1. Introduction

This commentary uses risk profiling software on a model dairy farm and a hard, steep hill country sheep and beef property in New Zealand. The authors demonstrate the method based on their experience working in the agricultural sector for over thirty years. Risk profiling is not an exact science; it provides a range of outcomes with a probability based upon the parameters of the frequency distributions fitted. In this work, two sets of financial budgets generated from industry data are used as inputs to provide examples of risk profiles. The methods employed could be of benefit to pastoral farmers in New Zealand.

Farm production systems provide financial opportunity but are fraught with risk. Some farmers may experience greater than average profit margins, whilst others experience a total crop loss even if they are using similar production systems. Misfortune to producers in one region can reduce supply and increase the price received by unaffected producers of the same commodity in another region.

Farmers run businesses and must manage and mitigate risk. Many factors that generate financial risk are not able to be controlled by the farmer [

1,

2]. For some farmers, risk mitigation is possible. Irrigation, for example, can reduce risks associated with drought. Two farms are risk profiled by the authors: one a sheep and beef farm which is not irrigated, whereas the dairy farm modelled is irrigated. Although specific event insurance may be purchased to reduce the risk of a large reduction of income, this is more common in horticulture and arable situations (e.g., hail cover) [

1].

When making business decisions and investment choices some partial budgeting and variance analysis is undertaken in order to rank opportunities and assess risk. Risk profiling as an additional tool to variance analysis is ideal for agricultural systems. This commentary demonstrates how risk profiling can be undertaken on two pastoral farming systems and how it may be used to assist farmers in their decision making.

The risks of an agricultural production system can be modelled by a frequency distribution. Palisade “@Risk” (Palisade, Ithaca, NY) provides a large range of distributions which may be fitted to spreadsheet inputs; for this exercise, they are fitted to typical farm budgets of a sheep and beef and dairy farm. For the sheep and beef farm a “normal distribution” is fitted to annual rainfall based on the 30-year average [

3]. The “normal distribution” is fitted to most of the natural systems for this simulation exercise. Consider, for example, that the numbers of lambs survived will vary depending on weather at lambing, but will always be less than average in a cold, wet spring than a mild one. The proportion of calves born that are female is more or less 0.5. The farm gate commodity price achieved is far more variable than the natural systems that drive production. There tends to be an inflationary trend increase to prices achieved, the trend is weak and for this exercise a risk profile is built for a specific budget covering a 12-month period [

4].

The analyst has a large selection of distributions which may be applied to inputs. A commodity may be at a record low price and an input for the commodity price may be chosen with a positive skew, as the analyst may expect the price to increase or vice versa. As each simulation takes a few seconds, any number of situations could be considered. For the examples demonstrated in this commentary, the current price for livestock was used with a “normal distribution”. A price of

$6.00 per kg milk solids (kg MS

−1) was used in the dairy farm, although the current price is

$6.50, as this was the price used in [

5,

6]. The standard deviation for any distribution is defined by the user, and, for this exercise, they were set to reflect deviation in price movements over recent years.

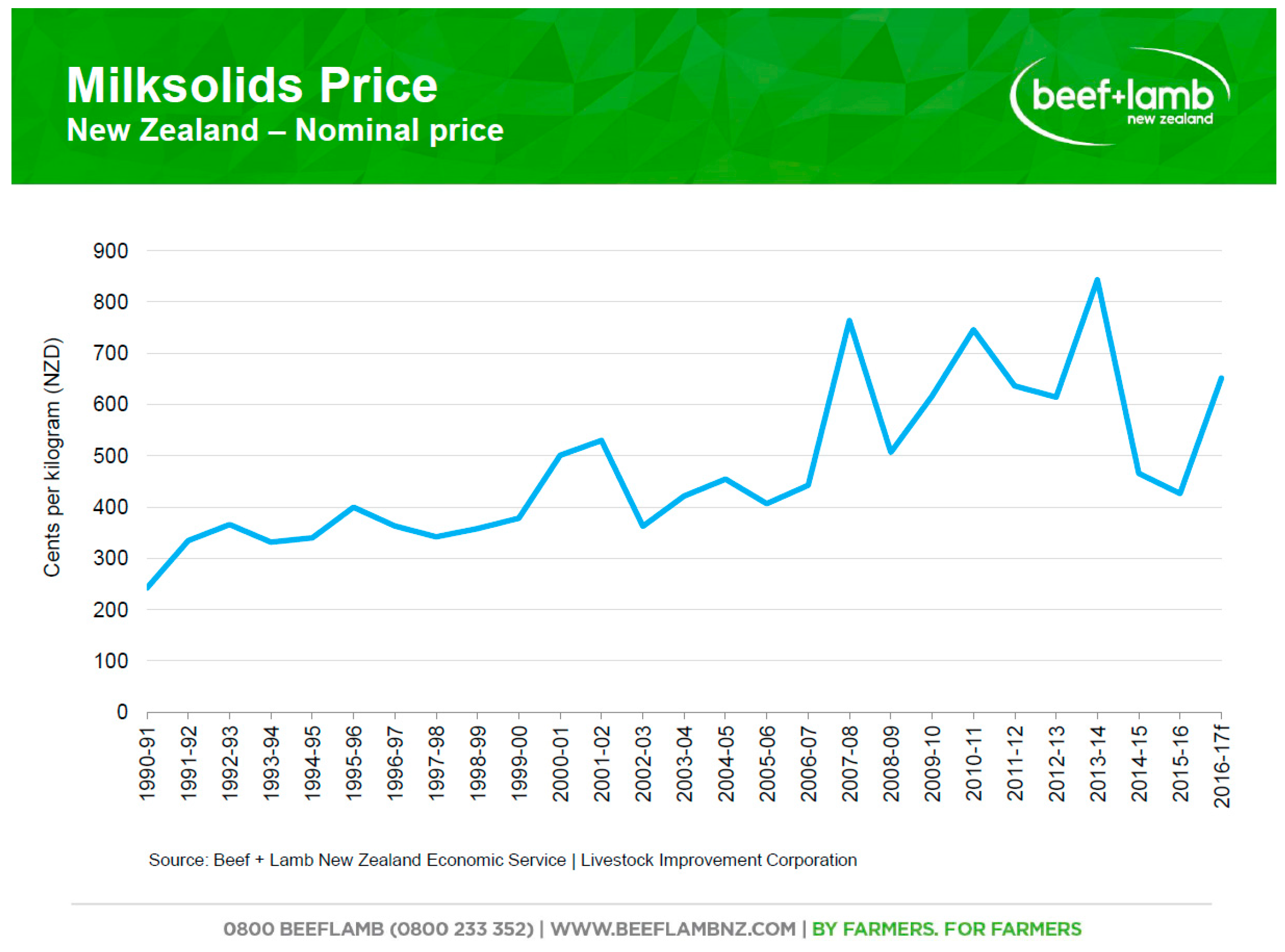

Rainfall for hill country sheep and beef farms is positively correlated to price achieved for stock sold, and negatively correlated to cost of stock feed. This is because when rainfall (especially summer rainfall) is higher than average stock can be finished cheaply on farm, as pasture remains actively growing and is the cheapest means of feeding stock. Wetter summers also mean that more grass can be harvested as hay and baleage, which provides more stock feed options, thus increasing the supply of stock feed supplements and reducing the demand and price of all feed supplements and grains fed to dairy cattle. The inverse occurs in times of drought, when stock must be sold early and cheaply and feed may need to be brought in to support capital livestock. Whereas for the dairy farm, which is irrigated, the price achieved for milk solid is highly variable, and has a high standard deviation [

2,

4,

5,

6]. Distributions can be either continuous, for variation in income output, or discrete, for example, the number of cows as in the stock numbers used in this commentary. Many costs such as repairs and maintenance should be fitted with positively skewed distributions, as there is a possibility of the costs being under budget, although they are usually close to budget if they are less than those budgeted. However, these costs have a chance of a large budget blowout. These situations occur from natural disasters, such as occasional floods and storms.

Once the distributions are fitted to the inputs and correlations established, a simulation may be run and the resulting effects on the selected outputs found. Outputs are items of interest such as total revenue, grouped expenses, and profit. The software is capable of 2 billion random sampling iterations of the Monte Carlo simulations to provide a system risk profile.

2. Methods

The method chosen to demonstrate risk profiling is by case study. Case studies are undertaken on farm budgets as they are common to all farmers and presented in a similar format as those presented here. Farm benchmarking data was used to build a hypothetical set of accounts created for a 4033 ha sheep station in the lower Western North island of New Zealand (LWNI), which provides publicly available information via a website [

7,

8]. Similarly, a model dairy farm benchmarking financial analysis was found for a Canterbury dairy farm [

9]. This dairy model farm budget was used as it was developed when the milk solid farm gate price was

$8.54 kg

−1, the budget price was

$6.00 kg

−1, whilst the actual 2014/2015 price was

$4.71 kg

−1, the 2015/2016 price was

$4.30 kg

−1, and the current price is

$6.50 kg

−1. Normal frequency distributions were fitted based on the authors’ judgement of commodity price movements of milk solids, cow beef, lamb, steer beef, mutton, and wool over the past 10 years in order to demonstrate risk profiling [

4,

7]. Some expenses, such as repairs and maintenance, regressing, and weed spraying, were fitted with skewed distributions to reflect the tendency of these expenses to blow out from time to time. Commodity prices obtained were compared to New Zealand climate data to see if there was a correlation between prices and climatic events [

3].

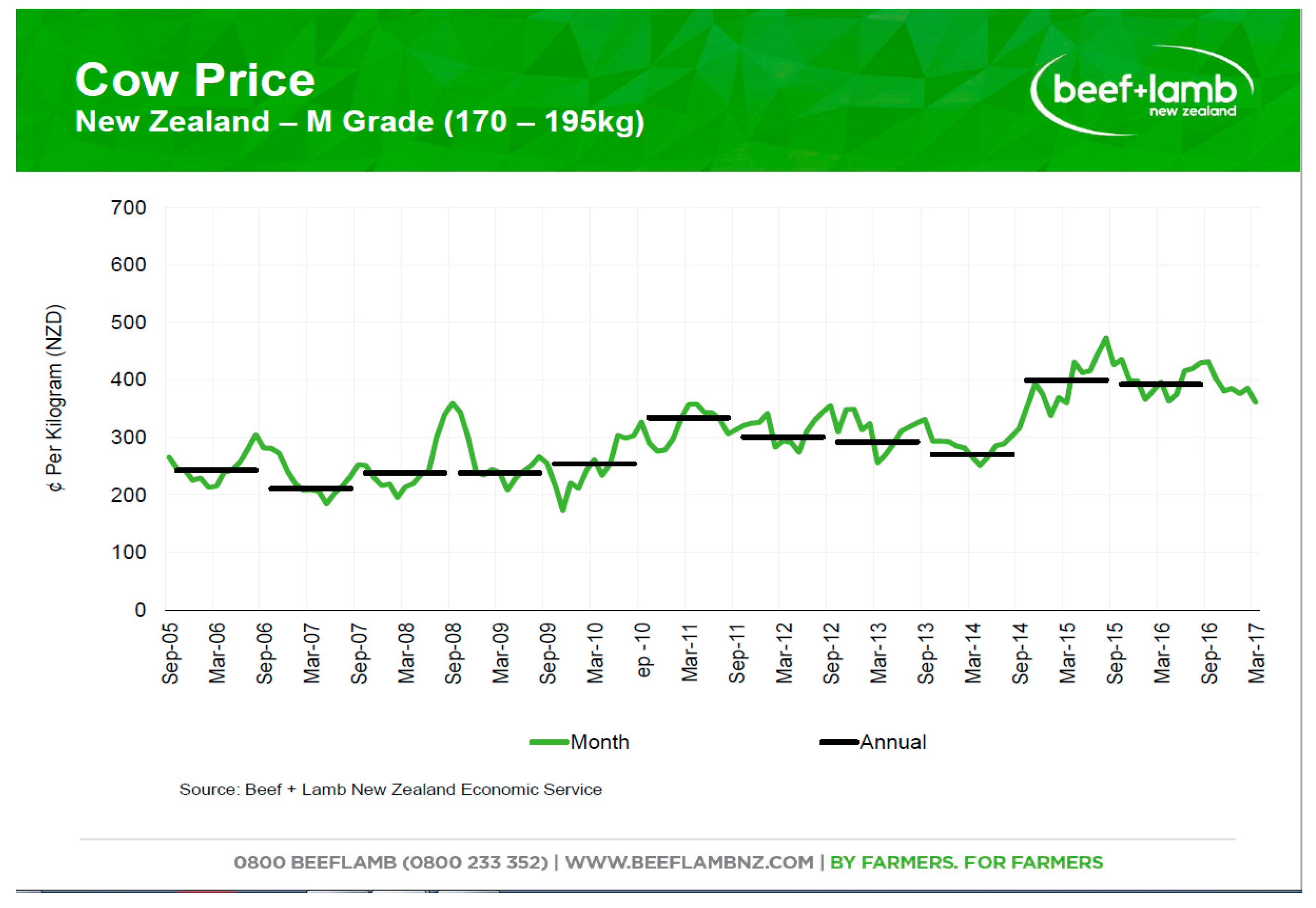

All commodity prices have fluctuated; however, mutton and lamb prices have moved together and all cattle beef prices are also highly correlated.

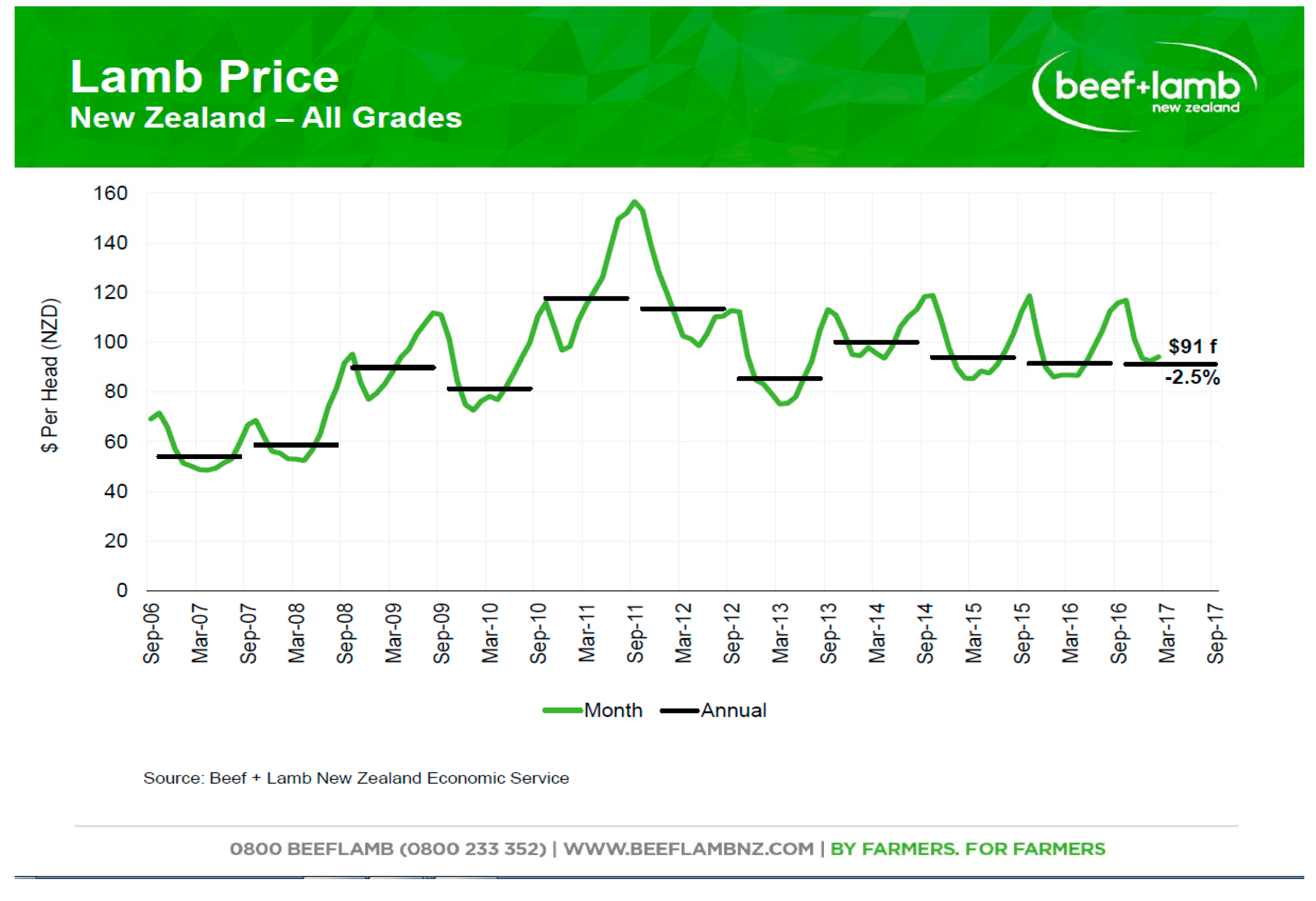

Figure 1,

Figure 2 and

Figure 3 show the fluctuation in commodity prices which were used to fit “normal distributions” to farm income streams. Sheep meat prices and milk solids prices fluctuated more than beef prices. Sheep and dairy prices were fitted with a standard deviation of 20% and 13%, respectively, whilst beef prices were fitted with a standard deviation of 10%.

Climatic correlation was found as sheep meat prices peaked during 2011 which was a wet year throughout New Zealand with frequent summer rainfall. The coastal lower West North Island recorded 1297 mm of rain, which is considerably more than the 30-year average of 921 mm. This was followed in 2012 by a nationwide drought, where the LWNI recorded 778 mm of rainfall and little summer rainfall [

3,

4]. There was about a

$100 difference in lamb prices between these years. In wet summers farmers can hold and finish their stock, as there is plenty of feed on the farm, so the farmers do not need to sell unless the price is high, whereas in drought years farmers must de-stock their properties or buy feed, which tends to be expensive in drought years, and are forced to sell stock on a buyers’ market. The correlation tool in “@Risk” software was used to add correlations for sheep and beef prices with rainfall, the price of hay was negatively correlated to rainfall, and as the dairy farm is irrigated no climate correlation was undertaken. These correlations impact the distributions in the risk profile. As sheep prices are much more variable in national droughts and wet summers than localised weather events, which are much more common, a weak correlation was used as an input for demonstration purposes. Cattle prices are much more stable than sheep prices so no correlation to rainfall was applied to cattle. A “normal distribution” was fitted to rainfall for the LWNI accounts with a mean of 921 mm and a standard deviation of 150 mm. Prices for individual sheep and cattle were estimated from sales data, wool sold as greasy from farm and hay bales as 20 kg bales yielding 15 kg dry matter [

7,

10], (

Table 1). Other analysts may choose to fit alternative distributions and apply different standard deviations or correlations depending on their outlook of the farm system, as each simulation takes a few seconds many scenarios may be considered.

The data inputs that have the greatest effect on dairy farm financial performance had normal distributions fitted. Feed grazing and purchased feed are heavily correlated and were fitted with a 70% correlation (see

Table 2). The price dairy farmers are willing to pay to have their animals grazed off farm is very dependent on the price of supplementary feed products [

9].

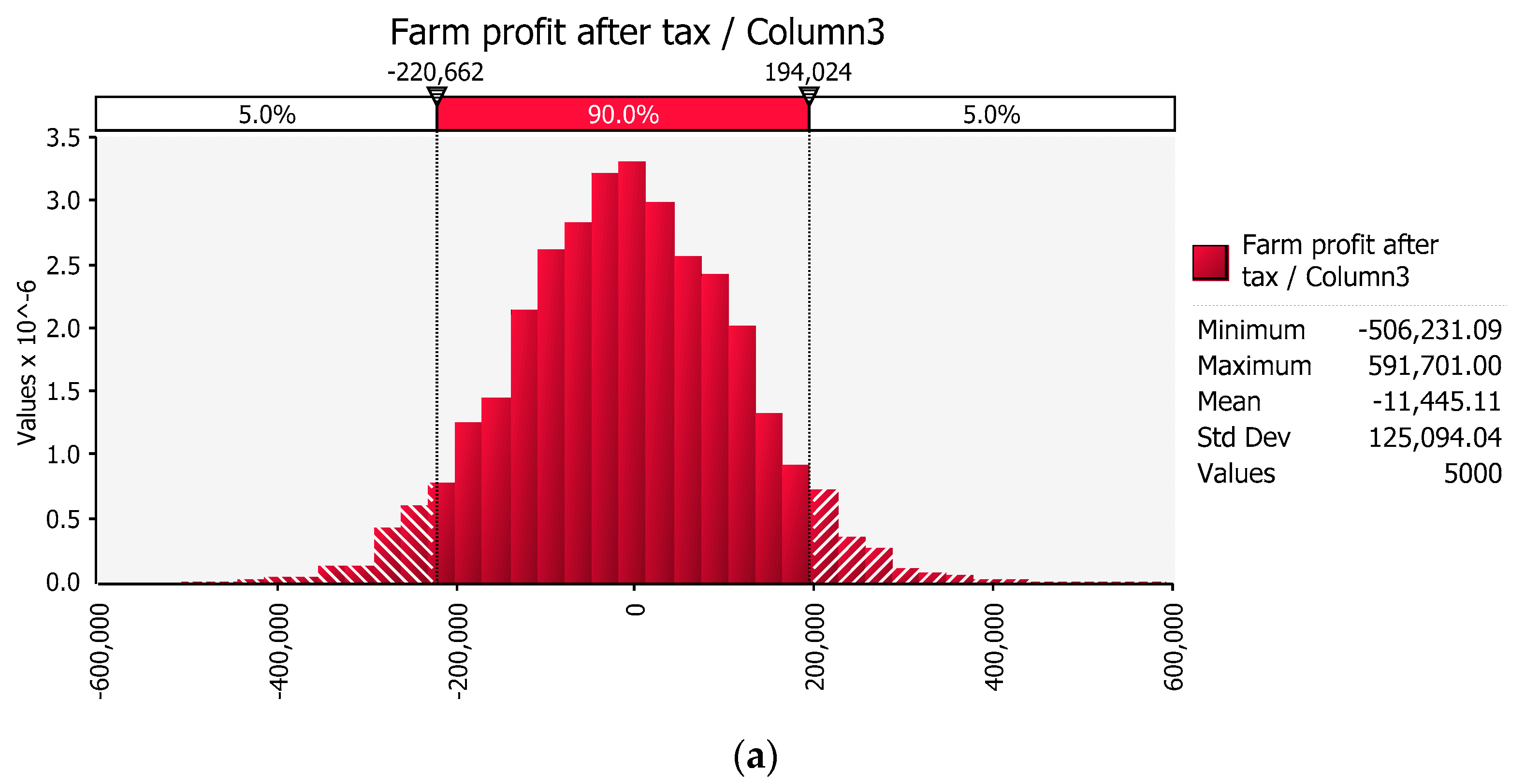

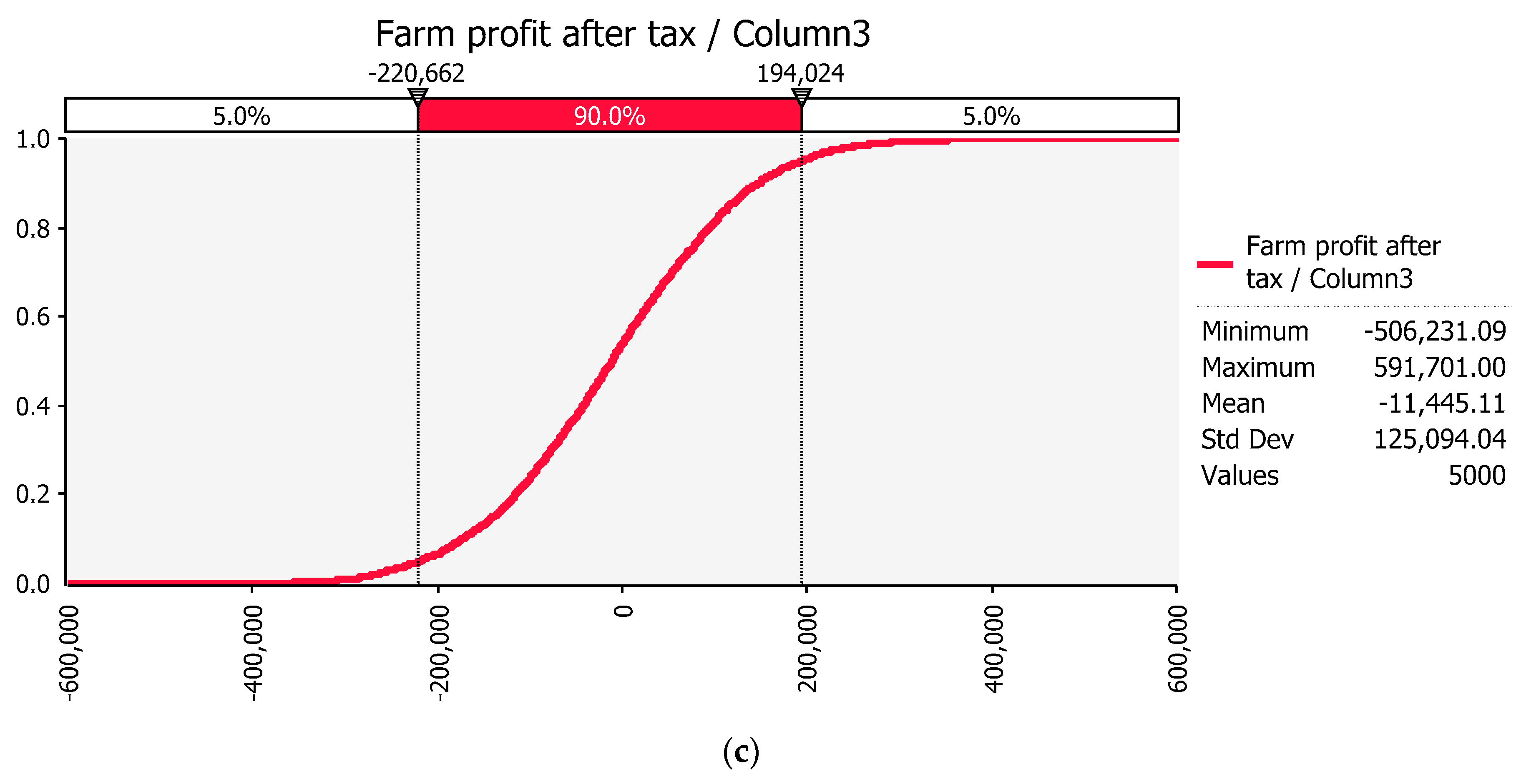

The model accounts were then run in “@Risk” to produce Monte Carlo simulations using the defined functions at a setting of 5000 iterations for each farm type. At this number of iterations, with the values for maximum, minimum, mean, and standard deviation for outputs after each simulation, a stable result is achieved.

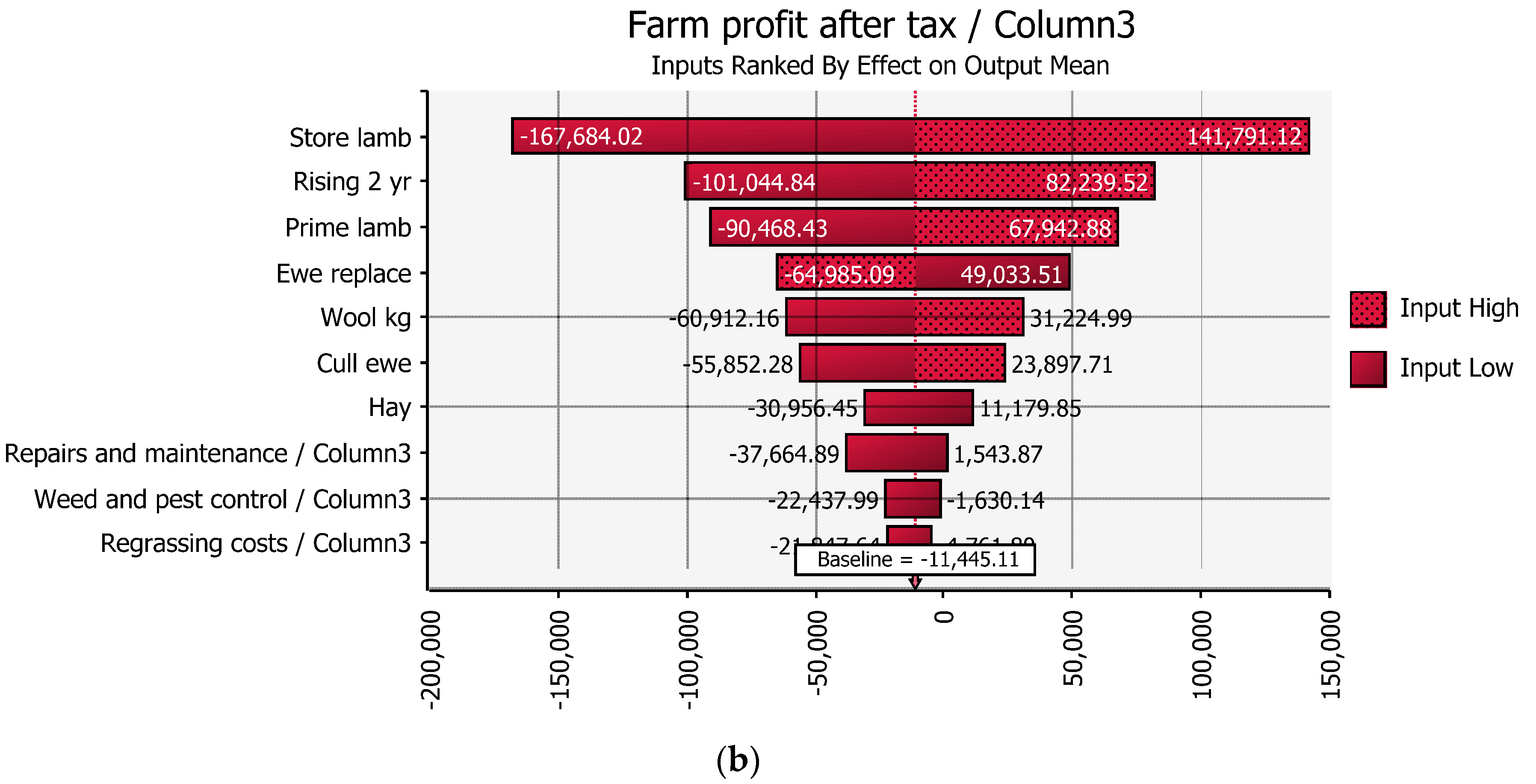

2.1. Sheep and Beef

The base accounts for the sheep and beef simulation are shown in

Table 3. Note that the farm has decided not to rear replacement sheep which provides an opportunity to earn grazing income (dairy support) and provides cash by reducing the value of the livestock inventory. This is done so as to evaluate changes to the production system using risk profiling. Costs were estimated from an economic survey of class 3 farm (hard hill country) production and weighted by hectares farmed [

8]. The farm accounts are set out as would be expected in generally accepted accounting practice in New Zealand.

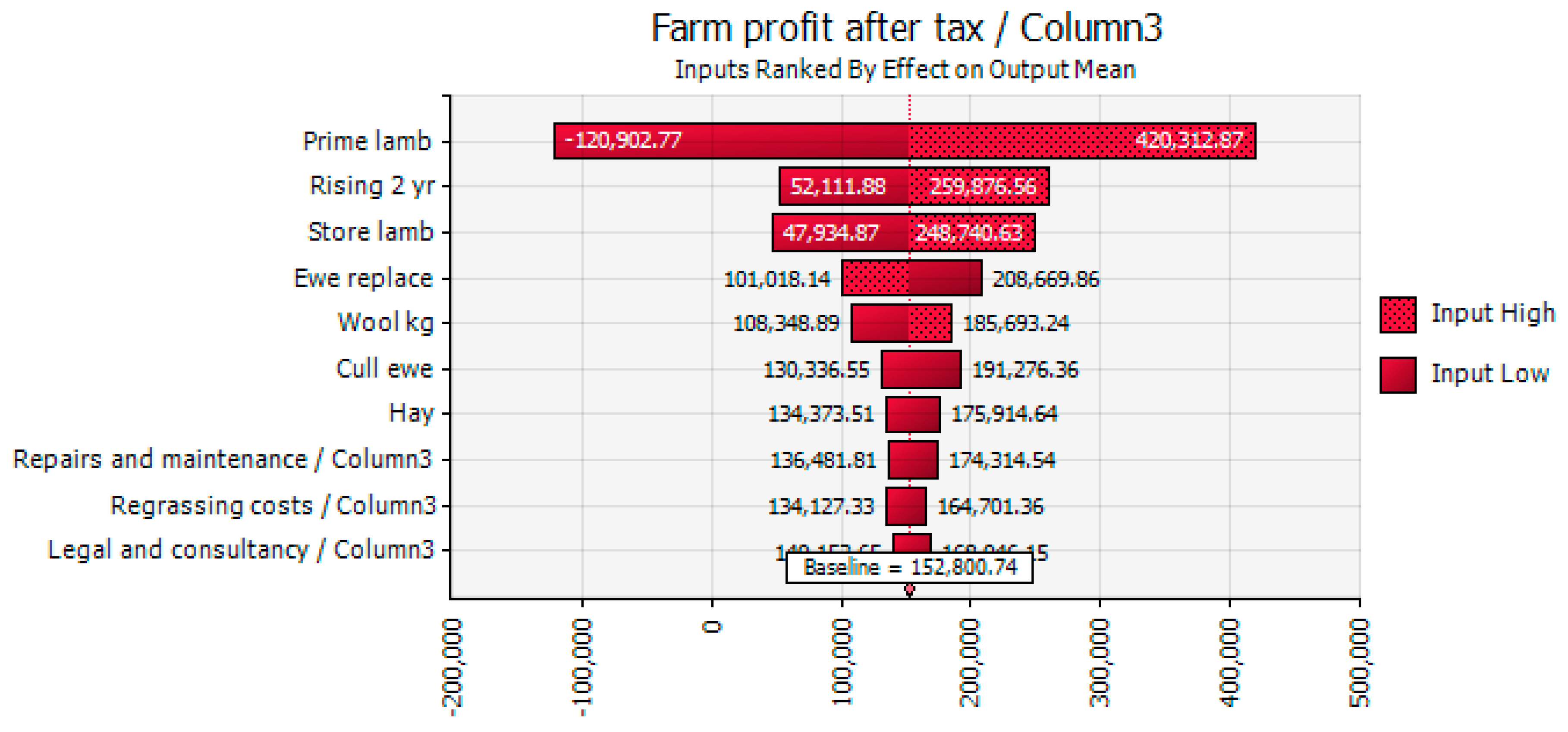

2.2. Dairy

The base accounts for the dairy simulation are shown in

Table 4. These are based on the model irrigated Canterbury dairy farm as produced in [

9].

4. Discussion

Provided some thought and research is undertaken by the consultant to provide useful functions to farm production inputs and outputs, risk profiling software can be a great tool in providing quick management feedback regarding the risk factors of a decision or of a farm in general [

12,

13].

The two pastoral farms considered in this study are quite different, although the software is useful in both situations. The highly leveraged dairy farm which is only 5% of the land area of the hill country station has a much higher baseline profit. This baseline profit is only slightly higher than the standard deviation of the profit, which reflects the sharp movements in the commodity price of milk solids, which means that for around 17% of the time the dairy farm may operate at a loss [

2].

One of the ways of mitigating milk solids price variability risk in a dairy situation is to employ a low input strategy. In the dairy farm modelled in

Table 4, the farm purchases around

$390,000 of supplementary feed (around 1300 tonnes), which converts to around half the milk solids produced. To enable feeding out, some infrastructure components such as feed pads, wintering barns, and feed conveying machinery is often required. In addition, higher stocking rates increase animal health costs and frequently more regressing is required to offset the damage done to pastures. A low input strategy would reduce the costs, lowering the breakeven point to less than

$5.20 kg

−1 milk solids, but would reduce the profit when milk solid prices were above the breakeven point.

The low input option in this example would half the number of cows farmed and reduce the income by approximately $950,000. It would also reduce farm working expenses by around $600,000 and would negate the capital costs of providing feeding structures and infrastructure, which would reduce interest expense and principal payments. Other cost reductions would be in effluent reticulation, repairs and maintenance, and labour.

Risk profiling may be an important tool for New Zealand farmers as they prepare for the impacts of climate change and environmental constraints. Some climate modelling predicts more severe rain events and a drier east coast climate with more severe droughts [

3]. The costs of flood damage are likely to increase and even farms which do not normally flood will be likely to be more prone to gully erosion, slips, and slumps. The costs of drains, fencing, and tree planting may offset some of the costs of these events and are suitable for modelling.

Distributions that reflect these risks and costs and benefits of changes in farm management are ideal for future proofing a farm. For example, deep rooting drought tolerant pasture crops such as plantain

Plantigo lanceolate, chicory

Circhorium intybus, and lucerne (alfalfa)

Medicago sativa are growing in popularity on properties suffering more frequent autumn droughts. These crops enable farmers to finish stock and achieve prime rather than store prices, therefore, enabling them to avoid being forced on a buyers’ market. The alternative to providing fodder crops is to finish stock earlier. Early lambing enables prime lambs to be finished before feed is in short supply. However, it also means young lambs are born in cold wet conditions which can lead to high mortality [

14]. Winter lambing also means that ewes are feeding at a time that pasture is not growing vigorously and inevitably at a rate less than stock demand [

15]. Farmers may mitigate the low pasture growth periods by feeding out or, when weather permits, by the addition of regular low application rates of nitrogenous fertilizers and gibberellic acid. It may be economic in some situations to lamb indoors, a common practice in Europe but not undertaken in New Zealand.

5. Conclusions

Farmers as risk managers are looking to mitigate the risks of climate to optimize a production system that is heavily climate dependent. Climatic variation has an impact on costs and can affect commodity prices, which are also subject to variation through market forces. Providing a means of evaluating production systems to understand the risk profile with a view to mitigating these risks is an important tool.

Risk profiling is a far more powerful tool than variance analysis, which is the common means of assessing farm risk. A farm advisor may examine a budget using variance analysis and vary a few items such as meat and dairy prices, or costs such as supplementary feed. However, this does not look at the whole picture and the production base in a natural environment. As long-term weather forecasting has improved, the impact of climate on farm production can be inputted to a risk profile and better farm decisions can be made. Predictions of a mild wet spring may correlate to more prime lambs being finished, more hay and baleage being made, a need to protect flat paddocks from stock to prevent pugging, higher regressing costs, and more likelihood of farm surplus. Similarly, if a series of tropical depressions is predicted, the likelihood of flood damage and associated large increases in repairs and maintenance can be profiled with a much greater chance of a farm deficit. Farming is, therefore, very well suited to risk profiling, which will likely add value to management information systems as the effects of climate change impacts.