Behavioral Framework of Asset Price Bubbles: Theoretical and Empirical Analyses

Abstract

:1. Introduction

2. Model

2.1. Basic Assumptions

2.2. Market Equilibrium

3. Parameter Settings of Numerical Simulation

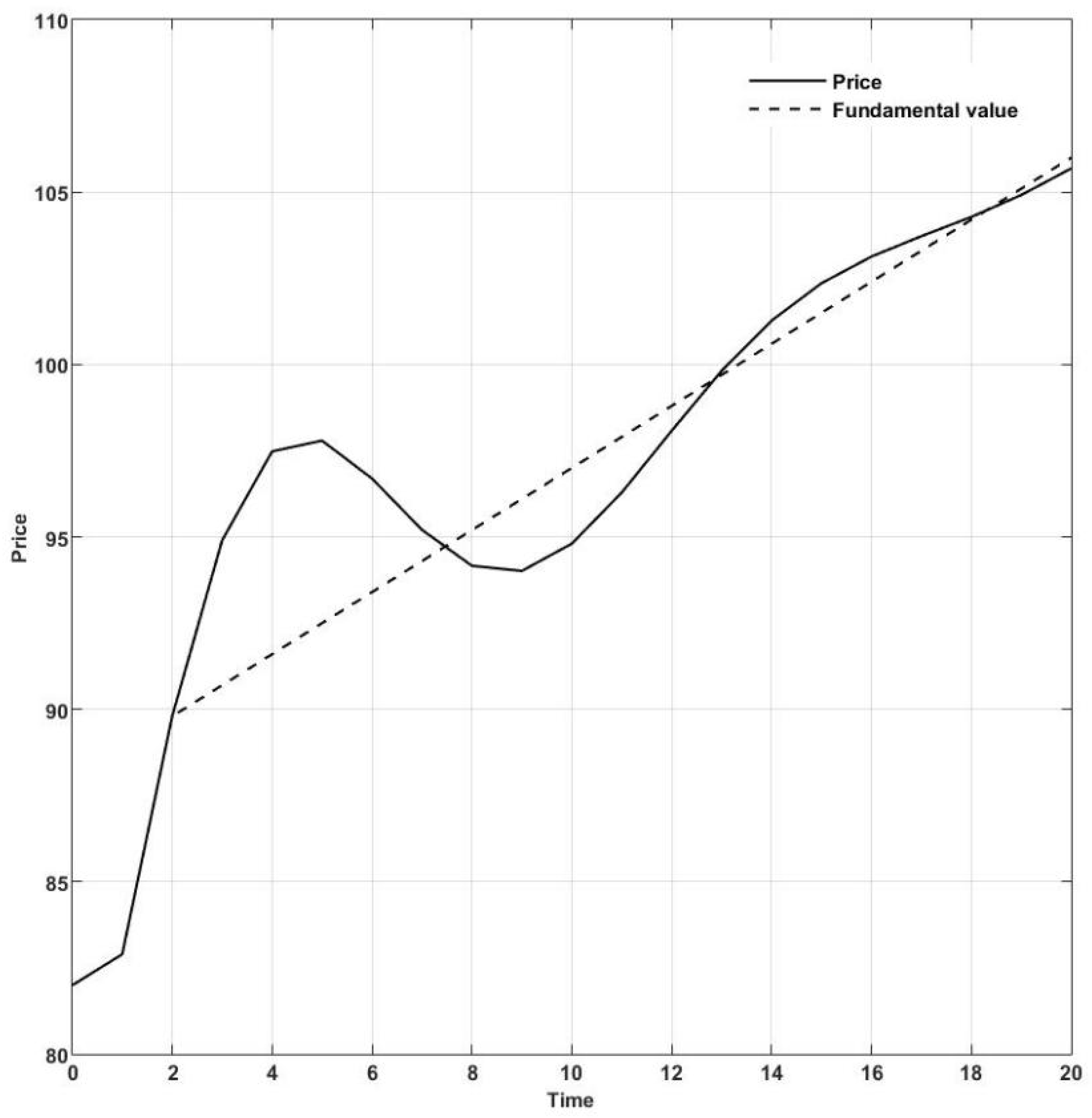

4. Numerical Simulation under Impact of Good News

4.1. Asset Price Characteristics in Bubbles

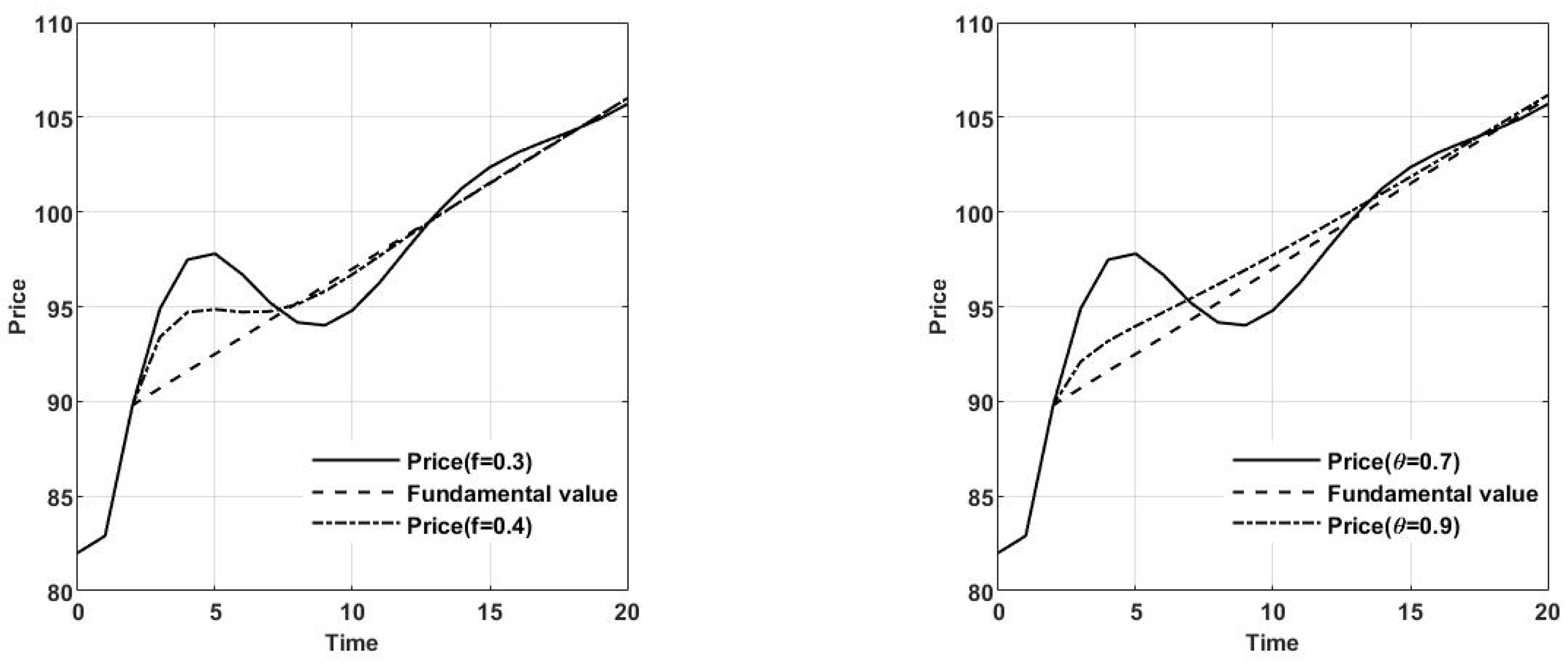

4.2. Comparative Static Analysis

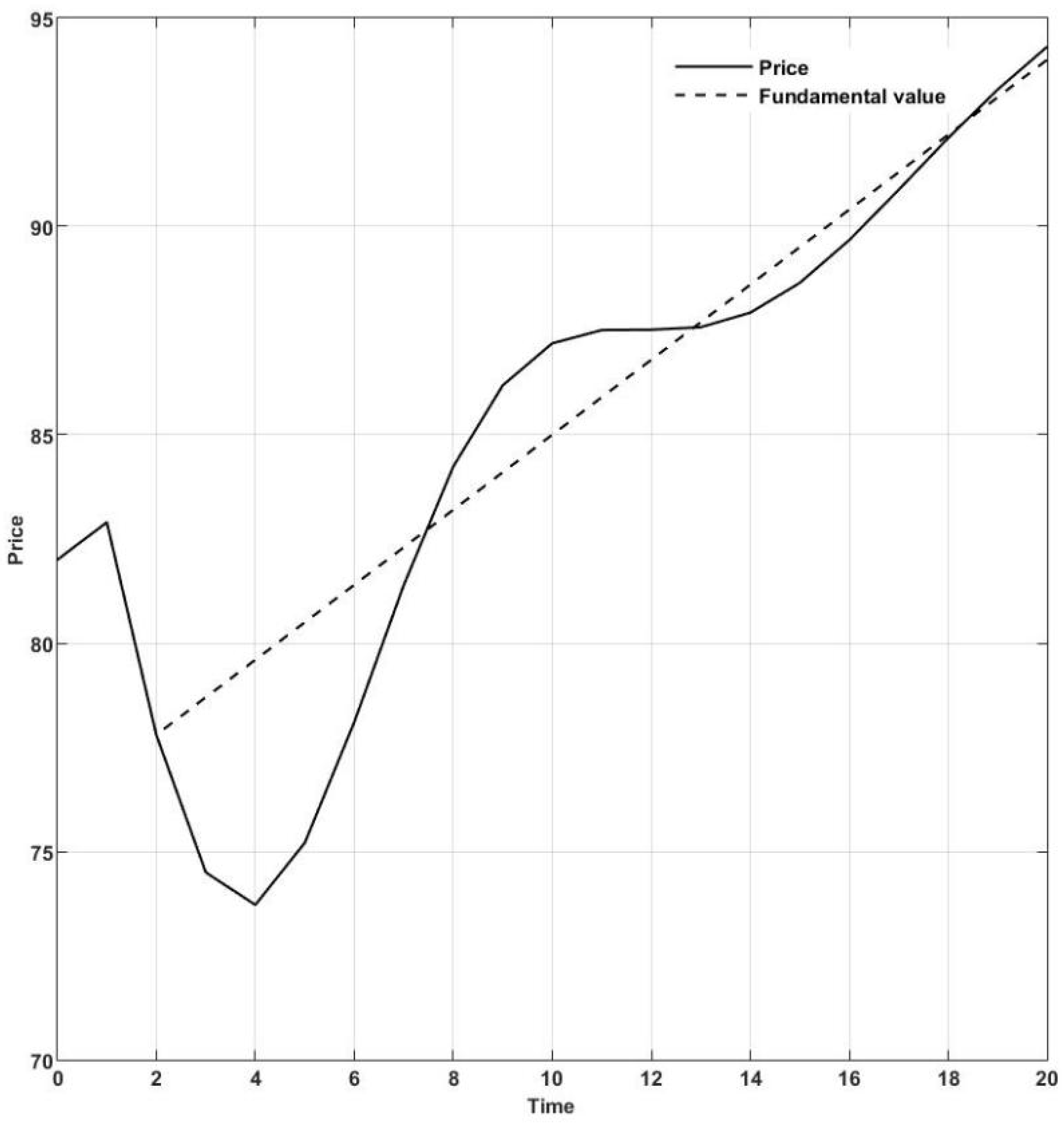

5. Numerical Simulation under Impact of Bad News

5.1. Asset Price Characteristics in Bubbles

5.2. Comparative Static Analysis

6. Empirical Test of Investor Sentiment and Ratio of Informed Trading

6.1. Data Description and Variable Construction

6.1.1. Investor Sentiment Index

6.1.2. Control Variable

6.1.3. Informed Trading Variable

6.2. Empirical Analysis

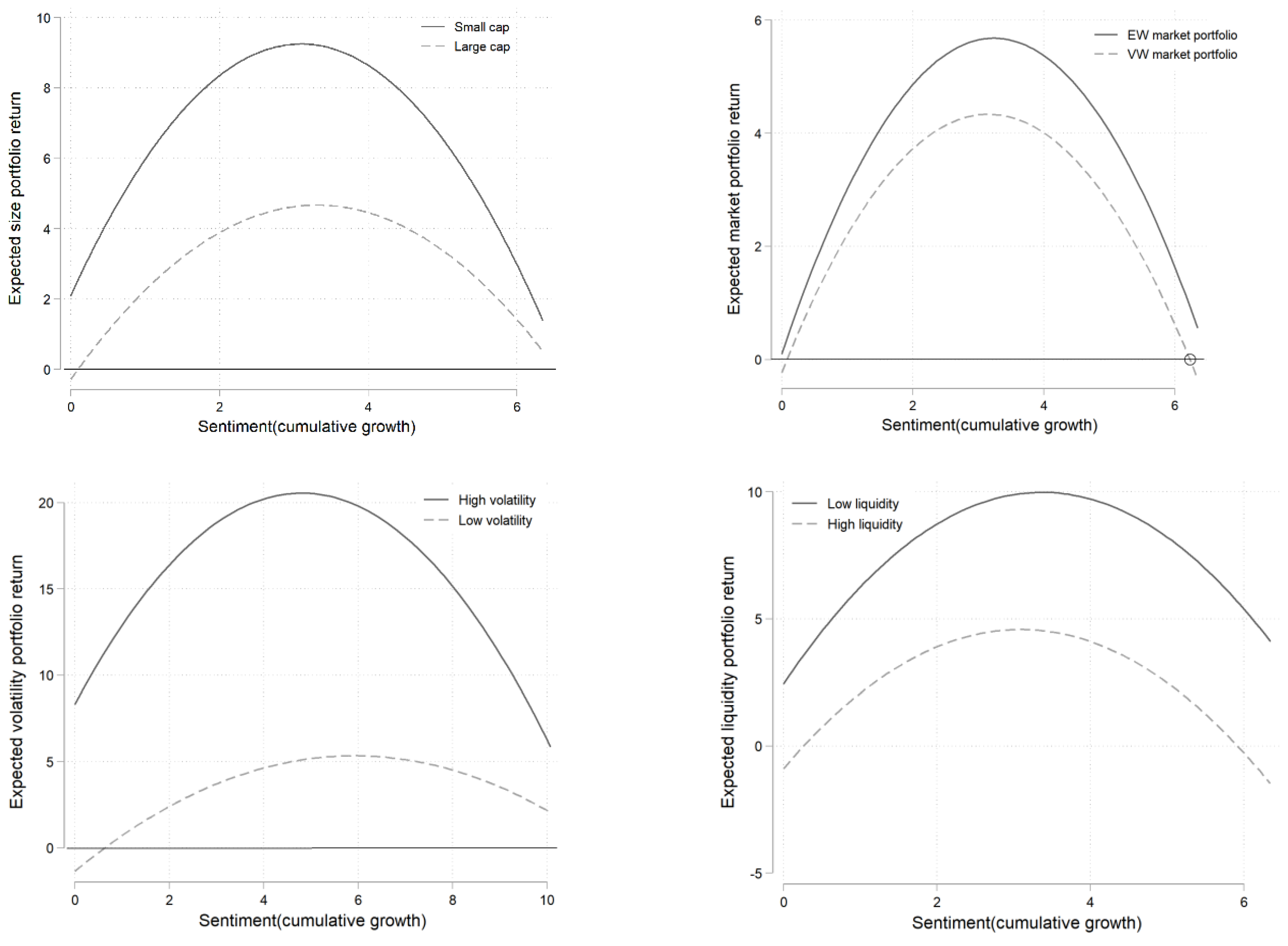

7. Investor Sentiment Accumulation and Asset Return

7.1. Data Description and Variable Construction

7.1.1. Investor Sentiment Cumulative Index

7.1.2. Portfolio Variable

7.2. Empirical Analysis

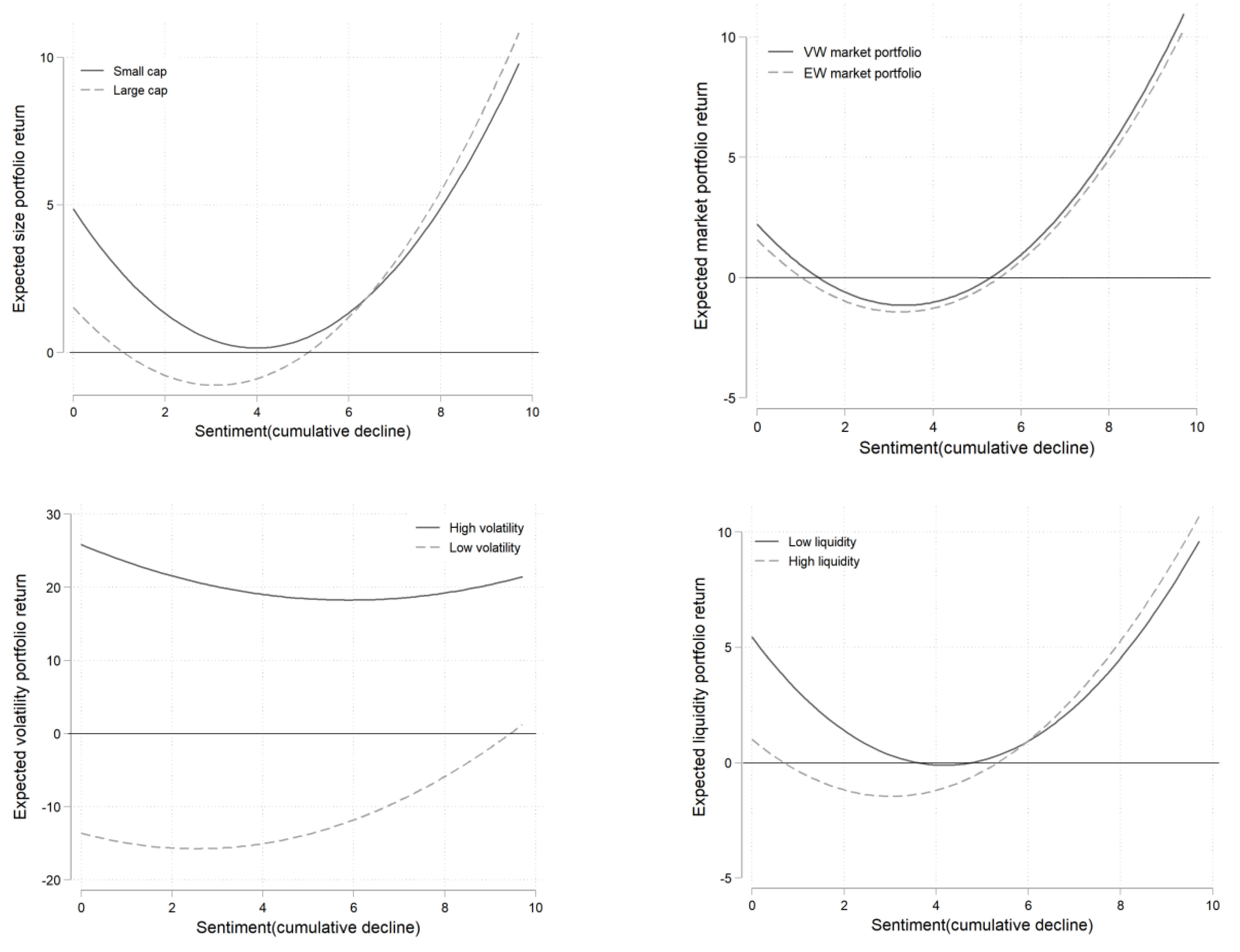

7.2.1. Cumulative High Investor Sentiment and Asset Returns

7.2.2. Cumulative Low Investor Sentiment and Asset Returns

8. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Barberis, N.; Thaler, R. A Survey of Behavioral Finance. In Handbook of The Economics of Finance; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 1053–1128. [Google Scholar] [CrossRef]

- Barberis, N. Psychology-Based Models of Asset Prices and Trading Volume. In Handbook of Behavioral Economics: Applications and Foundations 1; Elsevier: Amsterdam, The Netherland, 2018; Volume 1, pp. 79–175. [Google Scholar] [CrossRef]

- Giglio, S.; Kelly, B. Excess Volatility: Beyond Discount Rates. Q. J. Econ. 2018, 133, 71–127. [Google Scholar] [CrossRef]

- Augenblick, N.; Lazarus, E. Restrictions on Asset-Price Movements under Rational Expectations: Theory and Evidence. 2018. Available online: https://ssrn.com/abstract=3436384 (accessed on 7 March 2022).

- Campbell, J.Y.; Shiller, R.J. The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors. Rev. Financ. Stud. 1988, 1, 195–228. [Google Scholar] [CrossRef] [Green Version]

- Cutler, D.M.; Poterba, J.M.; Summers, L.H. Speculative Dynamics and the Role of Feedback Traders. In The American Economic Review: Papers and Proceedings; National Bureau of Economic Research Cambridge: Cambridge, MA, USA, 1990; Volume 80, pp. 63–68. Available online: http://www.nber.org/papers/w3243 (accessed on 7 March 2022).

- De Long, J.B.; Shleifer, A.; Summers, L.H.; Waldman, R.J. Positive Feedback Investment Strategies and Destabilizing Rational Speculation. J. Financ. 1990, 45, 375–395. [Google Scholar] [CrossRef] [Green Version]

- Hong, H.; Stein, J.C. A Unified Theory of Underreaction, Momentum Trading, and Overreaction in Asset Markets. J. Financ. 1999, 54, 2143–2184. [Google Scholar] [CrossRef] [Green Version]

- Barberis, N.; Shleifer, A. Style Investing. J. Financ. Econ. 2003, 68, 161–199. [Google Scholar] [CrossRef] [Green Version]

- Barberis, N.; Greenwood, R.; Jin, L.; Shleifer, A. X-CAPM: An Extrapolative Capital Asset Pricing Model. J. Financ. Econ. 2015, 115, 1–24. [Google Scholar] [CrossRef] [Green Version]

- Barberis, N.; Greenwood, R.; Jin, L.; Shleifer, A. Extrapolation and Bubbles. J. Financ. Econ. 2018, 129, 203–227. [Google Scholar] [CrossRef] [Green Version]

- Liao, J.; Peng, C.; Zhu, N. Extrapolative Bubbles and Trading Volume. Rev. Financ. Stud. 2022, 35, 1682–1722. [Google Scholar] [CrossRef]

- Xiong, W.; Yu, J. The Chinese Warrants Bubble. Am. Econ. Rev. 2011, 101, 2723–2753. [Google Scholar] [CrossRef] [Green Version]

- Baker, M.; Wurgler, J. Investor Sentiment in the Stock Market. J. Econ. Perspect. 2007, 21, 129–152. [Google Scholar] [CrossRef] [Green Version]

- Hu, C.S.; Chi, Y.C. Research on Investor Sentiment and Abnormal Volatility of Asset Price. Master’s Thesis, Wuhan University, Wuhan, China, 2014. [Google Scholar]

- Berger, D.; Turtle, H.J. Sentiment Bubbles. J. Financ. Mark. 2015, 23, 59–74. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, A.; Zhang, J.; Yao, J. An Optimal Stopping Problem of Detecting Entry Points for Trading Modeled by Geometric Brownian Motion. Comput. Econ. 2020, 55, 827–843. [Google Scholar] [CrossRef]

- Mendel, B.; Shleifer, A. Chasing Noise. J. Financ. Econ. 2012, 104, 303–320. [Google Scholar] [CrossRef]

- Hu, C.S.; Peng, Z.; Chi, Y.C. Feedback trading, Trading inducement and Asset price behavior. Econ. Res. J. 2017, 5, 189–202. [Google Scholar]

- Greenwood, R.; Shleifer, A. Expectations of Returns and Expected Returns. Rev. Financ. Stud. 2014, 27, 714–746. [Google Scholar] [CrossRef] [Green Version]

- Loewenstein, M.; Willard, G.A. The limits of investor behavior. J. Financ. 2006, 61, 231–258. [Google Scholar] [CrossRef]

- Chen, C.; Hu, C.S. Does Feedback Trading Cause the Instability of Rational Speculation? Forecasting 2021, 40, 53–59. [Google Scholar]

- Robert, S. Irrational Exuberance. Master’s Thesis, China Renmin University, Bejing, China, 2016. [Google Scholar]

- Stambaugh, R.F.; Yu, J.; Yuan, Y. Arbitrage Asymmetry and the Idiosyncratic Volatility Puzzle. J. Financ. 2015, 70, 1903–1947. [Google Scholar] [CrossRef] [Green Version]

- Hu, C.S.; Chen, C.; Chi, Y.C. Up and Down of Stock Movement is Caused by Sentiment: Sentiment Beta and Stock Market Style Dynamic Preference Shift. J. Stat. Inform. 2020, 35, 71–79. [Google Scholar]

- Sibley, S.E.; Wang, Y.; Xing, Y.; Zhang, X. The information content of the sentiment index. J. Bank. Financ. 2016, 62, 64–179. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lettau, M.; Malkiel, B.G.; Xu, Y. Have individual stocks become more volatile? An empirical exploration of idio-syncratic risk. J. Financ. 2001, 56, 1–43. [Google Scholar] [CrossRef]

- Brandt, M.W.; Brav, A.; Graham, J.R.; Kumar, A. The Idiosyncratic Volatility Puzzle: Time Trend or Speculative Episodes. Rev. Financ. Stud. 2010, 23, 863–899. [Google Scholar] [CrossRef]

- Llorente, G.; Michaely, R.; Saar, G.; Wang, J. Dynamic volume-return relation of individual stocks. Rev. Financ. Stud. 2002, 15, 1005–1047. [Google Scholar] [CrossRef]

- Markowitz, H. The Utility of Wealth. J. Polit. Econ. 1952, 60, 151–158. [Google Scholar] [CrossRef]

- Fama, E. Market Efficiency, Long Term Returns, and Behavioral Finance. J. Financ. Econ. 1998, 49, 283–306. [Google Scholar] [CrossRef]

| Parameter | Value |

|---|---|

| 100 | |

| 3 | |

| 1 | |

| 20 | |

| 0.3 | |

| 0.7 | |

| 0.1 | |

| 0.7 |

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| −14.060 | −13.060 | 70.312 | −3490.523 | 11,291.77 | |

| −15.601 | −15.962 | 17.203 | −86.378 | 44.398 | |

| Investor sentiment index | 0 | −0.197 | 1.362 | −4.200 | 3.983 |

| Unemployment rate | 4.089 | 4.1 | 0.132 | 3.61 | 4.3 |

| Illiquidity | 0.284 | 0.121 | 0.327 | 0.025 | 1.864 |

| Market volatility | 0.015 | 0.013 | 0.008 | 0.003 | 0.044 |

| Real GDP growth rate | 9.280 | 9.4 | 2.353 | 6.2 | 14.3 |

| Individual-share ROE synchronization | 0.462 | 0.823 | 0.499 | −5.070 | 3.620 |

| Market ROE synchronization | 2.102 | 2.355 | 0.933 | −0.038 | 4.111 |

| −5.319 ** | |

| (−2.42) | |

| −2.299 | |

| (−0.60) | |

| −1.603 | |

| (−1.02) | |

| −0.255 | |

| (−1.12) | |

| 0.001 | |

| (1.23) | |

| 3.355 | |

| (1.28) | |

| 3.224 | |

| (0.15) | |

| 0.065 | |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Small cap | 3.763 | 13.046 | −22.862 | 97.46 |

| Large cap | 0.9 | 8.365 | −28.666 | 32.502 |

| Low liquidity | 4.171 | 12.048 | −23.399 | 89 |

| High liquidity | 0.425 | 9.109 | −32.06 | 31.589 |

| High volatility | 10.884 | 14.311 | −26.616 | 62.595 |

| Low volatility | −0.074 | 7.607 | −23.406 | 48.249 |

| Investor sentiment change index | 0 | 1.522 | −9.701 | 10.071 |

| Cumulative high sentiment index | 0.795 | 1.494 | 0 | 10.071 |

| Cumulative low sentiment index | −0.776 | 1.388 | −9.701 | 0 |

| Risk-free rate | 0.002 | 0.001 | 0.001 | 0.003 |

| Value-weighted market return | 0.861 | 7.959 | −26.809 | 29.604 |

| Equal-weighted market return | 1.416 | 9.477 | −28.836 | 34.416 |

| Portfolio | (1) Intercept | (2) | (3) |

|---|---|---|---|

| EMkt | 0.178 | 3.372 ** | −0.520 * |

| (0.23) | (2.45) | (−1.86) | |

| VMkt | −0.167 | 2.612 ** | −0.438 * |

| (−0.26) | (2.32) | (−1.91) | |

| Small | 2.109 ** | 4.616 ** | −0.745 * |

| (1.96) | (2.43) | (−1.93) | |

| Large | −0.281 | 2.990 ** | −0.451 * |

| (−0.41) | (2.45) | (−1.82) | |

| Lowliq | −1.221 ** | 4.472 ** | −0.663 * |

| (2.47) | (2.56) | (−1.87) | |

| Highliq | −0.881 | 3.534 *** | −0.572 ** |

| (−1.17) | (2.66) | (−2.12) | |

| Highvol | 9.039 *** | 5.144 ** | −0.799 * |

| (7.68) | (2.48) | (−1.90) | |

| Lowvol | −1.221 * | 3.308 *** | −0.491 ** |

| (−1.94) | (2.75) | (−2.18) |

| Portfolio | (1) Intercept | (2) | (3) |

|---|---|---|---|

| EMkt | 2.221 *** | −2.013 ** | 0.300 * |

| (2.84) | (−2.00) | (1.91) | |

| VMkt | 1.580 ** | −1.847 ** | 0.283 ** |

| (2.41) | (−2.19) | (2.15) | |

| Small | 4.857 *** | −2.357 ** | 0.295 ** |

| (4.22) | (−2.04) | (2.04) | |

| Large | 1.532 ** | −1.701 * | 0.274 ** |

| (2.29) | (−1.87) | (2.39) | |

| Lowliq | 5.441 *** | −2.657 ** | 0.318 ** |

| (5.14) | (−2.39) | (2.33) | |

| Highliq | 1.011 | −1.637 * | 0.271 ** |

| (1.41) | (1.65) | (2.18) | |

| Highvol | 11.969 *** | −1.729 | 0.118 |

| (10.12) | (−1.13) | (0.50) | |

| Lowvol | 0.588 | −1.786 ** | 0.284 ** |

| (0.94) | (−2.22) | (2.25) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, C.; Hu, C.; Yao, H. Behavioral Framework of Asset Price Bubbles: Theoretical and Empirical Analyses. Systems 2022, 10, 251. https://doi.org/10.3390/systems10060251

Chen C, Hu C, Yao H. Behavioral Framework of Asset Price Bubbles: Theoretical and Empirical Analyses. Systems. 2022; 10(6):251. https://doi.org/10.3390/systems10060251

Chicago/Turabian StyleChen, Cong, Changsheng Hu, and Hongxing Yao. 2022. "Behavioral Framework of Asset Price Bubbles: Theoretical and Empirical Analyses" Systems 10, no. 6: 251. https://doi.org/10.3390/systems10060251