A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry

Abstract

:1. Introduction

2. Literature Review and Research Framework

2.1. R&D Capability and Absorptive Capacity: Process-Based

2.2. The Impact of R&D Capability and Absorptive Capacity on Innovation Performance: the Structural Model

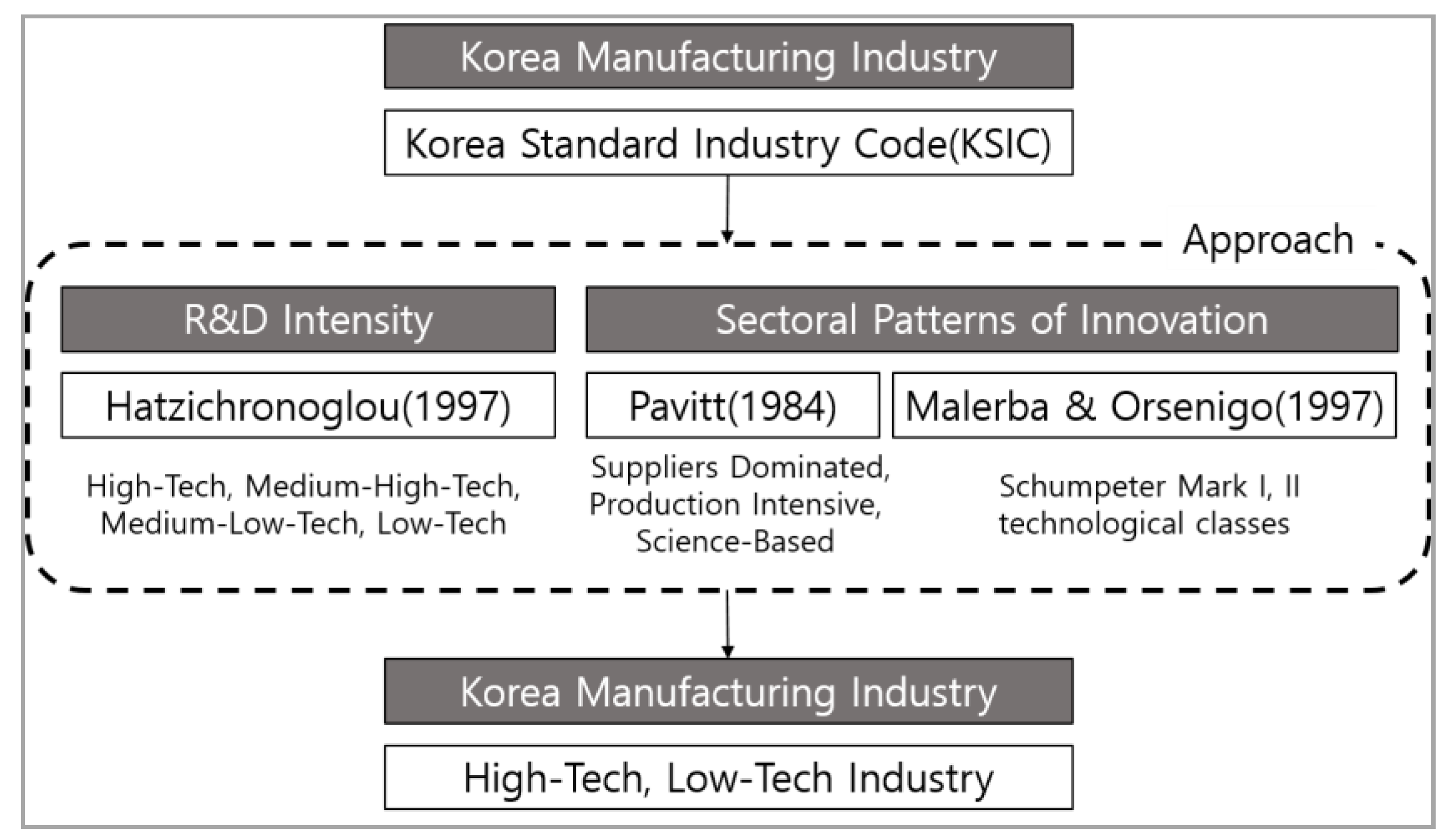

2.3. Necessity of Research by Industrial Sector

3. Method

3.1. Sample Characteristics

3.2. Measures

3.2.1. Internal R&D Capability

3.2.2. External R&D Capability

3.2.3. Potential Absorptive Capacity

3.2.4. Realized Absorptive Capacity

3.2.5. Technological Innovation

3.3. Analysis

4. Results

4.1. General Characteristics of Firms

4.2. Descriptive Statistics and Correlation Verification

4.3. Measurement Model Verification

4.4. Structural Model Verification

4.5. Latent Mean Analysis

4.6. Verification of Diffrence in the Multi-Group Path Coefficients

5. Discussion, Implications and Limitations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lichtenthaler, U.; Ernst, H. External technology commercialization in large firm; result if a quantitative benchmarking study. RD Manag. 2007, 37, 383–397. [Google Scholar] [CrossRef]

- Tsai, K.H.; Wang, J.C. External technology acquisition and firm performance; a longitudinal study. J. Bus. Ventur. 2008, 23, 91–112. [Google Scholar] [CrossRef]

- Tsai, K.H.; Wang, J.C. Does R&D Performance decline with firm size?—A re-examination in terms of elasticity. Res. Policy 2005, 34, 966–976. [Google Scholar]

- Lin, B.W.; Lee, Y.K.; Hung, S.H. R&D intensity and commercialization orientation effect on financial performance. J. Bus. Res. 2006, 59, 679–685. [Google Scholar]

- Kim, S.; Park, C.; Kim, M. Analysis on Innovation Characteristics in Low and Medium Technology Industry. Stepi Policy Res. 2015, 15, 1–105. [Google Scholar]

- Song, H. Comparative Analysis and Implications of R&D Capability of Local Enterprises. Kiet Induatrial Econ. 2009, 10, 50–60. [Google Scholar]

- Yam, R.C.; Guan, J.C.; Pun, K.F.; Tang, E.P. An audit of technological innovation capabilities in Chinese firms: some empirical findings in Beijing, China. Res. Policy 2004, 33, 1123–1140. [Google Scholar] [CrossRef]

- Schoenecker, T.; Swanson, L. Indicators of firm technological capability: validity and performance implications. IEEE Trans. Eng. Manag. 2002, 49, 36–44. [Google Scholar] [CrossRef]

- Romijn, H.; Albaladejo, M. Determinants of innovation capability in small electronics and software firms in southeast England. Res. Policy 2002, 31, 1053–1067. [Google Scholar] [CrossRef]

- Rothwell, R.; Dodgson, M. External linkages and innovation in small and medium-sized enterprises. RD Manag. 1991, 21, 125–138. [Google Scholar] [CrossRef]

- Hagedoorn, J. Trends and patterns in strategic technology partnering since the early seventies. Rev. Ind. Organ. 1996, 11, 601–616. [Google Scholar] [CrossRef]

- Tajudeen, F.P.; Jaafar, N.I.; Sulaiman, A. External Technology Acquisition and External Technology Exploitation: The Difference of Open Innovation Effects. J. Open Innov. Technol. Mark. Complex. 2019, 5, 97. [Google Scholar] [CrossRef] [Green Version]

- Dutta, S.; Narasimhan, O.; Rajiv, S. Success in high-technology markets: Is marketing capability critical? Mark. Sci. 1999, 18, 547–568. [Google Scholar] [CrossRef] [Green Version]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef] [Green Version]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar]

- Duchek, S. Capturing absorptive capacity: A critical review and future prospects. Schmalenbach Bus. Rev. 2013, 65, 312–329. [Google Scholar] [CrossRef]

- Rocha, F. Inter-firm technological cooperation: effects of absorptive capacity, firm-size and specialization. Econ. Innov. New Technol. 1999, 8, 253–271. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E.; Silverman, B.S. Strategic alliances and interfirm knowledge transfer. Strateg. Manag. J. 1996, 17, 77–91. [Google Scholar] [CrossRef] [Green Version]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Absorptive capacity and new product development. J. High Technol. Manag. Res. 2001, 12, 77–91. [Google Scholar] [CrossRef]

- Veugelers, R. Internal R & D expenditures and external technology rcing. Res. Policy 1997, 26, 303–315. [Google Scholar]

- Becker, W.; Peters, J. Technological Opportunities, Absorptive Capacities, and Innovation. 2000. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.196.3245&rep=rep1&type=pdf (accessed on 28 September 2020).

- Keller, W. Absorptive capacity: On the creation and acquisition of technology in development. J. Dev. Econ. 1996, 49, 199–227. [Google Scholar] [CrossRef]

- Gao, S.; Xu, K.; Yang, J. Managerial ties, absorptive capacity, and innovation. Asia Pac. J. Manag. 2008, 25, 395–412. [Google Scholar] [CrossRef]

- Cockburn, I.M.; Henderson, R.M. Absorptive capacity, coauthoring behavior, and the organization of research in drug discovery. J. Ind. Econ. 1998, 46, 157–182. [Google Scholar] [CrossRef]

- George, G.; Zahra, S.A.; Wheatley, K.K.; Khan, R. The effects of alliance portfolio characteristics and absorptive capacity on performance: A study of biotechnology firms. J. High Technol. Manag. Res. 2001, 12, 205–226. [Google Scholar] [CrossRef]

- Fosfuri, A.; Tribó, J.A. Exploring the antecedents of potential absorptive capacity and its impact on innovation performance. Omega 2008, 36, 173–187. [Google Scholar] [CrossRef] [Green Version]

- Szulanski, G. Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strateg. Manag. J. 1996, 17, 27–43. [Google Scholar] [CrossRef]

- Liao, J.; Welsch, H.; Stoica, M. Organizational absorptive capacity and responsiveness: An empirical investigation of growth–oriented SMEs. Entrep. Theory Pract. 2003, 28, 63–86. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Managing potential and realized absorptive capacity: how do organizational antecedents matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef] [Green Version]

- Murovec, N.; Prodan, I. Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation 2009, 29, 859–872. [Google Scholar] [CrossRef]

- Leal-Rodríguez, A.L.; Roldán, J.L.; Ariza-Montes, J.A.; Leal-Millán, A. From potential absorptive capacity to innovation outcomes in project teams: The conditional mediating role of the realized absorptive capacity in a relational learning context. Int. J. Proj. Manag. 2014, 32, 894–907. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development. The OECD Innovation Strategy: Getting a Head Start on Tomorrow; Organization for Economic Cooperation and Development: Paris, France, 2010. [Google Scholar]

- Schumpeter, J. Creative destruction. Cap. Soc. Democr. 1942, 825, 82–85. [Google Scholar]

- Yam, R.C.; Lo, W.; Tang, E.P.; Lau, K. Technological innovation capabilities and firm performance. Int. J. Econ. Manag. Eng. 2010, 4, 1056–1064. [Google Scholar]

- Damanpour, F. Organizational innovation: A meta-analysis of effects of determinants and moderators. Acad. Manag. J. 1991, 34, 555–590. [Google Scholar]

- Utterback, J.M.; Abernathy, W.J. A dynamic model of process and product innovation. Omega 1975, 3, 639–656. [Google Scholar] [CrossRef]

- Tidd, J.; Trewhella, M.J. Organizational and technological antecedents for knowledge acquisition and learning. RD Manag. 1997, 27, 359–375. [Google Scholar] [CrossRef]

- Souitaris, V. Firm–specific competencies determining technological innovation: A survey in Greece. RD Manag. 2002, 32, 61–77. [Google Scholar] [CrossRef]

- Burgelman, R.A.; Christensen, C.M.; Wheelwright, S.C. Strategic Management of Technology and Innovation; McGraw-Hill: New York, NY, USA, 2008. [Google Scholar]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Todorova, G.; Durisin, B. Absorptive capacity: Valuing a reconceptualization. Acad. Manag. Rev. 2007, 32, 774–786. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, M.-J.J.; Chang, C.-H. The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Ind. Mark. Manag. 2009, 38, 152–158. [Google Scholar] [CrossRef]

- Kim, Y. A Study on the Determinants of Technological Innovation in the Korean Manufacturing Firms-Focusing on Technological Regime. J. Ind. Econ. Bus. 2011, 24, 1451–1478. [Google Scholar]

- Malerba, F.; Orsenigo, L. Technological regimes and sectoral patterns of innovative activities. Ind. Corp. Chang. 1997, 6, 83–118. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: towards a taxonomy and a theory. Technol. Manag. Syst. Innov. 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Song, W. Comparative analysis of sectoral innovation pattern. Sci. Technol. Policy 2000, 6, 176–190. [Google Scholar]

- Son, M. A Study on The Role of Competitive. In Strategical Advertisement and R&D in Determining the Market Structure; Yonsei Graduate Scool: Seoul, Korea, 2002. [Google Scholar]

- Scherer, F.M. Industrial Market Structure and Economic Performance, 2nd ed; Rand Mcnally College: Chicago, IL, USA, 1980. [Google Scholar]

- Scherer, F.M. Demand-pull and technological invention: Schmookler revisted. J. Ind. Econ. 1982, 30, 225–237. [Google Scholar] [CrossRef]

- Scott, J. Firm versus industry variability in R&D intensity. In R&D, Patents, and Productivity; University of Chicago Press: Chicago, IL, USA, 1984; pp. 233–248. [Google Scholar]

- Mukhopadhyay, A.K. Technological progress and change in market concentration in the US, 1963–1977. South. Econ. J. 1985, 52, 141–149. [Google Scholar] [CrossRef]

- Hatzichronoglou, T. Revision of the High-Technology Sector and Product Classification. In OECD Science, Technology and Industry Working Papers, No. 1997/02; OECD Publishing: Paris, France, 1997. [Google Scholar]

- Lawrence, M. High-tech industries drive global economic activity. Natl. Sci. Found. 1998, 7, 319–322. [Google Scholar]

- Jang, W.; Jeon, H.; Ahn, J.; Choi, S.; Lee, J.; Lee, J. Measures to Improve the Competitiveness of the Domestic Automobile Industry. VIP Rep. 2018, 722, 1–12. [Google Scholar]

- Yun, J.J.; Jeong, E.; Lee, Y.; Kim, K. The Effect of Open Innovation on Technology Value and Technology Transfer: A Comparative Analysis of the Automotive, Robotics, and Aviation Industries of Korea. Sustainability 2018, 10, 2459. [Google Scholar] [CrossRef] [Green Version]

- Avalos-Quispe, G.A.; Hernández-Simón, L.M. Open Innovation in SMEs: Potential and Realized Absorptive Capacity for Interorganizational Learning in Dyad Collaborations with Academia. J. Open Innov. Technol. Mark. Complex. 2019, 5, 72. [Google Scholar] [CrossRef] [Green Version]

- James, L.R. Aggregation bias in estimates of perceptual agreement. J. Appl. Psychol. 1982, 67, 219. [Google Scholar] [CrossRef]

- Bliese, P.D. Within-group agreement, non-independence, and reliability: Implications for data aggregation and analysis. In Multilevel Theory, Research, and Methods in Organizations: Foundations, Extensions, and New Directions; John Wiley and Sons: Hoboken, NJ, USA, 2000. [Google Scholar]

- Sun, P.Y.; Anderson, M.H. An examination of the relationship between absorptive capacity and organizational learning, and a proposed integration. Int. J. Manag. Rev. 2010, 12, 130–150. [Google Scholar] [CrossRef]

- Kim, M.; Kim, J.; Hong, S. Writing a Dissertation with a Structural Equation Model; Communication Books: Seoul, Korea, 2009. [Google Scholar]

- Vandenberg, R.J.; Lance, C.E. A review and synthesis of the measurement invariance literature: Suggestions, practices, and recommendations for organizational research. Organ. Res. Methods 2000, 3, 4–70. [Google Scholar] [CrossRef]

- Byrne, B.M.; Shavelson, R.J.; Muthén, B. Testing for the equivalence of factor covariance and mean structures: the issue of partial measurement invariance. Psychol. Bull. 1989, 105, 456. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Earlbam Associates: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Teece, D.; Pisano, G. The dynamic capabilities of firms: an introduction. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef] [Green Version]

- Kim, S.; Kim, J. An Exploratory Study on the Performance of Open Product Innovation: Product Innovation Strategy, Source and Partner Contribution Perspectives. Korean J. Bus. Adm. 2011, 24, 685–703. [Google Scholar]

| Category | Measurement | Research | |

|---|---|---|---|

| Input/Output approach | Input | R&D Investment | R&D expenditure(Rocha [18]) R&D Intensity (Cohen and Levinthal [15]; Mowery et al. [19]; Stock et al. [20]) Own R&D department (Veugelers [21]; Becker and Peters [22]) |

| R&D Human Capital | R&D personnel with a doctorate degree (Veugelers [21]) R&D employee divided by total employee (Keller [23]; Gao et al. [24]) | ||

| Output | Patent, Publication | Total publications (Cockburn and Henderson [25]) Patents (George et al. [26]) Cross-citation rate (Mowery et al. [19]) | |

| Process approach | Unidime-nsional | Operating Level | External knowledge to innovation outcomes (Fosfuri and Tribo [27]) Lacks absorptive capacity to internal stickiness (Szulanski [28]) |

| Multidim-ensional | Multidimensional Measurement | Exploration and exploitation of knowledge (Zahra and George [14]; Liao et al. [29], Jansen et al. [30]) Based on scientific /Market information (Murovec and Prodan [31]) | |

| Category | Industry Sector (KSIC* 9th Code) |

|---|---|

| High-tech Industry | chemicals and chemicals (20), medical materials and medicines (21), electronic components, computers, images, acoustics and telecommunications equipment (26), medical, precision, optical instruments and watches (27), automobiles and trailers (30). |

| Low-tech Industry | grocery (10), beverage (11), tobacco (12), textile products: garment products (13), clothing, clothing accessories and fur products (14), leather, bag and shoe (15) wood and wood products: furniture manufacturing (16) pulp, paper and paper (17), printing and recording media reproduction (18) coke, briquettes and non-oil products (29) Rubber and plastic product (22), non-metallic mineral product (23), primary non-ferrous metal (24), metal processing: machinery and furniture exclusion (25), electrical equipment (28), other mechanical equipment (29), transportation equipment (31), furniture (32), other product (33) |

| Latent Variable | Measurement Variable | Items |

|---|---|---|

| Internal R&D Capability | IRC(1) | R&D intensity |

| IRC(2) | Job proficiency level of researcher | |

| IRC(3) | Ratio of full-time researcher | |

| External R&D Capability | ERC(1) | Promote strategic alliances |

| ERC(2) | Introduce relationships with external organizations | |

| Potential Absorptive Capacity | PAC(1) | Immediate response and understanding of customer demands |

| PAC(2) | Sufficient education and training | |

| PAC(3) | Management’s leadership in responding to changes in relation to knowledge exploration | |

| Realized Absorptive Capacity | RAC(1) | Implement in organizational structure, |

| RAC(2) | Use in knowledge management | |

| RAC(3) | Change in quality control methods | |

| Technological Innovation | INNO(1) | Degree of technological changes, |

| INNO(2) | Changes in lines or facilities at the workplace | |

| INNO(3) | Degree of development and introduction of new products |

| Category | Sum (n, %) | Scale (n, %) | Age (n, %) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| ~299 | 300~999 | 1000~1999 | 2000~ | ~10 Yrs | 11~20 Yrs | 20~30 Yrs | 30 Yrs~ | ||

| High-Tech | 138 (39.7) | 70 (50.7) | 56 (40.6) | 9 (6.5) | 3 (2.2) | 1 (0.7) | 24 (17.4) | 35 (25.4) | 86 (62.3) |

| Low-Tech | 210 (60.3) | 106 (50.5) | 76 (36.2) | 13 (6.2) | 15 (7.1) | 1 (0.5) | 27 (12.9) | 32 (15.2) | 157 (74.8) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | |||||||||||||

| 2 | 0.300 ** | 1 | ||||||||||||

| 3 | 0.217 ** | 0.434 ** | 1 | |||||||||||

| 4 | −0.016 | 0.001 | 0.050 | 1 | ||||||||||

| 5 | 0.101 | 0.018 | −0.017 | 0.246 ** | 1 | |||||||||

| 6 | 0.045 * | 0.039 | 0.071 | 0.146 ** | 0.058 | 1 | ||||||||

| 7 | 0.025 * | 0.021 | 0.104 | 0.073 | −0.017 | 0.409 ** | 1 | |||||||

| 8 | 0.031 * | 0.037 | 0.155 ** | 0.089 | −0.002 | 0.309 ** | 0.321 ** | 1 | ||||||

| 9 | 0.033 * | 0.010 | 0.041 | 0.159 ** | 0.085 | 0.234 ** | 0.172 ** | 0.140 ** | 1 | |||||

| 10 | 0.024 | 0.011 | 0.148 ** | 0.190 ** | 0.121 * | 0.126* | 0.087 | 0.194 ** | 0.310 ** | 1 | ||||

| 11 | 0.015 | 0.014 | 0.119 * | 0.126* | 0.139 ** | 0.041 * | 0.089 * | 0.055 * | 0.222 ** | 0.166 ** | 1 | |||

| 12 | 0.117 * | 0.174 ** | 0.179 ** | 0.087 | 0.025 | 0.176 ** | 0.213 ** | 0.267 ** | 0.201 ** | 0.214 ** | 0.122 * | 1 | ||

| 13 | 0.106 * | 0.192 ** | 0.165 ** | 0.194 ** | 0.124* | 0.178 ** | 0.122 * | 0.202 ** | 0.183 ** | 0.149 ** | 0.084 | 0.628 ** | 1 | |

| 14 | 0.036 | 0.143 ** | 0.131 * | 0.112 * | 0.031 | 0.052 | 0.105 | 0.162** | 0.206 ** | 0.189 ** | 0.056 | 0.468 ** | 0.300 ** | 1 |

| M | 1.29 | 2.96 | 0.08 | 0.28 | 0.08 | 3.65 | 3.13 | 3.61 | 0.33 | 0.11 | 0.52 | 2.27 | 2.03 | 2.28 |

| SD | 1.48 | 0.58 | 0.09 | 0.45 | 0.27 | 0.51 | 0.53 | 0.53 | 0.47 | 0.31 | 0.50 | 0.75 | 0.88 | 0.90 |

| SK | −1.68 | −0.09 | 1.92 | 0.96 | 3.17 | −0.14 | −0.12 | −0.05 | 0.72 | 2.57 | −0.08 | −0.07 | 0.22 | 0.13 |

| KU | 3.72 | 1.53 | 3.93 | −1.09 | 8.11 | 0.33 | 0.75 | 0.20 | −1.48 | 4.61 | −2.00 | −0.56 | −1.08 | −0.81 |

| Latent Variable | Measurement Variable | b | S.E | C.R. | β | AVE | CR |

|---|---|---|---|---|---|---|---|

| Internal R&D Capability | IRC(1) | 1.00 | 0.40 | 0.53 | 0.76 | ||

| IRC(2) | 0.51 * | 0.02 | 4.831 | 0.74 | |||

| IRC(3) | 0.35 * | 0.01 | 5.217 | 0.59 | |||

| External R&D Capability | ERC(1) | 1 | 0.66 | 0.67 | 0.79 | ||

| ERC(2) | 0.34 * | 0.13 | 2.530 | 0.38 | |||

| Potential Absorptive Capacity | PAC(1) | 1 | 0.62 | 0.67 | 0.86 | ||

| PAC(2) | 0.96 *** | 0.15 | 6.493 | 0.62 | |||

| PAC(3) | 0.86 *** | 0.14 | 6.283 | 0.54 | |||

| Realized Absorptive Capacity | RAC(1) | 1 | 0.59 | 0.60 | 0.81 | ||

| RAC(2) | 0.79 *** | 0.15 | 5.279 | 0.53 | |||

| RAC(3) | 0.55 ** | 0.13 | 4.228 | 0.34 | |||

| Technological Innovation | INNO(1) | 1 | 0.91 | 0.59 | 0.80 | ||

| INNO(2) | 0.89 *** | 0.09 | 10.108 | 0.69 | |||

| INNO(3) | 0.67 *** | 0.08 | 8.213 | 0.51 |

| Paths | b | β | SE | CR |

|---|---|---|---|---|

| IRD→PAC | 4.847 * | 0.410 | 2.126 | 2.281 |

| IRD→INNO | 15.052 * | 0.613 | 6.024 | 2.498 |

| ERD→PAC | 0.220 * | 0.209 | 0.133 | 2.052 |

| ERD→RAC | 0.375 * | 0.389 | 0.175 | 2.146 |

| ERD→INNO | 0.122 | 0.056 | 0.259 | 0.471 |

| PAC→RAC | 0.354 *** | 0.386 | 0.102 | 3.473 |

| PAC→INNO | 0.031 | 0.015 | 0.306 | 0.103 |

| RAC→INNO | 0.578 * | 0.255 | 0.273 | 2.114 |

| Paths | b | β |

|---|---|---|

| IRD→INNO | 1.143 | 0.047 |

| IRD→RAC | 1.716 * | 0.158 |

| ERD→INNO | 0.268 | 0.123 |

| ERD→RAC | 0.078 | 0.081 |

| PAC→INNO | 0.204 * | 0.098 |

| Model | χ2 | df | χ2/df | NNFI | CFI | RMSEA (90% CI) | Diff. Test | |

|---|---|---|---|---|---|---|---|---|

| Δχ2 | p-Value | |||||||

| Configural invariance (a) | 163.099 * | 134 | 1.217 | 0.941 | 0.956 | 0.025 (0.004~0.038) | ||

| Full Metric invariance (b) | 175.863 * | 143 | 1.230 | 0.937 | 0.951 | 0.026 (0.008~0.038) | 12.764 (b − a) | 0.174 |

| Full Metric and Scalar invariance (c) | 217.134 ** | 157 | 1.383 | 0.895 | 0.910 | 0.033 (0.022~0.044) | 41.271 (c − b) | 0.004 |

| Full Metric and Partial Scalar invariance (d) | 192.266 * | 153 | 1.257 | 0.930 | 0.941 | 0.027 (0.012~0.039) | 16.403 (d − b) | 0.089 |

| Full Metric, Partial Scalar and Full Factor Variance invariance (e) | 209.638 * | 168 | 1.248 | 0.932 | 0.937 | 0.027 (0.012~0.038) | 17.372 (e − d) | 0.297 |

| Latent Variable | High-Tech | Low-Tech | Effect Size(d) | Total M | ||

|---|---|---|---|---|---|---|

| Latent M | M | Latent M | M | |||

| IRD | 0 | 1.55 | −0.186 * | 1.29 | −0.939 | 1.39 |

| ERD | 0 | 0.16 | 0.021 | 0.19 | 0.226 | 0.18 |

| PAC | 0 | 3.45 | 0.014 | 3.47 | 0.122 | 3.46 |

| RAC | 0 | 0.31 | 0.047 | 0.33 | 0.588 | 0.32 |

| INNO | 0 | 2.22 | −0.217 * | 2.16 | −0.493 | 2.19 |

| Model | χ2 | df | χ2/df | NNFI | CFI | RMSEA (90% CI) | Diff. Test | |

|---|---|---|---|---|---|---|---|---|

| Δχ2 | p-Value | |||||||

| Configural invariance (a) | 190.077 ** | 154 | 1.234 | 0.912 | 0.923 | 0.026 (0.010~0.038) | ||

| Full metric invariance (b) | 207.121 ** | 163 | 1.271 | 0.909 | 0.920 | 0.030 (0.016~0.040) | 17.044 | 0.071 |

| Structural invariance (c) | 218.181 ** | 167 | 1.306 | 0.906 | 0.913 | 0.030 (0.018~0.040) | 11.059 | 0.019 |

| Paths | High-Tech | Low-Tech | Δχ2 | Δdf | ||

|---|---|---|---|---|---|---|

| b | β | b | β | |||

| IRD→INNO | 12.125 * | 0.854 | 3.288 * | 0.233 | 4.108 * | 1 |

| PAC→RAC | 0.341 ** | 0.434 | 0.433 ** | 0.426 | 0.227 | 1 |

| PAC→INNO | 0.023 | 0.013 | 0.451 * | 0.207 | 0.260 | 1 |

| ERD→PAC | 0.133 | 0.099 | 0.283 * | 0.338 | 1.175 | 1 |

| IRD→PAC | 3.351 * | 0.418 | 0.063 * | 0.010 | 4.833 * | 1 |

| ERD→INNO | 0.088 | 0.037 | −0.051 | −0.028 | 0.020 | 1 |

| RAC→INNO | 0.279 * | 0.123 | 0.779 * | 0.364 | 0.207 | 1 |

| ERD→RAC | 0.733 * | 0.698 | 0.178 * | 0.209 | 1.229 | 1 |

| All strains | 12.059 | 8 | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.; Choi, S.O. A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry. J. Open Innov. Technol. Mark. Complex. 2020, 6, 100. https://doi.org/10.3390/joitmc6040100

Kim J, Choi SO. A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):100. https://doi.org/10.3390/joitmc6040100

Chicago/Turabian StyleKim, Jaeseong, and Sang Ok Choi. 2020. "A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 100. https://doi.org/10.3390/joitmc6040100