Abstract

This paper investigates manufacturer encroachment on a sustainable supply chain, where the manufacturer holds exclusive information on product greenness and is responsible for both corporate social responsibility (CSR) and greening. The manufacturer and the retailer play a signaling game whereby CSR effort and wholesale price serve as joint green signals. Findings reveal that, firstly, encroachment induces higher CSR efforts from manufacturers. When customers exhibit a strong CSR preference, the resulting CSR increment leads to increased offline demand and drives up both wholesale and retail prices in a mutually beneficial manner. This phenomenon is referred to as the CSR effect, yielding a win-win encroachment. Secondly, when signaling product greenness to highly CSR-sensitive customers, the high-greenness manufacturer principally distorts her CSR effort downward to an extent unprofitable for the low-greenness manufacturer to mimic and subordinately distorts the wholesale price downward to counter CSR-induced demand decrement and mitigate CSR cost pass-through downstream. Finally, the win-win encroachment pattern is characterized by encroachment profit and signal expense sharing, with encroachment strengthening downward-distorted signaling while signaling weakens the CSR effect. These insights contribute valuable guidance for green manufacturers in CSR decision-making, which functions as a component of green signaling and facilitates transitioning to dual-channel sustainable supply chains.

1. Introduction

Motivated by the deteriorating ecological landscape and the rapid expansion of e-commerce, an increasing number of manufacturers have converted to sustainable supply chains (SSCs) and established their own direct channels to encroach on the downstream retail market [1]. SSCs adhere to relevant legislation and corporate ethical standards by integrating environmental, societal, and financial concerns. Hybrid channel systems, on the other hand, extend market reach by targeting a broader customer base [2]. The overarching goal is to achieve a mutually beneficial progression towards long-term profitability and sustainable socio-economic development within the supply chain. For instance, BYD, China’s leading electric vehicle manufacturer, has made significant investments in blade battery and cell-to-body integration technologies, allowing consumers to reduce energy consumption. Meanwhile, BYD is dedicated to upholding high-standard labor and human rights, the responsible sourcing of materials, and carbon-neutral practices. The eco-friendly and socially responsible Dynasty and Ocean coupe series are distributed through both physical 4S stores and the e-shopping website (mall.bydauto.com.cn). Nevertheless, encroachment alters the power hierarchy, profit distribution, and decision-making among supply chain members, potentially leading to intense channel conflict. In the context of complete information, manufacturers often lower wholesale prices to offset retailers’ market share loss and fully capitalize on their sales efficiency [3,4]. However, with the escalating intensity of channel competition, retailers will inevitably bear the brunt of encroachment.

In SSCs, products are designed to provide superior environmental benefits or impose smaller environmental costs throughout product lifecycles compared to similar products [5]. However, product greenness, i.e., environmental quality, is a “credence attribute” that means downstream retailers and consumers who lack expertise in environmental matters face challenges in obtaining accurate green information [6]. They cannot discern or evaluate whether and to which degree a purportedly green product is truly environmentally friendly, even after consumption. Such a green information gap jeopardizes consumer welfare, as well as the credibility and profitability of high-greenness manufacturers. Therefore, manufacturers often utilize price instruments to signal quality information. The natural way is to distort the price upward, wherein there is a positive relation between the degree of distortion and greenness [7]. Nevertheless, overpricing is neither exclusive nor necessarily the most effective green signal instrument.

Meanwhile, fulfilling corporate social responsibility (CSR) has become a key priority in achieving SSCs [8]. CSR refers to a firm’s operating constraints encompassing the legal obligation toward shareholders and moral obligations toward stakeholders—employees, consumers, communities, and the environment [9]. Recent empirical studies have demonstrated a positive link between a firm’s CSR performance and customers’ perceived product quality [10]. A favorable CSR image can enhance consumer trust in the brand and elevate product reputation, leading to increased willingness to purchase and a potential premium for high-quality products [11]. Nevertheless, implementing CSR involves substantial investment beyond core production and sales activities, resembling a fixed cost [12]. Consequently, high-greenness manufacturers may adopt a CSR strategy that is too costly for low-greenness manufacturers to mimic as a signal of superior (green) quality, enabling successful separation.

Motivated by the observations above, the primary purpose of this paper is to investigate manufacturer encroachment on a sustainable supply chain, wherein product greenness is the manufacturer-side private information. We aim to address the pressing issue of green information asymmetry impeding the supply chain’s sustainable development. Specifically, we focus on examining the research questions as follows:

- How do high-greenness manufacturers utilize CSR efforts and wholesale prices jointly to signal product greenness?;

- How do encroachment and manufacturers’ positive environmental and social responsibility undertakings influence supply chain members’ equilibrium decisions and profits?;

- What are the interactions between high-greenness manufacturer’s signaling behavior and encroachment effects and outcomes? How do supply chain members share encroachment benefits and distribute signal costs?

To address these issues, we consider a dyadic SSC of development-intensive green products comprising one manufacturer and one retailer. The manufacturer has private information about product greenness and determines whether to encroach on the retail market and how to send green signals through the CSR effort and wholesale price strategy. As the supply chain leader and signal sender, the manufacturer engages in a signaling game with the retailer, who acts as both follower and signal receiver. First, the (unique separating) equilibrium strategies and profits without and with encroachment under both symmetric and asymmetric information settings are derived and compared. Second, we employ numerical studies on key parameters to see the interactions between signaling and encroachment. Third, we consider an alternative marginal cost-intensive green product setting to verify the robustness of the main results across different green product types.

We find that the manufacturer’s signaling behavior regarding product greenness, though costly, can generate a surplus to offset the downside of encroachment for the retailer under certain circumstances. For one thing, as customers increasingly value high greenness and CSR products, encroachment induces higher CSR efforts from manufacturers. It also leads to a surge in offline demand and drives up both retail and wholesale prices in a mutually beneficial manner. This bright side of manufacturer encroachment is termed the CSR effect. For another, to convey product greenness, manufacturers distort CSR effort and wholesale price as a joint signal. When customers exhibit strong CSR preference, the high-greenness manufacturer principally distorts her CSR effort downward to an extent unprofitable for the low-greenness manufacturer to mimic. Simultaneously, the wholesale price is subordinately distorted downward to compensate for the retailer’s market loss from the CSR decrement while alleviating cost burdens. Under such a distorted CSR effect, supply chain members form a collaborative pattern characterized by shared encroachment benefits and signaling costs.

Our contributions are threefold. First, we expand the study of manufacturer encroachment by examining it in a sustainable supply chain context. Specifically, we consider an asymmetric information setting wherein product greenness is a credence attribute privately observed by the manufacturer. Second, we contribute to signaling game literature by integrating CSR efforts and wholesale prices as a joint signal to convey green quality information to downstream retailers and consumers. Our study delves into the interactions between signaling and encroachment. Third, we provide new insights on achieving a win-win encroachment, i.e., the distorted CSR effect. Our findings provide valuable guidance for some large and powerful manufacturers transitioning to dual-channel SSCs. They can successfully establish a green image and collaboratively share encroachment profits and signal expenses with retailers by adjusting a portfolio strategy of CSR effort and pricing.

The remainder of our paper is structured as follows. Section 2 reviews the related literature. Section 3 provides the model framework and assumptions. Section 4 analyzes and compares the equilibrium strategies and outcomes. Section 5 presents numerical studies to illustrate supply chain members’ profit-loss sharing patterns for encroachment and signaling. Section 6 considers a model extension. Section 7 concludes the paper and provides insights into future research.

2. Literature Review

This section reviews the related literature on three streams: manufacturer encroachment, sustainable supply chain management, and corporate social responsibility. Table 1 summarizes the main difference between this paper and the previous literature.

Table 1.

Summary of most relevant studies.

2.1. Manufacturer Encroachment

Contrary to the conventional belief that manufacturers benefit from encroachment at the expense of retailers’ profitability, various studies have demonstrated that a win-win encroachment could be achieved under certain circumstances [19]. For one thing, manufacturers might charge lower wholesale prices to mitigate double marginalization, i.e., the classical “wholesale price effect”. Several studies, including Chiang et al. [20], Arya et al. [3], Tsay and Agrawal [4], and Cai [21], all arrived at a similar conclusion that a mutually beneficial encroachment relationship is established when the retailer possesses significant advantages in sales efficiency. For another, manufacturers might adjust their production or operation strategies to compensate for retailers’ cannibalization losses. Yoon [22], Zhang et al. [23], and Hu et al. [5] found that encroachment led manufacturers to increase various self-interested investments, e.g., cost-reduction, advertising, and greening efforts. Retailers may unexpectedly but advantageously experience a spill-over effect with reduced wholesale prices, a demand expansion effect with higher offline demand, or an eco-labeling effect with higher green demand and retail prices. All the encroachment effects above could result in a win-win encroachment outcome, provided the channel competition was not overly intense.

A few studies have examined manufacturer encroachment under information asymmetry, where one party possesses private information about the market demand. Li et al. [13], Zhang et al. [14], Sun et al. [15], and Zhang et al. [24] found a similar result showing that encroachment induced the better-informed retailer to distort the order quantity downward (the retail margin upward) to signal a low (high) market size. Meanwhile, Tong et al. [25] found that encroachment caused the better-informed manufacturer to distort the wholesale price upward to signal a high market size. These scenarios often resulted in a likelihood of a “lose-lose” or “win-lose” outcome, characterized by distorted pricing that exacerbated the double marginalization issue. Nonetheless, the manufacturer might offset the adverse signaling effects by increasing endogenous quality or cost reduction efforts upon encroachment, leading to a “win-win” outcome. Considering the sustainable supply chain, Zhao and Hou [16] examined the relationship between asymmetric demand information, carbon emission reduction, and manufacturer encroachment. Their findings draw parallels with general supply chain scenarios.

Unlike the above studies, in which the manufacturer encroachment is based on demand information asymmetry, we investigate the case in which the manufacturer holds private information about product greenness in a sustainable supply chain. We explore the interactions between the manufacturer’s green signaling behavior and encroachment effects and outcomes.

2.2. Sustainable Supply Chain Management

Sustainable supply chain management (SSCM) is grounded in the Triple Bottom Line framework, emphasizing economic, environmental, and social factors as the three key pillars. Most papers consider only economic and environmental aspects, overlooking the social aspect. Chen et al. [26], Xia et al. [27], and Yang et al. [28] equivalented sustainability to the manufacturer’s green technology investment and found that imbalanced power structures led to increased individual profits but reduced environmental performance. Considering dual-channel SSCs, Li et al. [29], Yang et al. [30], and Li et al. [1] found that introducing an additional online channel could boost the manufacturer’s green investment. However, aligning individual profitability and environmental performance was seldom achieved.

A few works simultaneously consider all three dimensions of SSCM. Raj et al. [17] and Heydari and Rafiei [8] examined how to coordinate the SSC comprising an environmentally responsible manufacturer and a socially responsible retailer, wherein customers exhibited both product greenness and CSR preference. They found that the linear two-part tariff and the cost-sharing contract of product cost and CSR investment outperformed others in enhancing greening and CSR efforts. Biswas et al. [31], Raj et al. [2], and Peng et al. [32] analyzed how greening and social responsibilities are distributed between supply chain members, with CSR linked to customer surplus. They showed that specific contract designs (e.g., two-part tariff contract, side-payment self-enforcing contract) led to Pareto improvements in varying demand conditions.

None of these papers address product greenness as a “credence attribute” reliant on precise signals to eliminate information asymmetry. Our research differs in examining a dual-channel SSC fully aligned with the Triple Bottom Line framework. We assign the manufacturer simultaneous responsibility for CSR and greening while proposing a precise signal for communicating green information.

2.3. Corporate Social Responsibility (CSR)

Though the roots of CSR are quite old, a universal definition of CSR has yet to be established and research into the topic within supply chain contexts is still an emerging issue. Related to the definition of CSR, there are two prevalent approaches to capturing CSR in game-theoretical models. One defines supply chain CSR as a member’s concern for stakeholders’ welfare, wherein a share of consumer surplus is introduced into the objective function besides pure profit. A similar coordination mechanism was found in either two- or three-echelon supply chains where low wholesale prices, even below the marginal cost, were offered to promote sales. This approach could cause the manufacturer to suffer for her CSR efforts while positively impacting other members [9,33,34]. The other defines supply chain CSR as a member’s endogenous investment to enhance stakeholders’ welfare, directly influencing customer demand. Ni et al. [35], Hsueh [36], and Seyedhosseini et al. [37] underscored the positive impact of CSR efforts on sales volume and prices across various scenarios, driven by customers’ altruistic purchasing and warm-glow giving. In such contexts, the CSR performance, individual profits of supply chain members, and overall supply chain profits can be optimized simultaneously, especially when integrated with specific contracts.

A few works studied the signaling value of CSR amidst the challenges posed by information asymmetry. Li et al. [12] and Calvera and Ganuza [18] studied how a firm signaled product quality via CSR strategies, wherein the customers’ utility was either unaffected by or supermodular in CSR effort. They found that a high-quality firm could be successfully separated from a low-quality firm by adopting a positive and high level of CSR. Wu et al. [38] further classified CSR into observable and unobservable activities, between which the ratio was defined as the information transparency level. They found that a socially responsible firm could be separated from a strict profit maximizer by overinvesting in the observable activity when the information transparency was sufficiently high. You and Chen [39] found that firms undertaking value-enhancing internal initiatives would perform costly CSR activities to signal their high value in the financial market under an intermediate financial statement transparency. Candel-Sánchez and Perote-Peña [40] analyzed firms’ strategic application of CSR to signal their altruism to consumers in oligopolistic competition.

In contrast to the existing literature utilizing firms’ CSR activities as a single signal of quality or value, our research expands the literature on the green information signaling mechanism by incorporating CSR effort and wholesale price, working together in a principal and subordinate manner. We assume that consumers are sensitive to a product’s green quality and appreciate the manufacturer’s CSR efforts.

3. Model Formulation and Notations

Consider a two-echelon green supply chain with one manufacturer (she) and one retailer (he) distributing single development-intensive green products (DIGPs). The manufacturer initially sells DIGPs via a single offline channel. She can also sell DIGPs via dual channels by introducing an additional direct online channel to encroach on the end market.

The following assumptions are made in the paper:

Assumption 1.

DIGPs utilize emerging green technologies, significantly revolutionizing the existing design, production, and use of products to reduce the environmental footprints throughout product lifecycles [41,42,43]. Supported by the empirical evidence of Chen et al. [44] and Dangelico et al. [45], different manufacturers exhibit distinct levels of sustainability-oriented capabilities (i.e., green innovation capability and eco-design capability) and green transformational leadership. These factors not only directly enhance the development performance of green products but also indirectly influence green creativity, ultimately determining the differentiated greenness of green products. Therefore, we assume that there are two manufacturer types, denoted by : high-greenness () and low-greenness (). Nevertheless, product greenness is only known to manufacturers and those with superior performance must signal it to consumers in a credible manner. Otherwise, without any signals, consumers cannot distinguish between green and brown manufacturers, leading to a lack of willingness to pay a premium for greener products.

Assumption 2.

We employ the utility-based consumer choice model to describe the demand for DIGPs in dual channels, which has been widely used in the existing literature (e.g., Chiang et al. [20], Zhang et al. [24], and Hu et al. [46]). Customers are heterogeneous in their willingness to pay for basic product functionality, denoted by , following a uniform distribution, i.e., . The manufacturer’s greening effort () and CSR effort () benefit customers with additional utility , wherein and are customer greenness and CSR awareness. Following Xue et al. [47], Wan et al. [48], and Zhang et al. [49], it is assumed that customers attain less product value purchasing from online shopping with a discount fraction of (). Additionally, captures customers’ acceptance of the online channel, given their concerns about the absence of physical inspection, extended delivery and return times, and potential security and privacy issues [50]. Consequently, consumers’ net utility functions for DIGPs when purchasing from offline and online channels are and . Here, the total market potential is normalized to 1, and and are the selling prices in online and offline channels. A consumer purchases the DIGP from the channels that provide a higher net utility and the inverse demand functions are as follows:

Assumption 3.

Referencing Zhu and He [51] and Gao et al. [52], the major costs for DIGPs are fixed, including investments for emerging technology R&D and economic implementation, along with expenditures for facility tooling, retooling, and setup. Therefore, the manufacturers’ DIGP costs are assumed to be increasing and convex functions of their greening efforts, i.e., , where is the cost coefficient of green investment. This cost is independent of the production volume, while the variable manufacturing costs are normalized to zero. We will revise this cost assumption to examine marginal cost-intensive green products in Section 6. Meanwhile, referencing Raj et al. [17] and Heydari and Rafiei [8], the major costs for CSR are also fixed, including investments for the reduction of emissions, waste, and resource consumption, along with expenditures for fulfilling the humanitarian obligations to employees, consumers, and others. Therefore, the manufacturers’ CSR costs are formulated as increasing quadratic functions, i.e., , where is the cost coefficient of CSR effort. Specifically, we assume , which indicates that the h-type manufacturers exhibit greater cost efficiency in fulfilling CSR. This is backed by the empirical evidence of Hao and He [53] and Fosu et al. [54], showing that green innovation, as a key component of CSR, can help firms achieve better environmental responsibility, thereby boosting overall CSR performance. In addition, following the prior encroachment literature by Yoon [21] and Hu et al. [43], the marginal selling cost for each channel is assumed to be zero.

Assumption 4.

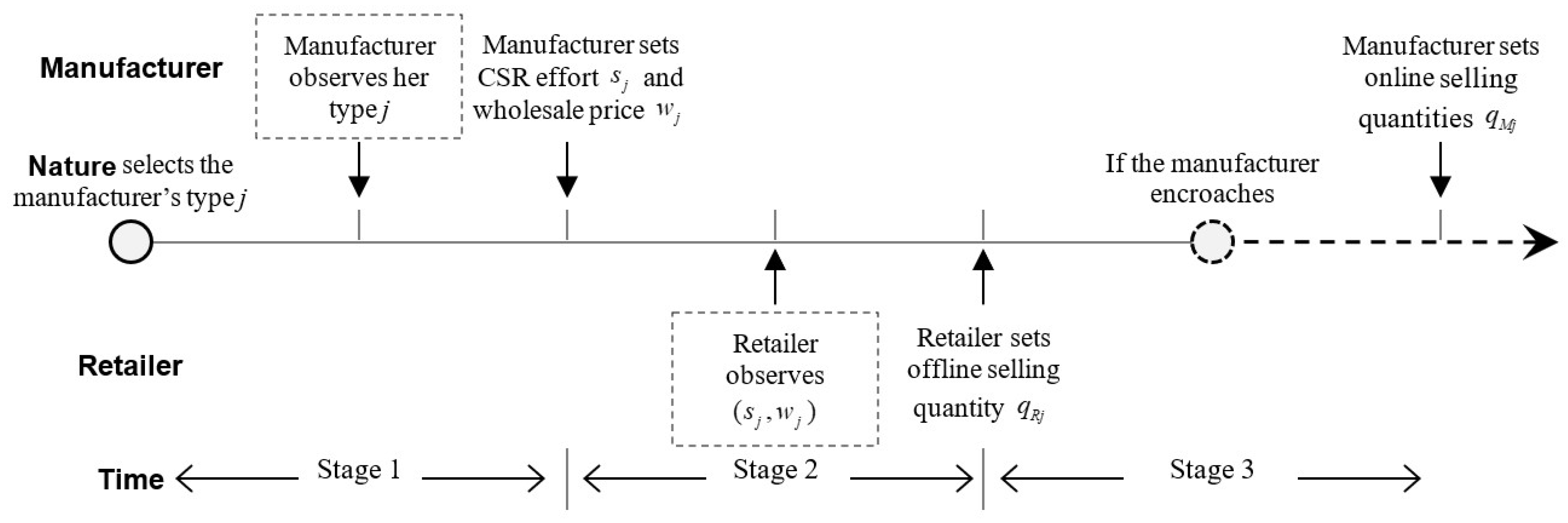

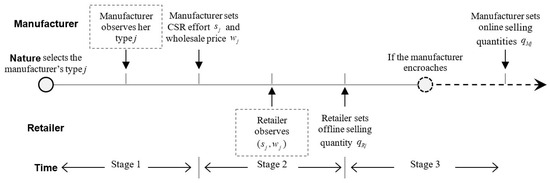

Applying a signaling game-theoretic approach (e.g., Li et al. [13], Zhang et al. [14], and Sun et al. [15]), this paper studies how the CSR effort and wholesale price can serve as manufacturers’ joint signals of product greenness. Figure 1 illustrates the event sequence of signaling games: (1) In the preliminary stage (Stage 0), Nature selects the manufacturer’s type according to a probability distribution and , also known as the retailer’s prior beliefs; (2) in the first stage (Stage 1), given her “true” product greenness , the manufacturer publicly determines the CSR effort () and wholesale price (); (3) in the second stage (Stage 2), after observing the pair , the retailer forms posterior beliefs about product greenness, and , based on which sets the offline selling quantity (); and (4) in the third stage (Stage 3), if the manufacturer encroaches, she sets the online selling quantity ().

Figure 1.

Sequence of events.

Table 2 summarises the notations used in this paper.

Table 2.

Notations.

4. Model Analysis

This section examines the interactions between manufacturer encroachment and green signaling. First, we obtain the supply chain members’ equilibrium with and without encroachment regarding both symmetric and asymmetric information scenarios. Second, we compare four models to identify the impacts of signaling and encroachment. We use superscript “*” to denote optimal solutions in symmetric information models and superscript “**” to denote optimal solutions in asymmetric information models.

4.1. Symmetric Information Cases

As benchmarks, this subsection solves the encroachment and non-encroachment models under symmetric information, i.e., all supply chain members possess identical information regarding product greenness.

The supply chain members’ profit functions under non-encroachment are characterized as:

The supply chain members’ profit functions under encroachment are characterized as:

Proposition 1.

On the condition that and , the equilibrium decisions for Model N and Model E in perfect information games are presented in Table 3.

Under symmetric information, firstly, . Since CSR fulfillment raises customers’ reservation value for green products, such investment is not entirely a “wasteful” expenditure for profit-oriented manufacturers. Both types of manufacturers must actively engage in CSR investments to stimulate consumption, premiums, and profits. Secondly, and if . As long as the h-type manufacturer has higher CSR cost efficiency, she, whether encroach or not, devotes more CSR efforts and sets higher wholesale prices than the l-type manufacturer. Throughout the paper, we assume that holds true, which is a necessary requirement for the effective functioning of the joint signaling mechanism we propose.

Table 3.

Equilibrium solutions for encroachment and non-encroachment models under symmetric information.

Table 3.

Equilibrium solutions for encroachment and non-encroachment models under symmetric information.

| Equilibrium | Model N | Model E |

|---|---|---|

| - |

4.2. Asymmetric Information Cases

Under asymmetric information, this subsection follows the classic signaling game approach to solve encroachment and non-encroachment models. We employ the solution concept of perfect Bayesian equilibrium (PBE) and adopt the classical rule “Intuitive Criterion” to refine multiple equilibria, eliminating all pooling equilibrium and selecting the unique separating equilibrium in each of our models.

In order for CSR effort and wholesale price strategies to serve as a pair of green signals, the h-type manufacturer maximizes her profit subject to two mimicking constraints: (1) The l-type manufacturer would not mimic the h-type manufacturer’s equilibrium strategies to be perceived as high product greenness and (2) the h-type manufacturer would not mimic the l-type manufacturer’s equilibrium strategies to be mistaken as low product greenness.

In the non-encroachment scenario, the h-type manufacturer determines as the solution to the following:

In the encroachment scenario, the h-type manufacturer determines as the solution to the following:

Proposition 2.

In the separating equilibrium: (1) is the l-type manufacturer’s optimal signaling strategy; (2) is the h-type manufacturer’s unique signaling strategy satisfying the intuitive criterion; and (3) the symbolic expressions of and the corresponding equilibrium decisions of and are presented in Table 4.

Following the “Intuitive Criterion”, firstly, the l-type manufacturers choose the first-best CSR efforts and wholesale prices. Secondly, the h-type manufacturers only achieve costly separating, i.e., , by choosing the equilibrium CSR efforts and wholesale prices that represent the lowest information cost. Thirdly, PBEs presented in Proposition 2 are backed by the following posterior beliefs held by the retailer and customers: and .

Table 4.

Equilibrium solutions for encroachment and non-encroachment models under asymmetric information.

Table 4.

Equilibrium solutions for encroachment and non-encroachment models under asymmetric information.

| Equilibrium | Model N | Model E |

|---|---|---|

| - |

Note: , .

4.3. Comparative Analysis

This subsection examines the effects of information asymmetry and manufacturer encroachment on supply chain members’ equilibrium decisions and profits. First, comparisons between symmetric and asymmetric information models, either with or without encroachment, are drawn to examine how the h-type manufacturers use CSR efforts and wholesale prices to signal product greenness. Second, comparisons between encroachment and non-encroachment, either under symmetric or asymmetric information, are drawn to examine the encroachment effects and outcomes considering the manufacturer’s positive environmental and social behaviors.

4.3.1. Asymmetric Information vs. Symmetric Information

Lemma 1.

Compared to the symmetric information scenarios:

- (1)

- The h-type manufacturer increases CSR efforts and charges higher wholesale prices in the separating equilibrium if under non-encroachment or under encroachment;

- (2)

- Otherwise, the h-type manufacturer decreases CSR efforts and charges lower wholesale prices (here, and are illustrated in Appendix B).

When customers’ CSR preference is relatively low, the h-type manufacturer upwardly distorts CSR efforts and wholesale prices to transmit accurate high greenness information. On the one hand, if the l-type manufacturer were to mimic the h-type’s excessively high CSR effort, she would deviate too much from the symmetric information level. Due to customers’ limited CSR attention and the l-type manufacturer’s low CSR cost efficiency, the new demand and premiums generated through the enhanced CSR fulfillment fail to offset the heightened CSR investment. On the other hand, if the l-type manufacturer were to mimic the h-type’s excessively high wholesale prices, the retail prices would increase sharply, resulting in greater losses from demand decrement than the gains from marginal profit increments.

When customers’ CSR preference is relatively high, the h-type manufacturer downwardly distorts CSR efforts and wholesale prices. High CSR fulfillment and steep wholesale prices would serve as a lucrative demand and profit margin generator, offsetting and even surpassing the l-type manufacturers’ mimicking expenditures. Therefore, the h-type manufacturer diminishes CSR efforts and wholesale prices to the extent that it is unprofitable for the l-type manufacturer to mimic.

Our findings are different from those of Li et al. [9] and Calvera and Ganuza [18], which utilized CSR as a single signal of product quality, in two aspects. Firstly, they assume that consumers lack CSR preference, in which case the high-quality firm could be successfully separated from a low-quality firm by upwardly distorting the CSR effort. In contrast, this paper assumes that customers exhibit a preference for CSR, which leads to the two segments of h-type manufacturers’ signaling behaviors. Secondly, this paper utilizes CSR and wholesale prices as joint signals and discovers the distinct roles of two joint signals, i.e., the CSR effort is dominant, whereas the wholesale price is subordinate. A threshold exists, below which the h-type manufacturers become less motivated to distort CSR efforts upward as customers’ CSR preference increases. Nevertheless, the CSR increment causes the overall demand to be higher compared to the information symmetry scenarios, so the wholesale prices are distorted upward to counteract such a positive effect while passing on the extra CSR investment. Otherwise, when exceeds the threshold value, the h-type manufacturer engages in stronger downward distortions of the CSR efforts as customers’ CSR preference increases. Correspondingly, wholesale prices are distorted downward to compensate for the market loss due to the CSR decrement while reducing the downstream CSR cost burden. In all, the distortion directions of the two signals are identical while the respective outcome is complementary, precluding any advantageous imitation by the l-type manufacturers.

Lemma 2.

Compared to the symmetric information scenarios:

- (1)

- The retailer benefits from the h-type manufacturer’s signaling behaviors in the separating equilibrium if under non-encroachment or under encroachment;

- (2)

- The h-type manufacturer always experiences losses due to her signaling behaviors.

The retailer achieves revenue growth under signaling as long as the h-type manufacturer’s distortion direction of separating strategies is upward. The inflated CSR fulfillment leads to a surge in offline demand and CSR premium while the increased wholesale prices are passed on to customers. Otherwise, the retailer suffers from the h-type manufacturer’s downward distortion strategies. Due to customers’ high CSR preference in such a case, any deviation below the optimal CSR efforts may cause a significant decline in the retailer’s offline market share and profitability, which lower wholesale prices cannot offset.

From the h-type manufacturer’s perspective, signaling the accurate greenness type is always costly. The major signaling cost stems from either investment escalation due to CSR upgradation or demand loss induced by CSR degradation. Although the subordinate wholesale price distortions transfer part of the CSR cost burden or attract some new demands, the h-type manufacturer’s signaling strategies always have adverse effects, albeit less on himself than on the l-type manufacturer.

4.3.2. Encroachment vs. Non-Encroachment

Lemma 3.

Compared to the non-encroachment scenarios:

- (1)

- Encroachment always increases the CSR efforts;

- (2)

- Encroachment increases the wholesale prices if under symmetric information or under asymmetric information;

- (3)

- Encroachment increases the offline selling quantities if under symmetric information or under asymmetric information (here, and are illustrated in Appendix B).

Lemma 3 indicates that encroachment always induces the manufacturer to invest more heavily in CSR, either under symmetric or asymmetric information. First, customers’ altruistic purchasing behaviors and willingness to pay the premium for CSR products indicate a thriving green market. Second, referencing manufacturer encroachment on a non-green supply chain, the introduction of an additional channel generally leads to a total demand increment. Therefore, the customer reward of each unit of CSR fulfillment becomes more prominent while the expense apportionment becomes less burdened. The dual context of SCC and encroachment creates a strong incentive for manufacturers to emphasize and promote their CSR efforts.

Encroachment induces the manufacturer to charge higher wholesale prices when customers’ CSR preference is relatively high. Higher wholesale prices are a necessary consequence of the manufacturer’s high CSR effort upon encroachment, with the increased CSR premiums and CSR investments both transmitted to the retailer. Furthermore, encroachment induces higher offline demands for the retailer when customers’ CSR preference is even higher. In such a case, customers exhibit a particularly strong inclination towards altruistic purchasing, allowing the offline market to expand despite the channel competition.

Conversely, encroachment induces lower wholesale prices when customers are less sensitive to CSR, i.e., the celebrated “wholesale price effect”. Significantly, the h-type manufacturer must adopt a relatively high retail price to signal high product greenness. Such signaling behavior may not align well with the established low-price strategy in the online channel, given customers’ limited willingness to engage in e-shopping. In such a case, the manufacturer is relatively dependent on the offline channel and offers a lower wholesale price to counteract the negative effects of both encroachment and signaling on the offline demand. Nevertheless, encroachment will certainly lower offline demand due to customers’ limited CSR preference. It results from either intense demand cannibalization or the manufacturer’s upwardly distorted CSR effort, which only has weak demand and premium driving forces.

Lemma 4.

Compared to the non-encroachment scenarios:

- (1)

- Encroachment always benefits the manufacturer;

- (2)

- Encroachment benefits the retailer if under symmetric information or under asymmetric information (here, is illustrated in Appendix B).

When customers’ CSR preference is relatively low, the manufacturer seeks to mitigate encroachment conflict through two approaches: either by increasing CSR efforts to stimulate new demand or by reducing wholesale prices to alleviate double marginalization. Nevertheless, neither approach is efficient and leaves the retailer suffering, given customers’ insufficient CSR concern and intense demand cannibalization. Meanwhile, the manufacturer reaps the rewards of encroachment with modest CSR investments.

When customers’ CSR preference is relatively high, the manufacturer’s optimal CSR effort significantly increases, whether under symmetric or asymmetric information. This contributes to substantial new demand and increased premiums for both online and offline channels. The retailer willingly accepts increased wholesale prices upon encroachment since it is a reasonable CSR and greening cost transfer, which is then reflected in higher retail prices and transferred to customers. In such a case, both the manufacturer and the retailer stand to benefit from encroachment and we refer to this mechanism as the CSR effect.

Similar to the encroachment effects observed under symmetric information (e.g., the spillover effect identified by Yoon [21]), the CSR effect confirms that manufacturers can generate spillovers and benefit retailers upon encroachment by adjusting production strategies catering to consumer interests. Differently, considering asymmetric green information, this paper further investigates the interaction between signaling and encroachment through numerical analysis, discovering the distorted CSR effort.

5. Numerical Analysis

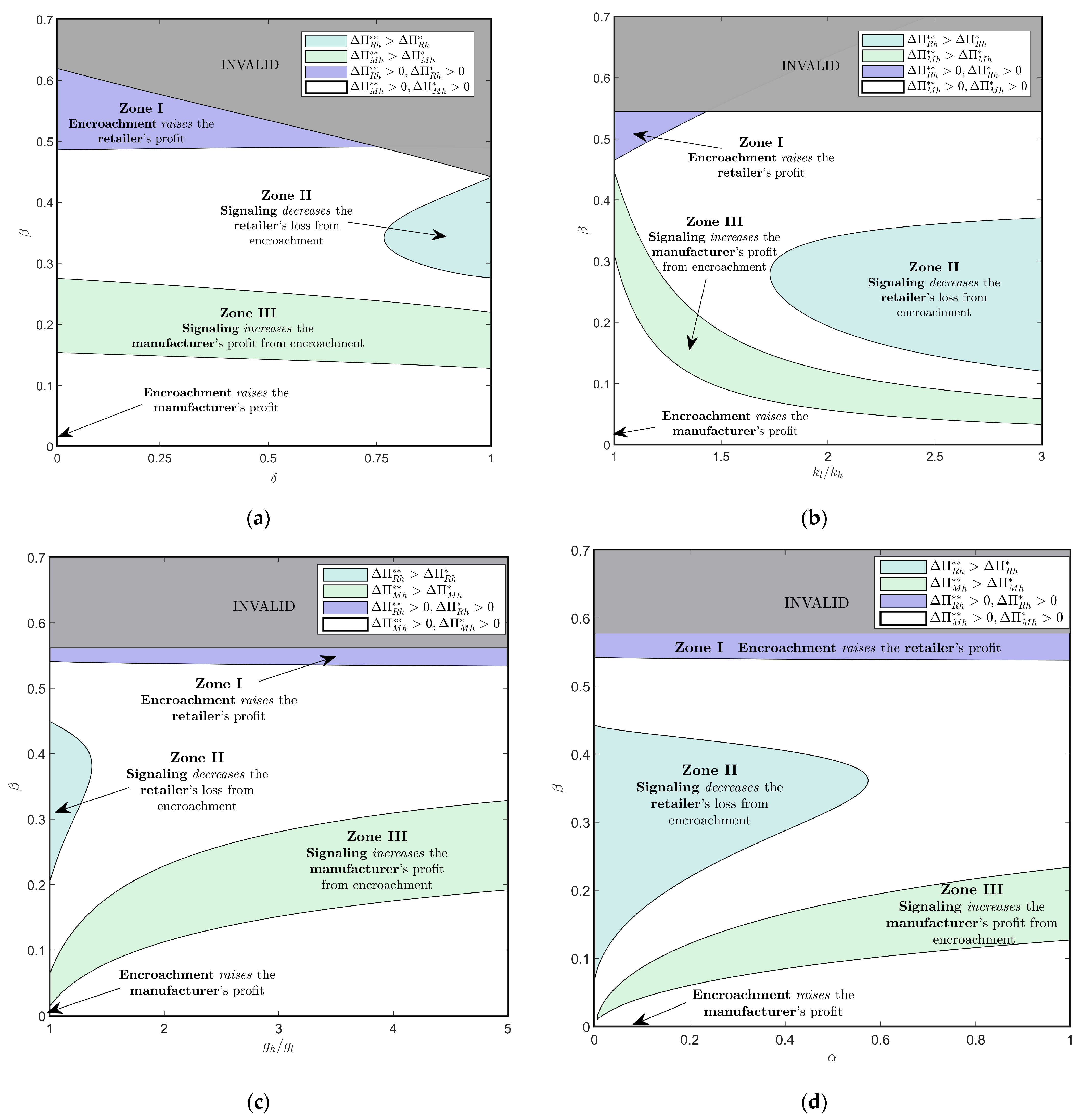

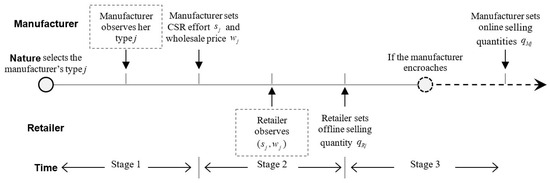

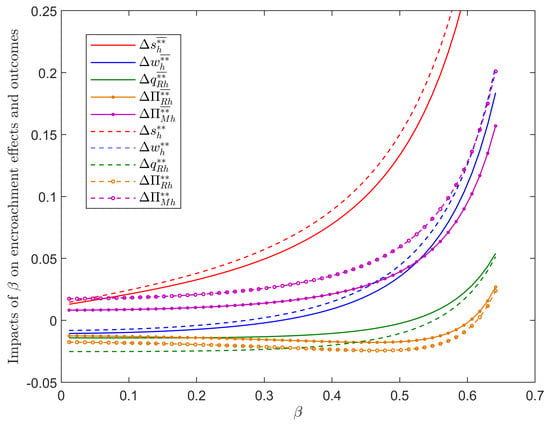

In order to gain further insights into Lemmas 1-4, this section employs various numerical analyses across crucial parameters to explore the complex interplay between the h-type manufacturer’s signaling behavior and encroachment effects and outcomes. These parameters include the l-type manufacturer’s CSR cost inefficiency (), the h-type manufacturer’s product greenness superiority (), customers’ greenness, CSR, and online channel preferences (, , ). We aim to examine, firstly, the sharing pattern of encroachment profits and losses under signaling and, secondly, the bearing pattern of signal cost under encroachment. The initial parameter set is given by: , , , , , , and . Additionally, and are defined to facilitate comparisons. Results are shown in Figure 2. Here, we focus on three distinctive zones whereas, in the rest, the manufacturer benefits while the retailer suffers as a result of encroachment and both share the signal expense.

Figure 2.

Impacts of key parameters on encroachment profit-sharing and signal expense-bearing patterns under DIGPs ((a–d) show comparisons of encroachment outcomes for the manufacturer and the retailer under symmetric and asymmetric information scenarios).

Zone I: When is relatively high, both the manufacturer and retailer share the encroachment profit and bear the signal expense.

First, encroachment causes the h-type manufacturer to adopt a stronger downward-distorted green signaling strategy. With the combined effects of customers’ high CSR concern and encroachment-induced total demand expansion, the l-type manufacturer’s gains from mimicking the h-type increase alongside the h-type manufacturer’s return from high-intensity CSR effort. Therefore, the h-type manufacturer must make a greater sacrifice to achieve separation by implementing more aggressive downward distortions of CSR effort and wholesale price to an extent unprofitable for the l-type to mimic.

Second, the h-type manufacturer’s signaling behavior causes a weaker CSR effect, i.e., encroachment merely induces small increments in CSR effort, wholesale price, and offline demand. To successfully separate, the h-type manufacturer gives up an excellent chance to win from high CSR fulfillment under encroachment, opting for a slightly higher CSR effort than non-encroachment. The wholesale and offline retail prices are also increased to a smaller extent under the combined effects of the amplified downward distortion signaling and the lessened CSR cost transfer. Thus, the retailer’s encroachment profit is reduced to support the h-type manufacturer’s signal behavior, ensuring accurate green information is demonstrated to customers.

In such a case, a win-win encroachment can be achieved. The manufacturer and the retailer collaboratively sacrifice their interests to send green signals. For example, within the emerging sector of electric vehicles, consumers demonstrate a high level of environmental and CSR awareness. BYD, the leading enterprise in the Chinese market, attains a mutually beneficial outcome through its transformation to a dual-channel SSC. Despite BYD’s significant emphasis on CSR, it has yet to fully align with its industry leadership. This can be attributed to BYD’s CSR decisions needing to fulfill the role of conveying green signals. Moreover, by refraining from excessively transferring signal costs downstream, BYD can strengthen supply chain relationships and enhance its competitive edge across dual channels.

Zone II: When is moderate, and are relatively high, and and are relatively low, the manufacturer monopolizes the encroachment profit and bears the signal expense alone.

First, encroachment also causes a stronger downward-distorted green signaling strategy, akin to but weaker than Zone Ⅰ. On the one hand, the CSR-induced demand and premium are undermined by the overheated dual-channel competition when customers’ acceptance of the online channel is relatively high. On the other hand, the high green investment is hardly unprofitable when customers have low green concerns or the greenness differentiation is slight between the two manufacturer types. The l-type manufacturer’s profit from pretending to be an h-type is very meager, especially when he is less cost-efficient in CSR investment.

Second, given customers’ intermediate social concern, the h-type manufacturer’s signaling behavior only causes a very weak CSR effect or manifests as the opposite and fails to achieve the win-win encroachment. Notably, the wholesale price, as the subordinate signal, is subject to a more significant distortion than the CSR effort. Not only does it bear variations in cost apportionment but it also offsets or reimburses the demand changes induced by CSR distortion. Consequently, influenced by signaling, the retailer either suffers less from the wholesale price increment or enjoys a higher wholesale price reduction upon encroachment.

In such a case, while the manufacturer reaps the encroachment profit, the burden of signal expense falls solely on the manufacturer and the retailer suffers a slight encroachment loss. For example, within the household appliances industry, consumers exhibit a moderate level of environmental and social awareness. Gree, one of the top three household appliance manufacturers in China, is facing challenges in transitioning to the dual-channel SSC. On the one hand, the differentiation in greenness is small and mainly lies in energy consumption for household products. Nevertheless, Gree remains committed to investing significantly in green technology innovation and application. Its fluorine-free air conditioners are sold at higher prices than competitors’ non-green products. Despite its established image of leading in green products, Gree’s CSR effort falls behind, failing to meet consumer expectations. This anomalous CSR strategy, alongside overpricing, serve as green signals, discouraging “greenwashing” imitators. However, the unfavorable situation is that customers’ increasing acceptance of the online channel and free-riding cause fierce channel competition. Offline retailers inevitably suffer losses from the dual-channel sales model and fail to benefit from various compensations Gree provides. Thus, the dual-channel sales model is evolving towards selling different products online and offline.

Zone III: When is relatively low, the retailer is deprived of any encroachment profits and forced to bear the entire signal expense.

First, contrary to Zone Ⅰ and Ⅱ, encroachment causes the h-type manufacturer to adopt a weaker upward-distorted green signaling strategy. Due to the wholesale price effect, the h-type manufacturer is less willing to distort the CSR effort upward. The additional investment cannot be transferred to the retailer but drives up online channel retail prices. Such signaling behavior virtually increases the l-type manufacturer’s imitation cost upon encroachment, allowing the h-type manufacturer to successfully separate from the l-type with only minor upward distortion of CSR effort and wholesale price.

Second, given customers’ low social concern, the h-type manufacturer’s signaling behavior influences encroachment effects by causing a more substantial wholesale price reduction but a comparatively smaller CSR increment. Consequently, while the manufacturer gains a more substantial wholesale revenue under signaling, the retailer’s encroachment losses are exacerbated. The weak CSR increase falls short, both in extent and lucrativeness, to shield the offline channel from cannibalization.

In such a case, a win-win encroachment is unattainable, with the manufacturer standing to gain the entire encroachment profit while transferring the full signaling burden to the retailer. This scenario extends across a wide array of industries, except those that deservedly engage in high CSR due to pollution levels or those easily monitored by the public due to their close connection to public welfare.

6. Extension: MIGPs

This section considers an alternative type of green product, known as marginal cost-intensive green products (MIGPs), to verify the robustness of our results. MIGPs utilize proven commodity technologies to achieve the intended greening effort, e.g., eco-friendly apparel made with environmentally safe fabric [51]. Referring to Hua et al. [43] and Gao et al. [55], the major costs for MIGPs are variable, including material costs for more expensive renewable material, clean energy, and green components, along with labor costs and factory overhead for installing additional or replacing old modules. Therefore, the manufacturers’ MIGP costs are assumed to be per unit product, where is the variable manufacturing cost coefficient. This cost is independent of green technology R&D and the relevant fixed asset additions, improvements, and replacements. Hereafter, we use superscript to denote MIGP scenarios.

The retailer’s profit functions are the same as Equations (3) and (5), while the h-type manufacturer’s maximization problem in the non-encroachment scenario becomes:

The h-type manufacturer’s maximization problem in the encroachment scenario becomes:

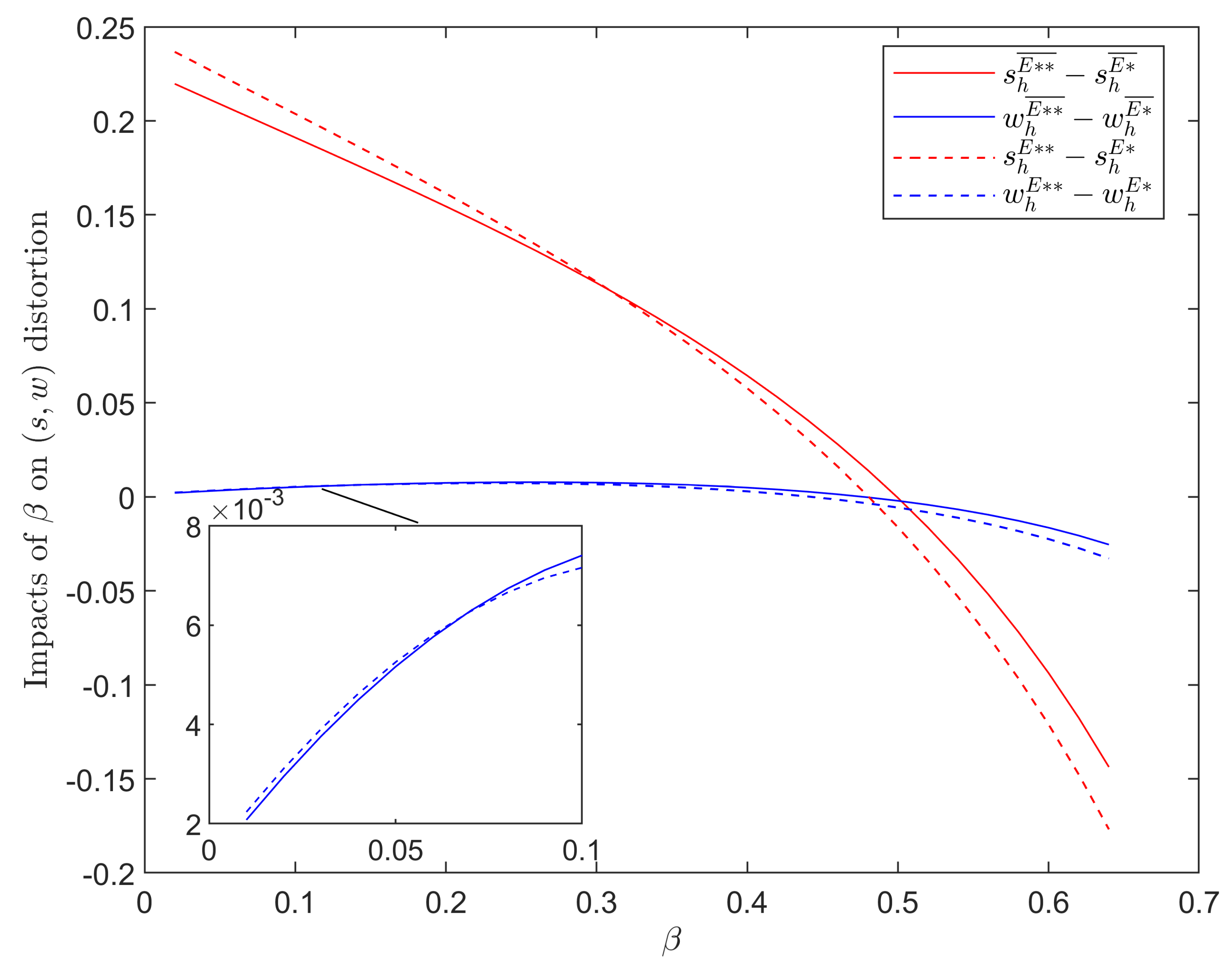

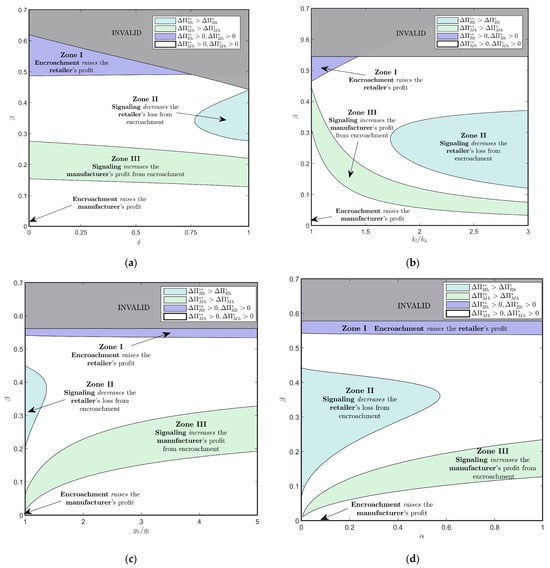

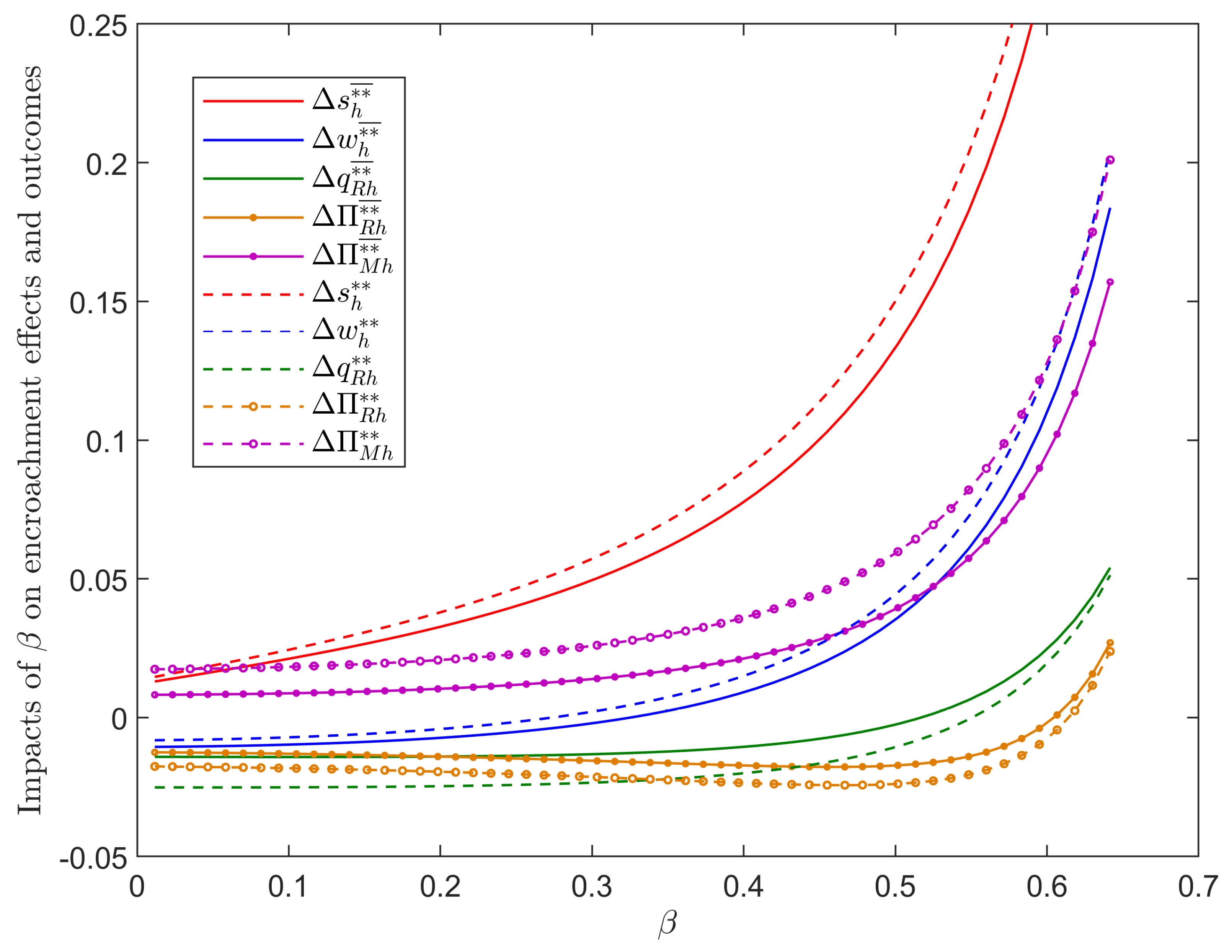

Due to the complexity of the h-type manufacturers’ maximization programs, analytical expressions for the equilibrium are hard to derive. Thus, this section conducts several numerical analyses to gain additional insights into the impact of green product types. We begin by examining how MIGPs’ variable cost coefficient () affects the impacts of customers’ CSR preference () on the h-type manufacturers’ signaling behaviors and encroachment effects and outcomes. To conduct this, we first set and to vary in . Results are shown in Figure 3 and Figure 4.

Figure 3.

Comparisons between the impacts of on the h−type manufacturer’s signaling behavior under MIGPs and DIGPs.

Lemma 5.

Compared to DIGP scenarios:

- (1)

- MIGPs cause the h-type manufacturer, in the separating equilibrium, to distort upward or downward less intensively when is relatively low or high, respectively;

- (2)

- Otherwise, MIGPs cause the h-type manufacturer to distort upward more intensively.

From the optimal decision perspective, the equilibrium CSR efforts for MIGPs are always less than those for DIGPs, whereas wholesale prices are always higher than those for DIGPs. For DIGPs, green costs are introduced into the manufacturers’ profit functions as fixed costs, causing no influence on the decision-making processes of supply chain members. However, for MIGPs, green costs manifest as unit variable costs, which are deducted from wholesale prices to determine the marginal profit, making it a crucial factor in decision-making. Since MIGP costs are typically perceived as higher than those of DIGPs during decision-making, manufacturers naturally pass the cost pressure downstream by increasing the wholesale price, leading to a subsequent increase in retail prices. Its ripple effect further translates into downturns both in overall market demand and manufacturers’ motivation to invest in CSR.

In such a case, manufacturers of MIGPs bear a heavier cost burden and experience limited demand and premium returns from CSR efforts compared to DIGPs. Therefore, when customers’ CSR preference is either too low or too high, the h-type manufacturers can discourage imitation by deviating slightly from the first-best CSR efforts and wholesale prices due to the l-type manufacturers’ inefficiency in CSR investment. Meanwhile, when customers’ CSR preference is intermediate, the effectiveness of CSR in generating demand and increasing premiums with MIGPs is passable but falls short of that with DIPGs. The h-type manufacturers need to distort CSR and wholesale prices more intensively to increase imitation costs for the l-type.

Figure 4.

Comparisons between the impacts of on encroachment effects and outcomes under MIGPs and DIGPs.

Figure 4.

Comparisons between the impacts of on encroachment effects and outcomes under MIGPs and DIGPs.

Lemma 6.

Compared to DIGP scenarios: MIGPs cause lower , , and and higher and

From the management accounting perspective, the two types of products exhibit distinct cost behavior patterns. For DIGPs, the green and CSR fixed costs are apportioned across products based on total market demand. The greater the total demand, the smaller the unit cost borne by each product. For MIGPs, the unit manufacturing cost of green products is independent of the production volume while the fixed cost of CSR is diluted as demand increases. Therefore, when the manufacturer faces an increase in total demand upon encroachment and intends to increase CSR effort, she should consider that MIGPs may not be as effective in diluting CSR investments as DIGPs. As a result, the CSR effort should be increased at a reduced intensity upon encroachment for MIGPs. Due to the reduced pressure to pass on CSR costs, manufacturers increase (decrease) wholesale prices less (more) intensively when consumers are sensitive (insensitive) to CSR.

Meanwhile, manufacturers of MIGPs rely more on retailers upon encroachment. To apportion CSR investments, the offline channel is relied on to expand the total market demand, thereby bearing only a little demand cannibalization from encroachment, as well as CSR cost pass-through. The encroachment-induced offline demand increment for MIGPs is also higher. Compared with DIGPs, manufacturers obtain fewer encroachment profits for MIGPs due to less effort towards CSR and higher compensation for the offline channel. Therefore, retailers either earn higher encroachment profits or suffer fewer encroachment losses under MIGPs.

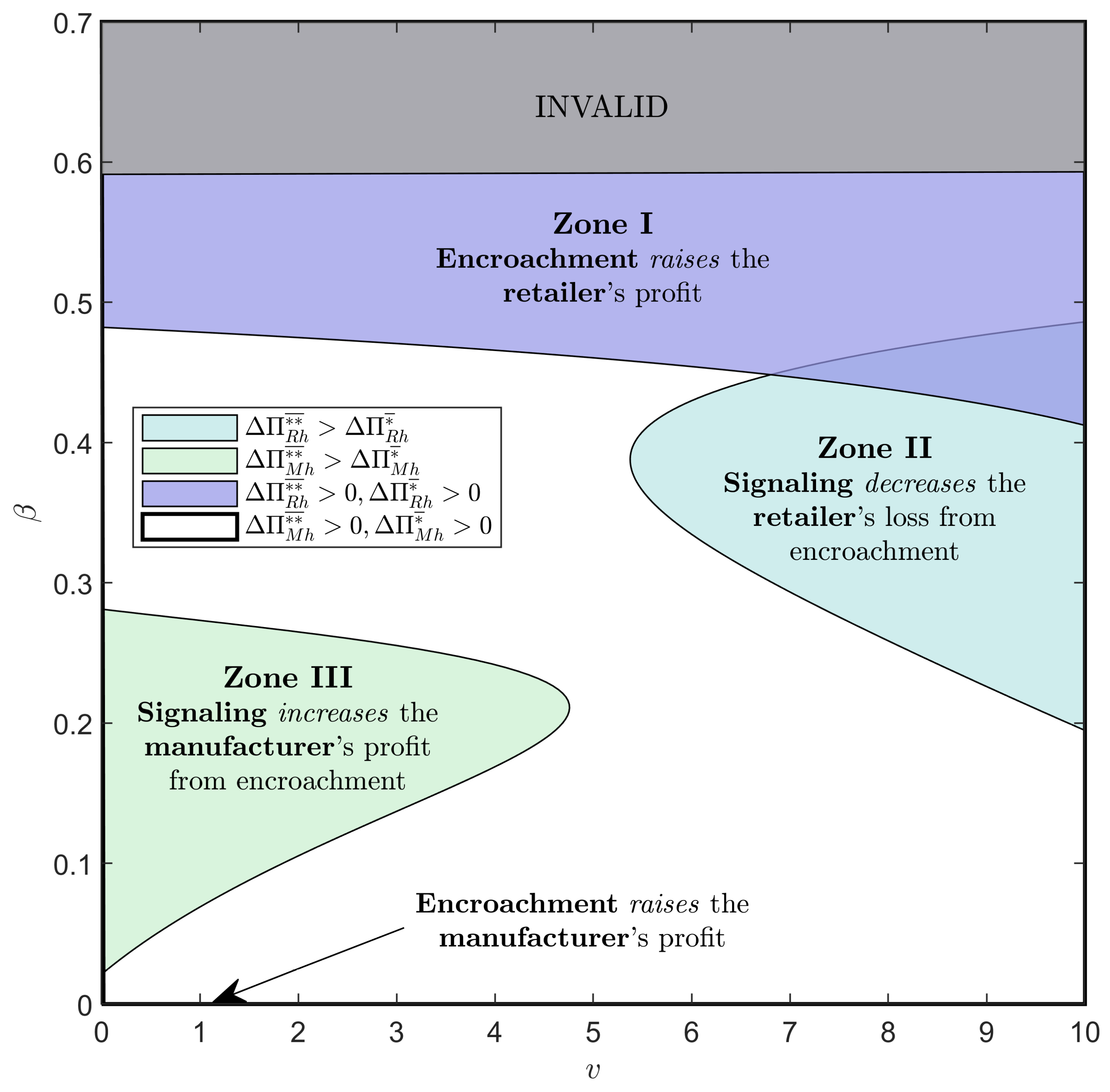

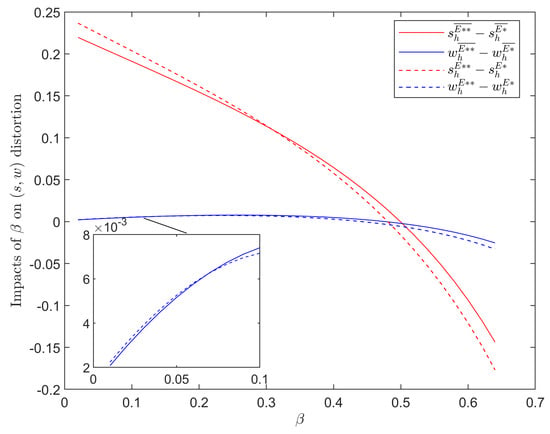

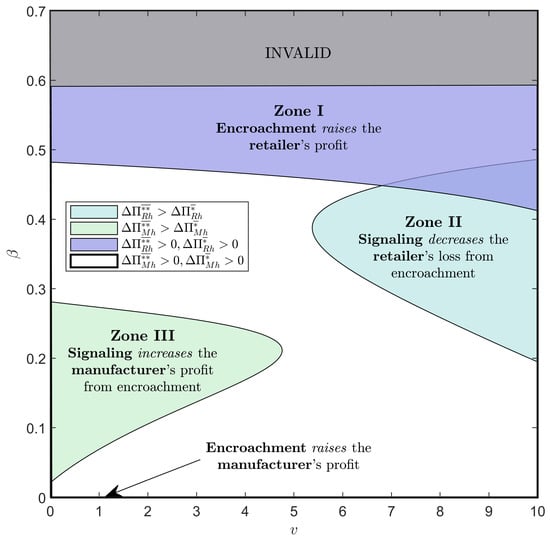

Next, we examine how affects the interactions between the patterns of encroachment profit-sharing and signal cost-bearing between supply chain members. To conduct this, we vary in . Results are shown in Figure 5.

Figure 5.

Impacts of on encroachment profit-sharing and signal expense-bearing patterns under MIGPs.

Zone I: When is relatively high, a stable pattern of encroachment profit and signal expense sharing can be observed. This pattern is consistent with the scenario observed under DIGPs despite the variable manufacturing cost for MIGPs.

Zone II: When is moderate while is exceedingly high, the retailer takes a share of the encroachment spoils while the manufacturer bears the entire burden of the signal expense. Otherwise, the retailer receives no encroachment profit nor pays for any signal cost.

First, encroachment causes the h-type manufacturer to adopt a stronger upward-distorted green signaling strategy. The increase in unit production cost of MIGPs always harms the profitability of SSC, making the system unsuitable for implementing high CSR. Nevertheless, considering the relatively high total demand associated with encroachment, the dual channels could undertake higher CSR investments and yield better returns in comparison to the single channel. In order to achieve separation upon encroachment, the h-type manufacturer must adopt a more intensive upward distortion of CSR and wholesale price to increase the imitation cost.

Second, the h-type manufacturer’s signaling behavior causes a stronger CSR effect, i.e., encroachment induces higher increments in CSR effort and offline demand while minor increments in wholesale price. In such a case, the direction and extent of CSR and wholesale price distortion turn out to be favorable to the retailer upon encroachment. Therefore, the manufacturer develops a new encroachment profit pattern that relies more on offline wholesale revenue and bears the signal cost alone. As the manufacturing cost per MIGP increases, the CSR effect gradually increases to offset the negative impact of encroachment on the retailer. A win-win encroachment could be achieved when the unit cost reaches a substantially high threshold.

Zone III: When both and are relatively low, the retailer suffers the double whammy of encroachment loss and entire signaling expense pass-through, albeit in a slightly different manner compared to the DIGPs scenario.

First, encroachment causes the h-type manufacturer to adopt a weaker upward-distorted green signaling strategy. Manufacturer encroachment and signaling behavior conspire to increase CSR efforts. Nevertheless, such a CSR level only exhibits moderate efficacy in generating demand and premiums, somewhat offset by the simultaneous rise in wholesale prices. Therefore, the CSR fixed investment borne by each MIGP becomes rather exorbitant and even a slight upward distortion of the CSR efforts and wholesale prices could achieve successful separation upon encroachment.

Second, the h-type manufacturer’s signaling behavior causes an anti-CSR effect, i.e., encroachment induces minor increments in CSR effort and offline demand while significant increments in wholesale price. Contrary to Zone Ⅲ under DIGPs, the small unit green cost of MIGP induces the manufacturer to prioritize increasing wholesale prices over fulfilling CSR to realize encroachment profit and green signaling. In the event of encroachment, the manufacturer may distort the CSR efforts and wholesale prices in a direction and extent very favorable to himself, culminating in substantial profits from the additional online channel. In such a case, the manufacturer shirks the signaling cost entirely and exploits any potential encroachment earnings of the retailer.

7. Conclusions

In this paper, we investigate manufacturer encroachment on a sustainable supply chain, wherein product greenness is the manufacturer-side private information. The h-type manufacturers must reveal to the downstream retailer and customers that their product is truly superior in greenness. A signaling game is employed to attain this objective by leveraging the CSR effort and wholesale price as joint signals. Through comparative and numerical analyses, we investigate the complex interactions between manufacturer encroachment and signaling behavior and examine how the resulting gains and losses are allocated between supply chain members. We summarize our main results in the following:

First, sustainable supply chains demonstrate a consistent pattern under either symmetric or asymmetric information in achieving encroachment coordination, i.e., the CSR effect. That is, encroachment stimulates greater CSR efforts from the manufacturer, resulting in increased demand and higher wholesale prices for the retailer to profit from and share. Such a CSR effect occurs and leads to a win-win encroachment when customers exhibit a strong CSR preference.

Second, the h-type manufacturers downwardly distort CSR effort and wholesale price as principal and subordinate green signals, whether encroach or not, under customers’ strong CSR preference. Otherwise, the distortion direction of the two is upward. On the one hand, leveraging the l-type manufacturers’ CSR cost inefficiency, the CSR effort is distorted in a manner that the incurred investment cannot be covered by the poor return in demand and premium increment. On the other hand, the wholesale price is distorted as the complement signal, offsetting CSR-induced demand decrement (increment) while mitigating (exacerbating) CSR cost pass-through.

Third, encroachment profit-sharing and signal expense-bearing patterns depend mainly on the degree of customers’ CSR preference. The best-case scenario occurs when consumers have a strong preference for CSR. A win-win encroachment can be achieved, in which the manufacturer and the retailer share profits from encroachment, as well as expenses from signaling. Here, encroachment causes a stronger downward-distorted signaling strategy while signaling weakens the CSR effect. Otherwise, the win-win encroachment is unattainable. When CSR preference is moderate, manufacturers share neither encroachment profits nor signaling expenses with retailers. However, when CSR preference is low, retailers bear both encroachment losses and signaling expenses. Moreover, these patterns remain largely robust across manufacturer encroachment under different green product types.

The above results provide several managerial implications. First, in transitioning to dual-channel sustainable supply chains, manufacturers should work along both lines on investing in green technology and CSR, rather than viewing them as passive strategies to cope with the government and customers. Manufacturers could leverage the symbiotic advantages of green and CSR investments to cultivate customers’ positive environment and social perceptions, thereby stimulating green demand, especially when introducing an additional online channel. Second, high-greenness manufacturers should proactively incorporate CSR fulfillment and wholesale pricing as powerful signal tools to accurately communicate the environmental quality of their products to downstream markets. Such a market-oriented approach could effectively separate and boycott “greenwashing” manufacturers who falsely portray a socially responsible image. By combating the issue of feigned environmental consciousness, a more transparent and well-organized green market could be achieved. Third, the government should cultivate a conducive atmosphere for CSR. This setting acts as a bedrock for enabling manufacturers to convey green information, thereby facilitating Pareto improvements for all stakeholders in dual-channel SSCs. Relevant departments should actively strengthen social value recognition through various promotional channels. By enhancing consumer understanding of CSR, firms are encouraged to uphold CSR commitments, enabling firms to attain competitive advantages while addressing social issues.

The work at hand has several limitations that can serve as directions for future research. First, the manufacturers’ CSR effort is assumed to be fully trusted by retailers and customers, based on which they form posterior beliefs of product greenness [38]. In the future, we may study the manufacturer’s green signaling behavior when customers only perceive the observed CSR activities or question the credibility of CSR disclosure. Second, we assume that all consumers exhibit CSR preference while the reality is that only a part of customers are willing to pay a premium for high CSR products and are informed of the CSR disclosure [56]. Analyzing the impact of consumers’ heterogeneous CSR preferences on encroachment effects and outcomes would be an interesting direction. Thirdly, we have not considered the government’s regulatory, facilitative, partnership, and supportive roles in driving firms’ CSR and green undertaking [43]. It is worthwhile to study how CSR and green policies, e.g., subsidies or tax exemptions, can affect the interactions between green signaling and manufacturer encroachment in future research.

Author Contributions

Conceptualization, Y.H.; methodology, Y.H.; software, Y.H.; validation, Y.H., X.D. and L.C.; formal analysis, Y.H.; investigation, X.D.; resources, L.C.; data curation, X.D.; writing—original draft preparation, Y.H.; writing—review and editing, Y.H.; visualization, Y.H.; supervision, L.C.; project administration, X.D.; funding acquisition, L.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 71772036.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available in the article.

Acknowledgments

The authors would like to thank the anonymous reviewers for very detailed and helpful comments and suggestions on this work.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Proof of Proposition A1.

Considering Model N under symmetric information, in Stage 2, the first-order condition of Equation (3) yields the retailer’s response function while the second-order condition is clearly satisfied. In Stage 1, substituting into the manufacturer’s profit function in Equation (4), the Hessian Matrix is derived as , which is negative definite (i.e., is jointly concave with and ) if . Solving jointly the first-order derivative conditions and , we obtain the optimal solutions of and , which are substituted into the response function to obtain the optimal solution of . All results are presented in the second column of Table 2. The equilibrium solutions of Model E under symmetric information can be similarly proven and presented in the third column of Table 2. Hence, we omit the proof here. □

Proof of Proposition A2.

Considering Model N under asymmetric information:

- (1)

- For the l-type manufacturer, by the definition of a separating PBE, the retailer and customers form posterior beliefs that . It is easy to see that the l-type manufacturer faces the same decision problem as in the case of symmetry information. Thus, and .

- (2)

- For the h-type manufacturer, employing the backward induction approach, the retailer’s response function in Stage 2 remains consistent with that of Model N under symmetric information. The Lagrangian for the h-type manufacturer’s maximization program is:where and are the Lagrangian multipliers.

The KKT conditions are:

Referring to Zhao et al. (2000) and Kalra and Li (2008), at the least-cost separation, the mimicking constraint of the l-type manufacturer is binding, whereas that of the h-type manufacturer is not. It can be inferred that , , , and . Solving the above conditions and discarding the implausible solution, we obtain the optimal solutions of and , which are substituted into the response function to obtain the optimal solution of . All results are presented in the second column of Table 3.

- (3)

- Equilibrium selection with the Intuitive Criterion. On the one hand, and are the h- and l-type manufacturers’ first-best and dominant strategies given signaling. On the other hand, considering the off-equilibrium subjected to the mimicking constraints, both h- and l-type manufacturers have no incentive to deviate from the equilibrium strategies, even when the retailer and consumers hold the most favorable belief .

The equilibrium solutions of Model E under asymmetric information can be similarly proven and presented in the third column of Table 3. Hence, we omit the proof here. □

Appendix B

Proof of Lemma A1.

Comparing the h-type manufacturers’ equilibrium decisions between symmetric and asymmetric information models, we have:

For , decreases in and , while first decreases then increases in and . Thus, for , there exists a unique zero point , where and hold if . Similarly, we can prove that there exists a unique zero point , where and hold if . □

Proof of Lemma A2.

Comparing the supply chain members’ optimal profits between symmetric and asymmetric information models, we have:

For , firstly, decreases in and . Thus, for , always holds. Secondly, the monotonicity of and is consistent, while . Thus, for , the zero point of is identical to that of , where holds if . Similarly, we can prove that always holds for and there exists the same zero point , where holds if . □

Proof of Lemma A3.

Comparing the supply chain members’ equilibrium decisions between encroachment and non-encroachment models, we have:

By algebra, we have if and if .

For , , , and increase in . , , and . Thus, and there exists unique zero points and , where if , and if . Here, , , , , , , , , , , and . □

Proof of Lemma A4.

Comparing the supply chain members’ optimal profits between encroachment and non-encroachment models, we have:

By algebra, we have if .

For , and increase in . and . Thus, and there exists a unique zero point , where holds if . Here, , , , and . □

References

- Li, J.; Hu, Z.; Shi, V.; Wang, Q. Manufacturer’s encroachment strategy with substitutable green products. Int. J. Prod. Econ. 2021, 235, 108102. [Google Scholar] [CrossRef]

- Raj, A.; Modak, N.M.; Kelle, P.; Singh, B. Analysis of a dyadic sustainable supply chain under asymmetric information. Eur. J. Oper. Res. 2021, 289, 582–594. [Google Scholar] [CrossRef]

- Arya, A.; Mittendorf, B.; Sappington, D.E.M. The Bright Side of Supplier Encroachment. Mark. Sci. 2007, 26, 651–659. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel Conflict and Coordination in the e-Commerce Age. Prod. Oper. Manag. 2004, 13, 93–110. [Google Scholar] [CrossRef]

- Hu, Y.; Chen, L.; Chi, Y.; Wang, Y. Manufacturer encroachment on a green supply chain with environmental labeling. Manag. Decis. Econ. 2023, 44, 3249–3268. [Google Scholar] [CrossRef]

- Baksi, S.; Bose, P. Credence Goods, Efficient Labelling Policies, and Regulatory Enforcement. Environ. Resour. Econ. 2006, 37, 411–430. [Google Scholar] [CrossRef]

- Mahenc, P. Are green products over-priced? Environ. Resour. Econ. 2007, 38, 461–473. [Google Scholar] [CrossRef][Green Version]

- Heydari, J.; Rafiei, P. Integration of environmental and social responsibilities in managing supply chains: A mathematical modeling approach. Comput. Ind. Eng. 2020, 145, 106495. [Google Scholar] [CrossRef]

- Panda, S. Coordination of a socially responsible supply chain using revenue sharing contract. Transp. Res. Part E Logist. Transp. Rev. 2014, 67, 92–104. [Google Scholar] [CrossRef]

- Wongpitch, S.; Minakan, N.; Powpaka, S.; Laohavichien, T. Effect of corporate social responsibility motives on purchase intention model: An extension. Kasetsart J. Soc. Sci. 2016, 37, 30–37. [Google Scholar] [CrossRef]

- Lee, H.C.B.; Cruz, J.M.; Shankar, R. Corporate Social Responsibility (CSR) Issues in Supply Chain Competition: Should Greenwashing Be Regulated? Decis. Sci. 2018, 49, 1088–1115. [Google Scholar] [CrossRef]

- Li, Y.; Ni, D.; Xiao, Z.; Tang, X. Signaling Product Quality Information in Supply Chains via Corporate Social Responsibility Choices. Sustainability 2017, 9, 2113. [Google Scholar] [CrossRef]

- Li, Z.; Gilbert, S.M.; Lai, G. Supplier Encroachment Under Asymmetric Information. Manag. Sci. 2014, 60, 449–462. [Google Scholar] [CrossRef]

- Zhang, J.; Li, S.; Zhang, S.; Dai, R. Manufacturer encroachment with quality decision under asymmetric demand information. Eur. J. Oper. Res. 2018, 273, 217–236. [Google Scholar] [CrossRef]

- Sun, X.; Tang, W.; Chen, J.; Li, S.; Zhang, J. Manufacturer encroachment with production cost reduction under asymmetric information. Transp. Res. Part E Logist. Transp. Rev. 2019, 128, 191–211. [Google Scholar] [CrossRef]

- Zhao, Y.; Hou, R. Manufacturer encroachment with carbon cap-and-trade policy under asymmetric information. J. Clean. Prod. 2024, 438, 140816. [Google Scholar] [CrossRef]

- Raj, A.; Biswas, I.; Srivastava, S.K. Designing supply contracts for the sustainable supply chain using game theory. J. Clean. Prod. 2018, 185, 275–284. [Google Scholar] [CrossRef]

- Calveras, A.; Ganuza, J. Corporate social responsibility and product quality. J. Econ. Manag. Strat. 2018, 27, 804–829. [Google Scholar] [CrossRef]

- Li, H.; Li, Z. Supplier Encroachment in the Supply Chain in the E-Commerce Age: A Systematic Literature Review. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2655–2671. [Google Scholar] [CrossRef]

- Chiang, W.-Y.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. 2003, 49, 5–142. [Google Scholar] [CrossRef]

- Cai, G. Channel Selection and Coordination in Dual-Channel Supply Chains. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Yoon, D. Supplier Encroachment and Investment Spillovers. Prod. Oper. Manag. 2016, 25, 1839–1854. [Google Scholar] [CrossRef]

- Zhang, J.; Cao, Q.; He, X. Manufacturer encroachment with advertising. Omega 2018, 91, 102013. [Google Scholar] [CrossRef]

- Zhang, S.; Wei, L.; Zhang, J. Demand forecast sharing for a dominant retailer with supplier encroachment and quality decisions. Eur. J. Oper. Res. 2022, 301, 39–50. [Google Scholar] [CrossRef]

- Tong, Y.; Lu, T.; Li, Y.; Ye, F. Encroachment by a better-informed manufacturer. Eur. J. Oper. Res. 2023, 305, 1113–1129. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Chan, H.K. Manufacturer and retailer coordination for environmental and economic competitiveness: A power perspective. Transp. Res. Part E Logist. Transp. Rev. 2017, 97, 268–281. [Google Scholar] [CrossRef]

- Xia, Q.; Zhi, B.; Wang, X. The role of cross-shareholding in the green supply chain: Green contribution, power structure and coordination. Int. J. Prod. Econ. 2021, 234, 108037. [Google Scholar] [CrossRef]

- Yang, D.; Song, D.; Li, C. Environmental responsibility decisions of a supply chain under different channel leaderships. Environ. Technol. Innov. 2022, 26, 102212. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Yang, D.; Xiao, T.; Huang, J. Dual-channel structure choice of an environmental responsibility supply chain with green investment. J. Clean. Prod. 2018, 210, 134–145. [Google Scholar] [CrossRef]

- Biswas, I.; Raj, A.; Srivastava, S.K. Supply chain channel coordination with triple bottom line approach. Transp. Res. Part E Logist. Transp. Rev. 2018, 115, 213–226. [Google Scholar] [CrossRef]

- Peng, Q.; Wang, C.; Goh, M. Green innovation decision and coordination of supply chain under corporate social responsibility and risk preferences. Comput. Ind. Eng. 2023, 185, 109703. [Google Scholar] [CrossRef]

- Modak, N.; Panda, S.; Mishra, R.; Sana, S. A three-layer supply chain coordination in socially responsible distribution system. Tékhne 2016, 14, 75–87. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N. Exploring the effects of social responsibility on coordination and profit division in a supply chain. J. Clean. Prod. 2016, 139, 25–40. [Google Scholar] [CrossRef]

- Ni, D.; Li, K.W.; Tang, X. Social responsibility allocation in two-echelon supply chains: Insights from wholesale price contracts. Eur. J. Oper. Res. 2010, 207, 1269–1279. [Google Scholar] [CrossRef]

- Hsueh, C.-F. Improving corporate social responsibility in a supply chain through a new revenue sharing contract. Int. J. Prod. Econ. 2014, 151, 214–222. [Google Scholar] [CrossRef]

- Seyedhosseini, S.M.; Hosseini-Motlagh, S.-M.; Johari, M.; Jazinaninejad, M. Social price-sensitivity of demand for competitive supply chain coordination. Comput. Ind. Eng. 2019, 135, 1103–1126. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, K.; Xie, J. Bad Greenwashing, Good Greenwashing: Corporate Social Responsibility and Information Transparency. Manag. Sci. 2020, 66, 3095–3112. [Google Scholar] [CrossRef]

- You, L.; Chen, Z. A theory of firm opacity and corporate social responsibility. J. Bank. Financ. 2022, 145, 106640. [Google Scholar] [CrossRef]

- Candel-Sánchez, F.; Perote-Peña, J. How does corporate altruism affect oligopolistic competition? Econ. Model. 2024, 135, 106701. [Google Scholar] [CrossRef]

- Krishnan, V.; Zhu, W. Designing a Family of Development-Intensive Products. Manag. Sci. 2006, 52, 813–825. [Google Scholar] [CrossRef]

- Zhang, X.; Song, Y.; Zhang, M. Exploring the relationship of green investment and green innovation: Evidence from Chinese corporate performance. J. Clean. Prod. 2023, 412, 137444. [Google Scholar] [CrossRef]

- Hua, J.; Lin, J.; Wang, K.; Liu, G. Government interventions in new technology adoption to improve product greenness. Int. J. Prod. Econ. 2023, 262, 108924. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Chang, C.-H. The Determinants of Green Product Development Performance: Green Dynamic Capabilities, Green Transformational Leadership, and Green Creativity. J. Bus. Ethic 2012, 116, 107–119. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D.; Pontrandolfo, P. Green product innovation in manufacturing firms: A sustainability-oriented dynamic capability perspective. Bus. Strategy Environ. 2017, 26, 490–506. [Google Scholar] [CrossRef]

- Hu, Y.; Chen, L.; Chi, Y.; Song, B. Manufacturer encroachment on a closed-loop supply chain with design for remanufacturing. Manag. Decis. Econ. 2021, 43, 1941–1959. [Google Scholar] [CrossRef]

- Xue, M.; Zhang, J. Supply chain encroachment with quality decision and different power structures. RAIRO–Oper. Res. 2020, 54, 693–718. [Google Scholar] [CrossRef]

- Wan, X.; Chen, J.; Li, W. The impact of retail pricing leadership under manufacturer encroachment. Eur. J. Oper. Res. 2023, 310, 217–237. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, J.; Zhu, G. Retail service investing: An anti-encroachment strategy in a retailer-led supply chain. Omega 2018, 84, 212–231. [Google Scholar] [CrossRef]

- Liu, C.; Dan, B.; Zhang, X.; Zhang, H. Composite Contracts for Dual-Channel Supply Chain Coordination with the Existence of Service Free Riding. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 789–808. [Google Scholar] [CrossRef]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H. Competition and coordination in a dual-channel green supply chain with an eco-label policy. Comput. Ind. Eng. 2020, 153, 107057. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate social responsibility (CSR) performance and green innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Fosu, E.; Fosu, F.; Akyina, N.; Asiedu, D. Do environmental CSR practices promote corporate social performance? The mediating role of green innovation and corporate image. Clean. Responsible Consum. 2024, 12, 100155. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H.; Zhou, G. Dual-channel green supply chain management with eco-label policy: A perspective of two types of green products. Comput. Ind. Eng. 2020, 146, 106613. [Google Scholar] [CrossRef]

- Verteramo Chiu, L.J.; Liaukonyte, J.; Gómez, M.I.; Kaiser, H.M. Socially responsible products: What motivates consumers to pay a premium? Appl. Econ. 2017, 49, 1833–1846. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).