State-Level Forestry Cost-Share Programs and Economic Impact of Increased Timber Outputs: A South Carolina Case Study

Abstract

:1. Introduction

2. Literature on Forest Cost-Share Programs

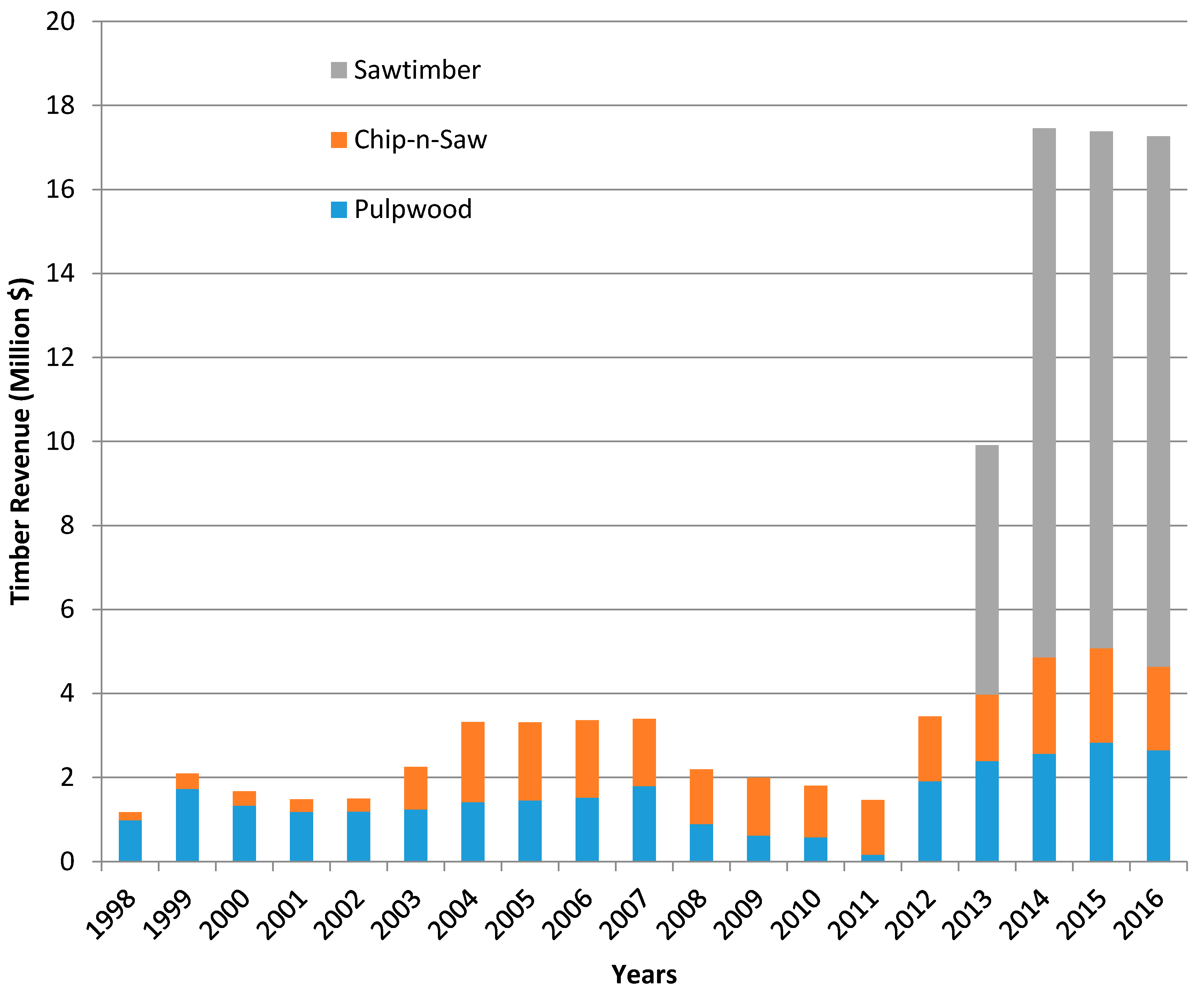

2.1. History and Research on State Cost-Share Programs

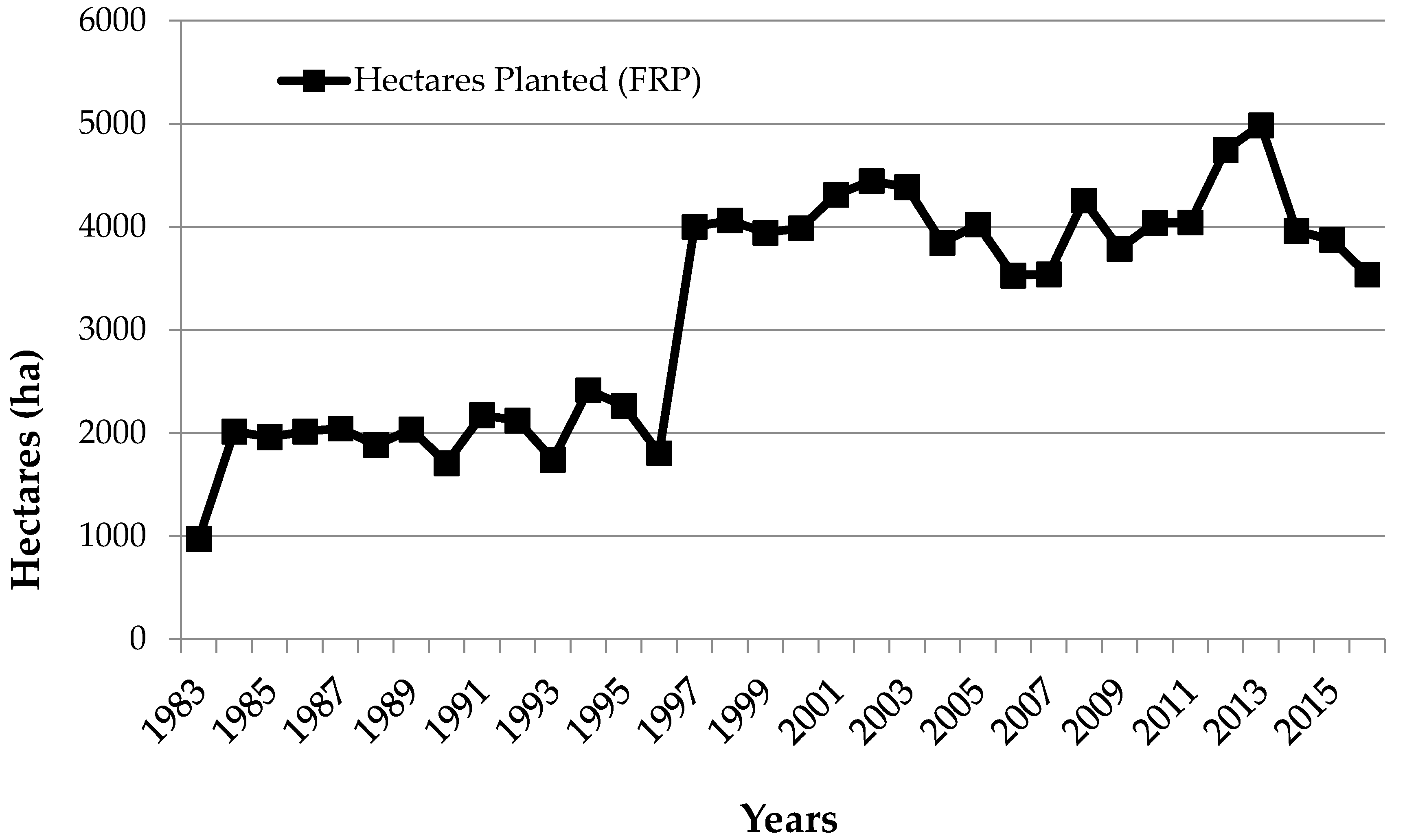

2.2. South Carolina’s Forest Renewal Program

3. Methods: Incremental Yields and Returns

4. Results

5. Discussion

Author Contributions

Conflicts of Interest

Abbreviations

| FFOs | Family Forest Owners |

| FRP | Forest Renewal Program |

| SCFC | South Carolina Forestry Commission |

References

- Cohen, M.A. Public Cost-Share Programs and Private Investment in Forestry in the South. In Proceedings of the Symposium on Non-Industrial Private Forests: A Review of Economic and Policy Studies, Durham, NC, USA, 19–20 April 1983; Royer, J.P., Risbrudt, C.D., Eds.; Duke University, School of Forestry and Environmental Studies: Durham, NC, USA; pp. 181–188.

- Butler, B.J. Family forest owners rule! For. Hist. Today 2011, 17, 87–91. [Google Scholar]

- Kilgore, M.A.; Greene, J.L.; Jacobson, M.G.; Straka, T.J.; Daniels, S.E. The influence of financial incentive programs in promoting sustainable forestry on the nation’s forests. J. For. 2007, 105, 184–191. [Google Scholar]

- Hatcher, J.E.; Straka, T.J.; Greene, J.L. The size of forest holding/parcelization problem in forestry: A literature review. Resources 2013, 2, 39–57. [Google Scholar] [CrossRef]

- Stoddard, C.H., Jr. Future of private forest land ownership in the northern Lake States. J. Land Public Util. Econ. 1942, 18, 267–283. [Google Scholar] [CrossRef]

- Stoddard, C.H. The Small Private Forest in the United States; Resources for the Future, Inc.: Washington, DC, USA, 1961. [Google Scholar]

- Cubbage, F.; Harou, P.; Sills, E. Policy instruments to enhance multi-functional forest management. For. Pol. Econ. 2007, 9, 833–851. [Google Scholar] [CrossRef]

- Straka, T.J.; Bullard, S.H. State cost-share programs for nonindustrial private forestry investments. In Proceedings of the 1986 Society of American Foresters National Convention, Birmingham, AL, USA, 5–8 October 1986; pp. 262–266.

- Haines, T. Federal and State Forestry Cost-Share Assistance Programs: Structure, Accomplishments, and Future Outlook; Research Paper S0-295; USDA Forest Service, Southern Forest Experiment Station: New Orleans, LA, USA, 1995.

- Bullard, S.H.; Gunter, J.E.; Doolittle, M.L.; Arano, K.G. Discount rates for nonindustrial private forest landowners in Mississippi: How high a hurdle? South. J. Appl. For. 2002, 26, 26–31. [Google Scholar]

- Bullard, S.H.; Straka, T.J. Structure and funding of state-level cost-share programs. North. J. Appl. For. 1988, 5, 132–135. [Google Scholar]

- Gregersen, H.; Walker, B. Forestry Incentive Payment Recipients Ten Years Later: A Minnesota Case Study; Station Bulletin 558; University of Minnesota Agricultural Experiment Station: St. Paul, MN, USA, 1985. [Google Scholar]

- Alig, R.J.; Lee, K.J.; Moulton, R.J. Likelihood of Timber Management on Nonindustrial Private Forests: Evidence from Research Studies; General Technical Report SE-60; USDA Forest Service, Southeastern Forest Experiment Station: Asheville, NC, USA, 1990.

- Bullard, S.H.; Moulton, R.J. The Economics of Public Assistance for Private Nonindustrial Timber Sales in Mississippi; Technical Bulletin 147; Mississippi State University, Mississippi Agricultural and Forestry Experiment Station: Starkville, MS, USA, 1988. [Google Scholar]

- Zhang, D.; Flick, W.A. Sticks, carrots, and reforestation investment. Land Econ. 2001, 77, 443–456. [Google Scholar] [CrossRef]

- South Carolina SFI Implementation Committee. A Landowner’s Guide to Forestry in South Carolina; South Carolina Forestry Association: Columbia, SC, USA, 2015. [Google Scholar]

- Mehmood, S.R.; Zhang, D. Causes for continuation of state cost-share programs for nonindustrial private forest landowners. For. Sci. 2002, 48, 471–478. [Google Scholar]

- Folweiler, A.D.; Vaux, H.J. Private forest land ownership and management in the loblolly-shortleaf type of Louisiana. J. For. 1944, 42, 783–790. [Google Scholar]

- James, L.M.; Hoffman, W.P.; Payne, M.A. Private Forest Landownership and Management in Central Mississippi; Technical Bulletin 33; Mississippi State College, Agricultural Experiment Station: Starkville, MS, USA, 1951. [Google Scholar]

- Cloud, M.C. Promoting forest management with owners of medium-sized parcels of land. J. For. 1966, 64, 536–537. [Google Scholar]

- Clawson, M. Forest Policy for the Future: Conflict, Compromise, Consensus; Resources for the Future, Inc.: Washington, DC, USA, 1974. [Google Scholar]

- McKillop, W.L. Social benefits of forestry incentive programs. J. For. 1975, 73, 214–216. [Google Scholar]

- Worrell, A.C.; Irland, L.C. Alternative means for motivating investment in private forestry. J. For. 1975, 73, 206–209. [Google Scholar]

- Sedjo, R.A.; Ostermeier, D.M. Policy Alternatives for Nonindustrial Private Forests; Society of American Foresters: Bethesda, MD, USA, 1978. [Google Scholar]

- Foster, B.B. Taxpayers gain from southern pine regeneration programs. South. J. Appl. For. 1982, 6, 188–194. [Google Scholar]

- Straka, T.J. Taxonomic review of classical and current literature on the perennial American family forest problem. Forests 2011, 2, 660–706. [Google Scholar] [CrossRef]

- Boyd, R. Government support of nonindustrial production: The case of private forests. South. Econ. J. 1984, 51, 88–107. [Google Scholar] [CrossRef]

- Royer, J.P. Reforestation tax incentives and cost-sharing in North Carolina: A question of efficiency. J. Soil Water Conserv. 1987, 42, 191–193. [Google Scholar]

- Bliss, J.C.; Martin, A.J. How tree farmers view management incentives. J. For. 1990, 88, 23–29. [Google Scholar]

- Melfi, F.M.; Straka, T.J.; Marsinko, A.P.; Baumann, J.L. Landowner’s attitudes toward South Carolina’s Forest Stewardship Program. South. J. Appl. For. 1997, 21, 158–163. [Google Scholar]

- Brockett, C.D.; Gerhard, L. NIPF tax incentives: Do they make a difference? J. For. 1999, 97, 16–21. [Google Scholar]

- Kluender, R.A.; Walkingstick, T.L.; Pickett, J.C. The use of forestry incentives by nonindustrial forest landowner groups: Is it time for a reassessment of where we spend our tax dollars? Nat. Resour. J. 1999, 39, 799–818. [Google Scholar]

- Lee, K.J.; Kaiser, H.F.; Alig, A.J. Substitution of public for private funding in planting southern pine. South. J. Appl. For. 1992, 16, 204–208. [Google Scholar]

- Straka, T.J.; Greene, J.L. Reforestation tax incentives under the American Jobs Creation Act of 2004. South. J. Appl. For. 2007, 31, 23–27. [Google Scholar]

- Flick, W.A.; Horton, D.A. Virginia’s reforestation of timberlands program: An economic analysis of the first six years. South. J. Appl. For. 1981, 5, 195–200. [Google Scholar]

- De Steiguer, J.E. Impact of cost-share programs on private reforestation investment. For. Sci. 1984, 30, 697–704. [Google Scholar]

- Mills, T.J.; Cain, D. 1974 Forestry Incentives Program: Indicators of cost-effectiveness. J. For. 1976, 74, 678–683. [Google Scholar]

- Mills, T.J.; Cain, D. Financial efficiency of the 1974 Forestry Incentives Program. J. For. 1979, 77, 661–666. [Google Scholar]

- Dunn, B.A.; Beese, M.J. Structure, Characteristics of Participants and Effectiveness of the Forestry Incentives Program in South Carolina; Forest Research Series No. 31; Clemson University Department of Forestry: Clemson, SC, USA, 1977. [Google Scholar]

- Barber, J.C. Impacts of State and Private Programs on Forest Resources and Industries in the South; Forest Resource Report No. 25; USDA Forest Service: Washington, DC, USA, 1989.

- Henly, R.K.; Ellefson, P.V.; Baughman, M.J. Minnesota’s Private Forestry Assistance Program: An Economic Evaluation; Miscellaneous Publication 58-1988; University of Minnesota Agricultural Experiment Station: St. Paul, MN, USA, 1988. [Google Scholar]

- Risbrudt, C.D.; Ellefson, P.V. An Economic Evaluation of the 1979 Forestry Incentive Program; Station Bulletin 550-1983; University of Minnesota Agricultural Experiment Station: St. Paul, MN, USA, 1988. [Google Scholar]

- Gaddis, D.A.; New, B.D.; Cubbage, F.W.; Abt, R.C.; Moulton, R.C. Accomplishments and Economic Evaluations of the Forestry Incentives Program: A Review; Working Pater No. 78; Southeastern Center for Forest Economics Research: Research Triangle Park, NC, USA, 1997. [Google Scholar]

- MacCleery, D.W. American Forests: A History of Resiliency and Recovery; Forest History Society: Durham, NC, USA, 1993; pp. 53–56. [Google Scholar]

- South Carolina Forestry Commission Cost Share Programs. Available online: http://www.state.sc.us/forest/frpbrochure.pdf (accessed on 8 July 2016).

- South Carolina’s Forest Renewal Program. Available online: https://www.state.sc.us/forest/frpbrochure.pdf (accessed on 24 November 2016).

- Hardie, I.W.; Parks, P.J. Individual choice and regional acreage response to cost-sharing in the South, 1971–1981. For. Sci. 1991, 37, 175–190. [Google Scholar]

- Hardie, I.W.; Parks, P.J. Program enrollment and acreage response to reforestation cost-sharing programs. Land Econ. 1996, 72, 248–260. [Google Scholar] [CrossRef]

- Amacher, G.S.; Conway, M.C.; Sullivan, J. Econometric analysis of nonindustrial forest landowners: Is there anything left to study? J. For. Econ. 2003, 9, 137–164. [Google Scholar]

- Song, N.; Aguilar, F.X.; Butler, B.J. Cost-share program participation and family forest owners’ past and intended future management practices. For. Pol. Econ. 2014, 46, 39–46. [Google Scholar] [CrossRef]

- Samuelson, W.F.; Marks, S.G. Managerial Economics, 7th ed.; John Wiley and Sons, Inc.: Hoboken, NJ, USA, 2012. [Google Scholar]

- Straka, T.J.; Anderson, W.S.; Bullard, S.H. An Economic Appraisal of Service Forester Activities in Mississippi; Technical Bulletin 137; Mississippi State University, Mississippi Agricultural and Forestry Experiment Station: Starkville, MS, USA, 1986. [Google Scholar]

- Barry, J.E. Making Sense of Loblolly Pine Seedling Varieties; FSA5030; University of Arkansas, Division of Agriculture: Fayetteville, AR, USA, 2011. [Google Scholar]

- Amateis, R.L.; Burkhart, H.E.; Allen, H.L.; Montes, C. FASTLOB: A Stand-Level Growth and Yield Model for Fertilized and Thinned Loblolly Pine Plantations; Virginia Tech Department of Forestry: Blacksburg, VA, USA, 2001. [Google Scholar]

- Burk, T.E.; Burkhart, H.E. Diameter Distributions and Yields of Natural Stands of Loblolly Pine; Publication No. FWS-1-84; Virginia Tech School of Forestry and Wildlife Resources: Blacksburg, VA, USA, 2001. [Google Scholar]

- Nicholson, H. Forestry BMPs in South Carolina: Compliance and Implementation monitoring Report, 2011–2014; Best Practices Monitoring Report BMP-9; South Carolina Forestry Commission: Columbia, SC, USA, 2015. [Google Scholar]

- Danskin, S.; Davis, B. Sand Hills State Forest, South Carolina, United States of America. In Forest Plans of North America; Siry, J.P., Bettinger, P., Merry, K., Grebner, D.L., Boston, K., Cieszewski, C., Eds.; Academic Press/Elsevier: Waltham, MA, USA, 2015; pp. 209–215. [Google Scholar]

- South Carolina Forestry Commission Reforestation Records, 1983–2015; South Carolina Forestry Commission: Columbia, SC, USA.

- Hood, H.; Harris, T.; Siry, J.; Smith, J. Timber Mart-South: U.S. South Annual Review: 2015, Timber Prices and Markets; Timber Mart-South: Athens, GA, USA, 2016. [Google Scholar]

- Stimson, R.J.; Stough, R.R.; Roberts, B.H. Regional Economic Development: Analysis and Planning Strategy, 2nd ed.; Springer: New York, NY, USA, 2006. [Google Scholar]

- Divison of Research. Underappreciated Assets: The Economic Impact of South Carolina’s Natural Resources; University of South Carolina, Moore School of Business, Division of Research: Columbia, SC, USA, 2009. [Google Scholar]

- Hughes, D.W. Economic Impact Analysis of SC’s Forestry Sector: Contributions of Forests and Forest Products to the South Carolina Economy; South Carolina Forestry Commission: Columbia, SC, USA, 2015. [Google Scholar]

- Aruna, P.B.; Cubbage, F.W.; Lee, K.J.; Redmond, C. Regional economic contributions of the forest-based industries in the South. For. Prod. J. 1997, 47, 35–45. [Google Scholar]

- Dahal, R.P.; Henderson, J.E.; Munn, I.A. Forest products industry size and economic multipliers in the US South. For. Prod. J. 2015, 65, 372–380. [Google Scholar] [CrossRef]

- Davis, H.C. Regional Economic Impact Analysis and Project Evaluation; UBC Press: Vancouver, BC, Canada, 2001. [Google Scholar]

- Sedjo, R.A. The potential of high-yield plantation forestry for meeting timber needs: Recent performance, future potentials, and environmental implications. New For. 1999, 17, 339–359. [Google Scholar] [CrossRef]

- Straka, T.J.; Phillips, S.L. Incremental Economic Impact of a South Carolina Forestry Commission Forester; Factsheet FNR 111; Clemson University Cooperative Extension: Clemson, SC, USA, 2016. [Google Scholar]

- Prestemon, J.P.; Abt, R.C. Timber products supply and demand. In The Southern Forest Resource Assessment; Wear, D.N., Greis, J.G., Eds.; General Technical Report GTR-SRS-53; USDA Forest Service, Southern Research Station: Asheville, NC, USA, 2002; pp. 299–325. [Google Scholar]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions, 2nd ed.; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Leuschner, W.A. Introduction to Forest Resource Management; John Wiley and Sons: New York, NY, USA, 1984. [Google Scholar]

- Straka, T.J. Timber supply fundamentals for extension forestry professionals. J. Ext. 2010, 48, 4TOT7. Available online: https://www.joe.org/joe/2010august/tt7.php (accessed on 17 January 2017). [Google Scholar]

- Wear, D.N.; Parks, P.J. The economics of timber supply: An analytical synthesis of modeling approaches. Nat. Resour. Model. 1994, 8, 199–203. [Google Scholar]

- London, J.B. The Impact of the Agribusiness Sector on the South Carolina Economy; London & Associates: Clemson, SC, USA, 2015. [Google Scholar]

- Haynes, R.W. An Analysis of the Timber Situation in the United States: 1952–2050; General Technical Report PNW-GTR-560; USDA Forest Service, Pacific Northwest Research Station: Portland, OR, USA, 2003.

| Year | Practice | Timber Yield (Tons per ha) | ||

|---|---|---|---|---|

| Pulpwood | Chip-n-Saw | Sawtimber | ||

| 15 | First Thinning | 94.6 | 6.7 | 0 |

| 20 | Second Thinning | 18.5 | 34.3 | 0 |

| 30 | Final Harvest | 11.1 | 12.1 | 244.1 |

| Year | Practice | Timber Yield (Tons per ha) | ||

|---|---|---|---|---|

| Pulpwood | Chip-n-Saw | Sawtimber | ||

| 25 | Thinning | 94.6 | 0 | 0 |

| 35 | Final Harvest | 62.8 | 93.4 | 92.4 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stoots, B.G.; Straka, T.J.; Phillips, S.L. State-Level Forestry Cost-Share Programs and Economic Impact of Increased Timber Outputs: A South Carolina Case Study. Resources 2017, 6, 4. https://doi.org/10.3390/resources6010004

Stoots BG, Straka TJ, Phillips SL. State-Level Forestry Cost-Share Programs and Economic Impact of Increased Timber Outputs: A South Carolina Case Study. Resources. 2017; 6(1):4. https://doi.org/10.3390/resources6010004

Chicago/Turabian StyleStoots, Brandon G., Thomas J. Straka, and Scott L. Phillips. 2017. "State-Level Forestry Cost-Share Programs and Economic Impact of Increased Timber Outputs: A South Carolina Case Study" Resources 6, no. 1: 4. https://doi.org/10.3390/resources6010004