3.1. Regularity Analysis for the Appearance of New Nodes

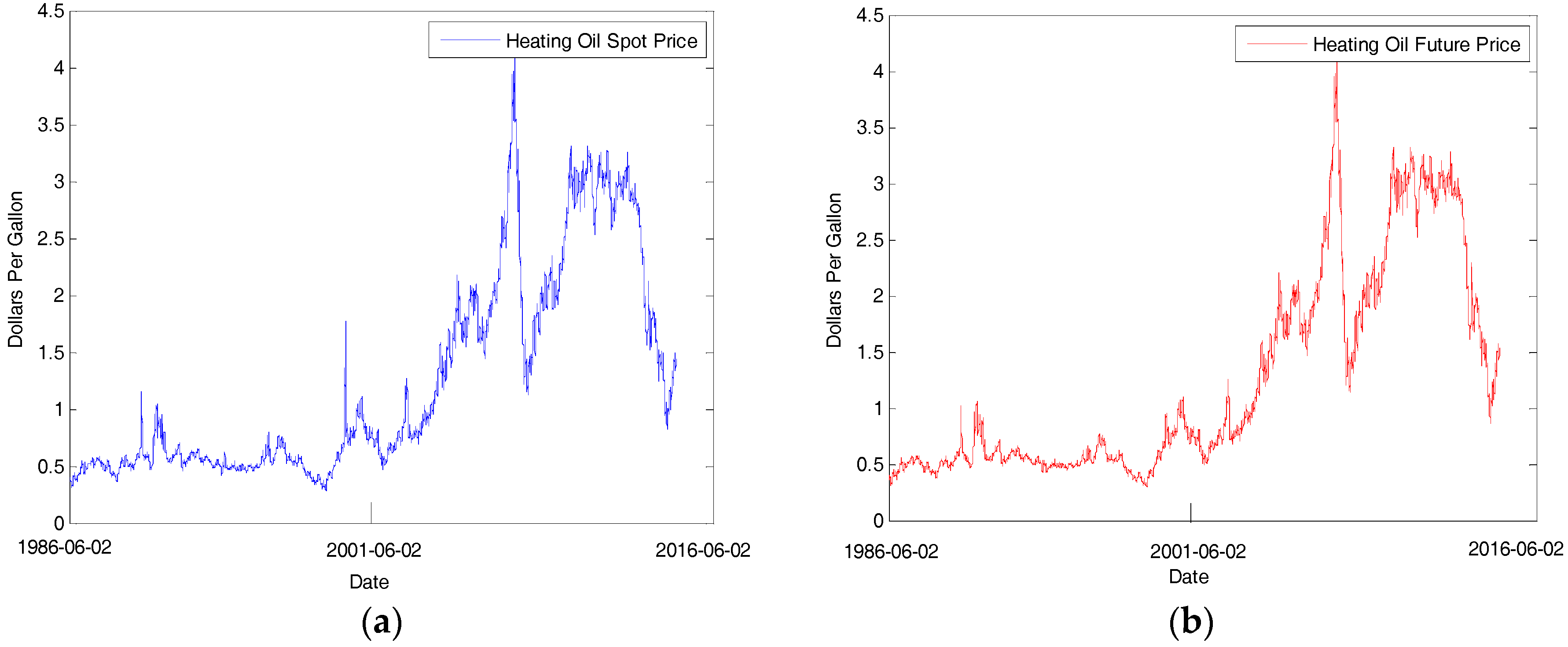

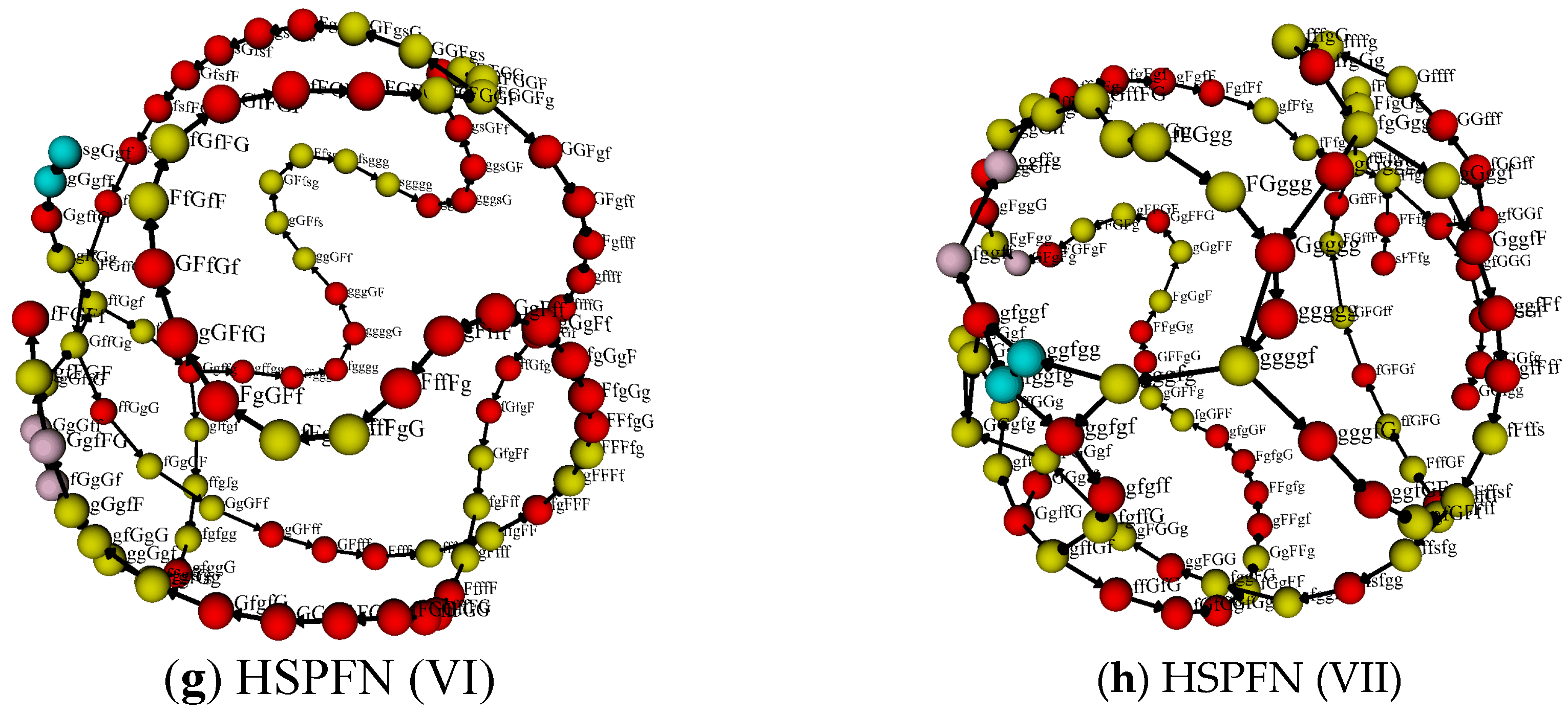

Based on the networks of spot and futures prices fluctuation in different periods in

Section 2.3.2, we study the emergence regularity of new nodes from the view of the cumulative time interval, as shown in

Figure 6.

Figure 6a shows that the red solid line indicates the equal time interval curve, and it can be seen that the cumulative time interval of new nodes is not equidistant but gradually increasing in a straight line in the evolution of HSPFN and HFPFN. The cumulative time of new nodes in HSPFN and HFPFN is regressed by the least square method, and the corresponding regression equations are as follows:

and

, respectively, of which 0.988 and 0.981 are the values of their trend line correlation coefficient

. It shows a higher credibility of the results, and indicates that the accumulation time of new nodes in HSPFN and HFPFN increases linearly, which presents a good regularity. This regularity reflects the temporal variation of spot and future prices can be forward-looking. For instance, in the futures price fluctuation network of heating oil, it can be projected that the 1700th new node will appear on 7 September 2018 according to this method, the emergence time of the 1800th new node will be on 3 August 2020. From the comparison of the network nodes, the length of new nodes’ time interval in the HFPFN (indicated by green “○” in

Figure 6a) is larger than that in HSPFN (indicated by the blue “Δ” in

Figure 6a), indicating that when the data are based on the same length to build the network, the number of network nodes in HSPFN will be more than that in HFPFN, which also explains the evolution of HSPFN is more complex to some extent.

From the perspective of different periods,

Figure 6b shows the cumulative time intervals between HSPFN and HFPFN in the stable and sharp fluctuation periods. It can be noticed that their cumulative time intervals also pose a good regularity, that is, which show a growth trend of straight line. Similarly, the regression equations of the cumulative time intervals of new nodes appearing in the stable fluctuation period and the sharp fluctuating period of HSPFN are respectively

and

, and the trend line correlation coefficient

are 0.956 and 0.935, respectively. However, the corresponding regression equations in HFPFN case are

and

separately, with their trend line correlation coefficient

are 0.945 and 0.922. Therefore, it is easy to notice that the reliability of their results is high, indicating that either in the period of sharp fluctuation or stable fluctuation, the accumulation time of new nodes appearing in HSPFN and HFPFN is not a disorder but a high degree of rectilinear growth trend. At the same time, for HSPFN, the cumulative time interval of new nodes in the stable fluctuation period is longer than that in the sharp fluctuation phase (see the upper part of

Figure 6b), the same is true of sharp fluctuation period (see the second part of

Figure 6b), and the two are very similar.

To sum up, new nodes appearing in the heating oil price fluctuation networks mean some nodes of abnormal volatility (different from the previous state of volatility), indicating that the fluctuation of heating oil prices has complex non-linearity, but the cumulative time of the abnormally fluctuating price node has shown rectilinearity. Using this law can effectively identify the occurrence time of these abnormally fluctuating nodes, and make price decision-makers react in time for the arrival of a new price fluctuation sequence, thereby improve the accuracy when forecasting energy prices.

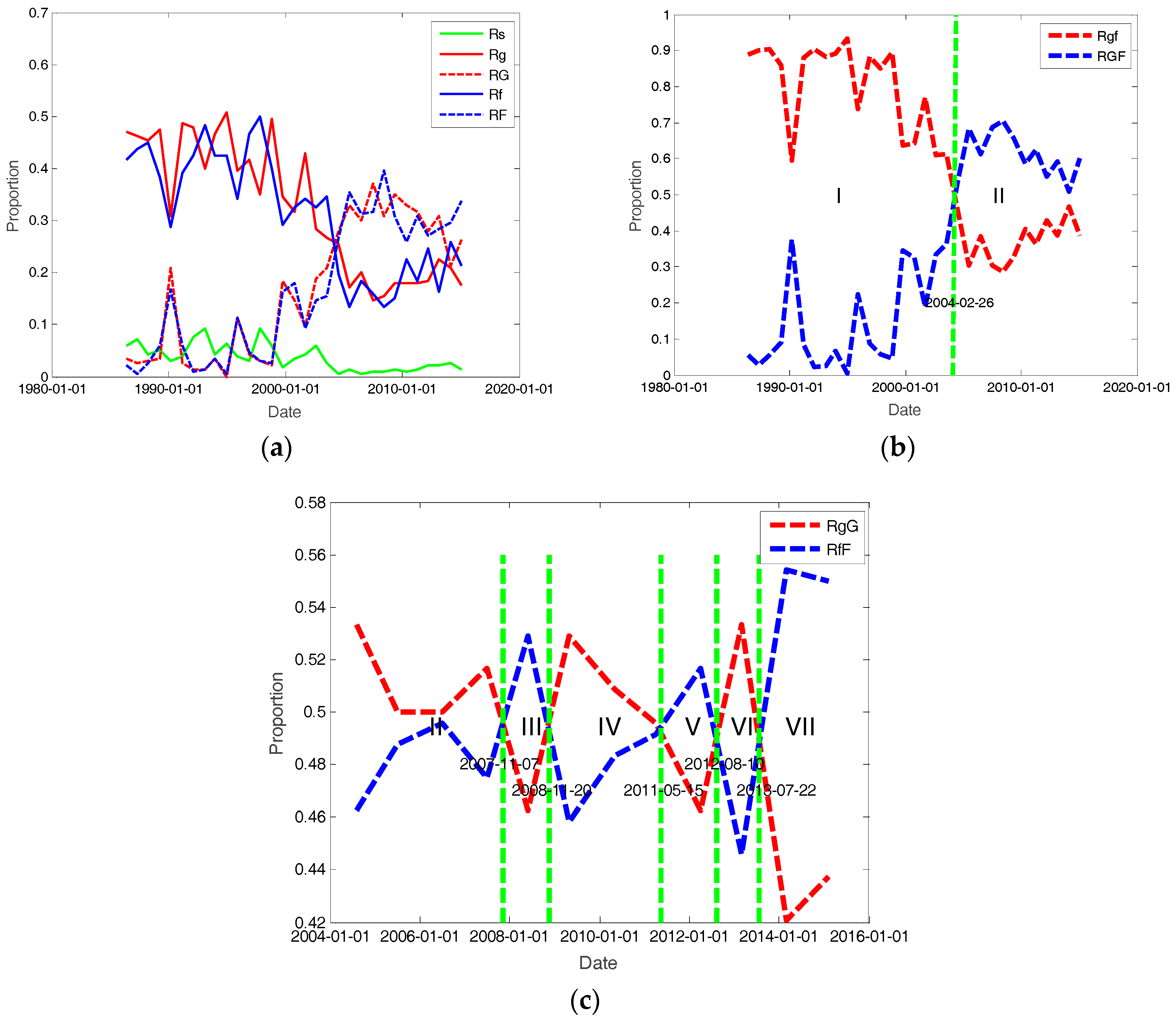

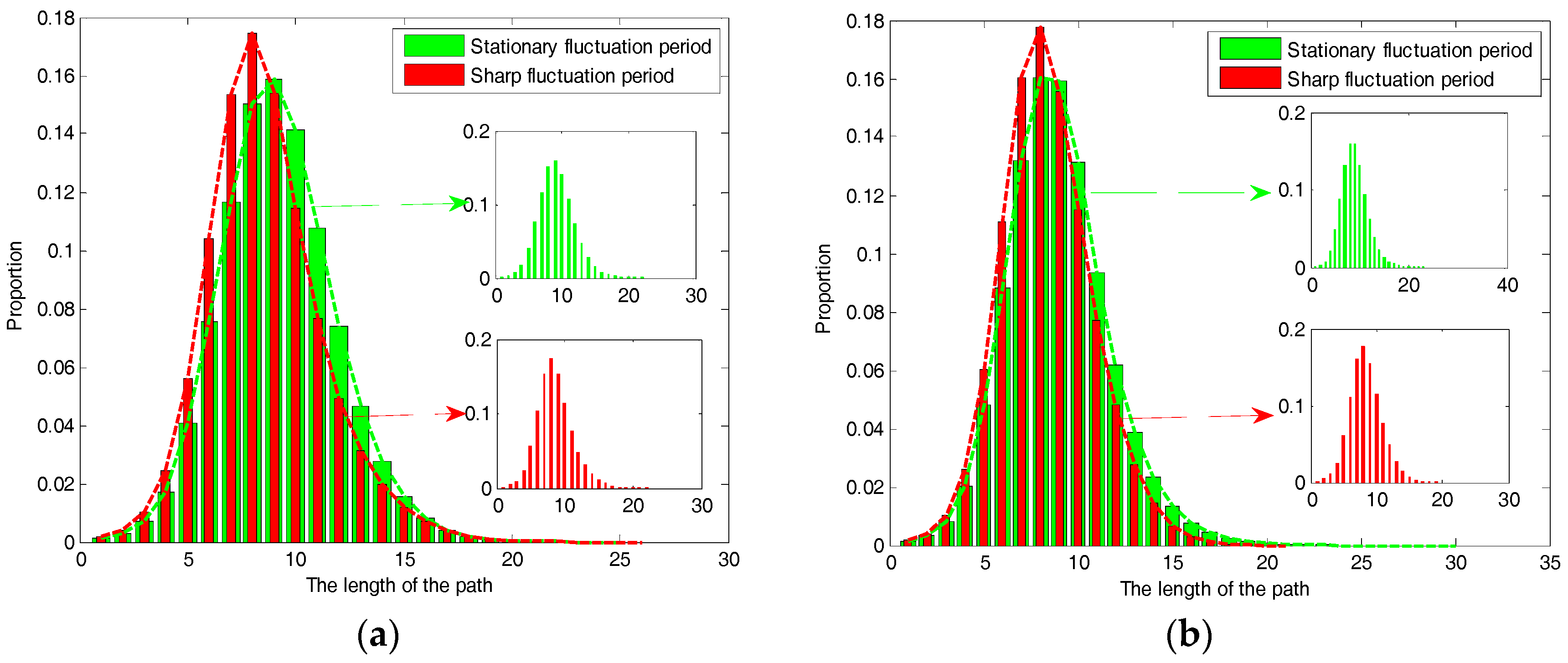

3.2. Conversion Cycle Analysis of Price Fluctuation Mode

According to the relevant definitions of the average path length in

Section 2.4.1, we use the Floyd algorithm [

29,

35] to calculate the distance between any two nodes in the network, the results and different path length distributions are shown in

Figure 7.

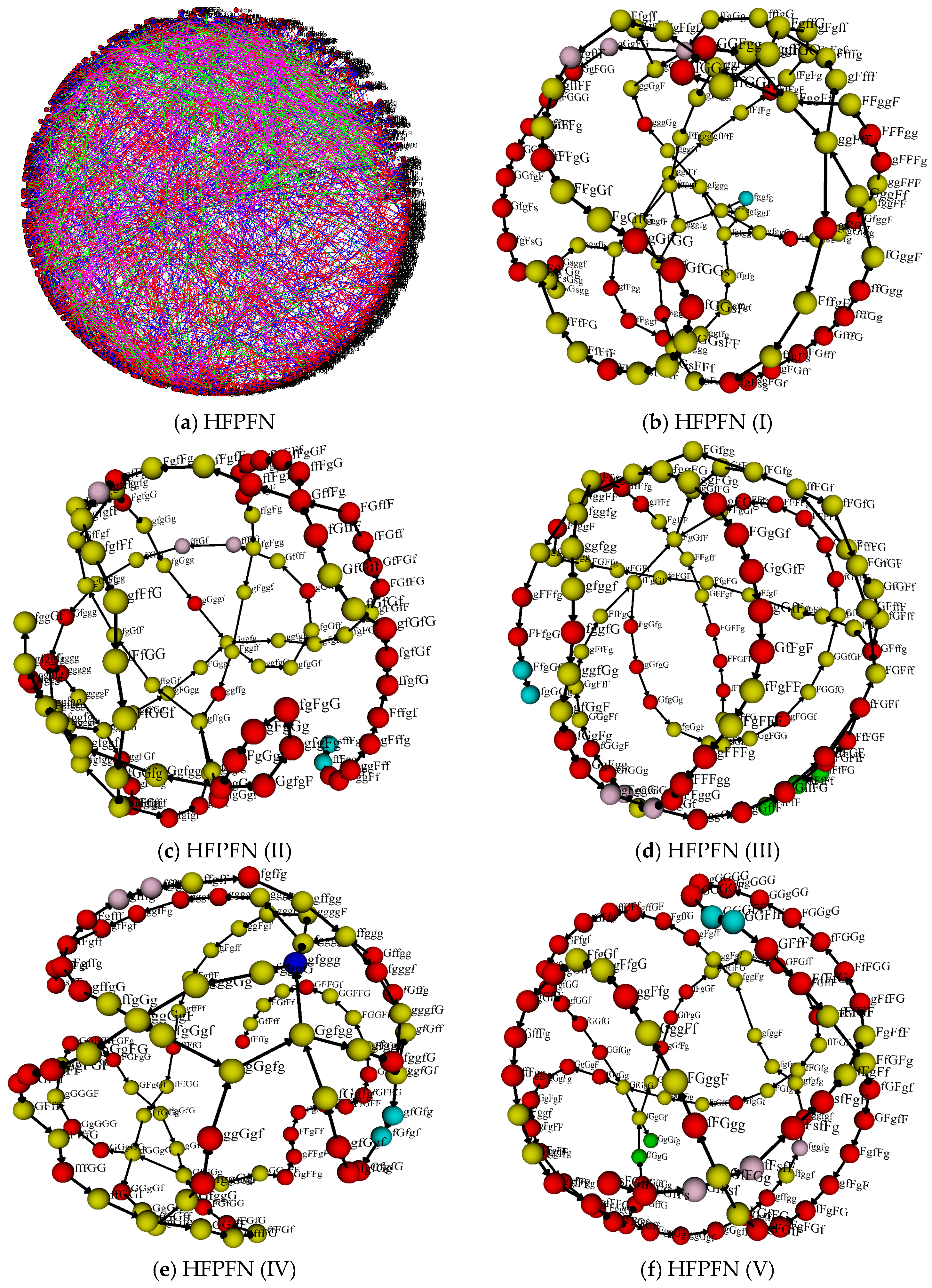

As shown in

Figure 7a,c, the network diameter

is 22 in HSPFN, the average path length of the network is 7.7834, and the distances between nodes of 6, 7, 8, 9 account for 66.28% of the total, indicating the price fluctuation modes in the HSPFN show a short-range correlation, and the conversion cycle of 7–8 days, showing that the conversion is frequent. Besides,

Figure 7b,d show the HFPFN situation, the network diameter

is 21, the average path length of this network is 7.7342, the distances between nodes of 6, 7, 8, 9 account for 66.52% of the total, which reveals that fluctuation modes also show a short-range related nature with a conversion cycle of 7–8 days. In contrast,

is slightly smaller than

, but the conversion cycles of price fluctuation modes basically the same, are 7–8 days. These properties provide a basis for predicting the periodic conversion rules of heating oil price fluctuations in the future.

Spot prices can reflect the influence of seasonal factors and other factors on heating oil prices, so we may consider from different periods (see

Figure 8a) for the spot price fluctuation network. In the stable fluctuation period, the network diameter is 25, the average path length is 9.1874, indicating that the conversion cycles of spot price fluctuation modes are 9–10 days. In addition, the distances between nodes are 7, 8, 9, 10 and 11, which account for 67.50% of the total number. In the period of sharp fluctuation, the network diameter is 26, and the average path length is 8.5679, which means the transformation periods of this case are 8-9 days. Besides, the distances between nodes are 6, 7, 8, 9, and 10, accounting for 70.05% of the total. By comparing the results of different periods, a longer diameter and a shorter volatility cycle can be found during the sharp fluctuation period for HSPFN. As the price volatility period is often caused by some significant impact of the incidents, thus our results can show that the occurrence of emergencies may accelerate the conversion cycle of price volatility.

As for HFPFN, taking the same angle of different periods to consider (see

Figure 8b). In the period of stable fluctuation, the network diameter is 30, the average path length is 8.9346, which indicates that the transition periods of fluctuation modes in futures prices are 8–9 days during the stable fluctuation period. In addition, the distances between nodes are 7, 8, 9 and 10, accounting for 58.24% of the total number. However, in the sharp fluctuation period, the network diameter is 21, the average path length is 8.3546, indicating that the conversion cycles of fluctuation modes in futures prices are 8–9 days. The distances between nodes are 6, 7, 8, 9 and 10, which account for 71.91% of the total. These show unexpected events on the conversion cycle of futures price fluctuations with little effect due to futures prices sometimes fail to make timely adjustments to the impact of emergencies.

The above analysis demonstrates that the heating oil spot and futures prices have a cyclical character from the whole point of view. That is, a change occurs in seven to eight days, and this change is likely to be wave modes occurred in the past. This phenomenon may due to some factors that affect the change of wave modes, and the volatility modes are sensitive to the influence of these factors. For instance, the trading days of heating oil are five days of a week, which may cause consumers to psychologically accept or reject such rules, and further influence the actual transaction price and trading volume, resulting in price volatility of a short period to change around a certain mode emerged in the past. Besides, it is respectively the mutual transformations between the 1501 and 1446 different modes that constitute complicated network structures in HSPFN and HFPFN established in this paper, that is why repetitive modes are generated. In another way, the conversion cycle of spot prices during the stable fluctuation period is different from that during the violent fluctuation period, but the difference is not significant, which reflects the impact of factors such as the occurrence of sudden events, changes in the natural environment and national policies on the volatility of spot prices. In terms of futures prices, the conversion cycle maintains consistency during different fluctuation periods. This shows that futures prices fail to make sensitive response to sudden situation, reflecting the difference between expectation and reality to a certain degree. In short, not only the early warning of heating oil price fluctuation can be provided according to the periodicity of spot price and futures price fluctuation, but also it reflects complex intrinsic dynamic characteristics of heating oil prices.

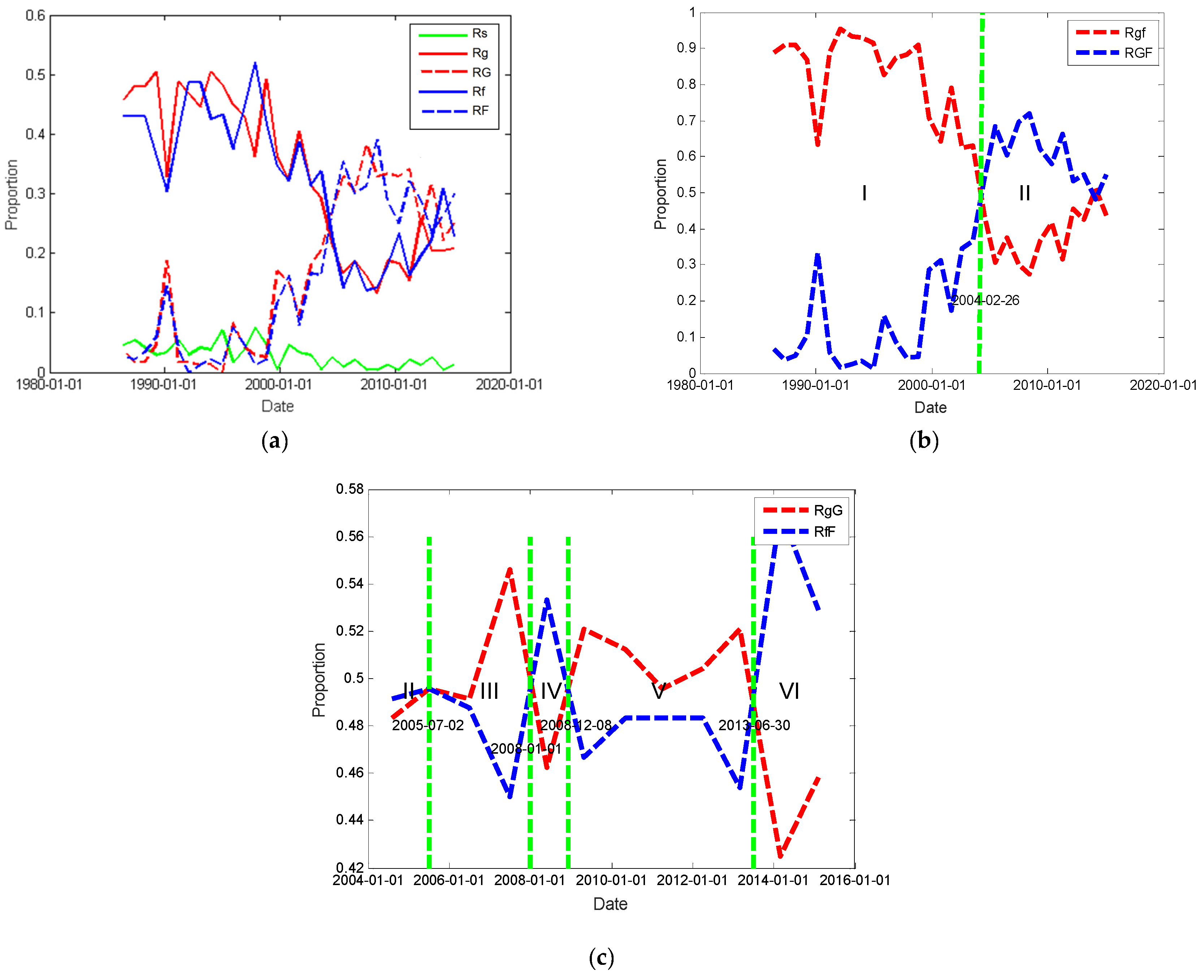

3.3. Analysis of Strength and Strength Distribution of Nodes

In order to further reveal the time distribution characteristics of important modes and the power-law distribution of some networks in different periods, the strength and cumulative strength distribution of nodes are investigated in the following.

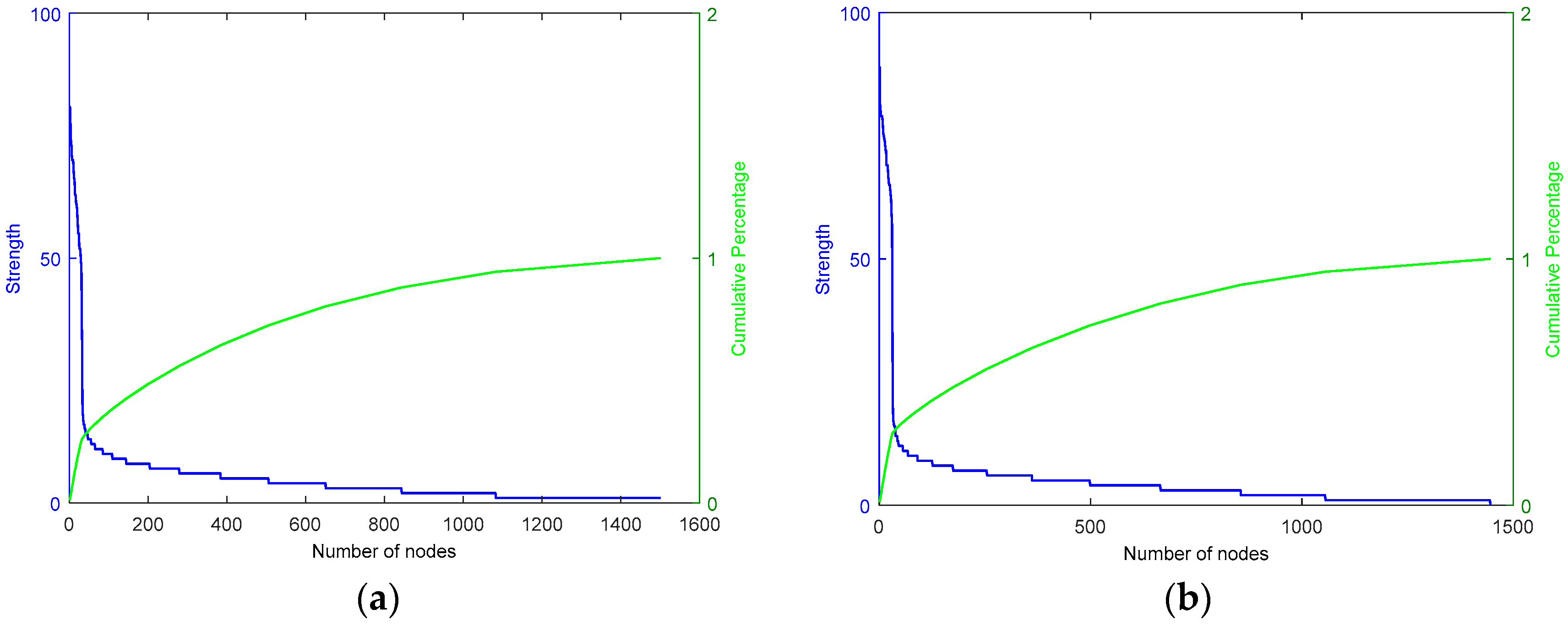

As shown in

Figure 9, the left coordinate represents the node strength and the right coordinate represents the cumulative strength distribution of nodes. Furthermore, most nodes in the heating oil spot and futures price fluctuation networks are small in strength, only a small number of nodes are large, which is a typical characteristic of the scale-free network. For HSPFN (see

Table 4), there are 1501 nodes in the network, of which 31 nodes are more than 40 in strength, accounting for 25.80% of the total strength, namely the sum of strength of 2.07% nodes is 25.80% of the total strength. For HFPFN (see

Table 4), there are 1446 nodes in the network, among which there are 30 nodes with their strength exceeding 40, accounting for 28.60% of the total strength, that is, the sum of strength of 2.07% nodes are 28.60% of the total strength.

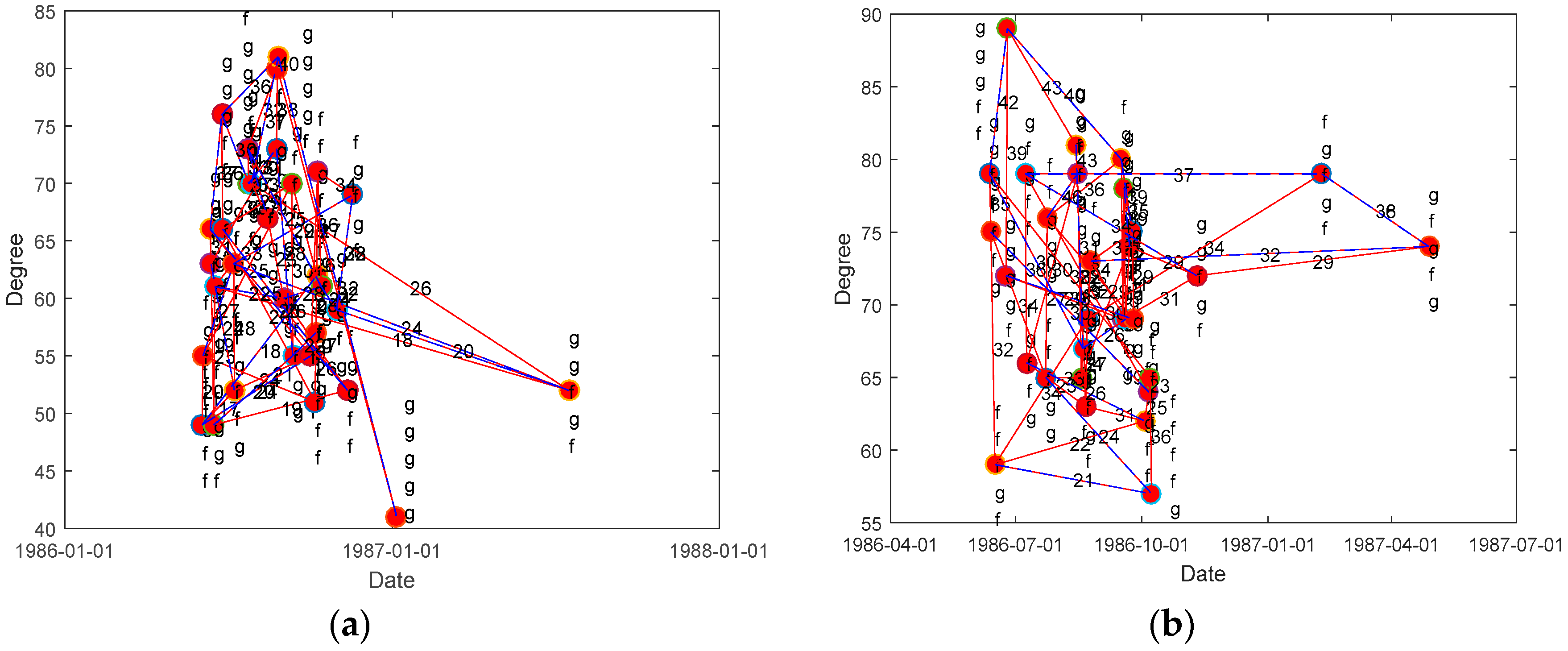

Node strength can reflect the influence or importance of nodes in the whole network to a certain extent. These nodes have been explored with their strength more than 40 in both HSPFN and HFPFN, and then their name, strength and appearing time (see

Figure 10) are obtained, among which the red line indicates the positive direction, the blue line represents the opposite direction, the character signifies the name of a node, and the number on the connecting line between two nodes indicates the weight.

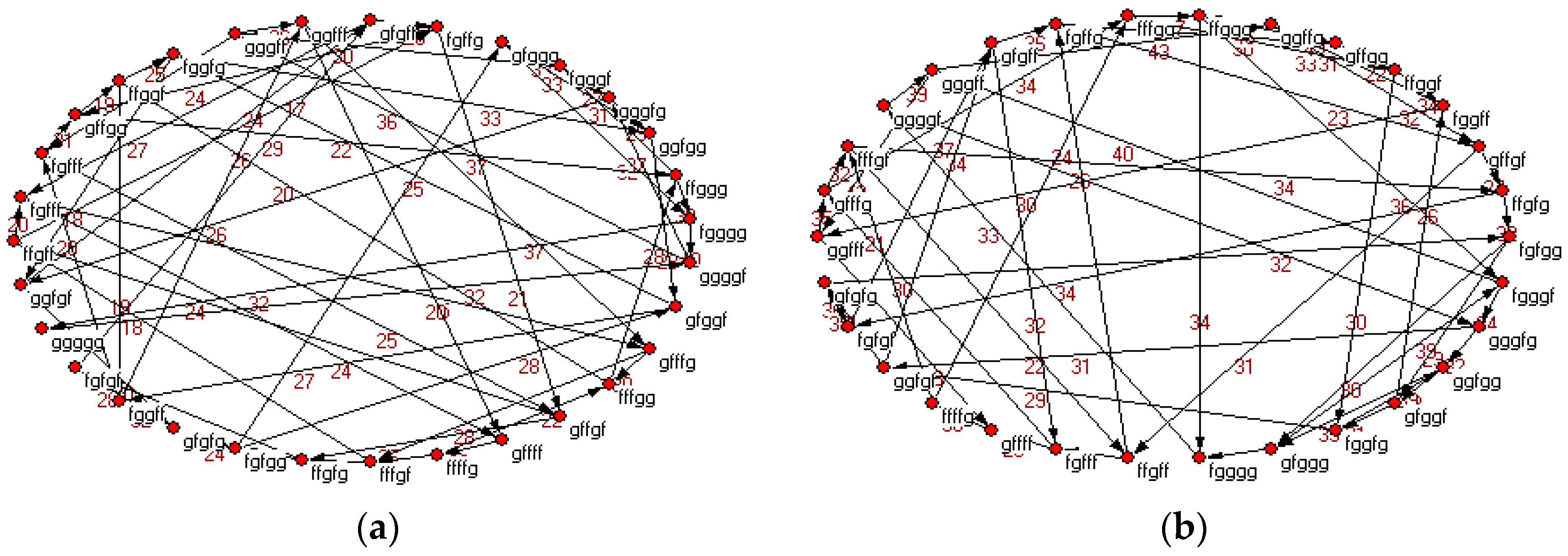

More clear transformation relations and the times of transformations among important nodes (nodes with strength greater than 40) are shown in

Figure 11. Among which, the transformation relationship between these nodes is represented by a black solid line, and the red number on each connecting line indicates the times of conversions between two nodes.

Figure 11 could facilitate the reader’s observation and understanding of the relationship between important nodes.

In

Figure 10, it can be seen from the emergence time of important nodes that the nodes with large strength tend to appear earlier at first, but the nodes appear earlier are not necessarily with large strength in HSPFN and HFPFN. In the spot price fluctuation network, 31 nodes with strength greater than 40 come from the first 135 nodes in this network. Among them, node

, which occurs on 27 August 1986, is the node with the largest strength, and it is the fifty-seventh node in the network. On one hand, there are 12 nodes whose strength are one before the 135th nodes in the spot price fluctuation network, where the earliest node is

with emergence time on 15 July 1986, and it is the thirtieth node appearing in the spot price volatility network. Therefore, a conclusion can be drawn that the node appears earlier does not necessarily have large strength in HSPFN. There are 30 nodes with strength greater than 40 coming from the first 122 nodes in the futures price fluctuation network. Among them, the node

, which appears on 14 August 1986, is the node with the largest strength. Moreover, it is the 50th node that appears in the futures price fluctuation network. On the other hand, there are 9 nodes with strength being 1 in the first 122 nodes, and the earliest node

occurring on 25 July 1986, which is the 37th node in the futures price fluctuation network. Second, it can be seen from the weight of connecting line between nodes that the nodes with large strength are all closely connected in the two price fluctuation networks of heating oil. The average contribution rate of the interconnection between important nodes is 85.74% for HSPFN, while which is 87.27% for HFPFN, hence it is easy to find both the two networks have obvious positive correlation characteristics, that is to say, the nodes with large strength are inclined to connect with nodes with large strength. These above analysis shows that although the conversions of heating oil spot and futures price fluctuations are very frequent and complicated, the first 9% nodes can reflect the core volatility state, which further confirms that the price volatility of heating oil in the future is likely to be similar to that in some past periods. Therefore, studying the fluctuating state of the first 9% nodes and their transformation relationship can help the essential characteristics of price fluctuations to be described approximately.

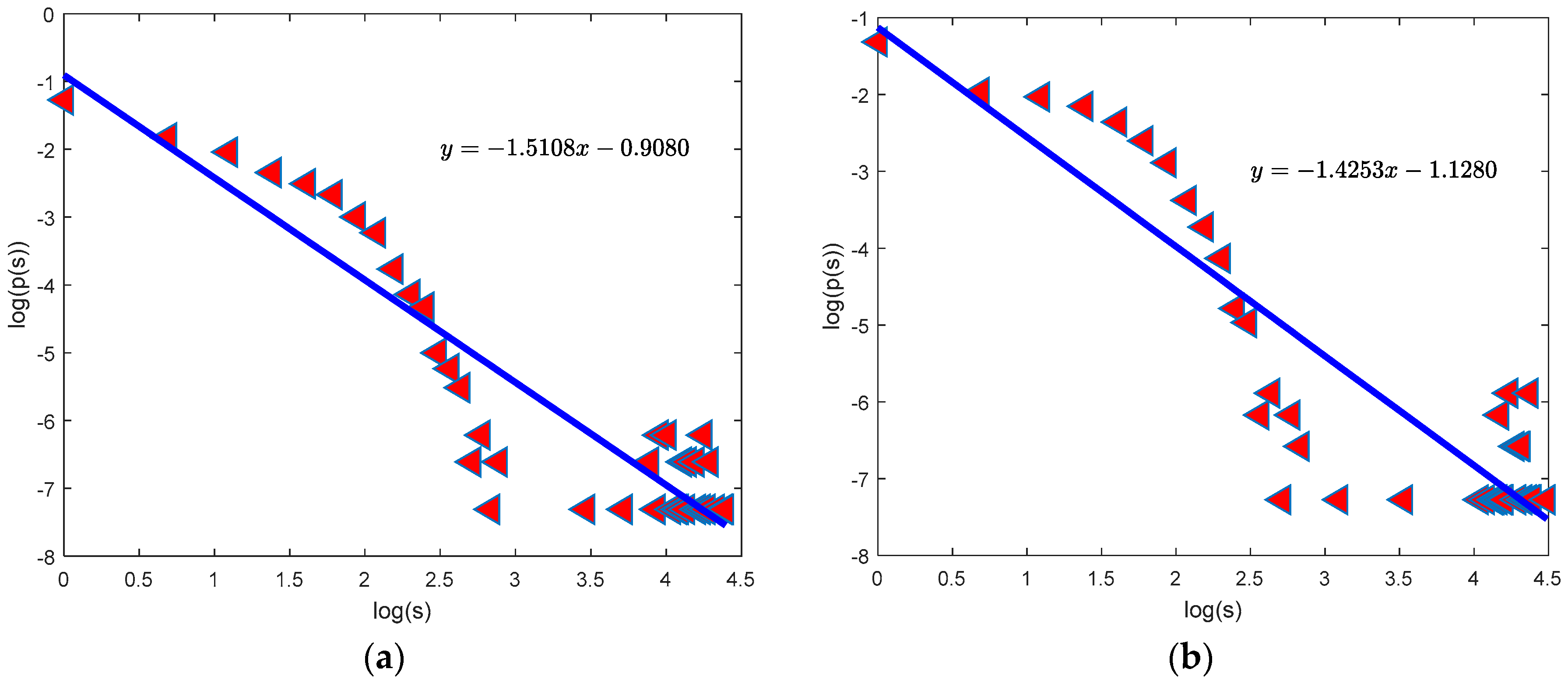

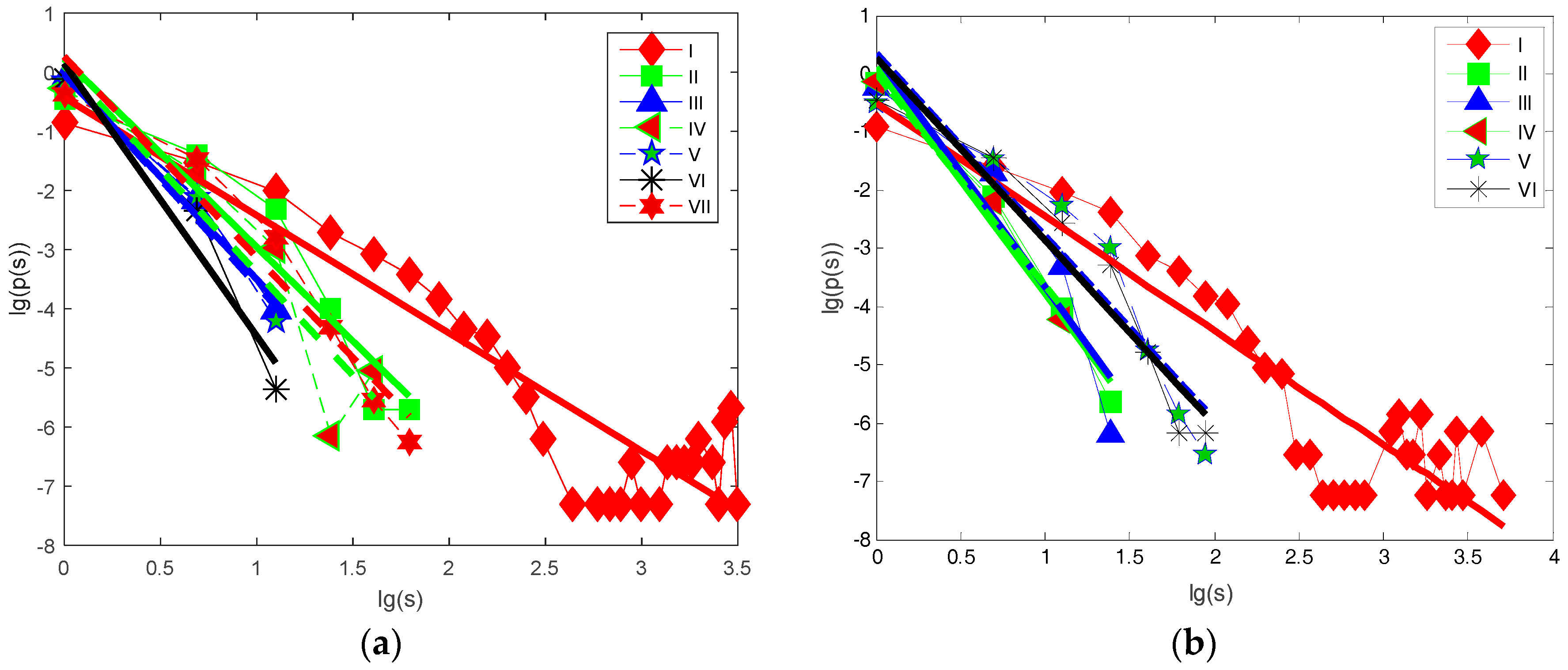

Figure 12 presents that most nodes in the two price fluctuation networks of heating oil have small strength, whereas a small number of nodes have larger strength as a whole. The double-logarithm curves of node strength in HSPFN and HFPFN are fitted by using the least squares linear fitting method. Then the corresponding linear regression equations are

and

, where 0.8511 and 0.8067 respectively are the values of trend line correlation coefficient

, the visible results have a high degree of credibility, indicating that the two networks obey power-law distribution as a whole, and the power indexes corresponding to 1.5108 and 1.4253, which also from one side shows these two networks are scale-free networks. At the same time, as for the scale-free network, the larger the power exponent

is, the higher the power-law distribution will be. Therefore, the power-law distribution of HSPFN is higher than that of HFPFN.

From the perspective of different periods, we investigate the double-logarithmic curves of node strength in the spot and futures price fluctuation networks of heating oil in different periods according to the time division method in

Section 2.2 (see

Figure 13).

Similarly, the least squares fitting method is used to regress the double-logarithmic curves of node strength in two price fluctuation networks in different periods, and the corresponding fitting parameters are shown in

Table 5.

Through the observation of

Figure 13 and

Table 5, it can be easily seen these two price fluctuation networks of heating oil follow the power-law distribution in different periods, and the power exponents of the network correspond to different values at different periods. From the whole point of view, the power exponents of the above two networks in the severe fluctuation period are both higher than that of the stationary fluctuation period, which indicates that the power-law distribution of node strength is higher in the period of severe fluctuation. However, from the change of the power exponents perspective, the power exponent increases from the first period to the sixth period and decreases from the sixth period to the seventh period in HSPFN, suggesting that the degree of power-law distribution of HSPFN increases first and then decreases. However, for HFPFN, the power exponent increases from the first to third period, and reduces from the third to fifth period, and then decreases from the period of the fifth to the sixth. This means the power-law distribution shows a trend of increasing first and then decreasing, then increasing again in HFPFN. On the other hand, it can be found by careful comparison that, whether it is in the network of heating oil spot price volatility or futures price volatility, the maximum power index and minimum power index are present in the period of sharp rise, which means that the power-law distribution is more volatile during the period of violent upswing, and more stable during the sharp decline period.

In conclusion, we can find from the above analysis that HSPFN and HFPFN are scale-free networks, and the important modes in HSPFN are mainly composed of 31 kinds at a long term, with an average contribution rate of 80%. While the important modes of HFPFN are consisted of 30 kinds, and their average contribution rate reaches 87.27%, indicating that the conversion between nodes with larger strength is more frequent. In addition, these important nodes often come from the first 9%, so the evolution of whole network can be grasped by researching the first 9% nodes. In another way, HSPFN and HFPFN of different periods are also scale-free networks, which means node strength obeys the power-law distribution. The degree of the power-distribution is higher in the period of violent fluctuation, and of great complexity and regularity for the two price networks of heating oil. This illustrates the complex intrinsic dynamics characteristics of fluctuations in heating oil prices from the side.

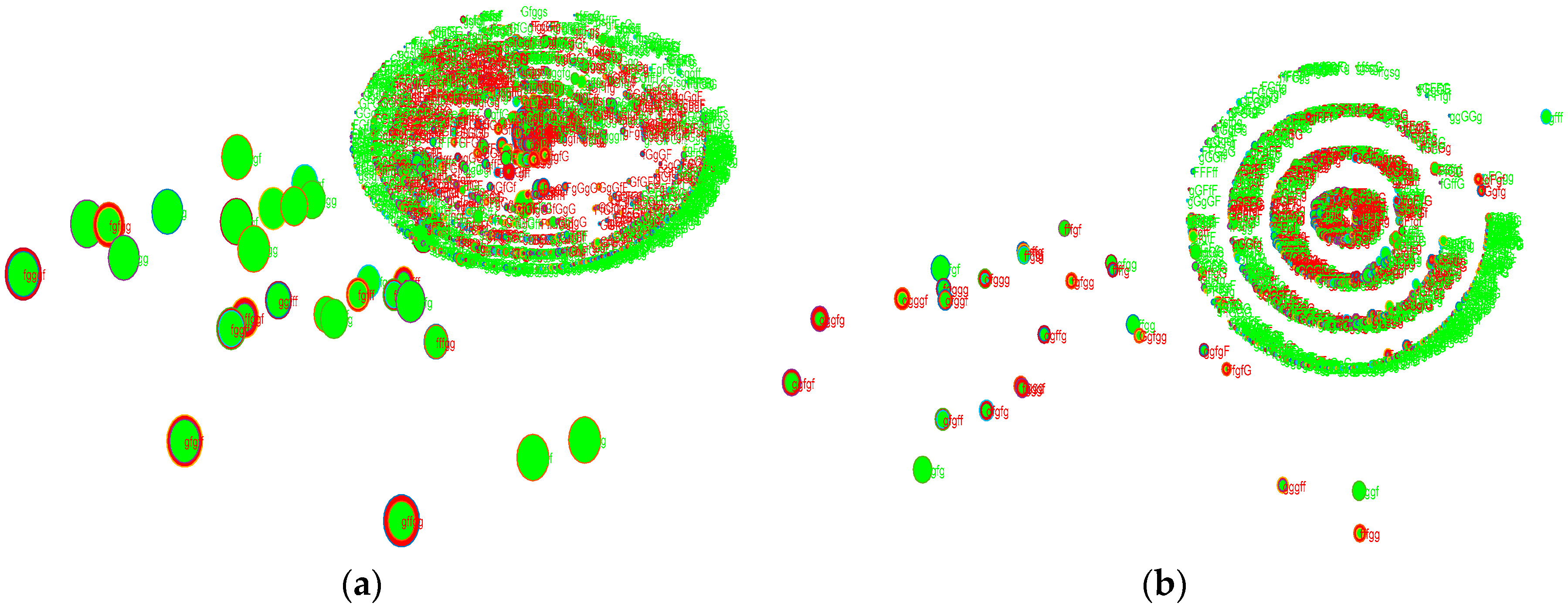

3.4. The Correlation between HSPFN and HFPFN

Over the years, many scholars have always believed that there is a close correlation between spot prices and futures prices of heating oil, and they conducted systematic studies [

1,

7]. The next section will measure the correlation between the two from the perspective of network nodes. From results above, it can be seen that the number of nodes in HSPFN and HFPFN are 1501 and 1446 respectively, and in all of these nodes, 1200 ones are identical. We do some relevant statistics about these 1200 nodes, which is reflected in

Figure 14, where the strength of a node is represented by its size, the green node remarks the node coming from spot price fluctuation network, and the red node signifies the node of futures price fluctuation network. When the strength of a node in spot price network is greater than that in futures price network with the green character representation, and vice versa by red characters.

Based on above results, the similarity of two price fluctuation networks of heating oil has been calculated using following formula:

where

and

are the total number of nodes in HSPFN and HFPFN,

is the total number of the same nodes, and

, which suggests that the similarity degree of two networks reaches the highest if

. By calculating, the correlation of the node strength of spot and futures price fluctuation networks is 0.7829, which shows that the similarity of these two networks is relatively high, and the interdependence between them is relatively close.

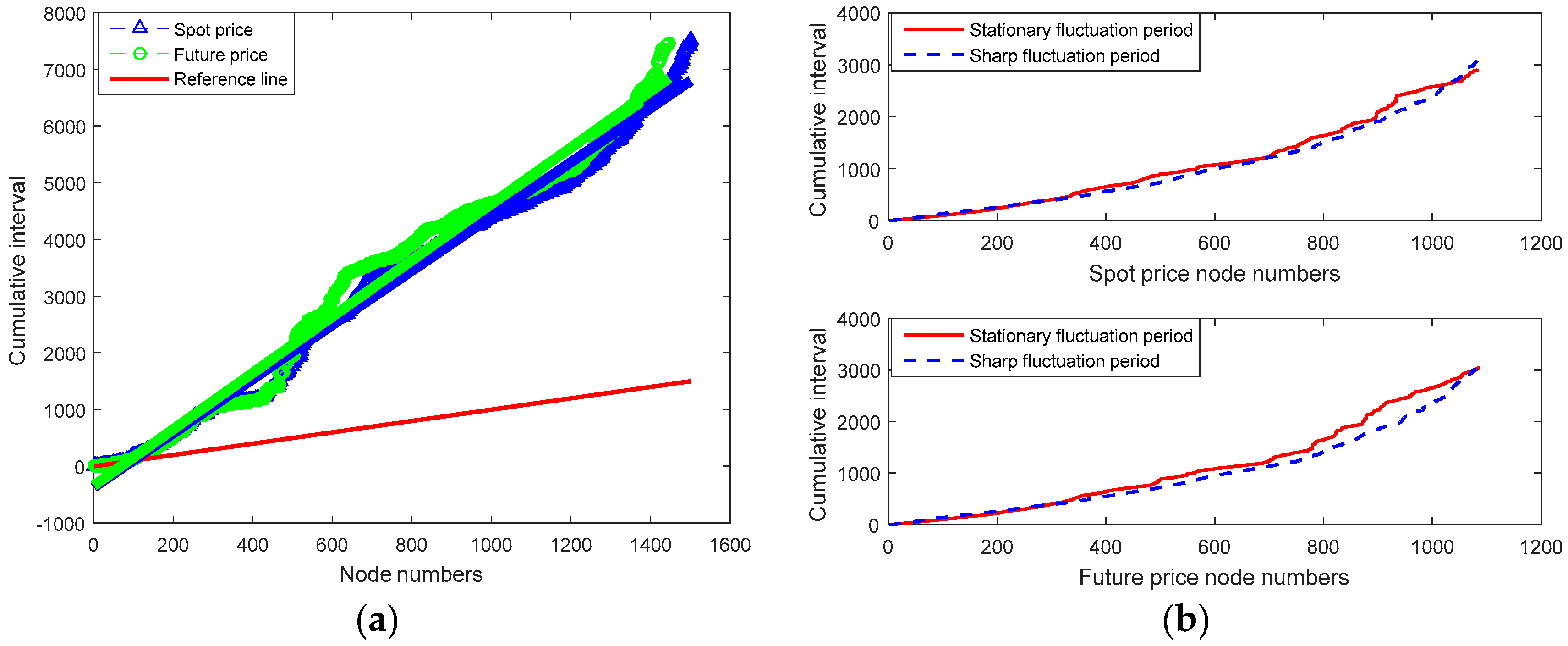

From the point of view of different periods, this part studies the relationship between the nodes of spot price fluctuation network and futures price fluctuation network in the stable fluctuation period and the violent fluctuation period based on the period division results in

Section 2.2 (see

Figure 15).

Figure 15 presents that there are 1061 identical nodes in the stable fluctuation period for HSPFN and HFPFN, with the network similarity of 0.6668, whereas only 876 nodes are same in that period of sharp fluctuation, the network similarity at this time is 0.1139. Therefore, the correlation between spot prices and futures prices of heating oil is complicated and the degree of correlation is very weak during the period of violent fluctuation, while there is strong dependency between the two during the stable fluctuation period.

To sum up, the research on similarity of node degree is very effective in describing the dependence between spot and futures price fluctuations of heating oil. Through the calculation, it can be obtained that the Spearman correlation coefficients [

36] of the two are 0.6153 and 0.1239 in the periods of stable fluctuation and sharp volatility. At the same time, based on the Pearson correlation coefficient formula [

37,

38], we find that the correlation values of them in stable fluctuation period and violent fluctuation period are 0.9013 and 0.1410, respectively. However, it is acknowledged that the Pearson correlation coefficient is more accurate and more sensitive than the Spearman rank correlation coefficient, and only if the Pearson correlation coefficient does not significantly deviate from the Spearman rank correlation coefficient can we use the former, if the difference between the two is too large, then the original data is irregular. Thus, the Pearson correlation coefficient can be taken into account directly according to our data and results, which also shows that the correlation between the spot prices and futures prices of heating oil in steady fluctuations is strong but weak in drastic fluctuations, which is consistent with our results getting from the network nodes perspective. Accordingly, it can be inferred from these findings that the futures prices of heating oil can be a good predictor of the spot prices during the stable fluctuation period, but the prediction function weakens in the severe fluctuation period. In addition, we can not only get the dependence degree between the two kinds of price fluctuations, but also secure the same modes and their number appearing in the fluctuation process, which means that our results are higher in differentiation than the previous research results.

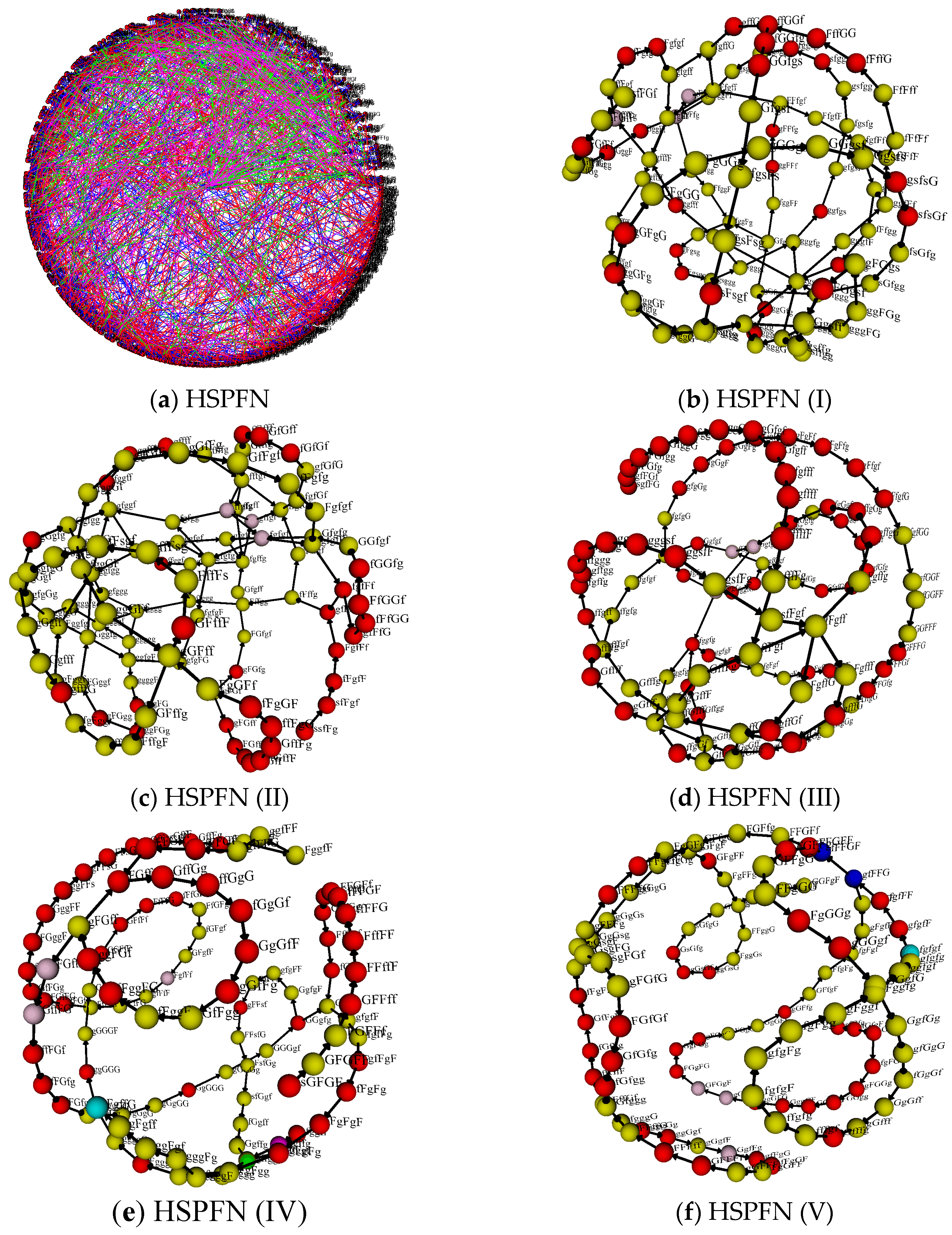

3.5. Intermediary Modal Analysis in Price Fluctuations

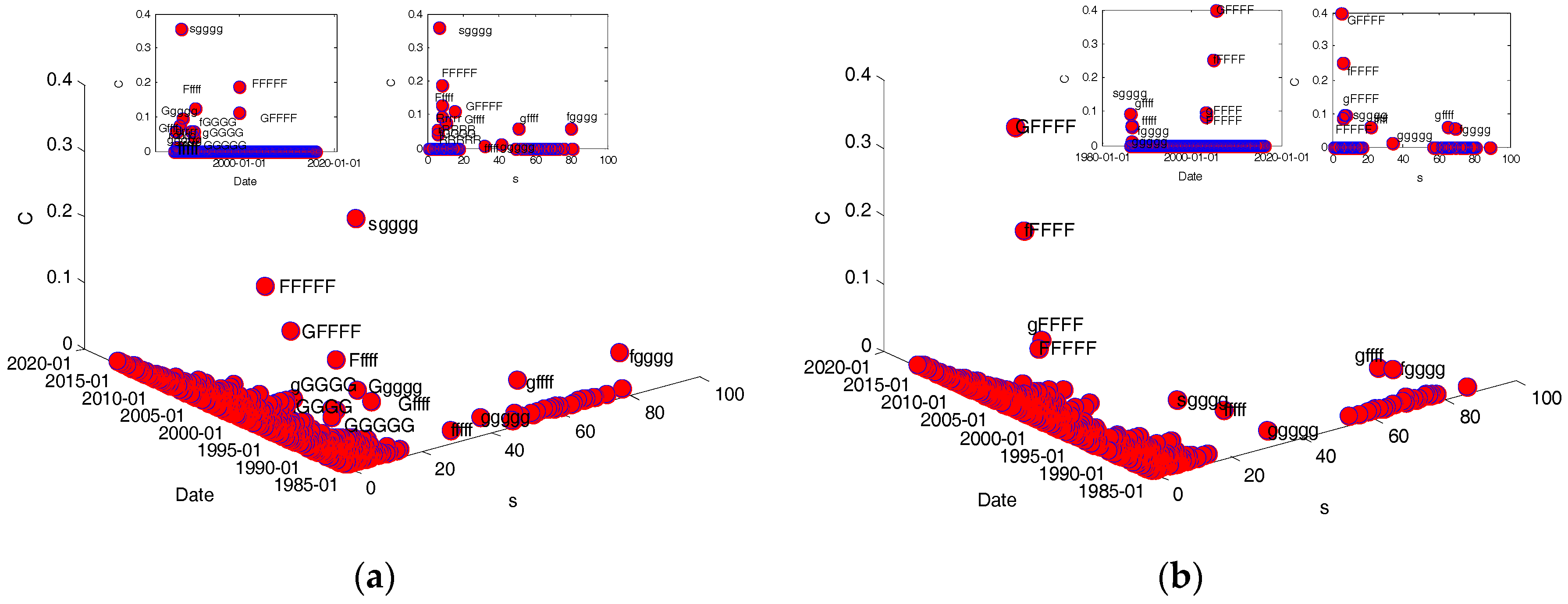

Firstly, the evolution of betweenness and strength of nodes over time in HSPFN and HFPFN has been analyzed in this section.

The results of

Figure 16 show that for the spot price fluctuation network of heating oil, the values of top five nodes in betweenness are 0.0433, 0.0344, 0.0312, 0.0307, 0.0305, which are nodes

,

,

,

,

, and their node strengths are 7, 5, 4, 4 and 7. Besides, the first appearance time of these nodes are 10 September 1990, 10 April 2007, 31 July 1986, 23 June 1998 and 16 August 1991. For the futures price fluctuation network of heating oil, the top five nodes in betweenness are

,

,

,

,

, with the corresponding values of 0.0420, 0.0400, 0.0356, 0.0341 and 0.0340. Their strengths respectively are 3, 4, 5, 4 and 6, and the first occurrences are respectively on 22 July 1986, 13 June 2001, 8 November 1991, 19 February 1991 and 7 July 1988. Based on the above analysis, we can see from the relationship between the betweenness and strength of nodes that the node with large betweenness has small strength.

In order to get the intermediate modes in price volatility, we explore the evolution of betweenness and strength of nodes in HSPFN and HFPFN within different fluctuation periods (see

Figure 17) are explored.

In the phase of stable fluctuation, for the spot price fluctuation network, the first five nodes with the largest betweenness are , , , , , their values respectively correspond to 0.0380, 0.0377, 0.0353, 0.0334 and 0.0330, and the strength of theirs are 4, 3, 4, 6 and 7. At the same time, the first five nodes in betweenness appearing in the futures price volatility network separately are , , , , , the betweenness values of which are 0.0393, 0.0366, 0.0356, 0.0355 and 0.0350, strengths of these nodes are 3, 4, 4, 4 and 8. Case of the wildly fluctuation period is as follows: the first five nodes with the largest value of betweenness are , , , , , with the values of 0.0411, 0.0401, 0.0390, 0.0390 and 0.0374 respectively in the spot price fluctuation network, and the strengths of these nodes are 4, 3, 3, 7 and 4. However, for the futures price fluctuation network, the top five betweenness of nodes are 0.0566, 0.0502, 0.0483, 0.0467 and 0.0393, respectively for the nodes , , , , , whose strengths are 3, 4, 4, 4 and 4.

Some details can be found by comparing the above results: (1) the betweeness centrality in the stable fluctuation period is less than that in the violent fluctuation period, which indicates the impact of some unexpected events enhances the intermediary degree of network nodes, and the same node (for example, ) corresponds to different values at different times. Thus, we can see that the intermediary capacity of network nodes is declining in the stable fluctuation period; (2) Whether it is in the overall network or local network concerning HSPFN and HFPFN, there is no symbol “s“ for the first five nodes with the largest betweenness, suggesting that the drastic changes in the futures and spot prices often have a relatively strong intermediary ability in the long-term heating oil market; (3) Both of the two kinds of price fluctuation network of heating oil show that the main mediating function is borne by the node with small strength, revealing from the side that the important node is not necessarily the node with large strength. When these nodes with a higher betweeness centrality turn up, it suggests that this period is a transitional stage, and reflects the alternation of changes in price volatility along with the precursors of change. Using this law can determine whether the heating oil market is in a transitional period, which can forecast the fluctuation states of spot prices and provide reference basis for the pricing of heating oil in the transition period.

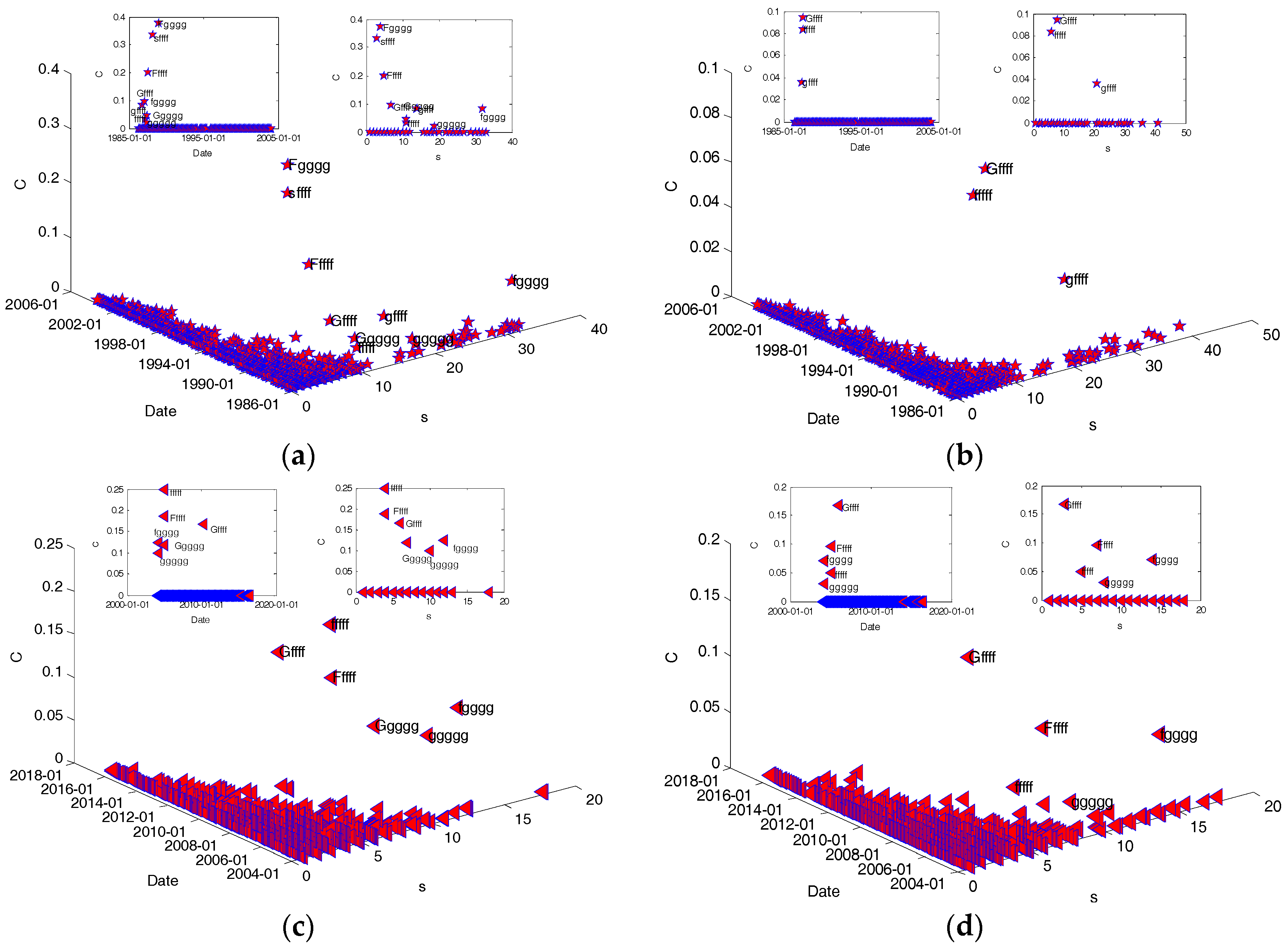

3.6. Analysis of Clustering Characteristics between Fluctuation Modes

This part mainly discusses the relationship among clustering coefficient, time as well as node strength of HSPFN and HFPFN according to some relevant definitions of clustering coefficient mentioned in

Section 2.4.4 (see

Figure 18).

As shown in

Figure 18a, for the spot price fluctuation network, the average clustering coefficient is 0.00082, and of all nodes only 13 nodes whose clustering coefficients are not zero, they are respectively

,

,

,

,

,

,

,

,

,

,

,

and

according to the order of their occurrence, with the corresponding clustering coefficients are 0.0563, 0.0564, 0.0052, 0.0122, 0.0758, 0.3571, 0.03938, 0.0556, 0.0556, 0.0417, 0.125, 0.1111 and 0.1875. In addition, their node strength in sequence are 80, 51, 32, 41, 11, 7, 8, 6, 6, 6, 8, 15 and 8.

Figure 18b shows that the average clustering coefficient is 0.00076 in HFPFN, while the clustering coefficients of 9 nodes are not zero, namely nodes

,

,

,

,

,

,

,

and

in accordance with the order of occurrence. The clustering coefficients of these nodes respectively are 0.0938, 0.0525, 0.0098, 0.059, 0.0568, 0.0952, 0.0833, 0.25 and 0.4, and their matching strengths are 8, 69, 34, 65, 22, 7, 6, 6 and 5. The contrast presents that both of the two price networks of heating oil have smaller clustering coefficients, that is, these two modes connecting with the same mode are also connected with each other with less probability. However, the clustering coefficient of HSPFN is slightly larger, indicating how closely the spot price volatility network higher than the futures price volatility network. However, we can also see that the nodes with non-zero clustering coefficients in these two price fluctuation networks are usually small in strength, only a few appear in the nodes with large strength. This presents that the price fluctuation network of heating oil is not completely random, to some extent with the “birds of a feather flock together” characteristics [

29,

39]. However, more obvious clustering characteristics of the network may occur in small groups or in large groups. From the occurrence time of clustering coefficients, the first appeared on 26 August 1986, and the last appeared on 7 February 2000 in HSPFN, while for HFPFN, the clustering coefficient emerged for the first time on 23 June 1986, the last time was 1 September 2005. In addition, the clustering coefficients will be different if on other time scales, which shows that in the actual spot and futures prices of heating oil changing with time, the volatility of prices is sometimes reflected on a large time scale, but sometimes reflected in a small time scale. Researching on the clustering coefficients of the two price networks of heating oil can provide some reference and help for us to study the clusters of price volatility in the future.

From the perspective of different periods,

Figure 19 displays the evolving images of the cluster coefficients existing in HSPFN and HFPFN during the stable fluctuation period and the severe fluctuation phase respectively.

Firstly, in the stage of stable fluctuation (see

Figure 19a,b), 0.00086 is the average clustering coefficient for the spot price volatility network, and there are only 9 nodes are not zero for clustering coefficients, according to the order in which they appear are separately

,

,

,

,

,

,

,

and

. At the same time, the clustering coefficients of these nine nodes are 0.0833, 0.0833, 0.0952, 0.0303, 0.0455, 0.0175, 0.2, 0.3333 and 0.375 respectively, and their node strengths are 14, 32, 7, 11, 11, 19, 5, 3 and 4. As for the futures price volatility network, the average clustering coefficient is 0.00015, and there are three nodes with clustering coefficients of non-zero, names of these nodes according to their order of occurrence are

,

and

, of which the clustering coefficients are respectively 0.0357, 0.0938 and 0.0833, as well as the node strength corresponding to 21, 8 and 6. Secondly, in the violent volatility phase (see

Figure 19c,d), for the spot price volatility network , the average clustering coefficient of which is 0.00088, and it has 6 nodes that their clustering coefficients are not 0, that is, these clustering coefficients are separately 0.125, 0.1, 0.119, 0.1875, 0.25 and 0.1667 according to the sequence of their appearance, with their corresponding node names are

,

,

,

,

and

. In addition, the strength of these nodes are as such: 12, 10, 7, 4, 4 and 6. While the average clustering coefficient of the futures price fluctuation network is 0.00038, and it is the cluster coefficients of five nodes that are not 0, the values of these cluster coefficients namely 0.0714, 0.0313, 0.0952, 0.05 and 0.1667 according to the order that they occur, their node names followed by

,

,

,

,

, and the strength consistent with those five nodes is namely 14, 8, 7, 5 and 3. It can be seen from comparison that for the spot price fluctuation network, the number of nodes whose clustering coefficient is not zero in the stable fluctuation phase is greater than that during the sharp fluctuation period, which shows the network becomes more closely during the stage of stable volatility. However, the situation is just opposite for the futures price fluctuation network, indicating it is in the period of intense fluctuations that the network shows more closely. On the whole, whether the futures price volatility network or the spot price volatility network, the average clustering coefficient in the stable fluctuation stage is less than that in the widely fluctuating phase. It turned out that the prices of heating oil in the period of stable volatility reflect higher complexity.

Furthermore, we find that the volatility of heating oil prices shows different characteristics in different periods from above experiment. Overall, the weighted clustering coefficients of only 9 nodes in HSPFN are not zero. That is, only the neighbors of these nine nodes are closely connected, which form nine small groups with these nodes as the core, while there are 6 small clusters in HFPFN. From different periods, there are respectively 9 and 3 small clusters for HSPFN and HFPFN during the stable fluctuation period. However, they respectively form 6 and 5 small groups in the violent fluctuation period. From different periods, there are respectively 9 and 3 small clusters for HSPFN and HFPFN during the stable fluctuation period. However, they respectively form 6 and 5 small groups in the violent fluctuation period. In addition, for HSPFN and HFPFN, the core modes that cause clusters have a great similarity in a certain period, that is to say, the core modes that cause clusters in futures price volatility are also prone to occur in spot price fluctuations. This reflects a good prediction function for futures prices, but some appropriate adjustments also should be made based on the own conditions of spot prices. To determine which fluctuation period they lie in depending upon the occurrence frequency of these fluctuating modes, which is useful and meaningful reference for making reasonable decision for price setting, avoiding excessive pricing errors or venture investments as well as avoiding market risk.

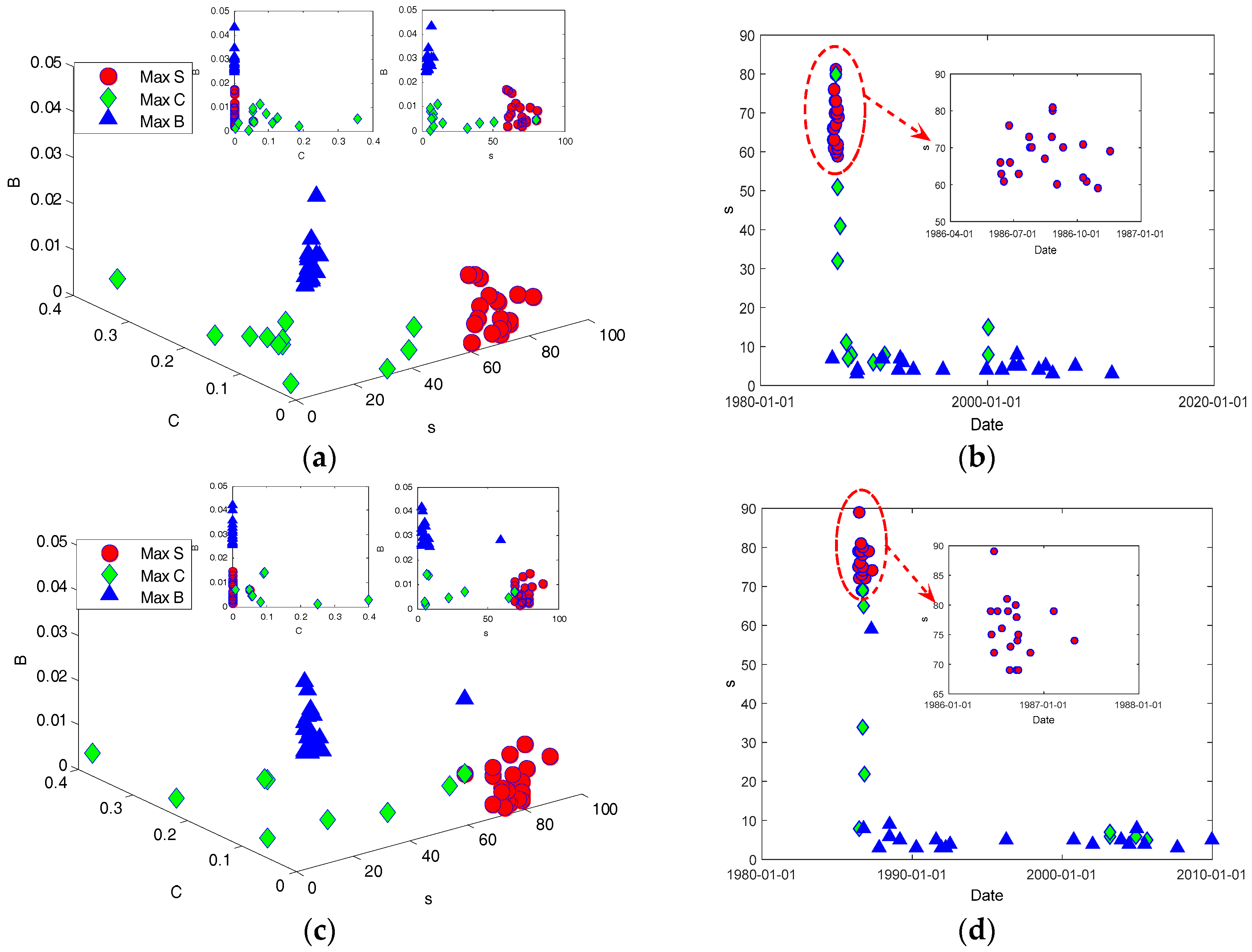

Next, the relationship among the three factors, such as node strength, betweenness and clustering coefficient, is investigated, mainly combining the above structural analysis of the three. First of all, some important nodes of strength or betweenness or clustering coefficient is relatively large are chosen to get the relationship among them (see

Figure 20a,c) and the time distribution of their first occurrence(see

Figure 20b,d).

It can be seen from

Figure 20a,c that both HSPFN and HFPFN demonstrate that the node with larger strength has smaller betweeness centrality and clustering coefficient, and the node with larger betweeness has smaller strength and clustering coefficient. Furthermore, nodes with larger clustering coefficients have smaller betweeness and strength. Taken together, the two price fluctuation networks of heating oil are characterized by smaller betweeness centrality, average path length and clustering coefficient, as well as larger average node strength, which is different from the characteristics of stochastic networks and chaotic networks. Then from the first appearance of node strength, betweenness and clustering coefficient of the two networks in terms of time (see

Figure 20b,d), the nodes with larger node strength (shown as “○”) occured earlier for the first time, generally focused on 1986, while the first emergence time of nodes with larger clustering coefficient (“◊” in the

Figure 20) was relatively scattered, concentrated in the period from 1986 to 2000, but still biased towards the early, nodes of greater betweenness (shown as “Δ”) appeared most scattered, concentrated in the stage of 1986 to 2009. Once they appear, it means that the futures or spot prices of heating oil are in a volatile transition period, to carry out in-depth study of them will help to better grasp the heating oil price changes in regularity.