1. Introduction

Generally, an integrated-production-inventory model defines the vendor-buyer or retailer-customer model. In that type of model, usually a vendor produces an item in a production batch line and the produced finished goods are transferred to several buyers. In spite of that, retailer’s production cycle time is measured as an integer multiple of the function of consumer’s ordering time. Many research articles highlighted various integrated vendor-buyer models with several key parameters. Chang et al. [

1] discussed an integrated vendor-buyer inventory system under trade-credit policies. Demand is measured as the diminishing function of retail-price. Additionally, they surveyed an iterative algorithm to figure out the optimal retail-price, number of buyer’s ordering amount, and numbers of deliveries per production run. Yang [

2] extended previous research models considering an integrated-inventory model with lead time crashing cost. Hoque [

3] analyzed a vendor-buyer integrated-production model, where lead time follows a normal distribution along with setup time of a machine, maximum boundary on capacity of shipping vehicle, cost of transportation, and batch time are also inserted in his model. Jha and Shanker [

4] established an integrated inventory model with transportation for a single-vendor and multi-buyer. It is observed that the vendor produces and deliveries products to buyers in distinct locations by similar capability of some vehicles. The external demands of buyers are taken to be independent and follows a normal distribution. Lead time of buyers without transportation time are reduced by an added crashing cost. Most of the above mentioned research articles related to the integrated-inventory model are formed with the assumption that all produced items are absolutely perfect. There are no defective items during production system. Sarkar et al. [

5] expanded former integrated-inventory models by including the concept of imperfect production. An inspection policy is given to examine defective items and also provides delay-in-payments in their model. In their model, non-defective item follows a binomial distribution and lead time demand follows a mixture of normal distribution. By highlighting the trade-credit policy, Ouyang et al. [

6] derived an integrated-inventory model with a capacity constraint and a permissible delay-payment system. An unit production cost is calculated as the function of rate of production. Sarkar et al. [

7] analyzed a continuous review inventory model on the basis of probability distribution of lead time demand. Some investment function is applied to improve the process quality. They presented two models, one with normal distributed lead time demand and another with an unknown distributed lead time demand. Sarkar [

8] discovered a vendor-buyer model by considering three steps of inspection process before vendor’s consignment. Ahmad et al. [

9] formulated an integrated-inventory model which includes single-supplier, single-manufacturer, and single-retailer. In addition, imperfect production process is also considered in their model. Fauza et al. [

10] provided a single-vendor and multiple buyers (SVMB) model to obtain the food inventory policy. They developed a kinetic model, which is utilized to present the quality degradation of the raw material at the vendor. In literature, there are several integrated inventory models, but no one of the above mentioned authors considered unequal power of player in the integrated model. Every model is considered to have equal power of the players. However, if the players are with unequal power then only game strategy (using leader-follower policy) can be used those models.

In many Stackelberg approaches, decision makers are always in the leading positions to obtain more profit jointly or individually. Those Stackelberg game models consider the assumption that leader first selects his decisions and then those decisions are becoming the constraint to the follower. Besides, concept of follower’s decision makes on the whole data of the leader’s action and his decisions turn the new constraints to that leader’s decision problem. Liou et al. [

11] described some multi-period inventory models which consists of one-buyer and one-seller. They highlighted the Stackelberg equilibrium framework for maximizing vendor’s total benefit with respect to the minimum total cost that the buyer is willing to obtain. Yu et al. [

12] showed how a manufacturer and its retailers are related with each other in order to optimize their individual total profits. They considered the fact that the manufacturer develops a single product at the same wholesale price to multiple retailers. After that, those multiple retailers sell that product in independent markets at some retail prices. In addition, they assumed that the demand rate is an increasing as well as concave function of advertising investments of both local retailers and the manufacturer while a decreasing and convex function of the retail prices. Yu et al. [

13] formulated an integrated inventory model in which Stackelberg game is incorporated to increase vendor’s profit in a vendor managed inventory (VMI) system. In their paper, vendor is assumed to be as a manufacturer who produces raw materials to develop a finished product and then distributed it to multiple retailers at the same wholesale price. Then, the retailers sell the product in independent markets at retail prices. Zhou and Zhou [

14] proposed a two-echelon supply chain which states that a supplier sells through a retailer a product with some stable market demand. By using some ‘supplier-Stackelberg’ setting, they observed two trade credit scenarios which are unconditional and conditional. They also provided that unconditional trade credit scenario is always profitable to the retailer but harmful to the supplier. On other hand, conditional trade credit scenario is always profitable to both parties. Wang et al. [

15] provided a win-win outcome for his Stackelberg game model. By examining two decision makers of that game, supplier along with a threshold and partial trade-credit policy is considered to adjust that model. Taleizadeh et al. [

16] described a Stackelberg game-theoretic approach in a composite (QFF) policy which consists of quantity, freight discount, and free shipping quantity policies. In their paper, they assumed that supplier offers some composite policy and manufacturer offers some composite (QPR) policy to the retailers. Wang et al. [

17] addressed a product family architecture (PFA) planning and supply chain configuration as a Stackelberg game approach. They presented the PFA decision making as an upper-level optimization problem. On the other side, the lower-level optimization problem deals with the supply chain decisions. Though there are several models considering Stackelberg game policy, but no one considered this strategy for integrated inventory model for unequal lot size within single-setup-multi-delivery policy. This research gap is fulfilled by the proposed research model.

Setup cost plays an important role in today’s advanced manufacturing companies for shipment of products on time. Setup process is not measured as a value adding constraint. Setup cost need to be discussed at the time of enhancing productivity, minimizing waste, enlarging resource utilization, and satisfy deadlines. To minimize capital investment function, manufacturer are required to reduce setup cost. Researchers made various inventory models with this concept of setup cost reduction. Denizel et al. [

18] studied a dynamic lot size model in which setup costs can be reduced by several amounts depending upon the level of raw-materials. They also derived a shortest path problem for these level of raw-materials. Diaby [

19] established a comprehensive model to reduce both setup time and setup cost. He also added that setup times can be reduced by contributing appropriate amounts of many resources like equipment, tooling, etc. He determined how much to cut setup time for every product and how much of each good to manufacture to minimize total cost. Nyea et al. [

20] developed some inventory models to forecast optimal setup times, or optimal investment in setup reduction. In their paper, a new model based on queuing theory was formed to estimate work-in-process (WIP) levels. Freimer et al. [

21] established two types of process improvements which are (i) setup costs reduction; and (ii) improvement in quality of the process. Huang et al. [

22] considered setup cost reduction policy by assuming an added investment. In their paper, demand of lead time is taken to be as compound poisson distribution. Annadurai and Uthayakumar [

23] analyzed a mixture-inventory model with the assumptions of setup cost reduction, backorders, and lost sales. They considered that an arrival order batch may hold some defective items. Both normally distributed demand and distribution free lead time demand are developed in their model. Sarkar and Majumder [

24] discussed an integrated vendor–buyer supply chain model for setup cost reduction. In their paper, two types of models are developed. In the first model, lead time demand follows a normal distribution while their second model considers the distribution free approach for the lead time demand. Sarkar and Moon [

25] extended previous models by involving the concept of quality improvement, reorder point, and also lead time in which backorder rate has a great impact. They also assumed production process as imperfect. Sarkar et al. [

26] included the concept of setup cost reduction along with quality improvement. The same distribution free approaches with known mean and standard deviation are discussed in their model. Allahverdi [

27] obtained independently addressed problems based on performance observers, shop, and setup times/costs environments. By providing the concept that setup cost is a logarithmic function of capital investment, Priyan and Uthayakumar [

28] represented an economic manufacturing quantity (EMQ) model for imperfect production process. They assumed three types of continuous probabilistic defective function. Sarkar et al. [

29] produced the impact of setup cost reduction in a deteriorated two-echelon supply chain model with deterioration. Quality improvement technique is added to their model. Sarkar et al. [

30] formulated a deteriorated two-echelon supply chain model where setup cost is taken to be as variable. In this case, setup cost is directly proportional to reliability. On the other hand, the deterioration rate is taken to be as inversely proportional to reliability. There are several models in the literature considering continuous investment function for reducing setup cost, but only a single model Huang et al. [

22], they only considered the realistic case. The proposed model also follows the same direction of discrete investment for reducing setup cost.

After receiving the order from the consumer, components and materials are shifted for production line, and then finally finished goods are sent to consumers by some transportation vehicle to meet their requirements within due dates. Therefore, transportation cost is an additional charge to the manufacturer. The transportation cost can be dependent on delivery path, and the capacity of delivery vehicle. Mason et al. [

31] discussed a multi-product supply chain including transportation cost to determine potential benefits, increase customer service-level by improved efficiencies, and minimize lead-time variability. Hill and Galbreth [

32] proposed a single-warehouse multi-retailer supply chain model, which incurs transportation discount cost functions. Kang and Kim [

33] surveyed a two-level supply chain model, where a supplier provides a set of retailers and derives a production plan for every retailer by applying the data on demands of end consumers. Transportation costs are included in their model for shipment of finished products. Deliveries are fulfilled through the same capability vehicles to several retailers in a one-time trip. Chan and Zhang [

34] determined a collaborative transportation management model with a simulation approach, which is utilized to (a) analyze profits of CTM; (b) describe view-point of carrier’s flexibility; and also (c) examine delivery speed ability. Lee and Fu [

35] proposed a producer-buyer supply chain model in which delivery or transportation cost is added and adjusted as a power function. Shu et al. [

36] observed an integrated-production-delivery lot size model with stochastic delivery time and transportation cost, which is the function of delivery quantity. Krishnakumari [

37] observed a multi-period inventory cum transportation problem (MPICTP) with single-product, single-stage for multiple suppliers and multiple destinations. In this direction of research, transportation costs along with piecewise constant setup cost are described in Pazhani et al. [

38]. They developed a mixed integer nonlinear programming model to observe the optimal inventory policy for the several stages in supply chain. They assumed some vehicles of several capabilities to shipment of materials. The integrated inventory model with discrete setup cost reduction and fixed as well as variable transportation is not considered yet by any researchers.

For reducing carbon-emission, production companies can monitor and enhance the emission performance of their products during their life-cycle stages. The carbon-emission assessment provides a possible mechanism to serve companies with some emission reduction. During production process, manufacturer should formulate low carbon system. There are several research papers, in which carbon-emission reduction is described briefly. To reduce global warming and carbon-emission from earth, Shi and Meier [

39] presented a hybrid carbon-emission model to meet up increasing necessities of practical low-carbon matters in manufacturing systems. Shi et al. [

40] described a carbon-emission reduction potential model for technology disruption and structural allowance in cement factory. They determined energy consumption and also derived the effects and trends of technological advancement. Zhang et al. [

41] generated a both split and traffic assignment model, which assumed the low-carbon constraints. Their model analyzed in particular two hypothetical examine networks. Hammami et al. [

42] deduced a multi-echelon supply chain model with different outside suppliers, several manufacturing facilities, distinct distribution centers, and reducing carbon-emission. Tang et al. [

43] presented a periodic inventory review system by reducing carbon-emission with minimum shipment frequency. Sarkar et al. [

44] produced a vendor-buyer system by assuming setup cost reduction technique, carbon-emission reduction, and inspection policy. Sarkar et al. [

45] discussed a three-echelon supply chain model in which both fixed and variable transportation costs along with carbon-emission costs are included. Tang et al. [

46] described a sustainable supply chain (SSC) network in which consumer environmental behaviors (CEBs) are introduced by including routing, inventory, and location. Cheng et al. [

47] observed a traditional inventory routing problem (IRP) with the effects of carbon-emission regulations. There is one assembly plant and a set of geographically dispersed suppliers in that traditional inventory routing problem (IRP). They assumed transportation cost as constant with some fuel consumption cost and inventory holding cost. In their model, the fuel consumption cost is calculated by distance, fuel price, and fuel consumption rate. See

Table 1 for the contribution of various authors.

After a long literature survey, it is found that there is no sustainable integrated inventory model for unequal power of players and where a discrete investment is used to reduce the setup cost, as well as fixed and variable transportation and carbon emission cost are introduced. This proposed research fulfils this existing research gap. The organization of this paper is as follows:

Section 2 gives problem definition, notation, and assumptions.

Section 3 develops mathematical model.

Section 4 discusses the solution methodologies. Numerical examples, graphical illustrations, sensitivity analysis are given in

Section 5. Finally, conclusions and future remarks are given in

Section 6.

3. Mathematical Model

Initially, buyer orders some products with ordering cost . Vendor produces items with a fixed production rate P and initial setup cost of vendor is . Vendor uses some investments I for reducing that setup cost and sends first lots of each batch i.e., Q units with some fixed transportation cost F as well as variable transportation cost . Vendor continues the whole delivery products in n times. Initially, first shipment lot size per batch is Q. It is assumed that the increasing rate of delivery lots as δ. Therefore, vendor’s second shipment lot size is . Vendor transports third shipment lot size as . In this way, it can be found that the number of quantity transferred to buyer on delivery is , . Throughout unequal delivery goods, vendor pays fixed carbon-emission cost and also variable carbon-emission cost . While that delivery lots placed to buyer, then buyer performs an inspecting procedure to check the quality of the received lots. Buyer incurs two types of inspection costs, which are variable inspection cost and unit inspection cost , where screening rate is α. The rate of imperfect item is ρ in each lot. When the inspection has been completed, both perfect and imperfect items are separated. For holding perfect items, buyer incurs some cost . In addition, buyer’s holding cost for imperfect items is . While next produced lot comes to buyer from vendor, buyer sent back all imperfect products of previous lot to vendor for reworking. In this case, it is assumed that buyer has not pay any delivery cost for shifting imperfect products to vendor.

3.1. Vendor’s Mathematical Model

Vendor sends ordering lots in n times in each production cycle by using single-setup-multi-delivery (SSMD) policy.

One can measured the total production batch, which shipped to buyer from vendor is formulated by adding the whole delivery lots

Total production cycle is obtained by splitting the demand with total production batch.

As the number of total production cycle is =, setup cost is , and investment to minimize setup cost is I.

Vendor’s total setup cost is .

Vendor’s total investment cost is .

At the beginning, while the production batch is around to commence, systems’s total stock is starting with zero. On the other hand, buyer has sufficient stock to meet satisfy the demand before the first delivery lot comes. Buyer stock is . The total stock inclined at a rate of while producing the batch quantity of with the rate P and arrives the maximum level of when manufacturing of batch completed.

Therefore, system’s average total stock is

On the other hand, average buyer stock consists of perfect as well as imperfect products.

i.e., average buyer stock is .

Then average vendor stock can be measured by deducting system’s average total stock less the average buyer stock.

Hence, average vendor stock is

Vendor’s total holding cost is

Vendor’s total transportation cost is measured by adding fixed and variable transportation costs which is

Vendor’s total carbon-emission cost can be obtained by calculating fixed and variable carbon-emission costs.

As the number of total production cycle is , vendor’s fixed carbon-emission cost per delivery is , and number of delivery lots of each batch per production is n.

Therefore, vendor’s fixed carbon-emission cost is .

Likewise, for defective rate ρ, demand D, and vendor’s variable carbon-emission cost per unit .

The vendor’s variable carbon-emission cost is given by .

Hence, the vendor’s total carbon-emission cost is .

Total rework cost for the vendor is .

Then, the vendor’s total inventory cost can be obtained by summing setup cost, holding cost, investment cost to minimize setup cost, fixed and variable transportation cost, fixed as well as variable carbon-emission cost, and rework cost.

3.2. Buyer’s Mathematical Model

The buyer incurs total ordering cost for whole production cycle is .

During the inspecting process, the buyer considers two types of inspection costs i.e., unit as well as variable inspection cost.

Total inspection cost for the buyer is .

The total number of perfect products for whole production cycle is observed from the area of the triangle given in

Figure 1, which is obtained as

Hence, the buyer’s total holding cost for perfect products

is obtained by multiplying all perfect products with production cycle i.e.,

The total quantity of imperfect products is calculated by the parallelogram shown in

Figure 1.

The buyer’s total holding cost for imperfect products

is given by multiplying total imperfect products with production cycle.

Therefore, the buyer’s total inventory cost can be determined by adding ordering cost, inspection cost, holding cost of perfect products items, and imperfect products.

Hence, the vendor-buyer system’s joint total cost

is given by

The necessary conditions to minimize the vendor-buyer system’s joint total cost are , , , and .

The first order partial derivative of the vendor-buyer system’s joint total cost

with respect to number of delivery lots of each batch per production

n (by considering number of shipment as continuous variable) is given by

By calculating , where , the optimal value of n (say ) is obtained.

See

Appendix A for the values of

,

, and

. The first order partial derivative of vendor-buyer system’s joint total cost

with respect to first shipment lot size per batch throughout the production

Q is

The optimum value

is given by

Now, the first order partial derivative of the vendor-buyer system’s joint total cost

with respect to investment for setup cost reduction per production run

I is

From the equation , the optimal value of I (say ) will be

Again, the first order partial derivative of vendor-buyer system’s joint total cost

regarding rate of increasing delivery lots

δ is

Similarly as n, I, and Q, in this case the optimal value of δ (say ) can be calculated if it satisfies , where .

Now, Hessian matrix at the optimal values, i.e.,

,

,

, and

are calculated as

where

.

The optimal values

,

,

, and

for minimize vendor-buyer system’s joint total cost

must fulfil the conditions that all principal minors of Hessian matrix

are positive. As the expressions of second order partial derivatives of

are non-linear (see

Appendix B), thus each principal minors of the Hessian matrix

are extremely non-linear. Hence, those conditions to minimize vendor-buyer system’s joint total cost

are determined by considering some numerical examples and graphical representations.

5. Numerical Example without Stackelberg Approach

Example 1. The values of parameters are considered by using the numerical data from Sarkar [8], Huang et al. [22], Sarkar et al. [44], and Sarkar et al. [45] as units/year, units/year, /order, /shipment, /delivery, /shipment, /unit, /delivery, /unit item inspected, /unit, , /unit, /unit/year, /unit/year, /unit/year, units/year, , and /setup. Therefore, after applying the investment vendor’s setup cost becomes /setup.

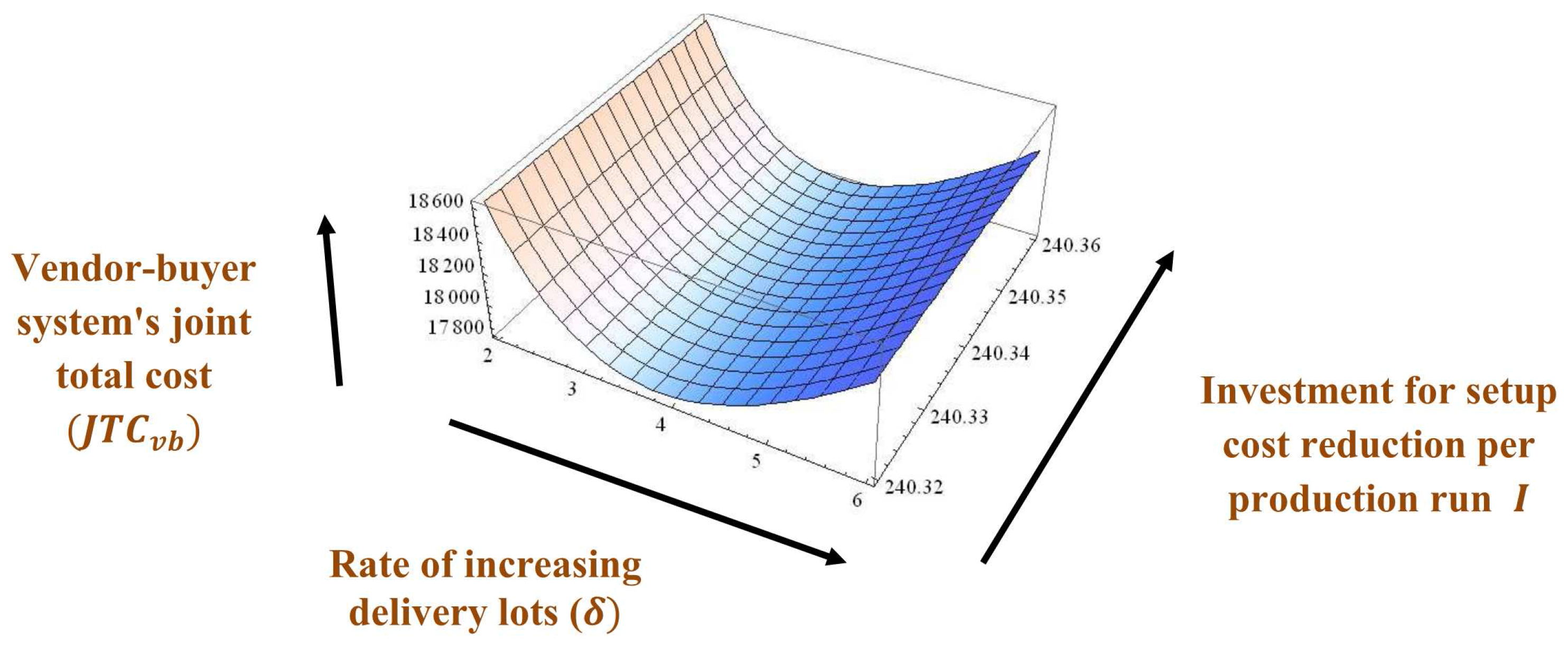

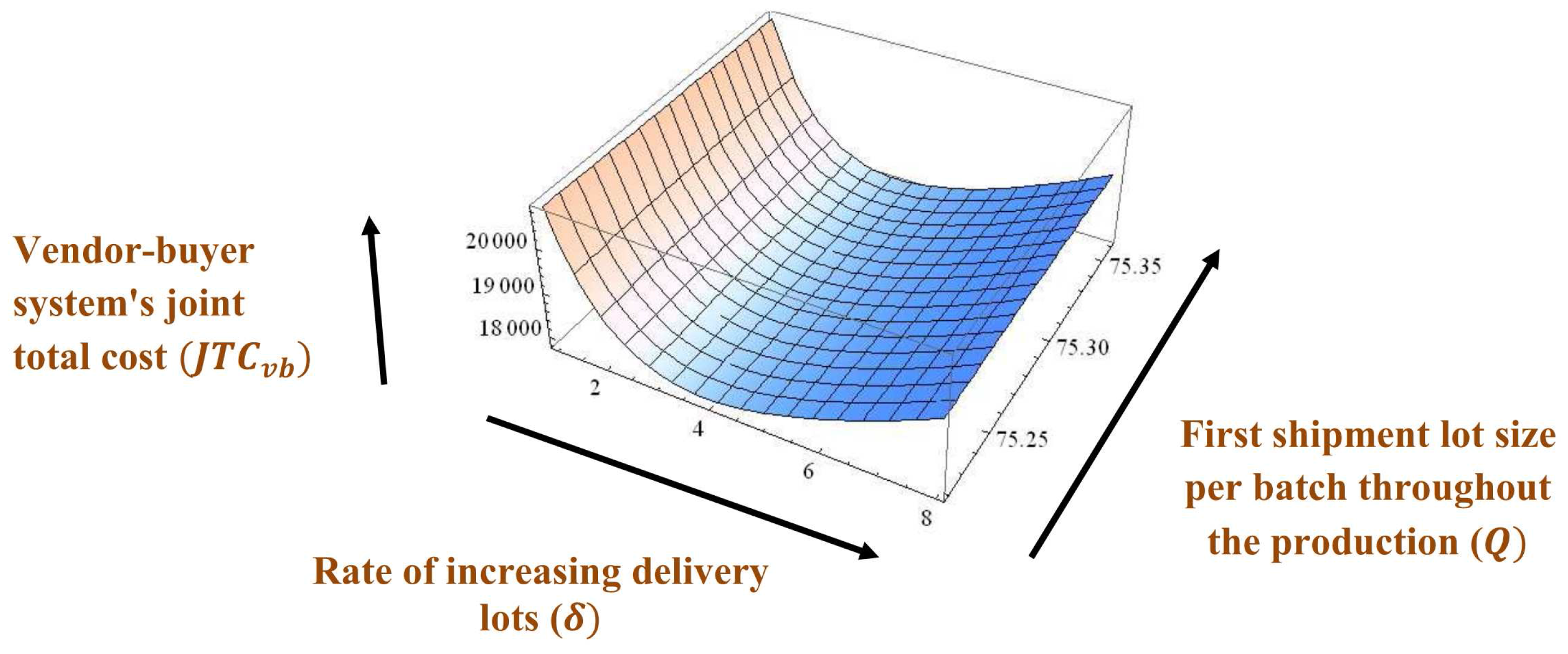

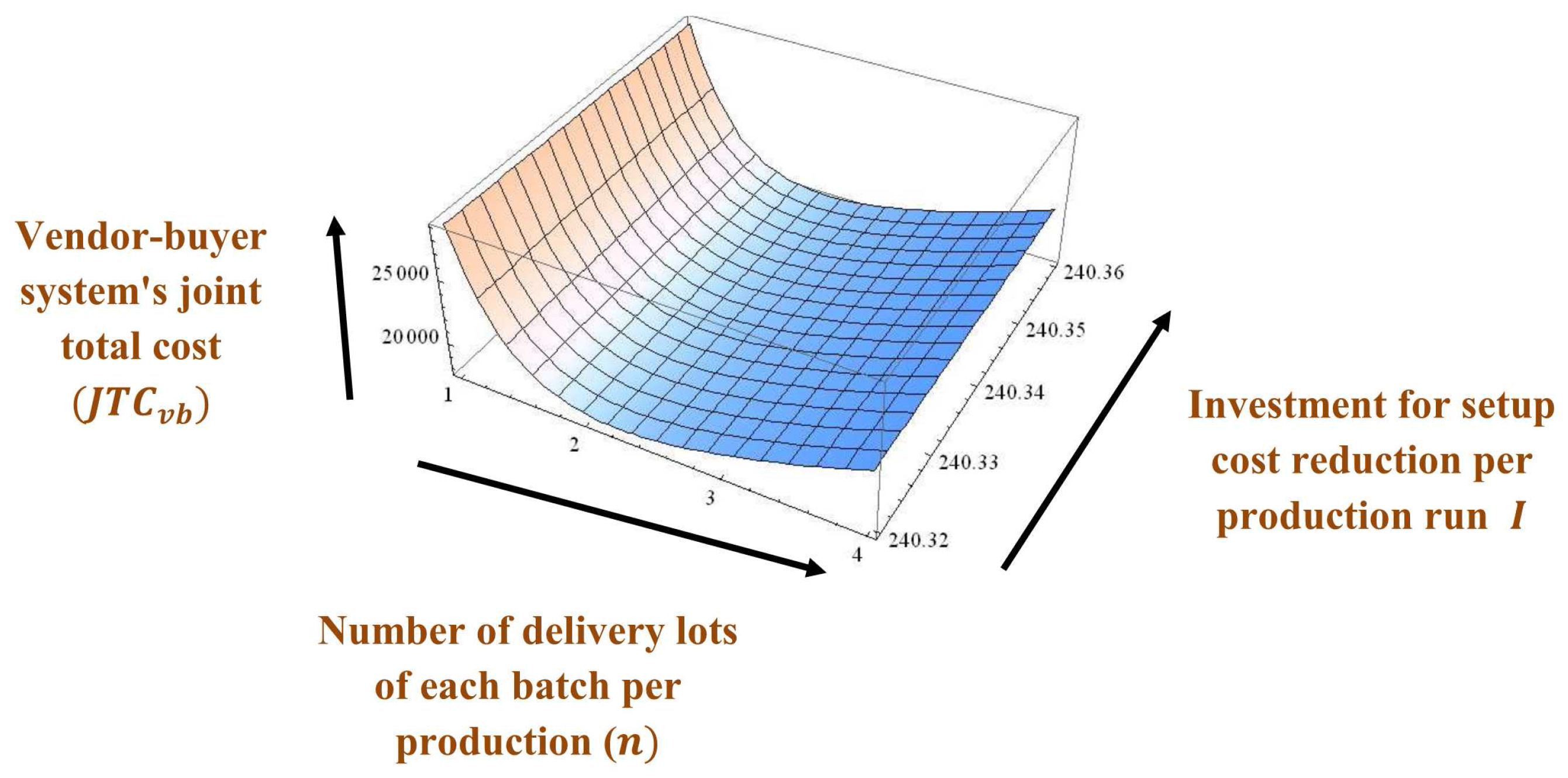

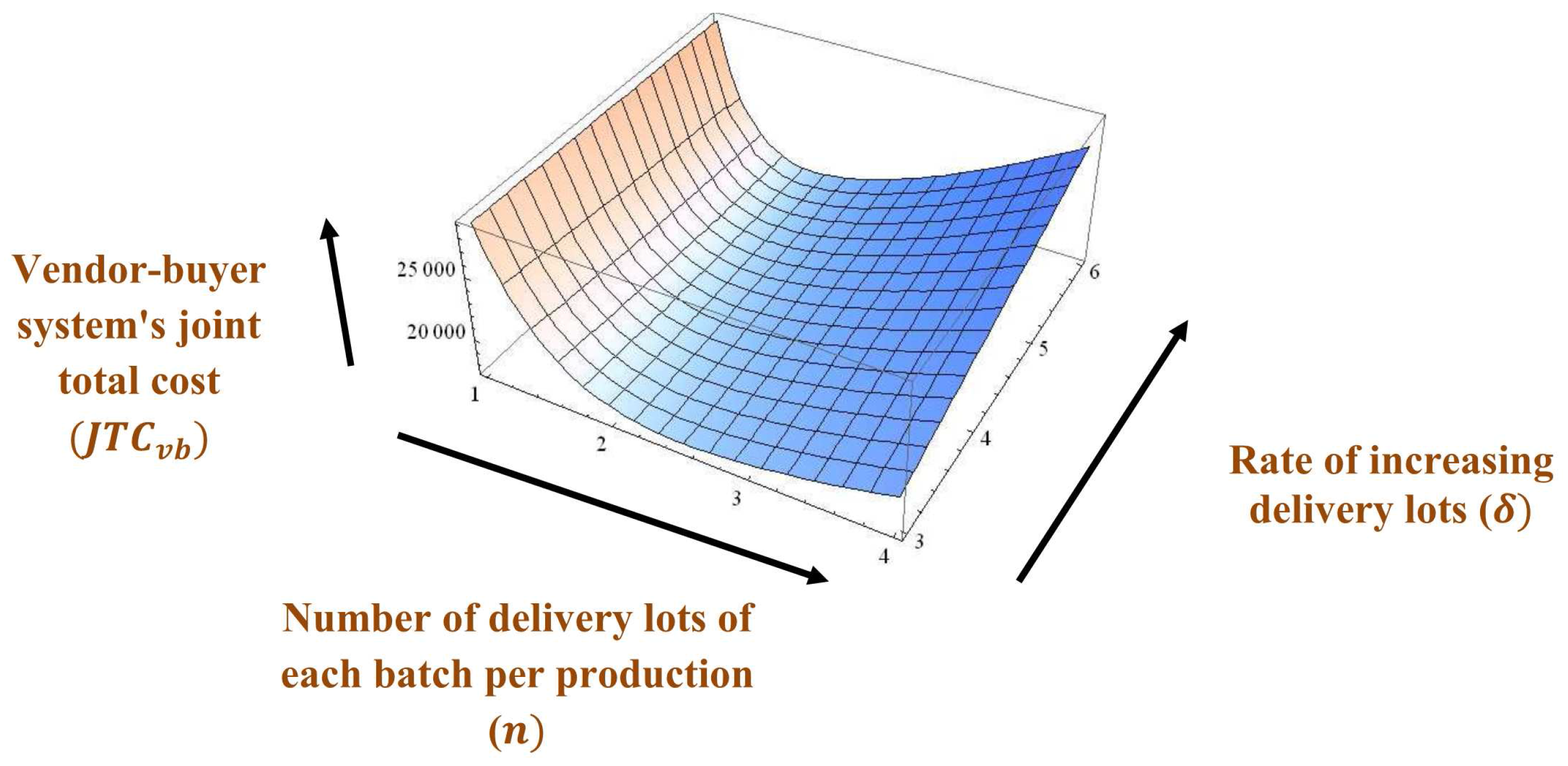

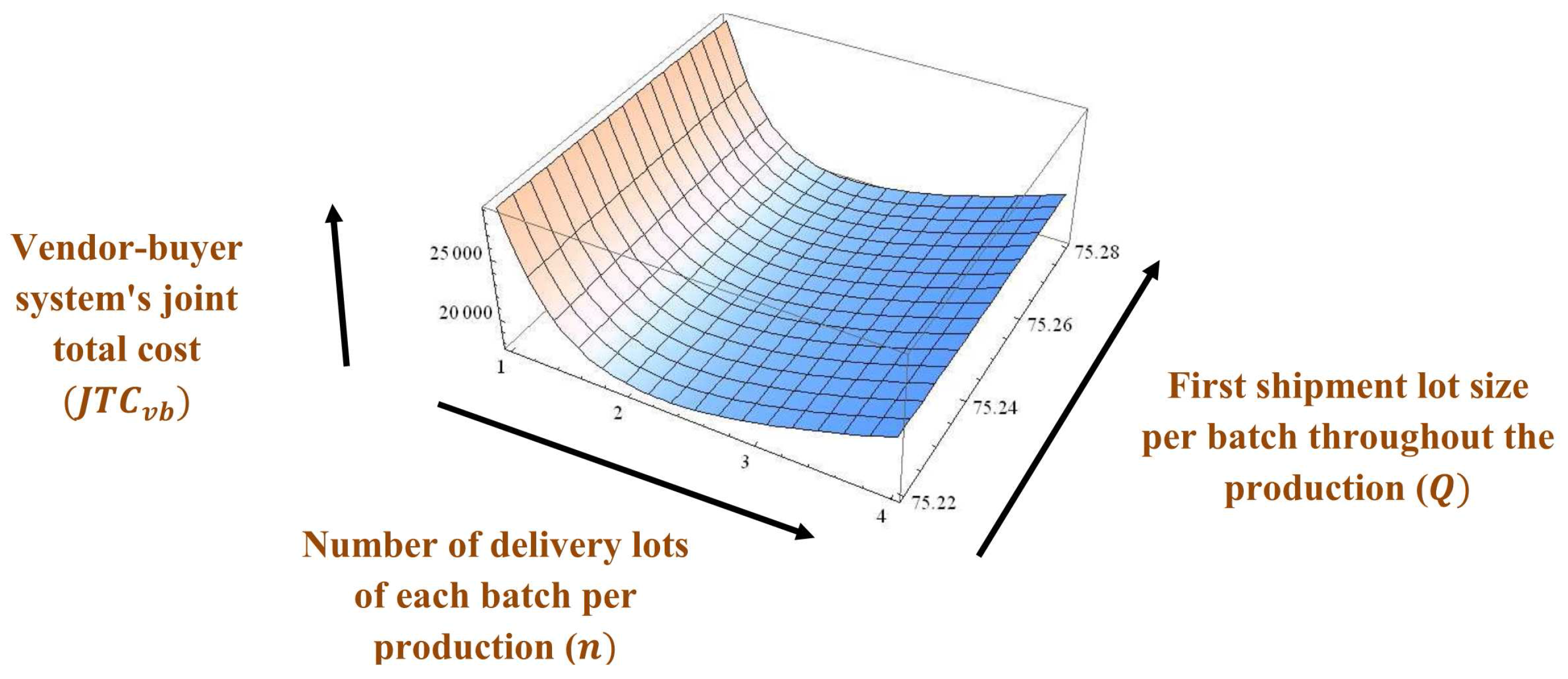

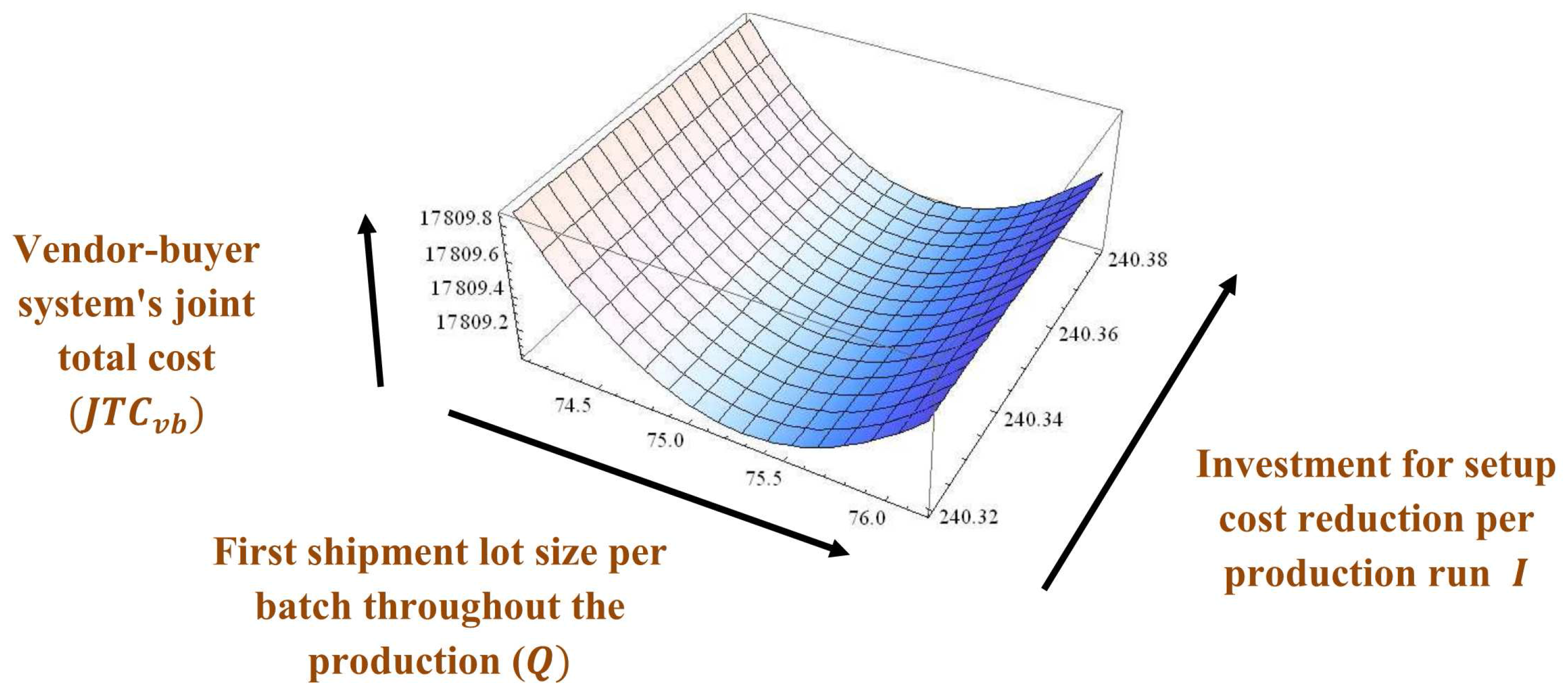

Hence, the vendor-buyer system’s joint total cost

, first shipment lot size per batch throughout the production

units, rate of increasing delivery lots

unit/year, and number of delivery lots of each batch per production

, and investment for setup cost reduction per production run

/production run, see

Figure 2,

Figure 3,

Figure 4,

Figure 5,

Figure 6 and

Figure 7 for graphical representations of the total cost with optimum values.

5.1. Sensitivity Analysis

The sensitivity analysis conducted for the key parameters.

This section illustrates sensitivity analysis, which shows (

Table 3) the impact of each parameters which are

,

,

F,

,

ρ,

,

,

,

, and

, respectively on vendor-buyer system’s joint total cost

.

- •

The vendor-buyer system’s joint total cost increases while unit and variable inspection costs i.e., and increase. On the other hand, if unit transportation cost F and variable transportation cost are increased, then vendor-buyer system’s joint total cost is also increased.

- •

If defective rate ρ, vendor’s holding cost , and vendor’s fixed carbon-emission cost increase, then vendor-buyer system’s joint total cost also increases.

- •

Increasing values in buyer’s holding cost for perfect items , holding cost for imperfect items , and buyer’s ordering cost imply that vendor-buyer system’s joint total cost is increased. It is found that the negative percentage changes for these three parameters , , are much more sensitive than the positive percentage changes.

5.2. Numerical Example by Using Stackelberg Approach

Case 1. Buyer as leader and vendor as follower

Example 2. units/year, units/year, /order, /shipment, /delivery, /shipment, /unit, /delivery, /unit item inspected, /unit, , /unit, /unit/year, /unit/year, /unit/year, units/year, , and /setup.

Hence, vendor-buyer system’s joint total cost , first shipment lot size per batch throughout the production units, rate of increasing delivery lots unit/year, and number of delivery lots of each batch per production , and investment for setup cost reduction per production run /production run.

The results, which are obtained in our paper, are compared with the paper of Sarkar et al. [

44]. In Sarkar et al. [

44], vendor-buyer system’s joint total cost is

which is larger in compared to this model. Therefore, this proposed model formulates more appropriate results than Sarkar et al. [

44] by incorporating the Stackelberg approach.

This section discusses the effect on the total cost for buyer

by changing several parameters such as

,

,

, and

, respectively (see

Table 4).

- •

For the parameter , which is buyer’s ordering cost, negative and positive percentage changes are similar. If the value of the parameter increases that indicates buyer’s total cost also increases.

- •

It is observed if unit inspection cost and variable inspection cost are increased, then buyer’s total cost also increases.

- •

When buyer’s holding cost for perfect items, i.e., increases, then buyer’s total cost is increased. Both negative percentage change and positive percentage changes are similar for this parameter.

This section allows sensitivity analysis for evaluating the effect of several parameters such as

,

,

F, and

, respectively on vendor’s total cost

(see

Table 5).

- •

If the vendor’s variable carbon-emission cost increases, then the vendor’s total cost also increases. In this case, both negative percentage change and positive percentage changes are equal.

- •

When vendor’s holding cost increases, then the vendor’s total cost increases. The negative percentage change is maximum than positive percentage change for this parameter. Thus, it is not in equilibrium position.

- •

As vendor’s fixed transportation cost F increases, then the vendor’s total cost also increases. Both the positive and negative percentage changes are same.

- •

An increasing value in the vendor’s fixed carbon-emission cost per delivery increases, the total cost for vendor increases. For this parameter, the positive percentage change is smaller than the negative percentage change.

Case 2. Vendor as leader and buyer as follower.

Example 3. All parameters for this model are as follows:

units/year, units/year, /order, /shipment, /delivery, /shipment, /unit, /delivery, /unit item inspected, /unit, , /unit, /unit/year, /unit/year, /unit/year, units/year, , and /setup.

Hence, the vendor-buyer system’s joint total cost is , first shipment lot size per batch throughout the production is units, rate of increasing delivery lots is = 3 unit/year, and number of delivery lots of each batch per production is , and investment for setup cost reduction per production run is /production run.

This section analyzes the effect on the buyer’s total cost

by changing key parameters such as

,

,

, and

(see

Table 6).

- •

It is found while unit inspection cost and variable inspection cost are increased, it implies the buyer’s total cost is also increased.

- •

The increasing values in buyer’s holding cost for perfect items and buyer’s holding cost for imperfect items indicates the increasing value of the buyer’s total cost . For this parameter, the negative percentage change is greater than the positive percentage change.

This section gives sensitivity analysis for examining the impact of various parameters like

,

,

, and

, respectively on the vendor’s total cost

(see

Table 7).

- •

If the vendor’s fixed and variable carbon-emission costs i.e., and increase, then the vendor’s total cost also increases. It is observed that the negative percentage change as well as the positive percentage changes are similar.

- •

For the increasing value in vendor’s rework cost and vendor’s holding cost indicate vendor’s total cost increases. Like and , both negative percentage change and positive percentage change are equal for and .

By analyzing the above comparison

Table 8 and

Table 9, it can be observed that the model with Stackelberg approach gives the lowest vendor-buyer system’s joint total cost

when compared with the model without Stackelberg approach.