The Catastrophe of Electric Vehicle Sales

Abstract

:1. Introduction

2. Catastrophe Theory

3. Results

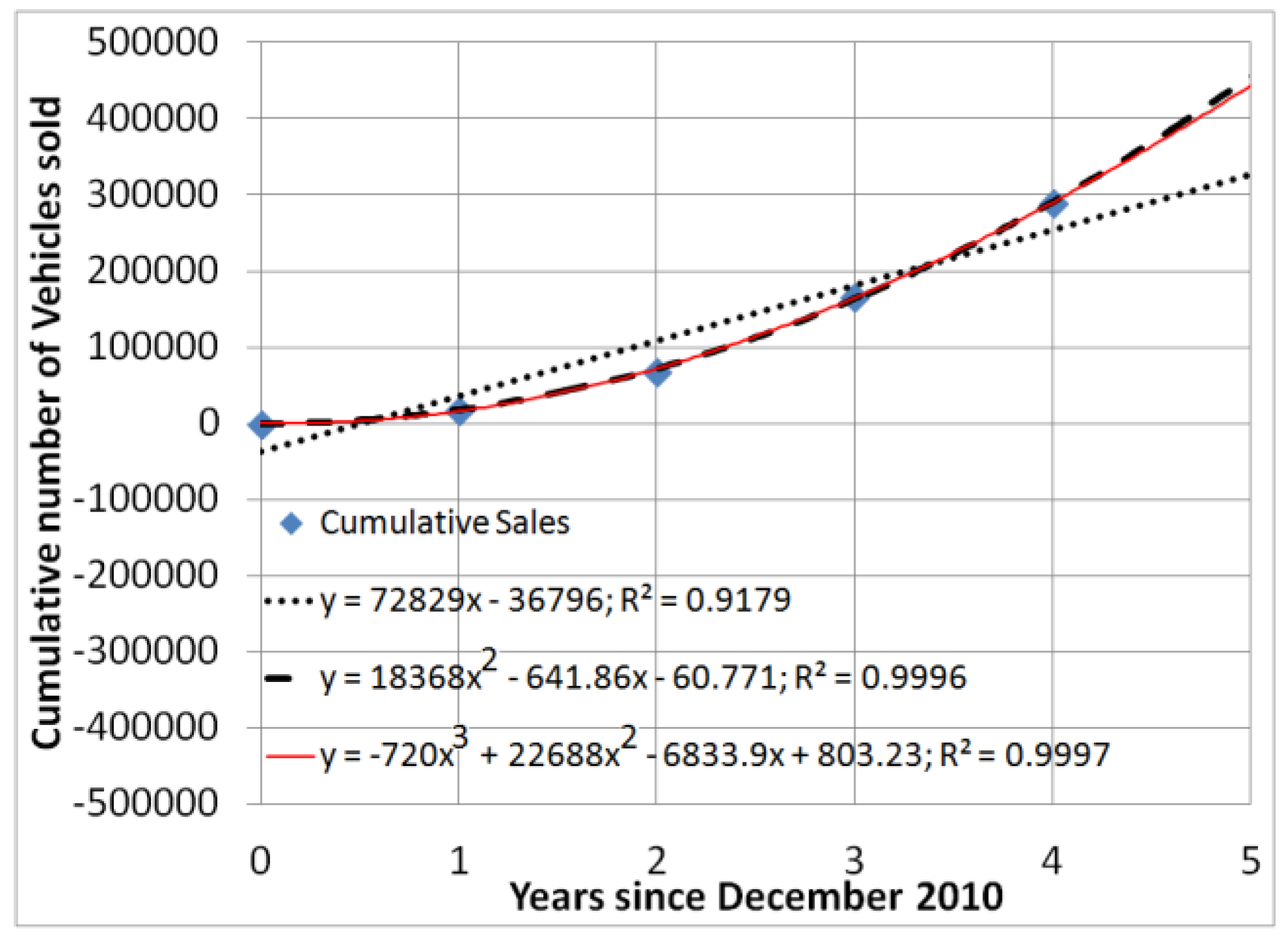

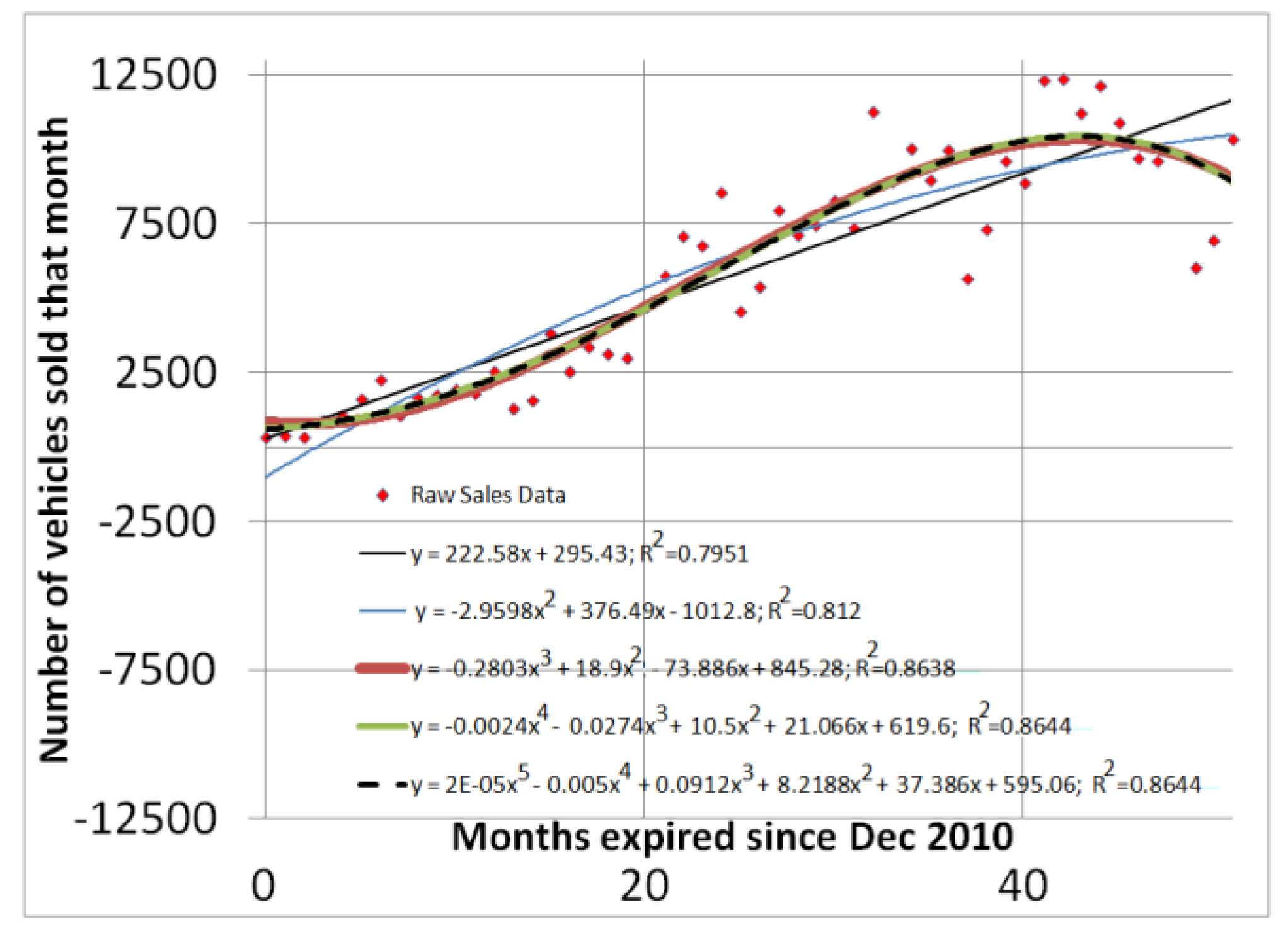

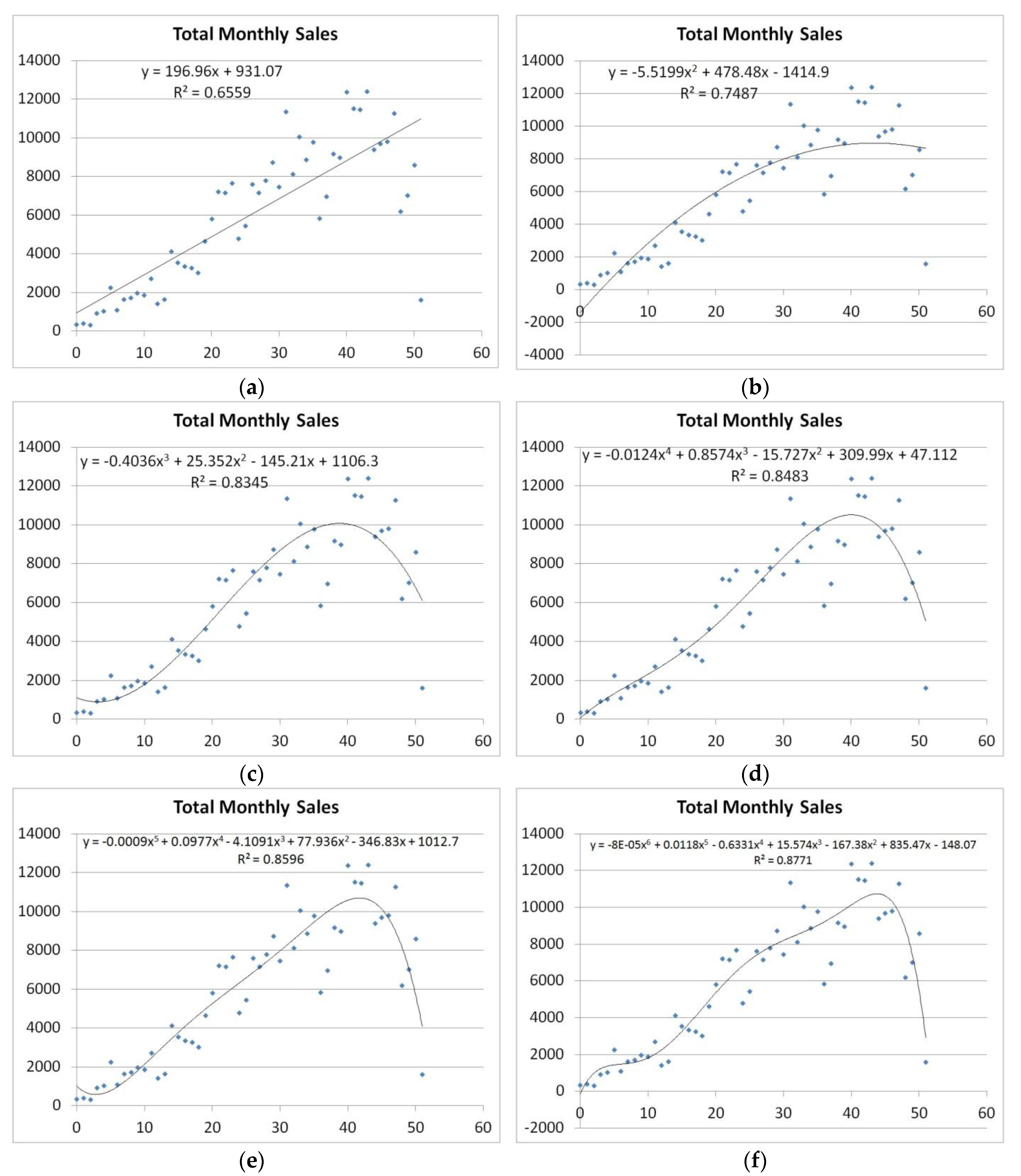

3.1. System Identification: Optimally Fitting Data to Assumed Models

Least squares

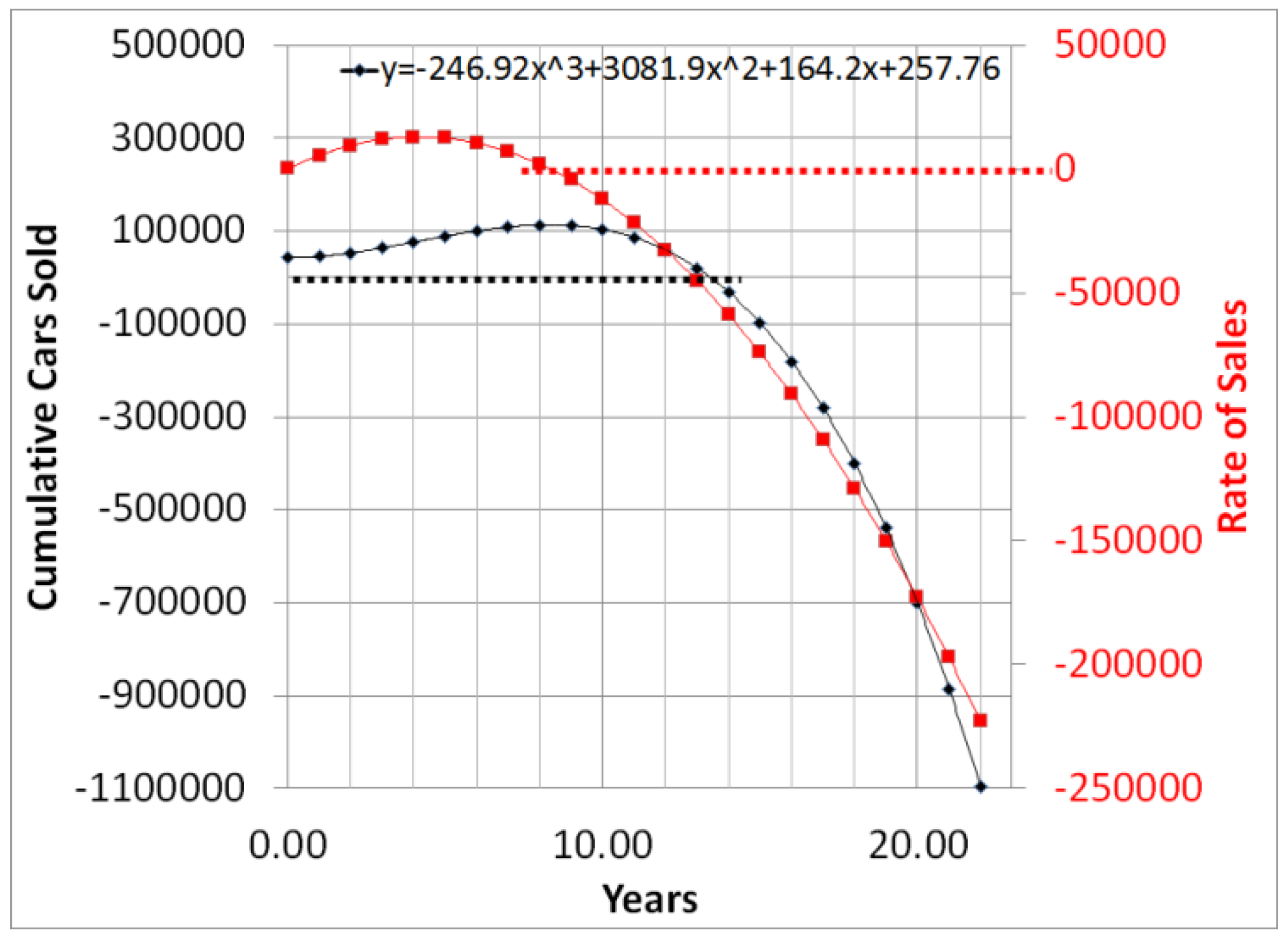

3.2. Sales Rates from Differentiation of Assumed Models

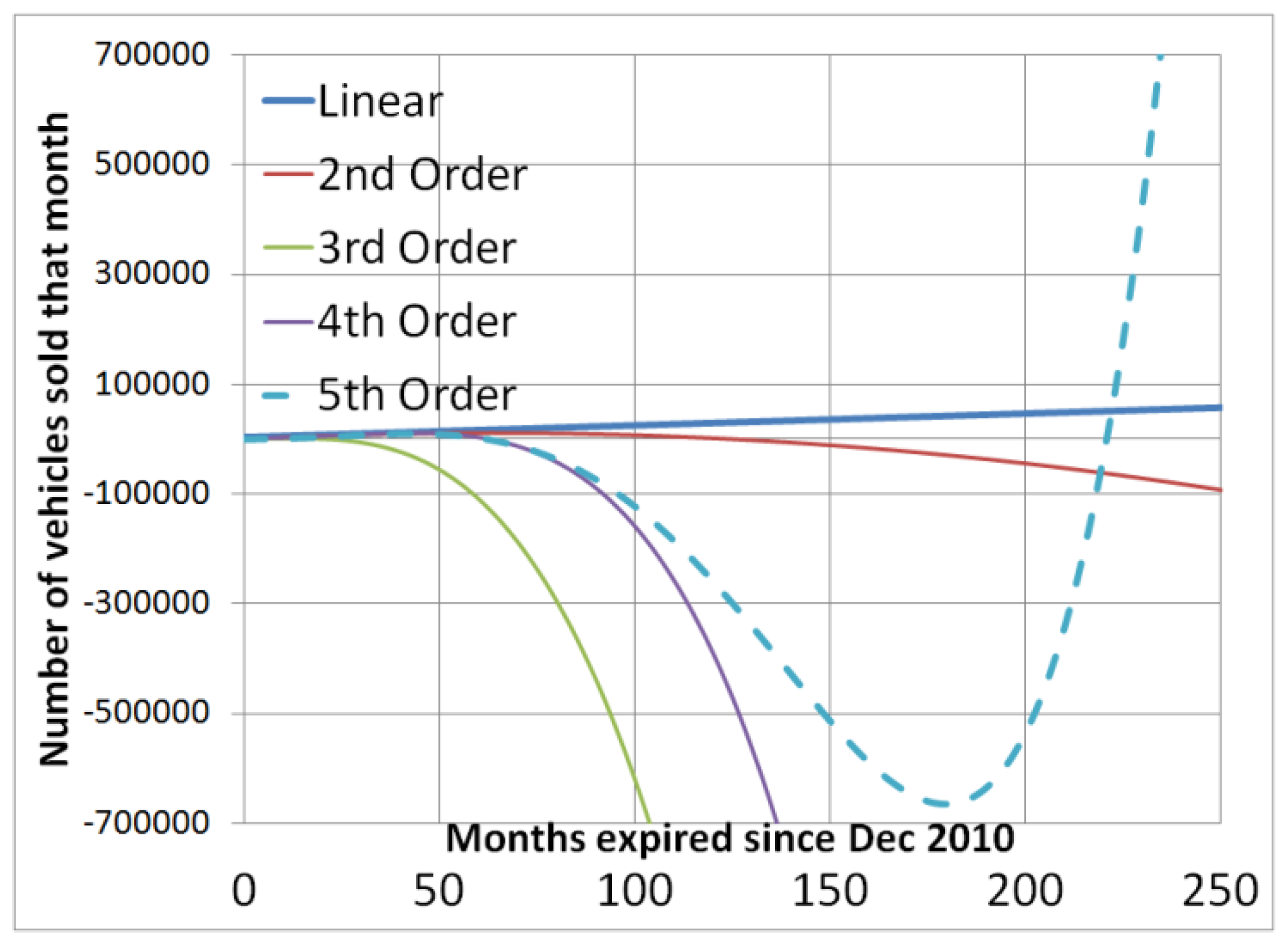

3.3. Extrapolation by Forward Time Propagation

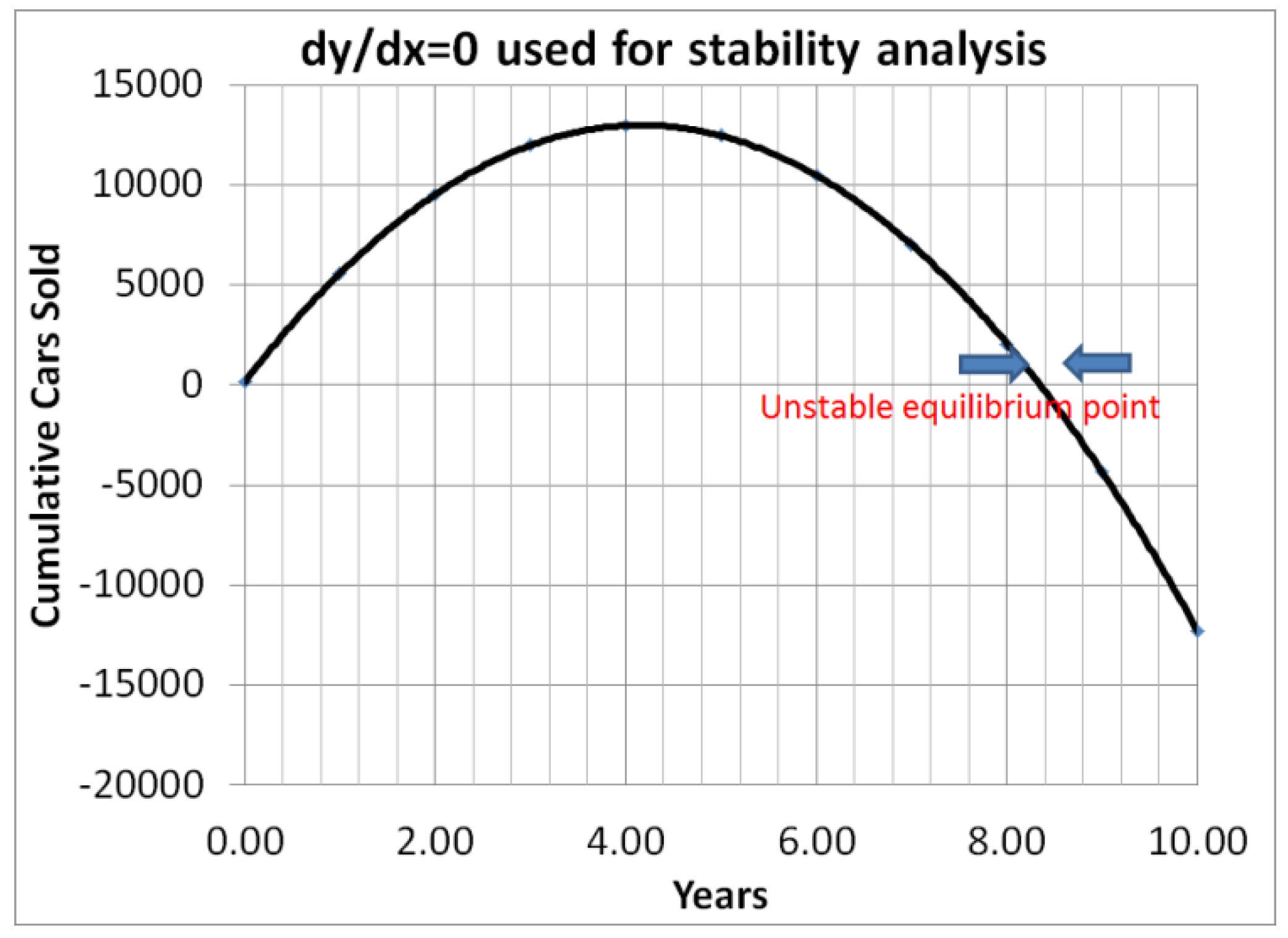

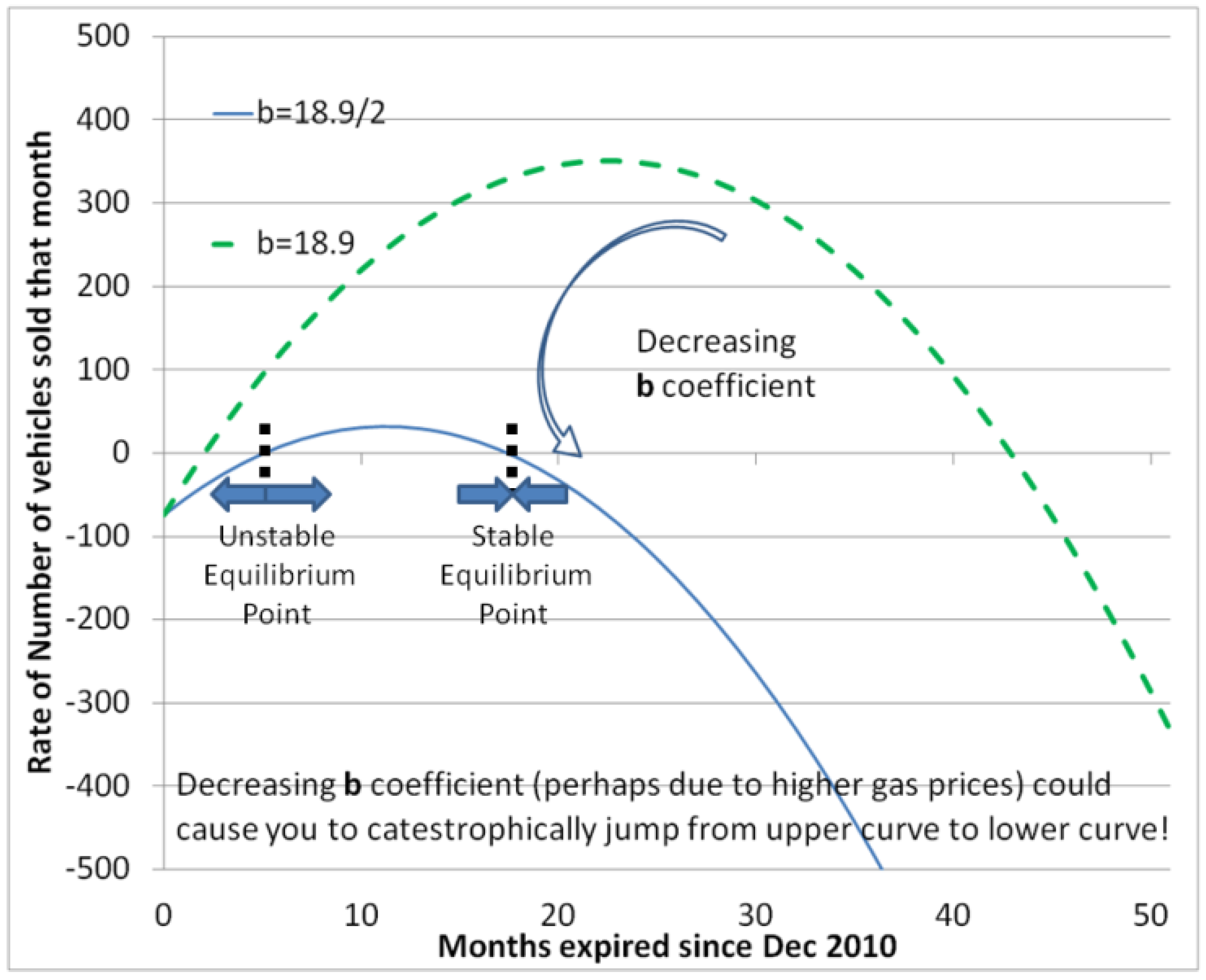

3.4. Equilibrium Point Analysis: Modeling Electric Car Sales with Catastrophe Theory: Fast and Slow Dynamics

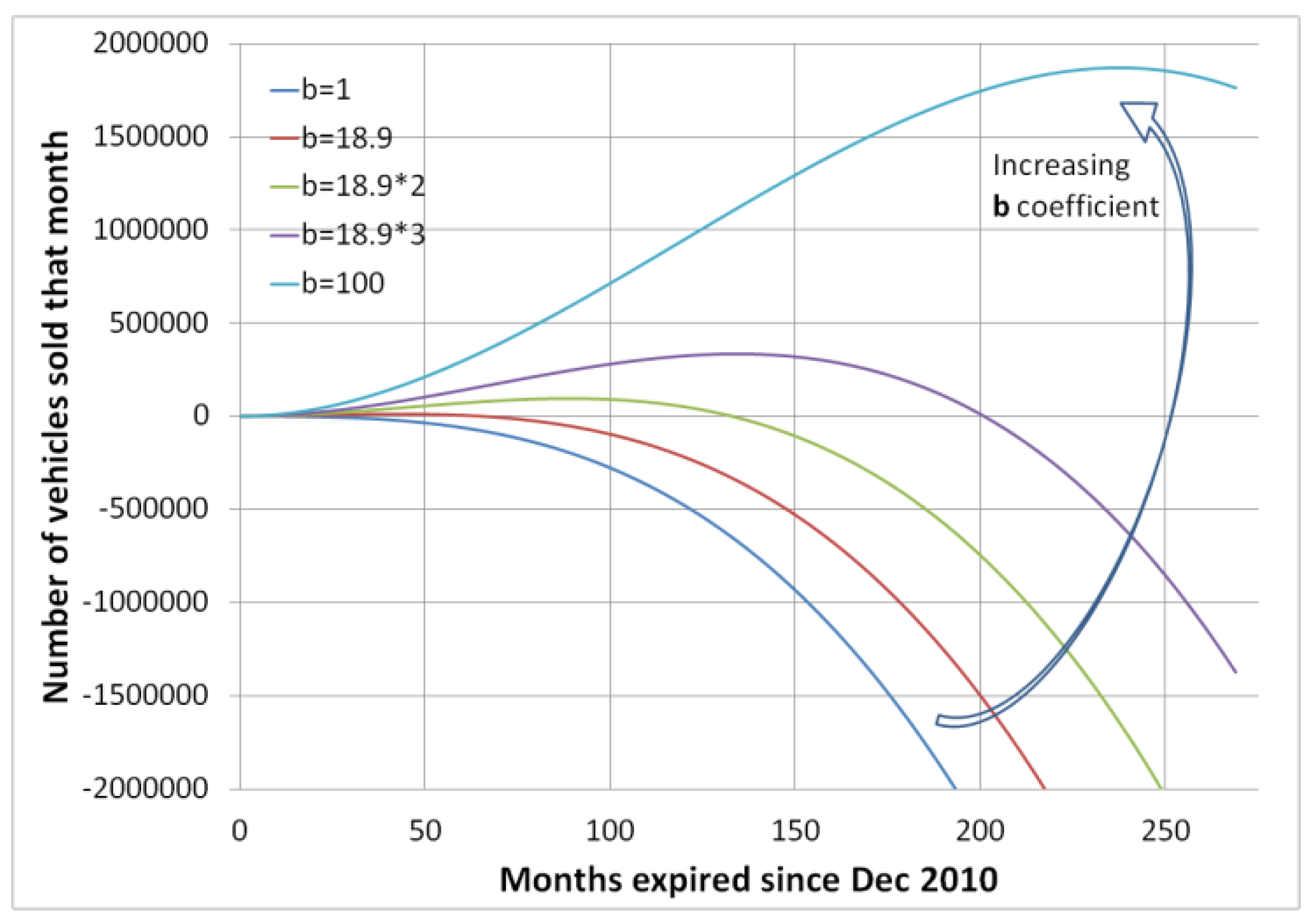

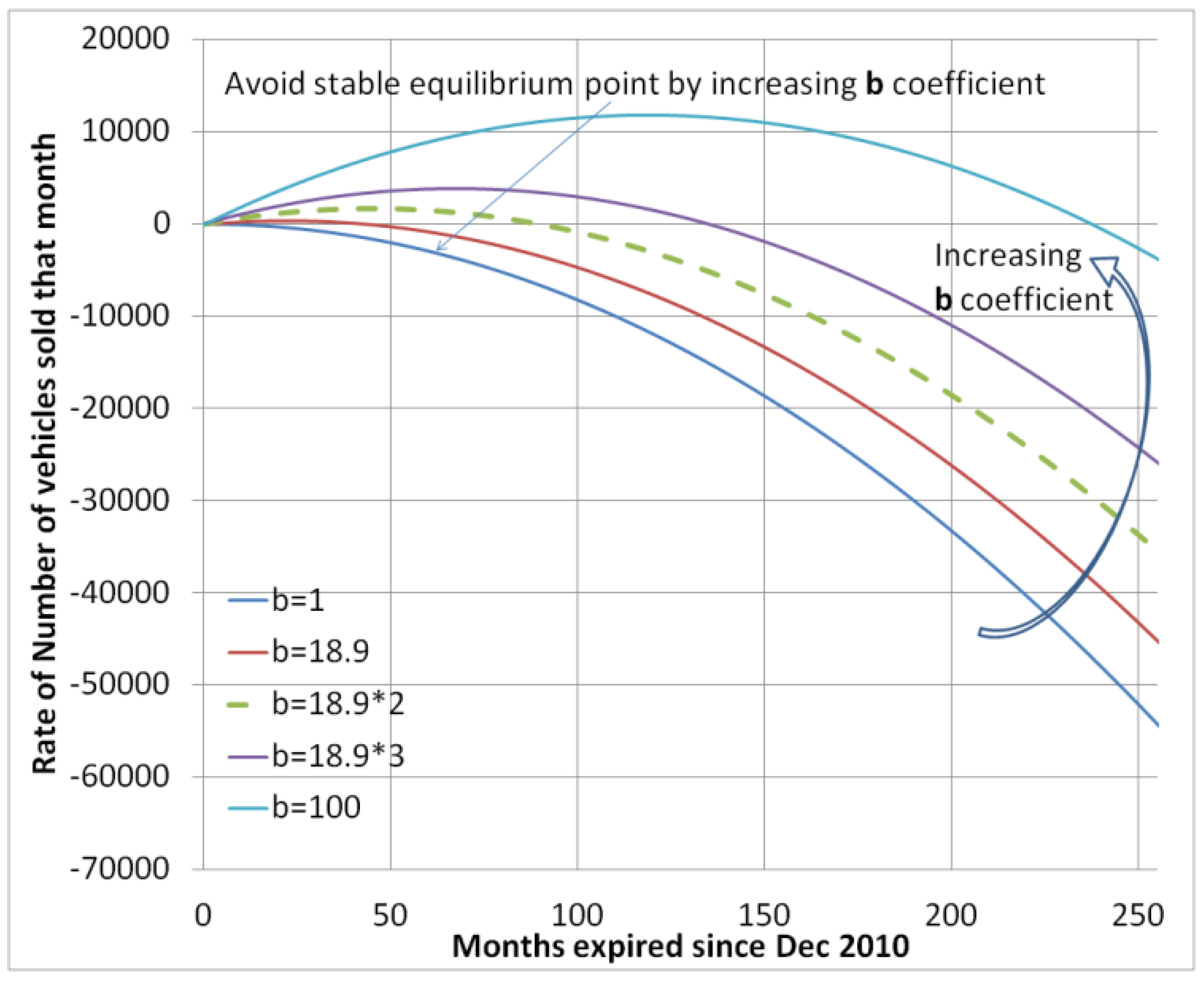

3.5. Impulse Iteration: Analysis of System with Slow Moving Dynamic

4. Discussion

Conflicts of Interest

References

- E-Volution—Electric Vehicles in Europe: Gearing Up for a New Phase? Amsterdam Roundtables Foundation Report; McKinsey & Company: Amsterdam, The Netherlands, 2014.

- Nemry, F.; Brons, M. Plug-In Hybrid Scenarios of Electric Drive Vehicles; JRC Technical 222Notes; European Commission Joint Research Center Institute for Prospective Technological Studies: Luxembourg, 2010. [Google Scholar]

- Small Business Website. Hearst Newspapers, LLC. Available online: http://smallbusiness.chron.com/define-sales-analysis-5258.html (accessed on 30 August 2017).

- Argonne National Laboratory, Energy Systems. Light Duty Electric Drive Vehicle Monthly Sales Updates. Available online: https://www.anl.gov/energy-systems/project/light-duty-electric-drive-vehicles-monthly-sales-updates (accessed on 9 August 2017).

- Faraway, J.J. Extending the Linear Model with R: Generalized Linear Mixed-Effects and Nonparametric Regressionmodels; Chapman and Hall/CRC: Boca Raton, FL, USA, 2006. [Google Scholar]

- Zeeman, E.C. Catastrophe theory. Sci. Am. 1976, 234, 65–83. [Google Scholar] [CrossRef]

- Chen, D.G.; Lin, F.; Chen, X.J.; Tang, W.; Kitzman, H. Cusp Catastrophe Model: A Nonlinear Model for Health Outcomes in Nursing Research. Nurs. Res. 2014, 63, 211–220. [Google Scholar] [CrossRef] [PubMed]

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sands, T. The Catastrophe of Electric Vehicle Sales. Mathematics 2017, 5, 46. https://doi.org/10.3390/math5030046

Sands T. The Catastrophe of Electric Vehicle Sales. Mathematics. 2017; 5(3):46. https://doi.org/10.3390/math5030046

Chicago/Turabian StyleSands, Timothy. 2017. "The Catastrophe of Electric Vehicle Sales" Mathematics 5, no. 3: 46. https://doi.org/10.3390/math5030046