Research vs. Practice on Manufacturing Firms’ Servitization Strategies: A Gap Analysis and Research Agenda

Abstract

:1. Introduction

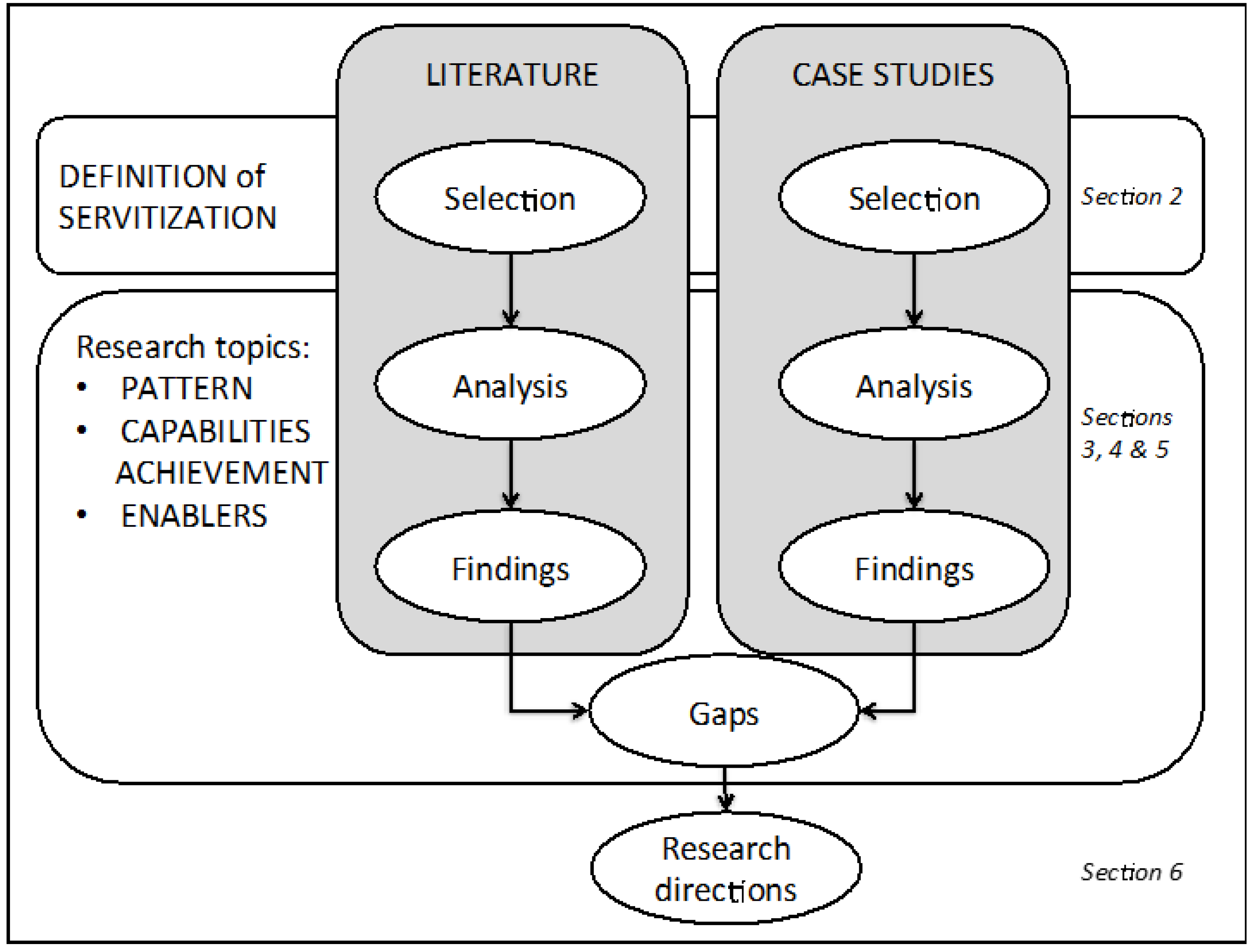

2. Research Methodology

2.1. Research Framework

- the servitization pattern, that is how a servitization transition can be modelled and described both in terms of its trajectory and final impact;

- how capabilities to support a successful servitization transition are achieved (e.g., internal development or external acquisition);

- the enablers of servitization, i.e., the endogenous or exogenous factors that facilitate or support the achievement of a successful servitization process.

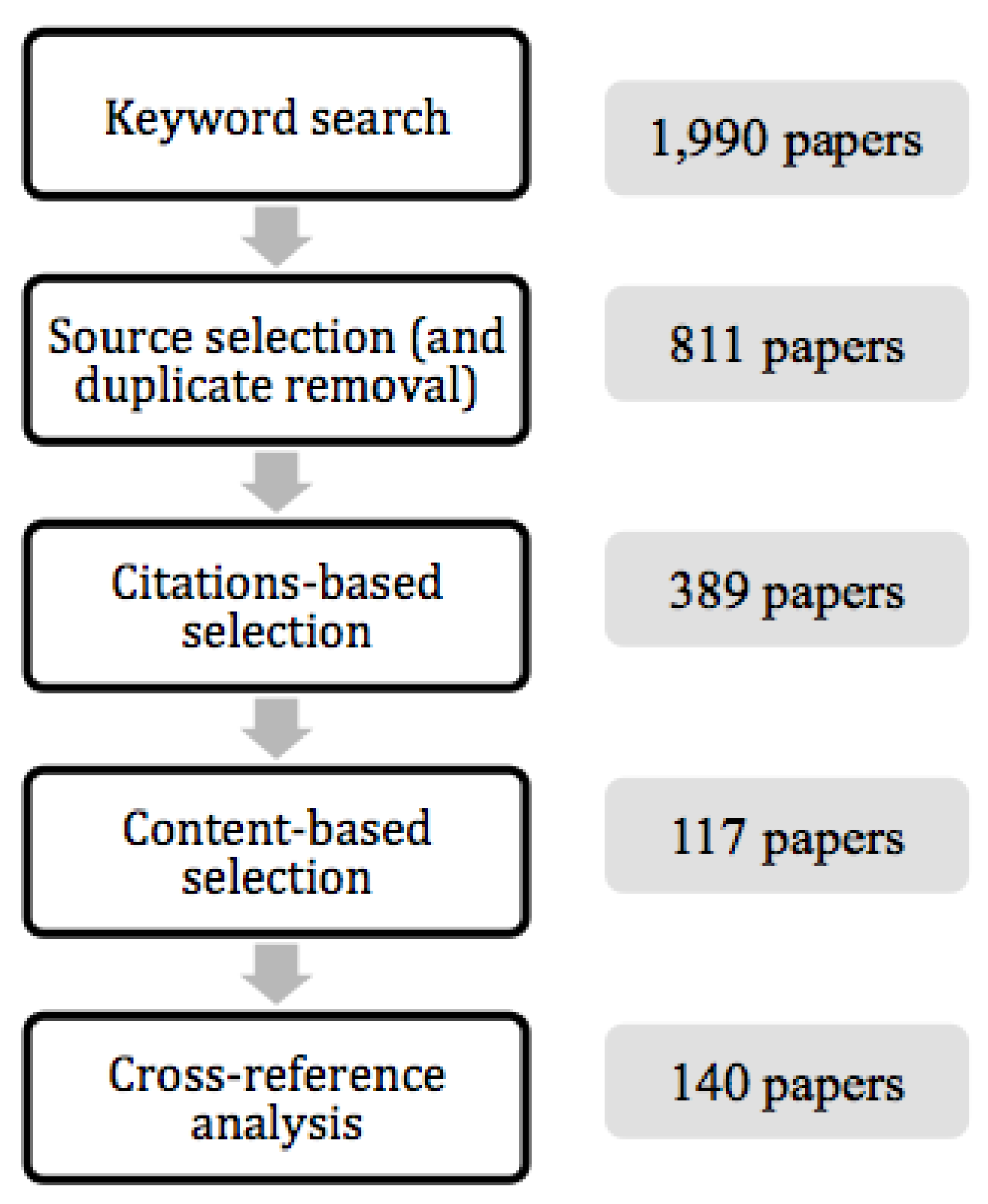

2.2. Literature Review

2.3. Case Studies

- time-pervasive, covering a time span long enough to thoroughly analyse the servitization transformation

- complete as to provide strategic, as well as tactical and operational points of view regarding the transformation process

- verifiable, thanks to the possibility to cross-check information and facts from different sources

- Apple was considered for the integrated design, marketing and sale of product-service systems, first with IPod + ITunes, and then with IPhone + Apple Store.

- Caterpillar was taken into consideration because it famously and successfully leveraged on an internal competence on spare parts logistics in order to start up a new service business on a “lateral” business compared to its main one.

- Dell was considered on the account that it pioneered in the personal computing market a new and customer-centric business model, based on disintermediation and direct customer contact.

- General Electric was considered as a leader in supporting the sale of capital goods with advanced financial services, and therefore because it proposed one of the first and most successful “solutions”.

- IBM was taken into consideration for its spectacular turnaround from being No. 1 global computers and peripherals manufacturer to achieving No. 1 position as global provider of information-related business services.

- Rolls Royce was especially credited for launching one of the first and most successful technology-enabled outcome-based contract schemes in the capital goods market.

- Finally, Xerox was also considered for pioneering the implementation of a “pay per use” business model in the printers and photocopying machine sector.

3. Servitization Pattern

- Finding 1: Both the literature and the cases identify two possible approaches to servitization, an incremental and a radical one. The literature has paid particular attention to the former, while practice shows the latter to be equally, if not more, relevant.

- Finding 2: When dealing with the incremental approach, the literature depicts a linear path that goes from an initial product-focused offering to a final service-focused one. The cases, however, highlight that this process may not be linear but rather a trial and error one, and that it can end up with the coexistence of service-focused offerings together with more product-focused ones.

- Finding 3: The cases highlight that the servitization process, despite having an incremental or radical approach, can achieve either a transformative or an integrative impact on the servitizing organization. This perspective on the servitization pattern has been overlooked by the literature.

4. Servitization Capabilities Achievement

- Finding 2a: Both the literature and case studies show that internal development, external acquisitions and partnering/ecosystems can all be effective ways to achieve the capabilities needed in the servitization process.

- Finding 2b: The literature neglects the fundamental role of financial resources, pointed out by the cases, in the definition of the capabilities’ achievement strategy and, in particular, for the external acquisition of capabilities.

5. Servitization Enablers

- Finding 3a: Several servitization enablers pointed out by the literature are confirmed by the case studies, such as the alignment of the organizational structure, the cultural change, the achievement of customer-centricity, the management of the value network, the installed base information management.

- Finding 3b: The cases studies point out other enablers that have received little or no attention in the scientific literature: time, leadership and continuity, digital technologies and operational excellence.

6. Conclusions and Future Research Directions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Case Studies Summary

| FEATURE | CASE HISTORY APPLE |

|---|---|

| Strategy | Shift from personal computing, to the exploitation of the digital convergence of mobile communications, geo-referencing and multimedia to create a seamless offering of hardware devices and services enabled by a proprietary platform. In this business model products give access to a huge market of content and applications, and the latter allow products to multiply their functionalities virtually endlessly. |

| Pattern | Radical: by embracing its new business model, Steve Jobs transformed Apple from a niche manufacturer of sleek and upmarket personal computing devices, to a global and high-end consumer-electronics and services company. Not only Apple was an absolute innovator in building on the convergence of several ICT technologies to initiate entirely new product categories, such as smartphones and tablets; it also understood before any other company the value of co-designing hardware products, software components, and the service market supported by them. As a response, competitive business platforms drove and nurtured the latest business innovations such as mass collaboration, social networking, community formation or community branding. In this process Apple withdraw from the direct manufacture of its products, that was assigned to third party specialized operators, in order to concentrate on the development of technology, design of products, and direct sale and support of products, though the network of directly owned Apple Retail Stores. |

| Capabilities development | Apple’s innovative business model was mainly achieved by leveraging on the development of internal competencies and know-how, by hiring highly specialized and skilled leaders in several functions. A second ingredient of Apple’s success was to invest in the development of an eco-system of independent partnering developers that could use the AppStore platform to make their application freely available to interested customers. |

| Main Enablers | Leadership: few industrial leaders are credited with the same charisma, energy and visionary reputation as Steve Jobs, Apple’s co-founder, who founded and chaired Apple in two distinctive phases of corporate’s development. Technology: Apple built a large amount of its success on constantly being ahead of competitors in the use of technology aimed at making things easier for its products’ users. For instance, it was the first computer company to introduce Xerox’s PARC innovations such as windows interfaces and mouse pointer back in the 1980s; it pioneered the integration of broadband mobile internet access with geo-localization, digital photography and multimedia; it introduced its iconic dual-touch screens in 2007, etc. Operational excellence: by personal supervising a relentless search for perfection in every detail, Jobs achieved a previously unattained excellence especially in the new product development process. He reportedly set technical and design goals, chose materials and industrial processes, selected suppliers and revised prototypes with unrivalled attention to every relevant feature of the hardware and software marketed by Apple. |

| Main facts | 1996: beginning of the second tenure of Jobs as Apple’s CEO and Chairman 1998: Apple is restored to profitability, after near bankruptcy 1998: launch of the iMac all-in-one personal computers line; launch of the worldwide chain of the Apple Retail Stores 2001: launch of the IPod; launch of the first version of the Mac OSX operating system 2001: opening of Apple’s first two retail Stores in California and Virginia 2003: launch of the ITunes platform integrated to the IPod, which is still now the largest music retailer worldwide 2006: all the IMac personal computers range was shifted to Intel Core Duo CPU chips 2007: launch of the IPhone 2007: Apple Computers Inc. is renamed as Apple Inc. to take into consideration the shift from personal computing to consumer electronics and services 2008: launch of the AppStore platform, integrated with the iPhone handset, still now the largest application software retailer worldwide 2009: Jobs takes a six months leave to focus on his health 2010: launch of the IPad tablet PC 2011: launch of ICloud, an online storage and syncing service for music, photos, files and software service and of the Mac Apple Store application software download platform for apple PCs 2011: death of Steve Jobs, and appointment of Tim Cook as his successor |

| Main references | [72,73,74,75,76] |

| FEATURE | CASE HISTORY CATERPILLAR |

|---|---|

| Strategy | Move from the offer of a wide range of construction and engineering equipment, to a more integrated offering, encompassing a set of services aside products. |

| Pattern | Radical: by launching a wide set of service and connected service divisions, CAT underwent a major redefinition of its internal organization and business model. Yet, while the majority of the launched services play a mere supporting role to CAT’s core business, the spare parts logistics and remanufacturing departments opened up entirely new markets for Caterpillar. Especially in spare parts logistics, CAT succeeded in taking advantage of its own internal competences, developed in managing its own assets, to create a service organization operating in a totally different market from its parent company. Forming Cat Logistics, the company set out to expand in the new market of spare parts management, serving companies in several industries ranging from automotive to electronics, including even some of its competitors. Starting from this point, Caterpillar further integrated its logistic service offering with more advanced services such as supply chain management and consultancy and created a network with other major players. As its spare arts logistics counterparts, also CAT’s remanufacturing division started as a captive business, but eventually evolved into an entirely new business, by offering remanufactured parts and groups not only to customer of CAT’s machines and engines, but also to users of other brands and alternative products, in the same, as well as other industry sectors, such as: industrial machinery, automotive and electronics. In time CAT developed a whole set of other services, that it offers only to its own customers, such as: retail and wholesale financing solutions; machinery rental; equipment monitoring; fleet management; automatic and remote machine control; job sites collaborative planning; etc. The physical equipment and support activities needed to operate these services are provided by a network of local mono-brand dealerships, often controlled or owned by CAT. |

| Capabilities development | In order to establish its spare parts logistics division and services, CAT mainly leveraged on its internal competencies and know-how. The new business units dedicated to the delivery of the aforementioned services were created from green field, and without substantial acquisitions. |

| Main Enablers | Operational Excellence gained by successfully managing internal business in spares logistics and distribution. This was in turn achieved through a mix of excellent logistics, well-integrated spares supply chain, and the ability to master related data acquisition, storage and analysis. Technology: CAT machines are redesigned and endowed with advanced auto-diagnostic systems, coupled with an on-board computer and a data transmission system. As soon as a part brakes down, the diagnostic system can identify it and by means of the on-board computer, by leveraging the above-mentioned operational excellence, the corresponding spare can be located within CAT’s network, and ordered. Leadership: although the relevance of Jim Owens’ chairmanship was far from being as decisive as Jack Welch’s, his ability to set strategic goals, and steer the company to achieve them was noteworthy. |

| Main facts | 1987: CAT Logistics is established 2002–2003: All CAT machines come fitted with advanced auto-diagnostic systems, coupled with a computer and a transmission system 2004: Jim Owens mandate as CAT’s Chairman and CEO begins 2010: D. R. Oberhelman succeeds Owens as CAT’s CEO and Chairman 2013: establishment of the Caterpillar Enterprise & Systems Group, an internal initiative shaped to standardize and steer the order-to-cash process through the whole group |

| Main references | [77,78,79,80,81] |

| FEATURE | CASE HISTORY DELL |

|---|---|

| Strategy | Disintermediate the traditional personal computers’ delivery chain by avoiding to resort to a network of dealers, and instead preferring to bear the direct contact with the end customer, and to assemble the computers on customers’ request. In turn this shift is habilitated by an e-commerce internet platform, directly created and operated by Dell. |

| Pattern | Despite the fact that Dell itself did not embark on a transformation process, but rather it was directly invented in its innovative form, it introduced a profound discontinuity from the traditional way PCs were produced and distributed. By taking over activities related to product customization, Dell embedded itself into the IT operations of its enterprise customers and, at the same time, it created additional revenues from services. For example, Dell was the first to provide not only computers, but also services related to hardware and software image development, migration and recovery, custom configuration and installation of software or parts replacement. This was achieved by adopting an innovative on-line-only distribution channel, connecting consumers directly to the company. In this case, therefore, servitization is achieved by a direct customer contact and supported by a peculiar and highly flexible operations strategy. |

| Capabilities development | In a first phase, from company’s foundation to approximately 2005, the deployment of Michael Dell’s bright strategic intuition to build on the internet in order to overcome retailers and directly connect with final customers was pursued internally by developing required capabilities and competencies within Dell Inc. This trajectory was very successful until Dell’s lean supply chain was able to yield a large cost and price advantage as compared to competitors. Yet, by the middle of the new century’s first decade, this advantage had been eroded partially because competitors had catch-up, and partially because the newly developed smartphones were attracting an increasing amount of interest, and volumes, from the market, progressively relegating laptops to a less attractive and less lucrative commoditized role. As a consequence, Dell quickly expanded its PC manufacturing business into corporate computer services, by purchasing leader companies in such segments as gaming consoles, IT consulting, or data storage systems. |

| Main Enablers | Operational Excellence was the main driver of Dell’s success through the 80’s and 90s, especially in manufacturing, logistics and supply chain management. Dell’s supply chain was so leaner than competitor’s that by 2002 operating costs were just 10% of Dell’s revenues, as compared to 20% at HP. Leadership: although Michael Dell played more the role of founder and entrepreneur, than that of boss, and despite the fact that he appointed Morton Meyerson, Lee Walker and Kevin Rollins as Dell’s CEOs, his flamboyant personality played a major role in determining his company’s fortunes, by conceiving the business idea that enforced Dell’s success from 1984 to 2004, relentlessly pushing to scale up sales volumes, and personally supervising the excellence with which his strategy was executed throughout Dell’s supply chain. Technology: as soon as the internet e-business technology was mature enough, Dell was able and quick to smartly leverage it in order to scale-up its direct sale business model, gaining a direct access to direct customer relations that competitor were dreaming of, and making a wise usage of the enormous amount of data that this novel business platform could generate. |

| Main facts | 1984: DELL Computers Inc. is established and headquartered at Round Rock, Texas, USA 1986: Morton Meyerson, former EDS CEO, is hired as CEO to transform DELL from a fast-growing medium-sized firm into a billion-dollar enterprise 1994: DELL leaves the (already residual) reseller retail channel to concentrate in direct sales 1995: Dell enters into the industrial servers market 1996: take-off of e.commerce site 1997: entrance in the consumer market, by creating an internal sales and marketing group dedicated to savy individual computer users 1999: acquisition of ConvergeNet Technologies to enhance Dell’s command of enterprise storage system’s technology 2002: Dell enters consumer electronics market, starting to manufacture TV sets, handheld phones, digital audio layers and printers 2006: start of the acquisition campaign that will see Dell gain control of (among others): AlienWare (2006, gaming consoles); EqualLogic (2008, storage devices); Perot Systems (2009, applications development and consulting). |

| Main references | [61,82,83,84,85,86,87,88,89,90,91,92,93,94] |

| FEATURE | CASE HISTORY GENERAL ELECTRIC |

|---|---|

| Strategy | Shift from manufacturing to services, as well as from product to solutions. GE scale was leveraged to start a new business in financial services (the well-known GE Capital BU), firstly dedicated to the captive market, and then turned inward out. Launch of integrated product-service offer in many product divisions, such as aviation, engine, healthcare. Redefinition of GE’s positioning within the interested industries, by applying the principle that GE should either attain No. 1 or 2 position in each industry or completely leave the considered sector. |

| Pattern | Thanks to the vastly recognized ability of Jack Welch to steer the turnaround process, the company underwent several organizational changes. Welch worked wonders in reshaping GE’s organization by dismantling the previously dominant internal bureaucracy and halving the number of hierarchical layers. Moreover, Welch was a fierce supporter of results-driven selection of managers, firing year after year the worse performing 10% and rewarding with a vast stock option scheme the best performing 20%. One key idea was to form a “services council”, where representatives from all its manufacturing businesses shared tips on how to expand the services business. |

| Capabilities development | Within GE Capital, GE could expand its service portfolio along different directions through massive acquisitions campaigns that allowed it to move horizontally to entirely new industries such as media, wind power and entertainment (with NBC acquisition). More than 600 acquisitions were made worldwide, following this plan. In order to make cash for the bold acquisition plan, Welch closed or sold the worst performing or less promising businesses (such as GE information systems), and fired around 81,000 people within continuing businesses. Meanwhile, the company undertook internal vertical transformation of the organization to promote the best performing managers and to provide product and service bundling solutions in each segment where it operated. |

| Main Enablers | The most evident enabler of GE’s turnaround was the leadership expressed by its legendary chairman and CEO Jack Welch. He relentlessly, reduced inventories, established GE as a business leader in any sector in which it operated and shifted GE from a large domestic player to a worldwide giant. Another key element in determining GE’s servitization turnaround success was its scale: in fact it would have been almost impossible to be successful in such a program for any company not having its vast dimension. It has to be underlined also that by leveraging on Jack Welch undisputed leadership, and GE scale, it was possible to achieve a radical turnaround, together with tremendous financial success in a strikingly short time frame. Finally, operational excellence was leveraged as a key internal asset in optimizing GE’s management, especially of of logistics and quality |

| Main facts | 1981: Jack Welch is appointed as GE’s Chairman and CEO 1982: dismantling of the majority of GE’s senior positions, simplification and consolidation of GE’s corporate organization 1986: acquisition of RCA, and subsequently spin-off of the majority of RCA’s assets, by keeping only NBC. Relocation of corporate headquarter to former RCA’s hq in the Rockefeller Centre in NYC 1990: and following years, progressive shift from manufacturing to financial services 1995: adoption of Motorola’s Six-Sigma quality program 1997: establishment of GE Capital International Services, the financial services business unit 2001: Jeff Immelt succeeds to Jack Welch as GE’s CEO and Chairman |

| Main References | [9,62,95,96] |

| FEATURE | CASE HISTORY IBM |

|---|---|

| Strategy | Switch from the traditional mission embedded in the corporate name (“Industrial Business Machines”) to apply IBM’s proprietary complex technologies and broad base of vertically-integrated technological capabilities, in order to solve directly business challenges and provide customers with complete integrated solutions. The new corporate mantra is to support worldwide “business decision making”. |

| Pattern | Transformational approach, applied to almost any relevant corporate aspect. Almost anything has been radically changed, from strategy to operations, from people to core markets. More specifically, IBM has pulled out of the consumer computers and peripherals markets, and has strengthened its position within the software and consulting markets. Notably, the turnaround happened in two specific phases: first, mainly under Gerstner’s tenure, a major switch was accomplished from the design, manufacture and sale of computers and peripherals, to consulting services: this phase started with the sale of Lexmark in 1992 and culminated with the purchase of PwC in 2002. then, more under Palmisano’s chairmanship, the corporate focus was re-directed from management consulting to highly specialized and high-tech software, Strong emphasis on the time frame: the whole turnaround happened in just 10 years, involving almost any of its around 200,000 employees. |

| Capabilities development | The turnaround was accomplished in two phases: In an early stage, mainly internal competences were used, by cherry-picking throughout the organization people with valuable knowledge and empowering them to fully diffuse their know-how. Meantime, a large amount of employees whose skills and competences were not aligned with IBM’s new business goals where laid-off. This phase culminated with the two famous jam programs of 2003 and 2004. Then, in 2005 a strong campaign of acquisitions was launched, in order to rapidly achieve a dominant position in the business software. Simultaneously the PC business was spun-off, in order to provide cash for supporting the acquisition program. Since then, more than 100 large, and many more small, sw companies were purchased. |

| Main Enablers | The most evident enabler of IBM’s turnaround was the leadership of its chairmen, given the high impact of Gerstner’s and Palmisano’s tenure. Both shared a common vision, seized the right moment to affirm it, and were able to safely steer the transformation process through turbulent times. Remarkable was also the continuity between the two CEOs on strategic goals and implementation. A second relevant issue was also IBM’s ability to keep the process in track and perform an impressive and radical turnaround in a remarkably short time frame. |

| Main facts | 1991: sale of Lexmark, IBM’s laser printer business unit 1993: posting of world largest corporate loss ever, of US$ 8 billion 1993: Lou Gerstner is appointed IBM’s CEO and starts its turnaround program 1994: development of disappointing OS/2 system completely withdrawn 1995–2000: more than 100,000 employees laid-off 1997: consolidation of worldwide communication and advertising strategies down to one global agency 2002: purchase of PwC Consulting 2003: on 1 January, Sam Palmisano succeeds to Lou Gerstner as IBM’s CEO 2003: Jam program. Through advanced IT tools, internet-based online internal discussion are held on key strategic issues with 50,000 employees. Discussions are analyzed for recurring topics through sophisticated text-mining software. As a result corporate values are rewritten. 2004: a new jam session is held among 52,000 employees to update IBM’s best practices 2005: spin-off of personal computer business to Lenovo. 2005: launch of massive acquisition program, starting with Micromuse and Secure Blue. Purchase of more than 25 sw companies specializing in data mining, analytics, cloud computing, data security, etc. 2008: Launch of “smarter planet” initiative, under which computer intelligence is used to help solve complex problems 2010: sale of IBM’s hard disk drives to Hitachi 2011: launch of artificial intelligence program Watson |

| Main References | [97,98,99,100,101,102] |

| FEATURE | CASE HISTORY ROLLS-ROYCE |

|---|---|

| Strategy | Focus on increasing revenues from after-sales services, in order to counter a drop in aero engines sales and margins, owning to increased competition with GE and Pratt & Whitney. Offer “TotalCare©” innovative business model whose pricing is connected to customers ‘processes’ performances rather than to the activities and materials actually employed to technically upkeep products |

| Pattern | Incremental: the introduction of the new servitized business model was achieved in steps.

|

| Capabilities development | Mainly internal competencies and know-how were leveraged to fit RR’s engines with auto-diagnostic and interconnection capabilities, able to support the Total Care business model. Despite rethinking its engines and equipping them with self-monitoring and interconnection capabilities, RR set-up a 14 engines and repair centres and 25 component repair centres worldwide. RR established Control and data Services (CDS) as its business unit devoted to build, install and operate the specialized equipment needed to support its Total Care business model, as well as the unit that captures, manages and analyses the technical data collected in field. |

| Main Enablers |

|

| Main facts | 1962: Power-by-the-hour concept invented by Bristol Siddeley o describe a support service provided for Viper engines 1968: Bristol Siddeley purchased by Rolls Royce 1971: Rolls Royce nationalised due to heavy financial problems (linked to the development of the RB211, that later turned out to be the leading technology in the industry) 1973: Automobile division separated from the aerospace one as Rolls-Royce Motor 1980es: Power-by-the-hour program re-launched by Rolls Royce, and protected as a trademark 1987: Aerospace company privatised as Rolls Royce plc 1991: Rolls Royce embarked on an internal quality-enhancing project, Project 2000 1996: John Rose becomes CEO (stays until 2011) 1998: the company reorganised into two types of business units: (a) customer-facing business units with responsibility for identifying and meeting customer needs; and (b) operating business units with responsibility for delivering sub-systems. This restructuring was pursued with the aim of making the customer, especially civil airlines, central to the strategy of the company 1999: Acquisition campaign started to sustain the marine propulsion and energy market segments 1999: Total Care program launched with American Airlines 2010: 65% of all in-service large engines covered by TotalCare 2013: installed base of over 54,000 engines and services business representing 52% of total revenues |

| Main References | [80,103,104,105,106,107,108,109,110,111,112,113,114,115,116] |

| FEATURE | CASE HISTORY XEROX |

|---|---|

| Strategy | Leveraging the corporate’s global lead in the copy machines technology and market in order to redefine corporate’s mission and widen its commercial offer in its historical core business. |

| Pattern | Incremental: first switching from the design, manufacture and sale of copy machines to the sale of copied pages, and then proceeding further on to the outsourcing of whole printing processes. Trial-and-error pattern. First Allaire pulled Xerox out of financial services business in the 80s, then he pushed the company to enter the document support service business. Rick Thoman’s tenure was a major disappointment and partially reverted the transition. |

| Capabilities development | Mainly external acquisition of competencies through a vast program of acquisitions, in order to accomplish the new corporate’s strategy by integrating the traditional leading product’s offer with the new pay per performance business model and outsourcing services. The main internal resources used in this process are the corporate’s knowledge of the copy machines technology and market, together with its leading brand and positioning within this market. Another internal valuable resource was the vast portfolio of proprietary ICT technologies and knowledge developed in the PARC from 1970 to 2002. |

| Main Enablers |

|

| Main facts | 1970: establishment of PARC (Paolo Alto research Center) 1990: (approx.) development of world-class digital and networked multi-function machines 1990: Paul Allaire is appointed CEO and launches his servitization program 1994: the corporate pay-off is relabelled: “the document company” 1999: Paul Allaire is succeeded by Rick Thoman as Chairman and CEO, who does not succeed in carrying on with the company’s turnaround, mainly because of lack of leadership, being labelled as an “outsider” by the internal bureaucracy 2000: purchase of Tektronix colour printing and imaging division to achieve solid ink colour printing technology 2001: Anne Mulcahy succeeds to Rick Thomas and resumes Allaire’s turnaround plan and servitization strategy 2003: creation of Xerox Global Services Business Unit, to provide document-related outsourcing, imaging and consulting services 2009: Ursula Burns is appointed CEO, succeeding Ann Mulcahy 2010: closing of multi-billion dollar deal to purchase Affiliated Computer Services |

| Main References | [68,80,117,118,119,120,121,122,123] |

References

- Wölfl, A. The Service Economy in OECD Countries: OECD/Centre D’études Prospectives et D’informations Internationales (CEPII); OECD Publishing: Paris, France, 2005. [Google Scholar]

- Karmarkar, U. Will you survive the services revolution? Harv. Bus. Rev. 2004, 82, 100–107. [Google Scholar] [PubMed]

- Gao, J.; Yao, Y. Service-oriented manufacturing: A new product pattern. J. Intell. Manuf. 2011, 22, 435–446. [Google Scholar] [CrossRef]

- Lele, M.M. After-sales service—Necessary evil or strategic opportunity? Manag. Serv. Qual. 1997, 7, 141–145. [Google Scholar] [CrossRef]

- Levitt, T. Production-line approach to service. Harv. Bus. Rev. 1972, 50, 41–52. [Google Scholar]

- Gebauer, H.; Fleisch, E. An investigation of the relationship between behavioral processes, motivation, investments in the service business and service revenue. Ind. Mark. Manag. 2007, 36, 337–348. [Google Scholar] [CrossRef]

- Vandermerwe, S.; Rada, J. Servitization of business: Adding value by adding services. Eur. Manag. J. 1988, 6, 314–324. [Google Scholar] [CrossRef]

- Lightfoot, H.; Baines, T.; Smart, P. The servitization of manufacturing: A systematic literature review of interdependent trends. Int. J. Oper. Prod. Manag. 2013, 33, 1408–1434. [Google Scholar] [CrossRef]

- Wise, R.; Baumgartner, P. Go downstream. Harv. Bus. Rev. 1999, 77, 133–141. [Google Scholar]

- Mathieu, V. Service strategies within the manufacturing sector benefits costs and partnership. Int. J. Serv. Ind. Manag. 2001, 5, 451–475. [Google Scholar] [CrossRef]

- Oliva, R.; Kallenberg, R. Managing the transition from products to services. Int. J. Serv. Ind. Manag. 2003, 14, 160–172. [Google Scholar] [CrossRef]

- Brax, S. A manufacturer becoming service provider-challenges and a paradox. Manag. Serv. Qual. 2005, 15, 142–155. [Google Scholar] [CrossRef]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2008, 1, 103–118. [Google Scholar] [CrossRef] [Green Version]

- Baines, T.; Lightfoot, H.; Peppard, J.; Johnson, M.; Tiwari, A.; Shehab, E.; Swink, M. Towards an operations strategy for product-centric servitization. Int. J. Oper. Prod. Manag. 2009, 29, 494–519. [Google Scholar] [CrossRef]

- Johnstone, S.; Dainty, A.; Wilkinson, A. Integrating products and services through life: An aerospace experience. Int. J. Oper. Prod. Manag. 2009, 29, 520–538. [Google Scholar] [CrossRef] [Green Version]

- Alghisi, A.; Saccani, N. Internal and external alignment in the servitization journey—Overcoming the challenges. Prod. Plan. Control 2015, 26, 1219–1232. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Friedl, T. Overcoming the service paradox in manufacturing companies. Eur. Manag. J. 2005, 23, 14–26. [Google Scholar] [CrossRef]

- Tukker, A. Product services for a resource-efficient and circular economy—A review. J. Clean. Prod. 2015, 97, 67–91. [Google Scholar] [CrossRef]

- Kindström, D. Towards a service-based business model—Key aspects for future competitive advantage. Eur. Manag. J. 2010, 28, 479–490. [Google Scholar] [CrossRef]

- Evanschitzky, H.; Wangenheim, F.V.; Woisetschlager, D.M. Service & solution innovation: Overview and research agenda. Ind. Mark. Manag. 2011, 40, 657–660. [Google Scholar]

- Copani, G. Machine Tool Industry: Beyond Tradition? In Servitization in Industry; Springer International Publishing: New York, NY, USA, 2014; pp. 109–130. [Google Scholar]

- Windahl, C.; Lakemond, N. Developing integrated solutions: The importance of relationships within the network. Ind. Mark. Manag. 2006, 35, 806–818. [Google Scholar] [CrossRef]

- Sampson, S.E.; Snow, D.C. An Empirical Review of Popular Service Definitions from the Literature. In Proceedings of the 4th International EurOMA Service Operations Management Forum (SOMF), Florence, Italy, 19–20 September 2011.

- Sampson, S.E. Customer-supplier duality and bidirectional supply chains in service organizations. Int. J. Serv. Ind. Manag. 2000, 11, 348–364. [Google Scholar] [CrossRef]

- Sampson, S.E.; Froehle, C.M. Foundations and implications of a proposed unified services theory. Prod. Oper. Manag. 2006, 15, 329–343. [Google Scholar] [CrossRef]

- Davies, A.; Brady, T.; Hobday, M. Charting a pathtoward integrated solutions. Sloan Manag. Rev. 2006, 47, 39–48. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Seuring, S.; Gold, S. Conducting content-analysis based literature reviews in supply chain management. Supply Chain Manag. Int. J. 2012, 17, 544–555. [Google Scholar] [CrossRef]

- Reim, W.; Parida, V.; Örtqvist, D. Product–Service Systems (PSS) business models and tactics—A systematic literature review. J. Clean. Prod. 2015, 97, 61–75. [Google Scholar] [CrossRef]

- Gebauer, H.; Fischer, T.; Gregory, M.; Ren, G.; Fleisch, E. Exploitation or exploration in service business development? Insights from a dynamic capabilities perspective. J. Serv. Manag. 2010, 21, 591–624. [Google Scholar]

- Neu, W.A.; Brown, S.W. Forming successful business-to-business services in goods-dominant firms. J. Serv. Res. 2005, 8, 3–17. [Google Scholar] [CrossRef]

- Gebauer, H. Identifying service strategies in product manufacturing companies by exploring environment—Strategy configurations. Ind. Mark. Manag. 2008, 37, 278–291. [Google Scholar] [CrossRef]

- Matthyssens, P.; Vandenbempt, K. Moving from basic offerings to value-added solutions: Strategies, barriers and alignment. Ind. Mark. Manag. 2008, 37, 316–328. [Google Scholar] [CrossRef]

- Matthyssens, P.; Vandenbempt, K. Service addition as business market strategy: Identification of transition trajectories. J. Serv. Manag. 2010, 21, 693–714. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Kindström, D.; Alejandro, T.B.; Brege, S.; Biggemann, S. Service infusion as agile incrementalism in action. J. Bus. Res. 2012, 65, 765–772. [Google Scholar] [CrossRef]

- Galbraith, J.R. Organizing to deliver solutions. Organ. Dyn. 2002, 31, 194–207. [Google Scholar] [CrossRef]

- Sawhney, M.; Sridhar, B.; Vish, V.K. Creating Growth with Services. Sloan Manag. Rev. 2004, 45, 34–43. [Google Scholar]

- Miller, D.; Hope, Q.; Eisenstat, R.; Foote, N.; Galbraith, J. The problem of solutions balancing clients and capabilities. Bus. Horiz. 2002, 45, 3–12. [Google Scholar] [CrossRef]

- Fischer, T.; Gebauer, H.; Fleisch, E. Service Business Development: Strategies for Value Creation in Manufacturing Firms; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Davies, A. Moving base into high-value integrated solutions: A value stream approach. Ind. Corp. Chang. 2004, 13, 727–756. [Google Scholar] [CrossRef]

- Windahl, C.; Lakemond, N. Integrated solutions from a service-centered perspective: Applicability and limitations in the capital goods industry. Ind. Mark. Manag. 2010, 39, 1278–1290. [Google Scholar] [CrossRef]

- Gebauer, H.; Friedl, T. Behavioral implications of the transition process from products to services. J. Bus. Ind. Mark. 2005, 20, 70–78. [Google Scholar] [CrossRef]

- Paiola, M.; Saccani, N.; Gebauer, H.; Perona, M. Moving from products to solutions: strategic approaches for developing capabilities. Eur. Manag. J. 2013, 31, 390–409. [Google Scholar] [CrossRef]

- Johnson, M.; Mena, C. Supply chain management for servitised products. A multi-industry case study. Int. J. Prod. Econ. 2008, 114, 27–39. [Google Scholar]

- Shepherd, C.; Ahmed, P.K. From product innovation to solutions innovation: A new paradigm for competitive advantage. Eur. J. Innov. Manag. 2000, 3, 100–106. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Kindström, D.; Witell, L. Internalisation or externalisation? Examining organisational arrangements for industrial services. Manag. Serv. Qual. 2011, 21, 373–391. [Google Scholar] [CrossRef]

- Bastl, M.; Johnson, M.; Lightfoot, H.; Evans, S. Buyer-supplier relationships in a servitized environment: An examination with Cannon and Perreault’s framework. Int. J. Oper. Prod. Manag. 2012, 32, 650–675. [Google Scholar] [CrossRef]

- Saccani, N.; Visintin, F.; Rapaccini, M. Investigating the linkages between service types and supplier relationships in servitized environments. Int. J. Prod. Econ. 2014, 149, 226–238. [Google Scholar] [CrossRef]

- Matthyssens, P.; Vandenbempt, K. Creating competitive advantage in industrial services. J. Bus. Ind. Mark. 1998, 13, 339–355. [Google Scholar] [CrossRef]

- Ahmed, P.K.; Shepherd, C. Innovation Management: Context, Strategies, Systems and Processes; Prentice Hall Publishing: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Oliva, R.; Gebauer, H.; Brann, J.M. Separate or integrate? Assessing the impact of separation between product and service business on service performance in product manufacturing firms. J. Bus.-to-Bus. Mark. 2012, 19, 309–334. [Google Scholar]

- Anderson, J.C.; Narus, J.A. Capturing the value of supplementary services. Harv. Bus. Rev. 1995, 73, 75–83. [Google Scholar]

- Knecht, T.; Lezinski, R.; Weber, F.A. Making Profits after the Sale. The McKinsey Quarterly, 1993; No. 4. 79–87. [Google Scholar]

- Gebauer, H.; Paiola, M.; Saccani, N. Characterizing service networks for moving from products to solutions. Ind. Mark. Manag. 2013, 42, 31–46. [Google Scholar] [CrossRef]

- Åhlström, P.; Nordin, F. Problems of establishing service supply relationships: Evidence from a high-tech manufacturing company. J. Purch. Supply Manag. 2006, 12, 75–89. [Google Scholar] [CrossRef]

- Lindberg, N.; Nordin, F. From products to services and back again: Towards a new service procurement logic. Ind. Mark. Manag. 2008, 37, 292–300. [Google Scholar] [CrossRef]

- Bastl, M.; Johnson, M.; Evans, S. Managing Supply Chains under Extreme Conditions a Conceptual Framework for Servitized Environments; Cranfield University, Innovative Manufacturing Research Centre: Cranfield, UK, 2009. [Google Scholar]

- Ulaga, W.; Reinartz, W.J. Hybrid offerings: how manufacturing firms combine goods and services successfully. J. Mark. 2011, 75, 5–23. [Google Scholar] [CrossRef]

- Fang, E.; Palmatier, R.W.; Steenkamp, J.B.E. Effect of service transition strategies on firm value. J. Mark. 2008, 72, 1–14. [Google Scholar] [CrossRef]

- Ryals, L. Rolls-Royce Totalcare: Meeting the needs of key customers. In Cranfiled Executive Briefing; Cranfield School of Management: Cranfield, UK, 2010. [Google Scholar]

- Kraemer, K.L.; Dedrick, J.; Yamashiro, S. Refining and extending the business model with information technology: Dell Computer Corporation. Inf. Soc. 2000, 16, 5–21. [Google Scholar]

- Allmendinger, G.; Lombreglia, R. Four strategies for the age of smart services. Harv. Bus. Rev. 2005, 83, 131. [Google Scholar] [PubMed]

- Kowalkowski, C.; Kindström, D.; Gebauer, H. ICT as a catalyst for service business orientation. J. Bus. Ind. Mark. 2013, 28, 506–513. [Google Scholar] [CrossRef]

- Baines, T.; Lightfoot, H.W. Servitization of the manufacturing firm: Exploring the operations practices and technologies that deliver advanced services. Int. J. Oper. Prod. Manag. 2014, 34, 2–35. [Google Scholar] [CrossRef]

- Grubic, T. Servitization and remote monitoring technology: A literature review and research agenda. J. Manuf. Technol. Manag. 2014, 25, 100–124. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How Smart, Connected Products Are Transforming Competition. Harv. Bus. Rev. 2014, 92, 11–64. [Google Scholar]

- Opresnik, D.; Taisch, M. The value of big data in servitization. Int. J. Prod. Econ. 2015, 165, 174–184. [Google Scholar] [CrossRef]

- Finne, M.; Brax, S.; Holmström, J. Reversed servitization paths: A case analysis of two manufacturers. Serv. Bus. 2013, 7, 513–537. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Windahl, C.; Kindström, D.; Gebauer, H. What service transition? Rethinking established assumptions about manufacturers’ service-led growth strategies. Ind. Mark. Manag. 2015, 45, 59–69. [Google Scholar] [CrossRef]

- Benson-Rea, M.; Brodie, R.J.; Sima, H. The plurality of co-existing business models: Investigating the complexity of value drivers. Ind. Mark. Manag. 2013, 42, 717–729. [Google Scholar] [CrossRef]

- Sousa, R.; Voss, C.A. Contingency research in operations management practices. J. Oper. Manag. 2008, 26, 697–713. [Google Scholar] [CrossRef]

- Flinn, L.J. Apple Offers Music Downloads with Unique Pricing. The New York Times. 29 April 2003. Available online: http://www.nytimes.com/2003/04/29/business/technology-apple-offers-music-downloads-with-unique-pricing.html (accessed on 20 February 2017).

- Yoffie, D.; Slind, M. Apple Inc.; Harvard Business School Publishing: Boston, MA, USA, 2008. [Google Scholar]

- Cusumano, M.A. Technology strategy and management platform and services: Understanding the resurgence of Apple. Comun. ACM. 2010, 53, 22–24. [Google Scholar] [CrossRef]

- Eaton, B.; Elaluf-Calderwood, S.; Sørensen, C.; Yoo, Y. Dynamic Structures of Control and Generativity in Digital Ecosystem Service Innovation: The Cases of the Apple and Google Mobile App Stores; London School of Economics and Political Science: London, UK, 2011. [Google Scholar]

- Apple Inc. Annual Report; Apple Inc.: Cupertino, CA, USA, 2014. [Google Scholar]

- Christensen, C.M. The past and future of competitive advantage. Sloan Manag. Rev. 2001, 42, 105–109. [Google Scholar]

- Hertz, S.; Alfredsson, M. Strategic development of third party logistics providers. Ind. Mark. Manag. 2003, 32, 139–149. [Google Scholar] [CrossRef]

- Dzilna, D.; Lucyshyn, W. Caterpillar Logistics Services: Providing No Excuses Logistics Support. In Transforming Government Supply Chain Management; Gansler, S., Luby, R.E., Eds.; Rowman & Littlefield: Lanham, MD, USA, 2004. [Google Scholar]

- Baines, T.; Lightfoot, H.W. Made to Serve: What It Takes for a Manufacturer to Compete through Servitization and Product-Service Systems; Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

- Caterpillar. Common Ground; 2013 Year in Review; Caterpillar: Peoria, IL, USA, 2013. [Google Scholar]

- Michael Dell: The Enfant Terrible of Personal Computers. Business Week, 13 June 1988; 61.

- Dell Computer Hits the Drawing Board. Business Week, 24 April 1989; 138.

- PC Slump? What PC Slump? Business Week, 1 July 1991; 66.

- Dell Computer: Selling PCs Like Bananas. Economist, 5 October 1996.

- For Compaq and Dell Accent Is on Personal in the Computer Wars. Wall Street Journal, 2 July 1993; A1.

- Magretta, J. The Power of Virtual Integration: An Interview with Dell Computer’s Michael Dell. Harv. Bus. Rev. 1998, 76, 72–84. [Google Scholar]

- Dell, M.; Fredman, C. Direct from Dell: Strategies That Revolutionized an Industry; Harper Business: New York, NY, USA, 1999. [Google Scholar]

- Personal Computers: Didn’t Delliver. Economist, 20 February 1999.

- You’ll Never Walk Alone. Economist, 26 June 1999.

- Jones, K. The Dell Way Michael Dell’s Famous Business Model Made His Company the World’s Premier Computer Maker. Now He’s Branching into New Fields and Taking on Virtually Every Other Hardware Manufacturer. Can “The Model” Stand the Strain? 1 February 2003. [Google Scholar]

- Selladurai, R.S. Mass customization in operations management: Oxymoron or reality? Omega 2004, 32, 295–300. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Hardy. Dell’s Life after Wall Street. The New York Times. November 2014. Available online: http://www.nytimes.com/2014/11/03/business/dells-life-after-wall-street.html?ref=topics&_r=1 (accessed on 20 February 2017).

- Slater, R. Jack Welch and the GE Way; McGraw-Hill: New York, NY, USA, 1999. [Google Scholar]

- Welch, J.; Byrne, J.A. Jack: Straight from the Gut; Hachette Digital, Inc.: New York, NY, USA, 2003. [Google Scholar]

- Austin, R.D.; Nolan, R.L. IBM Corporation Turnaround; Harvard Business School Publishing: Boston, MA, USA, 2000. [Google Scholar]

- Gerstner, L.V. Who Says Elephants Cannot Dance: Inside IBM’s Historic Turnaround; Harper Business: New York, NY, USA, 2002. [Google Scholar]

- Chesbrough, H. Business model innovation: It is not just about technology anymore. Strategy Leadersh. 2007, 35, 12–17. [Google Scholar] [CrossRef]

- Takeda, H.; Truex, D.; Carter, M. An Epistemology of Organizational Emergence: The Tripartite Domains of Organizational Discourse and the Servitization of IBM. In IFIP International Federation for Information Processing; Springer: Boston, MA, USA, 2010; Volume 267. [Google Scholar]

- Ahamed, Z.; Inohara, T.; Kamoshida, A. The servitization of manufacturing: An empirical case study of IBM corporation. Int. J. Bus. Adm. 2013, 4, 18. [Google Scholar] [CrossRef]

- Costa, R.M.; Ornellas, R.S.; Gandour, F.; Wright, J.; Yu, A.; Nascimento, P.T. Servitization strategy in the IT segment: The new competitive weapon. In Proceedings of the 23rd International Conference for Management of Technology (IAMOT 2014), Washington, DC, USA, 22–26 May 2014.

- Rolls-Royce flies high. The Economist, 26 July 1997.

- Howells, J. Innovation & Services: New Conceptual Frameworks; Centre for Research on Innovation and Competition, the University of Manchester: Manchester, UK, 2000. [Google Scholar]

- Lovelock, C.; Gummesson, E. Whither services marketing? In search of a new paradigm and fresh perspectives. J. Serv. Res. 2004, 7, 20–41. [Google Scholar] [CrossRef]

- Whirring, not purring. The Economist, 14 July 2005.

- Lazonick, W.; Prencipe, A. Dynamic capabilities and sustained innovation: Strategic control and financial commitment at Rolls-Royce plc. Ind. Corp. Chang. 2005, 14, 501–542. [Google Scholar] [CrossRef]

- Holt, J.E. The challenges of civil aircraft engine control system development at Rolls-Royce. In Proceedings of the IEEE United Kingdom Automatic Control Council (UKACC) International Control Conference, Glasgow, UK, 30 August–1 September 2006.

- Friedman, T.L. The World Is Flat: The Globalized World in the Twenty-First Century; Penguin: London, UK, 2006; pp. 3–543. [Google Scholar]

- Ward, Y.; Graves, A. Through-life management: The provision of total customer solutions in the aerospace industry. Int. J. Serv. Technol. Manag. 2007, 8, 455–477. [Google Scholar] [CrossRef]

- Britain’s lonely high-flier. The Economist, 8 January 2009.

- Waters, N. Engine health management. Ingenia 2009, 39, 37–42. [Google Scholar]

- Interview with David Gordon, Director of Services Strategy Rolls-Royce Defense. The Innovators, June 2012.

- Ng, I.; Parry, G.; Smith, L.; Maull, R.; Briscoe, G. Transitioning from a goods-dominant to a service-dominant logic. J. Serv. Manag. 2012, 23, 416–439. [Google Scholar] [CrossRef]

- Smith, D.J. “Power-by-the-hour”: The Role of Technology in Re-shaping Business Strategy at Rolls-Royce. Technol. Anal. Strateg. Manag. 2013, 25, 987–1007. [Google Scholar] [CrossRef]

- Rolls-Royce Holdings plc. Annual Report; Rolls-Royce Holdings plc: London, UK, 2014. [Google Scholar]

- Brown, S.J. Internet technology in support of the concept of “communities-of-practice”: The case of Xerox. Account. Manag. Inf. Technol. 1998, 8, 227–236. [Google Scholar]

- Lee, J. Teleservice engineering in manufacturing: Challenges and opportunities. Int. J. Mach. Tools Manuf. 1998, 38, 901–910. [Google Scholar] [CrossRef]

- Hiltzik, M.A. Dealers of Lightning: Xerox PARC and the Dawn of the Computer Age; HarperCollins Publishers: New York, NY, USA, 1999. [Google Scholar]

- Chesbrough, H.; Rosenbloom, R.S. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Wonglimpiyarat, J. The use of strategies in managing technological innovation. Eur. J. Innov. Manag. 2004, 7, 229–250. [Google Scholar] [CrossRef]

- Rothenberg, S. Sustainability through servicizing. MIT Sloan Manag. Rev. 2007. [Google Scholar]

- Baines, T.; Shi, V.G. Servitization transformation: Drivers, benefit and barriers. In Proceedings of the 21st International Annual EurOMA Conference, Palermo, Italy, 20–25 June 2014.

| Period | # Papers | % Papers |

|---|---|---|

| before 2000 | 2 | 1% |

| 2000–2004 | 4 | 3% |

| 2005–2009 | 31 | 22% |

| 2010–2014 | 103 | 74% |

| Total | 140 | 100% |

| Journal | # Papers | % Papers |

|---|---|---|

| Industrial Marketing Management | 19 | 14% |

| Journal of Service Management | 8 | 6% |

| Journal of Manufacturing Technology Management | 8 | 6% |

| Journal of Cleaner Production | 7 | 5% |

| International Journal of Operations and Production Management | 6 | 4% |

| Journal of Business and Industrial Marketing | 6 | 4% |

| International Journal of Production Economics | 5 | 4% |

| European Management Journal | 4 | 3% |

| Managing Service Quality | 4 | 3% |

| CIRP Journal of Manufacturing Science and Technology | 3 | 2% |

| Computers in Industry | 3 | 2% |

| International Journal of Project Management | 3 | 2% |

| Journal of Business-to-Business Marketing | 3 | 2% |

| Lecture Notes in Business Information Processing | 3 | 2% |

| Proceedings of the Institution of Mechanical Engineers, Part B: Journal of Engineering Manufacture | 3 | 2% |

| Service Business | 3 | 2% |

| Service Industries Journal | 3 | 2% |

| Supply Chain Management | 3 | 2% |

| Others (39 different journals) | 46 | 34% |

| Total | 140 | 100% |

| Case | HQ | Strategy | Servitization Pattern | Capabilities Achievement | Servitization Enablers |

|---|---|---|---|---|---|

| APPLE INC. | Cupertino, CA, USA | Exploit digital convergence to create a seamless offering of products and service platforms under proprietary control | Radical approach with transformative effect. Company transformed from failing computer producer to leading consumer electronics provider |

|

|

| CATERPILLAR INC. | Peoria, IL, USA | Take advantage of internal competences to establish dedicated service businesses in new markets. | Radical approach, with an integrative effect. Establishment of a new entity dedicated to spare parts logistics |

|

|

| DELL INC. | Round Rock, TX, USA | Increase customers’ value by enabling a high product customization supported by an innovative operations approach. | Radical approach with transformative effect. DELL became world’s No. 1 PC provider. |

|

|

| General Electric company | Fairfield, CT, USA | Use wide functional portfolio to support cross-functional services and spur dedicated service businesses. Expand horizontally towards new businesses to exploit scale and financial resources | Radical approach with integrative effect. GE Capital becomes GE’s largest BU. |

|

|

| IBM | Armonk, NY, USA | Change company mission and core business from computers and peripherals towards service provision. | Transformative impact, but with a 2 big steps incremental approach. |

|

|

| Rolls-Royce Holdings plc. | London, UK | Increase customers’ value using technological innovations to deliver an innovative and value-adding business model. | Integrative approach, based on two big steps. Integrative impact. |

|

|

| XEROX Corporation | Norwalk, CT, USA | Leverage the leadership in products market in order to integrate and expand on the document management business. | Incremental approach, based on two big steps. Integrative impact. Trial-and-error path. |

|

|

| APPROACH | |||

|---|---|---|---|

| Incremental | Radical | ||

| IMPACT | Transformative | IBM | DELL APPLE |

| Integrative | XEROX ROLLS ROYCE | GE, CAT | |

| Capabilities Achievement Strategy | Companies |

|---|---|

| Internal development | ROLLS ROYCE DELL CAT (Cat Logistics) IBM (step 1) |

| External acquisition | IBM (step 2) XEROX GE |

| Partnering | APPLE CAT (dealers’ network) |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Perona, M.; Saccani, N.; Bacchetti, A. Research vs. Practice on Manufacturing Firms’ Servitization Strategies: A Gap Analysis and Research Agenda. Systems 2017, 5, 19. https://doi.org/10.3390/systems5010019

Perona M, Saccani N, Bacchetti A. Research vs. Practice on Manufacturing Firms’ Servitization Strategies: A Gap Analysis and Research Agenda. Systems. 2017; 5(1):19. https://doi.org/10.3390/systems5010019

Chicago/Turabian StylePerona, Marco, Nicola Saccani, and Andrea Bacchetti. 2017. "Research vs. Practice on Manufacturing Firms’ Servitization Strategies: A Gap Analysis and Research Agenda" Systems 5, no. 1: 19. https://doi.org/10.3390/systems5010019