An Investigation of (Non-) Inclusive Growth in Nigeria’s Sub-Nationals: Evidence from Elasticity Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Introduction

2.2. Theoretical Literature

2.3. Empirical Literature

2.4. Gap in Literature

3. Methodology

3.1. Data Sources/Description

- i.

- Absolute Poverty line is N54, 401.16. Absolute (Objective) poverty measure considers both food expenditure and non-food expenditure using annualized per capita expenditure approach. Households that spend below this are categorized under this measure.

- ii.

- The Relative Poverty line is N66, 802.20. This line separates the poor from the non-poor. All households whose per capita expenditure is less than this are considered poor while those above the stated amount are considered non-poor.

- iii.

- The Dollar Per day Poverty line is N54, 750. This measure considers all individuals whose expenditure per day is less than a dollar per day. Using the official exchange rate of Naira to Dollar in 2009/2010 was annualized to this amount.

- iv.

- Another critical measure of poverty is the Gini Coefficient (inequality measurement). This measure explains the spread of income or expenditure among households.

3.2. Theoretical Background of the Model

Arc Elasticity

- i.

- It is symmetric with respect to the two variables, and

- ii.

- it is independent of the units of measurement.

3.3. Model Specification

3.4. Operationalization of the Inequality Elasticity of Poverty Index

- i.

- A positive real GDP (increasing function) for all sub-nationals in 2010. This is true as Nigeria had increased growth for the period under review as can be seen from the data Table in Appendix A.

- ii.

- Increase in growth or incomes always lead to a reduction in poverty holding inequality constant (Kanbur 2004).

- iii.

- Notwithstanding, inequality is a fact of life and can never be nonexistent, this is supported by the fact that talent, endowments and motivations always differ.

Scenarios

- i.

- Inequality can increase while poverty reduces. Let us call this Pareto efficient growth (for the poor). Here growth is inclusive.

- ii.

- Inequality can reduce while poverty can increase. Let us call this Pareto inefficient growth amounting to non-inclusive growth.

- iii.

- Inequality can increase while poverty increases. We call this Pro-rich or non-inclusive growth.

- iv.

- Inequality can reduce while growth also reduces. We call this Pro-poor or inclusive growth.

4. Results and Discussion

4.1. Parametric Analysis

4.1.1. Explanation of the Columns

4.1.2. Explanation of the Interaction of the Variables

4.1.3. Absolute Poverty Measure

4.1.4. Relative Poverty Measure

4.1.5. Dollar/Day Poverty Measure

4.2. Test of Hypothesis

5. Conclusions and Recommendations

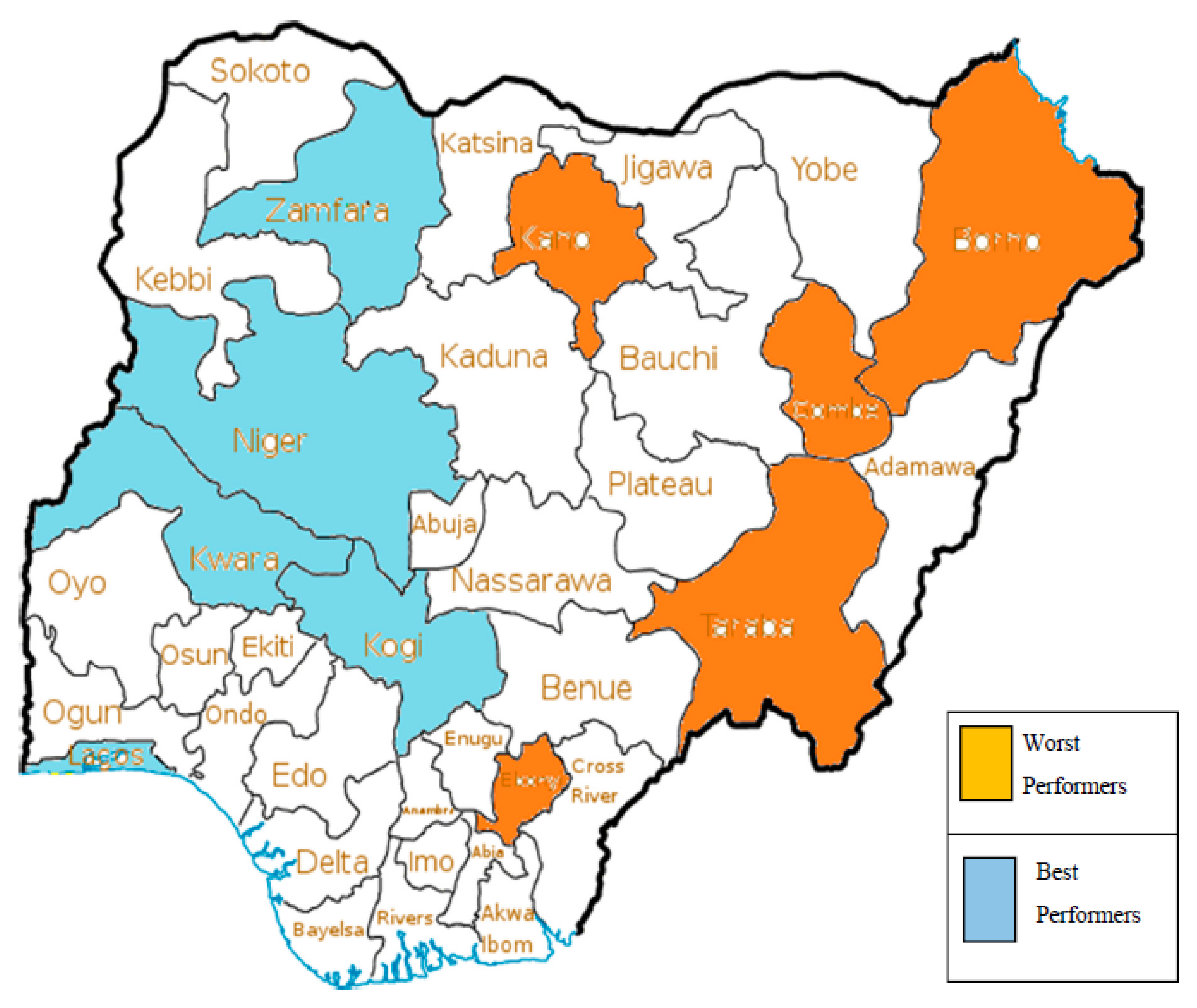

5.1. Conclusions

5.2. Recommendations

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Entities | Income Inequality | % Change from 2004–2010 | |

|---|---|---|---|

| 2004 | 2010 | ||

| NATIONAL | 0.3813 | 0.4088 | 7.21 |

| STATES | |||

| Abia | 0.3524 | 0.3968 | 12.6 |

| Adamawa | 0.4414 | 0.4339 | −1.7 |

| Akwa ibom | 0.3645 | 0.4381 | 20.2 |

| Anambra | 0.3534 | 0.3803 | 7.6 |

| Bauchi | 0.4705 | 0.3348 | −28.9 |

| Bayelsa | 0.3333 | 0.337 | 1.1 |

| Benue | 0.3888 | 0.4069 | 4.6 |

| Borno | 0.3601 | 0.3841 | 6.7 |

| Cross-river | 0.3977 | 0.4369 | 9.8 |

| Delta | 0.3582 | 0.4698 | 31.1 |

| Ebonyi | 0.3598 | 0.425 | 18.1 |

| Edo | 0.3742 | 0.4177 | 11.6 |

| Ekiti | 0.3695 | 0.4831 | 30.7 |

| Enugu | 0.3976 | 0.4273 | 7.5 |

| Gombe | 0.3652 | 0.4217 | 15.5 |

| Imo | 0.3844 | 0.425 | 10.6 |

| Jigawa | 0.3368 | 0.3976 | 18.1 |

| Kaduna | 0.3668 | 0.4005 | 9.2 |

| Kano | 0.375 | 0.4692 | 25.1 |

| Katsina | 0.4174 | 0.374 | −10.4 |

| Kebbi | 0.3046 | 0.3259 | 7 |

| Kogi | 0.4914 | 0.4145 | −15.7 |

| Kwara | 0.4848 | 0.3594 | −25.9 |

| Lagos | 0.504 | 0.3719 | −26.2 |

| Nassarawa | 0.3494 | 0.34 | −2.7 |

| Niger | 0.3665 | 0.3675 | 0.3 |

| Ogun | 0.3984 | 0.4076 | 2.3 |

| Ondo | 0.3274 | 0.3869 | 18.2 |

| Osun | 0.3482 | 0.3856 | 10.7 |

| Oyo | 0.3295 | 0.3923 | 19.1 |

| Plateau | 0.4242 | 0.3995 | −5.8 |

| Rivers | 0.4052 | 0.4614 | 13.9 |

| Sokoto | 0.3574 | 0.355 | −0.7 |

| Taraba | 0.3664 | 0.5241 | 43 |

| Yobe | 0.3283 | 0.523 | 59.3 |

| Zamfara | 0.3506 | 0.3397 | −3.1 |

| Federal Capital Territory | 0.4062 | 0.5116 | 26 |

| Regions & Entities | Absolute Poverty | Poor Below 2/3 of the Weighted Mean Household Per Capita Expenditure Regionally Deflated (Relative Poverty) | Dollar Per Day Based on an Adjusted PPP | ||||

|---|---|---|---|---|---|---|---|

| Revised 2010 | 2004 | 2010 | 2004 | 2010 | 2004 | ||

| Sector | Urban | 51.20 | 52.20 | 61.8 | 43.2 | 52.4 | 40.1 |

| Rural | 69.00 | 73.40 | 73.2 | 63.3 | 66.3 | 60.6 | |

| National | 63.46 | 64.50 | 69.37 | 54.1 | 61.64 | 51.69 | |

| Zone | North Central | 67.5 | 67 | 59.7 | 58.6 | ||

| North East | 76.3 | 72.2 | 69.1 | 64.8 | |||

| North West | 77.7 | 71.2 | 70.4 | 61.2 | |||

| South East | 67 | 26.7 | 59.2 | 31.2 | |||

| South South | 63.8 | 35.1 | 56.1 | 47.6 | |||

| South West | 59.1 | 43 | 50.1 | 40.2 | |||

| States | Abia | 50.20 | 40.90 | 63.4 | 22.27 | 57.8 | 28.01 |

| Adamawa | 77.80 | 76.60 | 80.7 | 71.73 | 74.3 | 68.91 | |

| Akwa Ibom | 51.00 | 56.80 | 62.8 | 34.82 | 53.8 | 46.04 | |

| Anambra | 53.70 | 41.40 | 68 | 20.11 | 57.4 | 30.39 | |

| Bauchi | 84.00 | 87.80 | 83.7 | 86.29 | 73.1 | 76.51 | |

| Bayelsa | 44.00 | 40.00 | 57.9 | 19.98 | 47 | 26.29 | |

| Benue | 73.60 | 64.70 | 74.1 | 55.33 | 67.2 | 42.84 | |

| Borno | 60.60 | 59.80 | 61.1 | 53.63 | 55.1 | 48.65 | |

| Cross-Rivers | 60.40 | 67.00 | 59.7 | 41.61 | 52.9 | 51.64 | |

| Delta | 53.80 | 70.60 | 70.1 | 45.35 | 63.6 | 62.28 | |

| Ebonyi | 82.90 | 63.20 | 80.4 | 43.33 | 73.6 | 46.06 | |

| Edo | 64.10 | 53.60 | 72.5 | 33.09 | 66 | 44.31 | |

| Ekiti | 55.90 | 60.40 | 59.1 | 42.27 | 52.6 | 35.51 | |

| Enugu | 60.60 | 50.20 | 72.1 | 31.12 | 63.4 | 33.89 | |

| Gombe | 81.60 | 73.10 | 79.8 | 77.01 | 74.2 | 66.34 | |

| Imo | 39.40 | 46.70 | 57.3 | 27.39 | 50.7 | 26.46 | |

| Jigawa | 88.50 | 95.30 | 79 | 95.07 | 74.2 | 89.54 | |

| Kaduna | 64.00 | 54.20 | 73 | 50.24 | 61.8 | 37.72 | |

| Kano | 70.40 | 59.40 | 72.3 | 61.29 | 66 | 46.7 | |

| Katsina | 77.60 | 72.90 | 82 | 71.06 | 74.8 | 60.42 | |

| Kebbi | 72.50 | 90.80 | 80.5 | 89.65 | 72.5 | 86.2 | |

| Kogi | 67.40 | 91.80 | 73.5 | 88.55 | 67.3 | 87.46 | |

| Kwara | 72.10 | 87.80 | 74.3 | 85.22 | 62 | 79.85 | |

| Lagos | 40.30 | 69.40 | 59.2 | 63.58 | 49.3 | 64.05 | |

| Nassarawa | 78.40 | 66.10 | 71.7 | 61.59 | 60.4 | 48.17 | |

| Niger | 51.00 | 64.40 | 43.6 | 63.9 | 33.9 | 56.01 | |

| Ogun | 57.60 | 49.90 | 69 | 31.73 | 62.5 | 29.84 | |

| Ondo | 57.70 | 62.80 | 57 | 42.14 | 46.1 | 41.47 | |

| Osun | 37.50 | 44.60 | 47.5 | 32.35 | 38.1 | 22.66 | |

| Oyo | 50.80 | 38.00 | 60.7 | 24.08 | 51.8 | 19.28 | |

| Plateau | 72.40 | 68.50 | 79.7 | 60.37 | 74.7 | 46.78 | |

| Rivers | 47.20 | 56.70 | 58.6 | 29.09 | 50.6 | 43.12 | |

| Sokoto | 86.10 | 75.20 | 86.4 | 76.81 | 81.9 | 70.54 | |

| Taraba | 68.30 | 60.50 | 76.3 | 62.15 | 68.9 | 54.07 | |

| Yobe | 81.70 | 88.00 | 79.6 | 83.25 | 74.1 | 74.12 | |

| Zamfara | 67.50 | 84.00 | 80.2 | 80.93 | 71.3 | 73.38 | |

| FCT | 45.50 | 53.30 | 59.9 | 43.32 | 55.6 | 46.98 | |

| Year | Real GDP (N Billion) at 1990 Constant Prices |

|---|---|

| 2004 | 527.6 |

| 2010 | 775.5 |

Appendix B

References

- Adigun, Grace, Taiwo Awoyemi, and Bolarin Omonona. 2011. Estimating Economic Growth and Inequality Elasticities of Poverty in Rural Nigeria. International Journal of Agricultural Economics & Rural Development 4: 25–35. [Google Scholar]

- Allen, Roy George. 1933. The Concept of Arc Elasticity of Demand. Review of Economic Studies 1: 226–29. [Google Scholar] [CrossRef]

- Anderson, W. H. Locke. 1964. Trickling down: The Relationship between Economic Growth and the Extent of Poverty among American Families. Quarterly Journal of Economic 78: 11–24. [Google Scholar] [CrossRef]

- Araar, Abdelkrim, and Jean-Yves Duclos. 2007. Poverty and Inequality Components: A Micro Framework. CIRPEE Working Paper No 07-35. Quebec City, QC, Canada: University Laval. [Google Scholar]

- Bakare, Adewale Stephen. 2014. Does Economic Growth Reduce Poverty? Developing Countries Studies 4: 54–59. [Google Scholar]

- Besley, Timothy, and Robin Burgess. 2000. Land Reform, Poverty Reduction and Growth: Evidence from India. Quarterly Journal of Economics 115: 389–430. [Google Scholar] [CrossRef]

- Bigsten, Arne, and Abebe Shimeles. 2005. Can Africa Reduce Poverty by Half by 2015? The Case for a Pro-Poor Growth Strategy. Gothenburg: University of Göteborg, Department of Economics. [Google Scholar]

- Bourguignon, François. 2004. The Poverty-Growth-Inequality Triangle. Paper presented at Indian Council for Research on International Economic Relations, New Delhi, India, February 4. [Google Scholar]

- Bruno, Michael, Martin Ravallion, and Lyn Squire. 1998. Equity and Growth in Developing Countries: Old and New Perspectives on the Policy Issues. In Income Distribution and High Quality Growth. Edited by Vito Tanzi and Ke-young Chu. Cambridge: MIT Press. [Google Scholar]

- Ekanem, Okon, and Milton Iyoha. 2000. Microeconomic Theory. Benin City: Mareh. [Google Scholar]

- Forbes, Kristin J. 2000. A reassessment of the relationship between inequality and growth. American Economic Review 90: 869–87. [Google Scholar] [CrossRef]

- Kakwani, Nanak, and Ernesto M. Pernia. 2000. What is Pro-Poor Growth? Asian Development Review 18: 1–16. [Google Scholar]

- Kanbur, Ravi. 2004. Growth, inequality and poverty: some hard questions. Paper presented at State of the World Conference, Princeton Institute for International and Regional Studies, Princeton University, Princeton, NJ, USA, February 13–14. [Google Scholar]

- Kanbur, Ravi, and Nora Lustig. 1999. Why is inequality back on the agenda? Paper presented at Annual World Bank Conference on Development Economics, Washington, DC, USA, April 28–30. Unpublished. [Google Scholar]

- Klasen, Stephan. 2003. In Search of the Holy Grail: How to Achieve Pro-Poor Growth. Ibero America Institute for Economic Research (IAI) Discussion Papers No 96. Gottingen, Germany: IAI. [Google Scholar]

- Kolawole, Bashir Olayinka, and Olufunsho Abayomi Omobitan. 2014. Raging Poverty and Agricultural Output in Nigeria: An Empirical Investigation. Journal of Economics and Sustainable Development 5: 63–72. [Google Scholar]

- Kolawole, Bashir Olayinka, Olufunsho Abayomi Omobitan, and Jameelah Omolara Yaqub. 2015. Poverty, Inequality and Rising Growth in Nigeria: Further Empirical Evidence. International Journal of Economics and Finance 7: 51–62. [Google Scholar] [CrossRef]

- Kraay, Aart. 2004. When is Growth Pro-Poor? Cross Country Evidence. IMF Working Paper. Washington, DC, USA: IMF. [Google Scholar]

- Li, Hongyi, and Heng-fu Zou. 1998. Income inequality is not harmful for growth: Theory and evidence. Review of Development Economics 2: 318–34. [Google Scholar] [CrossRef]

- Nuruddeen, Tanimu, and Saifullahi Sani Ibrahim. 2014. An Empirical study on the relationship between Poverty, Inequality and Economic Growth in Nigeria. Journal of Economics and Sustainable Development 5: 21–25. [Google Scholar]

- Nymoen, Ragner. 2004. Dynamic Models: Lecture Notes. Available online: http://folk.uio.no/rnymoen/ECON3410_v04_dynamic.pdf (accessed on 1 November 2017).

- Rajan, Raghuram G. 2010. Fault Lines: How Hidden Fractures Still Threaten the World Economy. Princeton: Princeton University Press. [Google Scholar]

- Ravallion, Martin. 2001. Growth, Inequality Poverty: Looking Beyond Averages. World Development 29: 1803–15. [Google Scholar] [CrossRef]

- Rawls, John. 1971. A Theory of Justice. Cambridge: Harvard University Press. [Google Scholar]

- Thiesenhusen, William H. 1989. Searching for Agrarian Reform in Latin America. Winchester: Unwin Hyman. [Google Scholar]

- Thornton, James R., Richard Agnello, and Charles Link. 1978. Poverty and Economic Growth: Trickle down Peters Out. Economic Inquiry 26: 385–94. [Google Scholar] [CrossRef]

- World Bank. 2002. World Development Indicators. Washington: World Bank. [Google Scholar]

| 1 | |

| 2 |

| Year | Estimated Population (Million) | Gini Index (%) | Relative Poverty Incidence (%) | GDP (Trillion Naira) |

|---|---|---|---|---|

| 1985 | 75 | 38.7 | 46.3 | 0.0679 |

| 1992 | 91.5 | 45.0 | 42.7 | 0.5326 |

| 1996 | 102.3 | 51.9 | 65.6 | 2.7027 |

| 2004 | 126.3 | 42.9 | 54.4 | 11.4111 |

| 2010 | 163 | 44.7 | 69.0 | 33.9847 |

| Variables | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

|---|---|---|---|---|

| ∆ Inequality | + | - | + | - |

| ∆ Poverty | - | + | + | - |

| ∆ Growth | + | + | + | + |

| Qualities of growth | Pareto efficient growth | Pareto inefficient growth | Pro-rich growth | Pro-poor growth |

| States (Alphabetical Order) | Absolute Poverty Measure | Relative Poverty Measure | Dollar/Day Measure | |||||||

| Direction of ∆ Gini (1) | Absolute Poverty η (2) | Direction of ∆ Poverty (3) | Quality of Growth (4) | Relative Poverty η (5) | Direction of ∆ Poverty (6) | Quality of Growth (7) | Dollar/day Poverty η (8) | Direction of ∆ Poverty (9) | Quality of Growth (10) | |

| Abia | + | 1.722 | + | PR | 8.101 | + | PR | 5.858 | + | PR |

| Adamawa | − | −0.907 | + | PI | −6.867 | + | PI | −4.392 | + | PI |

| Akwa Ibom | + | −0.586 | − | PE | 3.126 | + | PR | 0.848 | + | PR |

| Anambra | + | 3.528 | + | PR | 14.82 | + | PR | 8.392 | + | PR |

| Bauchi | − | 0.131 | − | PP | 0.090 | − | PP | 0.135 | − | PP |

| Bayelsa | + | 8.626 | + | PR | 88.21 | + | PR | 51.19 | + | PR |

| Benue | + | 2.829 | + | PR | 6.375 | + | PR | 9.732 | + | PR |

| Borno | + | 0.206 | + | PR | 2.019 | + | PR | 1.928 | + | PR |

| Cross−River | + | −1.102 | − | PE | 3.802 | + | PR | 0.257 | + | PR |

| Delta | + | −1.001 | − | PE | 1.590 | + | PR | 0.078 | + | PR |

| Ebonyi | + | 1.623 | + | PR | 3.606 | + | PR | 2.770 | + | PR |

| Edo | + | 1.624 | + | PR | 6.795 | + | PR | 3.580 | + | PR |

| Ekiti | + | −0.290 | − | PE | 1.246 | + | PR | 1.455 | + | PR |

| Enugu | + | 2.606 | + | PR | 11.03 | + | PR | 8.425 | + | PR |

| Gombe | + | 0.765 | + | PR | 0.248 | + | PR | 0.779 | + | PR |

| Imo | + | −1.690 | − | PE | 7.041 | + | PR | 6.262 | + | PR |

| Jigawa | + | −0.446 | − | PE | −1.115 | − | PE | −1.131 | − | PE |

| Kaduna | + | 1.888 | + | PR | 4.205 | + | PR | 5.509 | + | PR |

| Kano | + | 0.759 | + | PR | 0.739 | + | PR | 1.535 | + | PR |

| Katsina | − | −0.569 | + | PI | −1.303 | + | PI | −1.939 | + | PI |

| Kebbi | + | −3.317 | − | PE | −1.591 | − | PE | −2.555 | − | PE |

| Kogi | − | 1.806 | − | PP | 1.094 | − | PP | 1.535 | − | PP |

| Kwara | − | 0.661 | − | PP | 0.461 | − | PP | 0.847 | − | PP |

| Lagos | − | 1.759 | − | PP | 0.237 | − | PP | 0.863 | − | PP |

| Nassarawa | − | −6.242 | + | PI | −5.562 | + | PI | −8.261 | + | PI |

| Niger | + | −85.23 | − | PE | −138.6 | − | PE | −180.5 | − | PE |

| Ogun | + | 6.275 | + | PR | 32.42 | + | PR | 30.99 | + | PR |

| Ondo | + | −0.508 | − | PE | 1.799 | + | PR | 0.635 | + | PR |

| Osun | + | −1.696 | − | PE | 3.723 | + | PR | 4.986 | + | PR |

| Oyo | + | 1.656 | + | PR | 4.965 | + | PR | 5.258 | + | PR |

| Plateau | − | −0.923 | + | PI | −4.602 | + | PI | −7.664 | + | PI |

| Rivers | + | −1.409 | − | PE | 5.189 | + | PR | 1.231 | + | PR |

| States (Alphabetical Order) | Absolute Poverty Measure | Relative Poverty Measure | Dollar/Day Measure | |||||||

| Direction of ∆ Gini (1) | Absolute Poverty η (2) | Direction of ∆ Poverty (3) | Quality of Growth (4) | Relative Poverty η (5) | Direction of ∆ Poverty (6) | Quality of Growth (7) | Dollar/day Poverty η (8) | Direction of ∆ Poverty (9) | Quality of Growth (10) | |

| Sokoto | − | −20.05 | + | PI | −17.44 | + | PI | −22.12 | + | PI |

| Taraba | + | 0.342 | + | PR | 0.577 | + | PR | 0.681 | + | PR |

| Yobe | + | −0.162 | − | PE | −0.098 | − | PE | −0.0006 | − | PE |

| Zamfara | − | 6.897 | − | PP | 0.287 | − | PP | 0.910 | − | PP |

| FCT | + | −0.687 | − | PE | 1.399 | + | PR | 0.732 | + | PR |

| Rank | Absolute Poverty | Quality of Growth | Relative Poverty | Quality of Growth | Dollar/Day Poverty | Quality of Growth |

|---|---|---|---|---|---|---|

| 1 | Zamfara | Pro-poor | Kogi | Pro-poor | Kogi | Pro-poor |

| 2 | Kogi | Pro-poor | Kwara | Pro-poor | Zamfara | Pro-poor |

| 3 | Lagos | Pro-poor | Zamfara | Pro-poor | Lagos | Pro-poor |

| 4 | Kwara | Pro-poor | Lagos | Pro-poor | Kwara | Pro-poor |

| 5 | Niger | Pareto Efficient | Bauchi | Pro-poor | Bauchi | Pro-poor |

| 6 | Kebbi | Pareto Efficient | Niger | Pareto Efficient | Niger | Pareto Efficient |

| 7 | Osun | Pareto Efficient | Kebbi | Pareto Efficient | Kebbi | Pareto Efficient |

| 8 | Imo | Pareto Efficient | Jigawa | Pareto Efficient | Jigawa | Pareto Efficient |

| 9 | Rivers | Pareto Efficient | Yobe | Pareto Efficient | Yobe | Pareto Efficient |

| 10 | Cross River | Pareto Efficient | Sokoto | Pareto Inefficient | Sokoto | Pareto Inefficient |

| 11 | Delta | Pareto Efficient | Adamawa | Pareto Inefficient | Nassarawa | Pareto Inefficient |

| 12 | FCT | Pareto Efficient | Nassarawa | Pareto Inefficient | Plateau | Pareto Inefficient |

| 13 | Akwa Ibom | Pareto Efficient | Plateau | Pareto Inefficient | Adamawa | Pareto Inefficient |

| 14 | Ondo | Pareto Efficient | Katsina | Pareto Inefficient | Katsina | Pareto Inefficient |

| 15 | Jigawa | Pareto Efficient | Bayelsa | Pro-rich | Bayelsa | Pro-rich |

| 16 | Ekiti | Pareto Efficient | Ogun | Pro-rich | Benue | Pro-rich |

| 17 | Yobe | Pareto Efficient | Anambra | Pro-rich | Enugu | Pro-rich |

| 18 | Sokoto | Pareto Inefficient | Enugu | Pro-rich | Anambra | Pro-rich |

| 19 | Nassarawa | Pareto Inefficient | Abia | Pro-rich | Imo | Pro-rich |

| 20 | Plateau | Pareto Inefficient | Imo | Pro-rich | Abia | Pro-rich |

| 21 | Adamawa | Pareto Inefficient | Edo | Pro-rich | Kaduna | Pro-rich |

| 22 | Katsina | Pareto Inefficient | Benue | Pro-rich | Oyo | Pro-rich |

| 23 | Bayelsa | Pro-rich | Rivers | Pro-rich | Osun | Pro-rich |

| 24 | Ogun | Pro-rich | Oyo | Pro-rich | Edo | Pro-rich |

| 25 | Anambra | Pro-rich | Kaduna | Pro-rich | Ebonyi | Pro-rich |

| 26 | Benue | Pro-rich | Cross River | Pro-rich | Borno | Pro-rich |

| 27 | Enugu | Pro-rich | Osun | Pro-rich | Kano | Pro-rich |

| 28 | Kaduna | Pro-rich | Ebonyi | Pro-rich | Ekiti | Pro-rich |

| 29 | Abia | Pro-rich | Akwa Ibom | Pro-rich | Rivers | Pro-rich |

| 30 | Oyo | Pro-rich | Borno | Pro-rich | Akwa Ibom | Pro-rich |

| 31 | Edo | Pro-rich | Ondo | Pro-rich | Gombe | Pro-rich |

| 32 | Ebonyi | Pro-rich | Kano | Pro-rich | FCT | Pro-rich |

| 33 | Gombe | Pro-rich | Delta | Pro-rich | Taraba | Pro-rich |

| 34 | Kano | Pro-rich | FCT | Pro-rich | Ondo | Pro-rich |

| 35 | Taraba | Pro-rich | Ekiti | Pro-rich | Cross River | Pro-rich |

| 36 | Borno | Pro-rich | Taraba | Pro-rich | Delta | Pro-rich |

| Quality of Growth | Absolute Poverty | Relative Poverty | Dollar/Day Poverty |

|---|---|---|---|

| Pro-poor | 4 | 5 | 5 |

| Pareto Efficient | 13 | 4 | 4 |

| Total | 17 | 9 | 9 |

| % inclusive growth | 45.9% | 24.3% | 24.3% |

| % non-inclusive growth | 54.1% | 75.7% | 75.7% |

| Quality of Growth | Policy Advice |

|---|---|

| Pro-poor growth | Priority here should be to increase growth while minimizing inequality i.e., keep status quo. |

| Pareto efficient growth (for the poor) | The goal here should fully be on reducing inequality without which increased growth will not fully impact on poverty. |

| Pareto inefficient growth (for the poor) | The focus here should be to look for entirely new sources of growth that is different from previous. E.g., transiting from capital to labour intensive production or vice versa. |

| Pro-rich growth | The key priority here should be a simultaneous wealth redistribution/inequality reducing policies. |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Udoh, E.; Ayara, N. An Investigation of (Non-) Inclusive Growth in Nigeria’s Sub-Nationals: Evidence from Elasticity Approach. Economies 2017, 5, 43. https://doi.org/10.3390/economies5040043

Udoh E, Ayara N. An Investigation of (Non-) Inclusive Growth in Nigeria’s Sub-Nationals: Evidence from Elasticity Approach. Economies. 2017; 5(4):43. https://doi.org/10.3390/economies5040043

Chicago/Turabian StyleUdoh, Enobong, and Ndem Ayara. 2017. "An Investigation of (Non-) Inclusive Growth in Nigeria’s Sub-Nationals: Evidence from Elasticity Approach" Economies 5, no. 4: 43. https://doi.org/10.3390/economies5040043