Considering the Life-Cycle Cost of Distributed Energy-Storage Planning in Distribution Grids

Abstract

:1. Introduction

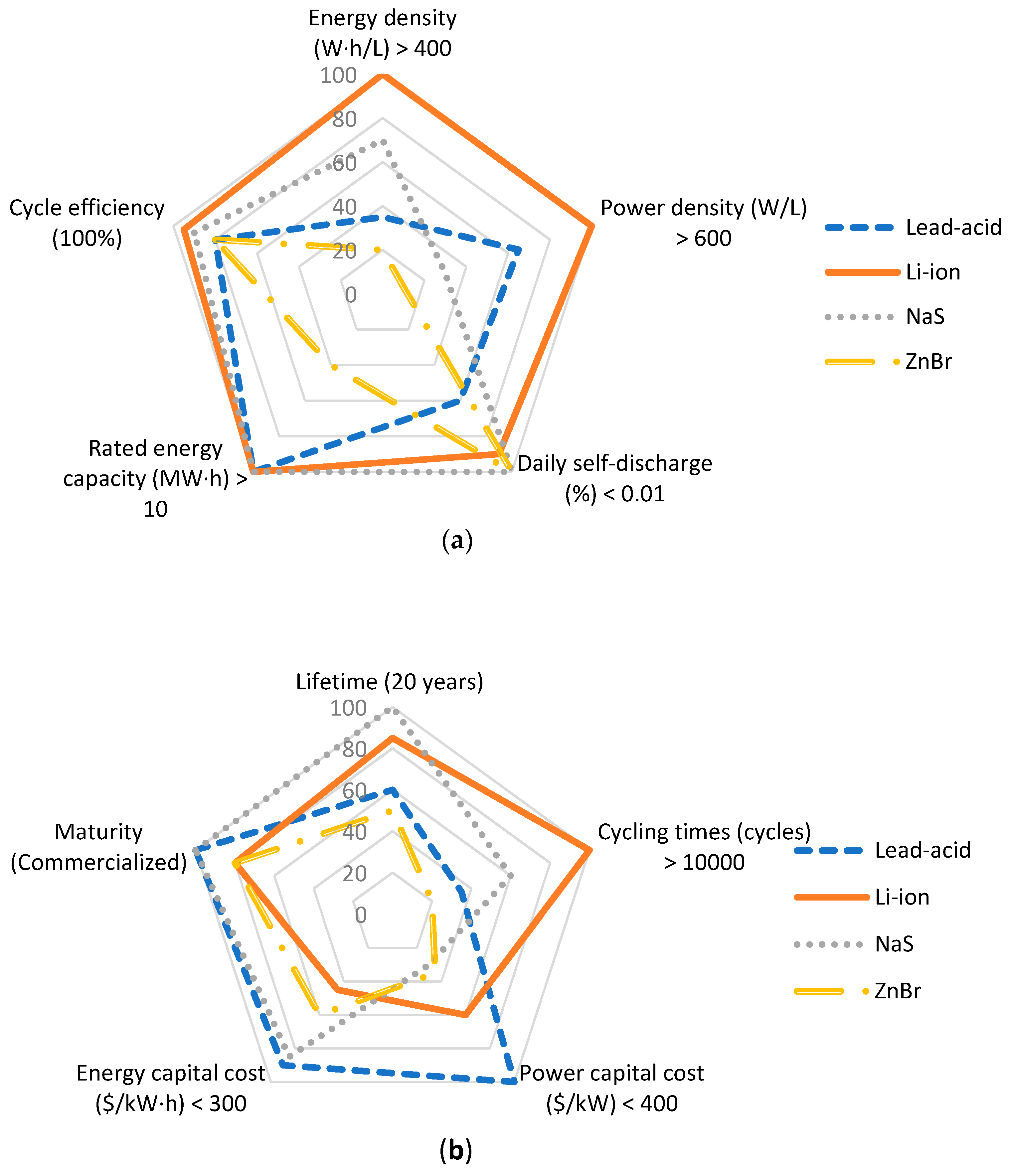

- The technical and economic characteristics of the various categories of ESSs are analyzed and the most suitable type of ESSs for a distribution network’s optimal optimization, is selected.

- The coupling effect between the sizing and sitting of the ESS are considered with a comprehensive LCC model, consequently, to achieve a distribution network optimization from the perspective of the whole project life with a minimum capacity and a limited infrastructure maintenance cost.

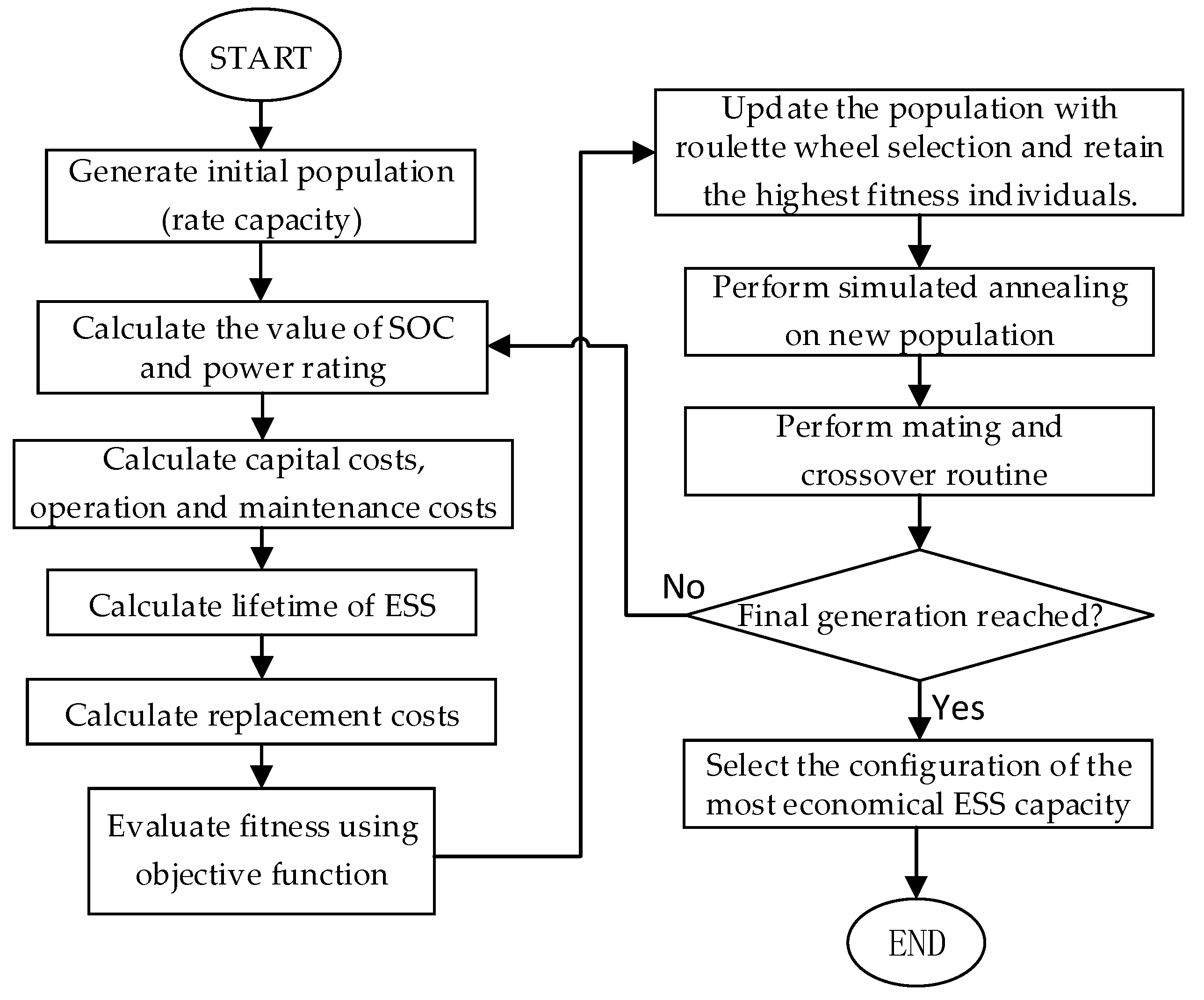

- The two-stage heuristic optimization method utilizing GA combined with SA can achieve a good tradeoff among accuracy, convergence, and efficiency of optimization, and the SA can avoid the premature convergence of GA.

2. ESS Type Selection

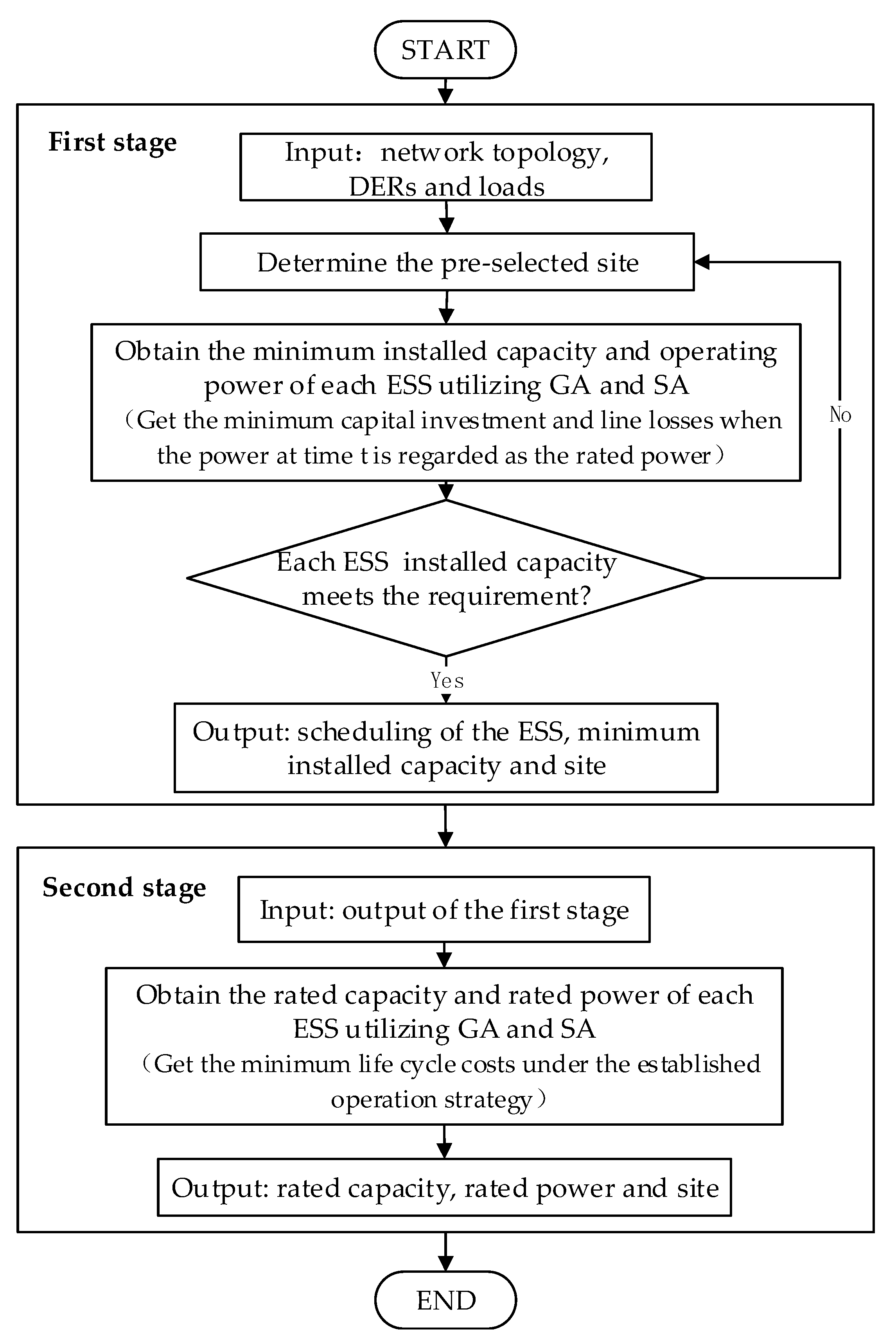

3. ESS Installation Site and Capacity Optimization

3.1. The First-Stage Optimization

3.2. The Second-Stage Optimization

3.2.1. Life-Cycle Cost Model

3.2.2. Capacity Fading Model

4. Sitting and Sizing Optimization

- Step 1: Randomly generate the initial population by binary encoding.

- Step 2: Calculate the objective function value of each population member.

- Step 3: Calculate and select the individuals with larger fitness from the population and constitute a new population.

- Step 4: Perform the annealing operations, according the probability represented in Equation (28).

- Step 5: On the basis of the population from step 3, get the new population by mating and the crossover routine.

- Step 6: Finally, if the final generation is reached or the convergence criteria is met, output the optimization results. Otherwise, return to step2.

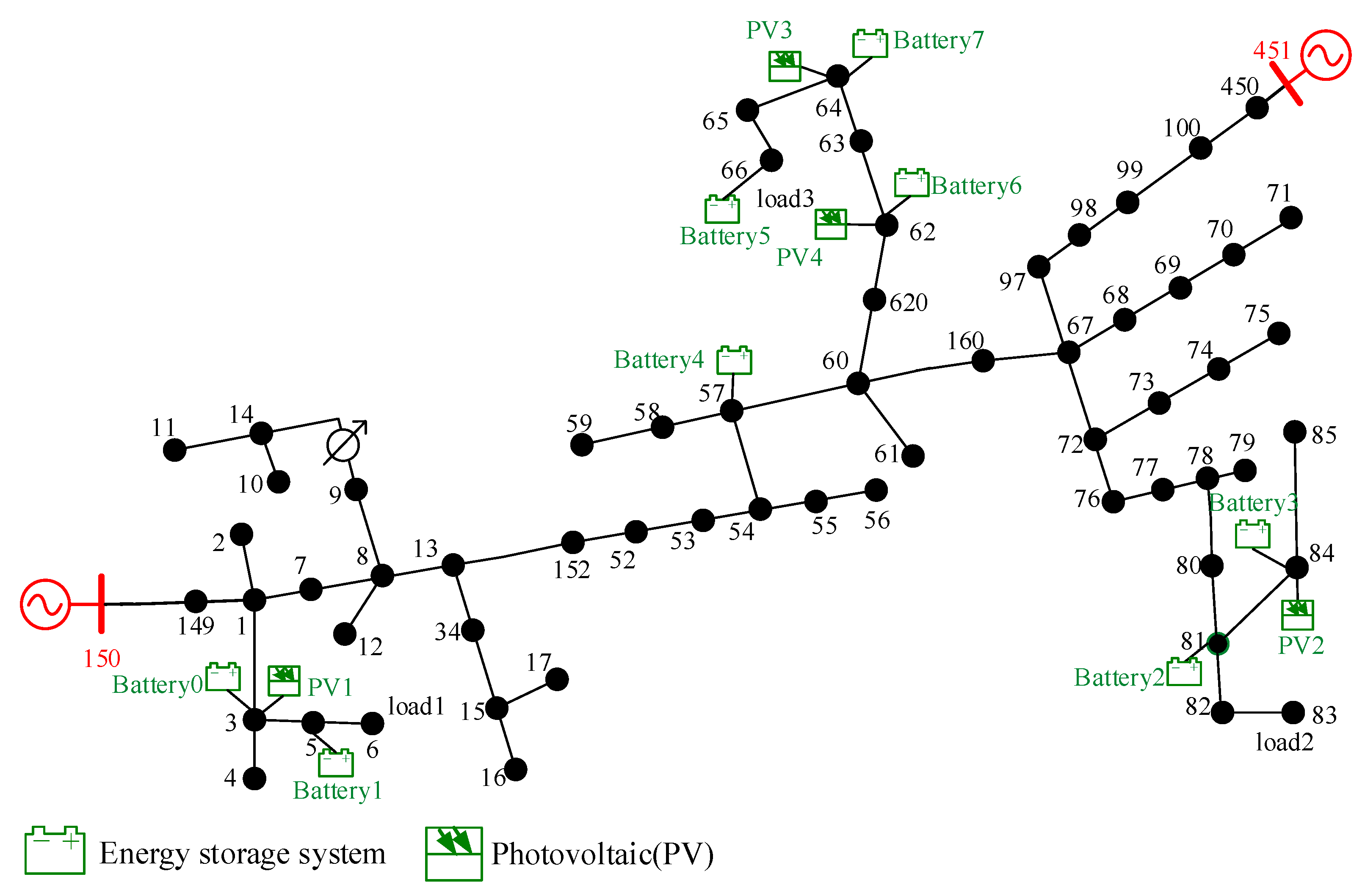

5. Case Studies

5.1. Profiles

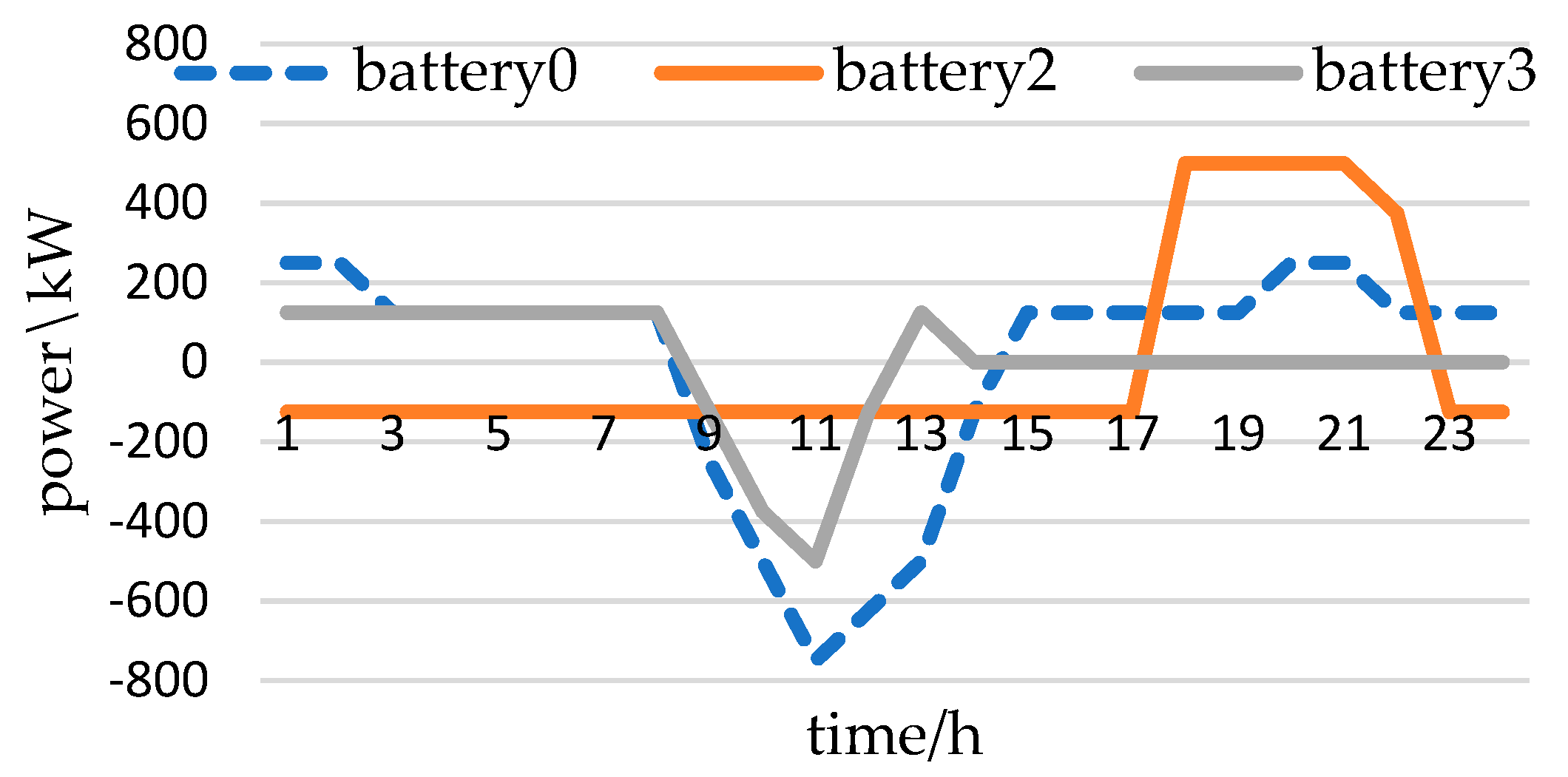

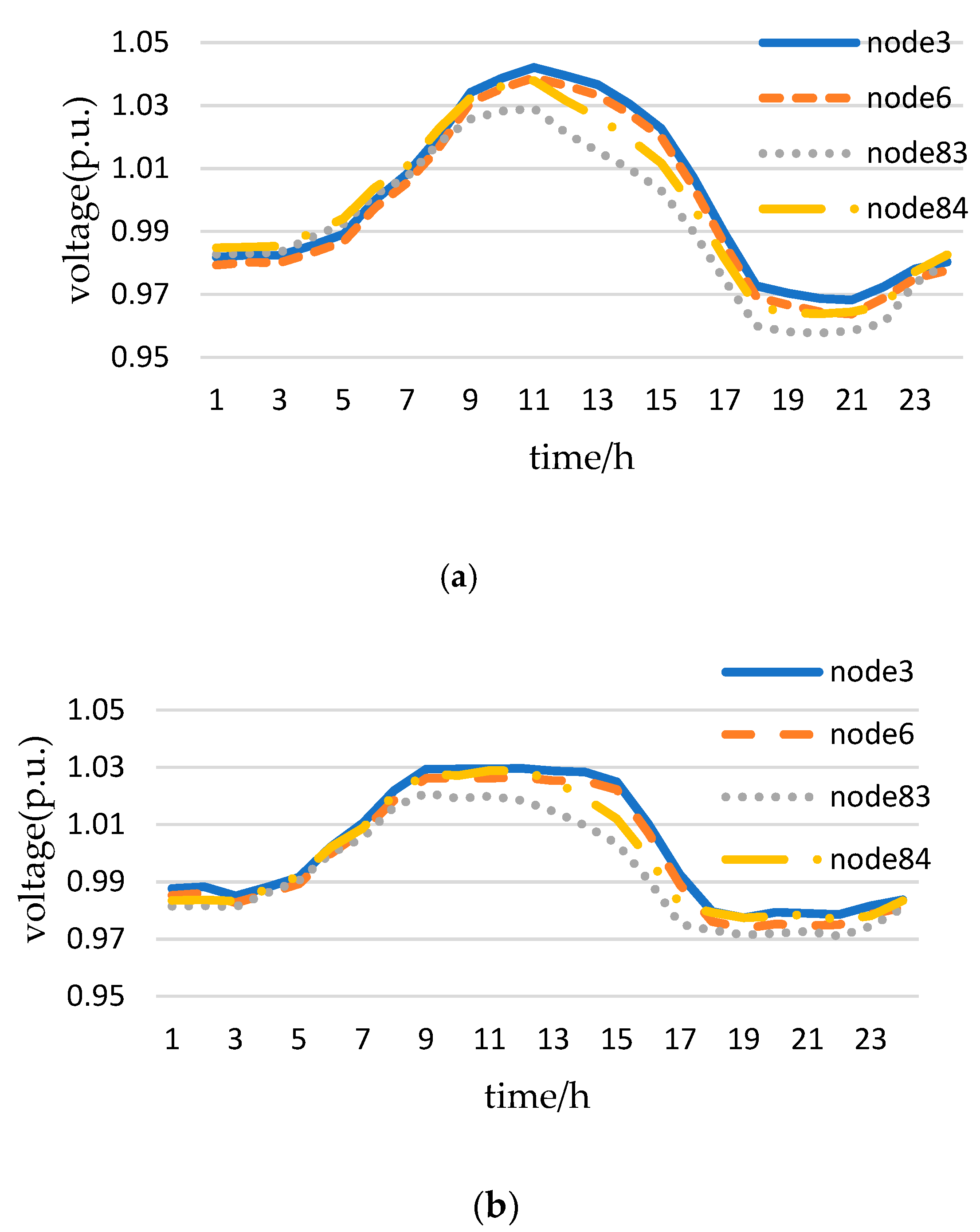

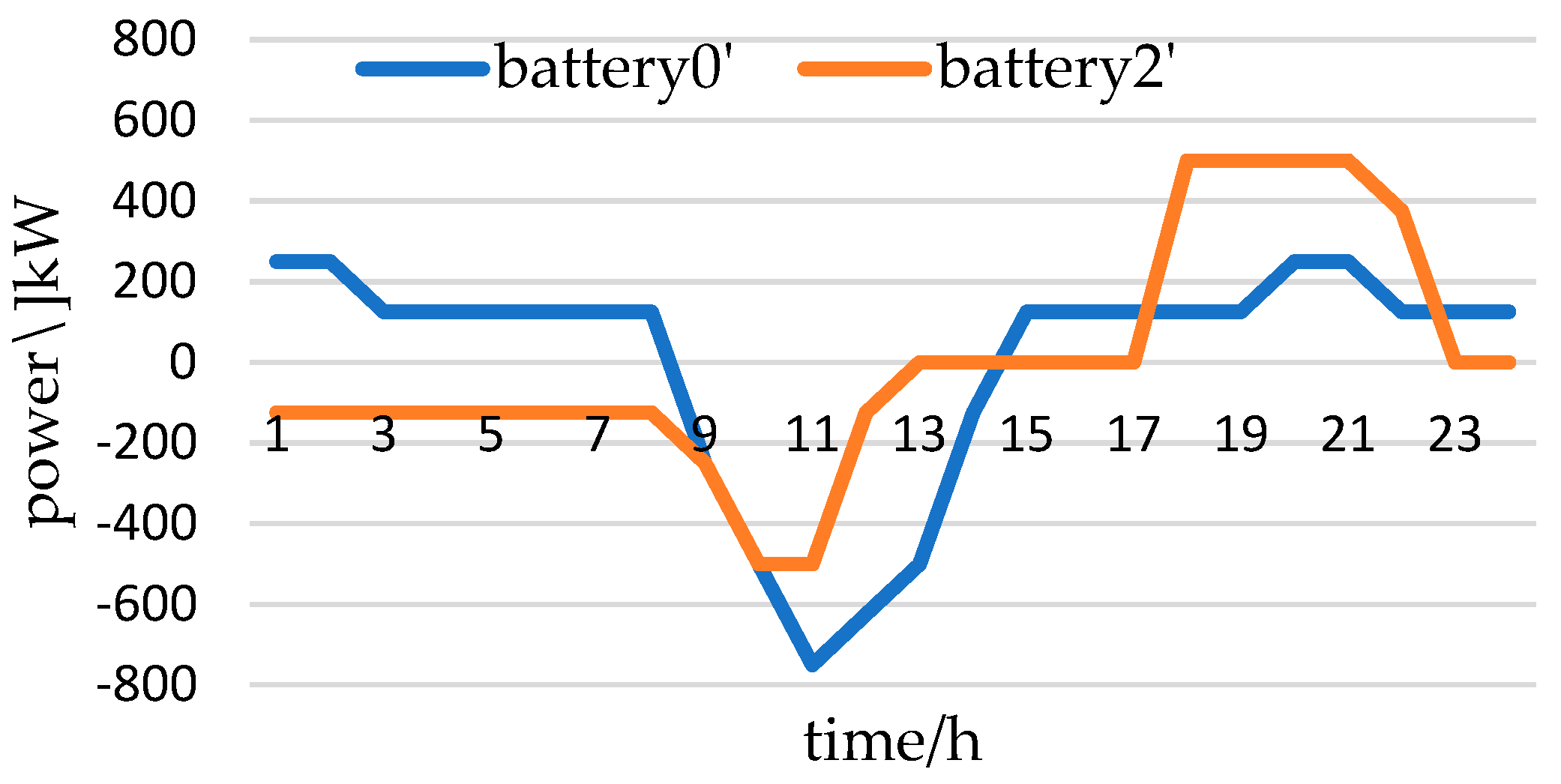

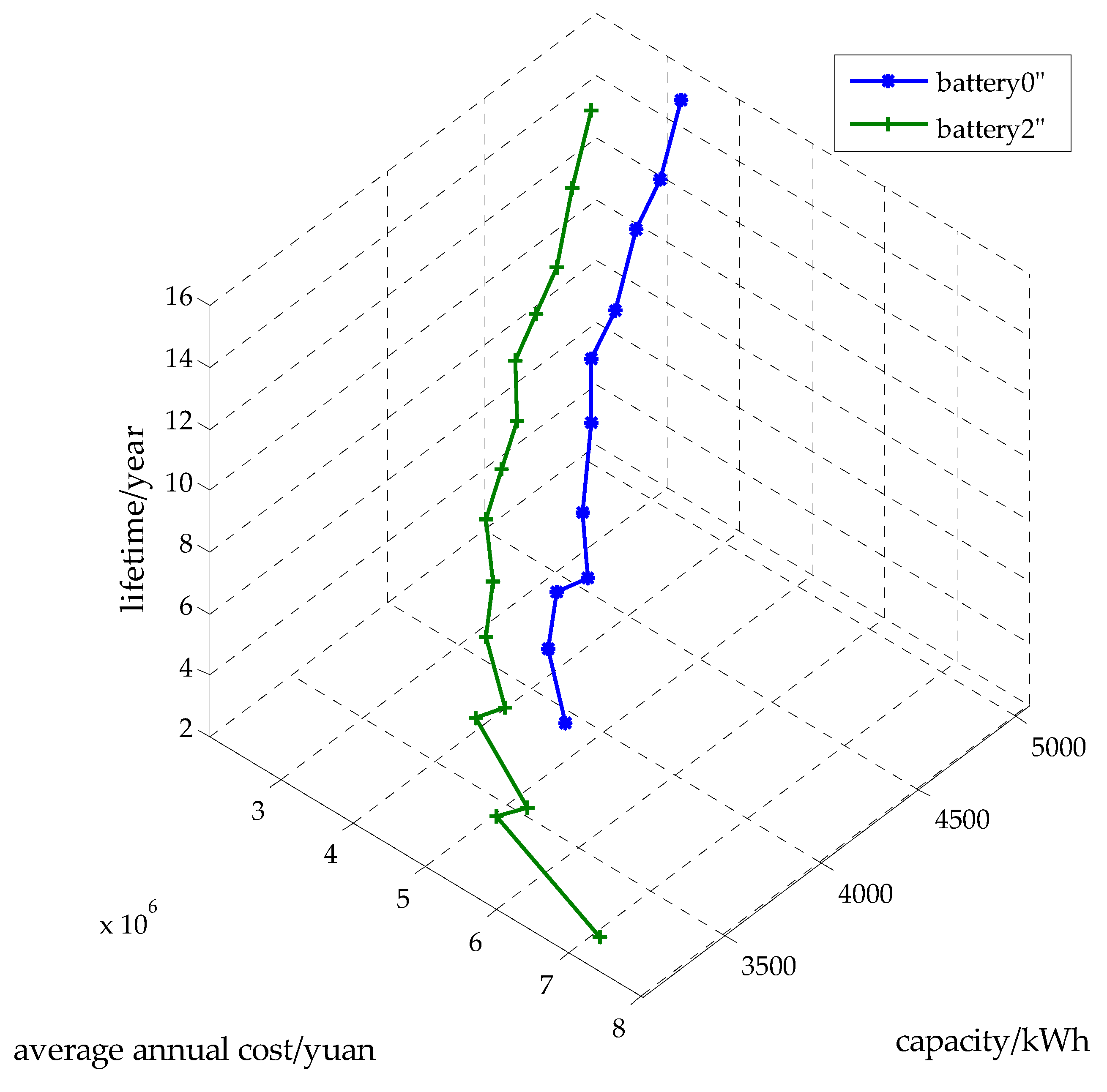

5.2. Case Study Results

6. Conclusions

- (1)

- The intermittence of renewables integrated in the distribution grid led to the risk of voltage fluctuations, which could be effectively solved by a suitable ESS configuration in low-voltage distribution networks.

- (2)

- A two-stage optimization model was built to optimize the installation site and the capacity of the ESS, which consider the coupling effects between the sizing and sitting of the ESS and the optimal operation of the system, in the first stage, and consider the LCC of the ESS in the second stage. Through the two-stage optimization, the overall cost of the ESS in the project cycle could be effectively reduced. It is worth noting that the second-stage optimization reduces costs by extending the ESSs’ service life, the life-cycle cost is, therefore, reduced due to the significant deduction of the replacement and the disposal cost.

- (3)

- The two-stage solution method reduced the computation scale and the difficulty of optimization, with a higher computation efficiency.

- (4)

- The effectiveness of this method was verified by the case study. The results showed that the costs per kW·h of battery 0 and battery 2 had reduced by 32.4% and 58.3%, respectively, after the second-stage optimization. The voltage profiles were regulated within the pre-defined limits, the economy of the ESS was greatly improved through the optimization.

- (5)

- The optimization method used in this study was mainly verified for low-voltage AC distribution networks, and could be extended to the AC/DC hybrid distribution grids, in the near future.

- (6)

- The revenue in a competitive market environment, with various types of participants, could also be considered into the ESS planning, to maximize the benefits of the storage and the entire distribution grids.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| AhI | the charging energy during event I. | PS | the active power of main grid |

| Cost | the average annual cost of the ESS within project planning period | PL | the active power of load |

| Cost1 | the capital investment of ESS in the first-stage optimization | Ploss | the active power of line loss |

| Cost2 | the LCC of ESS in the second-stage optimization | Pijmin | the lower active power limits of line ij |

| Csys | the annual average capital cost of ESS | Pijmax | the upper active power limits of line ij |

| Cbat | the cost of storage unit | Pij | the actual active power on line ij |

| CE | the price of capacity per kW·h | PESS,i,rate | the rated power of ESS at node i |

| CPCS | the cost of the PCS | PESS,i | The output power of ESS at node i |

| CP | the charging cost at per kW of CPCS | PESS,i(t) | the real charging/discharging power of node i at time t |

| CBOP | the cost of the necessary supporting facilities | PESS,rate | the power rating of ESS |

| CB | the cost per kW·h of the necessary supporting facilities | R | the gas constant |

| Closs | the cost of line losses | Rth | the empirical constant |

| Cpun | the cost of punishment | SOCmax | the upper limits of the SOC |

| CFOP | the fixed operation and maintenance cost | SOCmin | the lower limits of the SOC |

| Cf | the operation and maintenance cost per kW | SOCi | the SOC value of node i |

| CVOM | the variable operation and maintenance cost | SOCavg,I | the average SOC during the event I |

| Cc | the electricity cost | SOCdev,I | the SOC deviation during the event I |

| Crep | the annual average replacement cost | SOC(t) | the SOC in time t |

| Cdis | the annual average disposal cost | T | the initial temperature of annealing |

| Cd | the specific disposal cost per kW of the battery | Tref | the reference temperature in the operation process |

| COE | the cost per kW·h of ESS. | TI | the temperature of ESS in event I |

| D | the maximum depth of discharging | Vmax | the upper voltage limits |

| Ei | the capacity of ESS at node i in the first-stage optimization | Vmin | the lower voltage limits |

| E0,i | the minimum capacity that must meet ESSs’ output | Vj | the actual voltage magnitude at node j |

| Erate | the rated capacity of ESS | Y | the project cycle (year) |

| EESS,i(t) | the energy fluctuation relative to the initial state of ESS at every installation nodes | β | the average annual decline rate of ESS capital cost |

| Er | the energy rate of the ESS (kW/kW·h) | η | the overall round-trip efficiency |

| Ea | the activation energy | ηD | the efficiencies of discharging |

| G | the number of operation days in a year | ηC | the efficiencies of charging |

| k | the times of battery replacement | ηPCS | the nominal efficiency of the PCS |

| m | the number of annealing | σ | the discount rate (%) |

| N | the number of nodes which must be configured with ESS | ε | the times of replacement |

| Nset | the number of nodes which are nodes for ESS pre-selection | Γ | the total fade capacity |

| n | the average lifetime of the chosen ESS | the total number of events | |

| P | the accepted probability of new population member | Δt | the duration of charging/discharging |

| PESS,sum | the total power output of ESSs in the distribution network | δ | the self-discharging rate of ESS |

| PESS,max | the maximum actual required charging/discharging power of ESS | µC | the charging sign of ESS |

| PDG | the active power of DG | µD | the discharging sign of ESS |

Appendix A

| Node A | Node B | Length | Type | Node A | Node B | Length | Type |

|---|---|---|---|---|---|---|---|

| 1 | 2 | 0.33144 | LGJ150 | 78 | 80 | 0.42614 | LGJ150 |

| 1 | 3 | 0.47348 | LGJ150 | 80 | 81 | 0.42614 | LGJ150 |

| 1 | 7 | 0.56818 | LGJ240 | 81 | 82 | 0.42614 | LGJ150 |

| 3 | 4 | 0.37879 | LGJ150 | 82 | 83 | 0.42614 | LGJ150 |

| 3 | 5 | 0.61553 | LGJ150 | 81 | 84 | 0.42614 | LGJ150 |

| 5 | 6 | 0.47348 | LGJ150 | 84 | 85 | 0.42614 | LGJ150 |

| 7 | 8 | 0.37879 | LGJ240 | 97 | 98 | 0.52083 | LGJ240 |

| 8 | 12 | 0.42614 | LGJ150 | 98 | 99 | 0.104167 | LGJ240 |

| 8 | 9 | 0.42614 | LGJ150 | 99 | 100 | 0.056818 | LGJ240 |

| 8 | 13 | 0.56818 | LGJ240 | 100 | 450 | 0.151515 | LGJ240 |

| 202 | 14 | 0.80492 | LGJ150 | 149 | 1 | 0.75758 | LGJ240 |

| 13 | 34 | 0.28409 | LGJ150 | 160 | 67 | 0.66288 | LGJ240 |

| 13 | 152 | 0.000009 | LGJ150 | 152 | 52 | 0.75758 | LGJ240 |

| 14 | 11 | 0.47348 | LGJ150 | 52 | 53 | 0.37879 | LGJ240 |

| 14 | 10 | 0.47348 | LGJ150 | 53 | 54 | 0.23674 | LGJ240 |

| 15 | 16 | 0.71023 | LGJ150 | 54 | 55 | 0.52083 | LGJ240 |

| 15 | 17 | 0.66288 | LGJ150 | 54 | 57 | 0.66288 | LGJ240 |

| 34 | 15 | 0.18939 | LGJ150 | 55 | 56 | 0.52083 | LGJ240 |

| 67 | 68 | 0.37879 | LGJ150 | 57 | 58 | 0.47348 | LGJ240 |

| 67 | 72 | 0.52083 | LGJ150 | 57 | 60 | 0.142045 | LGJ240 |

| 67 | 97 | 0.47348 | LGJ240 | 58 | 59 | 0.47348 | LGJ240 |

| 68 | 69 | 0.52083 | LGJ150 | 60 | 160 | 0.000009 | LGJ150 |

| 69 | 70 | 0.61553 | LGJ150 | 60 | 61 | 0.104167 | LGJ240 |

| 70 | 71 | 0.52083 | LGJ150 | 60 | 620 | 0.47348 | LGJ240 |

| 72 | 73 | 0.52083 | LGJ150 | 620 | 62 | 0.000009 | LGJ150 |

| 72 | 76 | 0.37879 | LGJ150 | 62 | 63 | 0.33144 | LGJ240 |

| 73 | 74 | 0.66288 | LGJ150 | 63 | 64 | 0.66288 | LGJ240 |

| 74 | 75 | 0.75758 | LGJ150 | 64 | 65 | 0.80492 | LGJ240 |

| 76 | 77 | 0.75758 | LGJ150 | 65 | 66 | 0.61553 | LGJ240 |

| 77 | 78 | 0.18939 | LGJ150 | 9 | 202 | 0.000009 | LGJ150 |

| 78 | 79 | 0.42614 | LGJ150 | 150 | 201 | 0.000009 | LGJ150 |

References

- Manghani, R.; McCarthy, R. Global Energy Storage: 2017 Year Interview and 2018–2022 Outlook, GTM Research. 2018. Available online: https://www.woodmac.com/our-expertise/focus/Power--Renewables/Global-Energy-Storage/ (accessed on 27 August 2018).

- Amin, A.Z. Electricity Storage and Renewables: Costs and Markets To 2030, 3rd ed.; International Renewable Energy Agency: Abu Dhabi, Arab Emirates, 2017; pp. 1–131. ISBN 978-92-9260-038-9. [Google Scholar]

- Xiao, H.; Pei, W.; Yang, Y.H.; Qi, Z.P.; Kong, L. Energy storage capacity optimization for microgrid considering battery life and economic operation. High Volt. Eng. 2015, 41, 3256–3265. [Google Scholar] [CrossRef]

- Lin, S.B.; Han, M.X.; Zhao, G.P.; Niu, Z.H.; Hu, X.D. Capacity Allocation of Energy Storage in Distributed Photovoltaic Power System Based on Stochastic Prediction Error. Proc. CSEE 2013, 33, 25–33. [Google Scholar]

- Hu, G.Z.; Duan, S.X.; Cai, T.; Chen, C.S. Sizing and Cost Analysis of Photovoltaic Generation System Based on Vanadium Redox Battery. Trans. China Electrotech. Soc. 2012, 27, 260–267. [Google Scholar] [CrossRef]

- Tant, J.; Geth, F.; Six, D.; Tant, P.; Driesen, J. Multi-objective battery storage to improve PV integration in residential distribution grids. IEEE Trans. Sustain. Energy 2013, 4, 182–191. [Google Scholar] [CrossRef]

- Hung, D.Q.; Mithulananthan, N.; Bansal, R.C. Integration of PV and BES units in commercial distribution systems considering energy loss and voltage stability. Appl. Energy 2014, 11, 1162–1170. [Google Scholar] [CrossRef]

- Shi, N.; Luo, Y. Bi-Level Programming Approach for the Optimal Allocation of Energy Storage Systems in Distribution Networks. Appl. Sci. 2017, 7, 398. [Google Scholar] [CrossRef]

- Zhang, Y.X.; Ren, S.Y.; Dong, Z.Y.; Xu, Y.; Meng, K.; Zheng, Y. Optimal placement of battery energy storage in distribution networks considering conservation voltage reduction and stochastic load composition. IET Gener. Trans. Distrib. 2017, 11, 3862–3870. [Google Scholar] [CrossRef]

- Liu, H.A.; Li, D.Z.; Liu, Y.T.; Dong, M.Y.; Liu, X.N.; Zhang, H. Sizing Hybrid Energy Storage Systems for Distributed Power Systems under Multi-Time Scales. Appl. Sci. 2018, 8, 1453. [Google Scholar] [CrossRef]

- Marchi, B.; Pasetti, M.; Zanoni, S. Life cycle cost analysis for ESS optimal sizing. Energy Procedia 2017, 113, 127–134. [Google Scholar] [CrossRef]

- Bahramia, S.; Hadi Amini, M. A Decentralized Trading Algorithm for an Electricity Market with Generation Uncertainty. Appl. Energy 2018, 218, 520–532. [Google Scholar] [CrossRef]

- Sun, M.; Gui, X. Optimal allocation of energy storage system independent of time limits for specific load. Autom. Electr. Power Syst. 2018, 1–8. [Google Scholar] [CrossRef]

- Luo, X.; Wang, J.H.; Dooner, M.; Clarke, J. Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl. Energy 2015, 137, 511–536. [Google Scholar] [CrossRef]

- Wang, C.S.; Yu, B.; Xiao, J.; Guo, L. Sizing of Energy Storage Systems for Output Smoothing of Renewable Energy Systems. High Vol. Eng. 2015, 41, 3256–3265. [Google Scholar] [CrossRef]

- Demirocak, D.E.; Srinivasan, S.S.; Stefanakos, E.K. A Review on Nanocomposite Materials for Rechargeable Li-Ion Batteries. Appl. Sci. 2017, 7, 731. [Google Scholar] [CrossRef]

- Xue, J.H.; Ye, J.L.; Tao, Q.; Wang, D.S.; Sang, B.Y.; Yang, B. Economic Feasibility of User-Side Battery Energy Storage Based on Whole-Life-Cycle Cost Model. Power Syst. Technol. 2016, 40, 2471–2476. [Google Scholar] [CrossRef]

- Xiao, J.; Zhang, Z.Q.; Bai, L.Q.; Liang, H.S. Determination of the optimal installation site and capacity of battery energy storage system in distribution network integrated with distributed generation. IET Gener. Trans. Distrib. 2016, 10, 601–607. [Google Scholar] [CrossRef]

- Xiang, Y.P.; Wei, Z.N.; Sun, G.Q.; Sun, Y.H.; Shen, H.P. Life Cycle Cost Based Optimal Configuration of Battery Energy Storage System in Distribution Network. Power Syst. Technol. 2015, 39, 264–270. [Google Scholar]

- Marchi, B.; Zanoni, S.; Pasetti, M. A techno-economic analysis of Li-ion battery energy storage systems in support of PV distributed generation. In Proceedings of the 21st Summer School F. Turco of Industrial Systems Engineering, Naples, Italy, 13–15 September 2016. [Google Scholar]

- IRENA. Innovation Outlook-Renewable Mini-Grids. 2016. Available online: https://www.irena.org/publications/2016/Sep/Innovation-Outlook-Renewable-mini-grids (accessed on 10 November 2018).

- Li, F.B.; Xie, K.G.; Zhang, X.S.; Zhao, B.; Chen, J. Optimization of Coordinated Control Parameters for Hybrid Energy Storage System Based on Life Quantification. Autom. Electr. Power Syst. 2014, 38, 1–5. [Google Scholar] [CrossRef]

- Lam, L.; Bauer, P. Practial Capacity Fading Model for Li-Ion Battery Cells in Electric Vehicles. IEEE Trans. 2013, 28, 5910–5918. [Google Scholar] [CrossRef]

- Hoke, A.; Brissette, A.; Maksimovic, D.; Pratt, A.; Smith, K. Electric vehicle charge optimization including effects of lithium-ion battery optimization effects of lithium-ion battery degradation. In Proceedings of the 2011 IEEE Vehicle Power and Propulsion Conference, Chicago, IL, USA, 6–9 September 2011. [Google Scholar] [CrossRef]

- Wen, F.S.; Han, Z.X. Fault diagnosis of power system based on genetic algorithm and simulated annealing algorithm. Proc. CSEE 1994, 14, 29–35. [Google Scholar] [CrossRef]

- Crossland, A.F.; Jones, D.; Wade, N.S. Planning the location and rating of distributed energy storage in LV networks using a genetic algorithm with simulated annealing. Electr. Power Energy Syst. 2014, 59, 103–110. [Google Scholar] [CrossRef]

- Liu, K.Y.; Sheng, W.X.; Li, Y.H. Research on Reactive Power Optimization Based on Improved Genetic Simulated Annealing Algorithm. Power Syst. Technol. 2007, 31, 13–18. [Google Scholar] [CrossRef]

- Poonpun, P.; Jewell, W.T. Analysis of the Cost per Kilowatt Hour to Store Electricity. IEEE Trans. Energy Convers. 2008, 23, 529–534. [Google Scholar] [CrossRef]

| Parameters of GA | Parameters of SA | ||||

|---|---|---|---|---|---|

| Maximum generation | 300 | Variation probability | 0.02 | Annealing coefficient | 0.95 |

| Size of population | 50 | Crossover rate | 0.7 | Initial temperature | 100 |

| Installation Site | Node 3 | Node 81 |

|---|---|---|

| Rated capacity(kW·h) | 4950 | 4703 |

| Rated power(kW) | 750 | 500 |

| Optimization Stage | Installation Site | Lifetime/year | Average Annual Cost/¥ |

|---|---|---|---|

| First stage | Node 3 | 4 | 5,238,677 |

| Node 81 | 2 | 7,081,373 | |

| Second stage | Node 3 | 16 | 3,541,137 |

| Node 81 | 16 | 2,951,720 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, T.; Meng, H.; Zhu, J.; Wei, W.; Zhao, H.; Yang, H.; Li, Z.; Ren, Y. Considering the Life-Cycle Cost of Distributed Energy-Storage Planning in Distribution Grids. Appl. Sci. 2018, 8, 2615. https://doi.org/10.3390/app8122615

Xu T, Meng H, Zhu J, Wei W, Zhao H, Yang H, Li Z, Ren Y. Considering the Life-Cycle Cost of Distributed Energy-Storage Planning in Distribution Grids. Applied Sciences. 2018; 8(12):2615. https://doi.org/10.3390/app8122615

Chicago/Turabian StyleXu, Tao, He Meng, Jie Zhu, Wei Wei, He Zhao, Han Yang, Zijin Li, and Yi Ren. 2018. "Considering the Life-Cycle Cost of Distributed Energy-Storage Planning in Distribution Grids" Applied Sciences 8, no. 12: 2615. https://doi.org/10.3390/app8122615