A Structural Time Series Analysis of the Effect of Quantitative Easing on Stock Prices

Abstract

:1. Introduction

2. The Effect of QE on Stock Prices

3. Modelling the Relationship between Stock Prices and Quantitative Easing

4. The Data and Preliminary Analysis

5. Empirical Results

6. Concluding Remarks

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | For more details on the rounds and duration of QE that the Federal Reserve, the Bank of England and the Bank of Japan have implemented, see Farmer (2012), Joyce et al. (2011a, 2011b), Joyce et al. (2012), Joyce and Tong (2012), Kapetanios et al. (2012), Agostini et al. (2016), Greenwood (2017), and Al-Jassar and Moosa (2019). |

| 2 | A model corresponding to the third round of QE that the Bank of England engaged in could not be estimated because of a lack of observations. |

| 3 | One plausible explanation for this result is that perhaps QE becomes effective only after a certain threshold level is met. |

References

- Agostini, Gabriel, Juan P. Garcia, González, J. Álvaro, Laura Muller Jingwen, and Ali Zaidi. 2016. Comparative Study of Central Bank Quantitative Easing Programs. In Report Commissioned for the Markets Group at the Federal Reserve Bank of New York. New York: School of International and Public Affairs (SIPA), Columbia University, pp. 1–168. [Google Scholar]

- Al-Jassar, Sulaiman A., and Imad A. Moosa. 2019. The Effect of Quantitative Easing on Stock Prices: A Structural Time Series Approach. Applied Economics 51: 1817–27. [Google Scholar] [CrossRef]

- Andrés, Javier, J. David López-Salido, and Edward Nelson. 2004. Tobin’s Imperfect Asset Substitution in Optimizing General Equilibrium. Journal of Money, Credit and Banking 36: 665–90. [Google Scholar] [CrossRef] [Green Version]

- Baumeister, Christiane, and Luca Benati. 2013. Unconventional Monetary Policy and the Great Recession: Estimating the Macroeconomic Effects of a Spread Compression at the Zero Lower Bound. International Journal of Central Banking 9: 165–212. [Google Scholar]

- Bernanke, Ben S., and Vincent R. Reinhart. 2004. Conducting monetary policy at very low short-term interest rates. American Economic Review 94: 85–90. [Google Scholar] [CrossRef] [Green Version]

- Blanchard, Olivier J., Christopher G. Collins, Mohammad R. Jahan-Parvar, Thomas Pellet, and Beth A. Wilson. 2018. Why Has the Stock Market Risen So Much Since the US Presidential Election? In International Finance Discussion Papers 1235. Washington, DC: Board of Governors of the Federal Reserve System. [Google Scholar]

- Blinder, Alan S. 2013. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead. New York: Penguin Press, p. 528. [Google Scholar]

- Bosworth, Barry. 1975. The Stock Market and the Economy. Brookings Papers on Economic Activity 6: 257–300. [Google Scholar] [CrossRef]

- Bowman, Kimiko O., and Leonard R. Shenton. 1975. Omnibus Test Contours for Departures from Normality based on and Biometrika 62: 243–50. [Google Scholar] [CrossRef]

- Brunner, Karl, and Allan H. Meltzer. 1973. Mr Hicks and the ‘Monetarists’. Economica 40: 44–59. [Google Scholar] [CrossRef] [Green Version]

- Chen, Han, Vasco Cúrdia, and Andrea Ferrero. 2012. The Macroeconomic Effects of Large-Scale Asset Purchase Programmes. The Economic Journal 122: F289–F315. [Google Scholar] [CrossRef]

- Chen, Nai-Fu, Richard Roll, and Stephen A. Ross. 1986. Economic Forces and the Stock Market. The Journal of Business 59: 383–403. [Google Scholar] [CrossRef] [Green Version]

- Cúrdia, Vasco, and Michael D. Woodford. 2011. The Central-Bank Balance Sheet as an Instrument of Policy. Journal of Monetary Economics 58: 54–79. [Google Scholar] [CrossRef] [Green Version]

- D’Amico, Stefania, and Tim Seida. 2020. Unexpected Supply effects of Quantitative Easing and Tightening. Working Paper No. 2020-17. Chicago: Federal Reserve Bank of Chicago. [Google Scholar]

- Dobbs, Richard, Susan Lund, Tim Koller, and Ari Shwayder. 2013. QE and Ultra-low Interest Rates: Distributional Effects and Risks. McKinsey and Company Discussion Paper. New York: New York Global Institute. [Google Scholar]

- Durbin, James, and G. S. Watson. 1971. Testing for Serial Correlation in Least Squares Regression. Biometrika 58: 1–19. [Google Scholar] [CrossRef]

- Eggertsson, Gauti B., and Michael D. Woodford. 2003. The Zero Bound on Interest Rates and Optimal Monetary Policy. Brookings Papers on Economic Activity 34: 139–211. [Google Scholar] [CrossRef] [Green Version]

- Erb, Claude B., Campbell R. Harvey, and Tadas E. Viskanta. 1995. Country Risk and Global Equity Selection: Country Credit Ratings have Substantial Predictive Power. The Journal of Portfolio Management 21: 74–83. [Google Scholar] [CrossRef]

- Fabo, Brian, Martina Jančoková, Elisabeth Kempf, and L’uboš Pástor. 2021. Fifty Shades of QE: Comparing Findings of Central Bankers and Academics. Working Paper No. 27849. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Fama, Eugene F. 1981. Stock Returns, Real Activity, Inflation, and Money. American Economic Review 71: 545–65. [Google Scholar]

- Fama, Eugene F., and William G. Schwert. 1977. Asset Returns and Inflation. Journal of Financial Economics 5: 115–46. [Google Scholar] [CrossRef]

- Farmer, Roger E. A. 2012. The Effects of Conventional and Unconventional Monetary Policy Rules on Inflation Expectations: Theory and Evidence. Oxford Review of Economic Policy 28: 622–39. [Google Scholar] [CrossRef]

- Feldstein, Martin S. 1980. Inflation and the Stock Market. American Economic Review 70: 839–47. [Google Scholar]

- Firth, Michael. 1979. The Relationship between Stock Market Returns and Rates of Inflation. The Journal of Finance 34: 743–49. [Google Scholar] [CrossRef]

- Fischbacher, Urs, Thorsten Hens, and Stefan Zeisberger. 2013. The Impact of Monetary Policy on Stock Market Bubbles and Trending Behavior: Evidence from the Lab. Journal of Economic Dynamics and Control 37: 2104–22. [Google Scholar] [CrossRef]

- Florackis, Chris, Gianluigi Giorgioni, Alexandros Kostakis, and Costas Milas. 2014. On Stock Market Illiquidity and Real-Time GDP Growth. Journal of International Money and Finance 44: 210–29. [Google Scholar] [CrossRef]

- Friedman, Milton, and Anna J. Schwartz. 1971. A Monetary History of the United States, 9th ed. Princeton: Princeton University Press, p. 888. [Google Scholar]

- Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. The Financial Market effects of the Federal Reserve’s Large-Scale Asset Purchases. International Journal of Central Banking 7: 3–43. [Google Scholar]

- Galí, Jordi, and Luca Gambetti. 2015. The Effects of Monetary Policy on Stock Market Bubbles: Some Evidence. American Economic Journal: Macroeconomics 7: 233–57. [Google Scholar] [CrossRef] [Green Version]

- Geske, Robert, and Richard Roll. 1983. The Fiscal and Monetary Linkage between Stock Returns and Inflation. The Journal of Finance 38: 1–33. [Google Scholar] [CrossRef]

- Greenwood, John. 2017. The Japanese Experience with QE and QQE. The Cato Journal 37: 17–38. [Google Scholar]

- Hamburger, Michael J., and Levis A. Kochin. 1972. Money and Stock Prices: The Channels of Influences. The Journal of Finance 27: 231–49. [Google Scholar] [CrossRef]

- Harvey, Andrew C. 1985. Trends and Cycles in Macroeconomic Time Series. Journal of Business and Economic Statistics 3: 216–27. [Google Scholar]

- Harvey, Andrew C. 1989. Forecasting Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge University Press. [Google Scholar]

- Homa, Kenneth E., and Dwight M. Jaffe. 1971. The Supply of Money and Common Stock Prices. The Journal of Finance 26: 1045–66. [Google Scholar] [CrossRef]

- Hubble, Neil. 2013. Does QE Drive the Stock Market? November 13. Available online: http://www.dailyreckoning.com.au/does-qe-drive-the-stock-market/2013/11/13/ (accessed on 1 May 2022).

- Joyce, Michael A. S., David Miles, Andrew Scott, and Dimitri Vayanos. 2012. Quantitative Easing and Unconventional Monetary Policy—An Introduction. The Economic Journal 122: F271–F288. [Google Scholar] [CrossRef] [Green Version]

- Joyce, Michael A. S., Ana Lasaosa, Ibrahim Stevens, and Matthew Tong. 2011a. The Financial Market Impact of Quantitative Easing. International Journal of Central Banking 7: 113–61. [Google Scholar] [CrossRef]

- Joyce, Michael A. S., and Matthew Tong. 2012. QE and the Gilt Market: A Disaggregated Analysis. The Economic Journal 122: F348–F384. [Google Scholar] [CrossRef]

- Joyce, Michael A. S., Matthew Tong, and Robert Woods. 2011b. The United Kingdom’s Quantitative Easing Policy: Design, Operation and Impact. Bank of England Quarterly Bulletin 51: 200–12. [Google Scholar]

- Kapetanios, George, Haroon Mumtaz, Ibrahim Stevens, and Konstantinos Theodoridis. 2012. Assessing the Economy-Wide Effects of Quantitative Easing. The Economic Journal 122: F316–F347. [Google Scholar] [CrossRef] [Green Version]

- Kaul, Gautam. 1987. Stock Returns and Inflation: The Role of the Monetary Sector. Journal of Financial Economics 18: 253–76. [Google Scholar] [CrossRef] [Green Version]

- Koopman, Siem J., Andrew C. Harvey, Jurgen A. Doornik, and Neil Shephard. 2000. STAMP 6.30: Structural Time Series Analyser, Modeller and Predictor. London: Timberlake Consultants Press. [Google Scholar]

- Krishnamurthy, Arvind, and Annette Vissing-Jorgensen. 2011. The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy. Brookings Papers on Economic Activity 42: 215–88. [Google Scholar] [CrossRef] [Green Version]

- Lenzner, Robert. 2014. The Bull Market Will be Over When QE Ends. Forbes, June 20. [Google Scholar]

- Lintner, John. 1975. Inflation and Security Returns. The Journal of Finance 30: 259–80. [Google Scholar]

- Lintner, John. 1978. Inflation and Common Stock Prices in a Cyclical Context. In Modern Developments in Investment Management: A Book of Readings. Edited by James Lorey and Richard A. Brealey. Hinsdale: Dryden, pp. 669–82. [Google Scholar]

- Ljung, Greta M., and George E. P. Box. 1978. On a Measure of Lack of Fit in Time Series Models. Biometrika 65: 297–303. [Google Scholar] [CrossRef]

- Lucca, David O., and Johnathan H. Wright. 2022. The Narrow Channel of Quantitative Easing: Evidence from YCC Down Under; Staff Report No. 1013. New York: Federal Reserve Bank of New York.

- Newman, Rick. 2012. Why Wall Street Loves Quantitative Easing. US News and World Report, September 12. [Google Scholar]

- Olsen, James L. 2014. The Impact of Quantitative Easing on Equity Prices. Journal of Financial Planning 27: 52–60. [Google Scholar]

- Palley, Thomas I. 2011. Quantitative Easing: A Keynesian Critique. Investagación Económica 70: 69–86. [Google Scholar] [CrossRef]

- Pearce, Douglas K. 1983. Stock Prices and the Economy. Federal Reserve Bank of Kansas City Economic Review 68: 7–22. [Google Scholar]

- Ritholtz, Barry. 2013. How Much Is QE Driving Equity Markets? (Hint: Not 100%). October 23. Available online: http://www.ritholtz.com/blog/2013/10/how-much-is-qe-driving-equity-markets-hint-not-100/ (accessed on 1 May 2022).

- Szczerbowicz, Urszula. 2015. The ECB Unconventional Monetary Policies: Have They Lowered Market Borrowing Costs for Banks and Governments? International Journal of Central Banking 11: 91–127. [Google Scholar]

- Tobin, James. 1961. Money, Capital and other Stores of Value. American Economic Review: Papers and Proceedings 51: 26–37. [Google Scholar]

- Tobin, James. 1963. An Essay on the Principles of Debt Management. In Commission on Money and Credit, Fiscal and Debt Management Policies. Englewood Cliffs: Prentice Hall, pp. 143–218. [Google Scholar]

- Tobin, James. 1969. A General Equilibrium Approach to Monetary Theory. Journal of Money, Credit and Banking 1: 15–29. [Google Scholar] [CrossRef]

- Wallace, Neil. 1981. A Modigliani-Miller Theorem for Open-Market Operations. American Economic Review 71: 267–74. [Google Scholar]

- Wright, Johnathan H. 2012. What does Monetary Policy do at the Zero Lower Bound? The Economic Journal 122: F447–F466. [Google Scholar] [CrossRef]

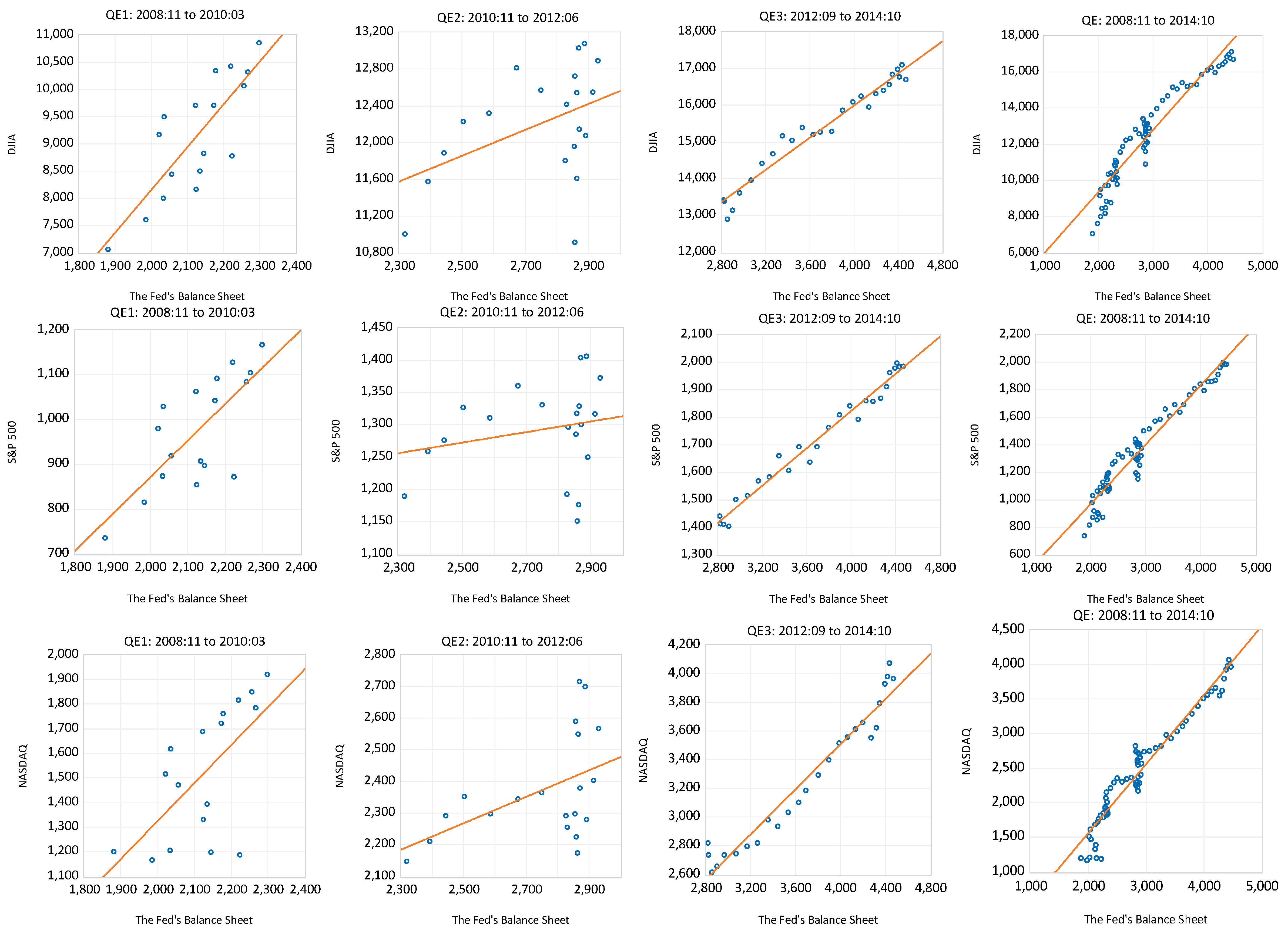

| Operation: | From: | To: | % Δ in BS | % Δ in DJIA | % Δ in S&P500 | % Δ in NASDAQ | % Δ in FTSE100 | % Δ in NIKKEI225 |

|---|---|---|---|---|---|---|---|---|

| The Federal Reserve | ||||||||

| QE1 | 2008:11 | 2010:03 | 12.52 | 22.97 | 30.16 | 60.18 | ||

| (t-statistic) | 0.808 (5.317) *** | 0.739 (4.253) *** | 0.645 (3.268) *** | |||||

| QE2 | 2010:11 | 2012:06 | 23.52 | 13.98 | 11.74 | 18.69 | ||

| (t-statistic) | 0.441 (2.082) * | 0.218 (0.946) | 0.483 (2.340) ** | |||||

| QE3 | 2012:09 | 2014:10 | 58.62 | 24.47 | 37.79 | 40.54 | ||

| (t-statistic) | 0.979 (23.564) *** | 0.988 (31.481) *** | 0.974 (20.862) *** | |||||

| QE | 2008:11 | 2014:10 | 108.37 | 51.98 | 60.75 | 135.26 | ||

| (t-statistic) | 0.953 (26.254) *** | 0.967 (31.950) *** | 0.966 (31.043) *** | |||||

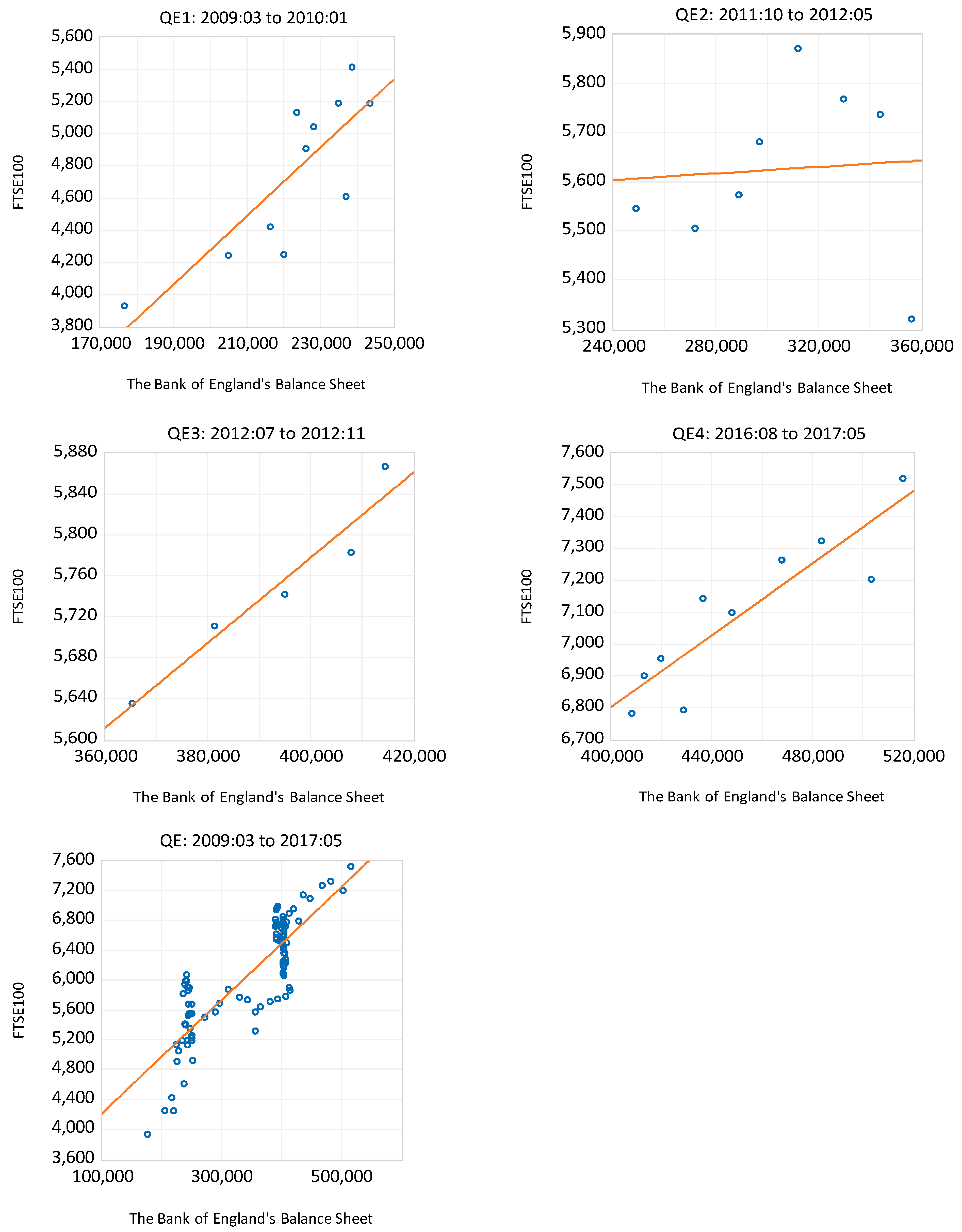

| Bank of England | ||||||||

| QE1 | 2009:03 | 2010:01 | 37.99 | 32.15 | ||||

| (t-statistic) | 0.821 (4.307) *** | |||||||

| QE2 | 2011:10 | 2012:05 | 43.15 | −4.03 | ||||

| (t-statistic) | 0.069 (0.167) | |||||||

| QE3 | 2012:07 | 2012:11 | 13.47 | 4.11 | ||||

| (t-statistic) | 0.966 (6.520) *** | |||||||

| QE4 | 2016:08 | 2017:05 | 26.43 | 10.89 | ||||

| (t-statistic) | 0.898 (5.794) *** | |||||||

| QE | 2009:03 | 2017:05 | 219.05 | 84.20 | ||||

| (t-statistic) | 0.847 (15.669) *** | |||||||

| Bank of Japan | ||||||||

| QE1 | 2010:10 | 2013:03 | 35.74 | 29.50 | ||||

| (t-statistic) | 0.229 (1.243) | |||||||

| QE2 | 2013:03 | 2016:06 | 162.58 | 31.24 | ||||

| (t-statistic) | 0.737 (6.722) *** | |||||||

| QE | 2010:10 | 2016:06 | 256.42 | 69.95 | ||||

| (t-statistic) | 0.900 (16.857) *** | |||||||

| Component | QE1 | QE2 | QE3 | QE |

|---|---|---|---|---|

| Dow Jones Industrial Average | ||||

| −4.443 | 7.061 *** | −0.655 | −1.716 | |

| (−1.495) | (4.021) | (−0.248) | (−0.695) | |

| 0.014 * | 0.002 | −0.004 | 3.60 × 10−4 | |

| (1.876) | (1.200) | (−1.046) | (0.079) | |

| −0.042 ** | 0.007 | 0.005 | 8.79 × 10−3 | |

| (−2.460) | (1.080) | (0.410) | (0.440) | |

| 0.028 | −0.058 *** | −0.011 | −2.53 × 10−3 | |

| (1.657) | (−8.738) | (−0.909) | (−0.125) | |

| 0.940 *** | 0.159 | 0.678 *** | 0.747 *** | |

| (4.644) | (1.350) | (3.948) | (4.632) | |

| −6.463 | −7.700 | −8.346 | −6.732 | |

| −6.267 | −7.501 | −8.152 | −6.605 | |

| 1.850 | 2.167 | 1.873 | 1.968 | |

| 0.9430 | 0.8962 | 0.9787 | 0.9787 | |

| 0.741 | 0.100 | 0.490 | 0.168 | |

| 12.02 *** | 2.342 | 6.271 ** | 14.58 ** | |

| 0.361 | 19.374 *** | 0.217 | 2.102 | |

| S&P500 | ||||

| −4.619 | −8.960 ** | −1.171 | −0.959 | |

| (−1.739) | (−2.130) | (−0.453) | (−0.368) | |

| 0.020 *** | −0.008 ** | 0.003 | 0.006 * | |

| (10.002) | (−2.420) | (0.884) | (1.710) | |

| −0.042 *** | 0.069 *** | −0.001 | 0.001 | |

| (−4.057) | (6.824) | (−0.088) | (0.068) | |

| 0.035 *** | −0.061 *** | −9.00 × 10−5 | −6.00 × 10−5 | |

| (3.102) | (−4.104) | (−0.007) | (−0.003) | |

| 0.800 *** | 1.081 *** | 0.573 *** | 0.559 *** | |

| (4.405) | (3.838) | (3.407) | (3.283) | |

| −6.678 | −6.887 | −7.759 | −6.401 | |

| −6.482 | −6.688 | −7.565 | −6.274 | |

| 1.675 | 2.253 | 2.122 | 1.833 | |

| 0.9600 | 0.8090 | 0.9793 | 0.9761 | |

| 0.391 | 1.252 | 0.208 | 0.280 | |

| 2.325 | 4.544 ** | 5.441 ** | 18.29 *** | |

| 1.190 | 15.198 *** | 0.865 | 0.559 | |

| NASDAQ | ||||

| 3.148 | 8.315 | −8.334 | 5.971 ** | |

| (1.458) | (1.070) | (−0.941) | (2.220) | |

| 0.032 *** | 0.009 | 0.002 | 0.015 *** | |

| (22.136) | (1.283) | (0.199) | (3.490) | |

| −0.050 *** | −0.001 | −0.004 | −0.012 | |

| (−6.331) | (−0.018) | (−0.178) | (−0.766) | |

| 0.002 *** | −0.032 | −0.004 | 0.026 | |

| (0.194) | (−0.636) | (−0.156) | (1.629) | |

| 0.304 * | −0.032 | 1.086 * | 0.152 | |

| (2.057) | (−0.061) | (1.878) | (0.866) | |

| −7.255 | −6.306 | −7.205 | −6.674 | |

| −7.059 | −6.107 | −7.012 | −6.548 | |

| 2.370 | 2.361 | 1.641 | 1.990 | |

| 0.9882 | 0.7674 | 0.9756 | 0.9898 | |

| 0.408 | 1.220 | 1.217 | 0.323 | |

| 2.373 | 1.868 | 2.614 | 16.747 *** | |

| 0.194 | 0.994 | 1.110 | 4.485 | |

| Component | QE1 | QE2 | QE3 | QE4 | QE |

|---|---|---|---|---|---|

| 6.720 ** | 10.942 | NA | 9.324 | 6.808 | |

| (2.529) | (1.224) | NA | (1.544) | (3.954) | |

| 0.021 | −0.058 | NA | 0.012 | 0.005 | |

| (1.754) | (−1.366) | NA | (0.803) | (1.255) | |

| −0.007 | 0.000 | NA | −0.000 | −0.003 | |

| (−0.771) | (0.005) | NA | (−0.003) | (−0.267) | |

| −0.024 ** | −0.000 | NA | 0.000 | 0.003 | |

| (−2.643) | (−0.002) | NA | (0.001) | (0.276) | |

| 0.148 | −0.185 | NA | −0.031 | 0.161 | |

| (0.694) | (−0.264) | NA | (−0.068) | (1.228) | |

| −6.533 | −5.986 | NA | −7.149 | −6.334 | |

| −6.388 | −5.946 | NA | −7.028 | −6.529 | |

| 1.614 | 1.490 | NA | 2.310 | 1.994 | |

| 0.9493 | 0.3217 | NA | 0.7262 | 0.9283 | |

| 0.521 | 285.150 ** | NA | 2.136 ** | 0.434 | |

| 4.263 ** | 1.384 | NA | 9.553 *** | 10.585 | |

| 0.858 | 0.604 | NA | 0.091 | 4.996 |

| Component | QE1 | QE2 | QE |

|---|---|---|---|

| 13.057 *** | 4.254 | 12.043 *** | |

| (4.306) | (0.464) | (3.336) | |

| 0.063 * | −0.010 | 0.005 | |

| (2.000) | (−0.642) | (0.344) | |

| 0.011 | −0.071 *** | −0.093 | |

| (0.186) | (−2.782) | (−0.731) | |

| 0.024 | 0.003 | −0.092 | |

| (0.416) | (0.134) | (−0.745) | |

| −0.255 | 0.361 | −0.148 | |

| (−1.205) | (0.602) | (−0.629) | |

| −5.919 | −5.920 | −5.886 | |

| −5.732 | −5.751 | −5.756 | |

| 1.656 | 1.543 | 1.934 | |

| 0.7628 | 0.8842 | 0.9721 | |

| 0.497 | 1.232 | 1.220 | |

| 20.566 | 22.138 | 12.275 | |

| 1.456 | 3.075 | 2.883 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tawadros, G.B.; Moosa, I.A. A Structural Time Series Analysis of the Effect of Quantitative Easing on Stock Prices. Int. J. Financial Stud. 2022, 10, 114. https://doi.org/10.3390/ijfs10040114

Tawadros GB, Moosa IA. A Structural Time Series Analysis of the Effect of Quantitative Easing on Stock Prices. International Journal of Financial Studies. 2022; 10(4):114. https://doi.org/10.3390/ijfs10040114

Chicago/Turabian StyleTawadros, George B., and Imad A. Moosa. 2022. "A Structural Time Series Analysis of the Effect of Quantitative Easing on Stock Prices" International Journal of Financial Studies 10, no. 4: 114. https://doi.org/10.3390/ijfs10040114