Policy Impact on the Chinese Stock Market: From the 1994 Bailout Policies to the 2015 Shanghai-Hong Kong Stock Connect

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data Description

3.2. Methodology

4. Empirical Analysis

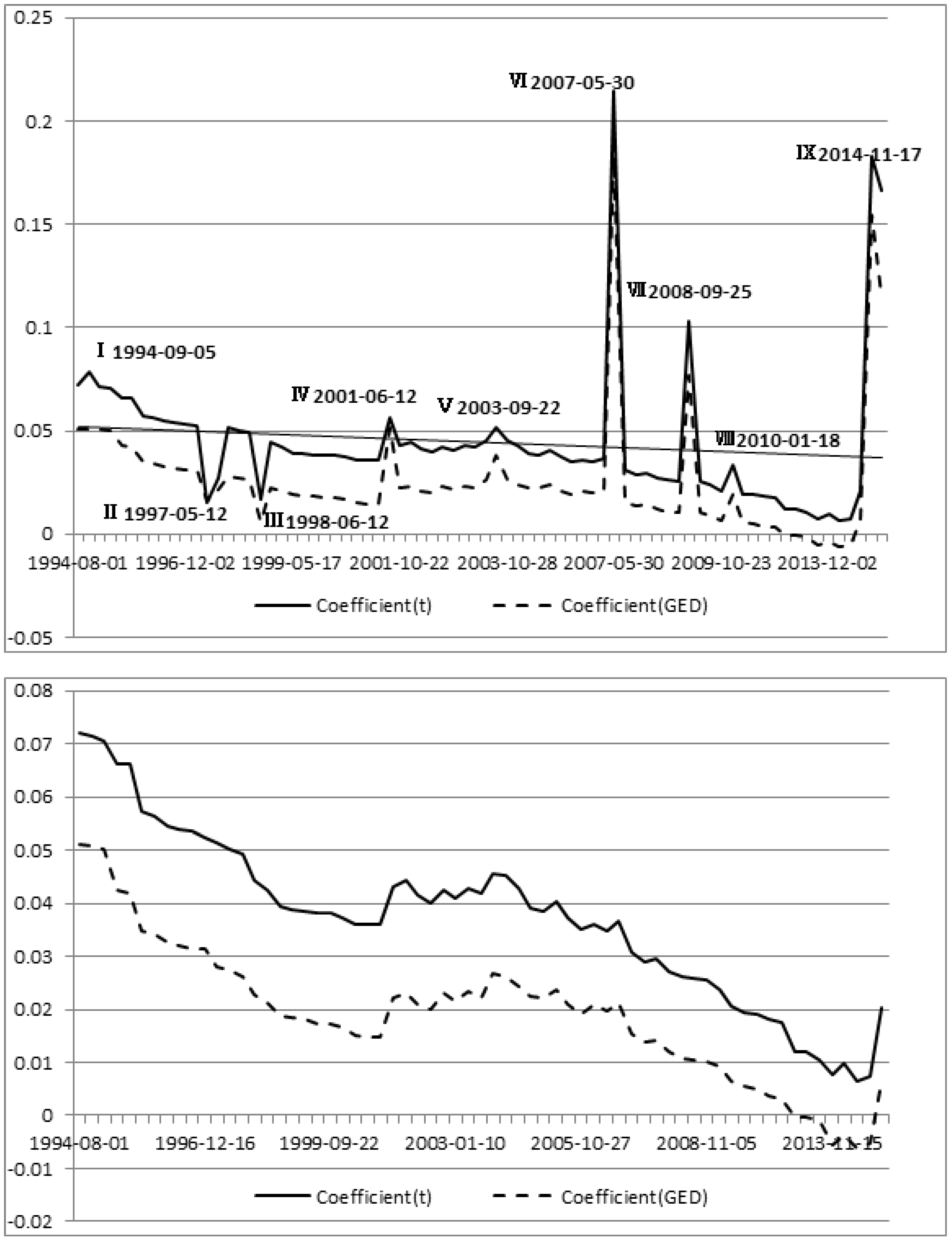

4.1. Analysis of Policies with Extreme Volatility

4.2. Analysis of Policy Stages

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- K.M. Chan, and S.S. Kwok. “Capital account liberalization and dynamic price discovery: Evidence from Chinese cross-listed stocks.” Appl. Econ. 48 (2016): 517–535. [Google Scholar] [CrossRef]

- J. Wang, J. Zhu, and F. Dou. “Who Plays the Key Role among Shanghai, Shenzhen and Hong Kong Stock Markets? ” China World Econ. 20 (2012): 102–120. [Google Scholar] [CrossRef]

- X. Chen, and Y.-W. Cheung. “Renminbi Going Global.” China World Econ. 19 (2011): 1–18. [Google Scholar] [CrossRef]

- J. Hua, and B. Sanhaji. “Volatility spillovers across daytime and overnight information between China and world equity markets.” Appl. Econ. 47 (2015): 5407–5431. [Google Scholar] [CrossRef]

- F. Wu, R. Pan, and D. Wang. “Renminbi’s Potential to Become a Global Currency.” China World Econ. 18 (2010): 63–81. [Google Scholar] [CrossRef]

- Y.-C. Wang, J.-J. Tsai, and W. Liu. “The impact of volatility index on China’s stock market.” J. Bus. Econ. 6 (2014): 23–46. [Google Scholar]

- W. Guo, M. Deng, and Q. Dong. “Chinese stock market’s jumping characteristics under the major events.” Syst. Eng. Theory Pract. 33 (2013): 308–316. [Google Scholar]

- K.C. Chan, and C.-H. Chang. “Analysis of Bond, Real Estate, and Stock Market Returns in China.” Chin. Econ. 47 (2014): 27–40. [Google Scholar] [CrossRef]

- J. Ma, D. Tang, and M. Wang. “An empirical study of policy effects of China’s stock market.” Enterp. Econ. 28 (2007): 169–171. [Google Scholar]

- Y. Du. “Empirical analysis of policy effect on Chinese stock market’s fluctuating.” Econ. Res. Guide 5 (2009): 88–90. [Google Scholar]

- J.-J. Tsai, Y.-C. Wang, and K. Weng. “The asymmetry and volatility of the Chinese stock market caused by the “New National Ten”.” Emerg. Mark. Finance Trade 51 (2015): S86–S98. [Google Scholar] [CrossRef]

- J.E. Stiglitz. “The role of the state in financial markets.” World Bank Econ. Rev. 7 (1993): 19–52. [Google Scholar] [CrossRef]

- Z.H. Lu. “Study on China’s stock market regulation policy.” J. Quant. Tech. Econ. 23 (2006): 14–23. [Google Scholar]

- X.-N. He. “A literature review on the policy market of China’s stock market.” Int. Econ. Trade Res. 25 (2009): 52–58. [Google Scholar]

- J. Stiglitz, and J. Long. “Balance between market mechanism and government intervention.” China Finance 8 (2004): 17–19. [Google Scholar]

- L. Gao, and G. Kling. “Regulatory changes and market liquidity in Chinese stock markets.” Emerg. Mark. Rev. 7 (2006): 162–175. [Google Scholar] [CrossRef]

- G. Li. “China’s Stock Market: Inefficiencies and Institutional Implications.” China World Econ. 16 (2008): 81–96. [Google Scholar] [CrossRef]

- H. Guo, and H.-G. Fung. “Growth Enterprise Board Initial Public. Offerings: Characteristics, Volatility and the Initial-day Performance.” China World Econ. 19 (2011): 106–121. [Google Scholar] [CrossRef]

- M. Holmén, and P. Wang. “Pyramid IPOs on the Chinese growth enterprise market.” Emerg. Mark. Finance Trade 51 (2015): 160–173. [Google Scholar] [CrossRef]

- H. Fung, Q. Liu, and J. Yau. “Financing Alternatives for Chinese Small and Medium Enterprises: The Case for a Small and Medium Enterprise Stock Market.” China World Econ. 15 (2007): 26–42. [Google Scholar] [CrossRef]

- L. Han, and Y. Tang. “The causation and countermeasure policy of the “policy market phenomenon” in China stock market.” Sci. Econ. Soc. 20 (2002): 36–39. [Google Scholar]

- C. Wang, S. Li, and L. Kang. “Empirical study on the phenomenon of over-reaction and “policy market” in Chinese stock market.” J. Northwest Agric. For. Univ. 3 (2003): 20–24. [Google Scholar]

- W. Peng, and J. Xiao. “The policies for stock market and the fluctuations of stock market.” Shanghai Econ. Rev. 21 (2002): 43–49. [Google Scholar]

- H. Zou, L. Tang, and G. Yuan. “The influence policy factors on China’s stock market: The game analysis of government and stock market.” J. World Econ. 23 (2000): 20–28. [Google Scholar]

- J. Xu, and Q. Li. “An empirical analysis of the impact of macroeconomic policy on China’s stock market.” Econ. Res. J. 47 (2001): 12–21. [Google Scholar]

- C. Zhang, and J. Clovis. “Financial Market Turmoil: Implications for Monetary Policy Transmission in China.” China World Econ. 17 (2009): 1–22. [Google Scholar] [CrossRef]

- M. Ivrendi, and B. Guloglu. “Changes in stock price volatility and monetary policy regimes: Evidence from Asian countries.” Emerg. Mark. Finance Trade 48 (2012): S54–S70. [Google Scholar] [CrossRef]

- J. Gang, and Z. Qian. “China’s monetary policy and systemic risk.” Emerg. Mark. Finance Trade 51 (2015): 701–713. [Google Scholar] [CrossRef]

- H. Chen, J. Chong, C. Lu, and K. Wang. “The effectiveness of regulatory policy changes on the volatility dynamics of the Chinese stock markets.” Chin. Econ. 41 (2008): 5–23. [Google Scholar] [CrossRef]

- S. Green. China’s Stock Market: A Guide to Its Progress, Players and Prospects. New York, NY, USA: Bloomberg Press, 2003. [Google Scholar]

- S.N. Neftci, and M.Y. Ménager-Xu. China’s Financial Markets: An Insider’s Guide to How the Markets Work. Burlington, MA, USA: San Diego, CA, USA: London, UK: Elsevier Academic Press, 2007. [Google Scholar]

- J. Ni, M.E. Wohar, and B. Wang. “Structural breaks in volatility: The case of Chinese stock returns.” Chin. Econ. 49 (2016): 81–93. [Google Scholar] [CrossRef]

- J.Q. Chen, H.B. Cai, and H.B. Li. “The regulation of stock market and the stock market cycle in China.” J. Finance Econ. 29 (2014): 107–118. [Google Scholar]

- X. Lv, W. Dong, and F. Fang. “The asymmetric effects of official interest rate changes on China’s stock market during different market regimes.” Emerg. Mark. Finance Trade 51 (2015): 826–841. [Google Scholar] [CrossRef]

- J. Yang, Z. Yang, and Y. Zhou. “Intraday price discovery and volatility transmission in stock index and stock index futures markets: Evidence from China.” J. Futures Mark. 32 (2012): 99–121. [Google Scholar] [CrossRef]

- Z. Peng, Q. Tang, and K. Wang. “Adjustment of the stamp duty on stock transactions and its effect on the Chinese stock market.” Emerg. Mark. Finance Trade 50 (2014): 183–196. [Google Scholar] [CrossRef]

- L.-R. Wang, and C.-H. Shen. “Do foreign investments affect foreign exchange and stock markets—The case of Taiwan.” Appl. Econ. 31 (1999): 1303–1314. [Google Scholar] [CrossRef]

- Y. Su, and L. Zheng. “The impact of securities transaction taxes on the Chinese stock market.” Emerg. Mark. Finance Trade 47 (2011): S32–S46. [Google Scholar] [CrossRef]

- P.G. Diacogiannis, N. Patsalis, N.V. Tsangarakis, and E.D. Tsiritakis. “Price limits and overreaction in the Athens stock exchange.” Appl. Financial Econ. 15 (2005): 53–61. [Google Scholar] [CrossRef]

- K. Li, T. Wang, Y.-L. Cheung, and P. Jiang. “Privatization and Risk Sharing: Evidence from the Split Share Structure Reform in China.” Rev. Financial Stud. 24 (2011): 2499–2525. [Google Scholar] [CrossRef]

- H.F. Yan, and Q. Dong. “Analysis of the impact of the CSI 300 stock index futures on the volatility of Chinese spot market with high frequency trading data.” Secur. Futur. China 1 (2011): 14–15. [Google Scholar]

- H.Y. Tang. “Research on risk conduction mechanism between futures market and spot market.” China J. Commer. 26 (2016): 63–64. [Google Scholar]

- J. Luo, and Y. Wang. “The impact of stock index futures on the volatility and liquidity of stock market: Based on the experience of Chinese market.” Macroeconomics 6 (2011): 55–77. [Google Scholar]

- A. Antoniou, and P. Holmes. “Futures trading, information and spot price volatility: Evidence for the FTSE-100 stock index futures contract using GARCH.” J. Bank. Finance 19 (1995): 117–129. [Google Scholar] [CrossRef]

- H.-J. Ryoo, and G. Smith. “The impact of stock index futures on the Korean stock market.” Appl. Financial Econ. 14 (2004): 243–251. [Google Scholar] [CrossRef]

- S.B. Lee, and K.Y. Ohk. “Stock index futures listing and structural change in time-varying volatility.” J. Futures Mark. 12 (1992): 493–509. [Google Scholar] [CrossRef]

- 2To some extent, short sales improve market efficiency [17].

- 3See also Fung et al. [20].

- 4The Shanghai Composite Index and the Shanghai A-share Index are officially released on 15 July 1991 and 21 February 1992 respectively, but both base dates are 19 December 1990.

- 5Our research controls for other factors in three ways. First, when we estimate the effect of one policy, the effects of the other policies are controlled. We incorporate all policy variables into the GARCH model simultaneously, allowing us to estimate each policy effect controlling for the effects of the other policies. Second, according to the properties of the GARCH model, the model describes the influence of all past and recent information shocks on volatility, capturing the total effect of the other factors at that time. When we incorporate the policy effects as explanatory variables of volatility, we separate out the policy impacts from the other effects. In other words, to some extent, we estimate policy effects while controlling for the total effect of the other factors indirectly. Third, we also perform tests which incorporate economic variables such as PMI, PPI, and GDP as explanatory variables into our model (i.e., directly control for the economic factors), but the results of the policy effects are almost the same. Not only are none of these economic variables statistically significant, but they also do not affect the coefficients and significance of the policy variables. These results further show that the Chinese stock market is a typical policy-oriented market. Considering that economic factors are not the focus of this study, we do not demonstrate the relevant results for clarity. However, these tests can be regarded as alternative robustness tests.

- 6Wang and Shen [37] demonstrate that opening up to the inflow of foreign investment increases volatility in stock returns and thus related policies may bring challenges.

- 7Retail investors hold over 80% of the total market value on average from 2006 to 2011 in the Chinese stock market. By contrast, in developed stock markets, institutional investors usually take the majority share of the total stock market value and contribute to rational adjustments of the stock prices. Moreover, after 2007, investors in China have a greater tendency to herd.

- 8Price limits restrict large price movements and give market participants time to reconsider their trading strategy [39].

- 9Yan and Dong [41] analyze high frequency trading data via the EGARCH model and conclude that CSI 300 stock index futures increase the fluctuations of the Chinese stock market. The Chinese securities market is an emerging market with imperfect regulation where the number of speculators exceeds the number of investors [42]. Among these, irrational speculators speculating in the futures market not only makes the stock market have less liquidity but also makes the futures market deliver more volatility to the spot market [43]. Particularly, sharp changes in the prices of the stock index futures in the final stage (the sixth stage) caused the futures market to contribute great fluctuations to the stock market. Furthermore, several studies investigating stock markets outside China also found that stock index futures may increase the stock price volatility because such futures accelerate information transmission [44,45,46].

| Time | Policy Measure |

|---|---|

| 2 March 2015 | Foreign investors were allowed to short A-shares by the Shanghai-Hong Kong Stock Connect. |

| 17 November 2014 | The Shanghai-Hong Kong Stock Connect was officially launched. |

| 4 June 2014 | Opinions of the State Council on Promoting Fair Market Competition and Maintaining the Normal Market Order were issued. The opinions included lifting the restrictions on listing access and improving the delisting system of listed companies. |

| 10 April 2014 | The Shanghai-Hong Kong Stock Connect program is first announced by Premier Li Keqiang. |

| 21 March 2014 | Measures for the Pilot Administration of Preferred Stock were issued by CSRC. |

| 30 November 2013 | Comments concerning Further Promoting the Reform of New Stock Issuance System were issued by CSRC. |

| 15 November 2013 | The Third Plenary Session of the 18th Central Committee of the Communist Party of China announced Decision of the CCCPC on Some Major Issues Concerning Comprehensively Deepening the Reform. |

| 28 April 2012 | CSRC formulated the Guiding Opinions on Further Reforming the Issue System of New Shares. |

| 16 December 2011 | Measures for Pilot Domestic Securities Investment Made by Renminbi Qualified Foreign Institutional Investors of Fund Management Companies and Securities Companies were announced. |

| 5 December 2011 | The central bank lowered the deposit reserve ratio seven times during 5 December 2011–5 February 2015. |

| 23 August 2010 | Guiding Opinions on Further Reforming the Issue System of New Shares (Exposure draft) were introduced by CSRC. |

| 14 May 2010 | Several Opinions of the State Council on Promoting and Guiding the Healthy Development of Private Investment (New Article 36) were launched. |

| 16 April 2010 | Launched the CSI 300 stock index futures. |

| 31 March 2010 | Launched margin trading and short selling business. |

| 18 January 2010 | The central bank raised the deposit reserve ratio twelve times consecutively during 18 January 2010–4 December 2011. |

| 23 October 2009 | Chinese growth enterprise market was officially listed in Shenzhen. |

| 22 May 2009 | The first stage of reforming the issue system of new shares improved the quotation constraint mechanisms for price inquiry and subscription. |

| 5 November 2008 | Premier Wen Jiabao chaired a State Council executive meeting. The meeting introduced 10 measures to expand domestic demand and promote economic growth. The state announced a 4 trillion yuan investment plan. |

| 25 September 2008 | The central bank lowered the deposit reserve ratio four times during 25 September 2008–17 January 2010. |

| 18 September 2008 | Three bailout policies: The 1‰ stamp duty on purchases of shares would be abolished, while the equivalent tax on sales of shares would remain; Central Huijin Investment Ltd repurchased the stocks of three major state-owned commercial banks; and the State Council supported central enterprises to repurchase shares of their holding companies. |

| 27 August 2008 | Decision on Amending Article 63 of the Administrative Measures for the Takeover of Listed Companies came into force. |

| 24 April 2008 | The stamp duty on share transactions was reduced from 3‰ to 1‰. |

| 9 January 2008 | China launched the gold futures trading on the Shanghai Futures Exchange. |

| 27 November 2007 | The central government took actions to curb inflation and prevent economic overheating. |

| 5 July 2007 | Trial Measures for the Administration of Overseas Securities Investment by Qualified Domestic Institutional Investors came into force. |

| 30 May 2007 | The stamp duty on share transactions was increased from 1‰ to 3‰. |

| 17 September 2006 | Measures for the Administration of Securities Offering and Underwriting were introduced and would come into force on 19 September 2006. |

| 18 May 2006 | Measures for the Administration of Initial Public Offering and Listing of Stocks came into force. |

| 15 January 2006 | CSRC Promulgated Measures for the Administration of Equity Incentive Plans of Listed Companies. |

| 27 October 2005 | The Securities Law and the Companies Law was revised by the Standing Committee of the National People’s Congress. The revised version went into effect on the first day of 2006. |

| 29 April 2005 | Notice of the China Securities Regulatory Commission on Piloting the Share-trading Reform of Listed Companies was issued. The split-share structure reform was begun. |

| 7 December 2004 | CSRC announced Circular of China Securities Regulatory Commission on Issuing the Provisions on Strengthening the Protection of the Rights and Interests of the General Public Shareholders. |

| 4 November 2004 | Revised Administrative Measures for Stock-Pledged Loans of Securities Companies. |

| 13 September 2004 | Premier Wen Jiabao said government would promptly implement Some Opinions of the State Council on Promoting the Reform, Opening and Steady Growth of Capital Markets. |

| 31 January 2004 | Some Opinions of the State Council on Promoting the Reform, Opening and Steady Growth of Capital Markets were implemented. |

| 28 October 2003 | Law of the People’s Republic of China on Securities Investment Fund was issued by the Standing Committee of the National People’s Congress. |

| 21 September 2003 | The central bank raised the deposit reserve ratio twenty times during 21 September 2003–24 September 2008. |

| 29 August 2003 | CSRC announced the Interim Measures for the Administration of Bonds of Securities Companies. |

| 4 April 2003 | The Shanghai and Shenzhen Stock Exchanges issued a notice that stocks with delisting risks would be designated by “ST” marks. |

| 20 March 2003 | Investment rules for qualified foreign institutional investors were clarified. |

| 10 January 2003 | The Shanghai Stock Exchange block trading platform was launched. |

| 7 November 2002 | Interim Measures on the Administration of Domestic Securities Investment by Qualified Foreign Institutional Investors were promulgated. |

| 6 June 2002 | Rules for the Establishment of Foreign-shared Securities Companies were promulgated. |

| 28 January 2002 | CSRC announced the initial results of the reduction of state-owned stocks. |

| 4 December 2001 | Delisting system was officially launched. |

| 22 October 2001 | CSRC announced to provisionally stop reducing state-owned stocks. |

| 12 June 2001 | The State Council issued Interim Measures on the Management of Reducing Held State Shares and Raising Social Security Funds. Note: On 23 June 2002 the central government announced cancellation of the policy. |

| 28 February 2000 | Initiation of Measure for Punishment of Illegal Financial Acts. |

| 22 February 2000 | Notice on the Issue of Placing New Shares to the Secondary Market Investors was issued by CSRC. |

| 2 February 2000 | Initiation of Administrative Measures for Stock-Pledged Loans of Securities Companies. |

| 27 October 1999 | Policies concerning the reduction of state-owned stocks were announced. The reduction would be achieved through placement. |

| 22 September 1999 | State Share Hold Reduction was cleared, which opened the way to the equity division reform. |

| 9 September 1999 | CSRC allowed state-owned enterprises and the listed companies to issue shares and trade stocks. |

| 1 July 1999 | Securities Law of the People’s Republic of China came into force. |

| 19 May1999 | The editorial in People’s Daily was entitled “Keep the Faith and Regulate Development.” |

| 16 May 1999 | Request of CSRC on further promoting and regulating the development of the securities market was approved by the State Council. |

| 29 December 1998 | Securities Law was adopted by the Standing Committee of the National People’s Congress. |

| 25 November 1998 | Notice on the Cessation of Employee Share Issuance was promulgated. The notice prohibited any issuance of employee shares when a company makes a public offering. |

| 12 June 1998 | The stamp duty on share transactions was reduced four times between 12 June 1998 and 29 May 2007 from 5‰ to 1‰. |

| 5 November 1997 | Interim Measures on the Management of Securities Investment Funds were adopted by the State Council. |

| 15 August 1997 | The State Council decided that the Shanghai and Shenzhen Stock Exchanges were managed directly by CSRC. |

| 6 June 1997 | Assets owned or controlled by banks were banned from being used to purchase stocks. |

| 22 May 1997 | State-owned enterprises and listed companies were banned from conducting stock trading. |

| 10 May 1997 | The stamp duty on share transactions was increased from 3‰ to 5‰. |

| 16 December 1996 | CSRC set the daily price limit at 10%. |

| 2 December 1996 | Investment funds were steadily developed with regulation. |

| 14 November 1996 | Bank loans were banned from being used to invest in stocks by the Central Bank. |

| 3 October 1996 | Reduction in commissions for stock and fund trading. |

| 24 July 1996 | The government took actions to cool the market. The actions included announcing Measures for the Administration of Stock Exchanges, Notice on Firmly Preventing Such Behaviors as Overdraft in Stock Issuance, and Notice on Several Issues Concerning Regulating the Behaviors of Listed Companies. |

| 30 April 1996 | Regulating insider ownership of listed companies. |

| 20 June 1995 | Commercial banks were banned to enter stock and trust businesses. |

| 18 May 1995 | CSRC banned the trading of futures on Treasury Bonds. |

| 1 January 1995 | Initiated T + 1 trading procedure. |

| 5 October 1994 | CSRC announced that T + 1 trading procedure would be initiated on the first day of 1995. |

| 5 September 1994 | Foreign institutions were permitted to buy A-shares by setting up funds. |

| 30 July 1994 | CSRC issued three bailout policies: measures to widen fund channels; halting issuance of new stocks; and controlling the scale of rights offerings. |

| Statistical Characteristics | Shanghai Composite Index | Shanghai A-Share Index |

|---|---|---|

| Mean | 0.0631 | 0.0639 |

| Median | 0.0684 | 0.0722 |

| Maximum | 71.9151 | 74.5174 |

| Minimum | –17.9050 | –18.4271 |

| Standard Deviation | 2.3828 | 2.4617 |

| Skewness | –0.3330 | –0.3431 |

| Kurtosis | 7.9655 | 8.0067 |

| Jarque-Bera | 3780.3170 | 3810.1050 |

| p-value for JB | <0.0001 | <0.0001 |

| Augmented Dickey-Fuller | –73.5561 | –73.5488 |

| p-value for ADF | <0.0001 | <0.0001 |

| Heteroscedasticity Test: ARCH | Shanghai Composite Index | Shanghai A-Share Index | ||

|---|---|---|---|---|

| Observations × R-Square | Probability Chi-Square | Observations × R-Square | Probability Chi-Square | |

| q = 1 | 2.92830 | 0.0870 | 3.13373 | 0.0767 |

| q = 2 | 12.24356 | 0.0022 | 14.03321 | 0.0009 |

| q = 3 | 23.13311 | 0.0001 | 23.61153 | 0.0000 |

| q = 4 | 27.26228 | 0.0000 | 30.10914 | 0.0000 |

| q = 5 | 27.42634 | 0.0000 | 30.27091 | 0.0000 |

| q = 6 | 28.95957 | 0.0001 | 32.03559 | 0.0000 |

| q = 7 | 30.13364 | 0.0001 | 33.36778 | 0.0000 |

| q = 8 | 30.51586 | 0.0002 | 33.79508 | 0.0000 |

| q = 9 | 31.48474 | 0.0002 | 34.80817 | 0.0001 |

| q = 10 | 31.80851 | 0.0004 | 35.24752 | 0.0001 |

| Models | |||||

|---|---|---|---|---|---|

| GARCH(1,1) | 0.027521 *** (0.006970) | 0.826759 *** (0.011198) | __ | 0.126448 *** (0.011442) | __ |

| GARCH(1,2) | 0.024795 *** (0.006437) | 0.839972 *** (0.011915) | __ | 0.139366 *** (0.022693) | –0.023319 (0.023693) |

| GARCH(2,1) | 0.028819 *** (0.008222) | 0.737607 *** (0.174520) | 0.078753 (0.149354) | 0.133600 *** (0.133600) | __ |

| GARCH(2,2) | 0.003826 ** (0.001649) | 1.483441 *** (0.089682) | –0.513139 *** (0.081835) | 0.167343 *** (0.022625) | –0.146477*** (0.020245) |

| Date | Effect | Date | Effect | Date | Effect |

|---|---|---|---|---|---|

| : 1 August 1994 | 0.07189 *** (0.01201) | 14 February 2000 | 0.03604 *** (0.00936) | 27 November 2007 | 0.02892 *** (0.01201) |

| : 5 September 1994 | 0.07873 *** (0.01239) | 22 February 2000 | 0.03596 *** (0.00935) | 9 January 2008 | 0.02944 *** (0.01209) |

| : 5 October 1994 | 0.07152 *** (0.01197) | 28 February 2000 | 0.03595 *** (0.00935) | 24 April 2008 | 0.02708 ** (0.01190) |

| 3 January 1995 | 0.07049 *** (0.01178) | 12 June 2001 | 0.05668 * (0.03898) | 27 August 2008 | 0.02611 ** (0.01182) |

| 18 May 1995 | 0.06611 *** (0.01140) | 22 October 2001 | 0.04320 *** (0.01054) | 18 September 2008 | 0.02578 ** (0.01179) |

| 20 June 1995 | 0.06615 *** (0.01139) | 4 December 2001 | 0.04436 *** (0.01061) | 18 September 2008 | 0.10327 ** (0.05987) |

| 30 April 1996 | 0.05717 *** (0.01055) | 28 January 2002 | 0.04154 *** (0.01045) | 5 November 2008 | 0.02549 ** (0.01176) |

| 24 July 1996 | 0.05626 *** (0.01044) | 6 June 2002 | 0.04011 *** (0.01035) | 22 May 2009 | 0.02377 ** (0.01164) |

| 3 October 1996 | 0.05445 *** (0.01030) | 7 November 2002 | 0.04240 *** (0.01073) | 23 October 2009 | 0.02069 ** (0.01154) |

| 14 November 1996 | 0.05379 *** (0.01024) | 10 January 2003 | 0.04095 *** (0.01071) | 18 January 2010 | 0.03317 * (0.02315) |

| 2 December 1996 | 0.05345 *** (0.01021) | 20 March 2003 | 0.04266 *** (0.01085) | 31 March 2010 | 0.01943 ** (0.01163) |

| 16 December 1996 | 0.05242 *** (0.01367) | 28 March 2003 | 0.04180 *** (0.01082) | 16 April 2010 | 0.01914 * (0.01170) |

| 12 May 1997 | 0.01528 (0.02824) | 29 August 2003 | 0.04564 *** (0.01131) | 14 May 2010 | 0.01828 * (0.01168) |

| 22 May 1997 | 0.02747 * (0.02132) | 22 September 2003 | 0.05151 *** (0.01830) | 23 August 2010 | 0.01767 * (0.01172) |

| 6 June 1997 | 0.05134 *** (0.00997) | 28 October 2003 | 0.04519 *** (0.01153) | 5 December 2011 | 0.01205 (0.01265) |

| 15 August 1997 | 0.05025 *** (0.00986) | 2 February 2004 | 0.04279 *** (0.01146) | 16 December 2011 | 0.01199 (0.01268) |

| 8 October 1997 | 0.04938 *** (0.00980) | 13 September 2004 | 0.03911 *** (0.01147) | 28 April 2012 | 0.01054 (0.01290) |

| 12 June 1998 | 0.01699 ** (0.00961) | 4 November 2004 | 0.03852 *** (0.01142) | 15 November 2013 | 0.00772 (0.01725) |

| 25 November 1998 | 0.04447 *** (0.00958) | 7 December 2004 | 0.04017 *** (0.01157) | 2 December 2013 | 0.00976 (0.01778) |

| 29 December 1998 | 0.04238 *** (0.00956) | 29 April 2005 | 0.03733 *** (0.01157) | 21 March 2014 | 0.00632 (0.01960) |

| 17 May 1999 | 0.03928 *** (0.00952) | 27 October 2005 | 0.03496 *** (0.01149) | 10 April 2014 | 0.00732 (0.02015) |

| 15 June 1999 | 0.03877 *** (0.00949) | 16 January 2006 | 0.03593 *** (0.01180) | 4 June 2014 | 0.02044 (0.02480) |

| 1 July 1999 | 0.03846 *** (0.00947) | 18 May 2006 | 0.03467 *** (0.01205) | 17 November 2014 | 0.18300 ** (0.11052) |

| 9 September 1999 | 0.03811 *** (0.00941) | 19 September 2006 | 0.03648 *** (0.01225) | 2 March 2015 | 0.16633 (0.19693) |

| 22 September 1999 | 0.03829 *** (0.00942) | 30 May 2007 | 0.21434 ** (0.10981) | ||

| 27 October 1999 | 0.03735 *** (0.00936) | 20 August 2007 | 0.03078 *** (0.01214) |

| Panel A t-Distribution | |||||

| Period | |||||

| December 1990–December 1996 | –0.190599 *** (0.014931) | 0.988806 *** (0.003862) | 0.353131 *** (0.039696) | –0.161909 *** (0.030805) | __ |

| January 1997–June 2001 | –0.209631 *** (0.032672) | 0.948557 *** (0.014569) | 0.346169 *** (0.050859) | –0.055816 ** (0.029334) | __ |

| July 2001–March 2005 | –0.124276 *** (0.034270) | 0.934201 *** (0.021163) | 0.223578 *** (0.048664) | –0.128893 *** (0.034145) | __ |

| April 2005–June 2008 | –0.104431 *** (0.026569) | 0.982297 *** (0.009627) | 0.178860 *** (0.041866) | –0.024260 (0.027322) | __ |

| July 2008–July 2010 | –0.106470 *** (0.036241) | 0.972607 *** (0.018163) | 0.175952 *** (0.049455) | –0.032081 † (0.030730) | –0.099305 *** (0.038615) |

| August 2010–May 2015 | 3.792457 *** (0.998503) | 0.028839 (0.048223) | 0.028660 (0.054407) | –0.130973 ** (0.064163) | 0.043270 *** (0.011006) |

| Panel B GED | |||||

| December 1990–December 1996 | –0.196597 *** (0.015461) | 0.977684 *** (0.004532) | 0.369153 *** (0.036288) | –0.036288 *** (0.030873) | __ |

| January 1997–June 2001 | –0.201044 *** (0.032217) | 0.957429 *** (0.013192) | 0.317254 *** (0.048456) | –0.026757 (0.026205) | __ |

| July 2001–March 2005 | –0.131681 (0.120007) | 0.975563 *** (0.037236) | 0.201374 *** (0.057750) | –0.049551 ** (0.024432) | __ |

| April 2005–June 2008 | –0.101185 *** (0.025936) | 0.985470 *** (0.009163) | 0.162179 *** (0.037685) | –0.018591 (0.025732) | __ |

| July 2008–July 2010 | –0.101834 *** (0.039060) | 0.965988 *** (0.020951) | 0.179319 *** (0.053614) | –0.033866 † (0.032412) | –0.110725 *** (0.043718) |

| August 2010–May 2015 | 1.546475 *** (0.057063) | 0.039902 *** (0.005929) | 0.001938 † (0.001618) | –0.041610 *** (0.005128) | 0.092210 *** (0.007494) |

| Type | Effect (t) | Effect (GED) |

|---|---|---|

| : Reform policies | –0.012925 *** (0.003988) | –0.012812 *** (0.004030) |

| : Stabilization policies | –0.004791 * (0.003159) | –0.005341 * (0.003371) |

| : Bailout policies | 0.081247 *** 0.020450 | 0.077100 *** 0.020894 |

| : Macro-control policies | 0.015515 † 0.013736 | 0.016733† 0.014157 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.-C.; Tsai, J.-J.; Li, Q. Policy Impact on the Chinese Stock Market: From the 1994 Bailout Policies to the 2015 Shanghai-Hong Kong Stock Connect. Int. J. Financial Stud. 2017, 5, 4. https://doi.org/10.3390/ijfs5010004

Wang Y-C, Tsai J-J, Li Q. Policy Impact on the Chinese Stock Market: From the 1994 Bailout Policies to the 2015 Shanghai-Hong Kong Stock Connect. International Journal of Financial Studies. 2017; 5(1):4. https://doi.org/10.3390/ijfs5010004

Chicago/Turabian StyleWang, Yang-Chao, Jui-Jung Tsai, and Qiaoqiao Li. 2017. "Policy Impact on the Chinese Stock Market: From the 1994 Bailout Policies to the 2015 Shanghai-Hong Kong Stock Connect" International Journal of Financial Studies 5, no. 1: 4. https://doi.org/10.3390/ijfs5010004