The Influence of the Sustainability Logic on Carbon Disclosure in the Global Logistics Industry: The Case of DHL, FDX and UPS

Abstract

:1. Introduction

2. Carbon Reporting in the Global Logistics Industry

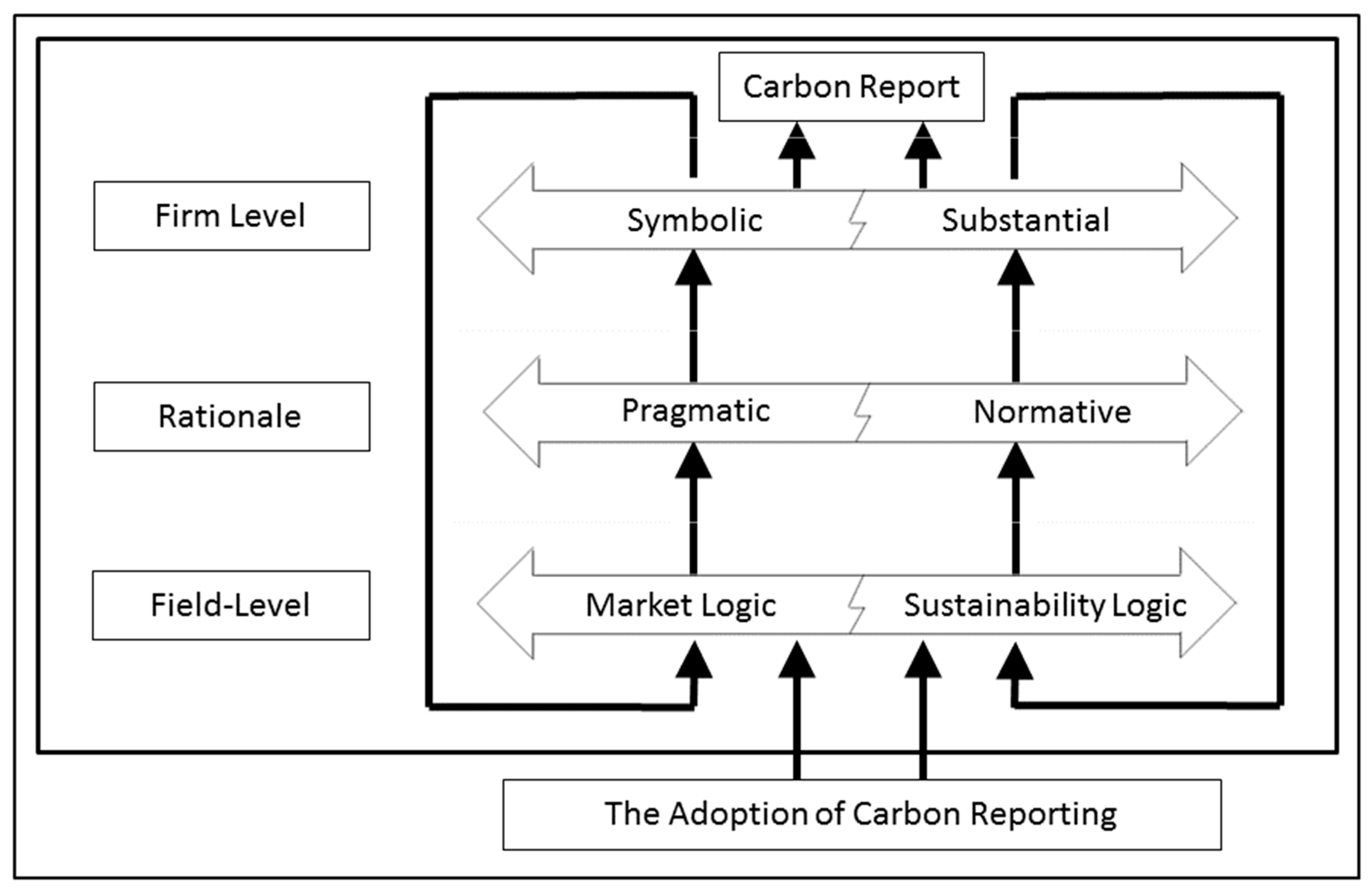

3. Legitimation and Carbon Reporting Approaches

4. The Influence of Underlying Competing Logics on Carbon Disclosure

5. Research Methods

6. Results and Discussion

6.1. Carbon Strategy/Climate Change Statements

6.2. Degree of Transparency

6.3. Internal Initiatives

6.4. External Stakeholder Engagement

7. Conclusions and Implications for Further Research

Author Contributions

Conflicts of Interest

References

- Kolk, A.; Levy, D.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Account. Rev. 2008, 17, 719–745. [Google Scholar] [CrossRef]

- KPMG. Corporate Sustainability—A Progress Report; KPMG: Amsterdam, The Netherlands, 2014. [Google Scholar]

- World Economic Forum. Logistics & Supply Chain; World Economic Forum: New York, NY, USA, 2012. [Google Scholar]

- Hahn, R.; Reimsbach, D.; Schiemann, F. Organizations, climate change, and transparency: Reviewing the literature on carbon disclosure. Organ. Environ. 2015, 28, 80–102. [Google Scholar] [CrossRef]

- Brundtland, G.H. Our Common Future: Report of the World Commission on Environment and Development; Oxford University Press: Oxford, UK, 1987; Volume 1, p. 383. [Google Scholar]

- UN. United Nations framework convention on climate change. In Proceedings of the United Nations Framework Convention on Climate Change, New York, NY, USA, 9 May 1992. [Google Scholar]

- Evangelista, P.; Huge-Brodin, M.; Isaksson, K.; Sweeney, E. Purchasing green transport and logistics services: Implications from the environmental sustainability attitude of 3pls. In Sustainable Practices: Concepts, Methodologies, Tools, and Applications; Information Resource Management Association: Hershey, PA, USA, 2013; Volume 1, pp. 86–102. [Google Scholar]

- Abbasi, M.; Nilsson, F. Developing environmentally sustainable logistics: Exploring themes and challenges from a logistics service providers’ perspective. Transport. Res. D Transp. Environ. 2016, 46, 273–283. [Google Scholar] [CrossRef]

- Lieb, K.J.; Lieb, R.C. Environmental sustainability in the third-party logistics (3pl) industry. Int. J. Phys. Distrib. Logist. Manag. 2010, 40, 524–533. [Google Scholar] [CrossRef]

- Perotti, S.; Zorzini, M.; Cagno, E.; Micheli, G.J. Green supply chain practices and company performance: The case of 3pls in italy. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 640–672. [Google Scholar] [CrossRef]

- Herold, D.M.; Lee, K.-H. Carbon Management in the Logistics and Transportation Sector: An Overview and New Research Directions. 2017. Available online: http://www.tandfonline.com/doi/abs/10.1080/17583004.2017.1283923 (accessed on 15 March 2017).

- Gotsi, M.; Wilson, A.M. Corporate reputation: Seeking a definition. Corp. Commun. Int. J. 2001, 6, 24–30. [Google Scholar] [CrossRef]

- Hrasky, S. Carbon footprints and legitimation strategies: Symbolism or action? Account. Audit. Account. J. 2011, 25, 174–198. [Google Scholar] [CrossRef]

- Kim, J.-N.; Bach, S.B.; Clelland, I.J. Symbolic or behavioral management? Corporate reputation in high-emission industries. Corp. Rep. Rev. 2007, 10, 77–98. [Google Scholar]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar]

- Hopwood, A.G. Accounting and the environment. Account. Organ. Soc. 2009, 34, 433–439. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hörisch, J. In search of the dominant rationale in sustainability management: Legitimacy-or profit-seeking? J. Bus. Ethics 2015. [Google Scholar] [CrossRef]

- Calhoun, C. Nationalism and ethnicity. Annu. Rev. Sociol 1993, 19, 211–239. [Google Scholar] [CrossRef]

- Onghena, E.; Meersman, H.; Van de Voorde, E. A translog cost function of the integrated air freight business: The case of fedex and ups. Transport. Res. A 2014, 62, 81–97. [Google Scholar] [CrossRef]

- Scott, W.R. Unpacking institutional arguments. In The New Institutionalism in Organizational Analysis; Powell, W.W., DiMaggio, P.J., Eds.; University of Chicago Press: Chicago, IL, USA, 1991; pp. 164–182. [Google Scholar]

- Levy, D.L.; Kolk, A. Strategic responses to global climate change: Conflicting pressures on multinationals in the oil industry. Bus. Politcs 2002, 4, 275–300. [Google Scholar] [CrossRef]

- Lash, J.; Wellington, F. Competitive advantage on a warming planet. Harv. Bus. Rev. 2007, 85, 95–102. [Google Scholar]

- Lee, K.-H.; Vachon, S. Business Value and Sustainability: An Integrated Supply Network Perspective; Palgrave Macmillan: London, UK, 2016. [Google Scholar]

- CDP. Transport Report; Carbon Disclosure Project: London, UK, 2010. [Google Scholar]

- Cashore, B.; Auld, G.; Newsom, D. Governing through Markets: Regulating Forestry through Non-state Environmental Governance; Yale University Press: New Haven, CT, USA, 2004. [Google Scholar]

- Murphy, D.F.; Bendell, J. Partners in Time? Business, NGOs and Sustainable Development; United Nations Research Institute for Social Development: New York, NY, USA, 1999; pp. 1–71. [Google Scholar]

- WRI/WBCSD. The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard, Revised Editon; World Resources Insititue: Washington, DC, USA, 2011. [Google Scholar]

- Lee, K.-H.; Herold, D.M. WBCSD & EMAN: Measuring sustainability performance—Corporate approaches and contributions. In Carbon Performance Measurement and Reporting in Global Logistics Industry: Challenges and Collaboration Opportunities between Corporations and Academics; Irwin, R., Schaltegger, S., Eds.; WBCSD: Geneva, Switzeland, 2015; pp. 60–63. [Google Scholar]

- FedEx. Fedex Annual Report; FedEx Corporation: Memphis, TN, USA, 2014. [Google Scholar]

- UPS. Ups Annual Report 2013; UPS: Louisville, GA, USA, 2014. [Google Scholar]

- McKinnon, A.; Piecyk, M. Setting targets for reducing carbon emissions from logistics: Current practice and guiding principles. Carbon Manag. 2012, 3, 629–639. [Google Scholar] [CrossRef]

- CDP. Investor CDP 2015 Information Request—Fedex Corporation; Carbon Disclosure Project: London, UK, 2015. [Google Scholar]

- Deutsche Post DHL. We Deliver Responsibility: Corporate Social Responsibility Report; Deutsche Post DHL: Bonn, Germany, 2011. [Google Scholar]

- CDP. Investor CDP 2015 Information Request—Ups; Carbon Disclosure Project: London, UK, 2015. [Google Scholar]

- Schaltegger, S.; Csutora, M. Carbon accounting for sustainability and management. Status quo and challenges. J. Clean. Prod. 2012, 36, 1–16. [Google Scholar] [CrossRef]

- European Commission. Carbon Footprint: What It Is and How to Measure It; EC: Geneva, Switcherland, 2007. [Google Scholar]

- Schmidt, M. Carbon accounting and carbon footprint—More than just diced results? Int. J. Clim. Chang. Strateg. Manag. 2009, 1, 19–30. [Google Scholar] [CrossRef]

- Guthrie, J.; Parker, L.D. Corporate social reporting: A rebuttal of legitimacy theory. Account. Bus. Res. 1989, 19, 343–352. [Google Scholar] [CrossRef]

- Dowling, J.; Pfeffer, J. Organizational legitimacy: Social values and organizational behavior. Pac. Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

- Lenssen, G.; Arenas, D.; Lacy, P.; Pickard, S.; Kolk, A.; Pinkse, J. Business and climate change: Emergent institutions in global governance. Corp. Gov. Int. J. Bus. Soc. 2008, 8, 419–429. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Socio. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Schaltegger, S.; Burritt, R. Business cases and corporate engagement with sustainability: Differentiating ethical motivations. J. Bus. Ethics 2015. [Google Scholar] [CrossRef]

- Bourdieu, P.; Wacquant, L.J. An Invitation Towards a Reflexive Sociology; Policy Press: Cambridge, UK, 1992. [Google Scholar]

- Scott, W.R. Institutions and Organizations: Foundations for Organizational Science; Sage: London, UK, 1995. [Google Scholar]

- Thornton, P.H. Markets from Culture: Institutional Logics and Organizational Decisions in Higher Education Publishing; Stanford University Press: Standford, CA, USA, 2004. [Google Scholar]

- Lounsbury, M.; Ventresca, M. The new structuralism in organizational theory. Organization 2003, 10, 457–480. [Google Scholar] [CrossRef]

- Suddaby, R.; Greenwood, R. Rhetorical strategies of legitimacy. Admin. Sci. Quarter. 2005, 50, 35–67. [Google Scholar] [CrossRef]

- Greenwood, R.; Díaz, A.M.; Li, S.X.; Lorente, J.C. The multiplicity of institutional logics and the heterogeneity of organizational responses. Organ. Sci. 2010, 21, 521–539. [Google Scholar] [CrossRef]

- Maguire, S.; Hardy, C.; Lawrence, T.B. Institutional entrepreneurship in emerging fields: Hiv/aids treatment advocacy in canada. Acad. Manag. J. 2004, 47, 657–679. [Google Scholar] [CrossRef]

- D’Aunno, T.; Sutton, R.I.; Price, R.H. Isomorphism and external support in conflicting institutional environments: A study of drug abuse treatment units. Acad. Manag. J. 1991, 34, 636–661. [Google Scholar] [CrossRef]

- Hoffman, A.J. Climate change strategy: The business logic behind voluntary greenhouse gas reductions. Calif. Manag. Rev. 2005, 47, 21–46. [Google Scholar] [CrossRef]

- Reay, T.; Hinings, C.B. The recomposition of an organizational field: Healthcare in alberta. Organ. Stud. 2005, 26, 351–384. [Google Scholar] [CrossRef]

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- Oberhofer, P.; Dieplinger, M. Sustainability in the transport and logistics sector: Lacking environmental measures. Bus. Strateg. Environ. 2014, 23, 236–253. [Google Scholar] [CrossRef]

- Castelo Branco, M.; Eugénio, T.; Ribeiro, J. Environmental disclosure in response to public perception of environmental threats: The case of co-incineration in portugal. J. Commun. Manag. 2008, 12, 136–151. [Google Scholar] [CrossRef]

- Hogan, J.; Lodhia, S. Sustainability reporting and reputation risk management: An australian case study. Int. J. Account. Inform. Manag. 2011, 19, 267–287. [Google Scholar] [CrossRef]

- Michelon, G. Sustainability disclosure and reputation: A comparative study. Corp. Rep. Rev. 2011, 14, 79–96. [Google Scholar] [CrossRef]

- Sridhar, K. Corporate conceptions of triple bottom line reporting: An empirical analysis into the signs and symbols driving this fashionable framework. Soc. Resp. J. 2012, 8, 312–326. [Google Scholar] [CrossRef]

- UNEP/SustainAbility. Trust Us: The Global Reporters 2002 Survey of Corporate Sustainability Reporting; UNEP: London, UK, 2002. [Google Scholar]

- Cormier, D.; Gordon, I.M. An examination of social and environmental reporting strategies. Account. Audit. Account. J. 2001, 14, 587–617. [Google Scholar] [CrossRef]

- Milne, M.J.; Tregidga, H.; Walton, S. The triple bottom line: Benchmarking New Zealand’s early reporters. Uni. Auckland Bus. Rev. 2003, 5, 36–50. [Google Scholar]

- Hammond, K.; Miles, S. Assessing quality assessment of corporate social reporting: UK perspectives. Account. Forum 2004, 28, 61–79. [Google Scholar] [CrossRef]

- Laine, M. Meanings of the term ‘sustainable development’in finnish corporate disclosures. Account. Forum 2005, 29, 395–413. [Google Scholar] [CrossRef]

- Crawford, S.E.; Ostrom, E. A grammar of institutions. Am. Political Sci. Rev. 1995, 89, 582–600. [Google Scholar] [CrossRef]

- Criado-Jiménez, I.; Fernández-Chulián, M.; Husillos-Carqués, F.J.; Larrinage-González, C. Compliance with mandatory environmental reporting in financial statements: The case of spain (2001–2003). J. Bus. Ethics 2008, 79, 245–262. [Google Scholar] [CrossRef]

- Burritt, R.L.; Hahn, T.; Schaltegger, S. Towards a comprehensive framework for environmental management accounting: Links between business actors and ema tools. Austr. Account. Rev. 2002, 12, 39–50. [Google Scholar] [CrossRef]

- Clark, C.E. Differences between public relations and corporate social responsibility: An analysis. Public Relat. Rev. 2000, 26, 363–380. [Google Scholar] [CrossRef]

- IPIECA. Petroleum Industry Guidelines for Reporting Greenhouse Gas Emissions; International Petroleum Industry Environmental Conservation Association: London, UK, 2011. [Google Scholar]

- Wooten, M.; Hoffman, A.J. Organizational fields: Past, present and future. In The Sage Handobook of Organizational Institutionalism; Greenwood, R., Oliver, C., Shalin-Andersson, K., Suddaby, R., Eds.; Sage: London, UK, 2008; pp. 130–147. [Google Scholar]

- CDP. Investor CDP 2010 Information Request—Ups; Carbon Disclosure Project: London, UK, 2010. [Google Scholar]

- CDP. Investor CDP 2011 Information Request—Deutsche Post AG; Carbon Disclosure Project: London, UK, 2011. [Google Scholar]

- CDP. Investor CDP 2012 Information Request—Fedex Corporation; Carbon Disclosure Project: London, UK, 2012. [Google Scholar]

- Hoffman, A.J. Getting Ahead of the Curve: Corporate Strategies That Address Climate Change; Pew Center on Global Climate Change: Airlington, VA, USA, 2006. [Google Scholar]

- CDP. Investor CDP 2012 Information Request—Ups; Carbon Disclosure Project: London, UK, 2012. [Google Scholar]

- CDP. Investor CDP 2014 Information Request—Deutsche Post AG; Carbon Disclosure Project: London, UK, 2014. [Google Scholar]

- CDP. Investor CDP 2013 Information Request—Deutsche Post AG; Carbon Disclosure Project: London, UK, 2013. [Google Scholar]

- CDP. Investor CDP 2011 Information Request—Ups; Carbon Disclosure Project: London, UK, 2011. [Google Scholar]

- Bouteligier, S. Exploring the agency of global environmental consultancy firms in earth system governance. Int. Environ. Agreem. Politics Law Econ. 2011, 11, 43–61. [Google Scholar] [CrossRef]

- O’Donovan, G. Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Account. Audit. Account. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- CDP. Investor CDP 2015 Information Request—Deutsche Post AG; Carbon Disclosure Project: London, UK, 2015. [Google Scholar]

- CDP. Investor CDP 2010 Information Request—Deutsche Post AG; Carbon Disclosure Project: London, UK, 2010. [Google Scholar]

- CDP. Investor CDP 2010 Information Request—Fedex corporation; Carbon Disclosure Project: London, UK, 2010. [Google Scholar]

- CDP. Climate Action and Profitability: CDP s&p 500 Climate Change Report 2014; CDP North America: New York, NY, USA, 2014. [Google Scholar]

- Milne, M.J.; Patten, D.M. Securing organizational legitimacy: An experimental decision case examining the impact of environmental disclosures. Account. Audit. Account. J. 2002, 15, 372–405. [Google Scholar] [CrossRef]

| Reporting Type | Description | Analysis |

|---|---|---|

| Carbon Strategy/Climate Change Statements | Statements indicating the intention of the carbon strategy, the motivation, commitment and recognition of the importance of carbon footprints, global warming and climate change | Review and analysis of the carbon/climate change statements and the organisational structure with regard to the company’s strategic positioning and logic of carbon-related activities |

| Degree of Transparency | The extent and details as well as the approach and development of carbon information provided in the reports | Review and analysis of the transparency of carbon information provided with a focus on exemplary behaviour of measurement and reporting of Scope 1, 2 and 3 emissions as well as the verification of the carbon data |

| Internal Initiatives | Statements about specific internal corporate actions taken relevant to carbon footprints, global warming and climate change | Review and analysis of the internal carbon-related initiatives and that have a direct impact on the reduction of the company’s carbon footprint |

| Stakeholder Engagement | Statements of the companies’ external stakeholder engagement in activities relevant to carbon footprints, global warming and climate change | Review and analysis of companies’ external engagement with multiple stakeholders and their influence of carbon-related activities |

| Carbon Strategy—Statements | |||||

|---|---|---|---|---|---|

| Year(s) | DHL | Year(s) | FDX | Year(s) | UPS |

| 2015–2013 | “… main aspect for a global logistics provider (…) is the carbon efficiency of its operations”/“Our long-term strategy is influenced by (…) ‘Shared Value’ approach…”/“We share (…) expertise with our customers, (…) helping them minimize the environmental impact of their business activities.”/“… improve efficiency (against target) including both own and subcontract operations”/“… growing influences in regulatory changes…”/“... we address key risk factor (…): potential pricing scenarios for GHG.” | 2015–2013 | “… Our short-term business strategy is heavily influenced by the longer-term goals (…) around aircraft emissions intensity and vehicle fuel efficiency…”/“… manage their environmental performance in line with business needs ”/“… fuel efficiency and alternative energy development should put us in in a position to take (strategic) advantage of any significant opportunities associated with climate change…”/“… GHGs emitted by companies in the airline and transportation industry could harm our reputation…” | 2015–2011 | “… UPS’s short term strategy (…) focus on avoiding and reducing energy use and emissions and (…) and management of Scope 3 emissions…”/“… UPS’s long term strategy (is) influenced (…) how customers will depend on UPS’s transparency and accuracy information to calculate (…) CO2 inventories…”/“UPS advocates full disclosure (Scope 1,2, and 3)…”/“… commitment to natural gas.”/“… UPS believes its climate change strategy results in gaining strategic advantages over its competitors.” |

| 2012–2010 | “… GoGreen is the core of our Climate Strategy is key constituent of our Corporate Strategy…”/“… Carbon efficiency is of strategic importance, since our carbon emissions are directly related to our fuel and energy consumptions and thus to cost efficiency.” | 2012 | “… main responsibility to create and sustain long-term stockholder value.”/“… we undertake (environmental) initiatives for business reasons. “ | 2010 | “Our long-term strategy is to optimize the processes that consume non-renewable resources.”/…UPS is a critical component of our customers’ supply chains, and we have an obligation to help them operate in a more environmentally sustainable way…” |

| 2011–2010 | “… continue to look at and identify our areas of exposure with regard to greenhouse gas emissions.”/“... determine the level of potential impact...”/“… set appropriate plans, including goals…”/“… monitor progress…” | ||||

| Year | Scope 1 | Scope 2 | Scope 3 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| DHL | FDX | UPS | DHL | FDX | UPS | DHL | FDX | UPS | |

| 2015 | (US&CA) | ||||||||

| 2014 | (US&CA) | ||||||||

| 2013 | (US only) | ||||||||

| 2012 | (US only) | ||||||||

| 2011 | (US only) | ||||||||

| 2010 | (US only) | (US only) | (US&CA) | ||||||

| Main Internal Initiatives | |||

|---|---|---|---|

| Year | DHL | FDX | UPS |

| 2015 |

|

|

|

| 2014 |

|

|

|

| 2013 |

|

|

|

| 2012 |

|

|

|

| 2011 |

|

|

|

| 2010 |

|

|

|

| Main Stakeholder Engagement | |||

|---|---|---|---|

| Engagement Categories | DHL | FDX | UPS |

| Public Policy Climate Change Activities |

|

|

|

| Legislation focus |

|

|

|

| Stakeholders involved |

|

|

|

| Board Membership and Funding of Trade Associations |

|

|

|

| Trade Associations Board Membership | - |

|

|

| Other Stakeholders Membership |

|

|

|

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Herold, D.M.; Lee, K.-H. The Influence of the Sustainability Logic on Carbon Disclosure in the Global Logistics Industry: The Case of DHL, FDX and UPS. Sustainability 2017, 9, 601. https://doi.org/10.3390/su9040601

Herold DM, Lee K-H. The Influence of the Sustainability Logic on Carbon Disclosure in the Global Logistics Industry: The Case of DHL, FDX and UPS. Sustainability. 2017; 9(4):601. https://doi.org/10.3390/su9040601

Chicago/Turabian StyleHerold, David M., and Ki-Hoon Lee. 2017. "The Influence of the Sustainability Logic on Carbon Disclosure in the Global Logistics Industry: The Case of DHL, FDX and UPS" Sustainability 9, no. 4: 601. https://doi.org/10.3390/su9040601