Exploring Malaysia’s Transformation to Net Oil Importer and Oil Import Dependence

Abstract

:1. Introduction

| Year | GDP (Billion USD) [2] | Oil export (Billion USD) * | % |

|---|---|---|---|

| 2006 | 146.0 | 14.4 | 9.9% |

| 2007 | 155.5 | 15.9 | 10.2% |

| 2008 | 163.0 | 21.7 | 13.3% |

| 2009 | 160.3 | 13.8 | 8.6% |

| 2010 | 171.8 | 17.7 | 10.3% |

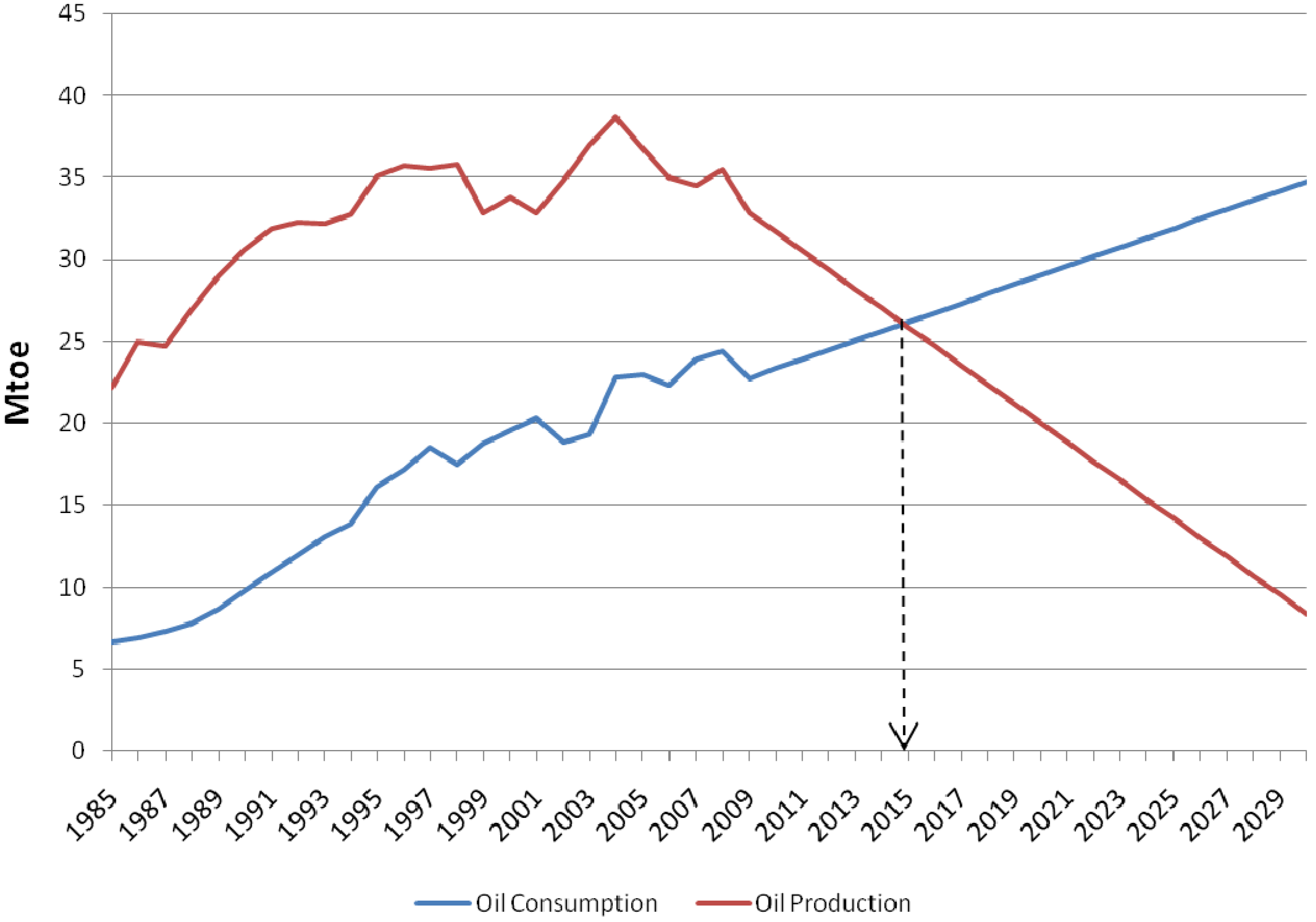

2. Prediction on Malaysia’s Net Oil Import Status

3. Malaysia’s Oil Sector Overview

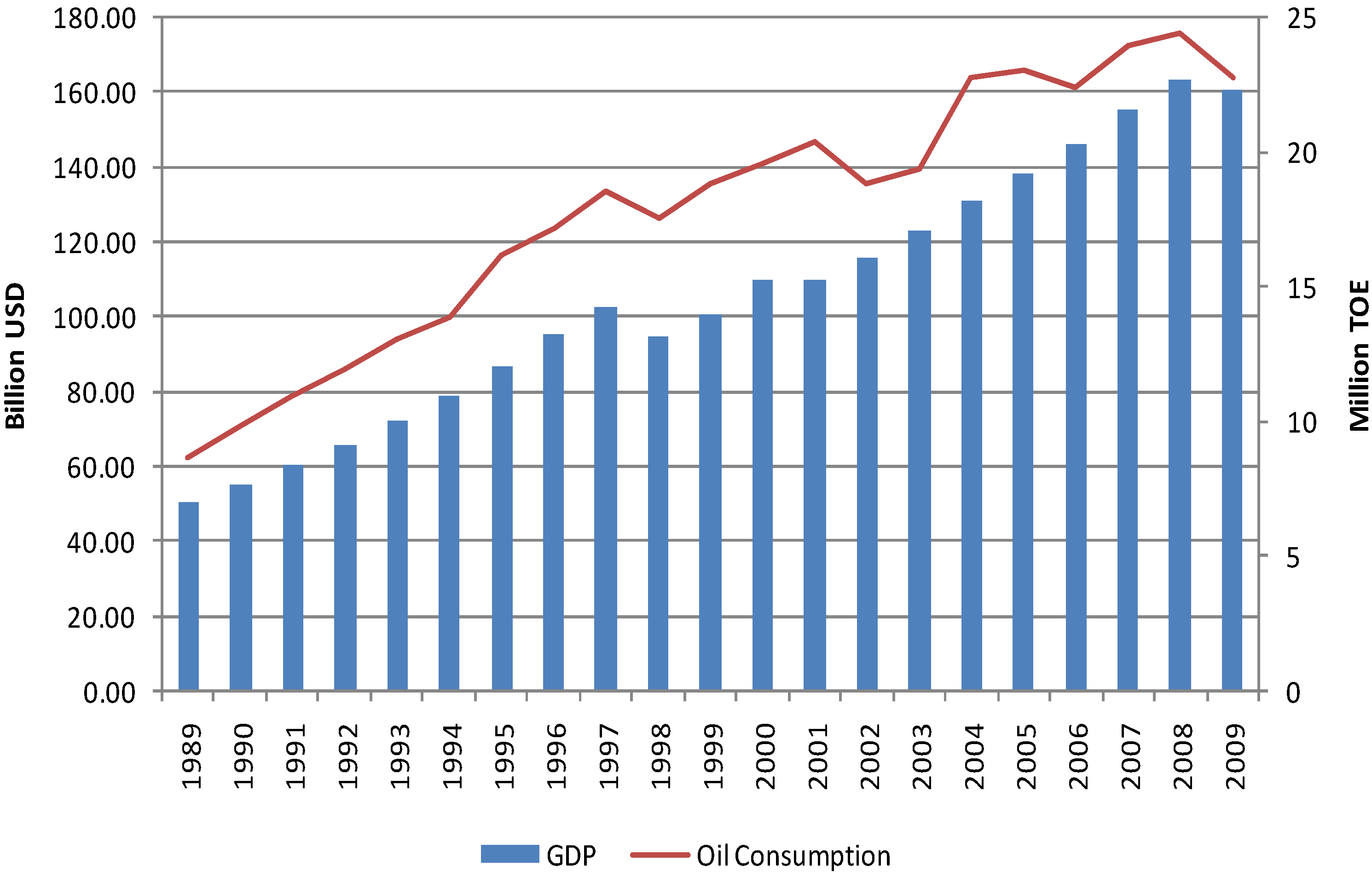

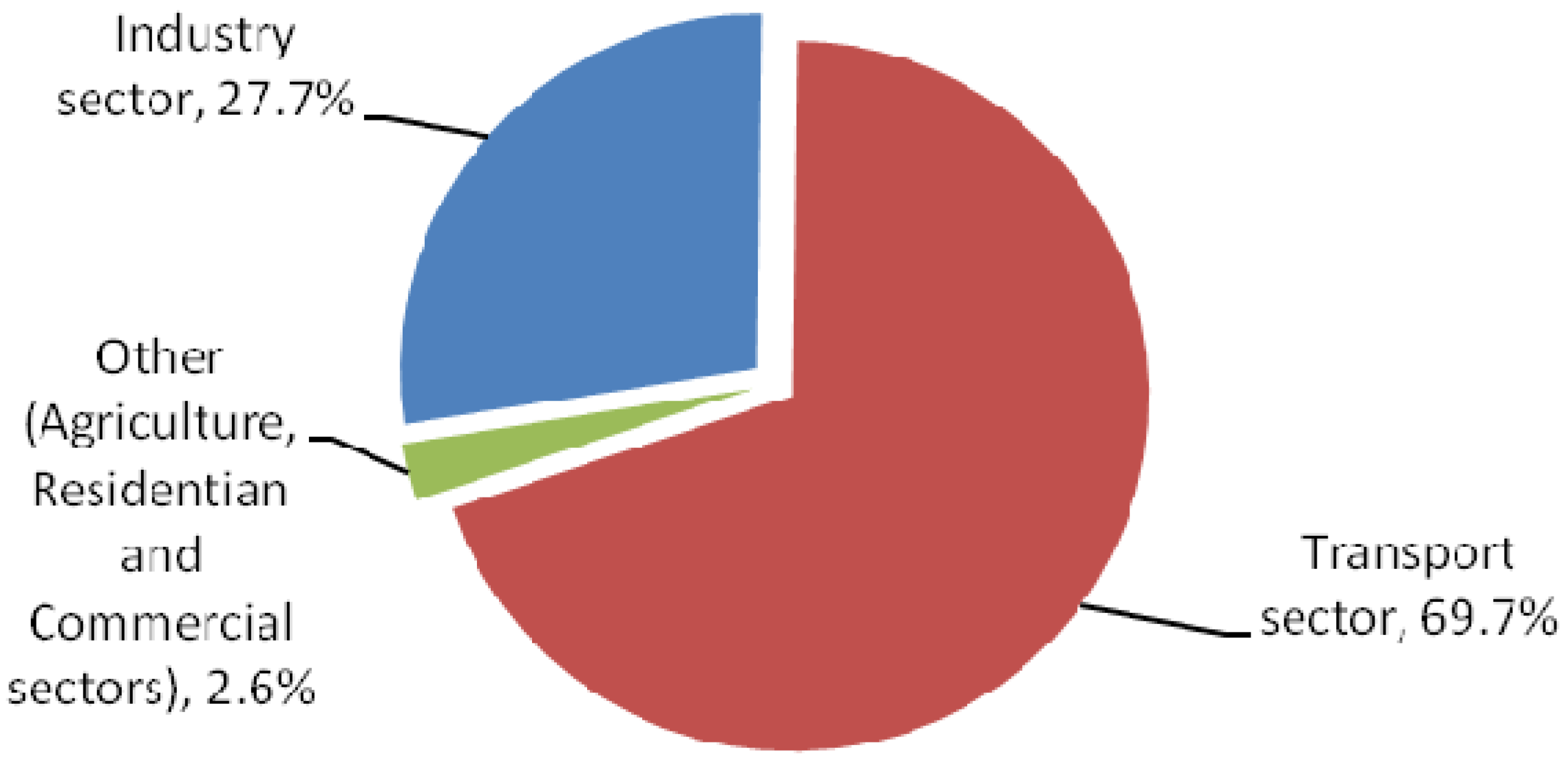

3.1. Oil Consumption

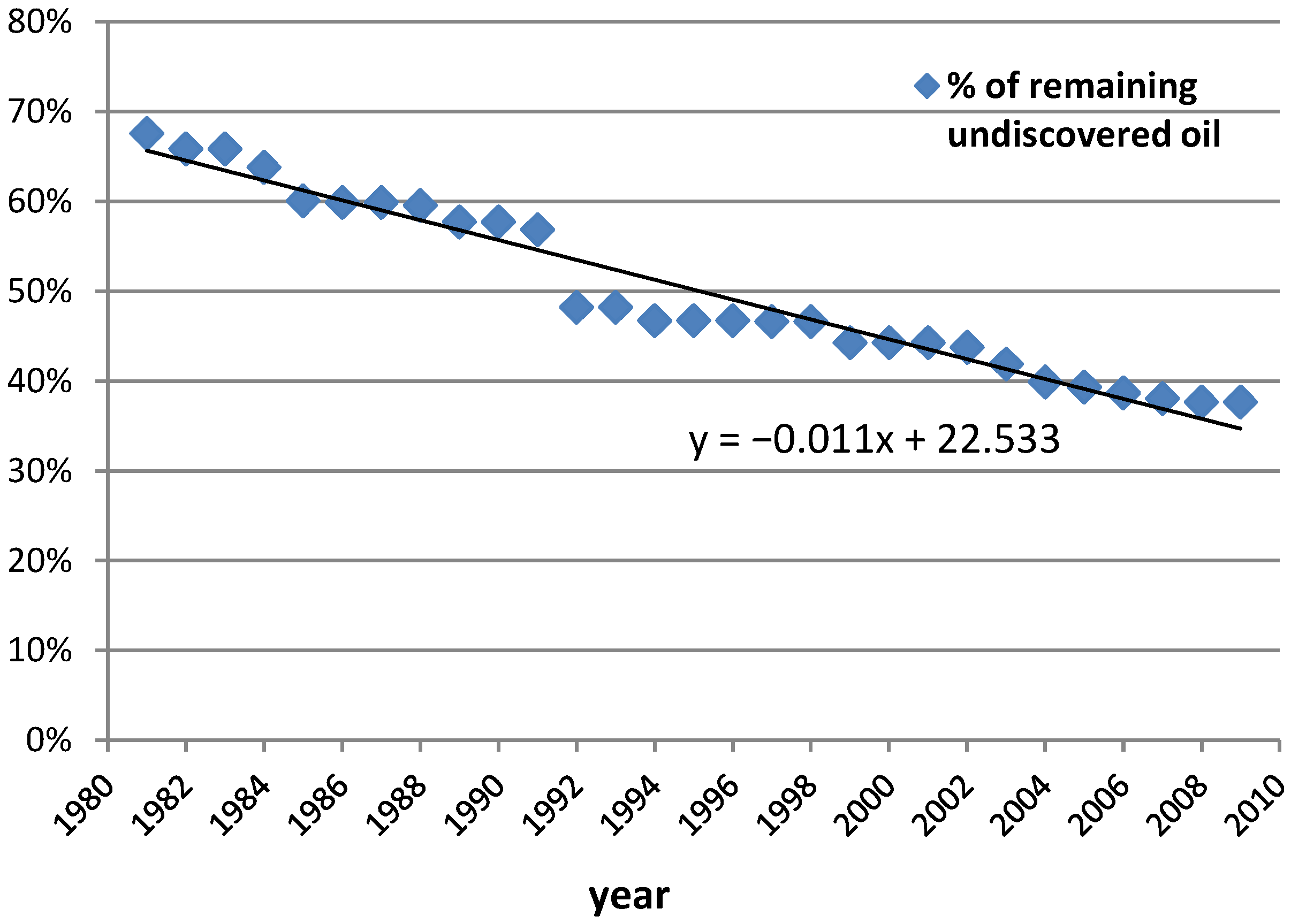

3.2. Oil Reserve and Production

4. Methodology

4.1. Overview

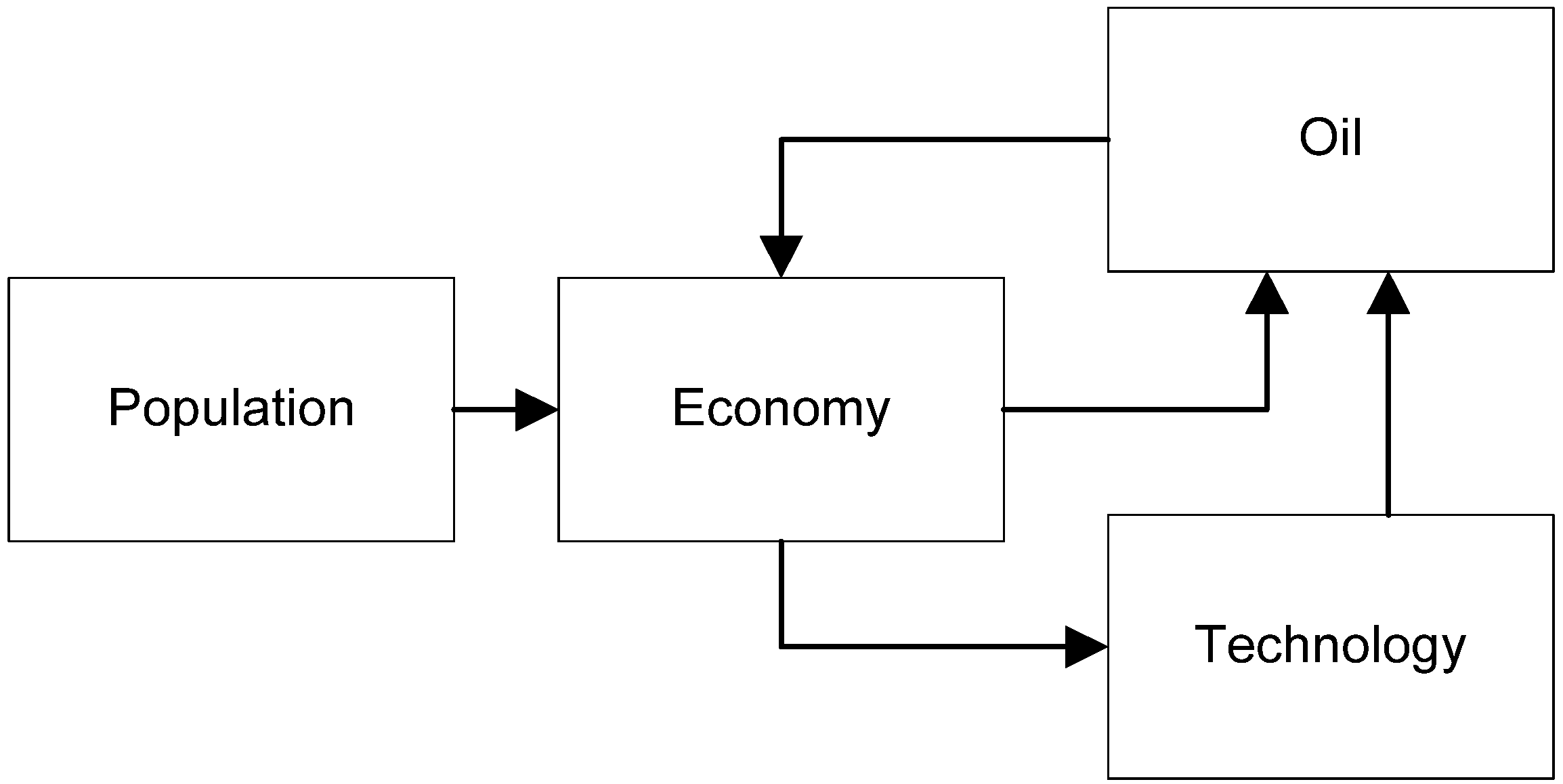

4.2. Model

4.2.1. Structure and Basic Assumptions

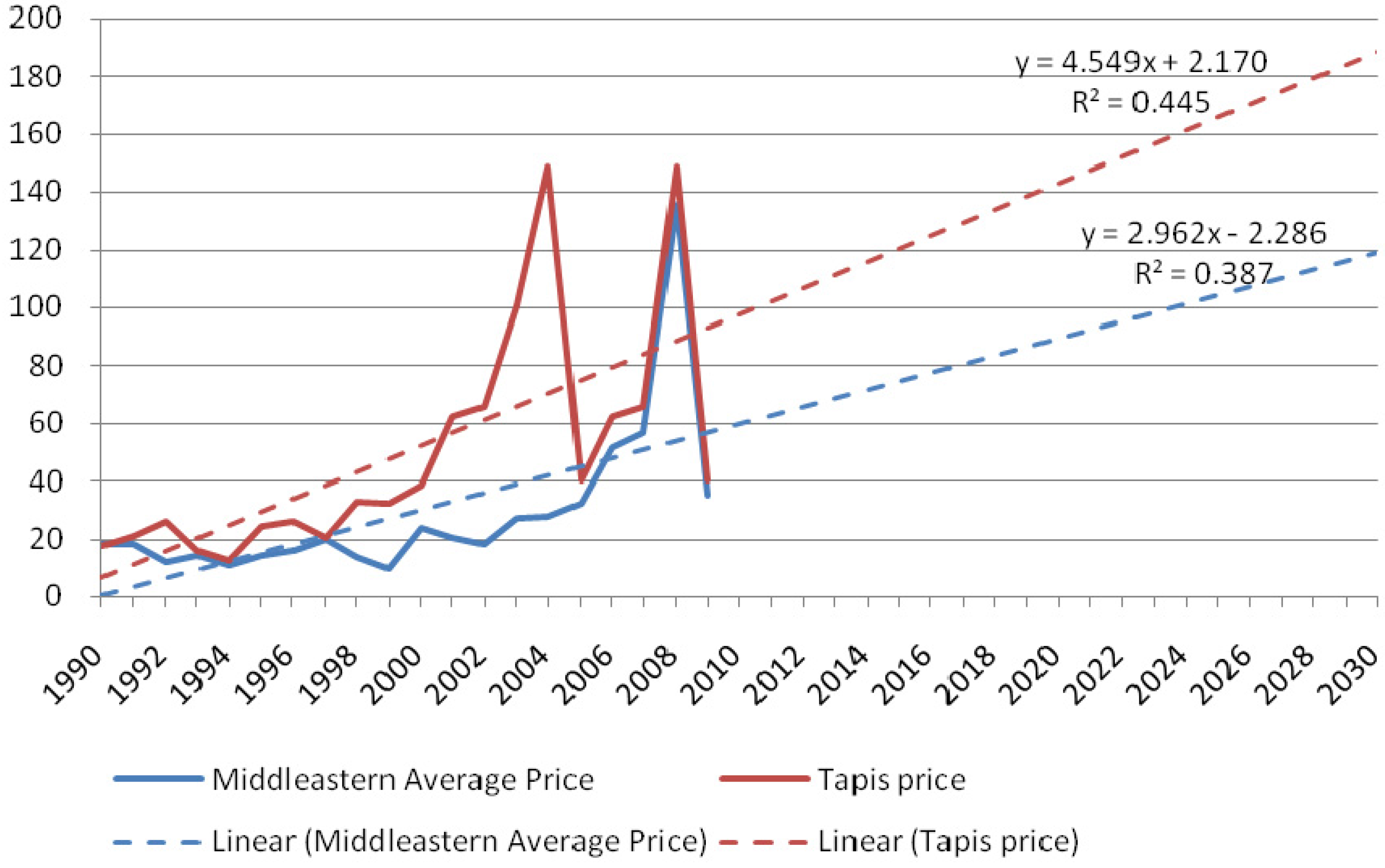

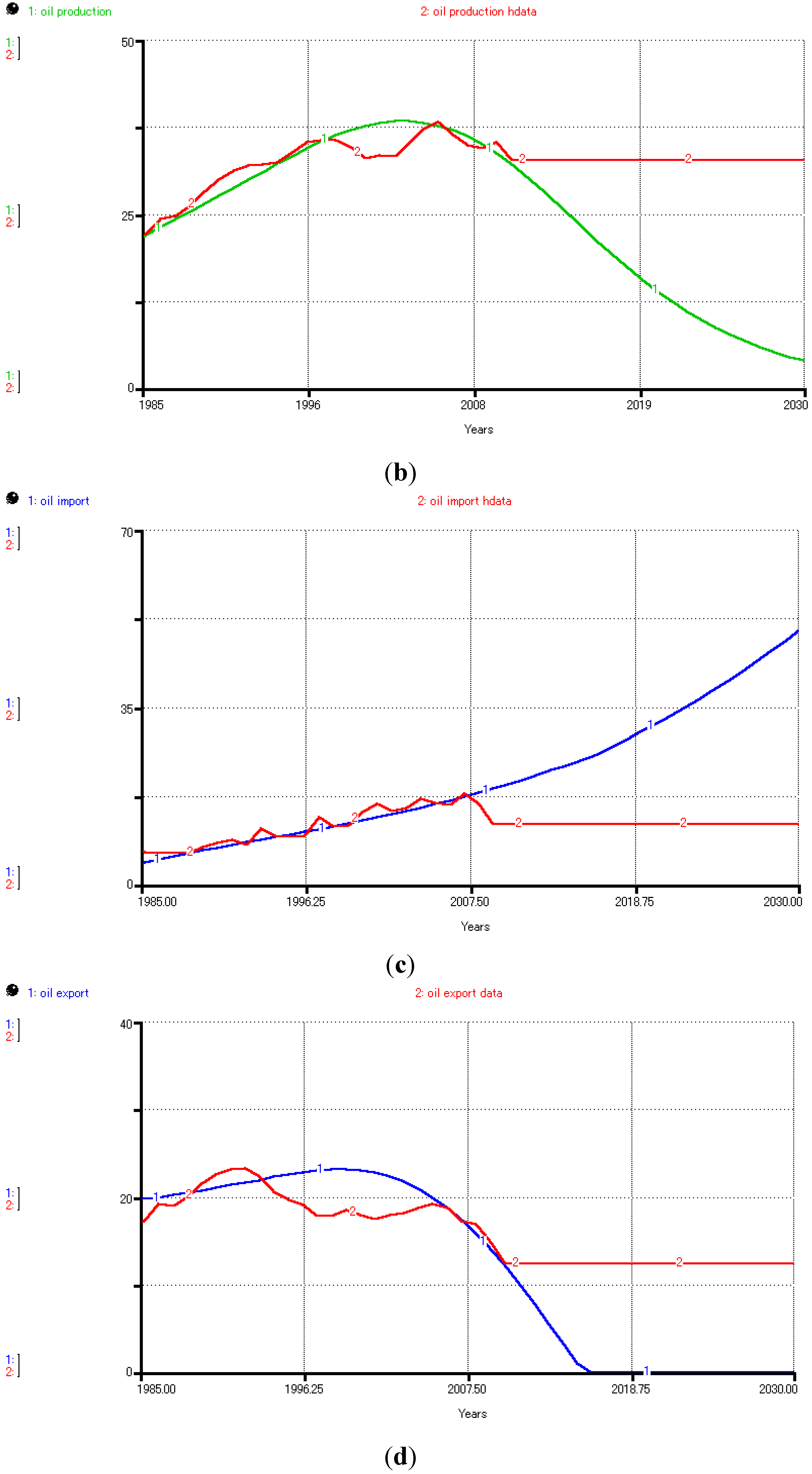

4.2.1.1. Oil Sector

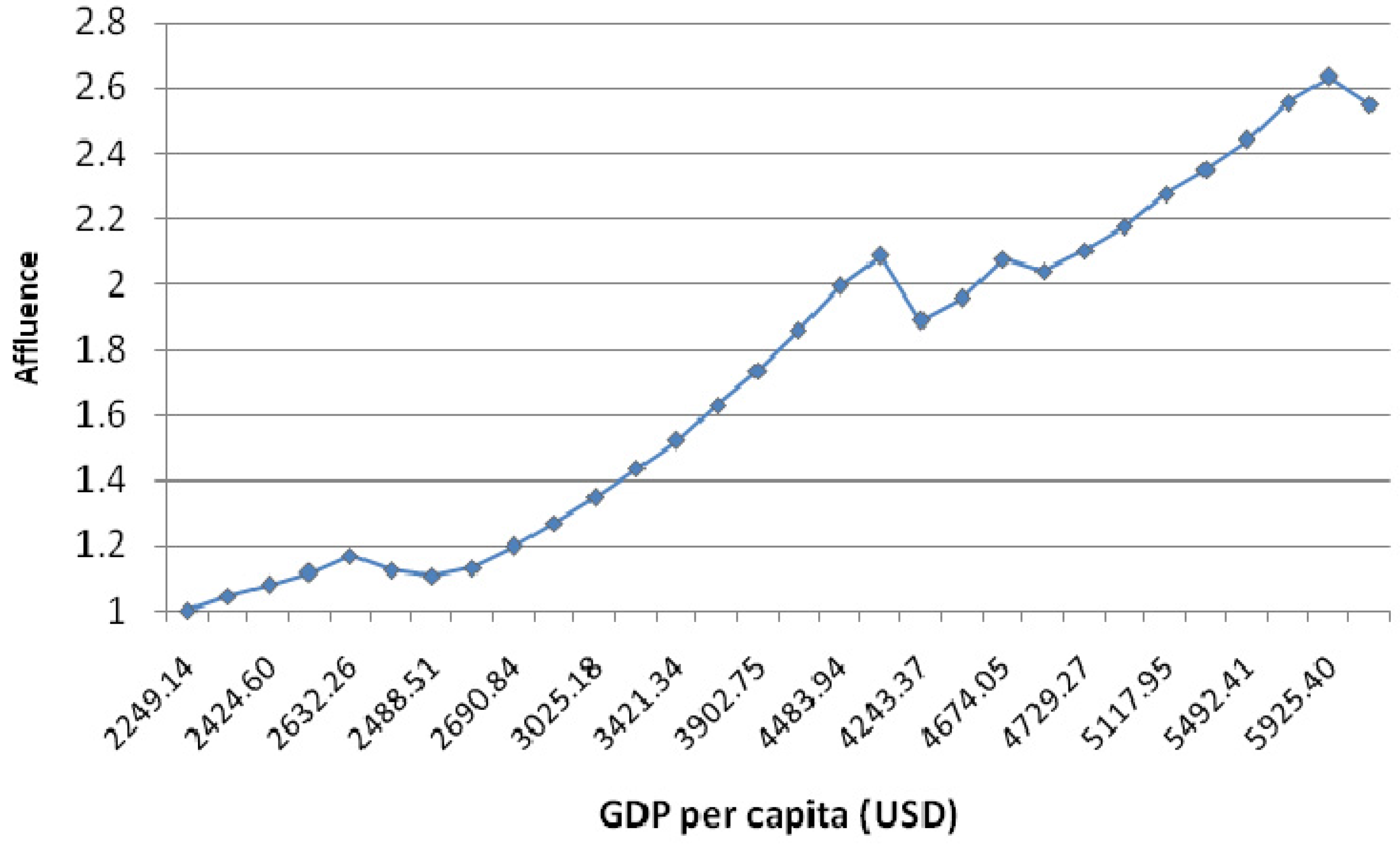

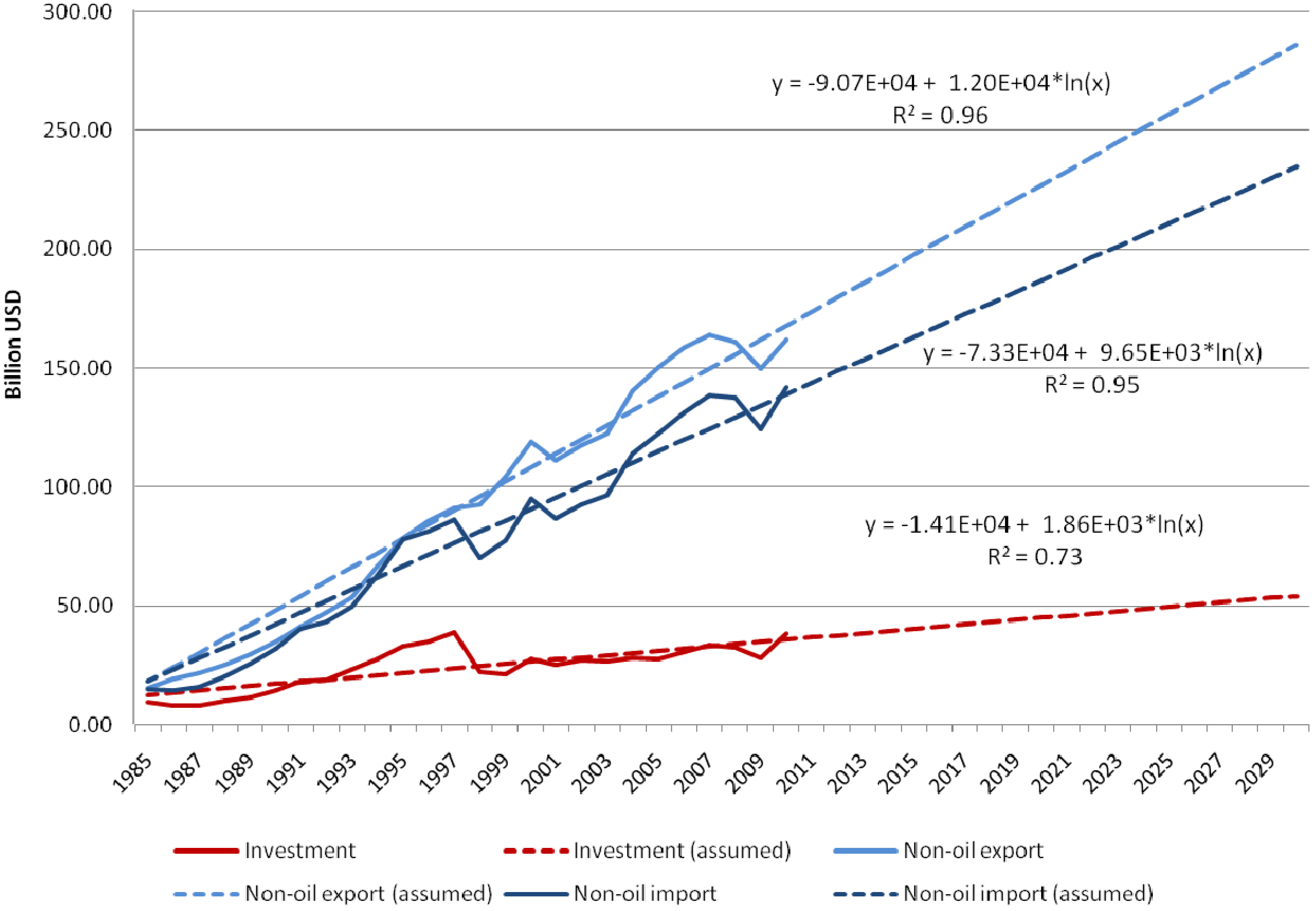

4.2.1.2. Economy Sector

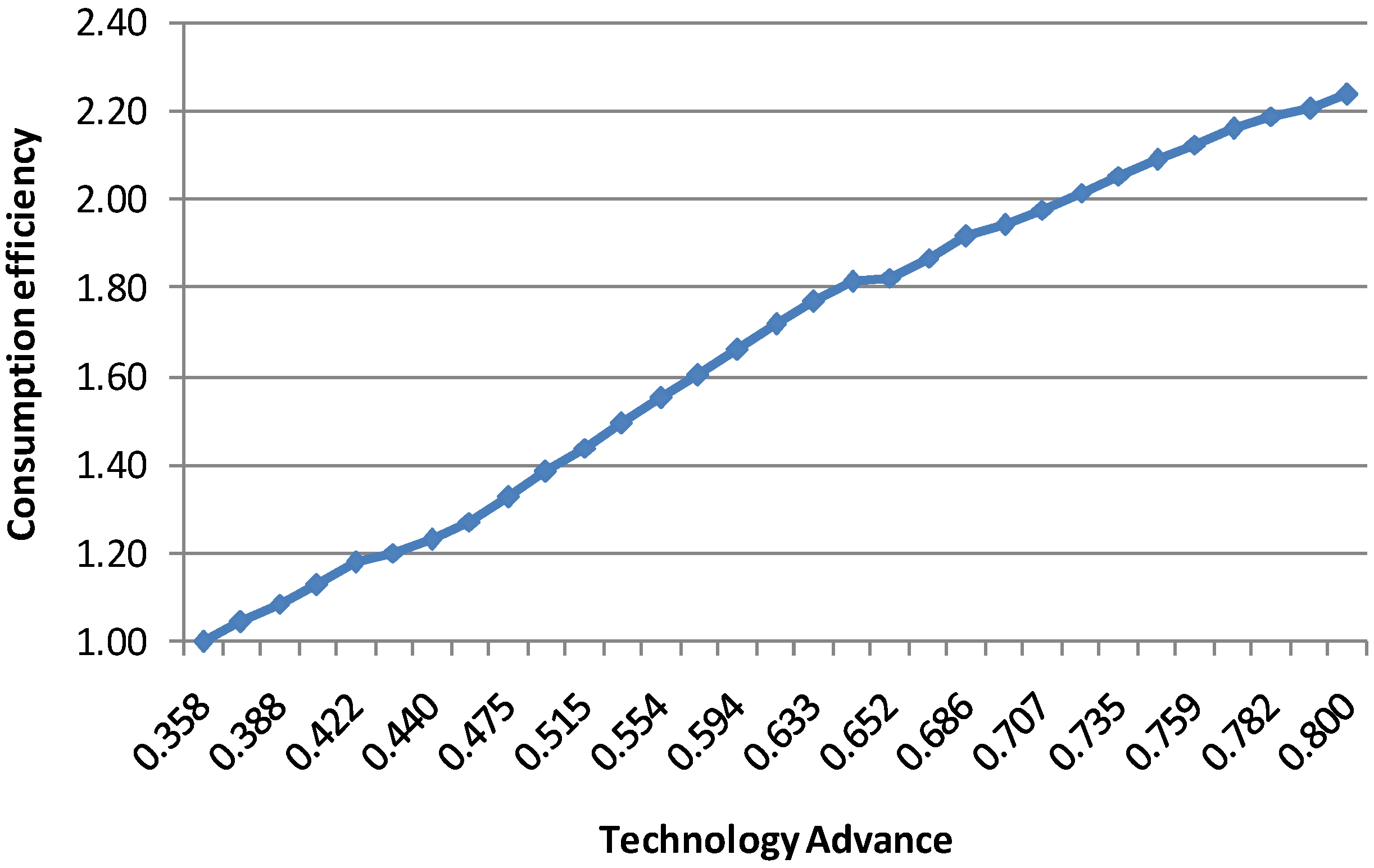

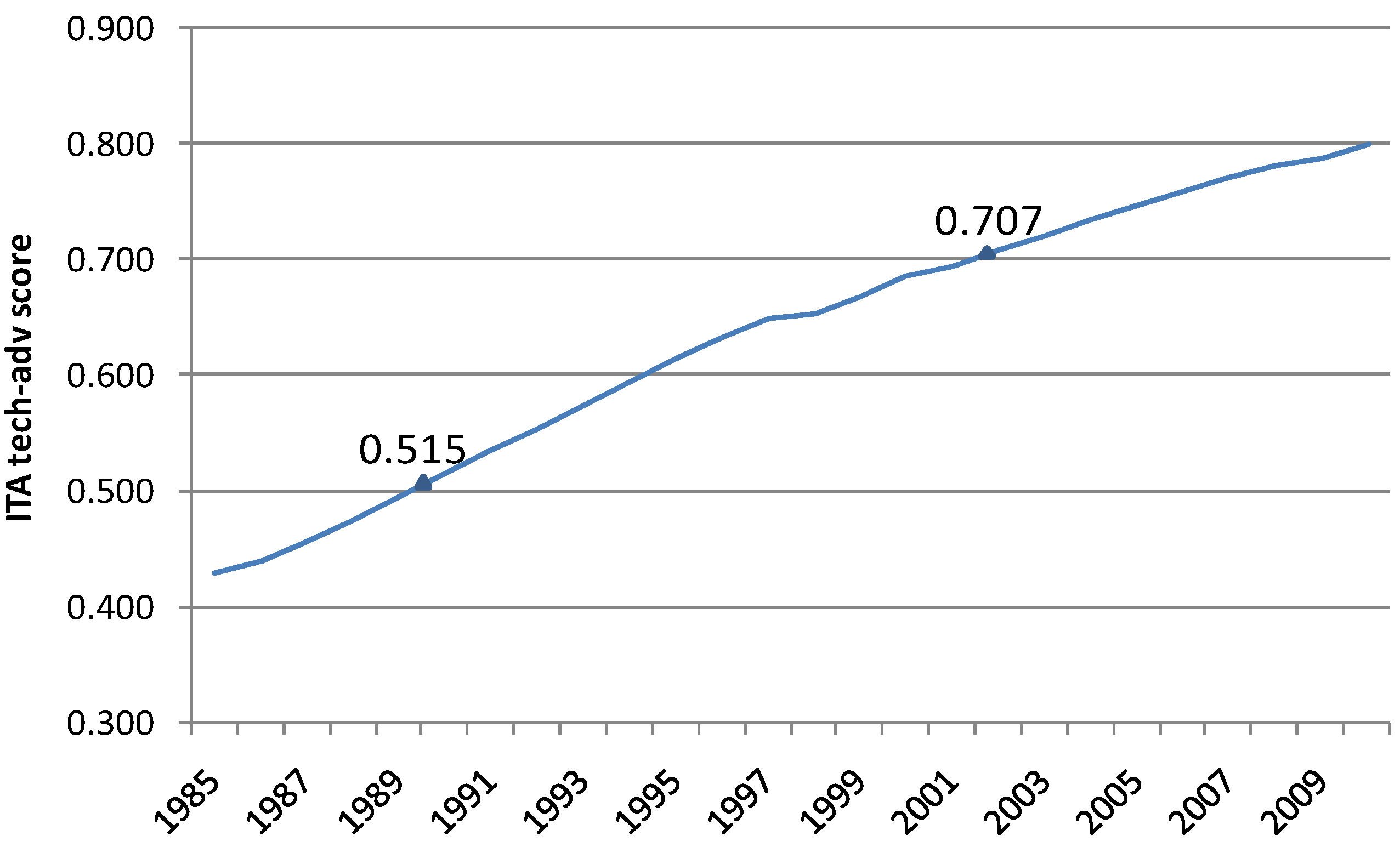

4.2.1.3. Technology Sector

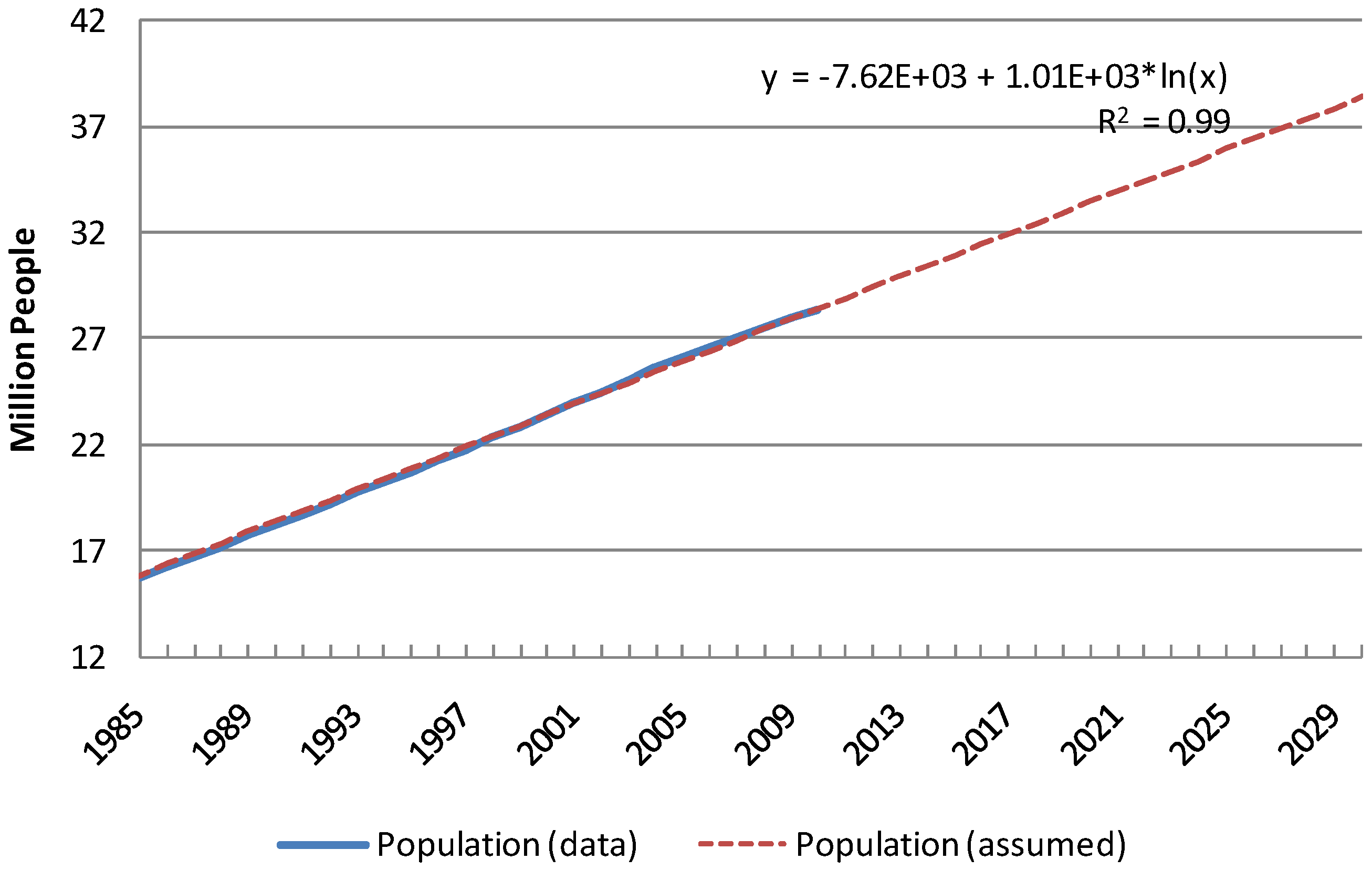

4.2.1.4. Population Sector

4.2.2. Feedback Loops

4.2.2.1. Major Loops Related to Oil Consumption Sector

4.2.2.2. Major Loops Related to Oil Production Sector

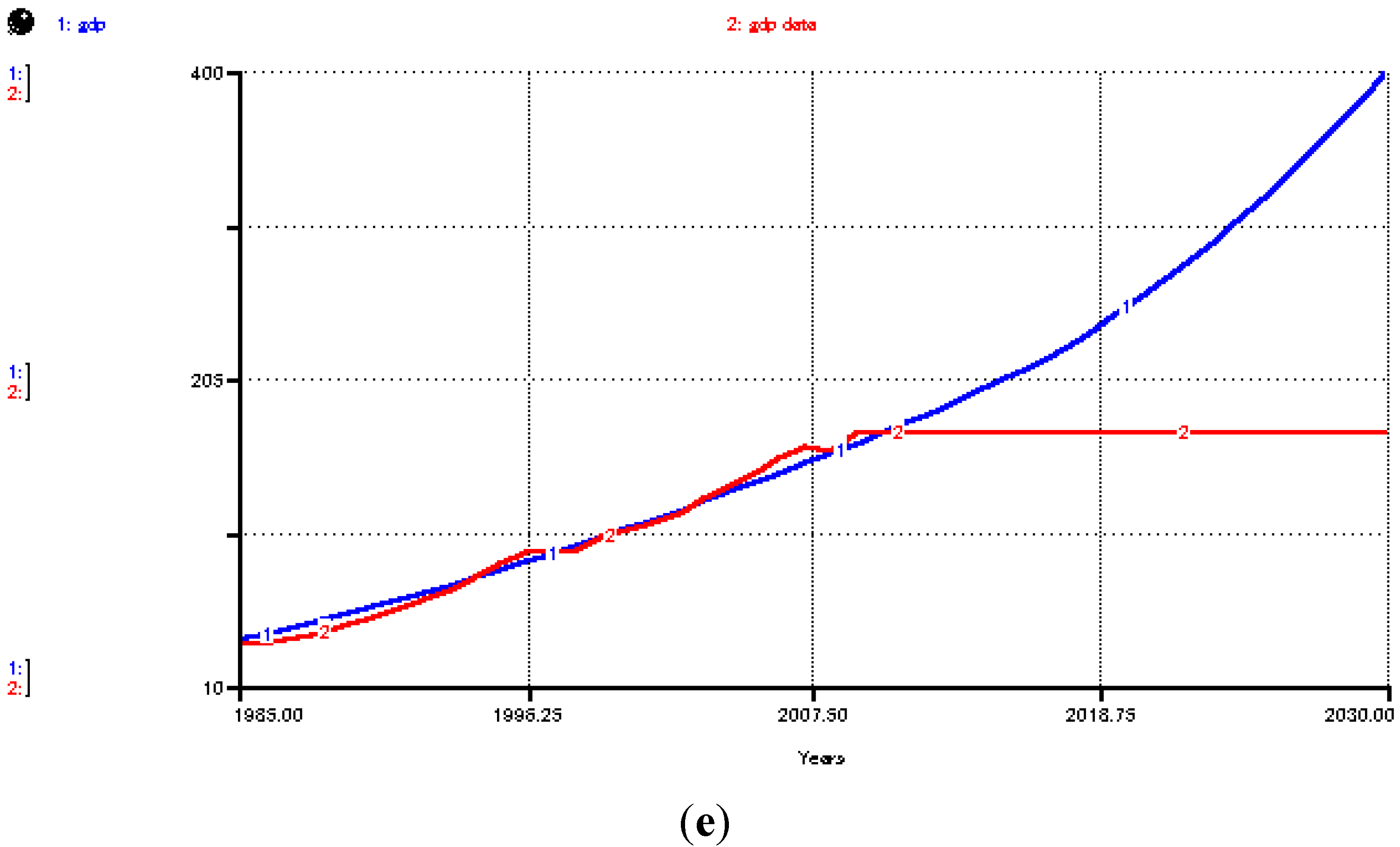

4.2.3. Validation

| Variable | Regression on historical data |

|---|---|

| Oil Consumption | CONSM = −17.46EFF + 30.047AFF − 5.44PRICE |

| R2 = 0.98 | |

| Oil Import | OM = 0.364CONSM − 0.058OP |

| R2 = 0.92 | |

| Oil Export | OX = −0.632CONSM + 0.938OP |

| R2 = 0.99 |

| Variable | MSE (unit2) | RMSE (unit) | RMSPE (%) |

|---|---|---|---|

| Oil production (Mtoe) | 4.3 | 2.1 | 0.32% |

| Oil consumption (Mtoe) | 3.8 | 1.9 | 1.97% |

| Oil export (Mtoe) | 21.0 | 4.6 | 2.2% |

| Oil import (Mtoe) | 11.6 | 3.4 | 2.1% |

| GDP (Bil. USD) | 45.5 | 6.7 | 1.41% |

4.2.4. Data

4.3. Scenarios

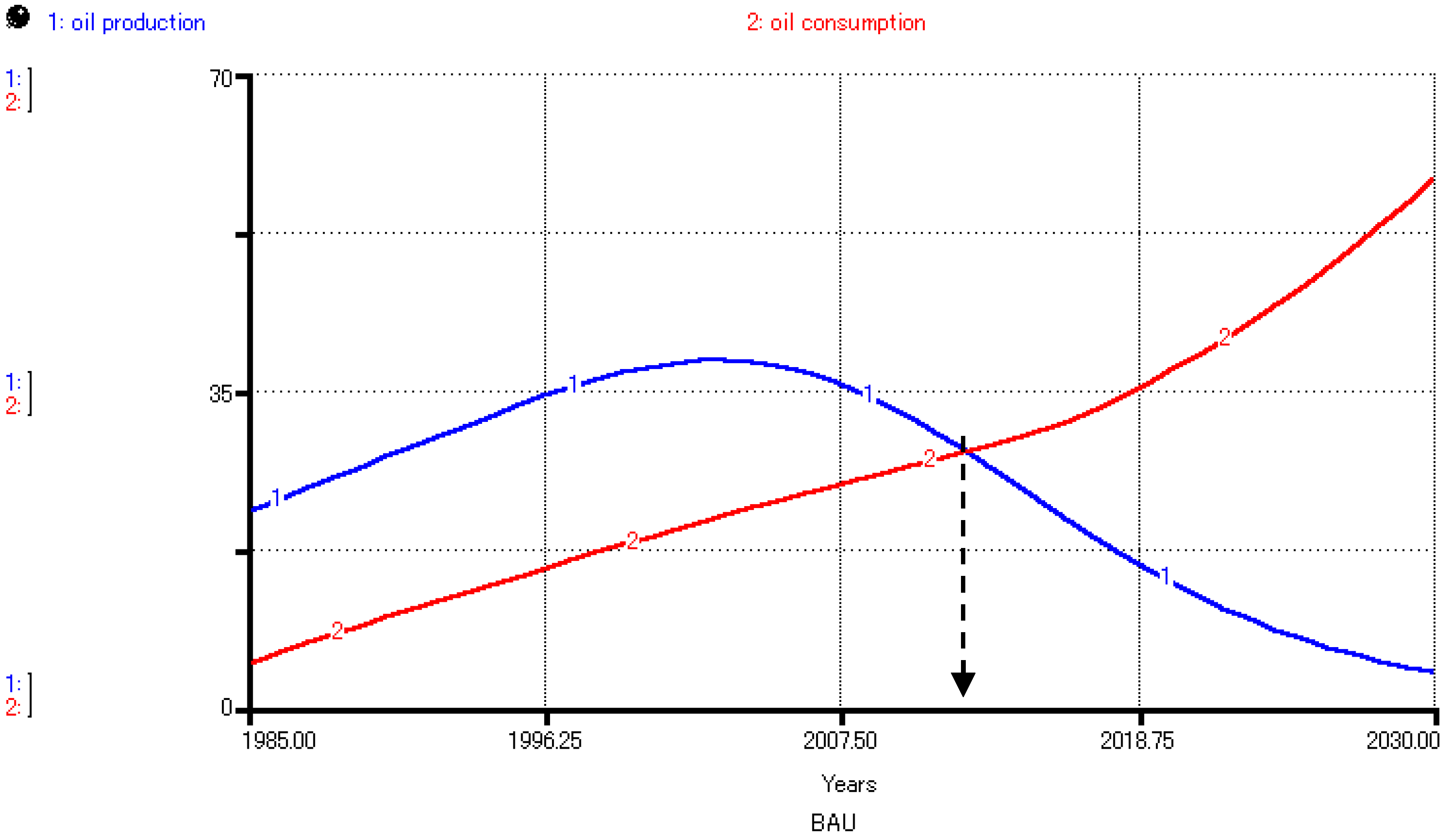

4.3.1. Business as Usual (BAU)

| Parameter | Scenario | ||||

|---|---|---|---|---|---|

| BAU | EOR | INV | TECH | SUB | |

| Subsidy | Constant at RM 2.46 | as BAU | as BAU | as BAU | Decrease to RM 0 in 2020 |

| Technology advance growth | 1× | as BAU | as BAU | 3× faster | as BAU |

| Intrinsic growth | Constant at 0.079 | Increase 32.8% annually from 2014 to 2020 | as BAU | as BAU | as BAU |

| E&P investment growth | Constant growth at 35% annually | as BAU | 75% annual growth from 2010 to 2015; 50% annual growth from 2016 to 2020 | as BAU | as BAU |

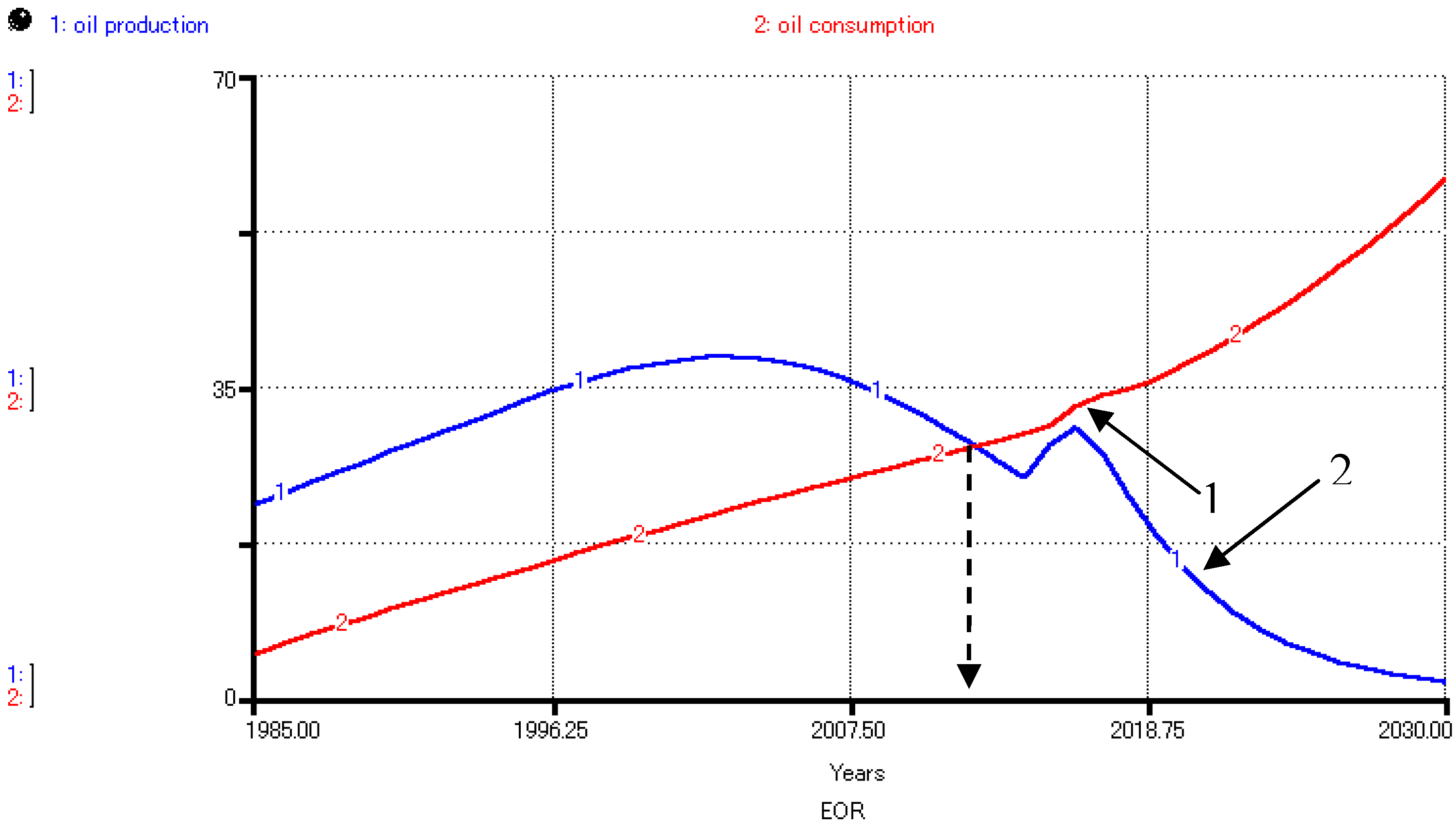

4.3.2. Enhanced Oil Recovery (EOR)

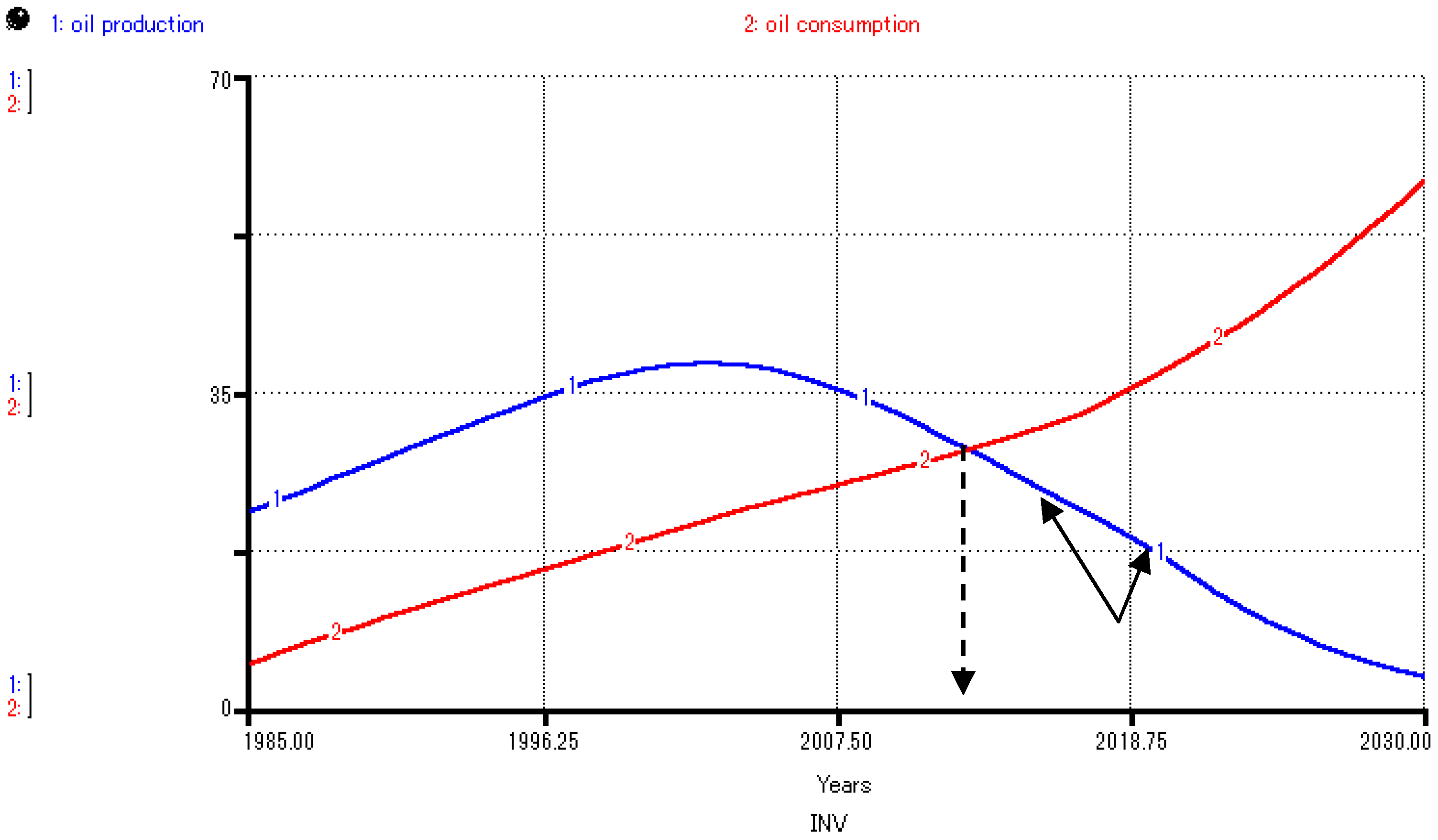

4.3.3. Investment (INV)

4.3.4. Technology Advance (TECH)

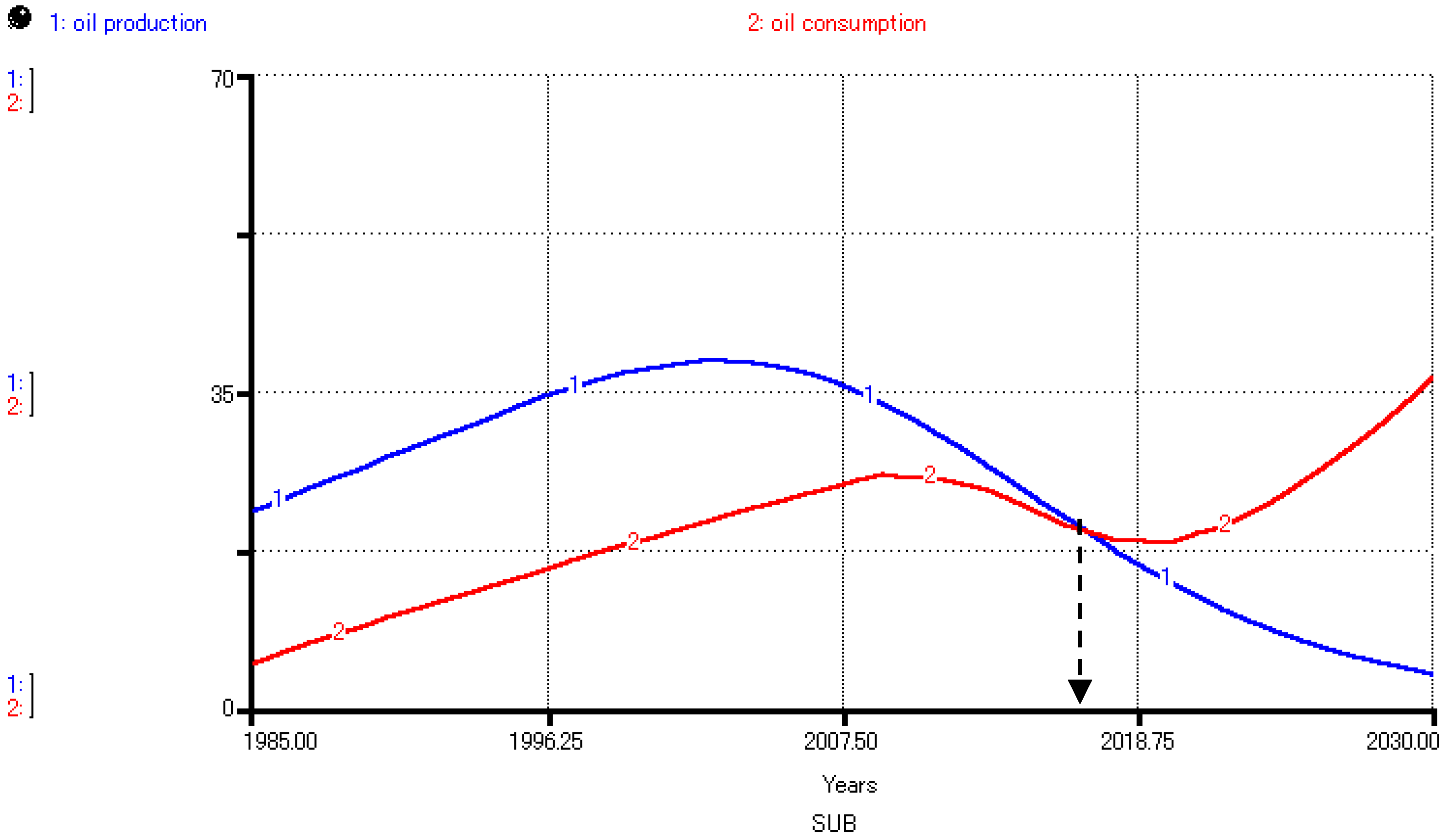

4.3.5. Subsidy (SUB)

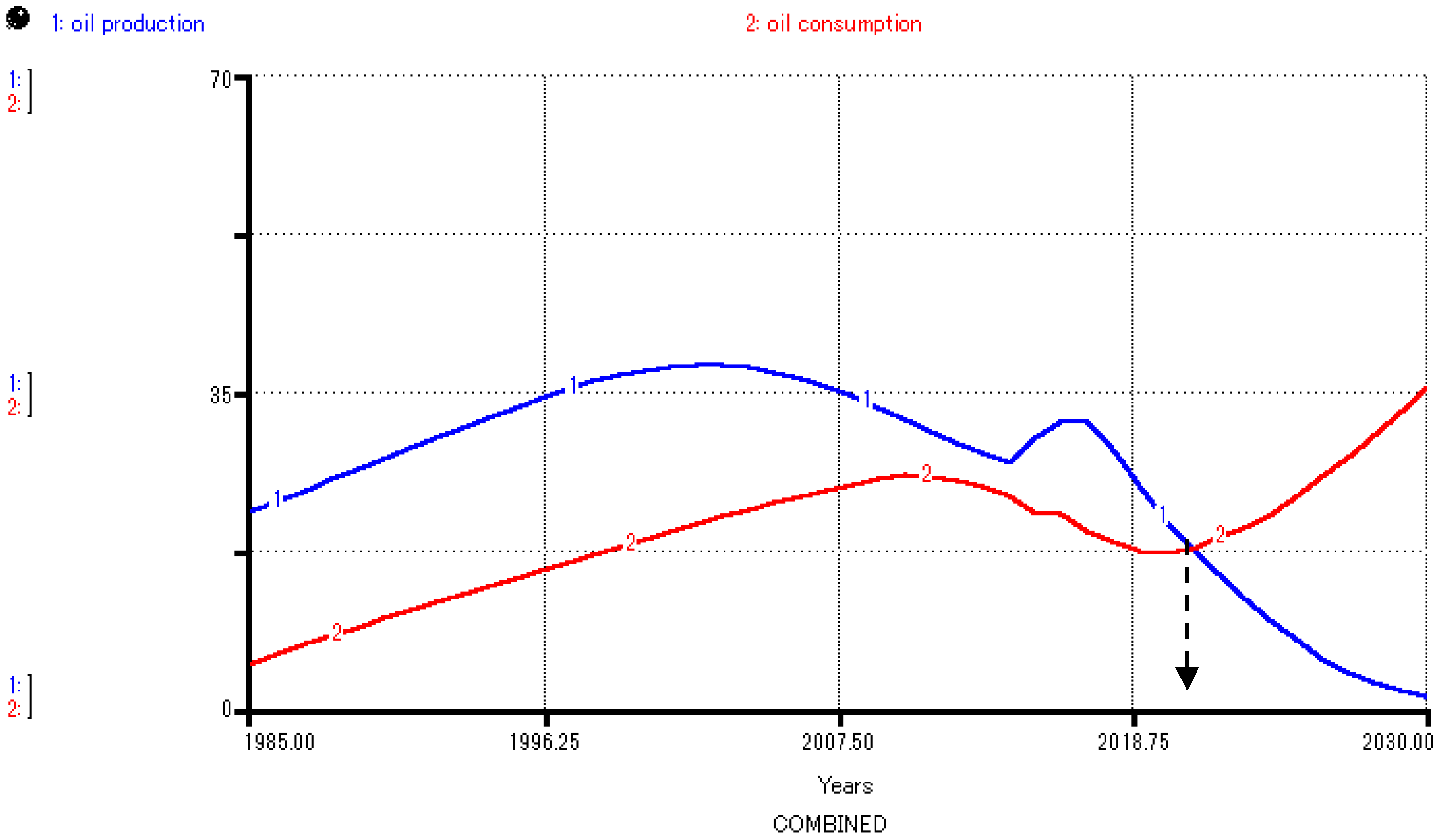

4.3.6. Combined

5. Results and Discussion

5.1. Transformation to Net Oil Importer

5.2. Oil Import Dependence

5.3. Discussion

| Predicted Transformation Year | |

|---|---|

| NEAC (2005) | 2009 |

| CPPS (2008) | 2012 |

| Gan and Li (2008) | 2013 |

| Bernama (2010) | 2011 |

| This study | 2012, 2017, 2021 |

6. Conclusions

Abbreviations

| API | American Petroleum Institute |

| BAU | Business as usual (scenario) |

| bbl/d | barrel per day |

| EOR | Enhance Oil Recovery |

| EOR * | Enhance oil recovery implementation (* scenario)

|

| INV | High Investment (scenario) |

| ITA | Industrial-cum-Technology Advance |

| L | Litre |

| MMBOE | Million barrels of oil equivalent |

| MMSTB | Million stock tank barrels |

| Mtoe | Million ton of oil equivalent |

| RM | Ringgit Malaysia |

| SUB | Subsidy elimination (scenario) |

| TECH | Fast New Technology adoption (scenario) |

Acknowledgement

References

- The Institute of Energy Economics. IEEJ. APEC Energy Database. Available online: http://www.ieej.or.jp/egeda/index.html (accessed on 27 January 2011).

- United Nations Statistics Division. National Accounts Statistics: Main Aggregates and Detailed Tables. 2011. Available online: http://unstats.un.org (accessed on 27 January 2011).

- EIA. International Petroleum (Oil) Prices; U.S. Energy Information Administration. 2011. Available online: http://www.eia.gov/emeu/international/oilprice.html (accessed on 5 January 2011). [Google Scholar]

- National Economic Action Council. Oil Prices and Subsidies (An Explanation); National Economic Action Council: Kualalumpur, Malaysia, 2005. [Google Scholar]

- Ministry of Energy, Water and Communication Malaysia. Integrated Energy Analysis for Malaysia Using the ENPEP Model—Final Report; MEWC: Kualalumpur, Malaysia, 1991. [Google Scholar]

- Agence de I’Environment et de la Maitrise de I’Energie. Study on Energy Policy Analysis and Planning to the Year 2020—Energy Demand for Malaysia to 2020; Agence de I’Environment et de la Maitrise de I’Energie: Kualalumpur, Malaysia, 1996. [Google Scholar]

- Malaysia Energy Center. Long-term National Strategy for the Malaysian Energy Sector—Synthesis Report; MEC: Selangor, Malaysia, 2000. [Google Scholar]

- Gan, P.Y.; Li, Z.D. An econometric study on long-term energy outlook and the implications of renewable energy utilization in Malaysia. Energy Policy 2008, 36, 890–899. [Google Scholar] [CrossRef]

- Centre for Public Policy Studies. Policy Fact Sheet: Oil and Gas. 2008. Available online: http://www.cpps.org.my (accessed on 1 February 2012).

- Bernama Malaysian News Agency. Malaysia Likely to be Net Oil Importer by 2011. Available online: http://www.bernama.com (accessed on 12 January 2012).

- International Energy Agency. World Energy Outlook 2011; IEA: Paris, France, 2011. [Google Scholar]

- Asia Pacific Energy Research Centre. APEC Energy Overview 2010; APEC: Tokyo, Japan, 2011. [Google Scholar]

- Ong, H.C.; Mahlia, T.M.I.; Masjuki, H.H. A review on energy pattern and policy for transportation sector in Malaysia. Renew. Sustain. Energy Rev. 2012, 16, 532–542. [Google Scholar] [CrossRef]

- Institute of Energy Economics Japan. Peer Review on Energy Efficiency in Malaysia; APEC: Tokyo, Japan, 2011. [Google Scholar]

- Jayed, M.H.; Masjuki, H.H.; Kalam, M.A.; Mahlia, T.M.I.; Husnawan, M.; Liaquat, A.M. Prospects of dedicated biodiesel engine vehicles in Malaysia and Indonesia. Renew. Sustain. Energy Rev. 2011, 15, 220–235. [Google Scholar] [CrossRef]

- Malaysiakini. RON97 price hits record high at RM2.90 per litre. Available online: http://www.malaysiakini.com/news/163256 (accessed on 23 February 2012).

- Ministry of Energy, Green Technology and Water. Malaysian Energy Efficiency Improvement Programme (MIEEIP). Available online: http://www.kettha.gov.my (accessed on 23 February 2012).

- Energy Information Administration. International Energy Statistics. Available online: http://www.eia.gov/countries/data.cfm (accessed on 15 June 2012).

- Ong, H.C.; Mahlia, T.M.I.; Masjuki, H.H. A review on energy scenario and sustainable energy in Malaysia. Renew. Sustain. Energy Rev. 2011, 15, 639–647. [Google Scholar] [CrossRef]

- Petronas. 2010 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2010. [Google Scholar]

- Petronas. Media Release—2011: Petronas Carigali Finds Oil off Sabah. Available online: http://www.petronas.com.my/media-relations/media-releases/Pages/article/PETRONAS-CARIGALI-FINDS-OIL-OFF-SABAH.aspx (accessed on 23 February 2012).

- Petronas. Media Release—2011: Petronas Carigali Finds New Oil and Gas Fields off Sarawak. Available online: http://www.petronas.com.my/media-relations/media-releases/Pages/article/PETRONAS-FINDS-NEW-OIL-AND-GAS-FIELDS-OFFSHORE-SARAWAK.aspx (accessed on 23 February 2012).

- Hamdan, M.K.; Darman, N.; Hussain, D.; Ibrahim, Z. Enhanced Oil Recovery in Malaysia: Making It a Reality. In Proceedings of SPE Asia Pacific Oil & Gas Conference and Exhibition, Jakarta, Indonesia, 5–7 April 2005; Society of Petroleum Engineers: Jakarta, Indonesia, 2005. [Google Scholar]

- Samsudin, Y.; Darman, N.; Husain, D.; Hamdan, M.K. Enhanced Oil Recovery in Malaysia: Making It a Reality (Part II). In Proceedings of SPE International Improved Oil Recovery Conference in Asia Pacific, Kuala Lumpur, Malaysia, 5–6 December 2005; Society of Petroleum Engineers: Kuala Lumpur, Malaysia, 2005. [Google Scholar]

- Petronas. 2011 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2011. [Google Scholar]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; McGraw Hill: Boston, MA, USA, 2000. [Google Scholar]

- Sovacool, B.K.; Mukherjee, I.; Drupady, I.M.; D’Agostino, A.L. Evaluating energy security performance from 1990 to 2010 for eighteen countries. Energy 2001, 36, 5846–5853. [Google Scholar] [CrossRef]

- Bassi, A.M. Evaluating the use of an integrated approach to support energy and climate policy formulation and evaluation. Energies 2010, 3, 1604–1621. [Google Scholar] [CrossRef]

- Kiani, B.; Mirzamohammadi, S.; Hosseini, S.H. A Survey on the role of system dynamics methodology on fossil fuel resources analysis. Int. Bus. Res. 2010, 3. [Google Scholar]

- Brandt, A.R.; Plevin, R.J.; Farrell, A.E. Dynamics of the oil transition: Modeling capacity, depletion, and emissions. Energy 2010, 35, 2852–2860. [Google Scholar] [CrossRef]

- Kiani, B.; Pourfakhraei, M.A. A system dynamic model for production and consumption policy in Iran oiland gas sector. Energy Policy 2010, 38, 7764–7774. [Google Scholar] [CrossRef]

- Tang, X.; Zang, B.; Höök, M.; Feng, L. Forecast of oil reserves and production in Daqing oilfield of China. Energy 2010, 35, 3097–3102. [Google Scholar] [CrossRef]

- Albin, S. Building A System Dynamics Model Part 1: Conceptualization; Massachusetts Institute of Technology: Cambridge, MA, USA, 2001. [Google Scholar]

- Hubbert, M.K. Nuclear energy and the fossil fuels. In Drilling and Production Practice, 1st ed.; The American Petroleum Institute: New York, NY, USA, 1956; pp. 7–25. [Google Scholar]

- Hubbert, M.K. Techniques of Prediction as Applied to Production of Oil and Gas (NBS Special Publication); US Department of Commerce: Gaithersburg, MD, USA, 1982; pp. 1–121. [Google Scholar]

- Laherrere, J.H. The Hubbert Curve: Its Strength and Weaknesses. 2000. Available online: http://dieoff.org/page191.htm (accessed on 15 June 2012).

- New Strait Times. Petronas denies discovery of huge oil field off Malaysia, Year. Available online: http://business.asiaone.com/Business/News/Story/A1Story20100325–206612.html (accessed on 15 June 2012).

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2005. [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2006. [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2007. [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2008. [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2009. [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe. Annual Report: Reserves, Resources and Availability of Energy Resources; BGR: Hannover, Germany, 2011. [Google Scholar]

- Petronas. 2005 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2005. [Google Scholar]

- Petronas. 2006 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2006. [Google Scholar]

- Petronas. 2007 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2007. [Google Scholar]

- Petronas. 2008 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2008. [Google Scholar]

- Petronas. 2009 Annual Report; Petroleam Nasional Berhad: Kualalumpur, Malaysia, 2009. [Google Scholar]

- British Petroleum. Statistical Review of World Energy; BP: London, UK, 2011. [Google Scholar]

- United Nations Industrial Development Organization. Capability Building for Catching-Up: Historical, Empirical and Policy Dimensions; UNIDO: Vienna, Austria, 2005. [Google Scholar]

- United Nations Statistics Division. Global Indicator Database. 2011. Available online: http://data.un.org/Data.aspx (accessed on 11 December 2011).

- Bernama Malaysian News Agency. Government announces subsidy reductions for fuel, sugar. 2010. Available online: http://www.bernama.com.my/bernama/v6/newsindex.php?id=547623 (accessed on 12 January 2012).

- Ministry of Energy, Green Technology and Water. The Green Technology Financing Scheme Guidelines. 2010. Available online: http://www.gtfs.my/page/gtfs-guideline (accessed on 12 January 2012).

- Bernama Malaysian News Agency. Kerajaan Tidak Hasrat Naik Harga Petrol RON95-Ismail Sabri. 2012. Available online: http://bernama.com.my/bernama/v6/bm/newsindex.php?id=659188 (accessed on 17 April 2012).

- Thestar. RON 95 price stays despite dearer fuel, says Ismail. 2012. Available online: http://thestar.com.my/news/story.asp?file=/2012/4/16/nation/11112904&sec=nation (accessed on 17 April 2012).

- Roy, J. The rebound effect: Some empirical evidence from India. Energy Policy 2000, 28, 433–438. [Google Scholar] [CrossRef]

- Syarifuddin, F. Oil Dependency and Energy Policy in Indonesia. 2007. Available online: http://www.bi.go.id/web/en/Publikasi/Kertas+Kerja+dan+Materi+Seminar/Kertas+Kerja/default.htm?Page=3&Year=0 (accessed on 17 June 2012).

- Beaton, C.; Lontoh, L. Lessons learned from Indonesia’s attempts to reform fossil-fuel subsidies. Available online: http://www.iisd.org/publications/pub.aspx?id=1355 (accessed on 19 June 2012).

- Abdo, H. UK energy security: Challenges, threats and solutions. Energy Sci. Technol. 2011, 1, 38–53. [Google Scholar]

- Leung, G.C.K.; Li, R.; Low, M. Transitions in China’s oil economy, 1990–2010. Eurasian Geogr. Econ. 2011, 52(4), 483–500. [Google Scholar]

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi dan Sumber daya Mineral Nomor: 03 TAHUN 2010. Tentang Alokasi dan Pemanfaatan Gas Bumi, Untuk Pemenuhan Kebutuhan dalam Negeri [In Indonesian]; MEMR: Jakarta, Indonesia, 2010. [Google Scholar]

- Ministry of Energy and Mineral Resources. Persentase Minimal Penjualan Batubara Dalam Negeri. Available online: www.esdm.go.id (accessed on 6 March 2011).

- Chester, L. Conceptualising energy security and making explicit its polysemic nature. Energy Policy 2010, 38, 887–895. [Google Scholar] [CrossRef]

- Vivoda, V. Evaluating energy security in the Asia-Pacific region: A novel methodological approach. Energy Policy 2010, 38, 5258–5263. [Google Scholar] [CrossRef]

© 2012 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Prambudia, Y.; Nakano, M. Exploring Malaysia’s Transformation to Net Oil Importer and Oil Import Dependence. Energies 2012, 5, 2989-3018. https://doi.org/10.3390/en5082989

Prambudia Y, Nakano M. Exploring Malaysia’s Transformation to Net Oil Importer and Oil Import Dependence. Energies. 2012; 5(8):2989-3018. https://doi.org/10.3390/en5082989

Chicago/Turabian StylePrambudia, Yudha, and Masaru Nakano. 2012. "Exploring Malaysia’s Transformation to Net Oil Importer and Oil Import Dependence" Energies 5, no. 8: 2989-3018. https://doi.org/10.3390/en5082989