1. Introduction

For insurance companies and financial institutions, regulations are established for solvency capital requirements. Internal targets and supervisory requirements are in constant evolution, following the progress in measurement techniques. For example, since recent financial events, regulators aim at protecting stakeholders against large unexpected losses using conservative measures. In this paper, we provide new ways to compute the contribution of each component of a portfolio composed of dependent classes of risks. We consider multivariate risk measures, represented by sets of curves, that can be used for risk comparison. We also provide methods to select optimal sets from these curves, in order to obtain vector-valued sets the same dimension as the total number of risks. Our approach allows a conservative risk protection, which is in line with desirable changes, as a consequence of the recent financial crisis and catastrophic events. Sherris [

1] studies how to distribute the expected policyholder deficit to each business line under a complete market condition. Kim and Hardy [

2] study the allocation principle on policyholders’ deficit. In this paper, we calculate the capital allocation for each class, following optimal capital allocation principles as presented in Dhaene et al. [

3], which consider diversification within each line of business, presented as the unified principle in Dhaene et al. [

4]. We calculate the contribution for each risk within a business unit using the top-down risk decomposition technique (see, e.g., Cossette et al. [

5]), based on multivariate risk measures. Therefore, our approach considers both the dependence between each risk within a class and the dependence between classes of risks.

For univariate random variables representing aggregate portfolios, Value-at-Risk (VaR) and Tail Value-at-Risk (TVaR), are useful tools that fulfil desirable risk measure properties when one studies tail distributions. For instance, the univariate VaR provides a quantile at a determined probability level and is always homogeneous, invariant in translation and monotonic. The TVaR has the advantage of providing information on the tail of the distribution and is always coherent, unlike the VaR. Note that TVaR and Conditional Tail Expectation (CTE) are equal for continuous random variables. We choose to work with TVaR, since CTE is not coherent for discrete random variables. In this paper, we do not use univariate risk decomposition techniques, since we consider portfolios where groups of homogeneous risks are heterogeneous and cannot be aggregated. We choose to base the risk decomposition on multivariate TVaR and focus on continuous random variables. As stated in Aziz and Rosen [

6], the aggregation of risks is still at an early stage, and for historical and business reasons, one might want more conservative methods, to ensure every business line to be covered up to a chosen level. For example, conglomerates cannot use dedicated capital from business operations to mitigate other risks. The Basel Committee on Banking Supervision (BCBS) and the Office of the Superintendent of Financial Institutions (OSFI) have also published discussions on the risks concerning aggregation techniques for capital allocation (e.g., BCBS [

7], BCBS [

8] and OSFI [

9]) and suggest considering capital allocation to protect every unique branch of activities to a defined level, instead of their aggregation, which is exactly in line with the multivariate TVaR-based risk decomposition technique presented in this paper. Under the terms of Basel and OSFI Own Risk and Solvency Assessment (ORSA), banks and insurance companies often measure the risk associated with a portfolio

in terms of

,

, the risk measure being calculated for the sum of its marginal components. This is for example the case for operational risk; see Embrechts and Puccetti [

10]. However, OSFI [

11] states that “No diversification between risk categories is permitted until evidence confirms diversification will hold in a stress situation”. In this paper, we suggest the multivariate TVaR-based risk decomposition technique to consider that there might be heterogeneous risks or risks that cannot be diversified by their aggregation. The contribution of each risk is expressed in terms of a curve. Then, we present three different methods to select specific sets from the curves, which can be useful for practical purposes. The latter situation legitimates the use of multivariate risk measures on which to base capital allocation, as presented in the next sections. See Cossette et al. ( [

12,

13]) for a review of multivariate risk measures.

We denote the truncated expectation of

X, truncated from below at

b, by

, where

is the indicator function, such that

, if

, and

, if

. Then, as introduced in Acerbi and Tasche [

14], for

, the univariate TVaR of

X at level

α,

,

where:

Insurance and reinsurance companies take responsibility not only to allocate capital for a portfolio, but most of the time, also to its individual components. This consideration is also useful for pricing and comparison purposes. Furthermore, the computation of the contributions of each risk to the overall portfolio allows the identification of riskier assets or classes of risks and to prevent from catastrophic events, in addition to fulfilling regulation requirements. Capital allocation techniques are mostly split into two different approaches. A top-down approach is presented in Tasche [

15], Panjer [

16] and Goovaerts et al. [

17], where the capital is first allocated to the aggregate portfolio and then split into its internal business lines, using different techniques. The other general method consists of optimization functions, as in Dhaene et al. [

3] and Kim and Hardy [

2]. It is desirable to share equitably the risk capital between the portfolio’s risky components, considering their dependence level. In this paper, we will focus on the top-down risk decomposition technique.

However, aggregating a portfolio implies that if a risk reaches a high probability level, the other risks will compensate, to preserve a portfolio risk level. This is still being considered and accepted by recent regulatory frameworks and guidelines, but only within each line of business. For cases where business units aggregation is not an option, multivariate risk measures are used to allocate capital for components or classes of aggregate risks of the overall portfolio. This conservative allocation reflects the uncertainty of our economy and attempts to find a balance between making expected losses and preserving capital for the extreme events. For example, we find its purpose for an insurance company with multivariate business lines, represented as follows:

From an insurance point of view, business lines can represent the capital allocated for losses and dependent allocation expenses, and the policies are the insureds. From a financial point of view, business lines can be interpreted as portfolios, and the policies would represent dependent positions. This framework is also considered in Izraylevich and Tsudikman [

18].

In

Section 2, desirable properties of risk contributions are set, the univariate TVaR-based allocation principle is described and multivariate extensions, lower and upper orthant VaR and TVaR, discussed in Cossette et al. ( [

12,

13]), are presented.

Section 3 defines lower and upper orthant risk decomposition methods for each risk and group of aggregated risks. We also present the multivariate extension of desirable properties for risk decomposition in a multivariate setting. In

Section 4, we select sets using optimization functions, in order to calculate the risk decomposition sets. Three different techniques to select allocation sets from the curves resulting from the contributions are presented.

Section 5 contains illustrative applications of our results. They illustrate different values obtained when changing the dependence structures within and between the lines of business of a portfolio composed of two aggregate classes.

3. Multivariate Contributions

We consider multivariate sums of random vectors. These can represent insurance products, business lines or financial positions. This section presents the multivariate lower and upper orthant TVaR-based contributions of each risk of the overall portfolio. Capital allocation values are calculated considering the dependence between heterogeneous classes of aggregated homogeneous risks.

3.1. Multivariate Lower Orthant TVaR-Based Contributions

In this section, we introduce the multivariate lower orthant TVaR-based contributions in the multi-class model represented by k dependent random vectors , . Define the random vector with .

Definition 2. The multivariate lower TVaR-based contribution of in the sector , given the information , , , is defined, for all:by:where . The multivariate lower orthant TVaR-based contribution represents the expectation of a single risk , being part of a business line j of aggregated risks, knowing that its business unit takes higher values than its multivariate lower orthant VaR, leading to a higher joint cdf value.

Proposition 1. The multivariate lower orthant TVaR-based contributions, , and , are given for all:by:where denotes the density function of the random vector , with . Proof. First we have that:

By definition of the multivariate lower TVaR-based contributions, one has:

which leads to Equation (

2), because:

The limits of the level curve representing the multivariate lower orthant TVaR-based contributions , and are given below. They are represented by the upper support of the fixed variables and the contribution based on the univariate TVaR.

Proposition 2. For and where and represent respectively the upper support and the inverse cdf of the random variable , and ; we have the following limits.and: 3.2. Multivariate Upper Orthant TVaR-Based Contributions

In this section, we find results analogous to the ones obtained for the multivariate lower orthant TVaR-based contributions. The main difference lies in the consideration of the multivariate survival distribution instead of the multivariate distribution function used to calculate the multivariate lower orthant TVaR.

Definition 3. The multivariate upper orthant TVaR-based contributions, denoted , and , are given for all:by: The multivariate upper orthant TVaR-based contributions can be interpreted as the expected values of a risk knowing that its aggregate business unit takes higher values (resulting in a smaller survival probability) than the aggregate business unit’s upper orthant VaR.

Proposition 3. Multivariate upper orthant TVaR-based contributions, , , , can be expressed for all:by: Proof. It is easily seen from the definition of

that:

Upper TVaR-based contributions are given by:

which is equivalent to (

4).

3.3. Properties

Since we are not interested in aggregating heterogeneous business lines, but only the risks within homogeneous classes, and because the multivariate TVaR risk decomposition technique relies on a conditional expectation, it is trivial that the contribution function

that satisfies

,

and

, respects axioms A1–A6 presented in

Section 2.1. This means that the axioms are respected in terms of individual risks within each business line of an entity composed of

k dependent lines of business.

3.4. Approximation of the Multivariate Lower and Upper Orthant TVaR-Based Contributions

In this section, we show how to approximate the multivariate lower and upper orthant TVaR-based contributions, using the importance sampling method. The aim of this paper being to provide a multivariate TVaR-based risk decomposition technique to obtain allocation curves and finite sets, we do not emphasize the importance sampling method. We refer the reader to Targino et al. [

22] and Arbenz et al. [

23] for more insightful information applied to capital allocation based on univariate risk measures and tail events approximation using importance sampling methods, respectively, and to McLeish [

24] for information on how to obtain an exponential family of distributions with bounded relative error for rare events, which allows one to use the importance sampling method. The first step consists of expressing the multivariate lower and upper orthant TVaR-based contributions using expectations of random variables, as presented in the next proposition.

Proposition 4. Let and , and , be the distribution and the survival functions of the random vector , and let and be the functions defined for all , by:Then, the multivariate lower orthant TVaR-based contribution is expressed, for all:by:Similarly, the multivariate upper orthant TVaR-based contributions is given, for all:by:where U and V are continuous random variables with supports and , and density function and , respectively. Let and be random variables, such that and are uniformly distributed over the interval and , respectively. Assume further that and are independent of U and V, for all and , respectively. Proof. For all

, we have:

which is equivalent to (

5). Similar arguments lead to (

6).

Note that the previous result is valid for every continuous random variables U and V defined over the intervals and , respectively. For simplicity, these random variables can be chosen as a shifted exponential random variables with density functions , and , , respectively.

Based on this idea, one can compute the multivariate lower and upper orthant TVaR-based contributions using the importance sampling as described below (Algorithm).

| Algorithm: |

| 1. Compute , for all . |

| 2. Successively, compute , for all and |

| , for all . |

| 3. Generate independent from Exp, and compute , |

| 4. Set and , |

| 5. Generate independent and from and , , respectively. |

| 6. Approximate and with |

| |

| and |

| |

| respectively. |

3.5. Illustration

Consider two dependent lines of business () where each risk corresponds to the cost associated with a policy j in line i, and and that dependence exists between and within each business line. Define where .

We assume that the dependence model is represented by a bivariate mixture of Erlang distributions (see Lee and Lin [

25]). Therefore, the joint cdf is represented by:

with moment-generating function:

where

represents the Erlang cdf evaluated at

x with shape parameter

a and scale parameter

b. We suppose that

,

and the following dependence matrix:

This model allows a closed-form expression of the multivariate lower and upper orthant TVaR-based contributions since the dependence is only represented in the dependence matrix, which leads to an easy computation of the multiple integrals.

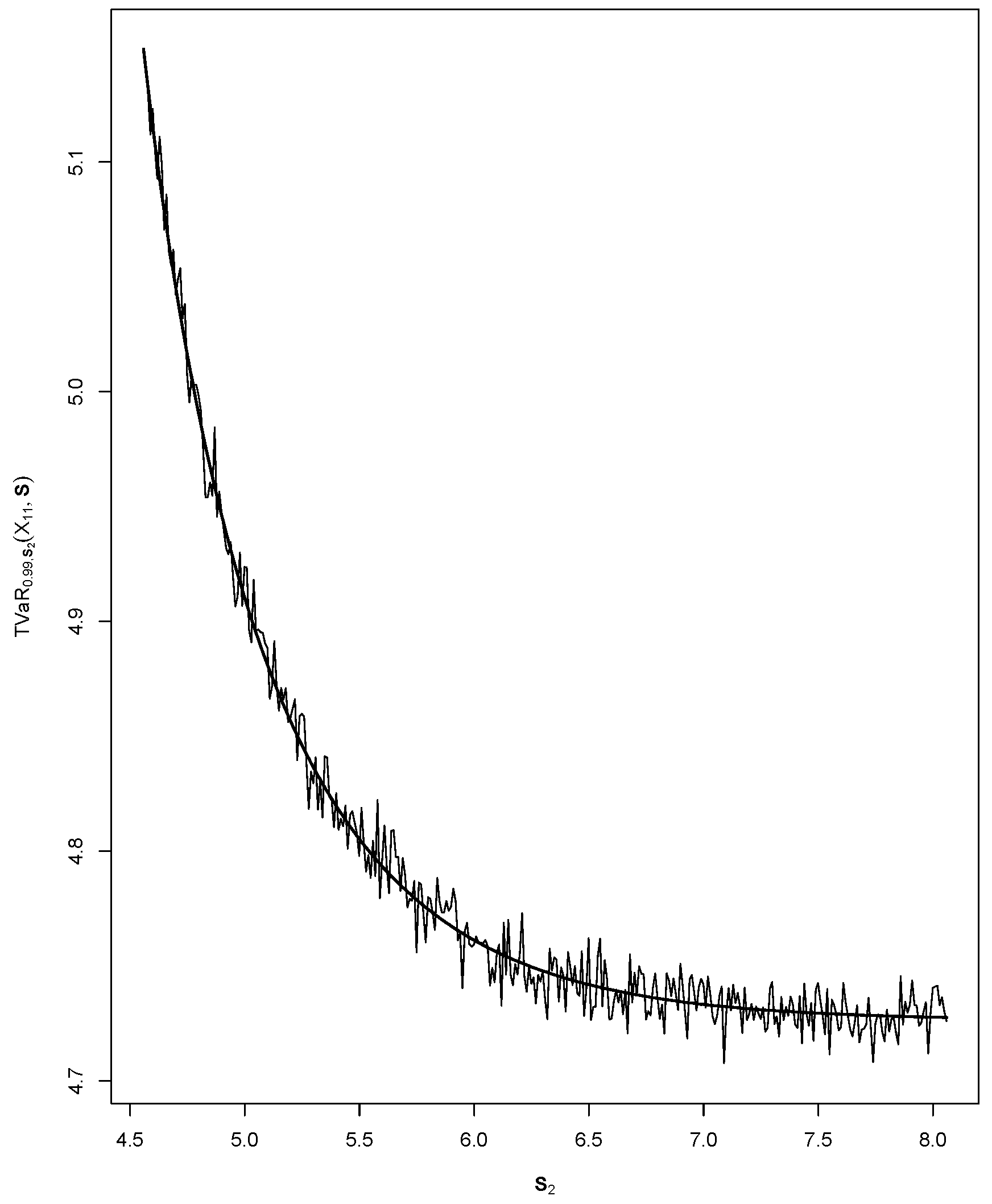

Figure 1 shows the effectiveness of our approximation using importance sampling. Note that calculations were instantaneous with

1,000,000 and that

.

4. Criteria for Capital Allocation Finite Sets

In this section, we present three different methods to derive the contributions of the portfolio’s risks. Each one results in solving an optimization function. Since multivariate TVaR’s are level sets, the resulting contributions are also sets. They provide an amount of capital for a level α and for each value of . As stated in the Introduction, regulators aim to establish fixed amounts for the overall business, and the importance of the risk contributions has become essential over time, although it has always been an enterprise risk management matter. Our objective here is to evaluate the contribution of each risk in given , , .

As

is a function of

, it will be interesting to derive procedures allowing one to find an optimal vector

in order to summarize the multivariate lower orthant TVaR-based contribution function

by a single value

. The three methods provide us with a finite size matrix, based on optimization criteria. Hence, the lower orthant TVaR-based contributions are given by:

For each method presented, one can find analogous results for the multivariate upper orthant TVaR-based contributions.

4.1. Orthogonal Projection Based on the Multivariate Lower Orthant VaR

We start by defining the vectors:

and:

The objective of this approach is to determine for all

the optimal solution:

, for

where

denote the the Euclidean distance and:

For fixed

, the vector of TVaR-based contributions of

in

,

is then given by:

where

is given by Proposition 4.

4.2. Orthogonal Projection Based on the Multivariate Lower Orthant TVaR

This method considers TVaR risk measures in order to build a criterion to obtain optimal values. First, we define:

and:

The objective is to find

, the solution to the following minimization problem:

The values of

resulting from this optimization problem are then used to compute, for fixed

, the vector of TVaR-based contributions of

in

,

given by:

4.3. Orthogonal Projection of Multivariate Lower and Upper Orthant TVaR-Based Contributions

The last criterion is based on the lower orthant TVaR-based contributions. For that method, we define the vectors:

and:

For fixed

, we find

by solving:

The value

resulting from this optimization problem is then used to compute, for fixed

, the vector of TVaR-based contributions of

in

,

given by:

5. Illustrations

In this section, we illustrate the orthogonal projections sets, based on the criteria presented in

Section 4. To simplify the presentation and avoid cumbersome notation, we restrict the application to the bivariate case. A more general multivariate situation can be obtained in a similar manner. Let us consider an investor having two dependent portfolios

, each of which representing dependent sums of random variables, such that

,

. In such a case, we have:

and:

The investor might be interested in a hedging strategy based on the multivariate TVaR at level

(using negative returns), which considers the dependence between the losses within and between the portfolios. Such a strategy is therefore based on the expectation of the union of conditional events. In this case, each individual event consists of the loss taking a value above level

α. Therefore, it is desirable for the investor to have vector-valued metrics in order to hedge his or her assets. Assume that the dependence structures of the random vectors

and

are described by Archimedean copulas with generators

and

, respectively. Therefore, the copula of

is also Archimedean with generator

ϕ. Furthermore, in this specific situation,

, because the Archimedean copulas are symmetric. Let

and

be the distribution functions of

and

,

, respectively. Suppose that

,

and that

and

are independent, which implies that

. For illustration, suppose that

ϕ represents the generator of a Clayton copula, expressed by

In this context, the components of the lower orthant TVaR-based contributions of

and

on

given

, are given by:

obtained from Proposition 4, that is:

and:

where:

and:

Since the copulas of

and

are Archimedean with generator

ϕ, then:

and:

Finally, using the projection methods developed in

Section 4, we obtain optimal values

, and calculate:

1. Orthogonal projection based on the multivariate lower orthant VaR:

We find the optimal

as the solution of the following minimization:

2. Orthogonal projection based on the multivariate lower orthant TVaR:

We compute the optimal

, as the solution of the following minimization:

3. Orthogonal projection of multivariate lower and upper orthant TVaR-based contributions:

For this approach, we look for

and

involved in:

by solving respectively the following optimization functions:

and:

Table 1 presents numerical results with

,

,

,

,

and a dependence parameter expressed in term of a Kendall’s

τ, for

ϕ, such that

, respectively.

Table 1 illustrates that the orthogonal projection based on the multivariate lower orthant VaR always provides smaller results compared to the orthogonal projection based on the multivariate lower orthant TVaR, which is consistent with previous results in Cossette et al. [

13]. Moreover, as the dependence parameter increases, one sees that allocation values also increase, which shows consistency for practical applications.