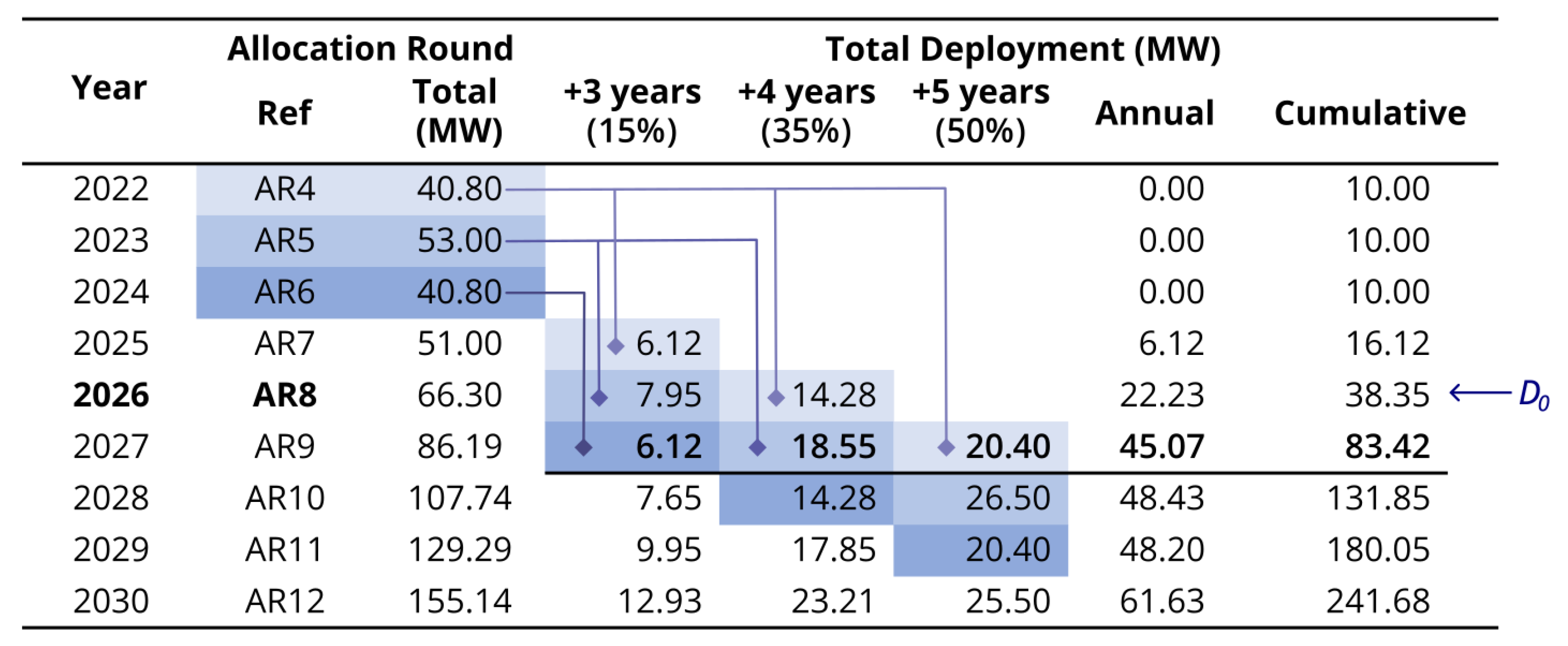

3.1.1. Deployment Trajectory

- A total of 10 MW in 2023, representing the existing deployment of tidal-stream energy in UK waters [25].

- A total of 0.9 GW in 2035, based on the UK Marine Energy Council’s ask for a target of 1 GW of ocean energy by 2035, assuming the majority of this will be from tidal stream, with the remainder coming from wave energy deployments.

- Around 6.2 GW in 2050, based on ESME modelling by ESC summarised above with further detail in [51].

3.1.2. Cost Reduction Inputs, Baseline Assumptions, and Sensitivity Ranges

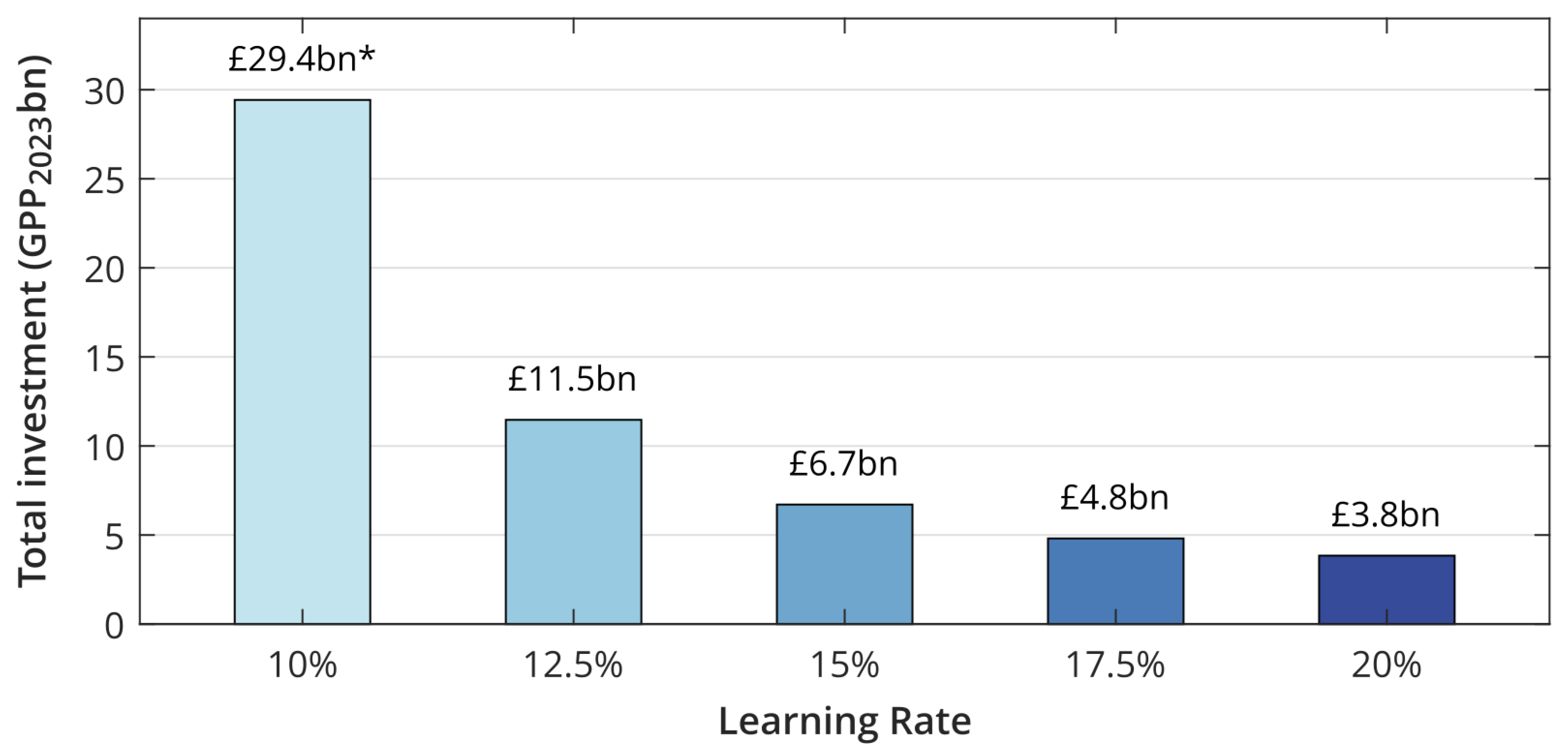

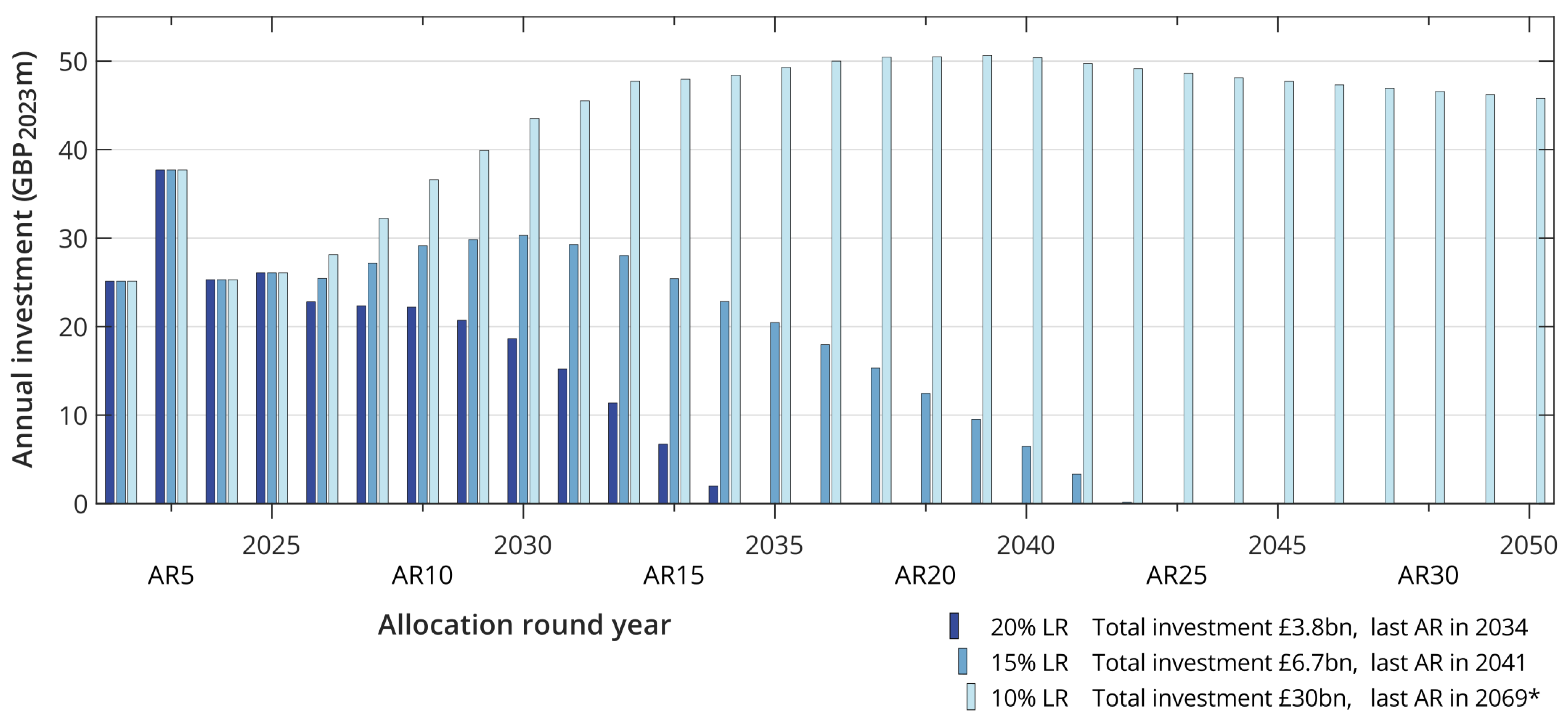

- 10%—a sub-optimal learning rate;

- 15%—a preferred and realistic learning rate;

- 20%—an ambitious learning rate.

3.2. Calculation of Cost Reductions and Total Market Support

4. Results and Discussion

4.1. Sensitivity to Learning Rate

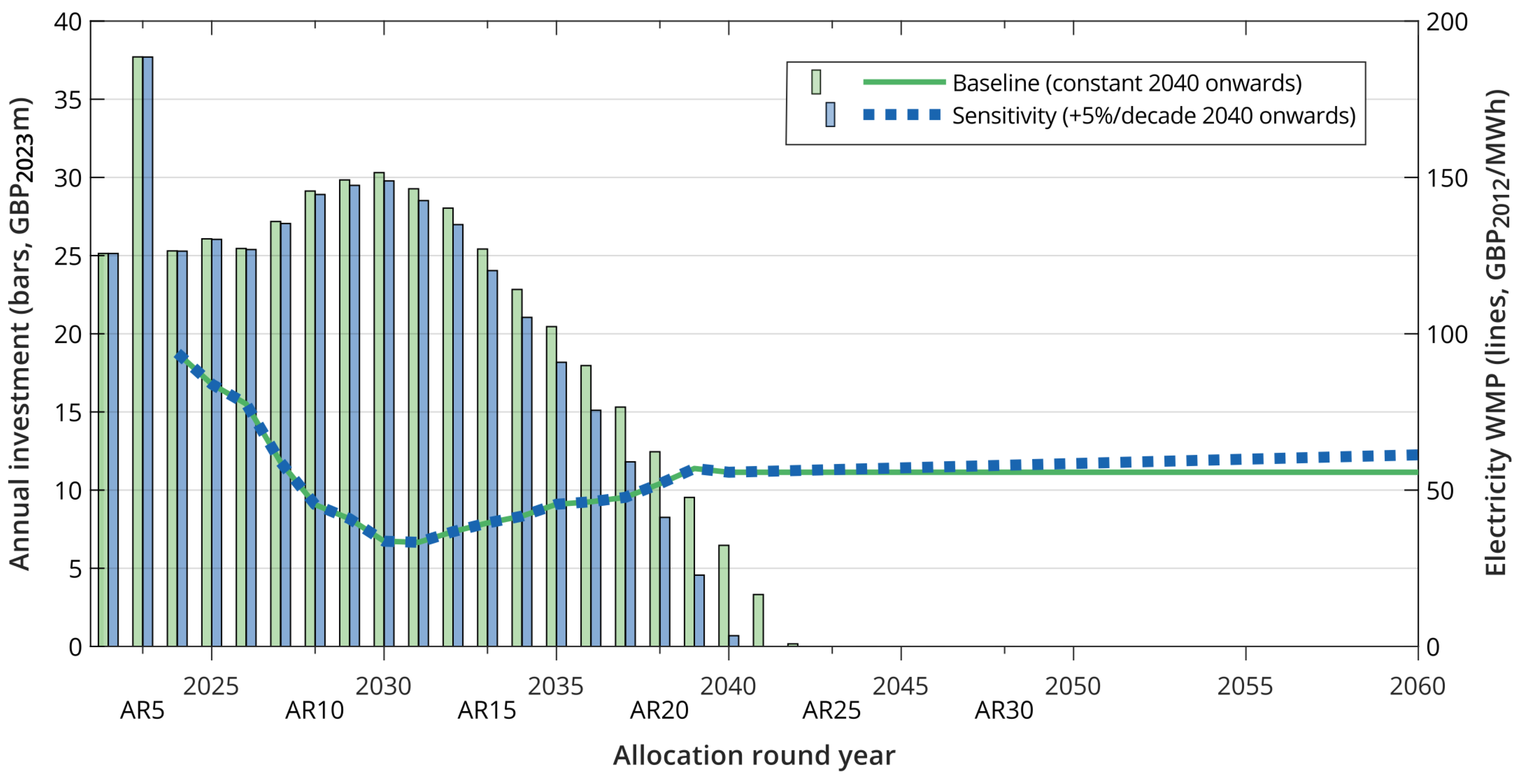

4.2. Annual Investment/Cfd Ringfence Required Per Round

4.3. Sensitivity to Ar6/Ar7 Strike Price

- The first two scenarios (a) and (b) assume that AR5 was a blip and that AR6 will be like AR4 at GBP 178.54/MWh, with a reduction in AR7 to (a) GBP 156/MWh or (b) GBP 160/MWh, resulting in total investment of GBP 6.7bn or GBP 7.3bn, respectively.

- Scenario (c) assumes that AR6 is mid-way between AR4 and AR5 at GBP 188.27/MWh, and AR7 is GBP 170/MWh, resulting in a total investment of GBP 8.9bn.

- Scenarios (d)–(f) then assume that AR6 is like AR5 at GBP 198.00/MWh, with AR7 reducing to (d) GBP 180/MWh, (e) GBP 190/MWh, or remaining at GBP 198/MWh in (f). The latter costs about double scenarios (a) or (b).

- Scenario (g) assumes that AR6 takes the Administrative Strike Price of GBP 261/MWh, but AR7 returns to GBP 198/MWh with prices reducing thereafter. Scenario (j) is a less extreme example of this with AR6 at GBP 220/MWh.

- Scenarios (h) and (i) assume higher Strike Prices in AR6 and AR7 before cost reductions occur. These require around three times the base case investment and do not meet cost parity by 2050.

4.4. Annual Investment/Cfd Ringfence Required for Selected Ar6/Ar7 Strike Prices

4.5. Sensitivity to Learning Rate and Ar6/Ar7 Strike Price

4.6. Other Considerations and Limitations

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AR | Allocation Round |

| ASP | Administrative Strike Price |

| CAGR | Compound Annual Growth Rate |

| CAPEX | Capital Expenditure |

| CfD | Contract for Difference |

| CPI | Consumer Prices Index |

| CSP | Concentrating Solar Power |

| DESNZ | [UK Government] Department for Energy Security and Net Zero |

| ESC | Energy Systems Catapult |

| ESME | Energy Systems Modelling Environment |

| GDP | Gross Domestic Product |

| IRENA | International Renewable Energy Agency |

| LCOE | Levelised Cost of Energy |

| LR | Learning Rate |

| ONS | Office for National Statistics |

| OPEX | Operational Expenditure |

| ORE | Offshore Renewable Energy |

| PV | Photovoltaic |

| WMP | [Electricity] Wholesale Market Price |

Appendix A. Sensitivity to Future Electricity Prices

References

- The Climate Change Act 2008 (2050 Target Amendment) Order 2019. Available online: https://www.legislation.gov.uk/uksi/2019/1056/made (accessed on 4 March 2024).

- Skidmore, C. Mission Zero—Independent Review of Net Zero. Technical Report, HM Government. 2023. Available online: https://www.gov.uk/government/publications/review-of-net-zero (accessed on 4 March 2024).

- Net Zero Strategy. Build Back Greener; Technical Report; HM Government: London, UK, 2021; ISBN 978-1-5286-2938-6.

- Climate Change Committee. Progress in Reducing Emissions 2023 Progress Report to Parliament; Technical Report; Climate Change Committee: London, UK, 2023. [Google Scholar]

- National Grid ESO. Future Energy Scenarios; Technical Report; National Grid ESO: London, UK, 2023. [Google Scholar]

- Coles, D.; Angeloudis, A.; Greaves, D.; Hastie, G.; Lewis, M.; Mackie, L.; McNaughton, J.; Miles, J.; Neill, S.; Piggott, M.; et al. A review of the UK and British Channel Islands practical tidal stream energy resource. Proc. R. Soc. A 2021, 477, 20210469. [Google Scholar] [CrossRef] [PubMed]

- EVOLVE Consortium. A Review of Practical Deployment Locations for European Ocean Energy Projects. EVOLVE Technical Note: RADMApp Modelling Study. Technical Report. Available online: https://evolveenergy.eu/project-outputs/ (accessed on 18 August 2023).

- Grubb, M. The integration of renewable electricity sources. Energy Policy 1991, 19, 670–688. [Google Scholar] [CrossRef]

- Lamy, J.V.; Azevedo, I.L. Do tidal stream energy projects offer more value than offshore wind farms? A case study in the United Kingdom. Energy Policy 2018, 113, 28–40. [Google Scholar] [CrossRef]

- Pearre, N.; Adye, K.; Swan, L. Proportioning wind, solar, and in-stream tidal electricity generating capacity to co-optimize multiple grid integration metrics. Appl. Energy 2019, 242, 69–77. [Google Scholar] [CrossRef]

- Pennock, S.; Coles, D.; Angeloudis, A.; Bhattacharya, S.; Jeffrey, H. Temporal complementarity of marine renewables with wind and solar generation: Implications for GB system benefits. Appl. Energy 2022, 319, 119276. [Google Scholar] [CrossRef]

- Coles, D.; Wray, B.; Stevens, R.; Crawford, S.; Pennock, S.; Miles, J. Impacts of tidal stream power on energy system security: An Isle of Wight case study. Appl. Energy 2023, 334, 120686. [Google Scholar] [CrossRef]

- Pudjianto, D.; Frost, C.; Coles, D.; Angeloudis, A.; Smart, G.; Strbac, G. UK studies on the wider energy system benefits of tidal stream. Energy Adv. 2023, 2, 789–796. [Google Scholar] [CrossRef]

- National Grid ESO. Future Energy Scenarios 2023 Data Workbook; Dataset; National Grid ESO: London, UK, 2023. [Google Scholar]

- IRENA. Innovation Outlook: Ocean Energy Technologies; Technical Report; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Serin, E.; Andres, P.; Martin, R.; Shah, A.; Valero, A. Seizing Sustainable Growth Opportunities from Tidal Stream Energy in the UK; Policy Report; London School of Economics and Political Science: London, UK, 2023. [Google Scholar]

- IEA-OES. Annual Report: An Overview of Ocean Energy Activities in 2023; Technical Report; The Executive Committee of Ocean Energy Systems: Lisbon, Portugal, 2024. [Google Scholar]

- EMEC. Tidal Clients. Available online: https://www.emec.org.uk/about-us/our-tidal-clients/ (accessed on 19 February 2024).

- IEA-OES. Annual Report, An Overview of Activities in 2017; Technical Report; The Executive Committee of Ocean Energy Systems: Lisbon, Portugal, 2018. [Google Scholar]

- Contracts for Difference (CfD) Allocation Round 4: Results. Available online: https://www.gov.uk/government/publications/contracts-for-difference-cfd-allocation-round-4-results (accessed on 1 November 2023).

- Contracts for Difference (CfD) Allocation Round 5: Results. Available online: https://www.gov.uk/government/publications/contracts-for-difference-cfd-allocation-round-5-results (accessed on 1 November 2023).

- Carbon Trust. Accelerating Marine Energy. The Potential for Cost Reduction—Insights from the Carbon Trust Marine Energy Accelerator; Technical Report CTC797; Carbon Trust: London, UK, 2011. [Google Scholar]

- Black & Veatch Ltd. UK Tidal Current Resource & Economics; Technical Report; Black & Veatch Ltd.: London, UK, 2011. [Google Scholar]

- Smart, G.; Noonan, M. Tidal Stream and Wave Energy Cost Reduction and Industrial Benefit; Technical Report; Offshore Renewable Energy Catapult: Blyth, UK, 2018. [Google Scholar]

- Frost, C. Cost Reduction Pathway of Tidal Stream Energy in the UK and France; Technical Report; Offshore Renewable Energy Catapult/TIGER Project: Blyth, UK, 2022. [Google Scholar]

- Callaghan, J.; Boud, R. Future Marine Energy. Results of the Marine Energy Challenge: Cost Competitiveness and Growth of Wave and Tidal Stream Energy; Technical Report CTC601; Carbon Trust: London, UK, 2006. [Google Scholar]

- MacGillivray, A.; Jeffrey, H.; Winskel, M.; Bryden, I. Innovation and cost reduction for marine renewable energy: A learning investment sensitivity analysis. Technol. Forecast. Soc. Chang. 2014, 87, 108–124. [Google Scholar] [CrossRef]

- Kerr, P.; Noble, D.R.; Hodges, J.; Jeffrey, H. Implementing Radical Innovation in Renewable Energy Experience Curves. Energies 2021, 14, 2364. [Google Scholar] [CrossRef]

- Vanegas Cantarero, M.; Avellaneda Domene, G.; Noble, D.R.; Pennock, S.; Jeffrey, H.; Ruiz Minguela, P.; Tunga, I.; Morrison, N.; Apolonia, M.; Luxcey, N.; et al. DTOceanPlus D8.1 Potential Markets for Ocean Energy; Technical Report; DTOceanPlus Consortium: Edinburgh, UK, 2020. [Google Scholar]

- Hansen, J.P.; Narbel, P.A.; Aksnes, D.L. Limits to growth in the renewable energy sector. Renew. Sustain. Energy Rev. 2017, 70, 769–774. [Google Scholar] [CrossRef]

- European Commission. An EU Strategy to Harness the Potential of Offshore Renewable Energy for a Climate Neutral Future; Technical Report COM/2020/741 final; European Commission: Brussels, Belgium, 2020.

- Noble, D.R. D3.3 Report on Infrastructural and Industrial Production Requirements; Technical Report; ETIP Ocean: Brussels, Belgium; Available online: https://www.etipocean.eu/knowledge_hub/report-on-infrastructural-and-industrial-production-requirements/ (accessed on 14 April 2024).

- Earth Policy Institute. Data Centre: Climate, Energy, and Transportation—Cumulative Installed Wind Power Capacity in Denmark, 1980–2014. Dataset. Available online: http://www.earth-policy.org/datacenter/xls/book_tgt_wind_7.xlsx (accessed on 24 November 2022).

- Earth Policy Institute. Data Centre: Climate, Energy, and Transportation—Cumulative Installed Wind Power Capacity in Top Ten Countries and the World, 1980–2014. Dataset. Available online: http://www.earth-policy.org/datacenter/xls/book_tgt_wind_2.xlsx (accessed on 24 November 2022).

- Bilgili, M.; Yasar, A.; Simsek, E. Offshore wind power development in Europe and its comparison with onshore counterpart. Renew. Sustain. Energy Rev. 2011, 15, 905–915. [Google Scholar] [CrossRef]

- IRENA. IRENASTAT Online Data Query Tool. Dataset. Installed Electricity Capacity by Country/Area (MW) by Country/Area, Technology, Grid Connection and Year. Available online: https://pxweb.irena.org/pxweb/en/ (accessed on 26 July 2023).

- WindEurope. Wind Energy in Europe 2022 Statistics and the Outlook for 2023–2027. Technical Report. Available online: https://windeurope.org/intelligence-platform/product/wind-energy-in-europe-2022-statistics-and-the-outlook-for-2023-2027/ (accessed on 1 March 2023).

- Ferioli, F.; Schoots, K.; van der Zwaan, B.C. Use and limitations of learning curves for energy technology policy: A component-learning hypothesis. Energy Policy 2009, 37, 2525–2535. [Google Scholar] [CrossRef]

- Jamasb, T. Technical Change Theory and Learning Curves: Patterns of Progress in Electricity Generation Technologies. Energy J. 2007, 28, 51–72. [Google Scholar] [CrossRef]

- Junginger, M.; Faaij, A.; Turkenburg, W.C. Global experience curves for wind farms. Energy Policy 2005, 33, 133–150. [Google Scholar] [CrossRef]

- International Energy Agency. Experience Curves for Energy Technology Policy; OECD: Paris, France, 2000. [Google Scholar] [CrossRef]

- IRENA. Renewable Power Generation Costs in 2019. Dataset. ISBN 978-92-9260-244-4. Available online: https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019 (accessed on 4 December 2023).

- IRENA. Renewable Power Generation Costs in 2022. Dataset. ISBN 978-92-9260-544-5. Available online: https://www.irena.org/Publications/2023/Aug/Renewable-power-generation-costs-in-2022 (accessed on 4 December 2023).

- Rubin, E.S.; Azevedo, I.M.L.; Jaramillo, P.; Yeh, S. A review of learning rates for electricity supply technologies. Energy Policy 2015, 86, 198–218. [Google Scholar] [CrossRef]

- Malhotra, A.; Schmidt, T.S. Accelerating Low-Carbon Innovation. Joule 2020, 4, 2259–2267. [Google Scholar] [CrossRef]

- Samadi, S. The experience curve theory and its application in the field of electricity generation technologies—A literature review. Renew. Sustain. Energy Rev. 2018, 82, 2346–2364. [Google Scholar] [CrossRef]

- Millman, G. AR5: Urgent Government Response Needed to Rebuild Leadership in UK Offshore Wind—Regen. Available online: https://www.regen.co.uk/ar5-urgent-government-response-needed-to-rebuild-leadership-in-uk-offshore-wind/ (accessed on 20 February 2024).

- Office for National Statistics. Gross Domestic Product at Market Prices: Implied Deflator:SA. Dataset. Available online: https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/ybgb/qna/ (accessed on 13 November 2023).

- Department for Energy Security and Net Zero. Energy and Emissions Projections: 2022 to 2040—Annex M: Growth Assumptions and Prices. Dataset. Available online: https://www.gov.uk/government/publications/energy-and-emissions-projections-2022-to-2040 (accessed on 13 November 2023).

- Office for National Statistics. Consumer Price Inflation Tables. Dataset. Available online: https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceinflation (accessed on 12 December 2023).

- Grattan, K.; Jeffrey, H. Delivering Net Zero: Forecasting Wave and Tidal Stream Deployment in UK Waters by 2050. Technical Report. Available online: https://www.policyandinnovationedinburgh.org/policymakers-toolkit.html (accessed on 21 November 2023).

- Committee on Climate Change. Net Zero Technical Report. Available online: https://www.theccc.org.uk/publication/net-zero-technical-report/ (accessed on 4 March 2024).

- Energy Systems Catapult. Innovating to Net Zero; Technical Report; Energy Systems Catapult: Birmingham, UK, 2020. [Google Scholar]

- European Commission. SET-Plan Ocean Energy—Implementation Plan; European Commission: Brussels, Belgium, 2021.

- Contracts for Difference (CfD) Allocation Round 6: Administrative Strike Prices Methodology Note. Available online: https://www.gov.uk/government/publications/contracts-for-difference-cfd-allocation-round-6-administrative-strike-prices-methodology-note (accessed on 14 February 2024).

- UK launches Biggest Electricity Market Reform in a Generation. Available online: https://www.gov.uk/government/news/uk-launches-biggest-electricity-market-reform-in-a-generation (accessed on 27 February 2024).

| 2022 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|

| Interconnectors | 7.4 | 11.7–17.5 | 15.9–25.4 | 15.9–26.8 |

| Biomass | 4.4 | 3.5–4.8 | 0.8–3.4 | 0.2–4.0 |

| Bioenergy with Carbon Capture and Storage | 0.0 | 0.0–0.6 | 2.2–8.8 | 2.2–8.8 |

| Nuclear | 6.1 | 4.6–4.6 | 9.1–11.4 | 9.8–15.9 |

| Hydrogen | 0.0 | 0.0–1.4 | 0.0–16.0 | 4.2–22.6 |

| Fossil fuel | 42.3 | 23.0–47.9 | 0.0–42.6 | 0.0–37.8 |

| Gas with Carbon Capture and Storage | 0.0 | 0.0–1.8 | 3.3–13.2 | 3.3–21.3 |

| Solar | 14.0 | 18.7–41.4 | 30.7–71.3 | 42.7–91.2 |

| Offshore Wind | 13.4 | 31.5–48.4 | 64.3–96.8 | 77.6–115.0 |

| Onshore Wind | 13.6 | 20.0–28.8 | 26.8–38.7 | 28.3–44.4 |

| Other Renewables † | 5.2 | 5.9–6.4 | 5.6–6.9 | 6.1–12.8 |

| Storage | 5.3 | 13.4–29.0 | 18.1–45.6 | 21.7–52.1 |

| Total Installed capacity | 111.7 | 158.7–206.7 | 231.2–320.5 | 280.8–369.3 |

| Peak System Demand | 57.7 | 62.8–68.5 | 62.8–68.5 | 97.5–114.2 |

| Year | Round | Amount | Strike Price(s) | Notes |

|---|---|---|---|---|

| (MW) | (/MWh) | |||

| 2022 | AR4 | 40.8 | 178.54 | From 2022 auction results [20] |

| 2023 | AR5 | 53.0 | 198.00 | From 2023 auction results [21] |

| 2024 | AR6 | 40.8 | 178.54–261.00 | Deployment amount as per AR4, SP range of AR4 SP to AR6 ASP [55] |

| 2025 | AR7 | 51.0 | 156.00–220.00 | Assumed growth in deployment to meet trajectory, and wide range of SP considered |

| Scenario | AR6 | AR7 | Total Investment | Last AR |

|---|---|---|---|---|

| (/MWh) | (/MWh) | (bn) | and Year | |

| (a) | 178.54 | 156.00 | 6.711 | AR24, 2042 |

| (b) | 178.54 | 160.00 | 7.273 | AR24, 2042 |

| (c) | 188.27 | 170.00 | 8.898 | AR27, 2045 |

| (d) | 198.00 | 180.00 | 10.811 | AR30, 2048 |

| (e) | 198.00 | 190.00 | 13.041 | AR32, 2050 |

| (f) | 198.00 | 198.00 | 15.092 | AR35, 2053 * |

| (g) | 261.00 | 198.00 | 15.272 | AR35, 2053 * |

| (h) | 210.00 | 210.00 | 18.723 | AR38, 2056 * |

| (i) | 220.00 | 220.00 | 22.268 | AR41, 2059 *‡ |

| (j) | 220.00 | 198.00 | 15.155 | AR35, 2053 * |

| Scenario | AR6 | AR7 | Total Investment (bn) | ||||

|---|---|---|---|---|---|---|---|

| (/MWh) | (/MWh) | 20% LR | 17.5% LR | 15% LR | 12.5% LR | 10% LR | |

| (a) | 178.54 | 156.00 | 3.843 | 4.808 | 6.711 | 11.466 * | 29.427 *‡ |

| (c) | 188.27 | 170.00 | 4.638 | 6.033 | 8.898 | 16.644 *‡ | 42.135 *‡ |

| (f) | 198.00 | 198.00 | 6.610 | 9.225 | 15.092 * | 33.383 *‡ | — |

| (g) | 261.00 | 198.00 | 6.790 | 9.405 | 15.272 * | 33.563 *‡ | — |

| (i) | 220.00 | 220.00 | 8.603 | 12.605 | 22.268 *‡ | 49.578 *‡ | — |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Noble, D.R.; Grattan, K.; Jeffrey, H. Assessing the Costs of Commercialising Tidal Energy in the UK. Energies 2024, 17, 2085. https://doi.org/10.3390/en17092085

Noble DR, Grattan K, Jeffrey H. Assessing the Costs of Commercialising Tidal Energy in the UK. Energies. 2024; 17(9):2085. https://doi.org/10.3390/en17092085

Chicago/Turabian StyleNoble, Donald R., Kristofer Grattan, and Henry Jeffrey. 2024. "Assessing the Costs of Commercialising Tidal Energy in the UK" Energies 17, no. 9: 2085. https://doi.org/10.3390/en17092085