Novel Integrated Multi-Criteria Model for Supplier Selection: Case Study Construction Company

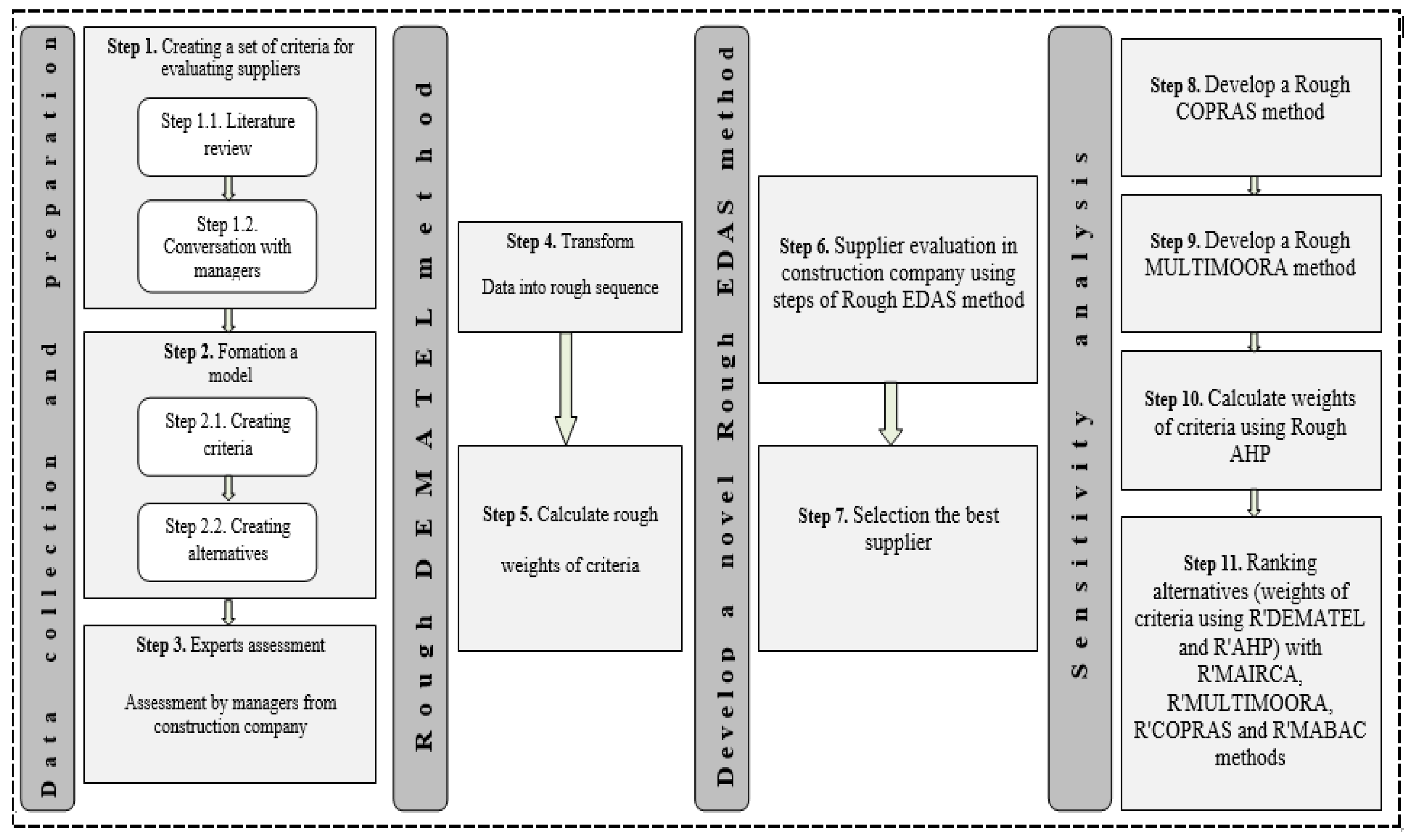

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. R’DEMATEL Method

3.2. Rough EDAS Method

4. Case Study

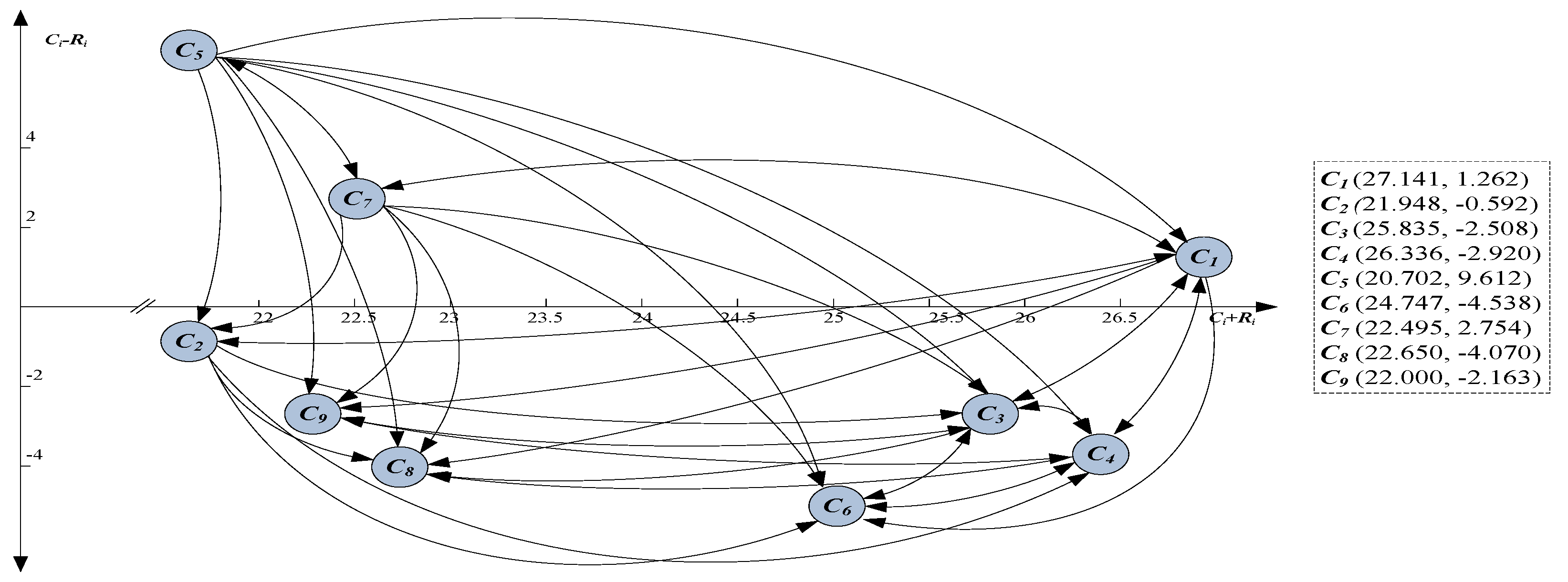

4.1. Estimation of the Criteria Weight by Applying R’DEMATEL Method

4.2. Supplier Selection Using Rough EDAS Method

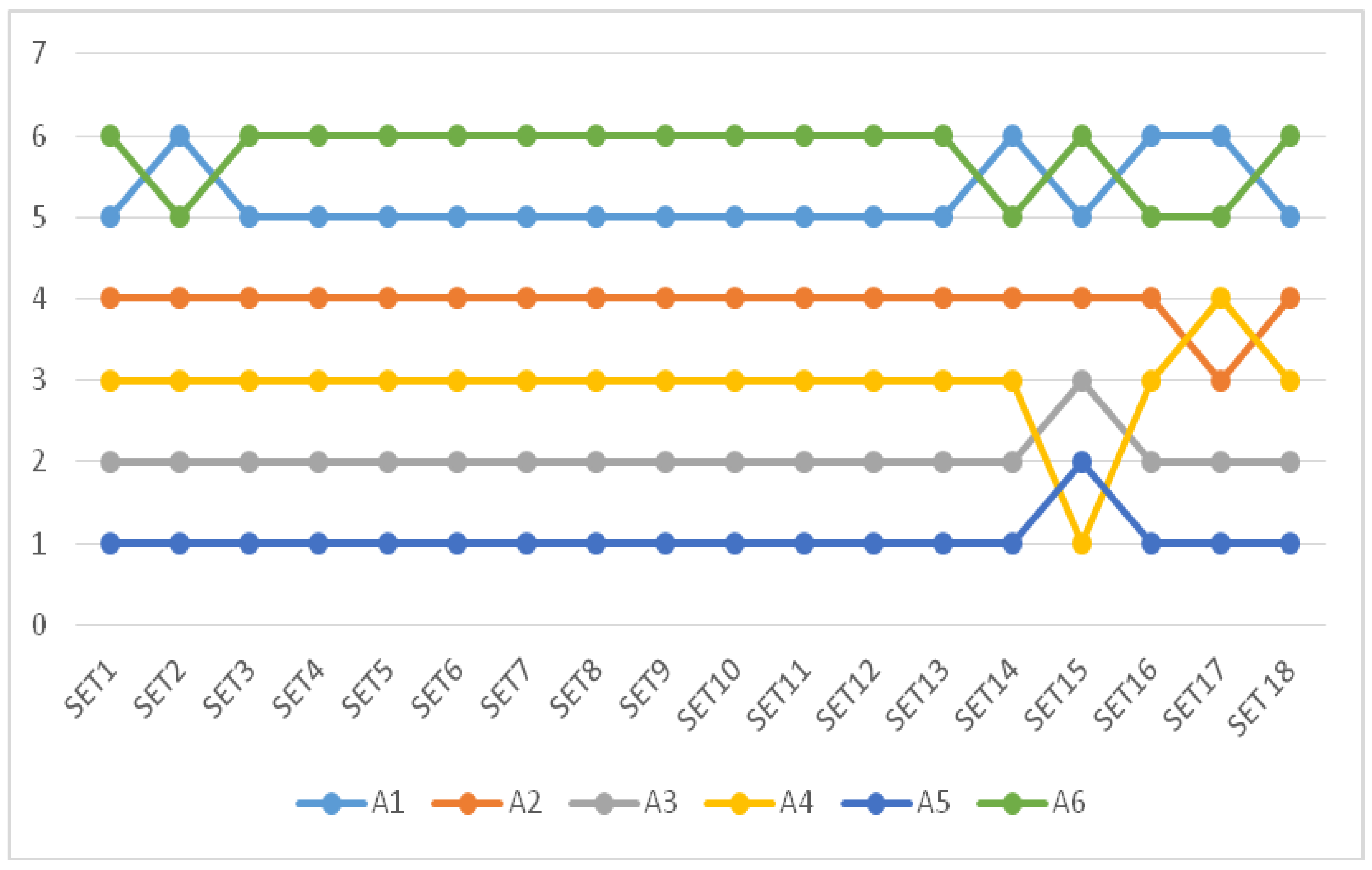

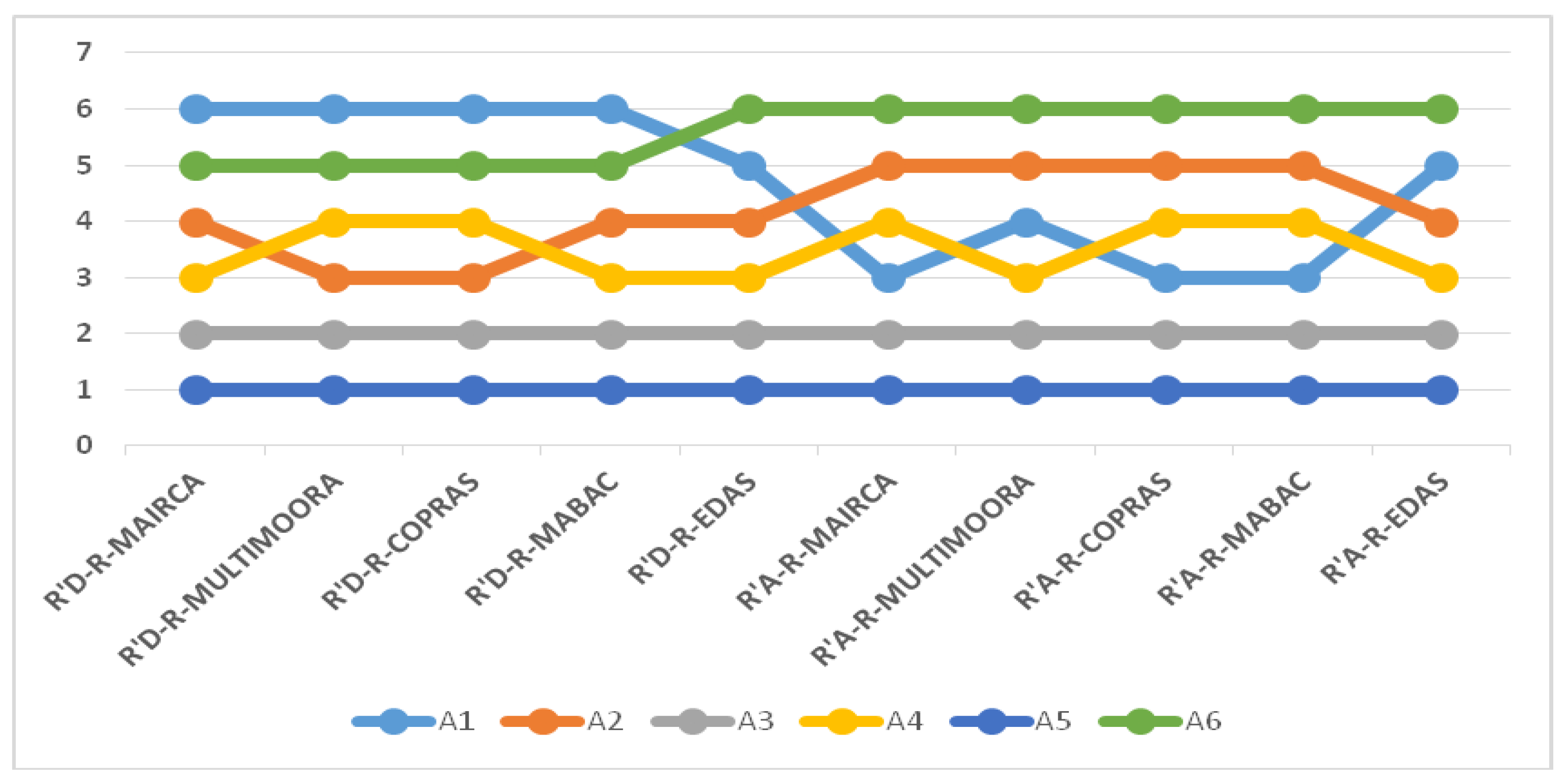

5. Sensitivity Analysis and Discussion

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Soheilirad, S.; Govindan, K.; Mardani, A.; Zavadskas, E.K.; Nilashi, M.; Zakuan, N. Application of data envelopment analysis models in supply chain management: A systematic review and meta-analysis. Ann. Oper. Res. 2017, 1–55. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Integrating sustainability into supplier selection with grey system and rough set methodologies. Int. J. Prod. Econ. 2010, 124, 252–264. [Google Scholar] [CrossRef]

- Ramanathan, R. Supplier selection problem: Integrating DEA with the approaches of total cost of ownership and AHP. Supply Chain Manag. Int. J. 2007, 12, 258–261. [Google Scholar] [CrossRef]

- Zhong, L.; Yao, L. An ELECTRE I-based multi-criteria group decision making method with interval type-2 fuzzy numbers and its application to supplier selection. Appl. Soft Comput. 2017, 57, 556–576. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Evaluating supplier development programs with a grey based rough set methodology. Expert Syst. Appl. 2011, 38, 13505–13517. [Google Scholar] [CrossRef]

- Zolfani, S.H.; Chen, I.S.; Rezaeiniya, N.; Tamošaitienė, J. A hybrid MCDM model encompassing AHP and COPRAS-G methods for selecting company supplier in Iran. Technol. Econ. Dev. Econ. 2012, 18, 529–543. [Google Scholar] [CrossRef]

- Cox, A.; Ireland, P. Managing construction supply chains: The common sense approach. Eng. Constr. Archit. Manag. 2002, 9, 409–418. [Google Scholar] [CrossRef]

- Saaty, T.L.; Tran, L.T. On the invalidity of fuzzifying numerical judgments in the Analytic Hierarchy Process. Math. Comput. Model. 2007, 46, 962–975. [Google Scholar] [CrossRef]

- Wang, Y.M.; Luo, Y.; Hua, Z. On the extent analysis method for fuzzy AHP and its applications. Eur. J. Oper. Res. 2008, 186, 735–747. [Google Scholar] [CrossRef]

- Garg, H.; Arora, R. Generalized and group-based generalized intuitionistic fuzzy soft sets with applications in decision-making. Appl. Intell. 2017, 1–14. [Google Scholar] [CrossRef]

- Garg, H. Generalized interaction aggregation operators in intuitionistic fuzzy multiplicative preference environment and their application to multicriteria decision-making. Appl. Intell. 2017, 1–17. [Google Scholar] [CrossRef]

- Garg, H. Some Picture Fuzzy Aggregation Operators and Their Applications to Multicriteria Decision-Making. Arab. J. Sci. Eng. 2017, 42, 5275–5290. [Google Scholar] [CrossRef]

- Garg, H. Confidence levels based Pythagorean fuzzy aggregation operators and its application to decision-making process. Comput. Math. Organ. Theory 2017, 23, 546–571. [Google Scholar] [CrossRef]

- Garg, H.; Arora, R. A nonlinear-programming methodology for multi-attribute decision-making problem with interval-valued intuitionistic fuzzy soft sets information. Appl. Intell. 2017, 1–16. [Google Scholar] [CrossRef]

- Lee, C.; Lee, H.; Seol, H.; Park, Y. Evaluation of new service concepts using rough set theory and group analytic hierarchy process. Expert Syst. Appl. 2012, 39, 3404–3412. [Google Scholar] [CrossRef]

- Garg, H. A new generalized improved score function of interval-valued intuitionistic fuzzy sets and applications in expert systems. Appl. Soft Comput. 2016, 38, 988–999. [Google Scholar] [CrossRef]

- Garg, H. A novel accuracy function under interval-valued pythagorean fuzzy environment for solving multicriteria decision making problem. J. Intell. Fuzzy Syst. 2016, 31, 529–540. [Google Scholar] [CrossRef]

- Garg, H. Generalized Pythagorean Fuzzy Geometric Aggregation Operators Using Einstein t-Norm and t-Conorm for Multicriteria Decision-Making Process. Int. J. Intell. Syst. 2017, 32, 597–630. [Google Scholar] [CrossRef]

- Lima-Junior, F.R.; Carpinetti, L.C.R. A multicriteria approach based on fuzzy QFD for choosing criteria for supplier selection. Comput. Ind. Eng. 2016, 101, 269–285. [Google Scholar] [CrossRef]

- Vonderembse, M.A.; Tracey, M. The impact of supplier selection criteria and supplier involvement on manufacturing performance. J. Supply Chain Manag. 1999, 35, 33–39. [Google Scholar] [CrossRef]

- Dickson, G.W. An analysis of vendor selection and the buying process. J. Purch. 1966, 2, 5–17. [Google Scholar] [CrossRef]

- Teeravaraprug, J. Outsourcing and vendor selection model based on Taguchi loss function. Songklanakarin J. Sci. Technol. 2008, 30, 523–530. [Google Scholar]

- Liao, C.N. Supplier selection project using an integrated Delphi, AHP and Taguchi loss function. Probstat Forum 2010, 3, 118–134. [Google Scholar]

- Parthiban, P.; Zubar, H.A.; Garge, C.P. A multi criteria decision making approach for suppliers selection. Procedia Eng. 2012, 38, 2312–2328. [Google Scholar] [CrossRef]

- Mehralian, G.; Rajabzadeh Gatari, A.; Morakabati, M.; Vatanpour, H. Developing a suitable model for supplier selection based on supply chain risks: An empirical study from Iranian pharmaceutical companies. Iran. J. Pharm. Res. 2012, 11, 209–219. [Google Scholar] [PubMed]

- Cristea, C.; Cristea, M. A multi-criteria decision making approach for supplier selection in the flexible packaging industry. MATEC Web Conf. 2017, 94, 06002. [Google Scholar] [CrossRef]

- Fallahpour, A.; Olugu, E.U.; Musa, S.N. A hybrid model for supplier selection: Integration of AHP and multi expression programming (MEP). Neural Comput. Appl. 2017, 28, 499–504. [Google Scholar] [CrossRef]

- Weber, C.A.; Current, J.R.; Benton, W.C. Vendor selection criteria and methods. Eur. J. Oper. Res. 1991, 50, 2–18. [Google Scholar] [CrossRef]

- Tam, M.C.; Tummala, V.R. An application of the AHP in vendor selection of a telecommunications system. Omega 2001, 29, 171–182. [Google Scholar] [CrossRef]

- Muralidharan, C.; Anantharaman, N.; Deshmukh, S.G. A multi-criteria group decision making model for supplier rating. J. Supply Chain Manag. 2002, 38, 22–33. [Google Scholar] [CrossRef]

- Simpson, P.M.; Siguaw, J.A.; White, S.C. Measuring the performance of suppliers: An analysis of evaluation processes. J. Supply Chain Manag. 2002, 38, 29–41. [Google Scholar] [CrossRef]

- Kannan, V.R.; Choon Tan, K. Buyer-supplier relationships: The impact of supplier selection and buyer-supplier engagement on relationship and firm performance. Int. J. Phys. Distrib. Logist. Manag. 2006, 36, 755–775. [Google Scholar] [CrossRef]

- Gencer, C.; Gürpinar, D. Analytic network process in supplier selection: A case study in an electronic firm. Appl. Math. Model. 2007, 31, 2475–2486. [Google Scholar] [CrossRef]

- Chan, F.T.; Kumar, N. Global supplier development considering risk factors using fuzzy extended AHP-based approach. Omega 2007, 35, 417–431. [Google Scholar] [CrossRef]

- Guo, X.; Yuan, Z.; Tian, B. Supplier selection based on hierarchical potential support vector machine. Expert Syst. Appl. 2009, 36, 6978–6985. [Google Scholar] [CrossRef]

- Lee, A.H. A fuzzy supplier selection model with the consideration of benefits, opportunities, costs and risks. Expert Syst. Appl. 2009, 36, 2879–2893. [Google Scholar] [CrossRef]

- Wang, W.P. A Fuzzy linguistic computing approach to supplier selection. Appl. Math. Model. 2010, 34, 3130–3141. [Google Scholar] [CrossRef]

- Lam, K.C.; Tao, R.; Lam, M.C.K. A material supplier selection model for property developers using fuzzy principal component analysis. Autom. Constr. 2010, 19, 608–618. [Google Scholar] [CrossRef]

- Balezentis, A.; Balezentis, T. An innovative multi-criteria supplier selection based on two-tuple MULTIMOORA and hybrid data. Econ. Comput. Econ. Cybern. Stud. Res. 2011, 45, 37–56. [Google Scholar]

- Raut, R.D.; Bhasin, H.V.; Kamble, S.S. Evaluation of supplier selection criteria by combination of AHP and fuzzy DEMATEL method. Int. J. Bus. Innov. Res. 2011, 5, 359–392. [Google Scholar] [CrossRef]

- Zeydan, M.; Çolpan, C.; Çobanoğlu, C. A combined methodology for supplier selection and performance evaluation. Expert Syst. Appl. 2011, 38, 2741–2751. [Google Scholar] [CrossRef]

- Jamil, N.; Besar, R.; Sim, H.K. A Study of Multicriteria Decision Making for Supplier Selection in Automotive Industry. J. Ind. Eng. 2013, 2013, 841584. [Google Scholar] [CrossRef]

- Kilic, H.S. An integrated approach for supplier selection in multi-item/multi-supplier environment. Appl. Math. Model. 2013, 37, 7752–7763. [Google Scholar] [CrossRef]

- Uygun, Ö.; Kaçamak, H.; Ayşim, G.; Şimşir, F. Supplier selection for automotive industry using multi-criteria decision making techniques. Tojsat Online J. Sci. Technol. 2013, 3, 126–137. [Google Scholar]

- Hruška, R.; Průša, P.; Babić, D. The use of AHP method for selection of supplier. Transport 2014, 29, 195–203. [Google Scholar] [CrossRef]

- Özbek, A. Supplier Selection with Fuzzy. Tojsat J.Econ. Sustain. Dev. 2015, 6, 114–125. [Google Scholar]

- Stević, Ž.; Tanackov, I.; Vasiljević, M.; Novarlić, B.; Stojić, G. An integrated fuzzy AHP and TOPSIS model for supplier evaluation. Serbian J. Manag. 2016, 11, 15–27. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Zavadskas, E.K.; Šileikaitė, I.; Turskis, Z. A novel hybrid MCDM approach for complicated supply chain management problems in construction. Procedia Eng. 2017, 172, 1137–1145. [Google Scholar] [CrossRef]

- Wang, T.K.; Zhang, Q.; Chong, H.Y.; Wang, X. Integrated Supplier Selection Framework in a Resilient Construction Supply Chain: An Approach via Analytic Hierarchy Process (AHP) and Grey Relational Analysis (GRA). Sustainability 2017, 9, 289. [Google Scholar] [CrossRef]

- Birgün Barla, S. A case study of supplier selection for lean supply by using a mathematical model. Logist. Inf. Manag. 2003, 16, 451–459. [Google Scholar] [CrossRef]

- Wang, G.; Huang, S.H.; Dismukes, J.P. Product-driven supply chain selection using integrated multi-criteria decision-making methodology. Int. J. Prod. Econ. 2004, 91, 1–15. [Google Scholar] [CrossRef]

- Ting, S.C.; Cho, D.I. An integrated approach for supplier selection and purchasing decisions. Supply Chain Manag. 2008, 13, 116–127. [Google Scholar] [CrossRef]

- Sawik, T.; Single, V.S. Multiple objective supplier selection in make to order environment. Omega 2010, 38, 203–212. [Google Scholar] [CrossRef]

- Yücenur, G.N.; Vayvay, Ö.; Demirel, N.Ç. Supplier selection problem in global supply chains by AHP and ANP approaches under fuzzy environment. Int. J. Adv. Manuf. Technol. 2011, 56, 823–833. [Google Scholar] [CrossRef]

- Rezaei, J.; Fahim, P.B.; Tavasszy, L. Supplier selection in the airline retail industry using a funnel methodology: Conjunctive screening method and fuzzy AHP. Expert Syst. Appl. 2014, 41, 8165–8179. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Application of a new combined intuitionistic fuzzy MCDM approach based on axiomatic design methodology for the supplier selection problem. Appl. Soft Comput. 2017, 52, 1222–1238. [Google Scholar] [CrossRef]

- Hudymáčová, M.; Benková, M.; Pócsová, J.; Škovránek, T. Supplier selection based on multi-criterial AHP method. Acta Montan. Slovaca 2010, 15, 249–255. [Google Scholar]

- Lin, H.T.; Chang, W.L. Order selection and pricing methods using flexible quantity and fuzzy approach for buyer evaluation. Eur. J. Oper. Res. 2008, 187, 415–428. [Google Scholar] [CrossRef]

- Ellram, L.M. The supplier selection decision in strategic partnerships. J. Purch. Mater. Manag. 1990, 26, 8–14. [Google Scholar] [CrossRef]

- Çebi, F.; Bayraktar, D. An integrated approach for supplier selection. Logist. Inf. Manag. 2003, 16, 395–400. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Vainiūnas, P.; Turskis, Z.; Tamošaitienė, J. Multiple criteria decision support system for assessment of projects managers in construction. Int. J. Inf. Technol. Decis. Mak. 2012, 11, 501–520. [Google Scholar] [CrossRef]

- Antuchevičiene, J.; Zavadskas, E.K.; Zakarevičius, A. Multiple criteria construction management decisions considering relations between criteria. Technol. Econ. Dev. Econ. 2010, 16, 109–125. [Google Scholar] [CrossRef]

- Garg, H. Generalized Intuitionistic Fuzzy Entropy-Based Approach for Solving Multi-attribute Decision-Making Problems with Unknown Attribute Weights. Proc. Natl. Acad. Sci. India Sect. A Phys. Sci. 2017, 1–11. [Google Scholar] [CrossRef]

- Garg, H. Generalized intuitionistic fuzzy interactive geometric interaction operators using Einstein t-norm and t-conorm and their application to decision making. Comput. Ind. Eng. 2017, 101, 53–69. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Tamošaitiene, J. Risk assessment of construction projects. J. Civ. Eng. Manag. 2010, 16, 33–46. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Zavadskas, E.K.; Turskis, Z. Multi-criteria risk assessment of a construction project. Procedia Comput. Sci. 2013, 17, 129–133. [Google Scholar] [CrossRef]

- Yao, M.; Minner, S. Review of multi-supplier inventory models in supply chain management: An update. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Izadikhah, M. Group decision making process for supplier selection with TOPSIS method under interval-valued intuitionistic fuzzy numbers. Adv. Fuzzy Syst. 2012, 2012, 407942. [Google Scholar] [CrossRef]

- Eshtehardian, E.; Ghodousi, P.; Bejanpour, A. Using ANP and AHP for the supplier selection in the construction and civil engineering companies; case study of Iranian company. KSCE J. Civ. Eng. 2013, 17, 262–270. [Google Scholar] [CrossRef]

- Fouladgar, M.M.; Yazdani-Chamzini, A.; Zavadskas, E.K.; Haji Moini, S.H. A new hybrid model for evaluating the working strategies: Case study of construction company. Technol. Econ. Dev. Econ. 2012, 18, 164–188. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Tamosaitiene, J. Selection of construction enterprises management strategy based on the SWOT and multi-criteria analysis. Arch. Civ. Mech. Eng. 2011, 11, 1063–1082. [Google Scholar] [CrossRef]

- Erdogan, S.A.; Šaparauskas, J.; Turskis, Z. Decision Making in Construction Management: AHP and Expert Choice Approach. Procedia Eng. 2017, 172, 270–276. [Google Scholar] [CrossRef]

- Turskis, Z.; Lazauskas, M.; Zavadskas, E.K. Fuzzy multiple criteria assessment of construction site alternatives for non-hazardous waste incineration plant in Vilnius city, applying ARAS-F and AHP methods. J. Environ. Eng. Landsc. Manag. 2012, 20, 110–120. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Vilutienė, T.; Turskis, Z.; Šaparauskas, J. Multi-criteria analysis of Projects’ performance in construction. Arch. Civ. Mech. Eng. 2014, 14, 114–121. [Google Scholar] [CrossRef]

- Petković, D.; Madić, M.; Radovanović, M.; Gečevska, V. Application of the performance selection index method for solving machining MCDM problems. FU Mech. Eng. 2017, 15, 97–106. [Google Scholar]

- Ristić, M.; Manić, M.; Mišić, D.; Kosanović, M.; Mitković, M. Implant material selection using expert system. FU Mech. Eng. 2017, 15, 133–144. [Google Scholar]

- Stefanović-Marinović, J.; Troha, S.; Milovančević, M. An application of multicriteria optimization to the two-carrier two-speed planetary cear trains. FU Mech. Eng. 2017, 15, 85–95. [Google Scholar]

- Eraslan, E.; Atalay, K.D. A Comparative holistic fuzzy approach for evaluation of the chain performance of suppliers. J. Appl. Math. 2014, 2014, 109821. [Google Scholar] [CrossRef]

- Liao, C.N.; Fu, Y.K.; Wu, L.C. Integrated FAHP, ARAS-F and MSGP methods for green supplier evaluation and selection. Technol. Econ. Dev. Econ. 2016, 22, 651–669. [Google Scholar] [CrossRef]

- Saad, S.M.; Kunhu, N.; Mohamed, A.M. A fuzzy-AHP multi-criteria decision-making model for procurement process. Int. J. Logist. Syst. Manag. 2016, 23, 1–24. [Google Scholar] [CrossRef]

- Bali, S.; Amin, S.S. An analytical framework for supplier evaluation and selection: A multi-criteria decision making approach. Int. J. Adv. Oper. Manag. 2017, 9, 57–72. [Google Scholar]

- Kabi, A.A.; Hussain, M.; Khan, M. Assessment of supplier selection for critical items in public organisations of Abu Dhabi. World Rev. Sci. Technol. Sustain. Dev. 2017, 13, 56–73. [Google Scholar] [CrossRef]

- Secundo, G.; Magarielli, D.; Esposito, E.; Passiante, G. Supporting decision-making in service supplier selection using a hybrid fuzzy extended AHP approach: A case study. Bus. Process Manag. J. 2017, 23, 196–222. [Google Scholar] [CrossRef]

- Yang, J.L.; Tzeng, G.H. An integrated MCDM technique combined with DEMATEL for a novel cluster-weighted with ANP method. Expert Syst. Appl. 2011, 38, 1417–1424. [Google Scholar] [CrossRef]

- Gharakhani, D. The evaluation of supplier selection criteria by fuzzy DEMATEL method. J. Basic Appl. Sci. Res. 2012, 2, 3215–3224. [Google Scholar]

- Ho, L.H.; Feng, S.Y.; Lee, Y.C.; Yen, T.M. Using modified IPA to evaluate supplier’s performance: Multiple regression analysis and DEMATEL approach. Expert Syst. Appl. 2012, 39, 7102–7109. [Google Scholar] [CrossRef]

- Hsu, C.W.; Kuo, T.C.; Chen, S.H.; Hu, A.H. Using DEMATEL to develop a carbon management model of supplier selection in green supply chain management. J. Clean. Prod. 2013, 56, 164–172. [Google Scholar] [CrossRef]

- Lin, R.J. Using fuzzy DEMATEL to evaluate the green supply chain management practices. J. Clean. Prod. 2013, 40, 32–39. [Google Scholar] [CrossRef]

- Mangla, S.; Kumar, P.; Barua, M.K. An evaluation of attribute for improving the green supply chain performance via DEMATEL method. Int. J. Mech. Eng. Robot. Res. 2014, 1, 30–35. [Google Scholar]

- Wu, K.J.; Tseng, M.L.; Chiu, A.S.; Lim, M.K. Achieving competitive advantage through supply chain agility under uncertainty: A novel multi-criteria decision-making structure. Int. J. Prod. Econ. 2017, 190, 96–107. [Google Scholar] [CrossRef]

- Chang, B.; Chang, C.W.; Wu, C.H. Fuzzy DEMATEL method for developing supplier selection criteria. Expert Syst. Appl. 2011, 38, 1850–1858. [Google Scholar] [CrossRef]

- Iirajpour, A.; Hajimirza, M.; Alavi, M.G.; Kazemi, S. Identification and evaluation of the most effective factors in green supplier selection using DEMATEL method. J. Basic Appl. Sci. Res. 2012, 2, 4485–4493. [Google Scholar]

- Sarkar, S.; Lakha, V.; Ansari, I.; Maiti, J. Supplier Selection in Uncertain Environment: A Fuzzy MCDM Approach. In Proceedings of the First International Conference on Intelligent Computing and Communication; Springer; Singapore, 2017; pp. 257–266. [Google Scholar]

- Song, W.; Ming, X.; Wu, Z.; Zhu, B. A rough TOPSIS approach for failure mode and effects analysis in uncertain environments. Qual. Reliab. Eng. Int. 2014, 30, 473–486. [Google Scholar] [CrossRef]

- Pamučar, D.; Ćirović, G. The selection of transport and handling resources in logistics centers using Multi-Attributive Border Approximation area Comparison (MABAC). Expert Syst. Appl. 2015, 42, 3016–3028. [Google Scholar] [CrossRef]

- Gigović, L.; Pamučar, D.; Božanić, D.; Ljubojević, S. Application of the GIS-DANP-MABAC multi-criteria model for selecting the location of wind farms: A case study of Vojvodina, Serbia. Renew. Energy 2017, 103, 501–521. [Google Scholar] [CrossRef]

- Pamučar, D.; Petrović, I.; Ćirović, G. Modification of the Best-Worst and MABAC methods: A novel approach based on interval-valued fuzzy-rough numbers. Expert Syst. Appl. 2017, 91, 89–106. [Google Scholar] [CrossRef]

- Roy, J.; Chatterjee, K.; Bandhopadhyay, A.; Kar, S. Evaluation and selection of Medical Tourism sites: A rough AHP based MABAC approach. arXiv, 2016; arXiv:1606.08962. [Google Scholar]

- Gigović, L.; Pamučar, D.; Bajić, Z.; Drobnjak, S. Application of GIS-Interval Rough AHP Methodology for Flood Hazard Mapping in Urban Areas. Water 2017, 9, 360. [Google Scholar] [CrossRef]

- Khoo, L.-P.; Zhai, L.-Y. A prototype genetic algorithm enhanced rough set-based rule induction system. Comput. Ind. 2001, 46, 95–106. [Google Scholar] [CrossRef]

- Zou, Z.; Tseng, T.L.B.; Sohn, H.; Song, G.; Gutierrez, R. A rough set based approach to distributor selection in supply chain management. Expert Syst. Appl. 2011, 38, 106–115. [Google Scholar] [CrossRef]

- Nauman, M.; Nouman, A.; Yao, J.T. A three-way decision making approach to malware analysis using probabilistic rough sets. Inf. Sci. 2016, 374, 193–209. [Google Scholar] [CrossRef]

- Liang, D.; Xu, Y.; Liu, D. Three-way decisions with intuitionistic fuzzy decision-theoretic rough sets based on point operators. Inf. Sci. 2017, 375, 183–201. [Google Scholar] [CrossRef]

- Pamučar, D.; Mihajlović, M.; Obradović, R.; Atanasković, P. Novel approach to group multi-criteria decision making based on interval rough numbers: Hybrid DEMATEL-ANP-MAIRCA model. Expert Syst. Appl. 2017, 88, 58–80. [Google Scholar] [CrossRef]

- Tiwari, V.; Jain, P.K.; Tandon, P. Product design concept evaluation using rough sets and VIKOR method. Adv. Eng. Inf. 2016, 30, 16–25. [Google Scholar] [CrossRef]

- Shidpour, H.; Cunha, C.D.; Bernard, A. Group multi-criteria design concept evaluation using combined rough set theory and fuzzy set theory. Expert Syst. Appl. 2016, 64, 633–644. [Google Scholar] [CrossRef]

- Chai, J.; Liu, J.N. A novel believable rough set approach for supplier selection. Expert Syst. Appl. 2014, 41, 92–104. [Google Scholar] [CrossRef]

- Zhu, G.N.; Hu, J.; Qi, J.; Gu, C.C.; Peng, J.H. An integrated AHP and VIKOR for design concept evaluation based on rough number. Adv. Eng. Inf. 2015, 29, 408–418. [Google Scholar] [CrossRef]

- Zhai, L.Y.; Khoo, L.P.; Zhong, Z.W. A rough set based QFD approach to the management of imprecise design information in product development. Adv. Eng. Inf. 2009, 23, 222–228. [Google Scholar] [CrossRef]

- Gigović, L.; Pamučar, D.; Lukić, D.; Marković, S. Application of the GIS-Fuzzy DEMATEL MCDA model for ecotourism development site evaluation: A case study of “Dunavski ključ”, Serbia. Land Use Policy 2016, 58, 348–365. [Google Scholar] [CrossRef]

- Keshavarz Ghorabaee, M.; Zavadskas, E.K.; Olfat, L.; Turskis, Z. Multi-Criteria Inventory Classification Using a New Method of Evaluation Based on Distance from Average Solution (EDAS). Informatica 2015, 26, 435–451. [Google Scholar] [CrossRef]

- Keshavarz Ghorabaee, M.; Zavadskas, E.K.; Amiri, M.; Turskis, Z. Extended EDAS Method for Fuzzy Multi-criteria Decision-making: An Application to Supplier Selection. Int. J. Comput. Commun. Control 2016, 11, 358–371. [Google Scholar] [CrossRef]

- Turskis, Z.; Juodagalvienė, B. A novel hybrid multi-criteria decision-making model to assess a stairs shape for dwelling houses. J. Civ. Eng. Manag. 2016, 22, 1078–1087. [Google Scholar] [CrossRef]

- Stević, Ž.; Tanackov, I.; Vasiljević, M.; Vesković, S. Evaluation in logistics using combined AHP and EDAS method. In Proceedings of the XLIII International Symposium on Operational Research, Belgrade, Serbia, 20–23 September 2016; pp. 309–313. [Google Scholar]

- Keshavarz Ghorabaee, M.; Amiri, M.; Olfat, L.; Khatami Firouzabadi, S.A. Designing a multi-product multi-period supply chain network with reverse logistics and multiple objectives under uncertainty. Technol. Econ. Dev. Econ. 2017, 23, 520–548. [Google Scholar] [CrossRef]

- Kahraman, C.; Keshavarz Ghorabaee, M.; Zavadskas, E.K.; Cevik Onar, S.; Yazdani, M.; Oztaysi, B. Intuitionistic fuzzy EDAS method: An application to solid waste disposal site selection. J. Environ. Eng. Landsc. Manag. 2017, 25, 1–12. [Google Scholar] [CrossRef]

- Keshavarz Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z. Multi-criteria group decision-making using an extended EDAS method with interval type-2 fuzzy sets. E+M Ekon. Manag. 2017, 20, 48–68. [Google Scholar]

- Ecer, F. Third-party logistics (3PLs) provider selection via Fuzzy AHP and EDAS integrated model. Technol. Econ. Dev. Econ. 2017, 1–20. [Google Scholar] [CrossRef]

- Peng, X.; Liu, C. Algorithms for neutrosophic soft decision making based on EDAS, new similarity measure and level soft set. J. Intell. Fuzzy Syst. 2017, 32, 955–968. [Google Scholar] [CrossRef]

- Keshavarz Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J. A new hybrid simulation-based assignment approach for evaluating airlines with multiple service quality criteria. J. Air Transp. Manag. 2017, 63, 45–60. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Cavallaro, F.; Podvezko, V.; Ubarte, I.; Kaklauskas, A. MCDM Assessment of a Healthy and Safe Built Environment According to Sustainable Development Principles: A Practical Neighborhood Approach in Vilnius. Sustainability 2017, 9, 702. [Google Scholar] [CrossRef]

- Trinkūnienė, E.; Podvezko, V.; Zavadskas, E.K.; Jokšienė, I.; Vinogradova, I.; Trinkūnas, V. Evaluation of quality assurance in contractor contracts by multi-attribute decision-making methods. Econ. Res.-Ekon. Istraž. 2017, 30, 1152–1180. [Google Scholar] [CrossRef]

- Song, W.; Ming, X.; Wu, Z. An integrated rough number-based approach to design concept evaluation under subjective environments. J. Eng. Des. 2013, 24, 320–341. [Google Scholar] [CrossRef]

| Criteria | References |

|---|---|

| Quality of material | [6,21,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49] |

| Price of material | [6,21,26,27,28,29,30,31,33,34,35,36,37,38,39,40,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56] |

| Certification of products | [26,31,40,42,44,50,52,57] |

| Delivery time | [21,26,27,28,29,30,31,33,34,35,36,37,38,39,40,42,43,44,45,46,47,48,49,51,53,54,55,56,58] |

| Reputation | [6,21,26,28,29,34,36,43,46,48,49,54,55,58,59,60] |

| Volume discounts | [37,40,42] |

| Warranty period | [21,26,31,35,37,40] |

| Reliability | [6,26,30,33,34,36,42,48,50,51,54,56,57,60] |

| Method of payment | [26,38,39,40,44,45,47,57] |

| E1 | E2 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| C1 | 0 | 5 | 5 | 5 | 2 | 4 | 4 | 4 | 3 | 0 | 5 | 5 | 4 | 3 | 5 | 4 | 4 | 3 |

| C2 | 4 | 0 | 4 | 2 | 2 | 3 | 5 | 4 | 3 | 4 | 0 | 4 | 4 | 1 | 5 | 5 | 3 | 3 |

| C3 | 4 | 3 | 0 | 3 | 3 | 4 | 2 | 4 | 3 | 4 | 1 | 0 | 5 | 3 | 5 | 3 | 4 | 3 |

| C4 | 4 | 3 | 5 | 0 | 2 | 3 | 3 | 3 | 5 | 4 | 2 | 5 | 0 | 2 | 5 | 3 | 3 | 5 |

| C5 | 5 | 4 | 5 | 4 | 0 | 4 | 5 | 5 | 3 | 5 | 3 | 5 | 5 | 0 | 5 | 5 | 5 | 3 |

| C6 | 4 | 4 | 3 | 3 | 1 | 0 | 2 | 4 | 4 | 4 | 2 | 4 | 4 | 1 | 0 | 2 | 4 | 4 |

| C7 | 4 | 4 | 3 | 4 | 2 | 4 | 0 | 5 | 5 | 4 | 2 | 4 | 5 | 2 | 5 | 0 | 5 | 5 |

| C8 | 3 | 3 | 4 | 2 | 1 | 2 | 2 | 0 | 3 | 4 | 2 | 5 | 4 | 1 | 4 | 2 | 0 | 3 |

| C9 | 3 | 3 | 4 | 2 | 2 | 2 | 3 | 3 | 0 | 3 | 1 | 4 | 3 | 2 | 4 | 3 | 3 | 0 |

| … | ||||||||||||||||||

| E6 | E7 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| C1 | 0 | 5 | 4 | 4 | 3 | 5 | 5 | 5 | 2 | 0 | 5 | 5 | 4 | 4 | 4 | 4 | 5 | 3 |

| C2 | 4 | 0 | 3 | 2 | 1 | 3 | 4 | 3 | 3 | 4 | 0 | 3 | 4 | 1 | 5 | 5 | 4 | 2 |

| C3 | 5 | 3 | 0 | 3 | 3 | 3 | 2 | 3 | 3 | 4 | 3 | 0 | 5 | 4 | 5 | 2 | 4 | 2 |

| C4 | 3 | 3 | 4 | 0 | 2 | 4 | 3 | 3 | 4 | 3 | 3 | 5 | 0 | 3 | 5 | 3 | 4 | 5 |

| C5 | 3 | 4 | 4 | 4 | 0 | 3 | 4 | 3 | 4 | 5 | 4 | 5 | 5 | 0 | 5 | 5 | 4 | 3 |

| C6 | 4 | 3 | 3 | 3 | 1 | 0 | 2 | 3 | 5 | 3 | 3 | 3 | 4 | 2 | 0 | 2 | 4 | 4 |

| C7 | 5 | 3 | 3 | 4 | 2 | 3 | 0 | 3 | 5 | 4 | 3 | 3 | 5 | 2 | 4 | 0 | 5 | 4 |

| C8 | 4 | 3 | 4 | 2 | 1 | 3 | 1 | 0 | 4 | 3 | 3 | 4 | 4 | 1 | 5 | 2 | 0 | 3 |

| C9 | 3 | 3 | 4 | 2 | 1 | 3 | 3 | 5 | 0 | 2 | 3 | 5 | 3 | 1 | 5 | 3 | 4 | 0 |

| Criterion | + | − | ||

|---|---|---|---|---|

| C1 | 14.201 | 12.939 | 27.141 | 1.262 |

| C2 | 10.678 | 11.270 | 21.948 | −0.592 |

| C3 | 11.663 | 14.171 | 25.835 | −2.508 |

| C4 | 11.708 | 14.628 | 26.336 | −2.920 |

| C5 | 15.157 | 5.545 | 20.702 | 9.612 |

| C6 | 10.105 | 14.642 | 24.747 | −4.538 |

| C7 | 12.624 | 9.870 | 22.495 | 2.754 |

| C8 | 9.290 | 13.360 | 22.650 | −4.070 |

| C9 | 9.919 | 12.082 | 22.000 | −2.163 |

| Criterion | + | − | ||

|---|---|---|---|---|

| C1 | [2.740, 25.844] | [2.551, 23.891] | [5.292, 49.734] | [−21.150, 23.292] |

| C2 | [2.190, 21.469] | [2.067, 22.051] | [4.257, 43.521] | [−19.861, 19.402] |

| C3 | [2.278, 22.797] | [2.779, 25.344] | [5.057, 48.141] | [−23.067, 20.018] |

| C4 | [2.424, 22.705] | [2.541, 26.193] | [4.964, 48.898] | [−23.770, 20.164] |

| C5 | [2.841, 27.027] | [1.387, 13.850] | [4.228, 40.876] | [−11.008, 25.640] |

| C6 | [2.122, 20.699] | [2.477, 26.275] | [4.599, 46.975] | [−24.153, 18.223] |

| C7 | [2.522, 23.897] | [2.171, 19.896] | [4.693, 43.793] | [−17.374, 21.725] |

| C8 | [1.935, 19.686] | [2.554, 24.467] | [4.488, 44.153] | [−22.532, 17.133] |

| C9 | [1.939, 20.628] | [2.464, 22.784] | [4.403, 43.412] | [−20.845, 18.164] |

| E1 | E2 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| A1 | 7 | 1 | 3 | 9 | 1 | 3 | 5 | 3 | 3 | 9 | 1 | 3 | 7 | 9 | 7 | 5 | 9 | 7 |

| A2 | 7 | 3 | 7 | 9 | 3 | 5 | 5 | 5 | 3 | 7 | 3 | 9 | 5 | 7 | 7 | 5 | 7 | 5 |

| A3 | 5 | 7 | 7 | 5 | 7 | 7 | 7 | 5 | 7 | 3 | 9 | 7 | 1 | 5 | 5 | 7 | 5 | 5 |

| A4 | 5 | 3 | 3 | 5 | 7 | 3 | 9 | 5 | 5 | 3 | 7 | 3 | 1 | 5 | 3 | 7 | 5 | 5 |

| A5 | 5 | 9 | 9 | 3 | 7 | 5 | 9 | 5 | 7 | 3 | 9 | 9 | 1 | 5 | 5 | 9 | 5 | 5 |

| A6 | 3 | 7 | 7 | 3 | 5 | 3 | 3 | 3 | 3 | 5 | 7 | 7 | 3 | 5 | 5 | 3 | 5 | 3 |

| E3 | E4 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| A1 | 3 | 1 | 1 | 9 | 1 | 3 | 3 | 1 | 3 | 5 | 3 | 3 | 9 | 3 | 1 | 3 | 1 | 1 |

| A2 | 3 | 3 | 5 | 9 | 3 | 5 | 5 | 3 | 1 | 5 | 1 | 5 | 7 | 5 | 3 | 1 | 1 | 3 |

| A3 | 5 | 3 | 3 | 7 | 7 | 3 | 5 | 3 | 3 | 7 | 5 | 5 | 7 | 5 | 5 | 3 | 3 | 5 |

| A4 | 5 | 5 | 1 | 7 | 5 | 5 | 3 | 3 | 5 | 7 | 3 | 3 | 5 | 5 | 3 | 3 | 3 | 3 |

| A5 | 5 | 5 | 5 | 5 | 9 | 7 | 5 | 5 | 5 | 3 | 5 | 7 | 5 | 7 | 7 | 3 | 5 | 5 |

| A6 | 3 | 7 | 3 | 5 | 3 | 3 | 3 | 3 | 7 | 5 | 5 | 5 | 5 | 3 | 5 | 3 | 5 | 7 |

| E5 | E6 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| A1 | 7 | 1 | 1 | 9 | 3 | 7 | 5 | 7 | 7 | 5 | 3 | 3 | 9 | 1 | 5 | 3 | 5 | 5 |

| A2 | 7 | 3 | 7 | 9 | 5 | 7 | 5 | 9 | 5 | 5 | 3 | 7 | 9 | 1 | 3 | 5 | 5 | 5 |

| A3 | 5 | 7 | 5 | 5 | 9 | 9 | 7 | 9 | 7 | 5 | 5 | 7 | 7 | 9 | 7 | 5 | 7 | 3 |

| A4 | 5 | 5 | 1 | 5 | 9 | 9 | 9 | 9 | 9 | 3 | 3 | 3 | 7 | 7 | 5 | 3 | 5 | 5 |

| A5 | 5 | 9 | 9 | 1 | 9 | 5 | 9 | 9 | 9 | 7 | 5 | 9 | 7 | 9 | 7 | 5 | 7 | 3 |

| A6 | 3 | 7 | 7 | 3 | 7 | 7 | 3 | 7 | 3 | 5 | 5 | 7 | 7 | 1 | 5 | 3 | 5 | 5 |

| E7 | ||||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | ||||||||||

| A1 | 5 | 3 | 3 | 9 | 1 | 5 | 3 | 5 | 7 | |||||||||

| A2 | 5 | 3 | 7 | 9 | 1 | 7 | 5 | 5 | 5 | |||||||||

| A3 | 5 | 5 | 7 | 7 | 9 | 7 | 5 | 7 | 5 | |||||||||

| A4 | 5 | 3 | 3 | 7 | 7 | 5 | 3 | 5 | 7 | |||||||||

| A5 | 5 | 5 | 9 | 7 | 9 | 3 | 5 | 7 | 7 | |||||||||

| A6 | 5 | 5 | 7 | 7 | 1 | 5 | 3 | 5 | 7 | |||||||||

| A1 | A2 | A3 | A4 | A5 | A6 | |

|---|---|---|---|---|---|---|

| C1 | [4.72, 7.03] | [4.74, 6.37] | [4.48, 5.52] | [4.00, 5.43] | [4.00, 5.43] | [3.65, 4.63] |

| C2 | [1.37, 2.35] | [2.47, 2.96] | [4.72, 7.03] | [3.35, 4.99] | [5.73, 7.69] | [5.65, 6.63] |

| C3 | [2.02, 2.84] | [6.00, 7.43] | [5.01, 6.65] | [2.02, 2.84] | [7.39, 8.83] | [5.39, 6.83] |

| C4 | [8.47, 8.96] | [7.39, 8.83] | [4.37, 6.60] | [4.12, 6.33] | [2.56, 5.67] | [3.72, 5.73] |

| C5 | [1.44, 4.26] | [2.22, 4.95] | [6.27, 8.28] | [5.63, 7.26] | [7.01, 8.65] | [3.05, 5.78] |

| C6 | [3.05, 5.78] | [4.09, 5.91] | [4.97, 7.28] | [3.67, 5.88] | [4.74, 6.37] | [4.00, 5.43] |

| C7 | [3.37, 4.35] | [3.94, 4.92] | [4.74, 6.37] | [3.77, 6.78] | [5.11, 7.78] | [3.00, 3.00] |

| C8 | [2.54, 6.38] | [3.39, 6.61] | [4.22, 6.95] | [4.05, 6.03] | [5.35, 6.99] | [4.00, 5.43] |

| C9 | [3.26, 6.12] | [3.01, 4.65] | [4.09, 5.91] | [4.57, 6.65] | [4.72, 7.03] | [3.93, 6.07] |

| PDA | A1 | A2 | A3 | A4 | A5 | A6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.18 | 0.92 | 0.17 | 0.74 | 0.22 | 0.51 | 0.30 | 0.49 | 0.30 | 0.49 | 0.00 | 0.00 |

| C2 | 0.19 | 1.17 | 0.07 | 0.84 | 0.00 | 0.00 | 0.32 | 0.58 | 0.00 | 0.00 | 0.00 | 0.00 |

| C3 | 0.00 | 0.00 | 0.02 | 0.87 | 0.15 | 0.67 | 0.00 | 0.00 | 0.25 | 1.22 | 0.09 | 0.72 |

| C4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.32 | 0.61 | 0.28 | 0.66 | 0.18 | 1.02 | 0.19 | 0.75 |

| C5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.04 | 1.26 | 0.14 | 0.98 | 0.07 | 1.36 | 0.00 | 0.00 |

| C6 | 0.00 | 0.00 | 0.33 | 0.69 | 0.19 | 1.08 | 0.00 | 0.00 | 0.22 | 0.82 | 0.00 | 0.00 |

| C7 | 0.00 | 0.00 | 0.00 | 0.00 | 0.14 | 0.86 | 0.32 | 0.98 | 0.08 | 1.28 | 0.00 | 0.00 |

| C8 | 0.00 | 0.00 | 0.47 | 0.96 | 0.34 | 1.07 | 0.37 | 0.79 | 0.16 | 1.08 | 0.00 | 0.00 |

| C9 | 0.00 | 0.00 | 0.00 | 0.00 | 0.33 | 0.75 | 0.25 | 0.97 | 0.22 | 1.09 | 0.35 | 0.80 |

| NDA | A1 | A2 | A3 | A4 | A5 | A6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.17 | 0.57 |

| C2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.11 | 1.11 | 0.00 | 0.00 | 0.09 | 1.31 | 0.07 | 0.99 |

| C3 | 0.19 | 0.98 | 0.00 | 0.00 | 0.00 | 0.00 | 0.19 | 0.98 | 0.00 | 0.00 | 0.00 | 0.00 |

| C4 | 0.21 | 1.05 | 0.05 | 1.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| C5 | 0.09 | 1.39 | 0.20 | 1.18 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.32 | 0.95 |

| C6 | 0.37 | 0.87 | 0.00 | 0.00 | 0.00 | 0.00 | 0.39 | 0.70 | 0.00 | 0.00 | 0.32 | 0.60 |

| C7 | 0.17 | 0.63 | 0.27 | 0.47 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.08 | 0.74 |

| C8 | 0.47 | 1.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.32 | 0.71 |

| C9 | 0.45 | 0.83 | 0.21 | 0.91 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| VPI | A1 | A2 | A3 | A4 | A5 | A6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.07 | 0.92 | 0.07 | 0.74 | 0.09 | 0.51 | 0.12 | 0.49 | 0.12 | 0.49 | 0.00 | 0.00 |

| C2 | 0.07 | 1.02 | 0.03 | 0.73 | 0.00 | 0.00 | 0.12 | 0.50 | 0.00 | 0.00 | 0.00 | 0.00 |

| C3 | 0.00 | 0.00 | 0.01 | 0.82 | 0.07 | 0.64 | 0.00 | 0.00 | 0.11 | 1.16 | 0.04 | 0.68 |

| C4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.14 | 0.58 | 0.12 | 0.64 | 0.08 | 0.98 | 0.09 | 0.73 |

| C5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 1.11 | 0.03 | 0.86 | 0.02 | 1.20 | 0.00 | 0.00 |

| C6 | 0.00 | 0.00 | 0.15 | 0.63 | 0.08 | 0.99 | 0.00 | 0.00 | 0.10 | 0.75 | 0.00 | 0.00 |

| C7 | 0.00 | 0.00 | 0.00 | 0.00 | 0.05 | 0.77 | 0.10 | 0.88 | 0.03 | 1.14 | 0.00 | 0.00 |

| C8 | 0.00 | 0.00 | 0.20 | 0.83 | 0.14 | 0.92 | 0.15 | 0.68 | 0.07 | 0.93 | 0.00 | 0.00 |

| C9 | 0.00 | 0.00 | 0.00 | 0.00 | 0.13 | 0.65 | 0.10 | 0.83 | 0.09 | 0.93 | 0.14 | 0.69 |

| VNI | A1 | A2 | A3 | A4 | A5 | A6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.07 | 0.57 |

| C2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.04 | 0.97 | 0.00 | 0.00 | 0.03 | 1.14 | 0.03 | 0.86 |

| C3 | 0.08 | 0.93 | 0.00 | 0.00 | 0.00 | 0.00 | 0.08 | 0.93 | 0.00 | 0.00 | 0.00 | 0.00 |

| C4 | 0.09 | 1.01 | 0.02 | 0.98 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| C5 | 0.02 | 1.22 | 0.04 | 1.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.07 | 0.84 |

| C6 | 0.17 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.17 | 0.64 | 0.00 | 0.00 | 0.14 | 0.55 |

| C7 | 0.06 | 0.56 | 0.09 | 0.41 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.66 |

| C8 | 0.20 | 0.99 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.14 | 0.61 |

| C9 | 0.18 | 0.72 | 0.08 | 0.78 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SPi | SNi | NSPi | NSNi | ASi | Rank | |

|---|---|---|---|---|---|---|

| A1 | [0.14, 1.94] | [0.79, 6.23] | [0.02, 3.20] | [0.87, −6.89] | −1.40 | 5 |

| A2 | [0.45, 3.76] | [0.24, 3.21] | [0.06, 6.21] | [0.96, −3.07] | 2.08 | 4 |

| A3 | [0.70, 6.16] | [0.04, 0.97] | [0.09, 10.17] | [0.99, −0.22] | 5.52 | 2 |

| A4 | [0.74, 4.88] | [0.26, 1.57] | [0.10, 8.06] | [0.96, −0.99] | 4.07 | 3 |

| A5 | [0.61, 7.57] | [0.03, 1.14] | [0.08, 12.49] | [0.99, −0.44] | 6.56 | 1 |

| A8 | [0.26, 2.10] | [0.46, 4.09] | [0.03, 0.28] | [0.93, −4.19] | −1.48 | 6 |

| E1 | E2 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| C1 | 1 | 4 | 9 | 7 | 8 | 3 | 6 | 5 | 2 | 1 | 3 | 8 | 6 | 7 | 2 | 5 | 4 | 2 |

| C2 | 0.25 | 1 | 5 | 3 | 4 | 0.50 | 3 | 2 | 0.33 | 0.33 | 1 | 5 | 3 | 4 | 0.500 | 3 | 2 | 0.33 |

| C3 | 0.11 | 0.20 | 1 | 0.33 | 0.50 | 0.16 | 0.25 | 0.33 | 0.12 | 0.12 | 0.20 | 1 | 0.33 | 0.500 | 0.16 | 0.25 | 0.33 | 0.12 |

| C4 | 0.14 | 0.33 | 3 | 1 | 2 | 0.25 | 0.50 | 0.33 | 0.16 | 0.16 | 0.33 | 3 | 1 | 2 | 0.25 | 0.500 | 0.33 | 0.16 |

| C5 | 0.12 | 0.25 | 2 | 0.50 | 1 | 0.20 | 0.33 | 0.25 | 0.14 | 0.14 | 0.25 | 2 | 0.500 | 1 | 0.20 | 0.33 | 0.25 | 0.14 |

| C6 | 0.33 | 2 | 6 | 4 | 5 | 1 | 3 | 3 | 0.50 | 0.500 | 2 | 6 | 4 | 5 | 1 | 3 | 3 | 0.500 |

| C7 | 0.16 | 0.33 | 4 | 2 | 3 | 0.33 | 1 | 0.50 | 0.25 | 0.20 | 0.33 | 4 | 2 | 3 | 0.33 | 1 | 0.500 | 0.25 |

| C8 | 0.20 | 0.50 | 3 | 3 | 4 | 0.33 | 2 | 1 | 0.33 | 0.25 | 0.500 | 3 | 3 | 4 | 0.33 | 2 | 1 | 0.33 |

| C9 | 0.50 | 3 | 8 | 6 | 7 | 2 | 4 | 3 | 1 | 0.50 | 3 | 8 | 6 | 7 | 2 | 4 | 3 | 1 |

| … | ||||||||||||||||||

| E6 | E7 | |||||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| C1 | 1 | 4 | 9 | 5 | 8 | 3 | 6 | 5 | 2 | 1 | 3 | 8 | 5 | 7 | 2 | 5 | 4 | 3 |

| C2 | 0.25 | 1 | 5 | 2 | 4 | 0.50 | 3 | 2 | 0.33 | 0.33 | 1 | 6 | 3 | 4 | 0.50 | 4 | 2 | 1 |

| C3 | 0.11 | 0.20 | 1 | 0.25 | 0.50 | 0.16 | 0.25 | 0.33 | 0.12 | 0.12 | 0.16 | 1 | 0.25 | 0.50 | 0.16 | 0.33 | 0.25 | 0.20 |

| C4 | 0.20 | 0.50 | 4 | 1 | 4 | 0.33 | 2 | 1 | 0.25 | 0.20 | 0.33 | 4 | 1 | 3 | 0.33 | 1 | 0.50 | 0.33 |

| C5 | 0.12 | 0.25 | 2 | 0.25 | 1 | 0.20 | 0.33 | 0.25 | 0.14 | 0.14 | 0.25 | 2 | 0.33 | 1 | 0.20 | 0.33 | 0.25 | 0.25 |

| C6 | 0.33 | 2 | 6 | 3 | 5 | 1 | 3 | 3 | 0.50 | 0.50 | 2 | 6 | 3 | 5 | 1 | 3 | 2 | 2 |

| C7 | 0.16 | 0.33 | 4 | 0.50 | 3 | 0.33 | 1 | 0.50 | 0.25 | 0.20 | 0.25 | 3 | 1 | 3 | 0.33 | 1 | 0.50 | 0.33 |

| C8 | 0.20 | 0.50 | 3 | 1 | 4 | 0.33 | 2 | 1 | 0.33 | 0.25 | 0.50 | 0.25 | 2 | 4 | 0.50 | 2 | 1 | 0.50 |

| C9 | 0.50 | 3 | 8 | 4 | 7 | 2 | 4 | 3 | 1 | 0.33 | 1 | 5 | 3 | 4 | 0.50 | 3 | 2 | 1 |

| A1 | A2 | A3 | A4 | A5 | A6 | |

|---|---|---|---|---|---|---|

| C1 | [1, 1] | [2.78, 3.49] | [7.78, 8.49] | [5.51, 6.22] | [7.08, 7.49] | [2.08, 2.49] |

| C2 | [0.3, 0.38] | [1, 1] | [5.18, 5.99] | [2.78, 3.83] | [4.18, 4.99] | [0.42, 0.63] |

| C3 | [0.12, 0.13] | [0.17, 0.19] | [1, 1] | [0.29, 0.33] | [0.51, 0.63] | [0.16, 0.17] |

| C4 | [0.16, 0.18] | [0.28, 0.38] | [3.08, 3.49] | [1, 1] | [2.18, 2.99] | [0.23, 0.29] |

| C5 | [0.14, 0.14] | [0.2, 0.24] | [1.74, 1.98] | [0.36, 0.47] | [1, 1] | [0.18, 0.20] |

| C6 | [0.42, 0.49] | [1.78, 2.49] | [6.04, 6.53] | [3.53, 4.51] | [5.06, 5.8] | [1, 1] |

| C7 | [0.19, 0.22] | [0.26, 0.32] | [3.74, 3.98] | [1.35, 1.92] | [3.02, 3.26] | [0.31, 0.33] |

| C8 | [0.23, 0.29] | [0.39, 0.49] | [2.27, 2.94] | [2.19, 2.91] | [3.74, 3.98] | [0.34, 0.38] |

| C9 | [0.50, 1.08] | [2.19, 3.52] | [7.17, 8.22] | [4.66, 6.15] | [6.19, 7.45] | [1.34, 2.23] |

| Alternative | R’D-R-MAIRCA | R’D-R-MULTIMOORA | R’D-R-COPRAS | R’D-R-MABAC | R’D-R-EDAS | ||||||||||

| Value | Rank | Value | Rank | Value | Rank | Value | Rank | Value | Rank | ||||||

| A1 | −0.243 | 1.540 | 6 | 0.778 | 4.055 | 6 | 63.32 | 83.67 | 6 | −9.508 | 8.469 | 6 | 0.892 | −3.690 | 5 |

| A2 | −0.324 | 1.449 | 4 | 0.962 | 4.392 | 3 | 79.70 | 87.89 | 3 | −9.053 | 8.875 | 4 | 1.021 | 3.139 | 4 |

| A3 | −0.543 | 1.394 | 2 | 1.059 | 5.080 | 2 | 88.60 | 93.74 | 2 | −8.779 | 9.968 | 2 | 1.086 | 9.949 | 2 |

| A4 | −0.402 | 1.454 | 3 | 0.858 | 4.406 | 4 | 78.93 | 88.10 | 4 | −9.079 | 9.263 | 3 | 1.057 | 7.073 | 3 |

| A5 | −0.696 | 1.332 | 1 | 1.150 | 5.402 | 1 | 100.00 | 100.00 | 1 | −8.470 | 10.73 | 1 | 1.075 | 12.053 | 1 |

| A6 | −0.170 | 1.463 | 5 | 0.933 | 4.137 | 5 | 77.23 | 78.93 | 5 | −9.123 | 8.106 | 5 | 0.960 | −3.913 | 6 |

| Alternative | R’A-R-MAIRCA | R’A-R-MULTIMOORA | R’A-R-COPRAS | R’A-R-MABAC | R’A-R-EDAS | ||||||||||

| Value | Rank | Value | Rank | Value | Rank | Value | Rank | Value | Rank | ||||||

| A1 | 0.024 | 0.628 | 3 | 0.711 | 2.103 | 4 | 90.72 | 100.00 | 3 | −2.638 | 2.919 | 3 | 0.759 | 0.255 | 5 |

| A2 | 0.115 | 0.595 | 5 | 0.796 | 1.991 | 5 | 93.58 | 91.70 | 5 | −2.470 | 2.466 | 5 | 1.056 | 2.312 | 4 |

| A3 | 0.064 | 0.568 | 2 | 0.928 | 2.320 | 2 | 98.60 | 92.26 | 2 | −2.334 | 2.721 | 2 | 1.205 | 4.461 | 2 |

| A4 | 0.075 | 0.599 | 4 | 0.810 | 2.151 | 3 | 94.25 | 92.67 | 4 | −2.489 | 2.668 | 4 | 1.148 | 3.928 | 3 |

| A5 | 0.034 | 0.560 | 1 | 0.966 | 2.420 | 1 | 100.00 | 95.39 | 1 | −2.295 | 2.872 | 1 | 1.195 | 4.844 | 1 |

| A6 | 0.225 | 0.650 | 6 | 0.820 | 1.982 | 6 | 83.13 | 80.28 | 6 | −2.746 | 1.915 | 6 | 0.879 | −1.461 | 6 |

| Methods | R’D-R-MAI RCA | R’D-R-MULTI MOORA | R’D-R-COP RAS | R’D-R-MA BAC | R’D-R- EDAS | R’A-R-MA IRCA | R’A-R-MULTI MOORA | R’A-R-COP RAS | R’A-R-MA BAC | R’A-R- EDAS | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|

| R’D-R-MAIRCA | 1.000 | 0.943 | 0.943 | 1.000 | 0.943 | 0.657 | 0.829 | 0.657 | 0.657 | 0.943 | 0.857 |

| R’D-R-MULTIMOORA | - | 1.000 | 1.000 | 0.943 | 0.886 | 0.600 | 0.714 | 0.600 | 0.600 | 0.886 | 0.803 |

| R’D-R-COPRAS | - | - | 1.000 | 0.943 | 0.886 | 0.600 | 0.714 | 0.600 | 0.600 | 0.886 | 0.779 |

| R’D-R-MABAC | - | - | - | 1.000 | 0.943 | 0.657 | 0.829 | 0.657 | 0.657 | 0.943 | 0.812 |

| R'D-R-EDAS | - | - | - | - | 1.000 | 0.829 | 0.943 | 0.829 | 0.829 | 1.000 | 0.905 |

| R’A-R-MAIRCA | - | - | - | - | - | 1.000 | 0.943 | 1.000 | 1.000 | 0.829 | 0.954 |

| R’A-R-MULTIMOORA | - | - | - | - | - | - | 1.000 | 0.943 | 0.943 | 0.943 | 0.957 |

| R’A-R-COPRAS | - | - | - | - | - | - | - | 1.000 | 1.000 | 0.829 | 0.943 |

| R’A-R-MABAC | - | - | - | - | - | - | - | - | 1.000 | 0.829 | 0.915 |

| R’A-R-EDAS | - | - | - | - | - | - | - | - | - | 1.000 | 1.000 |

| Overall average | 0.893 | ||||||||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stević, Ž.; Pamučar, D.; Vasiljević, M.; Stojić, G.; Korica, S. Novel Integrated Multi-Criteria Model for Supplier Selection: Case Study Construction Company. Symmetry 2017, 9, 279. https://doi.org/10.3390/sym9110279

Stević Ž, Pamučar D, Vasiljević M, Stojić G, Korica S. Novel Integrated Multi-Criteria Model for Supplier Selection: Case Study Construction Company. Symmetry. 2017; 9(11):279. https://doi.org/10.3390/sym9110279

Chicago/Turabian StyleStević, Željko, Dragan Pamučar, Marko Vasiljević, Gordan Stojić, and Sanja Korica. 2017. "Novel Integrated Multi-Criteria Model for Supplier Selection: Case Study Construction Company" Symmetry 9, no. 11: 279. https://doi.org/10.3390/sym9110279