Jute, known as the golden fiber, is an important traditional cash crop in Bangladesh. In fact, jute is the second most important natural fiber in terms of global consumption after cotton [

1]. Although there are more than 40 species of jute available, only two species are cultivated commercially, namely,

Corchorus capsularis L. (commonly known as white jute) and

C. olitorius L. (commonly known as Tossa/traditional jute). The planting time varies slightly between these two types of jute. The traditional, or Tossa, jute, which grows in low-lying land, is planted during March and April, and the white jute during April and May in Bangladesh. One of the important characteristics of jute is that it is free from health hazards and environmental pollution [

2]. Jute is also versatile, durable, reusable, cheap, and superior to synthetic fibers. Other major advantages of jute is that it is agro-based, produced annually, renewable, and biodegradable [

1]. Jute is regarded as the best natural substitute for nylon and polypropylene. Although jute has been recognized as a solution to produce eco-friendly products for the future [

3], the production of jute and jute products are actually declining globally. This is mainly due to the availability of plastic substitutes, which is likely to continue in the future [

4]. Europe, as well as China, have experienced a slow erosion of the market for jute products, particularly sacks and bags, while India still consumes over half of the world’s production of jute products [

4].

The Jute Sector in Bangladesh: History, Challenges, and Policy Developments

Jute has been an integral part of the culture of Bengal for centuries, primarily in the southwest of Bangladesh and parts of West Bengal. Bangladeshi farmers take pride in producing jute, which they call ‘sonali ansh’ (the golden fiber). Bangladesh actually produces the finest-quality natural jute fiber. The history of jute trading goes back to colonial times when the British East India Company was the first to trade in jute. The East India Company exported its first consignment of jute in 1793 and continued trading until the 19th century. During the 20th century, the company started trading raw jute with the jute industry in Dundee, Scotland. Jute products (e.g., sacks, bags, hessian for carpet backing, etc.) provide higher value added than raw jute, which necessitated the establishment of processing industries. The first jute mill was set up in 1855 near the bank of Hoogly River, Kolkata, India, and more mills followed in the West Bengal region well into the 1900s. However, after the partition of India in 1947, Bangladesh (then, East Pakistan) was left with the finest quality of raw jute stocks, while the major jute mills needed to process those raw jute remained on the other side of the border in West Bengal, India. This has led to the need to set up jute processing industries in Bangladesh.

Bangladesh used to enjoy a monopoly position in the production and marketing of jute during 1950s and 1960s. Currently, such a monopoly position does not exist because of competition from India, China, Uzbekistan, and Nepal. However, the country is still the second largest producer of jute after India, and jute has been a prominent export item for Bangladesh since the 1950s. However, the jute industry in Bangladesh went through major upheavals over time. The jute industry was supported by both implicit and explicit government subsidies during the early years, which were later discontinued. For example, the export bonus scheme, introduced in 1959, was discontinued in the 1970s [

6]. Furthermore, the direct incentives provided to the export-oriented private enterprises in terms of tax relief on imports of machineries and equipment to support the industrialization of the nation were not extended to the jute sector.

Finally, due to a fall in jute demand worldwide during the 1990s, and recurring losses in publicly-owned jute mills, the government signed an agreement with the World Bank/IDA during 1994 to reform the jute sector, which mainly translated into: (1) closing nine of the 29 jute mills and downsizing two large publicly-owned jute mills; (2) retrenchment of about 20,000 jute workers of publicly-owned jute mills to other public sectors; and (3) privatization of 18 of the remaining 20 jute mills [

6]. The process of such adjustment finally culminated in the closure of the flagship Adamjee Jute Mills on 24 June 2002, based on the claim that it had incurred a loss of BDT 12 billion (i.e., USD 35 million) over its 30 years of existence, which effectively brought the jute industry to a close. However, such closure of the key jute mills was criticized. This is because the reported losses were largely due to the lack of institutional support and modernization of these jute mills, which were essential to keep them competitive in the global market. Instead, the reported losses were attributed to corruption, mismanagement, and inefficiency in the processing of jute [

6].

Later, in order to revive the jute industry, Bangladesh produced a National Jute Policy 2011, which has the following objectives: (a) increase jute production in response to national and international demand; (b) land use planning for jute; (c) produce high quality jute seeds and distribute these to farmers; (d) develop modern varieties of jute and encourage adoption by farmers; (e) protect the market for jute and jute products to increase foreign exchange earnings; (f) develop modern equipment and improve existing jute processing mills; (g) encourage diversified use of jute; (h) increase interaction and institutional linkages amongst jute and jute seed producers, traders, jute industries, and the Bangladesh Jute Research Institute; and (i) strengthen the Management Information System (MIS) of the jute sector [

7]. Furthermore, to enhance the sector, the government has proposed a Draft National Jute Policy 2014, which has the following additional objectives: (j) establish composite jute mills to produce high-quality fabric from jute; (k) establish professional design institute to develop various designs of jute and jute products to meet international demand; (l) automation of the MIS of the jute sector; and (m) prioritize the jute sector in the National Export Policy of Bangladesh [

7]. The vision of the Draft National Jute Policy 2014 specifies reopening all of the closed jute mills, the modernization of the mills, and establishing jute as the second most important export item by 2021 [

7]. However, the Draft National Jute Policy 2014 has not been finalized yet.

Farmers in Bangladesh grow several crops in conjunction with rice as a staple in order to fulfil the dual role of meeting subsistence, as well as cash, needs [

8]. It has been widely recognized that, under non-irrigated or semi-irrigated conditions, better farming practices and varietal improvements in non-cereal crops (e.g., jute, potato, vegetables, oilseeds, and spices) will be more profitable and could lead to crop diversification as a successful strategy for the future growth and sustainability of Bangladeshi agriculture [

9,

10,

11].

There is a dearth of information about the jute sector in Bangladesh. Recently Rahman [

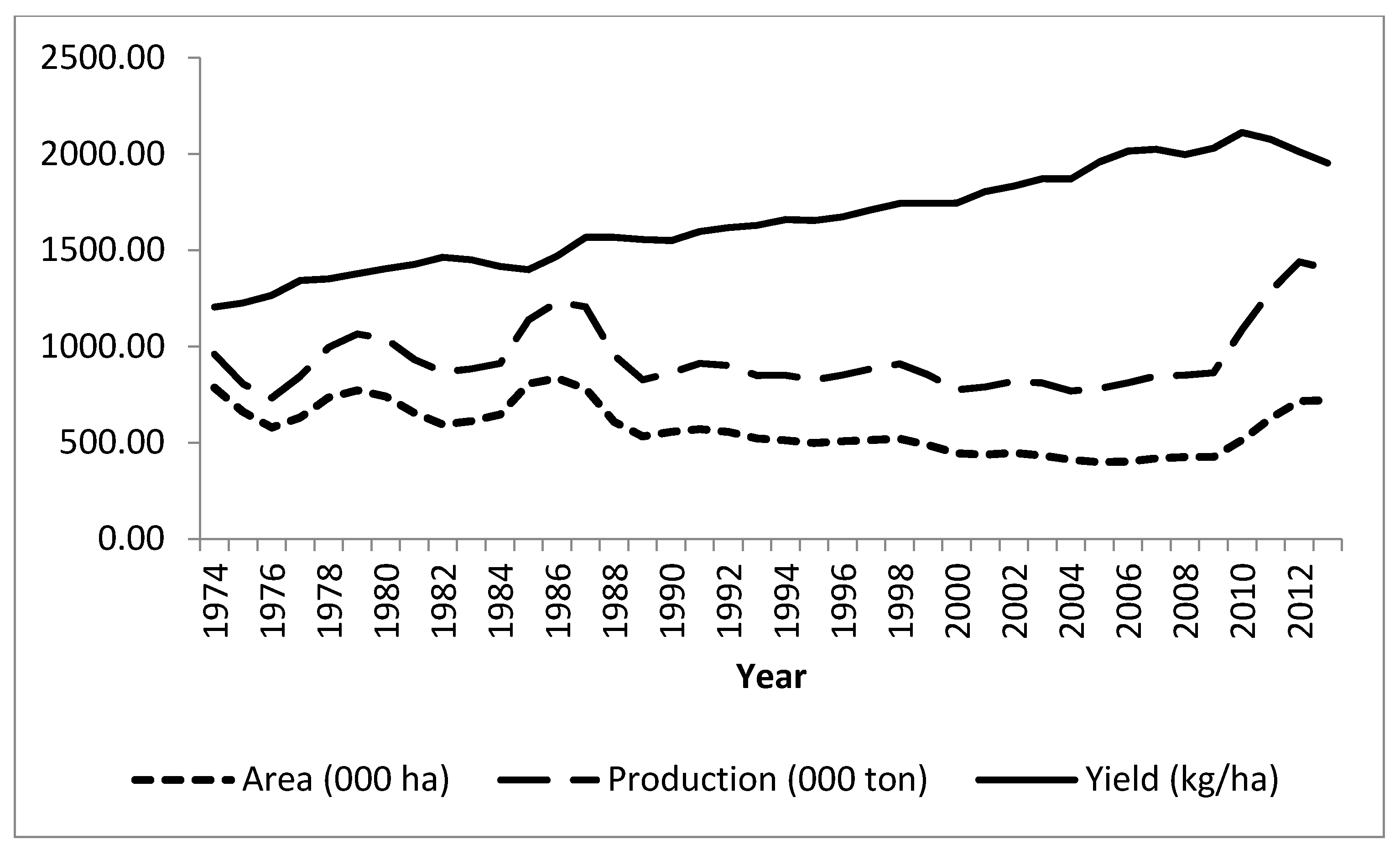

12] noted that the area under jute remained stagnant during the period 1960–1985 and then declined at the rate of 0.3% per annum (p.a.) (

p < 0.01) during the period 1986–2006, but the yield per ha increased marginally at the rate of 0.1% p.a. (

p < 0.01) for the same period. Similarly, Gupta et al. [

5] concluded that both Bangladesh and India demonstrated a declining trend in jute area, production, and productivity during the period 1961–2002, although Bangladesh has the potential to increase production through expanding the jute area, as well as improving productivity. The main reason behind the declining share of jute area in Bangladesh is the competition for land of high yielding varieties (HYVs) of rice, as well as falling demand in the market due to the increase in the use of synthetic fibers. Bangladesh, once at the forefront in the production and export of jute during the 1960s, can potentially regain its position and contribute positively to replace/reduce synthetic fiber use, as well as raise export earnings. However, a revival of jute will only be possible if the sector is globally competitive, profitable, and efficient. However, little is known about the sectors’ performance with respect to its international competitiveness, profitability, and efficiency.

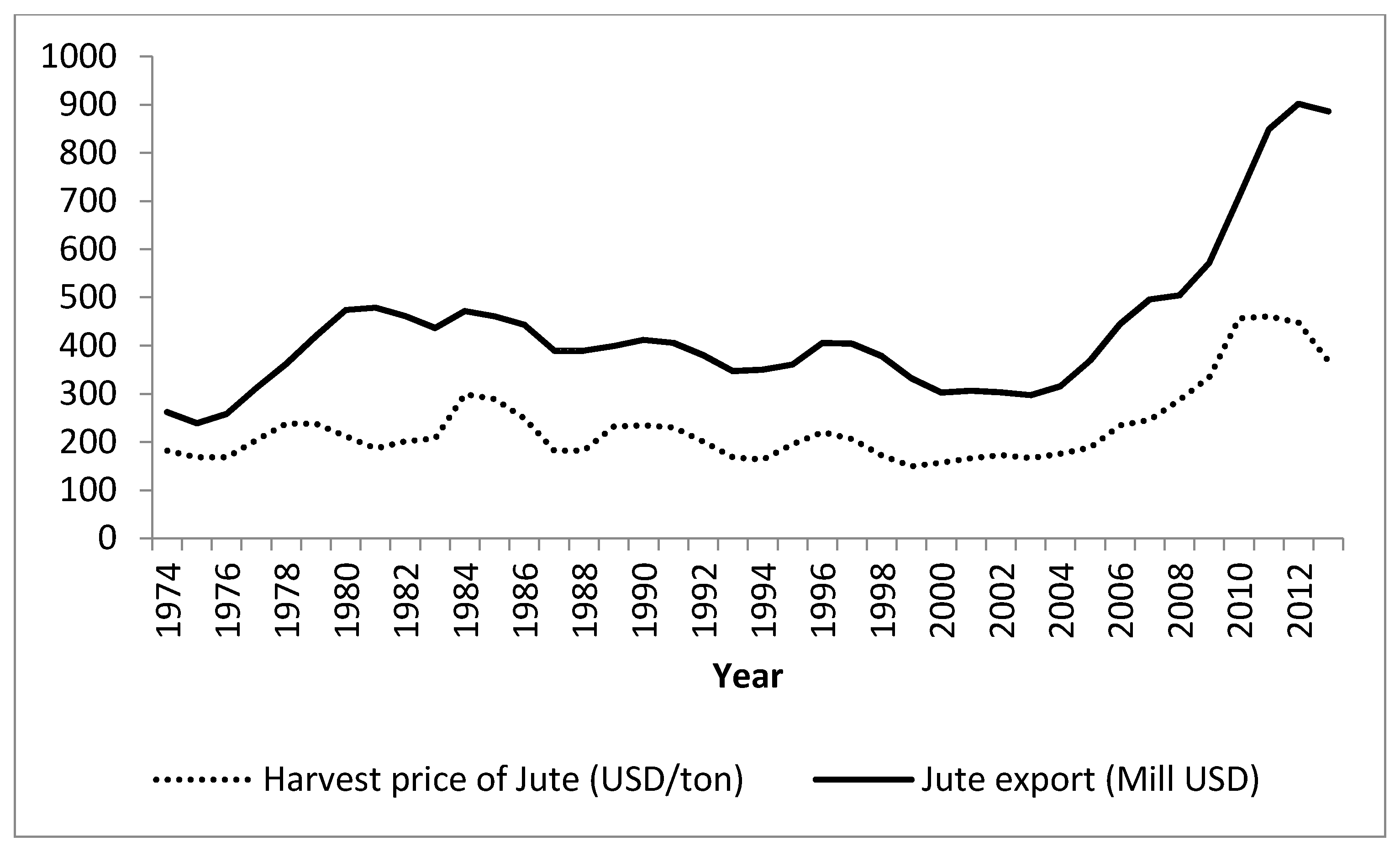

Given the dearth of information about the prospect of the jute sector, the present study specifically addresses this critical research gap and systematically examines the growth performance of the jute sector over time and determines its profitability, drivers of productivity, and production efficiency at the farm level in Bangladesh. The study uses a combination of national time-series data covering a 41-year period (1973–2013) and an in-depth farm survey data of 289 jute growers from two major jute-growing regions (Kishoreganj and Faridpur) to address the following specific objectives: (i) to examine trends in area, production, productivity, prices, and export of jute over time; (ii) to assess global competitiveness of the jute sector; (iii) to assess financial profitability of producing jute at the farm level; and (iv) to identify the drivers of productivity and technical efficiency of jute production at the farm level.