3.1. Parametric Estimators

Let

be a sample of independent random vectors, where

and

. Assume that the star body

K is given and Assumption 1 is satisfied. From now on, we suppose that

K is symmetric w.r.t. the origin. We consider a model family

of continuously differentiable densities for the star-generalized radius

R on

, see (

4).

is the parameter space which is assumed to be compact. Suppose that

is a continuous function.

Next we give two reasonable model classes for

:

- (1)

Modified exponential model.

,

with the expectation

- (2)

Weibull model.

,

with the expectation

Let

. In this section the aim is to fit the specific parametric model for the density

to the data by estimating the parameters

θ and

μ where

is given according to (

5) and (

4) with

. Therefore, the two models [1] and [2] fulfill the condition

which ensures the differentiability of the density

at zero.

For the statistical analysis we suppose that the data

are given and these data comprise independent random vectors having density

. Suppose that

θ and

μ are interior points of

and

, respectively. The concentrated log likelihood function (constant addends can be omitted) reads as follows

We introduce the maximum likelihood estimators

of

θ and

μ as joint maximizers of the likelihood function:

Under appropriate assumptions, the maximum-likelihood-estimator are asymptotically normally distributed (cf. Theorem 5.1 in [

18], p. 463)

where

is the symbol for convergence in distribution and the information matrix is given by

with

and

3.2. Nonparametric Estimators without Scale Fit

In the present section we deal with nonparametric estimators in the context of star-shaped distributions. This type of estimators is of special interest if no suitable parametric model can be found. The cdf of R will be denoted by .

3.2.1. Estimating μ and

Let

be the sample as in

Section 3.1. In the following the focus is on the estimation of the parameter

μ and the distribution function of the generalized radius

R.

First we choose an estimator for

μ. For this purpose we assume that

. In view of Lemma 1,

is an unbiased estimator for the unknown parameter

μ. Define

and

for

. Using this definition, an estimator for the cdf of

(cf. (

3)) is given by the formula

for

. At a first glance,

just approximates the empirical distribution function

which is not available from the data because of the unknown

μ. We can prove that

converges to

, in fact at the same rate as every common empirical distribution function converges to the cdf. This is the assertion of the following theorem.

Theorem 1. Suppose that Assumption 1 is satisfied, is Lipschitz-continuous on , and If further f is bounded on , then, for , Here the condition (

9) ensures that

which in turn is an assumption for the law of iterated logarithm of

.

3.2.2. Density Estimation

In the remainder of

Section 3.2, we establish an estimator for the density

in the case of a bounded generator function

g, and provide statements on convergence properties of the estimator. An estimator for

μ is available by Formula (

7), the estimation of

g is still an open problem. If we want to estimate

g, then it is necessary that this function is identifiable. In (

2), however, function

g is determined up to a constant factor. Therefore, we require

to obtain the uniqueness and identifiability. As a consequence, we get, according to [

12]

In the following we adopt the approach introduced in Section 2 of [

7] to the present much more general situation. This approach combines the advantages of two estimators and avoids their disadvantages. Let

be a function having a derivative

with

for

and the property

. We introduce the random variable

and denote the inverse function of

ψ by Ψ. The transformation using

ψ is applied to adjust the volcano effect described above. In view of (

4), the density

χ of

is given by

for

. This equation implies the following formula for

g:

The next step is to establish the estimator for

χ. Nonparametric estimators have the advantage that they are flexible and there is no need to assume a specific model. Let us consider the transformed sample

with

. Further we apply the following kernel density estimator for

χ:

where

is the bandwidth and

k the kernel function. Note that

represents the usual kernel density estimator for

χ based upon the

’s and including a boundary correction at zero (the second addend in the outer parentheses of (

10)). The mirror rule is used as a simple boundary correction. Other more elegant corrections can be applied at the price of a higher technical effort. The properties of

are essentially influenced by the bandwidth

b. Since the kernel estimator shows reasonable properties only in the case of bounded

χ, we have to guarantee by suitable assumptions that

in order to get the boundedness of

χ (see below). On the basis of

, we can establish the following estimator for

:

where

This approach has the property that the theory of kernel density estimators applies here (cf. [

19]). The kernel estimators are a very popular type of nonparametric density estimators because of their comparatively simple structure. In the literature the reader can find a lot of hints concerning the choice of the bandwidth.

Let us add here some words to the comparison between this paper and [

7]. Although the main idea for the construction of estimators is the same, there is a difference in the definition of the generator functions (say

g and

). Considering the special case

, identity

can be established for

. This causes some changes in the formulas. For more details in a particular case, see Section 3 in [

20].

3.2.3. Assumptions Ensuring Convergence Properties of Estimators

Next we provide the assumptions for the theorems below. Assumption 2 concerns the parameter and the function k of the kernel estimator whereas Assumption 3 is posed on function ψ.

Assumption 2. (a) We assume thatwith constants . (b) Suppose that the kernel function is continuous and vanishes outside the interval , and has a Lipschitz continuous derivative on . Moreover, assume that holds for ,for even , where is an integer. Note that continuity of the derivative at an enclosed boundary point means that the one-sided derivative exists and is the limit of the derivatives in a neighbourhood of this point. Symmetric kernel functions

k satisfying (

12) are called kernels of order

p. Assumption 2 ensures that the bias of the density estimator

converges to zero at a certain rate. Under Assumption 2 with

and

, the estimator

is indeed a density. The case

is added to complete the presentation and is of minor practical importance unless we have a very large sample size (cf. the discussion in [

21]). From the asymptotic theory for density estimators, it is known that the Epanechnikov kernel

is an optimal kernel of order 2 (i.e., in the case

in Assumption 2) with respect to the asymptotic mean square error (cf. [

19]). This kernel function is simple in structure and leads to fast computations. The consideration of optimal kernels can be extended to higher-order kernels. It turned out that their use is advantageous only in the case of sufficiently large sample sizes (for instance, for a size greater than 1000).

Assumption 3. The -th order derivative of exists and is continuous on , is positive and bounded on for some integer , and is bounded on . The functions and have bounded derivatives on with some . Moreover, Notice that in Assumption 3 we require that the right-sided limit of the

-th order derivative of

is finite at zero. Hence Assumption 3 implies that

and

with a finite constant

. On the other hand, it follows from (

13) that

with a finite constant

. Therefore,

χ is bounded under Assumption 3.

Example 10. Letwith a constant . Then , , Hence, Assumption 3 is satisfied for every .

Another condition is required now for .

Assumption 4. For any bounded subset Q of , the partial derivatives of exist and are bounded on Q, and is Hölder continuous of order on Q for each .

Assumption 5. For any bounded subset Q of , is Hölder continuous of order .

If Assumption 3 is fulfilled, the function has second order derivatives , and these are bounded on bounded subsets of , then the Assumption 4 is satisfied.

Example 11. We consider the q-norm/antinorm: ,Therefore, Assumption 4 is fulfilled in the case , and Assumption 5 is fulfilled in the case . Examples 1 and 2: (Continued) One can show that exists for , and is bounded. Moreover, is Lipschitz continuous on . Hence, Assumption 4 is satisfied.

3.2.4. Properties of the Density Estimator

First we provide the result on strong convergence of the density estimator.

Theorem 2. Suppose that the p-th order derivative of g exists and is bounded on for some even integer . Moreover, assume that condition (9) as well as Assumptions 1 to 3 are satisfied for the given p. Let Assumption 4 or Assumption 5 be satisfied. In the first case define , in the latter case . Then, for any compact set D with and , For any compact set D with and , Theorem 2 applies in particular to the Euclidean case

. Since Assumption 2 is weaker than the corresponding assumption on the kernel in [

7], Theorem 2 extends Theorem 3.1 in [

7] even in the case of

. The convergence rate in (

15) is the same as that known for one-dimensional kernel density estimators and cannot be improved under the assumptions posed here (cf. [

22]).

The next theorem represents the result about the asymptotic normality of the estimator .

Theorem 3. Suppose that the assumptions of Theorem 2 and Assumption 4 are satisfied. Let such that is continuous at .- (i)

DefineThenwhere - (ii)

If additionally holds true with a constant , then, for ,

The assertion of Theorem 3 can be used to construct an asymptotic confidence region for

. Term

describes the asymptotic behaviour of the the bias of the estimator

whereas the fluctuations of the estimator are represented by

. In view of Theorem 3,

converges in distribution to

. The mean squared deviation of the leading terms in the asymptotic expansion of

is thus given by

The minimization of this function w.r.t.

b leads to the asymptotically optimal bandwidth

The bandwidth

converges at rate

to zero. Under the conditions of Theorem 3(ii),

has the convergence rate

. This convergence rate of

is better than that of a nonparametric density estimator but slower than the usual rate

for parametric estimators. In principle, Formula (

16) could be used for the optimal choice of the bandwidth. However, one would need then an estimator for

and typically, estimators of derivatives of densities do not exhibit a good performance unless

n is very large. As a resort, one can consider a bandwidth which makes reference to a specific radius distribution.

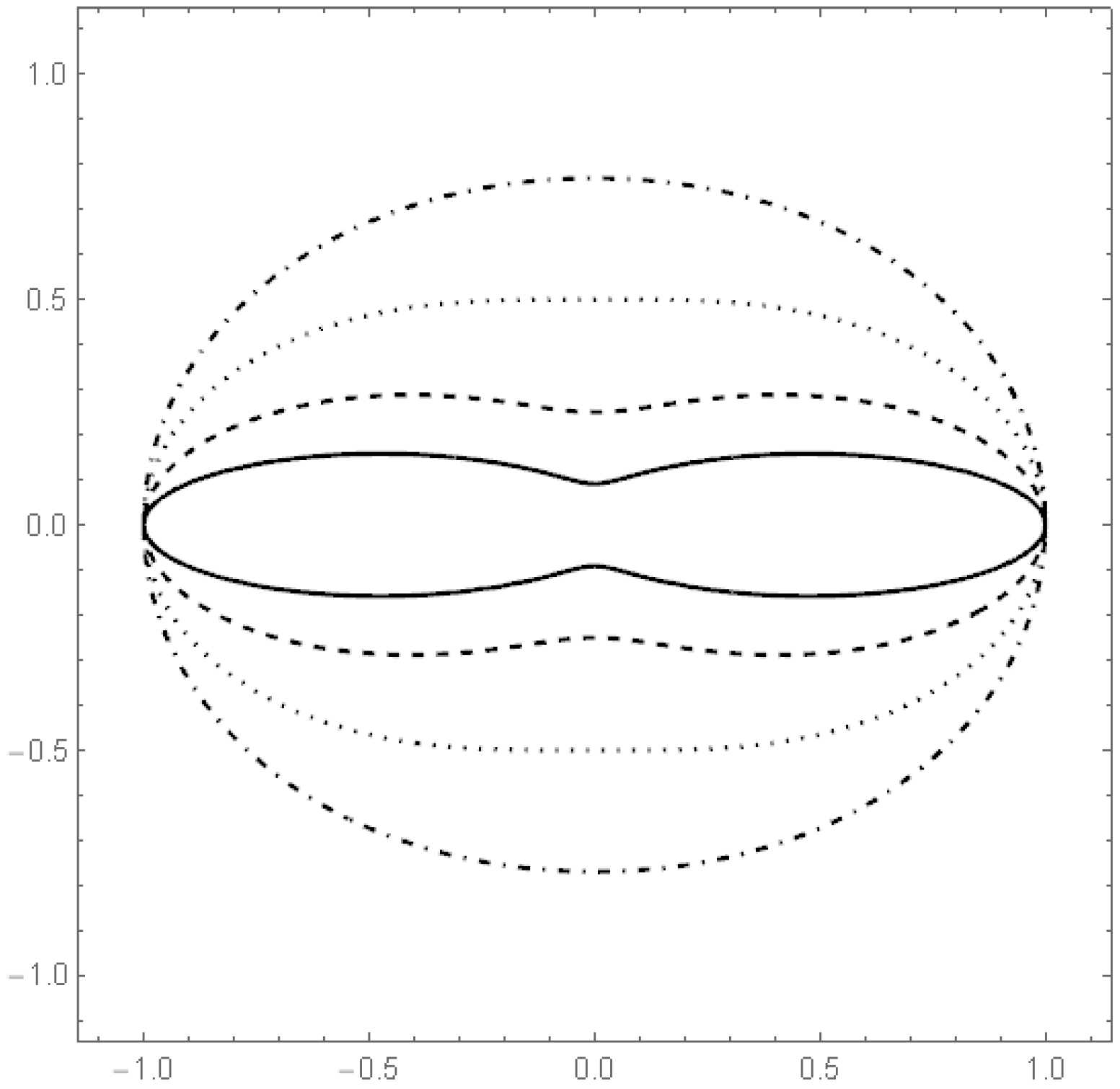

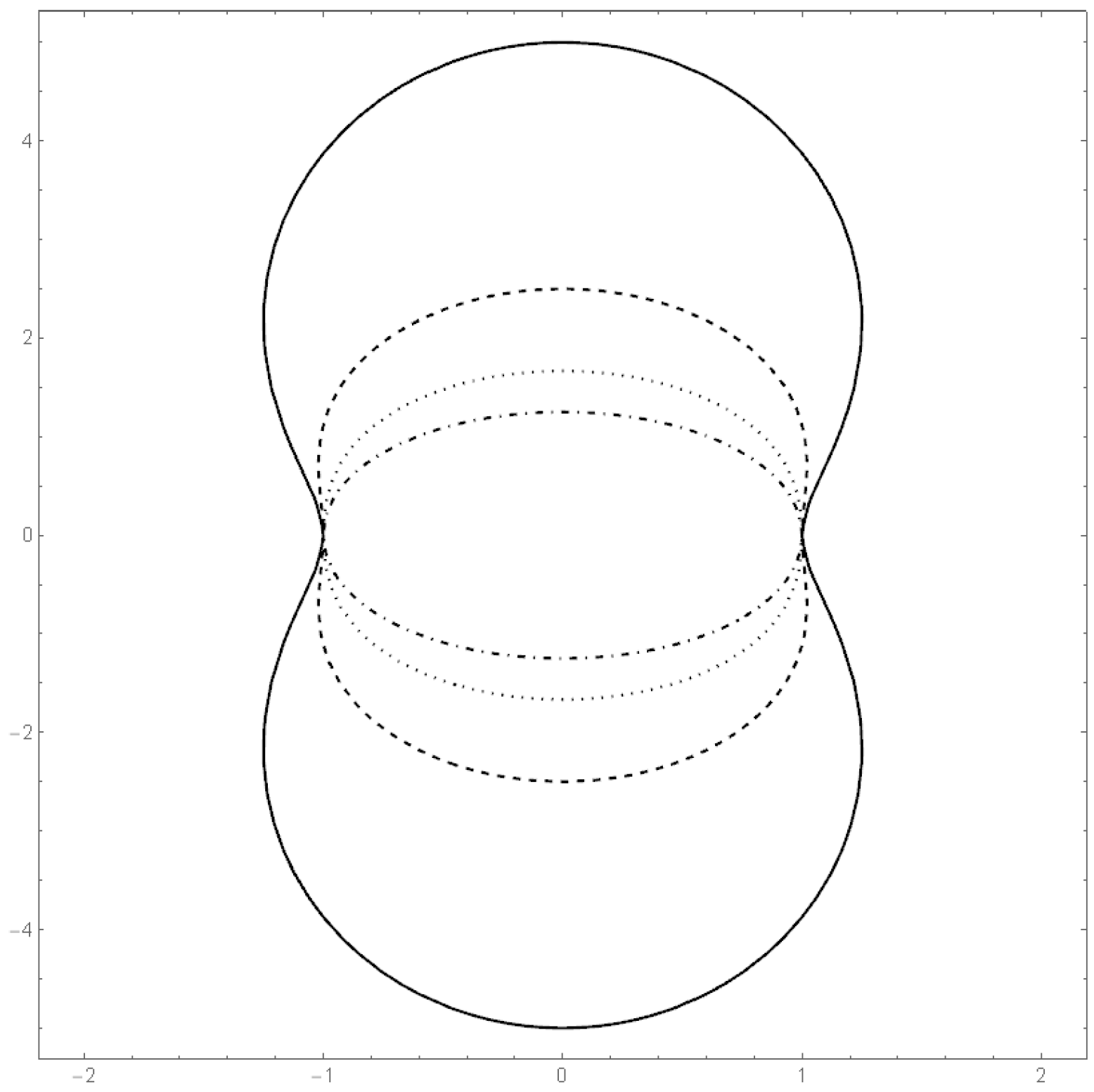

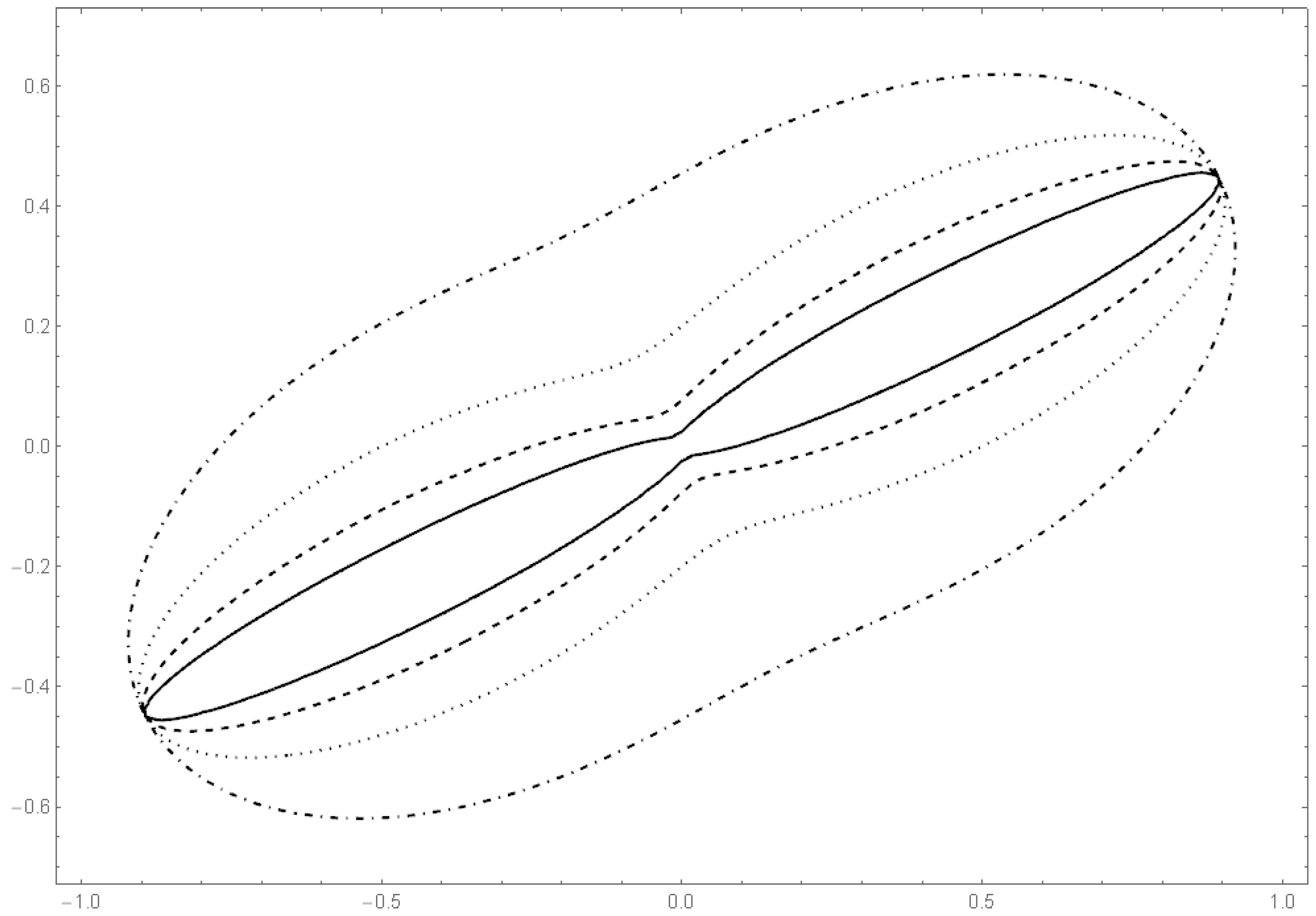

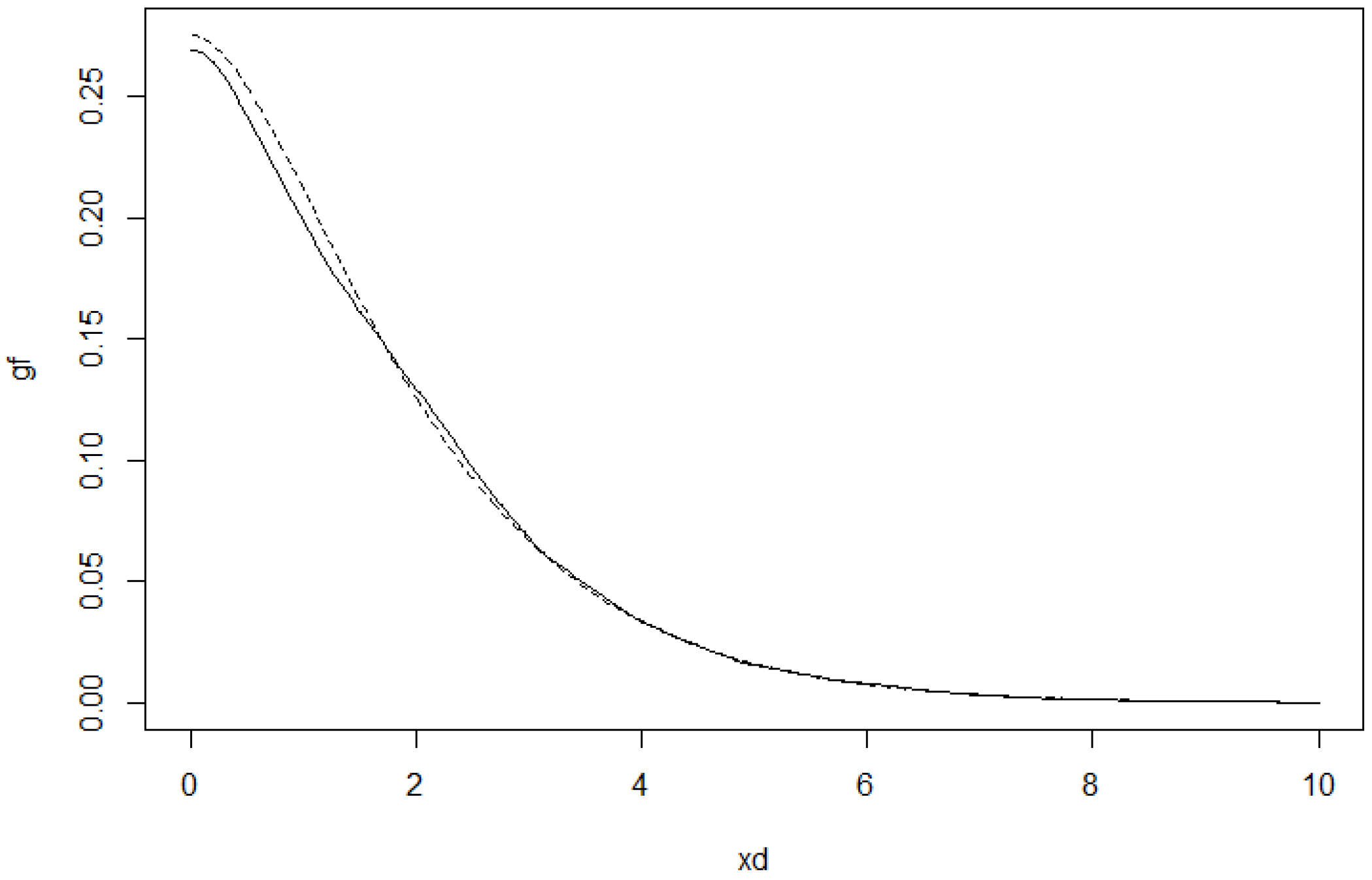

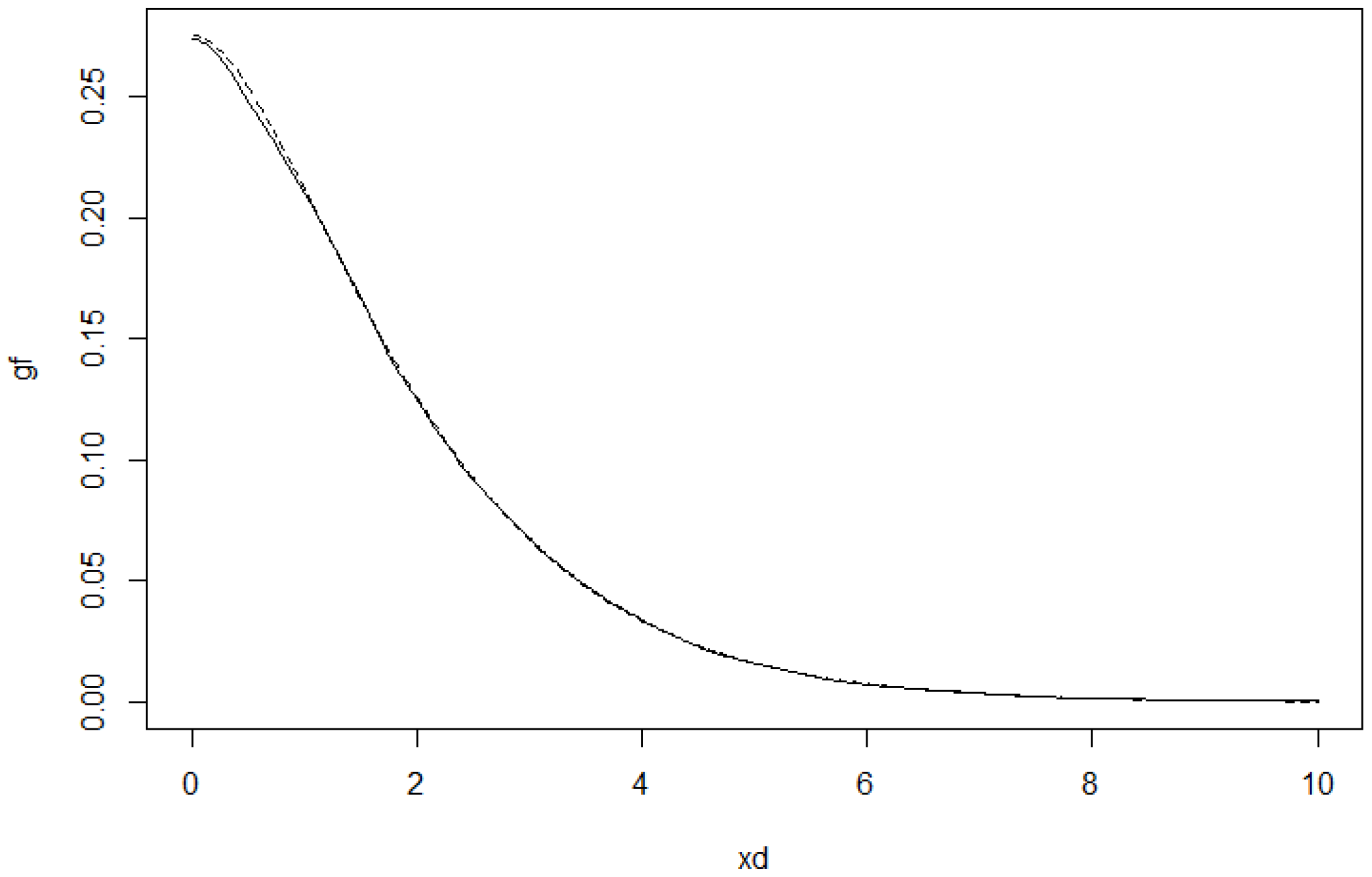

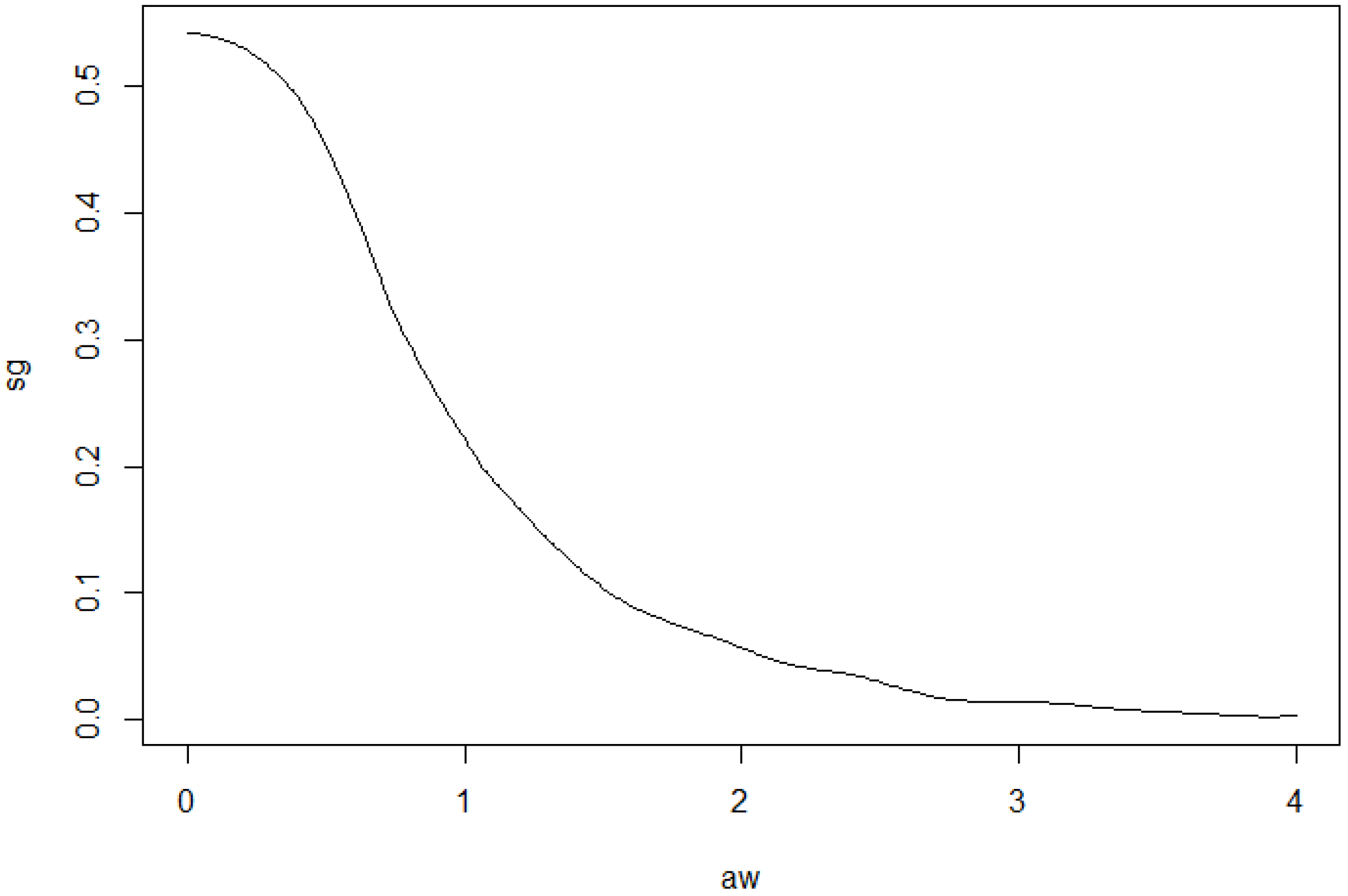

To illustrate how the estimators work in practice, we simulated data from a

q-norm distribution with

and the radius distribution to be the modified exponential distribution with

. The

Figure 7 and

Figure 8 include graphs of the underlying function

g and its estimator in two cases.

3.2.5. Reference Bandwidth

Let us consider an estimator

with Epanechnikov kernel, function

ψ as in Example 10, and modified exponential radius density in the case

. According to (

16), the reference bandwidth is then

where

This formula was generated using the computer algebra system Mathematica. The parameter

τ can be estimated by utilizing the above Formula (

6) for the expectation of the radius.

3.3. Semiparametric Estimators Involving a Scale and a Parameter Fit

In this section we consider the situation where the contour of the body

K depends on scale parameters

. Suppose that

. We introduce the diagonal matrix

and a master body

, which is symmetric w.r.t. the origin. Define

and

. The distribution of

is concentrated on the boundary

of

. We assume that

is given such that

Otherwise,

is rescaled. Suppose that

depends on a further parameter vector

where the parameter space

is a compact set. Then

The parameter vector

θ is able to describe the shape of the boundary of body

K, see Examples 1 and 2 (parameters

and

). From Lemma 1, we obtain

and

Here we see that (

17) results in

. The density is given by

In this context, a scaling problem occurs concerning

g. Assume that

g is a suitably given generator function satisfying

. Then

is a modified generator for every

with

. For any

, we obtain the same model when

g is replaced by

and

is replaced by

for

. To get uniqueness, we choose

t such that

Let

as above. Then

represents the variance of the

j-th component of

X. Based on this property, the sample variances of the components of

X can be used as estimators for

:

Moreover, we have the sample correlations

In the following we use the notation diag. If θ is unknown, we consider moment estimators based on the correlations. For this we need the following assumptions.

Assumption 6. Let I be a subset of with cardinality q. There is a vector such that for , Assume that has bounded partial derivatives, and θ is an interior point of Θ.

Assumption 7. For any bounded subset Q of , the partial derivatives , of exist, are bounded for , and , is Hölder continuous of order on for each .

Assumption 8. For any bounded subset Q of , is Hölder continuous of order .

Examples 1 and 2: (Continued) Similarly as above, it can be proven that Assumption 7 is fulfilled.

Let

be the sample version of

ρ. Then

is the estimator for

θ,

. Define

. With this definition,

is determined according to Formula (

8). The following result on the convergence rate of

can be proven:

Theorem 4. Suppose that Assumptions 1 and 6 are satisfied, andLet be bounded on . Then, for , In this section the transformed sample

is given by

with

ψ as in

Section 3.2. The estimator

for the generator

g is calculated using Formulas (

10) and (

11) from the previous section. The following estimator for the density has thus been established:

The next two theorems show the results concerning strong convergence and asymptotic normality of the density estimator:

Theorem 5. Suppose that the p-th order derivative of g exists and is bounded on for some even integer . Where needed, with this p, assume further that Assumptions 1, 2, 3, 6, (1) and (18) are satisfied. Let Assumption 7 or Assumption 8 be satisfied, and define in the first case and in the latter case .Then the claim of Theorem 2 holds true for estimator defined in (19). Theorem 6. Suppose that the assumptions of Theorem 5 are satisfied. Let such that is continuous at . Assume that holds true with a constant . Then for ,where is defined in (19), The remarks following Theorems 2 and 3 are valid similarly.

3.4. Applications

For many decades, statistical applications of multivariate distribution theory were manly based upon Gaussian and elliptically contoured distributions. Studies using non-elliptically contoured star-shaped distributions were basically made during the last two decades and are dealing in most cases with p-generalized normal distributions. Such distributions are convex or radially concave contoured if or respectively, and are also called power exponential distributions. Moreover, common elliptically contoured power exponential (ecpe) distributions build a particular class of the wide class of star-shaped distributions that allows modeling much more flexible contours than elliptically ones.

The class of ecpe distributions is used in a crossover trial on insulin applied to rabbits in [

23], in image denoising in [

24] and in colour texture retrieval in [

25]. Applications of multivariate

g-and-

h distributions to jointly modeling body mass index and lean body mass are demonstrated in [

26] and accompanied by star-shaped contoured density illustrations. The

-elliptically contoured distributions build another big class of star-shaped distributions and are used in [

27] to explore to which extent orientation selectivity and contrast gain control can be used to model the statistics of natural images. Mixtures of ecpe distributions are considered for bioinformation data sets in [

28]. Texture retrieval using the

p-generalized Gaussian densities is studied in [

29]. A random vector modeling data from quantitative genetics presented in [

30] are shown in [

31] to be more likely to have a power exponential distribution different from a normal one. The reconstruction of the signal induced by cosmic strings in the cosmic microwave background, from radio-interferometric data, is made in [

32] based upon generalized Gaussian distributions. These distributions are also used in [

33] for voice detection.

More recently, the considerations in [

11] opened a new field of financial applications of more general star-shaped asymptotic distributions, where suitably scaled sample clouds converge onto a deterministic set.

Figure 3 in [

34] represents a sample cloud which might be modeled with a density being star-shaped w.r.t. a fan having six cones that include sample points and other cones that do not. Note, however, that Figure 1 d-f in the same paper do not reflect a homogeneous density but might be compared in some sense to the level sets of the characteristic functions of certain polyhedral star-shaped distributions in [

16], Figure 5.2.

When modeling Lymphoma data, [

35] analyze sample clouds of points, see Figures 2 and 3, which might be interpreted as mixtures of densities having contours in part looking similar like that in [

36] where flow cytometric data, Australian Institute of Sport data and Iris data are analyzed, or like that of certain skewed densities as they were (analytically derived and) drawn in [

37]. In a similar manner, Figures 2 and 5 in [

20] indicate that mixtures of different types of star-shaped distributions might be suitable for modeling residuals of certain stock exchange indices. It could be of interest to closer study in future work more possible connections of all the models behind.

The following numerical examples of the present section are aimed to illustrate the agricultural and financial application of the estimators described in this paper. To this end, we make use of the new particular non-elliptically contoured but star-shaped distribution class introduced in

Section 2.2 of the present paper.

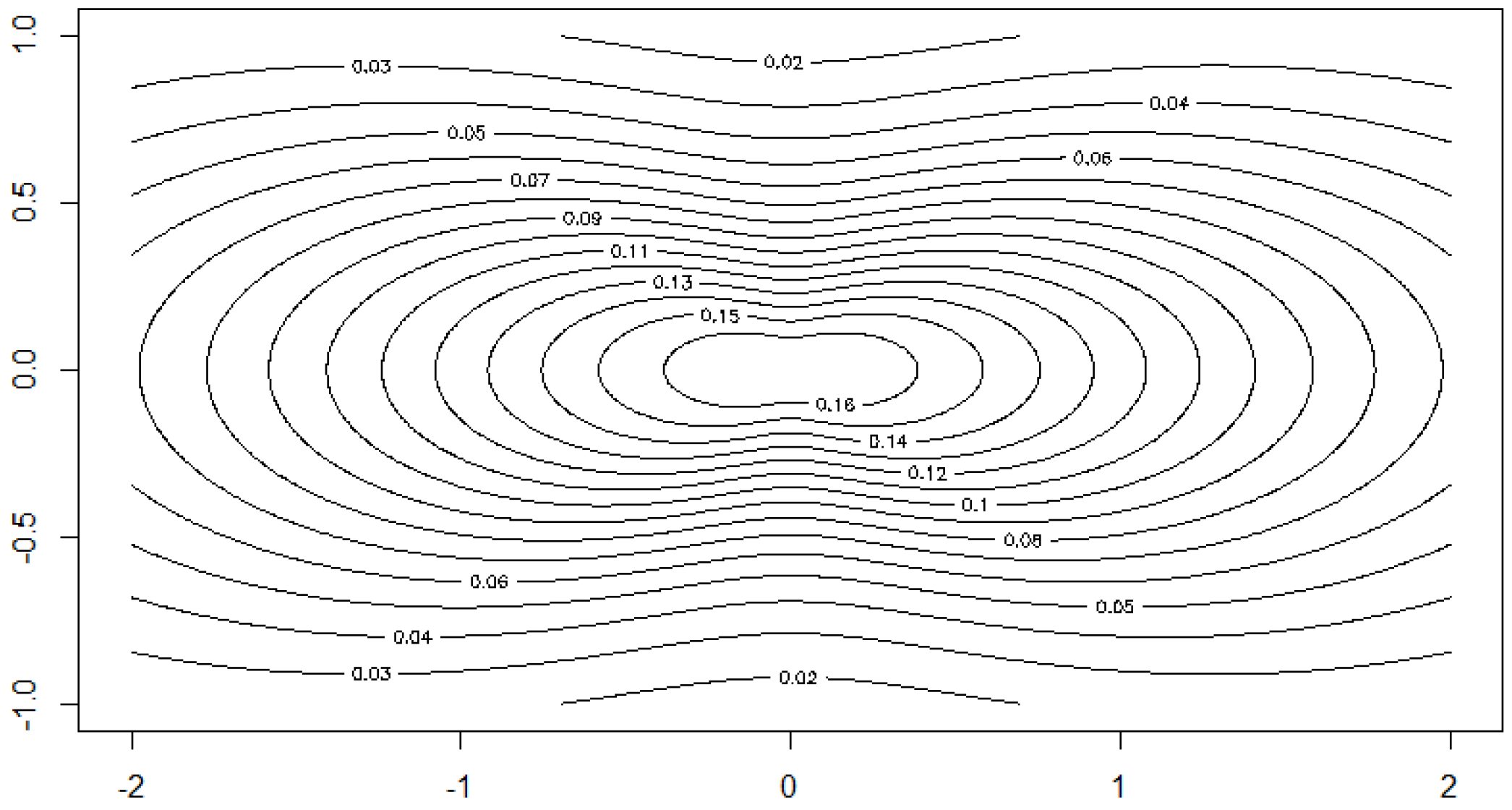

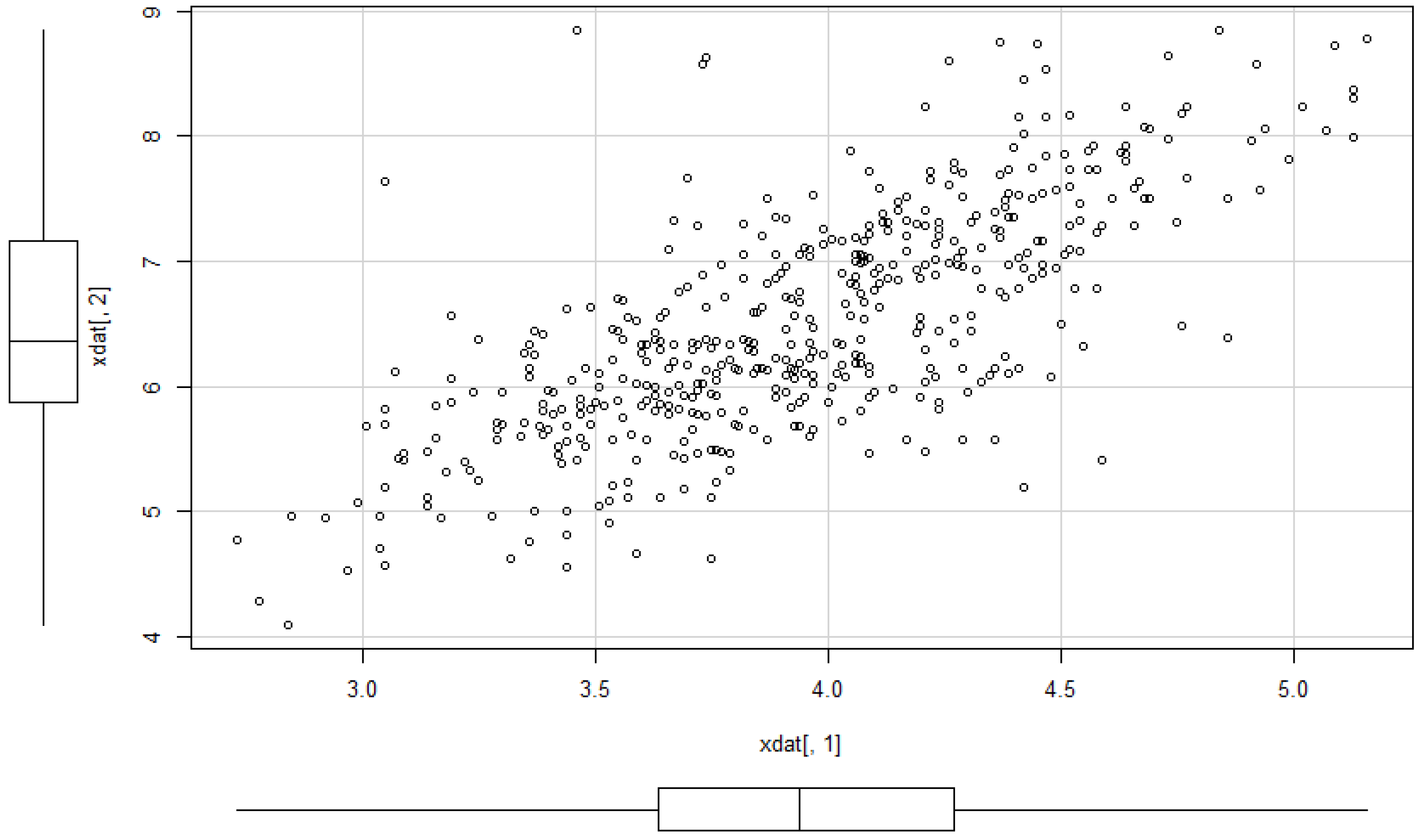

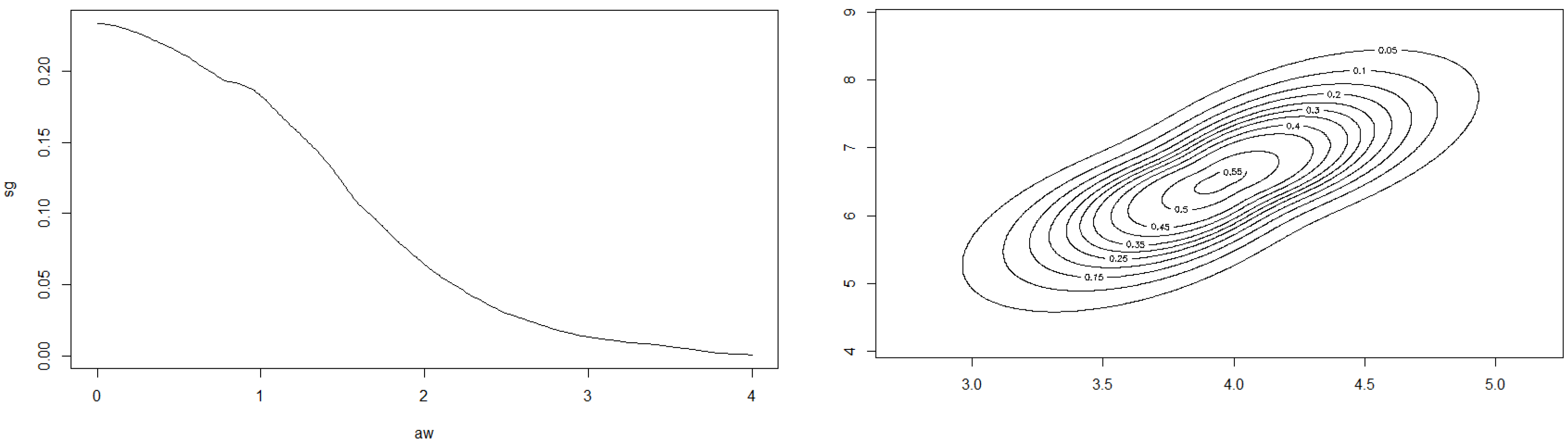

Example 12. Example 2 of Section 2.2 continued. We consider the class of bodies K of Example 2. Let . Figure 9 shows the dependence of the correlation on the parameter . Here we apply the above described methods to the dataset 5 of [

38]. The yield of grain and straw are the two variables. The sample correlation is 0.73077. Starting from that value, we can calculate the moment estimator for

:

. Moreover, we obtain

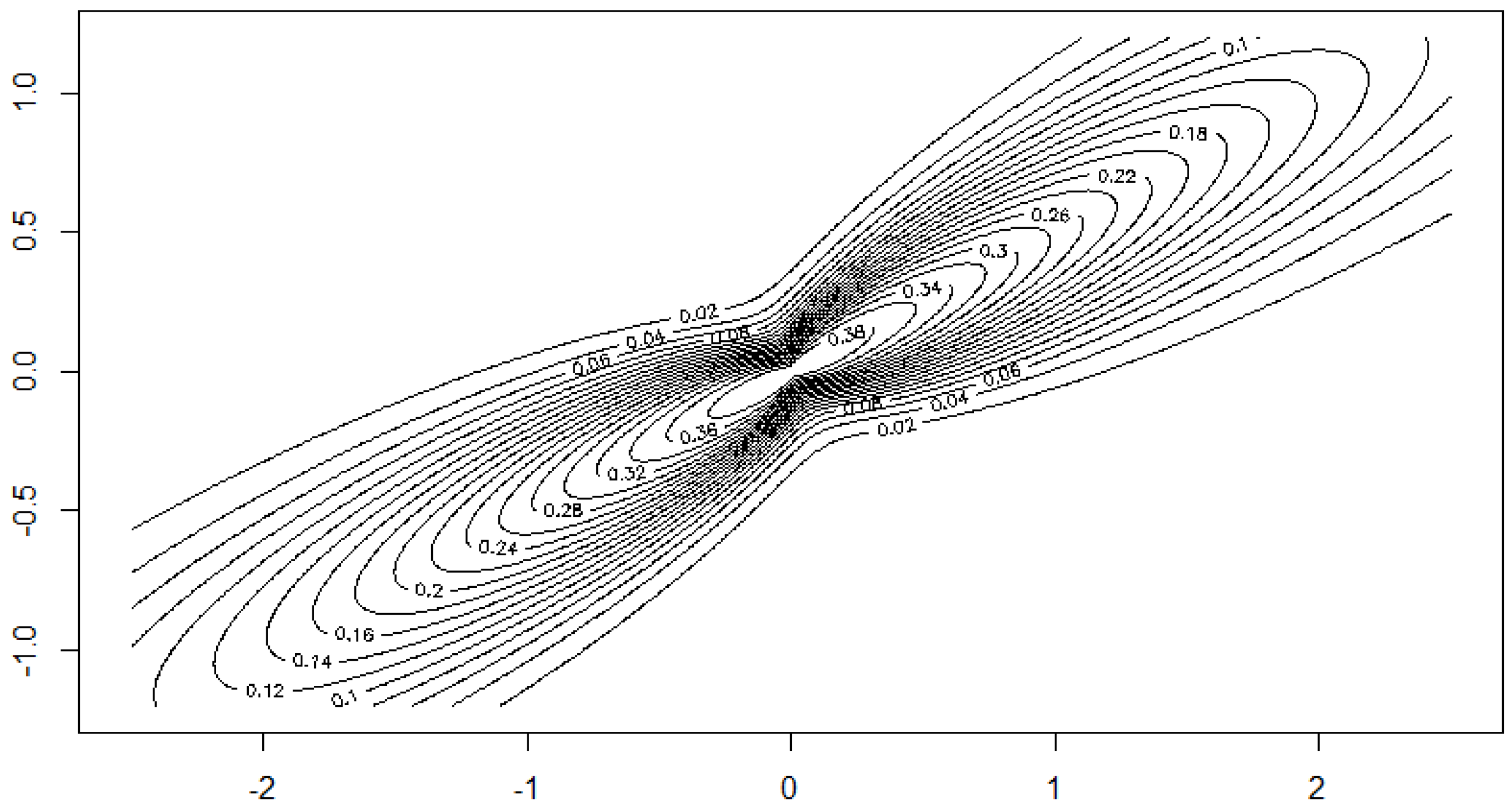

The data and the shape of the estimated multivariate density are depicted in

Figure 10 and

Figure 11.

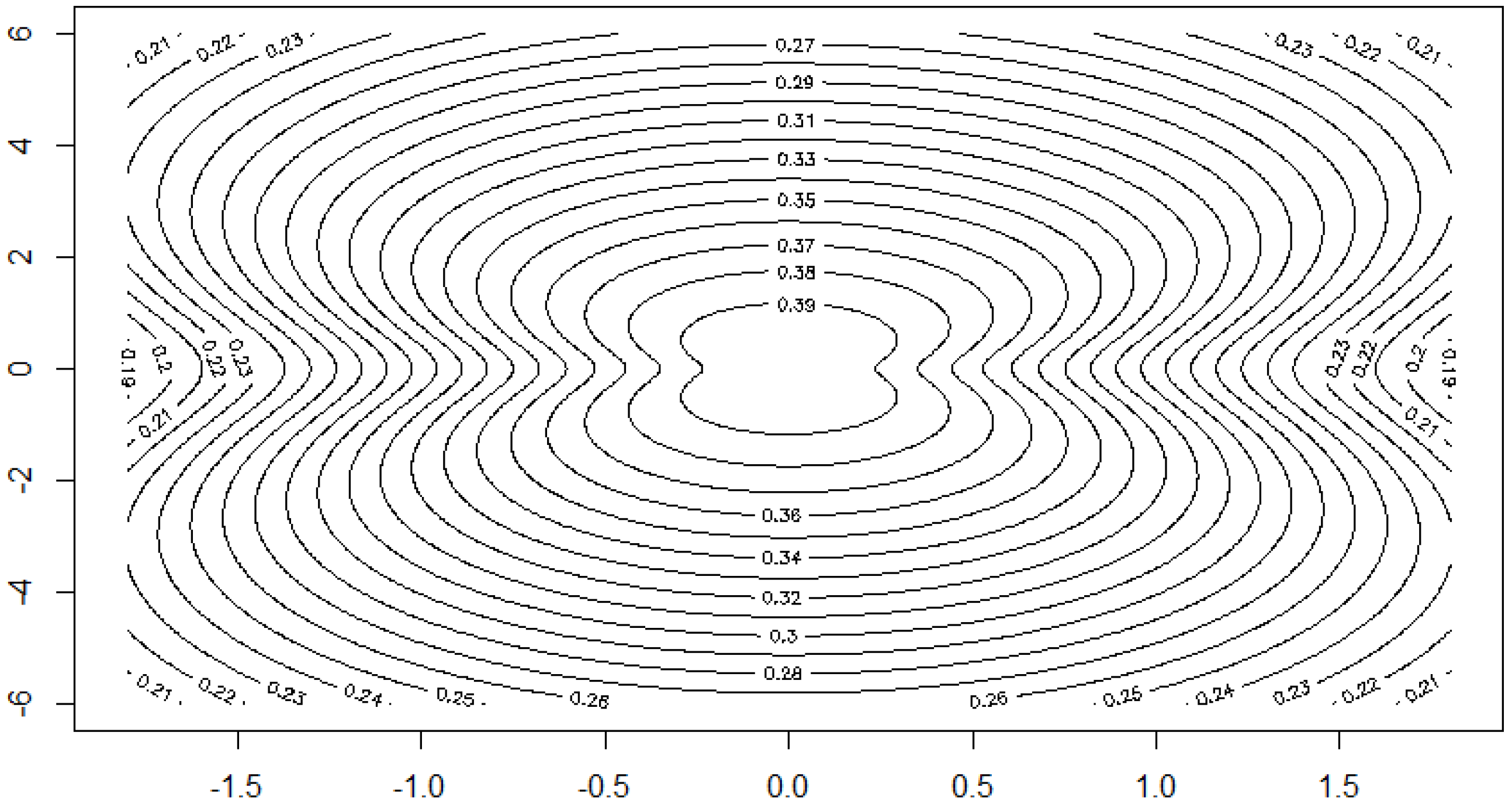

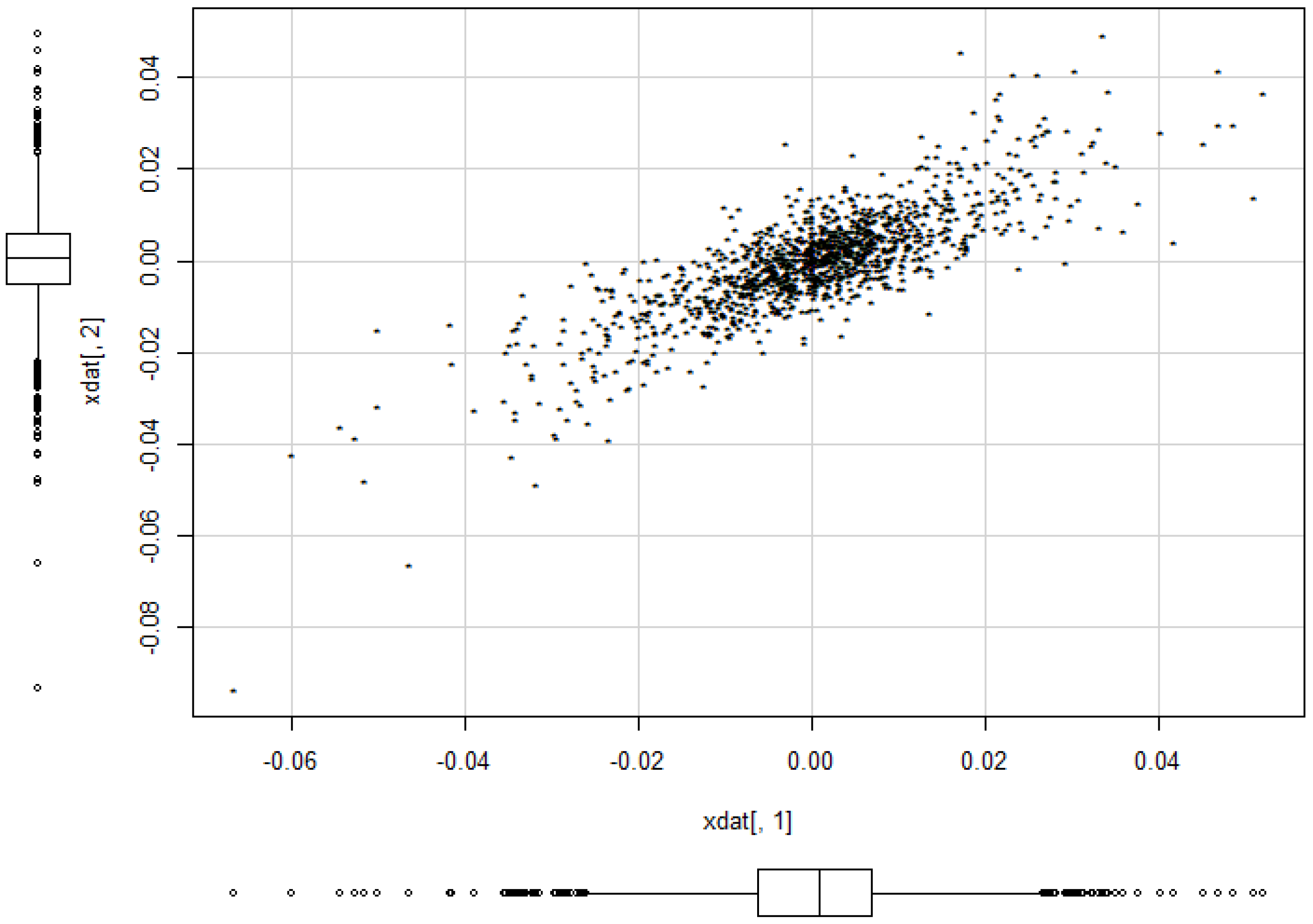

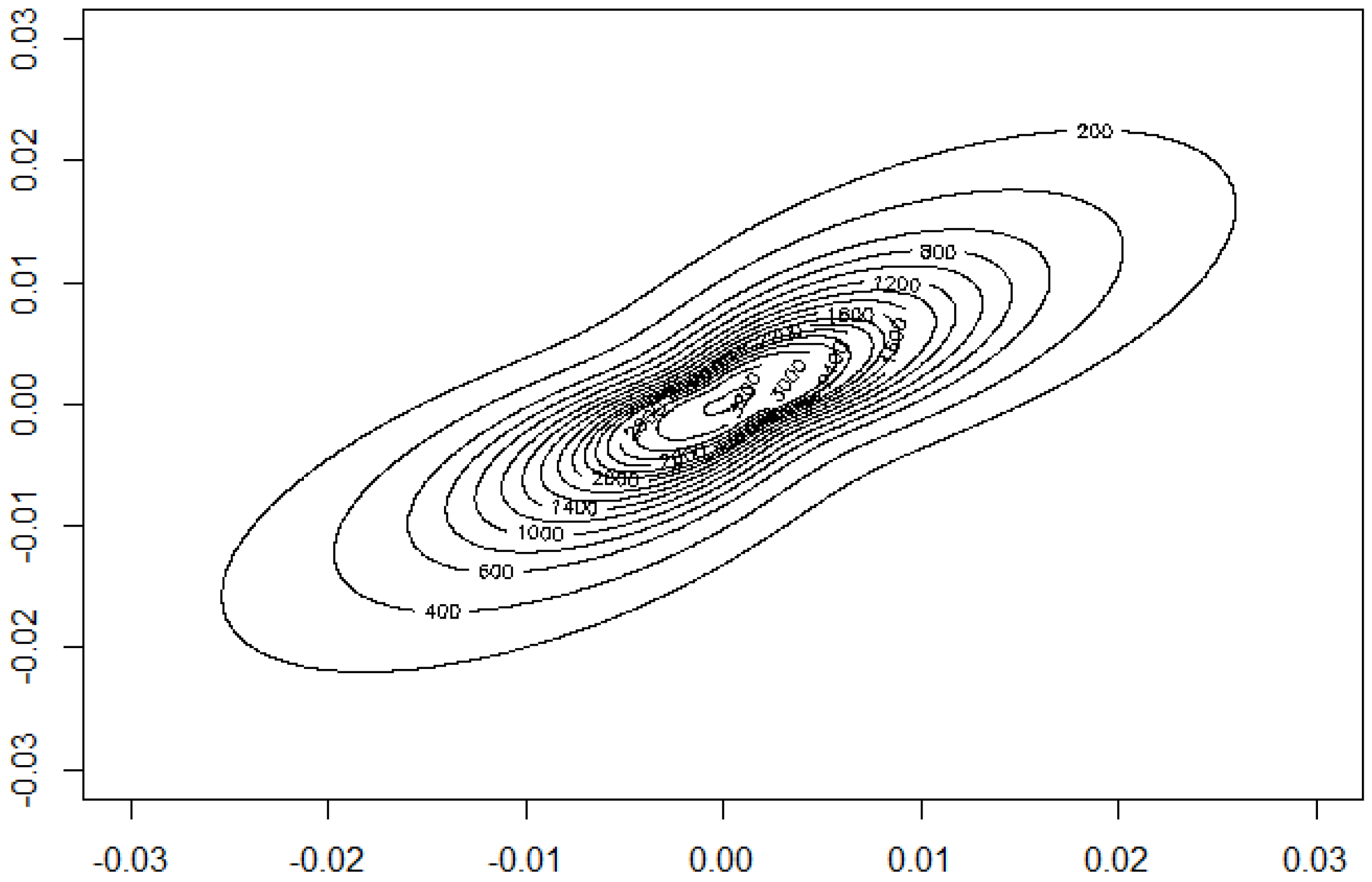

Example 13. We want to illustrate the potential of our approach for applications to financial data and consider daily index data from Morgan Stanley Capital International of the countries Germany and UK for the period August 2011 to June 2016. The data indicate the continuous daily return values computed as logarithm of the ratio of two subsequent index values. The modelling of MSCI data using elliptical models is considered in [5]. The data are depicted in Figure 12. A visual inspection seems to give some preference for our model from Section 2.2 compared to the elliptically contoured model. Figure 13 and Figure 14 show the estimated model for the data. The basic numerical results are: Further we proceed with proving the results.