Economic Assessment of Flood Control Facilities under Climate Uncertainty: A Case of Nakdong River, South Korea

Abstract

:1. Introduction

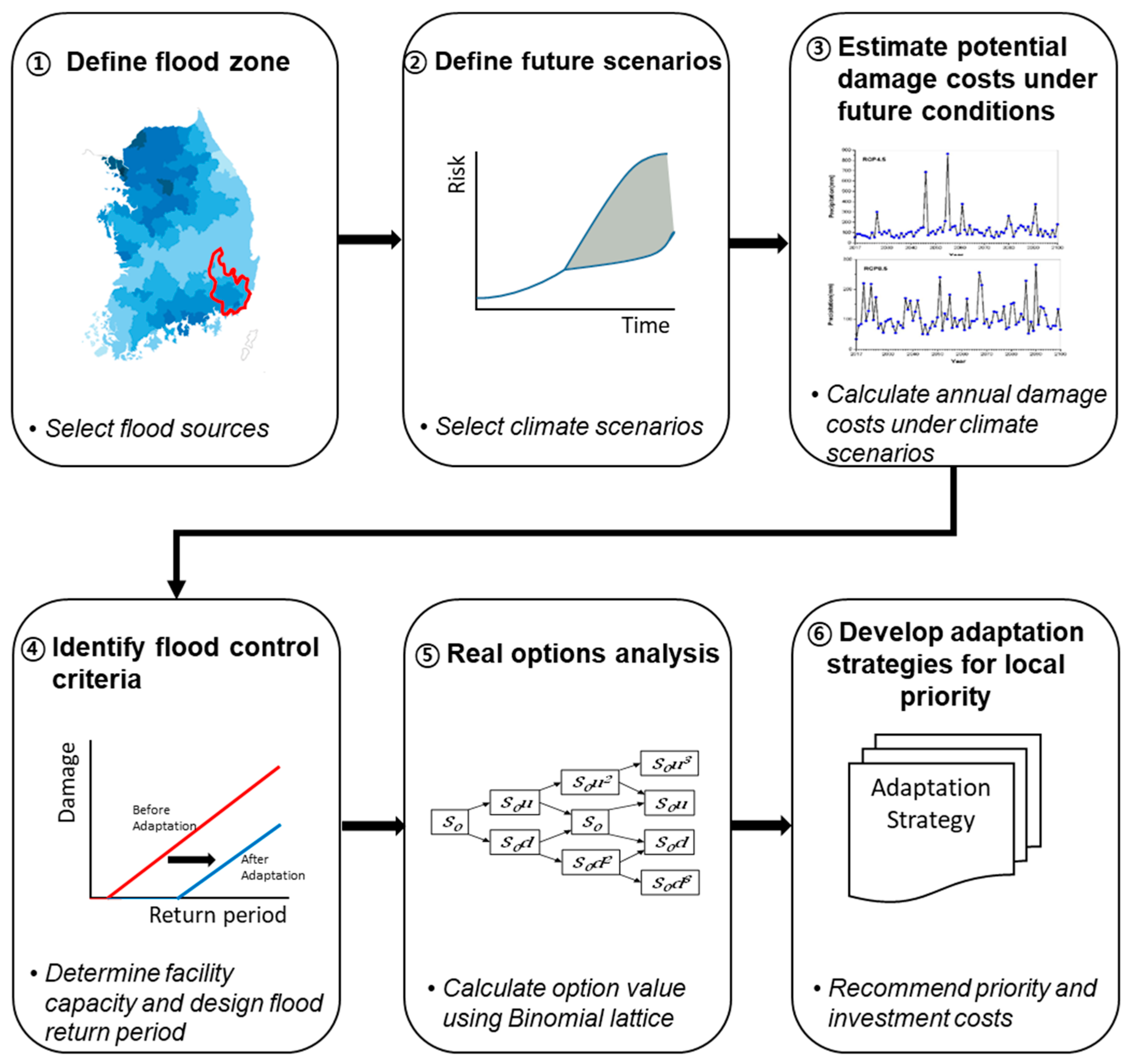

2. Methods

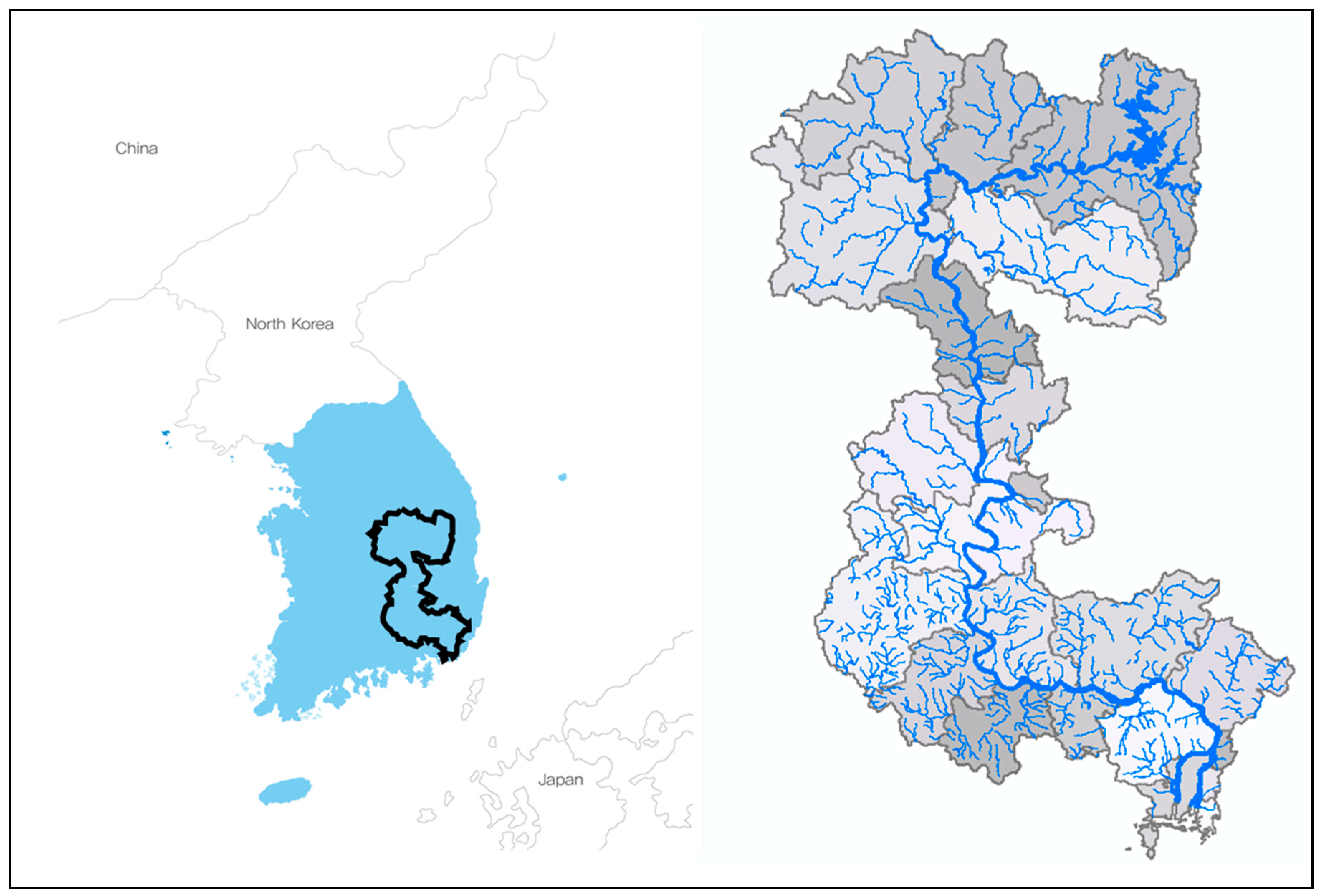

3. A Case Study of the Nakdong River Basin

3.1. Project Description

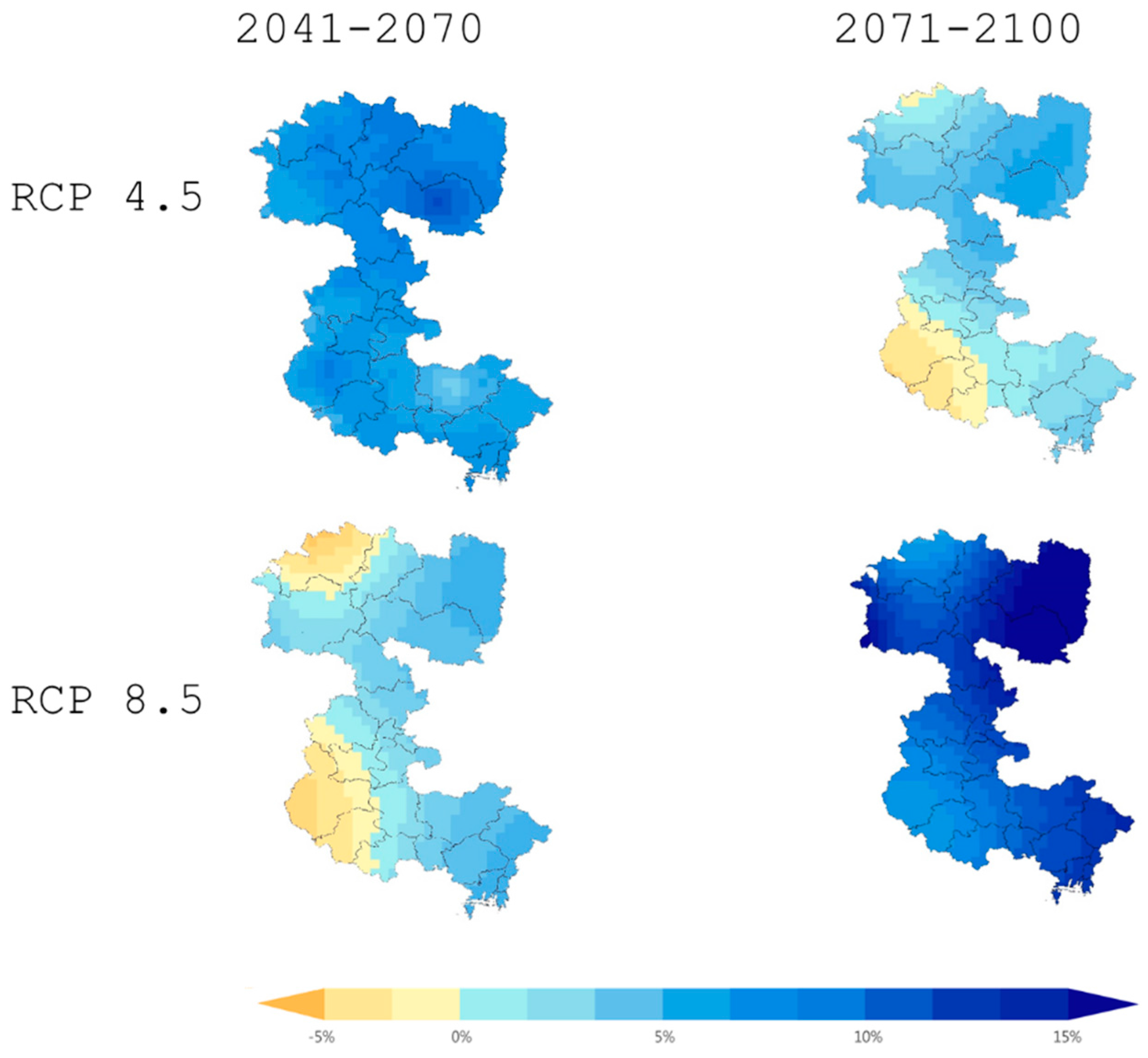

3.2. Case Study Conditions and Input Parameters

4. Results and Discussion

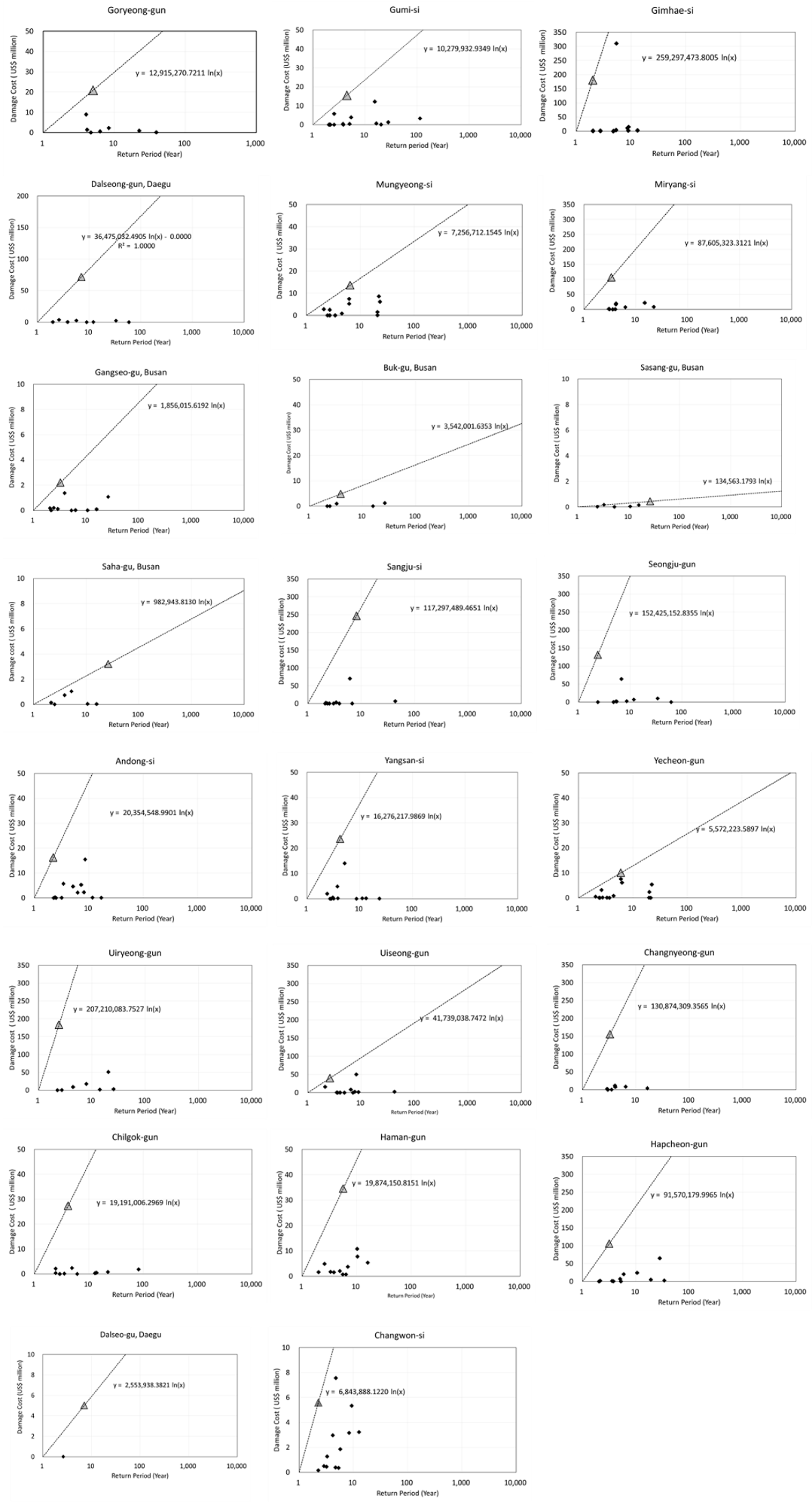

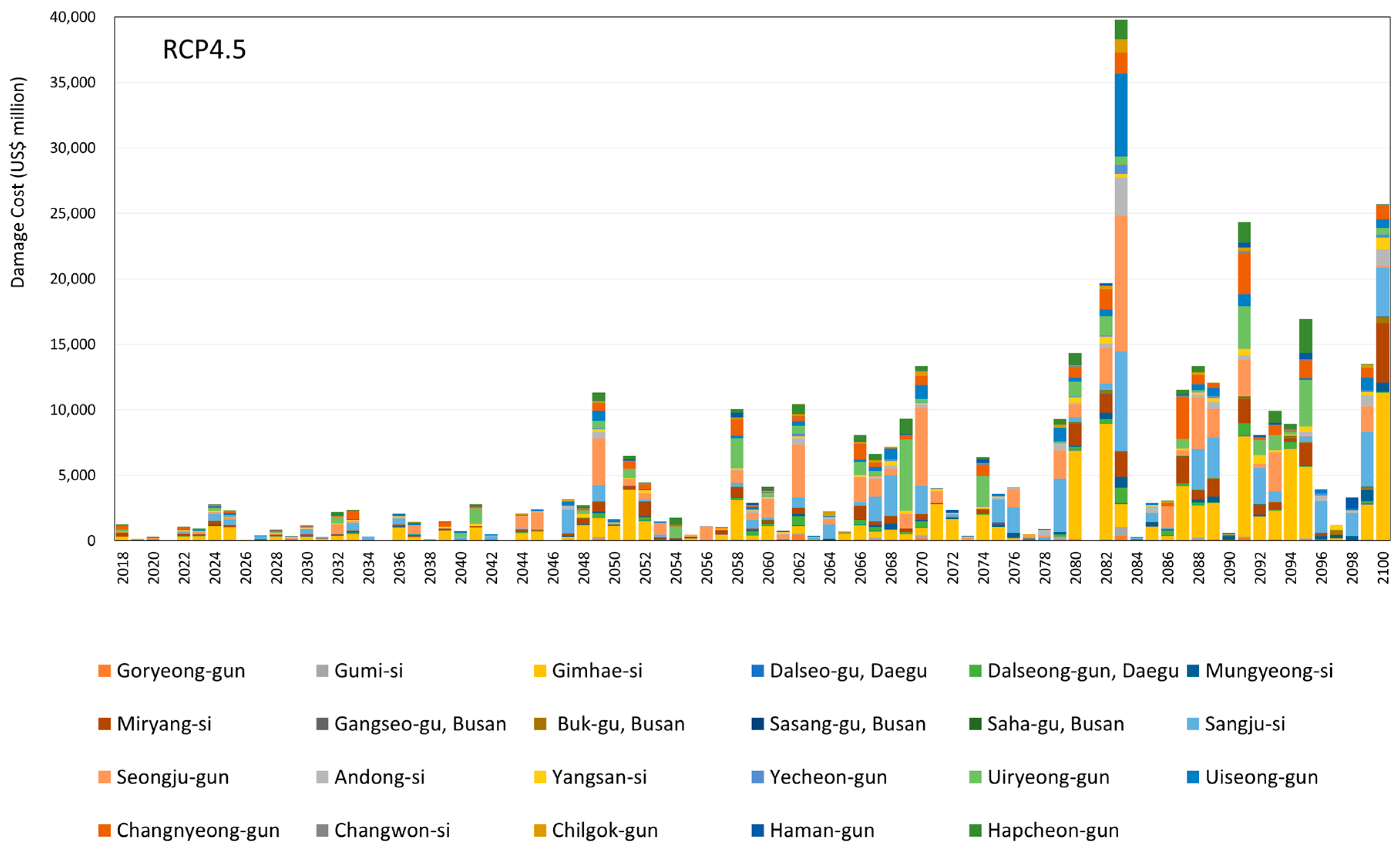

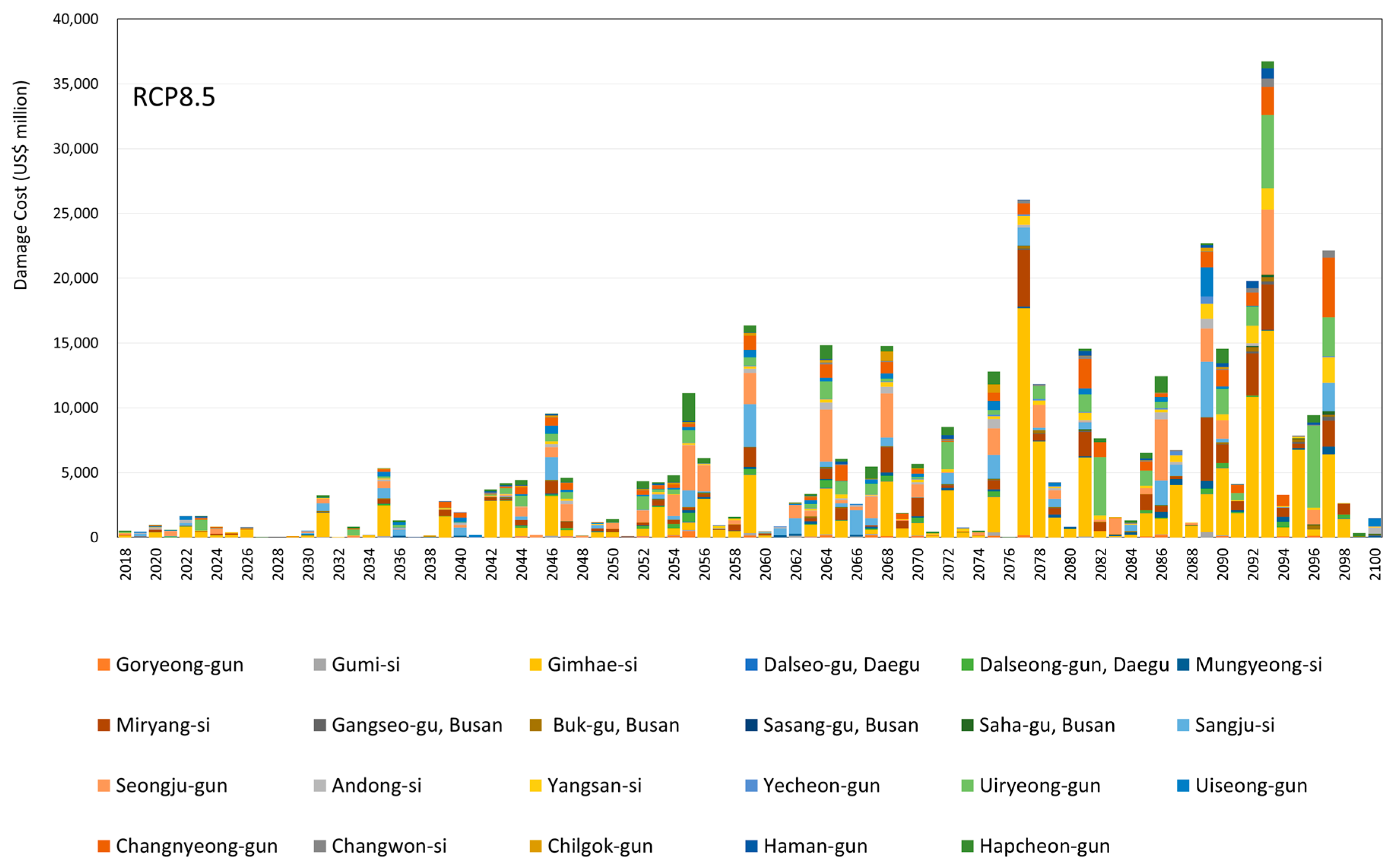

4.1. Future Damage Costs

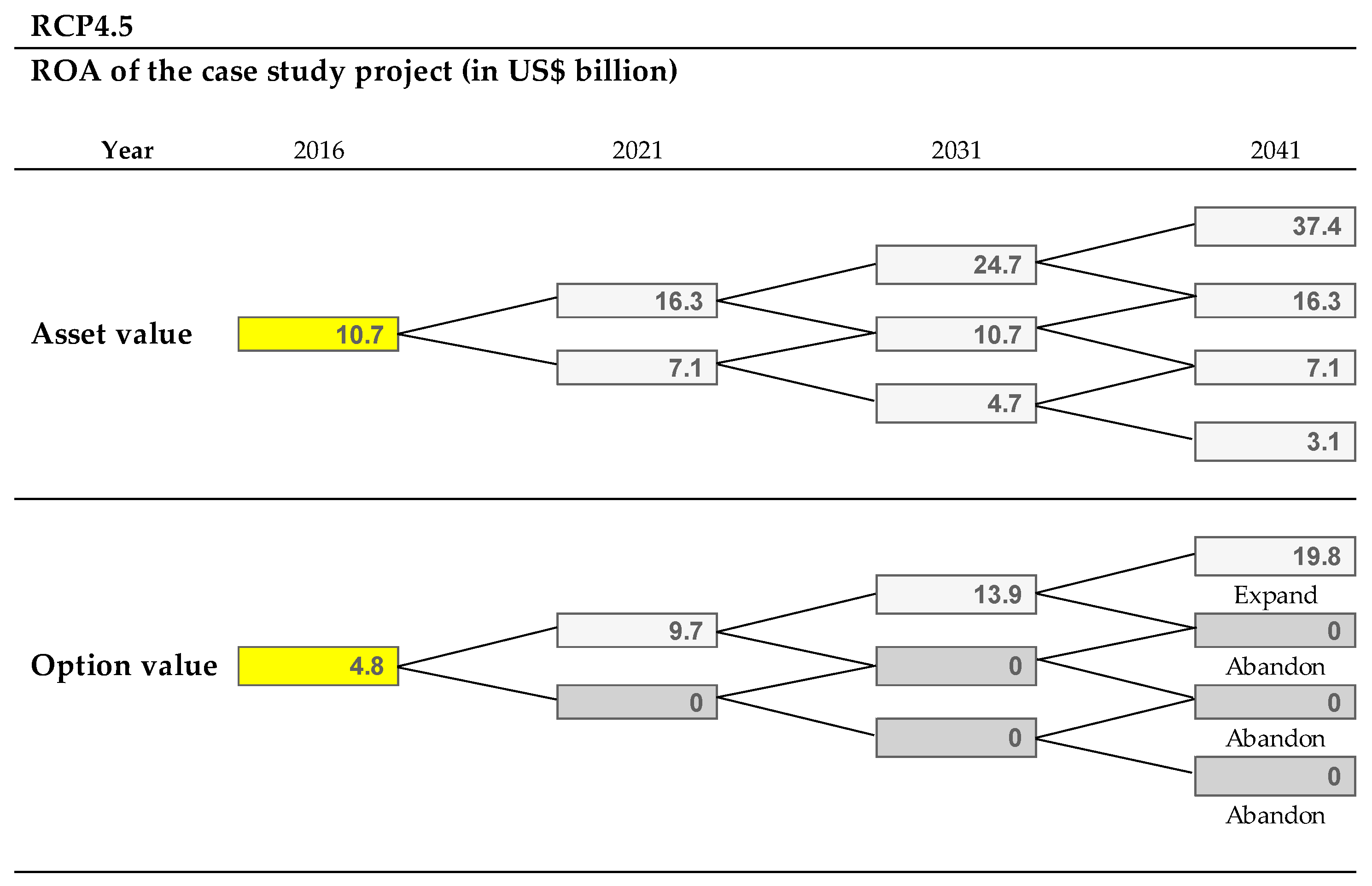

4.2. Decision Making on an Adaptation Strategy

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

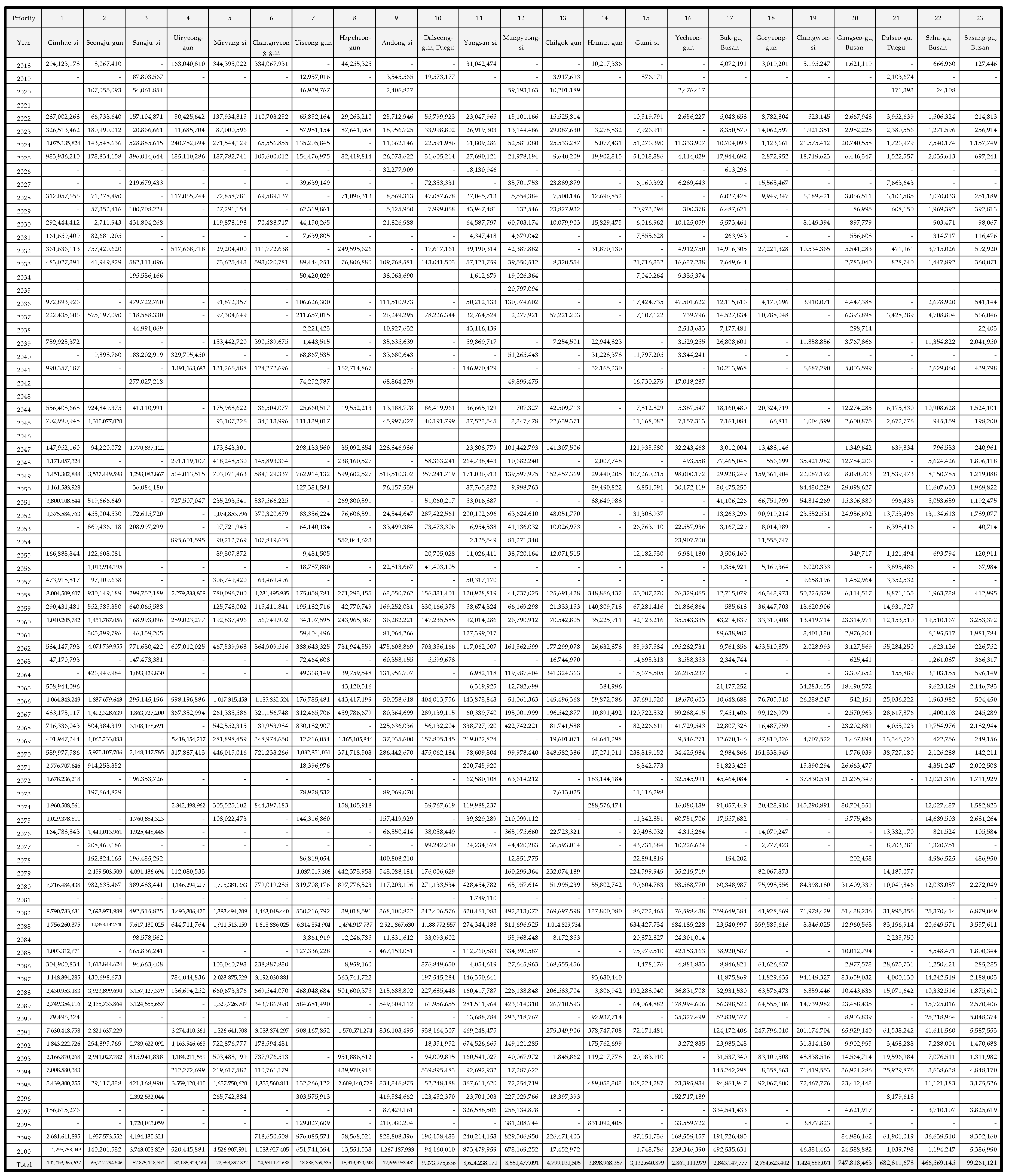

Appendix A

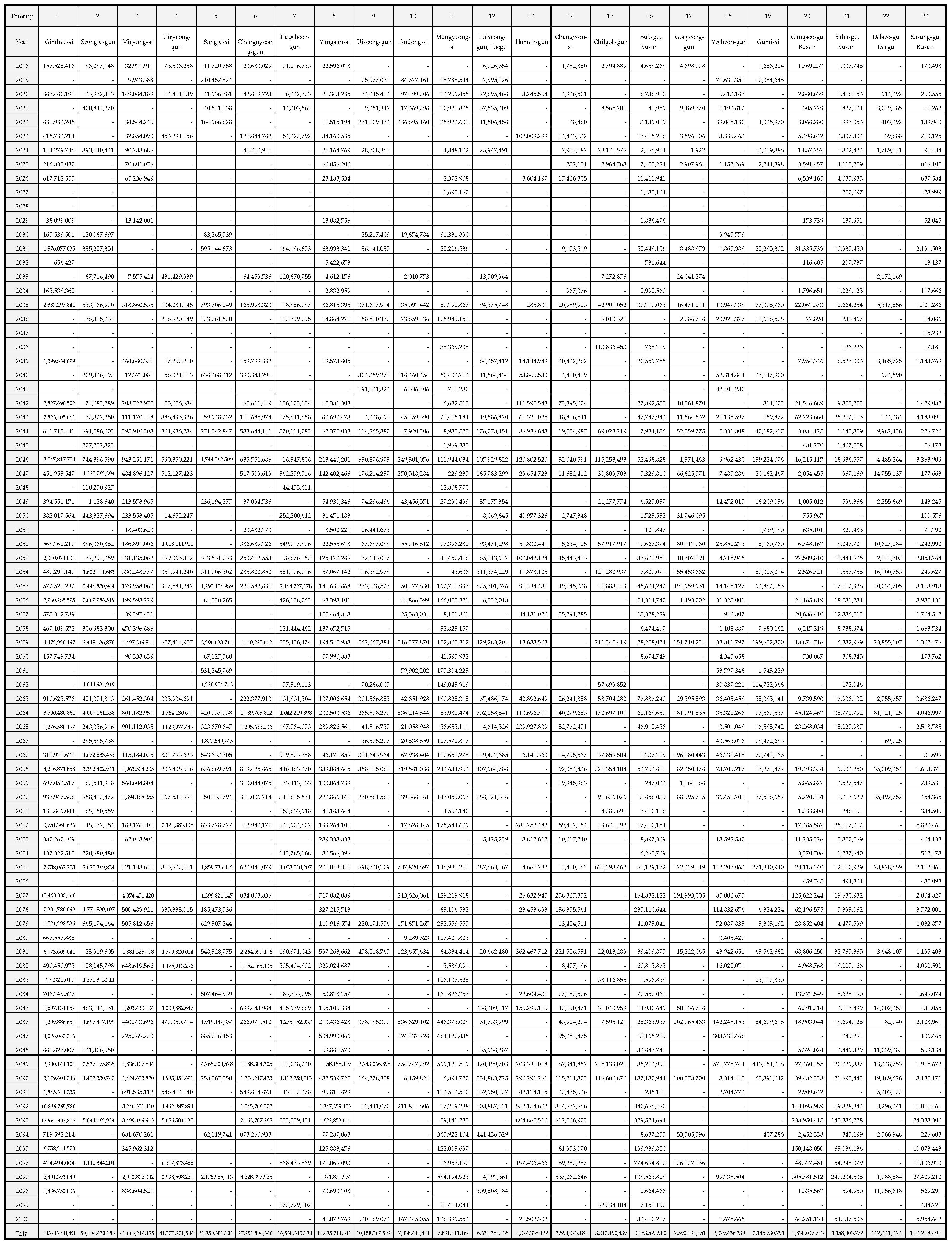

Appendix B

Appendix C

Appendix D

References

- Knight, K.; Schor, J. Economic Growth and Climate Change: A Cross-National Analysis of Territorial and Consumption-Based Carbon Emissions in High-Income Countries. Sustainability 2014, 6, 3722. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2014: Synthesis Report; Intergovernmental Panel on Climate Change (IPCC): Geneva, Switzerland, 2014.

- Ha, S.; Kim, H.; Kim, K.; Lee, H.; Kim, H. Algorithm for Economic Assessment of Infrastructure Adaptation to Climate Change. Natl. Hazards Rev. 2017, 18, 04017007. [Google Scholar] [CrossRef]

- Trærup, S.; Stephan, J. Technologies for adaptation to climate change. Examples from the agricultural and water sectors in Lebanon. Clim. Chang. 2015, 131, 435–449. [Google Scholar] [CrossRef]

- Arnbjerg-Nielsen, K.; Fleischer, H. Feasible adaptation strategies for increased risk of flooding in cities due to climate change. Water Sci. Technol. 2009, 60, 273–281. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Q.; Mikkelsen, P.S.; Halsnæs, K.; Arnbjerg-Nielsen, K. Framework for economic pluvial flood risk assessment considering climate change effects and adaptation benefits. J. Hydrol. 2012, 414–415, 539–549. [Google Scholar] [CrossRef]

- Olsen, A.S.; Zhou, Q.; Linde, J.J.; Arnbjerg-Nielsen, K. Comparing methods of calculating expected annual damage in urban pluvial flood risk assessments. Water 2015, 7, 255–270. [Google Scholar] [CrossRef] [Green Version]

- Ha, S.; Kim, K.; Kim, K.; Jeong, H.; Kim, H. Reliability Approach in Economic Assessment of Adapting Infrastructure to Climate Change. J. Manag. Eng. 2017, 33, 04017022. [Google Scholar] [CrossRef]

- Kim, K.; Park, H.; Kim, H. Real options analysis for renewable energy investment decisions in developing countries. Renew. Sustain. Energy Rev. 2017, 75, 918–926. [Google Scholar] [CrossRef]

- Kim, K.; Park, T.; Bang, S.; Kim, H. Real Options-Based Framework for Hydropower Plant Adaptation to Climate Change. J. Manag. Eng. 2017, 33, 04016049. [Google Scholar] [CrossRef]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; The MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Kim, Y.; Shin, K.; Ahn, J.; Lee, E.-B. Probabilistic Cash Flow-Based Optimal Investment Timing Using Two-Color Rainbow Options Valuation for Economic Sustainability Appraisement. Sustainability 2017, 9, 1781. [Google Scholar] [CrossRef]

- Dai, H.; Sun, T.; Guo, W. Brownfield Redevelopment Evaluation Based on Fuzzy Real Options. Sustainability 2016, 8, 170. [Google Scholar] [CrossRef]

- Ryu, Y.; Kim, Y.-O.; Seo, S.B.; Seo, I.W. Application of real option analysis for planning under climate change uncertainty: A case study for evaluation of flood mitigation plans in Korea. Mitig. Adapt. Strateg. Glob. Chang. 2017. [Google Scholar] [CrossRef]

- Kontogianni, A.; Tourkolias, C.H.; Damigos, D.; Skourtos, M. Assessing sea level rise costs and adaptation benefits under uncertainty in Greece. Environ. Sci. Policy 2014, 37, 61–78. [Google Scholar] [CrossRef]

- Kim, K.; Ha, S.; Kim, H. Using real options for urban infrastructure adaptation under climate change. J. Clean. Prod. 2017, 143, 40–50. [Google Scholar] [CrossRef]

- Gersonius, B.; Ashley, R.; Pathirana, A.; Zevenbergen, C. Climate change uncertainty: Building flexibility into water and flood risk infrastructure. Clim. Chang. 2013, 116, 411–423. [Google Scholar] [CrossRef]

- Woodward, M.; Kapelan, Z.; Gouldby, B. Adaptive flood risk management under climate change uncertainty using real options and optimization. Risk Anal. 2014, 34, 75–92. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Harrison, G.P.; Whittington, H.; Wallace, A.R. Climate change impacts on financial risk in hydropower projects. IEEE Trans. Power Syst. 2003, 18, 1324–1330. [Google Scholar] [CrossRef]

- Ministry of the Interior and Safety (MOIS). Yearbook of Disasters (in Korean); Ministry of the Interior and Safety: Sejong-si, Korea, 2017.

- Jeong, H.; Kim, H.; Kim, K.; Kim, H. Prediction of Flexible Pavement Deterioration in Relation to Climate Change Using Fuzzy Logic. J. Infrastruct. Syst. 2017, 23, 04017008. [Google Scholar] [CrossRef]

- Kim, K.; Jeong, H.; Ha, S.; Bang, S.; Bae, D.-H.; Kim, H. Investment timing decisions in hydropower adaptation projects using climate scenarios: A case study of South Korea. J. Clean. Prod. 2017, 142, 1827–1836. [Google Scholar] [CrossRef]

- Mun, J. Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2002; Volume 137. [Google Scholar]

- Kodukula, P.; Papudesu, C. Project Valuation Using Real Options: A practitioner’s Guide; J. Ross Publishing: Fort Lauderdale, FL, USA, 2006. [Google Scholar]

- Mayer, C.; Breun, P.; Schultmann, F. Considering risks in early stage investment planning for emission abatement technologies in large combustion plants. J. Clean. Prod. 2017, 142 Pt 1, 133–144. [Google Scholar] [CrossRef]

- Copeland, T.E.; Antikarov, V. Real Options: A Practitioner’s Guide, 2nd ed.; Cengage Learning: New York, NY, USA, 2003. [Google Scholar]

- Loncar, D.; Milovanovic, I.; Rakic, B.; Radjenovic, T. Compound real options valuation of renewable energy projects: The case of a wind farm in Serbia. Renew. Sustain. Energy Rev. 2017, 75, 354–367. [Google Scholar] [CrossRef]

- Korea Meteorological Administration (KMA). Climate Change Forecast for the Korean Peninsula; Korea Meteorological Administration (KMA): Seoul, Korea, 2013.

- Ministry of Land, Infrastructure and Transport (MOLIT). Information of Nakdong River Basin; Han River Flood Control Office: Seoul, Korea, 2017.

- Ministry of Land, Infrastructure and Transport (MOLIT). Study for Improvement and Supplementation of Design Rainfall; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2011.

- Riahi, K.; Rao, S.; Krey, V.; Cho, C.; Chirkov, V.; Fischer, G.; Kindermann, G.; Nakicenovic, N.; Rafaj, P. RCP 8.5—A scenario of comparatively high greenhouse gas emissions. Clim. Chang. 2011, 109, 33–57. [Google Scholar] [CrossRef]

- Thomson, A.M.; Calvin, K.V.; Smith, S.J.; Kyle, G.P.; Volke, A.; Patel, P.; Delgado-Arias, S.; Bond-Lamberty, B.; Wise, M.A.; Clarke, L.E.; et al. RCP4.5: A pathway for stabilization of radiative forcing by 2100. Clim. Chang. 2011, 109, 77–94. [Google Scholar] [CrossRef]

- Ministry of Land, Infrastructure and Transport (MOLIT). Longterm Plan of Water Resource (2001–2020); Ministry of Land, Infrastructure and Transport: Sejong-si, Korea, 2016.

| Parameter | Value |

|---|---|

| Case study site | 23 local municipalities in the Nakdong River Basin |

| Risk-free rate | 5.0%/year |

| Inflation rate | 3.0%/year |

| Yearly O&M costs | 3% of the damage costs |

| Climate scenarios | RCP4.5/8.5 |

| Project period | between 2017 and 2100 |

| Option type | Expansion option |

| Initial investment costs in 2017 | US$2 billion |

| Second investment costs for expansion in 2040 | US$17.5 billion |

| Result | RCP4.5 | RCP8.5 |

|---|---|---|

| Volatility | 41.6% | 29.2% |

| Option value | US$4.8 billion | US$4.8 billion |

| Net present value (NPV) | −US$6.9 billion | −US$6.7 billion |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, K.; Kim, J.-S. Economic Assessment of Flood Control Facilities under Climate Uncertainty: A Case of Nakdong River, South Korea. Sustainability 2018, 10, 308. https://doi.org/10.3390/su10020308

Kim K, Kim J-S. Economic Assessment of Flood Control Facilities under Climate Uncertainty: A Case of Nakdong River, South Korea. Sustainability. 2018; 10(2):308. https://doi.org/10.3390/su10020308

Chicago/Turabian StyleKim, Kyeongseok, and Ji-Sung Kim. 2018. "Economic Assessment of Flood Control Facilities under Climate Uncertainty: A Case of Nakdong River, South Korea" Sustainability 10, no. 2: 308. https://doi.org/10.3390/su10020308